- BKTI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BK Technologies (BKTI) DEF 14ADefinitive proxy

Filed: 21 Aug 15, 12:00am

| RELM Wireless Corporation |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Sincerely, | ||

| /s/ David P. Storey | ||

| David P. Storey | ||

| President and Chief Executive Officer |

| 1. | To approve the reincorporation of RELM Wireless Corporation from the State of Nevada to the State of Delaware (the “Reincorporation”); | |

| 2. | To approve an adjournment of the meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Reincorporation; and | |

| 3. | To transact such other business properly brought before the meeting and any adjournment or postponement of the meeting. |

| By Order of the Board of Directors, | ||

| /s/ William P. Kelly | ||

| William P. Kelly, Secretary |

| Page | ||

| ABOUT THE SPECIAL MEETING | 2 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 5 | |

| PROPOSAL 1: REINCORPORATION OF THE COMPANY FROM THE STATE OF NEVADA TO THE STATE OF DELAWARE | 6 | |

| PROPOSAL 2: ADJOURNMENT OF MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES IN FAVOR OF REINCORPORATION | 27 |

| Annex A | ― | Plan of Conversion | A-1 |

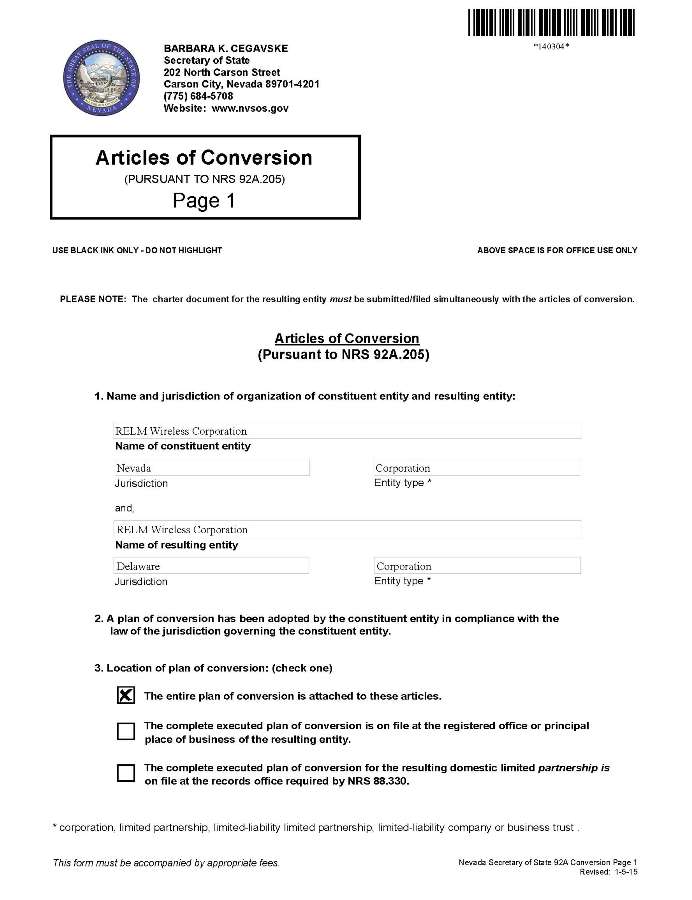

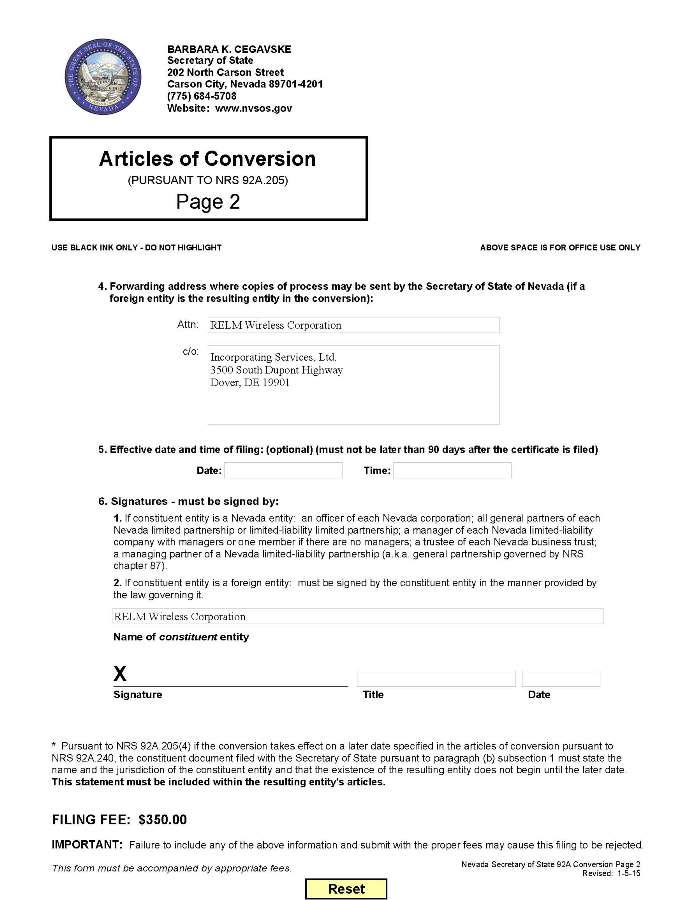

| Annex B | ― | Articles of Conversion | B-1 |

| Annex C | ― | Certificate of Conversion | C-1 |

| Annex D | ― | Certificate of Incorporation | D-1 |

| Annex E | ― | Bylaws | E-1 |

| ● | To approve the reincorporation of RELM Wireless Corporation from the State of Nevada to the State of Delaware (the “Reincorporation Proposal”); |

| ● | To approve an adjournment of the meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Reincorporation Proposal; and |

| ● | To transact such other business properly brought before the meeting and any adjournment or postponement of the meeting. |

| ● | take advantage of the benefits of Delaware corporate law; and |

| ● | provide us with additional flexibility to pursue growth through acquisitions. |

| ● | the reincorporation of the Company from the State of Nevada to the State of Delaware; and |

| ● | adjournment of the meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Reincorporation Proposal. |

| ● | each person who is known by us to own beneficially more than 5% of our common stock; |

| ● | each of our directors; |

| ● | each of our Named Executive Officers; and |

| ● | all of our directors and executive officers as a group. |

| Shares of Common Stock Beneficially Owned | ||||||||

| Name and Address of Beneficial Owner | Number of Shares | Percent of Class | ||||||

| Beneficial Owners of More Than 5% of Our Common Stock: | ||||||||

| Benchmark Capital Advisors(1) | 1,573,253 | 11.3 | ||||||

Fundamental Global Investors, LLC(2) Lewis M. Johnson Joseph H. Moglia D. Kyle Cerminara(7) | 1,826,261 | (5 | ) | 13.3 | ||||

Privet Fund LP(3) Privet Fund Management LLC Ryan Levenson(7) | 2,336,748 | (5 | ) | 16.8 | ||||

| Donald F.U. Goebert | 1,770,482 | (4 | )(5)(7) | 12.7 | ||||

| Directors and Named Executive Officers (not otherwise included above): | ||||||||

| Timothy W. O’Neil | 32,763 | (5 | )(7) | * | ||||

| David P. Storey | 177,779 | (5 | )(7)(8) | * | ||||

| William P. Kelly | 83,295 | (5 | )(6)(8) | * | ||||

| James E. Gilley | 34,000 | (5 | )(8) | * | ||||

| Benjamin L. Rosenzweig | 10,000 | (5 | )(7) | * | ||||

| James R. Henderson | 5,000 | (5 | )(7) | * | ||||

| All directors and executive officers as a group (9 persons) | 6,276,328 | (4 | )(5)(6) | 44.2 | ||||

| (1) | The amount shown and the following information is derived from a Schedule 13G (Amendment No. 1) filed by Benchmark Capital Advisors (“Benchmark”), reporting beneficial ownership as of February 14, 2015. According to the Schedule 13G, Benchmark beneficially owns 1,573,253 shares, and has sole voting and dispositive power with respect to 882,697 of these shares and shared voting and dispositive power with respect to 1,573,253 of these shares. Benchmark’s business address is 100 Wall Street, 8th Floor, New York, NY 10005. |

| (2) | The amount shown and the following information is derived from a Form 4 filed by Fundamental Global Investors, LLC (“Fundamental”), Lewis M. Johnson, Joseph H. Moglia and Kyle Cerminara reporting beneficial ownership as of July 7, 2015. According to the Form 4, Fundamental beneficially owns 1,826,261 shares, and has shared voting and dispositive power with respect to these 1,826,261 shares. Fundamental’s business address is 4201 Congress Street, Suite 140 Charlotte, North Carolina 28209. |

| (3) | The following information is derived from a Schedule 13D (Amendment No. 8) filed by Privet Fund Management, LLC (“Privet Management”), Privet Fund LP (the “Fund”) and Ryan Levenson, reporting beneficial ownership as of June 10, 2014. According to the Schedule 13D, the Fund beneficially owns 2,101,748 shares and has shared voting and dispositive power with respect to these 2,101,748 shares. Mr. Levenson is the sole managing member of Privet Management, which is the general partner and investment manager of the Fund. According to the Schedule 13D, Mr. Levenson, the Fund and Privet Management beneficially own 2,326,748 shares and have shared voting and dispositive power with respect to these 2,326,748 shares. The business address for the Fund, Privet Management and Mr. Levenson is 3280 Peachtree Rd. NE, Suite 2670, Atlanta, GA 30305. |

| (4) | Includes 144,355 shares owned by a partnership controlled by Mr. Goebert. The address for Mr. Goebert is 315 Willowbrook Lane, West Chester, Pennsylvania 19382. Also includes 809,154 shares held jointly by Mr. Goebert with his wife, and 3,887 shares held by his wife. |

| (5) | Share ownership of the following persons includes options presently exercisable or exercisable within 60 days of August 10, 2015 as follows: for Mr. Goebert – 20,000 shares; for Mr. O’Neil – 20,000; for Mr. Storey – 61,468 shares; for Mr. Kelly – 56,468 shares; for Mr. Gilley – 34,000; for Mr. Rosenzweig – 10,000 shares; for Mr. Levenson – 10,000 shares; for Mr. Henderson – 5,000 shares; and for Mr. Cerminara – no shares. |

| (6) | Includes 26,827 shares held jointly by Mr. Kelly with his wife. |

| (7) | The named person is a director. |

| (8) | The named person is a Named Executive Officer. |

| ● | The affairs of our company will cease to be governed by Nevada corporation laws and will become subject to Delaware corporation laws. |

| ● | The resulting Delaware corporation (referred to in this section as “RELM-Delaware”) will be the same entity as our company as currently incorporated in Nevada (referred to in this section as “RELM-Nevada”) and will continue with all of the rights, privileges and powers of RELM-Nevada, will possess all of the properties of RELM-Nevada, will continue with all of the debts, liabilities and obligations of RELM-Nevada and will continue with the same officers and directors of RELM-Nevada immediately prior to the reincorporation, as more fully described below. |

| ● | When the reincorporation becomes effective, all of our issued and outstanding shares of common stock will be automatically converted into issued and outstanding shares of common stock of RELM-Delaware, without any action on the part of our stockholders. The reincorporation will have no effect on the trading of shares of our common stock under the same symbol “RWC.” We will continue to file periodic reports and other documents as and to the extent required by the rules and regulations of the SEC. Shares of our common stock that are freely tradable prior to the reincorporation will continue to be freely tradable after the reincorporation, and shares of our common stock that are subject to restrictions prior to the reincorporation will continue to be subject to the same restrictions after the reincorporation. The reincorporation will not change the respective positions of our company or stockholders under federal securities laws. |

| ● | Upon effectiveness of the reincorporation, all of our employee benefit and incentive plans will become RELM-Delaware plans, and each option, equity award or other right issued under such plans will automatically be converted into an option, equity award or right to purchase or receive the same number of shares of RELM-Delaware common stock, at the same price per share, upon the same terms and subject to the same conditions as before the reincorporation. In addition, our employee benefit arrangements also will be continued by RELM-Delaware upon the terms and subject to the conditions in effect at the time of the reincorporation. |

| ● | our corporation would be governed by the DGCL, which is generally acknowledged to be the most advanced and flexible corporate statute in the country; |

| ● | the responsiveness and efficiency of the Division of Corporations of the Secretary of State of the State of Delaware; |

| ● | the Delaware General Assembly, which each year considers and adopts statutory amendments proposed by the Corporation Law Section of the Delaware State Bar Association in an effort to ensure that the corporate statute continues to be responsive to the changing needs of businesses; |

| ● | the Delaware Court of Chancery, which has exclusive jurisdiction over matters relating to the DGCL and in which cases are heard by judges, without juries, who have many years of experience with corporate issues, which can lead to quick and effective resolution of corporate litigation; and the Delaware Supreme Court, which is highly regarded; and |

| ● | the well-established body of case law construing Delaware law, which has developed over the last century and which provides businesses with a greater degree of predictability than most, if not all, other jurisdictions. |

| ● | financial institutions, insurance companies, regulated investment companies or real estate investment trusts; |

| ● | pass-through entities or investors in such entities; |

| ● | tax-exempt organizations; |

| ● | dealers in securities or currencies, or traders in securities that elect to use a mark-to-market method of accounting; |

| ● | persons that hold common stock as part of a straddle or as part of a hedging, integrated, constructive sale or conversion transaction; |

| ● | persons who are not U.S. holders; |

| ● | persons that have a functional currency other than the U.S. dollar; |

| ● | persons who acquired their shares of common stock through the exercise of an employee stock option or otherwise as compensation; |

| ● | persons whose common stock is “qualified small business stock” for purposes of Section 1202 of the Code; and |

| ● | persons who are subject to the alternative minimum tax. |

| ● | a citizen or resident of the United States; |

| ● | corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized under the laws of the U.S. or any of its political subdivisions; |

| ● | a trust that (1) is subject to the supervision of a court within the U.S. and the control of one or more U.S. persons or (2) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person; or |

| ● | an estate that is subject to U.S. federal income tax on its income regardless of its source. |

| ● | No gain or loss will be recognized by holders of our common stock upon receipt of common stock of RELM-Delaware pursuant to the reincorporation; |

| ● | The aggregate tax basis of the common stock of RELM-Delaware received by each stockholder of RELM-Nevada in the reincorporation will be equal to the aggregate tax basis of the common stock of RELM-Nevada surrendered in exchange therefor; |

| ● | The holding period of the common stock of RELM-Delaware received by each stockholder of RELM-Nevada will include the period for which such stockholder held the common stock of RELM-Nevada surrendered in exchange therefor, provided that such common stock of RELM-Nevada was held by such stockholder as a capital asset at the time of the reincorporation; and |

| ● | No gain or loss will be recognized by RELM-Nevada or RELM-Delaware as a result of the reincorporation. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Amendment of Charter | Nevada law requires a vote of the board of directors followed by the affirmative vote of the majority of shares entitled to vote to approve an amendment to the articles of incorporation. If any proposed amendment would adversely alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series adversely affected by the amendment. | Delaware law requires a vote of the board of directors followed by the affirmative vote of the majority of the outstanding shares entitled to vote to approve any amendment to the certificate of incorporation, unless a greater percentage vote is required by the certificate of incorporation. Where a separate vote by class or series is required, the affirmative vote of a majority of the outstanding shares of such class or series is required unless the certificate of incorporation requires a greater percentage vote. Further, Delaware law states that if an amendment would (i) increase or decrease the aggregate number of authorized shares of a class, (ii) increase or decrease the par value of shares of a class, or (iii) alter or change the powers, preferences or special rights of a particulazr class or series of stock so as to affect them adversely, the class or series so affected shall be given the power to vote as a class notwithstanding the absence of any specifically enumerated power in the certificate of incorporation. | The Delaware Certificate provides that, subject to any express provisions or restrictions contained in the Delaware Certificate, any provision of the Certificate may be amended, altered or repealed in the manner prescribed by law. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Amendment of Bylaws | The NRS provides that, unless otherwise prohibited by any bylaw adopted by the stockholders, the directors may adopt, amend or repeal any bylaw, including any bylaw adopted by the stockholders. The Nevada Articles do not address amendment of the Nevada Bylaws. The Nevada Bylaws provide that except as otherwise provided by applicable law, the Nevada Bylaws may be amended by a majority of the Board of Directors or by the vote of the holders of a majority of the outstanding stock entitled to vote. | The DGCL states that the power to adopt, amend or repeal a company’s bylaws shall be vested in the stockholders entitled to vote, provided that a company’s certificate of incorporation may confer such power on the board of directors, although the power vested in the stockholders is not divested or limited where the board of directors also has such power. | The Delaware Certificate expressly authorizes the Board of Directors to adopt, amend or repeal the Delaware Bylaws without action on the part of the stockholders, provided that any bylaw adopted or amended by the Board of Directors, and any powers thereby conferred, may be amended, altered or repealed by the stockholders. The Delaware Bylaws are consistent with the DGCL. | |||

Director Elections | The Nevada Bylaws provide for an annual election of directors, with the directors to hold office until the next annual meeting of stockholders or until they sooner resign or are removed or disqualified. The NRS provides that unless the articles of incorporation or bylaws require more than a plurality of the votes cast, election of directors is by a plurality of the vote. | The Delaware Bylaws also provide for an annual election of directors, with each director to hold office until a successor is duly elected and qualified or until the director’s earlier death, resignation, disqualification or removal. The DGCL and the Delaware Bylaws provide that election of directors is by a plurality of the vote. | The NRS and the Delaware Bylaws both provide for annual director elections by a plurality of the vote. | |||

Number of Authorized Directors | The Nevada Bylaws provide that except as otherwise fixed by the board of directors (which, subject to applicable law, shall have the authority to determine the number of directors that constitutes the board), the number of directors shall be five. The Nevada Bylaws do not provide stockholders with the right to set the Board size. | The Delaware Bylaws provide that the board of directors shall have authority to determine the number of directors to constitute the board. The Delaware Bylaws do not provide stockholders with the right to set the Board size. | The Delaware Bylaws are similar to the Nevada Bylaws. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Filling Vacancies on the Board of Directors | The NRS provides that all vacancies, including those caused by an increase in the number of directors, may be filled by a majority of the remaining directors, though less than a quorum, unless it is otherwise provided in the articles of incorporation. Unless otherwise provided in the articles of incorporation, pursuant to a resignation by a director, the board of directors may fill the vacancy or vacancies with each director so appointed to hold office during the remainder of the term of office of the resigning director or directors. The Nevada Bylaws provide that vacancies in the board shall be filled by the vote of a majority of the remaining members of the board. | The DGCL provides that, unless otherwise provided in the certificate of incorporation or bylaws, vacancies may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director. Further, if, at the time of filling any vacancy, the directors then in office shall constitute less than a majority of the whole board, the Delaware Court of Chancery may, upon application of any stockholder or stockholders holding at least 10% of the total number of the shares at the time outstanding having the right to vote for such directors, summarily order an election to be held to fill any such vacancies or newly created directorships, or to replace the directors chosen by the directors then in office. As with the Nevada Bylaws, the Delaware Bylaws provide that vacancies in the board shall be filled by the vote of a majority of the remaining members of the board. | The Nevada Bylaws and the Delaware Bylaws are similar with regard to filling vacancies on the board. In addition, the DGCL provides greater protection to RELM’s stockholders by permitting stockholders representing at least 10% of the issued and outstanding shares to apply to the Delaware Court of Chancery to have an election of directors in the situation where the directors in office constitute less than a majority of the whole board of directors. | |||

Removal of Directors | The NRS provides that, with limited exceptions regarding cumulative voting provisions and with regard to directors elected by a specific class or series of shares, and unless the articles of incorporation require a greater vote, any director may be removed by the vote of stockholders representing not less than two-thirds of the voting power of the issued and outstanding stock entitled to vote. The Nevada Bylaws do not address the removal of directors. | With limited exceptions applicable to classified boards and cumulative voting provisions, under Delaware law, directors of a company without a classified board may be removed, with or without cause, by the holders of a majority of shares then entitled to vote in an election of directors. | The Delaware Bylaws do not address the removal of directors, so your rights with regard to removal will be those granted by the DGCL. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Director Action by Written Consent | The NRS provides that unless otherwise provided in the articles of incorporation or bylaws, any action required or permitted to be taken at a meeting of the board of directors or a committee thereof may be taken without a meeting if, before or after the action, a written consent thereto is signed by all members of the board or of the committee, with exceptions if the director is interested and abstains from providing consent or if the director is a party to an action, suit or proceeding and abstains from providing consent. | The DGCL and the Delaware Bylaws provide that unless otherwise provided in the certificate of incorporation or bylaws, any action required or permitted to be taken at a meeting of the board of directors or a committee thereof may be taken without a meeting if all members of the board or committee consent thereto in writing. | Nevada and Delaware law are substantially similar in relation to board and committee action by written consent. | |||

Interested Party Transactions | The NRS provides that no contract or transaction between a company and one or more of its directors or officers, or between a company and any other entity of which one or more of its directors or officers are directors or officers, or in which one or more of its directors or officers have a financial interest, is void or voidable if (a) the director’s or officer’s interest in the contract or transaction is known to the board, committee or stockholders and the transaction is approved or ratified by the board of directors, committee or stockholders in good faith by a vote sufficient for the purpose (without counting the vote of the interested director or officer), (b) the fact of the common interest is not known to the director or officer at the time the transaction is brought before the board, or (c) the contract or transaction is fair to the company at the time it is authorized or approved. | The DGCL provides that no contract or transaction between a company and one or more of its directors or officers, or between a company and any other entity of which one or more of its directors or officers are directors or officers, or in which one or more of its directors or officers have a financial interest, is void or voidable if (a) the material facts as to the director’s or officer’s relationship or interest and as to the contract or transaction are disclosed or known to the board of directors or a committee thereof, which authorizes the contract or transaction in good faith by the affirmative vote of a majority of the disinterested directors, even though the disinterested directors are less than a quorum, (b) the material facts as to the director’s or officer’s relationship or interest and as to the contract or transaction are disclosed or known to the stockholders entitled to vote thereon and the contract or transaction is specifically approved in good faith by the stockholders, or (c) the contract or transaction is fair to the company as of the time it is authorized, approved or ratified by the board of directors, a committee thereof or the stockholders. | Nevada and Delaware law are substantially similar, with Delaware law providing additional provisions for the approval of related party transactions by stockholders. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Stockholder Voting-Quorum | The Nevada Bylaws provide that a majority of the outstanding shares of stock entitled to vote on a particular matter, present in person or by proxy, constitutes a quorum for the transaction of business. The NRS provides that unless the articles of incorporation or bylaws provide for different proportions, a majority of the outstanding shares of stock, present in person or by proxy, and regardless of whether the proxy has authority to vote on all matters, constitutes a quorum for the transaction of business. | The DGCL and the Delaware Bylaws provide that a majority of shares entitled to vote, present in person or by proxy, constitutes a quorum at a stockholder meeting. | Nevada and Delaware law and the Nevada Bylaws and Delaware Bylaws are substantially similar in respect to quorum requirements. | |||

Advance Notice Bylaw Provisions | The Nevada Bylaws contain advance notice requirements for business to be brought before an annual or special meeting of stockholders, including nominations of persons for election as directors. As a result, stockholders must satisfy specific timing and information requirements in order to have a proposal considered at or in order to nominate a person for election as a director at an annual or special meeting. Any proposal or nomination that fails to comply with these timing and information requirements may be disqualified. | Similarly, the Delaware Bylaws contain advance notice requirements for business to be brought before an annual or special meeting of stockholders, including nominations of persons for election as directors. As a result, stockholders must satisfy specific timing and information requirements in order to have a proposal considered at or in order to nominate a person for election as a director at an annual or special meeting. Any proposal or nomination that fails to comply with these timing and information requirements may be disqualified. | The advance notice provisions in the Nevada Bylaws and Delaware Bylaws are substantially similar. | |||

Duration of Proxies | Under the NRS, a proxy is effective only for a period of six months, unless it is coupled with an interest or unless provided otherwise in the proxy, which duration may not exceed seven years. | Under the DGCL and the Delaware Bylaws, a proxy executed by a stockholder will remain valid for a period of three years, unless the proxy provides for a longer period. | The statutory default under Delaware law provides for proxies to remain valid for a longer duration than the statutory default under the NRS. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Stockholder Vote for Mergers and Other Corporate Reorganizations | Under the NRS, a majority of outstanding shares entitled to vote, as well as approval by the board of directors, is required for a merger or a sale of substantially all of the assets of a company. Generally, Nevada law does not require a stockholder vote of the surviving company in a merger if: (a) the plan of merger does not amend the existing articles of incorporation; (b) each share of stock of the surviving corporation outstanding immediately before the effective date of the merger is an identical outstanding share after the merger; (c) the number of voting shares outstanding immediately after the merger, plus the number of voting shares issued as a result of the merger, either by the conversion of securities issued pursuant to the merger or the exercise of rights and warrants issued pursuant to the merger, will not exceed by more than 20% the total number of voting shares of the surviving domestic corporation outstanding immediately before the merger; and (d) the number of participating shares outstanding immediately after the merger, plus the number of participating shares issuable as a result of the merger, either by the conversion of securities issued pursuant to the merger or the exercise of rights and warrants issued pursuant to the merger, will not exceed by more than 20% of the total number of participating shares outstanding immediately before the merger. | Under the DGCL, a majority of outstanding shares entitled to vote, as well as approval by the board of directors, is required for a merger or a sale of substantially all of the assets of the corporation. Generally, Delaware law does not require a stockholder vote of the surviving corporation in a merger (unless the corporation provides otherwise in its certificate of incorporation) if: (a) the plan of merger does not amend the existing certificate of incorporation; (b) each share of stock of the surviving corporation outstanding immediately before the effective date of the merger is an identical outstanding share after the effective date of the merger; and (c) either no shares of common stock of the surviving corporation and no shares, securities or obligations convertible into such stock are to be issued or delivered under the plan of merger, or the authorized unissued shares or shares of common stock of the surviving corporation to be issued or delivered under the plan of merger plus those initially issuable upon conversion of any other shares, securities or obligations to be issued or delivered under such plan do not exceed 20% of the shares of common stock of such constituent corporation outstanding immediately prior to the effective date of the merger. | Nevada and Delaware law are substantially similar in relation to stockholder approval of mergers and other corporate reorganizations. Neither the Nevada Articles or Bylaws nor the Delaware Certificate or Bylaws contain any supermajority voting requirements for mergers or other corporate reorganizations. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Special Meetings of Stockholders | Under the NRS, unless otherwise provided in the articles of incorporation or bylaws, the entire board of directors, any two directors or the president may call annual and special meetings of the stockholders and directors. The Nevada Bylaws provide that special meetings of stockholders may be called by the president, the Board of Directors or the holders of at least one-fifth of the outstanding shares of stock of the corporation entitled to vote at the meeting. | Under the DGCL, a special meeting of stockholders may be called by the board of directors or by such persons as may be authorized by the certificate of incorporation or by the bylaws. The Delaware Bylaws provide that special meetings of stockholders may be called by the president, the Board of Directors or the holders of at least one-fifth of the voting power of the shares of stock of the corporation entitled to vote at the meeting. | The Delaware Bylaws are substantially similar to the Nevada Bylaws. | |||

Stockholder Action by Written Consent | The NRS provides that unless otherwise provided in the articles of incorporation or bylaws, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power, except that if a different proportion of voting power is required for such an action at a meeting, then that proportion of written consents is required. | The DGCL provides that unless otherwise provided in the certificate of incorporation, any action required by this chapter to be taken at any annual or special meeting of stockholders of a corporation, or any action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. | Nevada and Delaware law are substantially similar in relation to stockholder action by written consent. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Failure to Hold an Annual Meeting of Stockholders | The NRS provides that if a corporation fails to elect directors within 18 months after the last election of directors, a Nevada district court will have jurisdiction in equity and may order an election upon petition of one or more stockholders holding at least 15% of the voting power. | The DGCL provides that if an annual meeting for election of directors is not held on the date designated or an action by written consent to elect directors in lieu of an annual meeting has not been taken within 30 days after the date designated for the annual meeting, or if no date has been designated, for a period of 13 months after the latest to occur of the organization of the corporation, its last annual meeting or the last action by written consent to elect directors in lieu of an annual meeting, the Court of Chancery may summarily order a meeting to be held upon the application of any stockholder or director. | Delaware law provides for a shorter interval than Nevada law (13 months versus 18 months) before a stockholder can apply to a court to order a meeting for the election of directors. Nevada law requires that application be made by a stockholder holding at least 15% of the voting power; whereas, Delaware law permits any stockholder or director to make the application. | |||

Adjournment of Stockholder Meetings | Under the NRS, a company is not required to give any notice of an adjourned meeting or of the business to be transacted at an adjourned meeting, other than by announcement at the meeting at which the adjournment is taken, unless the board of directors fixes a new record date for the adjourned meeting. | Under the DGCL and the Delaware Bylaws, if a meeting of stockholders is adjourned due to lack of a quorum and the adjournment is for more than 30 days, or if after the adjournment a new record date is fixed for the adjourned meeting, notice of the adjourned meeting must be given to each stockholder of record entitled to vote at the meeting. At the adjourned meeting, the corporation may transact any business which might have been transacted at the original meeting. | Delaware law and Nevada law provide for similar rights in the case of adjournment of stockholder meetings; however, Delaware law also requires companies to provide stockholders with notice of the adjourned meeting if the adjournment is for more than 30 days. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Limitation on Director Liability | Under the NRS, unless the articles of incorporation or an amendment thereto provides for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that: (a) the director’s or officer’s act or failure to act constituted a breach of his or her fiduciary duties as a director or officer; and (b) the breach of those duties involved intentional misconduct, fraud or a knowing violation of law. The Nevada Bylaws provide that a director shall not be personally liable for monetary damages for any action taken, or failure to take action, unless (a) the director breached or failed to perform the duties of his office as provided in the NRS; and (b) the breach or failure to perform constituted self-dealing, willful misconduct or recklessness. The Nevada Articles provide that the personal liability of the directors of the corporation is eliminated to the fullest extent permitted by the NRS. | Under the DGCL, if a corporation’s certificate of incorporation so provides, the personal liability of a director for breach of fiduciary duty as a director may be eliminated or limited. A corporation’s certificate of incorporation, however, may not limit or eliminate a director’s personal liability (a) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (b) for acts or omissions not in good faith or involving intentional misconduct or a knowing violation of law, (c) for the payment of unlawful dividends, stock repurchases or redemptions, or (d) for any transaction in which the director received an improper personal benefit. The provisions in the Delaware Certificate and Delaware Bylaws comply with Delaware law as set forth above and limit the personal liability of a director for breach of fiduciary duty as permitted under the DGCL. | Delaware law is more extensive in the enumeration of actions under which we may not eliminate a director’s personal liability. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Indemnification Provision | Under the NRS, a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with the action, suit or proceeding if the person: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful. However, indemnification may not be made for any claim, issue or matter as to which such a person has been adjudged to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. To the extent that such person has been successful on the merits or otherwise in defense of any proceeding subject to the Nevada indemnification laws, the corporation shall indemnify him or her against expenses, including attorneys’ fees, actually and reasonably incurred by him or her in connection with the defense. The Nevada Articles and Nevada Bylaws comply with Nevada law as set forth above. | Under DGCL, a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. With respect to actions by or in the right of the corporation, no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit is brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnification for such expenses which such court shall deem proper. A director or officer who is successful, on the merits or otherwise in defending any proceeding subject to the Delaware corporate statutes’ indemnification provisions shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith. The Delaware Certificate and Delaware Bylaws comply with Delaware law as set forth above. | The indemnification provisions of the NRS and the DGCL are substantially similar as both the NRS and the DGCL permit us to indemnify officers, directors, employees and agents for actions taken in good faith and in a manner they reasonably believed to be in, or not opposed to, the best interests of the corporation and, with respect to any criminal action, which they had no reasonable cause to believe that such conduct was unlawful. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Advancement of Expenses | The NRS provides that the articles of incorporation, the bylaws or an agreement made by the corporation may provide that the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding must be paid by the corporation as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation. The Nevada Bylaws authorize us to advance expenses to our officers and directors. | Delaware law provides that expenses incurred by an officer or director of the corporation in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it is ultimately determined that such person is not entitled to be indemnified by the corporation as authorized under the indemnification laws of Delaware. Such expenses may be so paid upon such terms and conditions as the corporation deems appropriate. Under Delaware law, unless otherwise provided in its certificate of incorporation or bylaws, a corporation has the discretion whether or not to advance expenses. Similar to the Nevada Bylaws, the Delaware Bylaws and Delaware Certificate authorize us to advance expenses to our officers and directors. | Nevada law and Delaware law are substantially similar in regards to the advancement of expenses. | |||

Declaration and Payment of Dividends | Under the NRS, except as otherwise provided in the articles of incorporation, a board of directors may authorize and the corporation may make distributions to its stockholders, including distributions on shares that are partially paid. However, no distribution may be made if, after giving effect to such distribution: (a) the corporation would not be able to pay its debts as they become due in the usual course of business; or (b) except as otherwise specifically allowed by the articles of incorporation, the corporation’s total assets would be less than the sum of its total liabilities plus the amount that would be needed, if the corporation were to be dissolved at the time of distribution, to satisfy the preferential rights upon dissolution of stockholders whose preferential rights are superior to those receiving the distribution. | Under the DGCL, subject to any restriction contained in a corporation’s certificate of incorporation, the board of directors may declare, and the corporation may pay, dividends or other distributions upon the shares of its capital stock either (a) out of “surplus” or (b) in the event that there is no surplus, out of the net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. Dividends may not be paid if the capital of the corporation is less than the total amount of capital represented by the outstanding stock of all classes having a preference upon the distribution of assets. “Surplus” is defined as the excess of the net assets of the corporation over the amount determined to be the capital of the corporation by the board of directors (which amount cannot be less than the aggregate par value of all issued shares of capital stock). | Delaware law is more restrictive than Nevada law with respect to when dividends may be declared and paid. Neither the Delaware Certificate nor the Nevada Articles have terms imposing additional restrictions on the payment of dividends. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Business Combinations | The NRS prohibits certain business combinations between a Nevada corporation and an interested stockholder for two years after such person becomes an interested stockholder. Generally, an interested stockholder is a holder who is the beneficial owner of 10% or more of the voting power of a corporation’s outstanding stock and at any time within two years immediately before the date in question was the beneficial owner of 10% or more of the then outstanding stock of the corporation. After the two year period, business combinations remain prohibited unless they are (a) approved by the board of directors prior to the date that the person first became an interested stockholder or by a majority of the outstanding voting power not beneficially owned by the interested party, or (b) the interested stockholder satisfies certain fair-value requirements. An interested stockholder is (i) a person that beneficially owns, directly or indirectly, 10% or more of the voting power of the outstanding voting shares of a corporation, or (ii) an affiliate or associate of the corporation who, at any time within the past three years, was an interested stockholder of the corporation. | The DGCL prohibits, in certain circumstances, a “business combination” between the corporation and an “interested stockholder” within three years of the stockholder becoming an “interested stockholder.” Generally, an “interested stockholder” is a holder who, directly or indirectly, controls 15% or more of the outstanding voting stock or is an affiliate of the corporation and was the owner of 15% or more of the outstanding voting stock at any time within the three-year period prior to the date upon which the status of an “interested stockholder” is being determined. A “business combination” includes a merger or consolidation, a sale or other disposition of assets having an aggregate market value equal to 10% or more of the consolidated assets of the corporation or the aggregate market value of the outstanding stock of the corporation and certain transactions that would increase the interested stockholder’s proportionate share ownership in the corporation. This provision does not apply where, among other things, (i) the transaction which resulted in the individual becoming an interested stockholder is approved by the corporation’s board of directors prior to the date the interested stockholder acquired such 15% interest, (ii) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the outstanding voting stock of the corporation at the time the transaction commenced, or (iii) at or after the date the person becomes an interested stockholder, the business combination is approved by a majority of the board of directors of the corporation and an affirmative vote of at least 66 2/3% of the outstanding voting stock at an annual or special meeting and not by written consent, excluding stock owned by the interested stockholder. This provision also does not apply if a stockholder acquires a 15% interest inadvertently and divests itself of such ownership and would not have been a 15% stockholder in the preceding three years but for the inadvertent acquisition of ownership. | Nevada law and Delaware law provide for different thresholds in determining whether or not a person is an “interested stockholder.” Under Delaware law, since the threshold is higher, we will be able to engage in certain transactions with stockholders that would otherwise be prohibited under Nevada law. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Control Share Acquisition Statute | Under the NRS, an acquiring person who acquires a controlling interest in an issuing corporation is prohibited from exercising voting rights on any control shares unless such voting rights are conferred by a majority vote of the disinterested stockholders of the issuing corporation at a special or annual meeting of stockholders. Unless otherwise provided in the articles of incorporation or the bylaws, if the control shares are accorded full voting rights and the acquiring person acquires control shares with a majority or more of all the voting power, any stockholder, other than the acquiring person, who does not vote in favor of authorizing voting rights for the control shares is entitled to dissent and demand payment of the fair value of his or her shares. A controlling interest means the ownership of outstanding voting shares of an issuing corporation sufficient to enable the acquiring person, directly or indirectly and individually or in association with others, to exercise: (i) one-fifth or more but less than one-third; (ii) one-third or more but less than a majority; or (iii) a majority or more, of all the voting power of the corporation in the election of directors. Control shares means those outstanding voting shares of an issuing corporation which an acquiring person: (a) acquires in an acquisition or offer to acquire in an acquisition; and (b) acquires within 90 days immediately preceding the date when the acquiring person became an acquiring person. The control share acquisition statute applies to any acquisition of a controlling interest in a Nevada corporation with 200 or more stockholders of record, at least 100 of whom have addresses in Nevada, unless the articles of incorporation or bylaws of the corporation in effect on the 10th day following the acquisition of a controlling interest by an acquiring person provide that the provisions of those sections do not apply. | Delaware does not have a similar statute. | Consistent with Delaware law, neither the Delaware Certificate nor the Delaware Bylaws will contain a provision similar to the NRS control share acquisition statute. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Blank Check Preferred Stock | Under the Nevada Articles, RELM is authorized to issue up to 1,000,000 shares of preferred stock. The shares of preferred stock have not been designated into separate series. No shares of preferred stock are currently outstanding. The Nevada Articles authorize the Board of Directors to define the rights, preferences and privileges of the preferred stock prior to issuance. The ability of the Board of Directors to issue and set the rights, preferences and privileges of the preferred stock could make it more difficult or discourage an attempt to obtain control of our company by means of a merger, tender offer, proxy contest or otherwise, and thereby to protect the continuity of management. If, in the due exercise of its fiduciary obligations, the Board of Directors were to determine that a takeover proposal was not in our best interest, such shares could be issued by the Board of Directors without stockholder approval in one or more transactions that might prevent or render more difficult or costly the completion of the takeover transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder group, by putting a substantial voting block in institutional or other hands that might undertake to support the position of the incumbent Board of Directors, by effecting an acquisition that might complicate or preclude the takeover, or otherwise. In addition, the Nevada Articles grant the Board of Directors broad power to establish the rights and preferences of authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution to holders of shares of common stock. The issuance also may adversely affect the rights and powers, including voting rights, of those holders and may have the effect of delaying, deterring or preventing a change in control of our company. | Under the Delaware Certificate, RELM is authorized to issue up to 1,000,000 shares of preferred stock. The shares of preferred stock have not been designated into separate series. No shares of preferred stock will be outstanding as of the date of the reincorporation. The Delaware Certificate will authorize the Board of Directors to define the rights, preferences and privileges of the preferred stock prior to issuance. The ability of the Board of Directors to issue and set the rights, preferences and privileges of the preferred stock could make it more difficult or discourage an attempt to obtain control of our company by means of a merger, tender offer, proxy contest or otherwise, and thereby to protect the continuity of management. If, in the due exercise of its fiduciary obligations, the Board of Directors were to determine that a takeover proposal was not in our best interest, such shares could be issued by the Board of Directors without stockholder approval in one or more transactions that might prevent or render more difficult or costly the completion of the takeover transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder group, by putting a substantial voting block in institutional or other hands that might undertake to support the position of the incumbent Board of Directors, by effecting an acquisition that might complicate or preclude the takeover, or otherwise. In addition, the Delaware Certificate grants the Board of Directors broad power to establish the rights and preferences of authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution to holders of shares of common stock. The issuance also may adversely affect the rights and powers, including voting rights, of those holders and may have the effect of delaying, deterring or preventing a change in control of our company. | The Board of Directors has substantially similar rights under the Nevada Articles and the Delaware Certificate to designate and issue up to 1,000,000 shares of preferred stock. |

| Provision | NRS and Nevada Articles and Nevada Bylaws | DGCL and Delaware Certificate and Delaware Bylaws | Commentary |

Taxes and Fees | Nevada charges corporations incorporated in Nevada nominal annual corporate fees based on the value of the corporation’s authorized stock with a minimum fee of $175, as well as a $200 business license fee, and does not impose any franchise taxes on corporations. | Delaware imposes annual franchise tax fees on all corporations incorporated in Delaware. The annual fee ranges from a nominal fee to a maximum of $180,000, based on an equation consisting of the number of shares authorized, the number of shares outstanding and the net assets of the corporation. | We estimate that our annual Delaware franchise tax fee will be approximately $20,000, based on its existing capitalization and assets. We believe that the benefits discussed above in “—Reasons for the Reincorporation” justify the additional annual fees it will be required to pay as a Delaware corporation. |

| 1. | Conversion; Effect of Conversion. |

| (a) | Upon the Effective Time (as defined in Section 3 below), the Converting Entity shall be converted from a Nevada corporation to a Delaware corporation pursuant to Section 265 of the DGCL and Sections 92A.120 and 92A.250 of the NRS (the “Conversion”) and the Converting Entity, as converted to a Delaware corporation (the “Converted Entity”), shall thereafter be subject to all of the provisions of the DGCL, except that notwithstanding Section 106 of the DGCL, the existence of the Converted Entity shall be deemed to have commenced on the date the Converting Entity commenced its existence in the State of Nevada. |

| (b) | Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, the Converted Entity shall, for all purposes of the laws of the State of Delaware, be deemed to be the same entity as the Converting Entity existing immediately prior to the Effective Time. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, for all purposes of the laws of the State of Delaware, all of the rights, privileges and powers of the Converting Entity existing immediately prior to the Effective Time, and all property, real, personal and mixed, and all debts due to the Converting Entity existing immediately prior to the Effective Time, as well as all other things and causes of action belonging to the Converting Entity existing immediately prior to the Effective Time, shall remain vested in the Converted Entity and shall be the property of the Converted Entity, and the title to any real property vested by deed or otherwise in the Converting Entity existing immediately prior to the Effective Time shall not revert or be in any way impaired by reason of the Conversion; but all rights of creditors and all liens upon any property of the Converting Entity existing immediately prior to the Effective Time shall be preserved unimpaired, and all debts, liabilities and duties of the Converting Entity existing immediately prior to the Effective Time shall remain attached to the Converted Entity upon the Effective Time, and may be enforced against the Converted Entity to the same extent as if said debts, liabilities and duties had originally been incurred or contracted by the Converted Entity in its capacity as a corporation of the State of Delaware. The rights, privileges, powers and interests in property of the Converting Entity existing immediately prior to the Effective Time, as well as the debts, liabilities and duties of the Converting Entity existing immediately prior to the Effective Time, shall not be deemed, as a consequence of the Conversion, to have been transferred to the Converted Entity upon the Effective Time for any purpose of the laws of the State of Delaware. |

| (c) | The Conversion shall not be deemed to affect any obligations or liabilities of the Converting Entity incurred prior to the Conversion or the personal liability of any person incurred prior to the Conversion. |

| (d) | Upon the Effective Time, the name of the Converted Entity shall remain unchanged and continue to be “RELM Wireless Corporation”. |

| (e) | The Converting Entity intends for the Conversion to constitute a tax-free reorganization qualifying under Section 368(a) of the Internal Revenue Code of 1986, as amended. |

| 2. | Filings. As promptly as practicable following the adoption of this Plan by the Board of Directors and the stockholders of the Converting Entity, the Converting Entity shall cause the Conversion to be effective by: |

| (a) | executing and filing (or causing the execution and filing of) Articles of Conversion pursuant to Section 92A.205 of the NRS, substantially in the form of Exhibit A hereto (the “Nevada Articles of Conversion”), with the Secretary of State of the State of Nevada; |

| (b) | executing and filing (or causing the execution and filing of) a Certificate of Conversion pursuant to Sections 103 and 265 of the DGCL, substantially in the form of Exhibit B hereto (the “Delaware Certificate of Conversion”), with the Secretary of State of the State of Delaware; and |

| (c) | executing and filing (or causing the execution and filing of) a Certificate of Incorporation of the Converted Entity, substantially in the form of Exhibit C hereto (the “Delaware Certificate of Incorporation”), with the Secretary of State of the State of Delaware. |

| 3. | Effective Time. The Conversion shall become effective upon the last to occur of the filing of the Nevada Articles of Conversion, the Delaware Certificate of Conversion and the Delaware Certificate of Incorporation (the time of the effectiveness of the Conversion, the “Effective Time”). |

| 4. | Effect of Conversion. |

| (a) | Effect on Common Stock. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each share of Common Stock, $0.60 par value per share, of the Converting Entity (“Converting Entity Common Stock”) that is issued and outstanding immediately prior to the Effective Time shall convert into one validly issued, fully paid and nonassessable share of Common Stock, $0.60 par value per share, of the Converted Entity (“Converted Entity Common Stock”). |

| (b) | Effect on Outstanding Stock Options. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each option to acquire shares of Converting Entity Common Stock outstanding immediately prior to the Effective Time shall convert into an equivalent option to acquire, upon the same terms and conditions (including the vesting schedule and exercise price per share applicable to each such option) as were in effect immediately prior to the Effective Time, the same number of shares of Converted Entity Common Stock. |

| (c) | Effect on Stock Certificates. All of the outstanding certificates representing shares of Converting Entity Common Stock immediately prior to the Effective Time shall be deemed for all purposes to continue to evidence ownership of and to represent the same number of shares of Converted Entity Common Stock. |

| (d) | Effect on Employee Benefit, Equity Incentive or Other Similar Plans. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each employee benefit plan, equity incentive plan or other similar plan to which the Converting Entity is a party shall continue to be a plan of the Converted Entity. To the extent that any such plan provides for the issuance of Converting Entity Common Stock, upon the Effective Time, such plan shall be deemed to provide for the issuance of Converted Entity Common Stock. |

| (e) | Effect of Conversion on Directors and Officers. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, the members of the Board of Directors and the officers of the Converting Entity holding their respective offices in the Converting Entity existing immediately prior to the Effective Time shall continue in their respective offices as members of the Board of Directors and officers, respectively, of the Converted Entity. |

| 5. | Further Assurances. If, at any time after the Effective Time, the Converted Entity shall determine or be advised that any deeds, bills of sale, assignments, agreements, documents or assurances or any other acts or things are necessary, desirable or proper, consistent with the terms of this Plan, (a) to vest, perfect or confirm, of record or otherwise, in the Converted Entity its right, title or interest in, to or under any of the rights, privileges, immunities, powers, purposes, franchises, properties or assets of the Converting Entity existing immediately prior to the Effective Time, or (b) to otherwise carry out the purposes of this Plan, the Converted Entity and its officers and directors (or their designees), are hereby authorized to solicit in the name of the Converted Entity any third-party consents or other documents required to be delivered by any third party, to execute and deliver, in the name and on behalf of the Converted Entity, all such deeds, bills of sale, assignments, agreements, documents and assurances and do, in the name and on behalf of the Converted Entity, all such other acts and things necessary, desirable or proper to vest, perfect or confirm its right, title or interest in, to or under any of the rights, privileges, immunities, powers, purposes, franchises, properties or assets of the Converting Entity existing immediately prior to the Effective Time and otherwise to carry out the purposes of this Plan. |

| 6. | Delaware Bylaws. Upon the Effective Time, the bylaws of the Converted Entity shall be the Bylaws of RELM Wireless Corporation, substantially in the form of Exhibit D hereto. |

| 7. | Copy of Plan of Conversion. After the Conversion, a copy of this Plan will be kept on file at the offices of the Converted Entity, and any stockholder of the Converted Entity (or former stockholder of the Converting Entity) may request a copy of this Plan at no charge at any time. |

| 8. | Termination. At any time prior to the Effective Time, this Plan may be terminated and the transactions contemplated hereby may be abandoned by action of the Board of Directors of the Converting Entity if, in the opinion of the Board of Directors of the Converting Entity, such action would be in the best interests of the Converting Entity and its stockholders. In the event of termination of this Plan, this Plan shall become void and of no further force or effect. |

| 9. | Third-Party Beneficiaries. This Plan shall not confer any rights or remedies upon any person other than as expressly provided herein. |

| 10. | Severability. Whenever possible, each provision of this Plan will be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Plan is held to be prohibited by or invalid under applicable law, such provision will be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of this Plan. |

| RELM WIRELESS CORPORATION | ||

| a Nevada corporation | ||

| By: | ||

| Name: | ||

| Title: | ___________________________________ | |

| RELM WIRELESS CORPORATION | ||

| a Nevada corporation | ||

| By: | ||

| Name: | ||

| Title: | ||

RELM WIRELESS CORPORATIOIN THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS SPECIAL MEETING OF STOCKHOLDERS – SEPTEMBER 30, 2015 AT 10:30 AM LOCAL TIME |  | |||||||||||

| CONTROL ID: | ||||||||||||

| REQUEST ID: | ||||||||||||

The undersigned stockholder(s) of RELM Wireless Corporation, a Nevada corporation (the “Company”), hereby revoking any proxy heretofore given, does hereby appoint David P. Storey and William P. Kelly, and each of them, with full power to act alone, the true and lawful attorneys-in-fact and proxies of the undersigned, with full powers of substitution, and hereby authorize(s) them and each of them, to represent the undersigned and to vote all shares of common stock of the Company that the undersigned is entitled to vote at the Special Meeting of Stockholders of the Company to be held on September 30, 2015 at 10:30 a.m., local time, at the corporate offices of the Company at 7100 Technology Drive, West Melbourne, Florida, and any and all adjournments and postponements thereof, with all powers the undersigned would possess if personally present, on the following proposals, each as described more fully in the accompanying proxy statement, and any other matters coming before said meeting. | ||||||||||||

| (CONTINUED AND TO BE SIGNED ON REVERSE SIDE.) | ||||||||||||

| VOTING INSTRUCTIONS | ||||||||||||

| If you vote by phone, fax or internet, please DO NOT mail your proxy card. | ||||||||||||

| MAIL: | Please mark, sign, date, and return this Proxy Card promptly using the enclosed envelope. | ||||||||||

| FAX: | Complete the reverse portion of this Proxy Card and Fax to 202-521-3464. | ||||||||||

| INTERNET: | https://www.iproxydirect.com/RWC | ||||||||||

| PHONE: | 1-866-752-VOTE(8683) | ||||||||||

SPECIAL MEETING OF THE STOCKHOLDERS OF RELM WIRELESS CORPORATIOIN | PLEASE COMPLETE, DATE, SIGN AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE: ý | |||||||||

| PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS | ||||||||||

| Proposal 1 | à | FOR | AGAINST | ABSTAIN | ||||||

| Approval of Reincorporation of the Company from the State of Nevada to the State of Delaware. | ¨ | ¨ | ¨ | |||||||

| CONTROL ID: | ||||||||||

| REQUEST ID: | ||||||||||

| Proposal 2 | à | FOR | AGAINST | ABSTAIN | ||||||

| Adjournment of Special Meeting, if Necessary, to Solicit Additional Proxies. | ¨ | ¨ | ¨ | |||||||

| Proposal 3 | ||||||||||

| To transact such other business properly brought before the meeting and any adjournment or postponement of the meeting. | ||||||||||

MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING: ¨ | ||||||||||

This proxy will be voted in the manner directed herein by the undersigned. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED “FOR” THE APPROVAL OF REINCORPORATION OF THE COMPANY FROM THE STATE OF NEVADA TO THE STATE OF DELAWARE IN PROPOSAL 1, “FOR” THE ADJOURNMENT OF SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IN PROPOSAL 2, ANDIN THE DISCRETION OF THE PROXIES ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING OR ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF TO THE EXTENT PERMITTED UNDER APPLICABLE LAW. | MARK HERE FOR ADDRESS CHANGE ¨ New Address (if applicable): ____________________________ ____________________________ ____________________________ IMPORTANT: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. Dated: ________________________, 2015 | |||||||||

| (Print Name of Stockholder and/or Joint Tenant) | ||||||||||

| (Signature of Stockholder) | ||||||||||

| (Second Signature if held jointly) | ||||||||||