SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant o

Filed by a Party other than the Registrant o

Check the appropriate box:

| | x | Preliminary Proxy Statement |

| | o | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| | o | Definitive Proxy Statement |

| | o | Definitive Additional Materials |

| | o | Soliciting Material Under Rule 14a-12 |

DVL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

DVL, INC.

70 East 55th Street

New York, New York 10022

NOTICE OF SPECIAL ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 17, 2010

You are cordially invited to be present, either in person or by proxy, at the Special Annual meeting (“Special Annual Meeting”) of stockholders of DVL, Inc., a Delaware corporation (the “Company”), to be held on December 17, 2010 at 10:30 a.m. local time, or at any adjournments thereof (the “Meeting”), in the Justice Owen J. Roberts Conference Room at the law offices of Montgomery, McCracken, Walker & Rhoads, 123 South Broad Street, Philadelphia, PA 19109, to consider an act upon the following:

| | 1. | Election of Directors. To elect three directors to serve until the next Annual Meeting of Stockholders, and until their successors are duly elected and qualified. |

| | 2. | Reverse Stock Split of Common Stock. To approve, subject to final action by the Board of Directors of the Company (the “Board of Directors”), an amendment to the Company’s Certificate of Incorporation (“Charter”) effecting a 1-for-7,500 reverse stock split (the “Reverse Stock Split”) of the common stock, par value $0.01 per share, of the Company (the “Common Stock”) which would result in (i) holdings prior to such split of fewer than 7,500 shares of Common Stock being converted into a fractional share, which will then be immediately cancelled and converted into a right to receive cash consideration described in the attached Proxy Statement, and (ii) the Company having fewer than 300 stockholders of record, allowing the Company to deregister its Common Stock under the Securities Exchan ge Act of 1934 (the “Exchange Act”), and avoid the costs associated with being a public reporting company. |

| | 3. | Amend Company’s Charter. To approve an amendment to, the Company’s Charter to (a) implement the Reverse Stock Split in the Board of Directors’ discretion, (b) eliminate all authorized Preferred Stock in order to significantly reduce the Company’s Annual Franchise Tax payable to the State of Delaware, and (c) in order to simplify the Charter, to Amend and Restate the Company’s Certificate of Incorporation in its entirety. |

| | 4. | Other Business. To transact other business as may properly come before the meeting or any adjournment or postponement of the Special Annual Meeting. |

The Board of Directors knows of no other business to be transacted at the Special Annual Meeting.

The Board of Directors has designated October 22, 2010 as the record date for determining stockholders entitled to notice of and to vote at the Special Annual Meeting.

These items of business are more fully described in the Proxy Statement which we are sending you along with this Notice. Whether or not you plan to attend the Special Annual Meeting, it is important that your shares be represented.

NEITHER THE REVERSE STOCK SPLIT NOR ANY OF THE OTHER PROPOSED ACTIONS HAVE BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION; AND NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE COMMISSION HAS PASSED UPON THE FAIRNESS OR MERITS OF THE REVERSE STOCK SPLIT OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. ANY PRESENTATION TO THE CONTRARY IS UNLAWFUL.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | Charles Carames |

| | Secretary |

November , 2010

New York, New York

YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE ASKED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD AS PROMPTLY AS POSSIBLE REGARDLESS OF WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL ANNUAL MEETING.

TABLE OF CONTENTS

| | Page |

| | |

| | |

| OVERVIEW | 1 |

| SUMMARY OF TERMS OF REVERSE STOCK SPLIT | 2 |

| MANNER OF VOTING AND VOTE REQUIRED | 3 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS | 4 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 5 |

| PROPOSAL 1 – ELECTION OF DIRECTORS | 5 |

| Nominees for Directors | 5 |

| Executive Compensation | 6 |

| Employee Contracts and Arrangements | 7 |

| Option Grants in Last Fiscal Year | 7 |

| Compensation of Directors | 8 |

| MARKET FOR REGISTRANT’S COMMON EQUITY | 9 |

| Market Information for our Common Stock | 9 |

| Holders of Record | 9 |

| PROPOSAL 2 – REVERSE STOCK SPLIT | 10 |

| Reverse Stock Split; “Going Private”; Pink Sheet” Quotation | 10 |

| Background and History of The Reverse Stock Split Proposal | 11 |

| Alternative Transactions Considered | 13 |

| Purpose of The Reverse Stock Split | 15 |

| Going Private Transaction; Schedule 13E-3 Filing | 15 |

| Structure of The Reverse Stock Split | 15 |

| Effects on Stockholders With Less Than 7,500 Shares of Common Stock | 16 |

| Effects On Stockholders With 7,500 Or More Shares Of Common Stock | 17 |

| Effects On The Company | 17 |

| Advantages of The Reverse Stock Split | 18 |

| Cost Savings | 18 |

| Opportunity For Cashed Out Stockholders To Sell Their Holdings At Or Above The Current Market Trading Price, Without Brokerage Fees Or Commissions | 18 |

| Disadvantages of The Reverse Stock Split | 18 |

| Substantial or Complete Reduction of Public Sale Opportunities For Our Stockholders | 18 |

| Loss of Certain Publicly Available Information | 19 |

| Possible Significant Decline In The Value Of Our Shares | 19 |

| Inability To Participate In Any Future Increases In Value Of Our Common Stock | 19 |

| Opinion of Financial Advisor | 19 |

TABLE OF CONTENTS

(continued)

| | Page |

| | |

| Fairness of The Reverse Stock Split | 20 |

| Material U.S. Federal Income Tax Consequences of the Reverse Stock Split | 21 |

| Tax Consequences of the Reverse Stock Split to U.S. Holders | 22 |

| Stockholders Not Receiving Cash in the Reverse Stock Split | 22 |

| Stockholders Receiving Only Cash in Exchange for Common Stock in the Reverse Stock Split | 22 |

| Section 302 Tests | 23 |

| Tax Consequences to Stockholders Who Receive Both Stock And Cash | 24 |

| Tax Consequences of the Reverse Stock Split to Non-U.S. Holders | 24 |

| U.S. Federal Income Tax Withholding Requirements for All Stockholders | 25 |

| Tax Consequences of the Reverse Stock Split to the Company | 25 |

| Financing the Reverse Stock Split | 25 |

| PROPOSAL 3 – AMEND COMPANY’S CHARTER TO (A) IMPLEMENT REVERSE STOCK SPLIT, ASSUMING BOARD OF DIRECTORS CONCURS, (B) ELIMINATE AUTHORIZED PREFERRED STOCK, AND (C) IN ORDER TO SIMPLIFY THE CHARTER, AMEND AND RESTATE THE COMPANY’S CERTIFICATE OF INCORPORATION IN ITS ENTIRETY | 26 |

| GENERAL INFORMATION ABOUT THE SPECIAL ANNUAL MEETING AND VOTING | 26 |

| Proxy Solicitation | 26 |

| Special Annual Meeting and Voting Information | 27 |

| Time and Place | 27 |

| Revoking Your Proxy | 27 |

| Record Date | 27 |

| Quorum and Required Vote | 27 |

| Appraisal Rights | 28 |

| Costs/Source of Funds and Expenses | 28 |

| Recommendation of Our Board of Directors | 28 |

| Dividend Policy | 29 |

| OTHER MATTERS | 29 |

| Available Information | 29 |

| Where You Can Find More Information | 29 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 30 |

| Pemmil Transaction | 30 |

| Director Independence | 31 |

| RELATIONSHIP WITH INDEPENDENT AUDITORS | 31 |

| STOCKHOLDER PROPOSALS | 32 |

| INCORPORATION BY REFERENCE | 32 |

| ADDITIONAL FINANCIAL INFORMATION | 32 |

TABLE OF CONTENTS

(continued)

| EXHIBIT A | – | AMENDED CERTIFICATE OF INCORPORATION OF DVL, INC. |

| EXHIBIT B | – | AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF DVL, INC. |

| EXHIBIT C | – | FAIRNESS OPINION OF EXECUTIVE SOUNDING BOARD ADVISORS, INC. |

DVL, INC.

70 East 55th Street

New York, New York 10022

(212) 350-9900

PROXY STATEMENT

Special Annual Meeting of Stockholders

To Be Held December 17, 2010

10:30 a.m.

OVERVIEW

This Proxy Statement is furnished to the stockholders of DVL, Inc., a Delaware corporation (the “Company”), in connection with the solicitation by the Company’s Board of Directors (the “Board of Directors”) of proxies to be used at the Company’s Special Annual Meeting of Stockholders (“Special Annual Meeting”) to be held in the Justice Owen J. Roberts Conference Room at the law offices of Montgomery, McCracken, Walker & Rhoads, 123 South Broad Street, Philadelphia, PA 19109. It is anticipated that this Proxy Statement will be mailed to our stockholders on or about November , 2010. References to the “Company,” “us,” “we,” or “our,” refer to DVL, Inc.

Our registered office is located in the State of Delaware, 1013 Centre Road, City of Wilmington, Delaware 19901, County of New Castle. A form of proxy is enclosed for use at the Special Annual Meeting if a stockholder is unable to attend in person. Each proxy may be revoked at any time thereafter by the person giving the proxy by writing such to the Secretary of the Company prior to the meeting, by execution and delivery of a subsequent proxy, or by attendance and voting in person at the Special Annual Meeting. Shares represented by valid proxy, which if received pursuant to this solicitation and not revoked before it is exercised, will be voted as provided on the proxy at the Special Annual Meeting or at any adjournments thereof.

The directors of the Company have advised the Company that they will vote all of their 310,000 outstanding shares of common stock, $.01 per value per share, of the Company (the “Common Stock”), which they control (less than 1% of the outstanding shares of Common Stock) in favor of the proposals to:

| | 1. | Election of Directors. To elect three directors to serve until the next Special Annual Meeting of Stockholders, and until their successors are duly elected and qualified. |

| | 2. | Reverse Stock Split of Common Stock. To approve, subject to final action by the Board of Directors of the Company (the “Board of Directors”), an amendment to the Company’s Certificate of Incorporation (“Charter”) effecting a 1-for-7,500 reverse stock split (the “Reverse Stock Split”) of the Common Stock of the Company which would result in (i) holdings prior to such split of fewer than 7,500 shares of Common Stock being converted into a fractional share, which will then be immediately cancelled and converted into a right to receive cash consideration described in the attached Proxy Statement, and (ii) the Company having fewer than 300 stockholders of records allowing the Company to deregister its Common Stock under the Securities Exchange Act of 1934 (the “Exchange Act”) and to avoid the costs associated with being a public reporting company. |

| | 3. | Amend Company’s Charter. To approve an amendment of the Company’s Charter to (a) implement the Reverse Stock Split, in the Board of Directors’ discretion (b) eliminate all authorized Preferred Stock in order to significantly reduce the Company’s Annual Franchise Tax payable to the State of Delaware, and (c) in order to simplify the Charter, to Amend and Restate the Company’s Certificate of Incorporation in its entirety. |

| | 4. | Other Business. To transact such other business as may properly come before the meeting or any adjournment or postponement of the Special Annual Meeting. |

The Board of Directors of the Company has unanimously recommended that stockholders of the Company vote their shares of Common Stock to elect each of the Company’s nominees for Director and to approve each of the matters set forth in Proposal Numbers 2 – Reverse Stock Split of Common Stock and 3 – Elimination of Preferred Stocks and Amend and Restate Company’s Certificate of Incorporation in this Proxy Statement.

As of the date of this Proxy Statement, the Board of Directors does not intend to present to the Special Annual Meeting any other business, and it has not been informed of any business intended to be presented by others. Should any other matters, however, properly come before the Special Annual Meeting, the persons named in the enclosed proxy will take action, and vote proxies, in accordance with their judgment on such matters.

The executive offices of the Company are located at 70 East 55th Street, New York, New York 10022; telephone number (212) 350-9900.

IMPORTANT NOTE: Stockholders who hold shares of Common Stock in the name of one or more brokerage firms, banks or nominees can only vote their shares of Common Stock with respect to the matters set forth in Proposal Numbers 2 and 3 if such brokerage firms, banks or nominees give such stockholders a legal proxy to vote such shares of Common Stock or if such stockholders give such brokerage firms, banks or nominees specific instructions as to how to vote such stockholders’ Common Stock. Accordingly, it is critical that stockholders who hold shares of Common Stock in the name of one or more brokerage firms, banks or nominees promptly contact the person responsible for such stockholders’ accounts and give specific instructions as to how such shares of Common Stock should be voted with respect to the matters set forth in Proposal Numbers 2 and 3.

SUMMARY OF TERMS OF REVERSE STOCK SPLIT

The following is a summary of terms of the proposed Reverse Stock Split set forth on pages 9 through 25 of this Proxy Statement. If approved by a majority of the Company’s holders of common stock and consummated at the discretion of the Company’s Board of Directors, the Company’s Charter will be amended to effect a 1-for-7,500 share Reverse Stock Split reducing the number of record holders of common stock to fewer than 300, and thereby allowing the Company to Go Private, terminate its registration of Stock under the Exchange Act and eliminate the related cost of complying with public disclosure requirements and the requirements of Sarbanes-Oxley:

| | · | Issue 1 share for each 7,500 shares of Common Stock currently issued by the Company |

| | · | In lieu of fractional shares in the Common Stock, pay holders of any fractional shares, cash in amount of $0.14 free of any brokerage commissions and without interest |

| | · | Reduce number of record holders of Common Stock to fewer than 300 |

| | · | Terminate registration of Common Stock under the Exchange Act |

| | · | Eliminate significant annual expense of approximately $300,000 (excluding the cost of executives time) to comply with public reporting and related requirements required by the Exchange Act and Sarbanes-Oxley |

| | · | Company’s Board of Directors determined transaction is “fair” to all Common Stockholders |

| | · | Fairness Opinion issued by ESBA |

| | · | Reverse Stock Split cheaper and more viable than Tender Offer, Maintaining Status Quo, or Sale of all or part of the Company |

MANNER OF VOTING AND VOTE REQUIRED

Only holders of shares of Common Stock of record at the close of business on October 22, 2010 (the “Record Date”), will be entitled to vote at the Special Annual Meeting. As of the Record Date, 44,770,345 shares of Common Stock, the only class of voting securities of the Company, were issued and outstanding. Each holder of Common Stock is entitled to one vote for each share held by such holder. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum at the Special Annual Meeting.

Under the rules of the Securities and Exchange Commission (the “Commission”), boxes and a designated blank space are provided on the proxy card for stockholders to mark if they wish to withhold authority to vote for one or more nominees for Director or for Proposal Numbers 2 and 3. Votes withheld in connection with (a) the election of one or more of the nominees for Director or Proposal Numbers 2 (regarding the Reverse Stock Split of Common Stock) and 3 (regarding the Elimination of Preferred Stock and the amendment of the Company’s Certificate of Incorporation) and (b) broker “non-votes” will be counted as votes cast against such individuals or Proposals and will be counted toward the presence of a quorum for the transaction of business. If no direction is indicat ed, the proxy will be voted FOR the election of the nominees for Director and FOR each of Proposal Numbers 2 and 3. The form of proxy does not provide for abstentions with respect to the election of Directors; however, a stockholder present at the Special Annual Meeting may abstain with respect to such election.

The election of Directors will be by a plurality of the votes actually cast thereon. Approval of the Reverse Stock Split of the Common Stock and the Elimination of the Preferred Stock and the Amendment and Restatement of the Company’s Certificate of Incorporation, set forth in Proposals 2 and 3, respectively, requires the affirmative vote of a majority of the outstanding shares of Common Stock entitled to vote, in person or by proxy, at the Special Annual Meeting. Approval of a majority of unaffiliated stockholders is not required.

Pursuant to the Company’s Amended and Restated Charter, each stockholder will be entitled to one vote per share. The Common Stock as a class represents 100% of the outstanding voting power of the Company. There are no holders of the Company’s authorized but unissued Preferred Stock. The only such shares issued were 100 Class A Preferred Stock which the Company redeemed for $1,000 from its holder on October 1, 2010.

Abstentions and broker non-votes will be counted for purposes of establishing a quorum only. The presence at the Special Annual Meeting, in person or by proxy, of the holders of a majority of our Common Stock outstanding on the record date will constitute a quorum for the meeting. Our Board of Directors urges each stockholder to mark, sign and mail the enclosed Proxy card in the return envelope as promptly as possible.

Such other business as may properly come before the Special Annual Meeting or any adjustment or postponement thereof will also be considered.

You are requested to complete and sign the enclosed Proxy card, which is solicited on behalf of the Board of Directors, and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend and vote at the Special Annual Meeting in person.

THE REVERSE STOCK SPLIT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, AND NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE COMMISSION HAS PASSED UPON THE FAIRNESS OR MERITS OF THE REVERSE STOCK SPLIT OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of October 22, 2010, by (a) each person known by the Company to own beneficially more than 5% of such stock, (b) each Director and nominee for Director of the Company and (c) all Directors and executive officers of the Company as a group. Unless otherwise indicated, the shares listed in the table are owned directly by the individual and the individual has sole voting and investment power with respect to such shares. All Directors of the Company have indicated to the Company that they will vote all their issued shares of Common Stock (aggregating 310,000 shares, or less than 1% of the outstanding shares of Common Stock) in favor of each of the proposals set fort h herein.

| Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class(1) |

| | | | | | |

Lawrence J. Cohen (2) | | 4,691,397 | | | 10.5% |

| | | | | | |

Jay Chazanoff (2) | | 2,857,606 | | | 6.4% |

| | | | | | |

J.G. Wentworth, S.S.C. Limited Partnership (3) | | 3,000,000 | | | 6.7% |

| | | | | | |

| Alan E. Casnoff | | 335,000 | (4) | | Less than 1% |

| | | | | | |

| Ira Akselrad | | - 0 - | | | - 0 - |

| | | | | | |

| Gary Flicker | | 145,000 | | | Less than 1% |

| | | | | | |

| All current Directors and executive officers as a group (5 persons) | | 480,000 | | | 1% |

___________________________

| (1) | Based on 44,770,345 shares outstanding. |

Each named person and all executive officers, Directors and nominees for Director, as a group, are deemed to be the beneficial owners of securities that may be acquired within 60 days through the exercise of options, warrants or exchange or conversion rights. Accordingly, the number of shares and percentage set forth opposite each stockholder’s name in the above table under the columns captioned “Amount and Nature of Beneficial Ownership” include shares of Common Stock issuable upon exercise of presently exercisable warrants, convertible debentures and stock options. The shares of Common Stock so issuable upon such exercise, exchange or conversion by any such stockholder are not included in calculating the number of shares or percentage of Common Stock beneficially owned by any other stockhold er.

| (2) | According to a Schedule 13D filed with the SEC, Messrs. Cohen and Chazanoff are part of a group that holds in the aggregate 12,193,850 shares of common stock representing 27.2% of the outstanding common stock shares. The business address for each of Messrs. Cohen and Chazanoff is 70 East 55th Street, New York, New York 10022. Messrs. Cohen and Chazanoff are currently affiliated with Pembroke Companies, Inc. which is a managing member of NPO Management LLC, the entity which is engaged by us to provide us with management services. |

| (3) | Represents shares issuable upon the exercise of warrants. |

| (4) | Excludes 461 shares of the Company’s Common Stock held by Mr. Casnoff’s adult son, as to which shares Mr. Casnoff disclaims beneficial ownership. Includes 26,000 shares of the Company’s Common Stock owned by a corporation, partially owned and controlled by Mr. Casnoff. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s Directors and executive officers and persons who own more than ten percent of a registered class of the Company’s equity securities (i.e., the Company’s Common Stock), to file with the Commission initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Executive officers, Directors and greater than ten percent shareholders are required by Commission regulation to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, based solely on review of the copies of such reports furnished to the Company and written representations that no other reports were required during the two fiscal years ended December 31, 200 9 and 2010 to date, all Section 16(a) filing requirements applicable to the Company’s executive officers, Directors and greater than ten percent beneficial owners were met.

PROPOSAL 1 – ELECTION OF DIRECTORS

The Board of Directors, acting in accordance with the By-laws of the Company, has determined that the Board of Directors shall be comprised of three directors.

Three Directors are to be elected at the Special Annual Meeting to serve until the next Annual Meeting of Stockholders of the Company, and until their successors shall be duly elected and shall qualify.

As noted, unless otherwise indicated thereon, all proxies received will be voted in favor of the election individually, of the nominees of the Board of Directors named below. Should any of the nominees not remain a candidate for election at the date of the Special Annual Meeting (which contingency is not now contemplated or foreseen by the Board of Directors), proxies solicited thereunder will be voted in favor of those nominees who do remain candidates and may be voted for substitute nominees selected by the Board of Directors. Directors shall be elected by a plurality of the votes cast at the Special Annual Meeting. Whether a nominee is currently serving as a Director of the Company is indicated below. The names of the nominees and certain information with regard to each nominee follows:

| Nominee | | Age | | Director Since | | Position with Company |

| Alan E. Casnoff | | 66 | | 2001 | | President, CEO and Director |

| Ira Akselrad | | 55 | | 2006 | | Director |

| Gary Flicker | | 51 | | 2004 | | Director, Chairman of Audit Committee |

Nominees for Directors

ALAN E. CASNOFF (age 66) has served as President of the Company since November 1994, and was appointed as a director in November 2001. Mr. Casnoff served as Executive Vice President of the Company from October 1991 to November 1994. Mr. Casnoff has maintained his other business interests during this period and thus has devoted less than full time to the business affairs of DVL. From November 1990 to October 1991, Mr. Casnoff served as a consultant to the Company and from 1977 to October 1991, as secretary of the Company. Since May 1991, Mr. Casnoff has also served as a director of Kenbee Management, Inc. (“Kenbee”), an affiliate of the Company, and as President of Kenbee since November 1994. Since 1977, Mr. Casnoff has also been a partner of P&a mp;A Associates, a private real estate development firm headquartered in Philadelphia, Pennsylvania. Since 1969, Mr. Casnoff was associated with various Philadelphia, Pennsylvania law firms which have been legal counsel to the Company and Kenbee. Since November, 2004, he has been of counsel to Zarwin, Baum, DeVito, Kaplan, Schaer and Toddy, P.C. (“Zarwin”). Mr. Casnoff’s experience, qualifications, attributes and skills noted above led to the conclusion to elect him as a director of the Company.

IRA AKSELRAD (age 55) was elected to the Board of Directors of the Company to serve as a director on November 2, 2006. Mr. Akselrad is currently Executive Vice President and General Counsel to the Johnson Company, Inc., the private investment company of the Robert Wood Johnson IV Family. Prior to joining the Johnson Company, he was an attorney with the New York law firm of Proskauer Rose, LLP for the past 21 years. For 16 of those years he was a member of the firm and represented a wide range of corporate and real estate clients. In addition to his client responsibilities, he chaired numerous firm committees and served as a member of the firm’s six member Executive Committee. Mr. Akselrad’s experience, qualifications, attributes and skills noted abov e led to the conclusion to elect him as a direct of the Company.

GARY FLICKER (age 51) has served as a director of the Company since January 2004. Mr. Flicker was Chief Financial Officer and Executive Vice President of DVL from April 1997 to November 2001 and remained employed by the Company until May 2002. From June 2002 to present, Mr. Flicker has served as President and Chief Executive Officer of Flick Financial, an accounting and financial consulting firm headquartered in Atlanta, Georgia. From January 2007 through July 2008, Mr. Flicker was Chief Financial Officer, Executive Vice President, and Secretary of Xethanol Corp., a public company traded on the American Stock Exchange. Mr. Flicker is a Certified Public Accountant. Mr. Flicker’s experience, qualifications, attributes and skills noted above led to the conclu sion to elect him as a director of the Company.

Since February 2000, the Board of Directors of the Company held approximately 40 meetings. Each Director of the Company attended at least 90% of these meetings.

The Board of Directors has established an Audit Committee, which is comprised of Messrs. Akselrad and Flicker. The Audit Committee reviews the services provided by the Company’s independent auditors, consults with the independent auditors on audits and proposed audits of the Company and reviews certain filings with the Commission and the need for internal auditing procedures and the adequacy of internal controls. The Audit Committee held 4 quarterly meetings during each of 2009 and 2010, at which all members were present. The Board has not established any other committees at this time. The Board of Directors acts in the place of a formal Compensation Committee. The Board of Directors reviews the performance of its employees annually and sets their compensa tion level. Bonuses are awarded on a discretionary basis related to an employee’s performance.

Executive Compensation

The following table sets forth all compensation awarded to, earned by or paid to the following persons for services rendered to us in 2008, 2009 and 2010: (1) the person serving as our Chief Executive Officer during 2008, 2009 and 2010 through to September 30, 2010; (2) the other persons who were serving as an executive officer as of the end of 2009 and 2010 through to September 30, 2010, whose compensation exceeded $100,000 during 2008, 2009 and 2010.

SUMMARY COMPENSATION TABLE

| Principal Position | | Year | | Salary | | | Bonus | | | Other Compensation | | | Total(s) | |

| Alan E. Casnoff | | 2010 | | $ | 112,000 | | | | - | | | $ | 16,500 | | | $ | 128,500 | (1), (2) |

| President and Chief Executive Officer | | 2009 | | | 147,000 | | | | - | | | | 29,500 | | | | 176,500 | (1), (2) |

| | | 2008 | | | 146,000 | | | | - | | | | 59,500 | | | | 205,500 | |

| | | | | | | | | | | | | | | | | | | |

| Henry Swain | | 2010 | | | 94,000 | | | | - | | | | 12,000 | | | | 106,000 | (2) |

| Executive Vice President | | 2009 | | | 138,000 | | | | - | | | | 16,000 | | | | 154,000 | |

| | | 2008 | | | 135,000 | | | | 13,000 | | | | 16,000 | | | | 164,000 | (2) |

| | | | | | | | | | | | | | | | | | | |

| Charles Carames | | 2010 | | | 96,000 | | | | 20,000 | | | | 12,000 | | | | 128,000 | |

| Secretary | | 2009 | | | 125,000 | | | | 30,000 | | | | 16,000 | | | | 171,000 | |

| | | 2008 | | | 125,000 | | | | 30,000 | | | | 16,000 | | | | 171,000 | |

| | | | | | | | | | | | | | | | | | | |

RESIG(3) | | 2010 | | | 229,000 | | | | - | | | | - | | | | 229,000 | |

| | | 2009 | | | 77,000 | | | | - | | | | - | | | | 77,000 | |

| | | 2008 | | | - | | | | - | | | | - | | | | - | |

___________________

| (1) | Included in other compensation is $10,000 and $40,000 of compensation for services rendered by Mr. Casnoff in the years 2009 and 2008, respectively, in connection with the development of the Kearny, New Jersey development project. |

| (2) | Included in other compensation is $10,000, $12,000 and $12,000 of medical insurance for of Mr. Casnoff, Mr. Swain and Mr. Carames, respectively, for the nine months ended September 30, 2010. For the years ended December 31, 2009 and 2008 includes medical insurance of $13,000, $16,000 and $16,000 for Mr. Casnoff, Mr. Swain and Mr. Carames, respectively. In January of 2008, 2009 and 2010, the Company paid Mr. Casnoff an additional $6,500 of compensation. |

| (3) | Real Estate Systems Implementation Group LLC (“RESIG”) provides all of our internal accounting, financial statement preparation and bookkeeping functions on an outsourced basis. As part of the agreement with RESIG, Neil H. Koenig, a managing member of RESIG, was appointed Chief Financial Officer. Compensation to RESIG under the agreement is disclosed under salary in the table above. |

No Officers, Directors or stockholders of the Company have obtained loans or loan commitments from the Company.

Employee Contracts and Arrangements

We have entered into Indemnification Agreements with all officers and directors effective upon their election as an officer or director, contractually obligating us to indemnify them to the fullest extent permitted by applicable law, in connection with claims arising from their service to, and activities on behalf of, the Company.

We do not currently have employment contracts in force. Our affairs are administered by Compensation Solutions, Inc., which we refer to as CSI, pursuant to the terms of a “leasing” contract. Pursuant to the leasing contract, CSI provides us with the necessary personnel, including certain executive officers, necessary to administer the affairs of the Company. Accordingly, CSI provides such employees with their medical, unemployment, workmen’s compensation and disability insurance through group insurance plans maintained by CSI for the Company and other clients of CSI. Pursuant to the contract, the cost of such insurance as well as the payroll obligations for the leased employees is funded by us to CSI, and CSI is required to then apply such proceeds to cov er the payroll and administrative costs to the employees. Should CSI fail to meet its obligations under the contract, we would be required to either locate a substitute employee leasing firm or directly re-employ our personnel. The contract is cancelable upon 30 days written notice by either party.

On November 2, 2009, we entered into an agreement with Real Estate Systems Implementation Group, LLC, which we refer to as RESIG, an affiliate of Imowitz Koenig & Co., LLP, our former independent registered public accountants, pursuant to which RESIG will provide substantially all of our internal accounting, financial statement preparation and bookkeeping functions on an outsourced consulting basis. For these accounting services, the company pays an annual fee to RESIG of $305,000. Neil Koenig is paid directly $52,000 annually of this amount. A requirement of the agreement was the appointment of Neil H. Koenig as our Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer. Mr. Koenig is a managing member of RESIG and a managing m ember of IKC.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Options (#) Unexercisable | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | Option Exercise Price ($) | | Option Expiration Date |

| Alan E. Casnoff | | 100,000 | | - | | - | | 0.0750 | | 08-08-11 |

Option Grants in Last Fiscal Year

No options or other equivalents were granted by us in 2010 or 2009 nor do we have a plan in effect pursuant to which options can be issued.

At September 30, 2010, we had 340,000 options to purchase 340,000 shares outstanding which options had been issued pursuant to a since terminated option plan. All such options are currently exercisable. The following table sets forth the expiration dates of the outstanding options and the exercise price for such options.

| Expiration Date | | Number of Options | | | Exercise Price | |

| 08/08/2011 | | | 135,000 | | | $ | 0.075 | |

| 09/17/2011 | | | 45,000 | | | $ | 0.080 | |

| 09/17/2012 | | | 30,000 | | | $ | 0.140 | |

| 05/12/2013 | | | 25,000 | | | $ | 0.120 | |

| 09/17/2013 | | | 30,000 | | | $ | 0.150 | |

| 09/01/2014 | | | 15,000 | | | $ | 0.120 | |

| 09/17/2014 | | | 30,000 | | | $ | 0.130 | |

| 09/17/2015 | | | 30,000 | | | $ | 0.120 | |

Compensation of Directors

Members of our Board of Directors who are not officers or employees of the Company presently receive a Director’s Fee of $1,600 per month, plus five hundred dollars for each Audit Committee meeting of the Board of Directors attended, and the Chairman of the Audit Committee receives an additional five hundred dollars per meeting. Directors who are officers of the Company receive no compensation for their services as Directors or attendance at any Board of Directors or Committee meetings.

The following is a table summarizing the compensation for non-employee directors during each calendar year.

| Name | | Fees Earned or Paid in Cash | | | Stock Awards ($) | | | Option Awards ($) | | | Total | |

| Gary Flicker | | $ | 23,200 | | | | - | | | | - | | | $ | 23,200 | |

| Ira Akselrad | | | 21,200 | | | | - | | | | - | | | $ | 21,200 | |

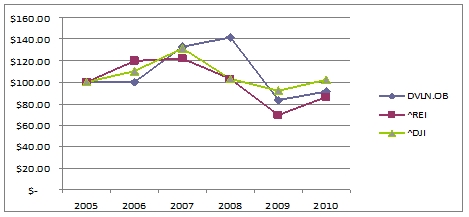

STOCK PERFORMANCE CHART

The following graph compares the yearly percentage change in the cumulative total stockholder return on the Company’s Common Stock for each of the Company’s last five fiscal years with the cumulative return (assuming reinvestment of dividends) of the Dow Jones Equity Market Index and the Dow Jones Real Estate Investment Index.

| | | Fiscal Year Ending (9/30) | |

| Company/Index/Market | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

| | | Closing Market Prices | |

| DVLN.OB | | $ | 0.12 | | | $ | 0.12 | | | $ | 0.16 | | | $ | 0.17 | | | $ | 0.10 | | | $ | 0.11 | |

| Dow Jones Reit Index | | | 243.52 | | | | 292.59 | | | | 297.08 | | | | 251.40 | | | | 168.67 | | | | 210.40 | |

| Dow Jones Market Index | | | 10,568.70 | | | | 11,679.07 | | | | 13,895.63 | | | | 10,850.66 | | | | 9,712.28 | | | | 10,788.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annual % Change | |

| DVLN.OB | | | 0.00% | | | | 0.00% | | | | 33.33% | | | | 6.25% | | | | -41.18% | | | | 10.00% | |

| ^REI | | | 0.00% | | | | 20.15% | | | | 1.53% | | | | -15.38% | | | | -31.91% | | | | 24.74% | |

| ^DJI | | | 0.00% | | | | 10.51% | | | | 18.98% | | | | -21.91% | | | | -10.49% | | | | 11.08% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Hypothetical $100 Invested | |

| DVLN.OB | | $ | 100.00 | | | $ | 100.00 | | | $ | 133.33 | | | $ | 141.67 | | | $ | 83.33 | | | $ | 91.67 | |

| ^REI | | | 100.00 | | | | 120.15 | | | | 121.99 | | | | 103.24 | | | | 69.26 | | | | 86.40 | |

| ^DJI | | | 100.00 | | | | 110.51 | | | | 131.48 | | | | 102.67 | | | | 91.90 | | | | 120.08 | |

MARKET FOR REGISTRANT’S COMMON EQUITY

Market Information for our Common Stock

The Company’s Common Stock is traded on the Over The Counter Bulletin Board under the symbol “DLVN.OB” The Common Stock is thinly traded and no established liquid trading market currently exists therefore.

The following table sets forth the range of high and low bids of the Company’s common stock for the calendar quarters indicated.

| 2010 | | High | | | Low | |

| | | | | | | |

| First Quarter | | $ | .12 | | | $ | .09 | |

| Second Quarter | | $ | .12 | | | $ | .10 | |

| Third Quarter | | $ | .13 | | | $ | .10 | |

| | | | | | | | | |

| 2009 | | High | | | Low | |

| | | | | | | | | |

| First Quarter | | $ | .12 | | | $ | .07 | |

| Second Quarter | | $ | .10 | | | $ | .06 | |

| Third Quarter | | $ | .12 | | | $ | .07 | |

| Fourth Quarter | | $ | .13 | | | $ | .09 | |

| | | | | | | | | |

| 2008 | | High | | | Low | |

| | | | | | | | | |

| First Quarter | | $ | .17 | | | $ | .09 | |

| Second Quarter | | $ | .19 | | | $ | .11 | |

| Third Quarter | | $ | .19 | | | $ | .16 | |

| Fourth Quarter | | $ | .18 | | | $ | .07 | |

Holders of Record

As of September 30, 2010 there were approximately 3,506 holders of record of the Company’s Common Stock.

The Board of Directors unanimously recommends that you vote “FOR” the election of the nominees for Director.

PROPOSAL 2 – REVERSE STOCK SPLIT

Reverse Stock Split; “Going Private”; Pink Sheet” Quotation

Proposal 2 of the meeting is to amend the Company’s Charter in order to effect a 1-for-7,500 share reverse stock split (the “Reverse Stock Split”). The Board of Directors has authorized the Reverse Stock Split, subject to stockholder approval and subsequent final action by the Board of Directors. Stockholders of record who own fewer than 7,500 shares on the effective date of the Reverse Stock Split (“Effective Date”) will receive a cash payment equal to $0.14 per share for each pre-split share they hold that in the aggregate total less than 7,500 shares. Stockholders of record who own 7,500 or more shares of our Common Stock on the Effective Date will remain stockholders, will continue to hold whole shares and will be entitled to receive cash for their f ractional share interests resulting from the Reverse Stock Split. For stockholders who own one or more shares after the Reverse Stock Split, a fractional share will be not be issued and they will receive cash for fractional shares in the amount of $0.14 per share of each share of Common Stock in excess of 7,500 shares but less than an even multiple thereof before the Reverse Stock Split.

The proposed amendment to the Company’s Charter is attached as Exhibit A to the accompanying Proxy Statement. The final text of the Amended and Restated Certificate of Incorporation is subject to change to the extent required by the Delaware Secretary of State.

Based on the 1-for-7,500 ratio of the Reverse Stock Split, we anticipate that following the consummation of the Reverse Stock Split, the Company will have less than 300 stockholders of Common Stock, assuming stockholders do not accumulate more than 7,500 shares of record as a result of either (i) purchases of Common Stock or (ii) the transfer of shares by beneficial holders from “street name” to record ownership.

If consummated, the Reverse Stock Split would be part of a plan to cease being a public reporting company, as discussed below, and would be a “going private” transaction under Rule 13e-3 of the Exchange Act. Following the Reverse Stock Split, the Company believes it will have fewer than 300 holders of record and would be eligible to terminate the registration of its Common Stock under the Exchange Act. We would then terminate our Exchange Act registration and become a non-reporting company for purposes of the Exchange Act.

This process will eliminate the significant expense required to comply with public reporting and related requirements including, but not limited to, those imposed on us by the Exchange Act and the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). Our Board of Directors has concluded that the cost associated with being a reporting company is not justified by its benefits in view of the limited trading activity in our Common Stock and our limited ability to access the capital markets, and has determined that the Reverse Stock Split is fair to and in the best interest of our stockholders, including our unaffiliated stockholders. See also the information in the sections “Recommendation of Our Board of Directors” and “Fairness of the Reverse Stock Split.”

After we “go private,” our shares may still be quoted in the “Pink Sheets” at www.pinksheets.com, an electronic interdealer quotation service, although it is highly unlikely. The Pink Sheets are not a stock exchange and we do not have the ability to list on, or control whether our shares are quoted on Pink Sheets. The price may exceed the current price on the OTC Bulletin Board (“OTCBB”) to reflect the Reverse Stock Split, but there is no assurance that it will, and it may be less than the current price. In addition, the spread between the bid and asked prices of our Common Stock may be wider than on the OTCBB and the liquidity of our shares may be lower. There is no assurance, however, that there will be any Pink Sheets quotations after we “go private” or that, if such quotations begin they will continue for any length of time.

The members of our Board of Directors have indicated that they intend to vote, or cause to be voted, the shares of our Common Stock that they directly or indirectly control in favor of the Reverse Stock Split.

The Reverse Stock Split is not expected to affect our current business plan or operations, except for the anticipated monetary cost and management time savings associated with termination of our public reporting company obligations.

If the proposal is approved by the stockholders, our Board of Directors would still retain the authority to determine whether to effect the Reverse Stock Split, notwithstanding the authorization by stockholders. While it is highly unlikely that it would do so, the Board of Directors could elect to delay or even abandon the Reverse Stock Split without further action by stockholders if, in their judgment, new or changed circumstances make the consummation of this transaction no longer in the best interests of the Company’s unaffiliated stockholders.

If the proposal is approved by the stockholders of the Company and carried out by our Board of Directors, each record holders of less than 7,500 shares of Common Stock immediately before the Reverse Stock Split will receive cash in the amount of $0.14 without interest for each share held immediately before the Reverse Stock Split and will no longer be a stockholder of the Company.

Each record holder of 7,500 shares of Common Stock or multiples thereof immediately prior to the Reverse Stock Split will receive one or more shares in respect thereof after the Reverse Stock Split. No fractional shares will be issued. In lieu of fractional shares, stockholders will receive $0.14 per share of pre-split shares of Common Stock that in the aggregate total less than 7,500 shares.

The Company’s Board of Directors hired Executive Sounding Board Associates, Inc. of New York City, New York and Philadelphia, Pennsylvania (“ESBA”) to provide an opinion as to the fairness to our unaffiliated stockholders, from a financial point of view, of the consideration to be paid in lieu of fractional shares in the Reverse Stock Split. ESBA conducted a discounted cash flow analysis, a comparable company analysis and a premiums paid analysis in rendering its fairness opinion.

Based upon ESBA’s fair value, the Company’s Board of Directors, has set the cash consideration to be paid to the stockholders with less than 7,500 pre-split shares at $0.14 per share. That price is 27% higher than the highest price determined by ESBA. As of October 19, 2010, the most recent closing price of our Common Stock was $0.11.

Stockholders are not entitled to appraisal rights under either (i) the Company’s Charter, (ii) its Bylaws, or (ii) under the Delaware General Corporation Law, even if a stockholder votes against the Reverse Stock Split.

Background and History of The Reverse Stock Split Proposal

In recent years, given the Company’s small size, yet complex business lines, the Company’s Common Stock has attracted only limited market research attention. There has been low trading volume, resulting in an inefficient market for our shares. Due to the low trading volume and our small market capitalization, we do not have the ability to use our Common Stock as a significant part of our employee compensation and incentives strategy or as consideration for acquisitions. Our Board of Directors does not foresee opportunities to raise capital through sales of equity or debt securities in a public offering. Also, our Board of Directors has determined that given our size and the absence of sustained interest by securities research analysts and other factors, we have not enjoyed the appreciable enhancement in company image that usually results from being a public company. In addition, because of the low price for the Company’s Common Stock, the relatively large spread between the bid and ask prices and the relatively high sales commission to sell the stock, individual stockholders cannot maximize the value of their share holdings.

We incur substantial direct and indirect costs associated with compliance with the Exchange Act’s filing and reporting requirements imposed on reporting companies. The cost of this compliance has increased significantly with the implementation of the provisions of Sarbanes-Oxley, including but not limited to, significant costs and burdens of compliance with the internal control audit requirements of Section 404 of Sarbanes-Oxley. Unless we delist and deregister, we expect to continue to incur substantial costs associated with these procedures. We have also incurred substantial indirect costs as a result of, among other things, the executive time expended to prepare and review our public filings. We estimate that the Reverse Stock Split will save the Company approxima tely $300,000 annually in aggregate accounting fees, legal fees and Delaware Franchise taxes.

In light of these circumstances, our Board of Directors believes that it is in our best interest to undertake the Reverse Stock Split, enabling the Company to deregister its Common Stock under the Exchange Act. Deregistering will relieve us of the administrative burden and cost associated with filing reports and otherwise complying with the requirements imposed under the Exchange Act and Sarbanes-Oxley. In addition to accounting and legal fees, we will save our executives and personnel a substantial amount of time annually on such matters, which time can be better spent developing the Company’s business.

Our Board of Directors began considering the issues that led to this proposal in August 2010. At that time, officers and directors began to evaluate whether we were achieving the benefits of being a publicly traded company when weighed against the costs of maintaining our public reporting obligations, coupled with the limited liquidity and limited trading volume of our Common Stock. No formal consideration of taking steps to deregister the Company’s Common Stock were considered by the Board of Directors until September 2010.

On October 15, 2010, the Board of Directors had a meeting discussing the significant costs associated with being a public company, including but not limited to, directors and officers insurance, accounting fees, legal fees, transfer agent fees, Delaware franchise taxes and Exchange Act filing fees. The Board discussed the various options the Company could pursue in connection with alleviating such costs. It was determined at that time that the best way to alleviate the costs associated with being a public company would be to effectuate a Reverse Stock Split combined with the payment of cash consideration in lieu of fractional shares held by stockholders to reduce the record number of holders of the Company’s Common Stock to less than 300. Under the Exchange Act, a company with less than 300 stockholders can deregister and terminate its obligations of monthly, quarterly and annual reports.

The Board of Directors considered whether the proposed Reverse Stock Split would be in the best interests of the Company and would be substantively and procedurally fair to all the Company’s stockholders. In particular, the Board of Directors evaluated the fairness of the Reverse Stock Split to the Company’s unaffiliated stockholders who would receive a cash payment for any fractional shares after the Reverse Stock Split. ESBA was hired to determine a fair price for cashing out fractional shares in connection with the Reverse Stock Split. Even though the Company’s Board of Directors worked with ESBA instead of appointing a Special Committee, we call to your attention that two members of the Company’s Board, Messrs. Akselrad and Flicker, are independent directo rs of the Company and have no relationship with any of the Company’s affiliates. During the entirety of their terms as a director, they have not received any compensation from any affiliate of the Company, have never engaged in any transaction of any kind with the Company and have, in the Board’s view, always acted as independent, disinterested directors of the Company.

The Board of Directors also determined that the transaction does not require a separate vote of disinterested or unaffiliated stockholders under the Company’s Bylaws or Delaware law. As noted above, the Board of Directors believes that it is sufficiently independent to evaluate the fairness of the Reverse Stock Split to the Company’s unaffiliated stockholders and thereby represent their interests.

On October 15, 2010, Alan Casnoff, the President of the Company, met with the other members of the Board of Directors to review and consider alternatives to the Reverse Stock Split and the terms of the Reverse Stock Split proposal,taking into account among other things:

| | · | The low price of the Company’s common stock and the relatively high transaction cost to sell it, assuming it could be sold |

| | · | The current and projected costs of remaining a public company |

| | · | The relationship of the Company’s revenues to those costs |

| | · | The cash needed to effect a Reverse Stock Split |

| | · | The viability of obtaining debt or equity financing for the Company in the capital markets |

| | · | The viability of selling the Company’s assets or effecting another business combination transaction |

| | · | Whether the most appropriate split would be a 1-for-7,500 reverse split or some other number |

| | · | The out of pocket expenses involved in a Reverse Stock Split or another going private transaction |

| | · | The current and historical market prices for the Company’s stock on the OTCBB at a price similar to the quoted marked price, especially for odd lot stockholders |

| | · | The effect on those unaffiliated stockholders who would be either cashed out or continue as minority stockholders after the split, including most importantly the fact that more than 1,900 stockholders or more than half of all stockholders own less then 300 shares of common stock each and as a practical matter cannot monetize the value of their shares. |

Alternative Transactions Considered

The Board of Directors reviewed various alternatives to a Reverse Stock Split including the possibility of selling assets, raising additional capital through the sale of shares and the following, each of which was rejected because of its disadvantages.

| | · | Issuer Tender Offer. The Board of Directors considered the feasibility of an issuer tender offer to repurchase the shares of our Common Stock held by our unaffiliated stockholders. A principal disadvantage of this type of transaction related to our ability to contact all record holders of the Company. Due to the relative large number of record holders of the Company, the Board of Directors did not believe that enough of the outstanding stockholders of the Company would respond to such tender given the low dollar value of most stockholders holdings and the related costs of such a transaction. Moreover, the rules regarding the treatment of our stockholders in a tender offer, including pro-rata acceptance of offers from our stockholders, make it difficult to ensure that we would be able to significantly reduce the nu mber of holders of record to a level below 300. |

| | · | Maintaining The Status Quo. Our Board of Directors considered maintaining the status quo. In that case, we would continue to incur the expenses of being a public reporting company without enjoying the benefits traditionally associated with public reporting company status. |

| | · | Possible Sale of The Company. Our Board of Directors also considered selling the Company. The Board of Directors determined such a sale was impractical given the complicated and specialized nature of the financial instruments it owns, and would not result in maximizing value for all stockholders. |

After much discussion, it was determined that while the sale of the structured settlement portfolio was a possibility, there were substantial issues with such a sale that would prevent the Company from maximizing its return on its structured portfolio assets. Structured settlements are a complicated asset type, and the sale of the individual claims were not Court approved. Accordingly, there is a very limited market for this asset type as a sale would be subject to various risks such as (a) the subordinated position of the interest in the assets (the payment to the Company is subordinate to the payments to the purchasers of the securitized interests as well as the payment obligation to the note holder), and (b) the requirement that any purchaser absorb phantom federal income tax resulting from the amortization of the underlying assets. Consequently, any purchaser would require a substantial discount from the Company’s carrying value. The Special Committee concluded that in order to maximize the value of the structured settlement portfolio, it is necessary to allow the portfolio to mature through its term.

The Board of Directors also discussed the possible sale of the mortgage portfolio. Because the Company cannot transfer its general partnership interest without the consent of the majority of the limited partners, and the Company does not believe that such consent could be obtained, any purchaser of the mortgages would be at a substantial disadvantage from the position currently held by the Company. Because the Company acts both as the general partner of the partnership and the holder of the mortgage it is able to negotiate with the limited partners in an attempt to sell properties prior to the maturity of the leases. Any purchaser of the mortgages would be buying long term fixed-rate assets with no assurance of early repayment and with underlying leases which have short remaining ter ms. These facts would require, in many cases for, the prospective purchaser to begin foreclosure actions against the partnerships which would be a potentially costly and time consuming process. As a result of these limitations, any purchaser of the portfolio would require a very substantial discount from the current values carried by the Company. Once again, the assets create their greatest value by being held through to maturity.

The last possibility considered by the Board of Directors was the raising of capital through the sale of Company’s Common Stock. However, there is a very limited, if any, market for the Company’s Common Stock. At the current price level of the stock and with the complexity of the Company’s assets, the Board determined that selling stock is not a viable alternative for the Company.

Also on October 15, 2010, the Board of Directors met with James Fox of ESBA to discuss the valuation of the Company and the range of the fair prices of its Common Stock in the Reverse Stock Split. The price estimates derived by ESBA ranged from less than a penny per share ($0.0078) to $0.12790 per share depending upon various valuation methods. Mr. Fox described the results of the various analyses and valuation methods (described more fully below under “Opinion of Financial Advisor”). ESBA observed that under all these valuation methods other than the quoted market price, the Company’s Common Stock had insignificant value, and that the market price of the Company’s Common Stock was below its book value.

The Board of Directors reviewed a chart of historical trading prices for the Company’s Common Stock and noted that the most recent prices for the Company’s Common Stock was about $0.11 per share. The Board of Directors also discussed the findings presented by ESBA as described under “Opinion of Financial Advisor” below. They also considered the very low probability that any funds or assets would be available for distribution to holders of Common Stock in the event of a liquidation of the Company, after payment of the Company’s creditors. The Board of Directors concluded that a price that reflected both the Company’s quoted market price and the range of values of the various valuation methods used by ESBA would be fair and in the best interests of t he Company’s stockholders. However, the Board decided that the $0.11 market price per share did not fully reflect a fair price to the Company’s stockholders. Accordingly, the Board of Directors determined to seek a price greater than the quoted market price of the Company’s Common Stock, as the market price for the Common Stock did not reflect the intrinsic value of the Company’s shares.

The Board of Directors discussed their conclusions, including their review of the Company’s recent historical trading prices, and the findings of ESBA. The Board of Directors concluded that a price of $0.14 per share, which was about 27% more than the most recent bid price for the Company’s Common Stock, was a fair price at which to effectuate the Reverse Stock Split. On the basis of the ESBA report and discussions among the Members of the Board of Directors, the Board concluded that a price equal to $0.14 per share was a fair price at which to effectuate the Reverse Stock Split. At the conclusion of the meeting, the Board of Directors found reasonable and expressly adopted ESBA’s opinion and their related financial analyses, which opinion and analyses are summarize d below, and also concluded that:

| | · | The Reverse Stock Split would be in the best interests of the Company as a whole |

| | · | The Reverse Stock Split with a cash out valuation of $0.14 per share (free of any sales commission) would be substantively and procedurally fair to all of the Company’s unaffiliated stockholders, including unaffiliated stockholders who receive a cash payment for their fractional shares after the Reverse Stock Split as well as those unaffiliated stockholders who would remain stockholders after the split |

| | · | The amount of cash consideration to be paid to the unaffiliated stockholders who would be cashed out after the Reverse Stock Split, based upon the recommendation in the ESBA report of its valuation of the Company, was fair to those stockholders since it was higher than the amount which those stockholders would be likely to obtain by (i) a sale in trading markets, if any such sale could even be effected as a result of the illiquid market for the shares, (ii) a sale of the Company or its assets in a business combination transaction, or (iii) a liquidation of the Company. The Board of Directors noted in its conclusion that ESBA reported that, based on their analyses, the Company’s Common Stock has little public value. |

The Board of Directors recommended that the Company implement a 1-for-7,500 Reverse Stock Split and repurchase for cash all fractional shares left outstanding after the Reverse Stock Split at a price of $0.14 per share.

The Board of Directors unanimously agreed that the increasing costs of operating as a reporting company warranted deregistering our shares of Common Stock under the Exchange Act and that the most viable method to achieve that deregistration was a Reverse Stock Split. The Board of Directors also agreed that the historically limited trading activity of the Company’s Common Stock supported the conclusion that it was in the Company’s best interest to effectuate a Reverse Stock Split and deregistration.

In addition, after considering the conclusions of ESBA, our Board of Directors unanimously and independently determined that the terms of the Reverse Stock Split were substantively and procedurally fair to all of our unaffiliated stockholders, including but not limited to those who would be cashed out after the Reverse Stock Split, because the amount to be paid to them was almost certainly greater than the amount that they could have reasonably expected to receive from a public or private sale of their stock in the foreseeable future. Accordingly, at a meeting held on October 15, 2010, our Board of Directors approved the final terms of the Reverse Stock Split and called for a stockholder vote on the Reverse Stock Split at the Company’s Special Annual Meeting, which the Board of Directors elected to hold on December 17, 2010.

Purpose of The Reverse Stock Split

The primary purpose of the Reverse Stock Split is to enable us to reduce the number of our stockholders of record to fewer than 300. This reduction in the number of our stockholders will allow:

| | · | Substantial cost savings of time and money derived from termination of the registration of our Common Stock under the Exchange Act and suspension of our duties to file periodic reports with the Securities and Exchange Commission (“SEC”) and comply with Sarbanes-Oxley |

| | · | Elimination of the administrative burden and expense of maintaining thousands of small stockholders’ accounts |

| | · | Liquidation by small stockholders of their shares of our Common Stock at a fair price, without having to pay brokerage commissions |

Going Private Transaction; Schedule 13E-3 Filing

The Reverse Stock Split which is the subject of Proposal 2 of this Proxy Statement is considered a “going private” transaction as defined in Rule 13e-3 promulgated under the Exchange Act, because, if consummated, it is intended to terminate the registration of our Common Stock under Section 12(g) of the Exchange Act and suspend our duty to file periodic reports with the SEC. Consequently, we have filed a Rule 13e-3 Transaction Statement on Schedule 13E-3 with the SEC on October 25, 2010 and amendments thereto on , 2010 and , 2010. The Schedule 13E-3 and amendments are available on the SEC’s website at http://www.sec.gov or from the Company. See “OTHER MATTERS – Where You Can Find More Information” below.

Structure of The Reverse Stock Split

Our Board of Directors has approved the submission of the Reverse Stock Split and recommends the transaction for your approval. Our Board of Directors has, however, retained the final authority to determine if and when to file the amendment to our Charter with the Office of the Secretary of State of the State of Delaware in order to effectuate the Reverse Stock Split. Notwithstanding authorization of the proposed transaction by our current stockholders, our Board of Directors may abandon the Reverse Stock Split at any time without further action by our stockholders, or may file the amendment at any time within 60 days of obtaining stockholder approval without further notice to or action by our stockholders. However, the Board of Directors expects to make this decision promptly and, i n any event, within 60 days after approval by the stockholders.

As of September 30, 2010 there were 44,770,345 shares of our Common Stock outstanding and approximately 3.506 holders of record. As of such date, approximately 3,300 holders of record held fewer than 7,500 shares of our Common Stock. At current market prices, 7,500 shares are valued at about $975. As a result, we believe that the Reverse Stock Split will reduce the number of our holders of record to approximately 200 while reducing the number of outstanding shares to approximately 6,000 (after the 1 for 7,500 reverse split. In addition, in a Reverse Stock Split, stockholders owning a small number of shares will be able to monetize their shares without having to pay a brokerage fee, which fee might well consume a large portion of the proceeds from any such independent sale of shares.

Effects on Stockholders With Less Than 7,500 Shares of Common Stock

If the Reverse Stock Split is implemented, stockholders holding less than 7,500 shares of our Common Stock immediately before the Reverse Stock Split, sometimes referred to as Cashed Out Stockholders, will:

| | · | Not receive any fractional shares of Common Stock as a result of the Reverse Stock Split |

| | · | Receive cash equal to $0.14 per share of our Common Stock which they held immediately before the Reverse Stock Split in accordance with the procedures described in this Proxy Statement |

| | · | Not be required to pay any service charges or brokerage commissions in connection with the Reverse Stock Split |

| | · | Not receive any interest on the cash payments made as a result of the Reverse Stock Split |

| | · | Have no further ownership interest in our Company, and no further voting rights. |

Cash payments to Cashed Out Stockholders as a result of the Reverse Stock Split will be subject to income taxation. For a discussion of the federal income tax consequences of the Reverse Stock Split, please see the section of this proxy statement entitled “Federal Income Tax Consequences.”

If you do not currently hold at least 7,500 shares of Common Stock in a single account and you want to continue to hold shares of our Common Stock after the Reverse Stock Split, you may be able to accomplish this goal by taking either of the following actions:

| | · | Purchasing a sufficient number of additional shares of our Common Stock in the open market or privately and (i) having them registered in your name and consolidated with your current record account, if you are a record holder, or (ii) having them entered in your account with a nominee (such as your broker or bank) in which you hold your current shares so that you hold at least 7,500 shares of our Common Stock in your account. If you hold your current shares in an account with a nominee, prior to the Effective Date you must instruct your nominee to transfer your shares into your name as record holder; or |

| | · | If you hold an aggregate of 7,500 or more shares in two or more accounts, consolidating your accounts so that you hold at least 7,500 shares of our Common Stock in one account, immediately before the Effective Date. |

There is no assurance that there will be shares available for purchase to enable you to continue being a stockholder of the Company, or that your nominee or the Company’s transfer agent will comply with instructions to transfer or establish record ownership within any time frame specified in such instructions. You will have to act far enough in advance so that the purchase or transfer of any shares of our Common Stock or the consolidation of your accounts containing shares of our Common Stock or both is completed by the close of business prior to the Effective Date. You are urged to contact your nominee in advance of the Special Annual Meeting and to ask them how the Reverse Stock Split will affect your shares.

Effects On Stockholders With 7,500 Or More Shares Of Common Stock

If the Reverse Stock Split is consummated, stockholders holding 7,500 or more shares of our Common Stock immediately before the Reverse Stock Split, otherwise referred to as Continuing Stockholders, will:

| | · | Continue to be our stockholders and will be the only persons entitled to vote as stockholders after the consummation of the Reverse Stock Split. |

| | · | Receive $0.14 per share of Common Stock for shares of Common Stock in excess of 7,500 shares that would otherwise equal a fractional share. No fractional shares will be issued in the Reverse Stock Split. |

| | · | Likely experience a reduction in liquidity (which may be significant) with respect to their shares of our Common Stock because, if our Common Stock continues to be quoted (which is highly unlikely), it will only be quoted in the Pink Sheets, which is a less widely followed quotation service than the OTCBB. Even if our Common Stock is quoted in the Pink Sheets after the Reverse Stock Split, of which there can be no assurance, there may be no trading market at all in our Common Stock. In order for our Common Stock to continue to be quoted in the Pink Sheets after the split, a number of brokerage firms must elect to act as a market maker for our Common Stock and sponsor our shares. However, because we will not file reports with the SEC, there can be no assurance that any brokerage firm will be willing to act as a market maker for our shares of Common Stock. |

| | · | If you currently own more than 7,500 share and you want to be cashed out and no longer want to be a stockholder of the Company, you may get cashed out by reducing your ownership of shares to less than 7,500 shares held in each of your accounts prior to the Effective Date for the Reverse Stock Split. |

Effects On The Company

If consummated, the Reverse Stock Split will affect the registration of our Common Stock under the Exchange Act, as we intend to apply for termination of such registration as soon as practicable after the consummation of the Reverse Stock Split.

We do not believe that the Reverse Stock Split limits our ability to utilize net operating loss carryforwards from prior fiscal years (which are, in the aggregate, approximately $3.65 million). If however, certain limitations under Section 382 of the Code are determined to apply, then the Company’s net operating loss carryforwards that could be applied to offset its taxable income (if any) in any future year would be limited.

We have no current plans to issue additional shares of our Common Stock after the Reverse Stock Split, but we reserve the right to do so at any time and from time to time at such prices, and on such terms as our Board of Directors determines to be in the Company’s best interest. Continuing Stockholders will not have any preemptive or other preferential rights to purchase any shares of the Company’s Common Stock that we may issue in the future, unless such rights are specifically hereafter granted.

After the Reverse Stock Split has been consummated, we may, from time to time, repurchase shares of our Common Stock pursuant to a share repurchase program, in privately negotiated sales or in other transactions. The timing of any such repurchase will depend on a number of factors, including our financial condition, operating results and available capital at the time. In addition, we may at our option at various times in the future repurchase shares of Common Stock in order to insure that the number of our holders of record is less than 300. We cannot predict the likelihood, timing or prices of such purchase and they may well occur without regard to our financial condition or available cash at the time.

Advantages of The Reverse Stock Split

Cost Savings

The costs of being a public reporting company have increased as a result of the internal control assessment and audit requirements of Section 404 and other requirements imparted by Sarbanes-Oxley, and the costs of our remaining a public reporting company are expected to increase substantially in the near future. Legislation such as Sarbanes-Oxley will continue to have the effect of increasing the compliance burdens and potential liabilities of being a public reporting company. It will increase audit fees and other costs of compliance, such as outside securities legal counsel fees, as well as outside director fees and large insurance premiums to cover potential liability faced by our officers and directors. We also incur substantial indirect costs as a result of, among other things, o ur managements’ time expended to prepare and review our public filings.

Our Board of Directors believes that by deregistering our shares of Common Stock and suspending our periodic reporting obligations, we will realize annual cost savings of approximately $300,000. These estimated annual cost savings reflect, among other things: (i) a reduction in audit, legal and other fees required for publicly held companies, (ii) the elimination of various internal costs associated with filing periodic reports with the SEC, and (iii) the reduction or elimination of various clerical and other expenses associated with being a public company.

The cost savings figures set forth above are only estimates. The actual savings we realize from the transaction may be higher or lower than such estimates, but the savings will continue annually. Estimates of the annual savings to be realized are based upon (i) the actual costs to us of the services and disbursements in each of the categories listed above that are reflected in our financial records and (ii) the allocation to each category of management’s estimates of the portion of the expenses and disbursements in such category believed to be solely or primarily attributable to our public reporting company status. In some instances, managements’ cost saving expectations were based on information provided or upon verifiable assumptions.

Opportunity For Cashed Out Stockholders To Sell Their Holdings At Or Above The Current Market Trading Price, Without Brokerage Fees Or Commissions

In connection with the Reverse Stock Split, our Board of Directors determined that a fair price for this transaction to Cashed Out Stockholders is $0.14 per share, the fair value as set forth in the section “Effects On Stockholders With Fewer Than 7,500 Shares of Common Stock” of this Proxy Statement, because it provides them an opportunity to liquidate their holdings at a fair price without brokerage commissions in an illiquid market, and based upon ESBA’s report of the valuation of the Company.

Disadvantages of The Reverse Stock Split

Holders of less than 7,500 shares of record will require stockholders to give up their shares and accept cash consideration. The Reverse Stock Split of 1-for-7,500 will force Stockholders who own less than 7,500 shares of record to be cashed out at a price of $0.14 per share which was fixed by the Board of Directors upon advice received from ESBA, an independent financial advisor. Other than acquiring more shares of stock before the Record Date, Stockholders may only vote against the proposed Reverse Stock Split, but if the Reverse Stock Split proposal is approved and implemented, the stockholders will be required to sell at a price of $0.14 per share.