UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to §240.14a-12

COLLINS INDUSTRIES, INC.

- --------------------------------------------------------------------------------

(Name of Registrant as Specified In Its Charter)

- --------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

- --------------------------------------------------------------------------------

2) Aggregate number of securities to which transaction applies:

- --------------------------------------------------------------------------------

3) Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

- --------------------------------------------------------------------------------

4) Proposed maximum aggregate value of transaction:

- --------------------------------------------------------------------------------

5) Total fee paid:

- --------------------------------------------------------------------------------

[_] Fee paid previously with preliminary materials:

- --------------------------------------------------------------------------------

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number,

or the form or schedule and the date of its filing.

1) Amount previously paid:

- --------------------------------------------------------------------------------

2) Form, Schedule or Registration Statement No.:

- --------------------------------------------------------------------------------

3) Filing Party:

- --------------------------------------------------------------------------------

4) Date Filed:

- --------------------------------------------------------------------------------

|

15 Compound Drive

Hutchinson, Kansas 67502-4349

(620) 663-5551

www.collinsind.com

August 30, 2005

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of

Collins Industries, Inc. which will be held at 10:00 a.m., local time, on

Tuesday, September 27, 2005, at the Dallas Marriott Solana, 5 Village Circle,

Westlake, Texas.

We plan to review the status of, and future opportunities for, the Company

and the industries we serve. The principal business matter to be considered at

the meeting will be the election of two directors.

Attached you also will find the Notice of the Annual Meeting of

Stockholders, the Company's proxy statement and a proxy for the meeting. It is

important that your shares be represented at the meeting, and we hope you will

be able to attend the meeting in person. Whether or not you plan to attend the

meeting, please be sure to vote as soon as possible. You may vote in person, by

mail, by telephone or via the Internet. Instructions to vote by each of these

methods are enclosed.

Your prompt response will save the Company the cost of further solicitation of

unreturned proxies.

We look forward to seeing you at the Annual Meeting.

Sincerely yours,

/s/ Don L. Collins

Don L. Collins,

Chairman of the Board

COLLINS INDUSTRIES, INC.

15 Compound Drive

Hutchinson, Kansas 67502

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On Tuesday, September 27, 2005

NOTICE IS HEREBY GIVEN THAT the annual meeting of Stockholders (the "Annual

Meeting") of Collins Industries, Inc., a Missouri corporation (the "Company"),

will be held at 10:00 a.m., local time, on Tuesday, September 27, 2005 at the

Dallas Marriott Solana, 5 Village Circle, Westlake, Texas, for the purpose of

considering and voting upon the following matters:

1. The election of two directors to serve their respective terms and

until their successors shall be elected and shall qualify, and

2. The transaction of such other business as may properly come before the

meeting and any adjournments thereof.

All of the above matters are more fully described in the accompanying Proxy

Statement.

The Board of Directors has fixed the close of business on July 25, 2005, as

the date of record for determining stockholders entitled to receive notice of

and to vote at the Annual Meeting and any adjournments thereof. The stock

transfer books of the Company will remain open between the record date and the

date of the meeting.

IN ORDER THAT YOUR SHARES MAY BE REPRESENTED AT THE ANNUAL MEETING, PLEASE

FILL OUT, DATE, SIGN AND RETURN THE ENCLOSED PROXY PROMPTLY, EVEN IF YOU PLAN TO

ATTEND THE ANNUAL MEETING IN PERSON. A RETURN-ADDRESSED ENVELOPE, WHICH REQUIRES

NO POSTAGE, IS ENCLOSED. IF YOU LATER DESIRE TO REVOKE OR CHANGE YOUR PROXY FOR

ANY REASON, YOU MAY DO SO AT ANY TIME BEFORE THE VOTING, BY DELIVERING TO THE

COMPANY A WRITTEN NOTICE OF REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER

DATE OR BY ATTENDING THE ANNUAL MEETING AND VOTING IN PERSON.

By order of the Board of Directors

Dated: August 30, 2005 /s/ Don L. Collins

Don L. Collins,

Chairman of the Board

COLLINS INDUSTRIES, INC.

15 Compound Drive

Hutchinson, Kansas 67502

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held on September 27, 2005

GENERAL INFORMATION

INTRODUCTION. This Proxy Statement is furnished in connection with the

solicitation by and on behalf of the Board of Directors of Collins Industries,

Inc. ("the Company") of proxies for use at the annual meeting of Stockholders to

be held at 10:00 a.m., local time, on Tuesday, September 27, 2005 at the Dallas

Marriott Solana, 5 Village Circle, Westlake, Texas and any adjournment thereof

(the "Annual Meeting"). This Proxy Statement, together with the enclosed Notice

of Annual Meeting, Form of Proxy and Annual Report to Stockholders for the

fiscal year ended October 31, 2004 (the "Annual Report"), is being mailed to

Stockholders on or about August 30, 2005. The address of the principal executive

offices of the Company is 15 Compound Drive, Hutchinson, Kansas 67502. Except

for items specifically incorporated by reference herein, the Annual Report does

not form any part of this Proxy Statement.

REVOCABILITY OF PROXIES. Each proxy that is properly executed and returned in

time for use at the Annual Meeting will be voted at the Annual Meeting, and any

adjournments thereof, in accordance with the choices specified. Any proxy given

pursuant to this solicitation may be revoked by the person giving it at any time

before the voting by delivering to the Company a written notice of revocation or

a duly executed proxy bearing a later date or by attending the Annual Meeting

and voting in person.

COST OF SOLICITATION. The entire cost of solicitation of proxies will be borne

by the Company. Solicitation will be made by mail. Additional solicitation may

be made by officers and employees of the Company by means of a follow-up letter,

personal interview, telephone or telegram. Such persons will receive no

additional compensation for such services. Proxy cards and materials also will

be distributed to beneficial owners through brokers, custodians, nominees and

similar parties, and the Company intends to reimburse such parties for

reasonable expenses incurred by them in connection with such distribution.

QUORUM AND VOTING. The authorized capital stock of the Company consists of

17,000,000 shares of Common Stock, $.10 par value per share (the "Common Stock")

and 3,000,000 shares of Capital Stock, other than Common Stock, $ .10 par value

per share (the "Capital Stock"). As of the close of business on July 25, 2005

(the "Record Date"), there were 6,625,324 shares of Common Stock outstanding and

no shares of Capital Stock outstanding. All of the shares of Common Stock issued

and outstanding as of the Record Date are entitled to vote at the Annual

Meeting.

Only stockholders of record on the Record Date will be entitled to vote. Each

share of Common Stock is entitled to one vote on all matters except in the

election of directors where the stockholders have cumulative voting rights as

described under "Election of Directors." The presence, in person or by proxy, of

the holders of record of a majority of the outstanding shares of Common Stock

entitled to vote is necessary to constitute a quorum at the Annual Meeting.

Abstentions and broker non-votes are counted for purposes of a quorum and are

tabulated as if votes were not cast for the matters indicated.

MATTERS TO BE ACTED UPON AT THE MEETING

As indicated in the Notice of Annual Meeting of Stockholders, two (2) directors

will be elected at the Annual Meeting.

Proposal 1:

ELECTION OF DIRECTORS

The Board of Directors is presently comprised of five (5) directors serving

staggered three-year terms.

Each Stockholder has cumulative voting rights in electing directors. This means

that the number of shares owned by each Stockholder is multiplied by the number

of directors to be elected and the resulting total number of votes may be cast

for one (1) candidate or divide and cast among any number of candidates.

Cumulative voting rights may be exercised in the same manner as other voting

rights; that is, by proxy or in person. The candidates receiving the highest

number of votes shall be elected. The persons named in the enclosed proxy, or

their substitutes, will vote signed and returned proxies for the nominees listed

below and, unless otherwise indicated on the proxy, cumulative votes will be

divided equally between the nominees. The nominees have been designated as such

by the Board of Directors for the terms specified by name and have agreed to

serve if elected. The nominees are currently serving as directors and

information about each nominee is set forth under "Management."

The Board of Directors has no reason to believe that the nominees will become

unavailable for election. However, if for any reason, any nominee is not

available for election, another person or persons may be nominated by the Board

of Directors and voted for in the discretion of the persons named in the

enclosed proxy. Vacancies on the Board of Directors occurring after the election

will be filled by Board appointment to serve until the next election of such

position by the Stockholders.

THE BOARD OF DIRECTORS RECOMMENDS ELECTION OF THE

FOLLOWING NOMINEES

Don L. Collins 3-year term

Don S. Peters 3-year term

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THIS PROPOSAL

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of July 25, 2005, with respect to

(i) each person who is known by the Company to own beneficially in excess of 5%

of the outstanding Common Stock, (ii) each director of the Company, (iii) each

named executive officer and (iv) all directors and executive officers of the

Company as a group. Each person listed below exercises sole voting power and

sole investment power unless otherwise indicated by footnote. As of July 25,

2005, there were 6,625,324 shares of Common Stock of the Company issued and

outstanding.

Shares

Beneficially Percentage

Name and Address Owned Owned

Venture Securities Corporation 646,061 (1) 9.75%

516 North Bethlehem Pike

Spring House, PA 19477

Collins Industries Tax Deferred 455,599 (2) 6.88%

Savings Plan and Trust

c/o InTrust Bank, Trustee

P.O. Box 8338 Prairie Village, KS 66208

Don L. Collins 715,148 (3) 10.79%

157 East New England Avenue, Suite 364

Winter Park, FL 32789

Donald Lynn Collins 627,552 9.47%

15 Compound Drive

Hutchinson, KS 67502

Arch G. Gothard, III 207,985 (4) 3.12%

15 Compound Drive

Hutchinson, KS 67502

Don S. Peters 132,339 (5) 2.00%

15 Compound Drive

Hutchinson, KS 67502

William R. Patterson 79,000 (6) 1.19%

15 Compound Drive

Hutchinson, KS 67502

Kent E. Tyler 80,704 (7) 1.21%

15 Compound Drive

Hutchinson, KS 67502

Terry L. Clark 58,405 (8) 0.88%

15 Compound Drive

Hutchinson, KS 67502

Larry W. Sayre 75,036 (9) 1.13%

15 Compound Drive

Hutchinson, KS 67502

All officers and directors 2,149,796 (10) 31.99%

as a group (13 persons)

- -----------------

(1) Pursuant to Schedule 13G/A filed with the Securities and Exchange

Commission on February 8, 2005, Venture Securities Corporation, ("Venture")

is a registered investment advisor and furnishes investment advice to over

1,200 clients and certain of those clients hold Collins Industries Common

Stock. In its role as investment advisor and investment manager, Venture

possesses both voting and investment power over certain securities owned by

their clients. All securities reported herein are owned by Venture or its

clients and Venture is deemed to have beneficial ownership of 646,061

shares of the Company's Common Stock as of December 30, 2004. However,

neither one client of Venture nor Venture itself, holds more than 5% of the

stock of Collins Industries in their account. Of the 646,061 shares as to

which Venture is deemed to have beneficial ownership, Venture is deemed to

have (i) sole voting power with respect to 303,975 shares (ii) shared

voting power with respect to 0 shares (iii) sole dispositive power with

respect to 646,061 shares and (iv) shared dispositive power with respect to

0 shares.

(2) As of July 25, 2005, based on information received from the Trustee of the

Plan.

(3) Does not include 7,559 shares owned by Sharon Collins, the wife of Mr.

Collins, as to which Mr. Collins disclaims beneficial ownership.

(4) Includes 45,000 shares deemed beneficially owned pursuant to options

exercisable within 60 days. Mr. Gothard also has shared investment power

with respect to 44,160 shares.

(5) Mr. Peters also has shared investment power with respect to 132,961 shares.

(6) Includes 10,000 shares deemed beneficially owned pursuant to options

exercisable within 60 days.

(7) Includes 30,000 shares deemed beneficially owned pursuant to options

exercisable within 60 days.

(8) Mr. Clark retired from the company on March 18, 2005.

(9) Mr. Sayre retired from the company on March 18, 2005.

(10) Includes 95,400 shares deemed beneficially owned pursuant to options

exercisable within 60 days.

MANAGEMENT

Directors and Executive Officers

The following table sets forth certain information with respect to the

directors and executive officers of the Company.

Name Age Position Within The Company

Don L. Collins (1) 74 Chairman and Director

Donald Lynn Collins (2) 53 President, Chief Executive Officer

and Director

Don S. Peters (1) 75 Director

Arch G. Gothard, III (3) 59 Director

William R. Patterson (2) 63 Director

Terry L. Clark (4) 53 Former Executive Vice President of

Operations

Larry W. Sayre (4) 56 Former Vice President of Finance,

Chief Financial Officer and Secretary

Randall Swift 39 Vice President and Chief Operating

Officer

Cletus Glasener 46 Vice President of Finance, Chief

Financial Officer

Rodney T. Nash 59 Vice President of Engineering

Kent E. Tyler 38 Vice President of Marketing

(1) Nominee for reelection. Term as director expires in 2005.

(2) Term as director expires in 2007.

(3) Term as director expires in 2006.

(4) Retired from the company March 18, 2005

Don L. Collins, founder of the Company, has served as Chairman of the Board

since its inception in 1971 and served as Chief Executive Officer until 1998. He

is Chairman of the Board's Executive Committee.

Donald Lynn Collins joined the Company in 1980 after being associated with

Arthur Andersen LLP, an international accounting firm. Mr. Collins has served as

Chief Executive Officer of the Company since 1998, as President since 1990 and

as a director since 1983. He served as the Chief Operating Officer from 1988

until 1998. He is Chairman of the Board's Policy Committee and a member of the

Board's Executive Committee. He is the son of Don L. Collins.

Don S. Peters, an independent director of the Company since 1983, founded and

was chairman of Peters, Gamm, West and Vincent, Inc., an investment advisory

firm in Wichita, Kansas, from 1983 to December

1991. He has been a financial consultant with Central Plains Advisors, Inc., an

investment advisory firm, since December 1991. He is Chairman of the Board's

Finance Committee and a member of the Board's Audit, Compensation, Nominating

and Policy Committees.

Arch G. Gothard, III, an independent director of the Company since 1987, was

president of First Kansas Group, an investment firm in Junction City, Kansas,

from 1988 to 1999. He was chief financial officer, treasurer and director of

Communications Services, Inc. from 1985 to 1989. He is Chairman of the Board's

Compensation and Nominating Committees and is a member of the Board's Audit,

Finance and Policy Committees. Mr. Gothard also serves as a director of Kenco

Plastics, a manufacturer and molder of plastic products, Colorado Power Sports,

a distributor of ATV's, motorcycles, watercraft and similar products, Pay Phone

Concepts and Dornoch Medical Systems.

William R. Patterson, an independent director of the Company since 1998, and has

been a principal of Stonecreek Management, LLC, a private investment firm, since

1998. From October 1996 to August 1998, he was Executive Vice President of

Premium Standard Farms, Inc., a fully-integrated pork producer and processor,

where he served as a consultant and as acting Chief Financial Officer from

January 1996 to October 1996. From September 1976 through December 1995, he was

a partner in Arthur Andersen LLP. Mr. Patterson is Chairman of the Board's Audit

Committee and is a member of the Board's Compensation, Executive, Finance and

Nominating Committees. Mr. Patterson also serves as a director of American

Italian Pasta Company, a producer of dry pasta, and Premium Standard Farm, Inc.,

an integrated pork producer and processor and as a director and chairman of the

board of Paul Mueller Company, a manufacturer of high-quality stainless steel

tanks and industrial processing equipment

Randall Swift was named Vice President and Chief Operating Officer on April 1,

2005. He joined the Company in 1998 as V.P./Sales and Marketing for Capacity of

Texas, Inc., a wholly-owned subsidiary of the Company. In 1999, Mr. Swift was

promoted to President of Capacity where he continued to serve prior to this

appointment. Mr. Swift possesses an extensive background in sales, engineering

and manufacturing with over six years at Cummins Southern Plains, Inc. prior to

coming to Capacity.

Cletus Glasener was named Vice President of Finance and Chief Financial Officer

on May 23, 2005. Prior to joining the Company he served as Vice President,

Controller and Treasurer of Vought Aircraft Industries since 2000.

Rodney T. Nash joined the Company in 1979 as Engineering Manager and was named

Vice President of Engineering of the Company in November 1986. Prior to joining

the Company, he held engineering positions with Hesston Corporation, a farm

equipment manufacturer, and Butler Manufacturing, a manufacturer of specialized

buildings.

Kent E. Tyler joined the Company in December 1997 as Vice President of

Marketing. Prior to joining the Company, he was Vice President of Ackerman

McQueen, a full-service national marketing and advertising agency.

All executive officers serve at the discretion of the Board of Directors.

Section 16(a) - Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires executive officers and directors of

the Company, and persons who beneficially own more than ten percent (10%) of the

Common Stock (collectively referred to herein as "Reporting Persons"), to file

initial reports of ownership and reports of changes in ownership with the

Securities and Exchange Commission (the "Commission"). Reporting Persons are

required by Commission regulations to furnish the Company with copies of all

Section 16(a) forms they file.

Based solely upon a review of copies of Forms 3, 4 and 5 and amendments thereto

furnished to the Company during its most recent fiscal year, and any written

representations from a person that no Form 5 is required, the Company believes

that all of these forms required to be filed by Reporting Persons were timely

filed pursuant to Section 16(a) of the Exchange Act, except for one late filing

by Donald Lynn Collins and Don L. Collins with respect to an indirect stock

transaction in fiscal year 2004.

COMMITTEES OF THE BOARD AND OTHER COPORATE GOVERNANCE MATTERS

The Board of Directors has established standing Audit, Compensation and

Nominating Committees. The principal responsibilities of each committee are

described below.

The Audit Committee consists of three directors, each of whom is "independent",

as defined by the rules of the National Association of Securities Dealers and

the Sarbanes-Oxley Act of 2002. The Audit Committee met nine (9) times during

Fiscal 2004. It appoints a firm of independent public accountants to examine the

accounting records of the Company and its subsidiaries for the coming year. In

making this appointment, it reviews the nature of both audit-related and

non-audit-related services rendered or to be rendered to the Company and its

subsidiaries by the independent public accountants. The Audit Committee meets

with representatives of the Company's independent public accountants and reviews

with them audit scope, procedures and results, including any recommendations. It

also meets with the Company's chief financial officer to review reports on the

functioning of financial controls. A more complete description of the Audit

Committee's functions is provided in its Charter. The Board of Directors has

determined that William R. Patterson is an "audit committee financial expert" as

defined in Item 401(h) of Regulation S-K. The members of the Audit Committee are

William R. Patterson, III, Arch G. Gothard, III and Don S. Peters.

The Compensation Committee, consisting of three independent directors, met once

during Fiscal 2004. The Compensation Committee establishes the compensation

policies of the Company and makes salary recommendations to the Board of

Directors for all elected officers. It also recommends bonuses for officers and

other senior executives. The members of the Compensation Committee are Arch G.

Gothard, III, William R. Patterson, III and Don S. Peters.

The Nominating Committee, consisting of three independent directors, met once

during Fiscal 2004. It recommends to the Board of Directors nominees for

director to be proposed for election by the stockholders and also reviews the

qualifications of, and recommends to the Board of Directors, candidates to fill

Board of Director vacancies as they may occur during the year. The Nominating

Committee considers suggestions from many sources, including stockholders,

regarding the process for evaluation and possible candidates for director. Such

suggestions, together with appropriate biographical information, should be

submitted to the Secretary of the Company for consideration by the Nominating

Committee by October 24, 2005 for the next annual stockholders meeting. The

views of members of the Nominating Committee regarding the qualifications of

candidates for directors, including shareholder proposed candidates, insofar as

they apply to non-employees, generally favor individuals who have managed

relatively large, complex business, educational, or other organizations or who,

in a professional or business capacity, are accustomed to dealing with complex

business or financial problems. In addition to these guidelines, the Committee

will also evaluate whether the candidate's skills are complementary to the

existing Board members' skills, and the Board's needs for operational,

management, financial and other expertise. A copy of the Nominating Committee's

Charter is available on the Company's website at www.collinsind.com. The members

of the Nominating Committee are Arch G. Gothard, III, William R. Patterson, III

and Don S. Peters.

Actions taken by any committee of the Board of Directors are reported to the

Board of Directors, usually at its next meeting.

There were eleven (11) meetings of the Board of Directors during Fiscal 2004. In

Fiscal 2004, each director attended more than 75% of (i) the total number of

meetings of the Board of Directors and (ii) the total number of meetings held by

all committees of the Board on which he served. The Board of Directors has

affirmatively determined that Messrs. Gothard, Patterson and Peters are

independent as defined by the rules of the National Association of Securities

Dealers.

Shareholder Communications

Historically, the Company has not adopted a formal process for shareholder

communication with the Board of Directors. Nevertheless, every effort has been

made to ensure that the views of shareholders are heard by the Board of

Directors or individual directors, as may be applicable, and that appropriate

responses are provided to shareholders in a timely manner. We believe our

responsiveness to shareholder communications to the Board of Directors has been

excellent.

The Company asks that each director attend the Annual Meeting of Stockholders.

All of the Company's directors attended the last Annual Meeting held on February

27, 2004.

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following table sets forth certain information regarding compensation paid

during each of the Company's last three fiscal years to the Company's Chief

Executive Officer and the other named executive officers.

LONG-TERM

ANNUAL COMPENSATION COMPENSATION

------------------- ------------

Name and Other Annual Restricted Stock

Principal Position Year Salary ($) Bonus ($) Compensation ($)(1) Awards ($) (2)

------------------ ---- ---------- --------- ------------------- --------------

Don L. Collins 2004 400,000 - - 101,000 (3)

Chairman 2003 400,000 - - 108,000 (3)

2002 403,287 90,000 - 150,000 (3)

Donald Lynn Collins 2004 385,000 125,000 28,750 353,500 (4)

President and Chief 2003 380,000 100,000 - 252,000 (4)

Executive Officer 2002 374,012 100,000 - 350,000 (4)

Terry L. Clark (5) 2004 238,500 55,000 39,450 75,750 (6)

Former Executive Vice 2003 237,000 44,000 - 54,000 (6)

President of Operations 2002 234,144 44,000 - 75,000 (6)

Larry W. Sayre (5) 2004 195,000 40,000 36,000 75,750 (7)

Former Vice President of 2003 190,000 30,000 - 54,000 (7)

Finance, CFO and 2002 182,763 30,000 - 75,000 (7)

Secretary

Kent E. Tyler 2004 157,500 25,000 38,550 75,750 (8)

Vice President of 2003 155,000 20,000 - 54,000 (8)

Marketing 2002 154,144 20,000 - 75,000 (8)

(1) Other Annual Compensation relates to relocation expenses paid in

Fiscal 2004.

(2) Under the terms of the Company's 2002 Restricted Stock Award

Agreements, the Restricted Stock fully vests three (3) years after the

date of the initial award. Under the terms of the Restricted Stock

Award Agreements granted in 2003 and 2004, the Restricted Stock vests

four (4) years after the date of the initial award. Dividends are paid

on Restricted Stock at the same rate as paid on all other outstanding

shares of the Company's stock.

(3) Aggregate value at October 31, 2004 amounted to $406,400 based on an

aggregate total of 80,000 Restricted shares.

(4) Aggregate value at October 31, 2004 amounted to $1,066,800 based on an

aggregate total of 210,000 Restricted shares.

(5) Retired from the Company on March 18, 2005.

(6) Aggregate value at October 31, 2004 amounted to $228,600 based on an

aggregate total of 45,000 Restricted shares.

(7) Aggregate value at October 31, 2004 amounted to $228,600 based on an

aggregate total of 45,000 Restricted shares.

(8) Aggregate value at October 31, 2004 amounted to $228,600 based on an

aggregate total of 45,000 Restricted shares.

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table provides information related to options exercised by the

named executive officers during the 2004 fiscal year and the number and value of

options held at October 31, 2004. The Company does not have any outstanding

stock appreciation rights.

Number of Underlying Value of Unexercised

Unexercised Options In-the-Money Options

at Fiscal Year End (1)

Shares Acquire on

Name Exercise (#) Value Realized ($) Exercisable/Unexercisable Excercisable/Unexercisable

Don L. Collins -- -- 205,800/0 $ 154,914/$ -

Donald Lynn Collins -- -- 282,600/0 $ 191,433/$ -

Terry L. Clark -- -- 80,800/0 $ 6,789/$ -

Larry W. Sayre -- -- 55,000/0 $ 6,725/$ -

Kent E. Tyler -- -- 30,000/0 $ 28,638/$ -

(1) The dollar values are calculated by determining the difference

between the fair market value of the underlying Common Stock and the

exercise price of the options at fiscal year end.

Directors' Compensation

During Fiscal 2004, the Company paid each employee director $1,300 for each

Board of Directors meeting attended. Outside directors received $1,900 for each

Board of Directors meeting attended and $1,200 for each Board of Directors

committee meeting attended prior to May 1, 2004, and $1,300 for each meeting

attended thereafter. In addition, Mr. Peters, Mr. Gothard and Mr. Patterson each

received Board of Directors retainer fees of $2,000 per month. Committee fees

are not paid (i) to employee directors and (ii) to outside directors when such

committee meetings are held in connection with a general managers meeting.

Report of the Compensation Committee on Executive Compensation

The Company applies a consistent philosophy of compensation for all employees,

including senior management. This philosophy is based on the premise that the

achievements of the Company result from the coordinated efforts of individuals

working toward common objectives. The Company strives to achieve those

objectives through teamwork that is focused on meeting the expectations of

customers, stockholders and employees.

Executive Compensation Philosophy. The Compensation Committee of the

Board of Directors makes compensation recommendations to the Board of

Directors and is composed of three outside, independent directors. The

goals of the Compensation Committee are to align compensation with

business objectives and performance, and to enable the Company to

attract,

retain and reward executive officers who contribute to the long-term

success of the Company. The Compensation Committee considers several

factors in establishing the executive compensation program of the

Company, including both subjective and objective factors. Although

profitability of the Company and market value of its Common Stock are

considered in establishing the executive compensation program, neither

of these factors is determinative. Rather, the Company's executive

compensation program is based on the following principles:

The Company attempts to compensate competitively.

The Company is committed to providing a compensation program

aimed at attracting and retaining highly qualified people,

primarily from within the industry. To ensure that

compensation is competitive, the Company periodically compares

its compensation practices with those of competitors and other

companies and sets its compensation parameters based on this

review.

The Company compensates sustained performance.

Executive officers are rewarded based upon corporate

performance and individual performance. Corporate performance

is not determined strictly on the basis of designated

criteria, but is evaluated on the basis of many factors,

including, but not limited to, earnings, revenues, product

innovation, market share, strategic and business plan goals,

the extent to which strategic and business plan goals are met

and current industry conditions. Individual performance is

evaluated by reviewing the executive officer's individual

performance as well as the performance of that officer's

functional area of responsibility.

The Company strives for fairness in the administration

of compensation.

The Company attempts to apply its compensation philosophy

uniformly. The Company strives to achieve a balance of the

compensation paid to a particular individual and the

compensation paid to other executives both inside the Company

and at competing companies.

The Company's process of assessing executive performance is as follows:

1. At the beginning of the annual performance cycle,

objectives and key goals are set for the Company's

executives.

2. Each executive is given ongoing feedback on

performance.

3. At the end of the annual performance cycle, the Chief

Executive Officer and the Compensation Committee

evaluate each executive's accomplishment of

objectives and attainment of key goals.

4. The accomplishment of objectives and attainment of

key goals affect decisions on salary increases and,

if applicable, equity compensation.

Executive Compensation Vehicles. The Company utilizes the three

components of its compensation program to attract and retain key executives,

enabling it to improve its products, motivate technological innovation, foster

teamwork and adequately reward executives, all with the goal of enhancing

stockholder value. The annual cash-based compensation for executives consists of

a base

salary which reflects the respective executive's level of responsibility,

breadth of knowledge and technical or professional skills and is subject to

increases or decreases at the discretion of the Compensation Committee. Salaries

are reviewed on an annual basis and may be changed at that time based on (i)

information derived from the evaluation procedures described above, (ii) a

determination that an individual's contributions to the Company have increased

(or decreased), and (iii) changes in market conditions and competitive

compensation levels.

From time to time the Company awards bonuses to executive officers upon

attainment of certain Company financial and operational goals. These bonuses are

set forth in the Summary Compensation Table. From time to time the Company also

makes available to directors and executive officers incentive bonuses of cash

and/or restricted Common Stock.

Long-term incentives are intended to be provided through the Company's

1997 Omnibus Incentive Plan (the "Plan") which provides for granting (i) stock

options, restricted stock awards, performance shares, and/or other incentive

awards to employees of the Company and its Subsidiaries on the terms and subject

to the conditions set forth in the Plan, and (ii) Director options and Director

awards to non-employee Directors of the Company as approved by the Board. The

Compensation Committee determines which executives will be eligible for

incentives with the objective of aligning executives' long range interests with

those of the stockholders by providing the executives with the opportunity to

build a meaningful interest in the Company.

Compensation of the Chief Executive Officer. As with the other

executive officers, the CEO's total compensation is based upon several factors,

including both subjective and objective factors. For Fiscal 2004, the

Compensation Committee compared the CEO's annual salary with the annual salaries

of chief executive officers of competitors and other peer groups, pursuant to

several published national studies (the "Studies"). The Compensation Committee

authorized a 2% merit increase in the CEO's annual salary based in part of the

Company's recent performance and determined the CEO's annual salary to be

reasonable and appropriate in light of the comparison to the Studies. The

Compensation Committee has authorized bonuses for the CEO upon the attainment of

certain Company financial and operational goals, just as for the executive

officers that are described above. These bonuses are set forth in the Summary

Compensation Table.

Compensation Committee Members: Arch G. Gothard, III, Chairman

William R. Patterson, III

Don S. Peters

Compensation Committee Interlocks and Insider Participation

During Fiscal 2004, the members of the Compensation Committee were primarily

responsible for determining executive compensation. Messrs. Arch G. Gothard,

III, William R. Patterson, III and Don S. Peters comprise the Compensation

Committee, none of whom is or was an officer or employee of the Company during

any of the past three fiscal years.

REPORT OF THE AUDIT COMMITTEE

The primary purpose of the Audit Committee is to appoint the Company's

independent public accountants to examine the financial records of the Company

and to assist the Board in monitoring the Company's auditing and financial

reporting practices and related matters. Each member of the Audit Committee

meets the current independence and experience requirements of the National

Association of Securities Dealers and the Sarbanes-Oxley Act of 2002.

Management is responsible for the preparation, presentation and integrity of the

Company's financial statements, accounting and financial reporting principles,

internal controls, and procedures designed to ensure compliance with applicable

accounting standards and applicable laws and regulations. The Company's

independent auditors are responsible for performing an independent audit of

Company's consolidated financial statements and expressing an opinion on the

conformity of those financial statements in accordance with generally accepted

accounting principles.

The Audit Committee reviewed and discussed with management the audited financial

statements of the Company for the year ended October 31, 2004. The Audit

Committee also met with representatives of KPMG LLP, independent auditors, to

discuss and review the results of the independent auditors' examination of the

financial statements for the year ended October 31, 2004 and the matters that

require discussion under Statement on Auditing Standards No. 61 as amended,

"Communications with Audit Committees". Additionally, KPMG LLP has provided the

Audit Committee with the written disclosures and the letter required by the

Independence Standards Board Standard No. 1, "Independence Discussions with

Audit Committees," and the Audit Committee has discussed with KPMG LLP their

independence and has satisfied itself as to the auditors' independence.

Based upon the Audit Committee's review of the financial statements and its

other reviews and discussions noted above, the Audit Committee recommended to

the Board of Directors that the audited financial statements be included in the

Company's Annual Report on Form 10-K for the year ended October 31, 2004 for

filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

William R. Patterson, III, Chairman

Arch G. Gothard, III

Don S. Peters

FEES AND SERVICES OF KPMG LLP

The following table summarizes fees billed to the Company for each of the fiscal

years ended October 31, 2004 and 2003 by the principal accounting firm for those

years, KPMG LLP:

2004 2003

---- ----

Audit Fees - Annual Audit & Quarterly Reviews $ 707,000 $ 202,000

Audit Related Fees - -

Tax Fees - Review of Tax Returns & Tax Consulting 12,200 9,250

All Other Fees - Audit Fee for Stock 1,500 -

--------- ---------

Repurchased in Fiscal 2004

Total Fees $ 720,700 $ 211,250

The Audit Committee has considered whether the provision of these services is

compatible with maintaining the principal accountant's independence. The

Company's Audit Committee approves all fees paid to independent auditors for

audit and non-audit services in advance of performance of services. There are no

other specific policies or procedures relating to the pre-approval of services

performed by independent auditors.

On August 3, 2005, KPMG LLP notified the Company that it had resigned as the

independent registered public accounting firm for the Company. The reports of

KPMG on the financial statements of the Company for the fiscal years ended

October 31, 2004 and 2003, did not contain any adverse opinion or disclaimer of

opinion, nor were they qualified or modified as to uncertainty, audit scope, or

accounting principle, except that KPMG's report on the financial statements of

the Company as of and for the years ended October 31, 2004 and 2003, contained a

separate paragraph that indicated that the financial statements for the year

ended October 31, 2003 have been restated and that the Company changed its

method of accounting for goodwill and other intangible assets in 2003 to comply

with the accounting provisions of Statement of Financial Accounting Standard No.

142.

During the fiscal years ended October 31, 2004 and 2003, and through August 9,

2005, there were no disagreements with KPMG an any matter of accounting

principles or practices, financial statement disclosure, or auditing scope of

procedures, which disagreements, if not resolved to the satisfaction of KPMG,

would have caused KPMG to make reference to the subject matter of the

disagreements in connection with KPMG's opinions on the financial statements for

such years.

During the fiscal years ended October 31, 2004 and 2003, and through August 9,

2005, there were no "reportable events" as described in Item 304(a)(1)(i)(v) of

Regulation S-K, other than the two material weaknesses in internal controls,

which were previously disclosed in Item 9A of the Company's Form 10-K filed on

August 3, 2005 and Part I, Item 4 of the Company's Forms 10-Q filed on August 3,

2005 regarding the following: (1) the Company's lack of effective policies and

procedures regarding management override of controls, and the ineffectiveness of

its policies and procedures implementing its Code of Conduct; and (2) the

Company's inadequate controls in place to record workers' compensation reserves

in accordance with generally accepted accounting principles. The Company has

authorized KPMG to respond fully to any inquiries of the Company's successor

accountants concerning the subject matter of these events.

KPMG did not seek the Company's consent to its resignation. As a result, the

Company's audit committee did not recommend or approve the resignation of KPMG.

The Company has provided KPMG a copy of the foregoing disclosures and requested

that KPMG furnish a letter to the Securities and Exchange Commission stating

whether or not KPMG agrees with the above statements. KPMG furnished such a

letter, dated August 9, 2005, a copy of which was filed as an exhibit to the

Company's Form 8-K filed on August 9, 2005.

On August 24, 2005, upon the recommendation and approval of the audit committee

of its board of directors, the Company engaged McGladrey & Pullen, LLP to serve

as the Company's independent auditors.

During the Company's two most recent fiscal years and the subsequent interim

period prior to the Company's engagement of McGladrey & Pullen, LLP, neither the

Company nor anyone on behalf of the Company consulted with McGladrey & Pullen,

LLP regarding either (i) the application of accounting principles to a specified

transaction, either completed or proposed, or the type of audit opinion that

might be rendered on the Company's consolidated financial statements; or (ii)

any other matter that was either the subject of a disagreement (as defined in

Regulation S-K Item 304(a)(1)(iv)) or a reportable event (as described in

Regulation S-k Item 304(a)(1)(iv)).

Representatives of KPMG are not expected to be present at the Annual Meeting and

shall thus not have the opportunity to make a statement and to respond to

questions. Representatives of McGladrey & Pullen, LLP are expected to be present

at the Annual Meeting and shall have the opportunity to make a statement and

respond to appropriate questions.

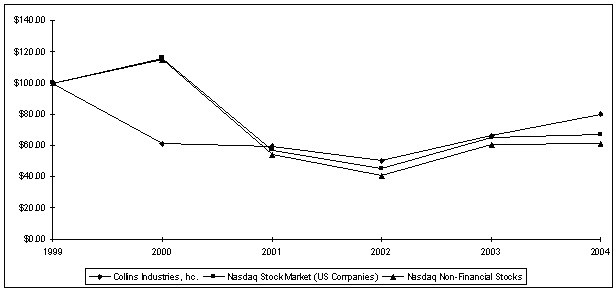

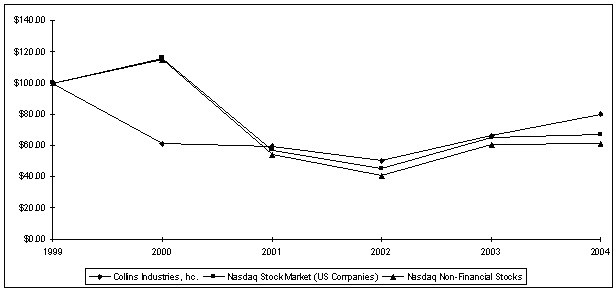

STOCK PERFORMANCE GRAPH

The following graph shows a five-year comparison of cumulative total stockholder

returns for the Company's Common Stock during the five (5) fiscal years ended

October 31, 2004 with the Nasdaq U.S. Stock Market Index and the Nasdaq

Non-Financial Stocks Index. The comparison assumes an investment of $100 on

October 31, 1999 in each index and the Company's Common Stock and that all

dividends were reinvested.

COLLINS INDUSTRIES, INC.

RELATIVE MARKET PERFORMANCE

TOTAL RETURN FISCAL 2004

|

STOCKHOLDER PROPOSALS

Proposals of Stockholders intended to be presented at the 2006 Annual Meeting of

Stockholders must be received by the Company at the offices shown on the first

page of the Proxy Statement within a reasonable time before the Company begins

to print and mail its proxy materials in order to be included in the proxy

material proposed to be issued in connection with such meeting. It is

anticipated that 2006 Annual Meeting of Stockholders will be held in February of

2006. The deadline for providing timely notice to the Company of matters that

Stockholders otherwise desire to introduce at the 2006 Annual Meeting of

Stockholders is within a reasonable time before the Company mails its proxy

materials. It is anticipated that 2006 Annual Meeting of Stockholders will be

held in February 2006. The proxies may exercise their discretionary voting

authority to direct the voting of proxies on any matter submitted for a vote at

the 2006 Annual Meeting of Stockholders if notice concerning proposal of such

matter is not received within a reasonable time before the Company mails its

proxy materials. It is suggested that Stockholders submit any proposals by

certified mail, return receipt requested.

OTHER MATTERS

Management is not aware of any matters to come before the Annual Meeting which

will require the vote of Stockholders other than those matters indicated in the

Notice of Meeting and this Proxy Statement. However, if any other matter

requiring Stockholder action should properly come before the Annual Meeting or

any adjournment thereof, those persons named as proxies on the enclosed proxy

card will vote thereon according to their best judgment.

Notwithstanding anything to the contrary set forth in any of the Company's

previous filings under the Securities Act of 1933, as amended, or the Exchange

Act of 1934 that might incorporate future filings, including this Proxy

Statement, in whole or in part, the Report of the Audit Committee, the Report of

the

Compensation Committee on Executive Compensation and the Stock Performance Graph

shall not be incorporated by reference to its filings.

By order of the Board of Directors

Dated: August 30, 2005 /s/ Don L. Collins

Don L. Collins,

Chairman of the Board

THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION Please

IS INDICATED, WILL BE VOTED "FOR" THE PROPOSAL. THIS Mark Here

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. for Address |_|

Change or

Comments

SEE REVERSE SIDE

1. ELECTION OF DIRECTORS

Insert your vote for the nominees named below in the designated space

provided. The directors will be elected by cumulative voting. Vote the

number of shares owned or controlled by you multiplied by two. This number

of votes may be cast for any one nominee or may be distributed between

nominees as you see fit. Stockholders may withhold authority to vote for

the nominee by entering zero in the space following the nominee's name.

FOR

both nominees

listed to the left, WITHHOLD

cumulative votes to be AUTHORITY

divided equally between to vote for the nominees

the nominees listed to the left

|_| |_|

Nominee - 3 Year Term Votes

01 Don L. Collins _____

02 Don S. Peters _____

Note:

The total number of the votes you cast in this election of directors may not

exceed the number in the box on the reverse side of this page.

2. OTHER MATTERS

In their discretion, the Proxies are further authorized to vote upon such

other matters as may properly come before the meeting.

Choose MLinkSM for Fast, easy and secure 24/7 online access to your future proxy

materials, investment plan statements, tax documents and more. Simply log on to

Investor ServiceDirect(R) at www.melloninvestor.com/isd where step-by-step

instructions will prompt you through enrollment.

Please sign your name below and print your name exactly as you signed it on the

signature line on the following line. When shares are held by joint tenants each

should sign. When signing as attorney, executor, administrator, trustee or

guardian, please give full title as such. If a corporation, please sign in full

corporate name by President or or other authorized officer. If partnership,

please sign in partnership name by authorized person.

Signature ______________________ Signature ______________________ Date _________

- --------------------------------------------------------------------------------

^ FOLD AND DETACH HERE ^

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11:59 PM Eastern

Time the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares

in the same manner as if you marked, signed and returned your proxy card.

- ------------------------------------ -------------------------------- ---------------------

Internet Telephone Mail

http://www.proxyvoting.com/coll 1-866-540-5760 Mark, sign and date

Use the Internet to vote your proxy. OR Use any touch-tone telephone to OR your proxy card

Have your proxy card in hand when vote your proxy. Have your proxy and

you access the web site. card in hand when you call. return it in the

enclosed postage-paid

envelope.

- ------------------------------------ -------------------------------- ---------------------

If you vote your proxy by Internet or by telephone, you do NOT

need to mail back your proxy card.

If you choose to divide your votes for Directors unequally, you MAY NOT use

Internet or telephone voting, you must vote by returning this proxy card in the

envelope provided.

COLLINS INDUSTRIES, INC.

15 Compound Drive, Hutchinson, Kansas 67502-4349

The undersigned hereby appoints Arch G. Gothard, III and William R. Patterson,

III, and each of them, as proxies (the "Proxies"), with full power of

substitution, and hereby authorizes them to represent and to vote in the order

named, as designated on the reverse side all the shares of common stock of

Collins Industries, Inc. (the "Company"), held of record by the undersigned as

of July 25, 2005, at the Annual Meeting of Stockholders to be held on September

27, 2005, and any adjournments thereof.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY

THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED

FOR THE ELECTION OF THE NOMINEES FOR DIRECTOR LISTED IN PROPOSAL 1. AS TO OTHER

MATTERS WHICH MAY PROPERLY COME BEFORE THE MEETING, THIS PROXY SHALL CONFER

DISCRETIONARY AUTHORITY UPON THE PROXIES TO VOTE ON SUCH MATTERS IN THEIR BEST

JUDGMENT.

The ballots cast by stockholders will be voted as marked at the Annual Meeting

on September 27, 2005, if received by the date of the meeting.

Upon attendance at the Annual Meeting by the Stockholder voting hereby, this

Proxy will be returned if requested, so the Stockholder may vote in person.

THIS PROXY IS SOLICITED ON BEHALF OF THE COMPANY'S BOARD OF DIRECTORS WHICH

ENCOURAGES EACH STOCKHOLDER OF RECORD TO VOTE.

(Continued and to be voted, signed and dated on reverse side.)

- --------------------------------------------------------------------------------

Address Change/Comments (Mark the corresponding box on the reverse side)

- --------------------------------------------------------------------------------

- --------------------------------------------------------------------------------

- --------------------------------------------------------------------------------

^ FOLD AND DETACH HERE ^

CALCULATION OF NUMBER OF VOTES YOU MAY CAST

IN THE ELECTION OF DIRECTORS

Fill in the number of shares you own: _____________

Multiply by 2: X2

Total votes: _____________

The number in the box is the total number of votes you may cast in the election

of directors. The total number of votes you may cast must be less than or equal

to the number in the box, and it cannot exceed the number in the box.

YOUR VOTE IS IMPORTANT!

You can vote in one of three ways:

1. Vote by Internet at our Internet Address: http://www.proxyvoting.com/coll

2. Call toll-free 1-866-540-5760 on a Touch-Tone telephone and follow the

instructions on the reverse side. There is NO CHARGE to you for this call.

3. Mark, sign and date your proxy card and return it promptly in the enclosed

envelope.

PLEASE VOTE