The Compensation Committee of the Board of Directors has furnished the following report on executive compensation.

Under the supervision of the Compensation Committee of the Board of Directors, the Company has developed and implemented compensation policies, plans and programs which seek to enhance the profitability of the Company and, as a result, shareholder value, by aligning the financial interests of the Company’s senior management with those of its shareholders. Annual base salary, incentive bonuses, and longer term incentive compensation is tied to the Company’s performance in a manner that encourages a sharp and continuing focus on building revenue growth and long-term profitability, and provides an important incentive in attracting and retaining corporate officers and other key employees and motivating them to perform to the full extent of their abilities in the best long-term interests of the shareholders. The Committee has retained a nationally- recognized independent compensation-consulting firm to assist the Committee in reviewing various analytical data to ensure that the Company’s compensation program for senior executives is competitive with compensation levels paid to senior management of similar-sized companies with comparable responsibilities.

In the early part of each fiscal year, the Compensation Committee, whom the Board has affirmatively determined to be comprised of independent directors, reviews with the Chief Executive Officer and recommends to the Board, with modifications it deems appropriate, an annual compensation plan for each of the Company’s senior executives other than the Chief Executive Officer. The Board’s independent directors vote on the recommendations in executive session. This compensation plan is based on a review of industry, peer group, and national surveys of compensation levels, historical compensation policies of the Company, and the subjective judgments of the Committee relating to the senior executives past and expected future contributions, level of experience, leadership abilities, and overall performance.

The Compensation Committee also reviews and recommends to the Board the compensation of the Chief Executive Officer based on a review of analytical data and the Compensation Committee’s assessment of his past performance and its expectation as to his future contributions in leading the Company and its businesses. The Board’s independent directors vote on the recommendations in executive session. For 2005, Mr. Off’s compensation was formulated by the Compensation Committee based on these factors as well as preset performance goals.

Mr. Off has served as Chairman of the Board, President and Chief Executive Officer since August 2002. Mr. Off’s salary for 2005 was $768,753 with a targeted bonus percentage of 100%. Mr. Off ‘s 2005 bonus was $710,717. The bonus payment for 2005 was paid in March 2006. In 2005, Mr. Off was also awarded 53,000 options and, under the newly adopted Performance Share Plan, which is described below, a target award of 30,000 RSUs for the 2005-2007 performance period.

Back to Contents

In addition to salary, senior management of the Company has the potential to receive additional compensation from one of three possible sources: the Company’s annual Corporate Bonus Plan, discretionary management bonuses, and the Omnibus Incentive Compensation Plan.

In 2005, the Board of Directors approved the 2005 Corporate Bonus Plan. The 2005 Corporate Bonus Plan provides for bonuses to be paid upon achievement of specified objectives and bonuses under the plan were approved by the Compensation Committee at its meeting on February 17, 2006. The 2006 Bonus Plan, which includes an earnings per share financial objective for senior management, was approved at the Board meeting held on February 17, 2006.

In order to provide equity-based and other long-term incentives to employees, the Company maintains the 2004 Omnibus Incentive Compensation Plan (“Omnibus Plan”). Under the Omnibus Plan, which was approved by the Shareholders at the 2004 Annual Meeting of Shareholders, the Compensation Committee has the authority to award stock options (incentive and non-qualified stock options), stock appreciation rights, stock awards (restricted and unrestricted), phantom shares, dividend equivalent rights and cash awards. All employees, non-employee directors and independent contractors of the Company and its subsidiaries are eligible to receive awards under the Omnibus Plan. The maximum number of shares available for awards under the Plan from its inception is approximately 3.5 million and approximately 1.9 million remain available for grant thereunder as of April 19, 2006. The Compensation Committee believes that the Omnibus Plan is an important tool in attracting and retaining employees and directors and encourages them to strive for the long-term success of the Company.

Several compensation and incentive plans operate under the Omnibus Plan, including the Company’s Stock Option Plan, Deferred Compensation Plan and Performance Share Plan. The Stock Option Plan was in place at the time of the adoption of the Omnibus Plan and provides additional structure by which stock options may be awarded to selected recipients. The Deferred Compensation Plan, as described below, allows executives to defer compensation and have the deferred amounts track the performance of Company stock.

The Performance Share Plan, which was developed and adopted in 2005, provides for a distributions under the Plan to be in shares of Company stock. Payment is to be made at the end of a performance period, typically three years. The number of shares awarded to the participant at the end of the performance period is the result of the automatic adjustment to a target number of shares awarded to the participant at the beginning of the performance period. The target number is adjusted up or down (within a range from 0 to 200% of the target number) based on actual performance during the period. The performance goals will typically be company-wide financial measures selected and set by the Compensation Committee and may be different for different performance periods. For the period ending December 2007, the financial measures are the Company’s operating income, operating margin, and return on capital employed. For the performance period ending December 2008, the financial measure is the Company’s free cash flow. For each financial measure a threshold, target and maximum level of performance will be set.

With the introduction of the Performance Share Plan, the Company has begun a shift in the make-up of its equity-based awards, away from options and toward a mix of time-vested restricted stock units, performance share awards and stock options, as appropriate for the

20

Back to Contents

individual receiving the awards. In 2006, time-vested restricted stock units, with both 3-year and 5-year vesting, have been awarded to certain executives and employees partially replacing traditional option grants.

In deciding the awards to the individual senior management group during 2005, including the Named Executive Officers other than the Chief Executive Officer, the Compensation Committee reviewed with the Chief Executive Officer the recommended individual awards, taking into account facts and subjective issues such as the respective scope of accountability, strategic and operational goals, performance requirements, anticipated contributions of each of the senior management group and information on previous awards made to the individual. Any awards to the Chief Executive Officer are determined separately by the Compensation Committee and are based, among other things, upon a subjective review of competitive compensation data from several surveys, data from selected peer companies, information regarding his total compensation and historical information regarding his long-term compensation awards as well as the Committee’s subjective evaluation of his past and expected future contributions to the Company’s achievement of long-term performance goals, including revenue and earnings growth. In 2005, the Compensation Committee granted stock options to purchase 53,000 shares of the Company’s Common Stock and a target award of 30,000 RSUs for the performance period ending December 2007 under the Performance Share Plan to the Chief Executive Officer.

Under the 1993 Omnibus Budget Reconciliation Act (“COBRA”) and Section 162(m) of the Code, income tax deductions of publicly-traded companies may be limited to the extent total compensation for certain executive officers exceeds $1 million in any one year, except for compensation payments which qualify as “performance-based.” To qualify as “performance-based,” compensation payments must be based solely upon the achievement of objective performance goals and made under a plan that is administered by the Compensation Committee. In addition, Compensation Committee must certify that the performance goals were achieved before payments can be made. The Compensation Committee has designed certain of the Company’s compensation programs to conform to Section 162(m) of the Code and related regulations so that total compensation paid to any employee covered by Section 162(m) should not exceed $1 million in any one year, except for compensation payments which qualify as “performance-based.” However, the Company may pay compensation which is not deductible in certain circumstances, when sound management of the Company so requires.

Deferred Compensation Plan |

On February 18, 2004, the Board adopted the Checkpoint Systems, Inc. Deferred Compensation Plan (“Deferred Compensation Plan”). The Deferred Compensation Plan was approved by the Company’s Shareholders at the 2004 Annual Meeting. The purpose of the Deferred Compensation Plan, which is administered by the Compensation Committee, is to provide certain eligible employees of the Company and its subsidiaries the opportunity to defer portions of their compensation. In addition, the Deferred Compensation Plan is designed to encourage participants to participate in an investment return which tracks the performance of Company stock, therefore aligning the interests of plan participants with those of the Company’s shareholders.

U.S. and non-US executives are eligible to participate in the Deferred Compensation Plan. The Compensation Committee may set minimum and maximum amounts allowed for deferral into the Deferred Compensation Plan, however, the maximum deferred amount

21

Back to Contents

may not exceed 50% of base salary and 100% of annual bonus. Deferral elections are irrevocable for one year, except in the case of unforeseeable severe financial emergency.

The Deferred Compensation Plan is unfunded and rights to payments from this plan are unsecured claims against the general assets of the Company. The Deferred Compensation Plan is not intended to qualify under Section 401(a) of the Code. Participant accounts under the Deferred Compensation Plan are merely hypothetical bookkeeping accounts which will incur hypothetical gains or losses tracking the performance of company stock.

Participants will receive a 25% match on amounts deferred. Company matching amounts are subject to incremental vesting over three years. Normally, lump-sum distribution will occur at termination of employment. However, at the time of completing the first election form, participants may choose distribution upon termination on or after age 55 in either a lump sum or a series of substantially equal annual payments over the five years immediately following termination. Distributions under the Plan will be in shares of Company stock.

On February 17, 2004 the Compensation Committee adopted the Checkpoint Systems, Inc. Management and Director Stock Ownership Program (“Stock Ownership Program”). The Stock Ownership Program sets stock ownership levels for executive officers and outside directors of the Company. The ownership levels under the Stock Ownership Program are as follows:

Title (or equivalent) | | Annual Average Deferral

From

Gross Salary | |

Level of Ownership

After 5 Years | |

| |

|

| |

|

| |

| Director | | | N/A | | | 10,000 | |

| Chief Executive Officer | | | 40% | | | 160,000 | |

| Executive Vice President/President | | | 25% | | | 50,000 | |

| Senior Vice President | | | 25% | | | 25,000 | |

| Vice President and General Mgr. | | | 15% | | | 10,000 | |

| | | | | | | | |

Each participant must achieve and maintain the Annual Average Deferral from Gross Salary for each five year period or achieve and maintain the Level of Ownership for such participant’s position by the fifth anniversary of the Effective Date. Shares relating to accounts under deferred compensation plans qualify toward the required ownership levels.

The foregoing report submitted by:

William S. Antle, III

Harald Einsmann

R. Keith Elliott

Jack W. Partridge, Chairperson

Sally Pearson

The foregoing Report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

22

Back to Contents

Compensation Committee Interlocks and Insider Participation |

No member of the Compensation Committee, as of the date of this proxy statement, is or has been an officer or employee of the Company or any of its subsidiaries.

No executive officer of the Company served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on the Compensation Committee.

No executive officer of the Company served as a director of another entity, one of whose executive officers served on the Compensation Committee.

No executive officer of the Company served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as a director of the Company.

23

Back to Contents

EXECUTIVE COMPENSATION

This table below shows for the last three fiscal years compensation information for the Company’s Chief Executive Officer, and the Named Executive Officers, as required under the rules of the SEC and certain other executive officers of the Company.

Summary Compensation Table

| | | Annual Compensation | | Long Term Compensation | | All Other Compensation | |

| |

| |

| |

| |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Securities Underlying Options(#) | | Other ($) | |

| |

| George W. Off | | | 2005 | | | 768,753 | | | 710,717 | | | 53,000 | | | 0 | |

| Chairman of the Board, | | | 2004 | | | 768,753 | | | 422,105 | | | 90,000 | | | 359,407 | (1) |

| President and Chief | | | 2003 | | | 772,820 | | | 762,375 | | | 60,000 | | | 0 | |

| Executive Officer | | | | | | | | | | | | | | | | |

| |

| W. Craig Burns | | | 2005 | | | 387,339 | | | 415,342 | (2) | | 11,250 | | | 0 | |

| Executive Vice President, | | | 2004 | | | 388,335 | | | 364,377 | (2) | | 60,000 | | | 0 | |

| Chief Financial Officer and | | | 2003 | | | 393,245 | | | 415,735 | (2) | | 60,000 | | | 0 | |

| Treasurer | | | | | | | | | | | | | | | | |

| |

| John E. Davies, Jr. | | | 2005 | | | 303,676 | | | 217,200 | | | 17,500 | | | 50,000 | (3) |

| President, Asia Pacific | | | 2004 | | | 304,671 | | | 265,462 | | | 60,000 | | | 0 | |

| and Latin America | | | 2003 | | | 308,773 | | | 433,600 | | | 60,000 | | | 0 | |

| |

| Per H. Levin | | | 2005 | | | 349,423 | | | 117,930 | | | 11,250 | | | 69,885 | (4) |

| President of Europe | | | 2004 | | | 347,844 | | | 122,850 | | | 60,000 | | | 69,569 | (4) |

| | | | 2003 | | | 315,579 | | | 294,010 | | | 60,000 | | | 62,813 | (4) |

| |

| David C. Donnan | | | 2005 | | | 380,690 | | | 275,500 | | | 15,000 | | | 0 | |

| President of North America | | | 2004 | | | 185,806 | | | 152,000 | | | 200,000 | | | 0 | |

| |

| John R. Van Zile | | | 2005 | | | 267,579 | | | 167,169 | | | 17,000 | | | 0 | |

| Senior Vice President, | | | 2004 | | | 243,112 | | | 109,161 | | | 30,000 | | | 0 | |

| General Counsel and Secretary | | | 2003 | | | 137,328 | | | 83,837 | | | 25,000 | | | 13,000 | (5) |

| |

| Raymond D. Andrews (6) | | | 2005 | | | 70,792 | | | 43,075 | | | 10,000 | | | 0 | |

| Vice President and | | | | | | | | | | | | | | | | |

| Chief Accounting Officer | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | |

| (1) | Consists of a relocation reimbursement of $359,407 in 2004. |

| | |

| (2) | In 2003, Mr. Burns received a special bonus of $350,000 which vested and became payable over three years. $116,666 of the special bonus is included in the 2003, 2004 and 2005 bonus award. |

| | |

| (3) | Consists of monies received from the exercise of stock options. |

| | |

| (4) | Amounts shown in All Other compensation includes pension and housing allowances related to Mr. Levin in the amount of $48,670 and $21,215 in 2005, $48,450 and $21,119 in 2004 and $43,969 and $18,844 in 2003 respectively. |

| | |

| (5) | Consists of a relocation reimbursement of $13,000. |

| | |

| (6) | Mr. Andrews employment with the Company commenced on August 1, 2005. |

24

Back to Contents

Stock Option Grants in 2005 |

The table below shows stock option grants to the individuals listed below in 2005.

Option Grants in Last Fiscal Year

| | | Number of Securities Underlying Options

Granted (#)(1) | | % of Total Options Granted to Employees in

Fiscal Year | | Exercise or Base Price

($/Share) | | Expiration

Date | | Potential Realizable Value at Assumed Annual Rates of

Stock Price Appreciation For

Option Term (2)

| |

Name | | | | | | | 5% ($) | | | 10% ($) | |

| |

| George W. Off | | | 5,903 | | | 0.7808 | | | 16.94 | | | 04/01/15 | | | 62,887 | | | 159,369 | |

| | | | 47,097 | | | 6.2298 | | | 16.94 | | | 04/01/15 | | | 501,747 | | | 1,271,525 | |

| |

| W. Craig Burns | | | 3,750 | | | 0.4960 | | | 16.94 | | | 04/01/15 | | | 39,951 | | | 101,242 | |

| | | | 7,500 | | | 0.9921 | | | 16.94 | | | 04/01/15 | | | 79,901 | | | 202,485 | |

| |

| John E. Davies, Jr. | | | 5,833 | | | 0.7716 | | | 16.94 | | | 04/01/15 | | | 62,142 | | | 157,479 | |

| | | | 11,667 | | | 1.5433 | | | 16.94 | | | 04/01/15 | | | 124,295 | | | 314,986 | |

| |

| David C. Donnan | | | 15,000 | | | 1.9841 | | | 16.94 | | | 04/01/15 | | | 159,802 | | | 404,970 | |

| |

| Per H. Levin | | | 7,500 | | | 0.9921 | | | 16.94 | | | 04/01/15 | | | 79,901 | | | 202,485 | |

| | | | 3,750 | | | 0.4960 | | | 16.94 | | | 04/01/15 | | | 39,951 | | | 101,242 | |

| |

| John R. Van Zile | | | 5,666 | | | 0.7495 | | | 16.94 | | | 04/01/15 | | | 60,363 | | | 152,971 | |

| | | | 11,334 | | | 1.4992 | | | 16.94 | | | 04/01/15 | | | 120,746 | | | 305,995 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | The top figure, where applicable, reflects an incentive stock option and the bottom figure reflects a non-qualified stock option. Under the Stock Option Plan, options vest over a period of three years at a rate of one-third per year. |

| | |

| (2) | Represents a gain that would be realized assuming the options were held until expiration and the stock price increased at compounded rates of 5% and 10% from the base price per share. The dollar amounts under these columns use the 5% and 10% rates of appreciation required by the SEC. This presentation is not intended to forecast possible future appreciation of the Company’s Common Stock. |

25

Back to Contents

Option Exercises and Fiscal Year-End Option Values |

The table below shows stock option exercises and the value of unexercised stock options held by the individuals listed below.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Name | | Shares Acquired

On Exercise (#) | | Realized

Value ($)(1) | | Number of

Securities

Underlying Unexercised

Options At

FY-End(#)(2)

Exercisable/

Unexercisable | | Value of

Unexercised

In-the-Money

Options At

FY-End ($)(3)

Exercisable/

Unexercisable | |

| |

| George W. Off | | | 0 | | | 0 | | | 490,000/133,000 | | | 6,498,688/1,016,445 | |

| |

| W. Craig Burns | | | 0 | | | 0 | | | 342,500/71,250 | | | 4,530,512/562,831 | |

| |

| John E. Davies, Jr. | | | 4,000 | | | 50,000 | | | 200,000/77,500 | | | 2,470,868/613,238 | |

| |

| David C. Donnan | | | 0 | | | 0 | | | 66,667/148,333 | | | 484,336/1,089,639 | |

| |

| Per H. Levin | | | 0 | | | 0 | | | 119,666/71,250 | | | 1,400,139/562,831 | |

| |

| John Van Zile | | | 0 | | | 0 | | | 26,667/45,333 | | | 224,287/336,918 | |

| | | | | | | | | | | | | | |

| | |

| (1) | Represents the difference between the fair market value of the shares at the date of exercise and the exercise price multiplied by the number of shares acquired. |

| | |

| (2) | The first number represents the number of exercisable but unexercised options; the second number represents the number of unexercisable options. |

| | |

| (3) | The first number represents the value based on the stock price at fiscal year-end of exercisable but unexercised options; the second number represents the value of unexercisable options. |

26

Back to Contents

LONG-TERM INCENTIVE PLANS – AWARDS IN LAST FISCAL YEAR

| Name | | Number of

Shares, Units

Or Other

Rights | | Performance Or

Other Period

Until Maturatio

Or Payout | | Estimated Future Payouts Under Non-Stock

Price-Based Plans

| |

| Threshold (1) | | Target (1) | | Maximum (1) | |

| |

| George W. Off | | | 30,000 | | | 2005-2007 | | | 15,000 | | | 30,000 | | | 60,000 | |

| |

| W. Craig Burns | | | 6,000 | | | 2005-2007 | | | 3,000 | | | 6,000 | | | 12,000 | |

| |

| John E. Davies, Jr. | | | 10,000 | | | 2005-2007 | | | 5,000 | | | 10,000 | | | 20,000 | |

| |

| David C. Donnan | | | 9,000 | | | 2005-2007 | | | 4,500 | | | 9,000 | | | 18,000 | |

| |

| Per H. Levin | | | 6,000 | | | 2005-2007 | | | 3,000 | | | 6,000 | | | 12,000 | |

| |

| John R. Van Zile | | | 10,000 | | | 2005-2007 | | | 5,000 | | | 10,000 | | | 20,000 | |

| | | | | | | | | | | | | | | | | |

| | |

| (1) | The performance-based award established for the 2005-2007 long-term incentive awards is based on a Performance Period that runs from June 2005 through December 2007. The number of shares earned is based on the Company’s performance in meeting specified operating income and operating margin goals in 2007. |

| |

Employment Agreements and Change-in-Control Arrangements |

Mr. Off has a written Employment Agreement, which expires December 31, 2008, pursuant to which Mr. Off receives an adjusted base salary of Seven Hundred Sixty-Seven Thousand Five Hundred Dollars $767,500 per annum. Mr. Off’s Agreement provides that he participate in annual incentive compensation programs, as determined by the Board of Directors, which would enable Mr. Off to earn incentive compensation up to a maximum of one hundred percent (100%) of base salary, provided specified goals and objectives are achieved. Mr. Off is also eligible for awards under the Company’s Omnibus Plan, which may be in the form of stock options, restricted stock units, performance shares or other forms of awards as determined by the Compensation Committee. Mr. Off’s Agreement provides that if the Agreement is not renewed at its expiration date, Mr. Off shall receive an amount equal to one year’s salary in effect at the time and that any stock options (other than options granted in the preceding nine (9) months prior to the termination date) shall vest immediately. Mr. Off is also subject to non-competition provisions, which range from twelve (12) to thirty (30) months from termination date, depending on various conditions of termination. Mr. Off’s Agreement also provides for payments, under certain conditions, related to Change-in Control as defined in the agreement or termination of employment by either the Company, without cause, as defined, or for good reason, as defined, during the term of Agreement. The payment under such circumstances is an amount equal to two hundred fifty percent (250%) of a combination of Mr. Off’s base salary and incentive compensation, as defined in the Agreement. After termination of employment with Company other than on account of termination by Company for cause or Executive without good reason, Mr. Off, his spouse, and his eligible dependents or survivors shall be entitled to continue to participate in such plans for life on the terms generally applied to actively employed senior management of the Company, including any employee cost sharing provisions. To the extent the terms and conditions of the aforesaid plans do not permit participation by Executive, his spouse, his dependents, or his survivors, the Company shall arrange to provide Mr. Off, his spouse, his dependents, or his survivors with the after-tax economic equivalent of such continued coverage.

Mr. Burns has a written Employment Agreement that renews annually. Under the Agreement, Mr. Burns is bound to a non-competition provision for a period of twelve (12) months from the date his employment terminates. In the event of non-voluntary

27

Back to Contents

termination, for other than cause, Mr. Burns would receive the greater of the benefits under his Employment Agreement or the Company’s Termination Policy for Executives, as defined below. Under his Employment Agreement he would receive as severance base salary and benefit continuation for twenty-four (24) months. Should a Change-in-Control of the Company take place, as defined in the Agreement, and his employment is terminated Mr. Burns would receive as severance benefits base salary continuation and various benefits for thirty-six (36) months. Mr. Burns receive a deferred bonus payment equal to $350,000, of which one-third was paid in 2004, one third was paid in January 2005; and the remaining one third was paid in January 2006. In addition, Mr. Burns agreement reflects an accrued bonus of $772,254 which was originally awarded in 2002.

Mr. Levin has a written Employment Agreement that renews annually. Mr. Levin is bound to a non-competition provision for a period of twelve (12) months from the date his employment terminates. In the event of non- voluntary termination, for other than cause, Mr. Levin would receive the greater of the benefits under his Employment Agreement or the Company’s Termination Policy for Executives, as defined below. Under his Employment Agreement he would receive as severance base salary and benefit continuation for twenty-four (24) months. Should a Change-in-Control of the Company take place, as defined in the Agreement, and his employment is terminated Mr. Levin would receive as severance benefits base salary continuation and various benefits for thirty-six (36) months. In addition to his base salary and eligibility to participate in an annual bonus plan, Mr. Levin receives a housing allowance and a $48,670 annual contribution to a private pension plan.

Each of the other Named Executives has an employment agreement or is covered by the Company’s termination policy (Policy) for Executives which the Board approved in February 2005. The contracts and Policy provide that in the absence of “cause”, the Company may terminate an Executives’ employment upon thirty (30) days written notice. In such event, subject to certain non-compete and confidentiality provisions, Executive shall be entitled to receive the following: Executive Vice President/President - 24 months; Senior Vice President - 18 months; and Vice President or General Manager -12 months

If Executive is terminated or properly terminates employment pursuant to a Change-in-Control as defined in the Policy the Executive shall be entitled to receive the following:

| | • | The Base Salary for a period equal to 1-1/2 times the Severance Payment Period; |

| | | |

| | • | Any payment to which Executive may be entitled in accordance with the terms of any applicable Bonus Plan then existing; |

| | | |

| | • | Continued participation in welfare benefit plans of the Company; |

| | | |

| | • | Accelerated vesting in any stock options or similar equity incentive rights previously granted to Executive. |

28

Back to Contents

AUDIT COMMITTEE REPORT

The Audit Committee provides the following report with respect to the Company’s audited financial statements for the fiscal year ended December 25, 2005.

Management is responsible for the Company’s internal controls and the financial reporting process. The Company has an internal audit staff, which performs testing of internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. The Committee has sole responsibility for selecting the Company’s independent auditors.

The Audit Committee has reviewed and discussed with management the Company’s fiscal 2005 audited financial statements. The Audit Committee has discussed with the Company’s independent registered public accounting firm, PricewaterhouseCoopers LLP, the matters required to be discussed by Statement on Auditing Standards No. 61 and 90. The Audit Committee has received the written disclosures and letter from PricewaterhouseCoopers required by Independence Standards Board No.1, relating to the auditors’ independence from the Company and its related entities, and has discussed with the auditors their independence from the Company.

The Audit Committee operates under a charter which is available on the Company’s website at www.checkpointsystems.com. In addition to being “independent” directors within the meaning of the New York Stock Exchange listing standards, as currently in effect, all members of the Audit Committee satisfy the heightened independence standards under the SEC rules, as currently in effect. Mr. Antle serves on the audit committee of ESCO Technologies, Inc. Mr. Elliott serves on the audit committee of Wilmington Trust Company and QSGI, Inc. The Board has determined that such simultaneous audit committee service would not impair the ability of such directors to effectively serve on the Company’s audit committee.

Based on, and in reliance upon these reviews and discussions, the Audit Committee recommended to the board of directors that the audited financial statements as of and for the year ended December 25, 2005 be included in the Company’s Annual Report on Form 10-K for the year ended December 25, 2005.

The foregoing report submitted by:

William S. Antle, III, Chairman

David W. Clark, Jr.

R. Keith Elliott

Jack W. Partridge

The foregoing Audit Committee Report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

29

Back to Contents

INDEPENDENT AUDITORS

Aggregate fees for professional services rendered by PwC in connection with its audit of the Company’s consolidated financial statements for the year ended December 25, 2005 and its limited reviews of the Company’s unaudited condensed consolidated interim financial statements were $ $2.8 million. For the year ended December 26, 2004 the amount was $2.8 million.

The Company did not engage PwC for services other than those described above in either of its last two fiscal years.

In addition to the fees described above, the Company engaged PwC to perform various tax compliance services and tax consulting for the Company for the years ended December 25, 2005 and December 26, 2004. The annual fees related to these tax related professional services were $44,000 and $397,000 respectively.

The Company did not engage PwC for services other than those described above in either of its last two fiscal years.

The Audit Committee pre-approves all audit and permissible non-audit services provided by PwC. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has adopted a policy for the pre-approval of services provided by PwC. Under the policy, pre-approval is generally provided for 12 months unless the Audit Committee specifically provides for a different period, and any pre-approval must be detailed as to the particular service or category of services and is subject to a specific budget. In addition, the Audit Committee may also approve particular services on a case by case basis. For each proposed service, PwC must provide detailed back-up documentation at the time of approval. The Audit Committee may delegate pre-approval authority to one or more of its members. Such member must report any decisions to the Audit Committee at the next scheduled meeting. The Audit Committee may not delegate to management its responsibilities to pre-approve services performed by PwC. All of the Audit, Audit-Related and Tax Fees described above were pre-approved by the Audit Committee.

30

Back to Contents

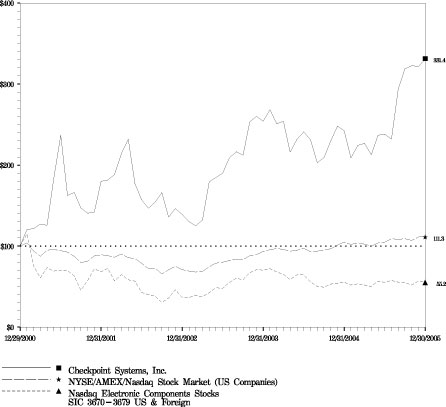

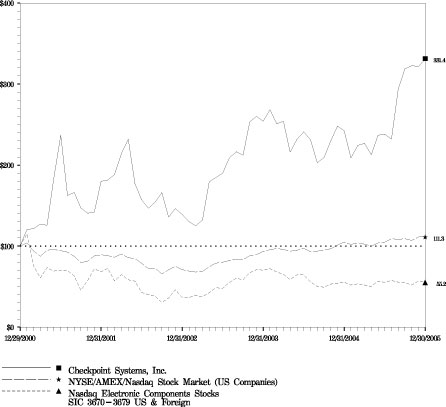

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on the Common Stock of the Company for the period beginning December 31, 2000 and ending on December 25, 2005, with the cumulative total return on the Center for Research in Security Prices Index (“CRSP Index”) for NYSE/AMEX/NASDAQ Stock market, and the CRSP Index for NASDAQ Electronic Components and Accessories, assuming the investment of $100 in the Company’s Stock, the CRSP Index for NYSE/AMEX/NASDAQ Stock market, and the CRSP Index for NASDAQ Electronic Components and Accessories and the reinvestment of all dividends.

| | | 12/2000 | | 12/2001 | | 12/2002 | | 12/2003 | | 12/2004 | | 12/2005 |

| | |

| |

| |

| |

| |

| |

|

| Checkpoint Systems, Inc. | | 100.0 | | 180.2 | | 139.0 | | 254.3 | | 242.7 | | 331.4 |

| NYSE/AMEX/Nasdaq Stock Market (US Companies) | | 100.0 | | 89.3 | | 70.9 | | 93.4 | | 104.9 | | 111.3 |

| Nasdaq Electronic Components Stocks | | 100.0 | | 68.3 | | 36.6 | | 70.4 | | 55.7 | | 55.2 |

| SIC 3670 — 3679 US & Foreign | | | | | | | | | | | | |

31

Back to Contents

The foregoing Stock Performance Graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and certain persons who own more than 10% of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, all required Section 16(a) reports during the fiscal year ended December 25, 2005, were timely filed.

SUBMISSION OF PROPOSALS FOR THE 2007 ANNUAL MEETING

Shareholders of the Company are entitled to submit proposals on matters appropriate for shareholder action consistent with regulations of the SEC and the Company’s By-Laws. If the date of the 2007 Annual Meeting of Shareholders is advanced or delayed more than 30 days from June 8, 2007, shareholder proposals intended to be included in the proxy statement for the 2007 annual meeting must be received by the Company within a reasonable time before the Company begins to print and mail its proxy materials for the 2007 annual meeting. Upon any determination that the date of the 2007 annual meeting will be advanced or delayed by more than 30 days from the date of the 2006 annual meeting, the Company will disclose the change in the earliest practicable Quarterly Report on Form 10-Q. Should a shareholder wish to have a proposal considered for inclusion in the proxy statement for the Company’s 2007 Annual Meeting, the proposal must be received at the Company’s offices no later than December 26, 2006.

In connection with the Company’s 2007 Annual Meeting, if the shareholders’ notice is not received by the Company on or before March 11, 2007, the Company (through management proxy holders) may exercise discretionary voting authority when the proposal is raised at the annual meeting without any reference to the matter in the proxy statement. However, if the date of the 2007 Annual Meeting of Shareholders has been changed by more than 30 days from the date of the 2006 annual meeting, the recommendation must be received a reasonable time before the Company begins to print and mail its proxy material for the 2007 annual meeting.

All shareholder proposals and notices should be directed to the Secretary of the Company at 101 Wolf Drive, Thorofare, New Jersey 08086.

COST OF SOLICITATION

The Company pays for distributing and soliciting proxies and reimburses brokers, nominees, fiduciaries and other custodian’s reasonable fees and expenses in forwarding proxy materials to shareholders. The Company is not using an outside proxy solicitation firm this year, but employees of the Company or its subsidiaries may solicit proxies through mail, telephone or other means. Employees do not receive additional compensation for soliciting proxies.

32

Back to Contents

HOUSEHOLDING

The SEC permits companies and intermediaries to satisfy delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement to those shareholders. This method of delivery, often referred to as “householding,” should reduce the amount of duplicate information that shareholders receive and lower printing and mailing costs for companies. The Company is not householding materials for our shareholders in connection with the Annual Meeting, however, the Company has been informed that certain intermediaries will household proxy materials.

If you wish to have only one annual report and proxy statement delivered to your address you can:

| | • | Contact us by calling (856) 848-1800 Ext. 3370 or by writing to Checkpoint Systems, Inc., 101 Wolf Drive, P.O. Box 188, Thorofare, New Jersey 08086, Attention: Corporate Secretary, to request a separate copy of the annual report and proxy statement for the Annual Meeting and for future meetings or you can contact your broker to make the same request. |

| | | |

| | • | Request delivery of a single copy of annual reports or proxy statements from your broker if you share the same address as another shareholder. |

ANNUAL REPORT ON FORM 10-K

The Company will provide, without charge, a copy of the Company’s Annual Report on Form 10-K as filed with the Securities and Exchange Commission, on written request. Written requests should be directed to the Secretary of the Company at 101 Wolf Drive, Thorofare, New Jersey 08086.

The Company’s internet website is www.checkpointsystems.com. Investors can obtain copies of the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act as soon as reasonably practicable after the Company has filed such materials with, or furnished them to, the Securities and Exchange Commission.

The Company has posted the Code of Ethics, the Governance Guidelines and each of the Committee Charters on its website at www.checkpointsystems.com, and will post on its website any amendments to, or waivers from, the Code of Ethics applicable to any of its directors or executive officers. The foregoing information will also be available in print upon request.

33

Back to Contents

OTHER BUSINESS

The Board knows of no other business for consideration at the meeting. If any matters not specifically set forth on the proxy card and in this Proxy Statement properly come before the Meeting, the persons named in the enclosed proxy will vote or otherwise act, on your behalf, in accordance with their reasonable business judgment on such matters.

BY ORDER OF THE BOARD OF DIRECTORS

John R. Van Zile

Senior Vice President,

General Counsel and Corporate Secretary

34