UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02676

Fidelity School Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Multi-Asset Income Fund

Annual Report

December 31, 2023

Includes Fidelity and Fidelity Advisor share classes

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you're an individual investing directly with Fidelity, call 1-800-835-5092 if you're a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you're an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended December 31, 2023 | Past 1 year | Past 5 years | Life of Fund A |

Class A (incl. 4.00% sales charge) | 6.97% | 9.29% | 7.13% |

Class M (incl. 4.00% sales charge) | 6.98% | 9.33% | 7.15% |

Class C (incl. contingent deferred sales charge) | 9.61% | 9.37% | 6.88% |

| Fidelity® Multi-Asset Income Fund | 11.72% | 10.49% | 7.94% |

| Class I | 11.70% | 10.46% | 7.92% |

| Class Z | 11.81% | 10.57% | 7.99% |

A From September 9, 2015

Class C shares' contingent deferred sales charges included in the past one year, past five years and life of fund total return figures are 1%, 0% and 0%, respectively.

The initial offering of Class Z shares took place on October 2, 2018. Returns prior to October 2, 2018, are those of Class I.

The initial offering of Fidelity® Multi-Asset Income Fund shares took place on March 28, 2018. Returns prior to March 28, 2018 are those of Class I.

| $10,000 Over Life of Fund |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Multi-Asset Income Fund - Class A, a class of the fund, on September 9, 2015, and the current 4.00% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

Market Recap:

U.S. equities gained 26.29% in 2023, according to the S&P 500® index, as a slowing in the pace of inflation and resilient late-cycle expansion of the U.S. economy provided a favorable backdrop for higher-risk assets for much of the year. After returning -18.11% in 2022, much of the index's sharp reversal was driven by a narrow set of firms in the information technology and communication services sectors. Since March 2022, the U.S. Federal Reserve has raised its benchmark interest rate 11 times in a series of increases aimed at cooling the economy and bringing down inflation, and since July, has held its target rate at a 22-year high. At the Fed's November 1 meeting, the central bank hinted it might be done raising rates, which helped reverse a three-month decline for the S&P 500® that had been driven by soaring yields on longer-term government bonds and mixed earnings from some big and influential firms. Favorable data on inflation, as well as better-than-expected corporate earnings, provided a further boost and the index rose 14% in the final two months of the year. In fixed income, the Bloomberg U.S. Aggregate Bond Index gained 5.53% for the year, as U.S. taxable investment-grade bonds rebounded after returning -13.01% in 2022. For the year, long-term bonds outpaced short-term issues, while lower-quality (higher yielding) bonds topped higher-quality debt. Higher-risk assets, including corporate bonds and asset-backed securities, fared better than U.S. Treasuries.

Comments from Lead Manager Adam Kramer:

For the year, the fund's share classes (excluding sales charges, if applicable) gained roughly 11% to 12%, lagging the 15.58% result of the Composite index, a 50/50 blend of the broad-based S&P 500® index and Bloomberg U.S. Aggregate Bond Index. A sizable underweight and security selection in the equities subportfolio notably detracted from the fund's performance versus the Composite index for the year. Non-Composite exposure to and security selection among convertibles, high-yield floating-rate debt and high-yield bonds also hurt. Conversely, a large underweight in investment-grade bonds more than made up for disappointing security selection within the asset class. Within the equities subportfolio - about 35% of assets, on average, in 2023 - stock picks and an underweight in the information technology sector notably detracted. Security selection in the industrials and consumer discretionary sectors and an overweight in real estate also hurt. Among the biggest individual detractors was a non-Composite position in the stock of Babcock & Wilcox Enterprises (-73%), which we sizably reduced in 2023. Underweights in Nvidia (+234%) and Apple (+50%) also significantly detracted versus the Composite. Conversely, security selection and large underweights in the financials, consumer staples and health care sectors aided relative performance. The top individual contributor was the stock of Uber Technologies (+101%), a new addition to the portfolio. A lack of exposure to Composite index component Pfizer (-41%) also helped.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

| Top Bond Issuers (% of Fund's net assets) |

(with maturities greater than one year) |

| U.S. Treasury Obligations | 37.6 | |

| Microsoft Corp. | 2.7 | |

| DHT Holdings, Inc. | 2.4 | |

| Uber Technologies, Inc. | 2.0 | |

| JPMorgan Chase & Co. | 1.7 | |

| Amazon.com, Inc. | 1.5 | |

| Energy Transfer LP | 1.4 | |

| Bass Pro Group LLC | 1.2 | |

| Petroleos Mexicanos | 1.2 | |

| Alphabet, Inc. | 1.2 | |

| | 52.9 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Energy | 10.6 | |

| Information Technology | 9.2 | |

| Consumer Discretionary | 9.1 | |

| Financials | 6.8 | |

| Industrials | 6.7 | |

| Health Care | 4.8 | |

| Communication Services | 4.2 | |

| Materials | 3.7 | |

| Consumer Staples | 2.7 | |

| Utilities | 2.2 | |

| Real Estate | 1.8 | |

| |

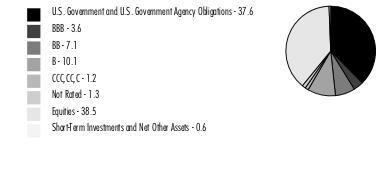

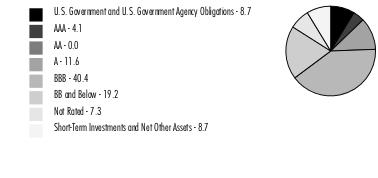

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

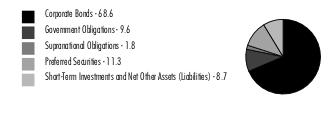

Asset Allocation (% of Fund's net assets) |

|

Written options - (0.1)% |

|

Showing Percentage of Net Assets

| Corporate Bonds - 13.2% |

| | | Principal Amount (a) | Value ($) |

| Convertible Bonds - 0.6% | | | |

| COMMUNICATION SERVICES - 0.2% | | | |

| Media - 0.2% | | | |

| DISH Network Corp. 3.375% 8/15/26 | | 11,380,000 | 6,031,400 |

| | | | |

| REAL ESTATE - 0.2% | | | |

| Real Estate Management & Development - 0.2% | | | |

| Redfin Corp. 0.5% 4/1/27 | | 6,943,000 | 4,456,712 |

| | | | |

| UTILITIES - 0.2% | | | |

| Independent Power and Renewable Electricity Producers - 0.2% | | | |

| NextEra Energy Partners LP 0% 11/15/25 (b) | | 4,396,000 | 3,839,906 |

| | | | |

| TOTAL CONVERTIBLE BONDS | | | 14,328,018 |

| Nonconvertible Bonds - 12.6% | | | |

| COMMUNICATION SERVICES - 1.7% | | | |

| Media - 1.7% | | | |

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp. 3.7% 4/1/51 | | 21,506,000 | 13,988,139 |

| Clear Channel International BV 6.625% 8/1/25 (b) | | 2,575,000 | 2,587,417 |

| Clear Channel Outdoor Holdings, Inc. 9% 9/15/28 (b) | | 4,145,000 | 4,325,162 |

| Gannett Holdings LLC 6% 11/1/26 (b) | | 4,685,000 | 4,134,513 |

| Magallanes, Inc.: | | | |

| 5.141% 3/15/52 | | 6,645,000 | 5,703,774 |

| 5.391% 3/15/62 | | 6,720,000 | 5,754,945 |

| Univision Communications, Inc. 4.5% 5/1/29 (b) | | 4,315,000 | 3,850,070 |

| | | | 40,344,020 |

| CONSUMER DISCRETIONARY - 1.7% | | | |

| Automobile Components - 0.2% | | | |

| Macquarie AirFinance Holdings 8.375% 5/1/28 (b) | | 3,650,000 | 3,822,828 |

| | | | |

| Automobiles - 0.4% | | | |

| Rivian Holdco & Rivian LLC & Rivian Automotive LLC 6 month U.S. LIBOR + 5.620% 11.4932% 10/15/26 (b)(c)(d) | | 9,410,000 | 9,381,820 |

| | | | |

| Hotels, Restaurants & Leisure - 0.8% | | | |

| Affinity Gaming LLC 6.875% 12/15/27 (b) | | 5,125,000 | 4,567,572 |

| Churchill Downs, Inc. 6.75% 5/1/31 (b) | | 3,830,000 | 3,887,203 |

| Dave & Buster's, Inc. 7.625% 11/1/25 (b) | | 4,220,000 | 4,272,750 |

| Ontario Gaming GTA LP 8% 8/1/30 (b) | | 4,440,000 | 4,578,750 |

| Scientific Games Corp. 7.5% 9/1/31 (b) | | 2,580,000 | 2,691,084 |

| | | | 19,997,359 |

| Specialty Retail - 0.3% | | | |

| Bath & Body Works, Inc. 7.6% 7/15/37 | | 2,515,000 | 2,565,300 |

| LCM Investments Holdings 8.25% 8/1/31 (b) | | 3,250,000 | 3,392,039 |

| PetSmart, Inc. / PetSmart Finance Corp. 4.75% 2/15/28 (b) | | 995,000 | 938,070 |

| | | | 6,895,409 |

TOTAL CONSUMER DISCRETIONARY | | | 40,097,416 |

| | | | |

| CONSUMER STAPLES - 0.2% | | | |

| Consumer Staples Distribution & Retail - 0.1% | | | |

| New Albertsons LP 8.7% 5/1/30 | | 2,165,000 | 2,343,613 |

| | | | |

| Personal Care Products - 0.1% | | | |

| HFC Prestige Products, Inc./HFC Prestige International U.S. LLC 6.625% 7/15/30 (b) | | 2,605,000 | 2,676,143 |

| | | | |

TOTAL CONSUMER STAPLES | | | 5,019,756 |

| | | | |

| ENERGY - 2.8% | | | |

| Oil, Gas & Consumable Fuels - 2.8% | | | |

| Calumet Specialty Products Partners LP/Calumet Finance Corp. 11% 4/15/25 (b) | | 5,285,000 | 5,343,323 |

| Enbridge, Inc. 8.5% 1/15/84 (c) | | 2,850,000 | 3,031,391 |

| Northern Oil & Gas, Inc.: | | | |

| 8.125% 3/1/28(b) | | 10,370,000 | 10,499,625 |

| 8.75% 6/15/31(b) | | 6,385,000 | 6,650,600 |

| PBF Holding Co. LLC/PBF Finance Corp. 6% 2/15/28 | | 3,050,000 | 2,969,250 |

| Petroleos Mexicanos 6.95% 1/28/60 | | 43,010,000 | 28,279,075 |

| Sitio Royalties OP / Sitio Finance Corp. 7.875% 11/1/28 (b) | | 8,445,000 | 8,750,878 |

| | | | 65,524,142 |

| FINANCIALS - 0.4% | | | |

| Financial Services - 0.4% | | | |

| GGAM Finance Ltd. 8% 6/15/28 (b) | | 3,400,000 | 3,517,637 |

| Scientific Games Holdings LP/Scientific Games U.S. Finco, Inc. 6.625% 3/1/30 (b) | | 4,630,000 | 4,377,341 |

| | | | 7,894,978 |

| INDUSTRIALS - 1.7% | | | |

| Commercial Services & Supplies - 0.4% | | | |

| Brand Energy & Infrastructure Services, Inc. 10.375% 8/1/30 (b) | | 3,800,000 | 4,018,614 |

| Neptune BidCo U.S., Inc. 9.29% 4/15/29 (b) | | 4,350,000 | 4,045,500 |

| | | | 8,064,114 |

| Ground Transportation - 1.3% | | | |

| Uber Technologies, Inc. 7.5% 9/15/27 (b) | | 29,570,000 | 30,623,579 |

| | | | |

TOTAL INDUSTRIALS | | | 38,687,693 |

| | | | |

| INFORMATION TECHNOLOGY - 1.7% | | | |

| Communications Equipment - 0.1% | | | |

| HTA Group Ltd. 7% 12/18/25 (b) | | 3,300,000 | 3,241,260 |

| | | | |

| Software - 1.6% | | | |

| Cloud Software Group, Inc. 9% 9/30/29 (b) | | 6,635,000 | 6,306,255 |

| McAfee Corp. 7.375% 2/15/30 (b) | | 6,990,000 | 6,383,628 |

| MicroStrategy, Inc. 6.125% 6/15/28 (b) | | 17,495,000 | 16,972,599 |

| Veritas U.S., Inc./Veritas Bermuda Ltd. 7.5% 9/1/25 (b) | | 8,400,000 | 6,934,792 |

| | | | 36,597,274 |

TOTAL INFORMATION TECHNOLOGY | | | 39,838,534 |

| | | | |

| MATERIALS - 1.5% | | | |

| Chemicals - 0.4% | | | |

| LSB Industries, Inc. 6.25% 10/15/28 (b) | | 4,079,000 | 3,868,539 |

| Olympus Water U.S. Holding Corp. 7.125% 10/1/27 (b) | | 2,800,000 | 2,803,136 |

| W.R. Grace Holding LLC 5.625% 8/15/29 (b) | | 4,445,000 | 3,911,409 |

| | | | 10,583,084 |

| Metals & Mining - 1.1% | | | |

| ATI, Inc.: | | | |

| 5.875% 12/1/27 | | 4,343,000 | 4,284,239 |

| 7.25% 8/15/30 | | 3,750,000 | 3,901,468 |

| Carpenter Technology Corp.: | | | |

| 6.375% 7/15/28 | | 2,320,000 | 2,311,295 |

| 7.625% 3/15/30 | | 4,353,000 | 4,488,730 |

| ERO Copper Corp. 6.5% 2/15/30 (b) | | 5,972,000 | 5,268,857 |

| Mineral Resources Ltd. 8% 11/1/27 (b) | | 4,895,000 | 5,018,779 |

| | | | 25,273,368 |

TOTAL MATERIALS | | | 35,856,452 |

| | | | |

| REAL ESTATE - 0.4% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.4% | | | |

| MPT Operating Partnership LP/MPT Finance Corp. 5% 10/15/27 | | 4,595,000 | 3,753,280 |

| VICI Properties LP 5.125% 5/15/32 | | 4,632,000 | 4,515,290 |

| | | | 8,268,570 |

| UTILITIES - 0.5% | | | |

| Electric Utilities - 0.5% | | | |

| Southern Co. 4% 1/15/51 (c) | | 5,700,000 | 5,419,805 |

| Vistra Operations Co. LLC: | | | |

| 5.625% 2/15/27(b) | | 3,125,000 | 3,082,481 |

| 7.75% 10/15/31(b) | | 3,800,000 | 3,946,638 |

| | | | 12,448,924 |

| TOTAL NONCONVERTIBLE BONDS | | | 293,980,485 |

| TOTAL CORPORATE BONDS (Cost $297,740,681) | | | 308,308,503 |

| | | | |

| U.S. Treasury Obligations - 37.6% |

| | | Principal Amount (a) | Value ($) |

| U.S. Treasury Bonds 3.875% 2/15/43 | | 255,243,000 | 243,358,246 |

| U.S. Treasury Notes: | | | |

| 3.5% 4/30/30 | | 237,451,000 | 232,080,526 |

| 4% 6/30/28 | | 80,608,000 | 80,988,999 |

| 4.125% 7/31/28 | | 189,659,000 | 191,614,858 |

| 4.125% 11/15/32 | | 130,584,000 | 132,736,596 |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $868,867,502) | | | 880,779,225 |

| | | | |

| Commercial Mortgage Securities - 0.0% |

| | | Principal Amount (a) | Value ($) |

BANK Series 2020-BN30 Class MCDG, 2.9182% 12/15/53 (c)(e) (Cost $177,690) | | 200,000 | 79,781 |

| | | | |

| Common Stocks - 37.1% |

| | | Shares | Value ($) |

| COMMUNICATION SERVICES - 2.3% | | | |

| Diversified Telecommunication Services - 0.0% | | | |

| AT&T, Inc. | | 3,040 | 51,011 |

| Verizon Communications, Inc. | | 1,921 | 72,422 |

| | | | 123,433 |

| Entertainment - 0.6% | | | |

| The Walt Disney Co. | | 87,400 | 7,891,346 |

| Warner Bros Discovery, Inc. (f) | | 455,200 | 5,180,176 |

| | | | 13,071,522 |

| Interactive Media & Services - 1.5% | | | |

| Alphabet, Inc. Class A (f) | | 192,779 | 26,929,299 |

| Meta Platforms, Inc. Class A (f) | | 20,900 | 7,397,764 |

| | | | 34,327,063 |

| Media - 0.2% | | | |

| Comcast Corp. Class A | | 133,030 | 5,833,366 |

| Interpublic Group of Companies, Inc. | | 902 | 29,441 |

| | | | 5,862,807 |

| Wireless Telecommunication Services - 0.0% | | | |

| T-Mobile U.S., Inc. | | 489 | 78,401 |

TOTAL COMMUNICATION SERVICES | | | 53,463,226 |

| CONSUMER DISCRETIONARY - 5.1% | | | |

| Automobiles - 0.5% | | | |

| Stellantis NV (g) | | 198,299 | 4,624,333 |

| Tesla, Inc. (f) | | 21,800 | 5,416,864 |

| | | | 10,041,197 |

| Broadline Retail - 1.5% | | | |

| Amazon.com, Inc. (f) | | 232,100 | 35,265,274 |

| Diversified Consumer Services - 0.0% | | | |

| H&R Block, Inc. | | 755 | 36,519 |

| Hotels, Restaurants & Leisure - 2.4% | | | |

| A&W Revenue Royalties Income Fund (g) | | 277,700 | 6,524,132 |

| Genius Sports Ltd. (f)(g) | | 1,924,565 | 11,893,812 |

| McDonald's Corp. | | 19,626 | 5,819,305 |

| Monarch Casino & Resort, Inc. | | 75,300 | 5,206,995 |

| Penn Entertainment, Inc. (f) | | 358,900 | 9,338,578 |

| Pizza Pizza Royalty Corp. | | 942,900 | 10,474,690 |

| Rush Street Interactive, Inc. (f) | | 1,079,439 | 4,846,681 |

| Super Group SGHC Ltd. (f) | | 866,314 | 2,746,215 |

| | | | 56,850,408 |

| Specialty Retail - 0.3% | | | |

| Academy Sports & Outdoors, Inc. | | 43,425 | 2,866,050 |

| Best Buy Co., Inc. | | 186 | 14,560 |

| Burlington Stores, Inc. (f) | | 263 | 51,148 |

| Dick's Sporting Goods, Inc. | | 28 | 4,115 |

| Lowe's Companies, Inc. | | 20,250 | 4,506,638 |

| TJX Companies, Inc. | | 1,146 | 107,506 |

| | | | 7,550,017 |

| Textiles, Apparel & Luxury Goods - 0.4% | | | |

| Columbia Sportswear Co. | | 72 | 5,727 |

| NIKE, Inc. Class B | | 41,500 | 4,505,655 |

| Tapestry, Inc. | | 671 | 24,700 |

| Under Armour, Inc. Class A (sub. vtg.) (f) | | 493,800 | 4,340,502 |

| | | | 8,876,584 |

TOTAL CONSUMER DISCRETIONARY | | | 118,619,999 |

| CONSUMER STAPLES - 2.5% | | | |

| Beverages - 0.5% | | | |

| Keurig Dr. Pepper, Inc. | | 200,775 | 6,689,823 |

| The Coca-Cola Co. | | 73,541 | 4,333,771 |

| | | | 11,023,594 |

| Consumer Staples Distribution & Retail - 0.2% | | | |

| Albertsons Companies, Inc. | | 203,405 | 4,678,315 |

| Alimentation Couche-Tard, Inc. Class A (multi-vtg.) | | 478 | 28,149 |

| BJ's Wholesale Club Holdings, Inc. (f) | | 540 | 35,996 |

| Costco Wholesale Corp. | | 45 | 29,704 |

| Dollar Tree, Inc. (f) | | 426 | 60,513 |

| Metro, Inc. | | 474 | 24,536 |

| Target Corp. | | 114 | 16,236 |

| Walmart, Inc. | | 814 | 128,327 |

| | | | 5,001,776 |

| Food Products - 1.1% | | | |

| Bunge Global SA | | 347 | 35,030 |

| Flowers Foods, Inc. | | 93,200 | 2,097,932 |

| JBS SA | | 1,190,400 | 6,104,427 |

| Mondelez International, Inc. | | 770 | 55,771 |

| The J.M. Smucker Co. | | 54,100 | 6,837,158 |

| Tyson Foods, Inc. Class A | | 106,400 | 5,719,000 |

| WK Kellogg Co. | | 450,400 | 5,918,256 |

| | | | 26,767,574 |

| Household Products - 0.0% | | | |

| Procter & Gamble Co. | | 878 | 128,662 |

| Personal Care Products - 0.7% | | | |

| Estee Lauder Companies, Inc. Class A | | 121 | 17,696 |

| Kenvue, Inc. | | 445,879 | 9,599,775 |

| Unilever PLC | | 216 | 10,457 |

| Unilever PLC sponsored ADR | | 115,900 | 5,618,832 |

| | | | 15,246,760 |

TOTAL CONSUMER STAPLES | | | 58,168,366 |

| ENERGY - 6.0% | | | |

| Oil, Gas & Consumable Fuels - 6.0% | | | |

| Antero Midstream GP LP (g) | | 359,100 | 4,499,523 |

| Canadian Natural Resources Ltd. | | 936 | 61,322 |

| Canadian Natural Resources Ltd. (g) | | 132,900 | 8,707,608 |

| ConocoPhillips Co. | | 903 | 104,811 |

| DHT Holdings, Inc. | | 5,765,228 | 56,556,887 |

| Energy Transfer LP | | 336,500 | 4,643,700 |

| Enterprise Products Partners LP | | 175,670 | 4,628,905 |

| Exxon Mobil Corp. | | 75,206 | 7,519,096 |

| Freehold Royalties Ltd. (g) | | 404,900 | 4,183,300 |

| Frontline PLC (NY Shares) (g) | | 464,400 | 9,311,220 |

| Hess Corp. | | 409 | 58,961 |

| Hess Midstream LP | | 148,400 | 4,693,892 |

| Imperial Oil Ltd. | | 1,042 | 59,356 |

| MPLX LP | | 127,100 | 4,667,112 |

| Northern Oil & Gas, Inc. | | 169,100 | 6,268,537 |

| Phillips 66 Co. | | 275 | 36,614 |

| Scorpio Tankers, Inc. | | 146,150 | 8,885,920 |

| Sitio Royalties Corp. | | 245,023 | 5,760,491 |

| Southwestern Energy Co. (f) | | 697,600 | 4,569,280 |

| Targa Resources Corp. | | 53,800 | 4,673,606 |

| Valero Energy Corp. | | 211 | 27,430 |

| | | | 139,917,571 |

| FINANCIALS - 1.9% | | | |

| Banks - 1.9% | | | |

| Bank of America Corp. | | 356,417 | 12,000,560 |

| Huntington Bancshares, Inc. | | 4,530 | 57,622 |

| JPMorgan Chase & Co. (h) | | 65,342 | 11,114,674 |

| M&T Bank Corp. | | 471 | 64,565 |

| PNC Financial Services Group, Inc. | | 78,001 | 12,078,455 |

| U.S. Bancorp | | 201,476 | 8,719,881 |

| Wells Fargo & Co. | | 3,247 | 159,817 |

| | | | 44,195,574 |

| Capital Markets - 0.0% | | | |

| BlackRock, Inc. Class A | | 82 | 66,568 |

| Consumer Finance - 0.0% | | | |

| Capital One Financial Corp. | | 405 | 53,104 |

| Financial Services - 0.0% | | | |

| Edenred SA | | 598 | 35,741 |

| Visa, Inc. Class A | | 205 | 53,372 |

| | | | 89,113 |

| Insurance - 0.0% | | | |

| American Financial Group, Inc. | | 389 | 46,248 |

| Chubb Ltd. | | 572 | 129,272 |

| Hartford Financial Services Group, Inc. | | 1,111 | 89,302 |

| Marsh & McLennan Companies, Inc. | | 336 | 63,662 |

| The Travelers Companies, Inc. | | 426 | 81,149 |

| | | | 409,633 |

TOTAL FINANCIALS | | | 44,813,992 |

| HEALTH CARE - 4.6% | | | |

| Biotechnology - 0.8% | | | |

| Gilead Sciences, Inc. | | 82,624 | 6,693,370 |

| Moderna, Inc. (f) | | 104,000 | 10,342,800 |

| | | | 17,036,170 |

| Health Care Providers & Services - 1.1% | | | |

| Centene Corp. (f) | | 75,700 | 5,617,697 |

| Cigna Group | | 314 | 94,027 |

| CVS Health Corp. | | 116,900 | 9,230,424 |

| Laboratory Corp. of America Holdings | | 22,000 | 5,000,380 |

| UnitedHealth Group, Inc. | | 11,448 | 6,027,029 |

| | | | 25,969,557 |

| Life Sciences Tools & Services - 0.6% | | | |

| Danaher Corp. | | 33,652 | 7,785,054 |

| Thermo Fisher Scientific, Inc. | | 12,400 | 6,581,796 |

| | | | 14,366,850 |

| Pharmaceuticals - 2.1% | | | |

| AstraZeneca PLC (United Kingdom) | | 55,492 | 7,485,311 |

| Bristol-Myers Squibb Co. | | 127,443 | 6,539,100 |

| Eli Lilly & Co. | | 23,772 | 13,857,174 |

| Johnson & Johnson | | 33,530 | 5,255,492 |

| Merck & Co., Inc. | | 64,197 | 6,998,757 |

| Roche Holding AG: | | | |

| (participation certificate) | | 328 | 95,347 |

| sponsored ADR | | 240,600 | 8,716,938 |

| Royalty Pharma PLC | | 1,410 | 39,607 |

| Sanofi SA | | 982 | 97,584 |

| | | | 49,085,310 |

TOTAL HEALTH CARE | | | 106,457,887 |

| INDUSTRIALS - 4.1% | | | |

| Aerospace & Defense - 1.1% | | | |

| General Dynamics Corp. | | 22,946 | 5,958,388 |

| Huntington Ingalls Industries, Inc. | | 24,496 | 6,360,141 |

| Lockheed Martin Corp. | | 15,000 | 6,798,600 |

| Northrop Grumman Corp. | | 12,638 | 5,916,353 |

| The Boeing Co. (f) | | 587 | 153,007 |

| | | | 25,186,489 |

| Air Freight & Logistics - 0.2% | | | |

| United Parcel Service, Inc. Class B | | 26,263 | 4,129,331 |

| Building Products - 0.4% | | | |

| Carrier Global Corp. | | 84,300 | 4,843,035 |

| Johnson Controls International PLC | | 86,165 | 4,966,551 |

| | | | 9,809,586 |

| Commercial Services & Supplies - 0.0% | | | |

| GFL Environmental, Inc. | | 522 | 18,007 |

| Veralto Corp. | | 208 | 17,110 |

| | | | 35,117 |

| Construction & Engineering - 0.2% | | | |

| Willscot Mobile Mini Holdings (f) | | 130,300 | 5,798,350 |

| Electrical Equipment - 0.6% | | | |

| AMETEK, Inc. | | 423 | 69,748 |

| Babcock & Wilcox Enterprises, Inc. (f) | | 733,363 | 1,070,710 |

| Eaton Corp. PLC | | 29,100 | 7,007,862 |

| Regal Rexnord Corp. | | 33,629 | 4,977,765 |

| | | | 13,126,085 |

| Ground Transportation - 0.5% | | | |

| CSX Corp. | | 208,200 | 7,218,294 |

| Uber Technologies, Inc. (f)(h) | | 70,000 | 4,309,900 |

| | | | 11,528,194 |

| Industrial Conglomerates - 0.0% | | | |

| General Electric Co. | | 1,137 | 145,115 |

| Hitachi Ltd. | | 376 | 27,046 |

| Siemens AG | | 224 | 42,024 |

| | | | 214,185 |

| Machinery - 0.6% | | | |

| Crane Co. | | 507 | 59,897 |

| Fortive Corp. | | 56,729 | 4,176,956 |

| Hillenbrand, Inc. | | 18,985 | 908,432 |

| ITT, Inc. | | 39,317 | 4,691,304 |

| Stanley Black & Decker, Inc. | | 57,200 | 5,611,320 |

| | | | 15,447,909 |

| Passenger Airlines - 0.3% | | | |

| Alaska Air Group, Inc. (f) | | 181,893 | 7,106,560 |

| Professional Services - 0.2% | | | |

| Clarivate Analytics PLC (f)(g) | | 465,200 | 4,307,752 |

| Experian PLC | | 526 | 21,458 |

| KBR, Inc. | | 605 | 33,523 |

| Paychex, Inc. | | 66 | 7,861 |

| | | | 4,370,594 |

| Trading Companies & Distributors - 0.0% | | | |

| Watsco, Inc. | | 116 | 49,703 |

TOTAL INDUSTRIALS | | | 96,802,103 |

| INFORMATION TECHNOLOGY - 6.7% | | | |

| Communications Equipment - 0.3% | | | |

| Cisco Systems, Inc. | | 118,081 | 5,965,452 |

| Electronic Equipment, Instruments & Components - 0.0% | | | |

| Crane Nxt Co. | | 377 | 21,440 |

| IT Services - 0.0% | | | |

| Accenture PLC Class A | | 204 | 71,586 |

| Amdocs Ltd. | | 860 | 75,585 |

| GTT Communications, Inc. (e) | | 1,508 | 52,976 |

| | | | 200,147 |

| Semiconductors & Semiconductor Equipment - 2.0% | | | |

| Advanced Micro Devices, Inc. (f) | | 66,900 | 9,861,729 |

| Analog Devices, Inc. | | 360 | 71,482 |

| NVIDIA Corp. | | 45,050 | 22,309,661 |

| NXP Semiconductors NV | | 34,060 | 7,822,901 |

| ON Semiconductor Corp. (f) | | 94,300 | 7,876,879 |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 975 | 101,400 |

| | | | 48,044,052 |

| Software - 3.3% | | | |

| Gen Digital, Inc. | | 120,145 | 2,741,709 |

| Microsoft Corp. (h) | | 170,595 | 64,150,544 |

| Roper Technologies, Inc. | | 10,594 | 5,775,531 |

| Zoom Video Communications, Inc. Class A (f) | | 70,300 | 5,055,273 |

| | | | 77,723,057 |

| Technology Hardware, Storage & Peripherals - 1.1% | | | |

| Apple, Inc. (h) | | 134,758 | 25,944,958 |

| Samsung Electronics Co. Ltd. | | 1,553 | 94,150 |

| Seagate Technology Holdings PLC | | 140 | 11,952 |

| | | | 26,051,060 |

TOTAL INFORMATION TECHNOLOGY | | | 158,005,208 |

| MATERIALS - 2.2% | | | |

| Chemicals - 0.7% | | | |

| CF Industries Holdings, Inc. | | 74,500 | 5,922,750 |

| Linde PLC | | 458 | 188,105 |

| Nutrien Ltd. | | 104,600 | 5,892,118 |

| The Mosaic Co. | | 156,700 | 5,598,891 |

| | | | 17,601,864 |

| Containers & Packaging - 0.7% | | | |

| Ball Corp. | | 831 | 47,799 |

| Crown Holdings, Inc. | | 94,312 | 8,685,192 |

| International Paper Co. | | 201,800 | 7,295,070 |

| | | | 16,028,061 |

| Metals & Mining - 0.8% | | | |

| Agnico Eagle Mines Ltd. (United States) (g) | | 87,600 | 4,804,860 |

| ATI, Inc. (f) | | 95,300 | 4,333,291 |

| Freeport-McMoRan, Inc. | | 2,921 | 124,347 |

| Newmont Corp. | | 116,300 | 4,813,657 |

| Wheaton Precious Metals Corp. | | 97,226 | 4,796,546 |

| | | | 18,872,701 |

TOTAL MATERIALS | | | 52,502,626 |

| REAL ESTATE - 1.2% | | | |

| Equity Real Estate Investment Trusts (REITs) - 1.2% | | | |

| American Tower Corp. | | 253 | 54,618 |

| Crown Castle International Corp. | | 56,900 | 6,554,311 |

| Digital Realty Trust, Inc. | | 20,000 | 2,691,600 |

| Lamar Advertising Co. Class A | | 757 | 80,454 |

| Postal Realty Trust, Inc. | | 224,094 | 3,262,809 |

| Public Storage | | 154 | 46,970 |

| Simon Property Group, Inc. | | 56,100 | 8,002,104 |

| Ventas, Inc. | | 147,800 | 7,366,352 |

| | | | 28,059,218 |

| UTILITIES - 0.5% | | | |

| Electric Utilities - 0.5% | | | |

| Constellation Energy Corp. | | 47,443 | 5,545,612 |

| Exelon Corp. | | 801 | 28,756 |

| FirstEnergy Corp. | | 653 | 23,939 |

| NextEra Energy, Inc. | | 107,412 | 6,524,205 |

| PG&E Corp. | | 1,726 | 31,120 |

| Southern Co. | | 959 | 67,245 |

| | | | 12,220,877 |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| Vistra Corp. | | 545 | 20,993 |

| Multi-Utilities - 0.0% | | | |

| Ameren Corp. | | 364 | 26,332 |

| CenterPoint Energy, Inc. | | 1,001 | 28,599 |

| Dominion Energy, Inc. | | 492 | 23,124 |

| WEC Energy Group, Inc. | | 369 | 31,059 |

| | | | 109,114 |

TOTAL UTILITIES | | | 12,350,984 |

| TOTAL COMMON STOCKS (Cost $746,650,073) | | | 869,161,180 |

| | | | |

| Nonconvertible Preferred Stocks - 0.4% |

| | | Shares | Value ($) |

| ENERGY - 0.3% | | | |

| Oil, Gas & Consumable Fuels - 0.3% | | | |

| Enbridge, Inc. Series L, U.S. TREASURY 5 YEAR INDEX + 3.150% 4.959% (c)(d) | | 110,300 | 2,100,112 |

| Energy Transfer LP 7.60% (c) | | 220,016 | 5,467,398 |

| | | | 7,567,510 |

| INDUSTRIALS - 0.1% | | | |

| Electrical Equipment - 0.1% | | | |

| Babcock & Wilcox Enterprises, Inc. 8.125% | | 149,087 | 2,937,014 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS (Cost $11,357,158) | | | 10,504,524 |

| | | | |

| Bank Loan Obligations - 4.3% |

| | | Principal Amount (a) | Value ($) |

| CONSUMER DISCRETIONARY - 2.3% | | | |

| Broadline Retail - 1.2% | | | |

| Bass Pro Group LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 9.2204% 3/5/28 (c)(d)(i) | | 28,750,085 | 28,721,335 |

| Hotels, Restaurants & Leisure - 1.1% | | | |

| City Football Group Ltd. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.4704% 7/21/28 (c)(d)(i) | | 6,097,833 | 6,054,660 |

| Fertitta Entertainment LLC NV Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 9.356% 1/27/29 (c)(d)(i) | | 6,328,954 | 6,327,625 |

| Four Seasons Hotels Ltd. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.500% 7.956% 11/30/29 (c)(d)(i) | | 13,677,190 | 13,714,802 |

| | | | 26,097,087 |

TOTAL CONSUMER DISCRETIONARY | | | 54,818,422 |

| FINANCIALS - 0.2% | | | |

| Capital Markets - 0.2% | | | |

| Citadel Securities LP Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.500% 7.9704% 7/25/30 (c)(d)(i) | | 3,391,690 | 3,395,929 |

| HEALTH CARE - 0.2% | | | |

| Health Care Technology - 0.2% | | | |

| Athenahealth Group, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 8.606% 2/15/29 (c)(d)(i) | | 3,945,400 | 3,923,700 |

| INDUSTRIALS - 0.8% | | | |

| Air Freight & Logistics - 0.1% | | | |

| Echo Global Logistics, Inc.: | | | |

| 1LN, term loan CME Term SOFR 3 Month Index + 4.750% 10.1981% 11/23/28 (c)(d)(e)(i) | | 1,876,250 | 1,876,250 |

| 2LN, term loan CME Term SOFR 3 Month Index + 7.000% 12.4832% 11/23/29 (c)(d)(e)(i) | | 655,000 | 652,380 |

| | | | 2,528,630 |

| Construction & Engineering - 0.2% | | | |

| Breakwater Energy Partners, LLC Tranche B 1LN, term loan 11.25% 9/1/26 (c)(d)(e)(i) | | 4,548,091 | 4,406,190 |

| Ground Transportation - 0.5% | | | |

| Uber Technologies, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.1346% 3/3/30 (c)(d)(i) | | 11,763,437 | 11,791,669 |

TOTAL INDUSTRIALS | | | 18,726,489 |

| INFORMATION TECHNOLOGY - 0.8% | | | |

| Software - 0.8% | | | |

| Project Alpha Intermediate Holding, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.750% 10.0929% 10/26/30 (c)(d)(i) | | 3,700,000 | 3,712,321 |

| Proofpoint, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8.7128% 8/31/28 (c)(d)(i) | | 4,454,120 | 4,449,487 |

| RealPage, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.4628% 4/22/28 (c)(d)(i) | | 1,892,107 | 1,874,851 |

| Sophia LP Tranche B 1LN, term loan CME Term SOFR 3 Month Index + 3.500% 8.956% 10/7/27 (c)(d)(i) | | 2,736,005 | 2,738,577 |

| Ukg, Inc. 1LN, term loan: | | | |

| CME Term SOFR 1 Month Index + 4.500% 9.9882% 5/4/26 (c)(d)(i) | | 233,825 | 234,410 |

| CME Term SOFR 3 Month Index + 3.250% 8.7643% 5/4/26 (c)(d)(i) | | 3,952,051 | 3,958,493 |

| VS Buyer LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 8.706% 2/28/27 (c)(d)(i) | | 2,592,826 | 2,596,067 |

| | | | 19,564,206 |

| TOTAL BANK LOAN OBLIGATIONS (Cost $99,867,102) | | | 100,428,746 |

| | | | |

| Preferred Securities - 5.8% |

| | | Principal Amount (a) | Value ($) |

| ENERGY - 1.5% | | | |

| Oil, Gas & Consumable Fuels - 1.5% | | | |

| Energy Transfer LP: | | | |

| 3 month U.S. LIBOR + 4.020% 9.6693% (c)(d)(j) | | 13,510,000 | 13,144,397 |

| 6.5% (c)(j) | | 2,450,000 | 2,348,749 |

| 6.625% (c)(j) | | 5,700,000 | 4,902,077 |

| 7.125% (c)(j) | | 3,615,000 | 3,364,403 |

| Plains All American Pipeline LP CME Term SOFR 3 Month Index + 4.110% 9.7513% (c)(d)(j) | | 11,825,000 | 11,576,449 |

| | | | 35,336,075 |

| FINANCIALS - 3.3% | | | |

| Banks - 2.5% | | | |

| Bank of America Corp.: | | | |

| CME Term SOFR 3 Month Index + 3.390% 8.7737% (c)(d)(j) | | 3,900,000 | 3,931,066 |

| 6.25% (c)(j) | | 3,585,000 | 3,624,616 |

| 6.5% (c)(j) | | 6,170,000 | 6,216,801 |

| Citigroup, Inc.: | | | |

| 7.625% (c)(j) | | 3,000,000 | 3,126,790 |

| 9.1073% (c)(d)(j) | | 3,700,000 | 3,753,243 |

| JPMorgan Chase & Co.: | | | |

| CME Term SOFR 3 Month Index + 2.840% 8.2187% (c)(d)(j) | | 13,730,000 | 13,870,082 |

| 4.6% (c)(j) | | 5,910,000 | 5,812,160 |

| 5% (c)(j) | | 5,788,000 | 5,802,781 |

| 6.125% (c)(j) | | 4,620,000 | 4,627,555 |

| Wells Fargo & Co.: | | | |

| 5.9% (c)(j) | | 4,350,000 | 4,316,061 |

| 7.625% (c)(j) | | 4,000,000 | 4,200,425 |

| | | | 59,281,580 |

| Capital Markets - 0.7% | | | |

| Charles Schwab Corp. 5.375% (c)(j) | | 4,805,000 | 4,760,301 |

| Goldman Sachs Group, Inc. CME Term SOFR 3 Month Index + 3.130% 8.5047% (c)(d)(j) | | 3,520,000 | 3,565,002 |

| Morgan Stanley 5.875% (c)(j) | | 3,220,000 | 3,132,671 |

| State Street Corp. CME Term SOFR 3 Month Index + 2.530% 8.1852% (c)(d)(j) | | 5,065,000 | 5,040,259 |

| | | | 16,498,233 |

| Consumer Finance - 0.1% | | | |

| Ally Financial, Inc. 4.7% (c)(j) | | 3,210,000 | 2,197,117 |

TOTAL FINANCIALS | | | 77,976,930 |

| UTILITIES - 1.0% | | | |

| Electric Utilities - 0.2% | | | |

| Duke Energy Corp. 4.875% (c)(j) | | 4,775,000 | 4,768,544 |

| Independent Power and Renewable Electricity Producers - 0.4% | | | |

| Vistra Corp.: | | | |

| 7% (b)(c)(j) | | 5,995,000 | 5,924,570 |

| 8% (b)(c)(j) | | 2,885,000 | 2,920,975 |

| | | | 8,845,545 |

| Multi-Utilities - 0.4% | | | |

| Dominion Energy, Inc. 4.65% (c)(j) | | 5,455,000 | 5,195,820 |

| Sempra 4.875% (c)(j) | | 3,515,000 | 3,474,640 |

| | | | 8,670,460 |

TOTAL UTILITIES | | | 22,284,549 |

| TOTAL PREFERRED SECURITIES (Cost $131,620,828) | | | 135,597,554 |

| | | | |

| Other - 1.0% |

| | | Shares | Value ($) |

| Other - 1.0% | | | |

Fidelity Private Credit Central Fund LLC (k)(l) (Cost $23,787,179) | | 2,393,014 | 24,121,580 |

| | | | |

| Money Market Funds - 1.8% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 5.40% (m) | | 15,235,251 | 15,238,298 |

| Fidelity Securities Lending Cash Central Fund 5.40% (m)(n) | | 27,527,185 | 27,529,938 |

| TOTAL MONEY MARKET FUNDS (Cost $42,768,236) | | | 42,768,236 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 101.2% (Cost $2,222,836,449) | 2,371,749,329 |

NET OTHER ASSETS (LIABILITIES) - (1.2)% | (28,430,778) |

| NET ASSETS - 100.0% | 2,343,318,551 |

| | |

| Written Options |

| | Counterparty | Number of Contracts | Notional Amount ($) | Exercise Price ($) | Expiration Date | Value ($) |

| Call Options | | | | | | |

| Apple, Inc. | Chicago Board Options Exchange | 495 | 9,530,235 | 195.00 | 02/16/24 | (256,163) |

| JPMorgan Chase & Co. | Chicago Board Options Exchange | 100 | 1,701,000 | 155.00 | 01/19/24 | (153,250) |

| Microsoft Corp. | Chicago Board Options Exchange | 792 | 29,782,368 | 360.00 | 01/19/24 | (1,469,160) |

| Uber Technologies, Inc. | Chicago Board Options Exchange | 200 | 1,231,400 | 50.00 | 01/19/24 | (235,500) |

| Uber Technologies, Inc. | Chicago Board Options Exchange | 500 | 3,078,500 | 52.50 | 01/19/24 | (465,000) |

| | | | | | | |

| TOTAL WRITTEN OPTIONS | | | | | | (2,579,073) |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $213,356,342 or 9.1% of net assets. |

| (c) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (d) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (g) | Security or a portion of the security is on loan at period end. |

| (h) | Security or a portion of the security is pledged as collateral for options written. At period end, the value of securities pledged amounted to $45,323,503. |

| (i) | Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. |

| (j) | Security is perpetual in nature with no stated maturity date. |

| (k) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. |

| (l) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $24,121,580 or 1.0% of net assets. |

| (m) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (n) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: |

| Security | Acquisition Date | Acquisition Cost ($) |

| Fidelity Private Credit Central Fund LLC | 4/28/22 - 12/12/23 | 23,787,179 |

| | | |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.40% | 18,295,144 | 1,014,805,276 | 1,017,862,122 | 505,696 | - | - | 15,238,298 | 0.0% |

| Fidelity Private Credit Central Fund LLC | 13,386,113 | 10,354,772 | - | 2,871,428 | 34,577 | 346,118 | 24,121,580 | 3.6% |

| Fidelity Securities Lending Cash Central Fund 5.40% | 30,634,576 | 236,134,585 | 239,239,223 | 158,161 | - | - | 27,529,938 | 0.1% |

| Total | 62,315,833 | 1,261,294,633 | 1,257,101,345 | 3,535,285 | 34,577 | 346,118 | 66,889,816 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 53,463,226 | 53,463,226 | - | - |

Consumer Discretionary | 118,619,999 | 118,619,999 | - | - |

Consumer Staples | 58,168,366 | 58,157,909 | 10,457 | - |

Energy | 147,485,081 | 147,485,081 | - | - |

Financials | 44,813,992 | 44,813,992 | - | - |

Health Care | 106,457,887 | 98,779,645 | 7,678,242 | - |

Industrials | 99,739,117 | 99,648,589 | 90,528 | - |

Information Technology | 158,005,208 | 157,952,232 | - | 52,976 |

Materials | 52,502,626 | 52,502,626 | - | - |

Real Estate | 28,059,218 | 28,059,218 | - | - |

Utilities | 12,350,984 | 12,350,984 | - | - |

|

| Corporate Bonds | 308,308,503 | - | 308,308,503 | - |

|

| U.S. Government and Government Agency Obligations | 880,779,225 | - | 880,779,225 | - |

|

| Commercial Mortgage Securities | 79,781 | - | - | 79,781 |

|

| Bank Loan Obligations | 100,428,746 | - | 93,493,926 | 6,934,820 |

|

| Preferred Securities | 135,597,554 | - | 135,597,554 | - |

|

| Other | 24,121,580 | - | 24,121,580 | - |

|

| Money Market Funds | 42,768,236 | 42,768,236 | - | - |

| Total Investments in Securities: | 2,371,749,329 | 914,601,737 | 1,450,080,015 | 7,067,577 |

Derivative Instruments: Liabilities | | | | |

Written Options | (2,579,073) | (2,579,073) | - | - |

| Total Liabilities | (2,579,073) | (2,579,073) | - | - |

| Total Derivative Instruments: | (2,579,073) | (2,579,073) | - | - |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of December 31, 2023. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

Primary Risk Exposure / Derivative Type | Value |

| Asset ($) | Liability ($) |

| Equity Risk | | |

Written Options (a) | 0 | (2,579,073) |

| Total Equity Risk | 0 | (2,579,073) |

| Total Value of Derivatives | 0 | (2,579,073) |

(a)Gross value is presented in the Statement of Assets and Liabilities in the written options, at value line-item.

| Statement of Assets and Liabilities |

| | | | December 31, 2023 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $26,632,446) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $2,156,281,034) | $ | 2,304,859,513 | | |

Fidelity Central Funds (cost $66,555,415) | | 66,889,816 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $2,222,836,449) | | | $ | 2,371,749,329 |

| Cash | | | | 5,699 |

| Foreign currency held at value (cost $24,503) | | | | 24,503 |

| Receivable for investments sold | | | | 250,135 |

| Receivable for fund shares sold | | | | 6,326,845 |

| Dividends receivable | | | | 1,210,694 |

| Interest receivable | | | | 18,688,179 |

| Distributions receivable from Fidelity Central Funds | | | | 381,609 |

| Prepaid expenses | | | | 1,863 |

| Other receivables | | | | 11,332 |

Total assets | | | | 2,398,650,188 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 19,809,106 | | |

| Payable for fund shares redeemed | | 3,059,527 | | |

| Distributions payable | | 716,927 | | |

| Accrued management fee | | 1,027,832 | | |

| Distribution and service plan fees payable | | 128,227 | | |

| Written options, at value (premium received $840,654) | | 2,579,073 | | |

| Other affiliated payables | | 311,291 | | |

| Other payables and accrued expenses | | 169,872 | | |

| Collateral on securities loaned | | 27,529,782 | | |

| Total Liabilities | | | | 55,331,637 |

| Commitments and contingent liabilities (see Commitments note) | | | | |

| Net Assets | | | $ | 2,343,318,551 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 2,414,041,020 |

| Total accumulated earnings (loss) | | | | (70,722,469) |

| Net Assets | | | $ | 2,343,318,551 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($217,454,061 ÷ 16,286,257 shares)(a) | | | $ | 13.35 |

| Maximum offering price per share (100/96.00 of $13.35) | | | $ | 13.91 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($24,030,827 ÷ 1,797,839 shares)(a) | | | $ | 13.37 |

| Maximum offering price per share (100/96.00 of $13.37) | | | $ | 13.93 |

| Class C : | | | | |

Net Asset Value and offering price per share ($97,311,346 ÷ 7,301,486 shares)(a) | | | $ | 13.33 |

| Fidelity Multi-Asset Income Fund : | | | | |

Net Asset Value, offering price and redemption price per share ($1,050,521,233 ÷ 78,644,001 shares) | | | $ | 13.36 |

| Class I : | | | | |

Net Asset Value, offering price and redemption price per share ($695,649,023 ÷ 52,091,340 shares) | | | $ | 13.35 |

| Class Z : | | | | |

Net Asset Value, offering price and redemption price per share ($258,352,061 ÷ 19,341,472 shares) | | | $ | 13.36 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Year ended December 31, 2023 |

| Investment Income | | | | |

| Dividends | | | $ | 32,476,701 |

| Interest | | | | 68,577,134 |

| Income from Fidelity Central Funds (including $158,161 from security lending) | | | | 3,511,733 |

| Total Income | | | | 104,565,568 |

| Expenses | | | | |

| Management fee | $ | 11,246,917 | | |

| Transfer agent fees | | 2,627,565 | | |

| Distribution and service plan fees | | 1,356,681 | | |

| Accounting fees | | 755,141 | | |

| Custodian fees and expenses | | 61,018 | | |

| Independent trustees' fees and expenses | | 7,188 | | |

| Registration fees | | 233,422 | | |

| Audit | | 82,940 | | |

| Legal | | 6,364 | | |

| Interest | | 13,748 | | |

| Miscellaneous | | 46,623 | | |

| Total expenses before reductions | | 16,437,607 | | |

| Expense reductions | | (155,879) | | |

| Total expenses after reductions | | | | 16,281,728 |

| Net Investment income (loss) | | | | 88,283,840 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (14,868,215) | | |

| Affiliated issuers | | 34,577 | | |

| Foreign currency transactions | | (84,777) | | |

| Written options | | (4,774,672) | | |

| Capital gain distributions from Fidelity Central Funds | | 23,552 | | |

| Total net realized gain (loss) | | | | (19,669,535) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 153,905,842 | | |

| Affiliated issuers | | 346,118 | | |

| Assets and liabilities in foreign currencies | | 6,829 | | |

| Written options | | (1,738,419) | | |

| Total change in net unrealized appreciation (depreciation) | | | | 152,520,370 |

| Net gain (loss) | | | | 132,850,835 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 221,134,675 |

| Statement of Changes in Net Assets |

| |

| | Year ended December 31, 2023 | | Year ended December 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 88,283,840 | $ | 64,882,530 |

| Net realized gain (loss) | | (19,669,535) | | (190,308,842) |

| Change in net unrealized appreciation (depreciation) | | 152,520,370 | | (142,207,654) |

| Net increase (decrease) in net assets resulting from operations | | 221,134,675 | | (267,633,966) |

| Distributions to shareholders | | (88,768,777) | | (79,967,145) |

| | | | | |

| Share transactions - net increase (decrease) | | 473,148,435 | | 192,272,417 |

| Total increase (decrease) in net assets | | 605,514,333 | | (155,328,694) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 1,737,804,218 | | 1,893,132,912 |

| End of period | $ | 2,343,318,551 | $ | 1,737,804,218 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity Advisor® Multi-Asset Income Fund Class A |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.48 | $ | 14.97 | $ | 13.15 | $ | 11.72 | $ | 9.81 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .527 | | .440 | | .339 | | .384 | | .293 |

| Net realized and unrealized gain (loss) | | .874 | | (2.378) | | 1.923 | | 1.464 | | 1.922 |

| Total from investment operations | | 1.401 | | (1.938) | | 2.262 | | 1.848 | | 2.215 |

| Distributions from net investment income | | (.531) | | (.448) | | (.407) | | (.401) | | (.298) |

| Distributions from net realized gain | | - | | (.104) | | (.035) | | (.017) | | (.007) |

| Total distributions | | (.531) | | (.552) | | (.442) | | (.418) | | (.305) |

| Net asset value, end of period | $ | 13.35 | $ | 12.48 | $ | 14.97 | $ | 13.15 | $ | 11.72 |

Total Return C,D | | 11.43% | | (13.08)% | | 17.40% | | 16.26% | | 22.84% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | |

| Expenses before reductions | | 1.00% | | 1.00% | | 1.01% | | 1.13% | | 1.26% |

| Expenses net of fee waivers, if any | | .99% | | 1.00% | | 1.01% | | 1.10% | | 1.10% |

| Expenses net of all reductions | | .99% | | 1.00% | | 1.01% | | 1.08% | | 1.09% |

| Net investment income (loss) | | 4.09% | | 3.34% | | 2.35% | | 3.27% | | 2.69% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 217,454 | $ | 151,549 | $ | 132,537 | $ | 30,583 | $ | 23,438 |

Portfolio turnover rate G | | 175% | | 256% | | 150% | | 308% | | 298% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DTotal returns do not include the effect of the sales charges.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report. For additional expense information related to investments in Fidelity Private Credit Central Fund LLC, please refer to the Investment in Fidelity Private Credit Central Fund LLC note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Multi-Asset Income Fund Class M |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.50 | $ | 14.99 | $ | 13.15 | $ | 11.72 | $ | 9.81 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .531 | | .444 | | .342 | | .383 | | .292 |

| Net realized and unrealized gain (loss) | | .873 | | (2.379) | | 1.943 | | 1.463 | | 1.923 |

| Total from investment operations | | 1.404 | | (1.935) | | 2.285 | | 1.846 | | 2.215 |

| Distributions from net investment income | | (.534) | | (.451) | | (.410) | | (.399) | | (.298) |

| Distributions from net realized gain | | - | | (.104) | | (.035) | | (.017) | | (.007) |

| Total distributions | | (.534) | | (.555) | | (.445) | | (.416) | | (.305) |

| Net asset value, end of period | $ | 13.37 | $ | 12.50 | $ | 14.99 | $ | 13.15 | $ | 11.72 |

Total Return C,D | | 11.44% | | (13.05)% | | 17.58% | | 16.24% | | 22.84% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | |

| Expenses before reductions | | .98% | | .99% | | .99% | | 1.13% | | 1.30% |

| Expenses net of fee waivers, if any | | .97% | | .99% | | .99% | | 1.10% | | 1.10% |

| Expenses net of all reductions | | .97% | | .99% | | .99% | | 1.08% | | 1.09% |

| Net investment income (loss) | | 4.11% | | 3.36% | | 2.37% | | 3.27% | | 2.69% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 24,031 | $ | 18,176 | $ | 18,698 | $ | 11,048 | $ | 9,719 |

Portfolio turnover rate G | | 175% | | 256% | | 150% | | 308% | | 298% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DTotal returns do not include the effect of the sales charges.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report. For additional expense information related to investments in Fidelity Private Credit Central Fund LLC, please refer to the Investment in Fidelity Private Credit Central Fund LLC note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Multi-Asset Income Fund Class C |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.46 | $ | 14.94 | $ | 13.13 | $ | 11.70 | $ | 9.80 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .430 | | .341 | | .231 | | .298 | | .210 |

| Net realized and unrealized gain (loss) | | .873 | | (2.368) | | 1.917 | | 1.463 | | 1.915 |

| Total from investment operations | | 1.303 | | (2.027) | | 2.148 | | 1.761 | | 2.125 |

| Distributions from net investment income | | (.433) | | (.349) | | (.303) | | (.314) | | (.218) |

| Distributions from net realized gain | | - | | (.104) | | (.035) | | (.017) | | (.007) |

| Total distributions | | (.433) | | (.453) | | (.338) | | (.331) | | (.225) |

| Net asset value, end of period | $ | 13.33 | $ | 12.46 | $ | 14.94 | $ | 13.13 | $ | 11.70 |

Total Return C,D | | 10.61% | | (13.69)% | | 16.50% | | 15.44% | | 21.87% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | |

| Expenses before reductions | | 1.75% | | 1.76% | | 1.76% | | 1.84% | | 2.13% |

| Expenses net of fee waivers, if any | | 1.74% | | 1.76% | | 1.76% | | 1.84% | | 1.85% |

| Expenses net of all reductions | | 1.74% | | 1.75% | | 1.76% | | 1.82% | | 1.84% |

| Net investment income (loss) | | 3.34% | | 2.59% | | 1.60% | | 2.53% | | 1.94% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 97,311 | $ | 66,028 | $ | 61,356 | $ | 13,015 | $ | 4,634 |

Portfolio turnover rate G | | 175% | | 256% | | 150% | | 308% | | 298% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DTotal returns do not include the effect of the contingent deferred sales charge.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report. For additional expense information related to investments in Fidelity Private Credit Central Fund LLC, please refer to the Investment in Fidelity Private Credit Central Fund LLC note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity® Multi-Asset Income Fund |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.49 | $ | 14.98 | $ | 13.15 | $ | 11.72 | $ | 9.81 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .563 | | .480 | | .378 | | .417 | | .322 |

| Net realized and unrealized gain (loss) | | .873 | | (2.381) | | 1.934 | | 1.460 | | 1.919 |

| Total from investment operations | | 1.436 | | (1.901) | | 2.312 | | 1.877 | | 2.241 |

| Distributions from net investment income | | (.566) | | (.485) | | (.447) | | (.430) | | (.324) |

| Distributions from net realized gain | | - | | (.104) | | (.035) | | (.017) | | (.007) |

| Total distributions | | (.566) | | (.589) | | (.482) | | (.447) | | (.331) |

| Net asset value, end of period | $ | 13.36 | $ | 12.49 | $ | 14.98 | $ | 13.15 | $ | 11.72 |

Total Return C | | 11.72% | | (12.83)% | | 17.80% | | 16.55% | | 23.14% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

| Expenses before reductions | | .73% | | .73% | | .74% | | .85% | | .94% |

| Expenses net of fee waivers, if any | | .72% | | .73% | | .74% | | .85% | | .85% |

| Expenses net of all reductions | | .72% | | .73% | | .74% | | .83% | | .84% |

| Net investment income (loss) | | 4.36% | | 3.62% | | 2.63% | | 3.53% | | 2.94% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 1,050,521 | $ | 912,819 | $ | 1,125,873 | $ | 211,236 | $ | 60,534 |

Portfolio turnover rate F | | 175% | | 256% | | 150% | | 308% | | 298% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report. For additional expense information related to investments in Fidelity Private Credit Central Fund LLC, please refer to the Investment in Fidelity Private Credit Central Fund LLC note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

EExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

FAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Multi-Asset Income Fund Class I |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.48 | $ | 14.97 | $ | 13.15 | $ | 11.72 | $ | 9.81 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .559 | | .474 | | .375 | | .417 | | .319 |

| Net realized and unrealized gain (loss) | | .874 | | (2.379) | | 1.924 | | 1.461 | | 1.922 |

| Total from investment operations | | 1.433 | | (1.905) | | 2.299 | | 1.878 | | 2.241 |

| Distributions from net investment income | | (.563) | | (.481) | | (.444) | | (.431) | | (.324) |

| Distributions from net realized gain | | - | | (.104) | | (.035) | | (.017) | | (.007) |

| Total distributions | | (.563) | | (.585) | | (.479) | | (.448) | | (.331) |

| Net asset value, end of period | $ | 13.35 | $ | 12.48 | $ | 14.97 | $ | 13.15 | $ | 11.72 |

Total Return C | | 11.70% | | (12.87)% | | 17.70% | | 16.56% | | 23.14% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

| Expenses before reductions | | .75% | | .76% | | .76% | | .83% | | 1.00% |

| Expenses net of fee waivers, if any | | .75% | | .76% | | .76% | | .83% | | .85% |

| Expenses net of all reductions | | .75% | | .76% | | .76% | | .81% | | .84% |

| Net investment income (loss) | | 4.33% | | 3.59% | | 2.60% | | 3.54% | | 2.94% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 695,649 | $ | 429,436 | $ | 461,353 | $ | 55,206 | $ | 26,507 |

Portfolio turnover rate F | | 175% | | 256% | | 150% | | 308% | | 298% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report. For additional expense information related to investments in Fidelity Private Credit Central Fund LLC, please refer to the Investment in Fidelity Private Credit Central Fund LLC note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

EExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

FAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Multi-Asset Income Fund Class Z |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.49 | $ | 14.98 | $ | 13.15 | $ | 11.72 | $ | 9.81 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .572 | | .480 | | .388 | | .431 | | .335 |

| Net realized and unrealized gain (loss) | | .874 | | (2.372) | | 1.933 | | 1.457 | | 1.916 |

| Total from investment operations | | 1.446 | | (1.892) | | 2.321 | | 1.888 | | 2.251 |

| Distributions from net investment income | | (.576) | | (.494) | | (.456) | | (.441) | | (.334) |

| Distributions from net realized gain | | - | | (.104) | | (.035) | | (.017) | | (.007) |

| Total distributions | | (.576) | | (.598) | | (.491) | | (.458) | | (.341) |

| Net asset value, end of period | $ | 13.36 | $ | 12.49 | $ | 14.98 | $ | 13.15 | $ | 11.72 |

Total Return C | | 11.81% | | (12.77)% | | 17.87% | | 16.65% | | 23.25% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

| Expenses before reductions | | .65% | | .66% | | .67% | | .77% | | .85% |

| Expenses net of fee waivers, if any | | .65% | | .66% | | .67% | | .76% | | .76% |

| Expenses net of all reductions | | .65% | | .66% | | .67% | | .74% | | .75% |

| Net investment income (loss) | | 4.43% | | 3.69% | | 2.69% | | 3.61% | | 3.03% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 258,352 | $ | 159,796 | $ | 93,316 | $ | 20,701 | $ | 5,123 |

Portfolio turnover rate F | | 175% | | 256% | | 150% | | 308% | | 298% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report. For additional expense information related to investments in Fidelity Private Credit Central Fund LLC, please refer to the Investment in Fidelity Private Credit Central Fund LLC note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

EExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

FAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended December 31, 2023

1. Organization.

Fidelity Advisor Multi-Asset Income Fund (the Fund) is a fund of Fidelity School Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, Fidelity Multi-Asset Income Fund, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Class A, Class M, Class C, Class I and Class Z are Fidelity Advisor classes. Each class has exclusive voting rights with respect to matters that affect that class. Class C shares will automatically convert to Class A shares after a holding period of eight years from the initial date of purchase, with certain exceptions.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Investment in Fidelity Private Credit Central Fund LLC.

The Fund invests in Fidelity Private Credit Central Fund LLC (formerly Fidelity Direct Lending Fund, LP), which is a limited liability company available only to certain investment companies managed by the investment adviser and its affiliates. On June 1, 2023, Fidelity Private Credit Central Fund elected to be regulated as a business development company (BDC). Fidelity Private Credit Central Fund LLC's units are not registered under the Securities Act of 1933 and are subject to substantial restrictions on transfer. The Fund has no redemption rights under Fidelity Private Credit Central Fund LLC's limited liability company agreement. There will be no trading market for the units.

Based on its investment objective, Fidelity Private Credit Central Fund LLC may invest or participate in various investments or strategies that are similar to those in which the Fund may invest or participate. These strategies are consistent with the investment objectives of the Fund and may involve certain economic risks which may cause a decline in value of Fidelity Private Credit Central Fund LLC and thus a decline in the value of the Fund. Fidelity Private Credit Central Fund LLC intends to invest primarily in directly originated loans to private companies but also with liquid credit investments, like broadly syndicated loans, and other select private credit investments.