UNITED STATES

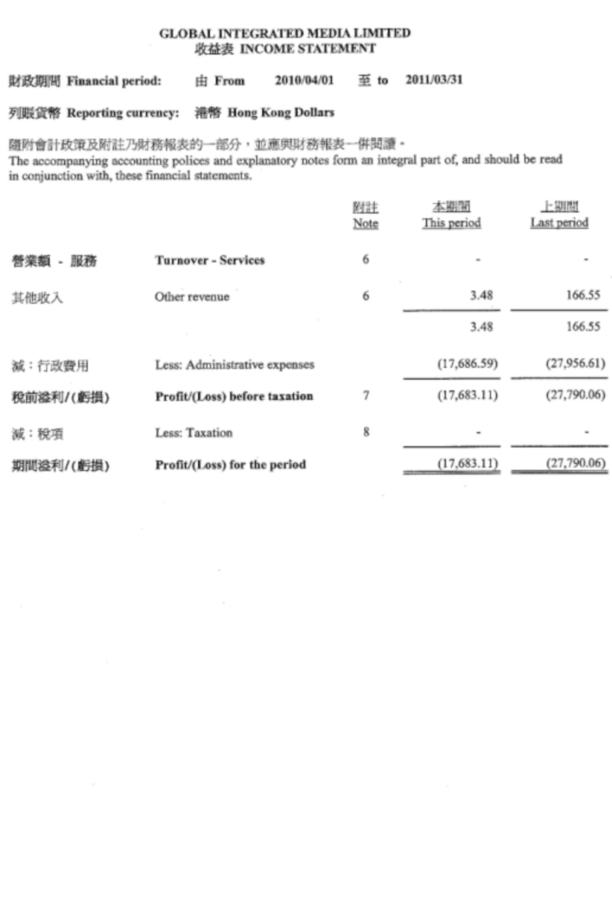

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 28, 2011

| Intelligent Communication Enterprise Corporation |

| (Exact name of registrant as specified in its charter) |

| | | | | |

| Pennsylvania | | 0-10822 | | 25-1229323 |

| (State or other jurisdiction of | | (Commission File Number) | | (IRS Employer |

| incorporation or organization) | | | | Identification No.) |

| | | | | |

| 75 High Street | | |

| Singapore | | 179435 |

| (Address of principal executive offices) | | (Zip code) |

| | | |

| Registrant’s telephone number, including area code: | | 011-65 6324-0225 |

| | | |

| n/a |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.01—COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On December 12, 2011, Intelligent Communication Enterprise Corporation filed a current report on Form 8-K disclosing its acquisition of all of the issued and outstanding shares of Global Interactive Media Limited. This Amendment No. 1 to that report amends Item 9.01—Financial Statements and Exhibits to add the historical financial statements of Global Interactive Media Limited and its affiliate, Asian Integrated Media, Ltd., which operated separately during these periods but subsequently has had all of its operations transferred to a subsidiary of Global Interactive Media Limited as a result of this acquisition, and the pro forma financial information required by Item 9.01.

ITEM 9.01—FINANCIAL STATEMENTS AND EXHIBITS

(a) Financial Statements of Business Acquired. Filed herewith, beginning at page F-1, are the audited consolidated financial statements of Global Interactive Media Limited for the years ended March 31, 2010 and 2011, interim consolidated financial statements as at December 31, 2011, and audited consolidated financial statements of Asian Integrated Media, Ltd., for the years ended December 31, 2010 and 2011.

(b) Pro Forma Information. Filed herewith are the following:

| Unaudited pro forma condensed consolidated balance sheets of Intelligent | |

| Communication Enterprise Corporation as at December 31, 2010 | F-82 |

| | |

| Unaudited pro forma condensed consolidated statements of operations | |

| for the year ended December 31, 2010 | F-83 |

| | |

| Notes to the unaudited pro forma condensed consolidated financial statements | |

| as at and for the year ended December 31, 2010 | F-84 |

| | |

| Unaudited pro forma condensed consolidated balance sheets of Intelligent | |

| Communication Enterprise Corporation as at December 31, 2011 | F-85 |

| | |

| Unaudited pro forma condensed consolidated statements of operations | |

| for the year ended December 31, 2011 | F-86 |

| | |

| Notes to the unaudited pro forma condensed consolidated financial statements | |

| as at and for the year ended December 31, 2011 | F-87 |

(c) Shell Company Transactions. Not applicable.

2

(d) The following is filed as an exhibit to this report:

Exhibit Number* | | Title of Document | | Location |

| | | | | |

| 10 | | Material Contracts | | |

| 10.31 | | Sale and Purchase Agreement between Clarita Ablazo Jeffery and Intelligent Communication Enterprise Corporation | | Incorporated by reference from the Current Report on Form 8-K filed December 12, 2011 |

_______________

| * | All exhibits are numbered with the number preceding the decimal indicating the applicable SEC reference number in Item 601 and the number following the decimal indicating the sequence of the particular document. Omitted numbers in the sequence refer to documents previously filed as an exhibit. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this amended report to be signed on its behalf by the undersigned hereunto duly authorized.

| | INTELLIGENT COMMUNICATION ENTERPRISE CORPORATION |

| | Registrant |

| | | |

| | | |

| Date: October 26, 2012 | By: | /s/ Sarocha Hatthasakul |

| | | Sarocha Hatthasakul |

| | | Chief Financial Officer |

3

| GLOBAL INTEGRATED MEDIA LIMITED |

| BALANCE SHEET |

| DECEMBER 31, 2011 |

| (UNAUDITED - PREPARED BY MANAGEMENT) |

| (HONG KONG DOLLARS) |

| | | | | | |

| | | | | | |

| ASSETS |

| | | | | | |

| CURRENT | | | | | |

| Cash | | | | $ | 86,180 |

| | | | | | |

| LIABILITIES | | | | | |

| | | | | | |

| CURRENT | | | | | |

| Accounts payable and accrued expenses | | | | $ | 33,105 |

| Due to director | | | | | 31,447 |

| Due to affiliated company | | | | | 91,609 |

| | | | | | 156,161 |

| | | | | | |

| SHAREHOLDER EQUITY AND DEFICIENCY |

| | | | | | |

| Share Capital | | | | | |

| | HK$1 par value, 10,000 authorized | | | | | |

| | issued and outstanding - 2 shares | | | | | 2 |

| Deficit | | | | | |

| | Beginning of Period | $ | (68,273) | | | |

| | Loss for the Period | | (1,710) | | | (69,983) |

| | | | | | | (69,981) |

| | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDER DEFICIENCY | | | | $ | 86,180 |

| | | | | | |

| | | | | | |

| See accompanying notes to financial statements. | | | | | |

| GLOBAL INTEGRATED MEDIA LIMITED |

| STATEMENT OF OPERATIONS |

| FOR THE EIGHT MONTHS ENDED DECEMBER 31, 2011 |

| (UNAUDITED - PREPARED BY MANAGEMENT) |

| (HONG KONG DOLLARS) |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| REVENUE | | $ | - |

| | | | |

| EXPENSES | | |

| | | | |

| | Bank service charges | | 1,710 |

| | | | |

| | | | |

| NET LOSS FOR THE PERIOD | $ | (1,710) |

| | | | |

| | | | |

| See accompanying notes to financial statements. | | |

| GLOBAL INTEGRATED MEDIA LIMITED |

| STATEMENT OF CASH FLOWS |

| FOR THE EIGHT MONTHS ENDED DECEMBER 31, 2011 |

| (UNAUDITED - PREPARED BY MANAGEMENT) |

| (HONG KONG DOLLARS) |

| | | |

| | | |

| | | |

| CASH USED IN OPERATING ACTIVITIES | | |

| | | |

| Net loss for the period | $ | (1,710) |

| | | |

| NET CASH USED IN OPERATING ACTIVITIES | | (1,710) |

| | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | |

| | | |

| Proceeds from affiliated company | | 82,066 |

| | | |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | 82,066 |

| | | |

| INCREASE IN CASH DURING THE PERIOD | | 80,356 |

| | | |

| CASH AT BEGINNING OF THE PERIOD | | 5,824 |

| | | |

| CASH AT END OF THE PERIOD | $ | 86,180 |

| | | |

| | | |

| See accompanying notes to financial statements. | | |

GLOBAL INTEGRATED MEDIA LIMITED

Notes to Interim Consolidated Financial Statements as at December 31, 2011

Note 1. Description of Business and Summary of Significant Accounting Policies

Organization

Global Integrated Media Limited (the “Company”) provides international contract payment and bank depository services to affiliated companies.

Interim Period Financial Statements

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) for interim financial information and with the Securities and Exchange Commission’s instructions. Accordingly, they do not include all the information and footnotes required by GAAP for complete financial statements. The results of operations reflect interim adjustments, all of which are of a normal recurring nature and, in the opinion of management, are necessary for a fair presentation of the results for such interim period. The results reported in these interim consolidated financial statements should not be regarded as necessarily indicative of results that may be expected for the entire year. Certain information and note disclosure normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to the Securities and Exchange Commission’s rules and regulations. These unaudited interim consolidated financial statements should be read in conjunction with the audited financial statements included in the Company’s Directors’ Report and Financial Statements for the year ended March 31, 2011.

Going Concern

The Company’s consolidated financial statements have been prepared in conformity GAAP applicable to a going concern that contemplates the realization of assets and liquidation of liabilities in the normal course of business. The operations of the Company depend upon the financial support of its directors and affiliated companies. However, the Company cannot assure that additional funds will be available to the Company when required or on terms acceptable to the Company, if at all. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Such limitations could have a material adverse effect on the Company’s business, financial condition, or operations, and these consolidated financial statements do not include any adjustment that could result. Failure to obtain sufficient additional funding would necessitate the Company to reduce or limit its operating activities or even discontinue operations.

Cash

Cash consists of checking accounts held at financial institutions in Hong Kong.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the fiscal year. The Company makes estimates for, among other items, useful lives for depreciation and amortization, determination of future cash flows associated with impairment testing for long-lived assets, determination of the fair value of stock options and warrants, determining fair values of assets acquired and liabilities assumed in business combinations, valuation allowance for deferred tax assets, allowances for doubtful accounts, and potential income tax assessments and other contingencies. The Company bases its estimates on historical experience, current conditions, and other assumptions that it believes to be reasonable under the circumstances. Actual results could differ from those estimates and assumptions.

Financial Instruments

The Company has the following financial instruments: cash, accounts payable and accrued expenses, due to director and due to affiliated company. The carrying value of these financial instruments approximates their fair value due to their liquidity or their short-term nature.

Note 2. Related-Party Transactions

During the eight months ended December 31, 2011, the Company made payments of HK$147,828 on behalf of an affiliated company and received deposits of HK$297,205. The unpaid balance of HK$91,609 is included in due to affiliated company.

Note 3. Share Capital

Common Stock

The Company is authorized to issue 10,000 shares of stock, par value of HK$1.00 each.

There were two shares issued and outstanding as of December 31, 2011.

Subsequent to December 31, 2011, the Company issued an additional 9,998 shares of stock at par value.

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

4th Floor Aguirre Building, Arnaiz Ave. Makati City

Philippines

AUDITED FINANCIAL STATEMENTS

For the period covered January 1, 2010 to December 31, 2010

AND

AUDITOR’S REPORT

OBERLEE J. SUBIDA

Certified Public Accountant

| Office: 3215 Limay St., Bo. Obrero, | Tel. Nos. (0917) 805-7147 |

| Tondo, Manila | 496-8359 |

| |

REPORT OF INDEPENDENT AUDITOR

TO ACCOMPANY INCOME TAX RETURN

The Board Of Directors

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

I have audited the financial statements of ASIAN INTEGRATED MEDIA (PHILS.) LTD. as of December 31, 2010, on which I have rendered the attached report.

In compliance with Revenue Regulation V-20, I am stating the following:

| | 1. | The taxes paid and accrued by the corporation for the year ended December 31, 2010 are shown in the Financial Statements for the year then ended. |

| | 2. | I am not related by consanguinity or affinity to any of the principal officers or trustees of the corporation. |

Very truly yours,

/s/ Oberlee J. Subida

OBERLEE J. SUBIDA

Certified Public Accountant

CPA Cert. No. 086415

BOA Registration No. 1177

PTR No6826797 dated

March 17, 2011 Pasig City

BIR Accreditation No. AN:07-002622-1-2009

Dated February 17, 2009

March 20, 2011

[Endorsement Guarantee Apr 06 2011 by Teller 1]

OBERLEE J. SUBIDA

Certified Public Accountant

| Office: 3215 Limay St., Bo. Obrero, | Tel. Nos. (0917) 805-7147 |

| Tondo, Manila | 502-77-43 |

| |

The Board of Directors

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

Makati City

REPORT OF INDEPENDENT AUDITOR

Report on the Financial Statements

I have audited the accompanying Comparative Financial Statements of ASIAN INTEGRATED MEDIA (PHILS.) LTD. which comprise the balance sheet as of December 31, 2010 and 2009 and the Income Statement, Statement of Changes in Equity and Cash Flow Statement for the year then ended, and notes to financial statements consisting of summary of significant accounting policies and other explanatory notes.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with Philippine Financial Reporting Standards. This responsibility includes designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error, selecting and applying appropriate accounting policies, and making accounting estimates that are reasonable in the circumstances.

Auditors’ Responsibility

My responsibility is to express an opinion on this financial statement based on our audits. I conducted my audits in accordance with the Philippine Standards on Auditing. Those standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes assessing the appropriateness of accounting policies used and reasonableness of accounting estimates made by management as well as evaluating the overall presentation of the financial statements.

I believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of ASIAN INTEGRATED MEDIA (PHILS.) LTD. as at December 31, 2010 and 2009; and the results of its operations and cash flows for the year then ended in accordance with the Philippine Financial Reporting Standards.

/s/ Oberlee J. Subida

OBERLEE J. SUBIDA

Certified Public Accountant

CPA Cert. No. 086415

BOA Registration No. 1177

PTR No6826797 dated

March 17, 2011 Pasig City

BIR Accreditation No. AN:07-002622-1-2009

Dated February 17, 2009

March 20, 2011

[Endorsement Guarantee Apr 06 2011 by Teller 1]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENT OF MANAGEMENT’S RESPONSIBILITY

FOR FINANCIAL STATEMENTS

The management of ASIAN INTEGRATED MEDIA ( PHILS.) LTD. is responsible for all information and representations contained in the financial statements as of December 31, 2010. The financial statements have been prepared in accordance with the Philippine Financial Reporting Standard and reflect amounts that are based on the best estimates and informal judgment of management with an appropriated consideration to materiality.

In this regard, management maintains a system of accounting and reporting which provides for the necessary internal controls to ensure that transactions are properly authorized and recorded, assets are safeguarded against unauthorized use or disposition and liabilities are recognized.

The board of directors reviews the financial statements before such are approved and submitted to the stockholders of the company.

Oberlee J. Subida, the independent auditor appointed by the board of directors, has examined the financial statements of the company in accordance with Philippine Standards on Auditing and has expressed his opinion on the fairness of presentation upon completion of such examination, in the attached report.

/s/ Clarita Jeffery

CLARITA JEFFERY

Resident Agent / President

/s/ Abigiel Doroga

ABIGIEL DOROGA

Corporate Secretary

/s/ Maricel Omanito

MARICEL OMANITO

Corporate Treasurer

[Endorsement Guarantee Apr 06 2011 by Teller 1]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

BALANCE SHEET

| December 31, 2010 | Notes | 2010 | 2009 |

| | | | |

| | | | |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalent | 2, 4 | 8,698,066.52 | 7,329,252.96 |

| Trade and other receivables | 2, 5 | 74,500.00 | 70,000.00 |

| Other current assets | 2, 6 | 0.00 | 0.00 |

| | | 8,772,566.52 | 7,399,252.96 |

| | | | |

| Non-Current Assets | | | |

| Property and equipment | 2, 7 | 162,920.36 | 217,227.14 |

| | | 162,920.36 | 217,227.14 |

| | | | |

| TOTAL ASSETS | | 8,935,486.88 | 7,616,480.10 |

| | | | |

| LIABILITIES AND EQUITY | | | |

| | | | |

| Current Liabilities | | | |

| Trade and other payables | 2, 9, 15 | 8,935,486.88 | 7,616,480.10 |

| | | | |

| Shareholder’s Equity | | | |

| Paid-up Capital | 2, 16 | 0.00 | 0.00 |

| Net Income from Operations | 2, 16 | 0.00 | 0.00 |

| Add: Additional Capital | | 0.00 | 0.00 |

| Less: Prior Period Adjustments | | 0.00 | 0.00 |

| Total Equity | | 0.00 | 0.00 |

| | | | |

| TOTAL LIABILITIES AND EQUITY | | 8,935,486.88 | 7,616,480.10 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

[Endorsement Guarantee Apr 06 2011 by Teller 1]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENT OF INCOME AND EXPENSES

| For the years ended December 31, 2010 | Notes | 2010 | 2009 |

| | | | |

| | | | |

| REVENUES | 2, 10 | 802,000.00 | 817,000.00 |

| | | | |

| COST OF SALES | 2, 11, 12,13 | 726,000.00 | 691,000.00 |

| | | | |

| GROSS PROFIT | | 76,000.00 | 126,000.00 |

| | | | |

| SALES AND ADMINISTRATIVE EXPENSES | 2, 14 | 1,382,181.78 | 106,750.00 |

| | | | |

| INCOME (LOSS) BEFORE TAX | | -1,306,181.78 | 19,250.00 |

| | | | |

| INCOME TAX | 2, 15 | 1,520.00 | 5,775.00 |

| | | | |

| NET INCOME (LOSS) | | -1,307,701.78 | 13,475.00 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

[Endorsement Guarantee Apr 06 2011 by Teller 1]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENT OF COST OF SALES

| For the years ended December 31, 2010 | Notes | 2010 | 2009 |

| | | | |

| | | | |

| BEGINNING BALANCE JANUARY 1, 2009: | 2, 11 | 0.00 | 0.00 |

| | | | |

| PURCHASES | 2, 12 | 726,000.00 | 691,000.00 |

| | | | |

| FREIGHT-IN | 2, 13 | 0.00 | 0.00 |

| | | | |

| TOTAL GOODS AVAILABLE FOR SALE | | 726,000.00 | 691,000.00 |

| | | | |

| | | | |

| LESS: IMPAIRMENT LOSS | | | |

| LESS: ENDING INVENTORY DEC. 31, 2009 | 6 | 0.00 | 0.00 |

| | | | |

| COST OF SALES | | 726,000.00 | 691,000.00 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENT OF CASH FLOWS

| For the years ended December 31, 2010 | Notes | 2010 | 2009 |

| | | | |

| | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income (loss) | | -1,307,701.78 | 13,475.00 |

| Depreciation | 2, 7 | 54,306.78 | 54,306.78 |

| Dividend | | 0.00 | 0.00 |

| | | -1,253,395.00 | 67,781.78 |

| | | | |

| Decrease (Increase) In Current Assets | | | |

| Trade and other receivables | 2, 5 | -4,500.00 | 0.00 |

| Other current assets | 2,6 | 0.00 | 0.00 |

| | | -4,500.00 | 0.00 |

| | | | |

| Increase (Decrease) In Current Liabilities | | | |

| Trade and other payable | 2, 9, 15 | 2,626,708.56 | -505,566.33 |

| | | | |

| NET CASH PROVIDED BY OPERATIONS | | 1,368,813.56 | -437,784.55 |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Property and equipment | 2, 7 | 0.00 | 0.00 |

| | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| | 2, 9 | 0.00 | 0.00 |

| | | | |

| NET INCREASE IN CASH | | 1,368,813.56 | -437,784.55 |

| | | | |

| CASH - Beginning | 2, 4 | 7,329,252.96 | 7,767,037.51 |

| | | | |

| CASH - Ending | 2, 4 | 8,698,066.52 | 7,329,252.96 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENTS OF CHANGES IN CAPITAL

| For the years ended December 31, 2010 | Notes | 2010 | 2009 |

| | | | |

| | | | |

| CAPITAL STOCK | 2, 16 | | |

| | | | |

| Balance - January 1 | | 0.00 | 0.00 |

| | | | |

| Additional | | 0.00 | 0.00 |

| | | | |

| Balance - December 31 | | 0.00 | 0.00 |

| | | | |

| NET INCOME | 2, 16 | | |

| | | | |

| Balance - January 1, 2010 | | 0.00 | 0.00 |

| | | | |

| Net income for the year 2010 | | 0.00 | 0.00 |

| | | | |

| Balance - December 31 | | 0.00 | 0.00 |

| | | | |

| | | | |

| TOTAL CAPITAL | | 0.00 | 0.00 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

Taxes and Licenses

December 31, 2010

| 1 | Barangay Clearance | 250.00 |

| 2 | COMMUNITY Tax Certificate | 132.50 |

| 3 | Mayor’s Permit | 15,156.00 |

| | TOTAL | 15,538.50 |

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

NOTES TO FINANCIAL STATEMENTS

1 COMPANY’S INFORMATION

On December 13, 2007 the company, which is a foreign corporation registered and obtained with SEC a license to transact business in the Philippines. The purpose of the corporation is to pursue in the transaction of its business in the Philippines as marketing representation and promotion. The foreign corporation is organized under the laws of Hong Kong on May 23, 2003 with principal office located at Rm. 2308709 23F Two Chinachem Exc. Square 338 Kings Rd. North Point, Hong Kong.

The company SEC registration number is FS00717229.

The company is also registered with the Bureau of Internal Revenue under Tax Identification 257-591-456-000.

The company’s principal place of business in the Philippines is located at 4/F Aguirre Bldg. 812 Arnaiz Ave. Makati City.

The company’s financial statements were reviewed and authorized for issue by company’s resident agent, Mrs. Claire Jeffery on March 20, 2011.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies that have been used in the preparation of these financial statements are summarized below. The policies have been consistently applied to all years presented, unless otherwise stated.

2.1 Basis of Preparation

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the Philippines as set forth in the Philippine Financial Reporting Standards (PFRS) and under the historical cost convention method.

2.2 The New Accounting Standards

The Philippine Accounting Standards Council (ASC) approved the issuance of new accounting standards which are based on new and revised International Accounting Standards (lAS). The ASC has renounced the standards that it issues to correspond better with the issuance of International Accounting Standards Board (IASB). The new standards, now name Philippine Accounting Standards (PAS) are effective for the periods beginning on or after January 01, 2005 and the company adopted the following PAS that became effective and which are relevant to the company as follows:

PAS 1 Presentation of Financial Statements

PAS 7 Cash Flow Statement

PAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

PAS 12 Income Taxes

PAS 16 Property, Plant and Equipment

PAS 18 Revenue

PAS 33 Earnings Per Share

PAS 36 Impairment of Assets

PAS 40 Investment Property

2.3 Revenue and Cost Recognition

Revenue is recognized to the extent that it is probable that economic benefits will flow to the company and the revenue can be reliably measured. The following specific recognition criteria must also be met before revenue is recognized:

a) Sales - Revenue is recognized when ownership of goods had been transferred from the seller to the buyer.

b) Interest - Revenue is recognized as the interest accrues (taking into account the effectivity yield on the assets).

Cost and expenses are recognized in the income statement upon utilization of the service or at the date they are incurred.

2.4 Financial Assets

Financial assets include cash and cash equivalent and receivables. These are re-evaluated at every reporting date at which date a choice of classification or accounting treatment is available, subject to compliance with specific provisions of applicable accounting standards.

Cash and cash equivalents are defined as cash on hand, demand deposits and short-term, highly liquid investment readily convertible to known amounts of cash.

Receivables are financial assets with fixed or determinable payments. These arise when the company provides money, goods or service directly to a debtor-customer with no intention of trading the receivables. These are included in current assets, except for those maturing greater than 12 months after the balance sheet date which are classified as non-current assets.

Receivables are stated in the amount expected to be realized. No allowances for doubtful accounts are provided to take care of the possible losses, which may be incurred in the collection of all receivables. The receivables are reviewed and all can be collected.

2.5 Property and Equipment

These are tangible items that are held for use to supply goods or services or for administrative purposes which are expected to be used for more than one accounting period.

The company’s property and equipment are stated at cost less accumulated depreciation and amortization and any impairment in value.

The cost of an asset comprises its acquisition cost and directly attributable costs of bringing the asset to working condition for its intended use.

Depreciation and amortization are computed on the straight-line basis over the estimated useful lives of the assets as follows:

| | Number of Years |

| | |

| Office equipment | 5 |

| Office furniture | 5 |

Depreciating an item begins when property, plant and equipment is available for use and to continue depreciating an item until it is derecognized, even if in the period the item is idle.

The depreciation methods and useful lives are reviewed periodically to ensure that the method and periods of depreciation are consistent with the expected pattern of the economic benefits from items of property and equipment.

Minor repairs and maintenance are charged to expense as incurred while major additions and betterments are capitalized to property account.

The carrying amount of a part of an item of property, plant, and equipment is derecognized if that part has been replaced and included in the cost of the replacement in the carrying amount of the item.

An item of property and equipment is derecognized upon disposal or when no future economic benefits are expected to arise from the continued use of the asset. Any gain or loss arising on derecognition of the asset (calculated as the difference between the net disposal proceeds and the carrying amount of the item) is included in the income statement in the year the item is derecognized.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount.

2.6 Investment Property

Investment property, which consists of parcel of land, is held for long-term capital appreciation. Any gain or loss resulting from the sale of the investment property is immediately recognized in the income statement.

2.7 Financial Liabilities

Financial liabilities, which are presented as Trade and Other Payable in the balance sheet are recognized when the company becomes a party to the contractual agreements of the instrument.

Trade and Other Payables are recognized initially at their nominal value and subsequently measured at amortized cost less settlement payments.

Financial liabilities that are due and payable within the 12 months period from the balance sheet date are classified under current liabilities while those which are due and payable beyond 12 months from balance sheet date are treated as non-current liabilities.

Financial liabilities are derecognized from the balance sheet only when the obligations are extinguished either through discharge, cancellation or expiration.

2.9 Income Taxes

Current tax assets or liabilities comprise those claims from, or obligations to, fiscal authorities relating to the current or prior reporting period, that are uncollected or unpaid at the balance sheet date. They are calculated based on the taxable profit for the year in accordance with the tax rates and tax laws applicable to the fiscal periods to which they relate.

Under the present income tax laws, corporation is subject to the income tax which is applied to the net taxable income or the minimum corporate income tax which is applied to the gross profit whichever is higher.

2.10 Impairment of Assets

An assessment is made at the end of each balance sheet date on whether there is any indication of impairment of an asset, or whether there is any indication that an impairment loss previously recognized as an asset in prior years may no longer exist or may have decreased. If any such indication exists, the assets recoverable amount is calculated at the higher of the assets value in use or net selling price.

An impairment loss is recognized for the amount by which the carrying amount of the asset exceeds its recoverable amount, which is the higher of an asset’s net selling price and value in use. An impairment loss is charged to operations in the period in which it arises.

This year, the company incurred impairment of its merchandise due to rust and obsolescence, thus it renders such goods to be of less value. The said goods were being held as stocks way back 10 years ago.

3 SIGNIFICANT ACCOUNTING ESTIMATES

The estimates and assumptions used in the financial statements are based upon management’s evaluation of relevant facts and circumstances of the company’s financial statements. Actual results could differ from those estimates. The following are the relevant estimates performed by management on its December 31, 2010 and 2009 financial statements:

3.1 Useful Lives of Property and Equipment

The company estimates the useful lives of property and equipment based on the period over which the assets are expected to be available for use. The estimated useful lives of property and equipment are reviewed periodically and are updated if expectations differ from previous estimates due to physical wear and tear, technical or commercial obsolescence and legal or other limits on the use of the assets. In addition, estimation of the useful lives of property and equipment is based on collective assessment of industry practice, internal technical evaluation and experience with similar assets. It is possible however, that future results of operations could be materially affected by changes in estimates brought about by change in factors mentioned above. A reduction in the estimated useful lives of the property and equipment would increase recorded operating expenses and decrease non-current assets.

3.2 Allowance for Impairment of Trade Receivables and Other Current Assets

Allowance is made for specific and groups of accounts, where objective evidence of impairment exists. The company evaluates these accounts based on available facts and circumstances, including, but not limited to, the length of the company’s relationship with the customers, the customers’ current credit status based on third party information, average age of accounts, collection experience and historical loss experience.

4 CASH AND CASH EQUIVALENTS

Cash and cash equivalents include the following as of December 31:

| | 2010 | 2009 |

| Petty cash fund | 0.00 | 0.00 |

| Cash on hand and in bank | 8,698,066.52 | 7,329,252.96 |

| | 8,698,066.52 | 7,329,252.96 |

5 TRADE AND OTHER RECEIVABLES

This includes the following as of December 31:

| | 2010 | 2009 |

| Advances to employees | 70,000.60 | 70,000.00 |

| Advances from others | 0.00 | 0.00 |

| Accounts receivable | 4,500.00 | 0.00 |

| | 74,500.00 | 70,000.00 |

6 OTHER CURRENT ASSETS

Other current assets include the following as of December 31:

| | 2010 | 2009 |

| Scrap Materials | 0.00 | 0.00 |

| Accessories | 0.00 | 0.00 |

| Automobile Spareparts | 0.00 | 0.00 |

| Input tax | 0.00 | 0.00 |

| Deferred income tax | 0.00 | 0.00 |

| | 0.00 | 0.00 |

7 PROPERTY AND EQUIPMENT

Breakdown of this account as of December 31 are shown below:

| | 2010 | 2009 |

| Transportation equipment | 0.00 | 0.00 |

| Office equipment | 216,623.21 | 216,623.21 |

| Office furniture | 54,910.71 | 54,910.71 |

| Land | 0.00 | 0.00 |

| Total Depreciable Assets | 271,533.92 | 271,533.92 |

| Accumulated depreciation | -108,613.56 | -54,306.78 |

| | 162,920.36 | 217,227.14 |

8 TRADE AND OTHER PAYABLES

Details of this account are shown below:

| | 2010 | 2009 |

| Output vat payable | 0.00 | 690.00 |

| SSS, Philhealth, Pagibig and ECC payable | 0.00 | 0.00 |

| Accounts payable | 6,656,943.56 | 6,656,943.56 |

| Withholding tax payable - COMPENSATION | 0.00 | 0.00 |

| Income tax payable | 1,520.00 | 3,000.00 |

| Income after tax, Due to Head Office – Hong Kong | 1,550,477.77 | 229,300.99 |

| Due from officer | 726,545.55 | 726,545.55 |

| Loans Payable | 0.00 | 0.00 |

| | 8,935,486.88 | 7,616,480.10 |

9 REVENUES

Revenues are composed of the following:

| | 2010 | 2009 |

| Sales - LOCAL | 802,000.00 | 817,000.00 |

| | 802,000.00 | 817,000.00 |

10 BEGINNING INVENTORY - JAN. 1

Breakdown of beginning inventory is as follows:

| | 2010 | 2009 |

| Purchases-LOCAL | 0.00 | 0.00 |

| Purchases -Foreign | 0.00 | 0.00 |

| Total | 0.00 | 0.00 |

11 PURCHASES

Breakdown of Purchases is as follows:

| | 2010 | 2009 |

| Purchases-LOCAL | 726,000.00 | 691,000.00 |

| Purchases -Foreign | 0.00 | 0.00 |

| Total | 726,000.00 | 691,000.00 |

12 FREIGHT-IN

Breakdown of Freight-in is as follows:

| | 2010 | 2009 |

| Trucking | 0.00 | 0.00 |

| Arrastre/wharfage | 0.00 | 0.00 |

| Demurrage | 0.00 | 0.00 |

| Freight F.O.B. | 0.00 | 0.00 |

| Brokerage Fee | 0.00 | 0.00 |

| Storage | 0.00 | 0.00 |

| Handling | 0.00 | 0.00 |

| Customs Duties | 0.00 | 0.00 |

| | 0.00 | 0.00 |

13 SALES AND ADMINISTRATIVE EXPENSES

Details of Sales and Administrative Expenses are shown below:

| | 2010 | 2009 |

| Salaries and wages | 1,254,750.00 | 52,443.22 |

| Employees benefits | 0.00 | 0.00 |

| Shipping and handling expenses | 0.00 | 0.00 |

| Postage, telephone and fax | 0.00 | 0.00 |

| Repairs and Maintenance | 0.00 | 0.00 |

| Depreciation | 54,306.78 | 54,306.78 |

| Taxes and licenses | 15,538.60 | 0.00 |

| Exhibits and promotions | 0.00 | 0.00 |

| SSS, Philheatth and Pagibig expenses | 57,586.40 | 0.00 |

| Representation and Entertainment | 0.00 | 0.00 |

| Research and development | 0.00 | 0.00 |

| Christmas and anniversary expenses | 0.00 | 0.00 |

| Insurance | 0.00 | 0.00 |

| Transportation expenses | 0.00 | 0.00 |

| Rental | 0.00 | 0.00 |

| Gasoline Oil and Fuel | 0.00 | 0.00 |

| Miscellaneous fee | 0.00 | 0.00 |

| Office supplies | 0.00 | 0.00 |

| Security services | 0.00 | 0.00 |

| Commission | 0.00 | 0.00 |

| | 1,382,181.78 | 106,750.00 |

1 INCOME TAX AND INCOME TAX PAYABLE

The company is not yet subject to the Minimum Corporate Income Tax (MCIT) which is computed at 2% of gross income or the Regular Corporate Income Tax (RCIT) whichever is higher as defined in the national internal revenue code.

As provided by the tax regulation, net operating loss of the business can be carried (NOLCO) over to the next three consecutive taxable years immediately following the year of such loss.

1 RCIT (Regular Corporate Income Tax)

This was computed as follows:

| | 2010 | 2009 |

| Taxable net income | | |

| Net income before tax | -1,306,181.78 | 19,250.00 |

| | | |

| RCIT at 30% | 0.00 | 5,775.00 |

1 MCIT (Minimum Corporate Income Tax)

This was computed as follows:

| | 2010 | 2009 |

| Gross profit | 76,000.00 | 126,000.00 |

| | | |

| MCIT at 2% | 1,520.00 | 0.00 |

1 Income Tax Due and Payable

This was computed as follows:

| | 2010 | 2009 |

| RCIT | 0.00 | 5,775.00 |

| MCIT | 1,520.00 | 0.00 |

| | | |

| Income tax due whichever is higher | 1,520.00 | 5,775.00 |

| | | |

| Payments of income tax in the 1st, 2nd, 3rd | | |

| quarters of the year and payments if tax | | |

| return was amended | | 2,775.00 |

| | 1,520.00 | 3,000.00 |

2 EQUITY

2 Capital Stock

The details of Capital Stock are as follows:

| | Shares |

| | 2010 | 2009 | 2010 | 2009 |

| Par value | | | 0.00 | 0.00 |

| | | | | |

| Authorized | 0 | | 0.00 | 0.00 |

| Subscribed | | | | |

| Balance at the beginning of the year | 0 | | 0.00 | 0.00 |

| Additional subscription | | | 0.00 | 0.00 |

| Balance at the end of the year | | | 0.00 | 0.00 |

| | | | | |

| Subscription receivable | | | | |

| Balance at the beginning of the year | | | 0.00 | 0.00 |

| Additional payments | | | 0.00 | 0.00 |

| Balance at the end of the year | | | 0.00 | 0.00 |

| | | | | |

| Paid up capital | | | 0.00 | 0.00 |

2 Retained Earnings

Compositions of Retained Earnings are as follows:

| | 2010 | 2009 |

| Balance at the beginning of the year | 0.00 | 0.00 |

| Net income (loss) during the year | 0.00 | 0.00 |

| Dividend | 0.00 | 0.00 |

| | 0.00 | 0.00 |

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

Philippines

AUDITED FINANCIAL STATEMENTS

For the period covered January 1, 2011 to December 31, 2011

AND

AUDITOR’S REPORT

OBERLEE J. SUBIDA

Certified Public Accountant

| Office: 3215 Limay St., Bo. Obrero, | Tel. Nos. (0917) 805-7147 |

| Tondo, Manila | 502-77-43 |

| |

SUPPLEMENTAL STATEMENT OF INDEPENDENT AUDITORS

The Board of Directors:

We have examined the financial statements of ASIAN INTEGRATED MEDIA (PHILS.) LTD. for the year ended December 31, 2011, on which we have rendered the attached report on March 30, 2012.

In compliance with SEC Rule 68, we are stating the Company has a total of two (2) stockholders owning 100 or more shares as of December 31, 2011, as also disclosed in the Notes to Financial Statements.

/s/ Oberlee J. Subida

OBERLEE J. SUBIDA

Certified Public Accountant

CPA Cert. No. 086415

BOA Registration No. 1177

PTR No. 7593667 dated

January 25, 2012 Pasig City

BIR Accreditation No. AN:07-000348-1-2012

Dated February 17, 2012

March 30, 2012

[Bureau of Internal Revenue April 16, 2012]

OBERLEE J. SUBIDA

Certified Public Accountant

| Office: 3215 Limay St., Bo. Obrero, | Tel. Nos. (0917) 805-7147 |

| Tondo, Manila | 502-77-43 |

| |

The Board of Directors

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

Makati City

REPORT OF INDEPENDENT AUDITOR

Report on the Financial Statements

I have audited the accompanying Comparative Financial Statements of ASIAN INTEGRATED MEDIA (PHILS.) LTD. which comprise the balance sheet as of December 31, 2011 and 2010 and the Income Statement, Statement of Changes in Equity and Cash Flow Statement for the year then ended, and notes to financial statements consisting of summary of significant accounting policies and other explanatory notes.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with Philippine Financial Reporting Standards. This responsibility includes; designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditors’ Responsibility

My responsibility is to express an opinion on this financial statement based on our audits. I conducted my audits in accordance with the Philippine Standards on Auditing. Those standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes assessing the appropriateness of accounting policies used and reasonableness of accounting estimates made by management as well as evaluating the overall presentation of the financial statements. I believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In my opinion, the financial statement referred to above present fairly, in all material respect, the financial position of ASIAN INTEGRATED MEDIA (PHILS.) LTD. as at December 31, 2011 and 2010; and the results of its operations and cash flows for the year then ended in accordance with the Philippine Financial Reporting Standards.

/s/ Oberlee J. Subida

OBERLEE J. SUBIDA

Certified Public Accountant

CPA Cert. No. 086415

BOA Registration No. 1177

PTR No. 7593667 dated

January 25, 2012 Pasig City

BIR Accreditation No. AN:07-000348-1-2012

Dated February 17, 2012

March 30, 2012

[Bureau of Internal Revenue April 16, 2012]

OBERLEE J. SUBIDA

Certified Public Accountant

| Office: 3215 Limay St., Bo. Obrero, | Tel. Nos. (0917) 805-7147 |

| Tondo, Manila | 502-77-43 |

| |

REPORT OF INDEPENDENT AUDITOR

TO ACCOMPANY INCOME TAX RETURN

The Board Of Directors

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

I have audited the financial statements of ASIAN INTEGRATED MEDIA (PHILS.) LTD. as of December 31, 2011, on which I have rendered the attached report.

In compliance with Revenue Regulation V-20, I am stating the following:

| | 1. | The taxes paid and accrued by the corporation for the year ended December 31, 2011 are shown in the Financial Statements for the year then ended. |

| | 2. | I am not related by consanguinity or affinity to any of the principal officers or trustees of the corporation. |

Very truly yours,

/s/ Oberlee J. Subida

OBERLEE J. SUBIDA

Certified Public Accountant

CPA Cert. No. 086415

BOA Registration No. 1177

PTR No. 7593667 dated

January 25, 2012 Pasig City

BIR Accreditation No. AN:07-000348-1-2012

Dated February 17, 2012

March 30, 2012

[Bureau of Internal Revenue April 16, 2012]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

BALANCE SHEET

| December 31, 2011 | Notes | 2011 | 2010 |

| | | | |

| | | | |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalent | 2, 4 | 603,267.51 | 8,698,066.52 |

| Trade and other receivables | 2, 5 | 74,500.00 | 74,500.00 |

| Other current assets | 2, 6 | 139,029.93 | 0.00 |

| | | 816,797.44 | 8,772,566.52 |

| | | | |

| Non-Current Assets | | | |

| Property and equipment | 2, 7 | 538,023.07 | 162,920.36 |

| | | | |

| | | 538,023.07 | 162,920.36 |

| | | | |

| TOTAL ASSETS | | 1,354,820.51 | 8,935,486.88 |

| | | | |

| LIABILITIES AND EQUITY | | | |

| | | | |

| Current Liabilities | | | |

| Trade and other payables | 2, 9, 15 | 1,354,820.51 | 8,935,486.88 |

| | | | |

| Shareholder’s Equity | | | |

| Paid-up Capital | 2, 16 | 0.00 | 0.00 |

| Net Income from Operations | 2, 16 | 0.00 | 0.00 |

| Add: Additional Capital | | 0.00 | 0.00 |

| Less: Prior Period Adjustments | | 0.00 | 0.00 |

| Total Equity | | 0.00 | 0.00 |

| | | | |

| TOTAL LIABILITIES AND EQUITY | | 1,354,820.51 | 8,935,486.88 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

[Bureau of Internal Revenue April 16, 2012]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENT OF INCOME AND EXPENSES

| For the years ended December 31, 2011 | Notes | 2011 | 2010 |

| | | | |

| | | | |

| REVENUES | 2, 10 | 4,027,148.92 | 802,000.00 |

| | | | |

| COST OF SALES | 2, 11, 12, 13 | 2,495, 573.68 | 726,000.00 |

| | | | |

| GROSS PROFIT | | 1,531,575.24 | 76,000.00 |

| | | | |

| SALES AND ADMINISTRATIVE EXPENSES | 2, 14 | 1,364,964.70 | 1,382,181 78 |

| | | | |

| INCOME (LOSS) BEFORE TAX | | 166,610.54 | -1,306,181.78 |

| | | | |

| INCOME TAX | 2, 15 | 49,983.16 | 1,520.00 |

| | | | |

| NET INCOME (LOSS) | | 116,627.38 | -1,307,701.78 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

[Bureau of Internal Revenue April 16, 2012]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENT OF COST OF SALES

| For the years ended December 31, 2011 | Notes | 2011 | 2010 |

| | | | |

| | | | |

| BEGINNING BALANCE JANUARY 1 | 2, 11 | 0.00 | 0.00 |

| PURCHASES | 2, 12 | 1,024,783.66 | 726,000.00 |

| DIRECT CHARGES - LABOR AND OVERHEAD | 2, 13 | 1,470,790.02 | 0.00 |

| | | | |

| TOTAL GOODS AVAILABLE FOR SALE | | 2,495,573.68 | 726,000.00 |

| | | | |

| | | | |

| | 6 | 0.00 | 0.00 |

| LESS: ENDING INVENTORY DEC. 31 | | 0.00 | 0.00 |

| | | | |

| | | | |

| COST OF SALES | | 2,495,573.68 | 726,000.00 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

[Bureau of Internal Revenue April 16, 2012]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

STATEMENT OF CASH FLOWS

| For the years ended December 31, 2011 | Notes | 2011 | 2010 |

| | | | |

| | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income (loss) | | 116,627.38 | -1,307,701.78 |

| Depreciation | 2, 7 | 19,864.88 | 54,306.78 |

| Dividend | | 0.00 | 0.00 |

| | | 136,492.26 | -1,253,395.00 |

| | | | |

| Decrease (Increase) In Current Assets | | | |

| Trade and other receivables | 2, 5 | 0.00 | -4,500.00 |

| Other current assets | 2,6 | -139,029.93 | 0.00 |

| | | -139,029.93 | -4,500.00 |

| | | | |

| Increase (Decrease) In Current Liabilities | | | |

| Trade and other payable | 2, 9 , 15 | -7,697,293.75 | 2,626,708.56 |

| | | | |

| NET CASH PROVIDED BY OPERATIONS | | -7,699,831.42 | 1,368,813.56 |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Property and equipment | 2, 7 | -394,967.59 | 0.00 |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| | 2, 9 | 0.00 | 0.00 |

| NET INCREASE IN CASH | | -8,094,799.01 | 1,368,813.56 |

| | | | |

| CASH - Beginning | | 8,698,066.52 | 7,329,252.96 |

| | | | |

| | | | |

| CASH - Ending | 2, 4 | 603,267.51 | 8,698,066.52 |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | | |

[Bureau of Internal Revenue April 16, 2012]

ASIAN INTEGRATED MEDIA (PHILS.) LTD.

NOTES TO FINANCIAL STATEMENTS

1 COMPANY’S INFORMATION

On December 13, 2007 the company, which is a foreign corporation registered and obtained with SEC a license to transact business in the Philippines. The purpose of the corporation is to pursue in the transaction of its business in the Philippines as marketing representation and promotion. The foreign corporation is organized under the laws of Hong Kong on May 23, 2003 with principal office located at Rm. 2308709 23F Two Chinachem Exc. Square 338 Kings Rd. North Point, Hong Kong.

The company SEC registration number is FS00717229.

The company is also registered with the Bureau of Internal Revenue under Tax Identification 257-591-456-000.

The company’s principal place of business in the Philippines is located at 4/F Aguirre Bldg. 812 Arnaiz Ave. Makati City.

The company’s financial statements were reviewed and authorized for issue by company’s resident agent, Mrs. Claire Jeffery on March 30, 2012.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies that have been used in the preparation of these financial statements are summarized below. The policies have been consistently applied to all years presented, unless otherwise stated.

2.1 Basis of Preparation

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the Philippines as set forth in the Philippine Financial Reporting Standards (PFRS) and under the historical cost convention method.

2.2 The New Accounting Standards

The Philippine Accounting Standards Council (ASC) approved the issuance of new accounting standards which are based on new and revised International Accounting Standards (IAS). The ASC has renounced the standards that it issues to correspond better with the issuance of International Accounting Standards Board (IASB). The new standards, now name Philippine Accounting Standards (PAS) are effective for the periods beginning on or after January 01, 2005 and the company adopted the following PAS that became effective and which are relevant to the company as follows:

[Bureau of Internal Revenue April 16, 2012]

PAS 1 Presentation of Financial Statements

PAS 7 Cash Flow Statement

PAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

PAS 12 Income Taxes

PAS 16 Property, Plant and Equipment

PAS 18 Revenue

PAS 33 Earnings Per Share

PAS 36 Impairment of Assets

PAS 40 Investment Property

2.3 Revenue and Cost Recognition

Revenue is recognized to the extent that it is probable that economic benefits will flow to the company and the revenue can be reliably measured. The following specific recognition criteria must also be met before revenue is recognized:

a) Sales - Revenue is recognized when ownership of goods had been transferred from the seller to the buyer.

b) Interest - Revenue is recognized as the interest accrues (taking into account the effectivity yield on the assets).

Cost and expenses are recognized in the income statement upon utilization of the service or at the date they are incurred.

2.4 Financial Assets

Financial assets include cash and cash equivalent and receivables. These are re-evaluated at every reporting date at which date a choice of classification or accounting treatment is available, subject to compliance with specific provisions of applicable accounting standards.

Cash and cash equivalents are defined as cash on hand, demand deposits and short-term, highly liquid investment readily convertible to known amounts of cash.

Receivables are financial assets with fixed or determinable payments. These arise when the company provides money, goods or service directly to a debtor-customer with no intention of trading the receivables. These are included in current assets, except for those maturing greater than 12 months after the balance sheet date which are classified as non-current assets.

Receivables are stated in the amount expected to be realized. No allowances for doubtful accounts are provided to take care of the possible losses, which may be incurred in the collection of all receivables. The receivables are reviewed and all can be collected.

[Bureau of Internal Revenue April 16, 2012]

2.5 Property and Equipment

These are tangible items that are held for use to supply goods or services or for administrative purposes which are expected to be used for more than one accounting period.

The company’s property and equipment are stated at cost less accumulated depreciation and amortization and any impairment in value.

The cost of an asset comprises its acquisition cost and directly attributable costs of bringing the asset to working condition for its intended use.

Depreciation and amortization are computed on the straight-line basis over the estimated useful lives of the assets as follows:

| | Number of Years |

| | |

| Office equipment | 5 |

| Office furniture | 5 |

Depreciating an item begins when property, plant and equipment is available for use and to continue depreciating an item until it is derecognized, even if in the period the item is idle.

The depreciation methods and useful lives are reviewed periodically to ensure that the method and periods of depreciation are consistent with the expected pattern of the economic benefits from items of property and equipment.

Minor repairs and maintenance are charged to expense as incurred while major additions and betterments are capitalized to property account.

The carrying amount of a part of an item of property, plant, and equipment is derecognized if that part has been replaced and included in the cost of the replacement in the carrying amount of the item.

An item of property and equipment is derecognized upon disposal or when no future economic benefits are expected to arise from the continued use of the asset. Any gain or loss arising on de-recognition of the asset (calculated as the difference between the net disposal proceeds and the carrying amount of the item) is included in the income statement in the year the item is derecognized.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount.

[Bureau of Internal Revenue April 16, 2012]

2.6 Investment Property

Investment property, which consists of parcel of land, is held for long-term capital appreciation. Any gain or loss resulting from the sale of the investment property is immediately recognized in the income statement.

2.7 Financial Liabilities

Financial liabilities, which are presented as Trade and Other Payable in the balance sheet are recognized when the company becomes a party to the contractual agreements of the instrument.

Trade and Other Payables are recognized initially at their nominal value and subsequently measured at amortized cost less settlement payments.

Financial liabilities that are due and payable within the 12 months period from the balance sheet date are classified under current liabilities while those which are due and payable beyond 12 months from balance sheet date are treated as non-current liabilities.

Financial liabilities are derecognized from the balance sheet only when the obligations are extinguished either through discharge, cancellation or expiration.

2.9 Income Taxes

Current tax assets or liabilities comprise those claims from, or obligations to, fiscal authorities relating to the current or prior reporting period, that are uncollected or unpaid at the balance sheet date. They are calculated based on the taxable profit for the year in accordance with the tax rates and tax laws applicable to the fiscal periods to which they relate.

Under the present income tax laws, corporation is subject to the income tax which is applied to the net taxable income or the minimum corporate income tax which is applied to the gross profit whichever is higher.

2.10 Impairment of Assets

An assessment is made at the end of each balance sheet date on whether there is any indication of impairment of an asset, or whether there is any indication that an impairment loss previously recognized as an asset in prior years may no longer exist or may have decreased. If any such indication exists, the assets recoverable amount is calculated at the higher of the assets value in use or net selling price.

An impairment loss is recognized for the amount by which the carrying amount of the asset exceeds its recoverable amount, which is the higher of an asset’s net selling price and value in use. An impairment loss is charged to operations in the period in which it arises.

[Bureau of Internal Revenue April 16, 2012]

This year, the company incurred impairment of its merchandise due to rust and obsolescence, thus it renders such goods to be of less value. The said goods were being held as stocks way back 10 years ago.

3 SIGNIFICANT ACCOUNTING ESTIMATES

The estimates and assumptions used in the financial statements are based upon management’s evaluation of relevant facts and circumstances of the company’s financial statements. Actual results could differ from those estimates. The following are the relevant estimates performed by management on its December 31, 2011 and 2010 financial statements:

3.1 Useful Lives of Property and Equipment

The company estimates the useful lives of property and equipment based on the period over which the assets are expected to be available for use. The estimated useful lives of property and equipment are reviewed periodically and are updated if expectations differ from previous estimates due to physical wear and tear, technical or commercial obsolescence and legal or other limits on the use of the assets. In addition, estimation of the useful lives of property and equipment is based on collective assessment of industry practice, internal technical evaluation and experience with similar assets. It is possible however, that future results of operations could be materially affected by changes in estimates brought about by change in factors mentioned above. A reduction in the estimated useful lives of the property and equipment would increase recorded operating expenses and decrease non-current assets.

3.2 Allowance for Impairment of Trade Receivables and Other Current Assets

Allowance is made for specific and groups of accounts, where objective evidence of impairment exists. The company evaluates these accounts based on available facts and circumstances, including, but not limited to, the length of the company’s relationship with the customers, the customers’ current credit status based on third party information, average age of accounts, collection experience and historical loss experience.

4 CASH AND CASH EQUIVALENTS

Cash and cash equivalents include the following as of December 31:

| | 2011 | 2010 |

| Petty cash fund | 0.00 | 0.00 |

| Cash on hand and in bank | 603,267.51 | 8,698,066.52 |

| | 603,267.51 | 8,698,066.52 |

[Bureau of Internal Revenue April 16, 2012]

5 TRADE AND OTHER RECEIVABLES

This includes the following as of December 31:

| | 2011 | 2010 |

| Advances to employees | 70,000.00 | 70,000.00 |

| Advances from Others | 0.00 | 0.00 |

| Accounts receivable | 4,500.00 | 4,500.00 |

| | 74,500.00 | 74,500.00 |

6 OTHER CURRENT ASSETS

Other current assets include the following as of December 31:

| | 2011 | 2010 |

| Other Asset | 95,781.93 | 0.00 |

| Creditable Income Tax | 43,248.00 | |

| | 139,029.93 | 0.00 |

7 PROPERTY AND EQUIPMENT

Breakdown of this account as of December 31 is shown below:

| | 2011 | 2010 |

| Transportation equipment | 0.00 | 0.00 |

| Office equipment | 611,590.80 | 216,623.21 |

| Office furniture | 54,910.71 | 54,910.71 |

| Land | 0.00 | 0.00 |

| Total Depreciable Assets | 666,501.51 | 271,533.92 |

| Accumulated depreciation | -128,478.44 | -108,613.56 |

| | 538,023.07 | 162,920.36 |

8 TRADE AND OTHER PAYABLES

Details of this account are shown below:

| | 2011 | 2010 |

| Accounts Payable-others | 28,716.84 | 0.00 |

| SSS, Philhealth, Pagibig and ECC payable | 145,437.50 | 0.00 |

| Accounts payable | 1,133,151.77 | 6,656,943.56 |

| Withholding tax payable - expanded | 1,731.24 | 0.00 |

| Income tax payable | 45,783.16 | 1,520.00 |

| Net Income after tax, Due to Head Office –Hong Kong | 0.00 | 1,550,477.77 |

| Due from officer | 0.00 | 726,545.55 |

| Loans Payable | 0.00 | 0.00 |

| | 1,354,820.51 | 8,935,486.88 |

[Bureau of Internal Revenue April 16, 2012]

9 REVENUES

Revenues is composed of the following:

| | 2011 | 2010 |

| | | |

| Sales - Local | 4,027,148.92 | 802,000.00 |

| | 4,027,148.92 | 802,000.00 |

10 BEGINNING INVENTORY - JAN. 1

Breakdown of beginning inventory is as follows:

| | 2011 | 2010 |

| Purchases-Local | 0.00 | 0.00 |

| Purchases -Foreign | 1,470,790.02 | 0.00 |

| Total | 1,470,790.02 | 0.00 |

11 PURCHASES

Breakdown of Purchases is as follows:

| | 2011 | 2010 |

| Purchases-Goods | 1,024,783.66 | 726,000.00 |

| Purchases-Services | 1,470,790.02 | 0.00 |

| | 2,495,573.68 | 726,000.00 |

12 FREIGHT-IN

Breakdown of Freight-in is as follows:

| | 2011 | 2010 |

| Trucking | 0.00 | 0.00 |

| Arrastre/wharfage | 0.00 | 0.00 |

| Demurrage | 0.00 | 0.00 |

| Freight F.O.B. | 0.00 | 0.00 |

| Brokerage Fee | 0.00 | 0.00 |

| Storage | 0.00 | 0.00 |

| Handling | 0.00 | 0.00 |

| Customs Duties | 0.00 | 0.00 |

| | 0.00 | 0.00 |

[Bureau of Internal Revenue April 16, 2012]

13 SALES AND ADMINISTRATIVE EXPENSES

Details of Sales and Administrative Expenses are shown below:

| | 2011 | 2010 |

| Salaries and wages | 389,462.85 | 1,254,750.00 |

| Employees benefits | 95,588.98 | 0.00 |

| Shipping and handling expenses | 0.00 | 0.00 |

| Communication expense | 26,850.69 | 0.00 |

| Repairs and Maintenance | 60,802.65 | 0.00 |

| Depreciation | 19,864.88 | 54,306.78 |

| Taxes and licenses | 16,691.00 | 15,538.60 |

| Dues and subscription | 19,010.31 | 0.00 |

| SSS, Philhealth and Pagibig expenses | 0.00 | 57,586.40 |

| Marketing expense | 127,124.22 | 0.00 |

| Light and water | 105,634.45 | 0.00 |

| Christmas and anniversary expenses | 0.00 | 0.00 |

| Insurance | 16,326.19 | 0.00 |

| Transportation expenses | 0.00 | 0.00 |

| Rental | 454,588.80 | 0.00 |

| Gasoline Oil and Fuel | 10,028.81 | 0.00 |

| Miscellaneous fee | 0.00 | 0.00 |

| Office supplies | 18,190.87 | 0.00 |

| Security services | 0.00 | 0.00 |

| Bank service charge | 4,800.00 | 0.00 |

| | 1,364,964.70 | 1,382,181.78 |

1 INCOME TAX AND INCOME TAX PAYABLE

The company is not yet subject to the Minimum Corporate Income Tax (MCIT) which is computed at 2% of gross income Regular Corporate Income Tax (RCIT) whichever is higher as defined in the national internal revenue code.

As provided by the tax regulation, net operating loss of the business can be carried (NOLCO) over to the next three consecutive taxable years immediately following the year of such loss.

1 RCIT (Regular Corporate Income Tax)

This was computed as follows:

| | 2011 | 2010 |

| Taxable net income | | |

| Net income before tax | 166,610.54 | -1,306,181.78 |

| | | |

| RCIT at 30% | 49,983.16 | 0.00 |

[Bureau of Internal Revenue April 16, 2012]

1 MCIT (Minimum Corporate Income Tax)

This was computed as follows:

| | 2011 | 2010 |

| Gross profit | 1,531,575.24 | 76,000.00 |

| | | |

| MCIT at 2% | 30,631.50 | 1,520.00 |

1 Income Tax Due and Payable

This is computed as follows:

| | 2011 | 2010 |

| RCIT | 49,983.16 | 0.00 |

| MCIT | 30,631.50 | 1,520.00 |

| | | |

| Income tax due whichever is higher | 49,983.16 | 1,520.00 |

| | | |

| Payments of income tax in the 1st, 2nd, 3rd | | |

| quarters of the year and payments if tax | | |

| return was amended | 4,200.00 | |

| | 45,783.16 | 1,520.00 |

[Bureau of Internal Revenue April 16, 2012]

| Intelligent Communication Enterprise Corporation | | | | | | | | | | | | | | | | | | | | |

| Pro Forma Condensed Consolidated Balance Sheets | | | | | | | | | | | | | | | | | | | | |

| as at December 31, 2010 | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Historical | | | Adjust to | | | Adjust | | | Adjusted | | | Adjusted | | | Historical | | | Pro Forma | | Pro Forma |

| | | | GIM | | | US GAAP | | | Purchase | | | Historical | | | Historical | | | Intelligent | | | Adjustments | | Consolidated |

| | | | | | | | | | Accounting | | GIM | | | GIM | | | | | | | | |

| | | | PH | | | PH | | | PH | | | PH | | | USD | | | USD | | | USD | | USD |

| Assets | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Cash | PH | 8,802,958 | | PH | | PH | | PH | 8,802,958 | | $ | 201,533 | | $ | 66,249 | | | | | 267,782 |

| | Other current assets | | 93,695 | | | | | | | | | 93,695 | | | 2,145 | | | 502,500 | | | | | 504,645 |

| | Advances to directors | | | | | | | | | | | - | | | - | | | - | | | | | - |

| | | | 8,896,653 | | | | | | | | | 8,896,653 | | | 203,678 | | | 568,749 | | | | | 772,427 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Property and equipment, net | | 162,920 | | | | | | | | | 162,920 | | | 3,730 | | | 21,643 | | | | | 25,373 |

| Purchased intangibles | | - | | | | | a | 58,834,339 | | | 58,834,339 | | | 1,346,940 | | | 3,499,999 | | | | | 4,846,939 |

| Assets of discontinued operations | | - | | | | | | | | | - | | | - | | | 2,435,492 | | | | | 2,435,492 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | 9,059,573 | | | | | | | | | 67,893,912 | | | 1,554,348 | | | 6,525,883 | | | | | 8,080,231 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities and Stockholders' Deficiency | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | | | | | | | | | | |

| | Accounts payable and accrued expenses | 9,314,613 | | | | | | | | | 9,314,613 | | | 213,247 | | | 886,285 | | | | | 1,099,532 |

| | Notes payable and advances | | - | | | | | | | | | - | | | - | | | 490,158 | | | | | 490,158 |

| | Liabilities of discontinued operations | - | | | | | | | | | - | | | - | | | 2,131,452 | | | | | 2,131,452 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 9,314,613 | | | | | | | | | 9,314,613 | | | 213,247 | | | 3,507,895 | | | | | 3,721,142 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Stockholders' Equity (Deficiency) | | (255,041) | | | | | a | 58,834,339 | | | 58,579,299 | | | 1,341,101 | | | 3,017,988 | | | | | 4,359,089 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | PH | 9,059,573 | | | | | | | | PH | 67,893,912 | | $ | 1,554,348 | | $ | 6,525,883 | | | | | 8,080,231 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| See accompanying notes to unaudited pro forma condensed consolidated financial statements. | | | | | | | | | | | |

| Intelligent Communication Enterprise Corporation | | | | | | | | | | | | | | | | | | |

| Pro Forma Condensed Consolidated Statements of Operations | | | | | | | | | | | | | | | | | | |

| For the year ended December 31, 2010 | | | | | | | | | | | | | | | | | | |

| (unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Historical | | | Adjust to | | | Adjust | | | Adjusted | | | Adjusted | | | Historical | | | Pro Forma | | | Pro Forma |

| | | | GIM | | | US GAAP | | | Purchase | | | Historical | | | Historical | | | Intelligent | | | Adjustments | | | Consolidated |

| | | | | | | | | | Accounting | | | GIM | | | GIM | | | | | | | | | |

| | | | PH | | | PH | | | PH | | | PH | | | USD | | | USD | | | USD | | | USD |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | PH | 802,000 | | PH | | | PH | | | PH | 802,000 | | $ | 17,728 | | $ | 80,267 | | $ | | | $ | 97,995 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of Sales | | 726,000 | | | | | | | | | 726,000 | | | 16,048 | | | - | | | | | | 16,048 |

| | | | 76,000 | | | | | | | | | 76,000 | | | 1,680 | | | 80,267 | | | | | | 81,947 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | 1,382,182 | | | | b | | 19,611,446 | | | 20,993,628 | | | 464,050 | | | 5,490,348 | | | | | | 5,954,398 |

| Impairment loss | | - | | | | | | | | | - | | | - | | | 3,175,856 | | | | | | 3,175,856 |

| Other (income) and expenses | | - | | | | | | | | | - | | | - | | | (2,984,466) | | | | | | (2,984,466) |

| | | | 1,382,182 | | | | | | | | | 20,993,628 | | | 464,050 | | | 5,681,738 | | | | | | 6,145,788 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | (1,306,182) | | | | | | | | | (20,917,628) | | | (462,370) | | | (5,601,471) | | | | | | (6,063,841) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (Loss) from discontinued operations | | - | | | | | | | | | - | | | - | | | (1,180,651) | | | | | | (1,180,651) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income taxes | | 1,520 | | | | | | | | | 1,520 | | | 34 | | | - | | | | | | 34 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income (Loss) for the year | PH | (1,307,702) | | | | | | | | PH | (20,919,148) | | $ | (462,404) | | $ | (6,782,122) | | | | | $ | (7,244,492) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss per shares | | | | | | | | | | | | | | | | | | | | | | | |

| | Basic and diluted net loss per share from | | | | | | | | | | | | | | | | | | | | | | | |

| | continuing operations | | | | | | | | | | | | | | | | | (0.01) | | | | | | (0.01) |

| | Basic and diluted net loss per share from | | | | | | | | | | | | | | | | | | | | | | | |

| | discontinued operations | | | | | | | | | | | | | | | | | (0.00) | | | | | | (0.00) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding | | | | | | | | | | | | | | | | | | | | | | | |

| | Basic and diluted | | | | | | | | | | | | | | | | | 605,850,878 | | | | | | 667,322,692 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| See accompanying notes to unaudited pro forma condensed consolidated financial statements. | | | | | | | | | | | | |

Intelligent Communication Enterprise Corporation

Unaudited Pro Forma Consolidated Information

Unaudited Pro Forma Consolidated Balance Sheet as at December 31, 2010

Unaudited Pro Forma Consolidated Statement of Operations for the year ended December 31, 2010

Notes to Unaudited Pro Forma Consolidated Financial Statements

On March 5, 2012, Intelligent Communication Enterprise Corporation (“Intelligent” or the “Company”) completed the requirements for the acquisition of all of the issued and outstanding shares of Global Integrated Media Limited (“GIM”) from a shareholder, Clarita Jeffery (“Jeffery”), in return for 61,471,814 fully paid and nonassessable common shares of the Company with a fair value of $1,383,000.

The pro forma transaction has been recorded as follows:

| Assets acquired | $ 107,445 |

| Purchased intangibles | 1,346,940 |

| Liabilities assumed | (71,385) |

| Common shares issued | $1,383,000 |

The unaudited pro forma condensed consolidated balance sheet is presented combining GIM’s balance sheet as at December 31, 2010, with Intelligent’s balance sheet as at December 31, 2010. The unaudited pro forma condensed consolidated statement of operations is presented combining GIM’s statement of operations for the year ended December 31, 2010, with Intelligent’s statement of operations for the year ended December 31, 2010, assuming the transaction occurred on January 1, 2010. The outstanding shares and weighted average shares include the issuance of the 61,471,814 common shares issued in conjunction with the transaction.

The unaudited pro forma condensed consolidated financial data and the notes thereto should be read in conjunction with Intelligent’s historical financial statements. The unaudited pro forma condensed consolidated financial data is based upon certain assumptions and estimates of management that are subject to change. The unaudited pro forma condensed consolidated financial data is presented for illustrative purposes only and is not necessarily indicative of any future results of operations or the results that might have occurred if the exchange transaction had actually occurred on the indicated date.

Basis of Presentation

The unaudited pro forma condensed consolidated balance sheet is presented combining GIM’s balance sheet as at December 31, 2010, with Intelligent’s balance sheet as at December 31, 2010. The unaudited pro forma condensed consolidated statement of operations is presented combining GIM’s statement of operations for the year ended December 31, 2010, with Intelligent’s statement of operations for the year ended December 31, 2010, assuming the transaction occurred on January 1, 2010.

The outstanding common shares and pro forma net loss per share is computed using the weighted average number of shares outstanding of Intelligent for the period presented, plus the shares to be issued pursuant to the acquisition of GIM.

a. To record the purchased intangibles related to the acquisition of GIM.

b. To record depreciation of software assets and amortization of purchased intangibles.

| Intelligent Communication Enterprise Corporation | | | | | | | | | | | | | | | | |

| Pro Forma Condensed Consolidated Balance Sheets | | | | | | | | | | | | | | | | |

| as at December 31, 2011 | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Historical | | | Adjust to | | | Adjust | | | Adjusted | | | Adjusted | | | Historical | | Pro Forma | | Pro Forma |

| | | | GIM | | | US GAAP | | | Purchase | | | Historical | | | Historical | | | Intelligent | | Adjustments | | Consolidated |