QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

IMAGE ENTERTAINMENT, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

IMAGE ENTERTAINMENT, INC.

9333 Oso Avenue

Chatsworth, California 91311

NOTICE OF 2002 ANNUAL MEETING OF SHAREHOLDERS

To be held September 13, 2002

Dear Fellow Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Image Entertainment, Inc. at the Hilton Hotel, 6360 Canoga Avenue, Woodland Hills, California, on September 13, 2002, at 10:00 a.m. The business of the annual meeting will be to:

- •

- Elect our directors,

- •

- Ratify the appointment of our independent auditors,

- •

- Review the status of the Company's business, and

- •

- Transact any other business that properly comes before the meeting, or any adjournments of the meeting.

A proxy statement and a proxy card are enclosed with this notice. The proxy statement describes the business to be transacted at the meeting and provides other information about the Company that you should know when you vote your shares. You may vote your shares in person at the annual meeting or by using the enclosed proxy card. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the meeting, you must obtain a proxy card issued in your name from the record holder.

Holders of record of the Company's common stock as of the close of business on July 16, 2002, will be entitled to vote.

| | | By Order of the Board of Directors, |

| | | |

| | | /s/ ERIC BESNER

ERIC BESNER

Corporate Secretary |

Chatsworth, California

July 29, 2002

Whether or not you plan to attend the annual meeting in person, you are urged to mark, sign, date and return the enclosed proxy card as promptly as possible in the envelope provided. Signing and returning a proxy will not prevent you from voting in person at the meeting.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

OF

IMAGE ENTERTAINMENT, INC.

To Be Held on September 13, 2002

Where is the Annual Meeting? The annual meeting of shareholders will be held at the Hilton Hotel located at 6360 Canoga Avenue in Woodland Hills, California, on September 13, 2002, at 10:00 a.m. local time.

Why am I receiving these materials? This Proxy Statement is being sent to all shareholders of record at the close of business on July 16, 2002, the record date fixed by the Company's Board of Directors. A copy of the Company's Annual Report is also being mailed to the Company's shareholders beginning July 29, 2002. Although the Annual Report and Proxy Statement are being mailed together, the Annual Report should not be deemed to be part of this Proxy Statement.

Who can attend the annual meeting? Only shareholders of the Company as of the record date, their authorized representatives, and invited guests of the Company will be able to attend the annual meeting.

Who is entitled to vote? Only holders of the Company's common stock at the close of business on July 16, 2002 are entitled to vote at the annual meeting. Except with respect to cumulative voting for directors, each share is entitled to one vote on each matter properly brought before the meeting. On the record date, there were 15,848,137 shares of the Company's common stock outstanding, and there were no outstanding shares of preferred stock.

How do I vote if I am a registered shareholder? You may vote in person or by proxy. Proxies are solicited to give all shareholders who are entitled to vote on the matters that come before the meeting the opportunity to do so whether or not they attend the meeting in person. If you are a registered holder, you can vote your proxy card by mail or in person at the annual meeting.

If you choose to vote by mail, mark your proxy card enclosed with this Proxy Statement, date and sign it, and mail it in the postage-paid envelope. If you wish to vote in person, you can vote the proxy card in person at the annual meeting.

How do I specify how I want my shares voted? If you are a registered shareholder, you can specify how you want your shares voted on each proposal by marking the appropriate boxes on the proxy card. Please review the voting instructions on the proxy card and read the entire text of the proposals and the positions of the Board of Directors in the Proxy Statement prior to marking your vote.

If your proxy card is signed and returned without specifying a vote it will be voted according to the recommendation of the Board of Directors on that proposal.

How do I vote if I am a beneficial shareholder? If you are a beneficial shareholder, you have the right to direct your broker or nominee on how to vote your shares. You should complete a voting instruction card which your broker or nominee is obligated to provide you. If you wish to vote in person at the meeting, you must first obtain from the record holder a proxy card issued in your name.

What items will be voted upon at the annual meeting? The following items will be voted upon at the annual meeting:

- (1)

- the election of the Company's directors, and

- (2)

- the ratification of the appointment of KPMG LLP as the Company's independent accountants for fiscal 2003.

The Board of Directors does not currently know of any other matters that may be brought before the meeting for a vote. However, if any other matters are properly presented for action, it is the intention of the persons named on the proxy card to vote on them according to their best judgment.

What are the Board of Directors' voting recommendations? For the reasons set forth in more detail later in the Proxy Statement, the Board of Directors recommends a vote FOR the election of directors proposed by the Board (Proposal 1) and FOR the ratification of the appointment of KPMG LLP as independent accountants for the 2003 fiscal year (Proposal 2).

How can I provide my comments to the Company? We have provided space on the proxy card for comments from our shareholders. We urge you to let us know your feelings about the Company or to bring a particular matter to our attention. If you are a beneficial owner who holds your shares through an intermediary, please feel free to write directly to the Company.

How many votes are needed to have the proposals pass? A plurality of the votes cast at the annual meeting is required to elect directors. The affirmative vote of a majority of the shares present in person or by proxy is required for ratification of the appointment of KPMG LLP as the Company's independent accountants.

How are the votes counted? If the proxy card is properly executed and returned prior to the annual meeting, the shares of common stock it represents will be voted as you direct. If a proxy card is unmarked, or if you indicate no direction, the shares of common stock it represents will be voted FOR the election of directors and FOR the ratification of the appointment of KPMG LLP as independent accountants for fiscal 2003.

Abstentions. Abstentions will be treated as present and entitled to vote for purposes of determining the presence of a quorum. Abstentions will not constitute a vote "FOR" or "AGAINST" any matter, and thus will be disregarded in the calculation of a plurality or of shares voting or votes cast on any matter submitted to the shareholders for a vote.

Broker Non-Votes. Broker non-votes, meaning shares held by brokers or nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote and as to which the broker has physically indicated on the proxy card that the broker or nominee does not have discretionary power to vote on a particular matter, will be counted as present and entitled to vote for purposes of determining the presence of a quorum. However, for purposes of determining the outcome of any matter as to which the broker has physically indicated on the proxy card that it does not have discretionary authority to vote, those shares will be treated as not present and not entitled to vote with respect to that matter (even though those shares are considered present for quorum purposes and may be entitled to vote on other matters).

Election of Directors. A majority of the shares of common stock outstanding on the record date, represented in person or by proxy, will constitute a quorum at the annual meeting. Assuming a quorum is present, the nominees receiving the highest number of votes will be elected as directors. Votes against a candidate have no legal effect. If voting for directors is noncumulative, the holders of a majority of the shares of common stock voting could elect all the directors.

If any shareholder gives notice at the annual meeting, before the voting for directors begins, of the shareholder's intention to cumulate votes, then all shareholders may cumulate their votes, but only for nominees whose names have been placed in nomination before the voting. Under cumulative voting, each shareholder is entitled to the number of votes equal to the number of directors to be elected multiplied by the number of shares of common stock held by the shareholder. The shareholder may cast all those votes for a single nominee or distribute them among as many nominees as the shareholder sees fit. If voting for directors is noncumulative, each share of common stock will be entitled to one vote for each of the nominees.

2

In the event of cumulative voting for directors, the persons named on the proxy card will have discretionary authority to cumulate votes among any director nominees for which authority to vote was not withheld. Except with respect to cumulative voting for directors, each share of common stock outstanding as of the record date is entitled to one vote on each matter of business that may properly come before the annual meeting.

Ratification of Appointment of KPMG LLP. Assuming a quorum is present, the affirmative vote of the holders of a majority of the shares of common stock represented in person or by proxy and voting at the annual meeting is required to ratify the appointment of KPMG LLP as the Company's independent auditors for the 2003 fiscal year. The shares affirmatively voted must also constitute at least a majority of the required quorum and of the votes cast.

How can I revoke my proxy? You may revoke your proxy at any time before it is voted at the meeting by taking one of the following three actions:

- (a)

- giving timely written notice of the revocation to the Secretary of the Company,

- (b)

- executing and delivering a proxy card with a later date, or

- (c)

- voting in person at the meeting.

How do I designate my proxy? If you wish to give your proxy to someone other than the persons named on the proxy card, you may cross out all of their names and insert the name or names of another person. The signed proxy card must be presented at the meeting by the person you have designated on the proxy card. The persons named on the proxy card will have discretionary authority to vote on business other than Proposals 1 and 2 (the election of directors and ratification of accountants) as may properly come before the annual meeting.

Who will pay for the costs involved in the solicitation of proxies? The Company will pay all costs of preparing, assembling, printing and distributing the proxy materials. Employees, officers and directors of the Company may, for no additional compensation, solicit proxies on behalf of the Board of Directors through the mail, in person and by telecommunications. The Company will, upon request, reimburse brokerage firms and other record holders for their reasonable expenses incurred for forwarding solicitation material to beneficial owners of stock.

BOARD OF DIRECTORS

The Board of Directors, which is elected by the shareholders, is the ultimate decision-making body of the Company, except with respect to those matters reserved to the shareholders. The Board selects the officers and other members of the senior management team, who are charged with the conduct of the Company's business. It has responsibility for establishing broad corporate policies and for the overall performance of the Company. The Board is not involved in operating details on a day-to-day basis.

The Board is kept advised of the Company's business through regular reports and analyses and discussions with the Chief Executive Officer and other officers of the Company. In addition, the Board administers the Company's 1994 Eligible Directors Stock Option Plan, as amended. Since the formula director awards provision of the 1998 Incentive Plan replace and supplant the annual awards to non-employee directors under the 1997 Eligible Directors Stock Option Plan, no grants have been made under the 1994 Eligible Directors Stock Option Plan since July 1998.

Meetings of the Board. The Board meets on a regular basis during the year to review significant developments affecting the Company and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend Board meetings to report on and discuss their areas

3

of responsibility. In fiscal 2002 (year ended March 31, 2002), there was one regular meeting and one special meeting, which were attended by all of our directors.

Committees of the Board. Although the full Board considers major decisions of the Company, the Board has established an Audit Committee and a Compensation Committee to more fully address certain areas of importance to the Company. (The Company does not have a nominating committee. The functions of a nominating committee are performed by the entire Board.) The Board has appointed individuals from among its members to serve on these two committees. The membership of these two committees is composed entirely of non-employee directors.

In fiscal 2002, the committees of the Board held a total of five meetings. The Audit Committee held four meetings, which were attended by all of its members except one meeting, which was attended by all of its members except one. The Compensation Committee held one meeting, which was attended by all of its members

Audit Committee. The Audit Committee is composed of Stuart Segall, Ira S. Epstein and M. Trevenen Huxley. As provided in the Audit Committee's Charter, adopted on June 5, 2000, the Audit Committee's primary functions are to:

- (a)

- monitor the integrity of the Company's financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance,

- (b)

- monitor the independence and performance of the Company's independent auditors and internal auditing department, and

- (c)

- provide an avenue of communication among the independent auditors, management, the internal auditing department, and the Board.

Compensation Committee. The Compensation Committee is also composed of Messrs. Segall, Epstein and Huxley. The Compensation Committee's primary functions are to review and approve salaries, bonuses and other compensation payable to the Company's executive officers. In addition, the Compensation Committee administers the Company's 1998 Incentive Plan, its 1990 and 1992 Stock Option Plans, and other employee benefit plans other than the Company's 1994 Eligible Directors Stock Option Plan.See "Compensation Committee Report on Executive Compensation."

Compensation of Non-Employee Directors. Non-employee directors each receive a cash fee of $400 for each Board or committee meeting attended.

Director RSUs. The formula director awards provision of the 1998 Incentive Plan provides that on each October 1 commencing in 1999 and ending in 2001, each director then in office who is not an executive officer of the Company will automatically be granted 2,240 restricted stock units, or Director RSUs, without any action by the Compensation Committee or the Board. In October 1999, 2000 and 2001, the Company made the three contemplated grants of the Director RSUs. The Director RSUs vest on a pro rata basis for each successive day of service during a 12-month period, commencing on the grant date. Currently, no additional Director RSU grants are contemplated.

The Board will periodically revisit, for three year cycles, the specific size of the annual grants (not to exceed 5,000 shares per director per year). A non-executive director will be eligible to receive no more than one Director RSU award in each year. RSUs will fully vest upon termination of services as a director due to death or total disability. Upon termination of services for any reason other than death or total disability, all Director RSUs not fully vested will be automatically forfeited. The Director RSUs are subject to the same conversion, termination, acceleration and other continuing terms as the restricted stock units granted to the executives under the 1998 Incentive Plan—see "Executive Compensation." If, however, a change of control event occurs, those terms govern only to the extent that any changes in the Director RSUs and any Board or Compensation Committee action are

4

consistent with the effect of the event on restricted stock or RSUs held by persons other than Company officers or directors and on shareholders generally with regard to shares of common stock.See "Description of Employment Contracts, Termination of Employment and Change of Control Arrangements."

Discretionary Option Grants. On July 3, 2000, the Board amended the 1998 Incentive Plan to authorize, within plan limits, discretionary stock option grants to non-executive directors, provided that (i) the maximum number of shares subject to options granted to any such individual does not exceed 5,000 shares within any 12 month period, (ii) the exercise price must be at least equal to the fair market value of the Company's common stock on the date of grant, and (iii) the shares cannot vest any earlier than at least one year after the date of grant, except in the case of death, disability or other circumstances, including a "change of control," contemplated under the 1998 Incentive Plan or the applicable award. At the same time, the Board granted options for 5,000 shares of the Company's common stock to each of Messrs. Segall, Epstein and Huxley, exercisable at $3.75 per share and vesting on the first anniversary of the grant date ("Year 2000 Grant"). On October 3, 2001, the Board granted to each of Messrs. Segall, Epstein and Huxley options for 5,000 shares of the Company's common stock, exercisable at $1.75 per share and vesting on the first anniversary of the grant date ("Year 2001 Grant").

The 1998 Incentive Plan continues to provide that discretionary awards may also be granted to non-executive directors in one or more of the following circumstances:

- •

- in connection with the grantee becoming a member of the Board,

- •

- to reward a director's exceptional or extraordinary services, or

- •

- in consideration for services to the Company outside of the scope of his normal duties in the ordinary course as a director.

Formula Option Grants. From July 1994 to July 1998, the Company made annual awards to non-employee directors, or Formula Options, under the Company's 1994 Eligible Directors Stock Option Plan, as amended, or Directors Plan. Since the Director RSUs replace and supplant the Formula Options, no grants have been made under the Directors Plan since July 1998.

Generally, the Formula Options expire ten years after their date of grant, subject to earlier termination, as described below, and vest in unequal installments over a sixteen-month period following the date of grant as follows: 50% of the options vest in month six, 25% vest in month twelve, and the remaining 25% vest in month sixteen.

If a director's services as a member of the Board terminate by reason of death or disability, his Formula Options and the Year 2000 and Year 2001 Grants become fully exercisable and remain exercisable for one year or until the expiration of their stated term, whichever occurs first. If the director's services terminate for any other reason, the options, to the extent they are exercisable on such date, remain exercisable for six months or until the expiration of their stated term, whichever occurs first. Except as noted above, any options not exercisable at the time of a termination of service will terminate.

Upon the occurrence of certain events (such as a dissolution, liquidation or certain merger or asset transactions or change of control of the Company), each outstanding Formula Option and each option underlying the Year 2000 and Year 2001 Grants will become immediately exercisable.

Compensation Committee Interlocks and Insider Participation. Stuart Segall is a non-salaried employee and non-executive officer of the Company, a director who served on the Company's Compensation Committee for the entire fiscal year 2002, and a nominee for director.

5

Ira Epstein is a non-employee director who served on the Company's Compensation Committee for the entire fiscal year 2002, and a nominee for director.

The national law firm of Greenberg Traurig, LLP was retained by the Company to provide legal services on December 14, 2001. Mr. Epstein became of counsel to Greenberg Traurig on July 1, 2002. The Company continues to pay Greenberg Traurig fees for its legal services at prices that, in the opinion of management, are fair and reasonable and as favorable to the Company as those which could have been obtained from unrelated third parties.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company entered into a credit agreement as of September 29, 1997 with Image Investors Co. ("IIC"), a principal shareholder of the Company owned and controlled by John W. Kluge and Stuart Subotnick, to borrow $5 million with interest payable quarterly at 8% per annum, and principal due in five years. On July 9, 2002, the Company and IIC amended the credit agreement to extend the maturity date three years to 2005, increase the interest rate to prime rate plus 5%, and provide for certain principal prepayment obligations. The loan is unsecured and subordinated to the Company's senior lender, Foothill Capital Corporation, and is convertible into the Company's common stock at IIC's option at any time at a conversion price of $3.625 per share, which was the closing price of the Company's common stock on September 29, 1997. Proceeds from the loan were used to pay down the Company's then-outstanding balance under its revolving credit facility.

The Company paid Weissmann, Wolff, Bergman, Coleman, Silverman & Holmes, LLP, a law firm at which Mr. Epstein was previously of counsel, a total of approximately $210,000 during fiscal 2002. The legal fees paid were, in the opinion of management, fair and reasonable, and as favorable to the Company as those which could have been obtained from unrelated third parties.

Dale Borshell, the mother of David Borshell, the Company's Chief Operating Officer, is a travel agent at Travel Syndicate. For many years, the Company has used Travel Syndicate nearly exclusively for its travel needs. The Company paid Travel Syndicate approximately $159,000, for travel services during fiscal year 2002, which included airplane ticket fees and costs, and expenses relating to hotel and other travel related services. The fees paid to Travel Syndicate were, in the opinion of management, fair and reasonable, and as favorable to the Company as those which could have been obtained through or from unrelated third parties.

6

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the shares of common stock beneficially owned or deemed to be beneficially owned as of July 16, 2002 by: (i) each person known to the Company to be the beneficial owner of more than 5% of the common stock of the Company, (ii) each director of the Company, (iii) each executive officer named in the Summary Compensation Table set forth in the Executive Compensation section, and (iv) all directors and executive officers as a group:

Name(1)

| | Common Stock

Beneficially Owned(2)(3)

| | Percent

of Class(4)

| |

|---|

| Image Investors Co.(5) | | 6,781,509 | | 39.36 | % |

| Martin W. Greenwald(6) | | 1,208,329 | | 7.43 | % |

| Stuart Segall(6) | | 694,061 | | 4.37 | % |

| David Borshell | | 172,094 | | 1.08 | % |

| Jeff Framer | | 132,694 | | * | |

| Ira S. Epstein(7) | | 104,616 | | * | |

| M. Trevenen Huxley(8) | | 26,616 | | * | |

| All directors and executive officers as a group (6 persons) | | 2,338,410 | | 14.01 | % |

- *

- Less than 1%.

Notes To Beneficial Ownership Table:

- (1)

- The mailing address of Image Investors Co. is c/o Metromedia Company, One Meadowlands Plaza, East Rutherford, NJ 07073. The mailing address of the other individuals listed is c/o Image Entertainment, Inc., 9333 Oso Avenue Chatsworth, CA 91311.

- (2)

- The number of shares beneficially owned includes shares of common stock in which a person has sole or shared voting power and/or sole or shared investment power. Except as noted below, each person named reportedly has sole voting and investment powers with respect to the common stock beneficially owned by that person, subject to applicable community property and similar laws. On July 16, 2002, there were 15,848,137 shares of common stock, no par value, outstanding.

- (3)

- The number of shares listed as beneficially owned by each named person (and the directors and executive officers as a group) includes shares of common stock underlying options and rights (including restricted stock units ("RSUs") and conversion rights) vested as of or vesting within 60 days after July 16, 2002, as follows:

| | Options

| | RSUs

| | Conversion Rights

|

|---|

| Image Investors Co.(5) | | 0 | | 0 | | 1,379,310 |

| Mr. Greenwald | | 403,840 | | 0 | | 0 |

| Mr. Segall | | 45,000 | | 2,136 | | 0 |

| Mr. Epstein | | 90,000 | | 2,136 | | 0 |

| Mr. Huxley | | 20,000 | | 2,136 | | 0 |

| Mr. Borshell | | 156,634 | | 0 | | 0 |

| Mr. Framer | | 119,135 | | 0 | | 0 |

| All directors and executive officers as a group (6 persons) | | 834,609 | | 6,408 | | 0 |

Options and rights are non-voting and do not represent prior to exercise, conversion, or, in the case of an RSU, a distribution event, any right to dispose of the shares.

7

- (4)

- Common stock not outstanding but which underlies options and rights (including RSUs and conversion rights) vested as of or vesting within 60 days after July 16, 2002 is deemed to be outstanding for the purpose of computing the percentage of the common stock beneficially owned by each named person (and the directors and executive officers as a group), but is not deemed to be outstanding for any other purpose.

- (5)

- Includes 1,379,310 shares of common stock issuable upon conversion of debt under a credit agreement between IIC and the Company dated as of September 29, 1997, amended July 9, 2002.

All of the shares of common stock are held of record by IIC. The shares of common stock listed in the table as beneficially owned by IIC may also be deemed to be beneficially owned by John W. Kluge and Stuart Subotnick by virtue of their being directors, executive officers and the only shareholders of IIC. Messrs. Kluge and Subotnick have shared voting and investment powers with respect to the shares. Amendment No. 11 (dated December 30, 1992) to a Schedule 13D, dated July 18, 1988, filed on behalf of IIC, John W. Kluge and Stuart Subotnick, states that IIC and Messrs. Kluge and Subotnick each "disclaims membership in a group, although a group might be deemed to exist."

- (6)

- Includes 50% of 1,030 shares of common stock held of record by Momandad, Inc., a corporation of which Messrs. Greenwald and Segall are the sole shareholders. With respect to these shares, Messrs. Greenwald and Segall share voting and investment powers.

- (7)

- Includes 2,000 shares of common stock held by Mr. Epstein's Keogh plan.

- (8)

- All of the shares of stock are held of record by Mr. Huxley individually. Mr. Huxley is Executive Vice President for Business Development and a director of Muze, Inc., a closely-held corporation which is owned and controlled by John W. Kluge and Stuart Subotnick, who also own and control IIC. Mr. Huxley disclaims membership in any group with Messrs. Kluge and Subotnick with regard to his shares.

Section 16(a) Beneficial Ownership Reporting Compliance. Under Section 16(a) of the Securities Exchange Act of 1934, as amended, the Company's directors, executive officers and the beneficial holders of more than 10% of the Company's common stock are required to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based on our records and other information, the Company believes that during fiscal 2002 all applicable Section 16(a) filing requirements were met.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Bylaws provide for a Board consisting of a minimum of four and a maximum of seven directors. The persons named in the enclosed proxy intend to vote the proxy for the election of each of the four nominees named below, unless you indicate on the proxy that your vote should be withheld from any or all of the nominees.

The following are the nominees for election as directors proposed by the current Board, with information including principal occupation and other business affiliations, age, positions and offices held with the Company, and the year each current director was first elected. For information regarding each nominee's security ownership,see "Security Ownership of Certain Beneficial Owners and Management."

Martin W. Greenwald (Age 60) Mr. Greenwald has served as Chairman of the Board, President and Chief Executive Officer for the Company since April 1981. Mr. Greenwald is a 1964 graduate of Fairleigh Dickinson University.

8

Stuart Segall (Age 57) Mr. Segall has served as a director and Vice President (not an executive officer) for the Company since April 1981. Mr. Segall's primary occupation is that of principal of Stu Segall Productions, a television and motion picture production company with executive offices in North Hollywood, California and a full-service production facility in San Diego, California. From 1984 to 1989, Mr. Segall was a supervising producer for Steven J. Cannell Productions, Hollywood, California.

Ira S. Epstein (Age 70) Mr. Epstein has served as director for the Company since June 1990. Mr. Epstein is of counsel to the national law firm of Greenberg Traurig, LLP. From 1993 to June 2002, Mr. Epstein was of counsel to the Beverly Hills law firm of Weissmann, Wolff, Bergman, Coleman, Silverman & Holmes, LLP. From 1975 to 1993, Mr. Epstein was the managing partner of the law firm Cooper, Epstein & Hurewitz. Mr. Epstein has held officer and director positions in numerous corporations.

M. Trevenen Huxley (Age 50) Mr. Huxley has served as a director for the Company since September 1998. In 1990, Mr. Huxley co-founded Muze, Inc., a provider of digital information about music, books and movies. From 1992 to March 1998, Mr. Huxley served as the President and Chief Executive Officer of Muze, Inc. and is currently its Executive Vice President for Business Development. Mr. Huxley is also a director of both Muze, Inc. and Muze UK, Ltd., a wholly-owned subsidiary of Muze, Inc. Muze, Inc. is a closely-held corporation which is controlled by John W. Kluge and Stuart Subotnick. Messrs. Kluge and Subotnick are the only shareholders of Image Investors Co., the largest shareholder of the Company.

The Board of Directors unanimously recommends a vote FOR the election of these nominees as Directors. We expect each nominee for election as a director to be able to serve if elected. If any nominee is not able to serve, the persons named on the proxy card will vote the proxies in favor of a substitute nominee. The election of the four nominees proposed by the Board will leave three vacancies on the Board, which pursuant to Article III, Section 5 of our Bylaws may be filed at any time by an affirmative vote or consent of a majority of shareholders or the Board. Each nominee elected as a director will continue in office until his successor has been elected and qualified, or until his or her earlier resignation, retirement or death.

9

EXECUTIVE COMPENSATION

The following table sets forth certain annual and long term compensation, for each of the last three fiscal years, paid to the Company's Chief Executive Officer and each executive officer whose salary and bonus exceeded $100,000 in the last fiscal year:

Summary Compensation Table

| |

| | Annual

Compensation

| | Long-Term

Compensation

| |

| |

|---|

Name &

Principal Position

| | Fiscal

Year

| | Salary

($)(1)

| | Bonus

($)(2)

| | Other

Annual

Compensation

($)(3)

| | Restricted

Stock

Award(s)

($)(4)

| | Securities Underlying

Options

(#)

| | All

Other

Compensation

($)

| |

|---|

Martin Greenwald,

President & Chief Executive Officer | | 2002

2001

2000 | | $

| 533,040

506,446

482,483 | | $

| 0

414,138

247,810 | | $

| —

—

— | | $

| 0

0

294,000 | | 72,500

120,000

0 | | $

| 39,083

37,573

38,667 | (5)

(6

(7) |

David Borshell,

Chief Operating Officer |

|

2002

2001

2000 |

|

|

206,083

195,905

186,473 |

|

|

0

149,188

89,419 |

|

|

—

—

— |

|

|

0

0

85,050 |

|

52,250

40,000

0 |

|

|

4,056

4,168

3,894 |

(8)

(8)

(8) |

Jeff Framer,

Chief Financial Officer |

|

2002

2001

2000 |

|

|

217,532

206,790

196,833 |

|

|

0

78,904

47,347 |

|

|

—

—

— |

|

|

0

0

89,775 |

|

42,250

40,000

0 |

|

|

4,457

4,404

4,102 |

(8)

(8)

(8) |

Notes To Summary Compensation Table:

- (1)

- The fiscal 2002, 2001 and 2000 salary figures for Mr. Greenwald include an additional annual salary component characterized as an "unaccountable personal expense allowance" in his employment agreement.

- (2)

- All executive officers waived their bonuses for fiscal 2002. For a description of the formula bonus plan under which each executive officer's fiscal 2001 and 2000 bonuses were awarded,see "Bonuses" in the Compensation Committee Report on Executive Compensation. Each of the named executive officers also received a nominal holiday bonus of $100 in fiscal 2002, $350 in fiscal 2001 and $325 in fiscal 2000.

- (3)

- While all the executive officers enjoyed certain perquisites in fiscal 2002, 2001 and 2000, their perquisites did not exceed the lesser of $50,000 or 10% of their annual salary and bonus for any fiscal year.

- (4)

- Reported awards for fiscal 2000 represent restricted stock units ("RSUs") of 43,354, 12,542 and 13,238 (valued at the prior five-day average of $6.78/share) granted to Messrs. Greenwald, Borshell and Framer, respectively under the Company's 1998 Incentive Plan on July 1, 1999. The RSUs are payable solely in shares of the Company's common stock and vest commencing one year from the award date and on each of the next four anniversaries of that date in equal installments at a minimum rate of 20% per year.

If in any fiscal year the Company achieves a minimum specified percentage of an applicable performance targets, the grant will vest instead at a rate of 331/3% for that year only. Each executive officer is entitled to receive "dividend equivalents" in additional RSUs if any dividends are paid on the common stock prior to vesting. The minimum specified percentage of the applicable performance targets for fiscal 2002 and 2000 were not met. The percentage for fiscal 2001 was met, but each executive officer waived their right to accelerated vesting for that year.

10

The number and market value of unvested RSUs held by each of these executive officers at March 31, 2002 (based on the $2.698/share closing price of the Company's common stock on NASDAQ/NM on March 28, 2002, the last trading day of our fiscal year) were:

Executive Officers:

Mr. Greenwald, 42,759 and $115,364,

Mr. Borshell, 12,360 and $33,347, and

Mr. Framer, 13,047 and $35,201.

If employment by the Company terminates due to total disability or death, any unvested RSUs in the executive officer's stock unit account will become fully vested and the shares issuable in payment thereof will be distributed immediately. Upon retirement, the executive officer's stock unit account will be credited with a pro rata portion of the next installment of the award that would otherwise vest based on the number of quarters or partial quarters served during the applicable fiscal year. If employment by the Company is terminated for any reason other than death, disability, retirement or in connection with a change of control event, all unvested RSUs will be forfeited. For a description of the effects of termination of employment prior to or following a change of control event,see "Other Change of Control Arrangements."

The 1998 Incentive Plan grants the Compensation Committee discretion to accelerate, extend or otherwise modify benefits payable under the RSU awards in various circumstances, including a termination of employment (other than "for cause") or a change of control event.See "Restricted Stock Unit Grants."

For the shares vesting in 2002, 2001 and 2000, the Board of Directors, acting on behalf of the Compensation Committee, allowed the award recipients to surrender vested shares to cover applicable withholding taxes if they so desired.

- (5)

- Includes $3,690 of term life insurance premium payments, $30,076 of universal life insurance premium payments and $5,317 of Company contributions to a 401(k) plan.

- (6)

- Includes $3,690 of term life insurance premium payments, $28,699 of universal life insurance premium payments and $5,184 of Company contributions to a 401(k) plan.

- (7)

- Includes $3,690 of term life insurance premium payments, $29,985 of universal life insurance premium payments and $4,992 of Company contributions to a 401(k) plan.

- (8)

- Entire amount consists of Company contributions to a 401(k) plan.

11

The following table summarizes options granted in fiscal 2002 to the executive officers named in the Summary Compensation Table:

Option Grants in Last Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation

for Option Term(1)

|

|---|

| | Number of

Securities

Underlying

Options

Granted

(#)(2)

| | Percent of

Total

Options

Granted

to Employees

in Fiscal Year

(3)

| |

| |

|

|---|

| | Exercise

Price

($/Sh)

| | Expiration

Date

| | 5%

($)

| | 10%

($)

|

|---|

| Martin W. Greenwald | | 72,500 | (4) | 19.9 | % | $ | 1.75 | (5) | 10/02/11 | | $ | 79,791 | | $ | 202,206 |

| David Borshell | | 52,250 | | 14.4 | | | 1.75 | | 10/02/11 | | | 57,505 | | | 145,729 |

| Jeff Framer | | 42,250 | | 11.6 | | | 1.75 | | 10/02/11 | | | 46,499 | | | 117,838 |

Notes to Option Grants in Last Fiscal Year Table

- (1)

- The amounts are based on the 5% and 10% annual rates of return prescribed by the Securities and Exchange Commission and are not intended to forecast future appreciation, if any, of the Company's common stock nor reflect actual gains, if any, realizable upon exercise.

- (2)

- In the event of a change of control (as defined in the Company's 1998 Incentive Plan), the unvested portion of an option immediately vests, and the committee administering each plan may (subject to Board approval) terminate the plan and the options. If a termination occurs, the committee will give each optionee written notice of the intention to terminate the Plan and the options, and permit the exercise of the options for at least 30 days immediately preceding the effective date of the termination. In the event an optionee's employment with the Company ceases for any reason other than death or disability, the options will terminate two weeks following the date employment ceases; however, the committee, in its sole discretion, may extend the exercise period from two weeks to three months. In the event of an optionee's death or disability, the options may be exercised for one year thereafter. Subject to the other provisions of the Plan, the committee has discretionary authority to amend or terminate the Plan and to do any other act advisable to administer the Plan.

- (3)

- Based on options granted to employees totaling 363,500 shares.

- (4)

- The options were granted under the 1998 Incentive Plan and vest in twelve generally equal increments beginning on January 2, 2002 and each three months thereafter through October 2, 2004.

- (5)

- The market price of the Company's common stock (based upon the closing price on NASDAQ/NM) on the date of grant was $1.75 per share.

12

The following table summarizes options exercised in fiscal 2002 by the named executive officers, and the value of the unexercised in-the-money options held by those executives at fiscal year-end:

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| |

| |

| | Number of Shares

Underlying Unexercised

Options at Fiscal Year-End

| | Value of Unexercised

Options

at Fiscal Year-End(1)

|

|---|

| | Shares

Acquired

on

Exercise

(#)

| |

|

|---|

| | Value

Realized

($)

| | Exercisable

(#)

| | Unexercisable

(#)(2)

| | Exercisable

($)

| | Unexercisable

($)

|

|---|

| Martin Greenwald | | 0 | | $ | 0 | | 380,655 | | 111,845 | | $ | 11,456 | | $ | 57,274 |

| David Borshell | | 0 | | | 0 | | 146,566 | | 60,684 | | | 8,255 | | | 41,278 |

| Jeff Framer | | 0 | | | 0 | | 109,900 | | 52,350 | | | 6,676 | | | 33,377 |

Notes to Aggregate Option Exercises and Fiscal Year-End Option Values Table

- (1)

- Based on the market value of the underlying shares of common stock at fiscal year end (using the $2.698 per share closing price on NASDAQ/NM on March 28, 2002, the last trading day of our fiscal year), minus the exercise price.

- (2)

- In the event of a change of control under the Company's Restated 1992 Stock Option Plan or 1998 Incentive Plan, the unvested portion of an option immediately vests.See "Other Change of Control Arrangements."

13

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Compensation Committee. The Company's Compensation Committee was established in 1992 and is composed entirely of non-executive directors. The Compensation Committee reviews with the full Board all aspects of the compensation packages for each executive officer of the Company. The Compensation Committee, and from time to time the full Board, approves compensation packages and any amendments thereto. The Compensation Committee administers the Company's 1990 Stock Option Plan, the Restated 1992 Stock Option Plan, the 1998 Incentive Plan and other employee benefit plans of the Company. The following report addresses the Compensation Committee's objectives and its actions and decisions with respect to compensation for the 2002 fiscal year.

Compensation Objectives. The Compensation Committee's goal is to maximize shareholder value over the long term by implementing programs designed to enable the Company to attract, retain and motivate the best possible key employees to operate and manage the Company at all levels. The Company offers a contributory 401(k) plan and provides health, life and disability insurance to full-time employees.

The executive officer compensation packages contain three primary components:

- •

- base salary,

- •

- long-term incentive compensation in the form of stock-based awards, including options and restricted stock unit awards, and

- •

- short-term incentive compensation in the form of annual cash bonuses based on the Company's financial performance.

Base Salary. An executive officer's base salary is determined by an assessment of their sustained performance against their individual job responsibilities including, where appropriate, the impact of their performance on the business results of the Company, current salary in relation to the salary range designated for the job, experience and mastery, and potential for advancement. In general, employment agreements with our executive officers provide that base salary will increase 5% annually. In fiscal 2002, no other increases in base salary were made.

Option Grants. The Compensation Committee views any option grant portion of the executive officer compensation packages as a special form of long-term incentive compensation to be awarded on a limited and non-regular basis. The objective of these awards is to advance the longer-term interests of the Company and its shareholders and complement incentives tied to annual performance. These awards provide rewards to executive officers based upon the creation of incremental shareholder value and the attainment of long-term financial goals. Stock options produce value to executive officers only if the price of the Company's stock appreciates, thereby directly linking the interests of executive officers with those of shareholders.

Stock options granted to executive officers are priced at or above the fair market value of the common stock on the date of grant. Awards of stock options are determined based on the Compensation Committee's subjective determination of the amount of awards necessary, as a supplement to an executive officer's base salary and performance-based bonus, to retain and motivate the executive officer.

In fiscal 2002, an option for 72,500 shares was granted to Mr. Greenwald, an option for 52,250 shares was granted to Mr. Borshell and an option for 42,250 shares was granted to Mr. Framer under the 1998 Incentive Plan. These options have an exercise price of $1.75 (equal to the closing price of the Company's common stock on the grant date). The options vest in twelve generally equal increments beginning on January 2, 2002 and each three months thereafter through October 2, 2004.

14

Restricted Stock Unit Grants. In fiscal 2000, the Compensation Committee authorized RSU grants to executive officers as an additional form of long term incentive intended to provide executive officers with a more direct incentive to enhance the value of the Company's common stock. The specific number of RSUs in each grant was based upon a multiple of the executive officer's base salary, divided by the average price of the Company's common stock prior to grant. In general, the base salary multiples for the executive officers, which ranged from 20% to 70%, increased with the level of responsibility and the perceived impact of each position on the strategic direction of the Company.

In fiscal 2000, the Compensation Committee authorized an award to executive officers of RSUs, which vest on an annual schedule but may be accelerated based on annual financial performance targets related to earnings before interest, taxes, depreciation and amortization. These grants are described in the Summary Compensation Table. The Compensation Committee did not authorize the award of RSUs to any of its executive officers in fiscal 2002 or 2001.

To encourage retention and promote an alignment of interest with the Company's shareholders, the RSUs vest over a maximum period of five years; vesting may be accelerated based upon the Company's financial performance. The RSUs will vest in equal annual installments of at least 20%; however, if performance meets or exceeds the minimum specified percentage of applicable performance targets established annually by the Compensation Committee, the RSUs will vest at the rate of 331/3% for that year.

For fiscal 2002, 2001 and 2000, the Compensation Committee authorized a minimum specific performance target related to EBITDA. The fiscal 2002 and 2000 targets were not met so no accelerated vesting occurred. The fiscal 2001 target was met, but all eligible executive officers waived their right to accelerated vesting.

Bonuses. All of the Company's executive officers waived their bonuses for fiscal 2002, which would have been payable in fiscal 2003.

Payments under the Company's bonus plan are tied to the Company's level of achievement of specific levels of EBITDA, as established by the Compensation Committee in the first quarter of the fiscal year, thereby establishing a direct link between executive officer pay and Company financial performance. An individual executive officer's annual cash bonus is a percentage of their salary determined by the executive officer's job level. Actual cash bonuses are determined by applying a formula based on achievement of target EBITDA to each executive officer's base salary. Applying this formula results in cash bonus payments at the targeted incentive opportunity level when specified levels of EBITDA are achieved and payments below the targeted level when performance on these measures is below those set by the Compensation Committee. The formula provides for payments above the targeted level only when financial performance exceeds target EBITDA.

Under the bonus plan, each executive officer's bonus is determined by multiplying a specified percentage of his salary (75% for Mr. Greenwald, 60% for Mr. Borshell and 30% for Mr. Framer) by a certain performance factor, which is a percentage derived from a comparison of the Company's actual EBITDA to the target EBITDA set by the Compensation Committee. In order for an executive officer to receive any bonus, the performance factor must equal a minimum of 40%, with the amount of the bonus increasing as the performance factor percentage increases, up to a maximum of 125%.

The specific performance criteria and targets used to determine the bonuses and RSU accelerated vesting are subject to change annually at the Compensation Committee's discretion to adjust for changes in the Company's business, competitive conditions, changes in its capitalization, performance and needs. The Compensation Committee has not disclosed publicly the exact targets specified in these awards because this information is deemed to be confidential and proprietary, the disclosure of which would be against the best interests of the Company.

15

Compensation of Chief Executive Officer. The compensation of our Chief Executive Officer results from his participation in the same compensation programs as the other executive officers of the Company. The Compensation Committee applied the principles outlined above in establishing Mr. Greenwald's compensation, in the same manner as they were applied to other executive officers of the Company.

Pursuant to the formula bonus plan described in his employment agreement, Mr. Greenwald was eligible for an annual bonus for fiscal 2002 of 30% to 94% of his base salary if the performance of the Company exceeded a specified minimum percentage of the applicable EBITDA performance target established by the Compensation Committee in the first quarter of the fiscal year.

While the Company exceeded its minimum EBITDA performance percentage established by the Compensation Committee for fiscal 2002, Mr. Greenwald waived his right to receive a bonus.

Section 162(m) Policy. To the extent reasonably practicable and within the Compensation Committee's control, the Compensation Committee prefers to limit executive officer compensation in ordinary circumstances to that which is deductible by the Company under Section 162(m) of the Internal Revenue Code. During fiscal year 2002, all compensation paid to executive officers was within the Section 162(m) limit. Grants of RSUs, however, are not considered performance-based for these purposes and are included as compensation for these purposes only when they vest. Accordingly, to the extent that the value of shares vesting in any future year under RSU awards, when combined with salary, allowances and other non-exempt compensation, exceeds $1,000,000, the excess would not be deductible. Under current circumstances, the Compensation Committee does not satisfy the Code requirement that performance-based (i.e., Section 162(m) exempt) compensation be awarded by a Compensation Committee of at least two "outside directors" (as defined in the Code) because of the directors' other relationships described elsewhere in this Proxy Statement. Nevertheless, the Compensation Committee does not expect non-exempt compensation to exceed the applicable limit for fiscal year 2003.

The Compensation Committee Report on Executive Compensation shall not be deemed to be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filings of the Company pursuant to the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this section by reference therein, and shall not be deemed soliciting material or otherwise deemed filed under either of the Acts.

| | | COMPENSATION COMMITTEE

Ira S. Epstein(Chairman)

Stuart Segall

M. Trevenen Huxley |

16

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors, upon the recommendation of its Audit Committee, has appointed KPMG LLP to serve as our independent auditors for fiscal 2003, subject to the ratification by our shareholders. The Audit Committee recommended KPMG LLP to the full Board because it has served the Company well in the past and is well qualified to perform this important function.

A representative of KPMG LLP is expected to be present at the annual meeting, to have an opportunity to make a statement if they desire to do so, and to be available to respond to appropriate questions.

Audit and Non-Audit Fees. The following table presents fees billed for professional audit services rendered by KPMG LLP for the audit of the Company's annual financial statements for the fiscal year ended March 31, 2002, and fees billed for other services rendered by KPMG LLP during the fiscal year:

Description

| | Fees

|

|---|

| Audit Fees (excluding audit related services) | | $ | 96,000 |

| Financial Information systems design and implementation | | | 0 |

| All Other Fees: | | | |

| | | | Audit Related Fees | | | 21,000 |

| | | | Tax Advisory Services | | | 64,000 |

| | | | Other Non-Audit Services | | | 0 |

| | |

|

| | | Total All Other Fees | | | 85,000 |

| | |

|

| | Total Audit and Non-Audit Fees | | $ | 181,000 |

| | |

|

The Board of Directors unanimously recommends a vote FOR the approval of KPMG LLP as our independent auditors for fiscal 2003. If the appointment is not ratified, the Board will reconsider the appointment. It is understood that even if the selection is ratified, the Audit Committee and Board may at their discretion direct the appointment of a new independent accounting firm any time during the fiscal year if the Board believes that a change is necessary in the best interests of the Company and its shareholders.

17

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors of the Company is composed of three directors and operates under a written charter approved by the Board of Directors. The Company's management is responsible for the Company's internal accounting controls and the financial reporting process. The Company's independent accountants, KPMG LLP, are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with auditing standards generally accepted in the United States and issuing a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In connection with these responsibilities, the Audit Committee has reviewed and discussed with management and the independent accountants the fair and complete presentation of the Company's financial results for the fiscal year ended March 31, 2002. In addition, the Audit Committee has discussed with the independent accountants the matters required by Statement of Auditing Standards No. 61,Communication with Audit Committees.

The Audit Committee has also received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and has discussed with the independent accountants that firm's independence from the Company and its management. In addition, the Audit Committee has considered whether non-audit services by the independent accountants are compatible with the independence requirements of Board Standard No. 1. The Committee has concluded that the independent auditors are independent from the Company and its management.

The Audit Committee discussed with the Company's independent auditors the overall scope and plans for their respective audits. The Committee met with the independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting.

Based on the Audit Committee's discussions with management and the independent accountants and the Audit Committee's review of the representations of management and the independent accountants, the Audit Committee has recommended to the Board of Directors that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended March 31, 2002 for filing with the Securities and Exchange Commission. The Audit Committee and the Board also have recommended, subject to shareholder ratification, the selection of the Company's independent auditors.

The foregoing report of the Audit Committee does not constitute "soliciting material" and shall not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates such report by reference therein.

| | | AUDIT COMMITTEE

Ira S. Epstein(Chairman)

Stuart Segall

M. Trevenen Huxley |

18

DESCRIPTION OF EMPLOYMENT CONTRACTS, TERMINATION OF

EMPLOYMENT AND CHANGE OF CONTROL ARRANGEMENTS

The Company is a party to employment agreements with each of the executive officers named in the Summary Compensation Table entered into as of July 1, 1998. Except for base salary, bonus compensation and fringe benefits, all of the terms and conditions of the agreements, as described below, are substantially similar.

Term. The employment agreements provide for an initial term of two years ending June 30, 2000, with automatic one year extensions on each July 1, unless the Company or the executive officer gives written notice of non-renewal by the preceding January 1. The terms of the employment agreements may not be extended beyond June 30, 2005.

Base Salary. The employment agreements provide that on each July 1, each executive officer will receive a 5% increase to his then annual base salary (including, for Mr. Greenwald, a 5% increase to his annual unaccountable personal expense allowance). In July 2002, pursuant to the agreements, the base salary amounts for Messrs. Greenwald, Borshell and Framer increased to $486,203, $218,791 and $230,946, respectively. In addition, Mr. Greenwald's annual unaccountable personal expense allowance increased to $79,777.

Cash Bonus. Pursuant to the formula bonus plan contemplated by the employment agreements, the executive officers earn cash bonuses as incentive short-term compensation based on the Company's financial performance relative to annually determined performance targets. The cash bonus plan for fiscal 2002 is based on a formula relative to earnings before interest, taxes, depreciation and amortization ("EBITDA"). The applicable cash bonus will be determined using a formula which measures the Company's performance against a confidential target EBITDA and multiplies the resulting percentage by a specified percentage of the executive officer's base salary. The specific performance criteria and targets as well as percentages of salary or other variables pursuant to which the cash bonuses are determined are applicable to all of the executive officers and subject to change annually at the discretion of the Compensation Committee. For a further description of the cash bonuses,see the "Compensation Committee Report on Executive Compensation."

Stock-Based Awards. The employment agreements provide that stock-based grants will be in the form and for the amounts, and at a time or times, as the Board (or, if applicable, the administrator of the relevant stock option or award plan) determines.

Severance Packages. The employment agreements provide for severance packages consisting of base salary (and, for Mr. Greenwald, his unaccountable personal expense allowance) and insurance continuation for six months, and a pro rata portion of any bonus payable for the longer of six months or that part of the fiscal year occurring prior to expiration of the term. The employment agreements also provide for comparable benefits in the event of an executive officer's death or total disability.

Termination of Employment. The employment agreements provide for varying benefits upon a termination of employment depending upon the reason for the termination and when it occurs. If an employment agreement is terminated prior to a change of control "without cause" (which generally means for any reason other than (a) death or disability, (b) for cause or (c) a voluntary termination), the executive officer will continue to receive all compensation, rights and benefits under the employment agreements through the expiration of the remaining term, plus the severance benefits described above.

If the employment agreement is terminated due to a change of control for any reason other than (1) (a) death or permanent disability/suspension, (b) "for cause" or (c) a voluntary termination by the executive officer (other than for good reason) and whether or not in breach of the employment agreement, or (2) the executive officer terminates the employment agreement for "good reason," the

19

executive officer will be entitled to receive all compensation, rights and benefits under the employment agreement for the longer of one year following the effective date of termination or through the expiration of the remaining term, plus the severance benefits described above. "Good reason" generally includes a material reduction in duties, status, compensation or benefits, a material breach by the Company, or a forced relocation.

If a termination "for cause" occurs, no severance, fringe benefits, compensation or other similar rights, including any pro rata portion of bonus otherwise due, is due or payable. A termination "for cause" generally includes the executive officer's fraud, willful misconduct, gross negligence, breach of fiduciary duty or material breach of an employment agreement with the Company.

The employment agreements provide that all then-unvested options granted to the executive officer will immediately vest if the employment agreement is terminated by the Company "without cause" or by the executive officer for "good reason" following a change of control. In addition, any unvested portion of the executive officer's RSU award that has not expired will vest immediately if the Company terminates the employment agreement "without cause" within one year after a change of control, or less than three months prior to and in express anticipation of an announced change of control. The definition of "change of control" under the employment agreements is substantially equivalent to the definition of a change of control event under the 1998 Incentive Plan, described under the heading "Other Change of Control Arrangements."

Fringe Benefits. The executive officers are entitled to receive medical, dental, life and short and long-term disability insurance, 401(k) plan participation, vacation and reimbursement for reasonable business expenses. Mr. Greenwald's employment agreement further provides for the payment of personal life and disability insurance premium payments and reimbursement for medical expenses not covered by medical insurance of up to $43,000 per annum, an additional annual salary component characterized as an "unaccountable personal expense allowance," and use of a company car.

Other Change of Control Arrangements. Outstanding stock options granted under the Company's stock option plans and individual option grants without reference to a plan include provisions for acceleration of exercisability upon a change of control substantially as summarized in Note 2 to the Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values Table. Options granted under the Company's 1990 Stock Option Plan include provisions for acceleration of exercisability upon a change of control except in the event the acquiring corporation (or a parent or subsidiary thereof) agrees to (a) assume the Company's obligations under the plan and the options or (b) replace the options with new options having terms at least as favorable to the optionee. Options granted on May 19, 1994 under individual plans include provisions allowing the Board to terminate the plan and the option term in the event of a change of control, whereupon the optionee may exercise the options for at least 60 days following the effective date of termination. Under the 1990 Stock Option Plan, "change of control" generally means (1) the dissolution of the Company, (2) the sale of all or substantially all of the Company assets, or (3) a merger or similar transaction in which the Company would not be the surviving corporation, or in which the Company would survive but as the wholly-owned subsidiary of another corporation.

Pursuant to the 1998 Incentive Plan, if an executive officer's employment is terminated by the Company for any reason other than because of death or total disability, either (a) in express anticipation of an announced transaction that would constitute a change of control event (as summarized below) and less than three months before its occurrence, or (b) within one year following a change of control event, then any unvested portion of his RSU award that has not previously expired will vest immediately, provided that no RSU vesting will be accelerated to a date less than six months after the date of grant. Furthermore, immediately prior to a change of control event, all RSUs credited to an executive officer's stock unit account (including dividend equivalents) will vest and will be distributed immediately.

20

A "change of control" event under the 1998 Incentive Plan generally includes (1) an acquisition by one person (or group of persons) of at least 45% of the ownership of the Company, other than an "excluded person," (2) certain changes in a majority of the Board over a two-year period, (3) Board and (if required by law) shareholder approval of a plan to consummate the dissolution or complete liquidation of the Company, or (4) mergers and similar transactions which result in a 50% change in ownership of the Company (subject to certain exceptions). The term "excluded persons" includes IIC, John Kluge and Stuart Subotnick, who own and control IIC, and Mr. Greenwald.

Additionally, the committee administering each plan may (subject to Board approval) terminate the plan and the options upon the occurrence of a change of control. If any termination occurs, the committee shall give each optionee written notice of the intention to terminate the plan and the options, and shall permit the exercise of the options for at least 30 days immediately preceding the effective date of the termination. In the event an optionee's employment with the Company ceases for any reason other than death or disability, the options will terminate two weeks following the date employment ceases; however, the committee, in its sole discretion, may extend the exercise period from two weeks to three months. In the event of an optionee's death or disability, the options may be exercised for one year thereafter. Subject to the other provisions of the plan, the committee has discretionary authority to amend or terminate the plan and to do any other act advisable to administer the plan.

21

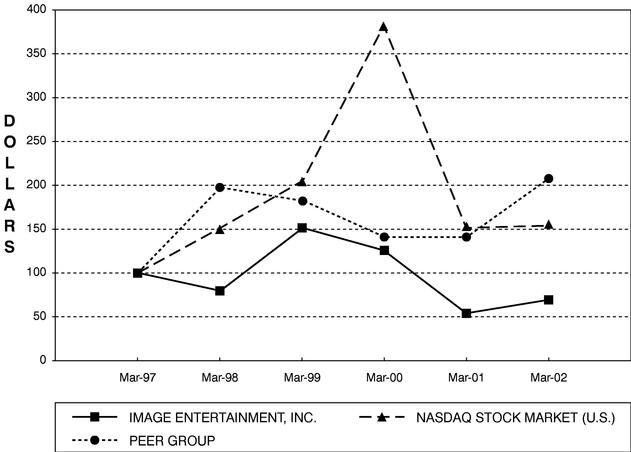

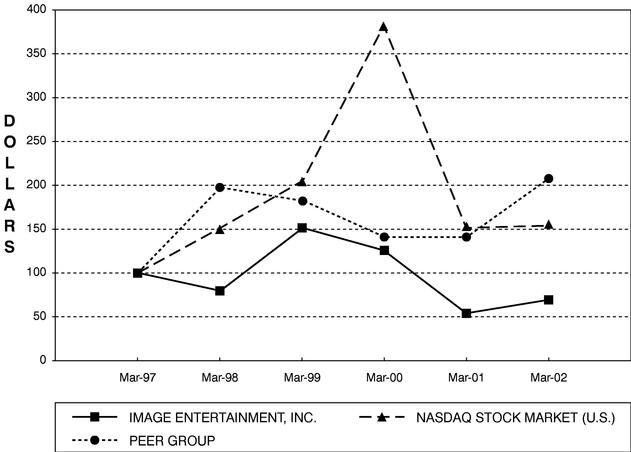

Stock Price Performance Graph

This section of the Proxy Statement shall not be deemed to be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filings of the Company pursuant to the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this section by reference therein, and shall not be deemed soliciting material or otherwise deemed filed under either of the Acts.

The graph below compares the cumulative total return of the Company, the NASDAQ U.S. Market Index and a Company-selected peer group for the 5-year period ending March 31, 2002. The peer group consists of Handleman Company, Trans World Entertainment Corp., and Movie Gallery, Inc. The graph assumes an initial investment of $100 on March 31, 1997 in the Company, the NASDAQ U.S. Market Index and the peer group. The peer group from fiscal 2002 excludes buy.com, Inc. and Valley Media, Inc., both of which were included in the peer group for fiscal 2001 because buy.com, Inc.'s common stock no longer trades and Valley Media, Inc. filed bankruptcy. The graph also assumes reinvestment of dividends, if any.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG IMAGE ENTERTAINMENT, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX AND A PEER GROUP

22

REQUIREMENTS, INCLUDING DEADLINES, FOR SUBMISSION OF PROXY PROPOSALS,

NOMINATION OF DIRECTORS AND OTHER BUSINESS OF SHAREHOLDERS

To be considered for inclusion in the Company's proxy solicitation materials for the 2003 Annual Meeting of Shareholders, a shareholder proposal under SEC Rule 14a-8 must be received by the Company's Corporate Secretary at the principal executive offices of the Company no later than April 1, 2003.

A shareholder may wish to have a proposal (other than a proposal in respect of a nominee for election to the Board) presented at the 2003 Annual Meeting of Shareholders but not to have the proposal included in the Company's proxy statement for the meeting. If notice of the proposal is not received by the Company by June 16, 2003, then the proposal will be deemed untimely under Rule 14a-4(c) under the Securities Exchange Act of 1934, and the Company will have the right to exercise discretionary voting authority with respect to the proposal.

Under Article III, Section 4 of our Bylaws, nominations for election of members of the Board may be made by the Board or any shareholder of any outstanding class of voting stock of the Company entitled to vote for the election of directors. Notice of intention to make any nominations, other than by the Board of Directors, must be made in writing and be received by the President of the Company no more than 60 days prior to a meeting of shareholders called for the election of directors, and no more than ten days after the date the notice of the meeting is sent to shareholders. The notice must contain the following information about each nominee:

- •

- name and address,

- •

- principal occupation, and

- •

- number of shares of Company voting stock owned.

The notice must also contain the name and residence address of the notifying shareholder, and the number of shares of voting stock of the Company owned by the notifying shareholder. Nominations not made in accordance with these procedures will be disregarded by the chairman of the meeting, and the inspectors of election will then disregard all votes cast for the nominees.

ANNUAL REPORT TO SHAREHOLDERS/FORM 10-K

The Company's Annual Report to Shareholders on Form 10-K for the fiscal year ended March 31, 2002 accompanies this Proxy Statement but does not constitute proxy soliciting material. Exhibits to the Annual Report/Form 10-K are available upon request for a reasonable fee. Please direct requests, in writing, to:

| | | ERIC BESNER

Corporate Secretary

Image Entertainment, Inc.

9333 Oso Avenue

Chatsworth, California 91311 |

23

OTHER BUSINESS

The Proxyholders will have discretionary authority to vote on such business (other than Proposals 1 and 2) as may properly come before the annual meeting of shareholders (the Board does not know of any such business as of this date), and all matters incident to the conduct of the meeting.

| | | By Order of the Board of Directors,

IMAGE ENTERTAINMENT, INC.

ERIC BESNER

Corporate Secretary |

Chatsworth, California

July 29, 2002

Whether or not you expect to attend the meeting, we urge you to promptly complete, date and sign the enclosed proxy and return it in the envelope provided. Thank You.

24

IMAGE ENTERTAINMENT, INC.

Proxy Solicited by the Board of Directors for the 2002 Annual Meeting of Shareholders

September 13, 2002

The undersigned appoints Martin W. Greenwald, Stuart Segall, Ira S. Epstein and M. Trevenen Huxley, and each of them, proxies (each with full power of substitution) to represent the undersigned at the Image Entertainment, Inc. 2002 Annual Meeting of Shareholders to be held on September 13, 2002, and any adjournments thereof and to vote the shares of the Company's common stock held of record by the undersigned on July 16, 2002 as directed below.

| 1. | | ELECTION OF DIRECTORS (Proposal 1). | | / / FOR all nominees listed below

(except as marked to the contrary below). | | / / WITHHOLD AUTHORITY

to vote for all nominees listed below. |

INSTRUCTION: To withhold authority to vote for any individual nominee(s) strike a line through the name of the nominee(s) in the following list:

Martin W. Greenwald Stuart Segall Ira S. Epstein M. Trevenen Huxley

| 2. | | Ratification of the appointment of KPMG LLP as the Company's independent auditors for the fiscal year ending March 31, 2003 (Proposal 2). |

| / / FOR / / AGAINST / / ABSTAIN |

| 3. | | The proxies are authorized to vote in their discretion upon such other business as may properly come before the Annual Meeting and any matters incident to the conduct of the Meeting. |

Please sign on reverse side

The shares represented by this Proxy will be voted as directed on the reverse side. If no direction is indicated, the shares represented by this Proxy will be votedFOR the director nominees named in Proposal 1 andFOR Proposal 2 and will be voted in the discretion of the proxies on such other business as may properly come before the Annual Meeting. The undersigned acknowledges receipt of the Notice of Annual Meeting of Shareholders and the Proxy Statement dated July 29, 2002.

Please promptly complete, date and sign this Proxy and return it in the envelope provided.

| | Signed: | |

|

|

Signed: |

|

|

| | Please date this Proxy and sign exactly as your name appears hereon. If shares are jointly held, this Proxy should be signed by each joint owner. Executors, administrators, guardians or others signing in a fiduciary capacity should state their full titles. A Proxy executed by a corporation should be signed in its name by its president or other authorized officer. A Proxy executed by a partnership should be signed in its name by an authorized person.