Investor Presentation

2 Safe Harbor Statement Disclaimer Neither RLJ Acquisition, Inc. nor any of their respective affiliates makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation. The sole purpose of the presentation is to assist persons in deciding whether they wish to proceed with a further review of the propos ed transaction discussed herein and is not intended to be all - inclusive or to contain all the information that a person may desire in considering the proposed transaction discussed herei n. It is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction. This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transactions. This presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any such offering will b e m ade in compliance with applicable securities laws or exemptions therefrom. Additional Information and Where to Find It This document may be deemed to be solicitation material in respect of the proposed business combination involving RLJ Acquisi tio n, Inc., Image Entertainment, Inc. and Acorn Media Group, Inc. On April 13, 2012, RLJ Entertainment, Inc. filed with the SEC a Registration Statement on Form S - 4 containing prelim inary proxy statements of Image Entertainment, Inc. and RLJ Acquisition, Inc. and a prospectus of RLJ Entertainment, Inc. regarding the proposed business combination. This material is not a substitute for the final joint proxy statement / prospectus regarding the proposed business combination. Investors and security holders are urged to read the preliminary joint proxy statement / prospectus, the final joint proxy statement / prospectus and any other relevant documents filed with the SEC when available carefully because they contain impo rta nt information regarding RLJ, Image and Acorn, the proposed business combination and related matters. The final joint proxy statement / prospectus will be mailed to stockholders of RLJ Acquisition, Inc. and Image Entertainment, Inc. When available, you will be able to obtain copies of all documents regarding this business combination a nd other documents filed by RLJ with the SEC, free of charge, at the SEC’s website (www.sec.gov) or by sending a request to RLJ Acquisition, Inc., 3 Bethesda Metro Center, Suite 1000, Bethes da, Maryland 20814, or by calling RLJ at (301) 280 - 7737. Image will also file certain documents with the SEC in connection with its stockholder meeting to be held in connection with the pr opo sed business combination, which will be available on the SEC’s website at www.sec.gov. Participants in the Business Combination RLJ, Image and their respective directors and executive officers may be deemed to be participants in the solicitation of prox ies from the stockholders of RLJ and Image in connection with the proposed business combination. Information regarding the officers and directors of RLJ is available in RLJ’s annual report on Fo rm 10 - K for the year ended December 31, 2011, which has been filed with the SEC. Information regarding the officers and directors of Image is available in Image annual report on For m 1 0 - K/A for the year ended March 31, 2011, which has been filed with the SEC. Additional information regarding the interests of such potential participants is also included in the Reg ist ration Statement on Form S - 4 (and will be included in the definitive joint proxy statement / prospectus for the proposed business combination) and the other relevant documents filed with the SEC . Non - GAAP Financials The financial information and data contained in this presentation is unaudited and does not conform to the SEC’s Regulation S - X . Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, the joint proxy statement / prospectus included in the Re gis tration Statement on Form S - 4 filed by RLJ Entertainment, Inc. with the SEC. This presentation includes certain estimated financial information and forecasts presented as pro forma financ ial measures that are not derived in accordance with generally accepted accounting principals (“GAAP”), and which may be deemed to be non - GAAP financial measures within the meaning of Regulat ion G promulgated by the SEC. RLJ Acquisition, Inc. believes that the presentation of these non - GAAP financial measures serve to enhance the understanding of the financial per formance of RLJ, Image and Acorn and the proposed business combination. However, these non - GAAP financial measures should be considered in addition to, and not as substitutes fo r or superior to, financial measures of financial performance prepared in accordance with GAAP. Pro forma financial measures may not be comparable to similarly titled pro for ma measures reported by other companies.

3 Forward Looking Statements This presentation includes “forward - looking statements” within the meaning of the safe harbor provisions of the United States Pr ivate Securities Litigation Reform Act of 1995. RLJ Acquisition, Inc’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate ,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements include, without limitation, RLJ Acquisition, Inc’s expectations with respect to future performance and anticipate d f inancial impacts of the proposed transaction; approval of the proposed certificate of incorporation amendments by shareholders, the satisfaction of the closin g c onditions to the proposed transaction; and the timing of the completion of the proposed transaction. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ mater ially from the expected results. Most of these factors are outside RLJ Acquisition, Inc’s control and difficult to predict. Factors that may cause such differences i ncl ude, but are not limited to, those described under the heading “Risk Factors” in RLJ Acquisition, Inc’s final prospectus, dated February 15, 2011, and annual report from 10 - K for the year ended December 31, 2011, and Image’s annual report on Form 10 - K, as amended, for the fiscal year ended March 31, 2011. Other factors include the possib ility that the transactions contemplated by a potential transaction agreement do not close, including due to the failure of certain closing conditions. RLJ Acquisition, Inc. cautions that the foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in RLJ Acquisition, Inc’s most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward - loo king statements concerning RLJ Acquisition, Inc., a potential transaction agreement, the related transactions, or other matters and attributable to RLJ Acqu isi tion, Inc. or any person acting on their behalf, are expressly qualified in their entirety by the cautionary statements above. RLJ Acquisition, Inc. cautions readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made. RLJ Acquisition, Inc. does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, condit ions or circumstances on which any such statement is based.

Executive Summary RLJ Entertainment will be one of the largest independent global distributors of video and digital content with expected combined 2012 revenue of approximately $230 million and expected 2013 revenue of approximately $264 million * Demonstrated track record of successfully acquiring, curating, pricing and extracting value from content Strong expertise in developing niche brands and genre categories, and effectively reaching targeted audiences Superior management team with over 150 years of combined industry experience and a history of success in the sector led by Robert Johnson Well - capitalized and profitable company with significant operational and financial flexibility Independent and nimble; can quickly react to changes in market dynamics Strong cash flow and conservative leverage based on 2012E pro forma EBITDA of $36.9 million and 2013E EBITDA of $44.2 million * Significant growth opportunities and synergies upon integration Product expansion (i.e., additional libraries), genre expansion (i.e., urban, faith, fitness) and channel expansion (i.e., Google and YouTube) Access to major strategic players and content creators 4 RLJ Entertainment, Inc. (“RLJ Entertainment”) is being formed through the three - way combination of RLJ Acquisition, Inc., Image Entertainment, Inc. (“Image”) and Acorn Media Group (“Acorn”) * Note: Projections as reported represent the approximate midpoint of ranges provided by management

TED GREEN Director Chief Executive Officer Chairman and CEO of Image Entertainment Former President and Co - Owner of distributor Anchor Bay Most recently Chairman of publically traded TM Entertainment Extensive media background including Sony Wonder, CBS, Polygram Records and ATCO/Warner Music 5 Strong, Experienced Management Team Founder and chairman of Black Entertainment Television (BET), the nation’s first and leading television network targeting an African American audience In 2001, Mr. Johnson sold BET to Viacom for approximately $3 billion and remained the Chief Executive Officer through 2006 In 2003, founded the RLJ Companies, a diversified holding company managing in excess of $3.5 billion in equity and employing over 300 people ROBERT JOHNSON Executive Chairman PETER EDWARDS Vice Chairman Founder and Chairman of Acorn Media Group CEO of Acorn from 1984 to 2007 Led creation of multi - national subsidiaries and the launch of a multi - channel direct to consumer marketing operation Director of Agatha Christie Limited MIGUEL PENELLA Director President & Chief Operating Officer CEO of Acorn Media Group since 2007 President of Acorn Direct Division from 2004 through 2007 Led efforts to acquire more significant content ownership with acquisitions of Greenlit Productions (Foyle’s War) and a controlling interest in Agatha Christie Ltd; and led creation of subscription video streaming service JOHN HYDE Director President, Global and Strategic Development Vice Chairman of Image Entertainment Seasoned industry executive specializing in turnaround situations Experience includes serving as COO of Starz Media, COO of IDT Entertainment, CEO of Film Roman and Vice Chairman of Jim Henson Company JOHN AVAGLIANO Chief Financial Officer COO and CFO of Image Entertainment President of Britania Holdings, a provider of strategic and financial services to film, video and apparel industries Previously held multiple financial and operation positions at Warner Bros. Home Entertainment (CFO), Warner Music (SVP of Financial Operations) and Polygram (SVP of Finance for North America)

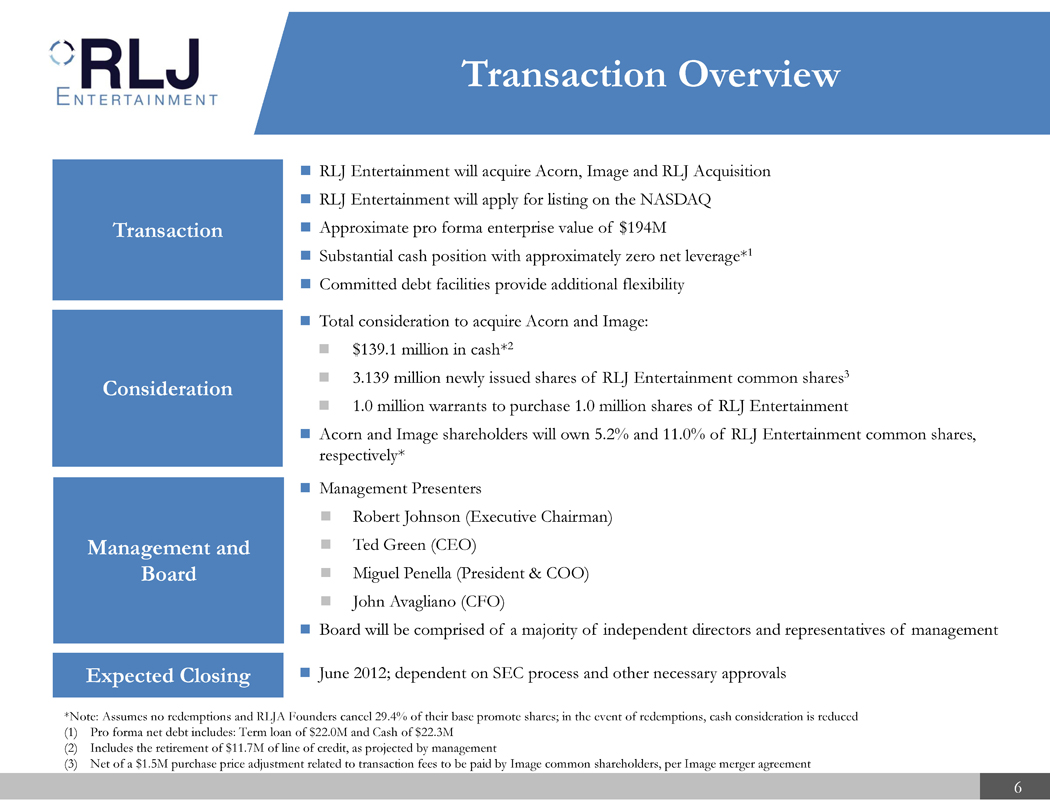

Transaction Overview 6 Transaction Consideration Management and Board Expected Closing RLJ Entertainment will acquire Acorn, Image and RLJ Acquisition RLJ Entertainment will apply for listing on the NASDAQ Approximate pro forma enterprise value of $194M Substantial cash position with approximately zero net leverage* 1 Committed debt facilities provide additional flexibility Total consideration to acquire Acorn and Image: $139.1 million in cash* 2 3.139 million newly issued shares of RLJ Entertainment common shares 3 1.0 million warrants to purchase 1.0 million shares of RLJ Entertainment Acorn and Image shareholders will own 5.2% and 11.0% of RLJ Entertainment common shares, respectively* Management Presenters Robert Johnson (Executive Chairman) Ted Green (CEO) Miguel Penella (President & COO) John Avagliano (CFO) Board will be comprised of a majority of independent directors and representatives of management June 2012; dependent on SEC process and other necessary approvals *Note: Assumes no redemptions and RLJA Founders cancel 29.4% of their base promote shares; in the event of redemptions, cash con sideration is reduced (1) Pro forma net debt includes: Term loan of $22.0M and Cash of $22.3M (2) Includes the retirement of $11.7M of line of credit, as projected by management (3) Net of a $1.5M purchase price adjustment related to transaction fees to be paid by Image common shareholders, per Image merge r a greement

Investment Highlights 7 One of the largest independent distributors of genre - based content in a highly - fragmented market Long - term control of 5,000+ niche and genre titles creates significant barriers to entry Over 20 million disks sold in 2011 on a combined basis yields economies of scale in manufacturing and distribution, and increases leverage with retail partners Strong and growing relationships with major online and streaming content providers Seasoned management team with over 150 cumulative years of directly relevant industry experience G ROWTH P RESENCE & S CALE D ISTRIBUTION F INANCIALS & C APITAL S TRUCTURE Significant and multiple opportunities to roll - up other entities and acquire libraries/content Leverage growing digital distribution across existing 3 rd Party relationships and proprietary outlets Robert Johnson and management’s expertise and relationships will accelerate growth Easily realized, substantial synergies Overall market expanding as consumers continue to increase their appetite for content and diversify the manner in which it is consumed Strong balance sheet with limited leverage positions the company for future growth Steady, predictable and diversified revenue streams Flexible capital structure Ability to make complementary and strategic acquisitions such as recent Agatha Christie library Ability to optimize content value by actively managing distribution across all formats, channels, and geographies (i.e. windowing strategies, format agnostic approach, price discrimination) Global distribution with centers of excellence in the U.S., Canada, U.K. and Australia Respected Acorn brand provides well - established direct - to - consumer channel

RLJ Entertainment Business Overview

S ELECT B USINESS T ERMS 9 Business Description 9 Content Focus: Genre - based titles, brands, and libraries Rights Term: Generally 5 - 20 years Historic renewal rate of more than 95% Acquisition Cost: Initial upfront royalty payment to content owner RLJ retains 100% of revenue from content distribution until it recoups its distribution fee, all distribution costs, and/or the royalty advance After the fees and/or royalty advance are recouped, royalty payments become payable to the content owner; usual revenue split is in favor of RLJ Return on Investment: ~30% target IRR for acquired content over the term of rights’ ownership Content Owner Content Distribution Physical Digital Broadcast Direct Royalty Payments Receive Revenue Deliver Content Acquire Content B USINESS M ODEL

Unique Content Offering 10 Market - leading position in British Mystery and Drama programming where long - running franchises provide steady and predictable revenue streams over long periods of time Films (feature films, independents, horror, documentaries, direct - to - DVD, etc.) Niche and genre - oriented brands and titles (health & wellness, British programming, life - long learning, urban, etc.) Specialty Content (classic television, comedy performances, music concerts, theatre productions, gospel, horror, etc.) Audio content Literary publishing rights RLJ Entertainment will own or have long - term rights to a variety of genre - based entertainment content in numerous formats C OMEDY B RITISH M YSTERY & D RAMA H ORROR F EATURE F ILMS U RBAN F ITNESS /H EALTH & W ELLNESS C RITERION C ATALOG M USIC

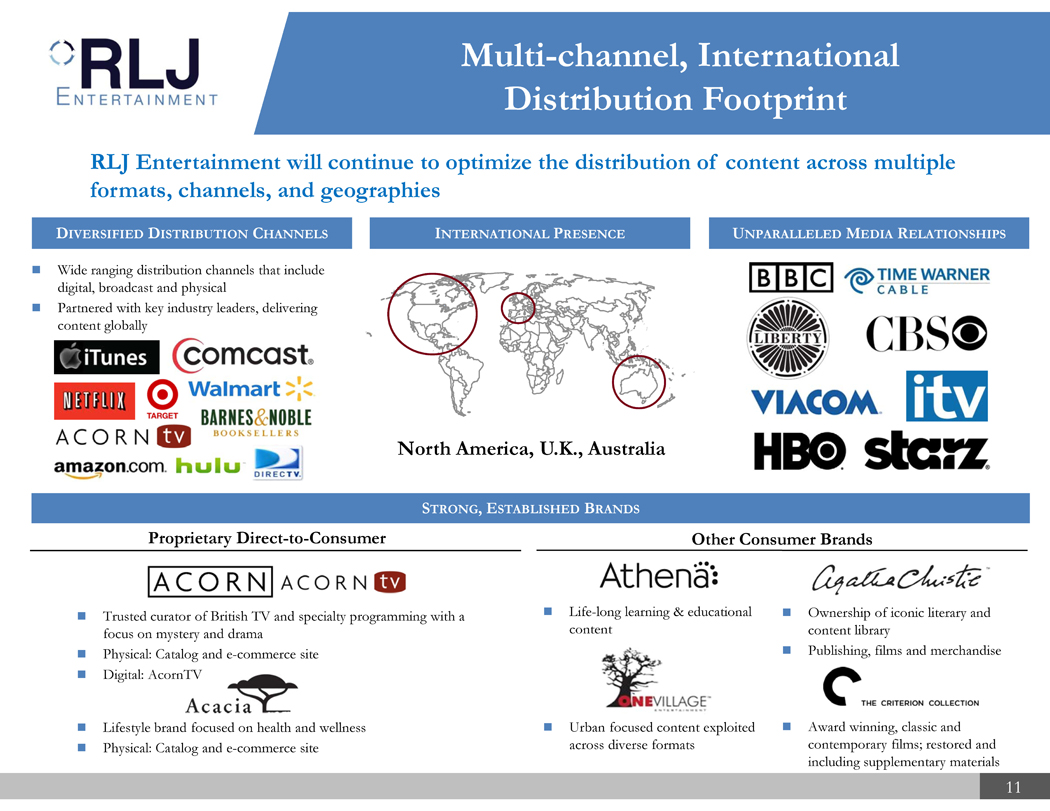

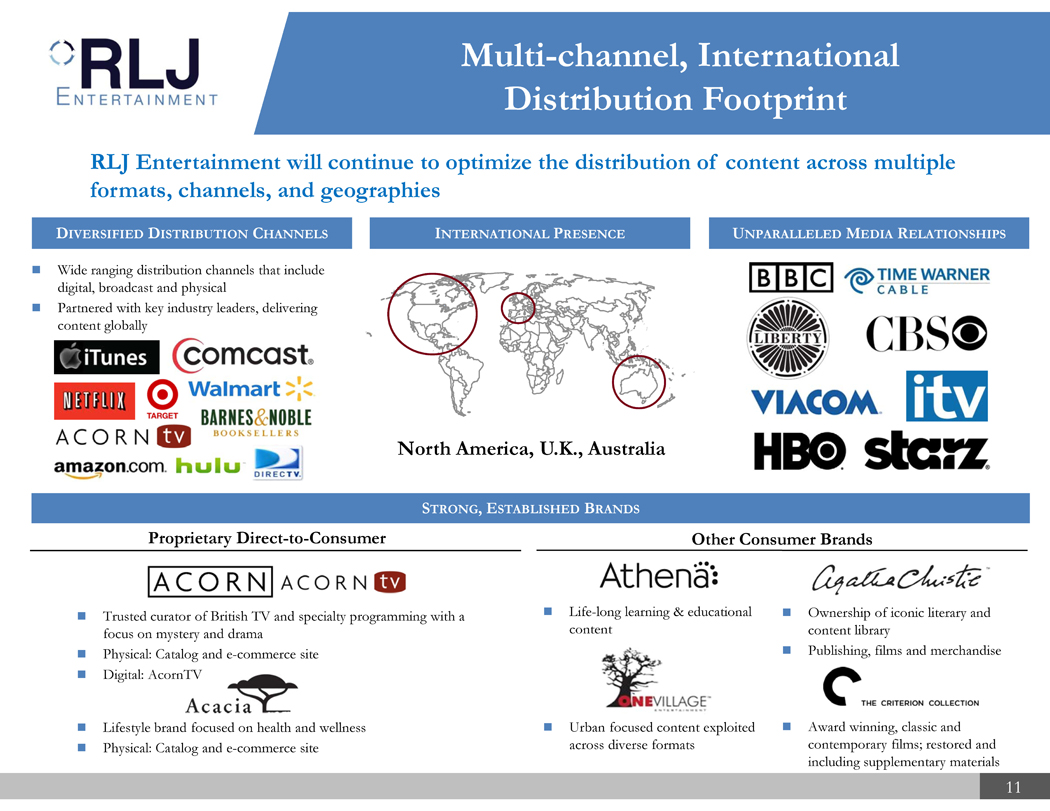

Trusted curator of British TV and specialty programming with a focus on mystery and drama Physical: Catalog and e - commerce site Digital: AcornTV Multi - channel, International Distribution Footprint 11 RLJ Entertainment will continue to optimize the distribution of content across multiple formats, channels, and geographies Proprietary Direct - to - Consumer Lifestyle brand focused on health and wellness Physical: Catalog and e - commerce site Other Consumer Brands D IVERSIFIED D ISTRIBUTION C HANNELS Wide ranging distribution channels that include digital, broadcast and physical Partnered with key industry leaders, delivering content globally I NTERNATIONAL P RESENCE U NPARALLELED M EDIA R ELATIONSHIPS North America, U.K., Australia S TRONG , E STABLISHED B RANDS Life - long learning & educational content Ownership of iconic literary and content library Publishing, films and merchandise Urban focused content exploited across diverse formats Award winning, classic and contemporary films; restored and including supplementary materials

Growth Strategy 12 Leverage current brands, content rights and categories along with current infrastructure through continued acquisition of titles Continue to build out key initiatives in urban, faith, horror, fitness and learning segments Acquire content libraries to augment current offering with new genres/niches Coordination with 3 rd party independent film community D ISTRIBUTION C ONTENT Develop and execute niche brand strategies focused on digital distribution and direct relationships with distinct audiences Focus on securing comprehensive distribution rights and/or content ownership; ensuring the ability to maximize exploitation opportunities as distribution platforms evolve Develop and build out monetization platform for content producers (i.e. AcornTV) Leverage international distribution capabilities Roll up digital and smaller distribution entities

Financial Overview

Retail Distribution 69% Direct - To - Consumer 18% Digital & Broadcast 12% Other 2% Entertainment Media 89% Other 11% $31.7 $38.9 $1.6 $5.3 $3.7 $22.2 $36.9 $44.2 $0 $10 $20 $30 $40 $50 2011 2012E 2013E Pro Forma Realized Synergies Annualized Synergies $199 $230 $264 $0 $50 $100 $150 $200 $250 $300 2011 2012E 2013E * Note: Projections as reported represent the approximate midpoint of ranges provided by management (1) Based on 2011 revenue of $187.6 million for Image and Acorn combined; ACL revenues and sales mix not included Consolidated Financial Snapshot Strong revenue - generating base with significant operating synergies and up - side potential 14 $ in millions $ in millions P RO F ORMA EBITDA P RO F ORMA R EVENUE C HANNEL M IX 1 P RODUCT M IX 1

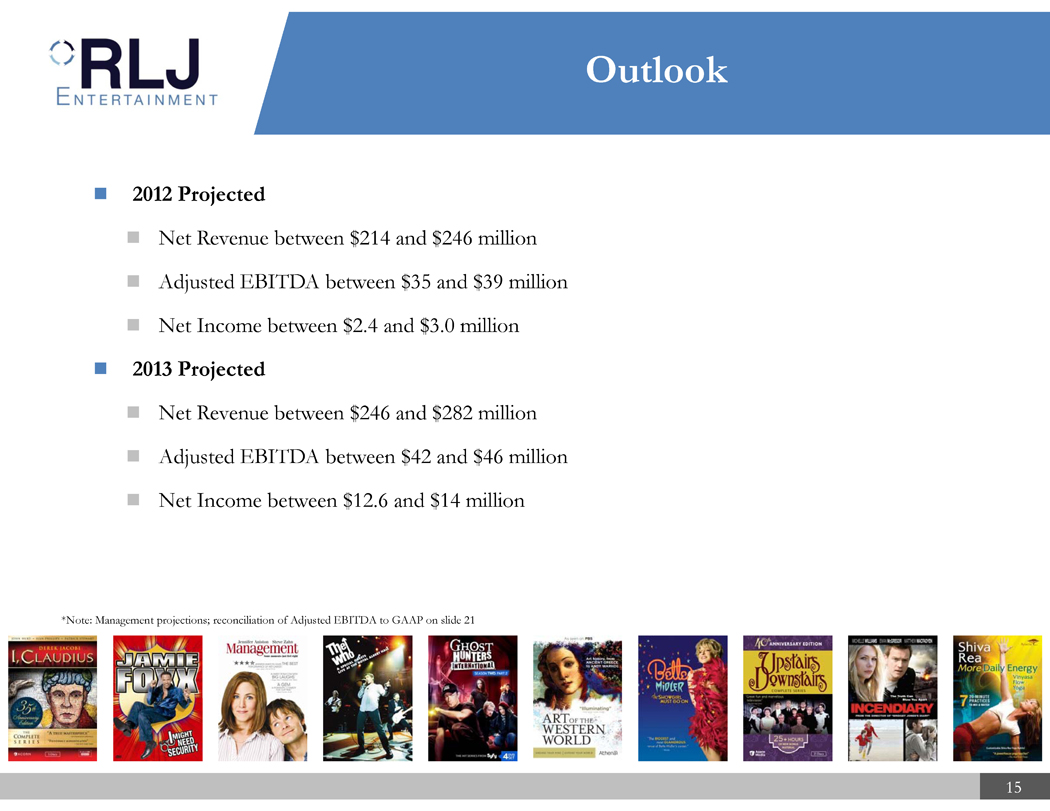

Outlook 2012 Projected Net Revenue between $214 and $246 million Adjusted EBITDA between $35 and $39 million Net Income between $2.4 and $3.0 million 2013 Projected Net Revenue between $246 and $282 million Adjusted EBITDA between $42 and $46 million Net Income between $12.6 and $14 million 15 *Note: Management projections; reconciliation of Adjusted EBITDA to GAAP on slide 21

Transaction Summary

Implied Share Price $10.00 Fully Diluted Shares 5 19.417 Pro Forma Fully Diluted Equity Value $194.2 Pro Forma Net Debt 6 (0.3) Implied Enterprise Value $193.9 2012E Pro Forma EBITDA 7 $36.9 Implied TEV/2012 EBITDA Multiple 5.3x 2013E EBITDA 7 $44.2 Implied TEV/2013 EBITDA Multiple 4.4x Sources Uses RLJ Cash 1 $140.7 Purchase of Acorn Debt Facility 22.0 Cash 3 $104.8 Vendor Working Capital Advance 2 3.8 Stock 10.0 RLJ Common Equity Issued 31.4 Revolver Retirement 4 3.2 Total Sources $197.9 Subtotal $118.0 Purchase of Image Cash $22.6 Stock 21.4 Debt Retirement 4 8.5 Subtotal $52.5 Fees & Expenses 5.1 Cash to Balance Sheet 22.3 Total Uses $197.9 RLJA Public 74.0% RLJA Founders 9.8% Image Shareholders 11.0% Acorn Shareholders 5.2% Transaction Valuation and Ownership 17 RLJA will offer the opportunity to redeem its common stock via a proxy process RLJA Sponsors will cancel 29.4% of their base promote shares, retaining 1,902,574 base shares RLJ Entertainment to operate under a December 31 fiscal year end Assuming no redemptions, cash may be used to opportunistically repurchase warrants at closing Image insiders to cancel up to 35,401,977 of Image common shares Sun Trust - Robinson Humphrey to provide debt financing in support of the transaction; $22M term loan and $20M line of credit ($16M available to be drawn at close) committed at close, and approximately 50% of the total debt facility up to $72M will be syndicated (delayed - draw term loan and line of credit) Image preferred equity holders to exchange stock for cash consideration and subordinated notes depending on the level of cash available at close *Note: Assumes no redemptions and RLJA Founders cancel 29.4% of their base promote shares; in the event of redemptions, cash consideration is reduced (1) Cash in trust net of deferred underwriting fees and RLJA unrestricted cash to be contributed (2) Interest - free working capital advance made by the company’s manufacturing and distribution partners (3) Assumes $2.9 million in ACL transaction fees to be paid as cash consideration per Acorn merger agreement (4) Represents management’s estimated revolver balances at close T RANSACTION H IGHLIGHTS P RO F ORMA E QUITY O WNERSHIP * T RANSACTION S OURCES & U SES * I MPLIED T RANSACTION V ALUE * (5) Net of Founders’ contingent shares (6) Pro forma net debt includes: Term Loan of $22.0M and Cash of $22.3M (7) Excludes any potential long - term equity incentive compensation plan to be provided to executives

% of Valuation Multiples Operating Metrics Stock 52 Week Market Enterprise EV/Sales EV/EBITDA Revenue Growth EBITDA Margin Company Name Price High Cap Value 2011 2012E 2013E 2011 2012E 2013E 2012E 2013E 2012E 2013E Lions Gate Entertainment Corp. $12.21 75.4% $1,751 $2,646 1.7x 1.3x 1.1x NM 9.3x 11.8x 32.5% 12.4% 13.5% 9.5% DreamWorks Animation SKG Inc. 17.42 63.6% 1,463 1,346 1.9x 1.9x 1.8x 10.4x 11.4x 9.8x 0.1% 7.7% 17.0% 18.3% Perform Group plc. 4.78 91.0% 1,078 978 5.9x 4.4x 3.5x NM 18.6x 13.5x 33.8% 25.5% 23.9% 26.2% Eros International Plc 4.06 89.3% 480 636 3.6x 2.8x 2.6x 8.5x 7.5x NA 29.7% 7.1% 37.3% NA Entertainment One Ltd. 2.55 76.7% 478 632 0.8x 0.7x 0.7x 9.6x 7.1x 6.6x 10.4% 5.9% 10.5% 10.6% Gaumont SA 59.08 92.5% 252 400 3.7x 4.4x 5.0x NA NA NA (15.3%) (13.4%) NA NA Bona Film Group Limited 5.61 84.5% 341 349 2.9x 2.0x 1.4x 18.9x 12.4x 7.5x 48.5% 40.4% 16.0% 18.8% Gaiam Inc. 4.09 65.7% 93 81 0.3x 0.4x 0.4x 12.5x 5.3x 4.2x (30.6%) 13.5% 8.1% 9.0% Max $2,646 5.9x 4.4x 5.0x 18.9x 18.6x 13.5x 48.5% 40.4% 37.3% 26.2% 75th Percentile 1,070 3.6x 3.2x 2.8x 12.5x 11.9x 11.3x 32.9% 16.5% 20.5% 18.7% Mean 884 2.6x 2.2x 2.1x 12.0x 10.2x 8.9x 13.7% 12.4% 18.1% 15.4% Median 634 2.4x 2.0x 1.6x 10.4x 9.3x 8.7x 20.1% 10.1% 16.0% 14.5% 25th Percentile 387 1.5x 1.1x 1.0x 9.6x 7.3x 6.9x (3.7%) 6.8% 12.0% 9.8% Min 81 0.3x 0.4x 0.4x 8.5x 5.3x 4.2x (30.6%) (13.4%) 8.1% 9.0% RLJ Entertainment $10.00 - - $193.9 1.0x 0.8x 0.7x 8.7x 5.3x 4.4x 15.6% 14.8% 16.0% 16.7% Public Comparables 18 Management believes RLJ Entertainment is being created at a substantial discount to the peer group At 5.3x 2012E EBITDA and 4.4x 2013E EBITDA, the entity’s implied trading range is at an approximate 50%+ discount to its peers Source: Capital IQ Note: All financial information as of market close on 4/12/12; RLJ Entertainment projections provided by management

Appendix

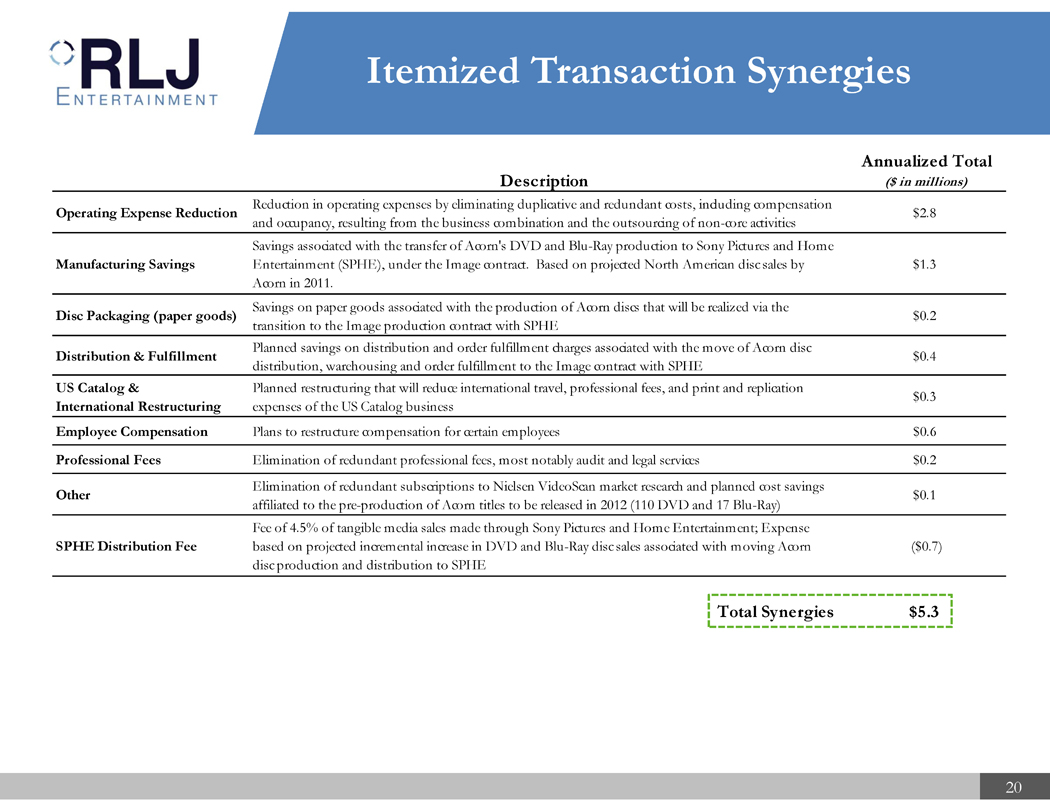

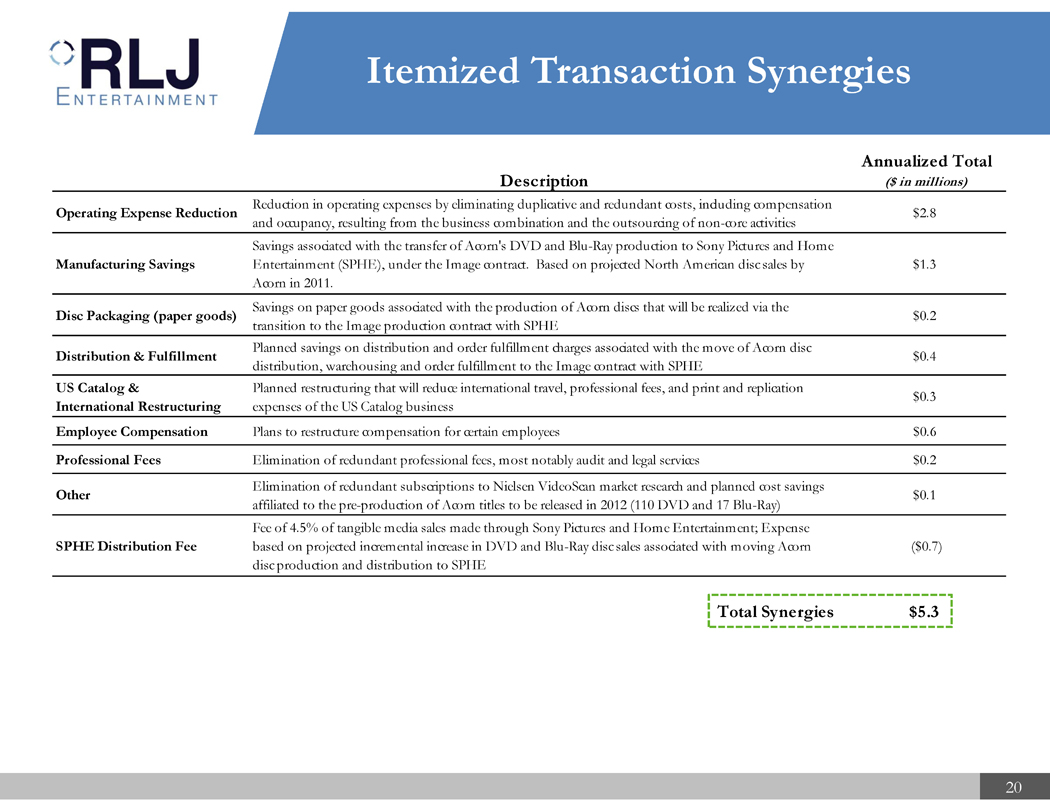

Description Annualized Total ($ in millions) Operating Expense Reduction Reduction in operating expenses by eliminating duplicative and redundant costs, including compensation and occupancy, resulting from the business combination and the outsourcing of non-core activities $2.8 Manufacturing Savings Savings associated with the transfer of Acorn's DVD and Blu-Ray production to Sony Pictures and Home Entertainment (SPHE), under the Image contract. Based on projected North American disc sales by Acorn in 2011. $1.3 Disc Packaging (paper goods) Savings on paper goods associated with the production of Acorn discs that will be realized via the transition to the Image production contract with SPHE $0.2 Distribution & Fulfillment Planned savings on distribution and order fulfillment charges associated with the move of Acorn disc distribution, warehousing and order fulfillment to the Image contract with SPHE $0.4 US Catalog & International Restructuring Planned restructuring that will reduce international travel, professional fees, and print and replication expenses of the US Catalog business $0.3 Employee Compensation Plans to restructure compensation for certain employees $0.6 Professional Fees Elimination of redundant professional fees, most notably audit and legal services $0.2 Other Elimination of redundant subscriptions to Nielsen VideoScan market research and planned cost savings affiliated to the pre-production of Acorn titles to be released in 2012 (110 DVD and 17 Blu-Ray) $0.1 SPHE Distribution Fee Fee of 4.5% of tangible media sales made through Sony Pictures and Home Entertainment; Expense based on projected incremental increase in DVD and Blu-Ray disc sales associated with moving Acorn disc production and distribution to SPHE ($0.7) Total Synergies $5.3 Itemized Transaction Synergies 20

Adjusted EBITDA Reconciliation 21 * Note: Projections as reported represent the approximate midpoint of ranges provided by management (1) Assumes transaction date of 6/30/12 (2) Assumes a 40% tax rate (3) Includes deferred manufacturing credit related to the $3.8 million vendor working capital advance (4) Includes step - up amortization of identified intangibles related to the business combination (5) One - time severance and other integration expenses, as projected by management ($ in Millions) 2011 2012E 1 2013E Net Income (Loss) to Common (1.9) 2.7 13.3 Income Taxes (Benefit) 2 (1.0) 4.3 8.8 Interest Expense, net 1.9 2.6 2.9 Other Expense 3 (0.1) - - Depreciation and Amortization 4 19.5 19.3 19.2 EBITDA, as presented 18.4 28.9 44.2 Acorn Normalizing Adjustments 1.3 3.5 - Image Normalizing Adjustments 3.0 - - ACL Normalizing Adjustments (1.0) - - RLJ Normalizing Adjustments 0.5 - - Unrealized Transaction Synergies - 3.7 - Non-Recurring Business Combination Adjustments 5 - 0.9 - Total Adjustments 3.8 8.0 0.0 Adjusted EBITDA, as presented $22.2 $36.9 $44.2

37.3% 23.9% 17.0% 16.0% 16.0% 13.7% 10.5% 8.1% N/A 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% Eros International Perform Group DreamWorks RLJ Entertainment Bona Film Lions Gate Entertainment One Gaiam Gaumont 13.5x 11.8x 9.8x 7.5x 6.6x 4.4x 4.2x N/A N/A 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x Perform Group Lions Gate DreamWorks Bona Film Entertainment One RLJ Entertainment Gaiam Eros International Gaumont 18.6x 12.4x 11.4x 9.3x 7.5x 7.1x 5.3x 5.3x N/A 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x 20.0x Perform Group Bona Film DreamWorks Lions Gate Eros International Entertainment One Gaiam RLJ Entertainment Gaumont 3.1x 1.7x 1.4x 0.2x - 0.1x - 0.9x - 1.0x - 1.9x N/A - 3.0x - 2.0x - 1.0x 0.0x 1.0x 2.0x 3.0x 4.0x Lions Gate Entertainment One Eros International Bona Film RLJ Entertainment Gaiam DreamWorks Perform Group Gaumont Public Comparables Benchmarking 22 TEV/2012P EBITDA TEV/2013E EBITDA N ET D EBT /2012P EBITDA 2012P EBITDA M ARGINS Source: Capital IQ Note: All financial information as of market close on 4/11/12; RLJ Entertainment projections provided by management