Exhibit 99.(d)(2)

B.11

Financial Statements

of the Government of

New Zealand

for the year ended 30 June 2009

978-0-478-33083-0 (Print)

978-0-478-33084-7 (Online)

© Crown Copyright Reserved

ISBN 978-0-478-33083-0 (Print)

ISBN 978-0-478-33084-7 (Online)

Internet

This document is available on the New Zealand Treasury’s

Internet site. The URL for this site is http://www.treasury.govt.nz

Contents

Ministerial Statement | 1 |

| |

Statement of Responsibility | 2 |

| |

Commentary | |

| |

At a glance | 3 |

Summary | 3 |

Fiscal Strategy | 5 |

Revenue | 6 |

Expenses | 9 |

Operating balance | 12 |

Debt | 15 |

Net Worth | 18 |

Historical Financial Information | 20 |

| |

Report of the Auditor General | 22 |

| |

Financial Statements | |

| |

Statement of Financial Performance | 24 |

Analysis of Expenses by Functional Classification | 25 |

Statement of Cash Flows | 26 |

Statement of Recognised Income and Expense | 29 |

Statement of Financial Position | 30 |

Statement of Segments | 31 |

Notes to the Financial Statements | 33 |

Note 1: Summary of Accounting Policies | 33 |

Note 2: Taxes and Levies Collected through the Crown’s Sovereign Power | 48 |

Note 3: Sales of Goods and Services | 50 |

Note 4: Interest Revenue and Dividends | 50 |

Note 5: Other Revenue | 51 |

Note 6: Transfer Payments and Subsidies | 51 |

Note 7: Personnel Expenses | 52 |

Note 8: Depreciation and Amortisation | 52 |

Note 9: Other Operating Expenses | 53 |

Note 10: Interest Expenses | 55 |

Note 11: Insurance Expenses | 55 |

Note 12: Gains and Losses on Financial Instruments | 56 |

Note 13: Gains and Losses on Non-Financial Instruments | 57 |

Note 14: Receivables | 58 |

Note 15: Marketable Securities, Deposits and Derivatives in Gain | 59 |

Note 16: Share Investments | 63 |

Note 17: Advances | 64 |

Note 18: Inventory | 65 |

Note 19: Other Assets | 69 |

Note 20: Property, Plant and Equipment | 69 |

Note 21: Equity Accounted Investments | 70 |

Note 22: Intangible Assets and Goodwill | 82 |

Note 23: Payables | 83 |

Note 24: Borrowings | 88 |

Note 25: Insurance Liabilities | 94 |

Note 26: Retirement Plan Liabilities | 99 |

Note 27: Provisions | 104 |

Note 28: Net Worth | 106 |

Note 29: Capital Objectives and Fiscal Policy | 107 |

Note 30: Deposit Guarantee Schemes | 111 |

Note 31: Commitments | 114 |

Note 32: Contingent Liabilities and Contingent Assets | 115 |

Note 33: Financial Instruments | 116 |

Note 34: Acquisition of Toll (NZ) Limited | 128 |

Supplementary Statements | |

Statement of Unappropriated Expenditure | 149 |

Statement of Expenses or Capital Expenditure Incurred in Emergencies | 156 |

Statement of Trust Money | 157 |

| |

Additional Financial Information | |

| |

Fiscal Indicator Analysis | 163 |

Core Crown Residual Cash | 163 |

Debt | 163 |

Information on State-owned Enterprises and Crown Entities | 166 |

Government Reporting Entity as at 30 June 2009 | 169 |

Ministerial Statement

The annual financial statements are a reminder that, while there are some promising signs that the recession is easing, there remain some significant challenges.

The international financial crisis has had a number of implications for the Crown’s fiscal position.

Tax revenue has fallen by $2 billion since last year as profits have declined and tax cuts have taken effect. At the same time, core government expenses have increased sharply, by $7 billion in the past year. This is in part due to the greater costs of providing welfare benefits and health and education services. It also reflects a recognition that future repayments of taxes and student loans will be later and, in some cases, less than originally estimated.

The value of our large investment portfolios held in the New Zealand Superannuation Fund and the Accident Compensation Corporation has declined while our borrowings and long term liabilities have increased.

The deposit guarantee schemes, a direct result of the emerging international financial crisis, were introduced to retain confidence in New Zealand’s financial sector. While these schemes have been successful in meeting that objective, they have come with some cost. To date the expected losses from entities in default have been covered by the revenue generated by the schemes. However, risk assessments carried out at 30 June estimated the likelihood of further default actions at just over $800 million, which has been provided for in these accounts. To reduce the transitional difficulties and the risk of further cost the Government has extended the retail deposit scheme to 31 December 2011.

The operating deficit, at $10.5 billion, is a large turnaround from last year’s $2.4 billion surplus. Our starting position for the 2010 financial year has net debt at 9.5% of GDP, two-thirds higher than it was a year ago.

By taking the shock on its balance sheet, the Government has helped to cushion New Zealanders from the worst of the recession. As outlined in Budget 2009, we have also put in place measures to get the deficit under control over time and keep government debt from growing to unmanageable levels. This is an appropriate balance to strike.

Hon Bill English

Minister of Finance

30 September 2009

1

Statement of Responsibility

These financial statements have been prepared by the Treasury in accordance with the provisions of the Public Finance Act 1989. The financial statements comply with New Zealand generally accepted accounting practice and with New Zealand equivalents to International Financial Reporting Standards (NZ IFRS) as appropriate for public benefit entities.

The Treasury is responsible for establishing and maintaining a system of internal control designed to provide reasonable assurance that the transactions recorded are within statutory authority and properly record the use of all public financial resources by the Crown. To the best of my knowledge, this system of internal control has operated adequately throughout the reporting period.

John Whitehead

Secretary to the Treasury

30 September 2009

I accept responsibility for the integrity of these financial statements, the information they contain and their compliance with the Public Finance Act 1989.

In my opinion, these financial statements fairly reflect the financial position of the Crown as at 30 June 2009 and its operations for the year ended on that date.

Hon Bill English

Minister of Finance

30 September 2009

2

Commentary

Introduction

These financial statements contain the audited results for the year ended 30 June 2009 in comparison to two sets of forecasts:

· the Original Budget for the year as published in the 2008 Budget Economic and Fiscal Update, and

· the Estimated Actuals forecast as published in the 2009 Budget Economic and Fiscal Update.

The financial statements of the Government of New Zealand refer to both core Crown and total Crown results. Core Crown includes Ministers, Departments, Offices of Parliament, the NZS Fund and the Reserve Bank of New Zealand but excludes state-owned enterprises (SOEs) and Crown entities (CEs). Total Crown includes the core Crown, SOEs and CEs.

This commentary should be read in conjunction with the financial statements on pages 27 to 166.

At a Glance

Table 1 — Financial results

Year ended 30 June

$million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

| | | | | | | | | | | | | | | | | |

Core Crown tax revenue | | 43,358 | | 47,468 | | 50,973 | | 53,477 | | 56,747 | | 56,523 | | 54,053 | | 54,681 | |

Core Crown expenses | | 41,882 | | 44,895 | | 49,320 | | 54,004 | | 56,997 | | 61,883 | | 62,363 | | 64,002 | |

Operating balance before gains and losses | | 5,573 | | 7,075 | | 7,091 | | 5,860 | | 5,637 | | 1,318 | | (2,916 | ) | (3,893 | ) |

Operating balance | | 7,309 | | 5,931 | | 9,542 | | 8,022 | | 2,384 | | 3,105 | | (9,303 | ) | (10,505 | ) |

Gross debt | | 36,017 | | 35,478 | | 33,903 | | 30,647 | | 31,390 | | 32,498 | | 44,217 | | 43,356 | |

Net debt | | 23,858 | | 19,879 | | 16,163 | | 13,380 | | 10,258 | | 16,375 | | 15,482 | | 17,119 | |

Total Crown net worth | | 39,595 | | 54,240 | | 83,971 | | 96,827 | | 105,514 | | 102,554 | | 95,698 | | 99,515 | |

Summary

Both the recession and past policy decisions have had a significant effect on the Crown’s fiscal position …

The recent recession has resulted in both decreases in revenue and increases in expenses. In comparison to the previous year, the major impacts are as follows:

· declining corporate and individual profits and interest rates have reduced tax revenue

· the introduction of the retail guarantee scheme in relation to financial institution deposits has resulted in an estimated cost to the Crown of $0.8 billion in the current year

· the value of the Crown’s tax receivable and student loan assets have declined as future recovery of monies is predicted to be less or later than previously estimated

· significant losses have been sustained in a number of the Crown’s investment portfolios. In particular the New Zealand Superannuation Fund (NZS Fund) reported an operating deficit of $2.8 billion for the year, and

· unemployment benefit expenses increased by $0.1 billion from $0.5 billion last year to $0.6 billion this year.

3

A number of current policies have also had an impact on the result when compared to the previous year:

· personal and corporate tax cuts, along with the introduction of measures to help small and medium-sized enterprises, have reduced tax revenue by approximately $3 billion

· additional spending announced in the 2008 Budget Economic and Fiscal Update (particularly in the areas of health and education) have contributed to an increase in expenses

· the annual inflation-indexation of welfare benefit payments, along with beneficiary growth in areas such as New Zealand superannuation, were contributing factors to an increase in social security and welfare expenses of approximately $1.4 billion (excluding unemployment benefits)

· the purchase of KiwiRail (in July 2008) resulted in a write-down of $0.3 billion, and

· the value of the Accident Compensation Corporation (ACC) claims liability increased by $5.8 billion since last year(1). A large portion of this increase resulted from the 30 June 2009 actuarial valuation (an actuarial loss of $4.5 billion was recorded). Significant factors in this actuarial loss were increases in predicted medical and rehabilitation costs along with a decrease in the discount rate used to calculate the present value of expected payments.

... however, this has been partially offset by some one-off revenue …

The decline in tax revenue was partially offset by recognition of tax revenue in relation to the tax treatment of certain structured finance transactions. Based on a High Court ruling for one structured finance case, all similar structured finance assessments have been recognised as revenue in the 2009 financial year ($1.4 billion).

… resulting in an operating deficit ...

Reduced revenue, increased expenses, and losses recorded this year have resulted in an operating deficit of $10.5 billion. This compares to a 2009 Budget forecast deficit of $9.3 billion and a surplus of $2.4 billion last year.

… and cash deficits which must be funded by an increase in debt…

The lower revenue and higher expenses have resulted in a residual cash deficit of $8.6 billion. This deficit has been funded by an increase in net debt. As a result net debt rose during the year by $6.9 billion to $17.1 billion (9.5% of GDP).

… and a reduction in the Crown’s net worth.

The operating deficit is the main contributor to a decline in net worth from $105.5 billion last year to $99.5 billion as at 30 June 2009.

(1) Actuarial valuations on large, long term liabilities such as the ACC claims liability are particularly sensitive to underlying assumptions such as discount rates and inflation rates. A small change in these assumptions could have a significant effect on the value of the liability and the operating balance. A discussion on the sensitivities of these assumptions (and the linkages between these assumptions) is included in the financial statements.

4

Fiscal Strategy

The financial statements of the Government provide a snapshot of the progress the Government has made in implementing its fiscal strategy as set out in the Fiscal Strategy Report.

Figure 1 — Financial results against the long-term fiscal objectives outlined in the 2009 Fiscal Strategy Report

5

Revenue

Table 2 — Breakdown of revenue

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Core Crown tax revenue | | 43,358 | | 47,468 | | 50,973 | | 53,477 | | 56,747 | | 56,523 | | 54,053 | | 54,681 | |

Core Crown other revenue | | 2,861 | | 3,577 | | 4,762 | | 4,734 | | 5,072 | | 5,368 | | 4,821 | | 4,801 | |

Core Crown revenue | | 46,219 | | 51,045 | | 55,735 | | 58,211 | | 61,819 | | 61,891 | | 58,874 | | 59,482 | |

Crown entities, SOE and eliminations | | 13,051 | | 14,322 | | 15,690 | | 16,378 | | 19,660 | | 18,228 | | 20,085 | | 20,446 | |

Total Crown revenue | | 59,271 | | 65,367 | | 71,425 | | 74,589 | | 81,479 | | 80,119 | | 78,959 | | 79,928 | |

% of GDP | | | | | | | | | | | | | | | | | |

Core Crown tax revenue | | 30.3 | % | 31.2 | % | 32.1 | % | 31.6 | % | 31.7 | % | 30.5 | % | 30.3 | % | 30.3 | % |

Core Crown other revenue | | 2.0 | % | 2.4 | % | 3.0 | % | 2.8 | % | 2.8 | % | 2.9 | % | 2.7 | % | 2.7 | % |

Core Crown revenue | | 32.3 | % | 33.6 | % | 35.1 | % | 34.4 | % | 34.5 | % | 33.4 | % | 33.0 | % | 33.0 | % |

Crown entities, SOE and eliminations | | 9.1 | % | 9.4 | % | 9.9 | % | 9.7 | % | 11.0 | % | 9.8 | % | 11.3 | % | 11.3 | % |

Total Crown revenue | | 41.4 | % | 43.0 | % | 45.0 | % | 44.1 | % | 45.5 | % | 43.2 | % | 44.2 | % | 44.4 | % |

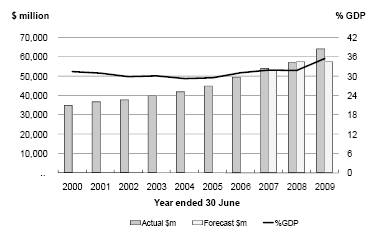

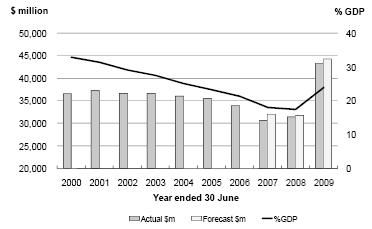

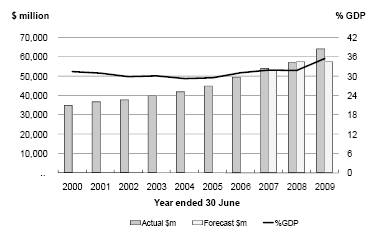

Core Crown tax revenue has declined over the year, falling by $2.1 billion to $54.7 billion. The 2009 revenue includes $1.4 billion in relation to certain structured finance transactions (refer below). Excluding these transactions the decline in underlying tax revenue was $3.5 billion.

Figure 2 — Core Crown tax revenue

Source: The Treasury

Underlying Tax Revenue

The reduction in tax revenue compared to 2008 was mostly due to:

· personal and corporate tax cuts, along with measures to help small and medium-sized enterprises, have reduced tax revenue by approximately $3 billion

· declining profits (both corporate and individual) as a result of the worsening economic climate, and

· declining interest rates (reducing the withholding tax revenue).

6

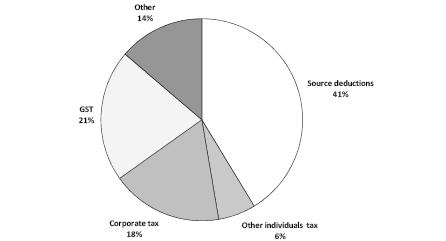

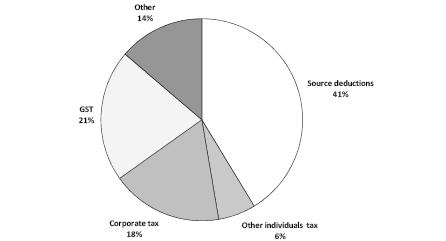

Figure 3 — 2009 core Crown tax revenue by type

Source: The Treasury

These declines were partially offset by the impact of wage growth on source deduction taxes such as PAYE.

Compared to the 2009 Budget this outcome was $0.6 billion lower than forecast with personal taxes (PAYE, other persons tax and interest withholding tax) coming in lower than expected.

7

Revenue from Structured Finance Transactions

The Crown is currently in dispute with a number of financial institutions regarding the tax treatment of certain structured finance transactions.

In July this year the High Court found in favour of the Commissioner of Inland Revenue in a case against the Bank of New Zealand. This decision was reviewed and the judgement measured against the other outstanding transactions. As a result all structured finance assessments have been recognised as revenue in the 2009 financial year (a total of $1.4 billion). However, as legal proceedings are ongoing, a contingent liability has also been disclosed for this amount.

In addition, a contingent asset of $1.2 billion has been disclosed in relation to these transactions. This contingent asset relates to use of money interest due on all structured finance transactions recognised in the current year. The interest has been calculated based on the maximum amount of tax that the taxpayers are due to pay to the Inland Revenue at 30 June 2009. However some of these taxpayers may have unallocated funds in tax pooling facilities which they could transfer to an earlier effective date. As this is at the taxpayers’ discretion, the exact amount of use of money interest is not quantifiable until all cases are resolved and taxpayers have made final payments to the Inland Revenue.

Contingent liabilities and contingent assets are excluded from the statement of financial position.

The inclusion of this revenue was not forecast in the 2009 Budget.

8

Expenses

Table 3 — Breakdown of expenses

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Social security and welfare | | 14,252 | | 14,682 | | 15,598 | | 16,768 | | 17,877 | | 18,898 | | 19,475 | | 19,382 | |

Health | | 8,111 | | 8,813 | | 9,547 | | 10,355 | | 11,297 | | 12,586 | | 12,395 | | 12,368 | |

Education | | 7,585 | | 7,930 | | 9,914 | | 9,269 | | 9,551 | | 10,524 | | 10,964 | | 11,455 | |

Core government services | | 2,091 | | 2,567 | | 2,507 | | 4,817 | | 3,371 | | 3,448 | | 3,853 | | 5,293 | |

Other core Crown expenses | | 9,843 | | 10,903 | | 11,754 | | 12,795 | | 14,901 | | 16,427 | | 15,676 | | 15,504 | |

Core Crown expenses | | 41,882 | | 44,895 | | 49,320 | | 54,004 | | 56,997 | | 61,883 | | 62,363 | | 64,002 | |

Crown entities, SOE and eliminations | | 11,816 | | 13,397 | | 15,015 | | 14,725 | | 18,845 | | 16,918 | | 19,512 | | 19,819 | |

Total Crown expenses | | 53,698 | | 58,292 | | 64,334 | | 68,729 | | 75,842 | | 78,801 | | 81,875 | | 83,821 | |

% of GDP | | | | | | | | | | | | | | | | | |

Social security and welfare | | 10.0 | % | 9.7 | % | 9.8 | % | 9.9 | % | 10.0 | % | 10.2 | % | 10.9 | % | 10.8 | % |

Health | | 5.7 | % | 5.8 | % | 6.0 | % | 6.1 | % | 6.3 | % | 6.8 | % | 6.9 | % | 6.9 | % |

Education | | 5.3 | % | 5.2 | % | 6.2 | % | 5.5 | % | 5.3 | % | 5.7 | % | 6.1 | % | 6.4 | % |

Core government services | | 1.5 | % | 1.7 | % | 1.6 | % | 2.8 | % | 1.9 | % | 1.9 | % | 2.2 | % | 2.9 | % |

Other core Crown expenses | | 6.9 | % | 7.2 | % | 7.4 | % | 7.6 | % | 8.3 | % | 8.9 | % | 8.8 | % | 8.6 | % |

Core Crown expenses | | 29.3 | % | 29.5 | % | 31.1 | % | 31.9 | % | 31.8 | % | 33.4 | % | 34.9 | % | 35.5 | % |

Crown entities, SOE and eliminations | | 8.3 | % | 8.8 | % | 9.5 | % | 8.7 | % | 10.5 | % | 9.1 | % | 10.9 | % | 11.0 | % |

Total Crown expenses | | 37.5 | % | 38.3 | % | 40.6 | % | 40.6 | % | 42.3 | % | 42.5 | % | 45.9 | % | 46.5 | % |

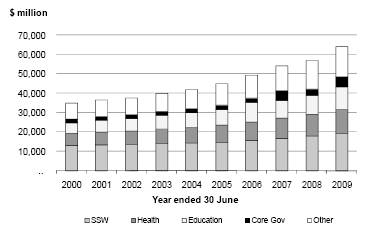

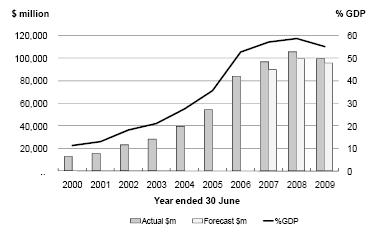

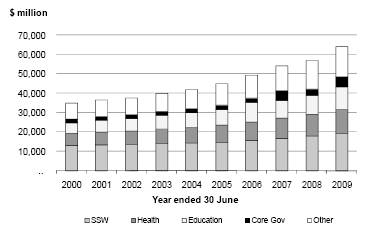

Total Crown expenses rose by $8.0 billion from the previous year. A significant component of this increase related to Core Crown expenses which increased $7.0 billion from $57.0 billion in 2008 to $64.0 billion, a 12.3% increase.

Figure 4 — Core Crown expenses

Source: The Treasury

Core Crown Expenses

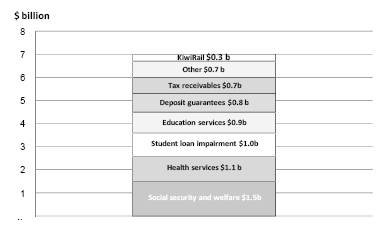

The major increases in core Crown expenses are explained below:

· Social security and welfare increased by $1.5 billion, with the annual inflation-indexation of welfare benefit payments being a major contributor to this rise. Growth in the numbers of beneficiaries, especially in the areas of unemployment benefits and New Zealand superannuation, also added to costs. Two other contributing factors were increases in Family Tax Credit rates and the impact of tax changes on New Zealand superannuation rates.

9

· Health increased by $1.1 billion with expense initiatives introduced in the 2008 Budget of $0.8 billion ($0.5 billion of which represents increased support for District Health Boards) and increased funding of the ACC non-earners account ($0.3 billion).

· Education increased by $1.9 billion with student loan impairment increasing $1.0 billion (refer below), and early childhood, primary and tertiary education services (each increasing $0.2 billion from the previous year).

· Core government services increased by $1.9 billion due to the deposit guarantee scheme provisioning (refer below) and tax receivables impairment (refer below).

· Other core Crown expenses increased by $0.6 billion and included a write-down of Kiwirail ($0.3 billion).

Compared to the 2009 Budget, core Crown expenses were $1.6 billion higher than forecast. The main contributors were the deposit guarantee scheme ($0.8 billion) and student loan and tax receivables impairments ($1.3 billion), offset by goodwill impairment which was forecast in the 2009 Budget but did not eventuate ($0.3 billion).

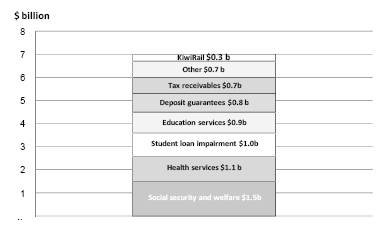

Figure 5 — Core Crown expenses by sector

Source: The Treasury

Deposit Guarantee Scheme

During the financial year the Government initiated the retail deposit scheme and the wholesale funding guarantee funding facility. The retail scheme is the most extensive, with 73 institutions and $124.2 billion of deposits guaranteed.

Figure 6 — Core Crown expense increase (2008 to 2009)

Source: The Treasury

10

The Crown regularly assesses the risk that any of these entities will default and the likely loss to the Crown. At 30 June 2009 the estimated cost to the Crown of these guarantees was $0.8 billion (including two entities already in default) and this has been included as an expense in the statement of financial performance.

In late August 2009 the Minister of Finance announced an extension to the retail deposit scheme. This decision has the potential to reduce future costs.

While this fiscal risk was highlighted in the 2009 Budget the expense was not included in the forecast as the likelihood of default was not considered probable at that time.

Asset Impairment

At the end of each financial year the assets of the Crown are tested to ensure the amount expected to be recovered (by future cash inflows) from the asset (referred to as the “recoverable amount”) is higher than the amount recorded in the statement of financial position (referred to as the “carrying value”). Where the recoverable amount is less than this carrying value the asset is impaired. Significant impairments have been recorded against both student loans and tax receivables this year ($0.8 billion and $1.7 billion respectively). These impairments are $1.8 billion higher than the previous year and $1.3 billion higher than forecast in the 2009 Budget.

These asset impairments are indications that the future cash inflows are predicted to be less or later than previously estimated. The value of student loans decreased because of a reduction in such things as forecast salary and employment levels as well as an increase in the number of students living overseas (and therefore not required to make repayments).

In the case of tax receivables, increases in the amount of overdue debt and lower than expected repayments have resulted in a write-down at 30 June 2009.

11

Operating Balance

Table 4 — Total Crown operating balance

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Total Crown Operating balance before gains and losses | | 5,573 | | 7,075 | | 7,091 | | 5,860 | | 5,637 | | 1,318 | | (2,916 | ) | (3,893 | ) |

Total Crown gains/(losses) | | 1,736 | | (1,144 | ) | 2,451 | | 2,162 | | (3,253 | ) | 1,787 | | (6,387 | ) | (6,612 | ) |

Total Crown Operating balance | | 7,309 | | 5,931 | | 9,542 | | 8,022 | | 2,384 | | 3,105 | | (9,303 | ) | (10,505 | ) |

% of GDP | | | | | | | | | | | | | | | | | |

Total Crown Operating balance before gains and losses | | 3.9 | % | 4.7 | % | 4.5 | % | 3.5 | % | 3.1 | % | 0.7 | % | -1.6 | % | -2.2 | % |

Total Crown gains/(losses) | | 1.2 | % | -0.8 | % | 1.5 | % | 1.3 | % | -1.8 | % | 1.0 | % | -3.6 | % | -3.7 | % |

Total Crown Operating balance | | 5.1 | % | 3.9 | % | 6.0 | % | 4.7 | % | 1.3 | % | 1.7 | % | -5.2 | % | -5.8 | % |

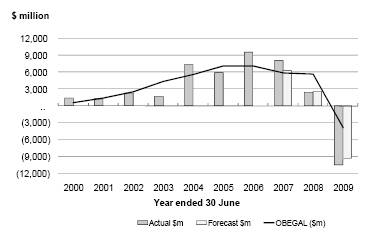

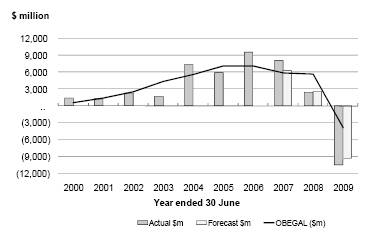

This year’s operating deficit of $10.5 billion is the largest deficit ever recorded by the Crown and compares to an operating surplus of $2.4 billion last year.

The operating balance before gains and losses declined by $9.5 billion compared to the previous year due to decreases in revenue and increases in expenses (as discussed earlier).

Total Crown losses totalled $6.6 billion this year, an increase of $3.3 billion from the previous year. These losses included an ACC actuarial loss of $4.5 billion and NZS Fund investment losses of $3.5 billion. These losses were offset by a gain on the net Kyoto position of $0.8 billion and gains on other financial instruments. These are discussed below in more detail.

Figure 7 — Operating balance

Source: The Treasury

Compared to the 2009 Budget, the operating deficit was $1.2 billion larger than forecast.The main contributors were higher than forecast expenses (deposit guarantee scheme, asset impairments) and actuarial loss on ACC, which were partially offset by higher than forecast revenue, investment gains since the 2009 Budget (NZS Fund and ACC) and a lower than expected actuarial loss on GSF (due to an improvement in asset performance and a decrease in the discount rate used to calculate the present value of the obligation).

12

Table 5 — Gains and losses

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

ACC actuarial gain/(loss) | | 309 | | (1,432 | ) | (706 | ) | (481 | ) | (1,709 | ) | — | | (2,095 | ) | (4,491 | ) |

GSF actuarial gain/(loss) | | 904 | | (851 | ) | 206 | | 1,133 | | (1,098 | ) | — | | (2,262 | ) | (695 | ) |

Kyoto net position | | — | | — | | (303 | ) | 20 | | (226 | ) | — | | 786 | | 768 | |

Investment portfolios: | | | | | | | | | | | | | | | | | |

NZS Fund | | 146 | | 557 | | 1,130 | | 1,313 | | (995 | ) | 1,068 | | (4,582 | ) | (3,495 | ) |

ACC | | 246 | | 439 | | 681 | | 419 | | (543 | ) | 257 | | (601 | ) | (181 | ) |

Earthquake Commission | | 146 | | 125 | | 504 | | (84 | ) | (166 | ) | 101 | | (282 | ) | (349 | ) |

Other gains/(losses) | | (15 | ) | 18 | | 939 | | (158 | ) | 1,484 | | 361 | | 2,649 | | 1,831 | |

| | 1,736 | | (1,144 | ) | 2,451 | | 2,162 | | (3,253 | ) | 1,787 | | (6,387 | ) | (6,612 | ) |

13

ACC Actuarial Loss

Each year ACC estimates the present value of expenditure commitments that exist in respect of claims notified and accepted in the current and previous years (but not fully met at balance date), and claims incurred but not notified, or accepted by ACC at balance date. The value of these future commitments is recognised in the statement of financial position as an insurance liability and is independently valued by an actuary each year.

The result of the current year’s valuation was an increase in the obligation by $4.5 billion ($2.4 billion higher than forecast). Significant factors in this increase were increases in predicted medical and rehabilitation costs along with a decrease in the discount rate used to calculate the present value of expected payments.

Actuarial valuations on large, long term liabilities such as the ACC claims liability are particularly sensitive to underlying assumptions such as discount rates and inflation rates. A small change in these assumptions could have a significant effect on the value of the liability and the operating balance. A discussion on the sensitivities of these assumptions (and the linkages between these assumptions) is included in the financial statements.

NZS Fund

The NZS Fund recorded an operating deficit of $2.8 billion, including net losses of $3.5 billion, for the year. The investment return for the year was -22.14% (compared to -4.92% last year). The majority of these losses were recorded in the first part of the financial year, while the Fund reported an investment return of 10.89% in the final three months of the year.

Since inception the Fund has returned 3.85% (annualised).

Table 6 — NZS Fund results

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Opening net worth | | 1,884 | | 3,956 | | 6,555 | | 9,855 | | 12,973 | | 14,461 | | 14,212 | | 14,212 | |

Revenue | | 131 | | 191 | | 359 | | 436 | | 385 | | 427 | | 399 | | 383 | |

Current tax expense | | (77 | ) | (234 | ) | (468 | ) | (707 | ) | (237 | ) | (323 | ) | 83 | | (4 | ) |

Inter-entity expenses | | — | | — | | — | | 171 | | 63 | | (14 | ) | 943 | | 400 | |

Other expenses | | (7 | ) | (22 | ) | (52 | ) | (119 | ) | (97 | ) | (140 | ) | (103 | ) | (77 | ) |

Gains/(losses) | | 146 | | 557 | | 1,130 | | 1,313 | | (995 | ) | 1,068 | | (4,582 | ) | (3,495 | ) |

Operating balance | | 193 | | 492 | | 969 | | 1,094 | | (881 | ) | 1,018 | | (3,260 | ) | (2,793 | ) |

Gross contribution from the Crown | | 1,879 | | 2,107 | | 2,337 | | 2,048 | | 2,104 | | 2,242 | | 2,242 | | 2,243 | |

Other movements in reserves | | — | | — | | (6 | ) | (24 | ) | 16 | | — | | 81 | | 26 | |

Closing net worth | | 3,956 | | 6,555 | | 9,855 | | 12,973 | | 14,212 | | 17,721 | | 13,275 | | 13,688 | |

Net Kyoto Position

The Government has committed (under the Kyoto Protocol) to ensuring that New Zealand’s average net emissions of greenhouse gases between 2008 and 2012 are reduced to 1990 levels. The net position at any point in time represents the Crown’s deficit (or surplus) emissions compared to those 1990 levels. At 30 June 2009, the Crown had surplus units with lower than expected emissions from the agricultural sector and planted forests removing more carbon dioxide per hectare than previously assumed. This surplus compares to a deficit in units last year. When converted at current carbon prices, the move to surplus units this year resulted in a gain of $0.8 billion.

14

Debt

Table 7 — Net debt(2) and Gross debt(3)

Year ended 30 June | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Net debt ($m) | | 23,858 | | 19,879 | | 16,163 | | 13,380 | | 10,258 | | 16,375 | | 15,482 | | 17,119 | |

Net debt (% GDP) | | 16.7 | % | 13.1 | % | 10.2 | % | 7.9 | % | 5.7 | % | 8.8 | % | 8.7 | % | 9.5 | % |

Gross debt ($m) | | 36,017 | | 35,478 | | 33,903 | | 30,647 | | 31,390 | | 32,498 | | 44,217 | | 43,356 | |

Gross debt (% GDP) | | 25.2 | % | 23.3 | % | 21.4 | % | 18.1 | % | 17.5 | % | 17.5 | % | 24.8 | % | 24.1 | % |

Net Debt

Net debt increases as a result of cash deficits and declines as a result of cash surpluses. In addition it will also fluctuate in line with valuation movements in the underlying financial assets and liabilities of the Crown and movements in the amounts of currency issued to New Zealand banks.

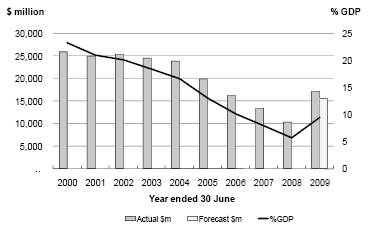

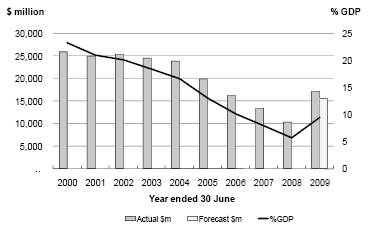

Figure 8 — Net debt

Source: The Treasury

The $6.9 billion increase in net debt compared to 2008 is primarily due to the residual cash deficit of $8.6 billion recorded this year (refer table 8).

Net core Crown cash from operations reduced by $9.3 billion dollars from last year resulting in a net operating cash deficit of $2.0 billion. This decrease represents the cash impact of reducing tax revenues and increasing core Crown expenses discussed previously.

(2) Net debt is defined as core Crown net debt excluding the NZS Fund and advances.

(3) Gross debt is defined as gross sovereign-issued debt excluding Reserve Bank settlement cash and Reserve Bank bills.

15

Table 8 — Movement in net debt

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Opening net debt | | 24,531 | | 23,858 | | 19,879 | | 16,163 | | 13,380 | | 12,985 | | 10,258 | | 10,258 | |

Net core Crown cash flow from operations | | (5,443 | ) | (8,560 | ) | (8,859 | ) | (8,586 | ) | (7,292 | ) | (2,551 | ) | 1,141 | | 1,967 | |

Contributions to NZS Fund | | 1,879 | | 2,107 | | 2,337 | | 2,048 | | 2,104 | | 2,242 | | 2,242 | | 2,243 | |

Purchase of physical assets | | 1,299 | | 1,372 | | 1,826 | | 1,755 | | 1,433 | | 1,802 | | 1,503 | | 1,625 | |

Advances and capital injections | | 1,745 | | 1,977 | | 1,711 | | 1,990 | | 1,698 | | 1,985 | | 3,572 | | 2,804 | |

Core Crown residual cash (surplus)/deficit | | (520 | ) | (3,104 | ) | (2,985 | ) | (2,793 | ) | (2,057 | ) | 3,478 | | 8,458 | | 8,639 | |

Movements in circulating currency | | (114 | ) | (188 | ) | (165 | ) | (81 | ) | (86 | ) | (181 | ) | (509 | ) | (475 | ) |

Other valuation changes in financial assets and financial liabilities | | (39 | ) | (687 | ) | (566 | ) | 91 | | (979 | ) | 93 | | (2,725 | ) | (1,303 | ) |

Closing net debt | | 23,858 | | 19,879 | | 16,163 | | 13,380 | | 10,258 | | 16,375 | | 15,482 | | 17,119 | |

In addition to a decline in operating cash flows, capital payments (contribution to NZS Fund, purchase of physical assets, advances and capital injections) totalled $6.6 billion, which is a $1.4 billion increase from the previous year.This increase includes $0.7 billion paid for KiwiRail in July 2008.

Figure 9 — Application of core Crown residual cash for the year ended 30 June 2009 ($ billion)

Compared to the 2009 Budget, net debt is $1.6 billion higher than forecast. While residual cash was in line with expectations, valuation changes to financial assets and financial liabilities (primarily due to movements in the exchange rates) increased net debt by $1.4 billion.

16

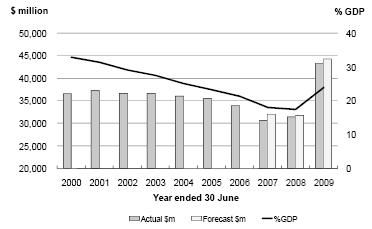

Gross Debt

Gross debt increased by $12.0 billion since last year. Net domestic bond issuances accounted for $3.1 billion of this increase (refer table 9). In addition, the New Zealand Debt Management Office increased their short term borrowing by $6.0 billion by issuing Treasury Bills.

Figure 10 — Gross debt

Source: The Treasury

While the amount of gross debt ($43.4 billion) is the highest since 1995, as a percentage of GDP (24.1%) it remains below 2004 levels.

Compared to the 2009 Budget, the increase in gross debt was slightly lower than forecast ($0.9 billion) as the market value of domestic bonds and derivative liabilities were lower than expected.

Table 9 — Net bond issuance

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Domestic bonds (market) | | 2,212 | | 2,146 | | 2,375 | | 2,294 | | 1,757 | | 3,314 | | 5,852 | | 5,775 | |

Repayment of domestic bonds (market) | | (3,044 | ) | (2,797 | ) | (2,574 | ) | (2,777 | ) | — | | (2,700 | ) | (2,700 | ) | (2,750 | ) |

Net increase/(decrease) in market domestic bonds | | (832 | ) | (651 | ) | (199 | ) | (483 | ) | 1,757 | | 614 | | 3,152 | | 3,025 | |

Domestic bonds (non-market) | | 478 | | 459 | | 740 | | 570 | | 130 | | 662 | | 593 | | 541 | |

Repayment of domestic bonds (non-market) | | (357 | ) | (338 | ) | (375 | ) | (421 | ) | — | | (451 | ) | (515 | ) | (515 | ) |

Net increase/(decrease) in non-market domestic bonds | | 121 | | 121 | | 365 | | 149 | | 130 | | 211 | | 78 | | 26 | |

Net total bond issuance/(repayment) | | (711 | ) | (530 | ) | 166 | | (334 | ) | 1,887 | | 825 | | 3,230 | | 3,051 | |

17

Net Worth

Table 10 — Movement in net worth

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Opening net worth | | 28,012 | | 39,595 | | 54,240 | | 83,971 | | 96,827 | | 99,383 | | 105,514 | | 105,514 | |

Operating balance | | 7,309 | | 5,931 | | 9,542 | | 8,022 | | 2,384 | | 3,105 | | (9,303 | ) | (10,505 | ) |

Property, plant and equipment revaluations | | 4,213 | | 8,197 | | 20,199 | | 5,232 | | 6,214 | | — | | (707 | ) | 4,235 | |

Other movements in reserves | | 61 | | 518 | | (10 | ) | (398 | ) | 89 | | 66 | | 194 | | 271 | |

Closing net worth | | 39,595 | | 54,240 | | 83,971 | | 96,827 | | 105,514 | | 102,554 | | 95,698 | | 99,515 | |

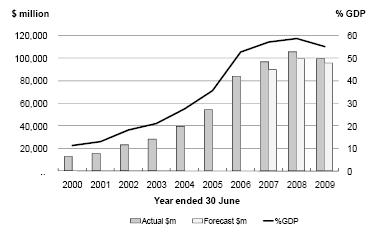

Figure 11 — Net worth

Source: The Treasury

For the first time since 1999, the net worth of the Crown has declined. A small decrease had been forecast in last year’s Budget but the deepening financial crisis led to further calls on the Crown’s finances. Declining tax revenue, combined with higher expenses and losses on financial investments required the Government to increase borrowings by $15.8 billion (34%) as outlined in table 11.

Other liabilities grew by $6.5 billion, primarily due to the increase in the ACC claims liability which increased by $5.8 billion from last year. A large portion of this increase was the result of the year-end valuation which increased the liability by $4.5 billion, discussed earlier in this commentary.

While total liabilities were increasing, total assets also grew during the year by $16.3 billion (8.1%). This growth includes purchases of property, plant and equipment, and increases in financial assets (mainly Kiwibank mortgages and marketable securities) as well as the purchase of KiwiRail.

The increasing size and diversity of the Crown’s balance sheet, particularly the levels of financial assets and liabilities (refer table 11), have increased the Crown’s exposure to financial risk. The level and types of financial risks and the risk management policies are set out in note 33 of these financial statements. The Crown’s exposure to financial risk also arises from sources that are not represented by assets or liabilities in the statement of financial position. This exposure includes the volatility in tax revenue arising from volatility in taxpayers’ incomes and volatility in interest rates. It also includes contingencies, such as the $124 billion of retail deposits and $6 billion of wholesale bank securities, discussed above and in more detail in note 30 of these financial statements.

18

Table 11 — Composition of the statement of financial position

Year ended 30 June

$ million | | Actual

2004 | | Actual

2005 | | Actual

2006 | | Actual

2007 | | Actual

2008 | | Forecast

Original

Budget | | Forecast

Est

Actuals | | Actual

2009 | |

Property, plant and equipment | | 57,940 | | 67,494 | | 89,141 | | 95,598 | | 103,329 | | 101,276 | | 106,498 | | 110,135 | |

Financial assets | | 32,654 | | 42,005 | | 66,396 | | 73,718 | | 85,063 | | 84,860 | | 99,522 | | 93,359 | |

Other assets | | 18,756 | | 19,714 | | 9,503 | | 11,031 | | 12,443 | | 13,517 | | 13,104 | | 13,657 | |

Total assets | | 109,351 | | 129,212 | | 165,040 | | 180,347 | | 200,835 | | 199,653 | | 219,124 | | 217,151 | |

Borrowings | | 37,720 | | 37,728 | | 40,027 | | 41,898 | | 46,110 | | 48,656 | | 69,156 | | 61,953 | |

Other liabilities | | 32,036 | | 37,243 | | 41,042 | | 41,622 | | 49,211 | | 48,443 | | 54,270 | | 55,683 | |

Total liabilities | | 69,756 | | 74,972 | | 81,069 | | 83,520 | | 95,321 | | 97,099 | | 123,426 | | 117,636 | |

Net worth | | 39,595 | | 54,240 | | 83,971 | | 96,827 | | 105,514 | | 102,554 | | 95,698 | | 99,515 | |

19

Historical Financial Information

Year ended 30 June

$ million | | 2000

Actual | | 2001

Actual | | 2002

Actual | | 2003

Actual | | 2004

Actual | | 2005

Actual | | 2006

Actual | | 2007

Actual | | 2008

Actual | | 2009

Actual | |

Statement of financial performance | | | | | | | | | | | | | | | | | | | | | |

Core Crown tax revenue | | 32,598 | | 35,345 | | 36,809 | | 40,518 | | 43,358 | | 47,468 | | 50,973 | | 53,477 | | 56,747 | | 54,681 | |

Core Crown other revenue | | 2,348 | | 2,497 | | 3,136 | | 2,922 | | 2,861 | | 3,577 | | 4,762 | | 4,734 | | 5,072 | | 4,801 | |

Core Crown revenue | | 34,946 | | 37,842 | | 39,945 | | 43,440 | | 46,219 | | 51,045 | | 55,735 | | 58,211 | | 61,819 | | 59,482 | |

Crown entities, SOE revenue and eliminations | | 6,666 | | 7,259 | | 10,003 | | 13,170 | | 13,051 | | 14,322 | | 15,690 | | 16,378 | | 19,660 | | 20,446 | |

Total Crown revenue | | 41,612 | | 45,101 | | 49,948 | | 56,611 | | 59,271 | | 65,367 | | 71,425 | | 74,589 | | 81,479 | | 79,928 | |

Social security and welfare | | 12,883 | | 13,207 | | 13,485 | | 13,907 | | 14,252 | | 14,682 | | 15,598 | | 16,768 | | 17,877 | | 19,382 | |

Health | | 6,146 | | 6,660 | | 7,032 | | 7,501 | | 8,111 | | 8,813 | | 9,547 | | 10,355 | | 11,297 | | 12,368 | |

Education | | 5,712 | | 6,136 | | 6,473 | | 7,016 | | 7,585 | | 7,930 | | 9,914 | | 9,269 | | 9,551 | | 11,455 | |

Core government services | | 1,992 | | 2,148 | | 1,890 | | 2,130 | | 2,091 | | 2,567 | | 2,507 | | 4,817 | | 3,371 | | 5,293 | |

Other core Crown expenses | | 8,096 | | 8,408 | | 8,633 | | 9,343 | | 9,843 | | 10,903 | | 11,754 | | 12,795 | | 14,901 | | 15,504 | |

Core Crown expenses | | 34,829 | | 36,559 | | 37,513 | | 39,897 | | 41,882 | | 44,895 | | 49,320 | | 54,004 | | 56,997 | | 64,002 | |

Crown entities, SOE expenses and eliminations | | 6,189 | | 7,120 | | 9,964 | | 12,347 | | 11,816 | | 13,397 | | 15,015 | | 14,725 | | 18,845 | | 19,819 | |

Total Crown expenses | | 41,018 | | 43,679 | | 47,476 | | 52,245 | | 53,698 | | 58,292 | | 64,334 | | 68,729 | | 75,842 | | 83,821 | |

OBEGAL | | 594 | | 1,422 | | 2,471 | | 4,366 | | 5,573 | | 7,075 | | 7,091 | | 5,860 | | 5,637 | | (3,893 | ) |

Gains/(losses) | | 811 | | (214 | ) | (185 | ) | (2,745 | ) | 1,736 | | (1,144 | ) | 2,451 | | 2,162 | | (3,253 | ) | (6,612 | ) |

Operating balance | | 1,405 | | 1,208 | | 2,286 | | 1,621 | | 7,309 | | 5,931 | | 9,542 | | 8,022 | | 2,384 | | (10,505 | ) |

Statement of financial position | | | | | | | | | | | | | | | | | | | | | |

Property, plant and equipment | | 43,609 | | 45,954 | | 50,536 | | 52,667 | | 57,940 | | 67,494 | | 89,141 | | 95,598 | | 103,329 | | 110,135 | |

Financial assets | | 18,756 | | 21,419 | | 22,497 | | 27,799 | | 32,654 | | 42,005 | | 66,396 | | 73,718 | | 85,063 | | 93,359 | |

Other assets | | 11,459 | | 11,467 | | 14,846 | | 18,461 | | 18,756 | | 19,714 | | 9,503 | | 11,031 | | 12,443 | | 13,657 | |

Total assets | | 73,824 | | 78,840 | | 87,879 | | 98,927 | | 109,351 | | 129,212 | | 165,040 | | 180,347 | | 200,835 | | 217,151 | |

Borrowings | | 37,527 | | 38,130 | | 38,492 | | 39,327 | | 37,720 | | 37,728 | | 40,027 | | 41,898 | | 46,110 | | 61,953 | |

Other liabilities | | 23,692 | | 25,260 | | 26,562 | | 31,588 | | 32,036 | | 37,243 | | 41,042 | | 41,622 | | 49,211 | | 55,683 | |

Total liabilities | | 61,219 | | 63,390 | | 65,055 | | 70,915 | | 69,756 | | 74,972 | | 81,069 | | 83,520 | | 95,321 | | 117,636 | |

Net worth | | 12,605 | | 15,450 | | 22,825 | | 28,012 | | 39,595 | | 54,240 | | 83,971 | | 96,827 | | 105,514 | | 99,515 | |

Fiscal Indicators | | | | | | | | | | | | | | | | | | | | | |

Core Crown tax revenue | | 32,598 | | 35,345 | | 36,809 | | 40,518 | | 43,358 | | 47,468 | | 50,973 | | 53,477 | | 56,747 | | 54,681 | |

Core Crown expenses | | 34,829 | | 36,559 | | 37,513 | | 39,897 | | 41,882 | | 44,895 | | 49,320 | | 54,004 | | 56,997 | | 64,002 | |

Operating balance before gains and losses | | 594 | | 1,422 | | 2,471 | | 4,366 | | 5,573 | | 7,075 | | 7,091 | | 5,860 | | 5,637 | | (3,893 | ) |

Operating balance | | 1,405 | | 1,208 | | 2,286 | | 1,621 | | 7,309 | | 5,931 | | 9,542 | | 8,022 | | 2,384 | | (10,505 | ) |

Net debt | | 25,895 | | 24,908 | | 25,388 | | 24,531 | | 23,858 | | 19,879 | | 16,163 | | 13,380 | | 10,258 | | 17,119 | |

Gross debt | | 36,580 | | 37,194 | | 36,650 | | 36,617 | | 36,017 | | 35,478 | | 33,903 | | 30,647 | | 31,390 | | 43,356 | |

Net worth | | 12,605 | | 15,450 | | 22,825 | | 28,012 | | 39,595 | | 54,240 | | 83,971 | | 96,827 | | 105,514 | | 99,515 | |

20

Historical Financial Information (continued)

Year ended 30 June

as % of GDP | | 2000

Actual | | 2001

Actual | | 2002

Actual | | 2003

Actual | | 2004

Actual | | 2005

Actual | | 2006

Actual | | 2007

Actual | | 2008

Actual | | 2009

Actual | |

GDP | | 111,044 | | 118,360 | | 125,818 | | 132,754 | | 143,167 | | 152,014 | | 158,629 | | 169,135 | | 179,227 | | 180,210 | |

Statement of financial performance | | | | | | | | | | | | | | | | | | | | | |

Core Crown tax revenue | | 29.4 | % | 29.9 | % | 29.3 | % | 30.5 | % | 30.3 | % | 31.2 | % | 32.1 | % | 31.6 | % | 31.7 | % | 30.3 | % |

Core Crown other revenue | | 2.1 | % | 2.1 | % | 2.5 | % | 2.2 | % | 2.0 | % | 2.4 | % | 3.0 | % | 2.8 | % | 2.8 | % | 2.7 | % |

Core Crown revenue | | 31.5 | % | 32.0 | % | 31.7 | % | 32.7 | % | 32.3 | % | 33.6 | % | 35.1 | % | 34.4 | % | 34.5 | % | 33.0 | % |

Crown entities, SOE and elimination revenue | | 6.0 | % | 6.1 | % | 8.0 | % | 9.9 | % | 9.1 | % | 9.4 | % | 9.9 | % | 9.7 | % | 11.0 | % | 11.3 | % |

Total Crown revenue | | 37.5 | % | 38.1 | % | 39.7 | % | 42.6 | % | 41.4 | % | 43.0 | % | 45.0 | % | 44.1 | % | 45.5 | % | 44.4 | % |

Social security and welfare | | 11.6 | % | 11.2 | % | 10.7 | % | 10.5 | % | 10.0 | % | 9.7 | % | 9.8 | % | 9.9 | % | 10.0 | % | 10.8 | % |

Health | | 5.5 | % | 5.6 | % | 5.6 | % | 5.7 | % | 5.7 | % | 5.8 | % | 6.0 | % | 6.1 | % | 6.3 | % | 6.9 | % |

Education | | 5.1 | % | 5.2 | % | 5.1 | % | 5.3 | % | 5.3 | % | 5.2 | % | 6.2 | % | 5.5 | % | 5.3 | % | 6.4 | % |

Core government services | | 1.8 | % | 1.8 | % | 1.5 | % | 1.6 | % | 1.5 | % | 1.7 | % | 1.6 | % | 2.8 | % | 1.9 | % | 2.9 | % |

Other core Crown expenses | | 7.3 | % | 7.1 | % | 6.9 | % | 7.0 | % | 6.9 | % | 7.2 | % | 7.4 | % | 7.6 | % | 8.3 | % | 8.6 | % |

Core Crown expenses | | 31.4 | % | 30.9 | % | 29.8 | % | 30.1 | % | 29.3 | % | 29.5 | % | 31.1 | % | 31.9 | % | 31.8 | % | 35.5 | % |

Crown entities, SOE and elimination expenses | | 5.6 | % | 6.0 | % | 7.9 | % | 9.3 | % | 8.3 | % | 8.8 | % | 9.5 | % | 8.7 | % | 10.5 | % | 11.0 | % |

Total Crown expenses | | 36.9 | % | 36.9 | % | 37.7 | % | 39.4 | % | 37.5 | % | 38.3 | % | 40.6 | % | 40.6 | % | 42.3 | % | 46.5 | % |

OBEGAL | | 0.5 | % | 1.2 | % | 2.0 | % | 3.3 | % | 3.9 | % | 4.7 | % | 4.5 | % | 3.5 | % | 3.1 | % | -2.2 | % |

Gains/(losses) | | 0.7 | % | -0.2 | % | -0.1 | % | -2.1 | % | 1.2 | % | -0.8 | % | 1.5 | % | 1.3 | % | -1.8 | % | -3.7 | % |

Operating balance | | 1.3 | % | 1.0 | % | 1.8 | % | 1.2 | % | 5.1 | % | 3.9 | % | 6.0 | % | 4.7 | % | 1.3 | % | -5.8 | % |

Statement of financial position | | | | | | | | | | | | | | | | | | | | | |

Property, plant and equipment | | 39.3 | % | 38.8 | % | 40.2 | % | 39.7 | % | 40.5 | % | 44.4 | % | 56.2 | % | 56.5 | % | 57.7 | % | 61.1 | % |

Financial assets | | 16.9 | % | 18.1 | % | 17.9 | % | 20.9 | % | 22.8 | % | 27.6 | % | 41.9 | % | 43.6 | % | 47.5 | % | 51.8 | % |

Other assets | | 10.3 | % | 9.7 | % | 11.8 | % | 13.9 | % | 13.1 | % | 13.0 | % | 6.0 | % | 6.5 | % | 6.9 | % | 7.6 | % |

Total assets | | 66.5 | % | 66.6 | % | 69.8 | % | 74.5 | % | 76.4 | % | 85.0 | % | 104.0 | % | 106.6 | % | 112.1 | % | 120.5 | % |

Borrowings | | 33.8 | % | 32.2 | % | 30.6 | % | 29.6 | % | 26.3 | % | 24.8 | % | 25.2 | % | 24.8 | % | 25.7 | % | 34.4 | % |

Other liabilities | | 21.3 | % | 21.3 | % | 21.1 | % | 23.8 | % | 22.4 | % | 24.5 | % | 25.9 | % | 24.6 | % | 27.5 | % | 30.9 | % |

Total liabilities | | 55.1 | % | 53.6 | % | 51.7 | % | 53.4 | % | 48.7 | % | 49.3 | % | 51.1 | % | 49.4 | % | 53.2 | % | 65.3 | % |

Net worth | | 11.4 | % | 13.1 | % | 18.1 | % | 21.1 | % | 27.7 | % | 35.7 | % | 52.9 | % | 57.2 | % | 58.9 | % | 55.2 | % |

Fiscal Indicators | | | | | | | | | | | | | | | | | | | | | |

Core Crown revenue (excl NZS Fund) | | 29.4 | % | 29.9 | % | 29.3 | % | 30.5 | % | 30.3 | % | 31.2 | % | 32.1 | % | 31.6 | % | 31.7 | % | 30.3 | % |

Core Crown expenses | | 31.4 | % | 30.9 | % | 29.8 | % | 30.1 | % | 29.3 | % | 29.5 | % | 31.1 | % | 31.9 | % | 31.8 | % | 35.5 | % |

Operating balance before gains and losses | | 0.5 | % | 1.2 | % | 2.0 | % | 3.3 | % | 3.9 | % | 4.7 | % | 4.5 | % | 3.5 | % | 3.1 | % | -2.2 | % |

Operating balance | | 1.3 | % | 1.0 | % | 1.8 | % | 1.2 | % | 5.1 | % | 3.9 | % | 6.0 | % | 4.7 | % | 1.3 | % | -5.8 | % |

Net debt | | 23.3 | % | 21.0 | % | 20.2 | % | 18.5 | % | 16.7 | % | 13.1 | % | 10.2 | % | 7.9 | % | 5.7 | % | 9.5 | % |

Gross debt | | 32.9 | % | 31.4 | % | 29.1 | % | 27.6 | % | 25.2 | % | 23.3 | % | 21.4 | % | 18.1 | % | 17.5 | % | 24.1 | % |

Net worth | | 11.4 | % | 13.1 | % | 18.1 | % | 21.1 | % | 27.7 | % | 35.7 | % | 52.9 | % | 57.2 | % | 58.9 | % | 55.2 | % |

21

Report of the Auditor-General

To the Readers of the Financial Statements of the Government of New Zealand for the year ended 30 June 2009

I have audited the financial statements of the Government of New Zealand for the year ended 30 June 2009, using my staff, resources and appointed auditors and their staff.

Unqualified Opinion

In our opinion, the financial statements of the Government of New Zealand on pages 27 to 166:

· comply with generally accepted accounting practice in New Zealand; and

· fairly reflect:

· the Government of New Zealand’s financial position as at 30 June 2009; and

· the results of its operations and cash flows for the year ended on that date;

The audit was completed on 30 September 2009, and is the date at which our opinion is expressed.

The basis of our opinion is explained below. In addition, we outline the responsibilities of the Government and the Auditor, and explain our independence.

Basis of Opinion

We carried out the audit in accordance with the Auditor-General’s Auditing Standards, which incorporate the New Zealand Auditing Standards.

We planned and performed the audit to obtain all the information and explanations we considered necessary in order to obtain reasonable assurance that the financial statements did not have material misstatements, whether caused by fraud or error.

Material misstatements are differences or omissions of amounts and disclosures that would affect a reader’s overall understanding of the financial statements. If we had found material misstatements that were not corrected, we would have referred to them in our opinion.

The audit involved performing procedures to test the information presented in the financial statements. We assessed the results of those procedures in forming our opinion.

Audit procedures generally include:

· determining whether significant financial and management controls are working and can be relied on to produce complete and accurate data;

· verifying samples of transactions and account balances;

· performing analyses to identify anomalies in the reported data;

· reviewing significant estimates and judgements made;

· confirming year-end balances;

· determining whether accounting policies are appropriate and consistently applied; and

22

· determining whether all financial statement disclosures are adequate.

We did not examine every transaction, nor do we guarantee complete accuracy of the financial statements.

We evaluated the overall adequacy of the presentation of information in the financial statements. We obtained all the information and explanations we required to support our opinion above.

Responsibilities of the Government and the Auditor

The Treasury is responsible for preparing financial statements for the Government in accordance with generally accepted accounting practice in New Zealand. Those financial statements must fairly reflect the financial position of the Government as at 30 June 2009. They must also fairly reflect the results of its operations and cash flows for the year ended on that date. The Minister of Finance is responsible for forming an opinion that those financial statements fairly reflect the financial position and operations of the Government for that year.The responsibilities of the Treasury and the Minister of Finance arise from the Public Finance Act 1989.

We are responsible for expressing an independent opinion on the financial statements and reporting that opinion to you. This responsibility arises from section 15 of the Public Audit Act 2001 and section 30 of the Public Finance Act 1989.

Independence

The Auditor-General and the Deputy Auditor-General, as Officers of Parliament, are constitutionally and operationally independent of the Government. Other than in exercising functions and powers under the Public Audit Act 2001 as the auditor of public entities, and in carrying out:

· a review of the Financial Statements of the Government for compliance with International Public Sector Accounting Standards; and

· a review of the processes, criteria, and rules used to determine the content of forecast financial statements under section 26Q of the Public Finance Act 1989,

the Auditor-General and the Deputy Auditor-General have no relationship with or interest in the Government.

Phillippa Smith

Deputy Controller and Auditor-General

Wellington

New Zealand

23

Audited Financial Statements

Statement of Financial Performance

for the year ended 30 June 2009

Forecast | | | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | Note | | 30 June

2009

$m | | 30 June

2008

$m | |

| | | | Revenue | | | | | | | |

55,911 | | 53,523 | | Taxation revenue | | 2 | | 54,145 | | 56,372 | |

4,037 | | 4,114 | | Other sovereign revenue | | 2 | | 4,118 | | 3,879 | |

59,948 | | 57,637 | | Total revenue levied through the Crown’s sovereign power | | | | 58,263 | | 60,251 | |

14,222 | | 15,248 | | Sales of goods and services | | 3 | | 15,356 | | 15,399 | |

3,358 | | 2,999 | | Interest revenue and dividends | | 4 | | 3,419 | | 3,214 | |

2,591 | | 3,075 | | Other revenue | | 5 | | 2,890 | | 2,615 | |

20,171 | | 21,322 | | Total revenue earned through operations | | | | 21,665 | | 21,228 | |

80,119 | | 78,959 | | Total revenue (excluding gains) | | | | 79,928 | | 81,479 | |

| | | | Expenses | | | | | | | |

19,681 | | 20,182 | | Transfer payments and subsidies | | 6 | | 19,962 | | 18,374 | |

17,061 | | 18,031 | | Personnel expenses | | 7 | | 18,064 | | 16,478 | |

3,950 | | 4,283 | | Depreciation and amortisation | | 8 | | 4,305 | | 3,670 | |

32,053 | | 32,605 | | Other operating expenses | | 9 | | 34,116 | | 30,656 | |

2,503 | | 3,358 | | Interest expenses | | 10 | | 3,492 | | 3,101 | |

3,799 | | 3,916 | | Insurance expenses | | 11 | | 3,882 | | 3,563 | |

249 | | — | | Forecast new operating spending | | | | — | | — | |

(495 | ) | (500 | ) | Top-down expense adjustment | | | | — | | — | |

78,801 | | 81,875 | | Total expenses (excluding losses) | | | | 83,821 | | 75,842 | |

1,318 | | (2,916 | ) | Operating balance before gains/(losses) | | | | (3,893 | ) | 5,637 | |

1,424 | | (3,266 | ) | Net gains/(losses) on financial instruments | | 12 | | (2,634 | ) | (617 | ) |

170 | | (3,450 | ) | Net gains/(losses) on non-financial instruments | | 13 | | (4,167 | ) | (2,925 | ) |

1,594 | | (6,716 | ) | Total gains/(losses) | | | | (6,801 | ) | (3,542 | ) |

193 | | 333 | | Net surplus from associates and joint ventures | | | | 212 | | 334 | |

3,105 | | (9,299 | ) | Operating balance from continuing activities | | | | (10,482 | ) | 2,429 | |

— | | (4 | ) | Gain/(loss) from discontinued operations | | | | 2 | | 22 | |

3,105 | | (9,303 | ) | Operating balance (including minority interest) | | | | (10,480 | ) | 2,451 | |

— | | — | | Operating balance attributable to minority interest in Air New Zealand | | | | (25 | ) | (67 | ) |

3,105 | | (9,303 | ) | Operating balance | | | | (10,505 | ) | 2,384 | |

The accompanying Notes and Accounting Policies are an integral part of these Statements.

24

Analysis of Expenses by Functional Classification

for the year ended 30 June 2009

Forecast | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | 30 June

2009

$m | | 30 June

2008

$m | |

| | | | Total Crown expenses | | | | | |

22,843 | | 23,409 | | Social security and welfare | | 23,273 | | 21,509 | |

652 | | 680 | | GSF pension expenses | | 655 | | 690 | |

12,024 | | 11,947 | | Health | | 12,042 | | 10,809 | |

11,017 | | 11,844 | | Education | | 12,465 | | 10,397 | |

3,412 | | 3,813 | | Core government services | | 5,137 | | 3,274 | |

3,341 | | 3,358 | | Law and order | | 3,250 | | 3,082 | |

1,697 | | 1,687 | | Defence | | 1,712 | | 1,525 | |

8,027 | | 9,349 | | Transport and communications | | 9,023 | | 7,424 | |

7,918 | | 8,055 | | Economic and industrial services | | 7,695 | | 9,038 | |

1,364 | | 1,437 | | Primary services | | 1,487 | | 1,459 | |

3,130 | | 2,414 | | Heritage, culture and recreation | | 2,397 | | 2,337 | |

1,036 | | 904 | | Housing and community development | | 1,075 | | 938 | |

83 | | 120 | | Other | | 118 | | 259 | |

2,503 | | 3,358 | | Finance costs | | 3,492 | | 3,101 | |

249 | | — | | Forecast new operating spending | | — | | — | |

(495 | ) | (500 | ) | Top-down expense adjustment | | — | | — | |

78,801 | | 81,875 | | Total Crown expenses excluding losses | | 83,821 | | 75,842 | |

Below is an analysis of core Crown expenses by functional classification. Core Crown expenses include expenses incurred by Ministers, Departments, Offices of Parliament, the NZS Fund and the Reserve Bank, but not Crown entities and State-owned enterprises.

Forecast | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | 30 June

2009

$m | | 30 June

2008

$m | |

| | | | Core Crown expenses | | | | | |

18,898 | | 19,475 | | Social security and welfare | | 19,382 | | 17,877 | |

652 | | 680 | | GSF pension expenses | | 655 | | 690 | |

12,586 | | 12,395 | | Health | | 12,368 | | 11,297 | |

10,524 | | 10,964 | | Education | | 11,455 | | 9,551 | |

3,448 | | 3,853 | | Core government services | | 5,293 | | 3,371 | |

3,101 | | 3,116 | | Law and order | | 3,089 | | 2,894 | |

1,741 | | 1,735 | | Defence | | 1,757 | | 1,562 | |

2,823 | | 2,954 | | Transport and communications | | 2,663 | | 2,244 | |

3,244 | | 3,145 | | Economic and industrial services | | 2,960 | | 2,889 | |

520 | | 545 | | Primary services | | 534 | | 541 | |

1,769 | | 1,062 | | Heritage, culture and recreation | | 1,002 | | 1,107 | |

334 | | 312 | | Housing and community development | | 297 | | 260 | |

83 | | 120 | | Other | | 118 | | 254 | |

2,406 | | 2,507 | | Finance costs | | 2,429 | | 2,460 | |

249 | | — | | Forecast new operating spending | | — | | — | |

(495 | ) | (500 | ) | Top-down expense adjustment | | — | | — | |

61,883 | | 62,363 | | Total core Crown expenses excluding losses | | 64,002 | | 56,997 | |

The accompanying Notes and Accounting Policies are an integral part of these Statements.

25

Statement of Cash Flows

for the year ended 30 June 2009

Forecast | | | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | Note | | 30 June

2009

$m | | 30 June

2008

$m | |

| | | | Cash Flows From Operations | | | | | | | |

| | | | Cash was provided from | | | | | | | |

54,681 | | 52,266 | | Taxation receipts | | 2 | | 51,119 | | 55,168 | |

3,675 | | 3,733 | | Other sovereign receipts | | 2 | | 3,716 | | 3,460 | |

14,596 | | 16,458 | | Sales of goods and services | | | | 16,592 | | 14,635 | |

2,807 | | 2,731 | | Interest and dividend receipts | | | | 2,792 | | 3,111 | |

2,527 | | 2,707 | | Other operating receipts | | | | 2,204 | | 2,211 | |

78,286 | | 77,895 | | Total cash provided from operations | | | | 76,423 | | 78,585 | |

| | | | Cash was disbursed to | | | | | | | |

19,123 | | 19,863 | | Transfer payments and subsidies | | | | 19,673 | | 18,026 | |

49,961 | | 52,281 | | Personnel and operating payments | | | | 50,391 | | 45,972 | |

2,284 | | 2,907 | | Interest payments | | | | 2,880 | | 2,820 | |

249 | | — | | Forecast new operating spending | | | | — | | — | |

(355 | ) | (400 | ) | Top-down expense adjustment | | | | — | | — | |

71,262 | | 74,651 | | Total cash disbursed to operations | | | | 72,944 | | 66,818 | |

7,024 | | 3,244 | | Net cash flows from operations | | | | 3,479 | | 11,767 | |

| | | | Cash Flows From Investing Activities | | | | | | | |

| | | | Cash was provided from | | | | | | | |

509 | | 521 | | Sale of physical assets | | | | 765 | | 401 | |

27,508 | | 29,106 | | Sale of shares and other securities | | | | 38,602 | | 26,208 | |

8 | | 18 | | Sale of intangible assets | | | | — | | 26 | |

2,560 | | 2,490 | | Repayment of advances | | | | 3,709 | | 1,173 | |

23 | | 30 | | Sale of investments in associates | | | | 2 | | 109 | |

30,608 | | 32,165 | | Total cash provided from investing activities | | | | 43,078 | | 27,917 | |

| | | | Cash was disbursed to | | | | | | | |

7,092 | | 6,627 | | Purchase of physical assets | | | | 6,202 | | 5,323 | |

28,084 | | 36,094 | | Purchase of shares and other securities | | | | 40,250 | | 32,288 | |

332 | | 409 | | Purchase of intangible assets | | | | 433 | | 346 | |

3,150 | | 3,503 | | Issue of advances | | | | 4,838 | | 3,819 | |

— | | 690 | | Acquisition of Toll (NZ) Limited | | 34 | | 690 | | — | |

253 | | 343 | | Acquisition of investments in associates | | | | 401 | | 472 | |

261 | | — | | Capital contingency provision | | | | — | | — | |

(350 | ) | (275 | ) | Top-down capital adjustment | | | | — | | — | |

38,822 | | 47,391 | | Total cash disbursed to investing activities | | | | 52,814 | | 42,248 | |

(8,214 | ) | (15,226 | ) | Net cash flows from investing activities | | | | (9,736 | ) | (14,331 | ) |

(1,190 | ) | (11,982 | ) | Net cash flows from operating and investing activities | | | | (6,257 | ) | (2,564 | ) |

The accompanying Notes and Accounting Policies are an integral part of these Statements.

26

Statement of Cash Flows (continued)

for the year ended 30 June 2009

Forecast | | | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | | | 30 June

2009

$m | | 30 June

2008

$m | |

(1,190 | ) | (11,982 | ) | Net cash flows from operating and investing activities | | | | (6,257 | ) | (2,564 | ) |

| | | | Cash Flows From Financing Activities | | | | | | | |

| | | | Cash was provided from | | | | | | | |

181 | | 509 | | Issues of circulating currency | | | | 475 | | 86 | |

4,318 | | 5,951 | | Issue of Government stock and treasury bills(1) | | | | 6,109 | | 2,769 | |

242 | | 857 | | Issue of foreign currency borrowings | | | | 2,448 | | 1,278 | |

1,081 | | 17,131 | | Issue of other New Zealand dollar borrowings | | | | 10,772 | | 2,147 | |

5,822 | | 24,448 | | Total cash provided from financing activities | | | | 19,804 | | 6,280 | |

| | | | Cash was disbursed to | | | | | | | |

3,083 | | 3,500 | | Repayment of Government stock and treasury bills(1) | | | | 3,765 | | 1,095 | |

541 | | 6,493 | | Repayment of foreign currency borrowings | | | | 4,284 | | 179 | |

(174 | ) | 1,055 | | Repayment of other New Zealand dollar borrowings | | | | 3,003 | | 2,819 | |

— | | — | | Dividends paid to minority interests | | | | 17 | | 25 | |

3,450 | | 11,048 | | Total cash disbursed to financing activities | | | | 11,069 | | 4,118 | |

2,372 | | 13,400 | | Net cash flows from financing activities | | | | 8,735 | | 2,162 | |

1,182 | | 1,418 | | Net movement in cash | | | | 2,478 | | (402 | ) |

5,217 | | 3,804 | | Opening cash balance | | | | 3,804 | | 4,162 | |

13 | | 131 | | Foreign-exchange gains/(losses) on opening cash | | | | (14 | ) | 44 | |

6,412 | | 5,353 | | Closing cash balance | | | | 6,268 | | 3,804 | |

(1) Net issues of Government stock and treasury bills is after elimination of holdings by entities such as NZS Fund, ACC and EQC. Further information on the proceeds and repayments of Government stock (“domestic bonds”) is available on page 170.

The accompanying Notes and Accounting Policies are an integral part of these Statements.

27

Statement of Cash Flows (continued)

for the year ended 30 June 2009

Forecast | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | 30 June

2009

$m | | 30 June

2008

$m | |

| | | | Reconciliation Between the Net Cash Flows from Operations and the Operating Balance | | | | | |

7,024 | | 3,244 | | Net Cash Flows from Operations | | 3,479 | | 11,767 | |

| | | | Items included in the operating balance but not in net cash flows from operations | | | | | |

| | | | Gains/(losses) | | | | | |

1,424 | | (3,266 | ) | Net gains/(losses) on financial instruments | | (2,634 | ) | (617 | ) |

170 | | (3,450 | ) | Net gains/(losses) on non-financial instruments | | (4,167 | ) | (2,925 | ) |

1,594 | | (6,716 | ) | Total gains/(losses) | | (6,801 | ) | (3,542 | ) |

| | | | Other Non-cash Items in Operating Balance | | | | | |

(3,950 | ) | (4,283 | ) | Depreciation and amortisation | | (4,305 | ) | (3,670 | ) |

(667 | ) | (718 | ) | Write-down on initial recognition of financial assets | | (630 | ) | (559 | ) |

1 | | 15 | | Impairment on financial assets (excl receivables) | | (851 | ) | 213 | |

(75 | ) | (39 | ) | Decrease/(increase) in defined benefit retirement plan liabilities | | (41 | ) | 2 | |

(1,313 | ) | (1,557 | ) | Decrease/(increase) in insurance liabilities | | (1,592 | ) | (1,358 | ) |

193 | | 333 | | Other | | 212 | | 334 | |

(5,811 | ) | (6,249 | ) | Total other non-cash Items | | (7,207 | ) | (5,038 | ) |

| | | | Movements in Working Capital | | | | | |

422 | | (371 | ) | Increase/(decrease) in receivables | | 461 | | 2,100 | |

333 | | (182 | ) | Increase/(decrease) in accrued interest | | 16 | | (179 | ) |

63 | | 134 | | Increase/(decrease) in inventories | | 118 | | 138 | |

13 | | (8 | ) | Increase/(decrease) in prepayments | | 31 | | 77 | |

(18 | ) | 74 | | Decrease/(increase) in deferred revenue | | (134 | ) | (326 | ) |

(515 | ) | 771 | | Decrease/(increase) in payables | | (468 | ) | (2,613 | ) |

298 | | 418 | | Total movements in working capital | | 24 | | (803 | ) |

3,105 | | (9,303 | ) | Operating balance | | (10,505 | ) | 2,384 | |

The accompanying Notes and Accounting Policies are an integral part of these Statements.

28

Statement of Recognised Income and Expense

for the year ended 30 June 2009

Forecast | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | 30 June

2009

$m | | 30 June

2008

$m | |

3,105 | | (9,303 | ) | Operating balance (including minority interest) | | (10,480 | ) | 2,451 | |

— | | (707 | ) | Revaluation of physical assets | | 4,087 | | 5,896 | |

— | | — | | Share of associates revaluation of physical assets | | 148 | | 318 | |

58 | | 4 | | Effective portion of changes in the fair value of cash flow hedges | | 333 | | 9 | |

— | | (1 | ) | Net change in fair value of cash flow hedges transferred to operating profit | | — | | 22 | |

— | | 65 | | Net change in fair value of cash flow hedges transferred to the hedged item | | (153 | ) | (60 | ) |

— | | 76 | | Foreign currency translation differences for foreign operations | | 15 | | 17 | |

6 | | 49 | | Valuation gain/(losses) on investments available for sale taken to reserves | | 22 | | 11 | |

2 | | 1 | | Other movements | | — | | — | |

66 | | (513 | ) | Total income/(expense) recognised directly in net worth | | 4,452 | | 6,213 | |

3,171 | | (9,816 | ) | Total recognised income and expense | | (6,028 | ) | 8,664 | |

| | | | Attributable to: | | | | | |

— | | — | | - minority interest in Air New Zealand | | 34 | | 83 | |

3,171 | | (9,816 | ) | - the Crown | | (6,062 | ) | 8,581 | |

3,171 | | (9,816 | ) | Total recognised income and expense | | (6,028 | ) | 8,664 | |

Note 28 details the allocation of income and expense items recognised in net worth to taxpayer funds and to each reserve.

The accompanying Notes and Accounting Policies are an integral part of these Statements.

29

Statement of Financial Position

as at 30 June 2009

Forecast | | | | | | Actual | |

Original

Budget

$m | | Estimated

Actuals

$m | | | | Note | | 30 June

2009

$m | | 30 June

2008

$m | |

| | | | Assets | | | | | | | |

6,412 | | 5,353 | | Cash and cash equivalents | | | | 6,268 | | 3,804 | |

12,749 | | 13,787 | | Receivables | | 14 | | 14,619 | | 14,158 | |

35,277 | | 54,676 | | Marketable securities, deposits and derivatives in gain | | 15 | | 45,708 | | 41,189 | |

13,446 | | 10,347 | | Share investments | | 16 | | 11,160 | | 12,964 | |

16,722 | | 15,042 | | Advances | | 17 | | 15,604 | | 12,948 | |

997 | | 1,099 | | Inventory | | 18 | | 1,082 | | 964 | |

1,561 | | 1,864 | | Other assets | | 19 | | 1,630 | | 1,663 | |

101,276 | | 106,498 | | Property, plant & equipment | | 20 | | 110,135 | | 103,329 | |

8,683 | | 8,805 | | Equity accounted investments | | 21 | | 8,777 | | 8,065 | |

1,929 | | 1,928 | | Intangible assets and goodwill | | 22 | | 2,168 | | 1,751 | |

951 | | — | | Forecast for new capital spending | | | | — | | — | |

(350 | ) | (275 | ) | Top-down capital adjustment | | | | — | | — | |

199,653 | | 219,124 | | Total assets | | | | 217,151 | | 200,835 | |

| | | | Liabilities | | | | | | | |

3,885 | | 4,039 | | Issued currency | | | | 4,005 | | 3,530 | |

8,497 | | 9,949 | | Payables | | 23 | | 9,139 | | 10,895 | |

1,064 | | 1,218 | | Deferred revenue | | | | 1,426 | | 1,292 | |

48,656 | | 69,156 | | Borrowings | | 24 | | 61,953 | | 46,110 | |

22,065 | | 24,136 | | Insurance liabilities | | 25 | | 26,567 | | 20,484 | |

8,221 | | 10,557 | | Retirement plan liabilities | | 26 | | 8,993 | | 8,257 | |

4,711 | | 4,371 | | Provisions | | 27 | | 5,553 | | 4,753 | |

97,099 | | 123,426 | | Total liabilities | | | | 117,636 | | 95,321 | |

102,554 | | 95,698 | | Total assets less total liabilities | | | | 99,515 | | 105,514 | |

| | | | Net Worth | | | | | | | |

49,886 | | 37,534 | | Taxpayer funds | | | | 36,382 | | 46,700 | |

52,486 | | 57,723 | | Property, plant and equipment revaluation reserve | | | | 62,612 | | 58,566 | |

(114 | ) | 59 | | Other reserves | | | | 74 | | (134 | ) |

102,258 | | 95,316 | | Total net worth attributable to the Crown | | | | 99,068 | | 105,132 | |

296 | | 382 | | Net worth attributable to minority interest in Air New Zealand | | | | 447 | | 382 | |

102,554 | | 95,698 | | Total net worth | | 28 | | 99,515 | | 105,514 | |

The accompanying Notes and Accounting Policies are an integral part of these Statements.

30

Statement of Segments

| | | | | | Current Year Actual vs Estimated Actual | |

| | Core Crown | | Crown Entities | | State-owned

enterprises | | Inter-segment

eliminations | | Total Crown | |

| | Actual

2009

$m | | Estimated

Actual

2009

$m | | Actual

2009

$m | | Estimated

Actual

2009

$m | | Actual

2009

$m | | Estimated

Actual

2009

$m | | Actual

2009

$m | | Estimated

Actual

2009

$m | | Actual

2009

$m | | Estimated

Actual

2009

$m | |

Revenue | | | | | | | | | | | | | | | | | | | | | |

Taxation revenue | | 54,681 | | 54,053 | | — | | — | | — | | — | | (536 | ) | (530 | ) | 54,145 | | 53,523 | |

Other sovereign revenue | | 808 | | 779 | | 4,417 | | 4,433 | | — | | — | | (1,107 | ) | (1,098 | ) | 4,118 | | 4,114 | |

Revenue from core Crown funding | | — | | — | | 21,847 | | 21,491 | | — | | — | | (21,847 | ) | (21,491 | ) | — | | — | |

Sales of goods and services | | 1,237 | | 1,266 | | 2,268 | | 1,749 | | 12,592 | | 13,066 | | (741 | ) | (833 | ) | 15,356 | | 15,248 | |

Interest revenue and dividends | | 1,872 | | 1,897 | | 1,248 | | 1,329 | | 1,193 | | 739 | | (894 | ) | (966 | ) | 3,419 | | 2,999 | |

Other revenue | | 884 | | 879 | | 1,549 | | 1,637 | | 1,117 | | 1,165 | | (660 | ) | (606 | ) | 2,890 | | 3,075 | |

Total Revenue (excluding gains) | | 59,482 | | 58,874 | | 31,329 | | 30,639 | | 14,902 | | 14,970 | | (25,785 | ) | (25,524 | ) | 79,928 | | 78,959 | |

Expenses | | | | | | | | | | | | | | | | | | | | | |

Transfer payments and subsidies | | 20,244 | | 20,463 | | — | | — | | — | | — | | (282 | ) | (281 | ) | 19,962 | | 20,182 | |

Personnel expenses | | 6,037 | | 6,102 | | 9,592 | | 9,513 | | 2,447 | | 2,419 | | (12 | ) | (3 | ) | 18,064 | | 18,031 | |

Other operating expenses | | 35,292 | | 33,791 | | 21,184 | | 20,368 | | 10,201 | | 10,712 | | (24,374 | ) | (24,067 | ) | 42,303 | | 40,804 | |

Interest expenses | | 2,429 | | 2,507 | | 185 | | 248 | | 1,392 | | 1,185 | | (514 | ) | (582 | ) | 3,492 | | 3,358 | |

Forecast new operating spending and top down adjustment | | — | | (500 | ) | — | | — | | — | | — | | — | | — | | — | | (500 | ) |

Total Expenses (excluding losses) | | 64,002 | | 62,363 | | 30,961 | | 30,129 | | 14,040 | | 14,316 | | (25,182 | ) | (24,933 | ) | 83,821 | | 81,875 | |

Operating Balance before gains/(losses) | | (4,520 | ) | (3,489 | ) | 368 | | 510 | | 862 | | 654 | | (603 | ) | (591 | ) | (3,893 | ) | (2,916 | ) |

Gains/(losses) | | (1,342 | ) | (3,255 | ) | (5,095 | ) | (2,878 | ) | 49 | | 11 | | (224 | ) | (265 | ) | (6,612 | ) | (6,387 | ) |

Operating Balance | | (5,862 | ) | (6,744 | ) | (4,727 | ) | (2,368 | ) | 911 | | 665 | | (827 | ) | (856 | ) | (10,505 | ) | (9,303 | ) |

Assets | | | | | | | | | | | | | | | | | | | | | |

Financial assets | | 65,613 | | 72,947 | | 25,323 | | 24,327 | | 14,702 | | 13,992 | | (12,279 | ) | (12,061 | ) | 93,359 | | 99,205 | |

Property, plant and equipment | | 30,487 | | 29,094 | | 46,553 | | 44,157 | | 33,095 | | 33,246 | | — | | 1 | | 110,135 | | 106,498 | |

Investments in associates, CEs and SOEs | | 27,536 | | 27,462 | | 7,468 | | 7,464 | | 257 | | 334 | | (26,484 | ) | (26,455 | ) | 8,777 | | 8,805 | |

Other assets | | 2,565 | | 2,584 | | 731 | | 761 | | 1,607 | | 1,577 | | (23 | ) | (31 | ) | 4,880 | | 4,891 | |

Forecast adjustments | | — | | (275 | ) | — | | — | | — | | — | | — | | — | | — | | (275 | ) |

Total Assets | | 126,201 | | 131,812 | | 80,075 | | 76,709 | | 49,661 | | 49,149 | | (38,786 | ) | (38,546 | ) | 217,151 | | 219,124 | |

Liabilities | | | | | | | | | | | | | | | | | | | | | |

Borrowings | | 49,889 | | 57,131 | | 4,939 | | 5,172 | | 16,963 | | 16,976 | | (9,838 | ) | (10,123 | ) | 61,953 | | 69,156 | |

Other liabilities | | 23,242 | | 24,076 | | 32,358 | | 29,204 | | 6,239 | | 6,368 | | (6,156 | ) | (5,378 | ) | 55,683 | | 54,270 | |

Total Liabilities | | 73,131 | | 81,207 | | 37,297 | | 34,376 | | 23,202 | | 23,344 | | (15,994 | ) | (15,501 | ) | 117,636 | | 123,426 | |

Net Worth | | 53,070 | | 50,605 | | 42,778 | | 42,333 | | 26,459 | | 25,805 | | (22,792 | ) | (23,045 | ) | 99,515 | | 95,698 | |

31

Statement of Segments (continued)

| | | | | | Current Year Actual vs Prior Year Actual | |

| | Core Crown | | Crown Entities | | State-owned

enterprises | | Inter-segment

eliminations | | Total Crown | |

| | Actual

2009

$m | | Actual

2008

$m | | Actual

2009

$m | | Actual

2008

$m | | Actual

2009

$m | | Actual

2008

$m | | Actual

2009

$m | | Actual

2008

$m | | Actual

2009

$m | | Actual

2008

$m | |

Revenue | | | | | | | | | | | | | | | | | | | | | |

Taxation revenue | | 54,681 | | 56,747 | | — | | — | | — | | — | | (536 | ) | (375 | ) | 54,145 | | 56,372 | |

Other sovereign revenue | | 808 | | 733 | | 4,417 | | 4,039 | | — | | — | | (1,107 | ) | (893 | ) | 4,118 | | 3,879 | |