Exhibit 99.(e)(4)

Statement of Responsibility

On the basis of the economic and fiscal information available to it, the Treasury has used its best professional judgement in supplying the Minister of Finance with this Economic and Fiscal Update. The Update incorporates the fiscal and economic implications both of Government decisions and circumstances as at 5 May 2009 that were communicated to me, and of other economic and fiscal information available to the Treasury in accordance with the provisions of the Public Finance Act 1989.

John Whitehead

Secretary to the Treasury

20 May 2009

This Economic and Fiscal Update has been prepared in accordance with the Public Finance Act 1989. I accept overall responsibility for the integrity of the disclosures contained in this Update, and the consistency and completeness of the Update information in accordance with the requirements of the Public Finance Act 1989.

To enable the Treasury to prepare this Update, I have ensured that the Secretary to the Treasury has been advised of all Government decisions and other circumstances as at 5 May 2009 of which I was aware and that had material economic or fiscal implications.

Hon Bill English

Minister of Finance

20 May 2009

1

Economic and Fiscal Update

Overview

The world is undergoing its deepest downturn since World War II…

The depth of the current global slowdown and the extent of its synchronisation across countries are unprecedented in the period since World War II. The economic performance of New Zealand’s trading partners will play a crucial role in the performance of the New Zealand economy over the next few years. This outlook is highly uncertain, and will be partly dependent on the effectiveness of the numerous large-scale policy responses introduced by governments in response to the financial crisis. A number of the policies undertaken, at least on the current scale, are relatively untested and as such many governments find themselves in uncharted waters.

Uncertainty surrounds how long disruptions in financial markets will continue, as well as the ramifications for world growth. Although not independent, this is complicated by the fact that current adjustments in the world economy are occurring at a time when a number of countries, including New Zealand, have imbalances such as large current account deficits. A number of countries also now face the added complication of significant deteriorations in their fiscal positions and consequential increases in debt. Judgements around such factors have significant impacts on the outlook for an economy. The main forecasts presented here represent the Treasury’s view as to the most likely path the New Zealand economy will take over the next several years. Two alternatives are also presented that fall within the range of possible outcomes. Given the considerable uncertainty surrounding forecasts in the current environment, these alternatives represent an integral part of the forecast story.

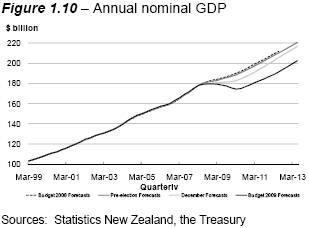

…with negative implications for the outlook for the New Zealand economy

The weaker outlook for New Zealand’s trading partners has resulted in further downward revisions to the forecasts for New Zealand economic activity, with the outlook for the New Zealand economy now weaker than the main track and downside scenario of the December Forecasts. As a result, forecasts of tax revenue are substantially lower, which leads to an increase in the size of forecast fiscal deficits and government debt levels. While some recent data have been less negative, it is too early to tell if this indicates a faster recovery than is incorporated in the main forecasts. An upturn in economic indicators is necessary for quarterly growth to return to positive territory by the end of the year, which is incorporated in the main forecast.

Table 1.1 – Forecast developments over the past year

| | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

| | Est./Actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

| | | | | | | | | | | | | |

Nominal expenditure GDP ($billion, March year) | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 178 | | 184 | | 190 | | 199 | | 209 | | — | |

Pre-election Forecasts | | 178 | | 183 | | 189 | | 197 | | 208 | | 218 | |

December Forecasts | | 178 | | 180 | | 183 | | 191 | | 202 | | 214 | |

Budget 2009 Forecasts | | 178 | | 179 | | 175 | | 181 | | 189 | | 200 | |

Real production GDP (AAPC, March year) | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 3.1 | | 1.5 | | 2.3 | | 3.2 | | 3.0 | | — | |

Pre-election Forecasts | | 3.0 | | 0.1 | | 1.8 | | 3.3 | | 3.4 | | 3.1 | |

December Forecasts | | 3.2 | | 0.3 | | 0.8 | | 2.9 | | 3.9 | | 3.8 | |

Budget 2009 Forecasts | | 3.1 | | -0.9 | | -1.7 | | 1.8 | | 2.9 | | 4.0 | |

Unemployment rate (%, March quarter) | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 3.5 | | 3.7 | | 4.4 | | 4.5 | | 4.3 | | — | |

Pre-election Forecasts | | 3.7 | | 4.4 | | 5.1 | | 5.1 | | 4.8 | | 4.6 | |

December Forecasts | | 3.7 | | 4.7 | | 6.4 | | 6.2 | | 5.4 | | 4.6 | |

Budget 2009 Forecasts | | 3.7 | | 5.0 | | 7.5 | | 7.5 | | 6.3 | | 5.1 | |

OBEGAL(1) (% GDP, June year) | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 2.9 | | 0.7 | | 0.5 | | 0.2 | | 0.1 | | — | |

Pre-election Forecasts | | 3.1 | | 0.0 | | -0.9 | | -1.2 | | -1.5 | | -1.5 | |

December Forecasts | | 3.1 | | -0.3 | | -2.2 | | -3.1 | | -3.1 | | -2.9 | |

Budget 2009 Forecasts | | 3.1 | | -1.6 | | -4.4 | | -5.1 | | -5.0 | | -4.2 | |

Gross debt(2) (% GDP, June year) | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 17.6 | | 17.5 | | 16.8 | | 17.8 | | 16.8 | | — | |

Pre-election Forecasts | | 17.4 | | 17.4 | | 18.0 | | 21.9 | | 23.1 | | 24.3 | |

December Forecasts | | 17.5 | | 19.2 | | 21.0 | | 26.0 | | 29.4 | | 33.1 | |

Budget 2009 Forecasts | | 17.5 | | 24.8 | | 29.1 | | 34.2 | | 36.9 | | 38.7 | |

Net debt(3) (% GDP, June year) | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 6.5 | | 8.1 | | 9.5 | | 10.8 | | 11.9 | | — | |

Pre-election Forecasts | | 5.7 | | 8.9 | | 11.4 | | 14.2 | | 16.7 | | 19.1 | |

December Forecasts | | 5.7 | | 9.3 | | 13.5 | | 18.5 | | 22.7 | | 26.7 | |

Budget 2009 Forecasts | | 5.7 | | 8.7 | | 15.6 | | 21.8 | | 27.1 | | 30.9 | |

Notes: | | (1) | | Operating balance before gains and losses |

| | (2) | | Gross sovereign-issued debt excluding Reserve Bank settlement cash and Reserve Bank bills |

| | (3) | | Net core Crown debt excluding the NZS Fund and advances |

Recession expected to be deeper with recovery relatively gradual…

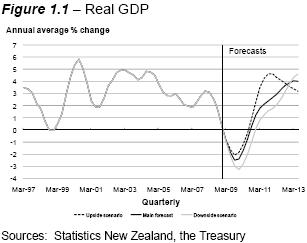

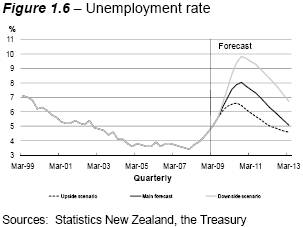

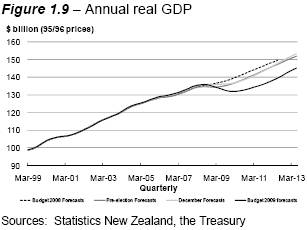

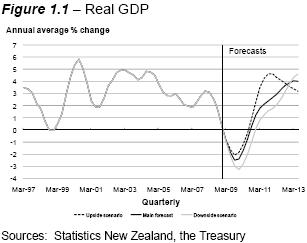

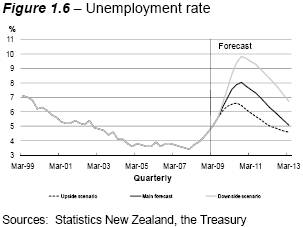

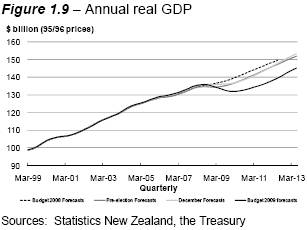

The New Zealand economy is forecast to continue contracting through to the September quarter of 2009, with positive, albeit weak, growth occurring from the end of 2009. This is expected to result in an annual average decline in real gross domestic product (GDP) of 0.9% in the March 2009 year, followed by a further decline of 1.7% in the 2010 March year. This is significantly below the 0.3% and 0.8% positive rates of growth predicted in the December Forecasts. The slower growth reflects lower levels of export and domestic demand, with the outlook for investment particularly affected by tight credit conditions and business uncertainty. The impact of the downturn on households will intensify with household spending declining. Rising unemployment, which is expected to peak at 8% in September 2010, will be a contributing factor. A gradual improvement in world growth prospects, combined with a low dollar and low interest rates, sees real GDP growth staging a relatively hesitant recovery with growth of 1.8% in the March 2011 year, increasing to 2.9% and 4.0% in 2012 and 2013 respectively.

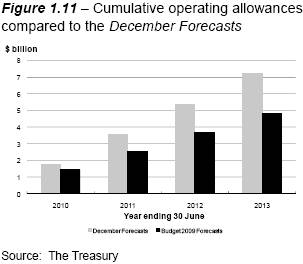

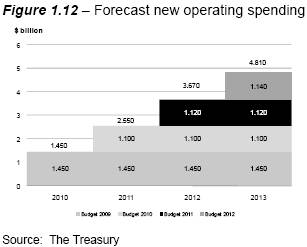

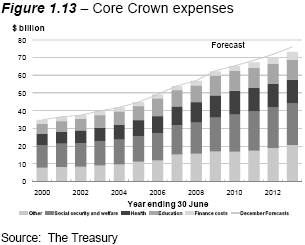

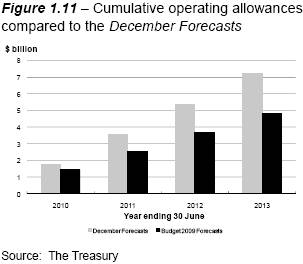

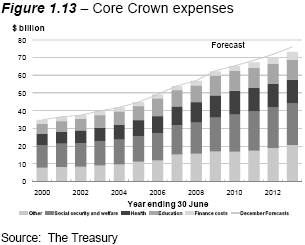

…adversely affecting tax revenue, while policy decisions reduce expense growth

Weaker income flows throughout the economy affect tax revenue which, despite the postponement of the 2010 and 2011 personal income tax changes, is forecast to be around a cumulative $15 billion below the December Forecasts over the 2009 to 2013 June years. More people will receive benefits and debt-servicing costs also increase. A decision to reduce the size of future budget allowances is the main driver for forecast core Crown expenses being a cumulative $5.9 billion lower over the 2009 to 2013 June years than forecast in the December Forecasts.

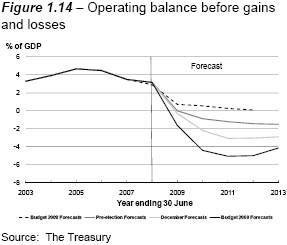

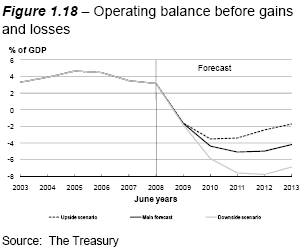

With lower tax revenue dominating, higher operating deficits and debt levels result

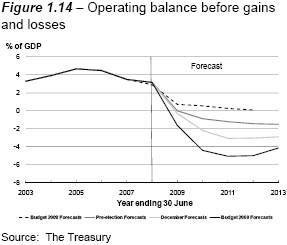

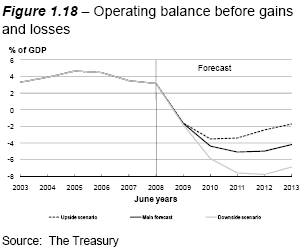

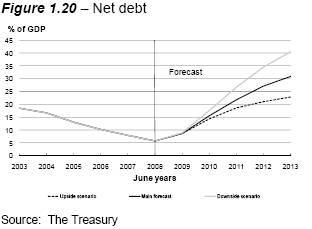

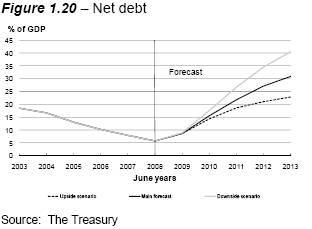

The operating balance before gains and losses (OBEGAL) deficit is expected to be larger than that predicted in the December Forecasts throughout the forecast period, peaking at 5.1% of GDP before declining to 4.2% of GDP by 2013. The financing of larger deficits sees debt rising more steeply than previously forecast with gross debt forecast to reach slightly below 39% of GDP by 2013 and net debt just below 31% of GDP.

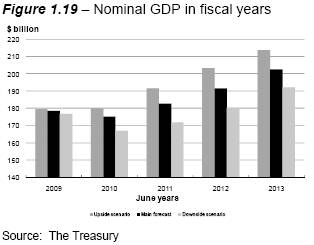

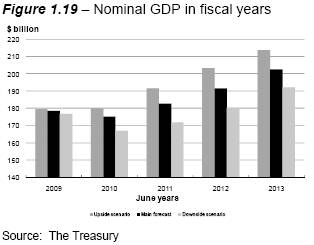

The potential for a wide range of outcomes exists given the unusual environment

Considerable uncertainty surrounds the evolution of growth in our trading partners with alternative economic forecasts illustrating the potential impacts on the New Zealand economy should trading partner growth differ from the main forecasts. The scenarios give rise to significantly different fiscal outcomes. Under a scenario of higher trading partner growth, New Zealand’s GDP growth is also higher and the peak in unemployment lower. Nominal GDP is forecast to be a cumulative $37 billion higher over the 2009 to 2013 fiscal years than in the main forecast, generating around an additional $13 billion of tax revenue. This flows through to less rapid debt accumulation with net debt just below 23% of GDP in 2013.

Table 1.2 – Key Budget 2009 forecasts and scenarios

| | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

| | Actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Nominal expenditure GDP ($billion, March year) | | | | | | | | | | | | | |

Upside scenario | | 178 | | 179 | | 179 | | 188 | | 200 | | 211 | |

Main forecast | | 178 | | 179 | | 175 | | 181 | | 189 | | 200 | |

Downside scenario | | 178 | | 179 | | 168 | | 170 | | 178 | | 189 | |

Real production GDP (AAPC, March year) | | | | | | | | | | | | | |

Upside scenario | | 3.1 | | -0.9 | | -1.2 | | 3.5 | | 4.3 | | 3.4 | |

Main forecast | | 3.1 | | -0.9 | | -1.7 | | 1.8 | | 2.9 | | 4.0 | |

Downside scenario | | 3.1 | | -1.0 | | -2.8 | | 0.8 | | 2.1 | | 4.3 | |

Unemployment rate (%, March quarter) | | | | | | | | | | | | | |

Upside scenario | | 3.7 | | 5.0 | | 6.5 | | 5.9 | | 5.0 | | 4.6 | |

Main forecast | | 3.7 | | 5.0 | | 7.5 | | 7.5 | | 6.3 | | 5.1 | |

Downside scenario | | 3.7 | | 5.0 | | 8.6 | | 9.5 | | 8.3 | | 6.7 | |

OBEGAL (% GDP, June year) | | | | | | | | | | | | | |

Upside scenario | | 3.1 | | -1.6 | | -3.5 | | -3.4 | | -2.4 | | -1.7 | |

Main forecast | | 3.1 | | -1.6 | | -4.4 | | -5.1 | | -5.0 | | -4.2 | |

Downside scenario | | 3.1 | | -1.8 | | -5.9 | | -7.6 | | -7.8 | | -6.9 | |

Gross debt (% GDP, June year) | | | | | | | | | | | | | |

Upside scenario | | 17.5 | | 24.6 | | 27.5 | | 30.4 | | 30.3 | | 30.3 | |

Main forecast | | 17.5 | | 24.8 | | 29.1 | | 34.2 | | 36.9 | | 38.7 | |

Downside scenario | | 17.5 | | 25.1 | | 31.9 | | 39.8 | | 45.0 | | 48.8 | |

Net debt (% GDP, June year) | | | | | | | | | | | | | |

Upside scenario | | 5.7 | | 8.6 | | 14.4 | | 18.6 | | 21.1 | | 22.9 | |

Main forecast | | 5.7 | | 8.7 | | 15.6 | | 21.8 | | 27.1 | | 30.9 | |

Downside scenario | | 5.7 | | 8.9 | | 17.7 | | 26.6 | | 34.6 | | 40.5 | |

A more pessimistic assumption regarding trading partner growth would result in higher unemployment and nominal GDP being a cumulative $43 billion lower over the 2009 to 2013 fiscal years. Lower tax revenue leads to net debt being forecast to reach nearly 41% of GDP in 2013. This would lead to a Government response to prevent this occurring as this result would breach the Government’s debt objective.

Main Forecasts

Global developments will play a key role in New Zealand’s economic prospects…

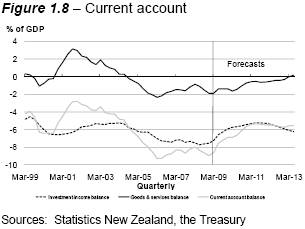

The main forecasts presented in this chapter are heavily influenced by the weak outlook for the global economy over the next few years. The world is currently facing the weakest conditions for economic growth since World War II. Such conditions represent a difficult environment for economies, such as New Zealand’s, that need to shift the composition of their growth away from domestic demand towards exports in an effort to unwind imbalances such as a large current account deficit.

…and contribute to further declines in economic growth…

The New Zealand economy contracted in every quarter during 2008. Drought conditions were particularly intense over the 2007/08 summer and this contributed to low agricultural production over the first half of 2008, with significant declines in the export volumes of important categories such as dairy. Also, domestic demand was easing as the lagged impact of monetary policy took effect after an extended period of growth. The impact of the global slowdown began to play an increasingly significant role over the second half of 2008 and into 2009.

New Zealand is forecast to experience a continued period of weak economic growth over the next couple of years as the economy continues to be affected by low global growth and the need to unwind past imbalances. Real production GDP is estimated to have declined by 0.9% in the year to March 2009, with a further 1.7% decline forecast for the March 2010 year. This is materially lower than both the main and downside outlooks that were presented in the December Forecasts. In addition, the recovery from current weakness in New Zealand and abroad is expected to be relatively drawn-out. Real GDP growth is expected to lift to around 1.8% in 2011 and just below 3% in 2012 before reaching 4% in 2013.

Quarterly growth is forecast to remain negative through to the September quarter of 2009. The current forecast means that by September 2009 the level of real GDP will be 3.5% below its level at the end of 2007. This is a slightly smaller decline than the recession of the mid-1970s. However, faster population growth relative to that in the mid-1970s means that the decline in GDP per capita is forecast to be larger, with the level of real GDP per capita 5.2% lower in December 2009 compared with two years earlier.

…as the slowdown is felt throughout the economy

The effects of the slowdown have been felt over the first part of 2009 and are likely to intensify as the year progresses. Firms can expect a continuation of weak demand, both domestically and abroad. Their profits are forecast to fall and they are likely to exercise caution when making investment and employment decisions. Households have experienced reduced job security and unemployment is likely to rise further over the next 18 months. Combined with constraints on borrowing, this will place pressure on household spending. Government will be affected through lower tax revenue, increased welfare payments and higher debt-servicing expenses as debt grows and it increasingly needs to borrow to fund its expenditure.

Table 1.3 – Economic forecasts(1)

(Annual average % change, March | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

years) | | Actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Private consumption | | 3.2 | | -0.4 | | -1.3 | | -1.5 | | -0.1 | | 1.9 | |

Public consumption | | 4.3 | | 3.6 | | 3.3 | | 2.8 | | 1.9 | | 1.5 | |

Total consumption | | 3.5 | | 0.5 | | -0.3 | | -0.5 | | 0.4 | | 1.8 | |

Residential investment | | 4.3 | | -25.2 | | -22.7 | | 7.1 | | 18.7 | | 20.6 | |

Non-market investment | | 7.4 | | 15.9 | | 5.2 | | -2.2 | | -3.6 | | 3.8 | |

Market Investment | | 4.7 | | -5.0 | | -23.4 | | 3.1 | | 18.4 | | 11.5 | |

Total investment | | 4.3 | | -9.6 | | -21.0 | | 6.0 | | 17.4 | | 12.8 | |

Stock change(2) | | 0.8 | | 0.2 | | -1.0 | | 0.5 | | 0.1 | | -0.1 | |

Gross national expenditure | | 4.4 | | -1.9 | | -5.8 | | 1.3 | | 3.9 | | 4.2 | |

Exports | | 2.9 | | -4.2 | | -1.5 | | 2.4 | | 4.1 | | 6.0 | |

Imports | | 9.6 | | -3.1 | | -14.3 | | 0.6 | | 7.3 | | 6.4 | |

GDP (expenditure measure) | | 2.3 | | -1.8 | | -1.9 | | 2.0 | | 2.9 | | 4.0 | |

GDP (production measure) | | 3.1 | | -0.9 | | -1.7 | | 1.8 | | 2.9 | | 4.0 | |

| | | | | | | | | | | | | |

Real GDP per capita | | 2.1 | | -1.9 | | -2.7 | | 0.8 | | 1.9 | | 3.1 | |

Nominal GDP (expenditure basis) | | 7.4 | | 0.7 | | -2.7 | | 3.7 | | 4.5 | | 5.7 | |

GDP deflator | | 4.9 | | 2.5 | | -0.7 | | 1.7 | | 1.5 | | 1.6 | |

Output gap (% deviation, March quarter) | | 1.9 | | -0.9 | | -1.9 | | -2.2 | | -1.5 | | 0.0 | |

| | | | | | | | | | | | | |

Employment(3) | | 0.8 | | 0.7 | | -3.4 | | -2.2 | | 1.8 | | 3.5 | |

Unemployment(4) | | 3.7 | | 5.0 | | 7.5 | | 7.5 | | 6.3 | | 5.1 | |

| | | | | | | | | | | | | |

Wages(5) | | 4.6 | | 4.2 | | 2.2 | | 1.2 | | 1.3 | | 1.6 | |

CPI inflation(6) | | 3.4 | | 3.0 | | 2.4 | | 1.7 | | 1.2 | | 1.6 | |

Merchandise terms of trade(7) | | 8.4 | | 0.9 | | -11.8 | | 0.8 | | 3.6 | | 2.4 | |

| | | | | | | | | | | | | |

Current account balance | | | | | | | | | | | | | |

- $billion | | -14.2 | | -15.4 | | -12.0 | | -9.8 | | -10.3 | | -11.1 | |

- % of GDP | | -8.0 | | -8.6 | | -6.9 | | -5.4 | | -5.5 | | -5.5 | |

| | | | | | | | | | | | | |

TWI(8) | | 71.9 | | 53.7 | | 49.5 | | 52.0 | | 52.1 | | 52.1 | |

90-day bank bill rate(8) | | 8.8 | | 3.7 | | 2.5 | | 2.5 | | 3.8 | | 5.4 | |

10-year bond rate(8) | | 6.3 | | 4.6 | | 5.2 | | 5.2 | | 5.6 | | 5.8 | |

Notes: | | (1) | | Forecasts finalised 18 April 2009 |

| | (2) | | Contribution to GDP growth |

| | (3) | | Household Labour Force Survey, full-time equivalent employment |

| | (4) | | Household Labour Force Survey, percentage of the labour force, March quarter, seasonally adjusted |

| | (5) | | Quarterly Employment Survey, average ordinary time hourly earnings, annual percentage change |

| | (6) | | Annual percentage change |

| | (7) | | SNA basis, annual average percentage change |

| | (8) | | Average for the March quarter |

Sources: Statistics New Zealand, Reserve Bank of New Zealand, the Treasury

World economy experiencing unusual times as financial market crisis continues to affect growth

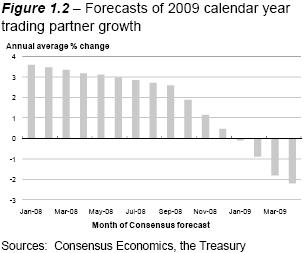

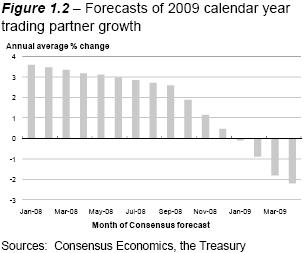

The magnitude of the current financial market crisis and the severity of its impact on real economies throughout the world became increasingly apparent at the end of 2008 and start of 2009. Forecasts for the growth of our trading partners have been consistently downgraded. The extent of synchronisation across countries of the current global slowdown and its depth are unprecedented in recent history. The International Monetary Fund (IMF) now characterises the current downturn as the deepest post-World War II.

A feature of downturns associated with financial stress is that they tend to be deep and relatively long-lasting. The synchronised nature of the downturn also offers less opportunity for individual countries to boost their growth via an export-led recovery. One

challenge facing many economies is how to unwind imbalances that have emerged over recent years, including large current account imbalances, and more recently the considerable build-up of government debt.

The path taken by the global economy is the most important factor underpinning the outlook for the New Zealand economy. The rate of annual average growth across our top 12 trading partners slowed to 1.8% in the 2008 calendar year, down from 4% in 2007. Over the 2009 calendar year, New Zealand’s top 12 trading partners are on average expected to contract by 2.5%, significantly weaker than the 0.9% increase assumed in the December Forecasts.(8) The slowdown is also assumed to be considerably more prolonged than the assumption in the December Forecasts, and the recovery in 2010 fairly modest with our top 12 trading partners growing only 1% in the 2010 calendar year and 2.2% in 2011.

High degree of uncertainty a dominant feature of current environment

Given the uncertainty over the current world outlook, alternative assumptions regarding the outlook for our trading partners and the resulting impacts on the New Zealand economy are considered as scenarios presented later in the chapter.

Recent data have been less negative…

Although forecasts for the world economy have been revised down in recent months, there is increasing evidence that the rate of decline in the global economy is slowing and some positive signs have appeared. There has been a strengthening of industrial production and exports in Asia, possibly in response to the large investment in infrastructure in China. Other positive developments include 2% annualised growth in private consumption in the US in the March quarter of 2009 and a slowing in the rate of job-shedding in the US in April. There have also been noticeable upturns in business and consumer confidence in the major economies in May, although most of these measures still point to a contraction in activity.

(8) | | The Treasury’s measure of trading partner growth has changed from the top 20 measure used in the December Forecasts to a top 12 measure. The 0.9% figure quoted here is the assumption from the December Forecasts on a top 12 basis. |

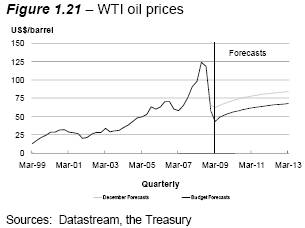

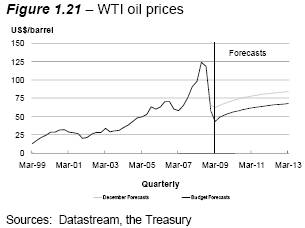

Rudimentary signs of stability have also been evident in global markets. Share markets have recovered from their low point in early March and in some cases have recouped their 2009 losses, but remain well down on previous peaks. Commodity prices have also risen, with the Commodity Research Bureau futures index up 20% from its low in early March. West Texas Intermediate oil prices have increased from their low of US$34/barrel in February to just under US$60/barrel in early May and world prices for New Zealand’s major commodity exports rose in spot markets in March and April 2009. Financial markets have also shown some signs of stabilisation with a narrowing of spreads between interbank and effective policy rates, particularly in the US; safe-haven demand for US dollar-denominated assets has declined, and – combined with higher commodity prices – this has led to the appreciation of the New Zealand dollar from below US 50 cents in early March to above US 60 cents in early May.

…which is necessary for a re-emergence of growth, although there are risks

So far, the developments indicate only a slowing in the rate of decline, but may be the first step towards an eventual recovery. It is too early to conclude that these recent economic developments will result in an upswing in growth greater than that in our main forecasts. In fact an upturn in these indicators is necessary if quarterly growth is to return to positive territory by the end of the year, which is incorporated in our main forecast. Risks lie in both directions: this incipient recovery may die out, for example, as further financial sector adjustment occurs, or the recovery may strengthen and stability and growth return sooner than currently forecast. There is also the possibility that growth may occur in a manner that sees less of an unwinding of imbalances than occurs in the main forecasts.

The global slowdown is being transmitted to New Zealand via four main channels: the cost and availability of credit in New Zealand; lower demand for New Zealand’s goods and services from abroad, including the impact this has on international commodity prices; impacts on the confidence of New Zealand businesses and consumers; and lower wealth levels. Uncertainty associated with developments abroad translates into uncertainty for New Zealand firms and households and hence the exact impact that each of these channels will have on the New Zealand economy is also uncertain.

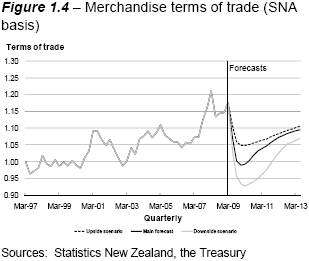

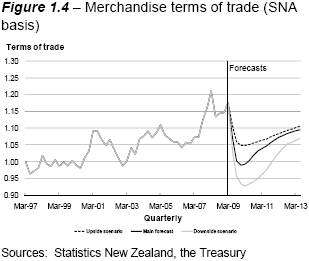

Weak outlook for global growth sees terms of trade fall…

Declining world growth has seen the world price of a number of our exports fall. International spot prices for dairy products, as measured by the ANZ commodity price index, fell by 58% between November 2007 and February 2009, and while there are some tentative signs that dairy prices may have reached a floor, the lag between spot prices and prices received by New Zealand producers should see further significant falls occurring as 2009 progresses. At the same time world prices for imports are also likely to be lower, but on balance the terms of trade are expected to be lower than previously forecast. Although some improvement is expected to occur as the world economy recovers, it is unlikely that the peaks experienced over 2008 will be reached again over the forecast period.

…contributing to a negative outlook for many businesses…

Firms are experiencing decreased demand for their goods and services as overseas consumers and New Zealand households respond to the difficult economic environment. The NZIER’s Quarterly Survey of Business Opinion (QSBO) showed business confidence near historically low levels with a net 47% of firms reporting a decrease in their own activity in the March quarter 2009, a deterioration from the net 43% who reported a decrease in December 2008. A net 38% of firms expect their own activity to fall further over the June quarter.

…and falling profits…

In a difficult trading environment firms are less able to increase prices in New Zealand. As discussed, falling world demand brought lower commodity prices, and the international prices of other goods and services are also being affected. While price developments will have different impacts across firms depending on individual firms’ input and output mixes, overall it is likely that a number of firms will find margins compressed, which – combined with lower volumes – will mean falling profits.

…flowing through to businesses paying less tax

As a consequence, the amount of corporate tax revenue forecast to flow to Government has been revised down. The ability of firms to use past losses to offset profits in future periods means that the impact of the current downturn on the corporate tax revenue received by the Government can persist into the period in which profits begin to recover. Total corporate tax revenue over the 2009 to 2013 June years is forecast to be 6% or around $3 billion lower than forecast in the December Forecasts.

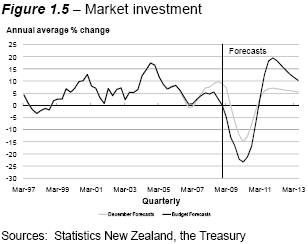

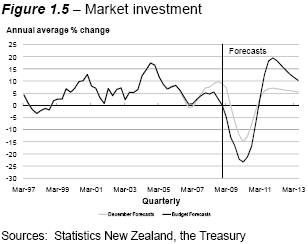

Investment is forecast to experience large declines…

The March QSBO showed investment intentions at record lows with a net 46% of firms reporting that they intend to reduce investment in buildings over the next 12 months and a net 44% of firms intending to reduce investment in plant and machinery. Given this, it is highly likely that investment activity will experience large falls over the next year or so. Following a decline of 5% in the 2009 March year, real market investment is forecast to fall

a further 23% over the 2010 March year. Nevertheless, it should be noted that investment levels are subject to large swings over economic cycles and can also be quite volatile and therefore relatively unpredictable.

…with credit to businesses easing

The availability of finance is another constraining factor for investment, with banks and other lenders more cautious than they have been in the past about the level of funds they provide, while falling house prices will limit the extent to which some small businesses relying on mortgage funding can secure finance. The amount of credit provided by banks and other financial institutions to businesses has experienced a considerable easing in growth, declining to 8.2% on an annual basis in March 2009, down from rates in excess of 16% during parts of 2007. In addition, monthly declines have been experienced over each of the first three months of 2009. The relatively muted concerns of some businesses about the extent to which they can access funds for investment need to be viewed in the current context of declining investment intentions and therefore could come more to the fore in the event that investment were to recover rapidly.

Firms are forecast to employ fewer workers and unemployment will rise

Unemployment is expected to rise with firms needing fewer workers as a result of lower demand. Firms are looking at areas they can cut costs and staff levels will be a key area of focus. The unemployment rate is forecast to peak at 8% in the second half of 2010, an increase relative to the 6.5% peak in the December Forecasts and also above the 7.5% peak contained in the December downside scenario. The Budget Forecasts show the number of seasonally adjusted unemployed increasing from the December 2008 level of 105,000 to 179,000 in September 2010. While unemployment is expected to rise, there is considerable uncertainty as to the exact peak it will reach. This will be dependent on how the New Zealand and overseas economies evolve and the resultant demand for labour. The scenarios presented later in this chapter show the peak in the unemployment rate varying between 6.6% and 9.8%, with the peak in the number of unemployed varying between 148,000 and 217,000.

…with the increase in the unemployment rate influenced by people’s decisions about labour force participation

The main Budget Forecasts incorporate a falling rate of labour force participation. Factors contributing to this include more people staying in education for longer given limited job opportunities, and people, particularly secondary income earners and older workers, no longer actively seeking employment given the increased difficulty they will face in gaining employment. Should more of these people remain in the labour force as unemployed then there is a risk that the unemployment rate may increase further. People who are close to their planned retirement age and have suffered significant losses of wealth are one group who may wish to remain in employment and the labour force for longer.

With many countries facing an economic slowdown, this could lead to higher net migration gains if fewer New Zealanders seek employment overseas and especially if more New Zealanders return home. The forecasts incorporate net migration levels returning to 10,000 per annum by mid-2010. Higher net migration could boost both aggregate demand and unemployment.

Wage growth is forecast to ease…

Firms are likely to try to manage costs by offering lower wage increases with a softer labour market enabling such an approach, as will forecasts of falling inflation. Changes in the composition of the workforce will also influence measures such as the Quarterly Employment Survey’s measure of average hourly earnings which is forecast to slow to under 2% annual growth in the second half of 2010, considerably slower than the experience of the past couple of years when it has generally been in the 4% to 5% range.

…reducing PAYE income tax

Lower wage growth and employment than in the December Forecasts have reduced PAYE forecasts by a total of $6.4 billion over the forecast period as a whole. However, policy changes discussed later mean average tax rates remain higher than previously forecast, resulting in the level of PAYE tax being lower than the December Forecasts by only a net $4.2 billion.

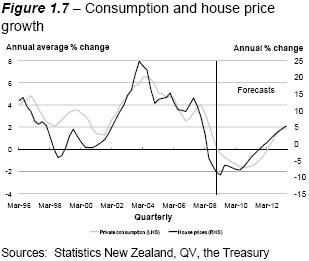

Consumption to continue falling with households yet to feel the full effects of the downturn

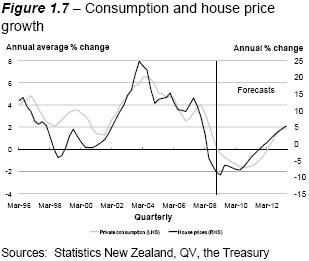

Household spending is expected to remain under considerable pressure throughout the forecast period, with real private consumption expected to contract in all but the final March year of the forecast period. In aggregate, labour incomes are forecast to decline in the March 2010 year and remain fairly flat in 2011. Slower income growth will constrain consumption growth and consumers are likely to remain cautious about taking on debt to fund discretionary purchases, particularly in light of concerns about job security.

Consumers’ attitudes to debt to become more conservative…

Rising unemployment is also forecast to put further pressure on the housing market, with nominal house prices forecast to decline nearly 8% and 4% over the March 2010 and 2011 years respectively, following a 9% decline in the 2009 March year. This will not only affect households’ perceptions of wealth but will also severely constrain the ability of households to borrow against their houses to finance spending. An increase in precautionary saving should also contribute to the rate of household dis-saving narrowing considerably.

After a period of considerable debt build-up, it is possible that adjustment on the part of households may be slower than is incorporated in the Budget Forecasts. This could occur if consumers were to spend the majority of the relief they receive from relatively low mortgage rates currently available, although it should be noted that low interest rates also constrain the incomes of those relying on investment income. While higher growth in consumption would have positive implications for demand and growth over the short term, the necessary adjustment as a result of a continued build-up in household debt would need to be greater in the future, potentially affecting the outlook for growth beyond the forecast horizon.

…and residential investment to contract further

Many of the factors that are forecast to act as a drag on consumption growth will also translate into low levels of residential investment. Banks are expected to continue to seek larger deposits before issuing home loans and funding for property developers remains constrained. Annual building consents are at their lowest level in over 25 years, contributing to the forecast that residential investment will fall by just under 23% in the March 2010 year following a 25% fall in the March 2009 year. There have been signs of a slight recovery in

house sales over April, but given the factors above it is unlikely that the housing market will stage a significant recovery any time soon, with the risks tilted towards further declines in house prices as 2009 progresses.

Imports forecast to fall sharply…

Slowing domestic demand, with large falls in investment and consumption, is forecast to result in a sharp 14.3% fall in import volumes in the 2010 March year with import volumes also remaining relatively flat in the March 2011 year. A low exchange rate contributes to subdued imports by making imported goods and services relatively expensive.

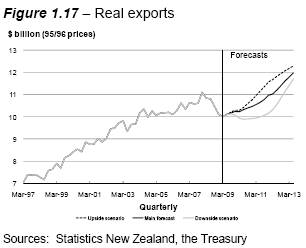

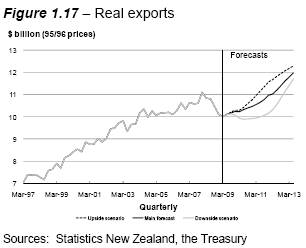

…while global weakness hampers exports

Export volumes are forecast to fall 4.2% in the year to March 2009 with a drought-affected 16% reduction in dairy export volumes and just under a 10% fall in service export volumes, which have been hampered by falling tourist arrivals. The New Zealand dollar fell 25% between the March 2008 and March 2009 quarters. Ordinarily this would be expected to provide quite an impetus for export volume growth but, despite a recovery in the growth in dairy export volumes, overall exports are expected to record a further 1.5% decline in the year to March 2010. Services export volumes are expected to fall by nearly a further 11% in the March 2010 year as global consumers cut back on discretionary expenditure including travel to distant destinations such as New Zealand.

While the outlook for overall exports over the next year or so is weak, a number of New Zealand firms and producers are relatively well placed compared to those abroad. This is because a large share of New Zealand’s exports are agriculturally-based with demand for these products likely to be relatively less affected than high-end consumer electronics or motor vehicles.

Inflation pressures ease further…

With weak domestic demand significantly freeing up capacity in the economy and constraining the ability of firms to increase prices, non-tradables inflation is forecast to fall significantly to below 2% throughout the 2011 and 2012 calendar years. The weak international environment will also see tradables inflation fall back significantly, although movements in the exchange rate will have some impact as the dollar is expected to depreciate to just below 50 on a trade weighted basis by the start of 2010 as the terms of trade decline and risk aversion remains elevated. The exchange rate is then expected to stage a relatively minor recovery with the Trade Weighted Index (TWI) increasing to around 52. Overall, this should see Consumers Price Index (CPI) inflation easing to around 1% by September 2009 and remaining significantly below 2% over the majority of the forecast period. The profile for inflation includes the assumption that the Emissions Trading Scheme will impact on stationary energy and liquid fuels from 1 January 2010 and 1 January 2011 respectively. The details of the scheme are currently under review but no decisions have been taken.

…and interest rates expected to remain low for some time…

Between July 2008 and April 2009 the Reserve Bank cut the Official Cash Rate (OCR) by 575 basis points from 8.25% to 2.5%. The reduction in the OCR over this period has been larger and more rapid than in any other New Zealand easing cycle and represents a larger easing in interest rates than was possible in the US or euro area. The low inflation

environment is forecast to enable interest rates to remain at low levels for some time, with 90-day interest rates expected to fall to around 2.5% and remain around this level until the second half of 2011. The reductions in interest rates help dampen the extent of the decline in economic activity and, with interest rates remaining low, will play an important role in promoting a gradual recovery in economic growth.

…contributing to a gradual recovery in GDP growth…

As world growth begins to recover in 2010 and picks up further in 2011 and beyond, exports help contribute to stronger growth in the New Zealand economy. Sentiment becomes more positive and firms step up investment levels again. Residential investment also begins to pick up as uncertainty in financial markets diminishes and population grows. While quarterly real GDP growth is expected to return to positive territory from the final quarter of the 2009 calendar year, consumers will continue to face challenging times as unemployment continues to rise over 2010. Households will continue to face an environment where credit is not as easily attainable as in recent years. In addition, the risks associated with weak savings behaviour will still be at the forefront of many households’ minds. Consumers are not expected to emerge from their current correction for around two years, with their rate of dis-saving narrowing considerably over the forecast period.

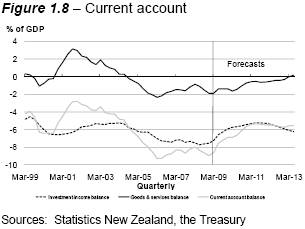

…and a narrowing of current account imbalances

The increase in investment activity is forecast to see import volumes increase over the final two years of the forecast period. However, the composition of this growth is weighted more towards capital goods than consumption goods. Overall, the forecast profile for nominal exports and imports implies a narrowing of the goods and services deficit in the current account, with a small surplus recorded by the end of the forecast period. Such a narrowing needs to be regarded in the context of unfavourable global conditions over much of the forecast period. These constrain a more rapid response to the lower exchange rate as well as having a negative impact on the terms of trade.

The investment income deficit is also expected to narrow as a percentage of GDP over the first half of the forecast period as profits of overseas-owned firms operating in New Zealand fall and interest rates on overseas debt fall below those of recent years. This contributes to the current account deficit narrowing to 5.4% of GDP by the beginning of 2011. The deficit is then expected to remain in this vicinity as the deficit on investment income begins to

widen again as profits accruing to overseas-owned firms operating in New Zealand recover and interest rates on debt also increase.

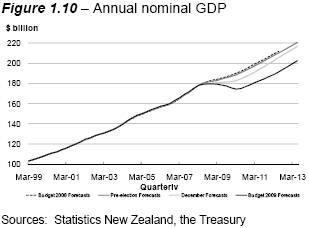

Despite recovery, the economy at the end of the forecast period is smaller than previously forecast

The widespread nature and magnitude of the current global slowdown has long-term implications for the size of the New Zealand economy. Current world economic developments appear to be of a more structural nature than just those of a typical unwinding of cyclical pressures. It is going to take some time before confidence in the financial system is fully restored. As a result there is likely to be a sustained period of more conservative behaviour on the part of investors, banks and ultimately consumers. The unwinding of imbalances, both in New Zealand and abroad, is going to require a shift in the composition of production and consumption. Accordingly, the Treasury has adjusted down its view as to the potential level of output of the economy and as a result in any particular year the level of real and nominal activity will not recover to the levels expected prior to the emergence of the crisis. This judgement is subject to considerable uncertainty.

As a result of a smaller nominal economy, changes to government policies were required to prevent debt reaching unsustainable levels…

Compared to the December Forecasts, nominal GDP is expected to be a cumulative $47 billion lower over the 2009 to 2013 March years, with the difference being largest in 2013 when nominal GDP is forecast to be $14 billion lower than in the December Forecasts. This reflects the level of real GDP in the 2013 March year being 5.4% below the December Forecasts as well as the impact of lower price levels arising from the period of economic weakness. As a result of the significantly lower tax revenue that is generated from the smaller economy, as well as rising expenses, the Government would have needed greater increases in its rate of borrowing if spending were to be maintained at the levels incorporated in the December Forecasts. As a result, the Government would face an increasing interest burden over time. Even with the recovery of growth in the later years of the forecast period, debt levels would continue to rise. The Government has taken steps to avoid a situation in which debt would reach unsustainable levels. The Government’s fiscal strategy is outlined in the Fiscal Strategy Report (FSR).

…including decreasing the size of future Budgets, temporarily suspending contributions to the New Zealand Superannuation Fund (NZS Fund) and postponing tax cuts

The Government has made a number of policy decisions in this Budget designed to maintain debt at manageable levels. These decisions include postponing its future personal income tax cuts, reducing future budget spending and suspending contributions to the NZS Fund.

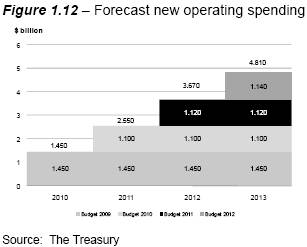

Previous Budgets included an allowance for future new spending of $1.75 billion per year. These Budget Forecasts include an operating allowance for future new spending of $1.45 billion per year in Budget 2009 and $1.1 billion per year (grown forward by 2% per year) in future Budgets, thereby reducing the rate of expenditure growth. As a result, expenditure is reduced by $5.4 billion over the forecast period as a whole.

With additions to new spending now expected to be smaller than previously outlined, government consumption will grow less rapidly than forecast in the December Forecasts. Real government consumption has consistently grown by 4% to 5% over the past five March years but is expected to slow to 1.5% by the year to March 2013. The postponement of tax cuts lowers household disposable income and therefore plays a role in constraining private consumption growth.

Since the December Forecasts the Government has also decided to temporarily suspend contributions to the NZS Fund until the Crown returns to operating surpluses sufficient to cover these contributions (currently projected to occur in the year to June 2021). A contribution of $250 million is forecast to be paid in the June 2010 year with contributions ceasing for the remainder of the forecast period. This decision reduces the Government’s cash requirements by an average of $2.3 billion a year when compared to the December Forecasts and $1.5 billion a year when compared to the contribution formula used to calculate future contributions (refer Table 1.4).

Further discussion on these policy decisions is available in the FSR.

Table 1.4 – NZS Fund contributions

Year ending 30 June | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ billion | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Contributions per fund formula | | 2.242 | | 1.466 | | 1.533 | | 1.565 | | 1.733 | |

Forecast contributions | | 2.242 | | 0.250 | | — | | — | | — | |

Reduction in contributions | | — | | 1.216 | | 1.533 | | 1.565 | | 1.733 | |

Source: The Treasury

The smaller economy generates less tax revenue…

Relative to the December Forecasts, the total reduction in core Crown tax revenue across the 2009 to 2013 June years is around $15 billion. Forecasts of all the major tax types have been reduced.

· A weaker outlook for wage rates and employment has taken about $6 billion off PAYE, offset somewhat by changes to personal income tax rates and thresholds adding about $2 billion, meaning a net fall of around $4 billion.

· A lower forecast for domestic demand has reduced the goods and services tax (GST) forecasts by nearly $4 billion.

· The profit outlook for both incorporated and unincorporated businesses is considerably lower than in the December Forecasts, which has reduced business income taxes (corporate tax and other persons tax) by around $5 billion.

· Other taxes are also down on the December Forecasts, most notably resident withholding tax on interest as a result of lower interest rates.

Table 1.5 – Movement in core Crown tax revenue

Year ending 30 June | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ billion | | Est./actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Nominal GDP | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 180.1 | | 185.5 | | 192.1 | | 201.8 | | 211.8 | | — | |

Forecast changes | | -0.1 | | -1.1 | | -1.4 | | -1.9 | | -1.6 | | — | |

Pre-election Forecasts | | 180.1 | | 184.4 | | 190.7 | | 199.9 | | 210.2 | | 220.6 | |

Forecast changes | | -1.0 | | -3.3 | | -6.2 | | -6.0 | | -4.8 | | -4.1 | |

December Forecasts | | 179.0 | | 181.1 | | 184.5 | | 193.9 | | 205.4 | | 216.5 | |

Forecast changes | | 0.2 | | -2.6 | | -9.5 | | -11.2 | | -13.9 | | -14.0 | |

Budget 2009 Forecasts | | 179.2 | | 178.5 | | 175.1 | | 182.7 | | 191.5 | | 202.5 | |

Core Crown tax revenue | | | | | | | | | | | | | |

Budget 2008 Forecasts | | 56.7 | | 56.5 | | 58.2 | | 60.3 | | 62.7 | | — | |

Forecast changes | | 0.1 | | -0.5 | | -0.8 | | -1.1 | | -0.8 | | — | |

Pre-election Forecasts | | 56.7 | | 56.1 | | 57.4 | | 59.3 | | 61.9 | | 65.1 | |

Forecast changes | | — | | -0.4 | | -2.0 | | -2.9 | | -2.7 | | -2.2 | |

Policy changes | | — | | -0.3 | | -1.1 | | -1.0 | | -0.9 | | -1.0 | |

December Forecasts | | 56.7 | | 55.4 | | 54.4 | | 55.3 | | 58.3 | | 61.9 | |

Forecast changes | | — | | -1.0 | | -2.7 | | -4.2 | | -4.4 | | -4.2 | |

Policy changes | | — | | -0.3 | | -0.1 | | 0.7 | | 0.7 | | 0.7 | |

Budget 2009 Forecasts | | 56.7 | | 54.1 | | 51.6 | | 51.8 | | 54.6 | | 58.4 | |

Composition of Budget 2009 Forecasts: | | | | | | | | | | | | | |

Source deductions | | 23.4 | | 23.0 | | 21.7 | | 21.7 | | 22.6 | | 23.9 | |

Corporate tax | | 10.4 | | 8.4 | | 8.5 | | 9.3 | | 10.3 | | 11.4 | |

GST | | 11.1 | | 11.6 | | 11.2 | | 11.3 | | 11.7 | | 12.3 | |

Other taxes | | 11.8 | | 11.1 | | 10.2 | | 9.5 | | 10.0 | | 10.8 | |

Note: Forecast changes calculated from unrounded values

Source: The Treasury

Inland Revenue tax forecasts

In line with established practice, Inland Revenue has also prepared a set of tax forecasts, which, like the Treasury’s tax forecasts, is based on the Treasury’s macroeconomic forecasts.

Table 1.6 – The Treasury and Inland Revenue core Crown tax revenue forecasts

Year ending 30

June | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ billion | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Source deductions | | | | | | | | | | | |

Treasury | | 23.0 | | 21.7 | | 21.7 | | 22.6 | | 23.9 | |

Inland Revenue | | 23.0 | | 21.7 | | 21.7 | | 22.7 | | 24.1 | |

Difference | | — | | — | | — | | (0.1 | ) | (0.2 | ) |

Net other persons tax | | | | | | | | | | | |

Treasury | | 2.9 | | 2.7 | | 2.6 | | 2.8 | | 3.0 | |

Inland Revenue | | 2.8 | | 2.7 | | 2.6 | | 2.8 | | 2.9 | |

Difference | | 0.1 | | — | | — | | — | | 0.1 | |

Corporate taxes | | | | | | | | | | | |

Treasury | | 8.4 | | 8.5 | | 9.3 | | 10.3 | | 11.4 | |

Inland Revenue | | 8.7 | | 8.7 | | 9.2 | | 10.1 | | 11.1 | |

Difference | | (0.3 | ) | (0.2 | ) | 0.1 | | 0.2 | | 0.3 | |

Goods and services tax | | | | | | | | | | | |

Treasury | | 11.6 | | 11.2 | | 11.3 | | 11.7 | | 12.3 | |

Inland Revenue | | 11.3 | | 11.2 | | 11.5 | | 11.8 | | 12.3 | |

Difference | | 0.3 | | — | | (0.2 | ) | (0.1 | ) | — | |

Other taxes | | | | | | | | | | | |

Treasury | | 8.2 | | 7.5 | | 6.9 | | 7.2 | | 7.8 | |

Inland Revenue | | 8.2 | | 7.5 | | 7.0 | | 7.0 | | 7.6 | |

Difference | | — | | — | | (0.1 | ) | 0.2 | | 0.2 | |

Total tax | | | | | | | | | | | |

Treasury | | 54.1 | | 51.6 | | 51.8 | | 54.6 | | 58.4 | |

Inland Revenue | | 54.0 | | 51.8 | | 52.0 | | 54.4 | | 58.0 | |

Difference | | 0.1 | | (0.2 | ) | (0.2 | ) | 0.2 | | 0.4 | |

Total tax (% of GDP) | | | | | | | | | | | |

Treasury | | 30.3 | | 29.5 | | 28.4 | | 28.5 | | 28.8 | |

Inland Revenue | | 30.3 | | 29.6 | | 28.5 | | 28.4 | | 28.6 | |

Difference | | — | | (0.1 | ) | (0.1 | ) | 0.1 | | 0.2 | |

Sources: The Treasury, Inland Revenue

As can be seen from the table above, the Treasury’s and Inland Revenue’s tax forecasts are similar. The largest difference occurs in the year to June 2013, when the Treasury has forecast a slightly stronger recovery in corporate taxes than has Inland Revenue.

Effect of policy changes on tax forecasts since the December Forecasts

Table 1.7 – Tax forecasting effects of tax policy changes

| | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ million | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

2009 Budget personal tax changes | | — | | 98 | | 494 | | 810 | | 836 | |

February 2009 SME package | | (294 | ) | (189 | ) | 214 | | (108 | ) | (108 | ) |

Total | | (294 | ) | (91 | ) | 708 | | 702 | | 728 | |

2009 Budget personal tax changes

The personal income tax rate and threshold changes scheduled to occur on 1 April 2010 and 1 April 2011, and the increase in the Independent Earner Tax Credit scheduled to occur on 1 April 2010, have been postponed. Table 1.7 shows only the tax effects of policy changes, incidental changes to NZS and benefit appropriations are not included in the table.

February 2009 SME package

In February, the Government announced measures to help small and medium-sized enterprises through the current economic downturn. Those measures that affected the tax forecasts included the reduction in the provisional tax uplift factor, the reduction of use-of-money interest rates and the increase in the GST registration threshold.

…and higher unemployment contributes to an increase in benefit costs

While the number of beneficiaries is forecast to increase compared to the December Forecasts, the resulting increase in benefit costs is mitigated by a decrease in the CPI forecast (meaning that CPI-linked benefits will grow at a slower rate than previously forecast).

Across the forecast period, benefit expenses are forecast to be a cumulative $2.5 billion higher than the December Forecasts.

As a result, sustained operating deficits are forecast to remain…

The operating balance before gains and losses is expected to remain in deficit throughout the forecast period, peaking at $9.6 billion in the year to June 2012. As a percentage of GDP the operating deficit peaks in the 2011 June year at 5.1%. By the end of the forecast period, tax is forecast to rise, and this, combined with the cumulative effect of smaller levels of incremental spending, sees the deficit reducing to $8.4 billion (4.2% of GDP) in the final year of the forecast.

The operating balance including gains and losses is also in deficit across the forecast period with the deficit peaking at $9.3 billion in 2009. This deficit is forecast to be smaller than the operating balance before gains and losses as Crown financial institutions such as the NZS Fund are forecasting, on average, to make gains over the forecast period.

The medium-term projections in the FSR show that the operating balance is expected to return to surplus in 2016 (and the operating balance before gains and losses in 2019).

Table 1.8 — Comparisons of the total Crown operating balance before gains and losses

Year ending 30 June | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ billion | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Budget 2008 Forecasts | | 1.3 | | 1.0 | | 0.5 | | 0.2 | | | |

Total OBEGAL change from Budget 2008 Forecasts | | (1.4 | ) | (2.7 | ) | (3.0 | ) | (3.3 | ) | | |

Pre-election Forecasts | | (0.1 | ) | (1.7 | ) | (2.5 | ) | (3.1 | ) | (3.4 | ) |

Total OBEGAL change from Pre-election Forecasts | | (0.5 | ) | (2.4 | ) | (3.5 | ) | (3.2 | ) | (2.9 | ) |

December Forecasts | | (0.6 | ) | (4.1 | ) | (6.0 | ) | (6.3 | ) | (6.3 | ) |

Economic-driven changes | | | | | | | | | | | |

Tax revenue | | (1.0 | ) | (2.6 | ) | (4.1 | ) | (4.4 | ) | (4.1 | ) |

Benefit expenses | | (0.1 | ) | (0.6 | ) | (0.7 | ) | (0.6 | ) | (0.5 | ) |

Total economic-driven changes | | (1.1 | ) | (3.2 | ) | (4.8 | ) | (5.0 | ) | (4.6 | ) |

Policy changes | | | | | | | | | | | |

Tax revenue | | (0.3 | ) | (0.1 | ) | 0.7 | | 0.7 | | 0.7 | |

Reduction in operating allowances | | — | | — | | 1.3 | | 1.7 | | 2.4 | |

Total policy changes | | (0.3 | ) | (0.1 | ) | 2.0 | | 2.4 | | 3.1 | |

Other forecast changes | | | | | | | | | | | |

Net finance costs | | (0.5 | ) | (0.2 | ) | (0.3 | ) | (0.4 | ) | (0.3 | ) |

Expense transfers | | 0.6 | | (0.6 | ) | — | | — | | — | |

Emissions Trading Scheme | | 0.2 | | 0.4 | | (0.2 | ) | (0.1 | ) | (0.8 | ) |

Top down adjustment | | (1.0 | ) | (0.1 | ) | (0.1 | ) | (0.1 | ) | — | |

Goodwill impairment | | (0.3 | ) | — | | — | | — | | — | |

Other changes | | 0.1 | | 0.2 | | 0.1 | | (0.1 | ) | 0.5 | |

Total OBEGAL change from December Forecasts | | (2.3 | ) | (3.6 | ) | (3.3 | ) | (3.3 | ) | (2.1 | ) |

Budget 2009 Forecasts | | (2.9 | ) | (7.7 | ) | (9.3 | ) | (9.6 | ) | (8.4 | ) |

Source: The Treasury

In addition to policy decisions detailed earlier, the forecasts have also been affected by the following factors (refer Table 1.8):

· Net finance costs have increased since the December Forecasts with the increase in net debt partially offset by a reduction in interest rates.

· Expense transfers (core Crown expenses which have been approved in the current financial year but, for reasons other than underspending, are deferred) of $0.6 billion have been transferred to later forecast years.

· Expenses in relation to the Emissions Trading Scheme (representing the cost of free allocation of New Zealand units) have reduced in the short term but increased overall when compared to the December Forecasts. Expenditure increases near the end of the forecast period as uptake of the scheme is forecast to rise.

· Expenditure forecasts have traditionally been reduced by way of a “top-down adjustment” to compensate for department expenditure forecasts that are traditionally too high. The 2009 top down adjustment has been reduced significantly since the December Forecasts as expense transfers and savings have reduced the risk of expenditure forecasts being too high.

· Each year the Crown assesses whether there is any indication that its assets have been impaired. As part of this assessment, valuations are currently underway with regards to goodwill on acquisitions held on the Crown’s balance sheet ($0.5 billion at 31 March 2009) and these will be completed by 30 June 2009. Given the expected life of the goodwill asset and the deteriorating economic conditions, an impairment of $0.3 billion has been forecast.

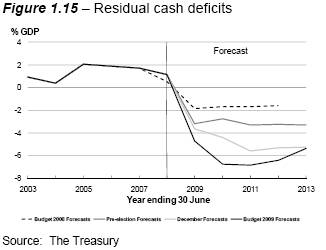

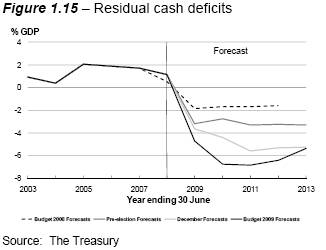

…although cash deficits begin to reduce by the end of the forecast period

Table 1.9 — Residual cash comparisons

Year ending 30 June | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ billion | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Budget 2008 Forecasts | | (3.5 | ) | (3.3 | ) | (3.4 | ) | (3.5 | ) | | |

Total residual cash change from Budget 2008 Forecasts | | (2.4 | ) | (2.0 | ) | (3.2 | ) | (3.3 | ) | | |

Pre-election Forecasts | | (5.9 | ) | (5.3 | ) | (6.6 | ) | (6.8 | ) | (7.3 | ) |

Total residual cash change from Pre-election Forecasts | | (0.7 | ) | (2.8 | ) | (4.3 | ) | (4.1 | ) | (4.1 | ) |

December Forecasts | | (6.6 | ) | (8.1 | ) | (10.9 | ) | (10.9 | ) | (11.4 | ) |

Economic-driven changes | | | | | | | | | | | |

Tax receipts | | (0.7 | ) | (3.4 | ) | (4.5 | ) | (5.1 | ) | (4.6 | ) |

Benefit expenses | | (0.2 | ) | (0.7 | ) | (0.8 | ) | (0.7 | ) | (0.5 | ) |

Total economic-driven changes | | (0.9 | ) | (4.1 | ) | (5.3 | ) | (5.8 | ) | (5.1 | ) |

Policy changes | | | | | | | | | | | |

Tax receipts | | (0.4 | ) | (0.1 | ) | 0.7 | | 0.7 | | 0.7 | |

Reduction in operating allowances | | — | | — | | 1.3 | | 1.7 | | 2.4 | |

Rephasing of capital allowance | | — | | (0.3 | ) | 0.2 | | 0.3 | | — | |

NZS Fund contribution holiday | | — | | 2.0 | | 2.3 | | 2.2 | | 2.4 | |

Total policy changes | | (0.4 | ) | 1.6 | | 4.5 | | 4.9 | | 5.5 | |

Other forecast changes | | | | | | | | | | | |

Net finance costs | | (0.4 | ) | (0.4 | ) | (0.4 | ) | (0.5 | ) | (0.4 | ) |

Expense transfers | | 0.6 | | (0.6 | ) | — | | — | | — | |

Capital transfers | | 0.1 | | (0.1 | ) | — | | — | | — | |

Top down adjustment | | (1.2 | ) | — | | — | | — | | — | |

Other changes | | 0.3 | | (0.2 | ) | (0.4 | ) | — | | 0.5 | |

Total residual cash change from December Forecasts(1) | | (1.9 | ) | (3.8 | ) | (1.6 | ) | (1.4 | ) | 0.5 | |

Budget 2009 Forecasts | | (8.5 | ) | (11.9 | ) | (12.5 | ) | (12.3 | ) | (10.9 | ) |

Note: 1 Cumulative effect of residual cash change | | (1.9 | ) | (5.7 | ) | (7.3 | ) | (8.7 | ) | (8.2 | ) |

Source: The Treasury

As with operating deficits, residual cash is expected to remain in deficit throughout the forecast period. As well as the cash impact of changes to the operating balance mentioned above, the cash deficits are reduced by the temporary suspension of the NZS Fund contributions (reducing the deficit by $8.9 billion across the forecast period when compared with the December Forecasts).

Residual cash deficits rise to $12.5 billion (6.9% of GDP) in the June 2011 year before reducing to $10.9 billion (5.4% of GDP) by the June 2013 year.

Another reason cash deficits are expected to be higher than the operating deficits is that they also include spending on capital items such as the purchase of property, plant and equipment. The forecasts include an allowance of $1.45 billion for new capital initiatives in future Budgets.

Table 1.10 demonstrates how the operating deficits flow through to the residual cash deficits.

Table 1.10 — Reconciliation of residual core Crown cash

Year ending 30 June | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ billion | | Actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Core Crown revenue | | 61.8 | | 58.9 | | 56.8 | | 57.5 | | 60.5 | | 65.0 | |

Core Crown expenses | | (57.0 | ) | (62.4 | ) | (65.3 | ) | (67.5 | ) | (70.4 | ) | (73.4 | ) |

Core Crown gains/(losses) and other items | | (0.9 | ) | (3.2 | ) | 1.4 | | 1.6 | | 1.6 | | 1.7 | |

Net surpluses/(deficits) of SOEs and CEs | | (1.5 | ) | (2.6 | ) | 1.4 | | 1.3 | | 1.2 | | 0.9 | |

Operating balance | | 2.4 | | (9.3 | ) | (5.7 | ) | (7.1 | ) | (7.1 | ) | (5.8 | ) |

Net total Crown (gains)/losses and other items | | 3.2 | | 6.4 | | (2.0 | ) | (2.2 | ) | (2.5 | ) | (2.6 | ) |

Operating balance before gains and losses (OBEGAL) | | 5.6 | | (2.9 | ) | (7.7 | ) | (9.3 | ) | (9.6 | ) | (8.4 | ) |

NZS Fund net revenue after tax | | — | | (0.4 | ) | (0.3 | ) | (0.3 | ) | (0.2 | ) | 0.1 | |

OBEGAL (excluding NZS Fund retained revenue) | | 5.6 | | (3.3 | ) | (8.0 | ) | (9.6 | ) | (9.8 | ) | (8.3 | ) |

Net retained surpluses of SOEs and CEs | | (0.8 | ) | (0.6 | ) | (0.8 | ) | (0.7 | ) | (0.3 | ) | 0.0 | |

Non-cash items and working capital movements | | 2.5 | | 2.8 | | 2.1 | | 2.2 | | 2.0 | | 1.8 | |

Net core Crown cash flow from operations | | 7.3 | | (1.1 | ) | (6.7 | ) | (8.1 | ) | (8.1 | ) | (6.5 | ) |

Contribution to NZS Fund | | (2.1 | ) | (2.2 | ) | (0.3 | ) | — | | — | | — | |

Net core Crown cash flow from operations after contributions to NZS Fund | | 5.2 | | (3.3 | ) | (7.0 | ) | (8.1 | ) | (8.1 | ) | (6.5 | ) |

Purchase of physical assets | | (1.4 | ) | (1.5 | ) | (2.3 | ) | (1.7 | ) | (1.4 | ) | (1.3 | ) |

Advances and capital injections | | (1.7 | ) | (3.6 | ) | (2.5 | ) | (2.0 | ) | (1.7 | ) | (1.6 | ) |

Forecast for future new capital spending | | — | | — | | (0.1 | ) | (0.7 | ) | (1.1 | ) | (1.5 | ) |

Core Crown residual cash | | 2.1 | | (8.4 | ) | (11.9 | ) | (12.5 | ) | (12.3 | ) | (10.9 | ) |

Source: The Treasury

The expected cash shortfall is met by increased borrowings …

Cash deficits represent the amount the Government has to fund (either by raising debt or reducing investments).

The basis for measuring both gross debt and net debt has been amended since the December Forecasts. Gross debt now excludes Reserve Bank bills used for liquidity management while the net debt measure excludes advances; for example, student loans. A full description of the change and the rationale for the change are outlined in the FSR.

As a result of the forecast cash deficits, net debt is expected to rise to $62.6 billion (30.9% of GDP) by the end of the forecast period (compared to $57.9 billion, or 26.7% of GDP, in the December Forecasts).

Gross debt is expected to increase to $78.5 billion (38.7% of GDP) by the end of the forecast period (compared to $71.6 billion, or 33.1% of GDP, in the December Forecasts).

Table 1.11 — Net debt comparisons

Year ending 30 June | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

$ billion | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Budget 2008 Forecasts | | 15.1 | | 18.3 | | 21.7 | | 25.1 | | | |

Total net debt change from Budget 2008 Forecasts | | 1.3 | | 3.4 | | 6.6 | | 9.9 | | | |

Pre-election Forecasts | | 16.4 | | 21.7 | | 28.3 | | 35.0 | | 42.2 | |

Total net debt change from Pre-election Forecasts | | 0.4 | | 3.2 | | 7.5 | | 11.7 | | 15.7 | |

December Forecasts | | 16.8 | | 24.9 | | 35.8 | | 46.7 | | 57.9 | |

Increase in residual cash deficits | | 1.9 | | 5.7 | | 7.3 | | 8.7 | | 8.2 | |

Movement in circulating currency | | (0.3 | ) | (0.3 | ) | (0.3 | ) | (0.3 | ) | (0.3 | ) |

Valuation changes to financial instruments | | (2.5 | ) | (2.6 | ) | (2.7 | ) | (2.8 | ) | (2.8 | ) |

Other | | (0.4 | ) | (0.4 | ) | (0.3 | ) | (0.4 | ) | (0.4 | ) |

Total net debt change from December Forecasts | | (1.3 | ) | 2.4 | | 4.0 | | 5.2 | | 4.7 | |

Budget 2009 Forecasts | | 15.5 | | 27.3 | | 39.8 | | 51.9 | | 62.6 | |

Source: The Treasury

Projections beyond 2013, as contained in the FSR, show that both gross debt and net debt are expected to peak in the June 2017 year and then decline.

The majority of the borrowing requirement will be met through the issuance of bonds in the New Zealand domestic market (refer Table 1.12). Issuances total $54.8 billion over the forecast period (taking the current year into account). After meeting debt maturities, net bond issuances total $36.9 billion (including net non-market issuances to the Earthquake Commission).

Table 1.12 — Net increase in domestic bonds

Year ending 30 June | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | | |

$ billion | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | | Total | |

Issue of domestic bonds (market) | | 5.8 | | 8.9 | | 11.4 | | 14.5 | | 14.2 | | 54.8 | |

Repayment of domestic bonds (market) | | (2.7 | ) | (4.2 | ) | — | | (6.0 | ) | (6.0 | ) | (18.9 | ) |

Net increase in domestic bonds (market) | | 3.1 | | 4.7 | | 11.4 | | 8.5 | | 8.2 | | 35.9 | |

Issue of domestic bonds (non-market) | | 0.6 | | 0.9 | | 0.2 | | 1.3 | | 1.5 | | 4.5 | |

Repayment of domestic bonds (non-market) | | (0.5 | ) | (0.7 | ) | — | | (1.0 | ) | (1.3 | ) | (3.5 | ) |

Net increase in domestic bonds (non-market) | | 0.1 | | 0.2 | | 0.2 | | 0.3 | | 0.2 | | 1.0 | |

Net bond issuance | | 3.2 | | 4.9 | | 11.6 | | 8.8 | | 8.4 | | 36.9 | |

Source: The Treasury

Further new funding is generated by an increase in forecast short-term borrowing, through an increase in Treasury Bills from $1.5 billion at 30 June 2008 to $9.5 billion by June 2013. Issuance in off-shore markets is also an option but any foreign currency borrowing would depend on the relative cost compared to New Zealand-dollar denominated issuance.

Alternative Scenarios

Global conditions mean that the level of uncertainty associated with any forecast made in the current environment is significantly larger than normal. This reflects the extent to which the world economy is in the most significant and synchronised downturn since World War II. In addition, policy responses to the downturn are increasingly occurring outside the realm of past experience and therefore the effectiveness and potential side-effects associated with such policy responses are yet to be fully understood.

Two alternative scenarios are presented below that consider how the economy and therefore fiscal outcomes could differ from the main forecast in the event that trading partner growth turns out to be different from that assumed in the main forecast. While the scenarios below do not represent the most likely track for the economy, the probability of such outcomes occurring should not be ignored and as such the scenarios provide an integral part of the overall information provided in the Budget Forecasts.

Upside Scenario

The upside scenario assumes higher levels of economic activity in New Zealand’s trading partners than is assumed in the main forecasts. New Zealand’s top 12 trading partners are assumed to experience a 1.8% decline in their real GDP over the 2009 calendar year followed by a 2.6% increase in 2010. This represents less of a decline and a greater recovery over 2010. As well as uncertainty associated with the outlook for the world economy over the next few years, there is also considerable uncertainty as to how the

New Zealand economy will be affected by any particular global outcome. Therefore the upside scenario could also broadly be interpreted as reflecting a view that the New Zealand economy will be less affected by a global downturn of similar magnitude to that incorporated in the main forecast.

Stronger trading partner growth contributes to greater exports…

A stronger global economy relative to the main forecast would result in increased demand for New Zealand’s exports, in particular non-commodity goods and services. This would also be reflected in higher prices for New Zealand’s exports with the outlook for the terms of trade likely to be more positive than in the main forecast, and the low point in the terms of trade assumed to be nearly 6% higher than in the main forecast.

…with higher incomes boosting domestic demand

Higher export incomes and improved sentiment abroad are assumed to translate into a reduction in risk aversion (both in New Zealand and abroad) with access to credit freeing up more rapidly than in the main forecast, and confidence increasing. As a result, consumption would contract less over the 2010 March year with annual average growth returning to around 1% in the 2011 to 2013 March years. This is significantly stronger than in the main forecasts which incorporated contractions in both the 2011 and 2012 years.

Table 1.13 — Key economic features of the upside scenario

(Annual average % change, | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

Year ending 31 March) | | Actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Real GDP components: | | | | | | | | | | | | | |

Private consumption | | 3.2 | | -0.3 | | -0.4 | | 0.9 | | 0.9 | | 1.0 | |

Residential investment | | 4.3 | | -25.2 | | -22.0 | | 13.6 | | 23.3 | | 19.9 | |

Market investment | | 4.7 | | -4.8 | | -20.7 | | 3.8 | | 17.5 | | 11.4 | |

Gross national expenditure | | 4.4 | | -1.8 | | -4.4 | | 3.1 | | 4.9 | | 4.0 | |

Exports of goods and services | | 2.9 | | -4.1 | | -1.1 | | 4.5 | | 7.0 | | 4.9 | |

Imports of goods and services | | 9.6 | | -3.4 | | -12.5 | | 3.1 | | 8.9 | | 6.8 | |

GDP (production measure) | | 3.1 | | -0.9 | | -1.2 | | 3.5 | | 4.3 | | 3.4 | |

Unemployment rate(1) | | 3.7 | | 5.0 | | 6.5 | | 5.9 | | 5.0 | | 4.6 | |

90-day bank bill rate(2) | | 8.8 | | 3.7 | | 2.7 | | 4.0 | | 5.0 | | 5.8 | |

TWI(2) | | 71.9 | | 53.7 | | 52.0 | | 53.4 | | 53.9 | | 53.8 | |

CPI(3) | | 3.4 | | 3.0 | | 2.6 | | 2.3 | | 2.2 | | 2.2 | |

Current account balance (% GDP) | | -8.0 | | -8.6 | | -5.9 | | -5.0 | | -5.1 | | -6.3 | |

Nominal GDP level (deviation from main forecast, $billion) | | 0.0 | | 0.2 | | 4.3 | | 7.5 | | 11.4 | | 11.4 | |

Notes: | | (1) | | Percentage of labour force, March quarter, seasonally adjusted |

| | (2) | | Average for March quarter |

| | (3) | | Annual percentage change, March quarter |

Sources: Statistics New Zealand, Reserve Bank of New Zealand, the Treasury

Weakness in the housing market is not as severe

While house prices would continue to decline in this scenario, the decline would not be as deep as in the main forecast, and prices would begin to recover earlier than in the main forecasts, as a result of improved confidence, in part stemming from higher employment. The upside scenario incorporates a smaller decline in house prices, with prices falling 14.7% from the peak in December 2007 whereas in the main forecasts, house prices fall 20.4%. With consumer confidence higher and weakness in the housing market easing more rapidly, growth in residential investment would be more rapid, particularly over the 2011 and 2012 March years.

A faster economic recovery sees unemployment rise less rapidly

The stronger outlook for the economy would flow through to a stronger real GDP profile than in the main economic forecasts with a smaller contraction of 1.2% in the March 2010 year, followed by growth of 3.5% and 4.3% in the 2011 and 2012 March years. This results in growth being 0.5% higher than the main forecasts in 2010 and 1.7% and 1.4% higher in 2011 and 2012 respectively. Relative to the main forecast, the level of real GDP in the March 2013 year is 2.9% higher. Higher levels of activity would see greater demand for labour relative to the main forecast, with the unemployment rate peaking at 6.6% in mid-2010.

The current account narrows sooner

Stronger demand in the New Zealand economy would flow through to greater demand for imports. Nevertheless, on balance the stronger growth in exports and the higher terms of trade would see the current account deficit narrow more rapidly owing to a faster narrowing of the goods and services balance over the next year. This would be partly offset by a larger investment income deficit as overseas-owned firms operating in New Zealand would be more profitable and a stronger global economy would also see interest rates on overseas debt higher than in the main forecast. Overall, the annual current account deficit in the upside scenario is forecast to narrow to 5.9% of GDP in March 2010 compared to 6.9% in the main forecast, before continuing to narrow to under 5% throughout the 2011 calendar year.

The higher terms of trade and reduced risk aversion result in a higher exchange rate relative to the main forecast with the TWI 3% to 5% higher over most of the forecast period. Greater demand for imports contributes to the current account deficit widening a little by the end of the forecast period to just over 6% of GDP as does the larger investment income deficit, although it should be noted that the level of net overseas liabilities as a percentage of GDP would still be lower than under the main forecast.

Higher nominal GDP flows through to greater tax revenue…

A combination of stronger real activity, a higher terms of trade and increased inflation contributes to nominal GDP being significantly higher than in the main forecasts, with nominal GDP in the final March year of the forecasts $11.4 billion higher, taking the cumulative difference over the 2009 to 2013 fiscal (June) years to $37 billion.

Higher incomes relative to the main forecast translate into higher personal and corporate income tax revenue, while the boost in domestic demand boosts GST revenue. In addition, higher interest rates cause a significant increase in tax on interest income. Altogether, core Crown tax revenue would be about $4 billion higher than in the main forecast by the end of the forecast period with a cumulative difference of around $13 billion across the 2009 to 2013 June years.

…while the impact on expenses would be influenced by offsetting forces…

Government expenses are only slightly lower than in the main forecasts. While there are fewer people on the unemployment benefit, higher inflation adjustments for benefits and the impact of higher inflation and wage growth on superannuation payments see overall welfare payments rise. This is offset by lower debt-servicing costs as a result of lower debt levels.

…resulting in lower deficits and a slower build-up of debt

The OBEGAL measure of the operating deficit under the upside scenario in the June 2010 year is estimated at $6.3 billion, declining to $3.7 billion by 2013. Smaller deficits relative to the main forecast mean that borrowings would be lower under the upside scenario. This would mean that both gross and net debt would be smaller under the upside scenario, with an estimated gross debt level of $64.7 billion or 30.3% of GDP by June 2013, with net debt totalling $48.9 billion or 22.9% of GDP.

Downside Scenario

Should the current financial crisis deteriorate further then the outlook for growth in our trading partners could be slower than that contained in the main forecasts. Further reductions in trade could result and economies dependent on trade flows, including many

Asian economies, may show much more limited responses to recent monetary and fiscal policy easing.

Slower growth in our trading partners…

In the downside scenario, our top 12 trading partners are assumed to contract 3.5% in the 2009 calendar year and 0.5% in 2010 before growing 2.5% in 2011. This contributes to a larger decline in the terms of trade relative to the main forecasts, with the trough in the terms of trade just over 6% lower than in the main forecasts.

…would constrain New Zealand’s trade

Lower demand from abroad would adversely affect New Zealand’s exports. As a result, export volumes are forecast to decline in each of the 2009, 2010 and 2011 March years, with areas such as tourism particularly affected.

Households would face further losses in income and wealth

New Zealand households would face further losses in wealth and incomes and consequently reduce their spending. With lower demand, employment levels would be lower and the unemployment rate would peak just below 10%. Higher unemployment would lead to more mortgagee sales and lower demand for houses with house prices falling further than in the main forecast. This would compound weakness in the housing market and, with a deepening in the financial crisis, credit levels would be constrained further, contributing to greater falls in residential investment.

Table 1.14 — Key economic features of the downside scenario

(Annual average % change, | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | |

Year ending 31 March) | | Actual | | Forecast | | Forecast | | Forecast | | Forecast | | Forecast | |

Real GDP components: | | | | | | | | | | | | | |

Private consumption | | 3.2 | | -0.4 | | -1.9 | | -1.8 | | -1.1 | | 1.3 | |

Residential investment | | 4.3 | | -25.3 | | -30.5 | | -4.7 | | 12.2 | | 21.5 | |

Market investment | | 4.7 | | -5.2 | | -26.0 | | 1.1 | | 19.1 | | 13.9 | |

Gross national expenditure | | 4.4 | | -1.9 | | -6.6 | | 0.3 | | 2.8 | | 3.9 | |

Exports of goods and services | | 2.9 | | -4.1 | | -2.7 | | -1.3 | | 2.2 | | 8.5 | |

Imports of goods and services | | 9.6 | | -3.4 | | -15.5 | | -2.8 | | 4.5 | | 7.1 | |

GDP (production measure) | | 3.1 | | -1.0 | | -2.8 | | 0.8 | | 2.1 | | 4.3 | |

Unemployment rate(1) | | 3.7 | | 5.0 | | 8.6 | | 9.5 | | 8.3 | | 6.7 | |

90-day bank bill rate(2) | | 8.8 | | 3.7 | | 1.5 | | 1.5 | | 2.0 | | 3.4 | |

TWI(2) | | 71.9 | | 53.7 | | 47.0 | | 45.8 | | 47.6 | | 49.7 | |

CPI(3) | | 3.4 | | 3.0 | | 1.7 | | 1.7 | | 0.6 | | 0.8 | |

Current account balance (% GDP) | | -8.0 | | -8.6 | | -7.9 | | -7.1 | | -6.5 | | -4.3 | |

Nominal GDP level (deviation from main forecast, $billion) | | 0.0 | | -0.7 | | -6.8 | | -10.5 | | -11.4 | | -10.7 | |

Notes: | | (1) | | Percentage of labour force, March quarter, seasonally adjusted |

| | (2) | | Average for March quarter |

| | (3) | | Annual percentage change, March quarter |

| | | | |

Sources: | | Statistics New Zealand, Reserve Bank of New Zealand, the Treasury |

Real GDP growth would be slower…