PROSPECTUS SUPPLEMENT

(To Prospectus Dated January 19, 2021)

$600,000,000

Commercial Metals Company

$300,000,000 4.125% Senior Notes due 2030

$300,000,000 4.375% Senior Notes due 2032

Commercial Metals Company is offering $600,000,000 in aggregate principal amount of senior notes in two series. We are offering $300,000,000 in aggregate principal amount of 4.125% Senior Notes due 2030 (the “2030 Notes”) and $300,000,000 in aggregate principal amount of 4.375% Senior Notes due 2032 (the “2032 Notes,” and together with the 2030 Notes, the “Notes”). The 2030 Notes will have an interest rate of 4.125% per annum. The 2032 Notes will have an interest rate of 4.375% per annum.

We will pay interest on the 2030 Notes semi-annually in arrears on January 15 and July 15 of each year, beginning on July 15, 2022. We will pay interest on the 2032 Notes semi-annually in arrears on March 15 and September 15 of each year, beginning on September 15, 2022. The 2030 Notes will mature as to principal on January 15, 2030. The 2032 Notes will mature as to principal on March 15, 2032.

Prior to January 15, 2025, we will have the option to redeem some or all of the 2030 Notes at a redemption price equal to 100% of the principal amount of the 2030 Notes, plus a “make-whole” premium and accrued and unpaid interest, if any, to, but excluding, the date of redemption. Additionally, on or after January 15, 2025, we may redeem some or all of the 2030 Notes at the redemption prices set forth in this prospectus supplement plus accrued and unpaid interest, if any, to, but excluding, the date of redemption.

Prior to March 15, 2027, we will have the option to redeem some or all of the 2032 Notes at a redemption price equal to 100% of the principal amount of the 2032 Notes, plus a “make-whole” premium and accrued and unpaid interest, if any, to, but excluding, the date of redemption. Additionally, on or after March 15, 2027, we may redeem some or all of the 2032 Notes at the redemption prices set forth in this prospectus supplement plus accrued and unpaid interest, if any, to, but excluding, the date of redemption.

Prior to January 15, 2025, we may redeem up to 40% of the 2030 Notes with the net cash proceeds of certain equity offerings at the applicable redemption price set forth in this prospectus supplement, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption. Prior to March 15, 2025, we may redeem up to 40% of the 2032 Notes with the net cash proceeds of certain equity offerings at the applicable redemption price set forth in this prospectus supplement, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption. See “Description of the Notes—Optional Redemption.”

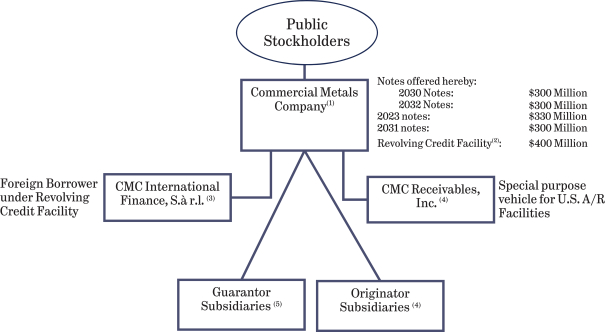

The Notes will be two separate series of our general unsecured obligations and will rank equally with all of our other unsecured and unsubordinated senior indebtedness. The Notes will be effectively subordinated to any of our secured debt to the extent of the assets securing such debt and will be structurally subordinated to the indebtedness and other liabilities of our subsidiaries, including trade payables. None of our subsidiaries will guarantee the Notes offered hereby nor do they guarantee any of our other outstanding notes.

Under certain change of control triggering events, holders of the Notes will have the right to require us to repurchase all or any part of their Notes at a repurchase price equal to 101% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to but excluding the repurchase date.

Each series of the Notes is a new issue of securities with no established trading market. We do not intend to list either series of the Notes on any securities exchange or to include them in any automated quotation system.

Investing in the Notes involves risks. See “Risk Factors” beginning on page S-18.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | | |

| | | Per 2030

Note | | | Total | | | Per 2032

Note | | | Total | |

Public Offering Price | | | 100.000 | % | | $ | 300,000,000 | | | | 100.000 | % | | $ | 300,000,000 | |

Underwriting Discount (1) | | | 1.25 | % | | $ | 3,750,000 | | | | 1.25 | % | | $ | 3,750,000 | |

Proceeds to Commercial Metals Company (before expenses) | | | 98.75 | % | | $ | 296,250,000 | | | | 98.75 | % | | $ | 296,250,000 | |

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

Interest on the Notes will accrue from January 28, 2022 to date of delivery.

The underwriters expect to deliver the Notes to purchasers on or about January 28, 2022, only in book-entry form through the facilities of The Depository Trust Company (“DTC”), and its participants.

Joint Book-Running Managers

| | | | | | |

| BofA Securities | | | | | | Citigroup |

| Wells Fargo Securities | | PNC Capital Markets LLC | | BMO Capital Markets | | Fifth Third Securities |

Co-Managers

| | | | | | |

| Truist Securities | | Capital One Securities | | US Bancorp | | Regions Securities LLC |

The date of this prospectus supplement is January 13, 2022