COMMERCIAL METALS COMPANY Q1 FY 2023 Supplemental Slides

Forward-Looking Statements Q1 FY23 Supplemental Slides │ January 9, 2023 2 This presentation contains forward-looking statements within the meaning of the federal securities laws with respect to general economic conditions, key macro-economic drivers that impact our business, the effects of ongoing trade actions, the effects of continued pressure on the liquidity of our customers, potential synergies and organic growth provided by acquisitions and strategic investments, demand for our products, shipment volumes, metal margins, the effect of COVID-19 and related governmental and economic responses thereto, the ability to operate our steel mills at full capacity, future availability and cost of supplies of raw materials and energy for our operations, share repurchases, legal proceedings, construction activity, international trade, the impact of the Russian invasion of Ukraine, capital expenditures, tax credits, our liquidity and our ability to satisfy future liquidity requirements, estimated contractual obligations, the expected capabilities and benefits of new facilities, the timeline for execution of our growth plan, and our expectations or beliefs concerning future events. The statements in this presentation that are not historical statements, are forward-looking statements. These forward-looking statements can generally be identified by phrases such as we or our management "expects," "anticipates," "believes," "estimates," "future," "intends," "may," "plans to," "ought," "could," "will," "should," "likely," "appears," "projects," "forecasts," "outlook" or other similar words or phrases, as well as by discussions of strategy, plans, or intentions. Our forward-looking statements are based on management’s expectations and beliefs as of the date of this presentation. Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in our filings with the Securities and Exchange Commission, including, but not limited to, in Part I, Item 1A, "Risk Factors" of our annual report on Form 10-K for the fiscal year ended August 31, 2022, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of our downstream contracts due to rising commodity pricing; impacts from COVID-19 on the economy, demand for our products, global supply chain and on our operations, including the responses of governmental authorities to contain COVID-19 and the impact of various COVID-19 vaccines; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing; the impact of the Russian invasion of Ukraine on the global economy, inflation, energy supplies and raw materials, which is uncertain, but may prove to negatively impact our business and operations; increased attention to environmental, social and governance (“ESG”) matters, including any targets or other ESG or environmental justice initiatives; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non- compliance of their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our repurchase program; financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions and realize any or all of the anticipated synergies or other benefits of acquisitions; the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third party consents and approvals; operating and startup risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; impact of goodwill or other indefinite lived intangible asset impairment charges; impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; ability to hire and retain key executives and other employees; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots.

3Q1 FY23 Supplemental Slides │ January 9, 2023 Leading positions in core products and geographies Focused strategy that leverages capabilities, competitive strengths, and market knowledge Strong balance sheet and cash generation provides flexibility to execute on strategy Vertical structure optimizes returns through the entire value chain Disciplined capital allocation focused on maximizing returns for our shareholders Increasing Shareholder Value....With a Winning Formula

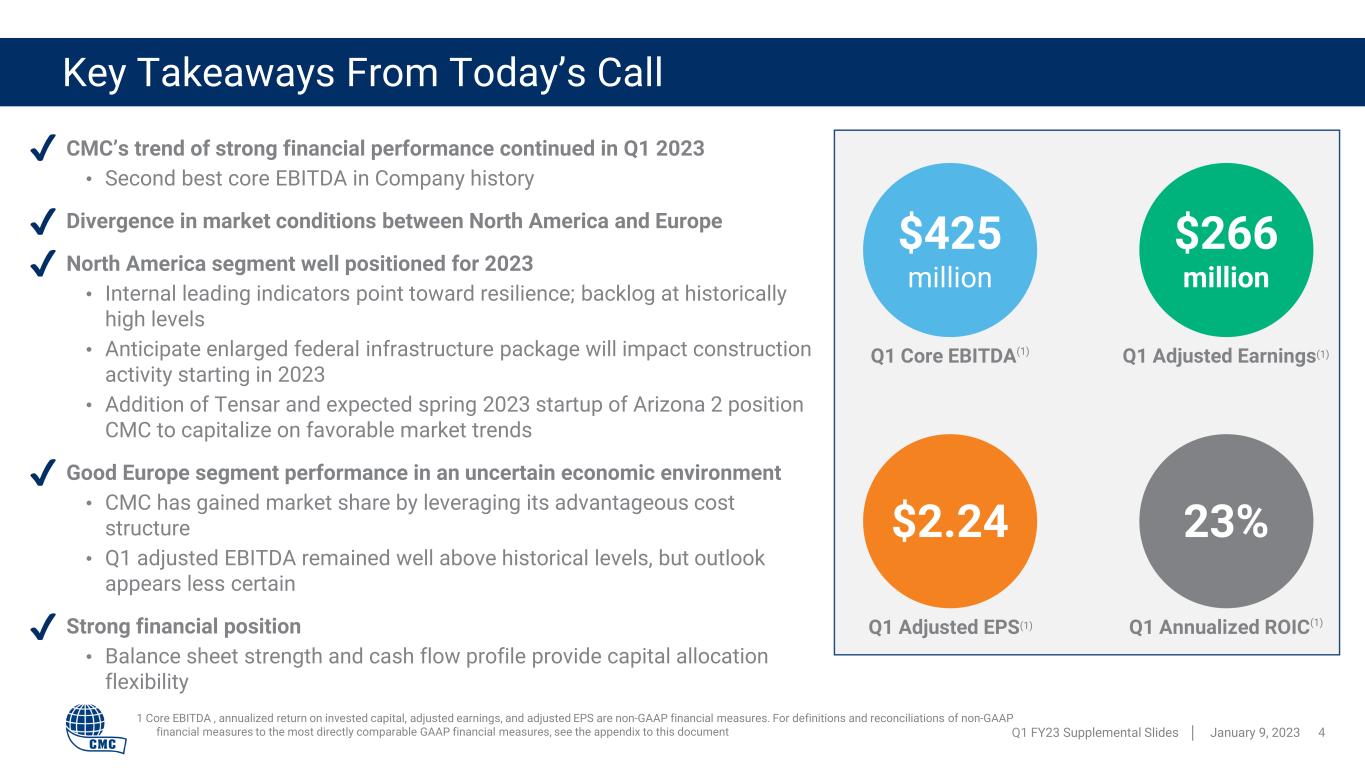

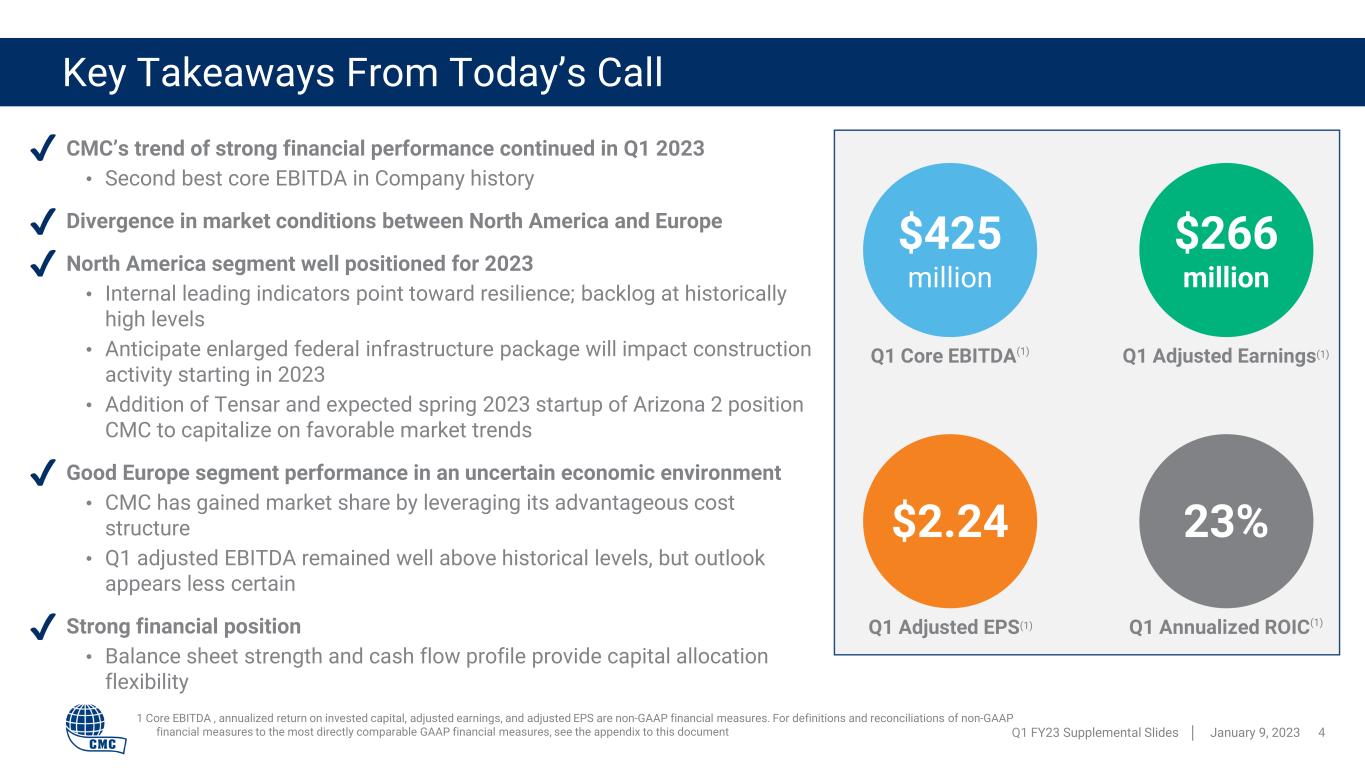

CMC’s trend of strong financial performance continued in Q1 2023 • Second best core EBITDA in Company history Divergence in market conditions between North America and Europe North America segment well positioned for 2023 • Internal leading indicators point toward resilience; backlog at historically high levels • Anticipate enlarged federal infrastructure package will impact construction activity starting in 2023 • Addition of Tensar and expected spring 2023 startup of Arizona 2 position CMC to capitalize on favorable market trends Good Europe segment performance in an uncertain economic environment • CMC has gained market share by leveraging its advantageous cost structure • Q1 adjusted EBITDA remained well above historical levels, but outlook appears less certain Strong financial position • Balance sheet strength and cash flow profile provide capital allocation flexibility Key Takeaways From Today’s Call Q1 FY23 Supplemental Slides │ January 9, 2023 4 $425 million Q1 Core EBITDA(1) 1 Core EBITDA , annualized return on invested capital, adjusted earnings, and adjusted EPS are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document $266 million $2.24 23% Q1 Adjusted Earnings(1) Q1 Adjusted EPS(1) Q1 Annualized ROIC(1) ✔ ✔ ✔ ✔ ✔

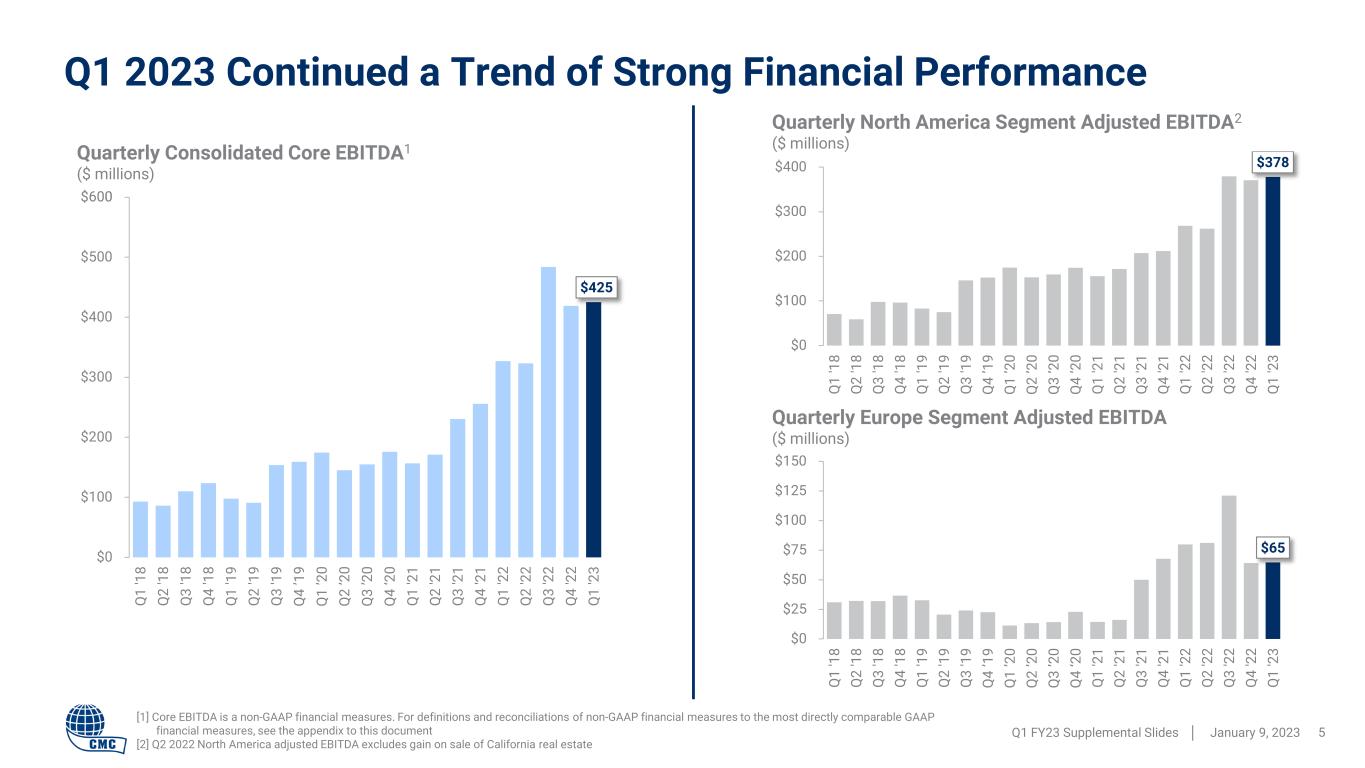

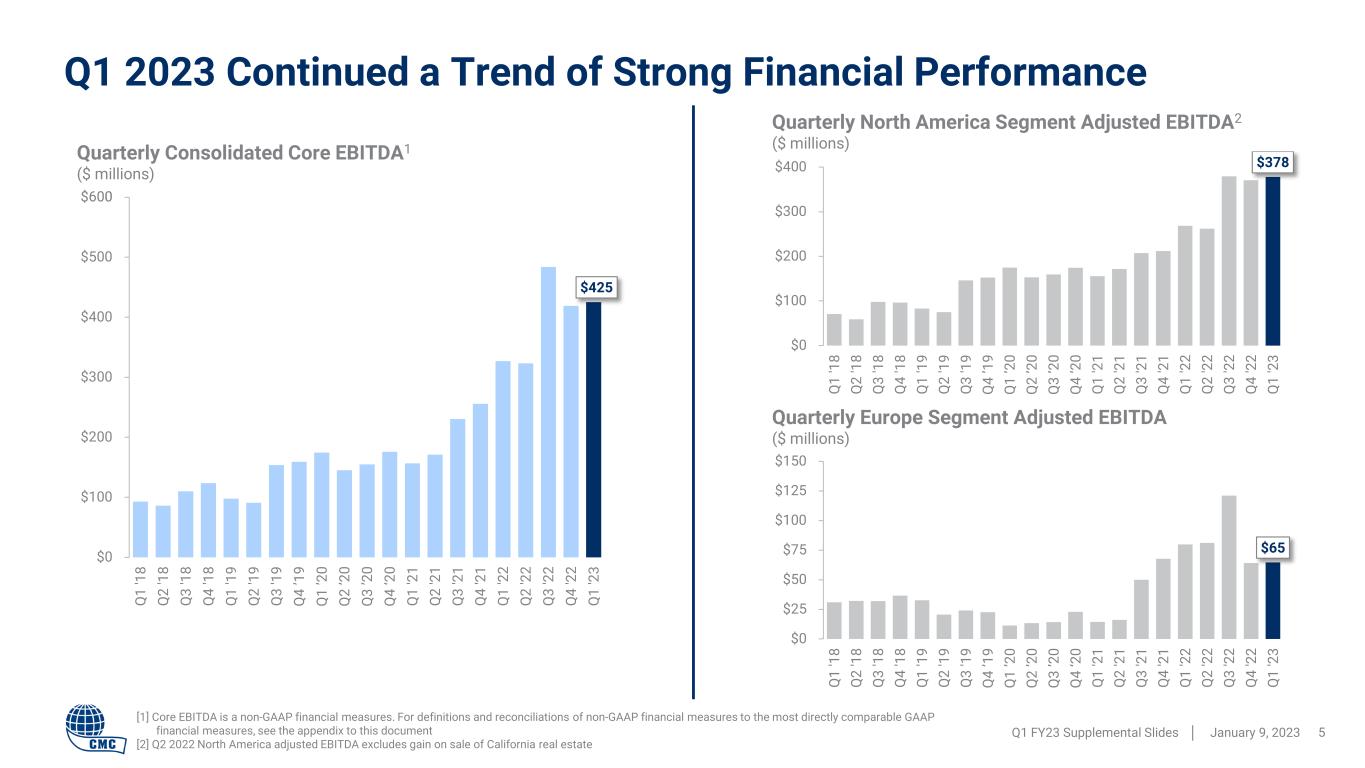

$425 $0 $100 $200 $300 $400 $500 $600 Q 1 '1 8 Q 2 '1 8 Q 3 '1 8 Q 4 '1 8 Q 1 '1 9 Q 2 '1 9 Q 3 '1 9 Q 4 ’1 9 Q 1 ’2 0 Q 2 ’2 0 Q 3 ’2 0 Q 4 ‘2 0 Q 1 '2 1 Q 2 '2 1 Q 3 '2 1 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q1 2023 Continued a Trend of Strong Financial Performance Q1 FY23 Supplemental Slides │ January 9, 2023 5 [1] Core EBITDA is a non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document [2] Q2 2022 North America adjusted EBITDA excludes gain on sale of California real estate Quarterly Consolidated Core EBITDA1 ($ millions) $378 $0 $100 $200 $300 $400 Q 1 '1 8 Q 2 '1 8 Q 3 '1 8 Q 4 '1 8 Q 1 '1 9 Q 2 '1 9 Q 3 '1 9 Q 4 ’1 9 Q 1 ’2 0 Q 2 ’2 0 Q 3 ’2 0 Q 4 ‘2 0 Q 1 '2 1 Q 2 '2 1 Q 3 '2 1 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Quarterly North America Segment Adjusted EBITDA2 ($ millions) $65 $0 $25 $50 $75 $100 $125 $150 Q 1 '1 8 Q 2 '1 8 Q 3 '1 8 Q 4 '1 8 Q 1 '1 9 Q 2 '1 9 Q 3 '1 9 Q 4 ’1 9 Q 1 ’2 0 Q 2 ’2 0 Q 3 ’2 0 Q 4 ‘2 0 Q 1 '2 1 Q 2 '2 1 Q 3 '2 1 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Quarterly Europe Segment Adjusted EBITDA ($ millions)

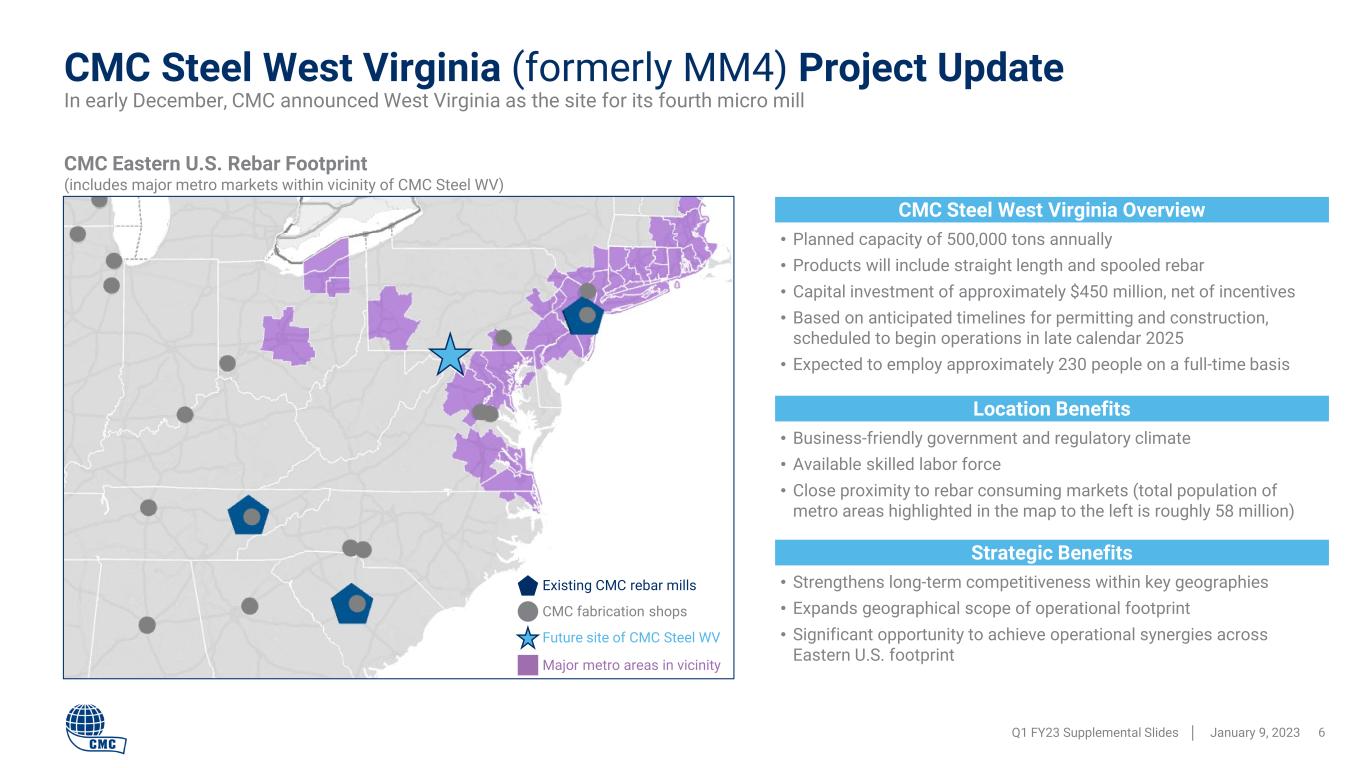

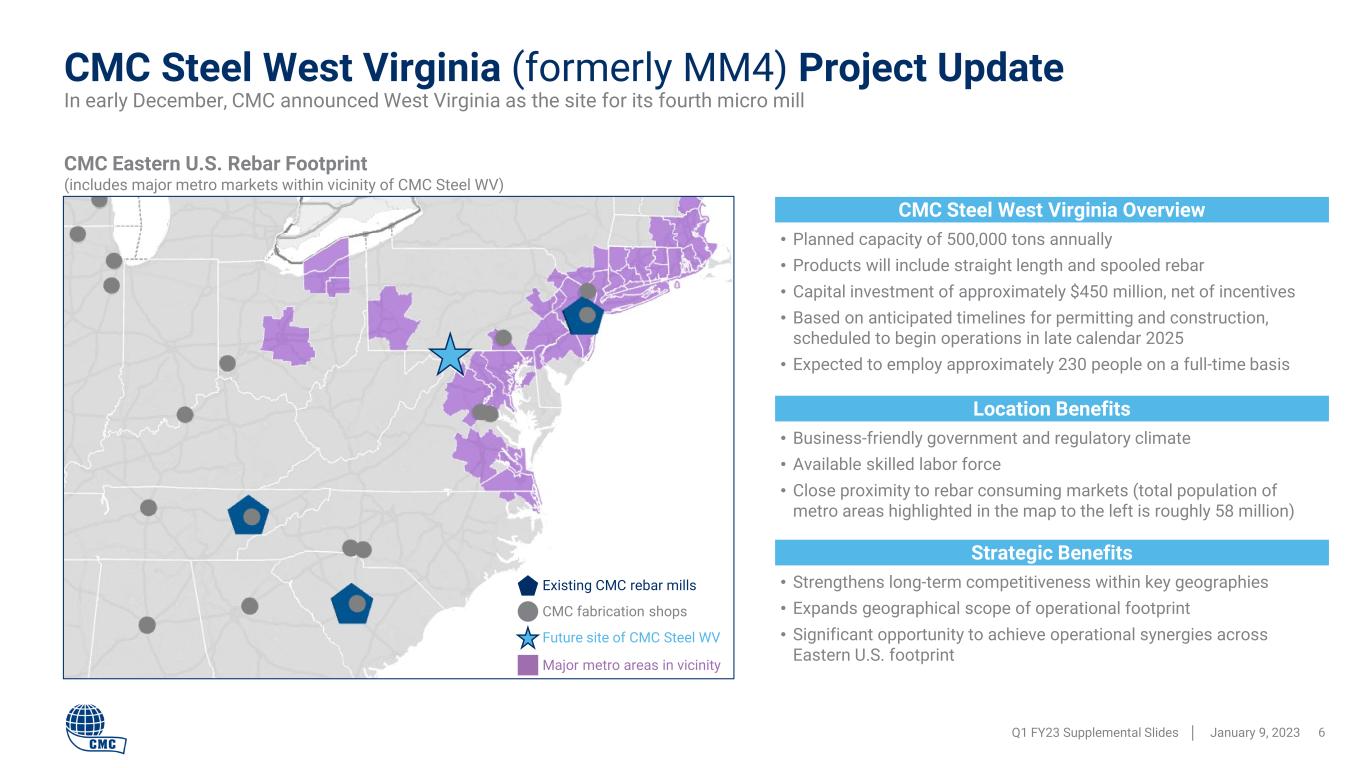

CMC Steel West Virginia (formerly MM4) Project Update Q1 FY23 Supplemental Slides │ January 9, 2023 6 In early December, CMC announced West Virginia as the site for its fourth micro mill Major metro areas in vicinity Existing CMC rebar mills CMC fabrication shops Future site of CMC Steel WV CMC Eastern U.S. Rebar Footprint (includes major metro markets within vicinity of CMC Steel WV) CMC Steel West Virginia Overview • Planned capacity of 500,000 tons annually • Products will include straight length and spooled rebar • Capital investment of approximately $450 million, net of incentives • Based on anticipated timelines for permitting and construction, scheduled to begin operations in late calendar 2025 • Expected to employ approximately 230 people on a full-time basis Location Benefits • Business-friendly government and regulatory climate • Available skilled labor force • Close proximity to rebar consuming markets (total population of metro areas highlighted in the map to the left is roughly 58 million) Strategic Benefits • Strengthens long-term competitiveness within key geographies • Expands geographical scope of operational footprint • Significant opportunity to achieve operational synergies across Eastern U.S. footprint

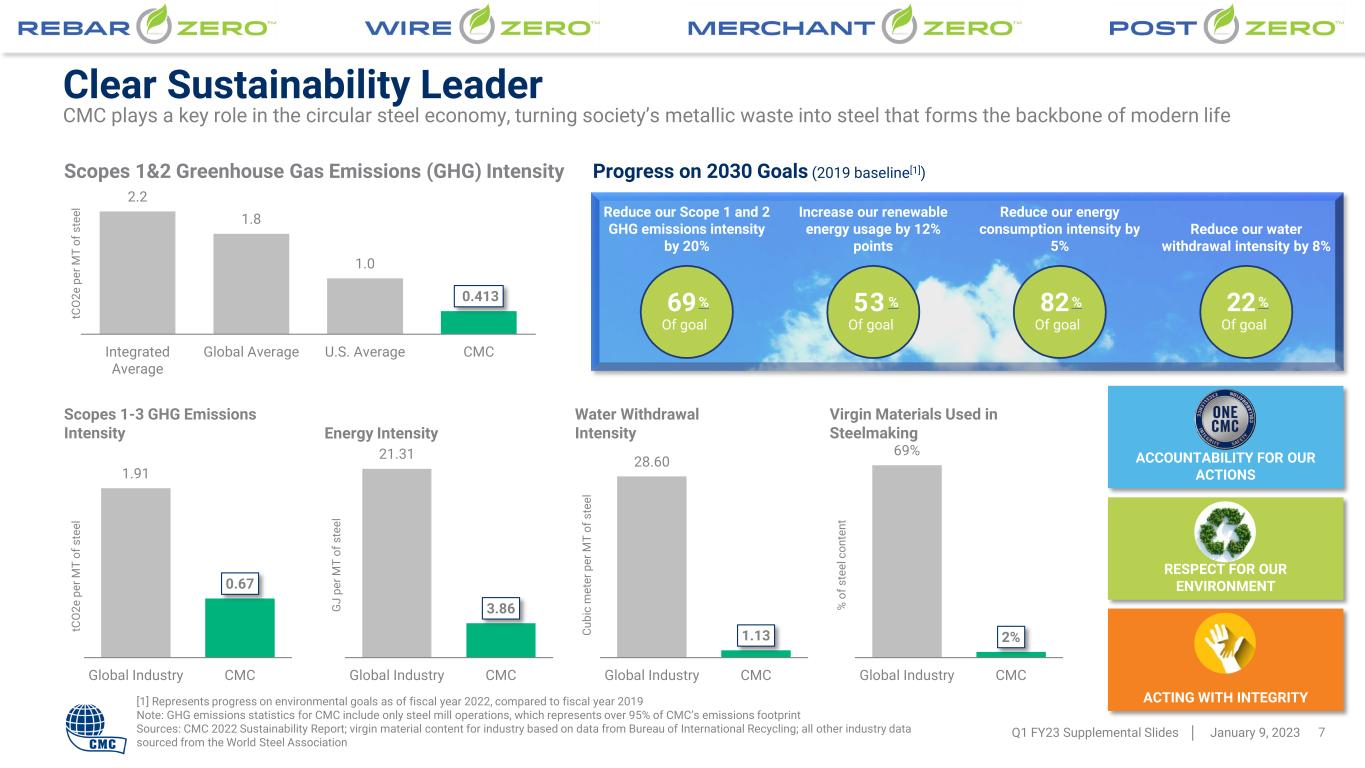

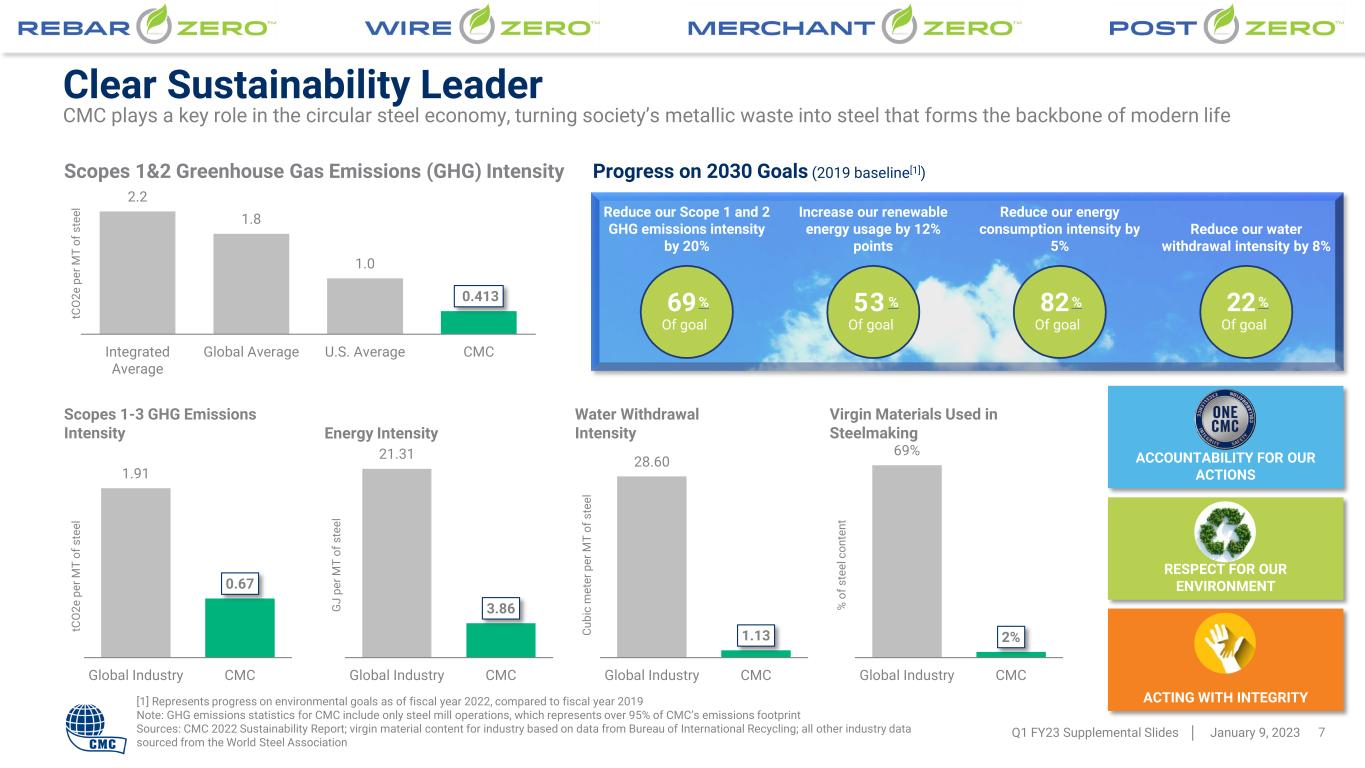

69% Of goal Clear Sustainability Leader Q1 FY23 Supplemental Slides │ January 9, 2023 7 [1] Represents progress on environmental goals as of fiscal year 2022, compared to fiscal year 2019 Note: GHG emissions statistics for CMC include only steel mill operations, which represents over 95% of CMC’s emissions footprint Sources: CMC 2022 Sustainability Report; virgin material content for industry based on data from Bureau of International Recycling; all other industry data sourced from the World Steel Association CMC plays a key role in the circular steel economy, turning society’s metallic waste into steel that forms the backbone of modern life ACCOUNTABILITY FOR OUR ACTIONS RESPECT FOR OUR ENVIRONMENT ACTING WITH INTEGRITY 2.2 1.8 1.0 0.413 Integrated Average Global Average U.S. Average CMC Scopes 1&2 Greenhouse Gas Emissions (GHG) Intensity tC O 2e p er M T of s te el 1.91 0.67 Global Industry CMC 21.31 3.86 Global Industry CMC 28.60 1.13 Global Industry CMC 69% 2% Global Industry CMC Reduce our Scope 1 and 2 GHG emissions intensity by 20% Increase our renewable energy usage by 12% points Reduce our energy consumption intensity by 5% Reduce our water withdrawal intensity by 8% 5 3 % Of goal 82% Of goal 22% Of goal Progress on 2030 Goals (2019 baseline[1]) Scopes 1-3 GHG Emissions Intensity tC O 2e p er M T of s te el Energy Intensity G J pe r M T of s te el Water Withdrawal Intensity Cu bi c m et er p er M T of s te el Virgin Materials Used in Steelmaking % o f s te el c on te nt

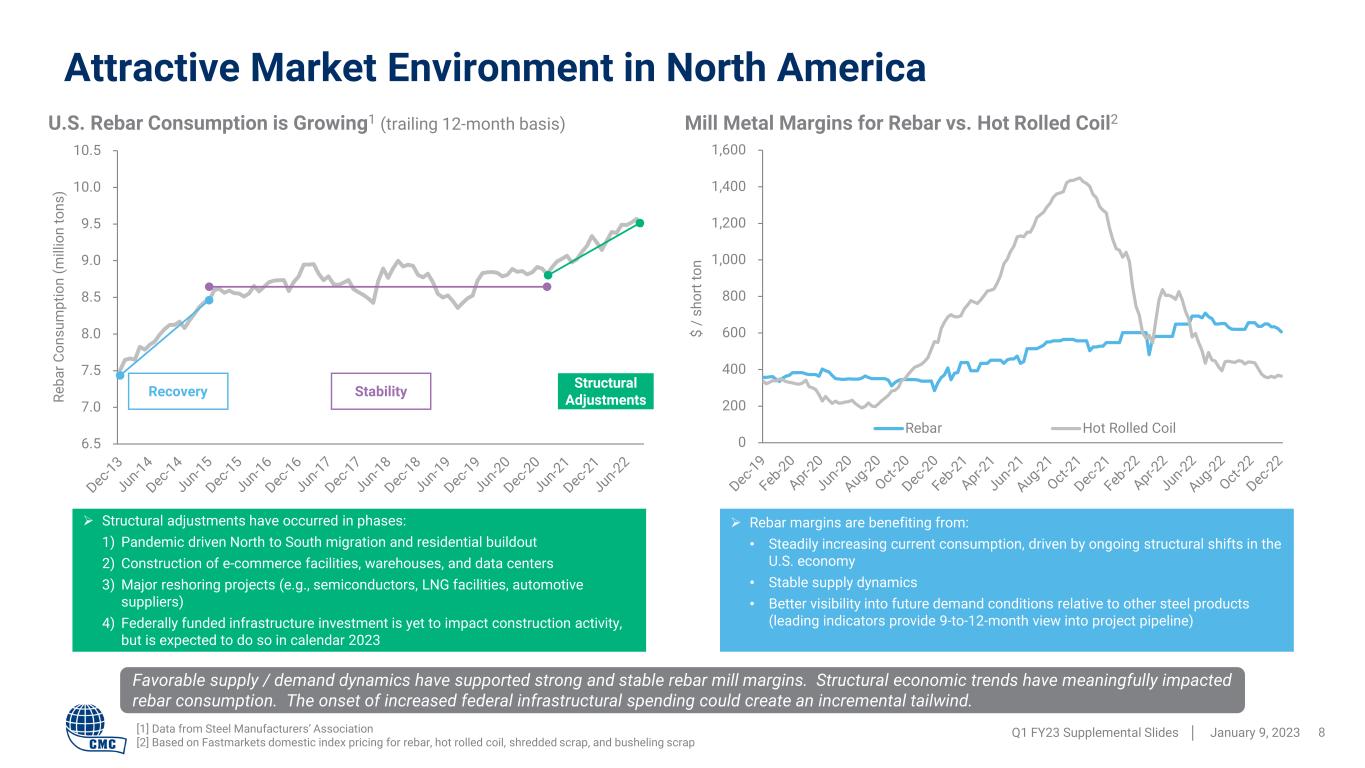

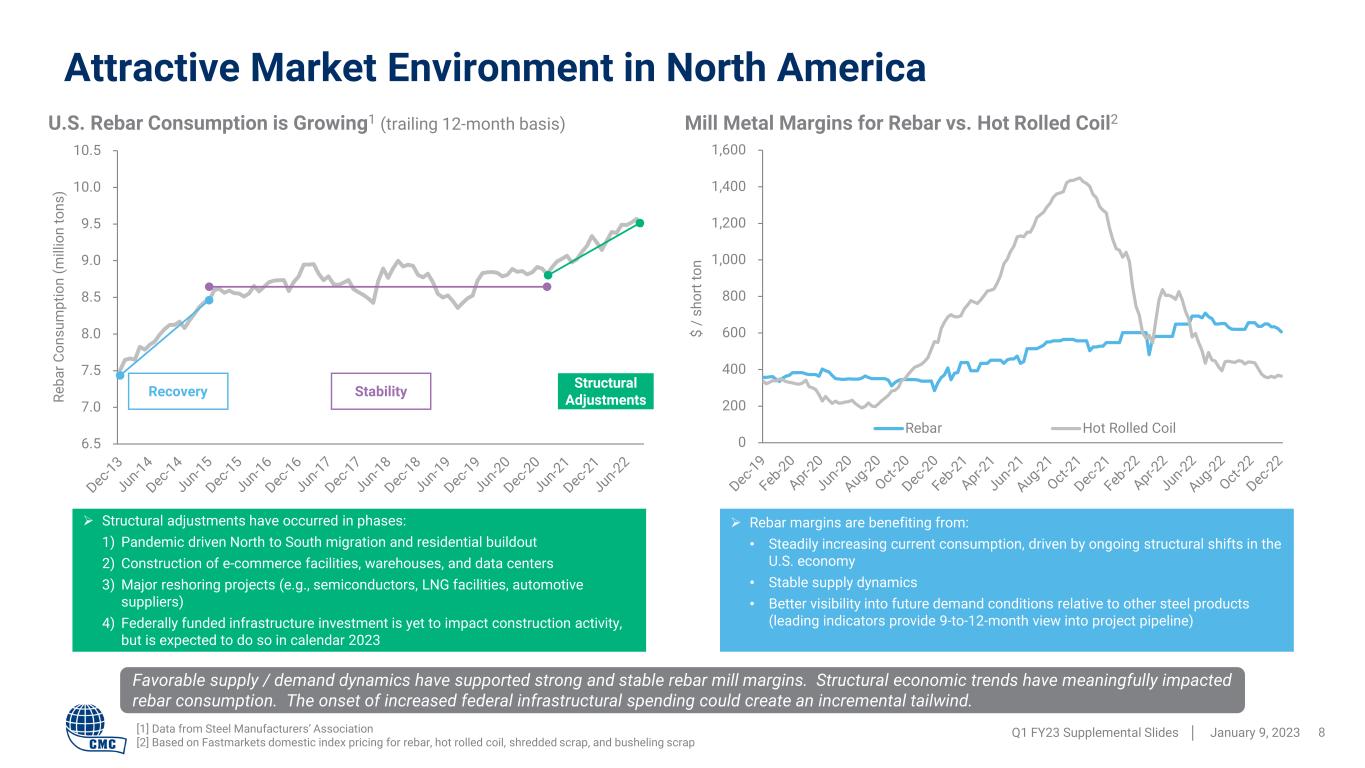

Attractive Market Environment in North America Favorable supply / demand dynamics have supported strong and stable rebar mill margins. Structural economic trends have meaningfully impacted rebar consumption. The onset of increased federal infrastructural spending could create an incremental tailwind. Q1 FY23 Supplemental Slides │ January 9, 2023 8 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 Recovery Stability Structural Adjustments Structural adjustments have occurred in phases: 1) Pandemic driven North to South migration and residential buildout 2) Construction of e-commerce facilities, warehouses, and data centers 3) Major reshoring projects (e.g., semiconductors, LNG facilities, automotive suppliers) 4) Federally funded infrastructure investment is yet to impact construction activity, but is expected to do so in calendar 2023 Re ba r C on su m pt io n (m ill io n to ns ) U.S. Rebar Consumption is Growing1 (trailing 12-month basis) 0 200 400 600 800 1,000 1,200 1,400 1,600 Rebar Hot Rolled Coil Rebar margins are benefiting from: • Steadily increasing current consumption, driven by ongoing structural shifts in the U.S. economy • Stable supply dynamics • Better visibility into future demand conditions relative to other steel products (leading indicators provide 9-to-12-month view into project pipeline) Mill Metal Margins for Rebar vs. Hot Rolled Coil2 $ / s ho rt to n [1] Data from Steel Manufacturers’ Association [2] Based on Fastmarkets domestic index pricing for rebar, hot rolled coil, shredded scrap, and busheling scrap

100 120 140 160 Backlog Bids CMC is Well-Positioned for 2023 Key construction indicators continue to point toward strength over the near-term. Looking further ahead, several structural trends are underway that could provide meaningful tailwinds to activity. CMC is positioned well to capitalize on upside or respond to softness. Q1 FY23 Supplemental Slides │ January 9, 2023 9 Arizona 2 Micro Mill • Scheduled to start up in spring 2023 • Expected to add 500,000 tons of low-cost production with ability to flex between rebar and merchant bar • Improves ability to capitalize on growing domestic demand for rebar • Provides opportunity to further optimize mill and fabrication network through production mix, logistics improvements, and resource sharing Tensar Acquisition • Increases CMC’s exposure to infrastructure • Customer value proposition enhanced by environment of labor and material shortages • Meaningfully extends CMC’s growth runway; creates a platform for further expansion in complementary high- margin engineered solutions Record Downstream Backlog • CMC has steadily improved the average pricing in its downstream backlog over the last eight quarters • Currently at historically high volume and pricing levels • Upward price trend for downstream products is expected to continue in the near-term • Expected to help stabilize CMC North America earnings if steel product margins decline Working Capital Release • CMC has invested roughly $900 million in working capital since end of FY 2020 • In a downturn, this amount would be converted to cash and help stabilize CMC cash flow Highly Flexible Operations Network • Ability to optimize production across facilities and products in various demand scenarios Sources of Growth in 2023Sources of Stability in 2023 Downstream Backlog and Bidding Volumes Trailing 3-month basis indexed to November CY 2020

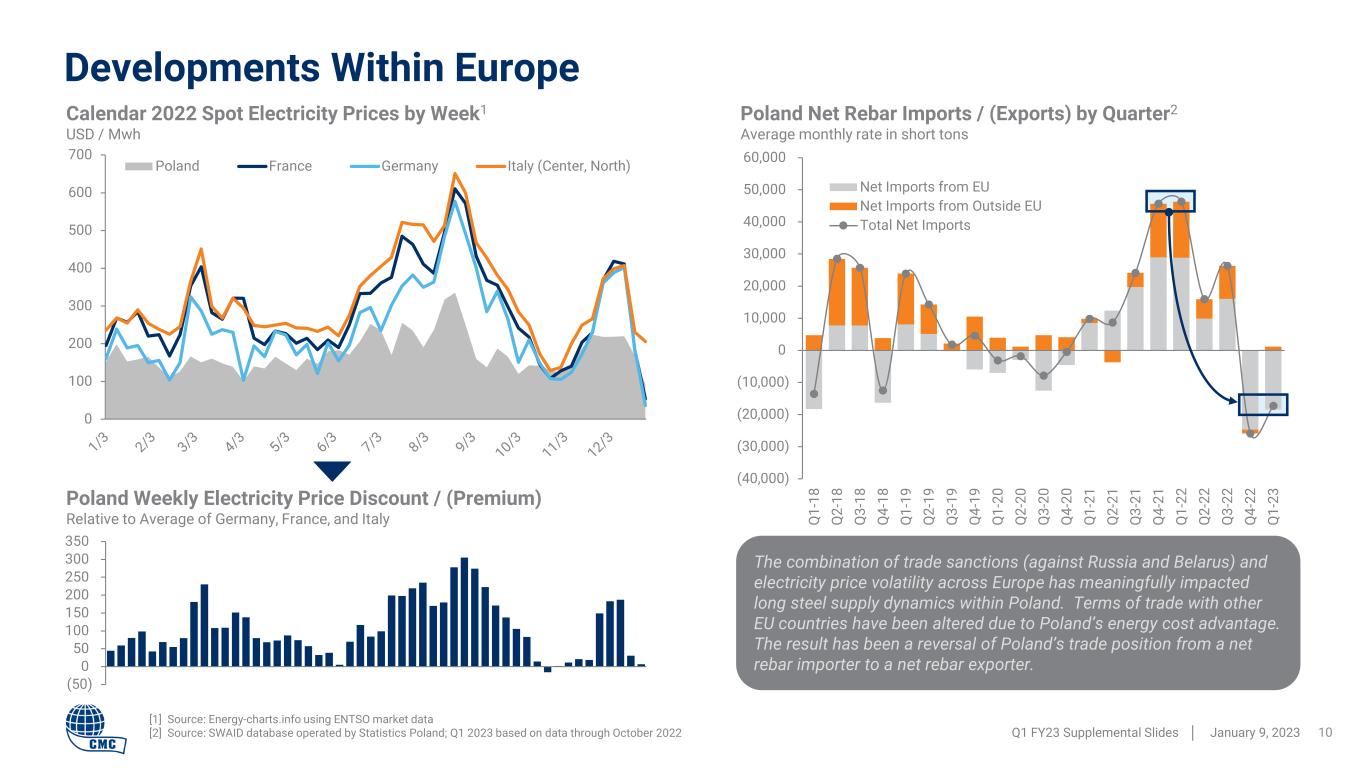

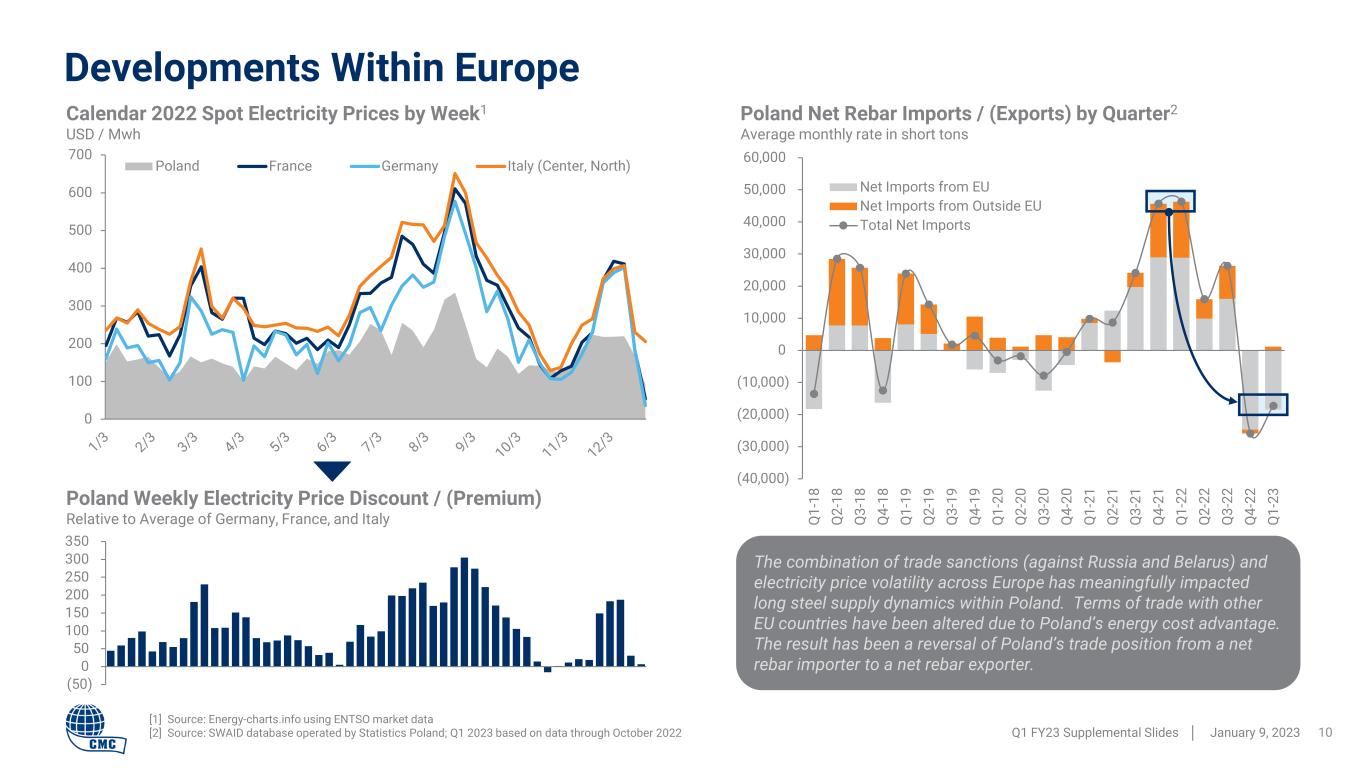

(40,000) (30,000) (20,000) (10,000) 0 10,000 20,000 30,000 40,000 50,000 60,000 Q 1- 18 Q 2- 18 Q 3- 18 Q 4- 18 Q 1- 19 Q 2- 19 Q 3- 19 Q 4- 19 Q 1- 20 Q 2- 20 Q 3- 20 Q 4- 20 Q 1- 21 Q 2- 21 Q 3- 21 Q 4- 21 Q 1- 22 Q 2- 22 Q 3- 22 Q 4- 22 Q 1- 23 Net Imports from EU Net Imports from Outside EU Total Net Imports Developments Within Europe Q1 FY23 Supplemental Slides │ January 9, 2023 10 Calendar 2022 Spot Electricity Prices by Week1 USD / Mwh [1] Source: Energy-charts.info using ENTSO market data [2] Source: SWAID database operated by Statistics Poland; Q1 2023 based on data through October 2022 0 100 200 300 400 500 600 700 Poland France Germany Italy (Center, North) (50) 0 50 100 150 200 250 300 350 Poland Weekly Electricity Price Discount / (Premium) Relative to Average of Germany, France, and Italy Poland Net Rebar Imports / (Exports) by Quarter2 Average monthly rate in short tons The combination of trade sanctions (against Russia and Belarus) and electricity price volatility across Europe has meaningfully impacted long steel supply dynamics within Poland. Terms of trade with other EU countries have been altered due to Poland’s energy cost advantage. The result has been a reversal of Poland’s trade position from a net rebar importer to a net rebar exporter.

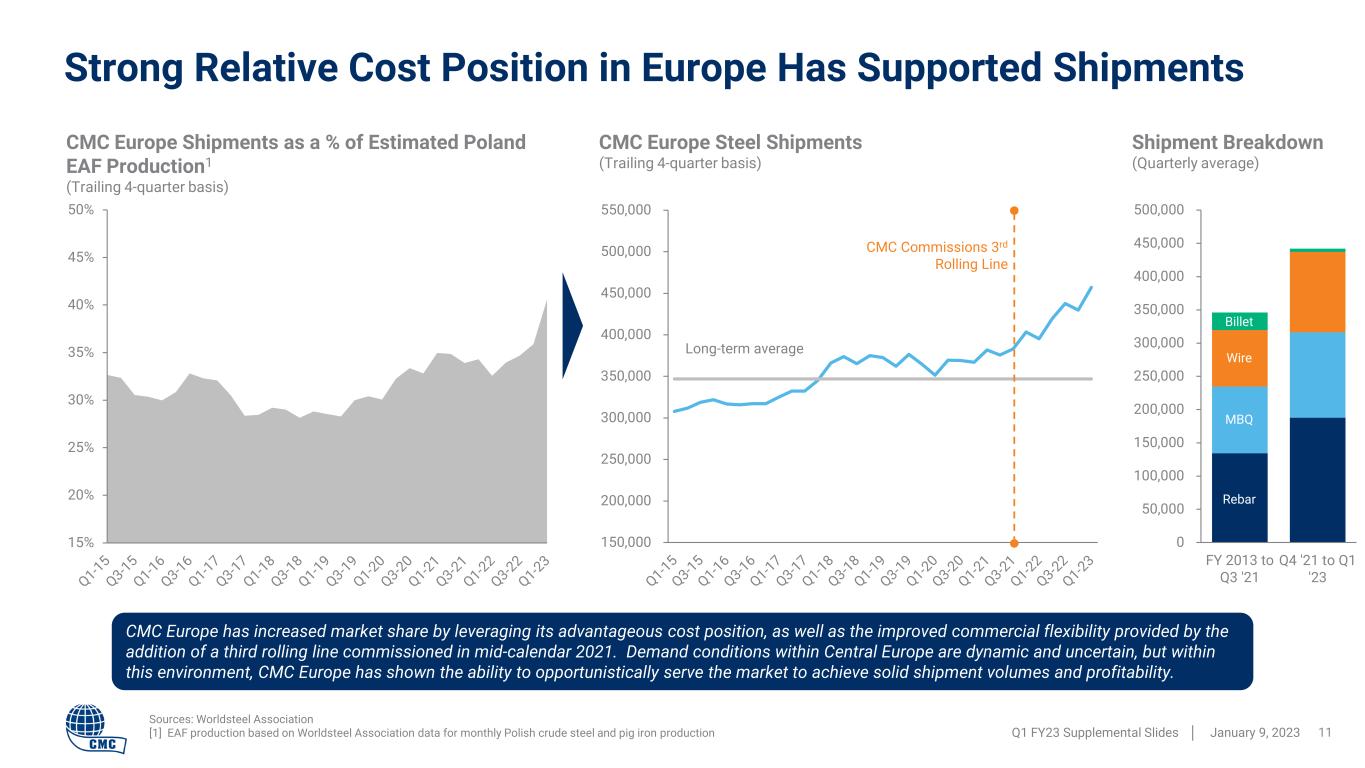

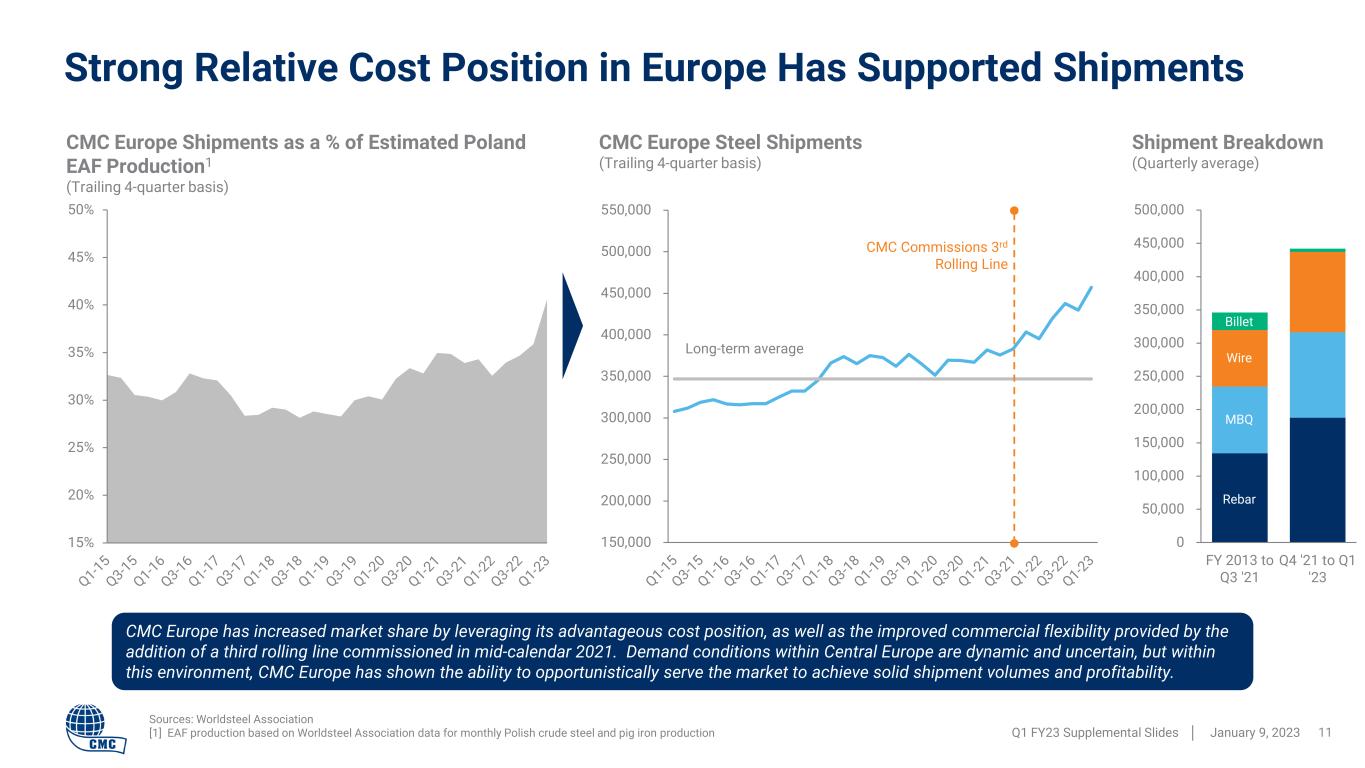

0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 FY 2013 to Q3 '21 Q4 '21 to Q1 '23 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 550,000 Strong Relative Cost Position in Europe Has Supported Shipments Q1 FY23 Supplemental Slides │ January 9, 2023 11 CMC Europe Shipments as a % of Estimated Poland EAF Production1 (Trailing 4-quarter basis) Sources: Worldsteel Association [1] EAF production based on Worldsteel Association data for monthly Polish crude steel and pig iron production 15% 20% 25% 30% 35% 40% 45% 50% Long-term average CMC Commissions 3rd Rolling Line CMC Europe Steel Shipments (Trailing 4-quarter basis) Rebar MBQ Wire Billet Shipment Breakdown (Quarterly average) CMC Europe has increased market share by leveraging its advantageous cost position, as well as the improved commercial flexibility provided by the addition of a third rolling line commissioned in mid-calendar 2021. Demand conditions within Central Europe are dynamic and uncertain, but within this environment, CMC Europe has shown the ability to opportunistically serve the market to achieve solid shipment volumes and profitability.

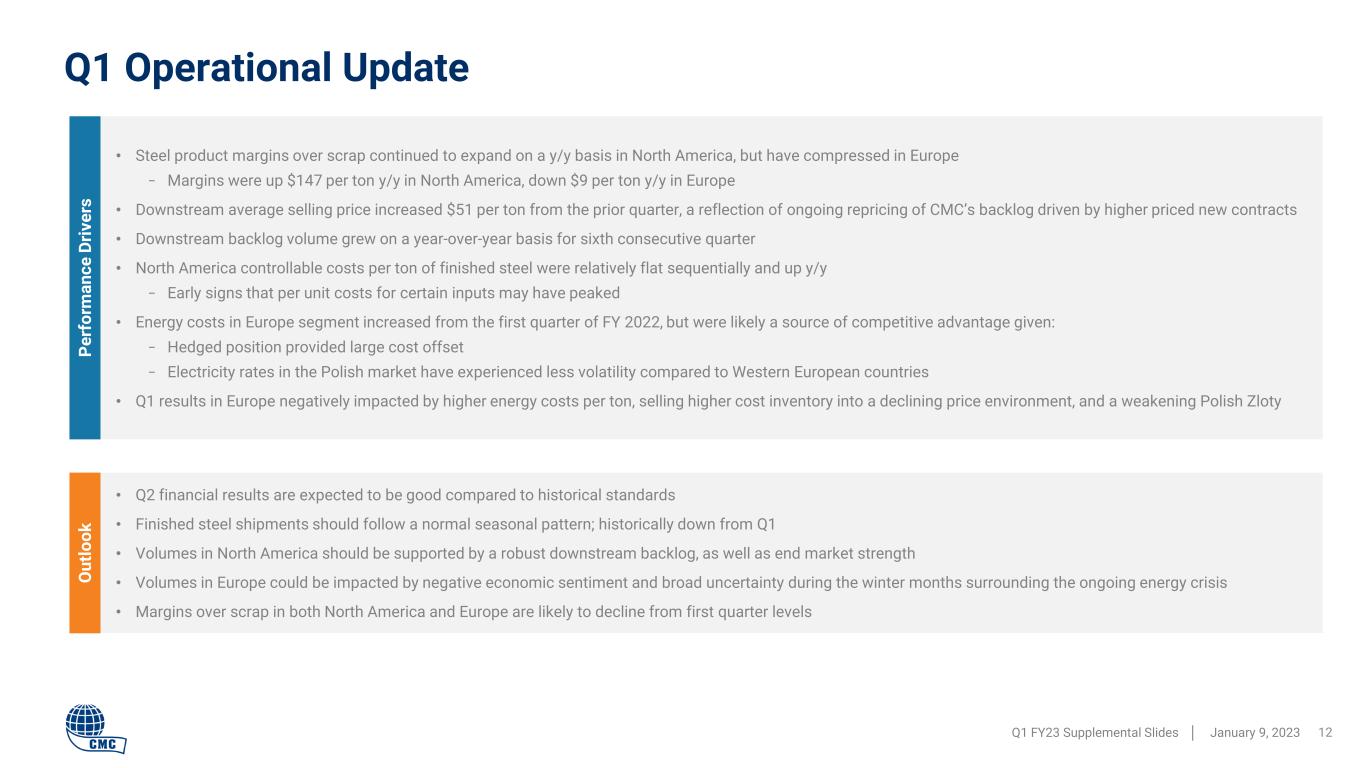

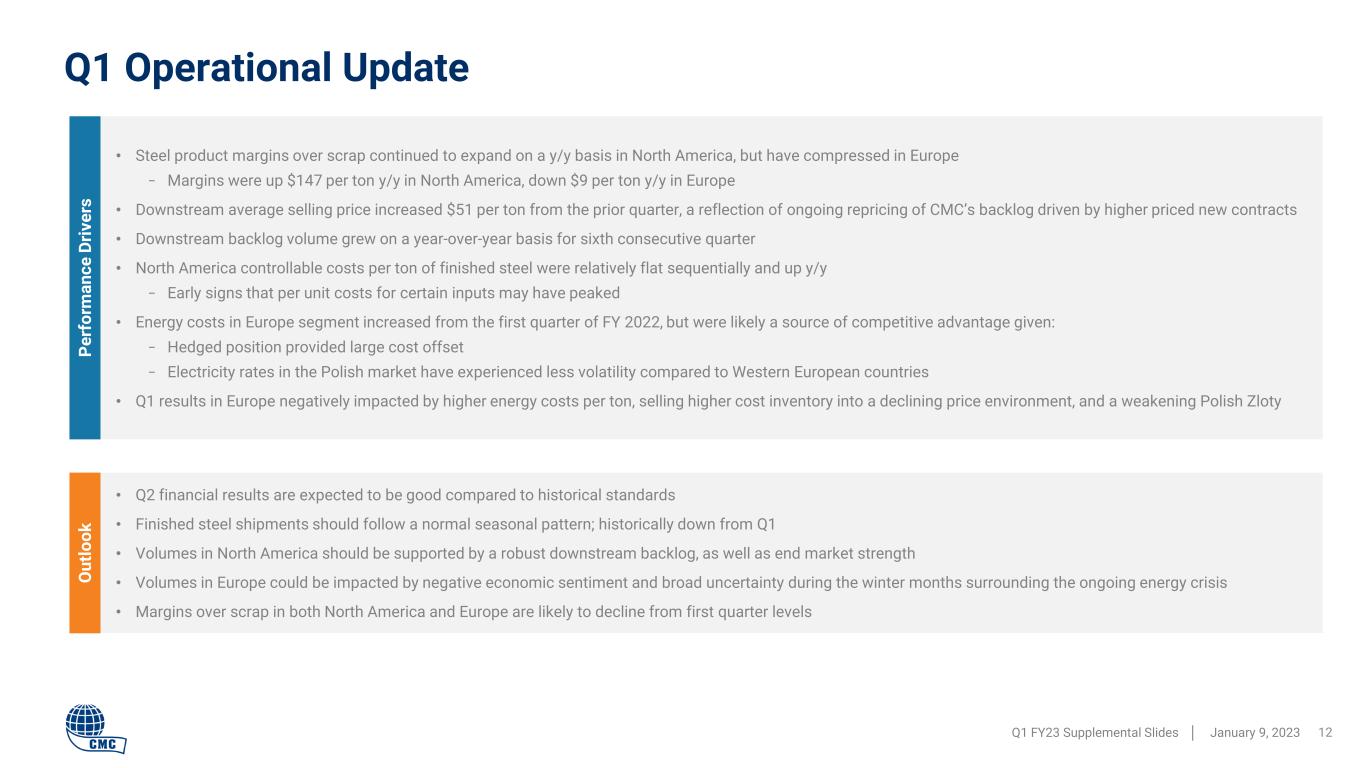

• Steel product margins over scrap continued to expand on a y/y basis in North America, but have compressed in Europe − Margins were up $147 per ton y/y in North America, down $9 per ton y/y in Europe • Downstream average selling price increased $51 per ton from the prior quarter, a reflection of ongoing repricing of CMC’s backlog driven by higher priced new contracts • Downstream backlog volume grew on a year-over-year basis for sixth consecutive quarter • North America controllable costs per ton of finished steel were relatively flat sequentially and up y/y − Early signs that per unit costs for certain inputs may have peaked • Energy costs in Europe segment increased from the first quarter of FY 2022, but were likely a source of competitive advantage given: − Hedged position provided large cost offset − Electricity rates in the Polish market have experienced less volatility compared to Western European countries • Q1 results in Europe negatively impacted by higher energy costs per ton, selling higher cost inventory into a declining price environment, and a weakening Polish Zloty • Q2 financial results are expected to be good compared to historical standards • Finished steel shipments should follow a normal seasonal pattern; historically down from Q1 • Volumes in North America should be supported by a robust downstream backlog, as well as end market strength • Volumes in Europe could be impacted by negative economic sentiment and broad uncertainty during the winter months surrounding the ongoing energy crisis • Margins over scrap in both North America and Europe are likely to decline from first quarter levels Pe rf or m an ce D riv er s O ut lo ok Q1 Operational Update Q1 FY23 Supplemental Slides │ January 9, 2023 12

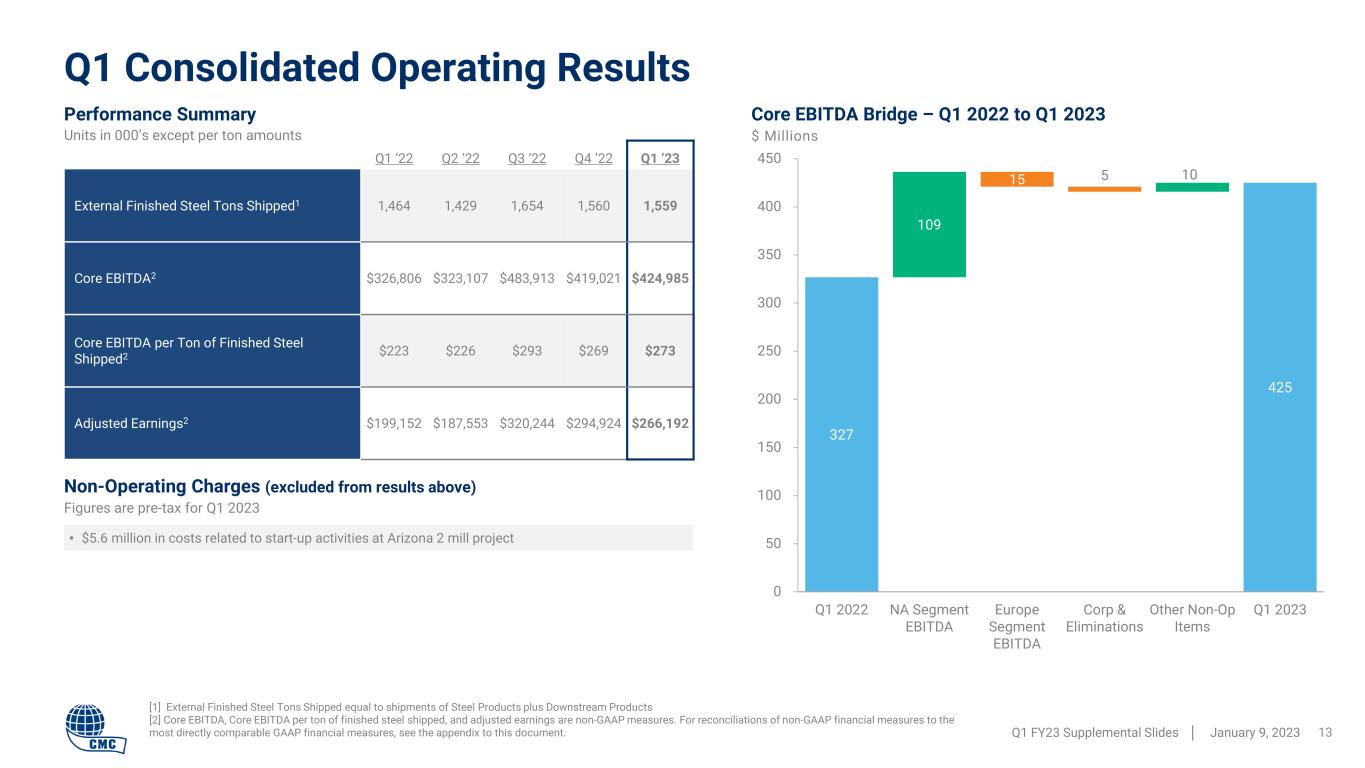

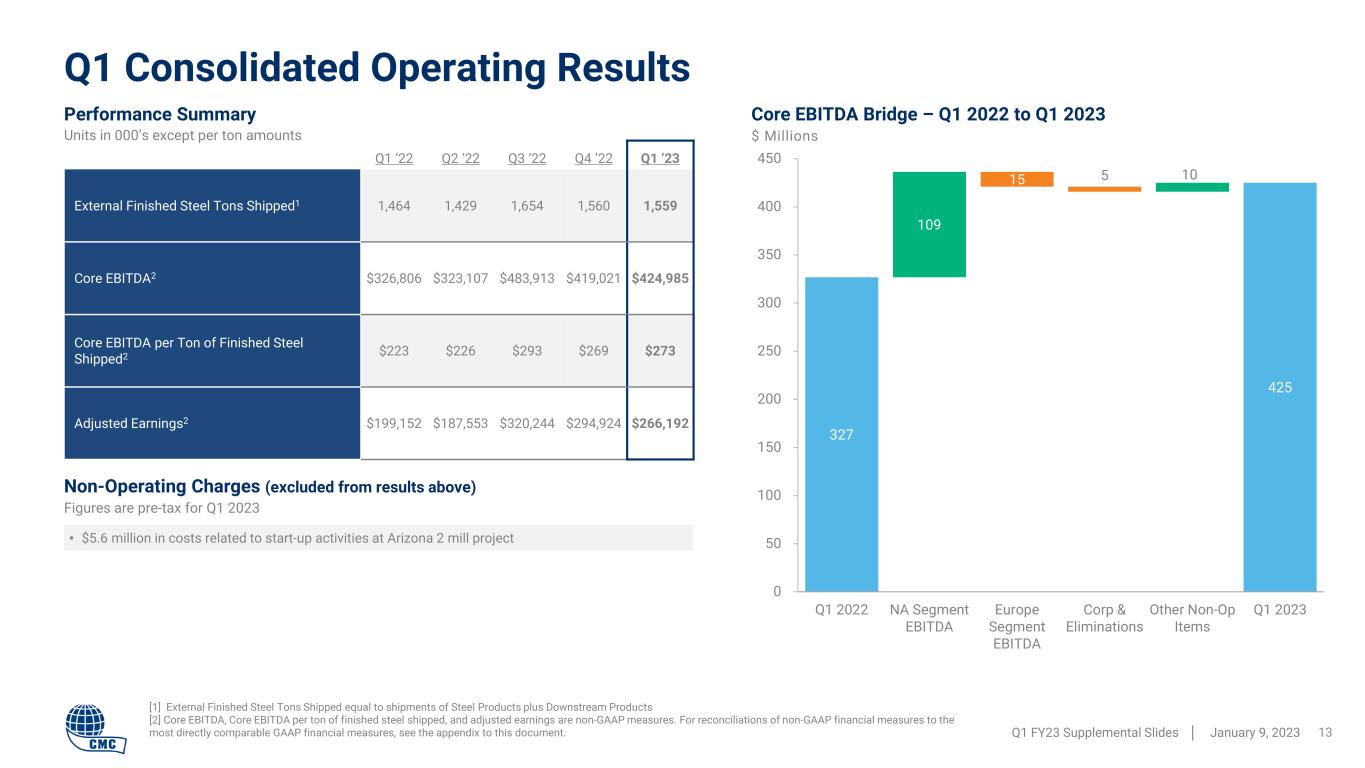

327 425 109 15 5 10 0 50 100 150 200 250 300 350 400 450 Q1 2022 NA Segment EBITDA Europe Segment EBITDA Corp & Eliminations Other Non-Op Items Q1 2023 Q1 Consolidated Operating Results Q1 FY23 Supplemental Slides │ January 9, 2023 13 Q1 ‘22 Q2 ‘22 Q3 ‘22 Q4 ’22 Q1 ’23 External Finished Steel Tons Shipped1 1,464 1,429 1,654 1,560 1,559 Core EBITDA2 $326,806 $323,107 $483,913 $419,021 $424,985 Core EBITDA per Ton of Finished Steel Shipped2 $223 $226 $293 $269 $273 Adjusted Earnings2 $199,152 $187,553 $320,244 $294,924 $266,192 Performance Summary Units in 000’s except per ton amounts • $5.6 million in costs related to start-up activities at Arizona 2 mill project Non-Operating Charges (excluded from results above) Figures are pre-tax for Q1 2023 [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Core EBITDA, Core EBITDA per ton of finished steel shipped, and adjusted earnings are non-GAAP measures. For reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Core EBITDA Bridge – Q1 2022 to Q1 2023 $ Millions

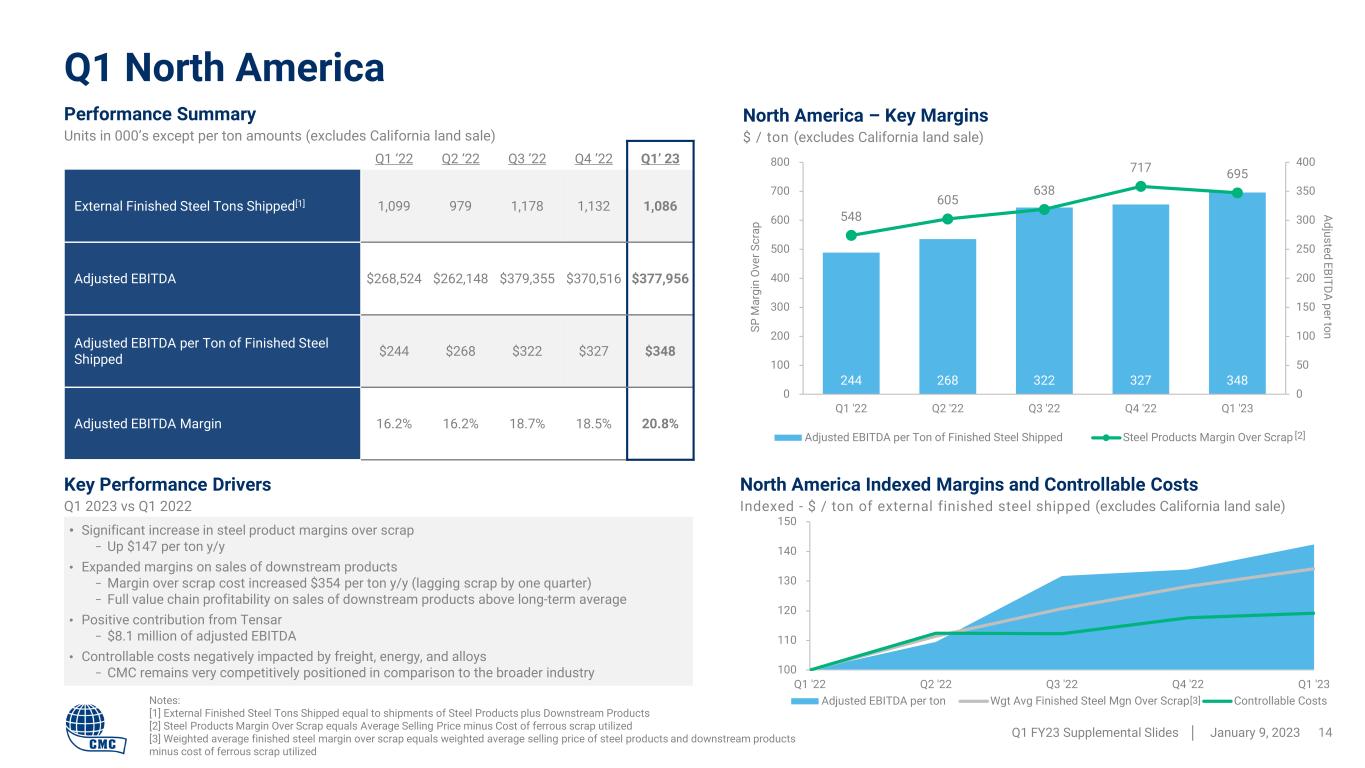

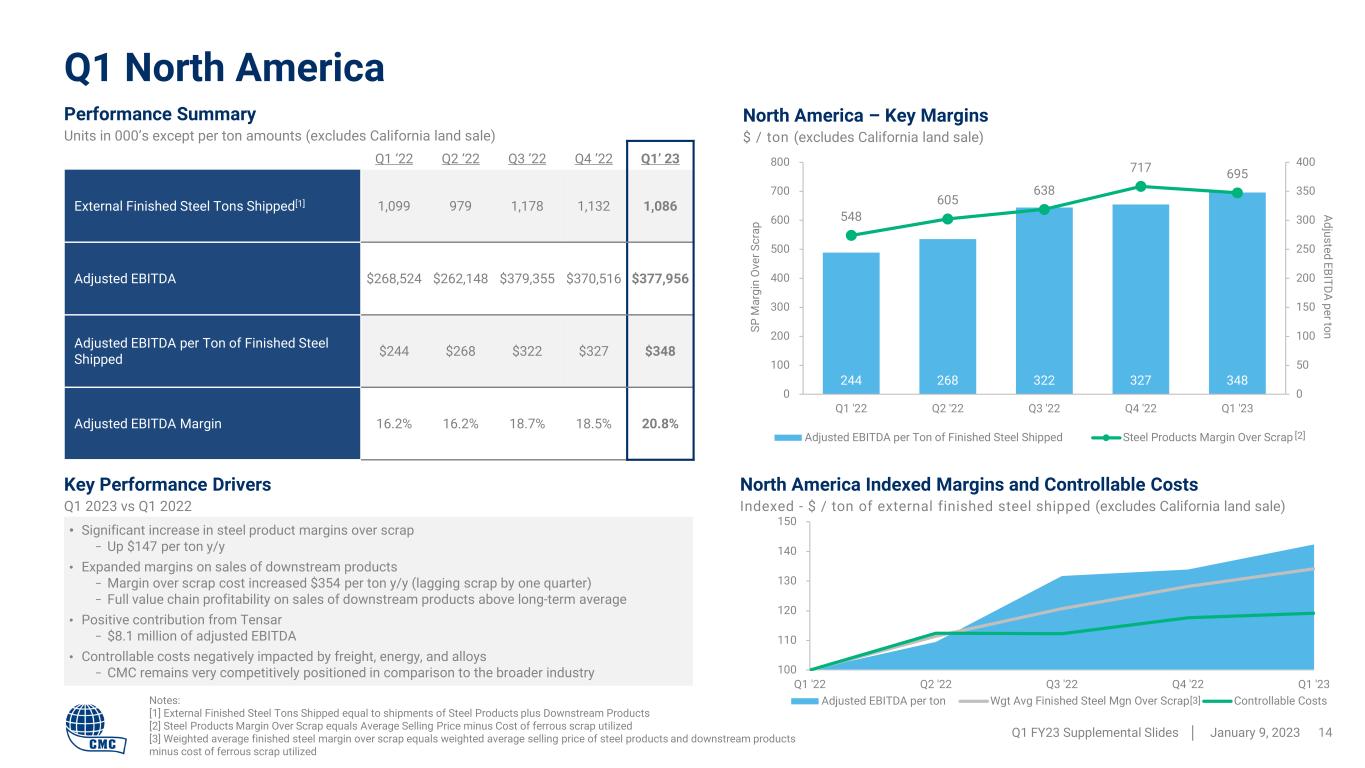

100 110 120 130 140 150 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Adjusted EBITDA per ton Wgt Avg Finished Steel Mgn Over Scrap Controllable Costs 244 268 322 327 348 548 605 638 717 695 0 50 100 150 200 250 300 350 400 0 100 200 300 400 500 600 700 800 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Adjusted EBITDA per Ton of Finished Steel Shipped Steel Products Margin Over Scrap Key Performance Drivers Q1 2023 vs Q1 2022 Q1 North America Q1 FY23 Supplemental Slides │ January 9, 2023 14 Q1 ‘22 Q2 ‘22 Q3 ’22 Q4 ’22 Q1’ 23 External Finished Steel Tons Shipped[1] 1,099 979 1,178 1,132 1,086 Adjusted EBITDA $268,524 $262,148 $379,355 $370,516 $377,956 Adjusted EBITDA per Ton of Finished Steel Shipped $244 $268 $322 $327 $348 Adjusted EBITDA Margin 16.2% 16.2% 18.7% 18.5% 20.8% Performance Summary Units in 000’s except per ton amounts (excludes California land sale) • Significant increase in steel product margins over scrap − Up $147 per ton y/y • Expanded margins on sales of downstream products − Margin over scrap cost increased $354 per ton y/y (lagging scrap by one quarter) − Full value chain profitability on sales of downstream products above long-term average • Positive contribution from Tensar − $8.1 million of adjusted EBITDA • Controllable costs negatively impacted by freight, energy, and alloys − CMC remains very competitively positioned in comparison to the broader industry Notes: [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Steel Products Margin Over Scrap equals Average Selling Price minus Cost of ferrous scrap utilized [3] Weighted average finished steel margin over scrap equals weighted average selling price of steel products and downstream products minus cost of ferrous scrap utilized North America – Key Margins $ / ton (excludes California land sale) SP M ar gi n O ve r S cr ap Adjusted EBITDA per ton North America Indexed Margins and Controllable Costs Indexed - $ / ton of external finished steel shipped (excludes California land sale) [2] [3]

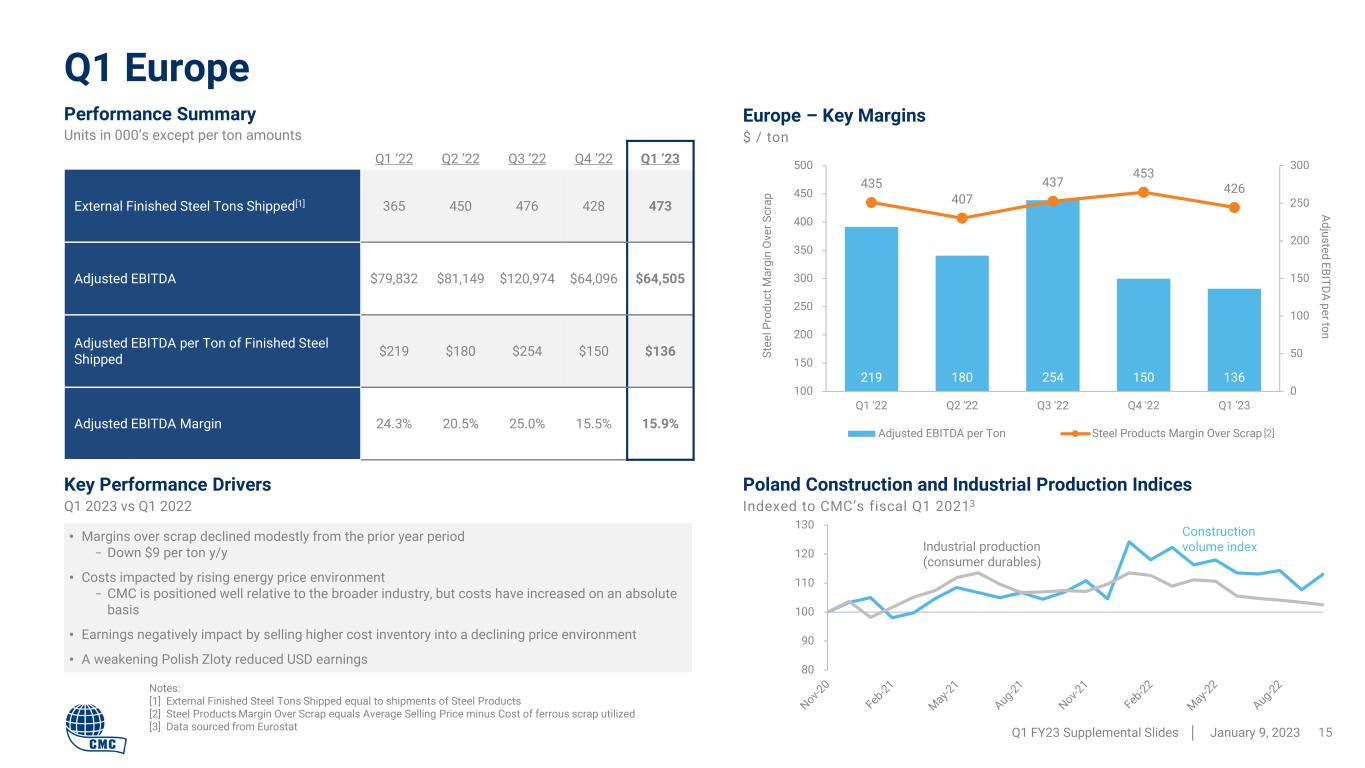

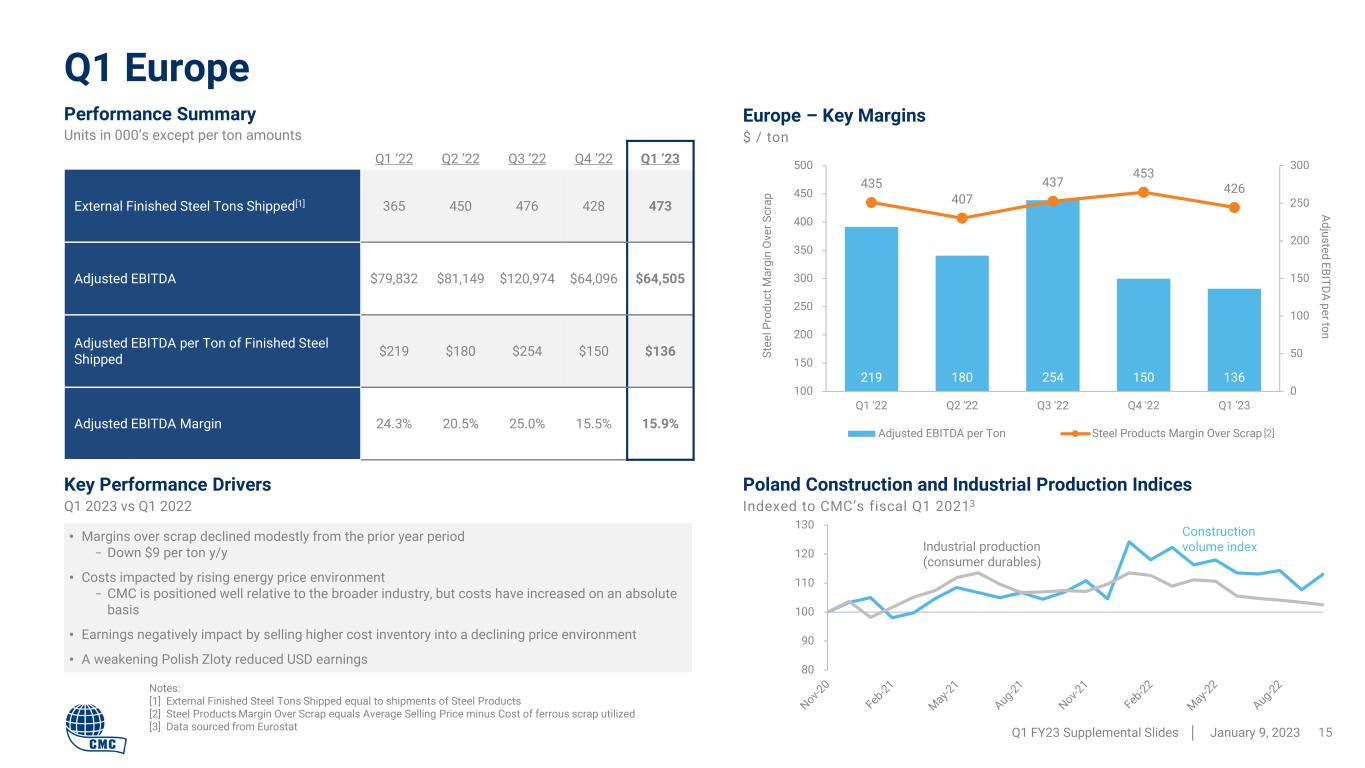

80 90 100 110 120 130 219 180 254 150 136 435 407 437 453 426 0 50 100 150 200 250 300 100 150 200 250 300 350 400 450 500 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Adjusted EBITDA per Ton Steel Products Margin Over Scrap Key Performance Drivers Q1 2023 vs Q1 2022 Q1 Europe Q1 FY23 Supplemental Slides │ January 9, 2023 15 Q1 ‘22 Q2 ’22 Q3 ’22 Q4 ’22 Q1 ’23 External Finished Steel Tons Shipped[1] 365 450 476 428 473 Adjusted EBITDA $79,832 $81,149 $120,974 $64,096 $64,505 Adjusted EBITDA per Ton of Finished Steel Shipped $219 $180 $254 $150 $136 Adjusted EBITDA Margin 24.3% 20.5% 25.0% 15.5% 15.9% Performance Summary Units in 000’s except per ton amounts • Margins over scrap declined modestly from the prior year period − Down $9 per ton y/y • Costs impacted by rising energy price environment − CMC is positioned well relative to the broader industry, but costs have increased on an absolute basis • Earnings negatively impact by selling higher cost inventory into a declining price environment • A weakening Polish Zloty reduced USD earnings Europe – Key Margins $ / ton Adjusted EBITDA per ton Poland Construction and Industrial Production Indices Indexed to CMC’s fiscal Q1 2021 [2] Notes: [1] External Finished Steel Tons Shipped equal to shipments of Steel Products [2] Steel Products Margin Over Scrap equals Average Selling Price minus Cost of ferrous scrap utilized [3] Data sourced from Eurostat St ee l P ro du ct M ar gi n O ve r S cr ap 3 Industrial production (consumer durables) Construction volume index

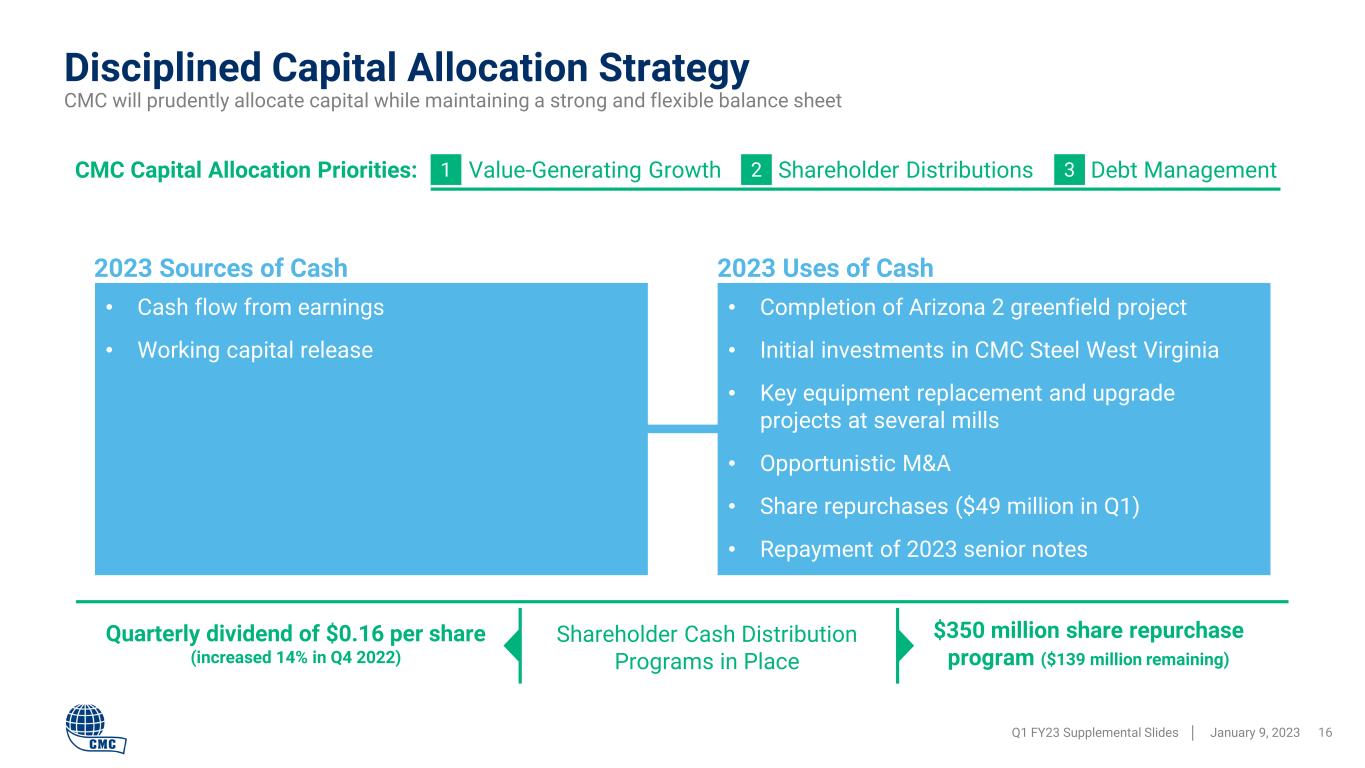

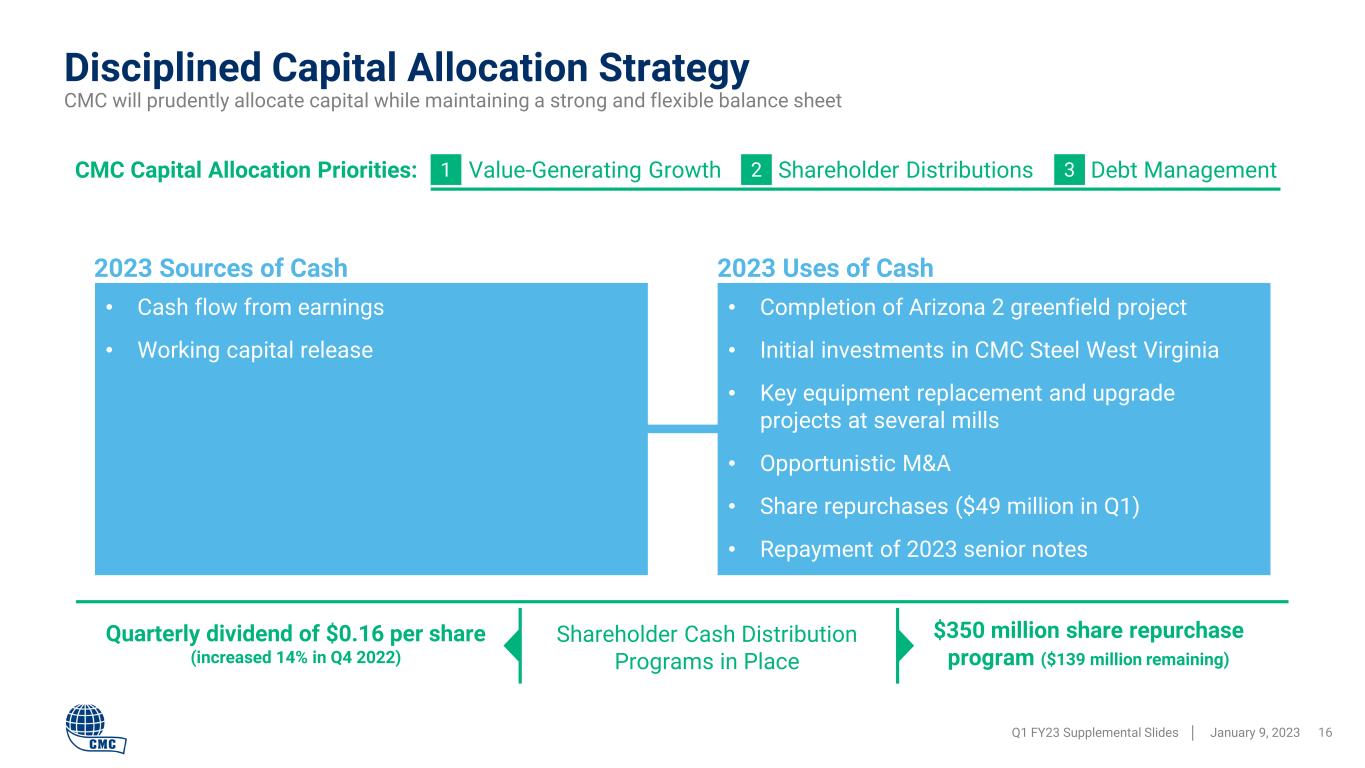

2 31 Disciplined Capital Allocation Strategy Q1 FY23 Supplemental Slides │ January 9, 2023 16 CMC Capital Allocation Priorities: $350 million share repurchase program ($139 million remaining) Quarterly dividend of $0.16 per share (increased 14% in Q4 2022) Shareholder Cash Distribution Programs in Place • Cash flow from earnings • Working capital release • Completion of Arizona 2 greenfield project • Initial investments in CMC Steel West Virginia • Key equipment replacement and upgrade projects at several mills • Opportunistic M&A • Share repurchases ($49 million in Q1) • Repayment of 2023 senior notes Value-Generating Growth Shareholder Distributions Debt Management CMC will prudently allocate capital while maintaining a strong and flexible balance sheet 2023 Sources of Cash 2023 Uses of Cash

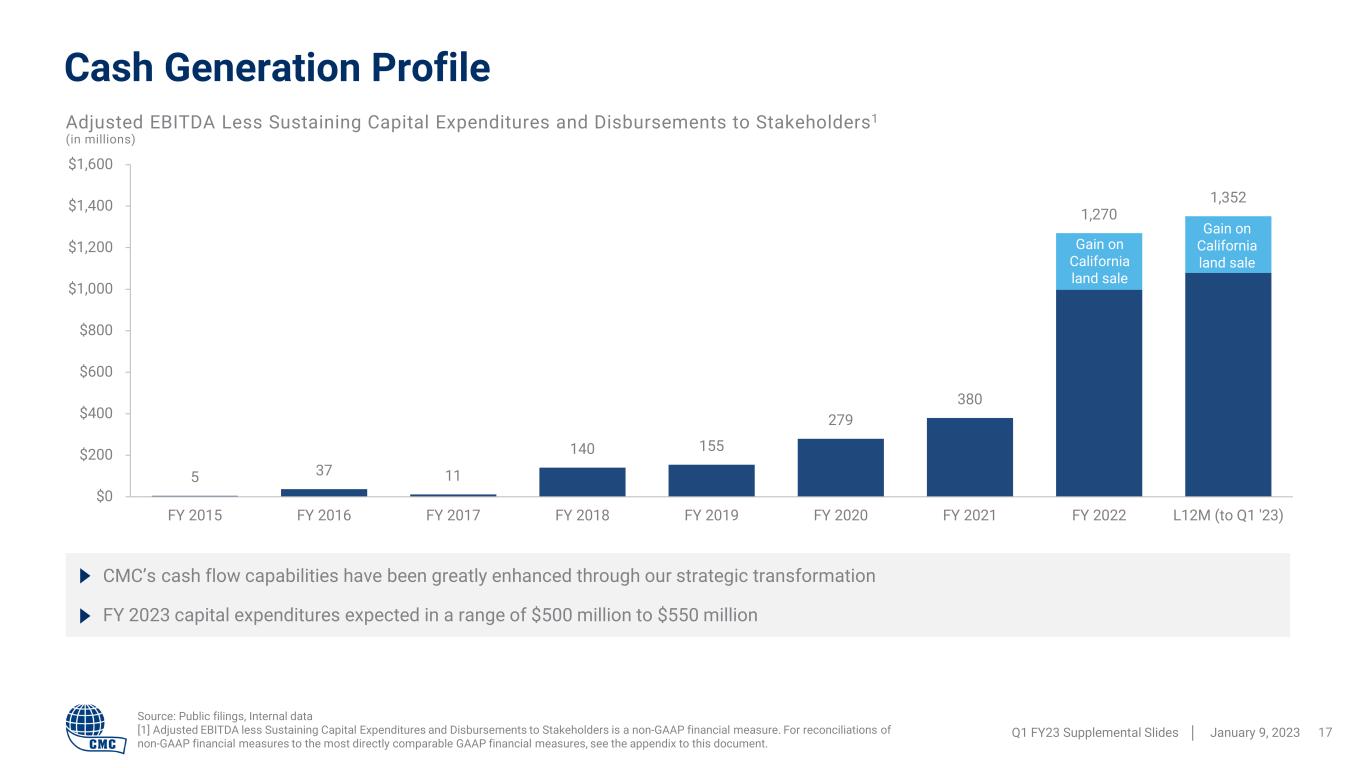

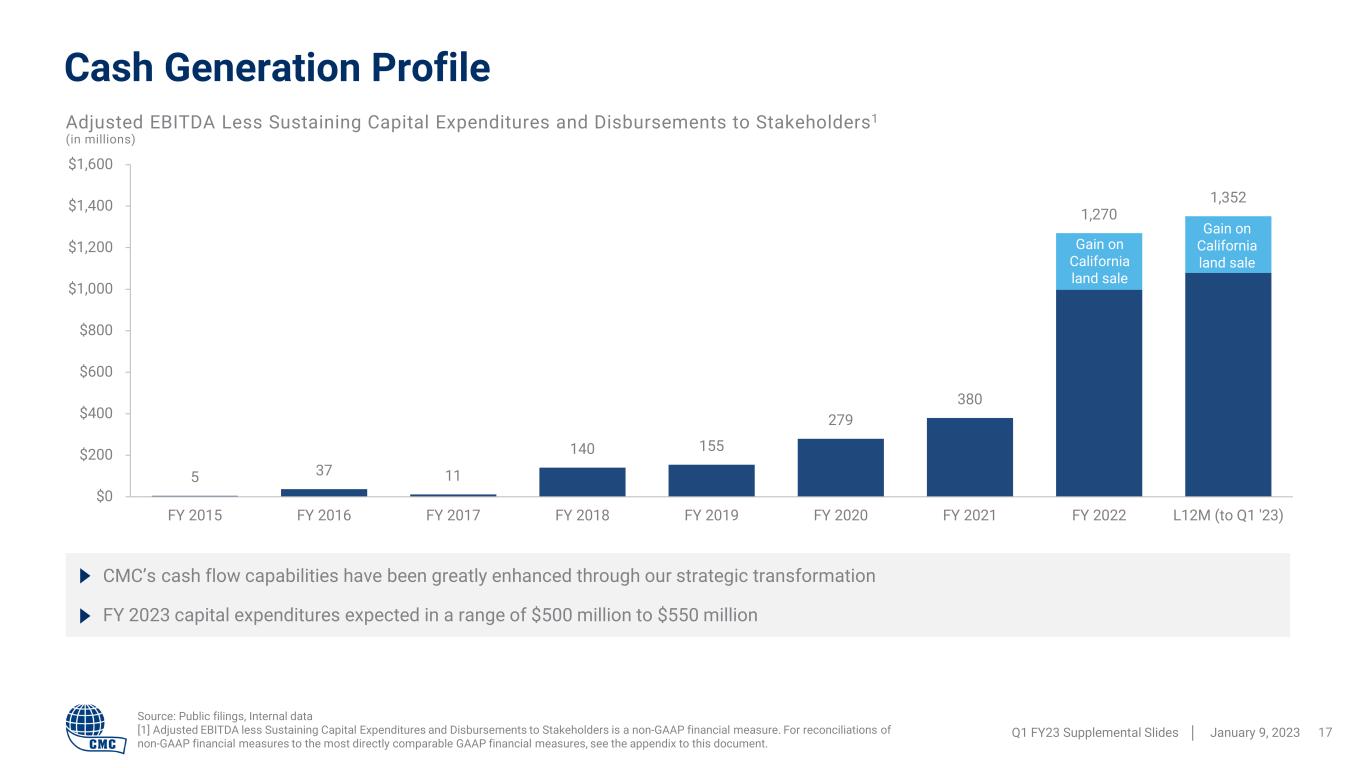

5 37 11 140 155 279 380 1,270 1,352 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 L12M (to Q1 '23) Cash Generation Profile Q1 FY23 Supplemental Slides │ January 9, 2023 17 Adjusted EBITDA Less Sustaining Capital Expenditures and Disbursements to Stakeholders1 (in millions) CMC’s cash flow capabilities have been greatly enhanced through our strategic transformation FY 2023 capital expenditures expected in a range of $500 million to $550 million Source: Public filings, Internal data [1] Adjusted EBITDA less Sustaining Capital Expenditures and Disbursements to Stakeholders is a non-GAAP financial measure. For reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Gain on California land sale Gain on California land sale

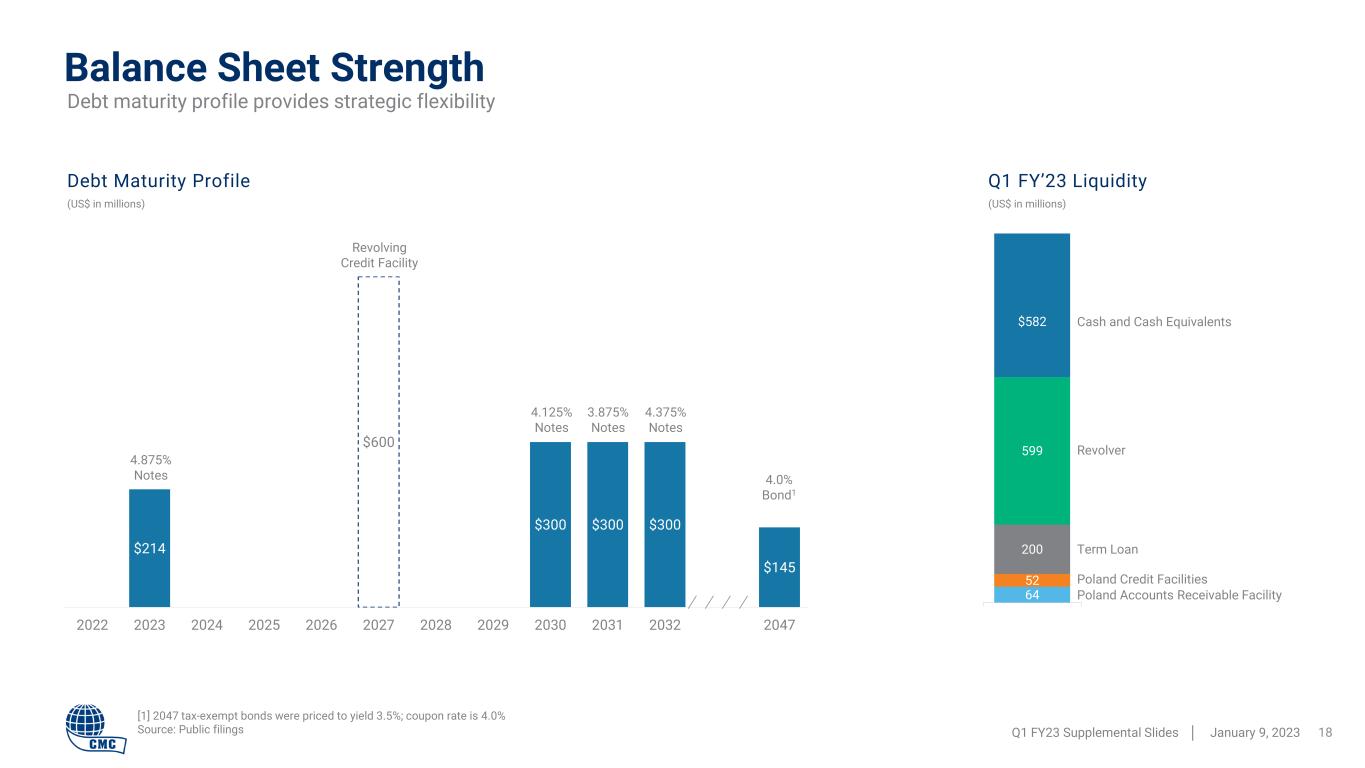

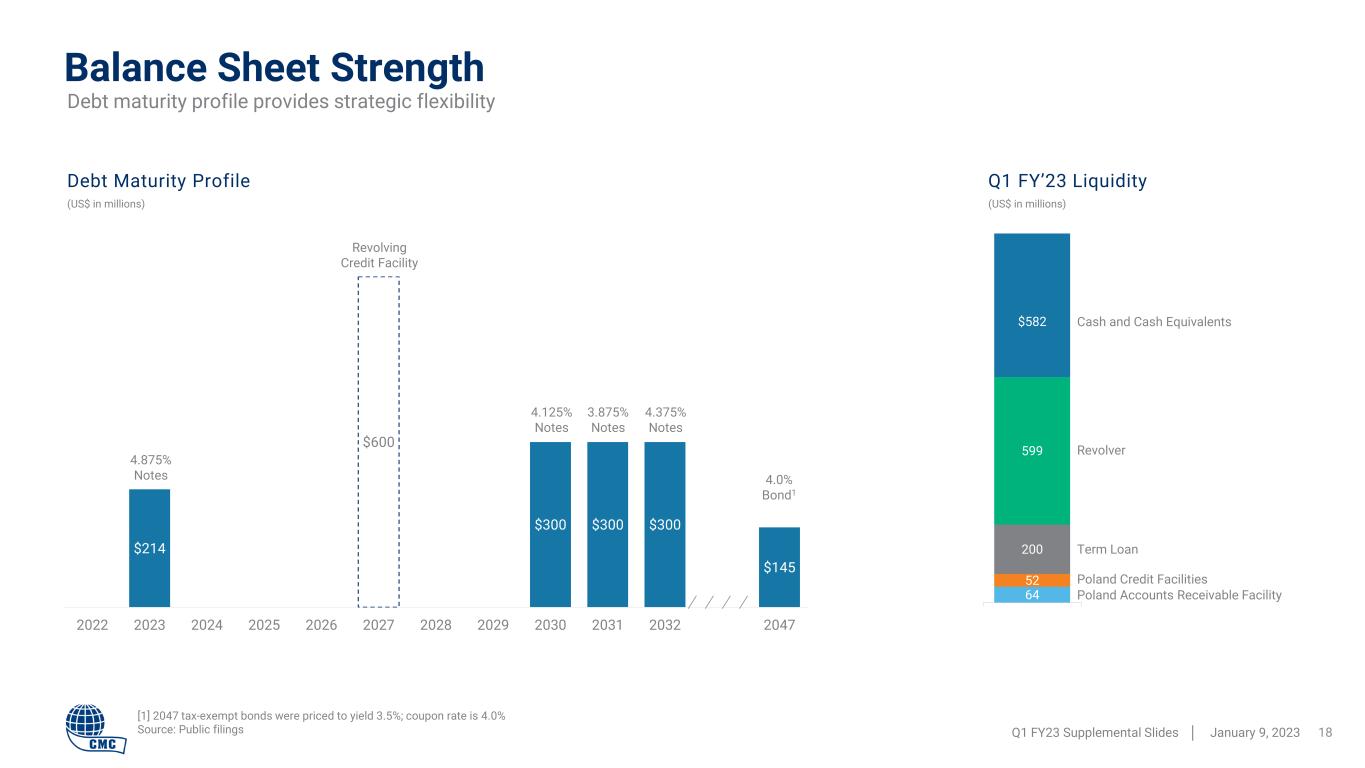

$214 $300 $300 $300 $145 $600 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2047 64 52 200 599 $582 Balance Sheet Strength Q1 FY23 Supplemental Slides │ January 9, 2023 18 [1] 2047 tax-exempt bonds were priced to yield 3.5%; coupon rate is 4.0% Source: Public filings Revolver Term Loan Poland Credit Facilities (US$ in millions) Revolving Credit Facility 4.125% Notes Cash and Cash Equivalents 4.875% Notes 3.875% Notes Debt maturity profile provides strategic flexibility Debt Maturity Profile Q1 FY’23 Liquidity (US$ in millions) 4.375% Notes 4.0% Bond1 Poland Accounts Receivable Facility

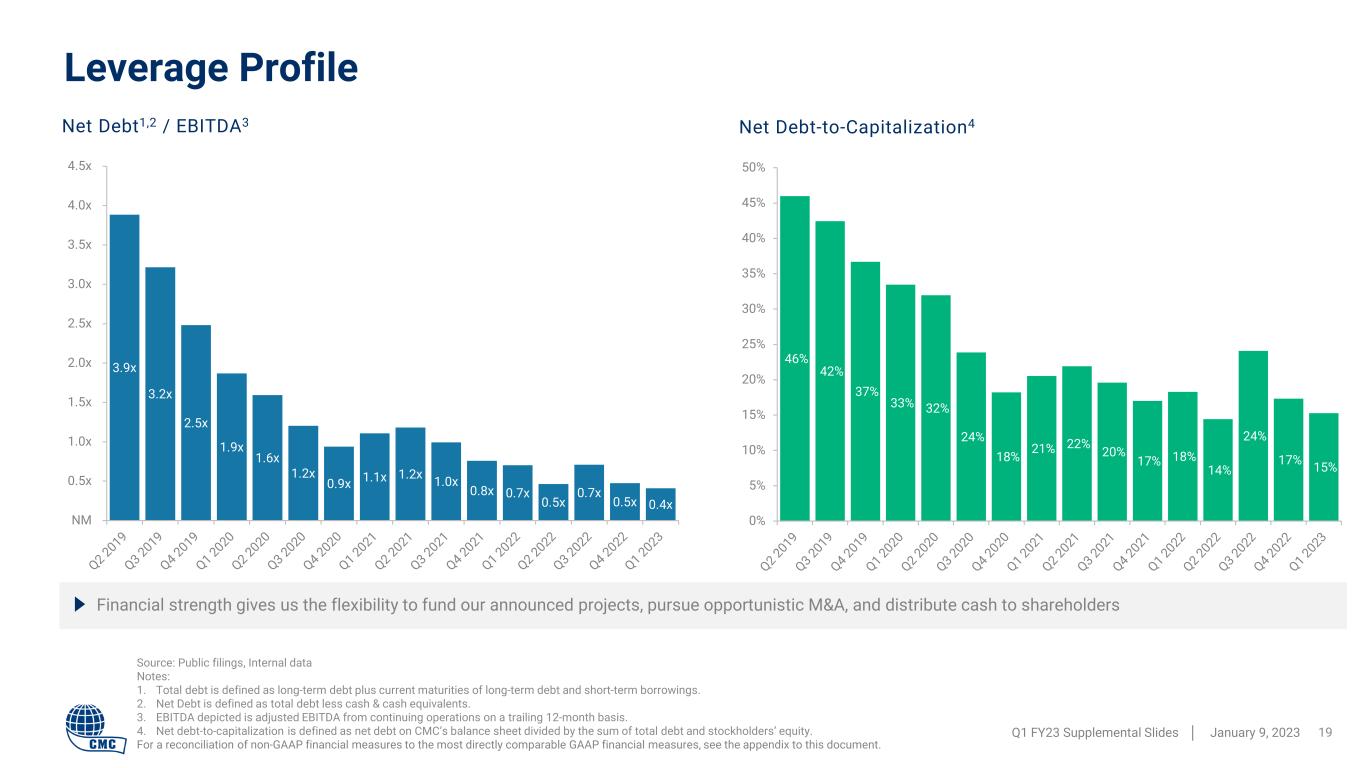

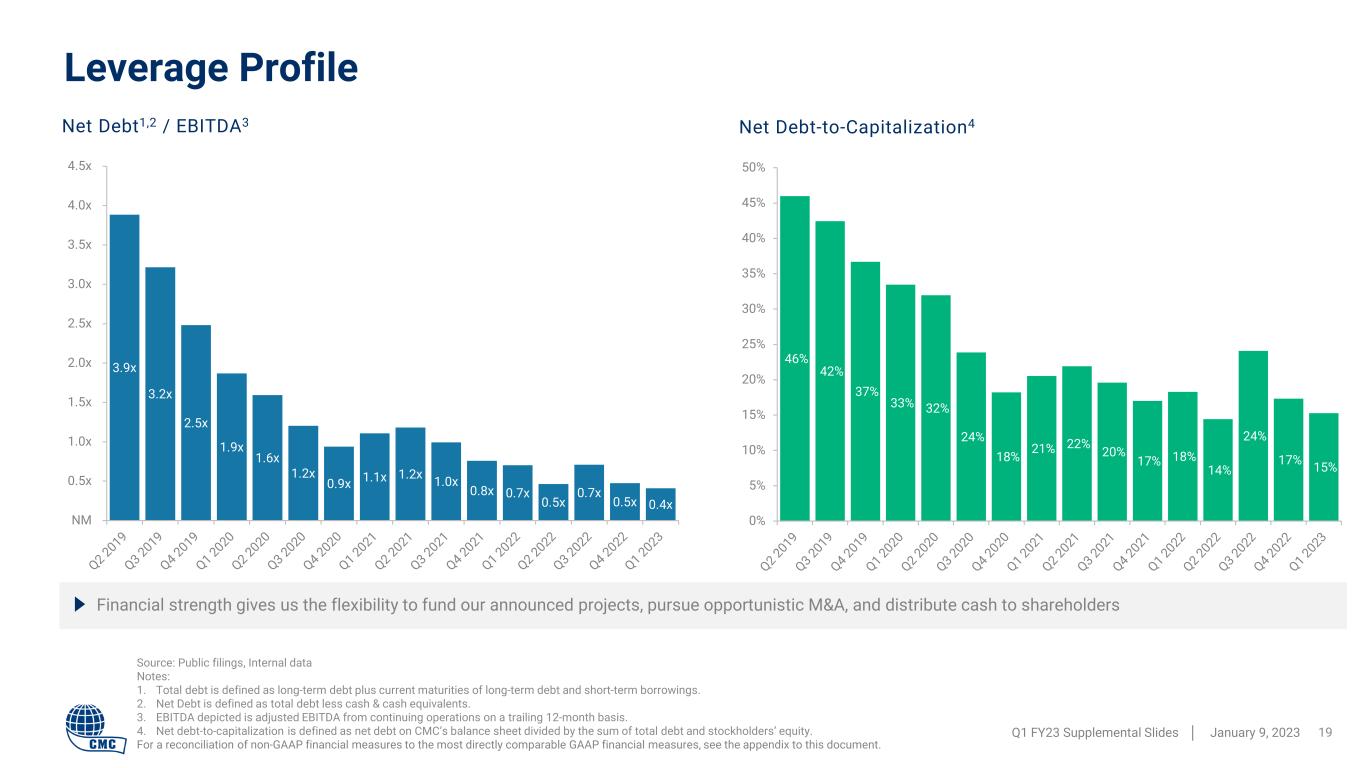

3.9x 3.2x 2.5x 1.9x 1.6x 1.2x 0.9x 1.1x 1.2x 1.0x 0.8x 0.7x 0.5x 0.7x 0.5x 0.4x NM 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 46% 42% 37% 33% 32% 24% 18% 21% 22% 20% 17% 18% 14% 24% 17% 15% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Leverage Profile Q1 FY23 Supplemental Slides │ January 9, 2023 19 Source: Public filings, Internal data Notes: 1. Total debt is defined as long-term debt plus current maturities of long-term debt and short-term borrowings. 2. Net Debt is defined as total debt less cash & cash equivalents. 3. EBITDA depicted is adjusted EBITDA from continuing operations on a trailing 12-month basis. 4. Net debt-to-capitalization is defined as net debt on CMC’s balance sheet divided by the sum of total debt and stockholders’ equity. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Financial strength gives us the flexibility to fund our announced projects, pursue opportunistic M&A, and distribute cash to shareholders Net Debt1,2 / EBITDA3 Net Debt-to-Capitalization4

Q1 FY23 Supplemental Slides │ January 9, 2023 20 Appendix: Non-GAAP Financial Reconciliations

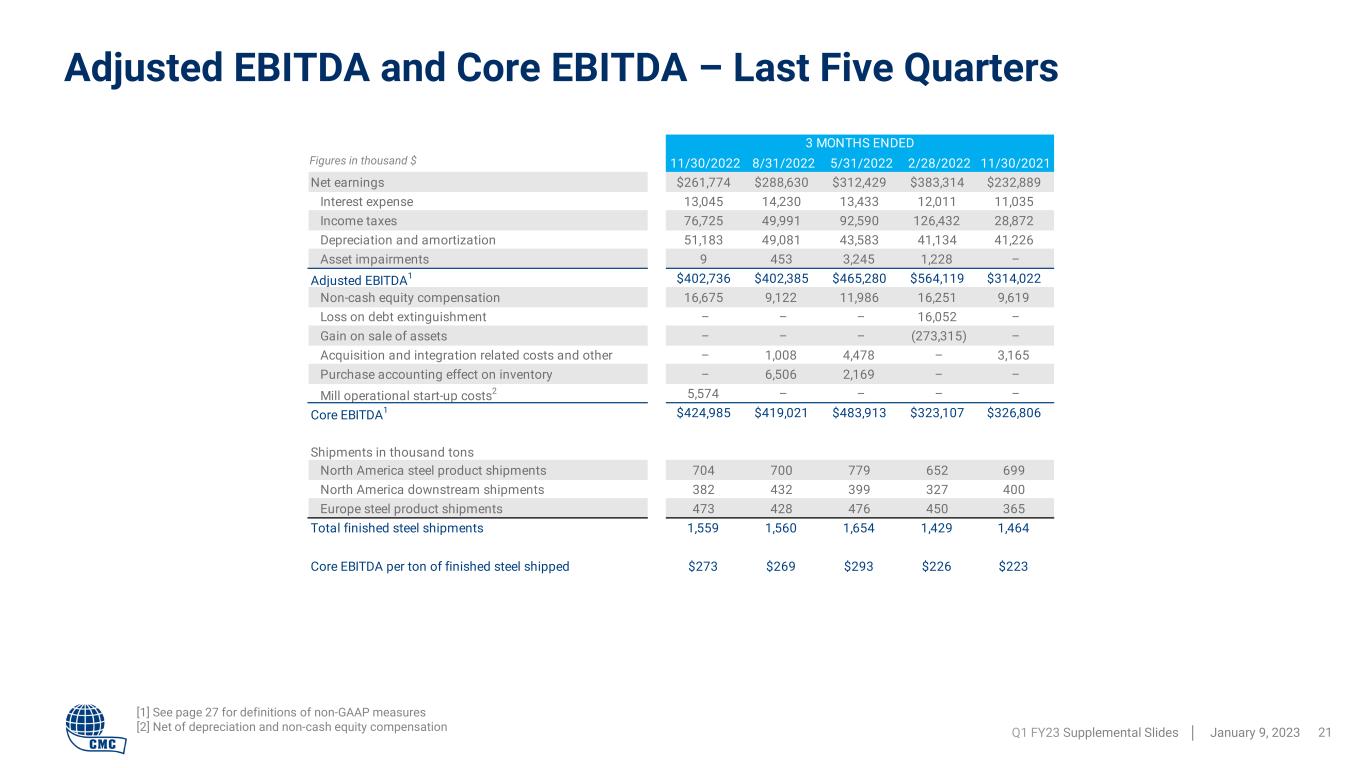

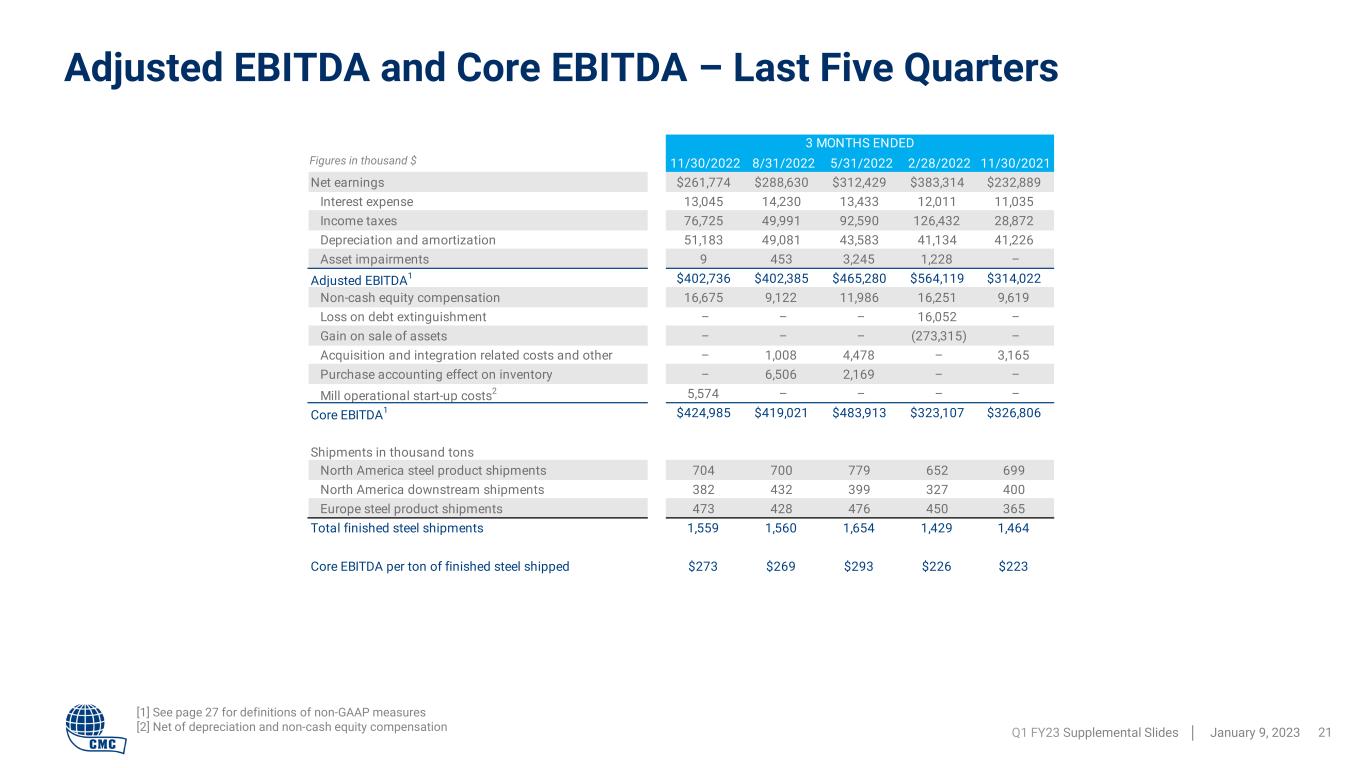

11/30/2022 8/31/2022 5/31/2022 2/28/2022 11/30/2021 Net earnings $261,774 $288,630 $312,429 $383,314 $232,889 Interest expense 13,045 14,230 13,433 12,011 11,035 Income taxes 76,725 49,991 92,590 126,432 28,872 Depreciation and amortization 51,183 49,081 43,583 41,134 41,226 Asset impairments 9 453 3,245 1,228 – Adjusted EBITDA1 $402,736 $402,385 $465,280 $564,119 $314,022 Non-cash equity compensation 16,675 9,122 11,986 16,251 9,619 Loss on debt extinguishment – – – 16,052 – Gain on sale of assets – – – (273,315) – Acquisition and integration related costs and other – 1,008 4,478 – 3,165 Purchase accounting effect on inventory – 6,506 2,169 – – Mill operational start-up costs2 5,574 – – – – Core EBITDA1 $424,985 $419,021 $483,913 $323,107 $326,806 Shipments in thousand tons North America steel product shipments 704 700 779 652 699 North America downstream shipments 382 432 399 327 400 Europe steel product shipments 473 428 476 450 365 Total finished steel shipments 1,559 1,560 1,654 1,429 1,464 Core EBITDA per ton of finished steel shipped $273 $269 $293 $226 $223 3 MONTHS ENDED Adjusted EBITDA and Core EBITDA – Last Five Quarters Q1 FY23 Supplemental Slides │ January 9, 2023 21 [1] See page 27 for definitions of non-GAAP measures [2] Net of depreciation and non-cash equity compensation Figures in thousand $

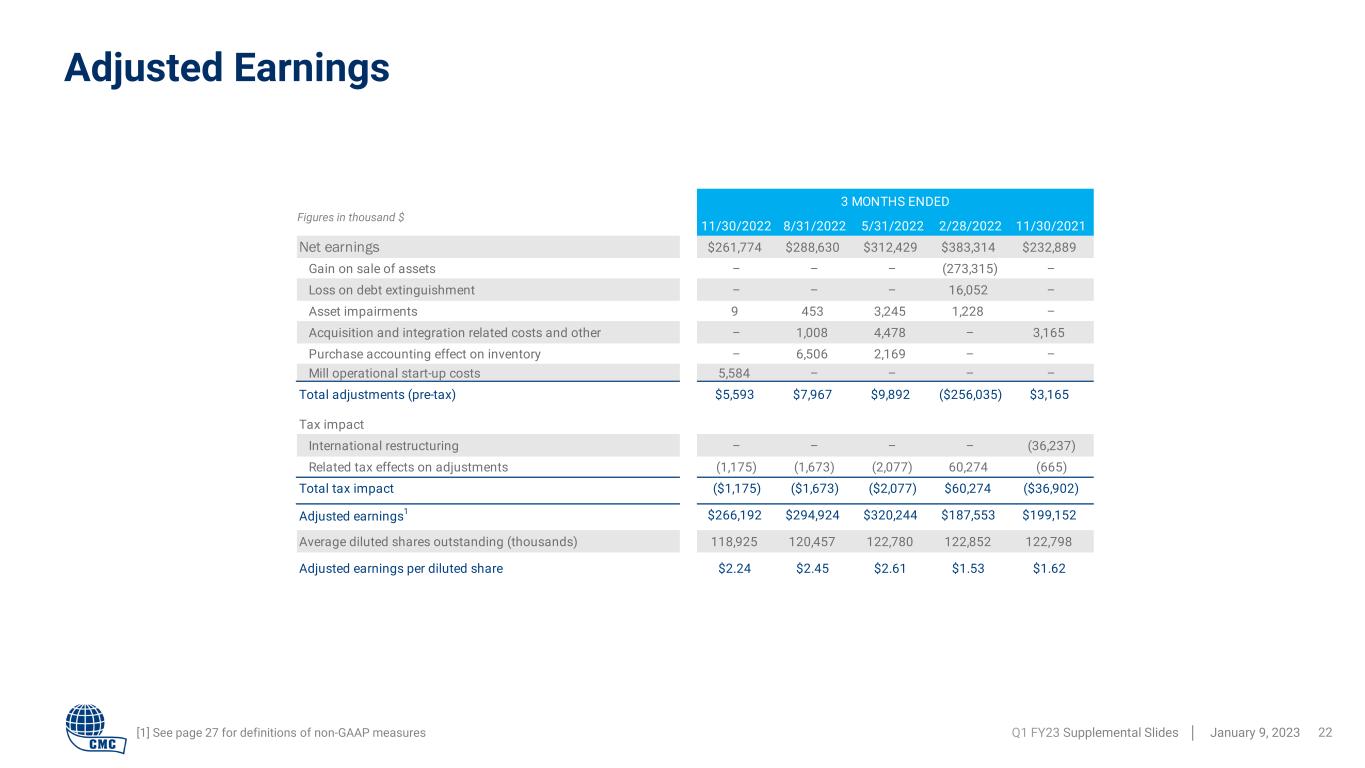

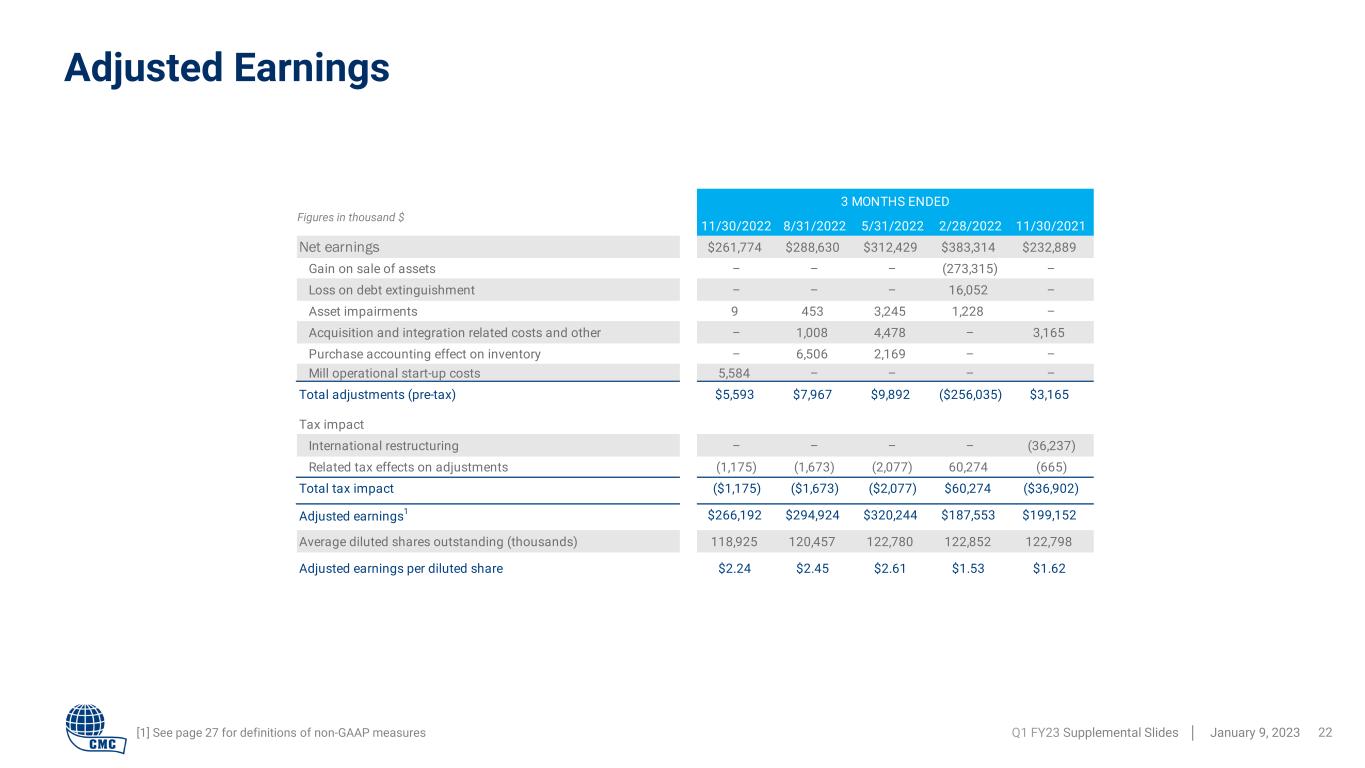

Adjusted Earnings Q1 FY23 Supplemental Slides │ January 9, 2023 22[1] See page 27 for definitions of non-GAAP measures Figures in thousand $ 11/30/2022 8/31/2022 5/31/2022 2/28/2022 11/30/2021 Net earnings $261,774 $288,630 $312,429 $383,314 $232,889 Gain on sale of assets – – – (273,315) – Loss on debt extinguishment – – – 16,052 – Asset impairments 9 453 3,245 1,228 – Acquisition and integration related costs and other – 1,008 4,478 – 3,165 Purchase accounting effect on inventory – 6,506 2,169 – – Mill operational start-up costs 5,584 – – – – Total adjustments (pre-tax) $5,593 $7,967 $9,892 ($256,035) $3,165 Tax impact International restructuring – – – – (36,237) Related tax effects on adjustments (1,175) (1,673) (2,077) 60,274 (665) Total tax impact ($1,175) ($1,673) ($2,077) $60,274 ($36,902) Adjusted earnings1 $266,192 $294,924 $320,244 $187,553 $199,152 Average diluted shares outstanding (thousands) 118,925 120,457 122,780 122,852 122,798 Adjusted earnings per diluted share $2.24 $2.45 $2.61 $1.53 $1.62 3 MONTHS ENDED

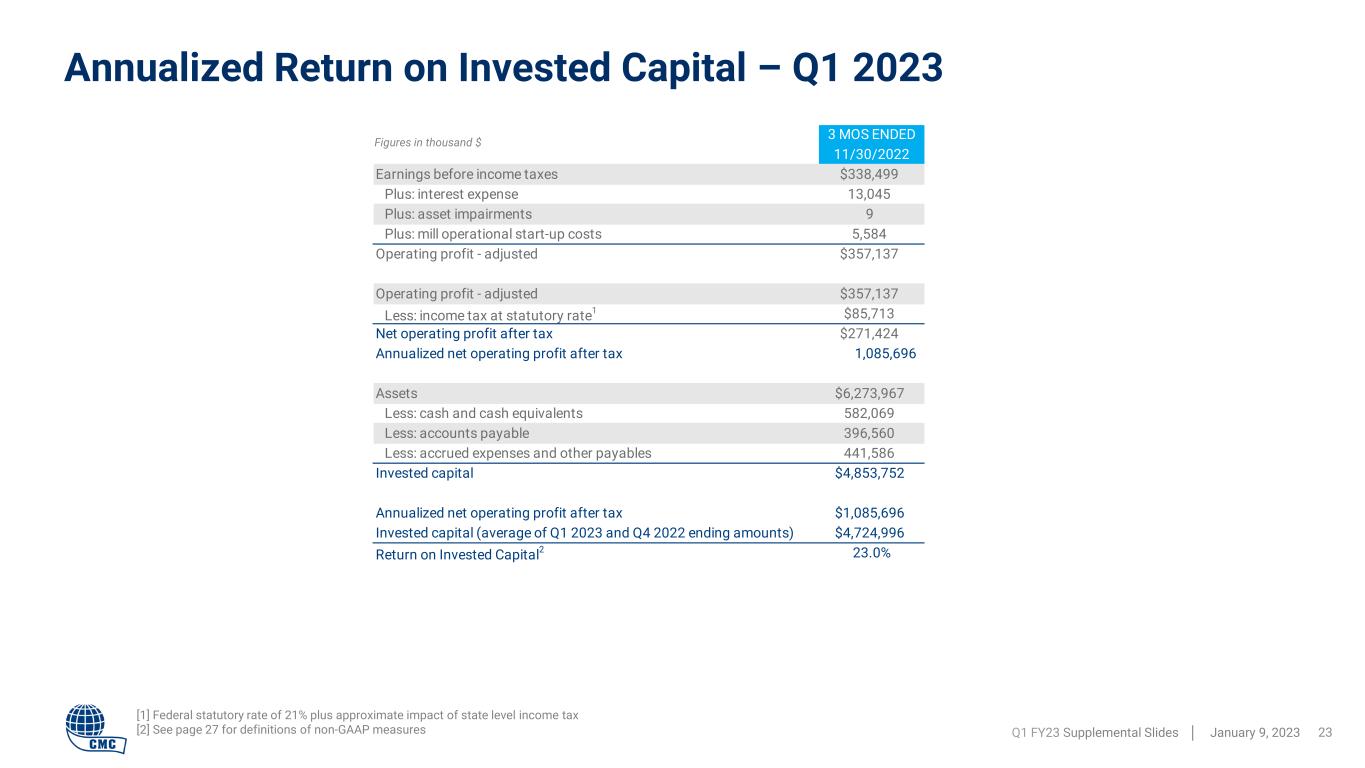

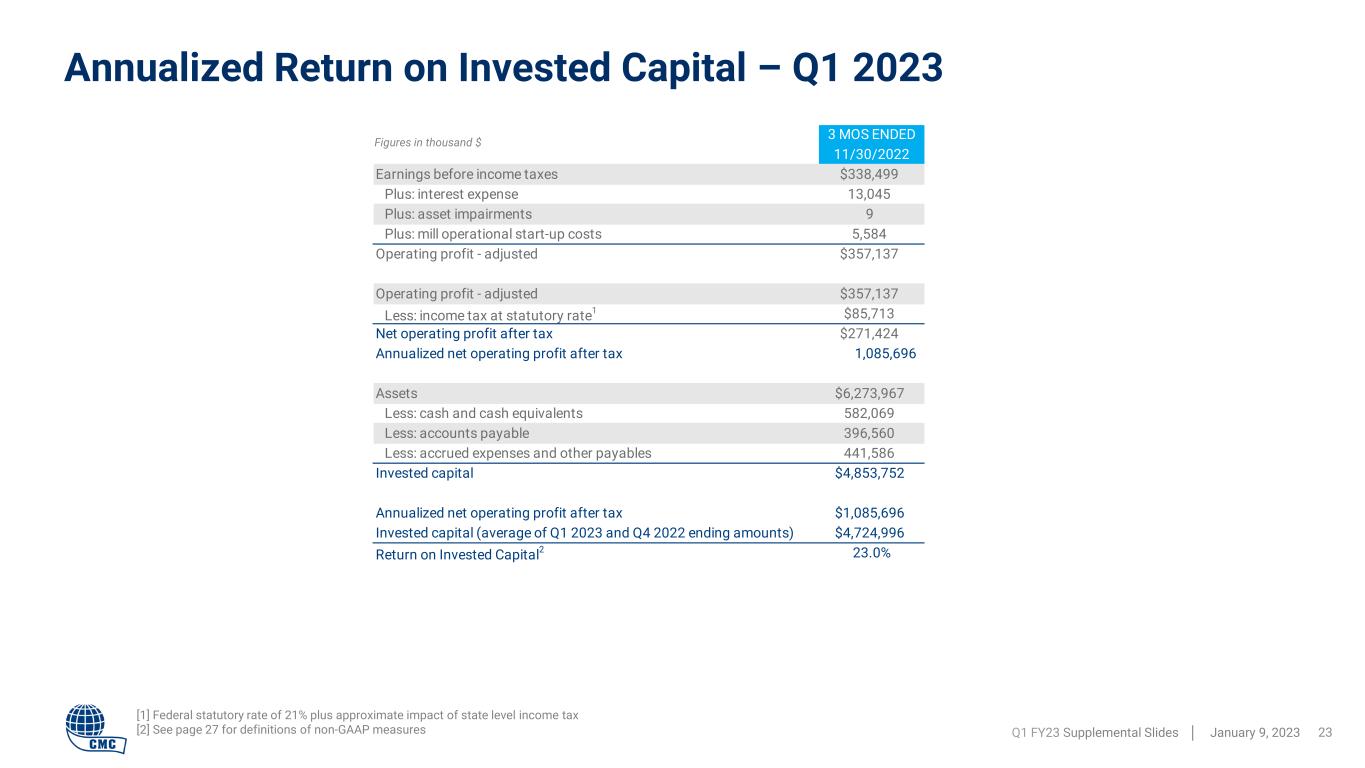

Annualized Return on Invested Capital – Q1 2023 Q1 FY23 Supplemental Slides │ January 9, 2023 23 [1] Federal statutory rate of 21% plus approximate impact of state level income tax [2] See page 27 for definitions of non-GAAP measures Figures in thousand $ 3 MOS ENDED 11/30/2022 Earnings before income taxes $338,499 Plus: interest expense 13,045 Plus: asset impairments 9 Plus: mill operational start-up costs 5,584 Operating profit - adjusted $357,137 Operating profit - adjusted $357,137 Less: income tax at statutory rate1 $85,713 Net operating profit after tax $271,424 Annualized net operating profit after tax 1,085,696 Assets $6,273,967 Less: cash and cash equivalents 582,069 Less: accounts payable 396,560 Less: accrued expenses and other payables 441,586 Invested capital $4,853,752 Annualized net operating profit after tax $1,085,696 Invested capital (average of Q1 2023 and Q4 2022 ending amounts) $4,724,996 Return on Invested Capital2 23.0%

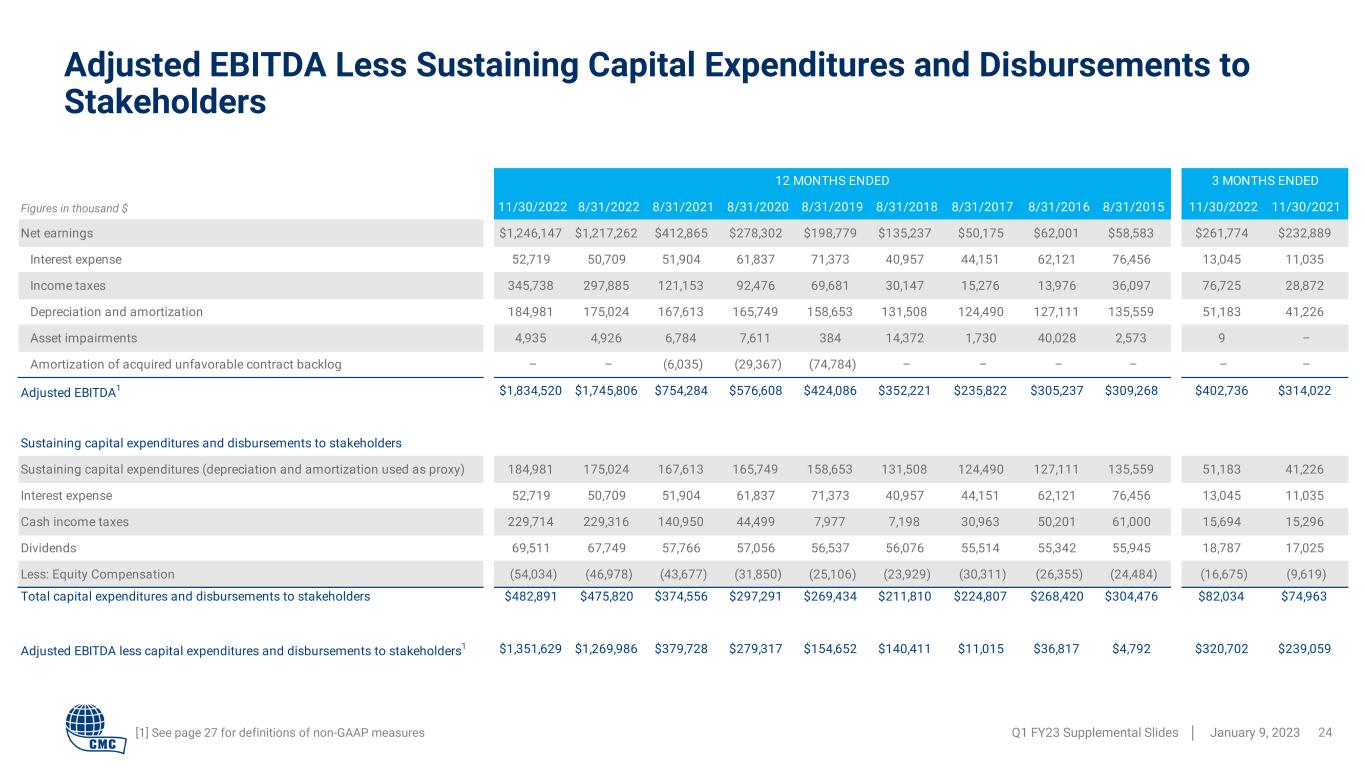

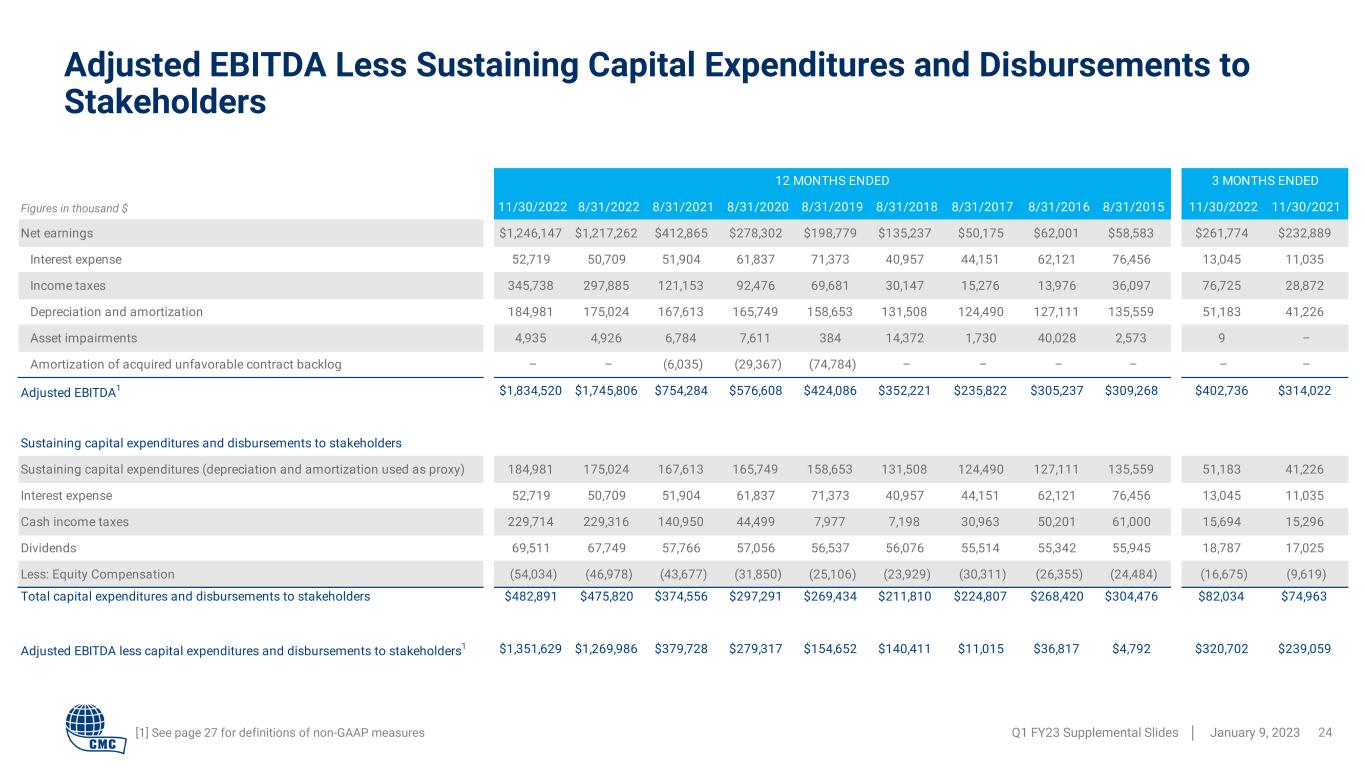

11/30/2022 8/31/2022 8/31/2021 8/31/2020 8/31/2019 8/31/2018 8/31/2017 8/31/2016 8/31/2015 11/30/2022 11/30/2021 Net earnings $1,246,147 $1,217,262 $412,865 $278,302 $198,779 $135,237 $50,175 $62,001 $58,583 $261,774 $232,889 Interest expense 52,719 50,709 51,904 61,837 71,373 40,957 44,151 62,121 76,456 13,045 11,035 Income taxes 345,738 297,885 121,153 92,476 69,681 30,147 15,276 13,976 36,097 76,725 28,872 Depreciation and amortization 184,981 175,024 167,613 165,749 158,653 131,508 124,490 127,111 135,559 51,183 41,226 Asset impairments 4,935 4,926 6,784 7,611 384 14,372 1,730 40,028 2,573 9 – Amortization of acquired unfavorable contract backlog – – (6,035) (29,367) (74,784) – – – – – – Adjusted EBITDA1 $1,834,520 $1,745,806 $754,284 $576,608 $424,086 $352,221 $235,822 $305,237 $309,268 $402,736 $314,022 Sustaining capital expenditures and disbursements to stakeholders Sustaining capital expenditures (depreciation and amortization used as proxy) 184,981 175,024 167,613 165,749 158,653 131,508 124,490 127,111 135,559 51,183 41,226 Interest expense 52,719 50,709 51,904 61,837 71,373 40,957 44,151 62,121 76,456 13,045 11,035 Cash income taxes 229,714 229,316 140,950 44,499 7,977 7,198 30,963 50,201 61,000 15,694 15,296 Dividends 69,511 67,749 57,766 57,056 56,537 56,076 55,514 55,342 55,945 18,787 17,025 Less: Equity Compensation (54,034) (46,978) (43,677) (31,850) (25,106) (23,929) (30,311) (26,355) (24,484) (16,675) (9,619) Total capital expenditures and disbursements to stakeholders $482,891 $475,820 $374,556 $297,291 $269,434 $211,810 $224,807 $268,420 $304,476 $82,034 $74,963 Adjusted EBITDA less capital expenditures and disbursements to stakeholders1 $1,351,629 $1,269,986 $379,728 $279,317 $154,652 $140,411 $11,015 $36,817 $4,792 $320,702 $239,059 12 MONTHS ENDED 3 MONTHS ENDED [1] See page 27 for definitions of non-GAAP measures Adjusted EBITDA Less Sustaining Capital Expenditures and Disbursements to Stakeholders Q1 FY23 Supplemental Slides │ January 9, 2023 24 Figures in thousand $

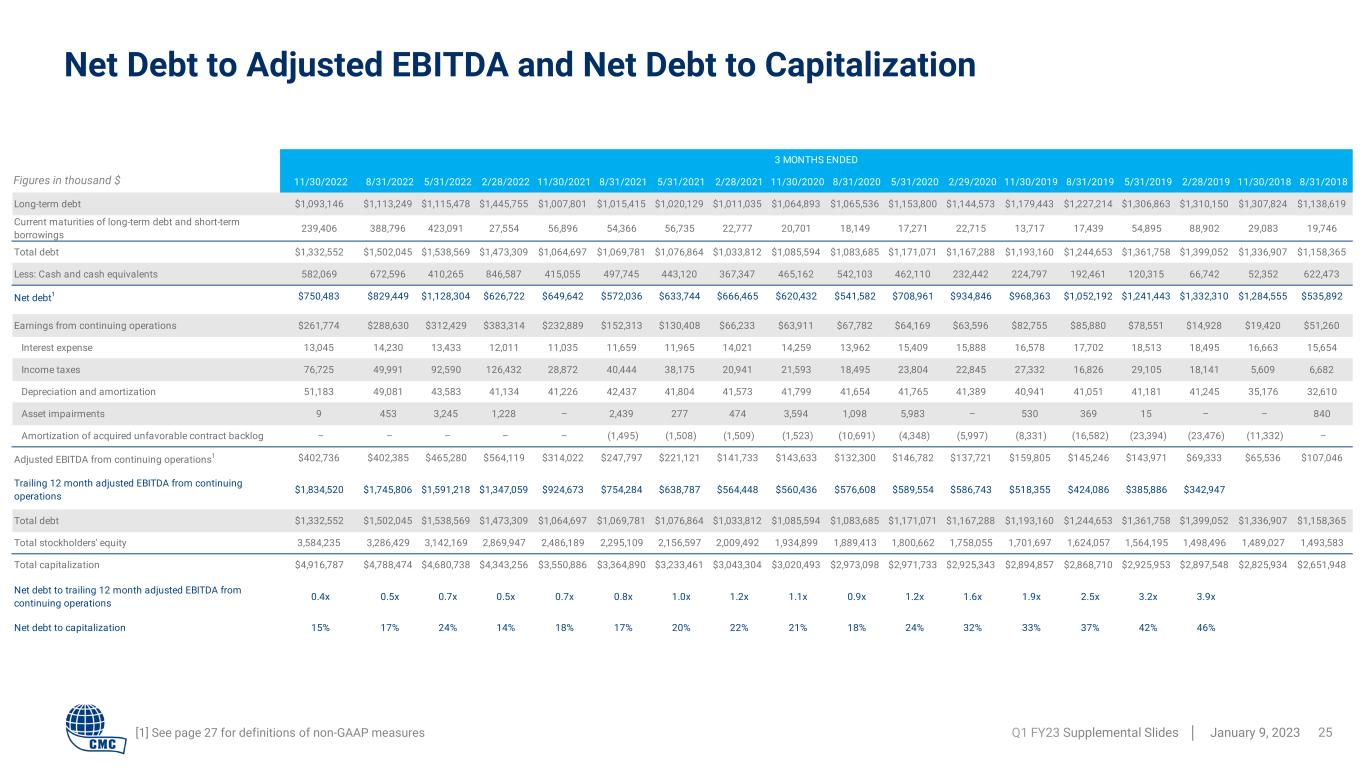

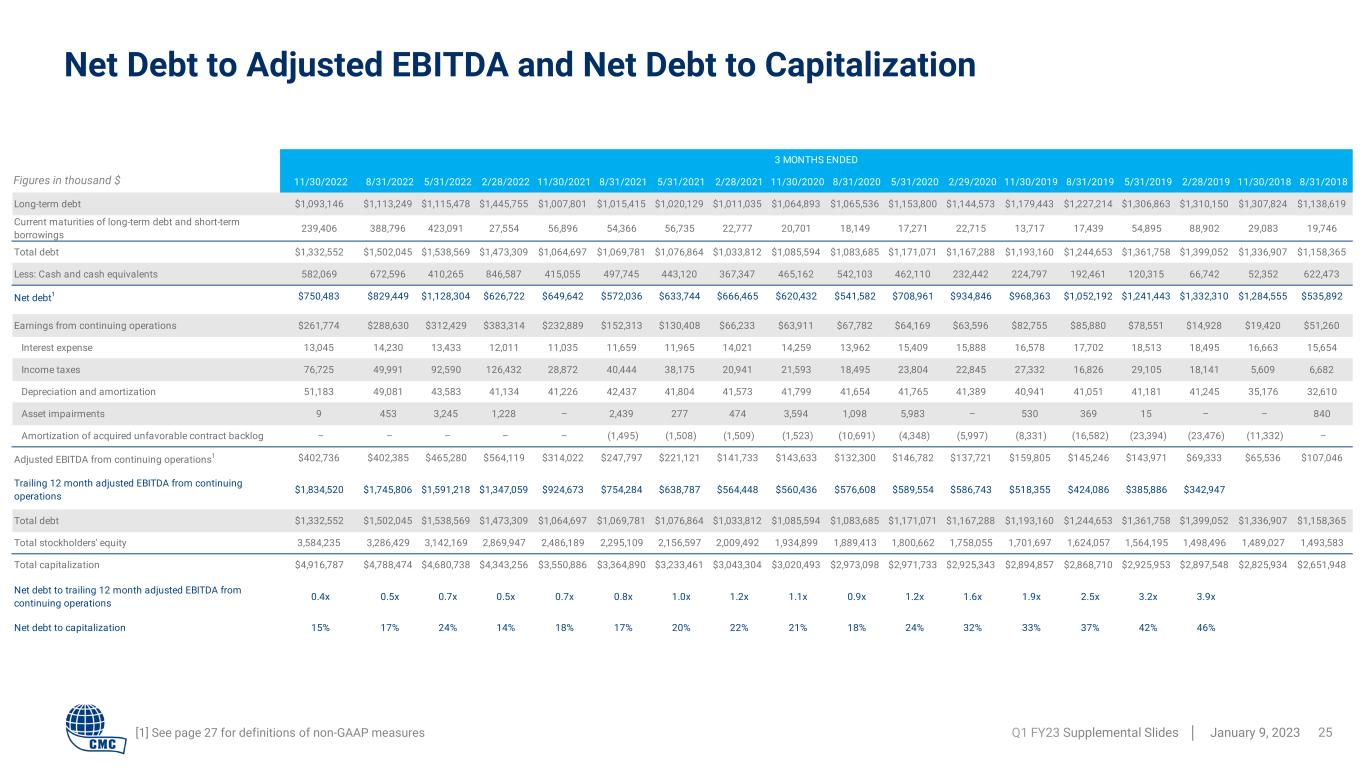

11/30/2022 8/31/2022 5/31/2022 2/28/2022 11/30/2021 8/31/2021 5/31/2021 2/28/2021 11/30/2020 8/31/2020 5/31/2020 2/29/2020 11/30/2019 8/31/2019 5/31/2019 2/28/2019 11/30/2018 8/31/2018 Long-term debt $1,093,146 $1,113,249 $1,115,478 $1,445,755 $1,007,801 $1,015,415 $1,020,129 $1,011,035 $1,064,893 $1,065,536 $1,153,800 $1,144,573 $1,179,443 $1,227,214 $1,306,863 $1,310,150 $1,307,824 $1,138,619 Current maturities of long-term debt and short-term borrowings 239,406 388,796 423,091 27,554 56,896 54,366 56,735 22,777 20,701 18,149 17,271 22,715 13,717 17,439 54,895 88,902 29,083 19,746 Total debt $1,332,552 $1,502,045 $1,538,569 $1,473,309 $1,064,697 $1,069,781 $1,076,864 $1,033,812 $1,085,594 $1,083,685 $1,171,071 $1,167,288 $1,193,160 $1,244,653 $1,361,758 $1,399,052 $1,336,907 $1,158,365 Less: Cash and cash equivalents 582,069 672,596 410,265 846,587 415,055 497,745 443,120 367,347 465,162 542,103 462,110 232,442 224,797 192,461 120,315 66,742 52,352 622,473 Net debt1 $750,483 $829,449 $1,128,304 $626,722 $649,642 $572,036 $633,744 $666,465 $620,432 $541,582 $708,961 $934,846 $968,363 $1,052,192 $1,241,443 $1,332,310 $1,284,555 $535,892 Earnings from continuing operations $261,774 $288,630 $312,429 $383,314 $232,889 $152,313 $130,408 $66,233 $63,911 $67,782 $64,169 $63,596 $82,755 $85,880 $78,551 $14,928 $19,420 $51,260 Interest expense 13,045 14,230 13,433 12,011 11,035 11,659 11,965 14,021 14,259 13,962 15,409 15,888 16,578 17,702 18,513 18,495 16,663 15,654 Income taxes 76,725 49,991 92,590 126,432 28,872 40,444 38,175 20,941 21,593 18,495 23,804 22,845 27,332 16,826 29,105 18,141 5,609 6,682 Depreciation and amortization 51,183 49,081 43,583 41,134 41,226 42,437 41,804 41,573 41,799 41,654 41,765 41,389 40,941 41,051 41,181 41,245 35,176 32,610 Asset impairments 9 453 3,245 1,228 – 2,439 277 474 3,594 1,098 5,983 – 530 369 15 – – 840 Amortization of acquired unfavorable contract backlog – – – – – (1,495) (1,508) (1,509) (1,523) (10,691) (4,348) (5,997) (8,331) (16,582) (23,394) (23,476) (11,332) – Adjusted EBITDA from continuing operations1 $402,736 $402,385 $465,280 $564,119 $314,022 $247,797 $221,121 $141,733 $143,633 $132,300 $146,782 $137,721 $159,805 $145,246 $143,971 $69,333 $65,536 $107,046 Trailing 12 month adjusted EBITDA from continuing operations $1,834,520 $1,745,806 $1,591,218 $1,347,059 $924,673 $754,284 $638,787 $564,448 $560,436 $576,608 $589,554 $586,743 $518,355 $424,086 $385,886 $342,947 Total debt $1,332,552 $1,502,045 $1,538,569 $1,473,309 $1,064,697 $1,069,781 $1,076,864 $1,033,812 $1,085,594 $1,083,685 $1,171,071 $1,167,288 $1,193,160 $1,244,653 $1,361,758 $1,399,052 $1,336,907 $1,158,365 Total stockholders' equity 3,584,235 3,286,429 3,142,169 2,869,947 2,486,189 2,295,109 2,156,597 2,009,492 1,934,899 1,889,413 1,800,662 1,758,055 1,701,697 1,624,057 1,564,195 1,498,496 1,489,027 1,493,583 Total capitalization $4,916,787 $4,788,474 $4,680,738 $4,343,256 $3,550,886 $3,364,890 $3,233,461 $3,043,304 $3,020,493 $2,973,098 $2,971,733 $2,925,343 $2,894,857 $2,868,710 $2,925,953 $2,897,548 $2,825,934 $2,651,948 Net debt to trailing 12 month adjusted EBITDA from continuing operations 0.4x 0.5x 0.7x 0.5x 0.7x 0.8x 1.0x 1.2x 1.1x 0.9x 1.2x 1.6x 1.9x 2.5x 3.2x 3.9x Net debt to capitalization 15% 17% 24% 14% 18% 17% 20% 22% 21% 18% 24% 32% 33% 37% 42% 46% 3 MONTHS ENDED Net Debt to Adjusted EBITDA and Net Debt to Capitalization Q1 FY23 Supplemental Slides │ January 9, 2023 25 Figures in thousand $ [1] See page 27 for definitions of non-GAAP measures

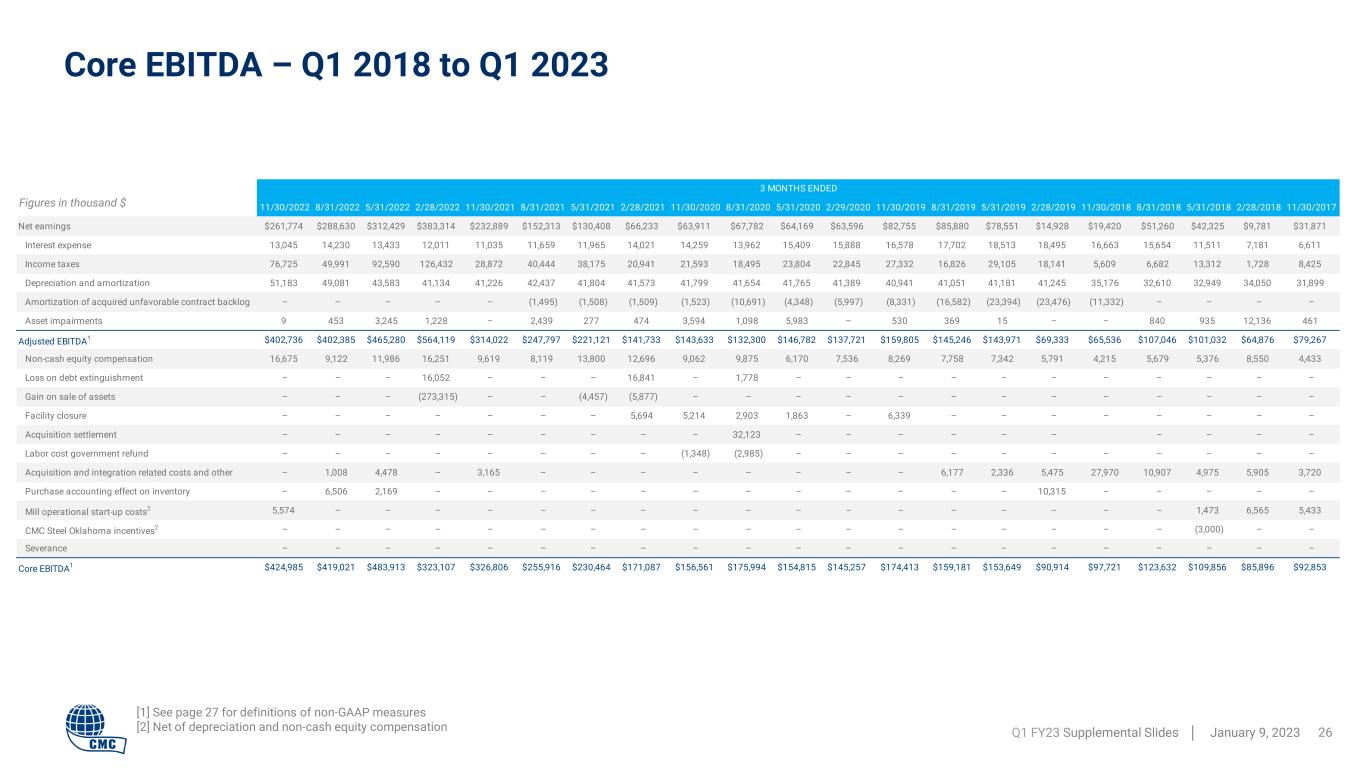

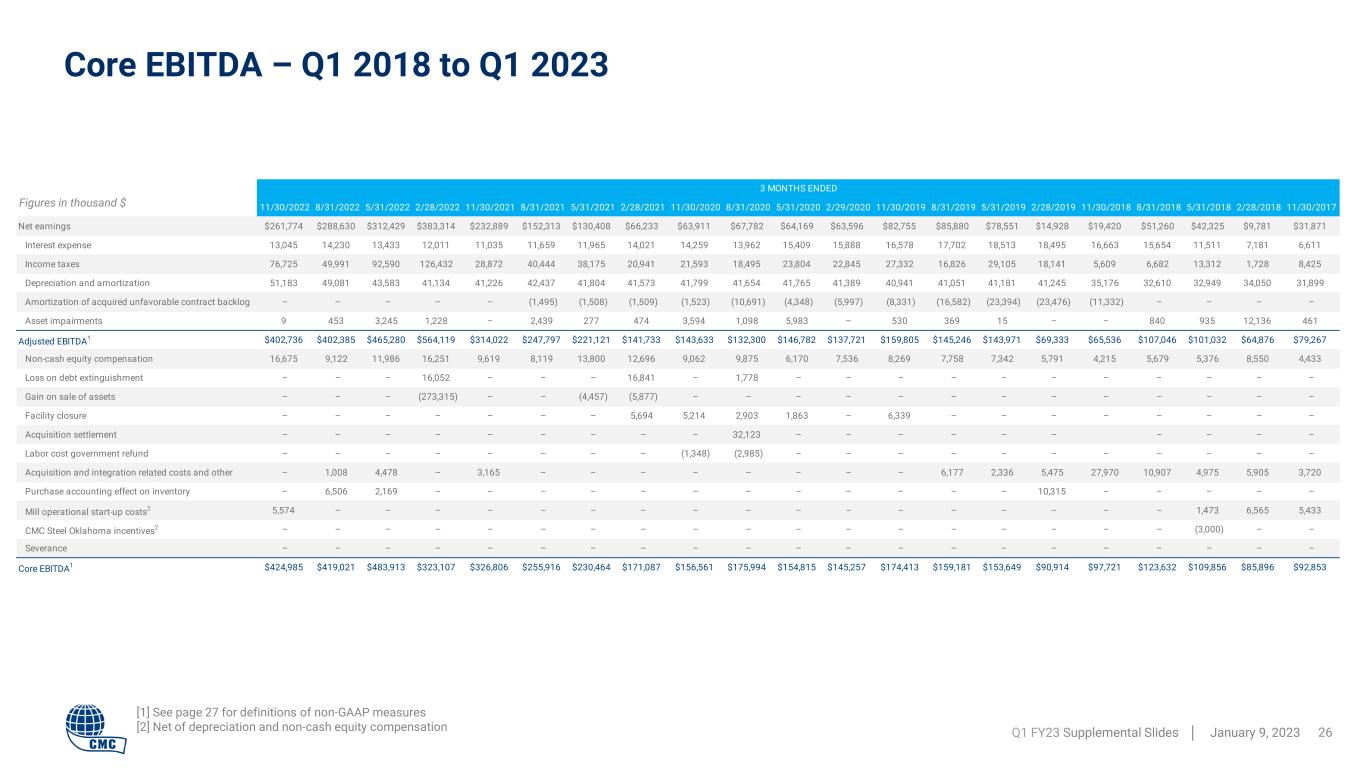

3 MONTHS ENDED 11/30/2022 8/31/2022 5/31/2022 2/28/2022 11/30/2021 8/31/2021 5/31/2021 2/28/2021 11/30/2020 8/31/2020 5/31/2020 2/29/2020 11/30/2019 8/31/2019 5/31/2019 2/28/2019 11/30/2018 8/31/2018 5/31/2018 2/28/2018 11/30/2017 Net earnings $261,774 $288,630 $312,429 $383,314 $232,889 $152,313 $130,408 $66,233 $63,911 $67,782 $64,169 $63,596 $82,755 $85,880 $78,551 $14,928 $19,420 $51,260 $42,325 $9,781 $31,871 Interest expense 13,045 14,230 13,433 12,011 11,035 11,659 11,965 14,021 14,259 13,962 15,409 15,888 16,578 17,702 18,513 18,495 16,663 15,654 11,511 7,181 6,611 Income taxes 76,725 49,991 92,590 126,432 28,872 40,444 38,175 20,941 21,593 18,495 23,804 22,845 27,332 16,826 29,105 18,141 5,609 6,682 13,312 1,728 8,425 Depreciation and amortization 51,183 49,081 43,583 41,134 41,226 42,437 41,804 41,573 41,799 41,654 41,765 41,389 40,941 41,051 41,181 41,245 35,176 32,610 32,949 34,050 31,899 Amortization of acquired unfavorable contract backlog – – – – – (1,495) (1,508) (1,509) (1,523) (10,691) (4,348) (5,997) (8,331) (16,582) (23,394) (23,476) (11,332) – – – – Asset impairments 9 453 3,245 1,228 – 2,439 277 474 3,594 1,098 5,983 – 530 369 15 – – 840 935 12,136 461 Adjusted EBITDA1 $402,736 $402,385 $465,280 $564,119 $314,022 $247,797 $221,121 $141,733 $143,633 $132,300 $146,782 $137,721 $159,805 $145,246 $143,971 $69,333 $65,536 $107,046 $101,032 $64,876 $79,267 Non-cash equity compensation 16,675 9,122 11,986 16,251 9,619 8,119 13,800 12,696 9,062 9,875 6,170 7,536 8,269 7,758 7,342 5,791 4,215 5,679 5,376 8,550 4,433 Loss on debt extinguishment – – – 16,052 – – – 16,841 – 1,778 – – – – – – – – – – – Gain on sale of assets – – – (273,315) – – (4,457) (5,877) – – – – – – – – – – – – – Facility closure – – – – – – – 5,694 5,214 2,903 1,863 – 6,339 – – – – – – – – Acquisition settlement – – – – – – – – – 32,123 – – – – – – – – – – Labor cost government refund – – – – – – – – (1,348) (2,985) – – – – – – – – – – – Acquisition and integration related costs and other – 1,008 4,478 – 3,165 – – – – – – – – 6,177 2,336 5,475 27,970 10,907 4,975 5,905 3,720 Purchase accounting effect on inventory – 6,506 2,169 – – – – – – – – – – – – 10,315 – – – – – Mill operational start-up costs2 5,574 – – – – – – – – – – – – – – – – – 1,473 6,565 5,433 CMC Steel Oklahoma incentives2 – – – – – – – – – – – – – – – – – – (3,000) – – Severance – – – – – – – – – – – – – – – – – – – – – Core EBITDA1 $424,985 $419,021 $483,913 $323,107 $326,806 $255,916 $230,464 $171,087 $156,561 $175,994 $154,815 $145,257 $174,413 $159,181 $153,649 $90,914 $97,721 $123,632 $109,856 $85,896 $92,853 Core EBITDA – Q1 2018 to Q1 2023 Q1 FY23 Supplemental Slides │ January 9, 2023 26 Figures in thousand $ [1] See page 27 for definitions of non-GAAP measures [2] Net of depreciation and non-cash equity compensation

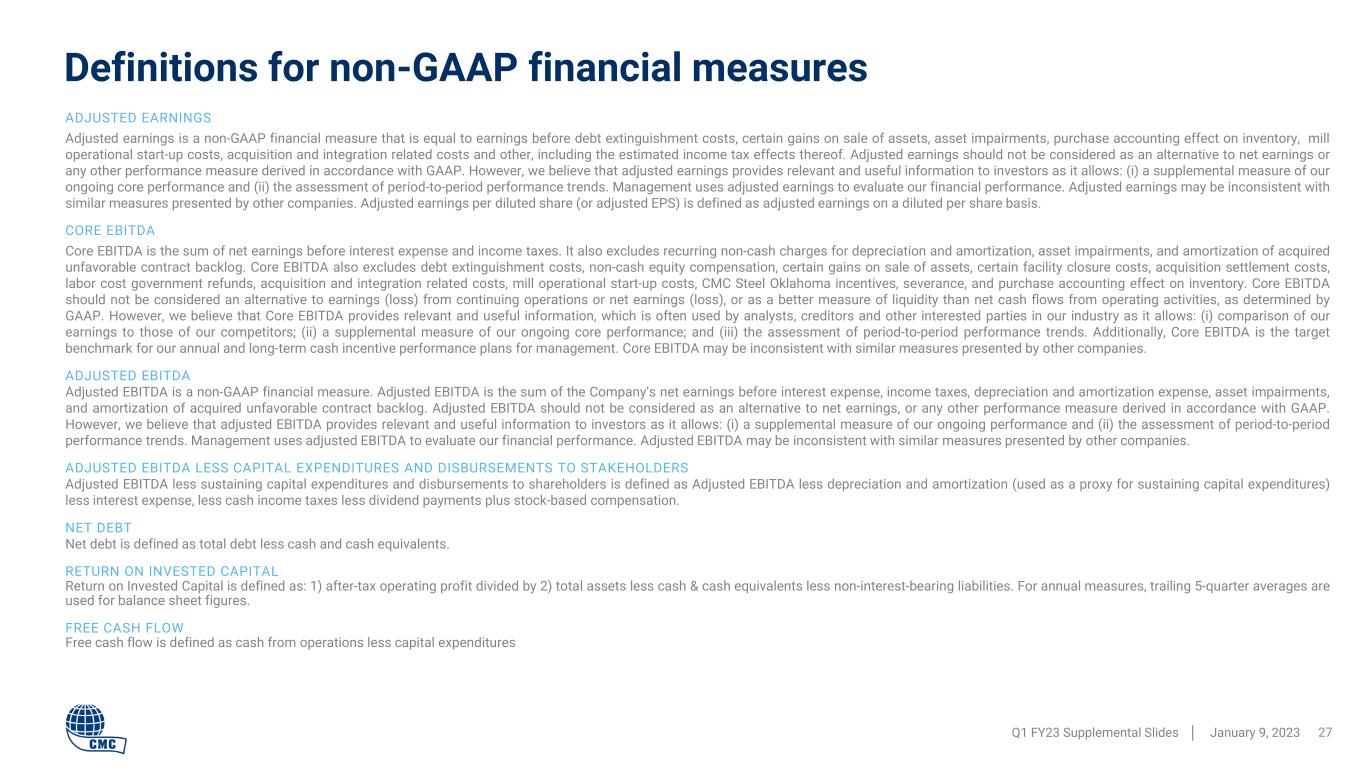

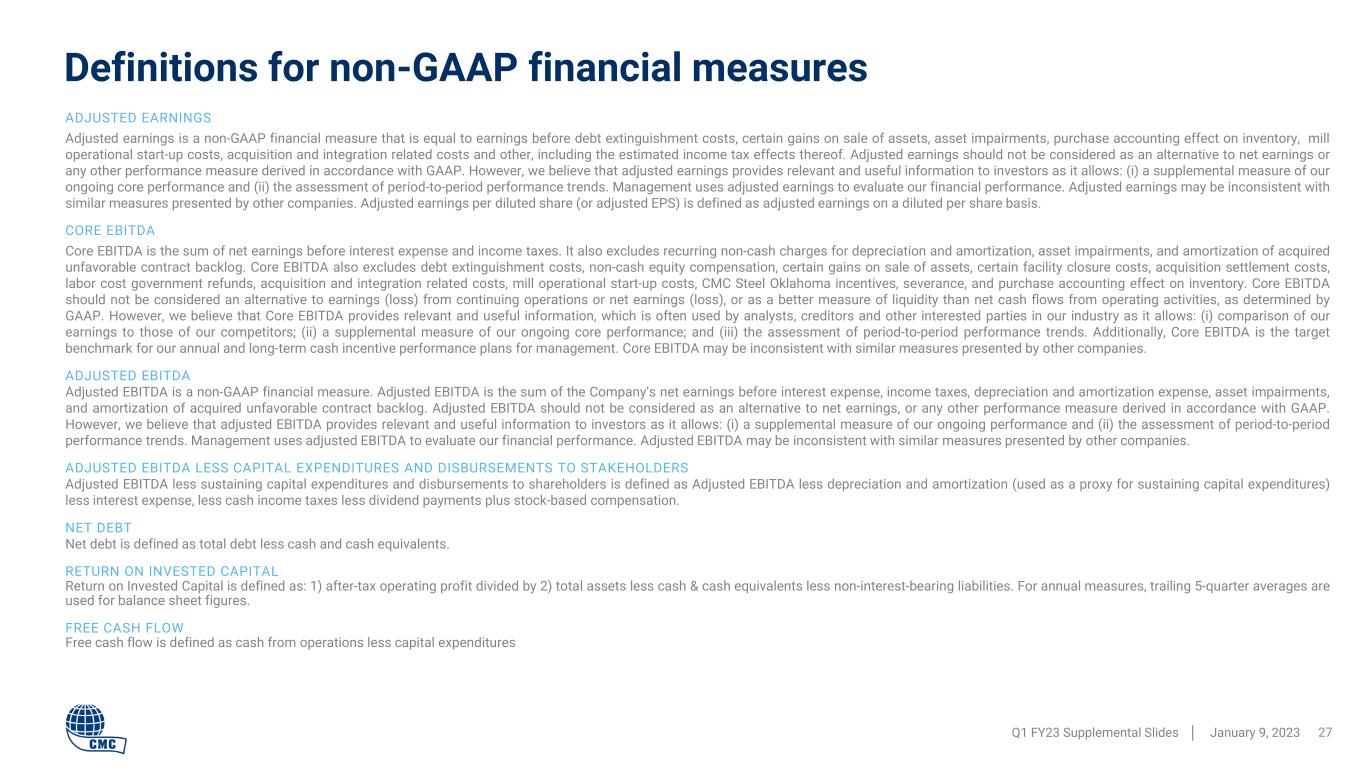

Definitions for non-GAAP financial measures Q1 FY23 Supplemental Slides │ January 9, 2023 27 ADJUSTED EARNINGS Adjusted earnings is a non-GAAP financial measure that is equal to earnings before debt extinguishment costs, certain gains on sale of assets, asset impairments, purchase accounting effect on inventory, mill operational start-up costs, acquisition and integration related costs and other, including the estimated income tax effects thereof. Adjusted earnings should not be considered as an alternative to net earnings or any other performance measure derived in accordance with GAAP. However, we believe that adjusted earnings provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing core performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted earnings to evaluate our financial performance. Adjusted earnings may be inconsistent with similar measures presented by other companies. Adjusted earnings per diluted share (or adjusted EPS) is defined as adjusted earnings on a diluted per share basis. CORE EBITDA Core EBITDA is the sum of net earnings before interest expense and income taxes. It also excludes recurring non-cash charges for depreciation and amortization, asset impairments, and amortization of acquired unfavorable contract backlog. Core EBITDA also excludes debt extinguishment costs, non-cash equity compensation, certain gains on sale of assets, certain facility closure costs, acquisition settlement costs, labor cost government refunds, acquisition and integration related costs, mill operational start-up costs, CMC Steel Oklahoma incentives, severance, and purchase accounting effect on inventory. Core EBITDA should not be considered an alternative to earnings (loss) from continuing operations or net earnings (loss), or as a better measure of liquidity than net cash flows from operating activities, as determined by GAAP. However, we believe that Core EBITDA provides relevant and useful information, which is often used by analysts, creditors and other interested parties in our industry as it allows: (i) comparison of our earnings to those of our competitors; (ii) a supplemental measure of our ongoing core performance; and (iii) the assessment of period-to-period performance trends. Additionally, Core EBITDA is the target benchmark for our annual and long-term cash incentive performance plans for management. Core EBITDA may be inconsistent with similar measures presented by other companies. ADJUSTED EBITDA Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is the sum of the Company’s net earnings before interest expense, income taxes, depreciation and amortization expense, asset impairments, and amortization of acquired unfavorable contract backlog. Adjusted EBITDA should not be considered as an alternative to net earnings, or any other performance measure derived in accordance with GAAP. However, we believe that adjusted EBITDA provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted EBITDA to evaluate our financial performance. Adjusted EBITDA may be inconsistent with similar measures presented by other companies. ADJUSTED EBITDA LESS CAPITAL EXPENDITURES AND DISBURSEMENTS TO STAKEHOLDERS Adjusted EBITDA less sustaining capital expenditures and disbursements to shareholders is defined as Adjusted EBITDA less depreciation and amortization (used as a proxy for sustaining capital expenditures) less interest expense, less cash income taxes less dividend payments plus stock-based compensation. NET DEBT Net debt is defined as total debt less cash and cash equivalents. RETURN ON INVESTED CAPITAL Return on Invested Capital is defined as: 1) after-tax operating profit divided by 2) total assets less cash & cash equivalents less non-interest-bearing liabilities. For annual measures, trailing 5-quarter averages are used for balance sheet figures. FREE CASH FLOW Free cash flow is defined as cash from operations less capital expenditures

Q1 FY23 Supplemental Slides │ January 9, 2023 28 Thank You