COMMERCE BANCSHARES, INC. EARNINGS HIGHLIGHTS 2nd Quarter 2021

CAUTIONARY STATEMENT A number of statements we will be making in our presentation and in the accompanying slides are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements of the Corporation’s plans, goals, objectives, expectations, projections, estimates and intentions. These forward- looking statements involve significant risks and uncertainties and are subject to change based on various factors (some of which are beyond the Corporation’s control). Factors that could cause the Corporation’s actual results to differ materially from such forward- looking statements made herein or by management of the Corporation are set forth in the Corporation’s 2020 Annual Report on Form 10-K, 1ST Quarter 2021 Report on Form 10-Q and the Corporation’s Current Reports on Form 8-K.

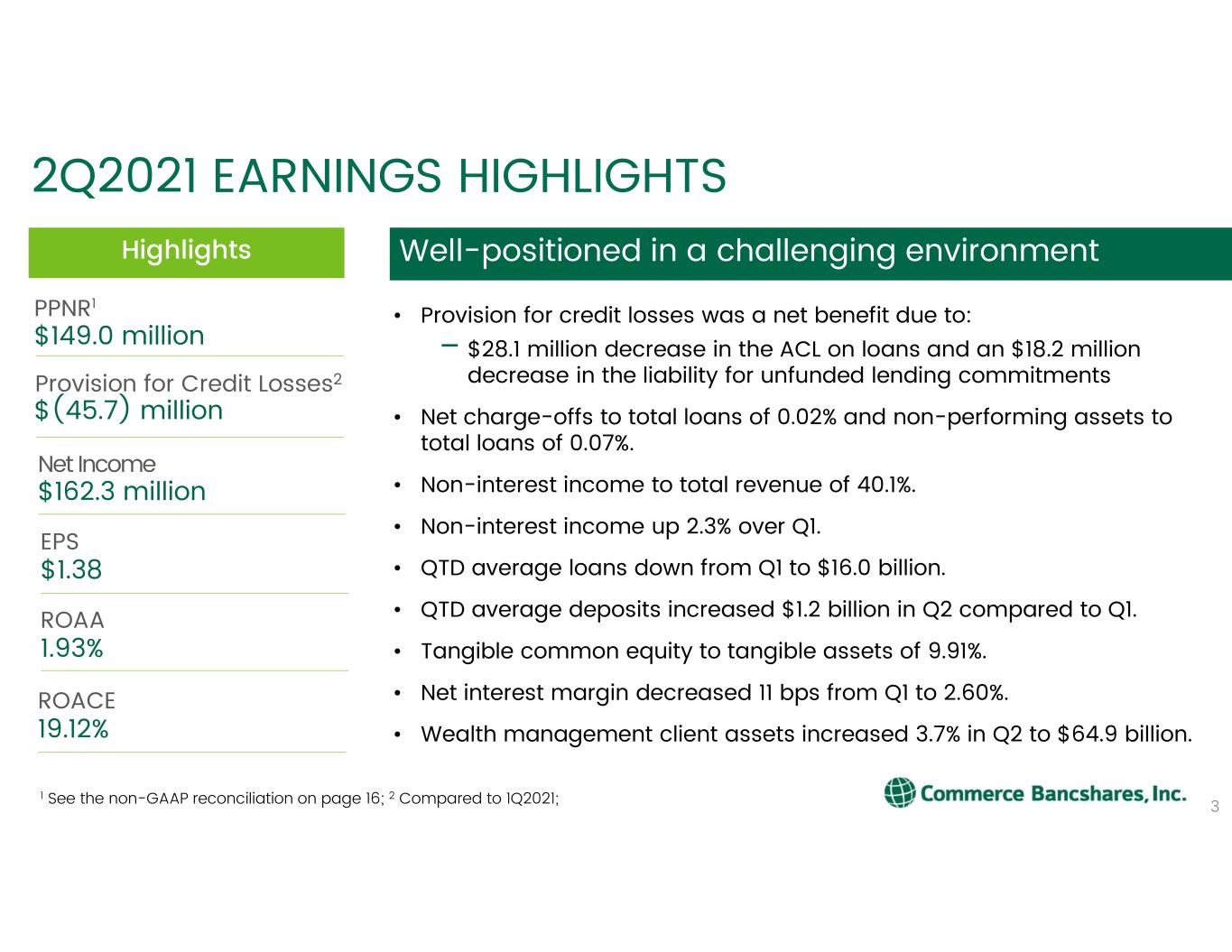

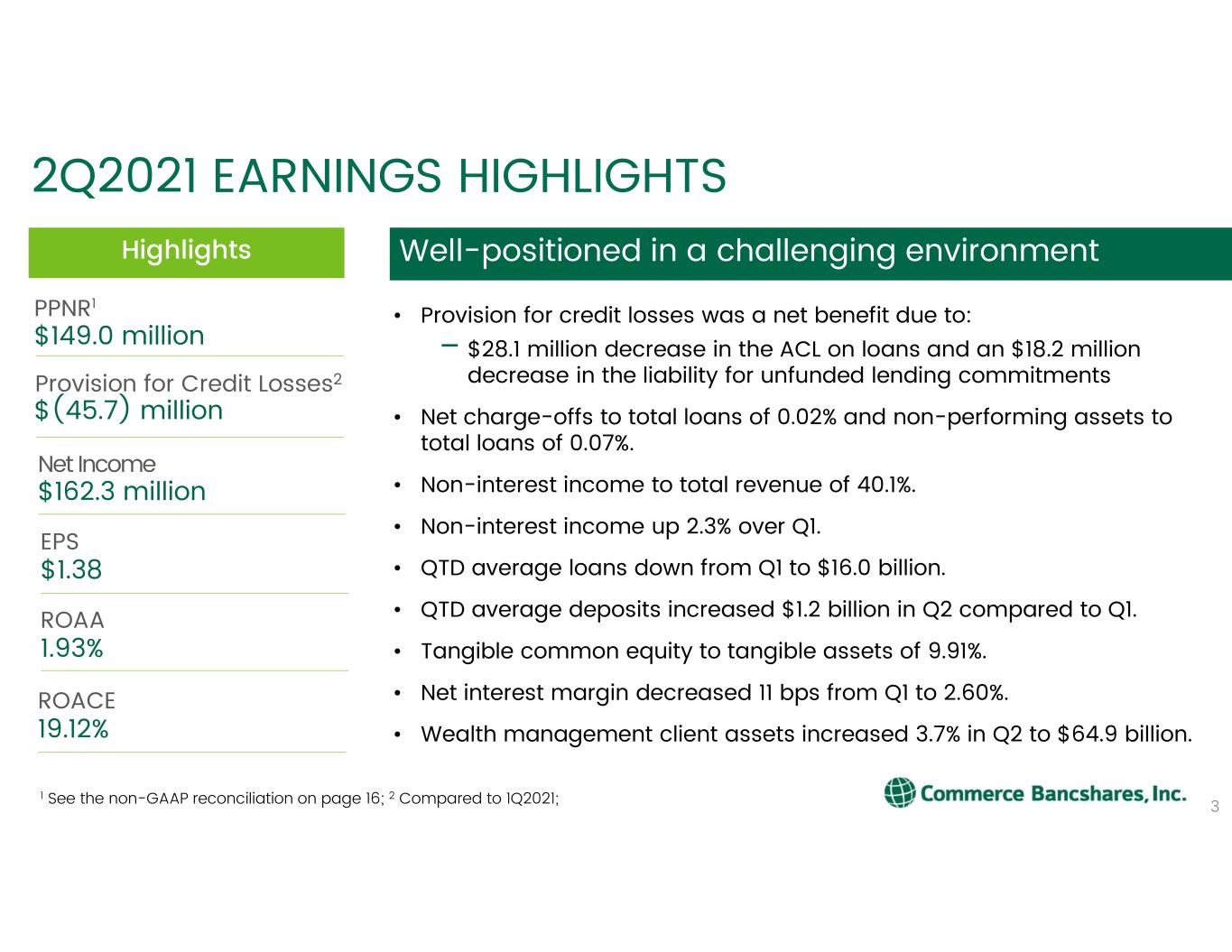

$1.38 EPS 3 • Provision for credit losses was a net benefit due to: – $28.1 million decrease in the ACL on loans and an $18.2 million decrease in the liability for unfunded lending commitments • Net charge-offs to total loans of 0.02% and non-performing assets to total loans of 0.07%. • Non-interest income to total revenue of 40.1%. • Non-interest income up 2.3% over Q1. • QTD average loans down from Q1 to $16.0 billion. • QTD average deposits increased $1.2 billion in Q2 compared to Q1. • Tangible common equity to tangible assets of 9.91%. • Net interest margin decreased 11 bps from Q1 to 2.60%. • Wealth management client assets increased 3.7% in Q2 to $64.9 billion. Highlights Well-positioned in a challenging environment 2Q2021 EARNINGS HIGHLIGHTS $149.0 million PPNR1 $(45.7) million Provision for Credit Losses2 $162.3 million Net Income 19.12% ROACE 1 See the non-GAAP reconciliation on page 16; 2 Compared to 1Q2021; 1.93% ROAA

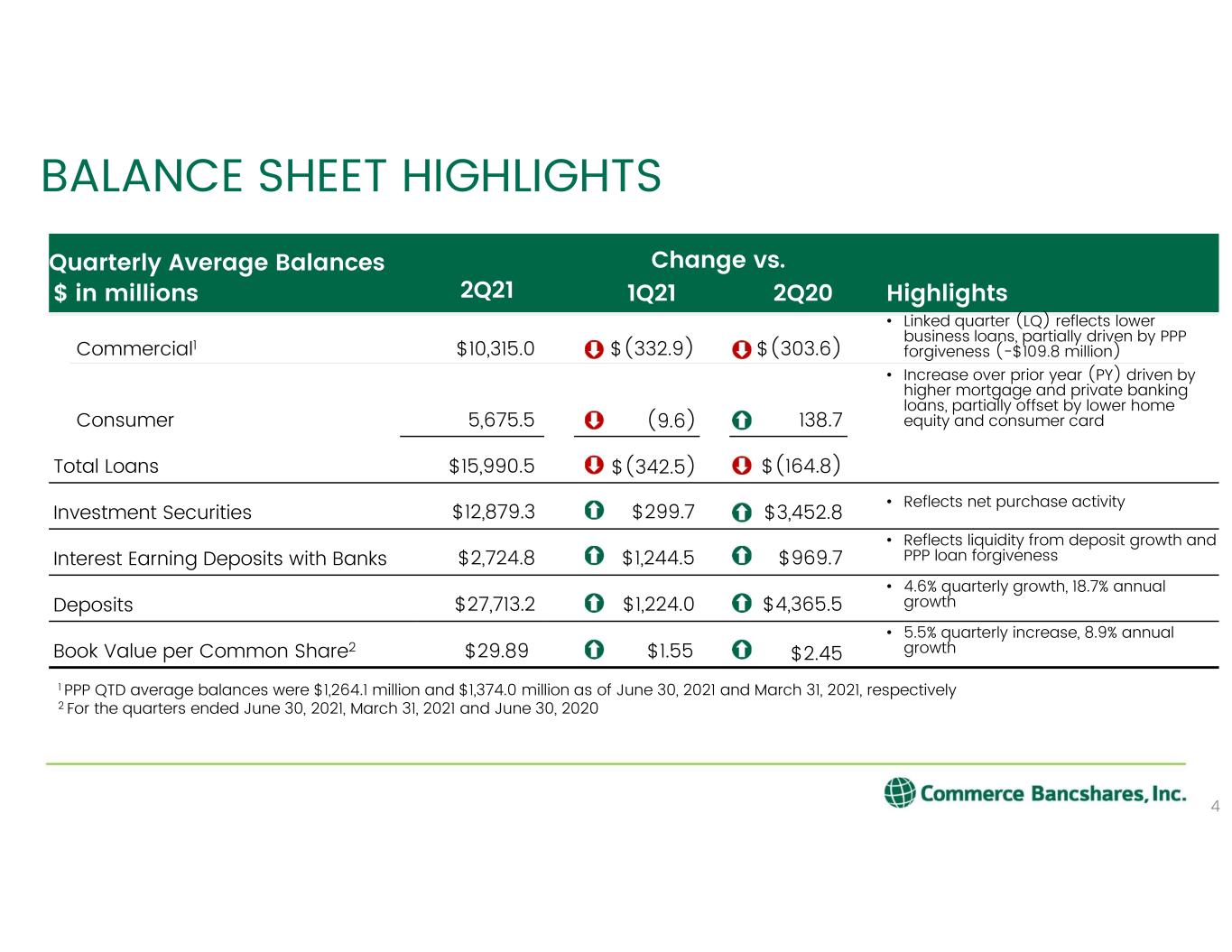

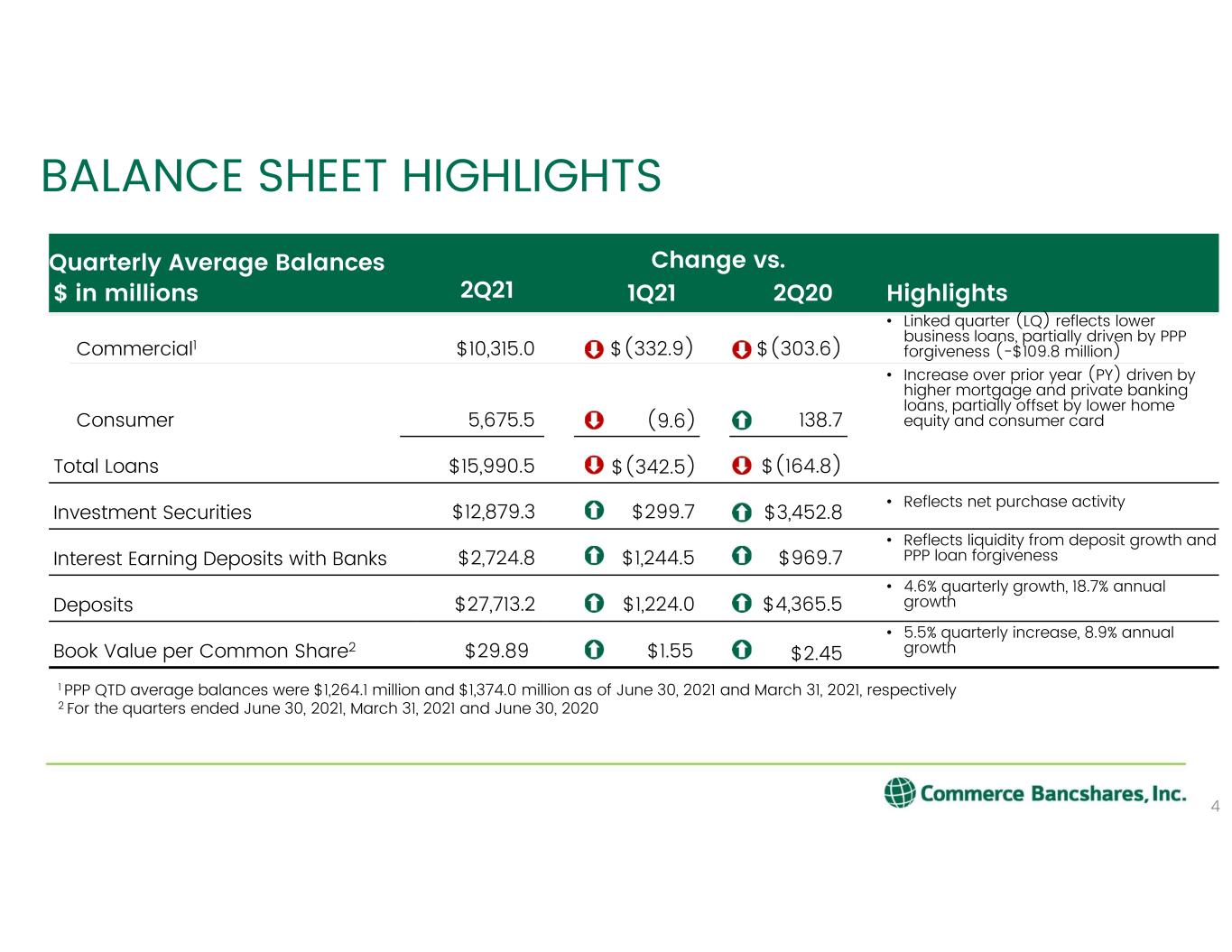

Quarterly Average Balances Change vs. $ in millions 2Q21 1Q21 2Q20 Highlights Commercial1 $10,315.0 $(332.9) $(303.6) • Linked quarter (LQ) reflects lower business loans, partially driven by PPP forgiveness (-$109.8 million) Consumer 5,675.5 (9.6) 138.7 • Increase over prior year (PY) driven by higher mortgage and private banking loans, partially offset by lower home equity and consumer card Total Loans $15,990.5 $(342.5) $(164.8) Investment Securities $12,879.3 $299.7 $3,452.8 • Reflects net purchase activity Interest Earning Deposits with Banks $2,724.8 $1,244.5 $969.7 • Reflects liquidity from deposit growth and PPP loan forgiveness Deposits $27,713.2 $1,224.0 $4,365.5 • 4.6% quarterly growth, 18.7% annual growth Book Value per Common Share2 $29.89 $1.55 $2.45 • 5.5% quarterly increase, 8.9% annual growth BALANCE SHEET HIGHLIGHTS 4 1 PPP QTD average balances were $1,264.1 million and $1,374.0 million as of June 30, 2021 and March 31, 2021, respectively 2 For the quarters ended June 30, 2021, March 31, 2021 and June 30, 2020

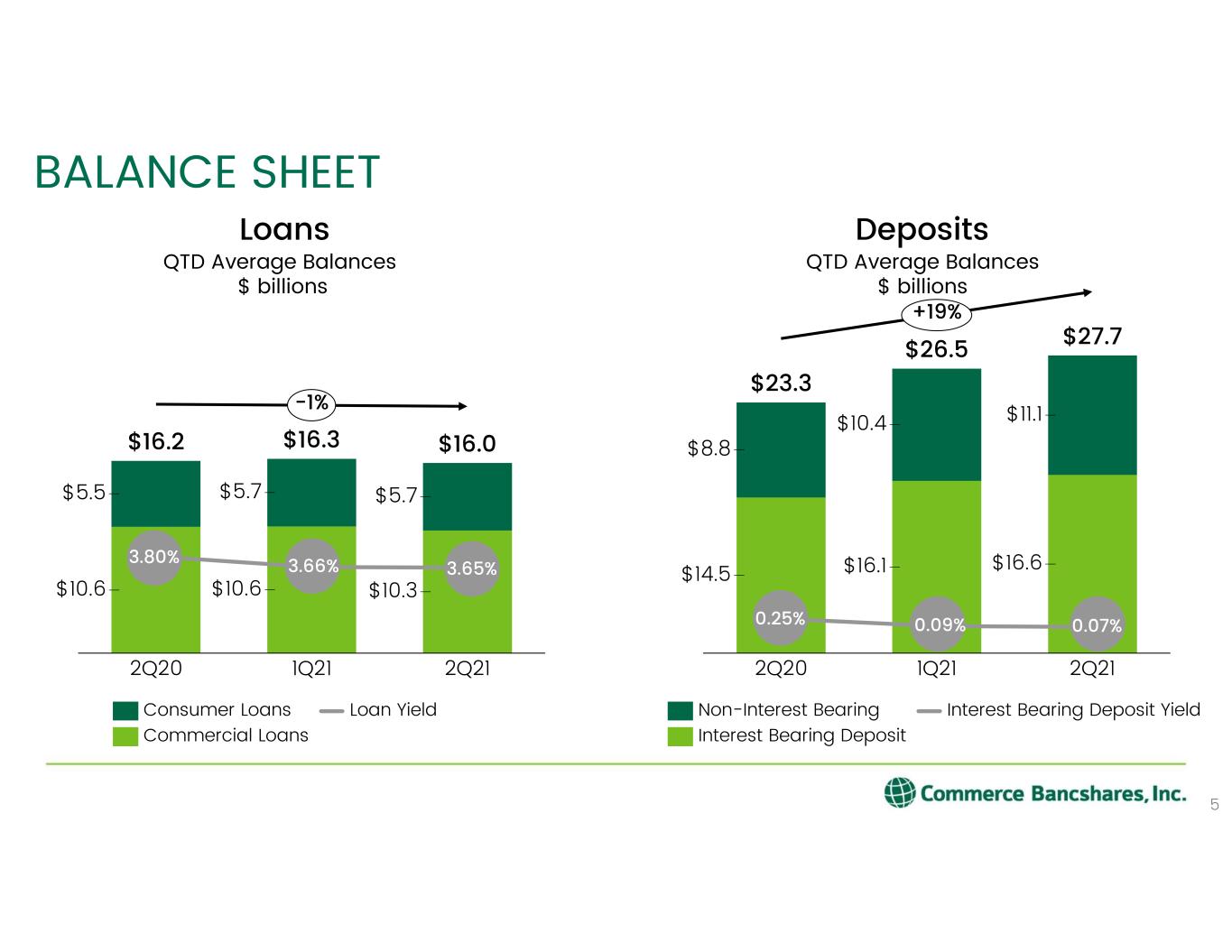

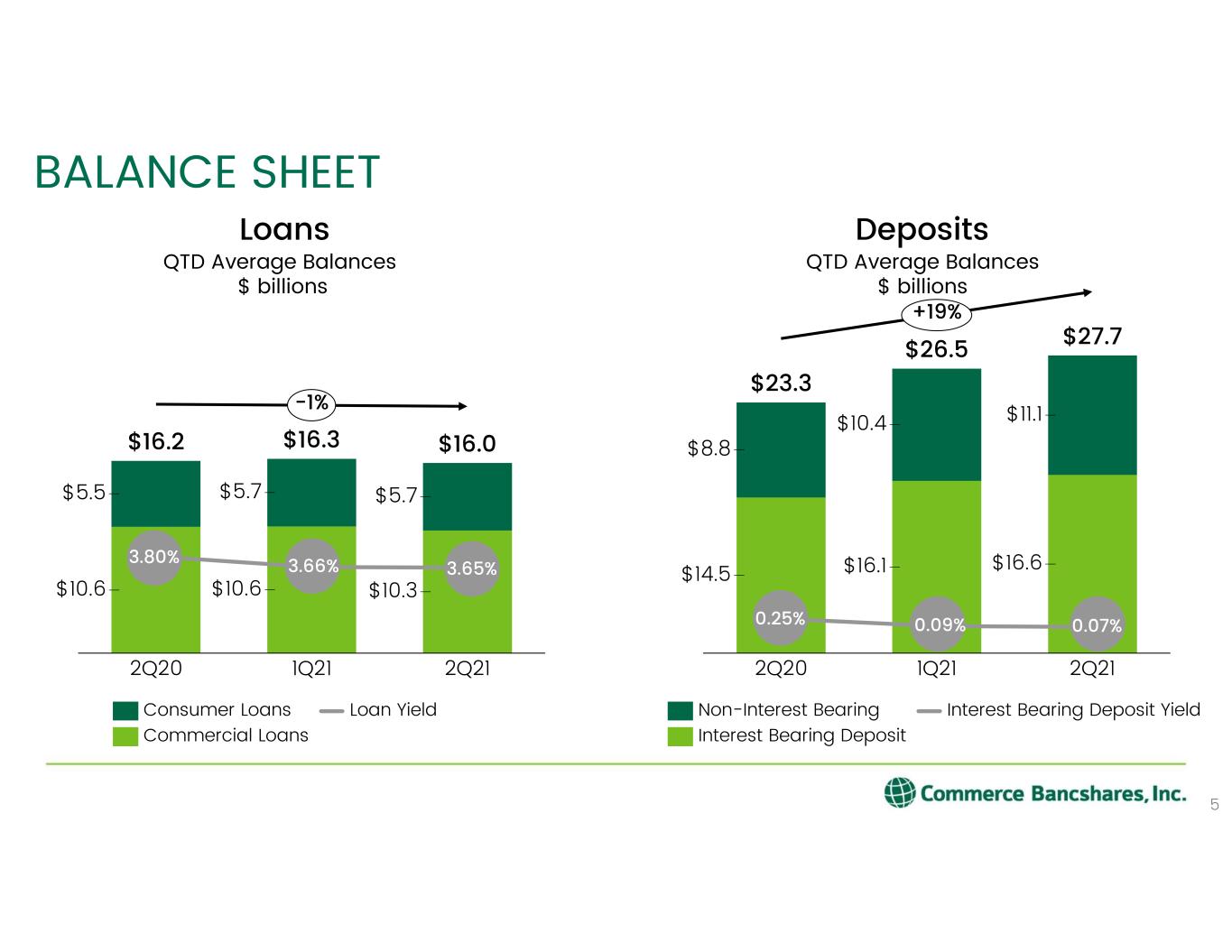

$14.5 $16.1 $16.6 $8.8 $10.4 $11.1 2Q20 1Q21 2Q21 $23.3 $26.5 $27.7 +19% $10.6 $10.6 $10.3 $5.5 $5.7 $5.7 $16.0 1Q21 2Q212Q20 $16.2 $16.3 -1% BALANCE SHEET 5 Loans Consumer Loans Commercial Loans Loan Yield Deposits QTD Average Balances $ billions Non-Interest Bearing Interest Bearing Deposit Interest Bearing Deposit Yield QTD Average Balances $ billions 3.80% 3.66% 3.65% 0.25% 0.09% 0.07%

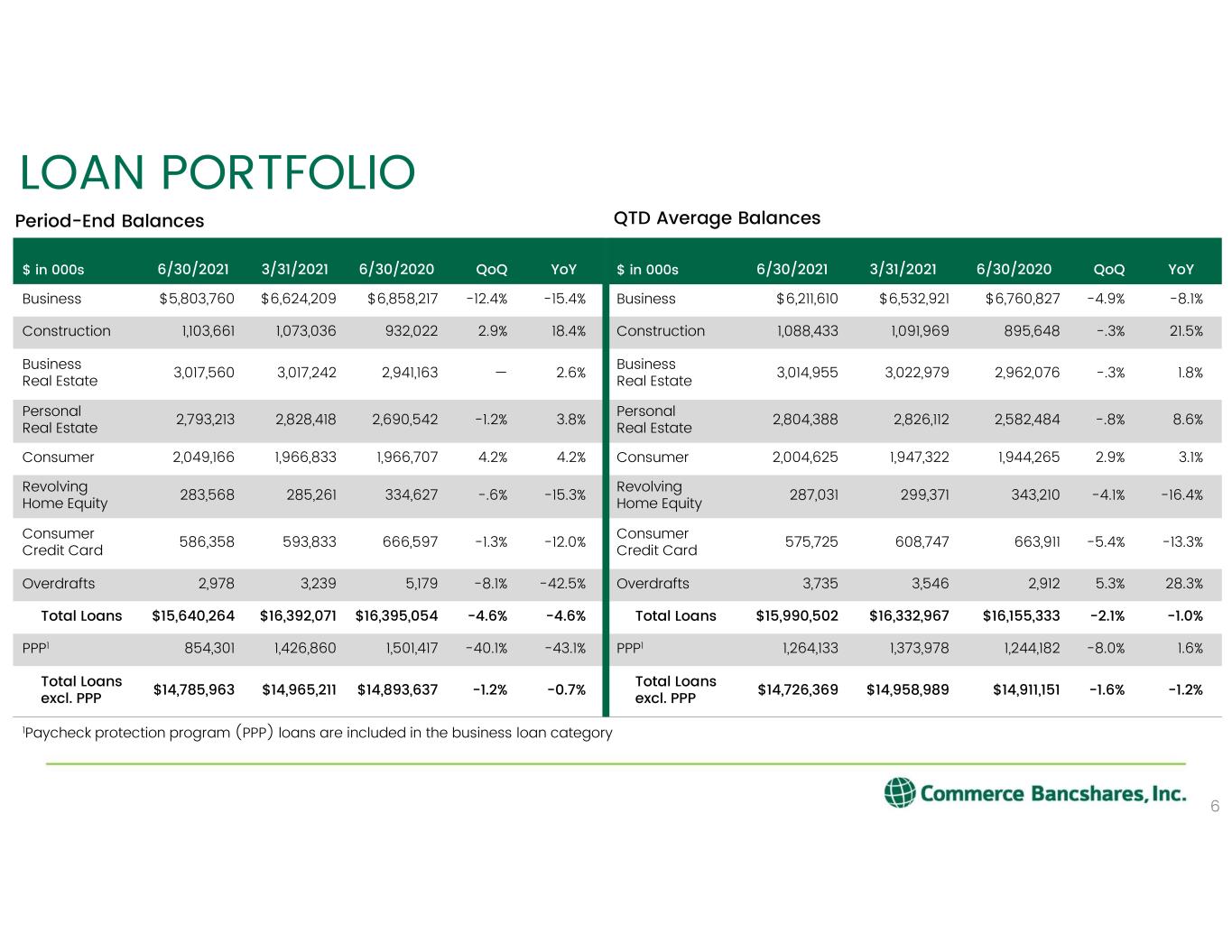

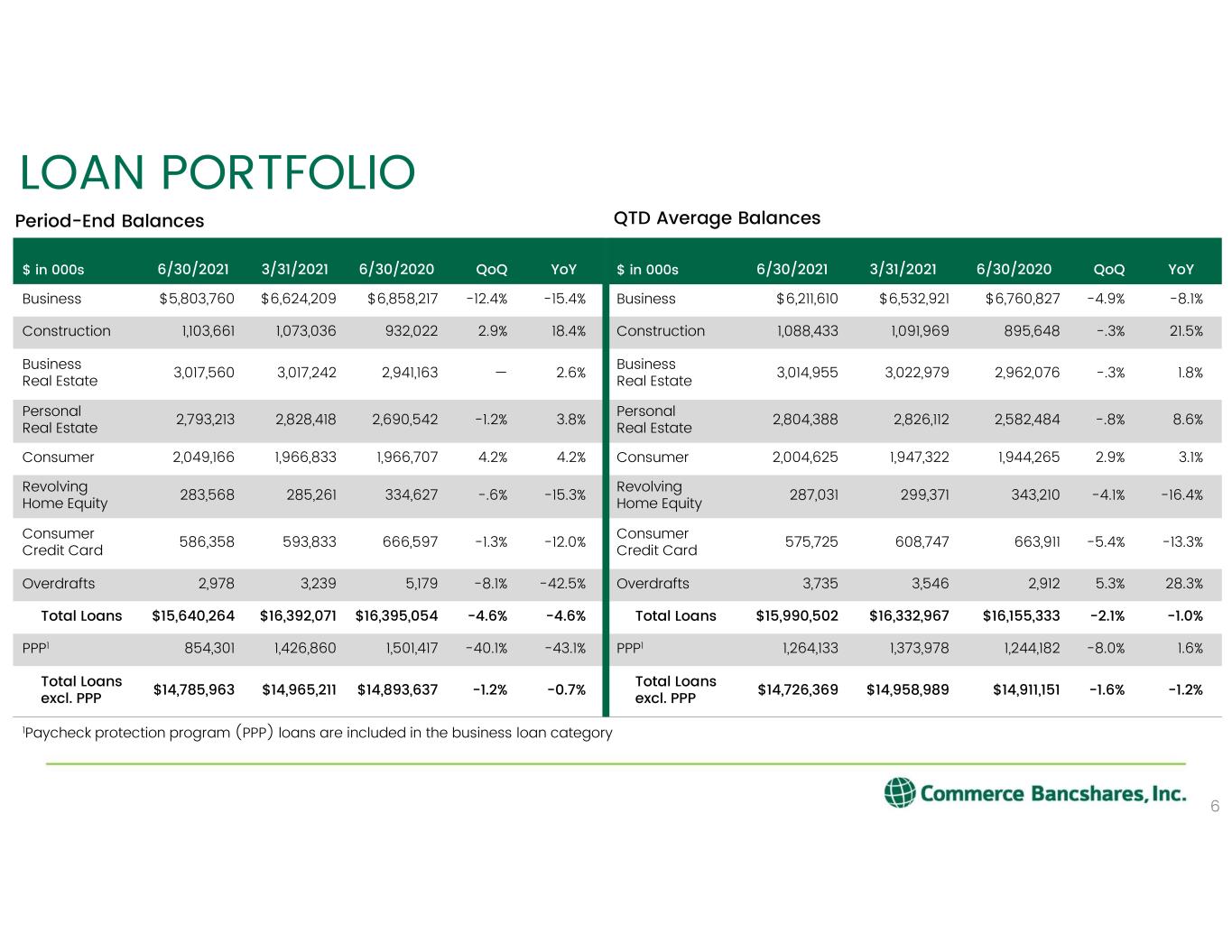

LOAN PORTFOLIO 6 $ in 000s 6/30/2021 3/31/2021 6/30/2020 QoQ YoY Business $5,803,760 $6,624,209 $6,858,217 -12.4% -15.4% Construction 1,103,661 1,073,036 932,022 2.9% 18.4% Business Real Estate 3,017,560 3,017,242 2,941,163 — 2.6% Personal Real Estate 2,793,213 2,828,418 2,690,542 -1.2% 3.8% Consumer 2,049,166 1,966,833 1,966,707 4.2% 4.2% Revolving Home Equity 283,568 285,261 334,627 -.6% -15.3% Consumer Credit Card 586,358 593,833 666,597 -1.3% -12.0% Overdrafts 2,978 3,239 5,179 -8.1% -42.5% Total Loans $15,640,264 $16,392,071 $16,395,054 -4.6% -4.6% PPP1 854,301 1,426,860 1,501,417 -40.1% -43.1% Total Loans excl. PPP $14,785,963 $14,965,211 $14,893,637 -1.2% -0.7% Period-End Balances $ in 000s 6/30/2021 3/31/2021 6/30/2020 QoQ YoY Business $6,211,610 $6,532,921 $6,760,827 -4.9% -8.1% Construction 1,088,433 1,091,969 895,648 -.3% 21.5% Business Real Estate 3,014,955 3,022,979 2,962,076 -.3% 1.8% Personal Real Estate 2,804,388 2,826,112 2,582,484 -.8% 8.6% Consumer 2,004,625 1,947,322 1,944,265 2.9% 3.1% Revolving Home Equity 287,031 299,371 343,210 -4.1% -16.4% Consumer Credit Card 575,725 608,747 663,911 -5.4% -13.3% Overdrafts 3,735 3,546 2,912 5.3% 28.3% Total Loans $15,990,502 $16,332,967 $16,155,333 -2.1% -1.0% PPP1 1,264,133 1,373,978 1,244,182 -8.0% 1.6% Total Loans excl. PPP $14,726,369 $14,958,989 $14,911,151 -1.6% -1.2% QTD Average Balances 1Paycheck protection program (PPP) loans are included in the business loan category

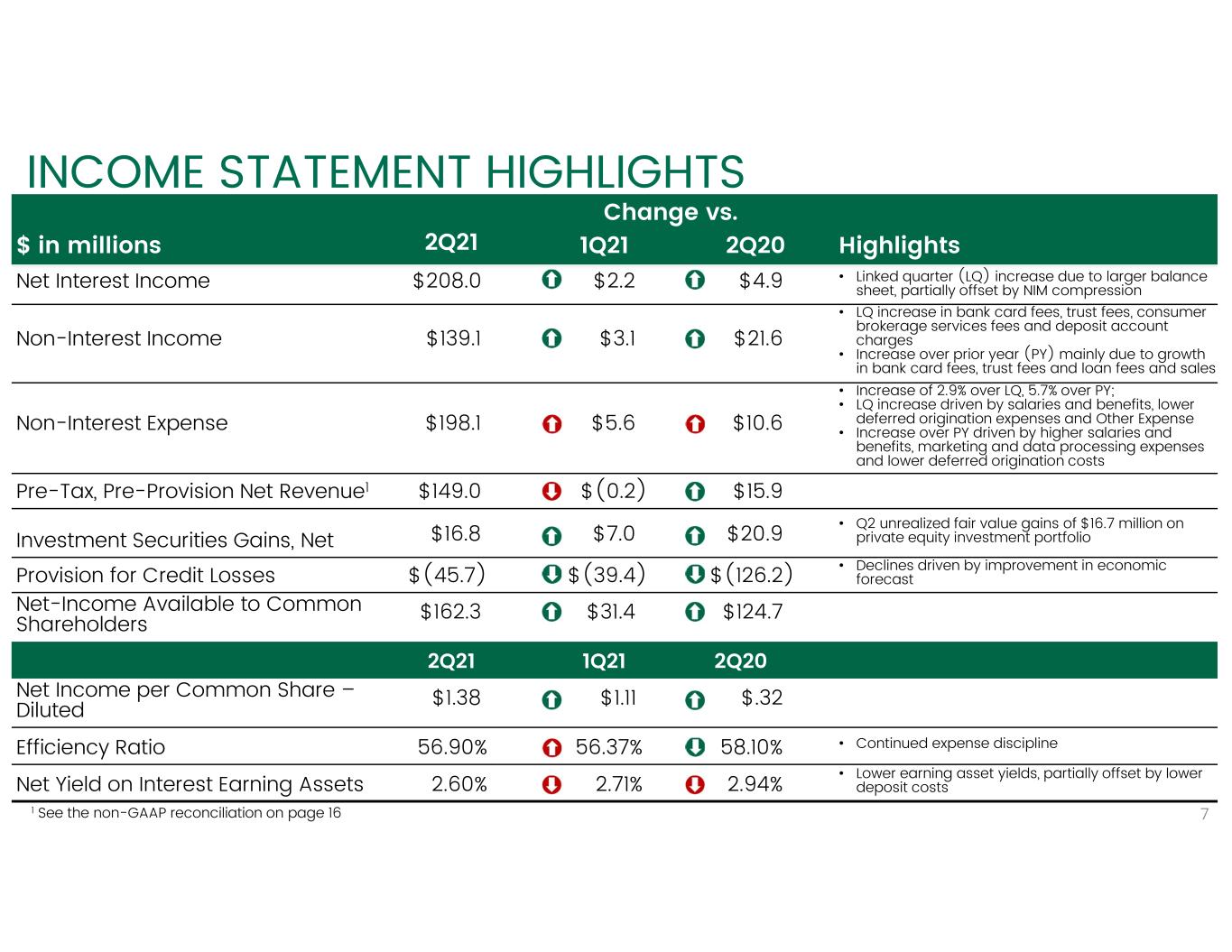

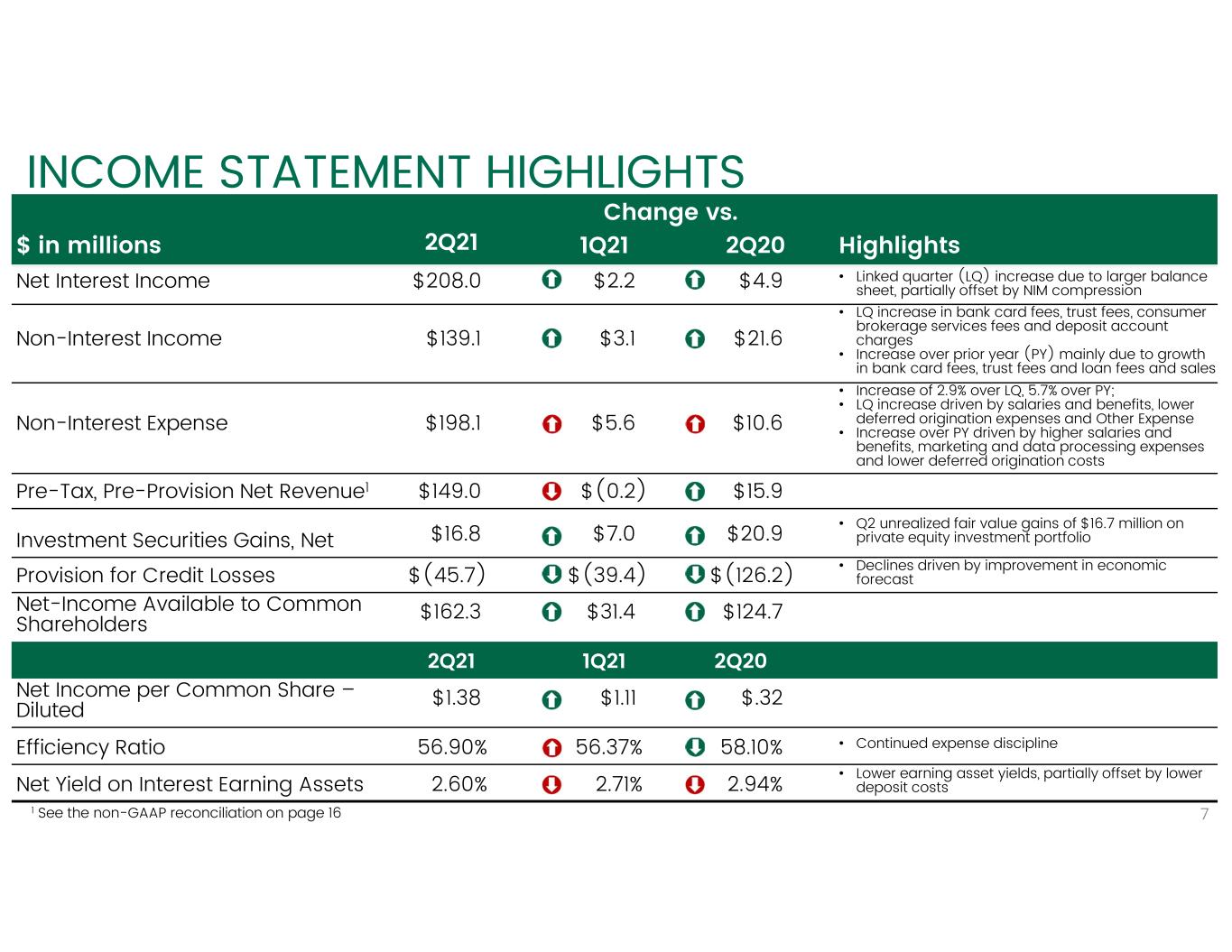

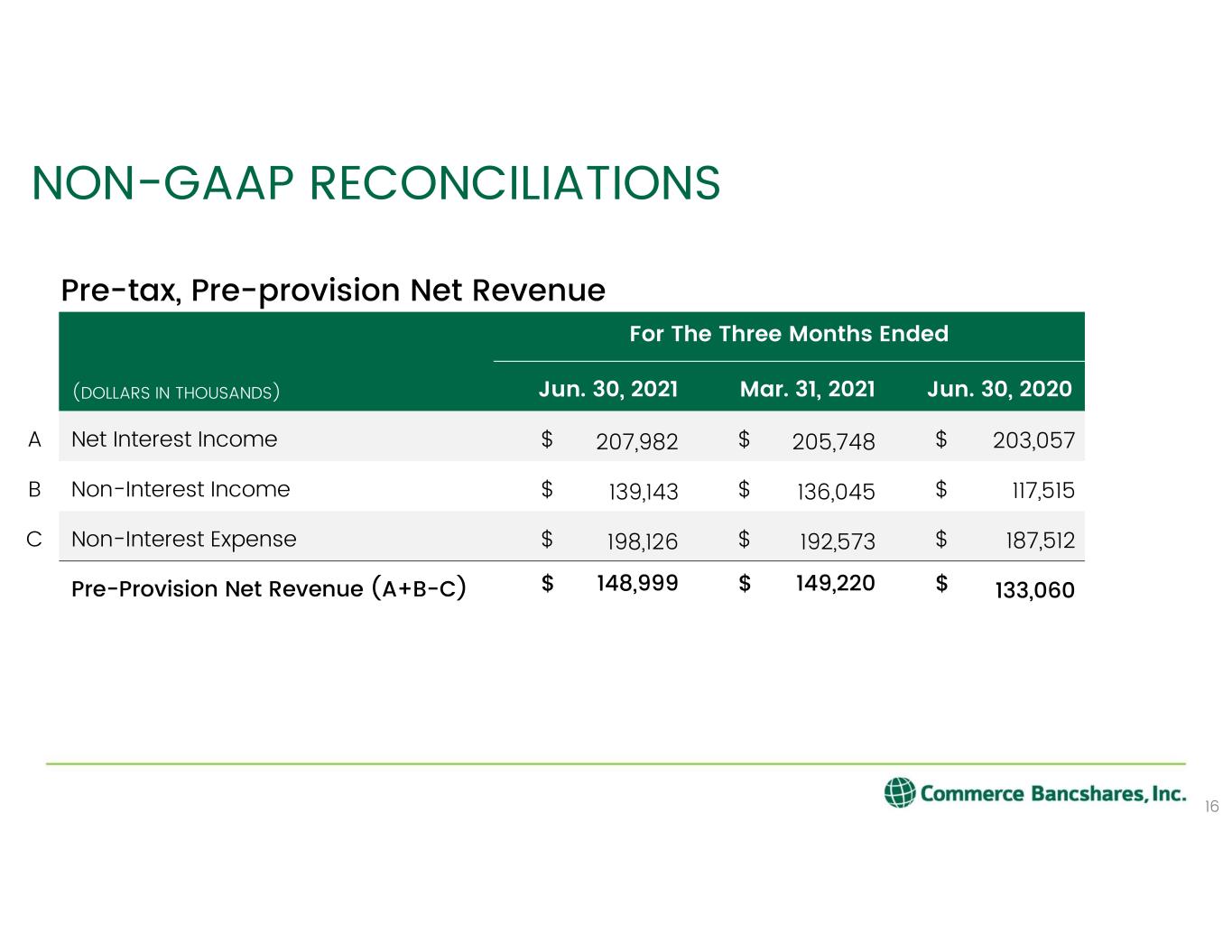

Change vs. $ in millions 2Q21 1Q21 2Q20 Highlights Net Interest Income $208.0 $2.2 $4.9 • Linked quarter (LQ) increase due to larger balance sheet, partially offset by NIM compression Non-Interest Income $139.1 $3.1 $21.6 • LQ increase in bank card fees, trust fees, consumer brokerage services fees and deposit account charges • Increase over prior year (PY) mainly due to growth in bank card fees, trust fees and loan fees and sales Non-Interest Expense $198.1 $5.6 $10.6 • Increase of 2.9% over LQ, 5.7% over PY; • LQ increase driven by salaries and benefits, lower deferred origination expenses and Other Expense • Increase over PY driven by higher salaries and benefits, marketing and data processing expenses and lower deferred origination costs Pre-Tax, Pre-Provision Net Revenue1 $149.0 $(0.2) $15.9 Investment Securities Gains, Net $16.8 $7.0 $20.9 • Q2 unrealized fair value gains of $16.7 million on private equity investment portfolio Provision for Credit Losses $(45.7) $(39.4) $(126.2) • Declines driven by improvement in economic forecast Net-Income Available to Common Shareholders $162.3 $31.4 $124.7 2Q21 1Q21 2Q20 Net Income per Common Share – Diluted $1.38 $1.11 $.32 Efficiency Ratio 56.90% 56.37% 58.10% • Continued expense discipline Net Yield on Interest Earning Assets 2.60% 2.71% 2.94% • Lower earning asset yields, partially offset by lower deposit costs INCOME STATEMENT HIGHLIGHTS 71 See the non-GAAP reconciliation on page 16

8 PRE-TAX, PRE-PROVISION NET REVENUE (PPNR) $118 $133 $203 $188 2Q2020 $321 $136 $149 $206 $193 1Q2021 $342 $139 $149 $208 $198 2Q2021 $347 Non-Interest Income (+) Net Interest Income (+) Non-Interest Expense (-) Pre-Tax, Pre-Provision Net Revenue (=) 2Q2021 Comparison vs. 2Q2020 12.0% vs. 1Q2021 (0.1)% See the non-GAAP reconciliation on page 16

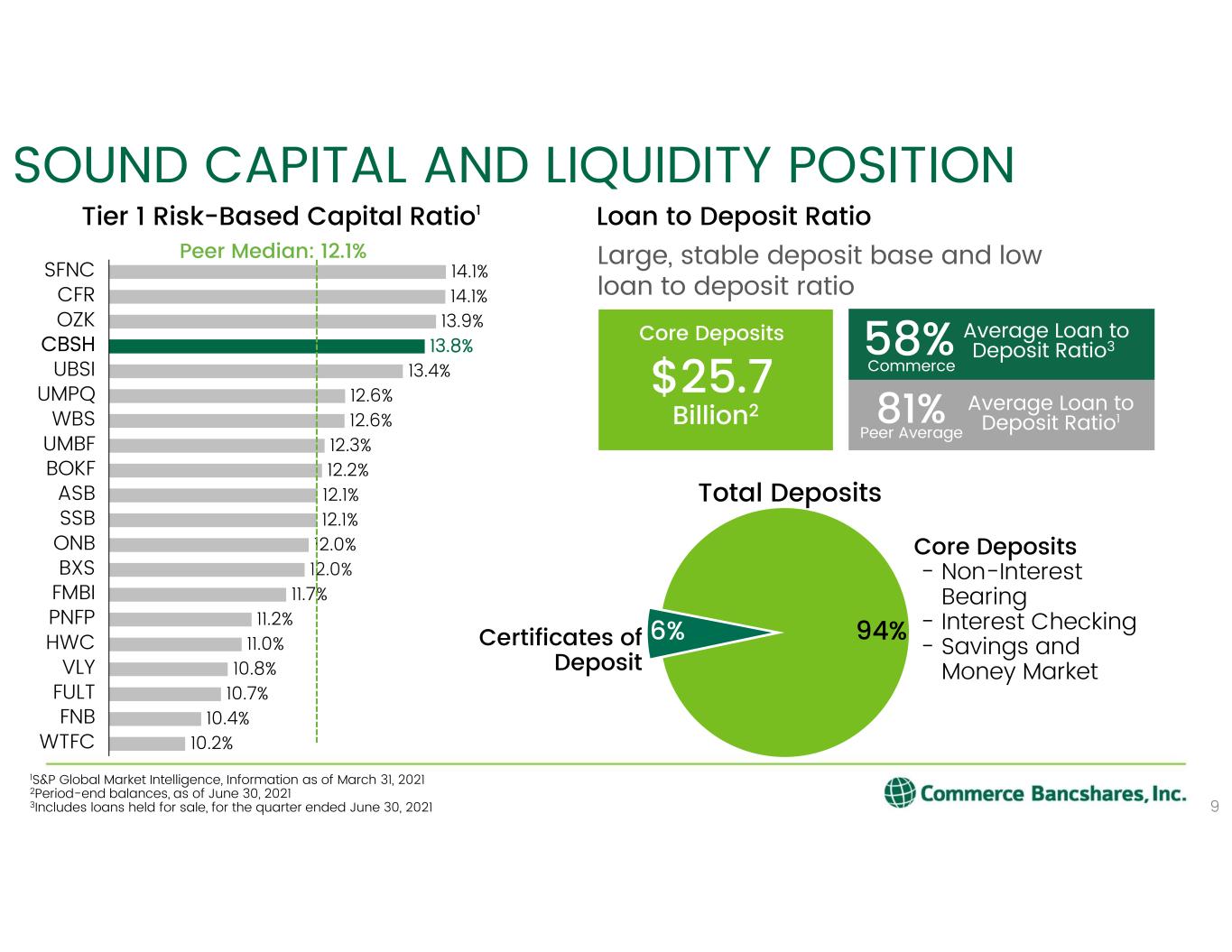

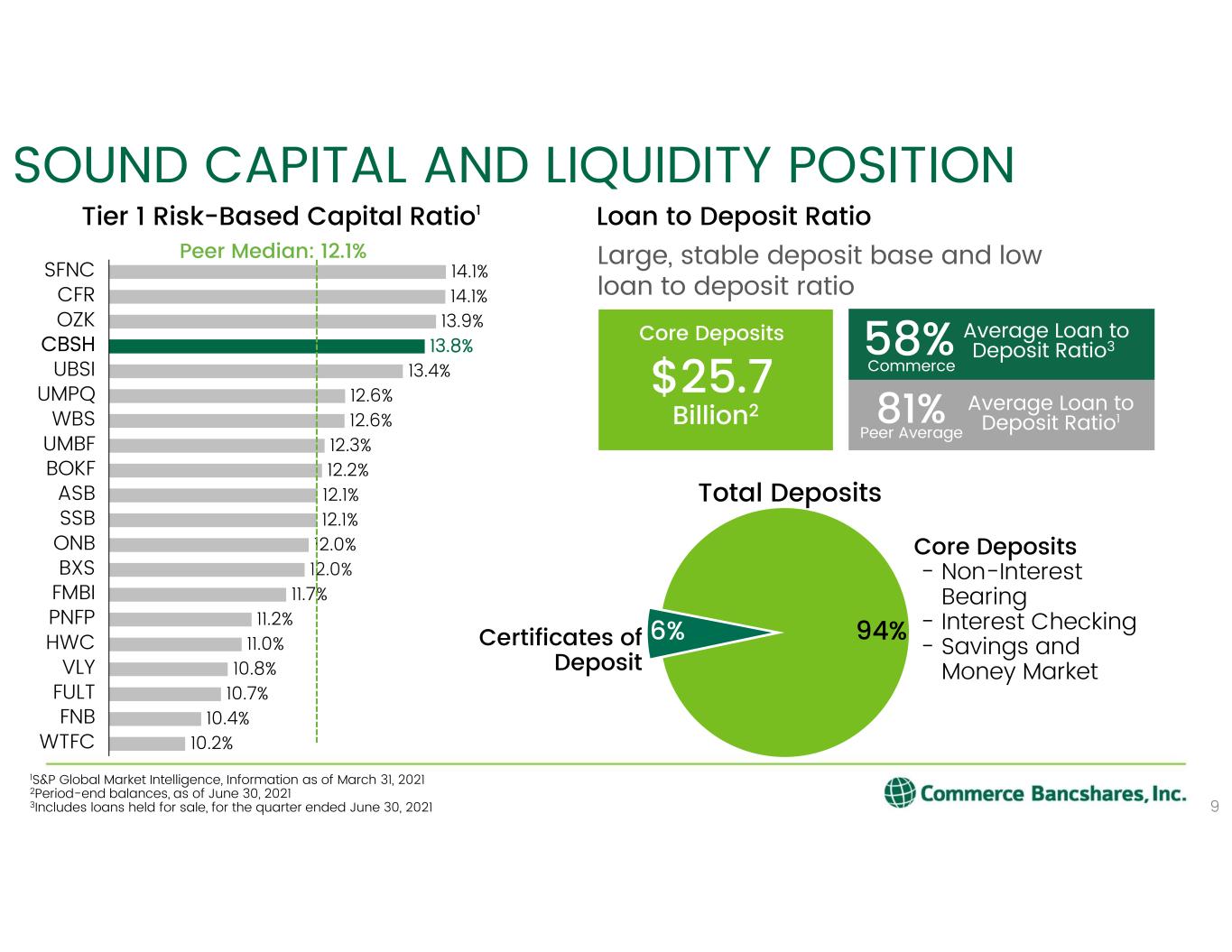

Average Loan to Deposit Ratio3 SOUND CAPITAL AND LIQUIDITY POSITION 9 Tier 1 Risk-Based Capital Ratio1 1S&P Global Market Intelligence, Information as of March 31, 2021 2Period-end balances, as of June 30, 2021 3Includes loans held for sale, for the quarter ended June 30, 2021 14.1% 14.1% 13.9% 13.8% 13.4% 12.6% 12.6% 12.3% 12.2% 12.1% 12.1% 12.0% 12.0% 11.7% 11.2% 11.0% 10.8% 10.7% 10.4% 10.2% UMBF UMPQ SFNC CFR OZK WBS CBSH UBSI HWC BOKF ASB WTFC SSB ONB FULT BXS FMBI PNFP VLY FNB Peer Median: 12.1% Core Deposits $25.7 Billion2 Large, stable deposit base and low loan to deposit ratio Loan to Deposit Ratio Total Deposits 58% Average Loan to Deposit Ratio181% Peer Average Commerce 94%6% Core Deposits - Non-Interest Bearing - Interest Checking - Savings and Money Market Certificates of Deposit

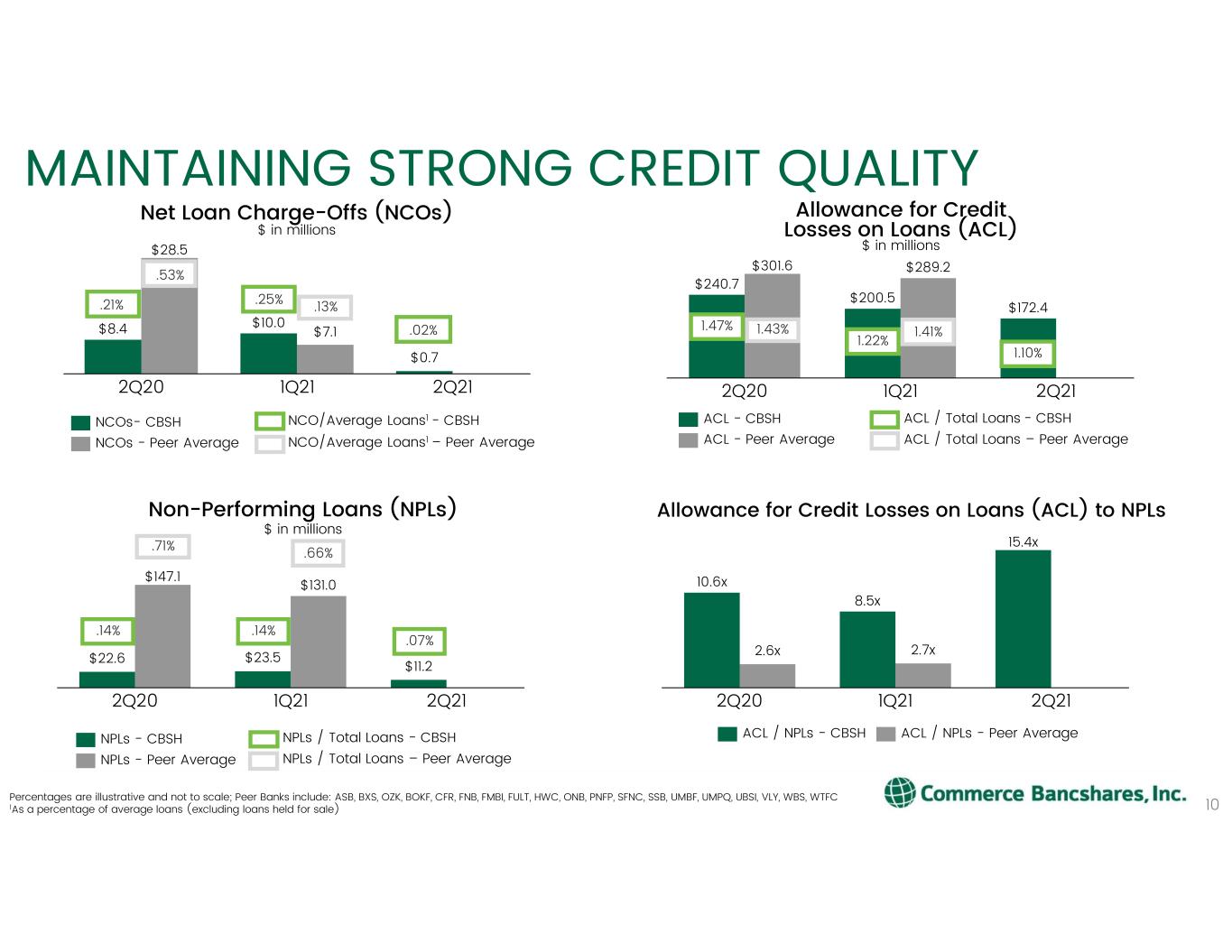

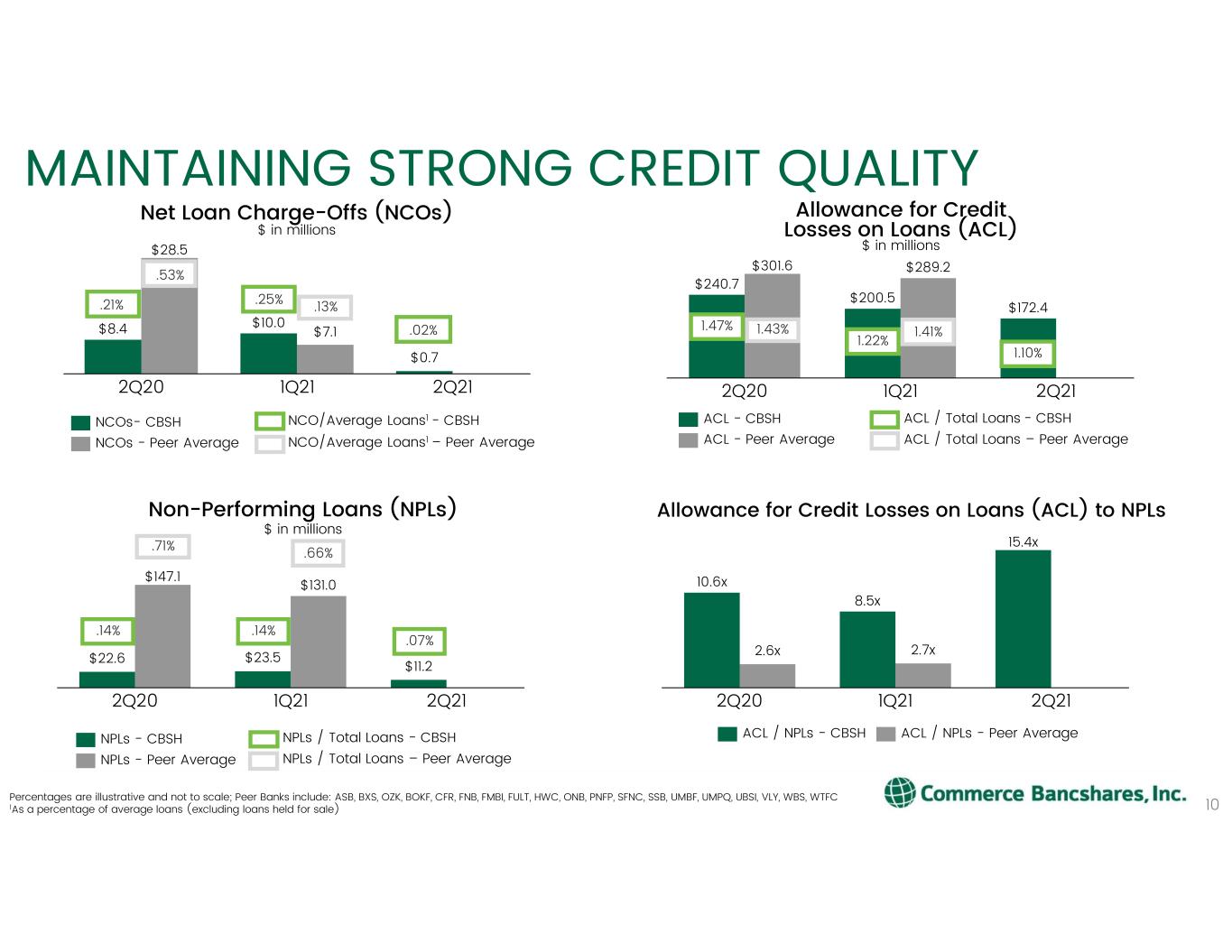

$8.4 $10.0 $0.7 $28.5 $7.1 1Q212Q20 2Q21 MAINTAINING STRONG CREDIT QUALITY 10 Net Loan Charge-Offs (NCOs) $ in millions NCOs- CBSH NCOs - Peer Average NCO/Average Loans1 - CBSH $240.7 $200.5 $172.4 $301.6 $289.2 2Q20 2Q211Q21 Allowance for Credit Losses on Loans (ACL) $ in millions ACL - CBSH ACL - Peer Average ACL / Total Loans - CBSH $22.6 $23.5 $11.2 $147.1 $131.0 2Q20 2Q211Q21 Non-Performing Loans (NPLs) $ in millions NPLs - CBSH NPLs - Peer Average 10.6x 8.5x 15.4x 2.6x 2.7x 2Q20 1Q21 2Q21 Allowance for Credit Losses on Loans (ACL) to NPLs ACL / NPLs - CBSH ACL / NPLs - Peer Average Percentages are illustrative and not to scale; Peer Banks include: ASB, BXS, OZK, BOKF, CFR, FNB, FMBI, FULT, HWC, ONB, PNFP, SFNC, SSB, UMBF, UMPQ, UBSI, VLY, WBS, WTFC 1As a percentage of average loans (excluding loans held for sale) NPLs / Total Loans - CBSH NCO/Average Loans1 – Peer Average .14% NPLs / Total Loans – Peer Average .14% .07% .71% .66% ACL / Total Loans – Peer Average 1.47% 1.22% 1.10% 1.43% 1.41% .21% .25% .02% .53% .13%

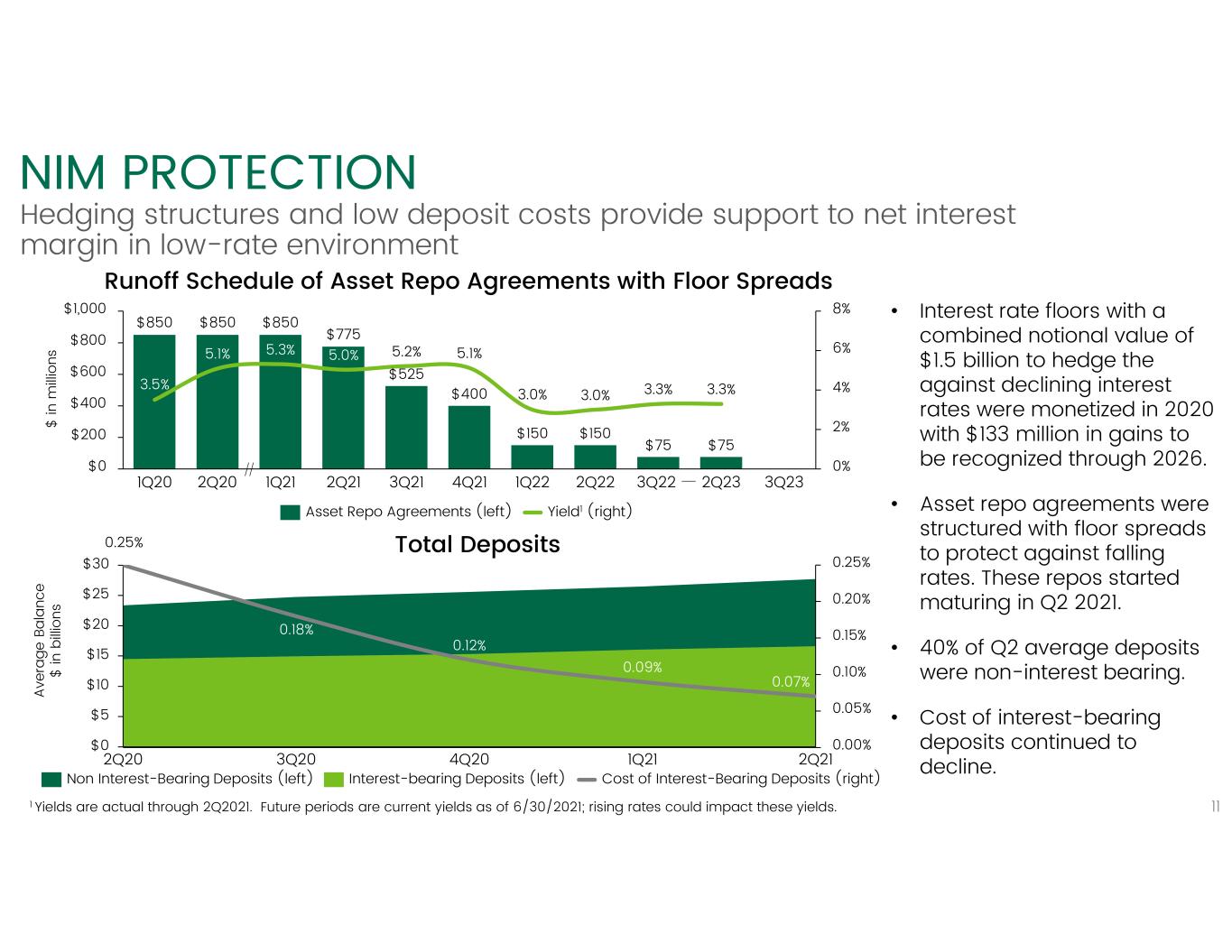

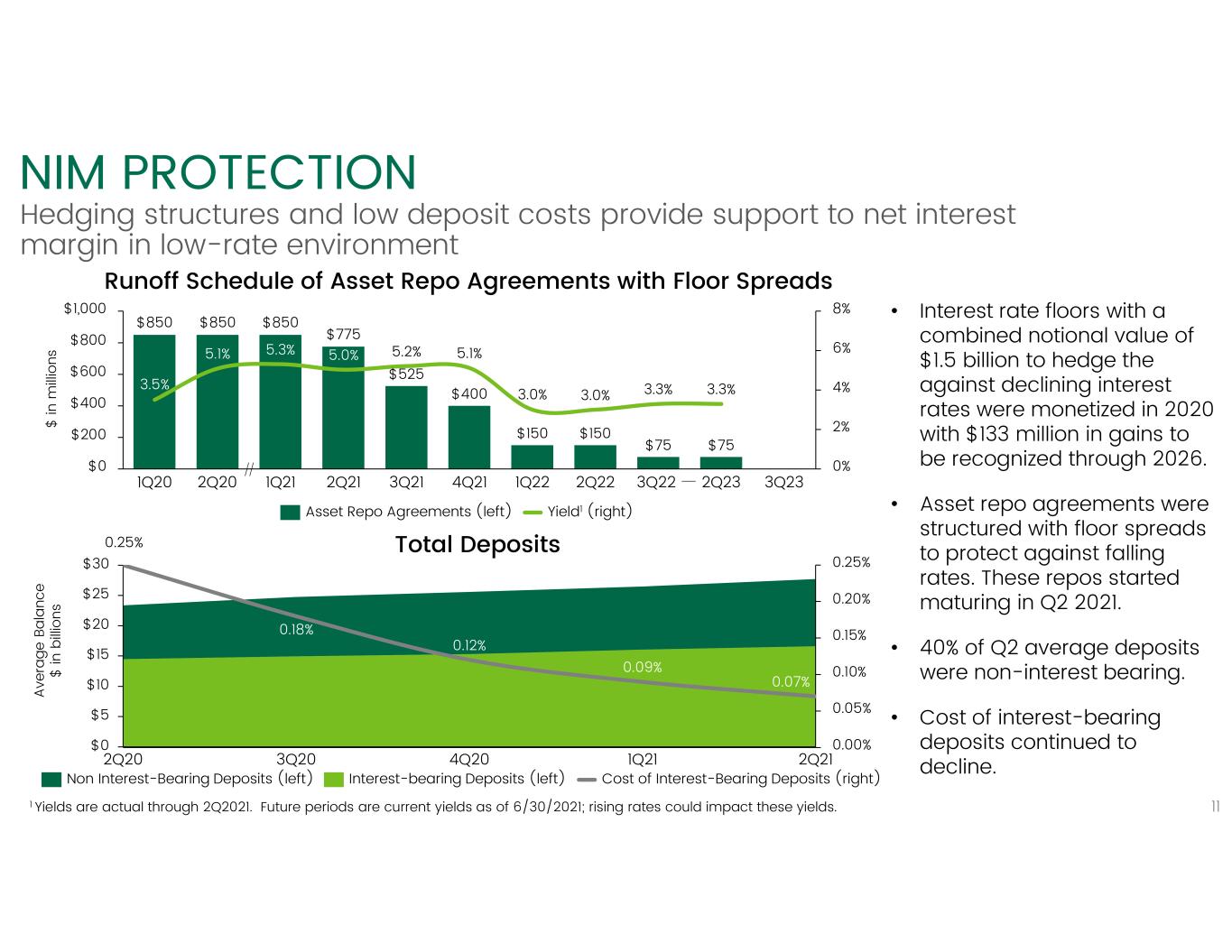

$25 $20 $0 $5 $10 $15 $30 2Q20 3Q20 4Q20 1Q21 2Q21 0.25% 0.18% 0.12% 0.09% 0.07% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% $850 $850 $850 $775 $525 $400 $150 $150 $75 $75 5.1% 5.3% 5.0% 5.2% 5.1% 3.0% 3.3% 3.3% 0% 2% 4% 6% 8% $0 $200 $400 $600 $800 $1,000 3.0% 3.5% 4Q211Q20 2Q20 1Q21 2Q21 3Q21 1Q22 3Q222Q22 2Q23 3Q23 NIM PROTECTION Hedging structures and low deposit costs provide support to net interest margin in low-rate environment • Interest rate floors with a combined notional value of $1.5 billion to hedge the against declining interest rates were monetized in 2020 with $133 million in gains to be recognized through 2026. • Asset repo agreements were structured with floor spreads to protect against falling rates. These repos started maturing in Q2 2021. • 40% of Q2 average deposits were non-interest bearing. • Cost of interest-bearing deposits continued to decline. Non Interest-Bearing Deposits (left) Interest-bearing Deposits (left) Runoff Schedule of Asset Repo Agreements with Floor Spreads $ in m illi on s Asset Repo Agreements (left) Yield1 (right) Total Deposits Av er ag e Ba la nc e $ in b illi on s Cost of Interest-Bearing Deposits (right) 111 Yields are actual through 2Q2021. Future periods are current yields as of 6/30/2021; rising rates could impact these yields.

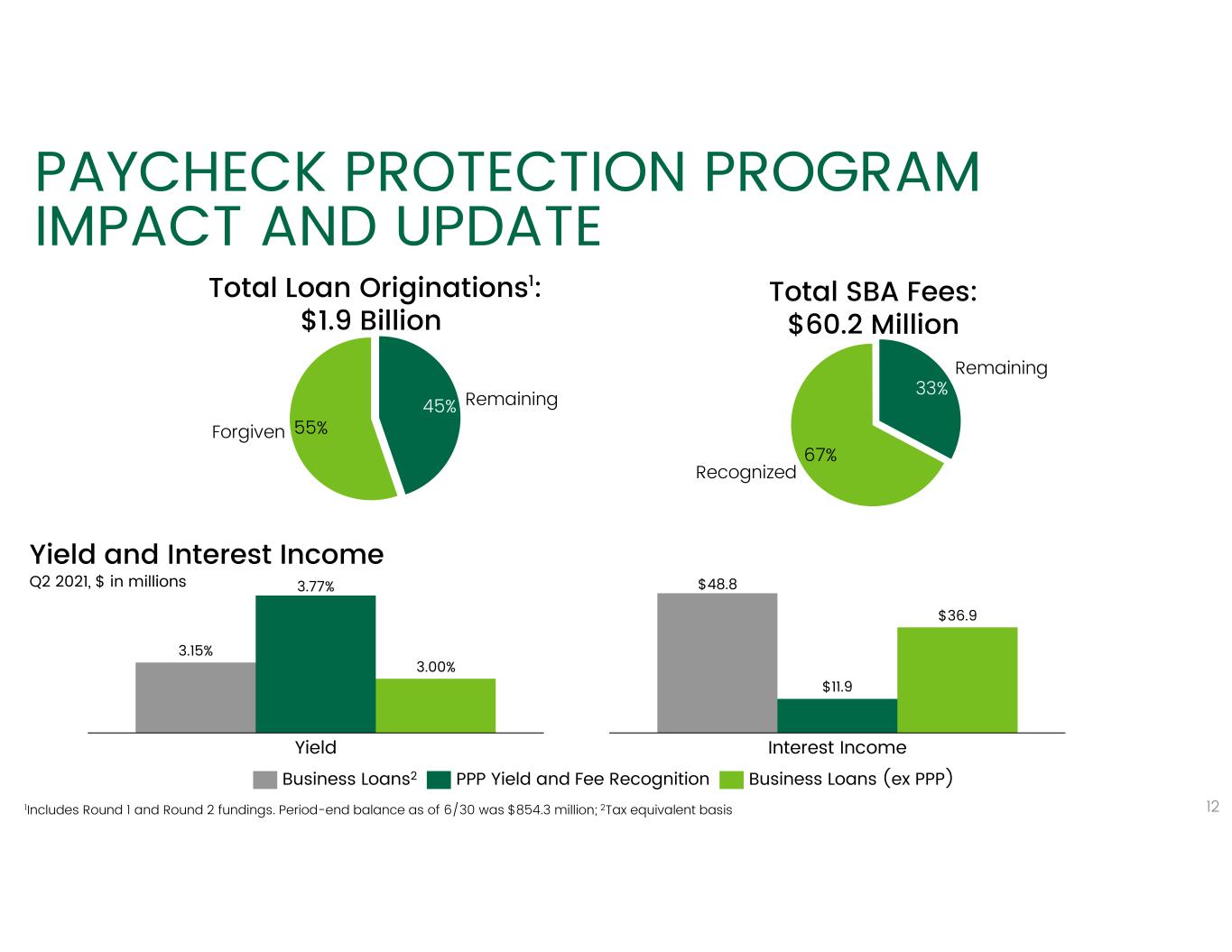

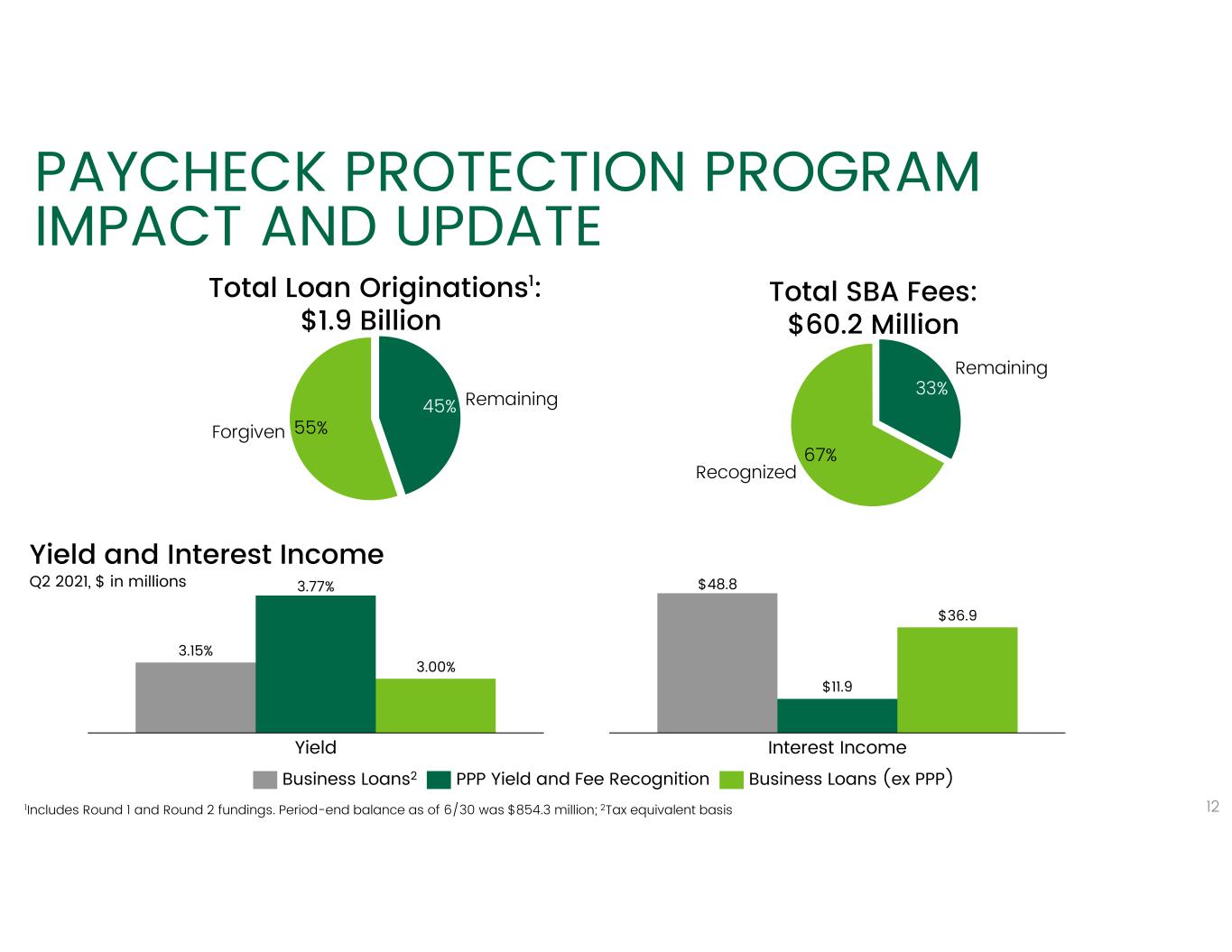

PAYCHECK PROTECTION PROGRAM IMPACT AND UPDATE 12 Yield and Interest Income Q2 2021, $ in millions 3.15% 3.77% 3.00% Yield PPP Yield and Fee RecognitionBusiness Loans2 Business Loans (ex PPP) $48.8 $11.9 $36.9 Interest Income Total Loan Originations1: $1.9 Billion Total SBA Fees: $60.2 Million 1Includes Round 1 and Round 2 fundings. Period-end balance as of 6/30 was $854.3 million; 2Tax equivalent basis 55% 45% Forgiven Remaining 67% 33% Recognized Remaining

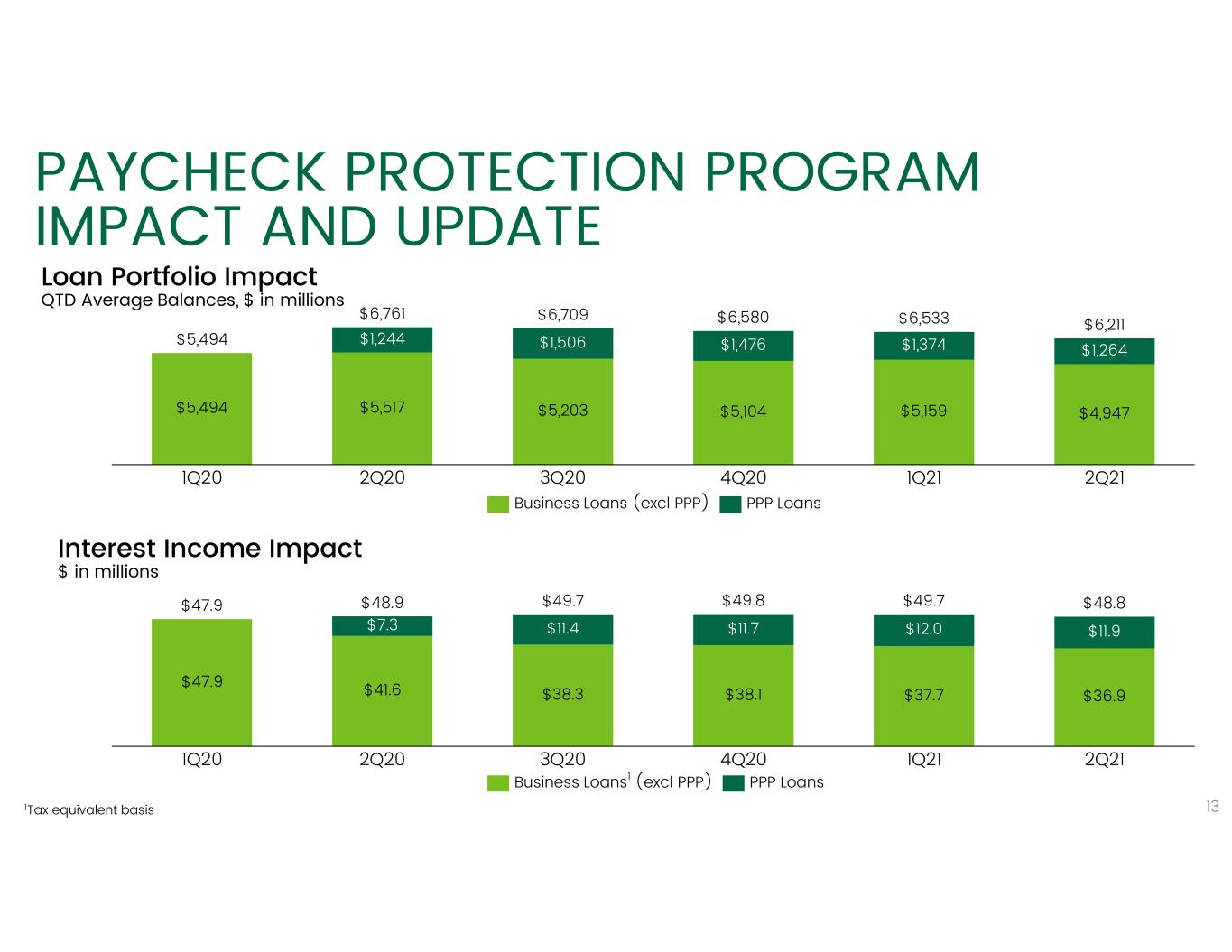

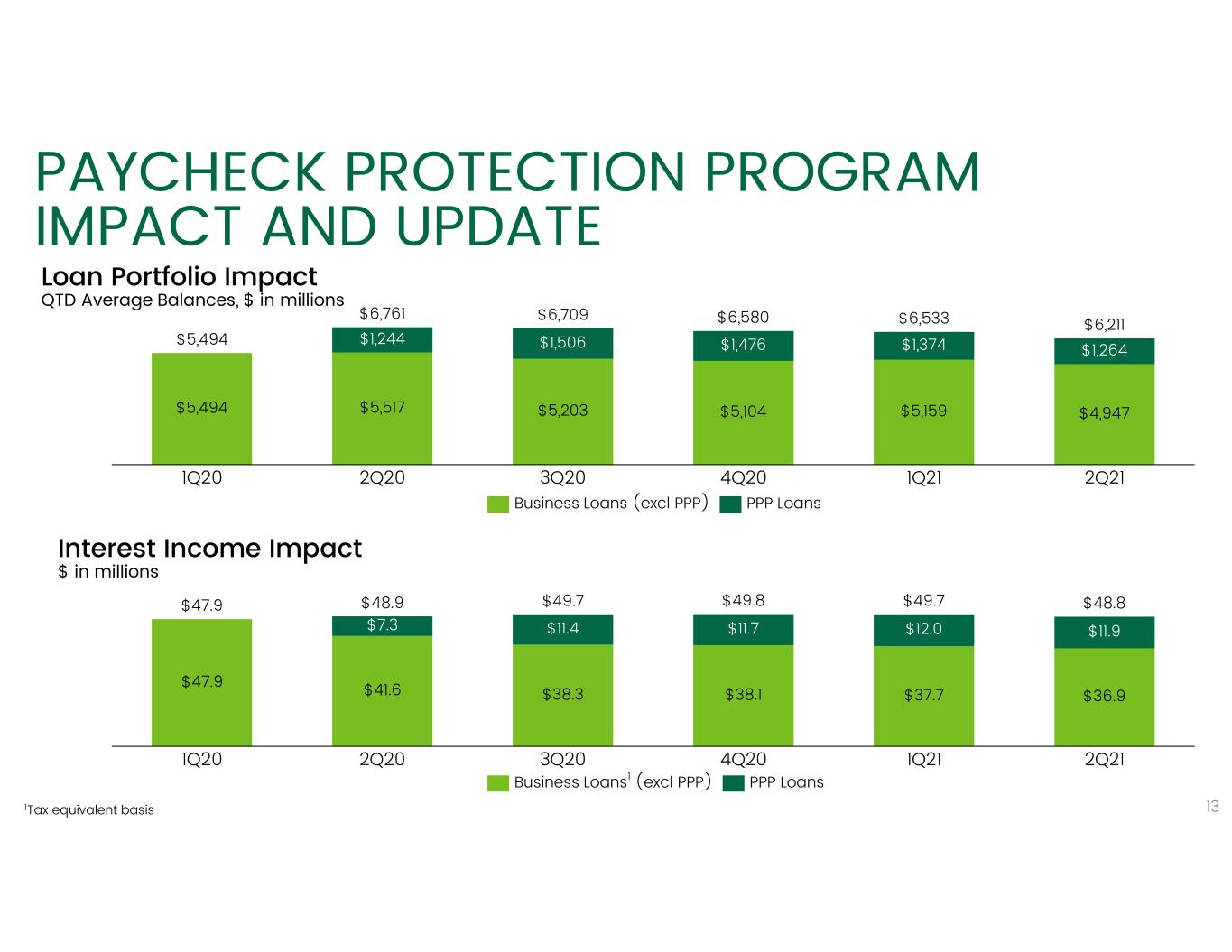

PAYCHECK PROTECTION PROGRAM IMPACT AND UPDATE 13 Loan Portfolio Impact QTD Average Balances, $ in millions $5,494 $5,517 $5,203 $5,104 $5,159 $4,947 $1,244 $1,506 $1,476 $1,374 $1,264 $6,709 2Q214Q203Q201Q20 2Q20 1Q21 $6,761 $5,494 $6,580 $6,533 $6,211 Interest Income Impact $ in millions $47.9 $41.6 $38.3 $38.1 $37.7 $36.9 $7.3 $11.4 $11.7 $12.0 $11.9 $48.9 2Q201Q20 3Q20 2Q214Q20 $47.9 1Q21 $49.7 $49.8 $49.7 $48.8 Business Loans (excl PPP) PPP Loans Business Loans1 (excl PPP) PPP Loans 1Tax equivalent basis

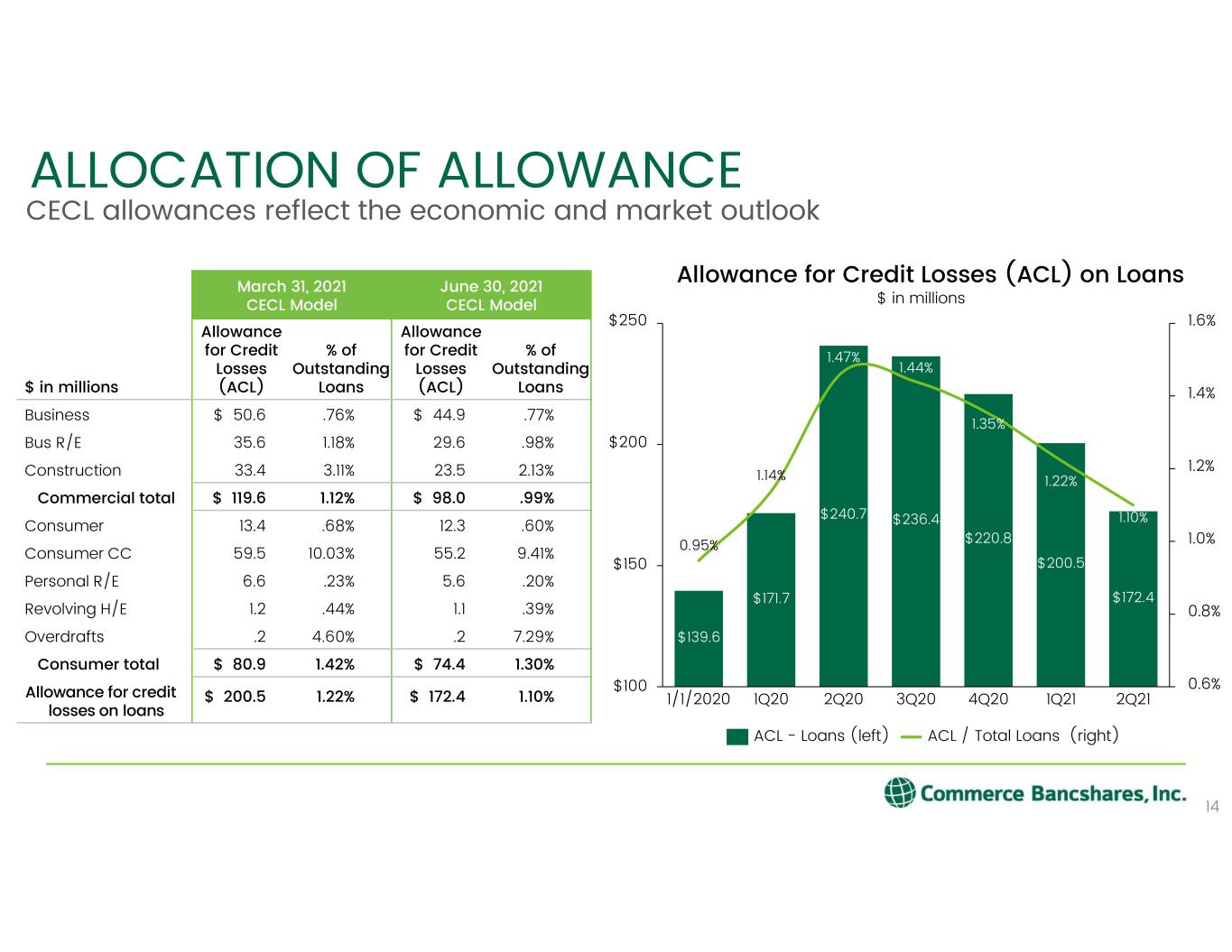

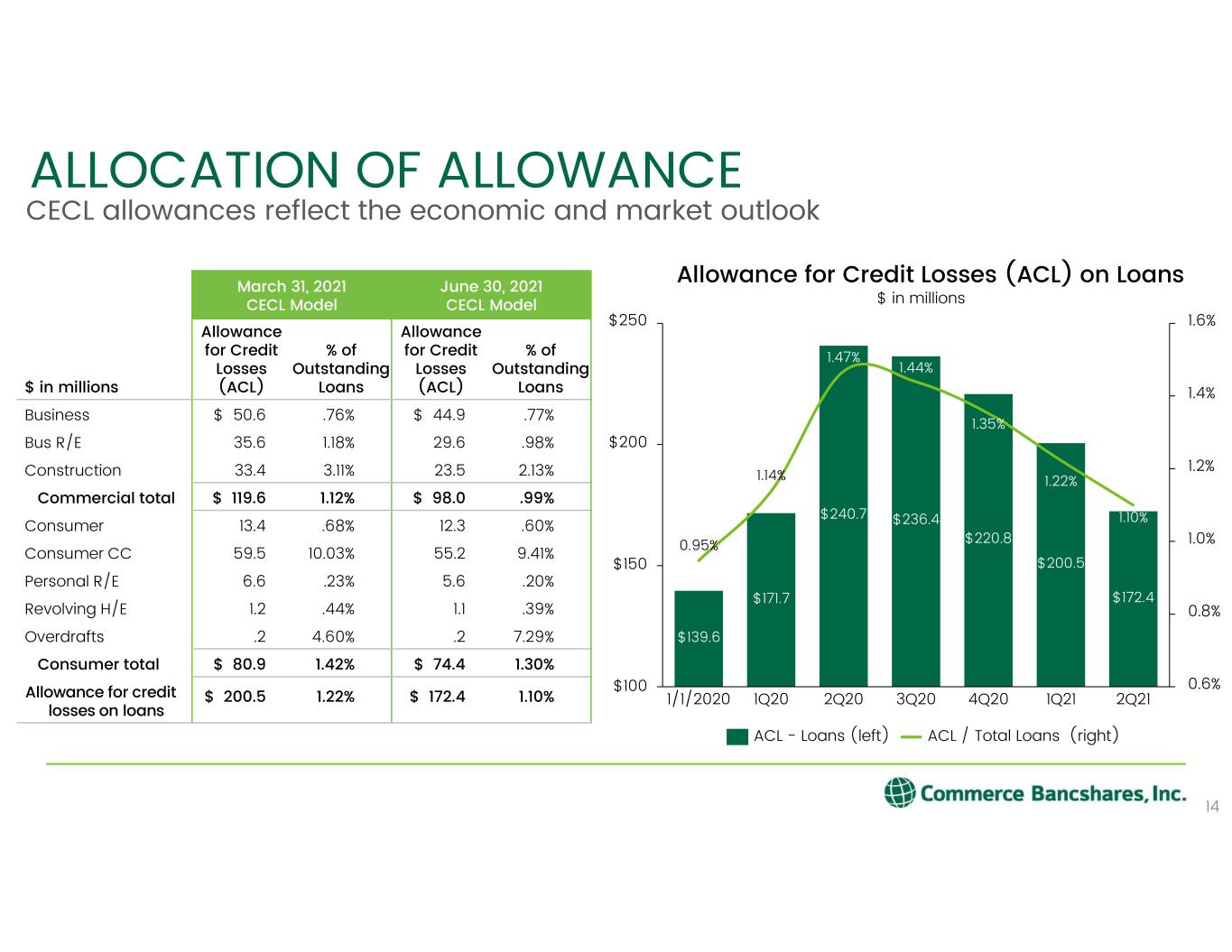

ALLOCATION OF ALLOWANCE 14 CECL allowances reflect the economic and market outlook March 31, 2021 CECL Model June 30, 2021 CECL Model $ in millions Allowance for Credit Losses (ACL) % of Outstanding Loans Allowance for Credit Losses (ACL) % of Outstanding Loans Business $ 50.6 .76% $ 44.9 .77% Bus R/E 35.6 1.18% 29.6 .98% Construction 33.4 3.11% 23.5 2.13% Commercial total $ 119.6 1.12% $ 98.0 .99% Consumer 13.4 .68% 12.3 .60% Consumer CC 59.5 10.03% 55.2 9.41% Personal R/E 6.6 .23% 5.6 .20% Revolving H/E 1.2 .44% 1.1 .39% Overdrafts .2 4.60% .2 7.29% Consumer total $ 80.9 1.42% $ 74.4 1.30% Allowance for credit losses on loans $ 200.5 1.22% $ 172.4 1.10% 1.47% 1.44% 1.22% 1.10% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% $200 $100 $250 $150 1/1/2020 2Q21 $171.7 $139.6 0.95% 1.14% 1Q20 $240.7 2Q20 $220.8 $236.4 3Q20 1.35% 4Q20 $200.5 1Q21 $172.4 Allowance for Credit Losses (ACL) on Loans ACL / Total Loans (right)ACL - Loans (left) $ in millions

Quick Facts: Small Business Investment Company (SBIC) founded in 1959 Nationwide footprint with Greater Midwest Focus 31 Portfolio Companies Representing $682 million in Revenue Over 2,600 Employees Fair Value as of June 30, 2021: $116.2 million Investment Criteria • Manufacturing, distribution and certain service companies • Cash flow positive • Good management • Consistent financial performers • Operate in niche markets • Significant and defensible market positions • Differentiated products and services • Scalable business platforms Target Parameters • Revenues - $10 million to $100 million • EBITDA - $2 million to $7 million CAPITAL FOR BUSINESS® A middle-market private equity firm focused on the success of industrial growth companies Transaction Types Management buyouts Leveraged buyouts Succession plans Recapitalizations Corporate divestitures Investment Structures Subordinated debt Preferred stock Common stock Warrants Other Information Co-investors Majority control Target 5-7 year hold period Management participation 15

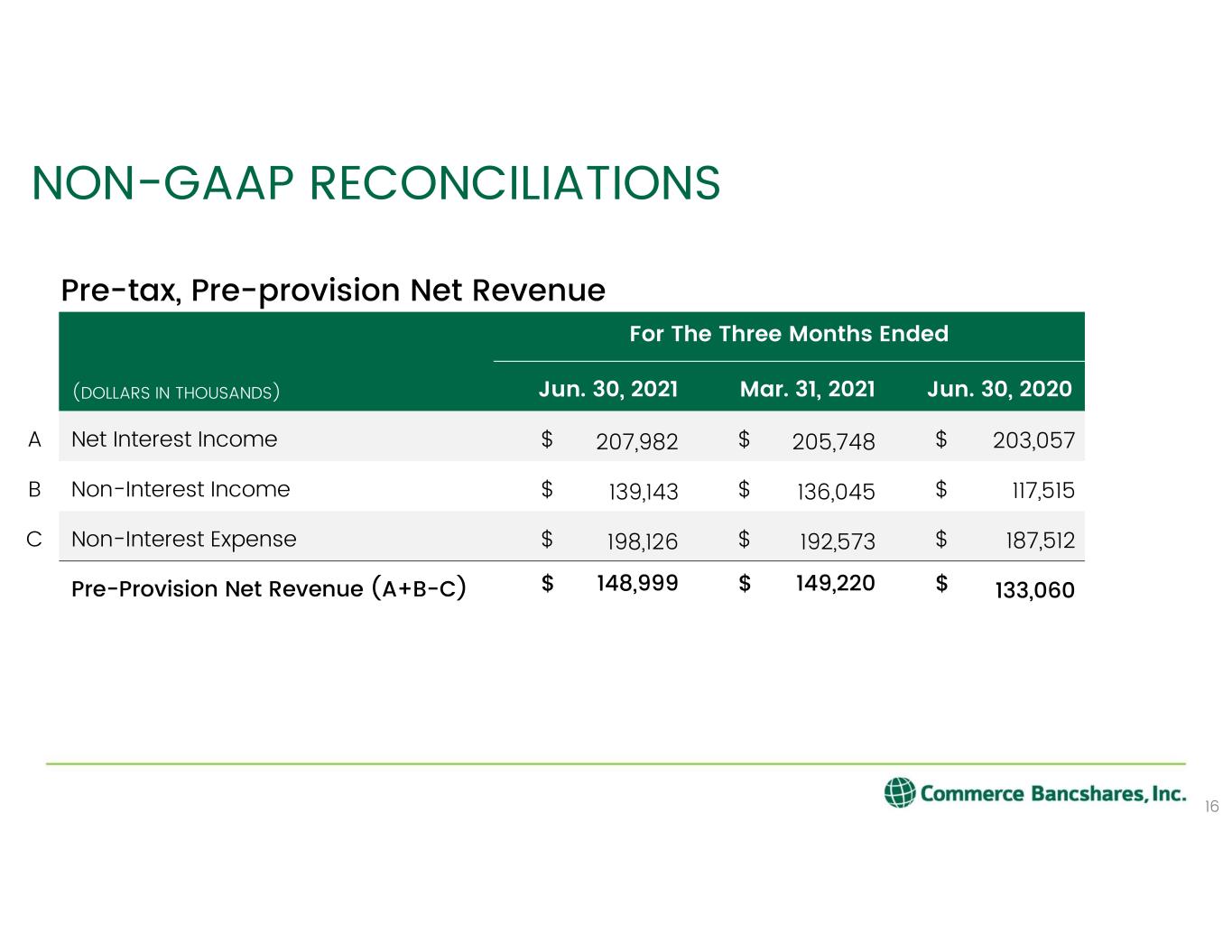

NON-GAAP RECONCILIATIONS 16 For The Three Months Ended (DOLLARS IN THOUSANDS) Jun. 30, 2021 Mar. 31, 2021 Jun. 30, 2020 A Net Interest Income $ 207,982 $ 205,748 $ 203,057 B Non-Interest Income $ 139,143 $ 136,045 $ 117,515 C Non-Interest Expense $ 198,126 $ 192,573 $ 187,512 Pre-Provision Net Revenue (A+B-C) $ 148,999 $ 149,220 $ 133,060 Pre-tax, Pre-provision Net Revenue