Table of Contents

As filed with the U.S. Securities and Exchange Commission on February 9, 2015

Registration No. 333-201382

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

COEUR MINING, INC.

(Exact name of registrant as specified in its charter)

| 1040 | Delaware | 82-0109423 | ||

(Primary Standard Industrial Classification Code Number) | (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

104 S. Michigan Ave.,

Suite 900

Chicago, Illinois 60603

(312) 489-5800

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Casey M. Nault

Senior Vice President, General Counsel and Secretary

104 S. Michigan Ave.,

Suite 900

Chicago, Illinois 60603

(312) 489-5800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Steven R. Shoemate Gibson, Dunn & Crutcher LLP 200 Park Avenue New York, NY 10166-0193 (212) 351-4000 | James T. Seery LeClairRyan, A Professional Corporation One Riverfront Plaza, 1037 Raymond Boulevard Newark, NJ 07102 (973) 491-3000 |

Approximate date of commencement of proposed sale of the securities to the public:As soon as practicable after this Registration Statement becomes effective and upon completion of the merger described in the enclosed joint proxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | þ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This document shall not constitute an offer to sell or the solicitation of any offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY—SUBJECT TO COMPLETION—DATED FEBRUARY 9, 2015

|  |

MERGER PROPOSAL — YOUR VOTE IS VERY IMPORTANT

Coeur Mining, Inc., a Delaware corporation (“Coeur”), Hollywood Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Coeur (“Merger Sub”), Paramount Gold and Silver Corp., a Delaware corporation (“Paramount”) and Paramount Nevada Gold Corp., a British Columbia corporation and a wholly-owned subsidiary of Paramount (“SpinCo”), have entered into an Agreement and Plan of Merger, dated as of December 16, 2014 (as it may be amended from time to time, the “merger agreement”). Pursuant to the merger agreement and a related separation and distribution agreement (the “separation agreement”), Coeur will acquire the Mexican mining business of Paramount and the Nevada mining business of Paramount will be spun-off to Paramount’s stockholders. Specifically, Paramount and SpinCo, which will own all of Paramount’s Nevada mining business, will enter into the separation agreement pursuant to which Paramount will spin off SpinCo to Paramount’s stockholders (the “spin-off”). Immediately following completion of the spin-off, Merger Sub will merge with and into Paramount with Paramount surviving the merger as a wholly-owned subsidiary of Coeur (the “merger” and, together with the spin-off, the “transaction”).

If the merger is completed, Paramount stockholders will have the right to receive 0.2016 shares of Coeur common stock for each share of Paramount common stock, with cash paid in lieu of fractional shares. This exchange ratio is fixed and will not be adjusted to reflect stock price changes prior to the closing of the merger.

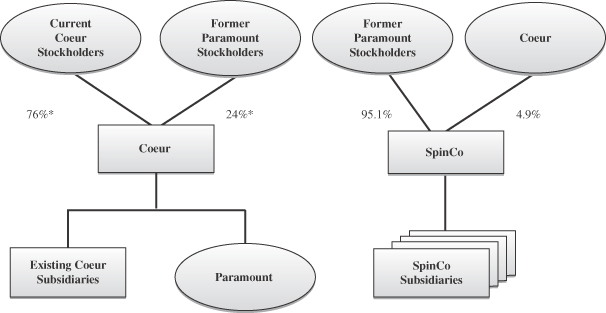

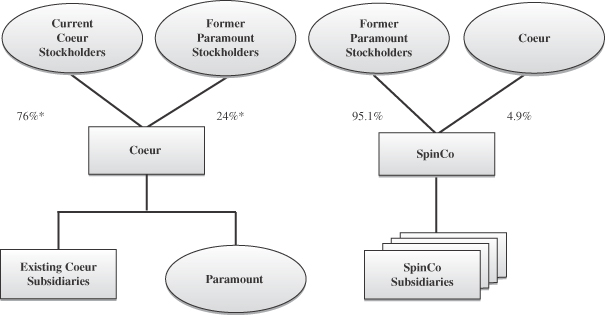

Based on the estimated number of shares of Paramount common stock outstanding on the record date for the special meeting of Paramount stockholders, Coeur expects to issue approximately [ ] million shares of Coeur common stock to Paramount stockholders in the merger. Upon completion of the transaction, it is projected that holders of Paramount common stock will own approximately 24% of Coeur’s outstanding common stock, while existing stockholders of Coeur will continue to own the remaining 76%. Additionally, holders of Paramount common stock will hold approximately 95.1% of SpinCo, and Coeur will own approximately 4.9% of SpinCo. Coeur common stock is currently traded on the New York Stock Exchange (the “NYSE”) under the symbol “CDE”. Paramount common stock is currently listed for trading on the NYSE MKT LLC and the Toronto Stock Exchange under the symbol “PZG”. Following completion of the merger, Coeur common stock will continue to trade on the NYSE under the symbol “CDE” and Paramount common stock will cease to be listed for trading.

Coeur and Paramount will each hold special meetings of their respective stockholders on [ ], 2015 in connection with the proposed merger.

At the special meeting of Coeur stockholders, Coeur stockholders will be asked to consider and vote on (i) a proposal to approve the issuance of Coeur common stock to Paramount stockholders in connection with the merger (the “share issuance proposal”) and (ii) a proposal to adjourn the Coeur special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to approve the share issuance proposal (the “Coeur adjournment proposal”). Approval of the share issuance proposal and the Coeur adjournment proposal each requires the affirmative vote of holders of a majority of the shares of Coeur common stock present in person or represented by proxy at the Coeur special meeting and entitled to vote at the meeting.

At the special meeting of Paramount stockholders, Paramount stockholders will be asked to consider and vote on (i) a proposal to adopt the merger agreement (the “merger proposal”), (ii) a proposal to adjourn the Paramount special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to approve the merger proposal (the “Paramount adjournment proposal”) and (iii) a non-binding, advisory proposal to approve the compensation that may become payable to Paramount’s named executive officers in connection with the merger (the “compensation proposal”). Approval of the merger proposal requires the affirmative vote of holders of a majority of the outstanding shares of Paramount common stock entitled to vote thereon. Approval of the Paramount adjournment proposal and the compensation proposal each requires the affirmative vote of holders of a majority of the shares of Paramount common stock present in person or represented by proxy at the Paramount special meeting and entitled to vote on the matter.

We cannot complete the merger unless the Coeur stockholders approve the share issuance proposal and the Paramount stockholders approve the merger proposal.Your vote is very important, regardless of the number of shares you own. Whether or not you expect to attend your special meeting in person, please submit a proxy as promptly as possible by (1) accessing the Internet website specified on your proxy card, (2) calling the toll-free number specified on your proxy card or (3) marking, signing, dating and returning all proxy cards that you receive in the postage-paid envelope provided, so that your shares may be represented and voted at the Coeur or Paramount special meeting, as applicable.

After careful consideration, the Coeur board of directors, on December 15, 2014, unanimously authorized and approved the merger agreement and the merger, directed that the issuance of shares of Coeur common stock pursuant to the merger agreement be submitted to the stockholders of Coeur for approval and determined that the merger is advisable and in the best interests of Coeur and its stockholders. The Coeur board of directors accordingly unanimously recommends that the Coeur stockholders vote “FOR” each of the share issuance proposal and the Coeur adjournment proposal.

After careful consideration, the Paramount board of directors, on December 15, 2014, unanimously approved and declared advisable the merger agreement and the transactions contemplated by the merger agreement, including the merger and the spin-off, directed that the merger agreement be submitted to the stockholders of Paramount for adoption and determined that the terms of the merger agreement, the merger, the spin-off and the other transactions contemplated by the merger agreement are fair to and in the best interests of Paramount’s stockholders. The Paramount board of directors accordingly unanimously recommends that the Paramount stockholders vote “FOR” each of the merger proposal, the Paramount adjournment proposal and the compensation proposal.

The obligations of Coeur and Paramount to complete the transactions are subject to the satisfaction or waiver of several conditions set forth in the merger agreement. More information about Coeur, Paramount and the transaction is contained in this joint proxy statement/prospectus.Coeur and Paramount encourage you to read this entire joint proxy statement/prospectus carefully, including the section entitled “Risk Factors” beginning on page [ ].

We look forward to the successful completion of the transaction.

Sincerely,

| Mitchell J. Krebs | Christopher Crupi | |

| President and Chief Executive Officer | President and Chief Executive Officer | |

| Coeur Mining, Inc. | Paramount Gold and Silver Corp. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this joint proxy statement/prospectus or determined that this joint proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated [ ], 2015 and is first being mailed to the stockholders of Coeur and stockholders of Paramount on or about [ ], 2015.

Table of Contents

Coeur Mining, Inc.

104 S. Michigan Ave., Suite 900

Chicago, Illinois 60603

(312) 489-5800

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On [ ], 2015

Dear Stockholders of Coeur Mining, Inc.:

We are pleased to invite you to attend the special meeting of stockholders of Coeur Mining, Inc., a Delaware corporation (“Coeur”), which will be held at 104 S. Michigan Ave., 2nd Floor Auditorium, Chicago, Illinois 60603, on [ ], 2015, at [ ] a.m., local time, for the following purposes:

| • | to consider and vote on a proposal to approve the issuance of Coeur common stock, par value $0.01 per share, in connection with the merger contemplated by the Agreement and Plan of Merger, dated as of December 16, 2014, by and among Coeur, Hollywood Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Coeur, Paramount Gold and Silver Corp., a Delaware corporation (“Paramount”) and Paramount Nevada Gold Corp., a British Columbia corporation and a wholly-owned subsidiary of Paramount (“SpinCo”), as it may be amended from time to time, a copy of which is included as Annex A in the joint proxy statement/prospectus accompanying this notice (the “share issuance proposal”); and |

| • | to consider and vote on a proposal to adjourn the Coeur special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to approve the share issuance proposal (the “Coeur adjournment proposal”). |

Coeur will transact no other business at the special meeting except such business as may properly be brought before the special meeting, or any adjournment or postponement thereof, at the direction of the Coeur board. Please refer to the attached joint proxy statement/prospectus for further information with respect to the business to be transacted at the Coeur special meeting.

The Coeur board of directors has fixed the close of business on [ ], 2015 as the record date for determination of Coeur stockholders entitled to receive notice of, and to vote at, the Coeur special meeting or any adjournments or postponements thereof. Holders of record of shares of Coeur common stock at the close of business on the record date are entitled to vote at the special meeting and any adjournment or postponement of the special meeting. A list of stockholders of record entitled to vote at the special meeting will be available for inspection by stockholders for any purpose germane to the special meeting of Coeur at our executive offices and principal place of business at 104 S. Michigan Ave., Suite 900, Chicago, Illinois 60603 during ordinary business hours for a period of ten days before the special meeting. The list will also be available at the special meeting for examination by any stockholder of record present at the special meeting.

Approval of the share issuance proposal and the Coeur adjournment proposal each requires the affirmative vote of holders of a majority of the shares of Coeur common stock present in person or represented by proxy at the Coeur special meeting and entitled to vote at the meeting.

Your vote is important. Whether or not you expect to attend in person, we urge you to submit your proxy as promptly as possible by (1) accessing the Internet website specified on your proxy card, (2) calling the toll-free number specified on your proxy card or (3) marking, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided, so that your shares may be represented and voted at the

Table of Contents

Coeur special meeting.If your shares are held in the name of a broker, bank, trust company or other nominee, please follow the instructions on the voting instruction card furnished to you by such record holder. Please note that if you hold shares in different accounts, it is important that you vote the shares represented by each account.

The enclosed joint proxy statement/prospectus provides a detailed description of the merger and the merger agreement. We urge you to read the joint proxy statement/prospectus, including any documents incorporated by reference, and the annexes carefully and in their entirety. If you have any questions concerning the merger or the joint proxy statement/prospectus, would like additional copies or need help submitting a proxy or voting your shares of Coeur common stock, please contact Coeur’s proxy solicitor:

MacKenzie Partners, Inc.

105 Madison Avenue

New York, New York 10016

proxy@mackenziepartners.com

Call Collect (212) 929-5500

or

Toll-Free (800) 322-2885

By Order of the Board of Directors,

Mitchell J. Krebs

President and Chief Executive Officer and Director

Chicago, Illinois

[ ], 2015

Table of Contents

Paramount Gold and Silver Corp.

665 Anderson Street

Winnemucca, Nevada 89445

(866) 481-2233

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On [ ], 2015

Dear Stockholders of Paramount Gold and Silver Corp.:

We are pleased to invite you to attend the special meeting of stockholders of Paramount Gold and Silver Corp., a Delaware corporation (“Paramount”), which will be held at The Westin Hotel at 321 North Fort Lauderdale Beach Boulevard, Ft. Lauderdale, FL 33304, on [ ], 2015, at [ ] a.m., local time, for the following purposes:

| • | to consider and vote on a proposal to adopt the Agreement and Plan of Merger, dated as of December 16, 2014, by and among Paramount, Coeur Mining, Inc., a Delaware corporation (“Coeur”), Hollywood Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Coeur (“Merger Sub”), and Paramount Nevada Gold Corp., a British Columbia corporation and a wholly-owned subsidiary of Paramount (“SpinCo”), as it may be amended from time to time, a copy of which is included as Annex A in the joint proxy statement/prospectus accompanying this notice; pursuant to which Merger Sub will be merged with and into Paramount (with Paramount surviving the merger as a wholly-owned subsidiary of Coeur) and each outstanding share of common stock of Paramount (other than shares owned by Paramount, Coeur or Merger Sub, which will be cancelled) will be converted into the right to receive 0.2016 shares of common stock of Coeur, with cash paid in lieu of fractional shares (the “merger proposal”); |

| • | to consider and vote on a proposal to adjourn the Paramount special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to approve the merger proposal (the “Paramount adjournment proposal”); and |

| • | to consider and vote on a non-binding, advisory proposal to approve the compensation that may become payable to Paramount’s named executive officers in connection with the completion of the merger (the “compensation proposal”). |

Paramount will transact no other business at the special meeting except such business as may be brought at the direction of the Paramount board of directors. Please refer to the attached joint proxy statement/prospectus for further information with respect to the business to be transacted at the Paramount special meeting.

The Paramount board of directors has fixed the close of business on [ ], 2015 as the record date for determination of Paramount stockholders entitled to receive notice of, and to vote at, the Paramount special meeting or any adjournments or postponements thereof. Only stockholders of record of Paramount at the close of business on the record date are entitled to notice of, and to vote at, the special meeting and at any adjournment or postponement of the special meeting. A list of stockholders of record entitled to vote at the special meeting will be available for inspection by stockholders for any purpose germane to the special meeting of Paramount at our executive offices and principal place of business at 665 Anderson Street, Winnemucca, Nevada 90445 during ordinary business hours for a period of ten days before the special meeting. The list will also be available at the special meeting for examination by any stockholder of record present at the special meeting.

Table of Contents

Approval of the merger proposal requires the affirmative vote of holders of a majority of the outstanding shares of Paramount common stock entitled to vote thereon. Certain stockholders of Paramount entered into a voting and support agreement, dated December 16, 2014, pursuant to which each such stockholder has agreed, among other things, to vote its shares of common stock of Paramount in favor of the approval of the merger agreement. Approval of the Paramount adjournment proposal and the compensation proposal each requires the affirmative vote of holders of a majority of the shares of Paramount common stock present in person or represented by proxy at the Paramount special meeting and entitled to vote on the proposal.

Your vote is important. Whether or not you expect to attend in person, we urge you to submit your proxy as promptly as possible by (1) accessing the Internet website specified on your proxy card, (2) calling the toll-free number specified on your proxy card or (3) marking, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided, so that your shares may be represented and voted at the Paramount special meeting. If your shares are held in the name of a broker, bank, trust company or other nominee, please follow the instructions on the voting instruction card furnished to you by such record holder.

Please note that if you hold shares in different accounts, it is important that you vote the shares represented by each account.

The enclosed joint proxy statement/prospectus provides a detailed description of the merger and the merger agreement. We urge you to read the joint proxy statement/prospectus, including any documents incorporated by reference, and the annexes carefully and in their entirety. If you have any questions concerning the merger or the joint proxy statement/prospectus, would like additional copies or need help submitting a proxy or voting your shares of Paramount common stock, please contact Paramount’s proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Call Collect (212) 750-5833

or

Toll-free (888) 750-5834

By order of the Board of Directors,

Christopher Crupi

President and Chief Executive Officer

Winnemucca, Nevada

[ ], 2015

Table of Contents

ADDITIONAL INFORMATION

This joint proxy statement/prospectus incorporates important business and financial information about Coeur and Paramount from other documents that are not included in or delivered with this joint proxy statement/prospectus. This information is available to you without charge upon your request. You can obtain the documents incorporated by reference into this joint proxy statement/prospectus by requesting them in writing or by telephone from the appropriate company at the following addresses and telephone numbers:

Coeur Mining, Inc. 104 S. Michigan Ave., Suite 900 Chicago, Illinois 60603 (312) 489-5800 Attn: Corporate Secretary or MacKenzie Partners, Inc. 105 Madison Avenue New York, New York 10016 proxy@mackenziepartners.com Call Collect (212) 929-5500 or Toll-Free (800) 322-2885 | Paramount Gold and Silver Corp. 665 Anderson Street Winnemucca, Nevada 89445 (866) 481-2233 Attn: Corporate Secretary or Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, New York 10022 Call Collect (212) 750-5833 or Toll-free (888) 750-5834 |

Investors may also consult Coeur’s or Paramount’s website. Coeur’s website is www.coeur.com. Paramount’s website is www.paramountgold.com. Information included on either website is not incorporated by reference into this joint proxy statement/prospectus.

If you would like to request any documents, please do so by [ ], 2015 in order to receive them before the respective special meetings.

For more information, see “Where You Can Find More Information” beginning on page [ ].

ABOUT THIS JOINT PROXY STATEMENT/PROSPECTUS

This joint proxy statement/prospectus, which forms part of a registration statement on Form S-4 filed with the U.S. Securities and Exchange Commission (the “SEC”) by Coeur (File No. 333-201382), constitutes a prospectus of Coeur under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the shares of Coeur common stock to be issued to Paramount stockholders in connection with the merger. This joint proxy statement/prospectus also constitutes a joint proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to the special meeting of Coeur stockholders and the special meeting of Paramount stockholders. It also constitutes a notice of meeting with respect to the special meeting of Coeur stockholders and a notice of meeting with respect to the special meeting of Paramount stockholders.

You should rely only on the information contained in or incorporated by reference into this joint proxy statement/prospectus. No one has been authorized to provide you with information that is different from that contained in or incorporated by reference into this joint proxy statement/prospectus. This joint proxy statement/prospectus is dated [ ], 2015. You should not assume that the information contained in, or incorporated by reference into, this joint proxy statement/prospectus is accurate as of any date other than that date or such information’s original date of publication, as applicable. Neither our mailing of this joint proxy statement/prospectus to Coeur stockholders or Paramount stockholders, nor the issuance by Coeur of common stock in connection with the merger will create any implication to the contrary.

For additional information relating to the spin-off, please see the Form S-1 filed by SpinCo with the SEC (File No. 333-201431). Information included in the Form S-1 is not incorporated by reference into this joint proxy statement/prospectus.

Table of Contents

This joint proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction. Information contained in this joint proxy statement/prospectus regarding Coeur has been provided by Coeur and information contained in this joint proxy statement/prospectus regarding Paramount has been provided by Paramount.

Unless otherwise indicated or as the context otherwise requires, all references in this joint proxy statement/prospectus to:

| • | “Coeur” means Coeur Mining, Inc., a Delaware corporation; |

| • | “Coeur common stock” means the common stock, par value $0.01 per share, of Coeur; |

| • | “Code” means the Internal Revenue Code of 1986, as amended; |

| • | “combined company” means Coeur and Paramount following completion of the merger (which will consist of the Paramount Mexico business but not the Paramount Nevada business), collectively; |

| • | “effective time” means the time the merger becomes effective; |

| • | “merger” means the merger of Merger Sub with and into Paramount, with Paramount surviving the merger and becoming a wholly-owned subsidiary of Coeur; |

| • | “merger agreement” means the Agreement and Plan of Merger, dated December 16, 2014, among Coeur, Merger Sub, Paramount and SpinCo, as it may be amended from time to time, a copy of which is included as Annex A in this joint proxy statement/prospectus; |

| • | “merger consideration closing value” means a value equal to the product of (i) the closing price of Coeur common stock on the first trading day immediately preceding the closing date of the merger, multiplied by (ii) the exchange ratio; |

| • | “Merger Sub” means Hollywood Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Coeur; |

| • | “Paramount” means Paramount Gold and Silver Corp., a Delaware corporation; |

| • | “Paramount common stock” means the common stock, par value $0.001, of Paramount; |

| • | “Paramount Mexico business” means Paramount’s business in Mexico, which will not be part of the spin-off and therefore will continue to be owned by Paramount following the spin-off; |

| • | “Paramount Nevada business” means Paramount’s business in Nevada, including the subsidiaries, assets, liabilities and employees transferred to, or assumed by, SpinCo pursuant to the separation agreement, which such transfers and assumptions will occur prior to the spin-off; |

| • | “separation agreement” means the Separation and Distribution Agreement, to be entered immediately prior to the effective time, between Paramount and SpinCo, as it may be amended from time to time, a form of which is included as Annex D in this joint proxy statement/prospectus; |

| • | “SpinCo” means Paramount Nevada Gold Corp., a British Columbia corporation and a wholly-owned subsidiary of Paramount and its consolidated subsidiaries; |

| • | “spin-off” means Paramount’s dividend to Paramount’s stockholders of all of the shares of SpinCo common stock then held by Paramount; |

| • | “transaction” or “transactions” refer to the spin-off, the merger and the other transactions contemplated by the merger agreement and the separation agreement; |

| • | “voting and support agreement” means the Voting and Support Agreement, dated December 16, 2014, entered into by certain stockholders of Paramount and Coeur, as it may be amended from time to time, a copy of which is included as Annex E in this joint proxy statement/prospectus; and |

| • | “we,” “our” and “us” refer to Coeur and Paramount, individually or Coeur and Paramount, collectively, as the context may require. |

Table of Contents

| Page | ||||

| iv | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 10 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

Summary Unaudited Pro Forma Condensed Combined Financial Information | 15 | |||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 24 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

i

Table of Contents

ii

Table of Contents

| Page | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| 122 | ||||

| 122 | ||||

| 122 | ||||

| 123 | ||||

| 123 | ||||

| 123 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

| E-1 | ||||

iii

Table of Contents

The following are some questions that you, as a stockholder of Coeur or a stockholder of Paramount, may have regarding the transaction, including the merger, and the other matters being considered at the special meetings and the answers to those questions. Coeur and Paramount urge you to read carefully the remainder of this joint proxy statement/prospectus because the information in this section does not provide all the information that might be important to you with respect to the merger and the other matters being considered at the special meetings. Additional important information is also contained in the annexes to and the documents incorporated by reference into this joint proxy statement/prospectus.

Questions and Answers about the Transaction

| Q: | What are the key steps of the transaction? |

| A: | Below is a summary of the key steps of the transaction. See “The Transactions and the Merger Agreement” beginning on page [ ]. |

Step 1. Equity Funding of SpinCo.

Prior to the spin-off, Coeur will make a loan to Paramount in the principal amount of $8,530,000, in the form of a promissory note (the “promissory note”), and Paramount will contribute all of the proceeds of such loan to SpinCo as an equity contribution. SpinCo will not be responsible for repayment of this note, as it will remain a debt of Paramount.

Step 2. Coeur Investment in SpinCo.

Pursuant to the terms of the merger agreement, prior to the spin-off, SpinCo will issue to Coeur, in exchange for a cash payment by Coeur in the amount of $1,470,000, newly issued shares of SpinCo common stock amounting to 4.9% of the outstanding SpinCo common stock after issuance.

Step 3. Spin-Off.

Following the equity funding of SpinCo and Coeur investment in SpinCo described above, immediately prior to the consummation of the merger, Paramount and SpinCo will enter into a separation agreement, and Paramount will dividend to Paramount’s stockholders all of the shares of SpinCo common stock then held by Paramount. After giving effect to the spin-off, Paramount stockholders will hold approximately 95.1% of SpinCo and Coeur will hold approximately 4.9% of SpinCo. Immediately following thespin-off, SpinCo will be a stand-alone, publicly traded company owned by pre-merger Paramount stockholders and Coeur.

Step 4. Merger.

Immediately following completion of the spin-off, Merger Sub will merge with and into Paramount, with Paramount surviving the merger and becoming a wholly-owned subsidiary of Coeur. In the merger, each share of Paramount common stock issued and outstanding immediately prior to the closing of the merger (other than shares owned by Paramount, Coeur or Merger Sub, which will be cancelled) will be converted into the right to receive 0.2016 shares of Coeur common stock. No fractional shares of Coeur’s common stock will be issued in the merger. Instead, Paramount’s stockholders will receive cash in lieu of any such fractional shares. Upon completion of the merger, it is projected that former holders of Paramount common stock will own approximately 24% of Coeur’s outstanding common stock, while existing stockholders of Coeur will continue to own the remaining 76%.

iv

Table of Contents

| Q: | What will Coeur stockholders receive in the transaction? |

| A: | Coeur stockholders will not receive any merger consideration in connection with the merger and will continue to hold their shares of Coeur common stock. Following completion of the merger, Coeur common stock will continue to trade on the NYSE under the symbol “CDE”. |

| Q: | What will Paramount stockholders receive in the transaction? |

| A: | If the transaction is completed, holders of Paramount common stock will be entitled to receive 0.2016 shares of Coeur common stock for each share of Paramount common stock they hold at the effective time. Paramount stockholders will not receive any fractional shares of Coeur common stock in the merger. Instead, Coeur will pay cash in lieu of any fractional shares of Coeur common stock that a Paramount stockholder would otherwise have been entitled to receive. Paramount stockholders will also receive shares of SpinCo common stock in the form of a dividend through the spin-off. Following the completion of the merger, Paramount common stock will cease to trade on the NYSE MKT and the Toronto Stock Exchange. |

| Q: | Where will the shares of SpinCo common stock be listed? |

| A: | Immediately following the spin-off, SpinCo will be a stand-alone, publicly traded company. SpinCo will use its reasonable best efforts to cause its common stock to be approved for listing on the NYSE MKT, the Toronto Stock Exchange or, with Coeur’s prior written consent, another exchange as reasonably determined by Paramount prior to the consummation of the spin-off. For additional information relating to SpinCo, please see the Form S-1 filed by SpinCo with the SEC (File No. 333-201431). |

| Q: | What will happen to outstanding Paramount equity awards in the merger? |

| A: | At the effective time, each outstanding stock option with respect to Paramount common stock will be deemed fully vested and will be cancelled in exchange for the right to receive shares of Coeur common stock (without interest, and subject to deduction for any required withholding tax, with cash being paid in lieu of issuing fractional shares of Coeur common stock) with a value equal to the product of (i) the excess (if any) of (a) the closing price of Coeur common stock on the first trading day immediately preceding the closing date of the merger multiplied by the exchange ratio (the “merger consideration closing value”) over (b) the exercise price per share under such stock option, multiplied by (ii) the number of shares subject to such stock option; provided, however, that (A) if the exercise price per share of any such Paramount stock option is equal to or greater than the merger consideration closing value, such Paramount stock option shall be cancelled without any payment being made in respect thereof, and (B) at the option of Coeur, in lieu of paying all or a portion of the amounts due to a holder of Paramount stock options in shares of Coeur common stock, Coeur may substitute for such shares an equivalent amount of cash. For information relating to Paramount’s equity awards, see “The Issuance of Coeur Shares and the Adoption of the Merger Agreement—Merger Consideration; Treatment of Paramount Stock Options” beginning on page [ ]. |

| Q: | Do any of the Paramount directors or officers have interests in the transaction that may differ from or be in addition to my interests as a stockholder? |

| A: | Yes. In considering the recommendation of the Paramount board of directors (the “Paramount board”) that Paramount stockholders vote to adopt the merger agreement and approve the adjournment proposal and the compensation proposal, Paramount stockholders should be aware that some of Paramount’s directors and executive officers have interests in the merger that may be different from, or in addition to, the interests of Paramount stockholders generally. The Paramount board was aware of and considered these potential interests, among other matters, in evaluating and negotiating the merger agreement and the transactions, in approving the merger agreement and in recommending the adoption of the merger agreement and the approval of the adjournment proposal and the compensation proposal. |

v

Table of Contents

For more information and quantification of these interests, please see “The Issuance of Coeur Shares and the Adoption of the Merger Agreement—Interests of Paramount Directors and Officers in the Merger” beginning on page [ ].

| Q: | Are there any conditions to the consummation of the merger? |

| A: | Yes. The consummation of the merger is subject to a number of conditions, including: |

| • | the approval by Paramount stockholders of the merger proposal; |

| • | the approval by Coeur stockholders of the share issuance proposal; |

| • | the authorization from the Mexican Federal Economic Competition Commission related to the merger and other transactions contemplated by the merger agreement; |

| • | the absence of any judgment or law issued or enacted by any governmental authority of competent jurisdiction that prohibits, enjoins or makes illegal the consummation of the transactions; |

| • | the SEC having declared effective SpinCo’s Form S-1 (File No. 333-201431) and Coeur’s Form S-4 (Reg. No. 333-201382), and the absence of any stop order or proceedings seeking a stop order; |

| • | the approval for listing by the NYSE, subject to official notice of issuance, of the Coeur common stock issuable to Paramount stockholders in the merger; |

| • | the consummation of the spin-off; |

| • | the accuracy of the representations and warranties of each party in the merger agreement, subject to certain materiality qualifications; |

| • | each party having performed in all material respects all obligations required to be performed by it under the merger agreement; |

| • | the absence of a material adverse effect on either Coeur or Paramount, as applicable, since the date of the merger agreement; |

| • | it is a condition to Paramount’s obligation to close the transaction that Paramount shall have received a written opinion from LeClairRyan, A Professional Corporation, to the effect that the merger will qualify as a “reorganization” described in Section 368(a) of the Code; and |

| • | it is a condition to Coeur’s obligation to close the transaction that Coeur shall have received a written opinion from Gibson, Dunn & Crutcher LLP to the effect that the merger will qualify as a “reorganization” described in Section 368(a) of the Code. |

| Q: | If the merger agreement is terminated, does either party owe the other party a termination fee or expense reimbursement? |

| A: | Generally, all fees and expenses incurred in connection with the merger and the transactions contemplated by the merger agreement will be paid by the party incurring those expenses. However, the merger agreement provides that, upon termination of the merger agreement under certain circumstances, Paramount may be obligated to pay Coeur a breakup fee of $5 million and, in other circumstances, Coeur may be obligated to pay Paramount liquidated damages of $5 million. In addition, Coeur or Paramount may be entitled to receive an expense reimbursement of up to $1.5 million by the other party under certain circumstances. See the section entitled “The Issuance of Coeur Shares and the Adoption of the Merger Agreement—The Merger Agreement—Expenses and Termination Fees” beginning on page [ ] for a more complete discussion of the circumstances under which termination fees will be required to be paid and expenses will be required to be reimbursed. |

vi

Table of Contents

| Q: | What stockholder approvals are needed in connection with the transaction? |

| A: | Coeur cannot complete the transaction unless the proposal relating to the issuance of shares of Coeur common stock to Paramount stockholders in the merger is approved by the affirmative vote of holders of a majority of the shares of Coeur common stock present in person or represented by proxy at the Coeur special meeting and entitled to vote at the meeting. This vote will satisfy the vote requirements of Section 312.07 of the NYSE Listed Company Manual with respect to the share issuance proposal, which requires that the votes cast in favor of such proposal must exceed the aggregate of votes cast against and abstentions. Paramount cannot complete the transaction unless the proposal relating to the adoption of the merger agreement is approved by the affirmative vote of holders of a majority of the outstanding shares of Paramount common stock entitled to vote thereon. |

| Q: | What are the material U.S. federal income tax consequences to Coeur and Coeur stockholders resulting from the transaction? |

| A: | There will be no U.S. federal income tax consequences to Coeur or Coeur stockholders as a result of the transaction. |

Coeur stockholders should consult their own tax advisors for a full understanding of the tax consequences to them of the merger.

| Q: | What are the material U.S. federal income tax consequences to Paramount and Paramount stockholders resulting from the transaction? |

| A: | Paramount will recognize gain, but not loss, on the spin-off equal to the difference between the fair market value of the SpinCo common stock distributed and Paramount’s adjusted basis in such stock. In general, the SpinCo common stock received by Paramount stockholders in the spin-off will be treated as a taxable dividend in an amount equal to the fair market value of the SpinCo common stock received, to the extent of Paramount’s current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If the fair market value of the SpinCo common stock received exceeds Paramount’s current and accumulated earnings and profits, the excess will be treated first, as reducing a Paramount stockholder’s adjusted basis in its shares of Paramount common stock, and second, to the extent it exceeds such adjusted basis, as capital gain from the sale or exchange of such common stock. |

Paramount is not expected to recognize any gain or loss for U.S. federal income tax purposes as a result of the merger. Paramount stockholders are not expected to recognize any gain or loss for U.S. federal income tax purposes upon the merger, except for any gain or loss attributable to the receipt of cash in lieu of fractional shares of Coeur common stock received in the merger.

The aggregate tax basis of the Coeur common stock received in the merger (including fractional shares deemed received and redeemed) will be equal to the aggregate adjusted tax basis of the shares of Paramount common stock surrendered for the Coeur common stock, and the holding period of the Coeur common stock (including fractional shares deemed received and redeemed) will include the period during which the shares of Paramount common stock were held.

Paramount stockholders should consult their own tax advisors for a full understanding of the tax consequences to them of the spin-off and the merger. The material U.S. federal income tax consequences of the spin-off and the merger are described in more detail in “The Issuance of Coeur Shares and the Adoption of the Merger Agreement—Material U.S. Federal Income Tax Consequences of the Spin-Off and the Merger” beginning on page [ ].

vii

Table of Contents

Questions and Answers about the Special Meetings and the Merger

| Q: | Why am I receiving this joint proxy statement/prospectus? |

| A: | You are receiving this joint proxy statement/prospectus because you were a stockholder of record of Coeur or a stockholder of record of Paramount as of the close of business on the record date for the Coeur special meeting or the Paramount special meeting, respectively. Coeur and Paramount have agreed to the acquisition of Paramount by Coeur, which will occur immediately following the spin-off, under the terms of a merger agreement that is described in this joint proxy statement/prospectus. A copy of the merger agreement is included in this joint proxy statement/prospectus as Annex A. |

This joint proxy statement/prospectus serves as the proxy statement through which Coeur and Paramount will solicit proxies to obtain the necessary stockholder approvals for the consummation of the proposed merger. It also serves as the prospectus by which Coeur will issue shares of its common stock as the merger consideration.

In order to complete the merger and the spin-off, Coeur stockholders must vote to approve the issuance of shares of Coeur common stock to Paramount stockholders in connection with the merger and Paramount stockholders must vote to adopt the merger agreement.

The spin-off does not require the approval of Paramount stockholders, although Paramount does not intend to consummate the spin-off unless the merger is also completed.

Coeur and Paramount will hold separate special meetings to obtain these approvals. This joint proxy statement/prospectus contains important information about the transactions and the special meetings of the stockholders of Coeur and stockholders of Paramount, and you should read it carefully and in its entirety. The enclosed voting materials allow you to submit proxies to have your shares voted without attending your respective special meeting.

Your vote is important. We encourage you to submit your proxy as soon as possible.

| Q: | What will I receive in the merger? |

| A: | If the merger is completed, holders of Paramount common stock will be entitled to receive 0.2016 shares of Coeur common stock for each share of Paramount common stock they hold at the effective time. Paramount stockholders will not receive any fractional shares of Coeur common stock in the merger. Instead, Coeur will pay cash in lieu of any fractional shares of Coeur common stock that a Paramount stockholder would otherwise have been entitled to receive. |

Coeur stockholders will not receive any merger consideration and will continue to hold their shares of Coeur common stock.

If the merger is completed, it is projected that holders of Paramount common stock will own approximately 24% of Coeur’s outstanding common stock, while existing stockholders of Coeur will continue to own the remaining 76%. In addition, Coeur will own approximately 4.9% of SpinCo and holders of record of Paramount will own approximately 95.1% of SpinCo, which following the spin-off will be an independent, publicly traded company.

| Q: | If I am a Paramount stockholder, how will I receive the merger consideration to which I am entitled? |

| A: | After receiving the proper documentation from you, following the effective date of the merger, the exchange agent will forward to you (if you are the holder of record) or to your broker, bank, trust company or other nominee (if your shares are held through such entity) the shares of Coeur common stock and cash in lieu of fractional shares to which you are entitled. For additional information about the exchange of Paramount shares of common stock for Coeur shares of common stock, see the section entitled “The Issuance of Coeur Shares and the Adoption of the Merger Agreement—Exchange of Shares in the Merger” beginning on page [ ]. You do not need to take any action at this time.Please do not send your Paramount stock certificates with your proxy card. |

viii

Table of Contents

| Q: | What is the value of the merger consideration? |

| A: | Because Coeur will issue 0.2016 shares of Coeur common stock in exchange for each share of Paramount common stock, the value of the merger consideration that Paramount stockholders receive will depend on the price per share of Coeur common stock at the effective time. The historical market prices of Coeur common stock may not be reflective of the value that Paramount stockholders will receive in the merger. |

| Q: | What happens if the market price of shares of Coeur common stock or shares of Paramount common stock changes before the closing of the merger? |

| A: | No change will be made to the exchange ratio of 0.2016 if the market price of shares of Coeur common stock or shares of Paramount common stock changes before the closing of the merger. |

| Q: | When and where will the special meetings be held? |

| A: | The Coeur special meeting will be held at 104 S. Michigan Ave., 2nd Floor Auditorium, Chicago, Illinois 60603, on [ ], 2015, at [ ] a.m., local time. The Paramount special meeting will be held at The Westin Hotel at 321 North Fort Lauderdale Beach Boulevard, Ft. Lauderdale, FL 33304, on [ ], 2015, at [ ] a.m., local time. |

| Q: | Who is entitled to vote at the special meetings? |

| A: | Only stockholders of record of Coeur common stock at the close of business on [ ], 2015, are entitled to notice of, and to vote at, the Coeur special meeting and any adjournment or postponement of the Coeur special meeting. Only stockholders of record of Paramount at the close of business on [ ], 2015 are entitled to notice of, and to vote at, the Paramount special meeting and at any adjournment or postponement of the Paramount special meeting. |

| Q: | How can I attend the special meetings? |

| A: | As of the applicable record date, all of Coeur’s stockholders are invited to attend the Coeur special meeting and all of Paramount’s stockholders are invited to attend the Paramount special meeting. Please be prepared to provide identification, such as a driver’s license or passport, before being admitted to the applicable special meeting. If you hold your shares in a stock brokerage account or if your shares are held by a broker, bank, trust company or other nominee (that is, in “street name”), you will need to provide proof of ownership to be admitted to the applicable special meeting. A brokerage statement or letter from your broker, bank, trust company or other nominee proving ownership of the shares on the record date for the applicable special meeting are examples of proof of ownership. To help Coeur and Paramount plan for the special meetings, please indicate whether you expect to attend by responding affirmatively when prompted during Internet or telephone proxy submission or by marking the attendance box on your proxy card. |

| Q: | What proposals will be considered at the special meetings? |

| A: | At the special meeting of Coeur stockholders, Coeur stockholders will be asked to consider and vote on (i) the share issuance proposal and (ii) the Coeur adjournment proposal. Coeur will transact no other business at its special meeting except such business as may properly be brought before the Coeur special meeting or any adjournment or postponement thereof at the direction of the Coeur board. |

At the special meeting of Paramount stockholders, Paramount stockholders will be asked to consider and vote on (i) the merger proposal, (ii) the Paramount adjournment proposal and (iii) the compensation proposal. Paramount will transact no other business at its special meeting except such business as may properly be brought before the Paramount special meeting or any adjournment or postponement thereof at the direction of the Paramount board.

ix

Table of Contents

| Q: | Why are the merger agreement and the merger not being considered and voted upon by Coeur stockholders? |

| A: | Under Delaware law, Coeur stockholders are not required to approve the merger or adopt the merger agreement. Coeur stockholders are being asked to consider and vote on the issuance of Coeur common stock in connection with the merger, which is required pursuant to Section 312.07 of the NYSE Listed Company Manual. |

| Q: | How does the Coeur board of directors recommend that I vote? |

| A: | The Coeur board of directors (the “Coeur board”) unanimously authorized and approved the merger agreement and the merger, directed that the issuance of shares of Coeur common stock pursuant to the merger agreement be submitted to the stockholders of Coeur for approval and determined that the merger is advisable and in the best interests of Coeur and its stockholders. The Coeur board accordingly unanimously recommends that the Coeur stockholders vote “FOR” each of the share issuance proposal and the Coeur adjournment proposal. |

| Q: | How does the Paramount board of directors recommend that I vote? |

| A: | The Paramount board unanimously approved and declared advisable the merger agreement and the transactions contemplated by the merger agreement, including the merger and the spin-off, directed that the merger agreement be submitted to the stockholders of Paramount for adoption and determined that the terms of the merger agreement, the merger, the spin-off and the other transactions contemplated by the merger agreement are fair to and in the best interests of Paramount’s stockholders. The Paramount board accordingly unanimously recommends that the Paramount stockholders vote “FOR” each of the merger proposal, the Paramount adjournment proposal and the compensation proposal. |

| Q: | How do I vote? |

| A: | If you are a stockholder of record of Coeur as of the close of business on the record date for the Coeur special meeting or a stockholder of record of Paramount as of the close of business on the record date for the Paramount special meeting, you may vote in person by attending your special meeting or, to ensure your shares are represented and voted at the meeting, you may submit a proxy by: |

| • | accessing the Internet website specified on your proxy card; |

| • | calling the toll-free number specified on your proxy card; or |

| • | marking, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided. |

If you hold Coeur or Paramount shares in the name of a broker, bank, trust company or other nominee, please follow the voting instructions provided by your broker, bank, trust company or other nominee to ensure that your shares are represented at your special meeting.

| Q: | What vote is required to approve each proposal? |

| A: | Coeur. Approval of the share issuance proposal and the Coeur adjournment proposal each requires the affirmative vote of holders of a majority of the shares of Coeur common stock present in person or represented by proxy at the Coeur special meeting and entitled to vote at the meeting. |

Paramount. Approval of the merger proposal requires the affirmative vote of holders of a majority of the outstanding shares of Paramount common stock entitled to vote thereon. Approval of the Paramount adjournment proposal and the compensation proposal each requires the affirmative vote of holders of a majority of the shares of Paramount common stock present in person or represented by proxy at the Paramount special meeting and entitled to vote on the proposal.

x

Table of Contents

| Q: | How many votes do I have? |

| A: | Coeur. You are entitled to one vote for each share of Coeur common stock that you owned as of the close of business on the Coeur record date. As of the close of business on the Coeur record date, there were [ ] shares of Coeur common stock outstanding and entitled to vote at the Coeur special meeting. |

Paramount. You are entitled to one vote for each share of Paramount common stock that you owned as of the close of business on the Paramount record date. As of the close of business on the Paramount record date, there were [ ] shares of Paramount common stock outstanding and entitled to vote at the Paramount special meeting.

| Q: | What will happen if I fail to submit a proxy or I abstain from voting? |

| A: | Coeur. If you are a Coeur stockholder and fail to submit a proxy or fail to instruct your broker or nominee to vote, it will have no effect on the share issuance proposal or the Coeur adjournment proposal, assuming a quorum is present. If you are a Coeur stockholder and you mark your proxy or voting instructions to abstain, it will have the effect of a vote against the share issuance proposal and the Coeur adjournment proposal. |

Paramount. If you are a Paramount stockholder and fail to submit a proxy or fail to instruct your broker or nominee to vote, it will have the effect of a vote against the merger proposal, but it will have no effect on the Paramount adjournment proposal or the compensation proposal, assuming a quorum is present. If you are a Paramount stockholder and you mark your proxy or voting instructions to abstain, it will have the effect of a vote against the merger proposal, the Paramount adjournment proposal and the compensation proposal.

| Q: | What constitutes a quorum? |

| A: | Coeur. A majority of the voting power of all issued and outstanding Coeur common stock entitled to vote at the Coeur special meeting, represented at the meeting in person or by proxy, will constitute a quorum for the transaction of business at the Coeur special meeting. The inspectors of election will treat abstentions and broker non-votes as shares that are present and entitled to vote for purposes of determining the presence of a quorum. A broker non-vote occurs when a broker or other nominee that holds shares on behalf of a street name stockholder returns a valid proxy card, but does not vote on a particular matter because it does not have discretionary authority to vote on that particular matter and has not received voting instructions from the street name stockholder. |

Paramount. The presence, in person or by proxy, of the holders of one-third of the voting power of the Paramount common stock entitled to vote at the Paramount special meeting shall constitute a quorum for the transaction of business and abstentions and broker non-votes will be counted as present for purposes of establishing a quorum.

| Q: | If my shares are held in “street name” by my broker, will my broker automatically vote my shares for me? |

| A: | No. If you hold your shares in a stock brokerage account or if your shares are held by a broker, bank, trust company or other nominee (that is, in “street name”), your broker, bank, trust company or other nominee cannot vote your shares on any of the proposals to be considered at the Coeur special meeting or the Paramount special meeting as all such proposals are “non-routine” matters. You should instruct your broker, bank, trust company or other nominee as to how to vote your shares, following the directions from your broker, bank, trust company or other nominee provided to you. Please check the voting form used by your broker, bank, trust company or other nominee. If you do not provide your broker, bank, trust company or other nominee with instructions, your shares of Coeur common stock or Paramount common stock, as applicable, will not be voted on any proposal at the Coeur special meeting or Paramount special meeting, as applicable. |

xi

Table of Contents

Please note that you may not vote shares held in street name by returning a proxy card directly to Coeur or Paramount or by voting in person at the applicable special meeting unless you provide a legal proxy, which you must obtain from your broker, bank, trust company or other nominee.

| Q: | What will happen if I return my proxy card without indicating how to vote? |

| A: | If you return your proxy card without indicating how to vote on any particular proposal, the Coeur common stock or Paramount common stock represented by your proxy will be voted in favor of such particular proposal. |

| Q: | Can I change my vote after I have returned a proxy or voting instruction card? |

| A: | Yes. You can change your vote at any time before your proxy is voted at your special meeting. If you are a holder of record, you can do this in one of three ways: |

| • | you can send a signed notice of revocation; |

| • | you can grant a new, valid proxy bearing a later date (including by telephone or through the Internet); or |

| • | you can attend your special meeting and vote in person, which will revoke any proxy previously given, or you may revoke your proxy in person, but your attendance alone will not revoke any proxy that you have previously given. |

If you provide a written notice of revocation, you must submit it to the Corporate Secretary of Coeur or the Corporate Secretary of Paramount, as appropriate, no later than the beginning of the applicable special meeting. If you grant a new proxy by telephone or Internet voting, your revised instructions must be received, in the case of the Coeur special meeting, by 11:59 p.m. Eastern Time on [ ], 2015, and, in the case of the Paramount special meeting, by 11:59 p.m. Eastern Time on [ ], 2015.

If your shares are held in street name by your broker, bank, trust company or other nominee, you should contact your broker, bank, trust company or other nominee to change your vote or revoke your proxy.

| Q: | What happens if I transfer my shares of Coeur or Paramount common stock before the special meetings? |

| A: | The record dates for the Coeur and Paramount special meetings are earlier than both the date of the special meetings and the date that the merger is expected to be completed. In addition, the record date for the spin-off has not yet been determined but such date will be after the record date for the Paramount special meeting. If you transfer your Coeur or Paramount shares after the applicable record date for the special meeting, you will retain your right to vote at the applicable special meeting. If you are a Paramount stockholder, you will have transferred the right to receive the merger consideration in the merger. In order to receive the merger consideration, you must hold your shares through the effective date of the merger. |

Paramount expects that a “when-issued” market in SpinCo common stock may develop as early as two trading days prior to the record date for the spin-off and continue up to and including the spin-off date. “When-issued” trading refers to a sale or purchase made conditionally on or before the spin-off date because the securities of the spun-off entity have not yet been distributed. If you own shares of Paramount common stock at the close of business on the record date for the spin-off, you will be entitled to receive shares of SpinCo common stock in the spin-off. You may trade this entitlement to receive shares of SpinCo common stock, without the shares of Paramount common stock you own, on the “when-issued” market. Paramount expects “when-issued” trades of SpinCo common stock to settle within four trading days after the spin-off date. On the first trading day following the spin-off date, Paramount expects that “when-issued” trading of SpinCo common stock will end and “regular-way” trading will begin. If the spin-off does not occur, all “when-issued” trading will be null and void.

xii

Table of Contents

Paramount also anticipates that, as early as two trading days prior to the record date for the dividend and continuing up to and including the spin-off date, there will be two markets in Paramount common stock: a “regular-way” market and an “ex-spin-off” market. Shares of Paramount common stock that trade on the regular-way market will trade with an entitlement to receive shares of SpinCo common stock in the spin-off. Shares that trade on the ex-spin-off market will trade without an entitlement to receive shares of SpinCo common stock in the spin-off. Therefore, if you sell shares of Paramount common stock in the regular-way market up to and including the spin-off date, you will be selling your right to receive shares of SpinCo common stock in the spin-off. However, if you own shares of Paramount common stock at the close of business on the record date for the dividend and sell those shares on the ex-spin-off market up to and including the spin-off date, you will still receive the shares of SpinCo common stock that you would otherwise be entitled to receive in the spin-off.

| Q: | What does it mean if I receive more than one set of voting materials for the Coeur special meeting or the Paramount special meeting? |

| A: | You may receive more than one set of voting materials for the Coeur special meeting and/or the Paramount special meeting, as applicable, including multiple copies of this joint proxy statement/prospectus and multiple proxy cards or voting instruction cards. For example, if you hold your shares of Coeur common stock or your shares of Paramount common stock in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares of Coeur common stock or shares of Paramount common stock. If you are a holder of record and your shares of Coeur common stock or your shares of Paramount common stock are registered in more than one name, you may receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive or, if available, please submit your proxy by telephone or over the Internet. |

| Q: | What if I hold shares in both Coeur and Paramount? |

| A: | If you are both a stockholder of Coeur and a stockholder of Paramount, you will receive two separate packages of proxy materials. A vote cast (or proxy submitted) as a Coeur stockholder will not count as a vote cast (or proxy submitted) as a Paramount stockholder, and a vote cast (or proxy submitted) as a Paramount stockholder will not count as a vote cast (or proxy submitted) as a Coeur stockholder. Therefore, please separately submit a proxy for each of your Coeur and Paramount shares. In addition, the Coeur and Paramount special meetings will be held on the same date. Since the meetings will be held on the same date and at the same time, you will not be able to attend and vote in person at both meetings and therefore need to submit a proxy for your shares with respect to at least one company if you plan to attend and vote in person your shares with respect to the other company. |

| Q: | What will happen if all of the proposals to be considered at the special meetings are not approved? |

| A: | As a condition to completion of the merger, Coeur’s stockholders must approve the share issuance proposal and Paramount’s stockholders must approve the merger proposal. However, completion of the transactions, including the merger, is not conditioned or dependent on approval of any of the other proposals to be considered by the stockholders at the special meetings. For example, the merger is not conditioned on the Paramount stockholders approving, on a non-binding advisory basis, the compensation that may be paid or become payable to Paramount’s named executive officers in connection with the completion of the merger. The spin-off does not require approval of Paramount stockholders, although Paramount does not intend to consummate the spin-off unless the merger is also completed. |

| Q: | Are Coeur stockholders or Paramount stockholders entitled to appraisal rights? |

| A: | No. Under the General Corporation Law of the State of Delaware (the “DGCL”), neither the holders of Coeur common stock nor the holders of Paramount common stock are entitled to appraisal rights in connection with the merger or the other transactions. For more information, see the section entitled “The Issuance of Coeur Shares and the Adoption of the Merger Agreement—No Appraisal Rights” beginning on page [ ]. |

xiii

Table of Contents

| Q: | Why are Paramount stockholders being asked to approve, on a non-binding advisory basis, the compensation that may be paid or become payable to Paramount’s named executive officers in connection with the completion of the merger? |

| A: | The rules promulgated by the SEC under Section 14A of the Exchange Act require Paramount to seek anon-binding, advisory vote with respect to certain compensation that may be paid or become payable to Paramount’s named executive officers in connection with the merger. For more information regarding such payments, see the section entitled “Advisory (Non-Binding) Vote on Compensation” beginning on page [ ]. |

| Q: | When do you expect the merger to be completed? |

| A: | Coeur and Paramount intend to complete the merger as soon as reasonably practicable and currently expect to complete the merger in the second quarter of 2015. However, the merger is subject to regulatory clearances and other conditions, in addition to the approvals of both Coeur and Paramount stockholders as described in this joint proxy statement/prospectus, and it is possible that factors outside the control of both companies could result in the merger being completed at a later time or not at all. |

| Q: | What do I need to do now? |

| A: | Carefully read and consider the information contained in and incorporated by reference into this joint proxy statement/prospectus, including its annexes. |

If you are a holder of record, in order for your shares to be represented at your special meeting:

| • | you can attend your special meeting in person; |

| • | you can submit a proxy through the Internet or by telephone by following the instructions included on your proxy card; or |

| • | you can indicate on the enclosed proxy card how you would like to vote and return the proxy card. |

If you hold your shares in street name, in order for your shares to be represented at your special meeting, you should instruct your broker, bank, trust company or other nominee as to how to vote your shares, following the directions from your broker, bank, trust company or other nominee provided to you.

| Q: | Who can help answer my questions? |

| A: | Coeur stockholders or Paramount stockholders who have questions about the merger, the Coeur share issuance or the other matters to be voted on at the special meetings or the other transactions contemplated by the merger agreement or who desire additional copies of this joint proxy statement/prospectus or additional proxy cards, should contact: |

| if you are a Coeur stockholder: | if you are a Paramount stockholder: | |

MacKenzie Partners, Inc. 105 Madison Avenue New York, New York 10016 proxy@mackenziepartners.com Call Collect (212) 929-5500 or Toll-Free (800) 322-2885 or Coeur Mining, Inc. 104 S. Michigan Ave., Suite 900 Chicago, Illinois 60603 (312) 489-5800 Attn: Corporate Secretary | Paramount Gold and Silver Corp. 665 Anderson Street Winnemucca, Nevada 89445 (866) 481-2233 Attn: Corporate Secretary or Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, New York 10022 Call Collect (212) 750-5833 or Toll-free (888) 750-5834 | |

xiv

Table of Contents

This summary highlights information contained elsewhere in this joint proxy statement/prospectus and may not contain all the information that is important to you. Coeur and Paramount urge you to read carefully the remainder of this joint proxy statement/prospectus, including the annexes and the other documents to which we have referred you, because this section does not provide all the information that might be important to you with respect to the merger and the other matters being considered at the applicable special meeting. See also the section entitled “Where You Can Find More Information” beginning on page [ ]. We have included page references to direct you to a more complete description of the topics presented in this summary.

Coeur Mining, Inc. (See page [ ])

Coeur Mining, Inc.

104 S. Michigan Ave., Suite 900

Chicago, Illinois 60603

Telephone: (312) 489-5800

Coeur Mining, Inc., a Delaware corporation, is a large silver producer with significant gold production and mines located in the United States, Mexico, and Bolivia; a silver streaming interest in Australia and exploration projects in Mexico and Argentina. Coeur operates the Palmarejo mine, San Bartolomé mine, Kensington mine, and Rochester mine and also owns Coeur Capital, which is primarily comprised of the Endeavor silver stream and other precious metal royalties. Coeur’s principal sources of revenue are its operating mines and the Endeavor silver stream.

Coeur’s business strategy is to discover, acquire, develop and operate low-cost silver and gold mines and acquire precious metal streaming and royalty interests that together produce long-term cash flow, provide opportunities for growth through continued exploration and generate superior and sustainable returns for stockholders. Coeur’s management focuses on maximizing net cash flow through identifying and implementing revenue enhancement opportunities, reducing operating and non-operating costs, consistent capital discipline, and efficient management of working capital.

Coeur common stock is listed on the NYSE under the symbol “CDE”.

Additional information about Coeur and its subsidiaries is included in documents incorporated by reference in this joint proxy statement/prospectus. See “Where You Can Find More Information” beginning on page [ ].

Paramount Gold and Silver Corp. (See page [ ])

Paramount Gold and Silver Corp.

665 Anderson Street

Winnemucca, Nevada 89445

Telephone: (866) 481-2233

Paramount Gold and Silver Corp., a Delaware corporation, is a U.S. based precious metals exploration company with projects in Nevada and northern Mexico. Paramount’s business strategy is to acquire and develop known precious metals deposits in large-scale geological environments in North America. This strategy helps eliminate discovery risks and significantly increases the efficiency of exploration programs. Its projects are located near successful operating mines. This greatly reduces the related costs for infrastructure requirements at the exploration stage and eventually for mine construction and operation.

1

Table of Contents

Paramount’s operating segments are the United States and Mexico.

Paramount’s Mexican business, known as the San Miguel Project, was assembled by completing multiple transactions with third parties from 2005 to 2009.

Paramount’s business in Nevada, United States, known as the Sleeper Gold Project, is located in Humboldt County, Nevada.

Pursuant to the terms of the separation agreement and the merger agreement, prior to the consummation of the merger, SpinCo (which will own and operate the Paramount Nevada business) will issue to Coeur newly issued shares of SpinCo common stock amounting to 4.9% of the outstanding SpinCo common stock after issuance, and Paramount will dividend to Paramount’s stockholders all of the shares of SpinCo common stock then held by Paramount. Following consummation of the spin-off, SpinCo will be a stand-alone, publicly traded company and Paramount will be comprised of the Paramount Mexico business, which will combine with Coeur in the merger.

Paramount common stock is currently listed for trading on the NYSE MKT and the Toronto Stock Exchange under the symbol “PZG”.

Additional information about Paramount and its subsidiaries is included in documents incorporated by reference in this joint proxy statement/prospectus. See “Where You Can Find More Information” beginning on page [ ]. For additional information relating to the spin-off, please see the Form S-1 filed by SpinCo with the SEC (File No. 333-201431).

Hollywood Merger Sub, Inc. (See page [ ])

Hollywood Merger Sub, Inc., a wholly-owned subsidiary of Coeur (“Merger Sub”), is a Delaware corporation that was formed on December 3, 2014 for the purpose of effecting the merger. Upon completion of the merger, Merger Sub will be merged with and into Paramount, with Paramount surviving as a wholly-owned subsidiary of Coeur. Merger Sub has not conducted any activities other than those incidental to its formation and the matters contemplated by the merger agreement in connection with the merger.

Paramount Nevada Gold Corp. (See page [ ])