Exhibit 99.(e)(4)

Economic and Fiscal Update

Statement of Responsibility

On the basis of the economic and fiscal information available to it, the Treasury has used its best professional judgement in supplying the Minister of Finance with this Economic and Fiscal Update. The Update incorporates the fiscal and economic implications both of Government decisions and circumstances as at 9 May 2008 that were communicated to me, and of other economic and fiscal information available to the Treasury in accordance with the provisions of the Public Finance Act 1989.

John Whitehead

Secretary to the Treasury

14 May 2008

This Economic and Fiscal Update has been prepared in accordance with the Public Finance Act 1989. I accept overall responsibility for the integrity of the disclosures contained in this Update, and the consistency and completeness of the Update information in accordance with the requirements of the Public Finance Act 1989.

To enable the Treasury to prepare this Update, I have ensured that the Secretary to the Treasury has been advised of all Government decisions and other circumstances as at 9 May 2008 of which I was aware and that had material economic or fiscal implications.

Hon Dr Michael Cullen

Minister of Finance

14 May 2008

Summary

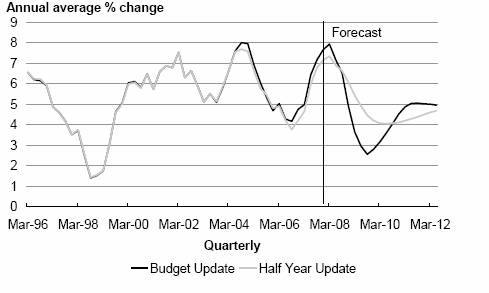

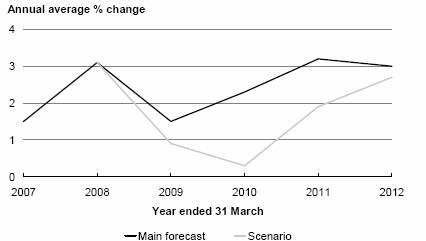

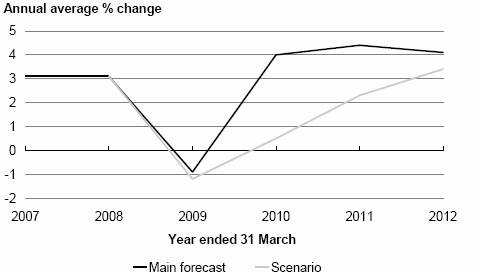

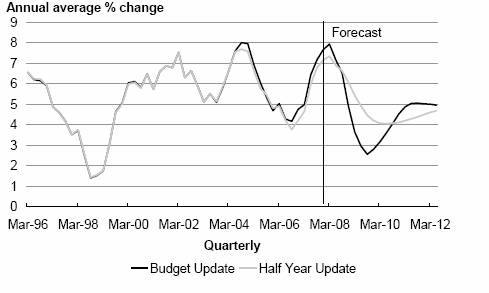

After annual average growth of 3.1% in the year to March 2008, the economy is forecast to record two years of sub-trend growth of 1.5% in the year to March 2009 and 2.3% in the year to March 2010. These Budget Update forecasts show a more cyclical path for the economy than in the Half Year Update.

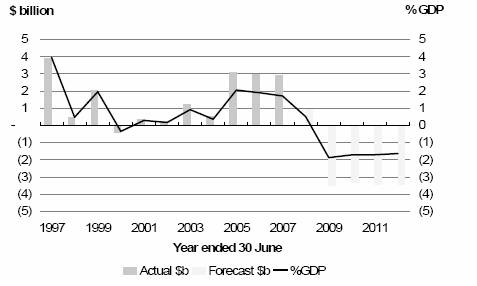

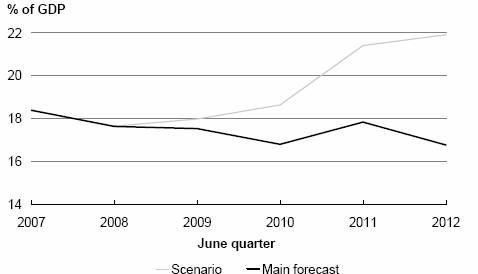

The operating balance before gains and losses (OBEGAL) is forecast to fall from 2.9% of GDP in the year to June 2008 to 0.7% in the year to June 2009, consistent with keeping gross sovereign-issued debt excluding Reserve Bank Settlement Cash around 20% of GDP. The fall in OBEGAL reflects past and Budget 2008 decisions, including the incorporation of a cut in personal taxes from 1 October 2008.

In addition to the usual risks to any economic and fiscal forecast, there are now greater risks on the downside, particularly those arising from a lack of stability in global financial markets.

Economic Outlook

The New Zealand economy is expected to grow by 2.5% per annum on average during the forecast period, somewhat below the 3.1% per annum experienced over the past decade. Real GDP growth is expected to fall from 3.1% in the year to March 2008 to 1.5% the next year because of factors such as recent drought conditions, high interest rates, falling house prices and higher petrol and food prices. From the year to March 2011, real GDP growth is forecast to rebound to around 3% per annum.

Table 1 – Major economic parameters

March years

(annual average % change) | | 2007/08

Estimate | | 2008/09

Forecast | | 2009/10

Forecast | | 2010/11

Forecast | | 2011/12

Forecast | |

Real GDP | | 3.1 | | 1.5 | | 2.3 | | 3.2 | | 3.0 | |

Employment | | 1.4 | | 1.4 | | 0.2 | | 0.3 | | 1.0 | |

Wages | | 4.1 | | 4.2 | | 4.7 | | 4.4 | | 4.0 | |

Consumer prices | | 3.4 | | 3.2 | | 2.8 | | 2.8 | | 2.8 | |

Note: Employment is on a full-time equivalent basis; consumer price inflation is measured as an annual % change.

Source: The Treasury

Domestic demand slowed from mid-2007, and is forecast to remain subdued, as a result of factors such as higher interest rates, falling house prices, lower net migration inflows and higher prices for petrol and food. Interest rates have been elevated because of ongoing inflation pressures and global credit constraints. Personal income tax cuts, growing labour incomes and high farm incomes (albeit lower owing to drought) partially offset these forces.

The recent drought in much of the country will negatively affect agricultural production and commodity exports in the coming year. Weaker growth in the world economy is also expected to dampen export growth. However, strong export prices are expected to provide a large boost to export receipts. Higher world prices for dairy products boosted the terms of trade to a 33-year high in late 2007 and are forecast to fall but stay relatively high.

Consumer price inflation is expected to remain elevated despite a period of sub-trend growth in the economy. Ongoing inflation reflects high food and energy prices and a decline in the exchange rate from early 2009.

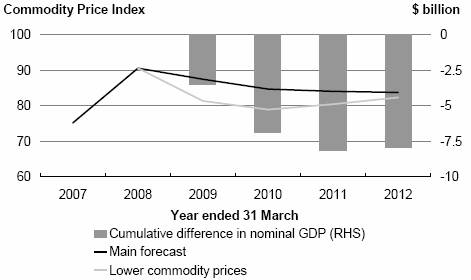

Nominal GDP growth is forecast to slow over the next two years, largely as a result of lower growth in real GDP. Nevertheless, strong terms of trade, driven by high world dairy prices, and an outlook for relatively high inflation continue to support nominal GDP.

There are a number of risks to the forecasts. These include the usual upside and downside risks to any economic and fiscal forecast such as different profiles for the terms of trade, the exchange rate and domestic demand. There is also a set of more extreme risks, albeit with a smaller probability, that could arise if recent financial market turmoil is more prolonged and/or deeper than we have assumed in the main forecast.

Fiscal Outlook

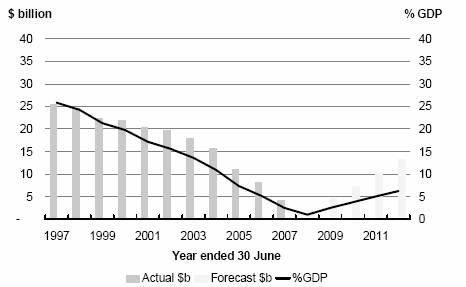

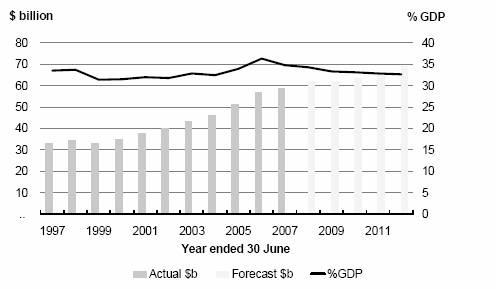

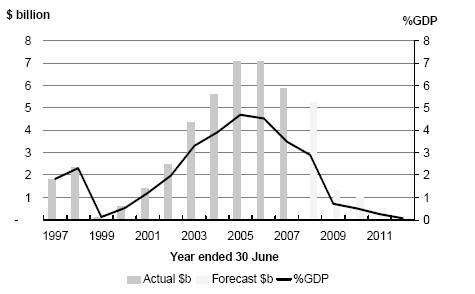

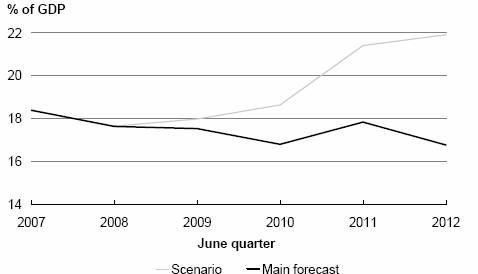

The fiscal position has strengthened over recent times, and operating and cash surpluses have risen to a level in excess of that required to meet the Government’s long-term fiscal objectives.

Looking forward, core Crown revenue (excluding the New Zealand Superannuation (NZS) Fund), while continuing to grow in nominal terms, is forecast to fall from 34.3% of GDP in the June 2008 year to 32.6% in the June 2012 year. This fall primarily results from last year’s decision to cut the corporate tax rate and the incorporation of the cut in personal taxes announced in Budget 2008.

Core Crown expenses are forecast to increase by around 1.2% of GDP between the June 2008 year and the June 2012 year. The increase in expenses largely arises from recent initiatives and KiwiSaver costs.

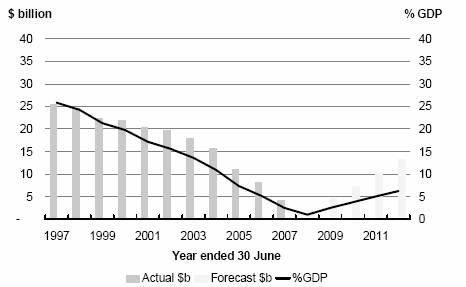

As a result, OBEGAL falls and cash surpluses become deficits. These deficits are met with a reduction in financial assets while gross sovereign-issued debt (GSID) excluding Reserve Bank Settlement Cash falls from 17.6% to 16.8% of GDP by the end of the forecast period.

Table 2 – Summary of fiscal aggregates

June years | | 2007/08

Forecast | | 2008/09

Forecast | | 2009/10

Forecast | | 2010/11

Forecast | | 2011/12

Forecast | |

OBEGAL ($b)(a) | | 5.2 | | 1.4 | | 1.0 | | 0.5 | | 0.2 | |

% of GDP | | 2.9 | | 0.7 | | 0.5 | | 0.3 | | 0.1 | |

Residual cash | | 0.9 | | (3.5 | ) | (3.3 | ) | (3.4 | ) | (3.5 | ) |

% of GDP | | 0.5 | | (1.9 | ) | (1.7 | ) | (1.7 | ) | (1.6 | ) |

GSID (% of GDP)(b) | | 17.6 | | 17.5 | | 16.8 | | 17.8 | | 16.8 | |

Net core Crown debt (% of GDP)(c) | | (6.2 | ) | (6.1 | ) | (6.1 | ) | (6.1 | ) | (6.1 | ) |

Note: (a) excludes NZS Fund; (b) gross sovereign-issued debt excluding Reserve Bank Settlement Cash;

(c) includes NZS Fund financial assets.

Source: The Treasury

Economic and Fiscal Forecasts – Finalisation Dates and Key Assumptions

Finalisation dates

Text finalised | | 14 May |

Economic data | | 15 April |

Economic forecasts (refer Chapter 1) | | 1 May |

Tax revenue forecasts | | 2 May |

Fiscal forecasts (refer Chapter 2), including: | | 9 May |

· Government decisions and circumstances | | 9 May |

· Actual asset revaluations | | 29 Feb |

· Foreign exchange rates | | 29 Feb |

Specific fiscal risks (refer Chapter 4) | | 7 May |

Contingent liabilities and commitments (refer Chapter 4) | | 31 Mar |

Key assumptions

Global economic activity – Economic growth for our top 20 trading partners (eg, Australia, the United States, China) is expected to fall from an estimated 4.0% in 2007 to 3.0% in 2008 and 3.2% in 2009, compared with 3.8% in 2008 and 3.7% in 2009 in the Half Year Update. Trading partner growth forecasts are based on March 2008 Consensus Forecasts with additional judgements. We assume trading partner growth will be 0.3 percentage points lower than March 2008 Consensus Forecasts in 2008 and 2009 because Consensus Forecasts tend to adjust slowly during a slowdown of growth. There are considerable risks associated with this outlook, which are discussed in the Economic and Tax Outlook and Risks and Scenarios chapters.

Global inflation and interest rates – As a result of previous robust economic growth and rising prices for food and energy, inflation among our major trading partners is expected to be higher than at the time of the Half Year Update. However, the outlook is for lower interest rates in the United States, Japan and the Euro area because of the weaker economic outlook. The outlook is for higher rates in Australia than in the Half Year Update owing to recent high inflation outturns.

Oil prices – We have assumed the price of West Texas Intermediate (WTI) crude oil will rise from US$98 per barrel in the March 2008 quarter to US$111 per barrel in the June 2008 quarter and then fall to just above US$100 per barrel in the first quarter of 2012. These projections, which are based on the futures prices from the New York Mercantile Exchange recorded on 15 April 2008, are around 35% higher than in the Half Year Update over the forecast period. There are upside risks to this forecast, at least in the short term, as oil prices rose over US$125 in May 2008, after these forecasts were finalised.

Terms of trade – Forecasts for the goods terms of trade (measured on a System of National Accounts basis) are similar to the Half Year Update. The terms of trade are expected to have peaked in the first quarter of 2008 and decline 8% by the end of the forecast period.

Monetary conditions – It is assumed that the New Zealand dollar exchange rate will decline from 71.9 on the Trade Weighted Index (TWI) in the first quarter of 2008 to 56.3 at the end of the forecast period. Ninety-day interest rates were 8.8% in the March 2008 quarter and are assumed to remain around this level until the first quarter of 2009, when they will start to decline, reaching 7.1% at the end of the period.

Net migration – The net inflow of permanent and long-term migrants is expected to decline to around 4,000 in the year to September 2008, before recovering to around 6,000 in the year to March 2009, 8,000 in the year to March 2010 and 10,000 per annum in subsequent years (its average over the past decade).

Emissions Trading Scheme (ETS) – The economic forecasts now include a provision for the ETS, which is being introduced by the Government to encourage efforts to reduce greenhouse gas emissions and to help meet New Zealand’s obligations under the Kyoto Protocol. At an aggregate level, the scheme is considered unlikely to lead to any significant reduction in output, but there will be different effects on different sectors of the economy and it will result in higher prices for carbon-sourced energy.

Climate – Following the recent drought, agricultural growing conditions and the level of hydro electricity storage lakes are assumed to be normal over the remainder of the forecast period.

Fiscal forecasts – The fiscal forecasts have been prepared in accordance with the Public Finance Act 1989. They are based on the Crown’s accounting policies and assumptions. The financial statements presented in the Budget Update 2008 have been prepared in accordance with New Zealand equivalents to International Financial Reporting Standards. A summary of the key economic assumptions that are particularly relevant to the fiscal forecasts is provided below (Table 3). These figures are on a June-year-end basis to align with the Crown’s balance date of 30 June. The figures in Table 1 above and in the Economic and Tax Outlook chapter are for the year to 31 March.

Table 3 – Key economic data for fiscal forecasts

| | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | 2011/12 | |

June years | | HYEFU | | BEFU | | BEFU | | BEFU | | BEFU | | BEFU | |

Real GDP (ann avg % chg) | | 2.7 | | 2.8 | | 1.6 | | 2.7 | | 3.2 | | 2.9 | |

Nominal GDP ($m) | | 178,199 | | 180,137 | | 185,478 | | 192,125 | | 201,802 | | 211,800 | |

CPI (ann avg % change) | | 2.7 | | 2.9 | | 3.2 | | 2.7 | | 2.9 | | 2.7 | |

Govt 10-year bonds (ann avg %) | | 6.4 | | 6.4 | | 6.3 | | 6.3 | | 6.2 | | 6.1 | |

90-day bill rate (ann avg %) | | 8.6 | | 8.8 | | 8.6 | | 8.0 | | 7.9 | | 7.3 | |

Unemployment rate (ann avg %) | | 3.8 | | 3.5 | | 3.7 | | 4.4 | | 4.5 | | 4.4 | |

Full-time equivalent employment (ann avg % change) | | 1.3 | | 1.5 | | 1.2 | | 0.1 | | 0.5 | | 1.1 | |

Current account (% of GDP) | | -6.9 | | -6.8 | | -7.2 | | -7.3 | | -6.9 | | -6.3 | |

Source: The Treasury

1 Economic and Tax Outlook

Introduction

This chapter outlines our view of the most likely path for the New Zealand economy and the expected impact on tax revenue over the next four years. The first part of the chapter discusses the recent course of the economy and focuses on what has happened since the Half Year Update. The second part of the chapter examines the external and domestic factors that are expected to influence the economy over the forecast period.

There is an unusual amount of uncertainty associated with the current economic and tax outlook. In addition to the usual upside and downside risks to any forecast, there are risks that have a low probability of happening but may have a significant negative impact on the economy should they eventuate. The key risks are introduced in this chapter and are discussed in more detail in the Risks and Scenarios chapter.

Recent Economic and Tax Developments

The economy picked up in 2007 …

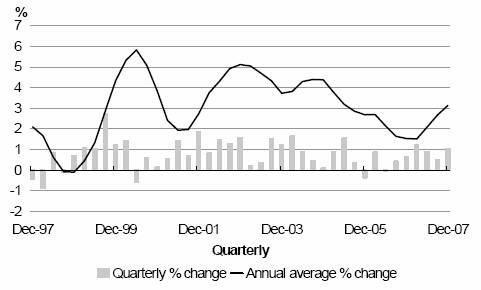

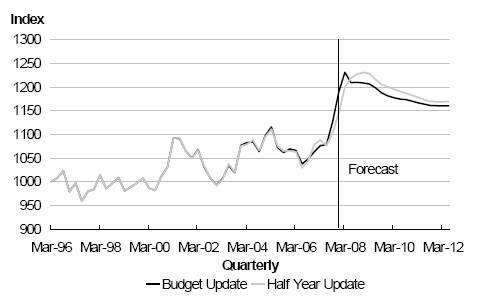

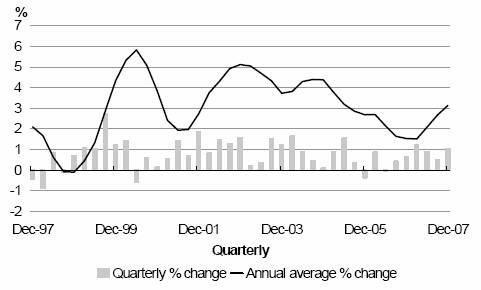

Figure 1.1 – Real GDP

Source: Statistics New Zealand

The New Zealand economy experienced an upturn in 2007. Quarterly real GDP growth averaged almost 1% in the five quarters to December 2007, up from ¼% in the previous five quarters, and annual average growth rose to 3.1% in 2007, the fastest pace since mid-2005 (Figure 1.1). The economy has now expanded in each of the nine years since the recession of 1997/98 and, with annual growth averaging 3.5% over this period, has outperformed the OECD average of 2.6%. The drivers of this strong performance have been well canvassed in the past (see pages 19-20 of the Half Year Update 2007).

The economy evolved broadly as expected in the second half of 2007 relative to the Half Year Update forecasts (finalised in early November 2007). Excluding data revisions, real expenditure GDP in the December 2007 quarter was 0.1% higher than expected as a result of higher business investment and exports, while both private consumption and residential investment slowed as expected.

… but appears to have slowed in early 2008 …

Economic growth had been expected to slow in the Half Year Update, but several factors have had a greater negative influence on the economy in early 2008. There are signs the slowdown in housing activity has been faster and larger than expected, drought conditions have affected agricultural production, the world economic environment has weakened, credit availability has tightened and oil prices have risen further. As a result, real GDP is expected to fall slightly in the March 2008 quarter and modest quarterly growth of 0.3% to 0.4% is forecast during the remainder of 2008.

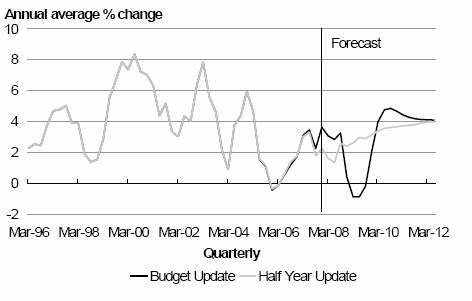

… as the slowdown in the housing market has been faster and larger than expected …

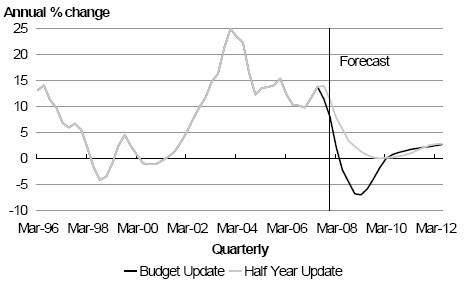

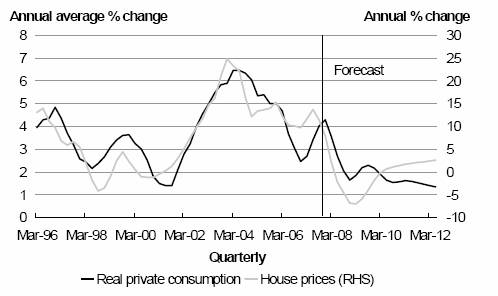

The slowing of property activity has been faster and larger than forecast (Figure 1.2). House prices were forecast to rise 6% in the year to June 2008 in the Half Year Update, but are now forecast to fall 2% over this period and decline further the following year. These house price falls represent a correction after house prices nearly doubled since 2002. Weaker property activity was precipitated by higher mortgage interest rates, lower net migration inflows and declining affordability, and has already contributed to a slowing of consumer spending. Risks to house prices are mainly on the downside and are examined in the Risks and Scenarios chapter.

Figure 1.2 – House Prices

Source: Quotable Value New Zealand, The Treasuy

… drought conditions lowered agricultural production, especially dairy …

Another negative event since the Half Year Update is the emergence of drought conditions. The current climate setting, reflecting the influence of a strong La Niña weather pattern that appeared at the end of 2007, brought dry conditions to much of New Zealand through until April 2008.

Agricultural production in 2007/08 is expected to be around 1% lower than the year before because of the drought. The largest impact is likely to be on dairy production as dry conditions have been most severe in dairy regions such as Waikato, which accounts for around a third of the country’s dairy cattle. Drought has led dairy farmers to dry off poor-performing cows, use high-cost supplementary feeding and move to once-a-day milking, although greater use of irrigation has helped insulate dairy farmers from dry conditions in areas such as Canterbury. For sheep and beef farmers, the drought is expected to have increased culling and exports in early 2008, but exports will then fall away and remain subdued as farmers look to rebuild their stock.

Although rainfall in April has eased the drought situation significantly, the full impact of recent dry conditions on the economy is uncertain. The extent to which the drought will also impact on next year’s agricultural production, and on other aspects of the economy such as electricity generation, will be dependent on future rainfall and winter weather conditions.

… and the outlook for the world economy weakened amidst financial market turmoil

Other significant developments since the Half Year Update relate to world events. Data from the United States have been weak, with concern the United States economy may be in recession. Economic data have also been weak in other major economies, including Europe and the United Kingdom. In response to developments in the United States, the Federal Reserve has reduced its official interest rate by 225 basis points since January and the United States Congress passed a US$168 billion fiscal stimulus package.

Financial market turmoil in the second half of 2007, combined with continuing weakness in the United States housing market, has led to further difficulties in the financial sector of the United States. Some financial institutions have been exposed to losses from sub-prime mortgages (ie, loans made to people with poor credit histories) and the risk of credit downgrades increased the need for banks to raise and hold higher amounts of capital. Large losses have also been announced by European financial institutions.

Equity markets have reacted nervously to economic and financial market developments with stock markets down significantly from levels that prevailed late last year. The risk of flow-on effects from these developments in major developed economies to other parts of the world was highlighted by large falls in Asian and Australasian equity markets.

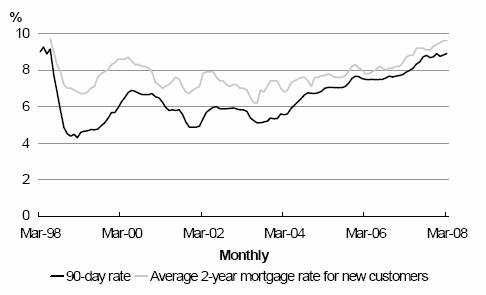

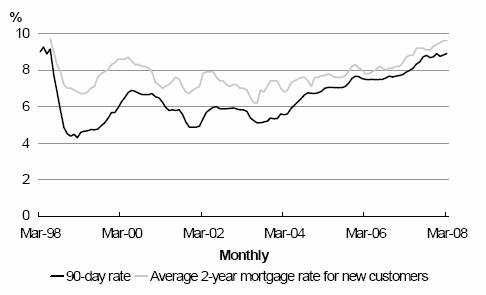

Figure 1.3 – Interest rates

Source: Reserve Bank of New Zealand

There are several channels by which recent developments in the world economy can affect New Zealand. The most immediate is through financial markets. Commercial interest rates have risen because of the risks associated with investments in sub-prime mortgages in the United States, raising the cost of credit globally. The borrowing costs of New Zealand banks have risen as a result, which, together with some restoration of margins by banks, has seen 2-year fixed term home loans in New Zealand rise by over ½ a percentage point since September 2007 to above 9.5% (Figure 1.3). There will be a larger increase in mortgage interest rates faced by those people rolling off existing lower mortgage rates (eg, the 2-year mortgage interest rate in March 2006 was around 7.8%). Higher interest rates are contributing to a slowing in consumer spending, housing activity

and business investment. Other transmission channels by which developments in the world economy can affect New Zealand are less direct and immediate and are examined in the next section covering the economic outlook.

Some key factors have been, and will continue to be, positives for the economy

There are some positive factors that supported the economy in the second half of 2007 and in early 2008. The most important of these, the terms of trade, rose to a 33-year high in late 2007 mainly as a result of higher dairy prices. A number of factors lifted dairy prices in 2007 (eg, income growth in developing nations, drought in Australia, biofuel production competing for land use and rising grain prices) and they have held up well despite the weaker global economy. The boost to national income from high dairy prices is, in aggregate, expected to more than offset the negative impact on the economy from drought and the reduction in the spending power of households from higher food prices. The rising terms of trade have also contributed to a fall in the current account deficit from 8.6% of GDP in the year to December 2006 to 7.9% in the year to December 2007, as forecast in the Half Year Update, with a further fall to 6.7% expected in the year to September 2008.

The labour market has been another positive factor. With the unemployment rate falling to a 21-year low of 3.4% in late 2007, labour market conditions were slightly tighter than expected in the Half Year Update. Ongoing high wage growth and relatively low unemployment mean the labour market will likely remain a positive influence throughout most of 2008, although data released since the forecasts were finalised suggest there are downside risks to labour market conditions (see Risks and Scenarios chapter for more discussion).

Higher fuel and food prices drive inflation as easing demand is yet to fully impact …

Inflation remained elevated in early 2008. Consumer price inflation of 3.4% in the year to March 2008 was above the Half Year Update forecast of 3.1%. Some of the major sources of inflation pressure have not been affected by lower demand, especially fuel and food prices. In the year to March 2008, petrol prices rose 20.5% as world oil prices rose above US$100 a barrel on a West Texas Intermediate basis (and have since risen above US$125). In addition, food prices rose 5.1% in the year to March 2008 on the back of higher prices for soft commodities, with price rises of at least 20% for many dairy products. So far, the effects of easing demand on inflation have not been fully felt.

Monetary conditions are tighter than expected, partly because of global credit conditions. In the March 2008 quarter, 90-day bank bill rates averaged 8.8% (the Half Year Update forecast was 8.5%) and the Trade Weighted Index (TWI) averaged 71.9 (the Half Year Update forecast was 70.0).

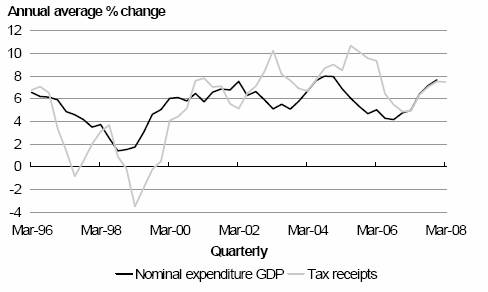

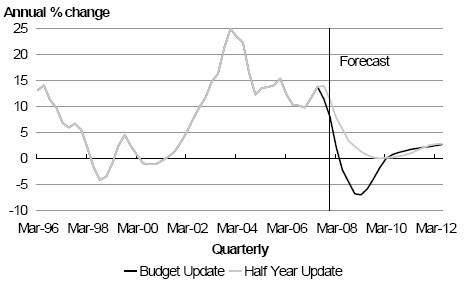

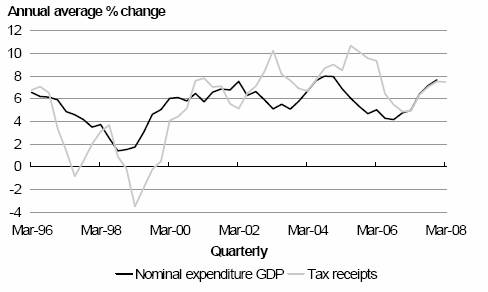

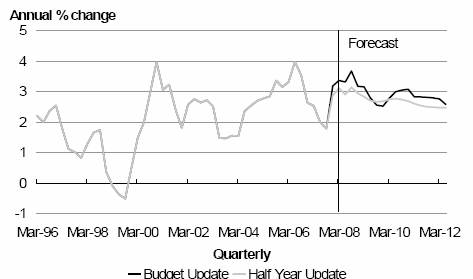

… and growth in nominal GDP led to further growth in tax revenues

Nominal GDP has continued to expand at a fast pace. Excluding data revisions, nominal GDP in the December 2007 quarter was around 1% above forecast as a result of higher terms of trade and, to a lesser extent, higher economic growth and inflation. Annual average growth in nominal GDP rose to 7.7% at December 2007 and is expected to have risen to 7.9% at March 2008, similar to growth in tax receipts (Figure 1.4). Growth in tax receipts remained high at March 2008 and was similar to that expected in the Half Year Update.

Figure 1.4 – Nominal GDP and tax receipts

Sources: Statistic New Zealand, The Tueaury

Source deductions, largely PAYE on wages and salaries, maintained higher-than-expected growth into early 2008, consistent with growth in jobs and wages. Company tax receipts over the nine months to March 2008 were similar to the Half Year Update forecast. Despite a slowing of consumer spending in early 2008, GST receipts were also similar to forecast, partly owing to higher inflation.

Economic and Tax Outlook

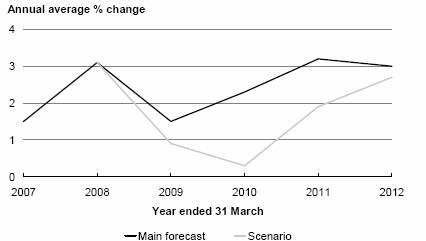

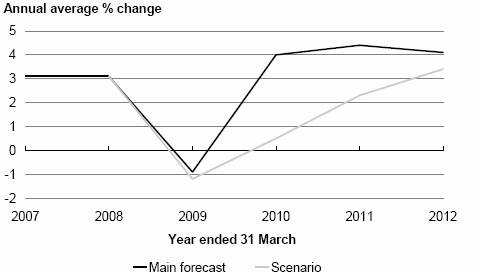

The forecasts are for a more cyclical path for the economy

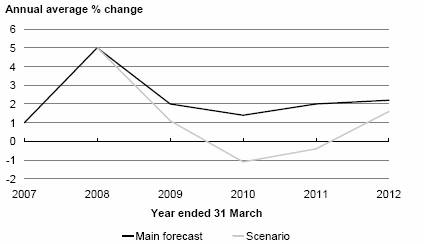

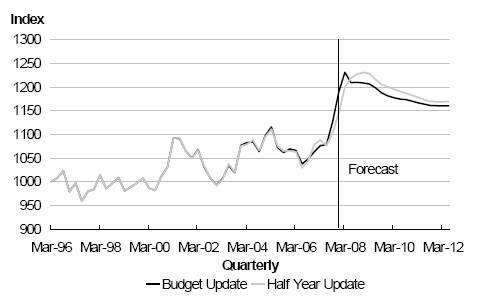

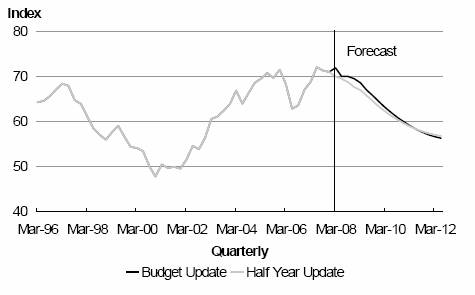

Figure 1.5 – Real GDP

Sources: Statistics New Zealand, The Treasury

The Budget Update forecasts show a more cyclical path for the economy than the Half Year Update. Economic growth in the second half of 2007 was slightly higher than expected in the Half Year Update, but a deeper slowdown in the years to March 2009 and 2010 is now forecast (Figure 1.5). After real GDP growth of 3.1% in the year to March 2008, the economy is forecast to record two years of sub-trend growth of 1.5% and 2.3% in the years to March 2009 and 2010 respectively. Growth is forecast to rebound to 3.2% in 2011 and then return to trend of around 3% in 2012.

Compared to the Half Year Update, several factors play more important roles in shaping the outlook for the economy. These factors relate to the world economy and financial markets, drought conditions and the housing market. Importantly, the key positive factors in the Half Year Update, strength in the terms of trade and personal tax cuts, are still predicted to support the economy.

External Factors

The world economic outlook has weakened considerably since the Half Year Update …

The outlook for economic growth among New Zealand’s trading partners has been revised down significantly in recent months. In the Consensus Forecasts for March 2008 (the latest when these forecasts were finalised), the growth outlook for our top 20 trading partners was revised to 3.3% in calendar year 2008 and 3.5% in 2009 from 3.8% and 3.7% respectively in October 2007. The downward revisions were mainly in the major economies, with forecasts for the United States, Japan and the Euro area revised down considerably for 2008 and 2009. The outlook was revised down only slightly for non-Japan Asia and Australia.

Consensus Forecasts are used as the basis of our trading partner growth forecasts, but they are typically slow to adjust to changing economic conditions so are likely to understate the extent of the current downturn. As a result, we assume trading partner growth will be 3.0% in calendar year 2008 and 3.2% in 2009, 0.3 percentage points below the March 2008 Consensus Forecasts. We expect that developments in the world economy will affect the New Zealand economy through four main channels:

· Credit constraints: The increased cost and reduced availability of credit will have a negative impact on private consumption, residential investment and business investment directly. This effect is already being felt as higher funding costs are being reflected in higher mortgage rates. The consequent cooling in the property market is expected to have a knock-on effect on private consumption and residential investment. We assume the credit constraint will gradually unwind in the year ahead but, in the Risks and Scenarios chapter, we acknowledge the risk it could worsen and continue for longer than expected in an alternative scenario for the economy.

Table 1.1 – Economic forecast(1)

Annual average % change,

year to 31 March | | 2007

Actual | | 2008

Estimate | | 2009

Forecast | | 2010

Forecast | | 2011

Forecast | | 2012

Forecast | |

Private consumption | | 2.7 | | 3.6 | | 1.9 | | 1.9 | | 1.6 | | 1.4 | |

Public consumption(2) | | 4.3 | | 4.6 | | 3.7 | | 3.1 | | 3.3 | | 3.3 | |

Total consumption | | 3.1 | | 3.8 | | 2.3 | | 2.2 | | 2.0 | | 1.8 | |

Residential investment | | -2.7 | | 4.5 | | -9.7 | | -3.1 | | 2.4 | | 3.0 | |

Central government investment | | -4.9 | | 1.9 | | 22.7 | | 4.2 | | 2.0 | | 2.0 | |

Other investment | | -1.2 | | 6.8 | | 2.8 | | -0.9 | | 2.1 | | 3.5 | |

Total investment | | -2.3 | | 5.2 | | 1.1 | | -0.9 | | 2.2 | | 3.4 | |

Stock change(3) | | -0.9 | | 0.7 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | |

Gross national expenditure | | 1.0 | | 5.0 | | 2.0 | | 1.4 | | 2.0 | | 2.2 | |

Exports | | 3.1 | | 3.1 | | -0.9 | | 4.0 | | 4.4 | | 4.1 | |

Imports | | -1.7 | | 9.6 | | 0.9 | | 1.3 | | 1.0 | | 2.0 | |

GDP (production measure) | | 1.5 | | 3.1 | | 1.5 | | 2.3 | | 3.2 | | 3.0 | |

- annual % change | | 2.3 | | 2.4 | | 1.6 | | 2.9 | | 3.2 | | 2.8 | |

Real GDP per capita | | 0.3 | | 2.1 | | 0.6 | | 1.4 | | 2.2 | | 2.0 | |

Nominal GDP (expenditure basis) | | 5.0 | | 7.9 | | 3.6 | | 3.2 | | 4.9 | | 5.0 | |

GDP deflator | | 2.5 | | 4.8 | | 2.3 | | 0.8 | | 1.7 | | 2.0 | |

Employment(4) | | 2.0 | | 1.4 | | 1.4 | | 0.2 | | 0.3 | | 1.0 | |

Unemployment(5) | | 3.7 | | 3.5 | | 3.7 | | 4.4 | | 4.5 | | 4.3 | |

Wages(6) | | 4.8 | | 4.1 | | 4.2 | | 4.7 | | 4.4 | | 4.0 | |

CPI inflation(7) | | 2.5 | | 3.4 | | 3.2 | | 2.8 | | 2.8 | | 2.8 | |

Export prices(8) | | 9.1 | | 2.5 | | 7.4 | | 3.1 | | 6.1 | | 4.7 | |

Import prices(8) | | 7.2 | | -4.8 | | 4.2 | | 5.0 | | 7.5 | | 5.6 | |

Current account balance | | | | | | | | | | | | | |

- $billion | | -13.5 | | -13.1 | | -13.3 | | -13.7 | | -14.1 | | -13.8 | |

- % of GDP | | -8.2 | | -7.4 | | -7.2 | | -7.2 | | -7.1 | | -6.6 | |

TWI(9) | | 68.8 | | 71.9 | | 68.6 | | 63.1 | | 59.1 | | 56.7 | |

90-day bank bill rate(9) | | 7.8 | | 8.8 | | 8.5 | | 7.9 | | 7.9 | | 7.2 | |

10-year bond rate(9) | | 5.9 | | 6.3 | | 6.3 | | 6.3 | | 6.2 | | 6.1 | |

Notes: | (1) | Forecast finalised 1 May 2008 incorporating data up until 15 April 2008. |

| (2) | The forecast profile for public consumption is influenced by government defence spending. |

| (3) | Contribution to GDP growth. |

| (4) | Household Labour Force Survey, full-time equivalent employment. |

| (5) | Household Labour Force Survey, percentage of the labour force, March quarter, seasonally adjusted. |

| (6) | Quarterly Employment Survey, average ordinary-time hourly earnings. |

| (7) | Annual percentage change. |

| (8) | Overseas Trade Index basis, annual average percentage change. |

| (9) | Average for the March quarter. |

Sources: Statistics New Zealand, Reserve Bank of New Zealand, The Treasury

· Wealth effects: Falls in share and other asset prices will make consumers more cautious in their spending plans. This effect will also negatively affect businesses’ ability to raise capital and their investment plans.

· Confidence: A lower level of confidence among firms and consumers, partly due to a slowdown in the global economy, is expected to increase precautionary saving and thus reduce consumption growth. It is difficult to separate out the impact that global developments are having in this area from local ones (eg, the weaker housing market), but they will compound the effect of local developments.

· Export demand: Weaker world growth will affect demand for New Zealand export products and their prices, particularly for commodities. Although this effect has yet to have any material impact, it is expected to take longer to show up than the first three channels.

… but the extent of this weakness and its impact on New Zealand remain uncertain

The outlook for trading partner growth remains uncertain. The overall effect of a downturn in the United States on the New Zealand economy depends on how it spreads to the rest of the world. The downturn in the United States could affect New Zealand via Asia and demand from that region for New Zealand exports, particularly soft commodities. So far, there is little sign of a severe slowing in emerging Asian economies and, while some commodity prices are down a little, they remain high. Although still dependent on exports to the United States, there is also now significant intra-regional trade in Asia and investment is a major source of growth in China, along with exports. A further channel would be the effect of a downturn in Asia on Australia via demand for hard commodities and the effect that might have on New Zealand exports to Australia of manufactured products and tourism services. The Risks and Scenarios chapter has more discussion of these risks and how they might affect the New Zealand economy.

Higher terms of trade as world dairy prices hold much of their recent gain …

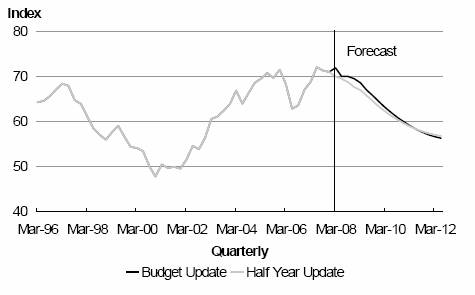

Despite developments in the world economy, the terms of trade follow a similar profile to the Half Year Update, with dairy continuing to dominate (Figure 1.6). As expected, the terms of trade rose sharply in late 2007 to their highest level since 1974 as dairy prices rose sharply. The outlook for the terms of trade became much more positive in 2007 as spot dairy prices rose by 120% in the year to August 2007. In April 2008, the ANZ dairy price index was down 10% from its peak in November 2007, but was still more than double its level of 20 months earlier.

Figure 1.6 – SNA goods terms of trade

Sources:statistics New Zealand The Treasury

World dairy prices for New Zealand products are expected to peak in the June 2008 quarter before declining from late 2008. The levelling off and decline in prices reflects increasing production from the United States (high dairy prices have more than covered the higher feed costs caused by increasing biofuel production), Europe (as production quotas have increased), Australia (recovery from drought), and “newer” producers (eg, Argentina, Uruguay, Brazil, Ukraine for export markets and China for the domestic market). High prices for consumer products will also reduce demand, leading in turn to lower prices. However, continuing strong demand for protein products from developing countries is expected to help maintain dairy prices, and thus the terms of trade, at high levels throughout the forecast period.

Prices for some other New Zealand exports are also expected to rise. World meat prices are expected to recover over the forecast period largely because of income growth in developing countries leading to demand for protein and supply reductions in Europe and Australasia. Prices for non-commodity exports are forecast to continue their upward trend in the forecast period as New Zealand manufacturers move out of low-end manufacturing into high-end or niche products, although this rise will be dampened by other countries such as China also broadening their manufacturing base towards the higher end.

… will be partially offset by higher oil prices throughout the period …

West Texas Intermediate (WTI) oil prices are expected to be around 35% higher than in the Half Year Update across the forecast period (Figure 1.7). Based on futures prices, we expect oil prices to still be relatively high at US$100 per barrel at the end of the period. Income growth in China, the Middle East and other developing countries continues to underpin demand for oil, despite the recent slowdown in parts of the developed world. In addition, oil supply remains tight and geo-political events pose risks to prices. There are still upside risks to this forecast, at least in the short term, as oil prices rose over US$125 in May 2008, after these forecasts were finalised.

Figure 1.7 – WTI oil prices

Sources: Datastream, The Treasury

Higher oil prices will offset some of the increase in dairy prices on the terms of trade and, as discussed below, will lower the spending power of households. However, high oil prices are also a factor supporting world demand for dairy products owing to strong demand from oil-exporting countries, and have also been a positive for New Zealand exports of oil.

… and will bring a temporary reduction in the current account deficit

The higher terms of trade, particularly high dairy prices, are expected to bring a fall in the current account deficit to 6.7% in the year to September 2008. However, this fall will be temporary as the current account deficit will rise back to 7.4% of GDP once the terms of trade begin to fall. Although an export recovery leads to a fall back towards 6% of GDP by the end of the forecast period, this remains a large deficit and the main risk is of a smaller narrowing of the deficit. In particular, financial market turmoil has raised the funding costs of debt acquired overseas and, if it persists, higher funding costs could result in a wider investment income deficit.

Exports recover as drought eases and the world economy picks up …

The high exchange rate, the impact of drought conditions and weak trading partner growth are all expected to weigh on export volumes in the coming year (Figure 1.8). Export volumes in the year to March 2009 are expected to be down nearly 1% from the year before compared with a forecast rise of almost 3% in the Half Year Update. As dairy areas were particularly affected by drought, this fall will be driven by a fall in the volume of dairy exports. Services export growth is picked to remain relatively low with the high exchange rate making New Zealand a more expensive destination for overseas visitors.

Figure 1.8 – Export volumes

Sources: Statistics New Zealand, The Treasury

Exports are expected to be a key driver of the rebound in economic growth over the year to March 2010. The turnaround in exports occurs as agricultural production recovers from the recent drought, with a strong rebound in dairy exports as dairy production was particularly affected by drought and will also benefit from further dairy conversions. Another positive for export growth will be higher economic growth among our trading partners of 3.6% per annum from the calendar year 2010. Export volumes are expected to rise by 4.0% over the year to March 2010 and this robust pace of growth will continue in the final two years of the forecast period, also helped by a decline in the exchange rate.

… and the exchange rate of the New Zealand dollar declines …

The TWI is expected to remain around 70 over the course of 2008 and depreciate from 2009 onwards (Figure 1.9). The exchange rate is expected to fall by around 20% over the forecast period as a result of a projected fall in soft commodity prices, a slowing in the New Zealand economy and a reduction in interest rate differentials versus the United States and Japan (as interest rates rise in those economies as they recover from weak growth and interest rates fall in New Zealand).

Figure 1.9 – TWI exchange rate

Sources : Reserve Bank of Zealand, The Tresury

… as interest rates ease from 2009

Despite a slowing in the economy, short-term (90-day) interest rates are expected to remain around their current level of 8.8% until early 2009 because of ongoing inflation pressures in the economy and funding difficulties arising from turmoil in global financial markets. After a period of lower economic growth, resource constraints are expected to have eased sufficiently for the Reserve Bank to begin easing monetary policy in early 2009. Interest rates are also expected to be lower as we assume that financial market turmoil and credit constraints will gradually unwind over the year ahead.

Domestic Factors

Domestic outlook is dominated by a number of negative factors …

As well as external events, the future path of the economy will be determined by some developments in the domestic economy. Domestic demand was expected to slow in the Half Year Update as a result of restrictive monetary conditions combined with high debt levels for households, slowing housing activity and a fall in net migration inflows. These factors are now expected to have a greater influence on domestic demand as monetary conditions are tighter than expected owing to global credit constraints, housing activity has slowed by more than expected and net migration inflows have tracked slightly below forecast. Additional factors have emerged since the Half Year Update, particularly higher fuel and food costs, general financial uncertainty and lower farm incomes than previously forecast owing to drought.

These factors will be offset to some degree by supportive factors such as personal income tax cuts and continuing momentum in the labour market, both of which will support private consumption. The net effect on the domestic economy is that growth in domestic demand (ie, real Gross National Expenditure) will fall from 5.0% in the year to March 2008 to around 2.0% the following year and 1.4% in the year to March 2010, picking up slightly to over 2% in the final year of the forecasts.

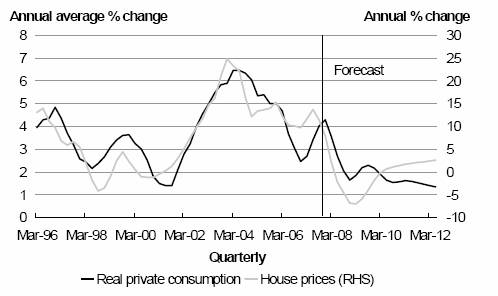

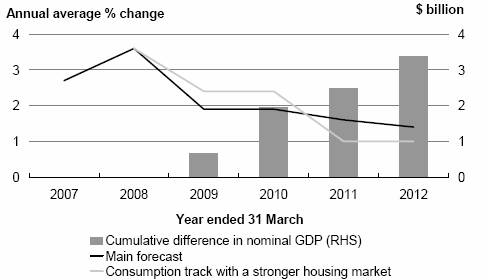

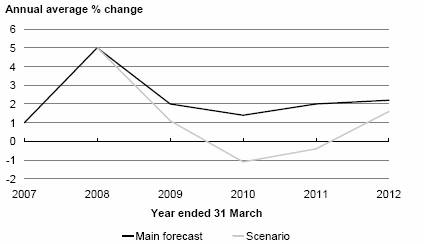

… as households are affected by high interest rates and declining house prices …

Real private consumption growth is fairly subdued over the forecast period (Figure 1.10). Growth in consumer spending slows sharply from 4.3% in the calendar year 2007 to 1.9% in the years to March 2009 and 2010. The main factors dampening this growth are higher mortgage servicing costs, higher fuel and food prices, a lower exchange rate

making imports more expensive, and falling house values lowering wealth. Whereas no decline was forecast in the Half Year Update, house prices are now expected to fall 7% over the year to March 2009 and this fall already appears to be underway. A gradual recovery in house prices is expected from late 2009.

Figure 1.10 – Consumption and house prices

Sources: Statistics New Zealand Quotable Value New Zealand, The Treasury

… but personal tax cuts provide some upside support to consumer spending …

The forecasts contain the personal tax cut in Budget 2008. Households will benefit from higher disposable incomes of $1.5 billion in 2008/09, $2.3 billion in 2009/10, $3.1 billion in 2010/11 and $3.8 billion in 2011/12 (June years). See Personal Income Tax Cuts box below for more details. This is larger than the assumption used in the Half Year Update, where the increase in disposable incomes was around $1.5 billion per annum from April 2009, rising to $1.7 billion in the year to June 2012. The boost to incomes helps support consumer spending growth of just under 2% in the years to March 2009 and 2010 during a time in which consumers face pressure from factors such as high interest rates and falling house prices.

Personal Income Tax Cuts

Personal income taxes will be reduced over the forecast period. Personal income tax rates and thresholds will be adjusted over the forecast period as per Table 1.2.

Table 1.2 – Personal income tax rates and thresholds

For 1 April 2008 | | From 1 October 2008 | | From 1 April 2010 | | From 1 April 2011 | |

Income over… | | is taxed

at… | | Income over… | | is taxed

at… | | Income over… | | is taxed

at… | | Income over… | | is taxed

at… | |

$ | 0 | | 15 | % | $ | 0 | | 12.5 | % | $ | 0 | | 12.5 | % | $ | 0 | | 12.5 | % |

$ | 9,500 | | 21 | % | $ | 14,000 | | 21 | % | $ | 17,500 | | 21 | % | $ | 20,000 | | 21 | % |

$ | 38,000 | | 33 | % | $ | 40,000 | | 33 | % | $ | 40,000 | | 33 | % | $ | 42,500 | | 33 | % |

$ | 60,000 | | 39 | % | $ | 70,000 | | 39 | % | $ | 75,000 | | 39 | % | $ | 80,000 | | 39 | % |

The Budget Update incorporates the actual policy change, whereas the Half Year Update incorporated a revenue reduction contingency assumption of $1.5 billion per annum from April 2009, rising to $1.7 billion in the year to June 2012. The personal income tax cuts will deliver an increase in disposable income to New Zealand households of $1.5 billion in 2008/09, $2.3 billion in 2009/10, $3.1 billion in 2010/11 and $3.8 billion in 2011/12 (June years).

In terms of fiscal cost, the increase in disposable income for households represents the headline reduction in Crown revenue, adjusted for the consequential changes in Crown expenditure on benefits and superannuation. These changes are explained on page 92 of the Fiscal Outlook chapter.

The impact of personal income tax cuts on the economic forecasts is mainly through higher private consumption as a result of higher disposable income. The cut in personal taxes raises growth in real GDP by about 0.3% over the year to March 2009. Although the personal income tax cuts do not come into effect until the December 2008 quarter, they impact on consumer spending from the previous quarter as we assume workers anticipate an increase in discretionary income and spend more accordingly. Consumer spending is boosted further when tax cuts are realised from the December 2008 quarter onwards. We assume the tax cuts will only impact on the labour market via increased employment (ie, higher consumer spending boosts the demand for labour) as we have not assumed any change in the supply of labour from the tax cuts.

The exact nature of the response to personal tax cuts is uncertain. The effect could be smaller if the weaker economic environment encourages households to save more of the tax cuts than we expect. However, the effect could be greater as the percentage increases in take-home pay are highest for people at the lower end of the income scale, who tend to spend more of a given increase in income.

… while non-market investment and public consumption are expected to increase …

Government consumption and investment are expected to support overall economic growth in the years to March 2009 and March 2010. Non-market investment (ie, central government and Crown entities) is forecast to grow strongly over this period as the Government expands infrastructure. The Government’s current expenditure is also forecast to increase throughout the forecast period, averaging growth of around 3.5% per annum in real terms.

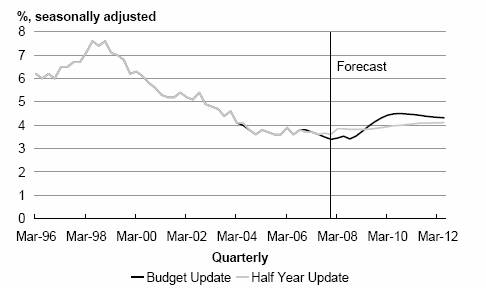

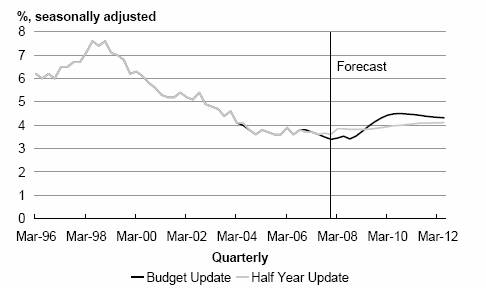

… and the labour market is expected to weaken but remain relatively tight

The labour market is fairly robust throughout the forecast period but the weak patch in economic growth does affect employment growth with a lag. While employment growth is not expected to be as strong as in recent years, firms are expected to be reluctant to shed staff for fear of not being able to hire people when growth begins to pick up, given recent difficulty attracting labour. Lower employment growth means the unemployment rate rises to 4.5% in the March 2011 quarter, higher than in the Half Year Update (Figure 1.11). This rise comes from a lower starting point than assumed in the Half Year Update, and is expected to be muted by slower labour force growth (as a result of lower net migration inflows).

Figure 1.11 – Unemployment rate

Sources: Statistics New Zealand, The Treasury

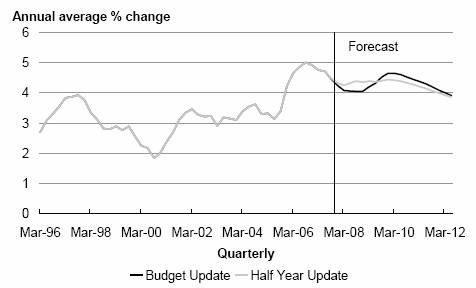

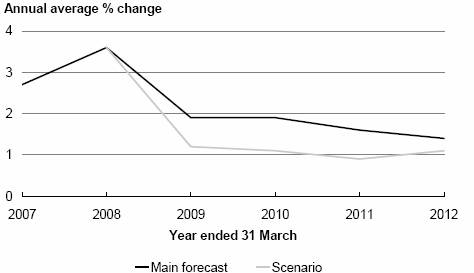

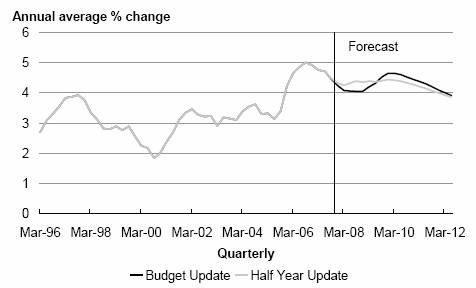

With earlier lower unemployment and continuing difficulties for firms in recruiting staff, as well as higher inflation, nominal wage growth is expected to be slightly higher than in the Half Year Update over the forecast period (albeit lower in the short term). Annual growth in average ordinary-time hourly earnings is forecast to rise to 4.7% at March 2010 before falling back towards 4% per annum (Figure 1.12). Ongoing wage growth is expected to keep growth in labour income near or above 5% per annum over the forecast period.

Figure 1.12 – Average hourly earnings

Sources: Statistics New Zealand, The Treasury

Real wage growth (ie, adjusted for inflation) averages around 1.5% per annum in the forecast period, supported by growth in labour productivity (output per work hour). On an economy-wide basis, labour productivity growth rose to a 7-year high of 2.6% in the calendar year 2007, partly reflecting the upturn in the economy and previous business investment. Although it eases in the short term as firms hoard labour amidst a slowing economy, labour productivity growth is expected to average 1.8% per annum over the forecast period.(8)

High interest rates and weaker economic outlook dampen business investment

Business investment slows sharply, with a weakening of growth in the year to March 2009 and a fall the next year. This coincides with predicted falls in business operating surpluses, prior to a recovery in both business investment and operating surplus growth over the final two forecast years. Capacity constraints and labour shortages continue to support market investment in the short term as firms seek to expand output and supplement or complement labour input. The increase in the terms of trade, plus the associated higher exchange rate, are also expected to support market investment in the near term. However, as the economy slows and the exchange rate declines, growth in market investment is also expected to ease.

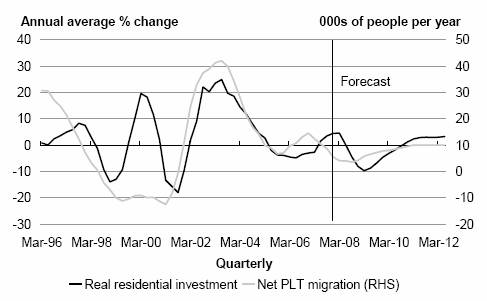

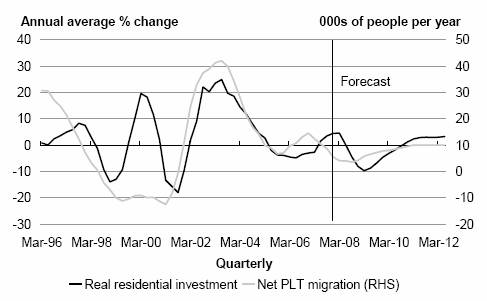

Net migration inflows are expected to stay low, with flow-on to residential investment

The net inflow of permanent and long-term (PLT) migrants tracked down steadily from a recent peak of 14,800 in the November 2006 year to 4,600 in the February 2008 year, the lowest since 2001 (Figure 1.13). Arrivals of overseas citizens to New Zealand increased over the past year as New Zealand remained an attractive destination for migrants with an upturn in the economy and ongoing tight labour market. However, a larger-than-expected increase in New Zealanders departing to Australia, where wages are higher and the labour market is similarly tight, more than offset the rise in arrivals and led to the larger fall in net migration inflows.

Net PLT migration inflows are expected to remain subdued, rising slightly to around 6,000 in the year to March 2009. A gradual rise back towards the average for the past decade of around 10,000 per annum is expected as arrivals increase slightly and departures fall. Immigration approvals, for both permanent residency and work permits, have been running at a high level recently, pointing to steady PLT arrivals. Economic weakness in

(8) For more discussion on productivity, see the recent Treasury Productivity Papers: http://www.treasury.govt.nz/publications/research-policy/tprp

the United Kingdom could result in more New Zealanders returning home. Departures to Australia are expected to fall from their recent high level as growth eases there.

Along with lower net migration inflows, residential investment is expected to be constrained by continuing high interest rates over the year ahead. Growth in residential investment is expected to recover by the end of the forecast period, with lower official interest rates from early 2009 flowing through to retail mortgage interest rates with a lag and net PLT migration inflows gradually recovering to 10,000 per annum (Figure 1.13).

Figure 1.13 – Residential investment and net PLT migration

Sources: Statistics New Zealand, The Treasury

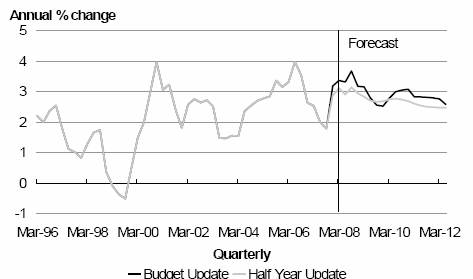

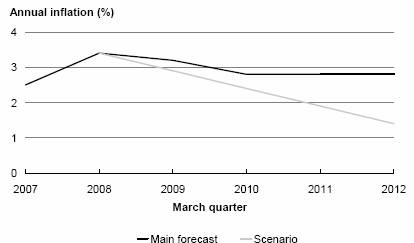

Inflation is expected to be higher for longer …

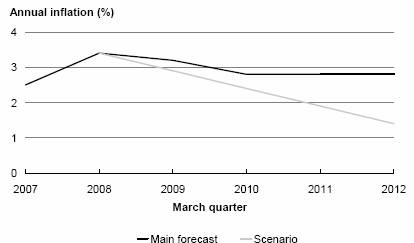

Consumer price inflation is expected to be elevated for much of the forecast period above or near the top of the Reserve Bank’s medium-term target range. After peaking at 3.7% in the year to September 2008, inflation is expected to ease to 3.2% in the year to March 2009 and 2.8% in each of the next three March years (Figure 1.14). The inflation profile is higher than in the Half Year Update and, from the start of the 2010 calendar year, is influenced by the incorporation of the Emissions Trading Scheme (ETS), which impacts on the price of energy and vehicle fuels. We estimate an impact on consumer price inflation of about 0.4 percentage points in 2010 as the ETS impacts on the price of stationary energy (eg, coal, gas and geothermal) from 1 January 2010 and about 0.4 percentage points in 2011 as the ETS affects fuel prices from 1 January 2011. These estimates are based on a carbon price for tradable units of NZD$25/tonne and indirect effects from the rise in the price of electricity and fuels of half the initial impact.

Figure 1.14 – Consumer price inflation

Sources: Statistics New Zealand, The The Treasury

Inflation pressures from higher fuel and food prices dominate in the short term and mean inflation does not fall away at a time when demand growth is easing. An assumed fall in oil prices is expected to lower tradables inflation from 2.8% in calendar year 2007 to 2.3% and 1.6% in the following two years respectively. As oil prices stabilise and a lower New Zealand dollar raises import prices, tradables inflation is forecast to rebound to 2.3% in the calendar year 2010. Despite easing domestic demand in the year ahead, non-tradables inflation remains elevated over much of the forecast period, peaking at 4.0% in the year to December 2008.

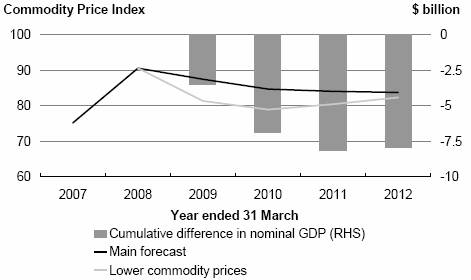

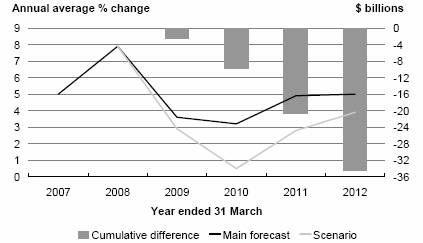

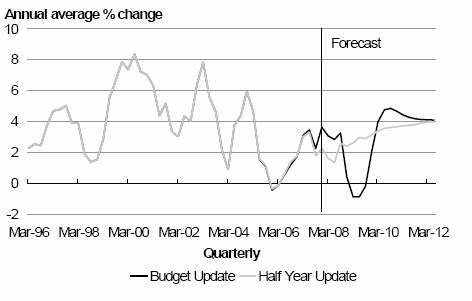

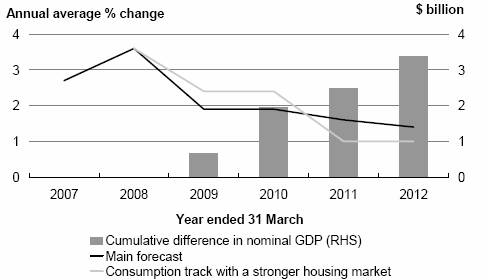

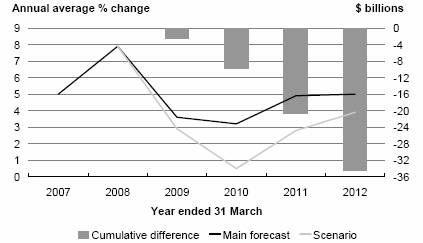

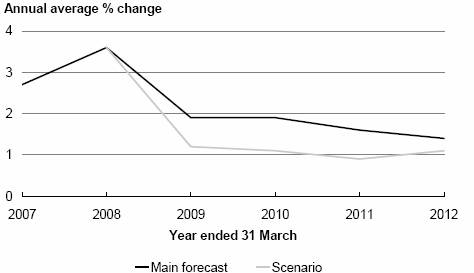

… but growth in nominal GDP is expected to be weaker than in the Half Year Update …

Despite higher inflation, weaker growth in real GDP leads to slower growth in nominal GDP than previously forecast (Figure 1.15). Nominal GDP is weaker from 2009 onwards and around a cumulative $9 billion lower than in the Half Year Update (excluding data revisions). This compares with an upward revision of around $22 billion for the 2008 to 2011 period from the Budget Update 2007 forecasts to the Half Year Update.

Figure 1.15 – Nominal GDP

Sources: Statistics New Zealand, The Treasury

Growth in nominal GDP is forecast to slow from 7.9% in the year to March 2008 to 3.6% in the year to March 2009 and 3.2% in the year to March 2010 as a result of weaker real GDP growth and the fall in the terms of trade. As real GDP growth recovers and the terms of trade stabilise in subsequent years, annual average growth in nominal GDP picks up again to 4.9% in March 2011 and 5.0% in March 2012.

… and tax revenue growth will also be lower as a result

Slower growth in nominal GDP results in lower core Crown tax revenue of about $1 billion in total across the forecast period compared to the Half Year Update, excluding the effects of the personal tax package and other tax policy initiatives. The reductions in tax forecasts are weighted more towards the early part of the forecast horizon rather than the later part, with the reduction in the total core Crown tax forecast being about $0.1 billion in the year to June 2012. The largest changes to the forecasts by tax type are as follows:

· Indirect taxes, mainly customs duty, excise duties and road user charges are negatively affected by high fuel prices, which will reduce volumes of fuel sold. Forecasts have been reduced by increasingly large amounts, with the forecast for the year to June 2012 being down by about $300 million on the Half Year Update.

· Other persons tax forecasts have been reduced by $200 to $350 million per year owing to lower entrepreneurial income (including farm incomes) and a lower assumed effective tax rate.

· Forecasts of GST are lower than in the Half Year Update by as much as $300 million in some years owing mainly to lower forecast paths for nominal consumption and residential investment.

· Source deductions (mostly PAYE) forecasts are higher than in the Half Year Update, supported by an increase in employment forecasts over the next couple of years and increased wage growth forecasts from 2010 onwards.

· Corporate tax forecasts are broadly similar to those in the Half Year Update.

In addition to all of the above, the personal tax package takes progressively larger amounts off tax revenue, amounting to $3.8 billion by the year to June 2012. Other policy changes such as tariff reductions also have a negative effect on tax revenue, culminating in a reduction of over $0.2 billion in the year to June 2012. The tax forecasts incorporate some second-round effects of the personal tax package. For example, personal tax cuts will result in higher disposable income, which is expected to lead to additional domestic spending and higher employment and wage growth. This will generate extra GST and PAYE and also provide a small boost to other taxes such as company tax.

Fiscal Policy and the Macroeconomy

The financial statements of the government, described in the Fiscal Outlook chapter of the Budget Update, summarise the financial position of the government. The information in the accounts is used in the economic forecasts presented in this chapter, which in turn feed into the fiscal forecasts. The information can also be utilised to develop summary indicators of fiscal sustainability and the effect of fiscal policy on the macroeconomy. Adjustments are made to the GAAP-based figures in the accounts dependent on the purpose of the measure being looked at. This box discusses the measures used to assess the impact of fiscal policy on the economy.

Economic forecasts

Forecasts of government spending enter the economic forecasts in the Budget Update directly. Adjustments to the spending figures in the GAAP-based financial statements are made to convert them to the System of National Accounts (SNA) framework used in Table 1.1 on page 76. Government operating spending is split into government consumption and transfers. The former adds to domestic demand directly. The latter forms part of household income and enters domestic demand indirectly via private consumption and residential investment. Capital spending that results in additions to fixed assets shows up in central government investment spending. Direct taxes also enter the economic forecasts indirectly. Taxes are a withdrawal from income, partially offsetting household and corporate income and affecting household and firm spending decisions.

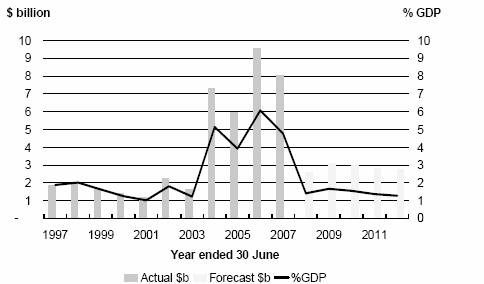

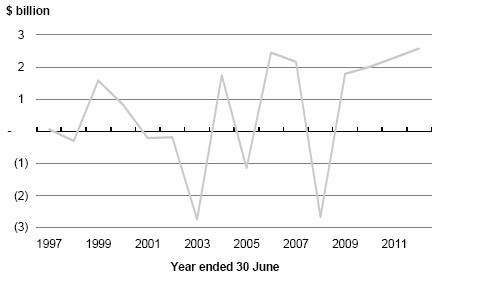

The fiscal impulse is an indicator of whether discretionary fiscal policy is adding to demand in the economy

One useful indicator that combines both spending and tax information to provide a summary guide to the impact of fiscal policy on demand in the economy is the fiscal impulse (see page 52 of the Fiscal Strategy Report). It is constructed from cash-flow information contained in the financial statements. A cash-based measure of the operating balance is constructed and then adjusted to remove the effect of the business cycle on taxes and transfers. From this, capital expenditure is deducted. The change in the resulting fiscal balance is the fiscal impulse. Because the impact of the business cycle is removed it represents a measure of changes in discretionary fiscal policy.

The fiscal impulse is interpreted as expansionary fiscal policy when the fiscal balance decreases (the government is adding to aggregate demand growth through the above channels) or contractionary when the fiscal balance increases (the government is reducing its contribution to aggregate demand). The fiscal impulse, however, does not provide any information on how a change in fiscal policy will be transmitted through the economy. In particular, it ignores any supply-side impacts of policy and does not contain any information about second-round effects, such as changes in the spending decision of households and businesses resulting from changes in interest rates, inflation and the exchange rate.

The fiscal impulse is not a measure of the impact of fiscal policy on inflation. Even if the fiscal impulse is unchanged between forecast rounds it does not mean that the inflation impact will be the same in each forecast. In particular, a changed cyclical position may mean a different inflationary impact from the same fiscal policy change; if there is more pressure on resources then the same changes in discretionary fiscal policy may have a greater inflation impact. In addition, a different make-up of spending and taxation could mean that the same fiscal impulse could have a different impact on inflation.

The Cyclically Adjusted Balance is an indicator of the underlying fiscal position

The Cyclically Adjusted Balance (CAB) removes the cyclical components from the accrual measures of government spending, taxes and transfers contained in the operating balance in the government’s accounts. The CAB is a measure of the underlying fiscal position and shows what the government’s operating balance would be if GDP was at an assumed level of potential GDP. This measure provides a useful indicator of the sustainability of fiscal policy as in the medium term GDP should fluctuate around its potential level. For example, a positive value of the CAB indicates that current operating surpluses are not the result of temporary factors impacting on the economy.

Additional methods, including macro-models, are also used to inform understanding of the effects of discretionary fiscal policy on the economy

Another approach used in the Treasury is to estimate the impact of fiscal policy changes using time series statistical methods applied to fiscal data. The advantage of this approach is that it can take account of the different impacts of the composition of fiscal measures and estimates how a change in fiscal policy is transmitted through the economy by allowing feedback between economic activity and the fiscal position.

2 Fiscal Outlook

Introduction

The fiscal position has strengthened over recent times. Operating and cash surpluses over the past few years have led to a build up of financial assets and to a lowering of debt (as a percentage of GDP).

Looking forward, growth in nominal GDP is forecast to slow resulting in a corresponding slowing in tax revenue growth. Additionally, Budget 2008 introduces personal tax cuts which results in core Crown revenue falling as a percentage of GDP. This is the main contributor to a reduction in OBEGAL and cash surpluses becoming deficits. These cash deficits are met by reducing financial assets accumulated in recent years and borrowing consistent with the debt objective of around 20% of GDP.

This chapter outlines the key trends for each of the indicators along with a comparison to the forecasts provided in the Half Year Update and should be read in conjunction with the financial statements (chapter 5) and the executive summary on pages 1 to 22. The chapter covers the fiscal results for the forecast period (2007/08 to 2011/12). The long-term fiscal outlook can be found on pages 42 to 64.

Each section in the chapter follows the five components of the fiscal strategy (outlined on page 45):

· Revenue and expenses

· Surpluses

· Cash position

· Debt, and

· The New Zealand Superannuation Fund (NZS Fund).

Table 2.1 – Fiscal indicators(9)

Year ended 30 June | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

$ million | | Actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Revenue and expenses | | | | | | | | | | | | | |

Core Crown revenue excl NZS Fund | | 58,482 | | 61,814 | | 61,787 | | 63,552 | | 66,284 | | 69,004 | |

Core Crown expenses | | 54,003 | | 57,364 | | 61,883 | | 63,890 | | 67,016 | | 69,943 | |

Surpluses | | | | | | | | | | | | | |

Total Crown OBEGAL | | 5,860 | | 5,227 | | 1,318 | | 1,004 | | 493 | | 154 | |

Total Crown OBEGAL excl NZS Fund retained revenue | | 6,250 | | 5,219 | | 1,354 | | 1,048 | | 543 | | 207 | |

Total Crown operating balance | | 8,023 | | 2,559 | | 3,105 | | 3,009 | | 2,779 | | 2,734 | |

Cash position | | | | | | | | | | | | | |

Core Crown residual cash | | 2,877 | | 908 | | (3,478 | ) | (3,302 | ) | (3,447 | ) | (3,457 | ) |

Debt | | | | | | | | | | | | | |

GSID (excl Settlement Cash) | | 30,647 | | 31,763 | | 32,498 | | 32,251 | | 35,974 | | 35,499 | |

Net core Crown debt (incl NZS Fund financial assets) | | (7,467 | ) | (11,254 | ) | (11,337 | ) | (11,787 | ) | (12,348 | ) | (12,970 | ) |

Net core Crown debt | | 4,109 | | 1,846 | | 4,578 | | 7,272 | | 10,145 | | 13,193 | |

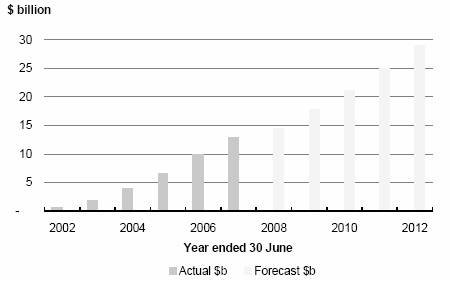

NZS Fund | | | | | | | | | | | | | |

NZS Fund net worth | | 12,973 | | 14,461 | | 17,721 | | 21,152 | | 24,947 | | 29,011 | |

Nominal GDP | | 168,106 | | 180,137 | | 185,478 | | 192,125 | | 201,802 | | 211,800 | |

% of GDP | | | | | | | | | | | | | |

Revenue and expenses | | | | | | | | | | | | | |

Core Crown revenue excl NZS Fund | | 34.8 | | 34.3 | | 33.3 | | 33.1 | | 32.8 | | 32.6 | |

Core Crown expenses | | 32.1 | | 31.8 | | 33.4 | | 33.3 | | 33.2 | | 33.0 | |

Surpluses | | | | | | | | | | | | | |

Total Crown OBEGAL | | 3.5 | | 2.9 | | 0.7 | | 0.5 | | 0.2 | | 0.1 | |

Total Crown OBEGAL excl NZS Fund retained revenue | | 3.7 | | 2.9 | | 0.7 | | 0.5 | | 0.3 | | 0.1 | |

Total Crown operating balance | | 4.8 | | 1.4 | | 1.7 | | 1.6 | | 1.4 | | 1.3 | |

Cash position | | | | | | | | | | | | | |

Core Crown residual cash | | 1.7 | | 0.5 | | (1.9 | ) | (1.7 | ) | (1.7 | ) | (1.6 | ) |

Debt | | | | | | | | | | | | | |

GSID (excl Settlement Cash) | | 18.2 | | 17.6 | | 17.5 | | 16.8 | | 17.8 | | 16.8 | |

Net core Crown debt (incl NZS Fund financial assets) | | (4.4 | ) | (6.2 | ) | (6.1 | ) | (6.1 | ) | (6.1 | ) | (6.1 | ) |

Net core Crown debt | | 2.4 | | 1.0 | | 2.5 | | 3.8 | | 5.0 | | 6.2 | |

NZS Fund | | | | | | | | | | | | | |

NZS Fund net worth | | 7.7 | | 8.0 | | 9.6 | | 11.0 | | 12.4 | | 13.7 | |

Source: The Treasury

Core Crown vs Total Crown

The Fiscal Outlook chapter refers to both core Crown and total Crown results.

Core Crown includes Ministers, Departments, Offices of Parliament, the NZS Fund and the Reserve Bank of New Zealand.

Total Crown includes the Core Crown, State-Owned Enterprises and Crown Entities.

(9) An historical trend series of the above indicators is available on page 188. The glossary on pages 184 to 187 includes a definition of these indicators.

Revenue and Expenses

Core Crown Revenue

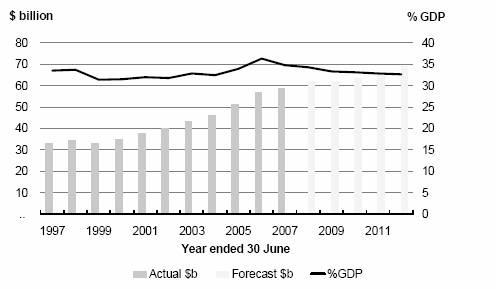

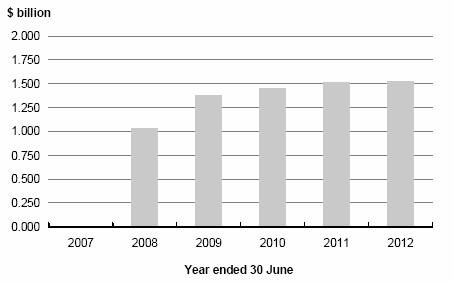

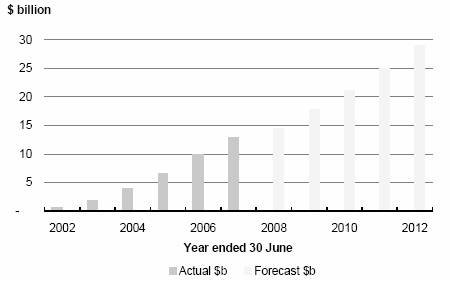

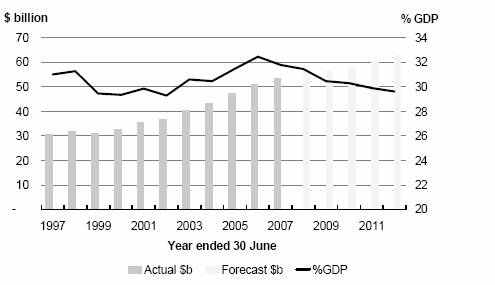

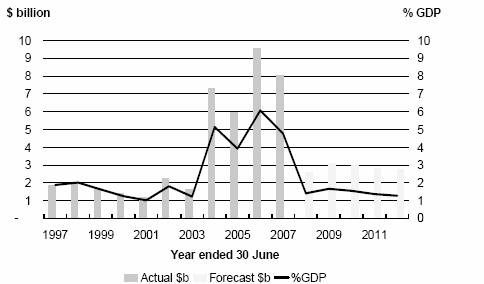

Figure 2.1 – Core Crown revenue excluding the NZS Fund

Source: The Treasury

Core Crown revenue consists mainly of tax revenue. Also included are interest and dividend revenues, and sales of goods and services.

The key indicator used to measure core Crown revenue is core Crown revenue excluding the NZS Fund. This best represents the revenue available to meet the Government’s spending needs.

Core Crown revenue excluding the NZS Fund treats the NZS Fund as a third party (ie, its revenue is not included but the tax it pays is).

Core Crown revenue falls as a percentage of GDP …

While core Crown revenue excluding the NZS Fund grows over the period from $58.5 billion in 2006/07 to $69 billion by 2011/12, it falls as a percentage of GDP as initiatives such as the personal tax cuts and business tax reform (announced in Budget 2007) take effect.

… as personal tax cuts are introduced …

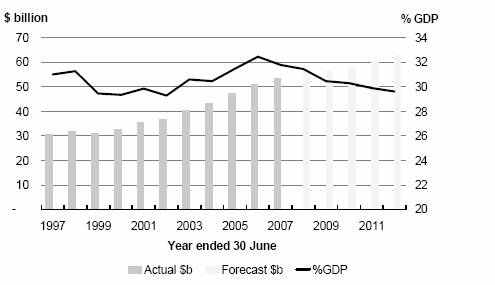

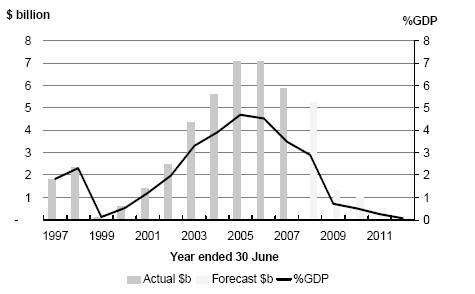

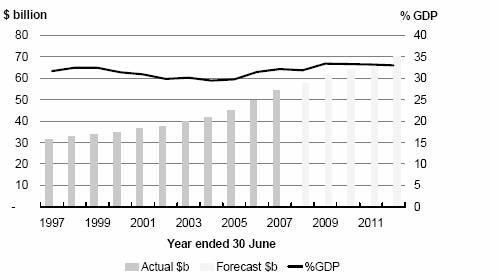

Figure 2.2 – Core Crown tax revenue

Source: The Treasury

Core Crown tax revenue increases over the period from $53.5 billion in 2006/07 to $62.7 billion by 2011/12, but falls as a percentage of GDP.

The fall in percentage of GDP is due, in the main, to the introduction of personal tax cuts. The resulting core Crown tax revenue reduction is detailed in Table 2.2 and ranges from $1.6 billion in 2008/09 to $4.2 billion in 2011/12.

· These tax cuts have now been incorporated into the tax forecasts, whereas in the Half Year Update it was separately identified as a revenue reduction contingency that appeared below the tax revenue line in the forecast financial statements. Further detail of personal tax cuts can be found on page 81.

Table 2.2 Reconciliation of reduction in core Crown tax revenue

Year ended 30 June | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | | |

$ million | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | | Total | |

| | | | | | | | | | | | | |

Reduction in core Crown tax revenue | | — | | 1,633 | | 2,440 | | 3,351 | | 4,152 | | 11,576 | |

Change to benefits and superannuation | | — | | (118 | ) | (166 | ) | (290 | ) | (393 | ) | (967 | ) |

Increase in taxpayers’ disposable income | | — | | 1,515 | | 2,274 | | 3,061 | | 3,759 | | 10,609 | |

Source: The Treasury

The tax package will result in a reduction in core crown tax revenue of nearly $11.6 billion over the forecast period. Part of this revenue reduction represents reduced tax on benefits and superannuation payments. Under the personal tax reductions, after-tax benefit payments do not change while after-tax New Zealand Superannuation (NZS) payments increase. Given this, gross benefit appropriations are reduced to the extent that tax paid on them is lower following the personal tax changes. With NZS, the increased after-tax payments are accompanied by decreased tax paid stemming from the tax changes, meaning gross NZS appropriations change. The change in disposable income (being $10.6 billion over the forecast period) represents the reduction in tax paid by those working and the increase in the after-tax income of superannuitants.

In addition to the personal tax cuts, there have been two changes to tax forecasts in comparison to the Half Year Update:

· Forecasting changes mainly related to changes in the macroeconomic forecasts. However, some other factors have also led to forecasting changes, eg, changes in the estimated effective tax rate on “other persons” taxpayers’ income and changes in the assumed future rate of growth of fuel consumption in response to historically-high fuel prices. Further detail on the tax forecasting changes can be found on page 85.

· Other tax policy changes have also reduced forecasts of tax revenue compared to the Half Year Update. Details of these policies can be found on page 95.

… and other core Crown revenue increases over the forecast period

Other core Crown revenue increases slightly over the forecast period from $5 billion in 2006/07 to $6.3 billion in 2011/12. The main highlights are:

· The Emissions Trading Scheme (ETS) revenue is forecast to increase to $0.9 billion by 2011/12. Forecasts of carbon units to be surrendered by emitters under the ETS have been reduced reflecting the decision to defer introducing liquid fossil fuels to the scheme until 2011. Compared to the Half Year Update, revenue forecasts associated with the surrender of units have reduced by $0.3 billion over the forecast period.

· Forecasts for the Kyoto liability incorporate revised expectations of net emissions over the commitment period 2008 to 2012. Forecasts assume the net position will be 21.7 m tonnes compared with 45.5 m tonnes reported in the Half Year Update. The $0.4 billion reduction in the liability in 2007/08 due to fewer expected emissions is recognised as revenue. Changes to the liability from carbon prices and exchange rates are reported in Table 2.8 on page 100 as a change in gains and losses.

· Investment income increases slightly over the forecast period but reduces in comparison to the Half Year Update in line with a reduction in financial assets in addition to netting out interest on the Crown settlement account (with a corresponding reduction in interest expense).

Table 2.3 – Core Crown revenue excluding the NZS Fund comparison to the Half Year Update

Year ended 30 June | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

$ million | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Core Crown revenue excluding NZS Fund | | | | | | | | | | | |

Half Year Update | | 62,130 | | 63,147 | | 65,412 | | 68,965 | | 72,168 | |

Personal tax cuts | | — | | (1,633 | ) | (2,440 | ) | (3,351 | ) | (4,152 | ) |

Tax forecasting changes | | (491 | ) | 170 | | (336 | ) | (277 | ) | (96 | ) |

Other tax policy changes | | (2 | ) | (86 | ) | (114 | ) | (184 | ) | (247 | ) |

Revenue reduction contingency | | — | | 375 | | 1,500 | | 1,600 | | 1,700 | |

Decrease in core Crown tax revenue | | (493 | ) | (1,174 | ) | (1,390 | ) | (2,212 | ) | (2,795 | ) |

Kyoto valuation due to emissions | | 368 | | — | | — | | — | | — | |

Emissions trading scheme | | — | | 47 | | (191 | ) | (148 | ) | 30 | |

Investment income | | (254 | ) | (366 | ) | (445 | ) | (509 | ) | (615 | ) |

Other core Crown revenue | | 63 | | 133 | | 166 | | 188 | | 216 | |

Increase/(decrease) in other core Crown revenue | | 177 | | (186 | ) | (470 | ) | (469 | ) | (369 | ) |

Budget update | | 61,814 | | 61,787 | | 63,552 | | 66,284 | | 69,004 | |

Source: The Treasury

Inland Revenue Tax Forecasts

In line with established practice, Inland Revenue has also prepared a set of tax forecasts, which, like the Treasury’s tax forecast, is based on the Treasury’s macroeconomic forecast. Inland Revenue’s forecasts are shown here for comparative purposes. The Treasury’s forecasts remain the Crown’s official forecasts.

The main differences between the Treasury’s and Inland Revenue’s forecasts (Table 2.4) are in:

· source deductions (mostly PAYE), where Inland Revenue is more optimistic than the Treasury in the current year and the gap widens in later years in line with forecast growth in underlying incomes, and

· GST, in which the departments have taken different views on the extent to which the housing downturn will affect the tax take, causing the Treasury’s forecast to be generally lower than Inland Revenue’s forecast.

These differences are not large compared to differences between the two sets of forecasts in the past.

Table 2.4 – The Treasury and Inland Revenue core Crown tax revenue forecasts

Year ended 30 June | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

$ billion | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Source deductions | | | | | | | | | | | |

Treasury | | 22.7 | | 22.9 | | 23.6 | | 24.4 | | 25.3 | |

Inland Revenue | | 22.9 | | 23.1 | | 24.0 | | 24.8 | | 25.7 | |

Difference | | (0.2 | ) | (0.2 | ) | (0.4 | ) | (0.4 | ) | (0.4 | ) |

Net other persons tax | | | | | | | | | | | |

Treasury | | 3.7 | | 3.8 | | 3.9 | | 3.9 | | 4.0 | |

Inland Revenue | | 3.8 | | 3.8 | | 3.9 | | 4.0 | | 4.0 | |

Difference | | (0.1 | ) | — | | — | | (0.1 | ) | — | |

Corporate tax | | | | | | | | | | | |

Treasury | | 10.4 | | 9.7 | | 10.1 | | 10.7 | | 11.3 | |

Inland Revenue | | 10.2 | | 9.4 | | 10.1 | | 10.7 | | 11.1 | |

Difference | | 0.2 | | 0.3 | | — | | — | | 0.2 | |

Goods and services tax | | | | | | | | | | | |

Treasury | | 11.8 | | 11.9 | | 12.3 | | 13.0 | | 13.5 | |

Inland Revenue | | 11.7 | | 12.1 | | 12.6 | | 13.3 | | 13.9 | |

Difference | | 0.1 | | (0.2 | ) | (0.3 | ) | (0.3 | ) | (0.4 | ) |

Other tax | | | | | | | | | | | |

Treasury | | 8.1 | | 8.2 | | 8.3 | | 8.3 | | 8.6 | |

Inland Revenue | | 8.1 | | 8.4 | | 8.5 | | 8.4 | | 8.5 | |

Difference | | — | | (0.2 | ) | (0.2 | ) | (0.1 | ) | 0.1 | |

Total tax revenue | | | | | | | | | | | |

Treasury | | 56.7 | | 56.5 | | 58.2 | | 60.3 | | 62.7 | |

Inland Revenue | | 56.7 | | 56.8 | | 59.1 | | 61.2 | | 63.2 | |

Difference | | — | | (0.3 | ) | (0.9 | ) | (0.9 | ) | (0.5 | ) |

Total tax revenue (% of GDP) | | | | | | | | | | | |

Treasury | | 31.5 | | 30.5 | | 30.3 | | 29.9 | | 29.6 | |

Inland Revenue | | 31.5 | | 30.6 | | 30.8 | | 30.3 | | 29.8 | |

Difference | | — | | (0.1 | ) | (0.5 | ) | (0.4 | ) | (0.2 | ) |

Sources: The Treasury, Inland Revenue

Tax Policy Changes

Table 2.5 – Effect of policy changes on tax forecasts since the Half Year Update

Year ended 30 June | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

$ million | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

| | | | | | | | | | | |

Personal tax cuts(1) | | — | | (1,633 | ) | (2,440 | ) | (3,351 | ) | (4,152 | ) |

Petrol tax - no indexation(2) | | — | | (30 | ) | (56 | ) | (81 | ) | (107 | ) |

Tariff rate reductions(3) | | — | | — | | (10 | ) | (50 | ) | (90 | ) |

Gas exploration(4) | | (2 | ) | (17 | ) | (24 | ) | (31 | ) | (38 | ) |

Life insurance - taxing risk income(5) | | — | | — | | 8 | | 22 | | 35 | |

Life insurance - extending PIE treatment(6) | | — | | — | | (21 | ) | (23 | ) | (26 | ) |

SMEs - thresholds(7) | | — | | (16 | ) | (5 | ) | (15 | ) | (15 | ) |

Other(8) | | — | | (23 | ) | (6 | ) | (6 | ) | (6 | ) |

| | (2 | ) | (1,719 | ) | (2,554 | ) | (3,535 | ) | (4,399 | ) |

Source: The Treasury

Summary of Policy Changes

(1) Personal income tax rates and thresholds will be adjusted (refer table 2.2).

(2) Annual indexation of the National Land Transport Fund (NLTF) portion of the petroleum fuel excise rate has been suspended so as to better align the contributions to the NLTF from the various transport-related taxes.

(3) As a result of the Free Trade Agreement signed with China, tariff rates on some goods imports will be gradually reduced.

(4) A number of tax measures intended to remove disincentives that may affect investment in oil and gas exploration and development in New Zealand.

(5) The taxation of risk income of life insurers will be comprehensively reformed.

(6) The Portfolio Investment Entity rules will be extended to include certain life insurance products.

(7) A number of tax thresholds will be raised in order to lower compliance costs for businesses, especially small and medium enterprises.

(8) A range of policy measures, each of which is below the materiality threshold of $10 million.

Core Crown Expenses

Core Crown expenses represent the day-to-day operating spending of the Government (ie, it does not include purchases of physical assets or capital spending).

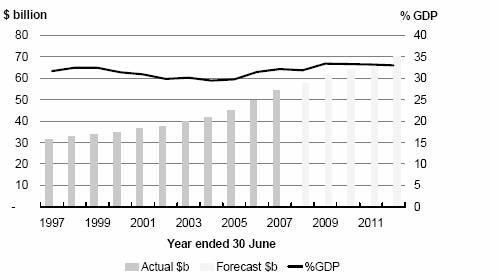

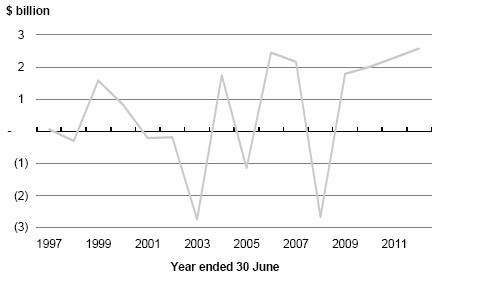

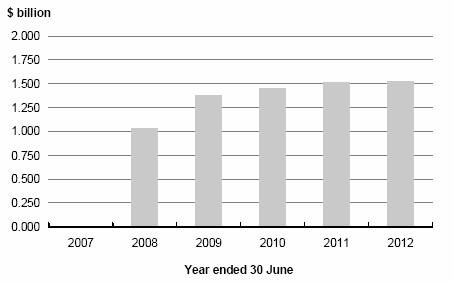

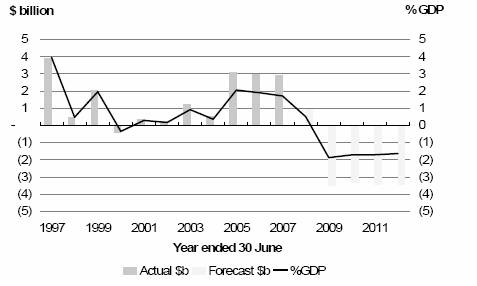

Core Crown expenses increase initially as a percentage of GDP but level off …

Figure 2.3 – Core Crown expenses

Source: The Treasury

The forecast growth in expenses largely arises from expense initiatives introduced in recent Budgets. These policy decisions tend to have rising profiles to allow sufficient time for full implementation.

Core Crown expenses grow over the forecast period from $54 billion in 2006/07 to $69.9 billion by 2011/12 (an increase of $15.9 billion).

These expenses rise as a percentage of GDP in 2008/09 as the full impact of past Budget decisions such as KiwiSaver ($1 billion in 2008/09) and the Emissions Trading Scheme ($0.7 billion in 2008/09) take effect. Subsequent forecast years remain at around 33% of GDP.

… as Budget 2008 operating initiatives are introduced …

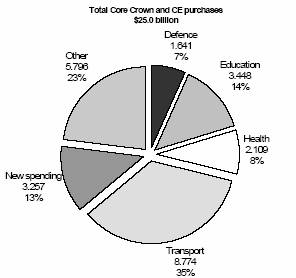

Page 5 presents an overview of the new operating expenditure committed in Budget 2008. The Budget 2008 package includes a revenue reduction relating to business tax reform and the personal tax cuts. These have been deducted in Table 2.6 to show the impact on core Crown expenses.

Table 2.6 – Net amounts of new operating expenditure

Year ended 30 June | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

$ million | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Budget 2008 operating initiatives | | — | | 4,752 | | 5,417 | | 6,236 | | 6,972 | |

Less increase in taxpayers’ disposable income | | — | | (1,515 | ) | (2,274 | ) | (3,061 | ) | (3,759 | ) |

Less business tax reform revenue decrease | | — | | (916 | ) | (915 | ) | (870 | ) | (870 | ) |

New operating expenditure | | — | | 2,321 | | 2,228 | | 2,305 | | 2,343 | |

Source: The Treasury

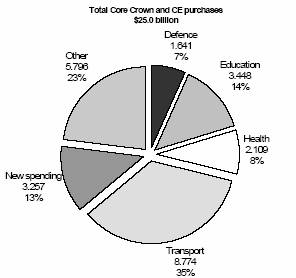

Budget 2008 operating initiatives increase expenditure by $2 billion by 2011/12 including:

· Health spending of $0.75 billion

· Education receive almost $0.6 billion

· Non Government Organisations receive $0.2 billion to improve partnership with community-based social services, and