Exhibit 4.1

EXECUTION COPY

WARRANT AGREEMENT

by and among

COEUR D’ALENE MINES CORPORATION,

COMPUTERSHARE TRUST COMPANY, N.A.,

and

COMPUTERSHARE INC.

as Warrant Agent

Dated as of April 16, 2013

TABLE OF CONTENTS

| Page | ||||||

ARTICLE I DEFINITIONS | 1 | |||||

1.01 | Definitions | 1 | ||||

1.02 | Defined Terms Index | 5 | ||||

1.03 | Rules of Construction | 5 | ||||

ARTICLE II WARRANTS | 6 | |||||

2.01 | Form | 6 | ||||

2.02 | Global Warrants; Book-Entry Only Warrants | 8 | ||||

2.03 | Registry | 10 | ||||

2.04 | Cancellation of Warrants | 11 | ||||

2.05 | Lost, Stolen, Destroyed or Mutilated Warrants | 11 | ||||

2.06 | Transferability and Assignment | 11 | ||||

2.07 | Issuance of Certificated Warrants | 12 | ||||

2.08 | Registration and Listing | 12 | ||||

2.09 | No Impairment | 12 | ||||

2.10 | CUSIP Numbers | 12 | ||||

2.11 | Purchase of Warrants by the Company; Cancellation | 12 | ||||

2.12 | No Rights as Stockholders | 12 | ||||

ARTICLE III EXERCISE TERMS | 13 | |||||

3.01 | Exercise Number; Exercise Price; Term | 13 | ||||

3.02 | Exercise of Warrant | 13 | ||||

3.03 | [Intentionally Omitted.] | 14 | ||||

3.04 | Exercise of Certificated Warrants | 14 | ||||

3.05 | Exercise of Uncertificated Warrants | 14 | ||||

3.06 | No Fractional Shares or Scrip | 15 | ||||

3.07 | Issuance of Shares | 15 | ||||

3.08 | Issued Shares | 15 | ||||

3.09 | Reservation of Sufficient Shares | 15 | ||||

ARTICLE IV ANTIDILUTION PROVISIONS | 16 | |||||

4.01 | Antidilution Adjustments | 16 | ||||

4.02 | Certificates | 20 | ||||

ARTICLE V WARRANT AGENT | 20 | |||||

5.01 | Appointment of Warrant Agent | 20 | ||||

5.02 | Rights and Duties of Warrant Agent | 20 | ||||

5.03 | Individual Rights of Warrant Agent | 21 | ||||

5.04 | Warrant Agent’s Disclaimer | 22 | ||||

5.05 | Compensation and Indemnity | 22 | ||||

5.06 | Successor Warrant Agent | 23 | ||||

5.07 | Representations of the Company | 24 | ||||

5.08 | Anti-Money Laundering | 24 | ||||

5.09 | SEC Reporting | 25 | ||||

TABLE OF CONTENTS

(continued)

| Page | ||||||

ARTICLE VI MISCELLANEOUS | 25 | |||||

6.01 | Persons Benefitting | 25 | ||||

6.02 | Amendment | 25 | ||||

6.03 | Notices | 26 | ||||

6.04 | Governing Law | 27 | ||||

6.05 | Successors | 27 | ||||

6.06 | Multiple Originals | 27 | ||||

6.07 | Inspection of Agreement | 27 | ||||

6.08 | Table of Contents | 27 | ||||

6.09 | Severability | 27 | ||||

6.10 | Force Majeure | 28 | ||||

ii

WARRANT AGREEMENT (this “Agreement”), dated as of April 16, 2013, is entered into by and among COEUR D’ALENE MINES CORPORATION, an Idaho corporation (the “Company”), COMPUTERSHARE TRUST COMPANY, N.A., a federally chartered, limited purpose trust company (the “Trust Company”) and COMPUTERSHARE INC., a Delaware corporation (“Computershare,” and together with the Trust Company, the “Warrant Agent”).

WHEREAS, the Company, 0961994 B.C. LTD., a corporation existing under the laws of the Province of British Columbia and Orko Silver Corp. (“Orko”), a company existing under the laws of the Province of British Columbia, are parties to that certain Arrangement Agreement, dated as of February 20, 2013, as amended on March 12, 2013 (the “Arrangement Agreement”), providing for, among other things, the acquisition of Orko by the Company through the consummation of the Arrangement (as defined in the Arrangement Agreement);

WHEREAS, in partial consideration of the Arrangement, the Company has agreed to issue warrants (each a “Warrant” and collectively the “Warrants”) to acquire shares of common stock of the Company, par value $0.01 per share (the “Common Stock”; the shares of Common Stock that are issued upon exercise of the Warrants are referred to as the “Shares”); and

WHEREAS, the Company desires to provide for the form and provisions of the Warrants, the terms upon which the Warrants shall be issued and exercised and the respective rights and obligations of the Company, the Warrant Agent and the registered owners of the Warrants (each, a “Holder” and collectively, the “Holders”).

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration given to each party hereto, the receipt of which is hereby acknowledged, the Company and the Warrant Agent agree as follows:

ARTICLE I

DEFINITIONS

1.01Definitions.

“Affiliate” shall have the meaning ascribed to such term under Rule 12b-2 of the Exchange Act.

“Agent Members” means the securities brokers and dealers, banks and trust companies, clearing organizations and certain other organizations that are participants in the U.S. Depositary’s system.

“Authenticated” means (a) with respect to the issuance of Certificated Warrants, one which has been duly signed by the Company in accordance withSection 2.01(c) and authenticated by manual signature of an authorized officer of the Warrant Agent, and (b) with respect to the issuance of Book-Entry Only Warrants, one in respect of which the Warrant Agent has completed all Internal Procedures such that the particulars of such Book-Entry Warrant as required bySection 2.03 are entered in the Registry.

1

“Board of Directors” means the board of directors of the Company, including any duly authorized committee thereof.

“Book-Entry Only Participants” means the organizations that participate directly or indirectly in the Canadian Depositary’s book entry registration system for the Warrants.

“Book-Entry Only Warrant” means Warrants that are to be held only by or on behalf of the Depositories.

“Business Combination” means a merger, consolidation, statutory share exchange or similar transaction that requires the approval of the Company’s stockholders.

“business day” means any day except Saturday, Sunday and (a) at any time when the Warrants are listed on the NYSE, any day on which the NYSE is authorized or required by law or by a Governmental Agency to close, (b) at any time when the Warrants are listed on the TSX, any day on which the TSX is authorized or required by law or by a Governmental Agency to close, or (c) at any time when the Warrants are not listed on the NYSE or the TSX, any day on which banking institutions in the State of New York are authorized or required by law or other Governmental Entity to close.

“Canadian Agent” means Computershare Trust Company of Canada.

“Canadian Depositary” means CDS Clearing and Depositary Services Inc., its nominees and their respective successors.

“CDS Global Warrant” means Warrants representing all or a portion of the aggregate number of Warrants issued in the name of the Canadian Depositary represented by a Certificated Warrant, or if requested by the Canadian Depositary or the Company, by an Uncertificated Warrant.

“Capital Stock” means (a) with respect to any Person that is a corporation or company, any and all shares, interests, participations or other equivalents (however designated) of capital or capital stock of such Person, and (b) with respect to any Person that is not a corporation or company, any and all partnership or other equity interests of such Person.

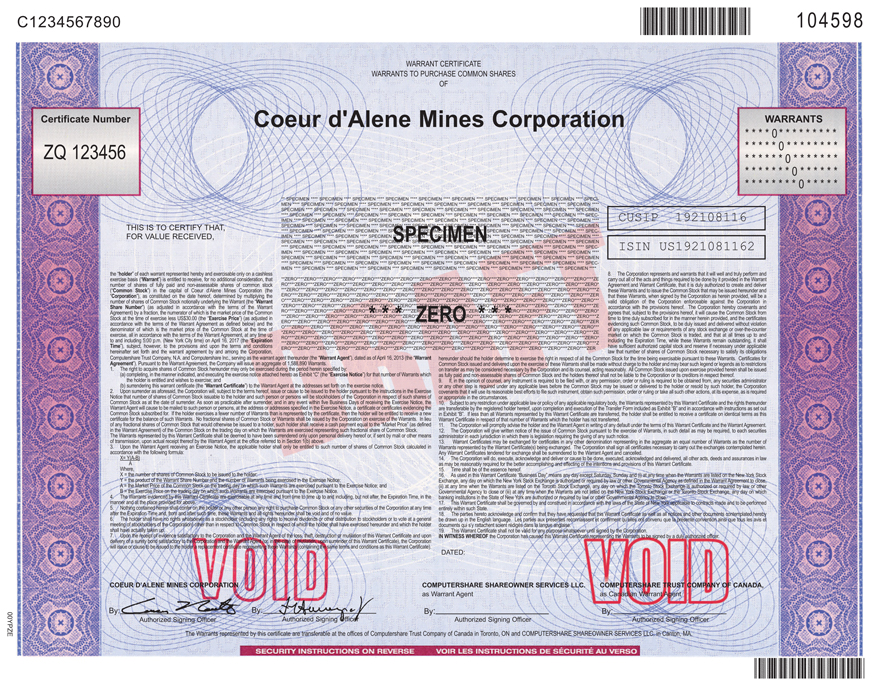

“Certificated Warrant” means any fully registered certificate issued by the Company and authenticated by the Warrant Agent under this Agreement evidencing the Warrants, substantially in the form set out inExhibit A hereto.

“Depositaries” means the U.S. Depositary and the Canadian Depositary.

“DTC Global Warrant” means Warrants representing all or a portion of the aggregate number of Warrants issued in the name of the U.S. Depositary represented by an Uncertificated Warrant, or if requested by the U.S. Depositary or the Company, by a Certificated Warrant.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

2

“Exercise Price” means $30.00, subject to adjustment as set forth herein.

“Expiration Time” means 5:00 p.m., New York City time, on April 16, 2017.

“Fair Market Value” means, with respect to any security or other property, the fair market value of such security or other property as determined by the Board of Directors, acting in good faith.

“Global Warrants” means collectively the CDS Global Warrant and the DTC Global Warrant.

“Governmental Agencies” means, collectively, all United States and other governmental, regulatory or judicial authorities.

“Internal Procedures” means in respect of the making of any one or more entries to, changes in or deletions of any one or more entries in the Registry at any time (including original issuance or registration of transfer of ownership) the minimum number of the Warrant Agent’s internal procedures customary at such time for the entry, change or deletion under the operating procedures followed at the time by the Warrant Agent.

“Market Price” at any date means the weighted average of the trading price per share of the Common Stock, calculated by dividing the total value by the total volume of the securities traded, for each day there was a closing price for the five consecutive trading days ending prior to such date on the NYSE or if on such date the Common Stock is not listed on the NYSE, on such stock exchange upon which such Common Stock is listed and as selected by the Board of Directors, acting reasonably, or, if such Common Stock is not listed on any stock exchange then on such over-the-counter market as may be selected for such purpose by the Board of Directors or, if not on any over-the-counter-market, as determined by the Board of Directors, acting reasonably;provided,however, if making such determination requires the conversion of any currency other than U.S. dollars into U.S. dollars, such conversion shall be done in accordance with customary procedures based on the rate for conversion of such currency into U.S. dollars displayed on the relevant page by Bloomberg L.P. (or any successor or replacement service) on or by 4:00 p.m., New York City time, on such exercise date. For the purposes of determining the Market Price of the Common Stock on the “trading day” preceding, on or following the occurrence of an event, (a) that trading day shall be deemed to commence immediately after the regular scheduled closing time of trading on the NYSE or, if trading is closed at an earlier time, such earlier time, and (b) that trading day shall end at the next regular scheduled closing time, or if trading is closed at an earlier time, such earlier time (for the avoidance of doubt, and as an example, if the Market Price is to be determined as of the last trading day preceding a specified event and the closing time of trading on a particular day is 4:00 p.m. and the specified event occurs at 5:00 p.m. on that day, the Market Price would be determined by reference to such 4:00 p.m. closing price). For the avoidance of doubt, if any particular security is traded on the NYSE and is also listed or traded on a non-U.S. market, “Market Price” shall be determined by reference to the NYSE.

“NYSE” means the New York Stock Exchange.

3

“Officer” means the Chief Executive Officer, the President, the Chief Financial Officer, any Vice President, the Treasurer, any Assistant Treasurer, the Secretary or any Assistant Secretary of the Company.

“Ordinary Cash Dividends” means a regular quarterly cash dividend on shares of Common Stock out of surplus or net profits legally available therefor (determined in accordance with U.S. GAAP in effect from time to time).

“Person” means an individual, corporation, partnership, joint venture, association, joint-stock company, limited liability company, limited liability partnership, trust, unincorporated organization, or Governmental Agency or political subdivision thereof or any other entity.

“Pro Rata Repurchases” means any purchase of shares of Common Stock by the Company or any Affiliate thereof pursuant to (a) any tender offer or exchange offer subject to Section 13(e) or 14(e) of the Exchange Act or Regulation 14E promulgated thereunder, or (b) any other offer available to substantially all holders of Common Stock, in the case of both (a) and (b), whether for cash, shares of Capital Stock of the Company, other securities of the Company, evidences of indebtedness of the Company or any other Person or any other property (including shares of Capital Stock, other securities or evidences of indebtedness of a subsidiary), or any combination thereof, effected while this Warrant Certificate is outstanding;provided,however, any tender offer subject to Section 13(e) or 14(e) of the Exchange Act or Regulation 14E promulgated thereunder with respect to the Company’s 3.25% convertible senior notes due 2028 shall not be considered a “Pro Rata Repurchase.” The “Effective Date” of a Pro Rata Repurchase shall mean the date of acceptance of shares for purchase or exchange by the Company under any tender or exchange offer that is a Pro Rata Repurchase or the date of purchase with respect to any Pro Rata Repurchase that is not a tender or exchange offer.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“trading day” means (a) if the shares of Common Stock are not traded on any national or regional securities exchange or association or over-the-counter market, a business day, or (b) if the shares of Common Stock are traded on any national or regional securities exchange or association or over-the-counter market, a business day on which such relevant exchange or quotation system is scheduled to be open for business and on which the shares of Common Stock (i) are not suspended from trading on any national or regional securities exchange or association or over-the-counter market for any period or periods aggregating one half hour or longer, and (ii) have traded at least once on the national or regional securities exchange or association or over-the-counter market that is the primary market for the trading of the shares of Common Stock. The term “trading day” with respect to any security other than the Common Stock shall have a correlative meaning based on the primary exchange or quotation system on which such security is listed or traded.

“Transfer Agent” means Mellon Investor Services LLC.

“TSX” means the Toronto Stock Exchange.

4

“U.S. Depositary” means The Depository Trust Company, its nominees and their respective successors.

“U.S. GAAP” means United States generally accepted accounting principles.

“Warrant Share Number” means one Share, subject to adjustment as set forth herein.

1.02Defined Terms Index.

Agreement | 1 | |||

Arrangement Agreement | 1 | |||

Common Stock | 1 | |||

Company | 1 | |||

Computershare | 1 | |||

Confirmation | 14 | |||

CUSIP | 12 | |||

Exercise Notice | 14 | |||

Holder | 1 | |||

Orko | 1 | |||

Per Share Fair Market Value | 17 | |||

Registry | 10 | |||

Shares | 1 | |||

Trust Company | 1 | |||

Uncertificated Warrant | 6 | |||

Warrant | 1 | |||

Warrant Agent | 1 |

1.03Rules of Construction. Unless the text otherwise requires:

(a) a defined term has the meaning assigned to it;

(b) an accounting term not otherwise defined has the meaning assigned to it in accordance with U.S. GAAP as in effect on the date hereof;

(c) “or” is not exclusive;

(d) “including” means including, without limitation;

(e) “$” shall mean United States dollars; and

(f) words in the singular include the plural and words in the plural include the singular.

5

ARTICLE II

WARRANTS

2.01Form.

(a)Form of Warrants. Each Warrant shall be either (i) a Certificated Warrant;provided,however, that no Warrant may be issued as a Certificated Warrant without the prior written consent of the Company, or (ii) represented by book entry registration on the books and records of the Warrant Agent (each an “Uncertificated Warrant” and collectively the “Uncertificated Warrants”), which Uncertificated Warrants shall be held by or on behalf of the Depositaries. All Global Warrants may be either Certificated Warrants or Uncertificated Warrants. Each Certificated Warrant and Uncertificated Warrant, as applicable, shall have such insertions as are required or permitted by this Agreement and may have such letters, numbers or other marks of identification and such legends and endorsements, stamped, printed, lithographed or engraved thereon, as may be required to comply with this Agreement, any applicable law or any rule of any securities exchange on which the Warrants may be listed, including the NYSE and the TSX.

(b)Execution and Countersignature. Each Certificated Warrant shall be executed on behalf of the Company by an Officer of the Company and attested by its Secretary or an Assistant Secretary. The signature of any such Officers on the Certificated Warrants may be manual or facsimile. Certificated Warrants bearing the manual or facsimile signatures of individuals who were at any time the Officers of the Company shall bind the Company, notwithstanding that such individuals or any one of them shall have ceased to hold such offices prior to the delivery of such Warrants or did not hold such offices on the date of this Agreement. Each Certificated Warrant shall be countersigned by the Warrant Agent (or any successor to the Warrant Agent then acting as warrant agent under this Agreement) by manual or facsimile signature and shall not be valid for any purpose unless and until so countersigned. Certificated Warrants may be countersigned and delivered, notwithstanding the fact that the persons or any one of them who countersigned the Warrants shall have ceased to be proper signatories prior to the delivery of such Warrants or were not proper signatories on the date of this Agreement. Each Certificated Warrant shall be dated as of the date of its countersignature by the Warrant Agent. The Warrant Agent’s countersignature shall be conclusive evidence that the Warrant Certificate so countersigned has been duly authenticated and issued under this Agreement.

(c)Authentication of Certificated Warrants.

(i) Each Certificated Warrant shall be Authenticated manually on behalf of the Warrant Agent.

(ii) Any Certificated Warrant validly issued and Authenticated in accordance with the terms of this Agreement in effect at the time of issue of such Certificated Warrant shall, subject to the terms of this Agreement and applicable law, validly entitle the holder to acquire Shares, notwithstanding that the form of such Certificated Warrant may not be in the form currently required by this Agreement.

6

(d)Authentication of Uncertificated Warrants. The Warrant Agent shall authenticate Uncertificated Warrants (whether upon original issuance, exchange, registration of transfer, partial payment, or otherwise) by completing its Internal Procedures and the Company shall, and hereby acknowledges that it shall, thereupon be deemed to have duly and validly issued such Uncertificated Warrants under this Agreement. Such Authentication shall be conclusive evidence that such Uncertificated Warrant has been duly issued hereunder and that the Holder or Holders are entitled to the benefits of this Agreement. The Registry shall be final and conclusive evidence as to all matters relating to Uncertificated Warrants with respect to which this Agreement requires the Warrant Agent to maintain records or accounts. In case of differences between the Registry at any time and any later time, the Registry at the later time shall be controlling, absent manifest error and such Uncertificated Warrants are binding on the Company.

(e)Validity of Authentication. No Warrant shall be considered issued, valid or an obligation of the Company or shall entitle the Holder thereof to the benefits of this Agreement, until it has been Authenticated by the Warrant Agent. Authentication by the Warrant Agent, including by way of entry on the Registry, shall not be construed as a representation or warranty by the Warrant Agent as to the validity of this Agreement or of such Certificated Warrants or Uncertificated Warrants (except the due Authentication thereof) or as to the performance by the Company of its obligations under this Agreement and the Warrant Agent shall in no respect be liable for the use made of the Warrants. Authentication by the Warrant Agent shall be conclusive evidence as against the Company that the Warrants so Authenticated have been duly issued hereunder and that the Holder thereof is entitled to the benefits of this Agreement.

(f)Canadian Depositary Legend. Each CDS Global Warrant held by the Canadian Depositary (whether a Certificated Warrant or Uncertificated Warrant), and each CDS Global Warrant issued in exchange or in substitution therefor shall bear or be deemed to bear the following legend or such variation thereof as the Company may prescribe from time to time:

“UNLESS THIS WARRANT IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF CDS CLEARING AND DEPOSITORY SERVICES INC. (“CDS”) TO COEUR D’ALENE MINES CORPORATION (THE “ISSUER”) OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY WARRANT ISSUED IN RESPECT THEREOF IS REGISTERED IN THE NAME OF CDS & CO., OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF CDS (AND ANY PAYMENT IS MADE TO CDS & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF CDS), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL SINCE THE REGISTERED HOLDER HEREOF, CDS & CO., HAS A PROPERTY INTEREST IN THE SECURITIES REPRESENTED BY THIS WARRANT HEREIN AND IT IS A VIOLATION OF ITS RIGHTS FOR ANOTHER PERSON TO HOLD, TRANSFER OR DEAL WITH THIS WARRANT.”

7

(g)U.S. Depositary Legend. Each DTC Global Warrant held by the U.S. Depositary (whether a Certificated Warrant or Uncertificated Warrant), and each DTC Global Warrant issued in exchange or in substitution therefor shall bear or be deemed to bear the following legend or such variation thereof as the Company may prescribe from time to time:

“UNLESS THIS WARRANT IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), NEW YORK, NEW YORK, TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY WARRANT CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

TRANSFERS OF THIS WARRANT SHALL BE LIMITED TO TRANSFERS IN WHOLE, BUT NOT IN PART, TO NOMINEES OF DTC OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE AND TRANSFERS OF PORTIONS OF THIS WARRANT SHALL BE LIMITED TO TRANSFERS MADE IN ACCORDANCE WITH THE RESTRICTIONS SET FORTH IN THE WARRANT AGREEMENT REFERRED TO ON THE REVERSE HEREOF.”

2.02Global Warrants; Book-Entry Only Warrants.

(a) The DTC Global Warrant will be issued as an Uncertificated Warrant, unless otherwise requested in writing by DTC or the Company. The CDS Global Warrant will be issued as a Certificated Warrant, unless otherwise requested in writing by CDS or the Company.

(b) Registration of Book-Entry Only Warrants held by either Depositary shall be made only through the book entry registration system of such Depositary and no Certificated Warrants shall be issued in respect of such Warrants except as set forth herein or as may be requested by such Depositary, with the prior written consent of the Company. Except as provided in this section, beneficial holders of Book-Entry Only Warrants shall not be entitled to have Warrants registered in their names and shall not receive or be entitled to receive Certificated Warrants or to have their names appear in the Registry.

(c) Notwithstanding any other provision in this Agreement, no Global Warrants may be exchanged in whole or in part for Warrants registered, and no transfer of any Global Warrants in whole or in part may be registered, in the name of any Person other than the Canadian Depositary or U.S. Depositary, as applicable, or a nominee thereof unless:

(i) the applicable Depositary notifies the Company that it is unwilling or unable to continue to act as depositary in connection with the Global Warrants and the Company is unable to locate a qualified successor;

8

(ii) the Company determines that the applicable Depositary is no longer willing, able or qualified to discharge properly its responsibilities as holder of the applicable Global Warrants and the Company is unable to locate a qualified successor;

(iii) the applicable Depositary ceases to be a clearing agency or otherwise ceases to be eligible to be a depositary and the Company is unable to locate a qualified successor;

(iv) the Company determines that the Warrants shall no longer be held as Uncertificated Warrants through the Depositories; or

(v) such right is required by applicable law, as determined by the Company and outside counsel to the Company;

following which, Warrants for those beneficial holders of Book-Entry Only Warrants shall be evidenced by Certificated Warrants registered in the Registry in the name of a Person other than the Depositories. The Company shall provide notice to the Warrant Agent of the occurrence of any event outlined in thisSection 2.02(c).

(d) The rights of beneficial owners of Book-Entry Only Warrants shall be limited to those established by applicable law and agreements between either of the Depositories, on the one hand, and the Agent Members or Book-Entry Only Participants, on the other hand, and between such Agent Members or Book-Entry Only Participants and the beneficial owners of such Book-Entry Only Warrants, and such rights must be exercised through an Agent Member or Book-Entry Only Participant in accordance with the rules and procedures of the applicable Depositary.

(e) Notwithstanding anything in this Agreement to the contrary, neither the Company nor the Warrant Agent, nor any agent thereof shall have any responsibility or liability for:

(i) the electronic records maintained by either Depositary relating to any ownership interests or any other interests in the Warrants or the depositary system maintained by such Depositary, or payments made on account of any ownership interest or any other interest of any person in any Warrant represented by an electronic position in the book entry registration system (other than either Depositary or its nominee);

(ii) maintaining, supervising or reviewing any records of either Depositary or any Agent Member or Book-Entry Only Participant relating to any such interest; or

(iii) any advice or representation made or given by either Depositary or those contained herein that relate to the rules and regulations of such Depositary or any action to be taken by either Depositary on its own direction or at the direction of any Agent Member or Book-Entry Only Participant.

(f) The Company may terminate the application of thisSection 2.02 in its sole discretion in which case all Warrants shall be evidenced by Certificated Warrants registered in the Registry in the name of a Person other than the Depositories.

9

2.03Registry.

(a) The Warrant Agent shall maintain records and accounts concerning the Warrants, whether Certificated Warrants or Uncertificated Warrants, which shall contain the information called for below with respect to each Warrant, together with such other information as may be required by law or as the Warrant Agent may elect to record. All such information shall be kept in one set of accounts and records which the Warrant Agent shall designate (in such manner as shall permit it to be so identified as such by an unaffiliated party) as the register (the “Registry”) of the Holders. The information to be entered for each account in the Registry shall include:

(i) the name and address of the Holder, the date of Authentication thereof and the number Warrants;

(ii) whether such Warrant is a Certificated Warrant or an Uncertificated Warrant and, if a Certificated Warrant, the unique number or code assigned to and imprinted thereupon and, if an Uncertificated Warrant, the unique number or code assigned thereto, if any;

(iii) whether such Warrant has been cancelled; and

(iv) a register of transfers in which all transfers of Warrants and the date and other particulars of each transfer shall be entered.

(b) Once an Uncertificated Warrant has been Authenticated, the information set forth in the Registry with respect thereto at the time of Authentication may be altered, modified, amended, supplemented or otherwise changed only to reflect exercise or proper instructions to the Warrant Agent from the Holder as provided herein, except that the Warrant Agent may act unilaterally to make purely administrative changes internal to the Warrant Agent and changes to correct errors. Each person who becomes a Holder of an Uncertificated Warrant, by his, her or its acquisition thereof shall be deemed to have irrevocably (i) consented to the foregoing authority of the Warrant Agent to make such minor error corrections, and (ii) agreed to pay to the Warrant Agent, promptly upon written demand, the full amount of all loss and expense (including reasonable legal fees of the Company and the Warrant Agent plus interest, at an appropriate then prevailing rate of interest to the Warrant Agent), sustained by the Company or the Warrant Agent as a result of such error if but only if and only to the extent that such Holder realized any benefit as a result of such error and could reasonably have prevented, forestalled or minimized such loss and expense by prompt reporting of the error or avoidance of accepting benefits thereof whether or not such error is or should have been timely detected and corrected by the Warrant Agent;provided, that no person who is a bona fide purchaser shall have any such obligation to the Company or to the Warrant Agent.

(c) The Holder of any Global Warrant will be the applicable Depositary or their respective nominees in whose name the Warrant is registered. The Warrant holdings of Agent Members or Book-Entry Only Participants will be recorded on the books of the applicable Depositary. The beneficial interests in the Global Warrant held by customers of Agent Members or Book-Entry Only Participants will be reflected on the books and records of such Agent Member or Book-Entry Only Participant, and will not be known to the Warrant Agent, the Company or to either Depositary.

10

2.04Cancellation of Warrants. If and when any Certificated Warrant has been exercised in full, the Warrant Agent shall promptly cancel such Certificated Warrant following its receipt from the Holder or, to the extent required by applicable law, retain such Certificated Warrant. Upon exercise of a Certificated Warrant in part and not in full, the Warrant Agent shall, subject toArticle III, issue and deliver or shall cause to be issued and delivered to the Holder a new Certificated Warrant evidencing the Holder’s remaining Warrants. If requested by the Company, at the Company’s discretion, the Warrant Agent shall deliver to the Company the cancelled Certificated Warrants. The Warrant Agent and no one else may cancel Certificated Warrants surrendered for transfer, exchange, replacement, cancellation or exercise. The Company may not issue new Certificated Warrants to replace cancelled Certificated Warrants that have been exercised or purchased by it. If and when any Uncertificated Warrant has been exercised, whether in part or in full, the Warrant Agent shall promptly reflect such exercise on the books and records of the Warrant Agent in book entry form.

2.05Lost, Stolen, Destroyed or Mutilated Warrants. If any of the Certificated Warrants shall be mutilated, lost, stolen or destroyed, the Warrant Agent shall countersign and deliver, in exchange and substitution for, and upon cancellation of the mutilated Certificated Warrant, or in lieu of and substitution for the Certificated Warrant lost, stolen or destroyed, a new Certificated Warrant of like tenor and representing an equivalent number of Warrants, but only upon receipt of evidence reasonably satisfactory to the Warrant Agent of the loss, theft or destruction of such Certificated Warrant and an affidavit and agreement to indemnify the Warrant Agent and Company satisfactory to it. Applicants for such substitute Certificated Warrant shall also comply with such other reasonable regulations and pay such other reasonable charges as the Warrant Agent may prescribe and as required by Section 8-405 of the Uniform Commercial Code as in effect in the State of New York.

2.06Transferability and Assignment.

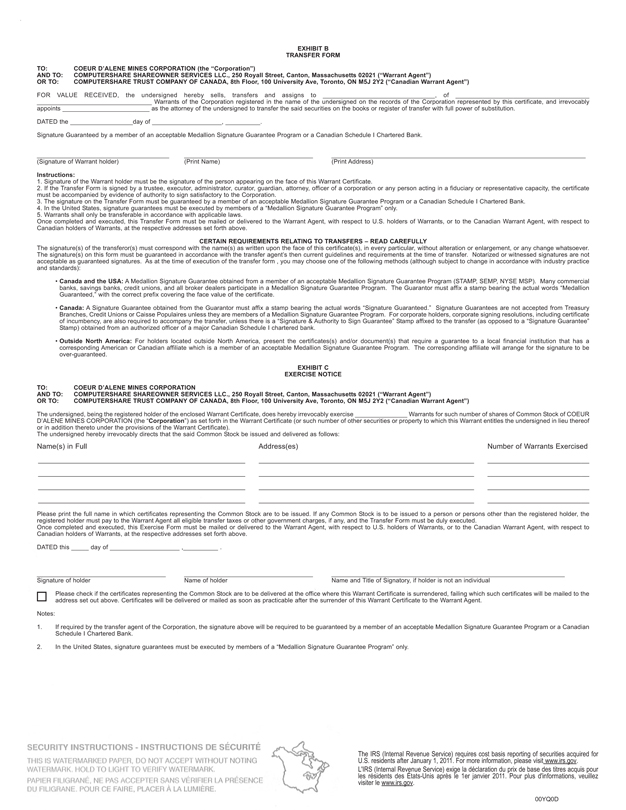

(a) The Warrants may only be transferred on the Registry upon receipt of an instrument in writing in form and execution satisfactory to the Warrant Agent upon (i) in the case of a Certificated Warrant, surrendering to the Warrant Agent the Certificated Warrants representing the Warrants to be transferred together with a duly executed transfer form as set forth inExhibit B, (ii) in the case of a Book-Entry Only Warrant, in accordance with procedures prescribed by the applicable Depositary under the book entry registration system, and (iii) upon compliance with:

a) the conditions herein;

b) such reasonable requirements as the Warrant Agent may prescribe; and

c) all applicable securities legislation and requirements of regulatory authorities;

and such transfer shall be duly noted in such Registry by the Warrant Agent. Upon compliance with such requirements, the Warrant Agent shall issue to the transferee of a Certificated Warrant, a Certificated Warrant and to the transferee of an Uncertificated Warrant, an Uncertificated

11

Warrant, in each case representing the Warrants transferred and the transferee of a Book-Entry Only Warrant shall be recorded through the relevant Agent Member or Book-Entry Only Participant in accordance with the book entry registration system of such Agent Member or Book-Entry Only Participant.

2.07Issuance of Certificated Warrants. When any Holder, transferee of a Holder or other designee of a Holder is entitled to receive a new or replacement Certificated Warrant, the Warrant Agent shall issue or shall cause to be issued such new or replacement Certificated Warrant as promptly as reasonably practicable.

2.08Registration and Listing. The Company shall register or shall cause to be registered any and all shares of its Common Stock (including the Shares) and the Warrants under the Exchange Act, and the Company shall use commercially reasonable efforts to maintain such registration of such shares of its Common Stock (including the Shares) and all the Warrants. The Company shall use reasonable best efforts to (a) procure, or cause to be procured, at its sole expense, the listing of the Shares, subject to issuance or notice of issuance, on all principal stock exchanges the Common Stock is listed and traded on and the listing of the Warrants, subject to issuance or notice of issuance, on the NYSE and the TSX, and (b) maintain such listings at all times until the Expiration Date. The Company shall use reasonable best efforts to ensure that the Shares and the Warrants may be issued without violation of any applicable law or regulation or of any requirement of any securities exchange on which such shares of its Common Stock (including the Shares) and the Warrants are listed or traded.

2.09No Impairment. The Company will not, and the Company will cause its subsidiaries not to, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed by the Company under this Agreement. The Company shall at all times in good faith assist in the carrying out of all provisions of this Agreement and in the taking of all such action as may be necessary or appropriate in order to protect the rights of the Holders.

2.10CUSIP Numbers. The Company, in issuing the Warrants, may use “CUSIP” numbers (if then generally in use) and, if so, the Warrant Agent shall use CUSIP numbers in notices as a convenience to Holders;provided,however, that any such notice may state that no representation is made as to the correctness of such numbers either as printed on the Certificated Warrants or as contained in any notice and that reliance may be placed only on the other identification numbers printed on the Certificated Warrants.

2.11Purchase of Warrants by the Company; Cancellation. The Company shall have the right, except as limited by law, other agreements or as provided herein, to purchase or otherwise acquire Warrants at such times, in such manner and for such consideration as it and the applicable Holder may deem appropriate and approve. In the event the Company shall purchase or otherwise acquire Warrants, the same shall thereupon be delivered to the Warrant Agent and retired and, for the avoidance of doubt, if the approval of Holders is required to take any action, the Company’s (or any of its Affiliates’) ownership in any Warrants shall not be considered in calculating whether the requisite number of Holders have approved such action.

2.12No Rights as Stockholders. A Warrant shall not, prior to its exercise, confer upon its Holder or such Holder’s transferee, in such Holder’s or such transferee’s capacity as a

12

Holder, the right to vote or receive dividends, or consent or receive notice as stockholders in respect of any meeting of stockholders for the election of directors of the Company or any other matter, or any rights whatsoever as stockholders of the Company. The Company agrees that the Shares so issued will be deemed to have been issued to a Holder as of the close of business on the date on which the Warrants were duly exercised, notwithstanding that the stock transfer books of the Company may then be closed or certificates (if any) representing such Shares may not be actually delivered on such date.

ARTICLE III

EXERCISE TERMS

3.01Exercise Number; Exercise Price; Term. Each Warrant initially entitles its Holder to purchase from the Company the Warrant Share Number of Shares for the Exercise Price. The Warrant Share Number and the Exercise Price are subject to adjustment as provided inArticle IV, and all references to “Warrant Share Number” and “Exercise Price” in this Agreement shall be deemed to include any such adjustment or series of adjustments. All or a portion of the Warrants are exercisable by the Holder at any time and from time to time on or after the date of this Agreement until the Expiration Time.

3.02Exercise of Warrant.

(a) Upon the Warrant Agent receiving an Exercise Notice or a Confirmation, the applicable Holder or beneficial holder of Book-Entry Only Warrants, as the case may be, shall be entitled to such number of Shares calculated in accordance with the following formula:

| X | = | Y (A-B) | ||||||||

A |

Where,

X = the number of Shares to be issued to the Holder or beneficial holder of Book-Entry Only Warrants;

Y = the product of the Warrant Share Number and the number of Warrants being exercised in the Exercise Notice or the Confirmation, as the case may be;

A = the Market Price of the Common Stock on the trading day on which such Warrants are exercised pursuant to the Exercise Notice or the Confirmation, as the case may be; and

B = the Exercise Price on the trading day on which such Warrants are exercised pursuant to the Exercise Notice or the Confirmation, as the case may be.

(b) The Warrant Agent shall have no obligation under this section to calculate the number of Shares to be issued under this section.

13

3.03 [Intentionally Omitted.]

3.04Exercise of Certificated Warrants. Holders of Certificated Warrants who wish to exercise the Warrants held by them in order to acquire Shares must complete the exercise form (the “Exercise Notice”), which form is attached hereto asExhibit C and which may be amended by the Company with the consent of the Warrant Agent, if such amendment does not, in the reasonable opinion of the Company and the Warrant Agent, materially and adversely affect the rights, entitlements and interests of the Holders, and deliver such Certificated Warrant(s) and the executed Exercise Notice to the Warrant Agent in the manner set forth inSection 6.03. The Warrants represented by a Certificated Warrant shall be deemed to be surrendered upon personal delivery of such certificate and Exercise Notice or, if such documents are sent by mail or other means of transmission, upon actual receipt thereof by the Warrant Agent. Any Exercise Notice referred to in thisSection 3.04 shall be signed by the Holder, or its executors or administrators or other legal representatives or an attorney of the Holder, duly appointed by an instrument in writing satisfactory to the Warrant Agent but such Exercise Notice need not be executed by the Depositary.

3.05Exercise of Uncertificated Warrants.

(a) A beneficial holder of Book-Entry Only Warrants who desires to exercise his or her Warrants must do so by causing an Agent Member or Book-Entry Only Participant to deliver to the Depositary on behalf of such beneficial holder, notice of such beneficial holder’s intention to exercise Warrants in a manner acceptable to the Depositary. Upon receipt by the Depositary of such notice the Depositary shall deliver to the Warrant Agent confirmation of its intention to exercise Warrants (a “Confirmation”) in a manner acceptable to the Warrant Agent, including by electronic means through the book entry registration system.

(b) The applicable Depositary will initiate the exercise by way of the Confirmation and the Warrant Agent will execute the exercise by issuing to the Depositary through the book entry registration system the Shares to which the exercising beneficial holder of Book-Entry Only Warrants is entitled pursuant to the exercise. Any expense associated with the exercise process will be for the account of the beneficial holder exercising the Warrants or the Agent Member or Book-Entry Only Participant exercising the Warrants on its behalf.

(c) By causing an Agent Member or Book-Entry Only Participant to deliver notice to the Depositary, a beneficial holder of Book-Entry Only Warrants shall be deemed to have irrevocably surrendered his or her Warrants so exercised and appointed such Agent Member or Book-Entry Only Participant to act as his or her exclusive settlement agent with respect to the exercise and the receipt of Shares in connection with the obligations arising from such exercise.

(d) Any notice which the applicable Depositary determines to be incomplete, not in proper form or not duly executed shall for all purposes be void and of no effect and the exercise to which it relates shall be considered for all purposes not to have been exercised thereby. A failure by an Agent Member or Book-Entry Only Participant to exercise or to give effect to the settlement thereof in accordance with the beneficial holder’s instructions will not give rise to any obligations or liability on the part of the Company or Warrant Agent to the Agent Member or Book-Entry Only Participant or the beneficial holder of the Book-Entry Only Warrants.

14

3.06No Fractional Shares or Scrip.

(a) No fractional Shares or scrip representing fractional Shares shall be issued upon any exercise of Warrants. In lieu of any fractional Shares that would otherwise be issued to a Holder or beneficial holder of Book-Entry Only Warrants upon exercise of any Warrants, such Person shall receive a cash payment equal to the Market Price of the Common Stock on the trading day on which such Warrants are exercised representing such fractional Share.

(b) The Company acknowledges that the bank accounts maintained by Computershare, if any, in connection with the services provided under this Agreement, including holding funds for fractional shares under this section, will be in its name and that Computershare may receive investment earnings in connection with the investment at Computershare’s sole risk and for its benefit of funds held in those accounts from time to time;provided any losses associated with such investments shall not reduce or affect Computershare’s obligation to hold such funds in trust on behalf of the Company, distribute such funds in lieu of fractional Shares or return such funds to the Company. Neither the Company nor the Holders will receive interest on any such deposits, to the extent such funds are held by Computershare hereunder.

3.07Issuance of Shares. Upon the exercise of any Certificated Warrants, the Warrant Agent shall deliver or shall cause to be delivered the number of full Shares to which such Holder shall be entitled, together with any cash to which such Holder shall be entitled in respect of fractional Shares pursuant toSection 3.06, as promptly as reasonably practicable. All Shares shall be issued in such name or names as the exercising Holder may designate and delivered to the exercising Holder or its nominee or nominees. Upon the exercise of any Book-Entry Only Warrants, the Warrant Agent shall deliver or shall cause to be delivered the number of full Shares to which such beneficial holder shall be entitled, together with any cash to which such beneficial holder shall be entitled in respect of fractional Shares pursuant toSection 3.06, through the applicable Depositary’s book entry system.

3.08Issued Shares. The Company hereby represents and warrants that all Shares issued in accordance with the terms of this Agreement will be duly and validly authorized and issued, fully paid and nonassessable and free from all taxes, liens and charges (other than liens or charges created by a Holder or beneficial holder of Book-Entry Only Warrant, income and franchise taxes incurred in connection with the exercise of the Warrant or taxes in respect of any transfer occurring contemporaneously therewith). The Company agrees that the Shares so issued will be deemed to have been issued to a Holder or beneficial holder of Book-Entry Only Warrant as of the close of business on the date on which the Warrants were duly exercised, notwithstanding that the stock transfer books of the Company may then be closed or certificates (if any) representing such Shares may not be actually delivered on such date.

3.09Reservation of Sufficient Shares.

(a) There have been reserved, and the Company shall at all times through the Expiration Date keep reserved, out of its authorized but unissued Common Stock, solely for the purpose of the issuance of Shares in accordance with the terms of this Agreement, a number of shares of Common Stock sufficient to provide for the exercise of the rights of purchase

15

represented by the outstanding Warrants. The Transfer Agent for the Common Stock and every subsequent transfer agent for any shares of the Company’s Capital Stock issuable upon the exercise of any of the rights of purchase aforesaid shall be irrevocably authorized and directed at all times to reserve such number of authorized Shares as shall be required for such purpose. If applicable, the Company shall supply the Transfer Agent with duly executed stock certificates for such purposes and shall provide or otherwise make available any cash that may be payable upon exercise of Warrants in respect of fractional Shares pursuant toSection 3.06. The Company shall furnish the Transfer Agent with a copy of all notices of adjustments and certificates related thereto, transmitted to each Holder and beneficial holder of Book-Entry Only Warrants pursuant toSection 6.03.

(b) The Company shall provide an opinion of counsel prior to the consummation of the Arrangement, which will provide that all Warrants or Shares, as applicable, are or will be:

(i) issued pursuant to an effective registration statement pursuant to the Securities Act or pursuant to an exemption thereof, and all required state securities law filings have been made, or will be made at the time of issuance, with respect to such Warrants and Shares; and

(ii) validly issued, fully paid and non-assessable.

ARTICLE IV

ANTIDILUTION PROVISIONS

4.01Antidilution Adjustments. The Exercise Price and the Warrant Share Number shall, subject to any applicable law or any rule of any securities exchange on which the Warrants may be listed, including the NYSE and the TSX, be subject to adjustment from time to time as follows;provided that if more than one subsection of thisArticle IV is applicable to a single event, the subsection shall be applied that produces the largest adjustment and no single event shall cause an adjustment under more than one subsection of thisArticle IV so as to result in duplication:

(a)Stock Splits, Subdivisions, Reclassifications or Combinations. If the Company shall (i) declare and pay a dividend or make a distribution on its Common Stock in shares of Common Stock, (ii) subdivide, split or reclassify the outstanding shares of Common Stock into a greater number of shares, or (iii) combine, reverse split or reclassify the outstanding shares of Common Stock into a smaller number of shares, the Warrant Share Number at the time of the record date for such dividend or distribution or the effective date of such subdivision, split, combination, reverse split or reclassification shall be proportionately adjusted so that the Warrant after such date shall represent the right to purchase the number of shares of Common Stock if such Warrant had been exercised immediately prior to such date. In such event, the Exercise Price in effect immediately prior to the record date for such dividend or distribution or the effective date of such subdivision, split, combination, reverse split or reclassification shall be adjusted by multiplying such Exercise Price by the quotient of (x) the Warrant Share Number immediately prior to such adjustment divided by (y) the new Warrant Share Number determined pursuant to the immediately preceding sentence.

16

(b)Other Distributions. In case the Company shall fix a record date for the making of a distribution to all holders of shares of its Common Stock of securities, evidences of indebtedness, assets, cash, rights or warrants (excluding Ordinary Cash Dividends, dividends of its Common Stock and other dividends or distributions referred to inSection 4.01(a)), in each such case, the Exercise Price in effect prior to such record date shall be reduced immediately thereafter to the price determined by multiplying the Exercise Price in effect immediately prior to the reduction by the quotient of (i) the Market Price of the Common Stock on the last trading day preceding the first date on which the Common Stock trades regular way on the principal national securities exchange in the U.S. on which the Common Stock is listed or admitted to trading without the right to receive such distribution, minus the amount of cash or the Fair Market Value of the securities, evidences of indebtedness, assets, rights or warrants to be so distributed in respect of one share of Common Stock (such subtracted amount or Fair Market Value, the “Per Share Fair Market Value”) divided by (ii) such Market Price on such date specified in clause (i); such adjustment shall be made successively whenever such a record date is fixed. In such event, the Warrant Share Number shall be increased to the number obtained by multiplying the Warrant Share Number immediately prior to such adjustment by the quotient of (x) the Exercise Price in effect immediately prior to the distribution giving rise to this adjustment divided by (y) the new Exercise Price determined in accordance with the immediately preceding sentence. In the case of adjustment for a cash dividend that is, or is coincident with an Ordinary Cash Dividend, the Per Share Fair Market Value would be reduced by the per share amount of the portion of the cash dividend that would constitute an Ordinary Cash Dividend. In the event that such distribution is not so made, the Exercise Price and the Warrant Share Number then in effect shall be readjusted, effective as of the date when the Board of Directors determines not to distribute such shares, evidences of indebtedness, assets, rights, cash or warrants, as the case may be, to the Exercise Price and the Warrant Share Number that would then be in effect if such record date had not been fixed.

(c)Certain Repurchases of Common Stock. In case the Company effects a Pro Rata Repurchase of Common Stock, then the Exercise Price shall be reduced to the price determined by multiplying the Exercise Price in effect immediately prior to the Effective Date of such Pro Rata Repurchase by a fraction of which (i) the numerator shall be (x) the product of (A) the number of shares of Common Stock outstanding immediately before such Pro Rata Repurchase and (B) the Market Price of a share of Common Stock on the trading day immediately preceding the first public announcement by the Company or any of its Affiliates of the intent to effect such Pro Rata Repurchase, minus (y) the aggregate purchase price of the Pro Rata Repurchase, and of which (ii) the denominator shall be the product of (x) the number of shares of Common Stock outstanding immediately prior to such Pro Rata Repurchase minus the number of shares of Common Stock so repurchased, and (y) the Market Price per share of Common Stock on the trading day immediately preceding the first public announcement by the Company or any of its Affiliates of the intent to effect such Pro Rata Repurchase. In such event, the Warrant Share Number shall be increased to the number obtained by multiplying the Warrant Share Number immediately prior to such adjustment by the quotient of (x) the Exercise Price in effect immediately prior to the Pro Rata Repurchase giving rise to this adjustment divided by (y) the new Exercise Price determined in accordance with the immediately preceding sentence. For the avoidance of doubt, no increase to the Exercise Price or decrease in the Warrant Share Number shall be made pursuant to thisSection 4.01(c).

17

(d)Business Combinations or Reclassifications of Common Stock. In case of any Business Combination or reclassification of Common Stock (other than a reclassification of Common Stock referred to inSection 4.01(a)), a Holder’s or beneficial holder of a Book-Entry Only Warrant’s right to receive Shares upon exercise of a Warrant shall be converted into the right to exercise such Warrant to acquire the number of shares of stock or other securities or property (including cash) which the Common Stock issuable (at the time of such Business Combination or reclassification) upon exercise of such Warrant immediately prior to such Business Combination or reclassification would have been entitled to receive upon consummation of such Business Combination or reclassification; and in any such case, if necessary, the provisions set forth herein with respect to the rights and interests thereafter of such Person shall be appropriately adjusted so as to be applicable, as nearly as may reasonably be, to such Person’s right to exercise a Warrant in exchange for any shares of stock or other securities or property pursuant to this paragraph. In determining the kind and amount of stock, securities or the property receivable upon exercise of a Warrant following the consummation of such Business Combination, if the holders of Common Stock have the right to elect the kind or amount of consideration receivable upon consummation of such Business Combination, then the consideration that a Holder or beneficial owner of a Book-Entry Only Warrant shall be entitled to receive upon exercise shall be deemed to be the types and amounts of consideration received by the majority of all holders of the shares of Common Stock that affirmatively make an election (or of all such holders if none make an election). For purposes of determining any amount to be withheld pursuant toArticle III from stock, securities or the property that would otherwise be delivered to a Person upon exercise of Warrants following any Business Combination, the amount of such stock, securities or property to be withheld shall have a Market Price equal to the aggregate Exercise Price as to which such Warrants are so exercised, based on the fair market value of such stock, securities or property on the trading day on which such Warrants are exercised and the Exercise Notice, with respect to Certificated Warrants, or Confirmation, with respect to Book-Entry Only Warrants, is delivered to the Warrant Agent;provided that in the case of any property that is not a security, the Market Price of such property shall be deemed to be its fair market value as determined in good faith by the Board of Directors in reliance on an opinion of a nationally recognized independent investment banking firm retained by the Company for this purpose; andfurther,provided that if making such determination requires the conversion of any currency other than U.S. dollars into U.S. dollars, such conversion shall be done in accordance with customary procedures based on the rate for conversion of such currency into U.S. dollars displayed on the relevant page by Bloomberg L.P. (or any successor or replacement service) on or by 4:00 p.m., New York City time, on such exercise date.

(e)Rounding of Calculations; Minimum Adjustments. All calculations under thisArticle IV shall be made to the nearest one-tenth (1/10th) of a cent or to the nearest one-hundredth (1/100th) of a share, as the case may be. Any provision of thisArticle IV to the contrary notwithstanding, no adjustment in the Exercise Price or the Warrant Share Number shall be made if the amount of such adjustment would be less than $0.01 or one-tenth (1/10th) of a share of Common Stock, but any such amount shall be carried forward and an adjustment with respect thereto shall be made at the time of and together with any subsequent adjustment which, together with such amount and any other amount or amounts so carried forward, shall aggregate $0.01 or 1/10th of a share of Common Stock, or more, or on exercise of a Warrant if it shall earlier occur.

18

(f)Timing of Issuance of Additional Common Stock Upon Certain Adjustments. In any case in which the provisions of thisArticle IV shall require that an adjustment shall become effective immediately after a record date for an event, the Company may defer until the occurrence of such event (i) issuing to a Holder or beneficial holder of Book-Entry Only Warrants of Warrants exercised after such record date and before the occurrence of such event the additional shares of Common Stock issuable upon such exercise by reason of the adjustment required by such event over and above the shares of Common Stock issuable upon such exercise before giving effect to such adjustment, and (ii) paying to such Holder or beneficial holder of Book-Entry Only Warrants any amount of cash in lieu of a fractional share of Common Stock;provided,however, that the Company upon request shall deliver to such Person a due bill or other appropriate instrument evidencing such Person’s right to receive such additional shares, and such cash, upon the occurrence of the event requiring such adjustment.

(g)Other Events. Neither the Exercise Price nor the Warrant Share Number shall be adjusted in the event of a change in the par value of the Common Stock or a change in the jurisdiction of incorporation of the Company, each of which is expressly permitted, provided that no other changes are made that would trigger any other adjustment provision set forth herein.

(h)Statement Regarding Adjustments. Whenever the Exercise Price or the Warrant Share Number shall be adjusted as provided inArticle IV, the Company shall forthwith file at the principal office of the Company a statement showing in reasonable detail the facts requiring such adjustment and the Exercise Price that shall be in effect and the Warrant Share Number after such adjustment. The Company shall deliver to the Warrant Agent a copy of such statement and shall cause a copy of such statement to be sent or communicated to the Holders and beneficial holders of Book-Entry Only Warrants pursuant toSection 6.03.

(i)Notice of Adjustment Event. In the event that the Company shall propose to take any action of the type described in thisArticle IV (but only if the action of the type described in thisArticle IV would result in an adjustment in the Exercise Price or the Warrant Share Number or a change in the type of securities or property to be delivered upon exercise of a Warrant), the Company shall deliver to the Warrant Agent a notice and shall cause such notice to be sent or communicated to the Holders and beneficial holders of Book-Entry Only Warrants in the manner set forth inSection 6.03, which notice shall specify the record date, if any, with respect to any such action and the approximate date on which such action is to take place. Such notice shall also set forth the facts with respect thereto as shall be reasonably necessary to indicate the effect on the Exercise Price and the number, kind or class of shares or other securities or property which shall be deliverable upon exercise of a Warrant. In the case of any action which would require the fixing of a record date, such notice shall be given at least 10 days prior to the date so fixed, and in case of all other action, such notice shall be given at least 15 days prior to the taking of such proposed action. Failure to give such notice, or any defect therein, shall not affect the legality or validity of any such action.

(j)Proceedings Prior to Any Action Requiring Adjustment; Limitation on Adjustment. As a condition precedent to the taking of any action which would require an adjustment pursuant to thisArticle IV, the Company shall take any action which may be necessary, including obtaining regulatory, NYSE, TSX or other applicable national securities exchange or stockholder approvals in order that the Company may thereafter validly and legally

19

issue as fully paid and nonassessable all Shares that a Holder or beneficial holder of Book-Entry Only Warrants is entitled to receive upon exercise of a Warrant pursuant to thisArticle IV;provided,however, and not withstanding anything herein to the contrary, to the extent the issuance of the Shares underlying the Warrants upon any adjustment pursuant toArticle IV, absent the application of this proviso, would require the Company to obtain shareholder approval pursuant to NYSE rules, such adjustment shall be limited to the maximum number of Shares issuable without requiring any such approval.

(k)Adjustment Rules. Any adjustments pursuant to thisArticle IV shall be made successively whenever an event referred to herein shall occur. If an adjustment in Exercise Price made hereunder would reduce the Exercise Price to an amount below par value of the Common Stock, then such adjustment in Exercise Price made hereunder shall reduce the Exercise Price to the par value of the Common Stock.

(l)Calculations. The Warrant Agent shall have no obligation under this section to calculate any of the adjustments included this section.

4.02Certificates. The form of Certificated Warrant need not be changed because of any adjustment made pursuant toArticle IV, and Certificated Warrants issued after such adjustment may state the same Exercise Price and the same Warrant Share Number as are stated in the Certificated Warrants initially issued pursuant to this Agreement. The Company, however, may at any time in its sole discretion make any change in the form of Certificated Warrant that it may deem appropriate to give effect to such adjustments and that does not affect the substance of the Certificated Warrant, and any Certificated Warrant thereafter issued or countersigned, whether in exchange or substitution for an outstanding Certificated Warrant or otherwise, may be in the form as so changed.

ARTICLE V

WARRANT AGENT

5.01Appointment of Warrant Agent. The Company hereby appoints the Warrant Agent to act as agent for the Company in accordance with the provisions of this Agreement and the Warrant Agent hereby accepts such appointment. The Warrant Agent shall not be liable for anything that it may do or refrain from doing in connection with this Agreement, except for its own gross negligence, willful misconduct or bad faith. The parties hereby agree and acknowledge that the Warrant Agent shall appoint the Canadian Agent as its agent for processing of Warrants in Canada. The Company agrees that the Canadian Agent shall have the benefit of all the protections provided to the Warrant Agent hereunder and all references to the Warrant Agent hereunder shall be deemed to also include the Canadian Agent as applicable.

5.02Rights and Duties of Warrant Agent.

(a)Agent for the Company. In acting under this Warrant Agreement and in connection with the Warrants, the Warrant Agent is acting solely as agent of the Company and does not assume any obligation or relationship of agency or trust for or with any of the Holders or beneficial holders of Book-Entry Only Warrants.

20

(b)Counsel. The Warrant Agent may consult with counsel satisfactory to it (who may be counsel to the Company), and the advice of such counsel shall be full and complete authorization and protection in respect of any action taken, suffered or omitted by it hereunder in good faith and in accordance with the advice of such counsel.

(c)Documents. The Warrant Agent shall be protected and shall incur no liability for or in respect of any action taken or thing suffered by it in reliance upon any Warrant, notice, direction, consent, certificate, affidavit, statement or other paper or document reasonably believed by it to be genuine and to have been presented or signed by the proper parties.

(d)No Implied Obligations. The Warrant Agent shall be obligated to perform only such duties as are specifically set forth herein, and no implied duties or obligations of the Warrant Agent shall be read into this Agreement against the Warrant Agent. The Warrant Agent shall not be under any obligation to take any action hereunder that may involve it in any expense or liability for which it does not receive indemnity if such indemnity is reasonably requested. The Warrant Agent shall not be accountable or under any duty or responsibility for the use by the Company of any of the Warrants countersigned by the Warrant Agent pursuant to this Agreement. The Warrant Agent shall have no duty or responsibility in case of any default by the Company in the performance of its covenants or agreements contained herein or in the case of the receipt of any written demand from a Holder or beneficial holders of Book-Entry Only Warrants with respect to such default, including any duty or responsibility to initiate or attempt to initiate any proceedings at law or otherwise.

(e)Not Responsible for Adjustments or Validity of Shares. The Warrant Agent shall not at any time be under any duty or responsibility to any Holder or beneficial holders of Book-Entry Only Warrants to determine whether any facts exist that may require an adjustment of the Warrant Share Number or the Exercise Price, or with respect to the nature or extent of any adjustment when made, or with respect to the method employed, or herein or in any supplemental agreement provided to be employed, in making the same. The Warrant Agent shall not be accountable with respect to the validity or value of any Shares or of any securities or property that may at any time be issued or delivered upon the exercise of any Warrant or upon any adjustment pursuant toArticle IV, and it makes no representation with respect thereto. The Warrant Agent shall not be responsible for any failure of the Company to make any cash payment or to issue, transfer or deliver any Shares or stock certificates upon the surrender of any Certificated Warrant for the purpose of exercise or upon any adjustment pursuant toArticle IV, or to comply with any of the covenants of the Company contained in this Agreement.

(f)Notices or Demands Addressed to the Company. If the Warrant Agent shall receive any notice or demand (other than any Exercise Notice or Confirmation) addressed to the Company by the Holder of a Warrant or the beneficial holder of a Book-Entry Only Warrant, the Warrant Agent shall promptly forward such notice or demand to the Company.

5.03Individual Rights of Warrant Agent. The Warrant Agent and any stockholder, director, officer or employee of the Warrant Agent may buy, sell or deal in any of the Warrants or other securities of the Company or its Affiliates or become pecuniarily interested in transactions in which the Company or its Affiliates may be interested, or contract with or lend money to the Company or its Affiliates or otherwise act as fully and freely as though it were not the Warrant Agent under this Agreement. Nothing herein shall preclude the Warrant Agent from acting in any other capacity for the Company or for any other legal entity.

21

5.04Warrant Agent’s Disclaimer. The Warrant Agent shall not be responsible for, and makes no representation as to the validity or adequacy of, this Agreement (except the due and valid authorized execution and delivery of this Agreement by the Warrant Agent) or the Certificated Warrants (except the due countersignature of the Warrant Certificate(s) by the Warrant Agent) and it shall not be responsible for any statement in this Agreement or the Certificated Warrants other than its countersignature thereon.

5.05Compensation and Indemnity.

(a) The Company agrees to pay the Warrant Agent from time to time reasonable compensation for its services as agreed and to reimburse the Warrant Agent upon request for all reasonable out-of-pocket expenses incurred by it, including the reasonable compensation and expenses of the Warrant Agent’s agents and counsel as agreed. The Company shall indemnify and hold harmless the Warrant Agent, its officers, directors, agents and counsel against any loss, liability or expense (including reasonable agents’ and attorneys’ fees and expenses) incurred by it without gross negligence, willful misconduct or bad faith on its part arising out of or in connection with the acceptance or performance of its duties under this Agreement, including any action or inaction of the Warrant Agent taken in reliance upon instructions provided by the Company under this Agreement. The Warrant Agent shall notify the Company promptly of any claim for which it may seek indemnity. The Company need not reimburse any expense or indemnify against any loss or liability incurred by the Warrant Agent through willful misconduct, gross negligence or bad faith.

(b) The Warrant Agent shall be responsible for and shall indemnify and hold the Company harmless from and against any and all losses, damages, costs, charges, counsel fees, payments, expenses and liability arising out of or attributable to the Warrant Agent’s refusal or failure to comply with the terms of this Agreement, or which arise out of Warrant Agent’s gross negligence, bad faith or willful misconduct or which arise out of the breach of any representation or warranty of the Warrant Agent hereunder, for which the Warrant Agent is not entitled to indemnification under this Agreement;provided,however, the Warrant Agent’s aggregate liability hereunder during any term of this Agreement with respect to, arising from, or arising in connection with this Agreement, whether in contract, or in tort, or otherwise, is limited to, and shall not exceed, the amounts paid hereunder by the Company to the Warrant Agent as fees and charges, but not including reimbursable expenses.

(c) Neither party to this Agreement shall be liable to the other party for any consequential, indirect, special or incidental damages under any provisions of this Agreement or for any consequential, indirect, punitive, special or incidental damages arising out of any act or failure to act hereunder even if that party has been advised of or has foreseen the possibility of such damages.

(d) The rights and obligations of the Company and the Warrant Agent under thisSection 5.05 shall survive resignation or removal of the Warrant Agent and termination of this Agreement.

22

5.06Successor Warrant Agent.

(a)Company to Provide and Maintain Warrant Agent. The Company agrees for the benefit of the Holders and the beneficial holders of the Book-Entry Only Warrants that there shall at all times be a Warrant Agent hereunder until all the Warrants have been exercised or cancelled or are no longer exercisable.

(b)Resignation and Removal. The Warrant Agent may at any time resign by giving written notice to the Company of such intention on its part, specifying the date on which its desired resignation shall become effective;provided,however, that such date shall not be less than 60 days after the date on which such notice is given unless the Company otherwise agrees. The Warrant Agent hereunder may be removed at any time by the filing with it of an instrument in writing signed by or on behalf of the Company and specifying such removal and the date when it shall become effective, which date shall not be less than 60 days after such notice is given unless the Warrant Agent otherwise agrees. Any removal under this section shall take effect upon the appointment by the Company as hereinafter provided of a successor Warrant Agent (which shall be (i) a bank or trust company, (ii) organized under the laws of the United States of America or one of the states thereof, (iii) authorized under the laws of the jurisdiction of its organization to exercise corporate trust powers, (iv) having a combined capital and surplus of at least $50,000,000 (as set forth in its most recent reports of condition published pursuant to law or to the requirements of any United States federal or state regulatory or supervisory authority), and (v) having an office in the Borough of Manhattan, The City of New York) and the acceptance of such appointment by such successor Warrant Agent. The obligations of the Company underSection 5.05 shall continue to the extent set forth herein notwithstanding the resignation or removal of the Warrant Agent.

(c)Company to Appoint Successor. In the event that at any time the Warrant Agent shall resign, or shall be removed, or shall become incapable of acting, or shall be adjudged bankrupt or insolvent, or shall commence a voluntary case under the Federal bankruptcy laws, as now or hereafter constituted, or under any other applicable Federal or state bankruptcy, insolvency or similar law or shall consent to the appointment of or taking possession by a receiver, custodian, liquidator, assignee, trustee, sequestrator (or other similar official) of the Warrant Agent or its property or affairs, or shall make an assignment for the benefit of creditors, or shall admit in writing its inability to pay its debts generally as they become due, or shall take corporate action in furtherance of any such action, or a decree or order for relief by a court having jurisdiction in the premises shall have been entered in respect of the Warrant Agent in an involuntary case under the Federal bankruptcy laws, as now or hereafter constituted, or any other applicable Federal or state bankruptcy, insolvency or similar law, or a decree or order by a court having jurisdiction in the premises shall have been entered for the appointment of a receiver, custodian, liquidator, assignee, trustee, sequestrator (or similar official) of the Warrant Agent or of its property or affairs, or any public officer shall take charge or control of the Warrant Agent or of its property or affairs for the purpose of rehabilitation, conservation, winding up or liquidation, a successor Warrant Agent, qualified as aforesaid, shall be appointed by the Company by an instrument in writing, filed with the successor Warrant Agent. In the event that a successor Warrant Agent is not appointed by the Company, a successor Warrant Agent, qualified as aforesaid, may be appointed by the Warrant Agent or the Warrant Agent may petition a court to appoint a successor Warrant Agent. Upon the appointment as aforesaid of a

23

successor Warrant Agent and acceptance by the successor Warrant Agent of such appointment, the Warrant Agent shall cease to be Warrant Agent hereunder;provided,however, that in the event of the resignation of the Warrant Agent under thissubsection(c), such resignation shall be effective on the earlier of (i) the date specified in the Warrant Agent’s notice of resignation and (ii) the appointment and acceptance of a successor Warrant Agent hereunder.

(d)Successor to Expressly Assume Duties. Any successor Warrant Agent appointed hereunder shall execute, acknowledge and deliver to its predecessor and to the Company an instrument accepting such appointment hereunder, and thereupon such successor Warrant Agent, without any further act, deed or conveyance, shall become vested with all the rights and obligations of such predecessor with like effect as if originally named as Warrant Agent hereunder, and such predecessor, upon payment of its charges and disbursements then unpaid, shall thereupon become obligated to transfer, deliver and pay over, and such successor Warrant Agent shall be entitled to receive, all monies, securities and other property on deposit with or held by such predecessor, as Warrant Agent hereunder.

(e)Successor by Merger. Any entity into which the Warrant Agent hereunder may be merged or consolidated, or any entity resulting from any merger or consolidation to which the Warrant Agent shall be a party, or any entity to which the Warrant Agent shall sell or otherwise transfer all or substantially all of its assets and business, shall be the successor Warrant Agent under this Agreement without the execution or filing of any paper or any further act on the part of any of the parties hereto;provided,however, that it shall be qualified as aforesaid.

5.07Representations of the Company. The Company represents and warrants to the Warrant Agent that:

(a) the Company has been duly organized and is validly existing under the laws of the jurisdiction of its incorporation;