UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrant ☒

Filed by Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

JOHN HANCOCK INVESTMENT TRUST

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| | ☐ | Fee paid previously with preliminary materials. |

| | ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY.

| | EASY VOTING OPTIONS: |

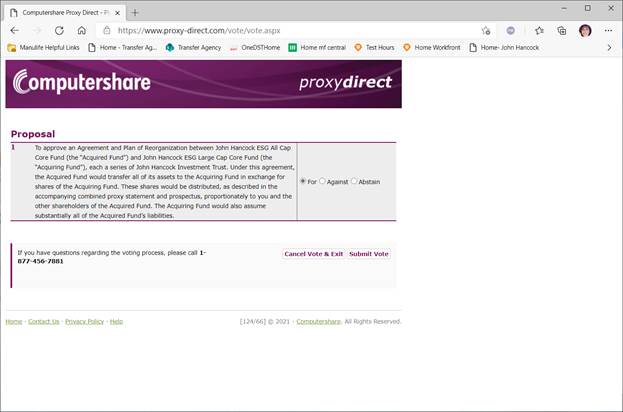

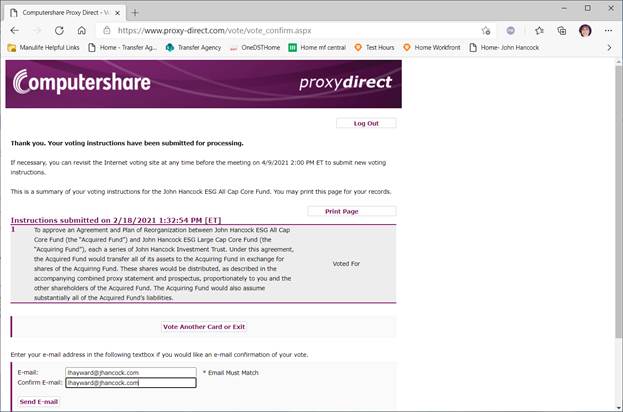

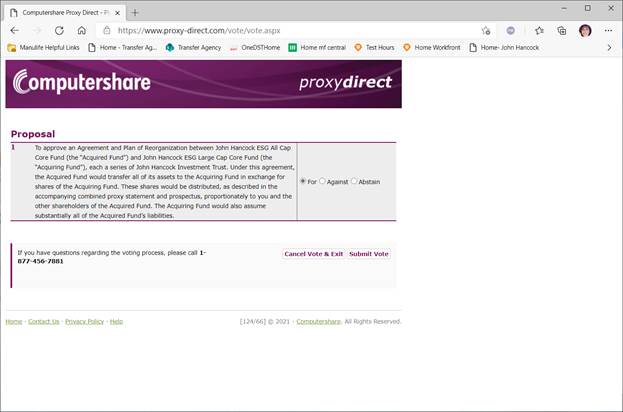

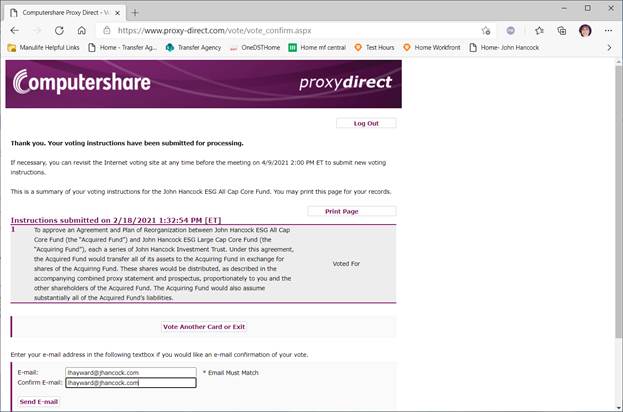

| |  | VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours |

| |  | VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours |

| |  | VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope |

| |  | VOTE AT THE TELEPHONIC MEETING on April 9, 2021 at 2:00 p.m. Eastern Time. Please refer to the Proxy Statement for instructions on how to participate in the Telephonic Meeting |

Please detach at perforation before mailing.

| PROXY | JOHN HANCOCK ESG ALL CAP CORE FUND (a series of John Hancock Investment Trust) Special Meeting of Shareholders April 9, 2021 | |

THIS PROXY IS SOLICITED BY THE BOARD OF TRUSTEES.

The undersigned, revoking previous proxies, hereby appoint(s) Andrew G. Arnott, Jay Aronowitz, Phil Fontana, Charles Rizzo, Sal Schiavone, John J. Danello, Christopher Sechler, Ariel Ayanna, Sarah M. Coutu, Thomas Dee, Nicholas J. Kolokithas, Kinga Kapuscinski, Suzanne M. Lambert, Edward Macdonald, Mara C.S. Moldwin, Harsha Pulluru, Betsy Anne Seel and Steven Sunnerberg, or any one or more of them, proxies and attorneys of the undersigned, each with full power of substitution, to vote all shares of John Hancock ESG All Cap Core Fund, a series of John Hancock Investment Trust, which the undersigned is entitled to vote at the Special Meeting of Shareholders of the Fund, (the “Meeting"), to be held on April 9, 2021, at 2:00 P.M., Eastern Time, and at any adjournments thereof, with all of the powers the undersigned would possess if then and there personally present and especially (but without limiting the general authorization and power hereby given) to vote as indicated on the proposal, as more fully described in the Proxy Statement and Prospectus (“Proxy Statement”) for the Meeting. In light of the COVID-19 pandemic, the Meeting will be held via telephone only. Please refer to the proxy statement for instructions on how to participate in the telephonic meeting. All powers may be exercised by a majority of said proxy holders or substitutes voting or acting or, if only one votes and acts, then by that one. Receipt of the Notice of the Special Meeting of Shareholders and the accompanying Proxy Statement is hereby acknowledged.

When this proxy is properly executed, the shares to which this proxy relates will be voted as specified. If no specification is made, this proxy will be voted FOR the proposal. The persons named as proxies have discretionary authority, which they intend to exercise in favor of the proposal referred to and according to their best judgment as to any other matters which may properly come before the meeting.

| | VOTE VIA THE INTERNET: www.proxy-direct.com |

| | VOTE VIA THE TELEPHONE: 1-800-337-3503 |

| | | | |

JHS_31918_021721

PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THE PROXY CARD USING THE ENCLOSED ENVELOPE.

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY.

Important Notice Regarding the Availability of Proxy Materials for the

Special Meeting of Shareholders to be held via telephone only on April 9, 2021.

The Proxy Statement and Proxy Card for this meeting are available free of charge at:

https://www.jhinvestments.com/proxy-information

IF YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU NEED NOT RETURN THIS PROXY CARD

Please detach at perforation before mailing.

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS Example: ☒

| A | Proposal THE BOARD OF TRUSTEES RECOMMENDS A VOTE FOR THE PROPOSAL. | FOR | AGAINST | ABSTAIN |

| 1 | To approve an Agreement and Plan of Reorganization between John Hancock ESG All Cap Core Fund (the “Acquired Fund”) and John Hancock ESG Large Cap Core Fund (the “Acquiring Fund”), each a series of John Hancock Investment Trust. Under this agreement, the Acquired Fund would transfer all of its assets to the Acquiring Fund in exchange for shares of the Acquiring Fund. These shares would be distributed, as described in the accompanying combined proxy statement and prospectus, proportionately to you and the other shareholders of the Acquired Fund. The Acquiring Fund would also assume substantially all of the Acquired Fund’s liabilities. | ☐ | ☐ | ☐ |

| 2. | To transact such other business as may properly come before the meeting or any adjournment of the meeting. | | | |

B Authorized Signatures ─ This section must be completed for your vote to be counted.─ Sign and Date Below

Note: Please sign exactly as your name(s) appear(s) on this proxy card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature.

| Date (mm/dd/yyyy) ─ Please print date below | | Signature 1 ─ Please keep signature within the box | | Signature 2 ─ Please keep signature within the box |

| / / | | | | |

| xxxxxxxxxxxxxx | JHS 31918 | xxxxxxxx |