As filed with the Securities and Exchange Commission

on April 4, 2024

Registration No. 33-

(Investment Company Act Registration No. 811-02737)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

| | |

| Pre-Effective Amendment No. | | [ ] |

| |

| Post-Effective Amendment No. | | [ ] |

Fidelity Summer Street Trust

(Exact Name of Registrant as Specified in Charter)

Registrant’s Telephone Number (617) 563-7000

245 Summer St., Boston, MA 02210

(Address Of Principal Executive Offices)

Margaret Carey, Secretary and Chief Legal Officer

245 Summer Street

Boston, MA 02210

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933.

The Registrant has registered an indefinite amount of securities under the Securities Act of 1933 pursuant to Section 24(f) under the Investment Company Act of 1940; accordingly, no fee is payable herewith because of reliance upon Section 24(f).

It is proposed that this filing will become effective on May 4, 2024, pursuant to Rule 488.

FIDELITY ® GLOBAL HIGH INCOME FUND

A SERIES OF

FIDELITY SUMMER STREET TRUST

245 SUMMER STREET, BOSTON, MASSACHUSETTS 02210

1-800-544-8544 (RETAIL CLASS)

1-877-208-0098 (ADVISOR CLASSES)

To the Shareholders of Fidelity® Global High Income Fund:

Enclosed is important information concerning your investment in Fidelity Global High Income Fund. We wish to inform you that the Board of Trustees (the Board) of Fidelity Summer Street Trust (the Trust), after careful consideration, has approved an Agreement and Plan of Reorganization providing for the transfer of all of the assets of Fidelity Global High Income Fund to Fidelity High Income Fund, a series of the Trust, that has the same investment objective and somewhat similar investment strategies, in exchange solely for corresponding shares of beneficial interest of Fidelity High Income Fund and the assumption by Fidelity High Income Fund of Fidelity® Global High Income Fund’s liabilities, in complete liquidation of Fidelity® Global High Income Fund.

The attached combined Prospectus/Information Statement describes the Reorganization in greater detail and contains important information about Fidelity® High income Fund. The Board believes that this Reorganization will benefit shareholders.

Following the close of business on September 13, 2024, Fidelity Global High Income Fund will be reorganized into Fidelity High Income Fund.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE TRANSACTION WILL NOT REQUIRE ANY ACTION ON YOUR PART. Shareholder approval of the merger is not required because the differences between Fidelity Global High Income Fund and Fidelity High Income Fund do not mandate shareholder approval under Rule 17a-8(a)(3) under the 1940 Act. You will automatically receive shares of Fidelity High Income Fund in exchange for your shares of Fidelity Global High Income Fund as of the closing date. If, after reviewing the information contained in the enclosed Prospectus/Information Statement, you do not wish to receive shares of the Fidelity High Income Fund pursuant to the Reorganization, you may redeem your shares of the Fidelity Global High Income Fund at any time prior to the close of business on September 13, 2024. Keep in mind that any such redemption may have tax consequences and you should consult your tax advisor. If you have questions, you may contact us at 1-800-544-8544 (Retail Class) or 1-877-208-0098 (Advisor Classes). If you invest through another financial institution, such as a brokerage firm, please contact your financial institution should you have any questions.

| | |

| | By order of the Board of Trustees, |

| | MARGARET CAREY, |

| | Secretary |

May 20, 2024

FIDELITY ® GLOBAL HIGH INCOME FUND

A SERIES OF

FIDELITY SUMMER STREET TRUST

FIDELITY® HIGH INCOME FUND

A SERIES OF

FIDELITY SUMMER STREET TRUST

245 SUMMER STREET, BOSTON, MASSACHUSETTS 02210

1-800-544-8544 (RETAIL CLASS)

1-877-208-0098 (ADVISOR CLASSES)

INFORMATION STATEMENT AND PROSPECTUS

MAY 20, 2024

This combined Information Statement and Prospectus (Information Statement) is furnished to shareholders of Fidelity® Global High Income Fund, a series of Fidelity Summer Street Trust (the trust), in connection with a separate Agreement and Plan of Reorganization (the Agreement) for Fidelity Global High Income Fund that has been approved by the Board of Trustees (the Board) of the trust.

As more fully described in the Information Statement, the transaction contemplated by the Agreement is referred to as the Reorganization. When the Reorganization occurs, each shareholder of Fidelity Global High Income Fund will become a shareholder of Fidelity® High Income Fund. Fidelity Global High Income Fund will transfer all of its assets to Fidelity High Income Fund in exchange solely for shares of beneficial interest of Fidelity High Income Fund and the assumption by Fidelity High Income Fund of Fidelity Global High Income Fund’s liabilities in complete liquidation of the fund. The total value of your fund holdings will not change as a result of the Reorganization. The Reorganization is currently scheduled to take place as of the close of business of the New York Stock Exchange (the NYSE) on September 13, 2024, or such other time and date as the parties may agree (the Closing Date).

Fidelity High Income Fund (together with Fidelity Global High Income Fund, the funds), a high income fund, is a diversified series of Fidelity Summer Street Trust, an open-end management investment company registered with the Securities and Exchange Commission (the SEC). Fidelity High Income Fund seeks a high level of current income. Growth of capital may also be considered. Fidelity High Income Fund seeks to achieve its investment objective by normally investing primarily in income-producing debt securities, preferred stocks, and convertible securities, with an emphasis on lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds).

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS INFORMATION STATEMENT AND PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Information Statement sets forth concisely the information about the Reorganization and Fidelity High Income Fund that shareholders should know. Please read it carefully and keep it for future reference.

The following documents have been filed with the SEC and are incorporated into this Information Statement by reference, which means they are part of this Information Statement for legal purposes:

| | (i) | the Statement of Additional Information dated May 20, 2024, relating to this Information Statement; |

| | (ii) | the Prospectus for Fidelity High Income Fund dated June 29, 2023, as supplemented March 1, 2024, relating to Fidelity High Income Fund shares, a retail class of Fidelity High Income Fund, a copy of which, if applicable, accompanies this Information Statement; |

| | (iii) | the Prospectus for Fidelity High Income Fund, relating to Class A, Class M, Class C, Class I and Class Z shares and Fidelity Global High Income Fund, relating to Class A, Class M, Class C, and Class I, dated June 29, 2023, as revised November 8, 2023 and as supplemented March 1, 2024, a copy of which, if applicable, accompanies this Information Statement; |

| | (iv) | the Statement of Additional Information for Fidelity High Income Fund dated June 29, 2023, as supplemented March 1, 2024, relating to Fidelity High Income Fund shares, a retail class of Fidelity High Income Fund; |

| | (v) | the Statement of Additional Information for Fidelity High Income Fund, relating to Class A, Class M, Class C, Class I and Class Z shares and Fidelity Global High Income Fund, relating to Class A, Class M, Class C, and Class I, dated June 29, 2023, as supplemented March 1, 2024; |

| | (vi) | the Annual Report for Fidelity High Income Fund for the fiscal year ended April 30, 2023; |

| | (vii) | the Semiannual Report for Fidelity High Income Fund for the fiscal period ended October 31, 2023; |

| | (viii) | the Prospectus for Fidelity Global High Income Fund dated June 29, 2023, as supplemented March 1, 2024, relating to Fidelity Global High Income Fund shares, a retail class of Fidelity Global High Income Fund; |

| | (ix) | the Statement of Additional Information for Fidelity Global High Income Fund dated June 29, 2023, as supplemented March 1, 2024, relating to Fidelity Global High Income Fund shares, a retail class of Fidelity Global High Income Fund; |

2

| | (x) | the Annual Report for Fidelity Global High Income Fund for the fiscal year ended April 30, 2023; and |

| | (xi) | the Semiannual Report for Fidelity Global High Income Fund for the fiscal period ended October 31, 2023. |

You can obtain copies of the funds’ current Prospectuses, Statements of Additional Information, or annual or semiannual reports without charge by contacting the trust at Fidelity Distributors Company LLC (FDC), 900 Salem Street, Smithfield, Rhode Island 02917, by calling 1-800-544-8544 (Retail Class) or 1-877-208-0098 (Advisor Classes), or by logging on to www.fidelity.com (Retail Class) or institutional.fidelity.com (Advisor Classes).

The trust is subject to the informational requirements of the Securities and Exchange Act of 1934, as amended. Accordingly, the Trust must file proxy material, reports, and other information with the SEC. You can review and copy such information at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington D.C. 20549, the SEC’s Northeast Regional Office, 200 Vesey Street, Suite 400, New York, NY 10281-1022, and the SEC’s Midwest Regional Office, 175 W. Jackson Blvd., Suite 1450, Chicago, IL 60604. Such information is also available from the EDGAR database on the SEC’s web site at http://www.sec.gov. You can also obtain copies of such information, after paying a duplicating fee, by sending a request by e-mail to publicinfo@sec.gov or by writing the SEC’s Public Reference Room, Office of Consumer Affairs and Information Services, Washington, DC 20549. You may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-202-551-8090.

An investment in the funds is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the funds.

3

TABLE OF CONTENTS

4

SYNOPSIS

The following is a summary of certain information contained elsewhere in this Information Statement, in the Agreement, and/or in the Prospectuses and Statements of Additional Information of Fidelity Global High Income Fund and Fidelity High Income Fund, which are incorporated herein by reference. Shareholders should read the entire Information Statement and the Prospectus of Fidelity High Income Fund carefully for more complete information.

What is involved in the Reorganization?

As more fully described in “The Transaction” below, the Board of the trust has approved the Reorganization of Fidelity Global High Income Fund into Fidelity High Income Fund, a series of the trust. You are receiving this Information Statement because you are a shareholder of Fidelity Global High Income Fund and will be impacted by the Reorganization.

When the Reorganization occurs, each shareholder of Fidelity Global High Income Fund will become a shareholder of Fidelity High Income Fund instead. Fidelity Global High Income Fund will transfer all of its assets to Fidelity High Income Fund in exchange solely for shares of beneficial interest of Fidelity High Income Fund and the assumption by Fidelity High Income Fund of Fidelity Global High Income Fund’s liabilities in complete liquidation of the fund. Each shareholder of Fidelity Global High Income Fund will receive shares of the corresponding class of Fidelity High Income Fund. The Reorganization is currently scheduled to take place as of the close of business of the NYSE on the Closing Date.

For more information, please refer to the section entitled “The Transaction – Agreement and Plan of Reorganization.”

Has the Board of Trustees approved the Reorganization?

Yes. The fund’s Board of Trustees has carefully reviewed and approved the Agreement and the Reorganization.

What am I being asked to vote on?

Because Rule 17a-8 under the 1940 Act does not require shareholder approval under these conditions, we are not asking you for a proxy and you are requested not to send us one.

What are the reasons for the Reorganization?

The Board of Trustees considered the following factors, among others, in determining to approve the Agreement:

| | • | | The Reorganization will permit Fidelity Global High Income Fund shareholders to pursue the same investment objective and somewhat similar investment strategies in a larger fund with better long-term viability and lower expenses. |

| | • | | Fidelity Global High Income Fund shareholders are expected to benefit from a lower management fee rate for each class, with projected rates expected to decrease by 12 to 13 basis points, depending on the class, due to the benefit of Fidelity High Income Fund’s lower fee schedule and larger asset base, which drives a greater discount under the funds’ unified fee structure for classes not operating at the maximum rate. |

| | • | | The Agreement contains provisions designed to protect shareholders from dilution. |

| | • | | The Reorganization will qualify as a tax-free reorganization for federal income tax purposes. |

For more information, please refer to the section entitled “The Transaction – Reasons for the Reorganization.”

How will you determine the number of shares of Fidelity High Income Fund that I will receive?

Although the number of shares you own will most likely change, the total value of your holdings will not change as a result of the Reorganization. As provided in the Agreement, Fidelity Global High Income Fund will distribute shares of Fidelity High Income Fund to its shareholders so that each shareholder will receive the number of full and fractional shares of Fidelity High Income Fund equal in value to the net asset value of shares of Fidelity Global High Income Fund held by such shareholder on the Closing Date.

For more information, please refer to the section entitled “The Transaction – Agreement and Plan of Reorganization.”

What class of shares of Fidelity High Income Fund will I receive?

Holders of Fidelity Global High Income Fund (Retail Class), Class A, Class M, Class C and Class I shares of Fidelity Global High Income Fund will receive Fidelity High Income Fund (Retail Class), Class A, Class M, Class C and Class I shares of Fidelity High Income Fund, respectively.

Is the Reorganization considered a taxable event for federal income tax purposes?

No. Each fund will receive an opinion of counsel that the Reorganization will not result in any gain or loss for federal income tax purposes to either fund or to the shareholders of either fund, except that a fund may recognize gain or loss with respect to assets (if any) that are subject to “mark-to-market” tax accounting. In addition, any portfolio adjustments to the funds may result in net realized gains which may need to be distributed in the form of taxable distributions to shareholders before and/or after the date of the Reorganization.

5

For more information, please refer to the section entitled “The Transaction – Federal Income Tax Considerations.”

How do the funds’ investment objectives, strategies, policies, and limitations compare?

The funds have the same investment objective. Each fund seeks a high level of current income. Growth of capital may also be considered. Fidelity Global High Income Fund’s investment objective is non-fundamental and does not require shareholder approval to change. Fidelity High Income Fund’s investment object is fundamental and may only be changed with shareholder approval.

Although the funds have somewhat similar principal investment strategies, there are some differences of which you should be aware. The following compares the principal investment strategies of Fidelity Global High Income Fund and Fidelity High Income Fund:

| | |

Fidelity Global High Income Fund | | Fidelity High Income Fund |

| |

| The Adviser normally invests the fund’s assets primarily in income-producing debt securities, preferred stocks, and convertible securities, with an emphasis on lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds), of U.S. and non-U.S. issuers, including emerging markets. Many lower-quality debt securities are subject to legal or contractual restrictions limiting the Adviser’s ability to resell securities to the general public. The Adviser may also invest the fund’s assets in non-income producing securities, including defaulted securities and common stocks. The Adviser may invest in companies whose financial condition is troubled or uncertain and that may be involved in bankruptcy proceedings, reorganization or financial restructurings. The proportions of the fund’s assets invested in each type of security vary based on the Adviser’s interpretation of economic conditions and underlying security values. Emerging markets include countries that have an emerging stock market as defined by MSCI, countries or markets with low- to middle-income economies as classified by the World Bank, and other countries or markets that the Adviser identifies as having similar emerging markets characteristics. Emerging markets tend to have relatively low gross national product per capita compared to the world’s major economies and may have the potential for rapid economic growth. | | The Adviser normally invests the fund’s assets primarily in income-producing debt securities, preferred stocks, and convertible securities, with an emphasis on lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds). Many lower-quality debt securities are subject to legal or contractual restrictions limiting the Adviser’s ability to resell the securities to the general public. The Adviser may also invest the fund’s assets in non-income producing securities, including defaulted securities and common stocks. The Adviser currently intends to limit common stocks to 10% of the fund’s total assets. The Adviser may invest in companies whose financial condition is troubled or uncertain and that may be involved in bankruptcy proceedings, reorganizations, or financial restructurings. |

| |

| No corresponding principal strategy. | | The Adviser uses the credit quality distribution of an index representing the overall high yield bond market as a guide in structuring the fund’s credit quality composition. As of April 30, 2023, the Adviser used the ICE BofA US High Yield Constrained Index to represent the overall high yield bond market. |

| |

| The Adviser normally allocates the fund’s investments across different countries and regions. | | The Adviser may invest the fund’s assets in securities of foreign issuers in addition to securities of domestic issuers. |

| |

| Although the fund will invest in securities of issuers located throughout the world, it may invest a significant portion of its assets in securities of U.S. issuers. | | No corresponding principal strategy. |

| |

| The Adviser allocates the fund’s assets among four markets: U.S. high yield; emerging markets debt; European high yield; and Asian high yield. The fund’s neutral mix, or the benchmark for its combination of investments in each category over time, is 60% U.S. high yield, 20% emerging markets debt, 15% European high yield, and 5% Asian high yield. The Adviser periodically reviews, and may change, the fund’s neutral weightings. | | No corresponding principal strategy. |

| |

| The Adviser may adjust the fund’s allocation among markets within the following ranges: U.S. high yield (40%-80%); emerging markets debt (5%-35%); European high yield (0%-30%); and Asian high yield (0%-10%). | | No corresponding principal strategy. |

6

| | |

Fidelity Global High Income Fund | | Fidelity High Income Fund |

| |

| In buying and selling securities for the fund, the Adviser generally analyzes the issuer of a security using fundamental factors and evaluates each security’s current price relative to its estimated long-term value. | | In buying and selling securities for the fund, the Adviser relies on fundamental analysis of each issuer and its potential for success in light of its current financial condition, its industry position, and economic and market conditions. Factors considered include a security’s structural features and current price compared to its long-term value, and the earnings potential, credit standing, and management of the security’s issuer. |

For a comparison of the principal risks associated with the funds’ principal investment strategies, please refer to the section entitled “Comparison of Principal Risk Factors.”

Although the funds have substantially similar fundamental and non-fundamental investment policies and limitations, there are some differences of which you should be aware. The following summarizes the investment policy and limitation differences between Fidelity Global High Income Fund and Fidelity High Income Fund:

| | |

Fidelity Global High Income Fund | | Fidelity High Income Fund |

| |

| Fundamental policies and limitations (subject to change only by shareholder vote) | | Fundamental policies and limitations (subject to change only by shareholder vote) |

| |

| No corresponding policy. | | Pooled Funds. The fund may, notwithstanding any other fundamental investment policy or limitation, invest all of its assets in the securities of a single open-end management investment company managed by FMR or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund. |

| |

| Non-Fundamental Policies and Limitations | | Non-Fundamental Policies and Limitations |

| |

| No corresponding policy. | | Pooled Funds. The fund does not currently intend to invest all of its assets in the securities of a single open-end management investment company managed by FMR or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund. |

Except as noted above, the funds have the same fundamental and non-fundamental investment policies and limitations.

For more information about the funds’ investment objectives, strategies, policies, and limitations, please refer to the “Investment Details” section of the funds’ Prospectuses, and to the “Investment Policies and Limitations” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Following the Reorganization, the combined fund will be managed in accordance with the investment objective, strategies, policies, and limitations of Fidelity High Income Fund.

How do the funds’ management and distribution arrangements compare?

The following summarizes the management and distribution arrangements of Fidelity Global High Income Fund and Fidelity High Income Fund:

Management of the Funds

The principal business address of FMR, each fund’s investment adviser, is 245 Summer Street, Boston, Massachusetts 02210.

As the manager, FMR has overall responsibility for directing the funds’ investments and handling their business affairs. As of December 31, 2023, the Adviser had approximately $3.9 trillion in discretionary assets under management, and approximately $4.9 trillion when combined with all of its affiliates’ assets under management.

FMR Investment Management (UK) Limited (FMR UK), at 1 St. Martin’s Le Grand, London, EC1A 4AS, United Kingdom; Fidelity Management & Research (Hong Kong) Limited (FMR H.K.), at Floor 19, 41 Connaught Road Central, Hong Kong; and Fidelity Management & Research (Japan) Limited (FMR Japan), at Kamiyacho Prime Place, 1-17, Toranomon-4-Chome, Minato-ku, Tokyo, Japan are sub-advisers to each fund. As of December 31, 2023, FMR UK had approximately $14.6 billion in discretionary assets under management. As of December 31, 2023, FMR H.K. had approximately $24.4 billion in discretionary assets under management. As of March 31, 2023, FMR Japan had approximately $2.9 billion in discretionary assets under management. FMR UK, FMR H.K., and FMR Japan may provide investment research and advice on issuers based outside the United States and may also provide investment advisory services for each fund.

FIL Investment Advisors (FIA), at Pembroke Hall, 42 Crow Lane, Pembroke HM19, Bermuda, and FIL Investment Advisors (UK) Limited (FIA(UK)), at Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP, United Kingdom, are sub-advisers to Fidelity Global High Income Fund. As of December 31, 2023, FIA had approximately $9.0 billion in discretionary assets under management. As of December 31, 2023,

7

FIA(UK) had approximately $7.3 billion in discretionary assets under management. Currently, FIA and FIA (UK) have day-to-day responsibility for choosing certain types of investments for Fidelity Global High Income Fund.

FMR is expected to continue serving as manager, and FMR UK, FMR H.K, and FMR Japan are expected to continue serving as sub-advisers of the combined fund after the Reorganization.

James Durance is Co-Portfolio Manager of Fidelity Global High Income Fund, which he has managed since 2019. Since joining Fidelity International in 2013, Mr. Durance has worked as a senior credit analyst and portfolio manager.

Timothy Gill is Co-Portfolio Manager of Fidelity Global High Income Fund, which he has managed since 2019. He also manages other funds. Since joining Fidelity Investments in 2000, Mr. Gill has worked as an assistant portfolio manager and portfolio manager.

Alexandre Karam is Co-Portfolio Manager of Fidelity Global High Income Fund, which he has managed since 2019. He also manages other funds. Since joining Fidelity Investments in 2016, Mr. Karam has worked as a research analyst and portfolio manager.

Harley Lank is Co-Portfolio Manager of Fidelity Global High Income Fund, which he has managed since 2011. He also manages other funds. Since joining Fidelity Investments in 1996, Mr. Lank has worked as a research analyst and portfolio manager.

Nader Nazmi is Co-Portfolio Manager of Fidelity Global High Income Fund, which he has managed since 2020. He also manages other funds. Since joining Fidelity Investments in 2020, Mr. Nazmi has worked as a research analyst and portfolio manager. Prior to joining the firm, Mr. Nazmi served as a sovereign analyst and macro strategist on the emerging markets debt team at Wellington Management from 2016 to 2020.

Terrence Pang is Co-Portfolio Manager of Fidelity Global High Income Fund, which he has managed since 2020. Mr. Pang joined Fidelity International in 2013 and is part of the portfolio management team managing Asian High Yield and China High Yield Funds. Prior to joining the portfolio management team in January 2020, Mr. Pang has worked as a Credit Analyst working closely with Portfolio Managers, Traders & other Analysts, and as an assistant portfolio manager.

Tae Ho Ryu is Co-Portfolio Manager of Fidelity Global High Income Fund, which he has managed since 2020. Mr. Ryu joined Fidelity International in 2010 and is part of the portfolio management team managing Asian High Yield and China High Yield funds. Before becoming a portfolio manager in January 2020, Mr. Ryu has worked as an analyst and assistant portfolio manager for Fidelity International. Before working in Fidelity International, Mr. Ryu was a Fixed Income Trader at Deutsche Asset Management based in Seoul for over 3 years.

Jared Beckerman is Co-Portfolio Manager of Fidelity High Income Fund, which he has managed since 2024. He also manages other funds. Since joining Fidelity Investments in 2012, Mr. Beckerman has worked as a research analyst and portfolio manager.

Benjamin Harrison is Co-Portfolio Manager of Fidelity High Income Fund, which he has managed since 2022. He also manages other funds. Since joining Fidelity Investments in 2009, Mr. Harrison has worked as a managing director of research and business development and portfolio manager.

Alexandre Karam is Co-Portfolio Manager of Fidelity High Income Fund, which he has managed since 2018. He also manages other funds. Since joining Fidelity Investments in 2016, Mr. Karam has worked as a research analyst and portfolio manager.

Mr. Beckerman, Mr. Harrison, and Mr. Karam, who are currently the portfolio managers of Fidelity High Income Fund, are expected to continue to be responsible for portfolio management of the combined fund after the Reorganization.

For information about the compensation of, any other accounts managed by, and any fund shares held by a fund’s portfolio manager(s), please refer to the “Management Contract(s)” section of each fund’s Statements of Additional Information, which are incorporated herein by reference.

Each fund has entered into a management contract with FMR, pursuant to which FMR furnishes investment advisory and other services.

Each class of each fund pays a management fee to the Adviser. The management fee is calculated and paid to the Adviser every month. When determining a class’s management fee, a mandate rate is calculated based on the monthly average net assets of a group of funds advised by FMR within a designated asset class. A discount rate is subtracted from the mandate rate once the fund’s monthly average net assets reach a certain level. The mandate rate and discount rate may vary by class.

The annual management fee rate for each class of shares of each fund is the lesser of (1) the class’s mandate rate reduced by the class’s discount rate (if applicable) or (2) the amount listed below:

| | |

| Fidelity Global High Income Fund |

| Fidelity Global High Income Fund | | 0.83% |

| Fidelity Advisor Global High Income Fund - Class A | | 0.85% |

| Fidelity Advisor Global High Income Fund - Class M | | 0.85% |

| Fidelity Advisor Global High Income Fund - Class C | | 0.85% |

| Fidelity Advisor Global High Income Fund - Class I | | 0.85% |

| | |

| Fidelity High Income Fund |

| Fidelity High Income Fund | | 0.67% |

| Fidelity Advisor High Income Fund - Class A | | 0.71% |

8

| | |

| Fidelity Advisor High Income Fund - Class M | | 0.72% |

| Fidelity Advisor High Income Fund - Class C | | 0.74% |

| Fidelity Advisor High Income Fund - Class I | | 0.76% |

| Fidelity Advisor High Income Fund - Class Z | | 0.61% |

One-twelfth of the management fee rate for a class is applied to the average net assets of the class for the month, giving a dollar amount which is the management fee for the class for that month.

A different management fee rate may be applicable to each class of a fund. The difference between classes is the result of separate arrangements for class-level services and/or waivers of certain expenses. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of a fund’s assets, which do not vary by class.

The basis for the Board of Trustees approving the management contract and sub-advisory agreements for each fund is available in the fund’s semi-annual report for the fiscal period ended October 31, 2023 and will be available in the fund’s annual report for the fiscal period ended April 30, 2024.

The combined fund will retain Fidelity High Income Fund’s management fee structure.

For more information about fund management, please refer to the “Fund Management” section of the funds’ Prospectuses, and to the “Control of Investment Advisers” and “Management Contracts” sections of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Expense Limitation and Reimbursement Arrangements

FMR has contractually agreed to reimburse Class A, Class M, Class C, Class I, and Retail Class of Fidelity Global High Income Fund to the extent that total operating expenses (excluding interest, certain taxes, fees and expenses of the Independent Trustees, proxy and shareholder meeting expenses, extraordinary expenses, and acquired fund fees and expenses (including fees and expenses associated with a wholly owned subsidiary), if any, as well as non-operating expenses such as brokerage commissions and fees and expenses associated with the fund’s securities lending program, if applicable), as a percentage of their respective average net assets, exceed 1.05%, 1.05%, 1.80%, 0.80%, and 0.80% through August 31, 2024 (the Expense Caps).

Distribution of Fund Shares

The principal business address of FDC, each fund’s principal underwriter and distribution agent, is 900 Salem Street, Smithfield, Rhode Island, 02917.

Fidelity Global High Income Fund (Retail Class) and Fidelity High Income Fund (Retail Class) have each adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 (1940 Act) that recognizes that FMR may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of fund shares and/or shareholder support services. A fund’s Distribution and Service Plan does not authorize payments by the fund other than those that are to be made to FMR under the fund’s management contract.

Class A, Class M, Class C, and Class I of Fidelity Global High Income Fund and Fidelity High Income Fund have each adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act.

Class A of each fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act. Under the plan, Class A of each fund is authorized to pay FDC a monthly 12b-1 (distribution) fee as compensation for providing services intended to result in the sale of Class A shares. Class A of each fund may pay this 12b-1 (distribution) fee at an annual rate of 0.15% of its average net assets, or such lesser amount as the Trustees may determine from time to time. Currently, the Trustees have not approved such payments. The Trustees may approve 12b-1 (distribution) fee payments at an annual rate of up to 0.15% of Class A’s average net assets when the Trustees believe that it is in the best interests of Class A shareholders to do so.

In addition, pursuant to each Class A plan, Class A of each fund pays FDC a monthly 12b-1 (service) fee at an annual rate of 0.25% of Class A’s average net assets throughout the month for providing shareholder support services.

Class M of each fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act. Under the plan, Class M of each fund is authorized to pay FDC a monthly 12b-1 (distribution) fee as compensation for providing services intended to result in the sale of Class M shares. Class M of each fund may pay this 12b-1 (distribution) fee at an annual rate of 0.15% of its average net assets, or such lesser amount as the Trustees may determine from time to time. Currently, the Trustees have not approved such payments. The Trustees may approve 12b-1 (distribution) fee payments at an annual rate of up to 0.15% of Class M’s average net assets when the Trustees believe that it is in the best interests of Class M shareholders to do so.

In addition, pursuant to each Class M plan, Class M of each fund pays FDC a monthly 12b-1 (service) fee at an annual rate of 0.25% of Class M’s average net assets throughout the month for providing shareholder support services.

Class C of each fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act. Under the plan, Class C of each fund is authorized to pay FDC a monthly 12b-1 (distribution) fee as compensation for providing services intended to result in the sale of Class C

9

shares. Class C of each fund currently pays FDC a monthly 12b-1 (distribution) fee at an annual rate of 0.75% of its average net assets throughout the month.

In addition, pursuant to each Class C plan, Class C of each fund pays FDC a monthly 12b-1 (service) fee at an annual rate of 0.25% of Class C’s average net assets throughout the month for providing shareholder support services.

Class I of each fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act that recognizes that the Adviser may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of Class I shares and/or shareholder support services. The Adviser, directly or through FDC, may pay significant amounts to intermediaries that provide those services. Currently, the Board of Trustees of each fund has authorized such payments for Class I.

The Distribution and Service Plans for the combined fund will remain unchanged.

For more information about fund distribution, please refer to the “Fund Distribution” section of the funds’ Prospectuses, and to the “Distribution Services” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

How do the funds’ fees and operating expenses compare, and what are the combined fund’s fees and operating expenses estimated to be following the Reorganization?

The following tables allow you to compare the fees and expenses of each fund and to analyze the pro forma estimated fees and expenses of the combined fund.

Annual Fund and Class Operating Expenses

The following tables show the fees and expenses of Fidelity Global High Income Fund and Fidelity High Income Fund for the 12 months ended October 31, 2023 (adjusted to reflect current contractual arrangements), and the pro forma estimated fees and expenses of the combined fund based on the same time period after giving effect to the Reorganization. Sales charges, if applicable, are paid directly to FDC, each fund’s distributor. Annual fund or class operating expenses are paid by each fund or class, as applicable.

As shown below, the Reorganization is expected to result in lower total annual operating expenses for shareholders of Fidelity Global High Income Fund.

Retail Class

Shareholder Fees (paid directly from your investment)

| | | | | | |

| | | Fidelity

Global High Income

Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

Maximum sales charge (load) on purchases

(as a % of offering price) | | None | | None | | None |

Maximum contingent deferred sales charge

(as a % of the lesser of original purchase price or redemption proceeds) | | None | | None | | None |

Annual Class Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | |

| | | Fidelity

Global High Income

Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Management fee | | 0.80%A, B | | 0.67%A, B | | 0.67%A, B |

Distribution and/or Service (12b-1) fees | | None | | None | | None |

Other expenses | | 0.27%B | | 0.03%B | | 0.03%B |

Acquired Fund Fees and Expenses | | 0.00% | | 0.15%D | | 0.14%D |

| | | | | | |

Total annual operating expenses | | 1.07% | | 0.85% | | 0.84% |

Fee waiver and/or expense reimbursement | | 0.27%B, C | | 0.00% | | 0.00% |

| | |

| Total annual operating expenses after fee waiver and/or expense reimbursement | | 0.80% | | 0.85%D | | 0.84%D |

| A | The management fee covers administrative services previously provided under separate services agreements with the fund, for which 0.19% for Fidelity Global High Income Fund (Retail Class) and 0.15% for Fidelity High Income Fund (Retail Class) was previously charged under the services agreements. |

| B | Adjusted to reflect current fees. |

| C | FMR has contractually agreed to reimburse the class of shares of the fund to the extent that total operating expenses (excluding interest, certain taxes, fees and expenses of the Independent Trustees, proxy and shareholder meeting expenses, extraordinary expenses, and acquired fund fees and expenses (including fees and expenses associated with a wholly owned subsidiary), if any, as well as non-operating expenses such as brokerage commissions and fees and expenses |

10

| | associated with the fund’s securities lending program, if applicable), as a percentage of its average net assets, exceed 0.80% (the Expense Cap). If at any time during the current fiscal year expenses for the class of shares of the fund fall below the Expense Cap, FMR reserves the right to recoup through the end of the fiscal year any expenses that were reimbursed during the current fiscal year up to, but not in excess of, the Expense Cap. This arrangement will remain in effect through August 31, 2024. FMR may not terminate this arrangement before the expiration date without the approval of the Board of Trustees and may extend it in its discretion after that date. |

| D | Includes interest expense of certain underlying Fidelity funds. Excluding interest expense of the applicable underlying Fidelity funds, Total annual operating expenses are 0.72% and 0.71% for Retail Class of Fidelity High Income Fund and Fidelity High Income Fund Pro forma combined, respectively. |

Class A

Shareholder Fees (paid directly from your investment)

| | | | | | |

| | | Fidelity

Global High Income

Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Maximum sales charge (load) on purchases

(as a % of offering price) | | 4.00% | | 4.00% | | 4.00% |

| | | |

Maximum contingent deferred sales charge

(as a % of the lesser of original purchase price or redemption proceeds) | | NoneA | | NoneA | | NoneA |

| A | Class A purchases of $1 million or more will not be subject to a front-end sales charge. Such Class A purchases may be subject, upon redemption, to a contingent deferred sales charge (CDSC) of 1.00%. |

Annual Class Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | |

| | | Fidelity

Global High Income

Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| Management fee | | 0.84%A, B | | 0.71%A, B | | 0.71%A, B |

| Distribution and/or Service (12b-1) fees | | 0.25% | | 0.25% | | 0.25% |

| Other expenses | | 0.26%B | | 0.03%B | | 0.03%B |

| Acquired Fund Fees and Expenses | | 0.00% | | 0.15%D | | 0.14%D |

| | | | | | |

| Total annual operating expenses | | 1.35% | | 1.14% | | 1.13% |

| Fee waiver and/or expense reimbursement | | 0.30%B,C | | 0.00% | | 0.00% |

| | |

| Total annual operating expenses after fee waiver and/or expense reimbursement | | 1.05% | | 1.14%D | | 1.13%D |

| A | The management fee covers administrative services previously provided under separate services agreements with the fund, for which 0.22% for Fidelity Global High Income Fund and 0.19% for Fidelity High Income Fund was previously charged under the services agreements. |

| B | Adjusted to reflect current fees. |

| C | FMR has contractually agreed to reimburse the class of shares of the fund to the extent that total operating expenses (excluding interest, certain taxes, fees and expenses of the Independent Trustees, proxy and shareholder meeting expenses, extraordinary expenses, and acquired fund fees and expenses (including fees and expenses associated with a wholly owned subsidiary), if any, as well as non-operating expenses such as brokerage commissions and fees and expenses associated with the fund’s securities lending program, if applicable), as a percentage of its average net assets, exceed 1.05% (the Expense Cap). If at any time during the current fiscal year expenses for the class of shares of the fund fall below the Expense Cap, FMR reserves the right to recoup through the end of the fiscal year any expenses that were reimbursed during the current fiscal year up to, but not in excess of, the Expense Cap. This arrangement will remain in effect through August 31, 2024. FMR may not terminate this arrangement before the expiration date without the approval of the Board of Trustees and may extend it in its discretion after that date. |

| D | Includes interest expense of certain underlying Fidelity funds. Excluding interest expense of the applicable underlying Fidelity funds, Total annual operating expenses are 1.01% and 1.00% for Class A of Fidelity High Income Fund and Fidelity High Income Fund Pro forma combined, respectively. |

11

Class M

Shareholder Fees (paid directly from your investment)

| | | | | | |

| | | Fidelity Global High Income Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Maximum sales charge (load) on purchases (as a % of offering price) | | 4.00% | | 4.00% | | 4.00% |

| | | |

Maximum contingent deferred sales charge (as a % of the lesser of original purchase price or redemption proceeds) | | NoneA | | NoneA | | NoneA |

| A | Class M purchases of $1 million or more will not be subject to a front-end sales charge. Such Class M purchases may be subject, upon redemption, to a contingent deferred sales charge (CDSC) of 0.25%. |

Annual Class Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | |

| | | Fidelity Global High Income Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Management fee | | 0.84%A,B | | 0.72%A,B | | 0.72%A,B |

Distribution and/or Service (12b-1) fees | | 0.25% | | 0.25% | | 0.25% |

Other expenses | | 0.26%A | | 0.03%A | | 0.03%A |

Acquired Fund Fees and Expenses | | 0.00% | | 0.15%D | | 0.14%D |

| | | | | | |

Total annual operating expenses | | 1.35% | | 1.15% | | 1.14% |

Fee waiver and/or expense reimbursement | | 0.30%A,B | | 0.00% | | 0.00% |

Total annual operating expenses after fee waiver and/or expense reimbursement | | 1.05% | | 1.15%D | | 1.14%D |

| A | The management fee covers administrative services previously provided under separate services agreements with the fund, for which 0.24% for Fidelity Global High Income Fund and 0.19% for Fidelity High Income Fund was previously charged under the services agreements. |

| B | Adjusted to reflect current fees. |

| C | FMR has contractually agreed to reimburse the class of shares of the fund to the extent that total operating expenses (excluding interest, certain taxes, fees and expenses of the Independent Trustees, proxy and shareholder meeting expenses, extraordinary expenses, and acquired fund fees and expenses (including fees and expenses associated with a wholly owned subsidiary), if any, as well as non-operating expenses such as brokerage commissions and fees and expenses associated with the fund’s securities lending program, if applicable), as a percentage of its average net assets, exceed 1.05% (the Expense Cap). If at any time during the current fiscal year expenses for the class of shares of the fund fall below the Expense Cap, FMR reserves the right to recoup through the end of the fiscal year any expenses that were reimbursed during the current fiscal year up to, but not in excess of, the Expense Cap. This arrangement will remain in effect through August 31, 2024. FMR may not terminate this arrangement before the expiration date without the approval of the Board of Trustees and may extend it in its discretion after that date. |

| D | Includes interest expense of certain underlying Fidelity funds. Excluding interest expense of the applicable underlying Fidelity funds, Total annual operating expenses are 1.02% and 1.01% for Class M of Fidelity High Income Fund and Fidelity High Income Fund Pro forma combined, respectively. |

Class C

Shareholder Fees (paid directly from your investment)

| | | | | | |

| | | Fidelity Global High Income Fund | | Fidelity® High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Maximum sales charge (load) on purchases (as a % of offering price) | | None | | None | | None |

| | | |

Maximum contingent deferred sales charge (as a % of the lesser of original purchase price or redemption proceeds) | | 1.00%A | | 1.00%A | | 1.00%A |

| A | On Class C shares redeemed less than one year after purchase. |

12

Annual Class Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | |

| | | Fidelity Global High Income Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Management fee | | 0.84%A, B | | 0.72%A, B | | 0.72%A, B |

Distribution and/or Service (12b-1) fees | | 1.00% | | 1.00% | | 1.00% |

Other expenses | | 0.26%B | | 0.03%B | | 0.03%B |

Acquired Fund Fees and Expenses | | 0.00% | | 0.15%D | | 0.14%D |

| | | | | | |

Total annual operating expenses | | 2.10% | | 1.90% | | 1.89% |

Fee waiver and/or expense reimbursement | | 0.30%B, C | | 0.00% | | 0.00% |

| | |

| Total annual operating expenses after fee waiver and/or expense reimbursement | | 1.80% | | 1.90%D | | 1.89%D |

| A | The management fee covers administrative services previously provided under separate services agreements with the fund, for which 0.24% for Fidelity Global High Income Fund and 0.22% for Fidelity High Income Fund was previously charged under the services agreements. |

| B | Adjusted to reflect current fees. |

| C | FMR has contractually agreed to reimburse the class of shares of the fund to the extent that total operating expenses (excluding interest, certain taxes, fees and expenses of the Independent Trustees, proxy and shareholder meeting expenses, extraordinary expenses, and acquired fund fees and expenses (including fees and expenses associated with a wholly owned subsidiary), if any, as well as non-operating expenses such as brokerage commissions and fees and expenses associated with the fund’s securities lending program, if applicable), as a percentage of its average net assets, exceed 1.80% (the Expense Cap). If at any time during the current fiscal year expenses for the class of shares of the fund fall below the Expense Cap, FMR reserves the right to recoup through the end of the fiscal year any expenses that were reimbursed during the current fiscal year up to, but not in excess of, the Expense Cap. This arrangement will remain in effect through August 31, 2024. FMR may not terminate this arrangement before the expiration date without the approval of the Board of Trustees and may extend it in its discretion after that date. |

| D | Includes interest expense of certain underlying Fidelity funds. Excluding interest expense of the applicable underlying Fidelity funds, Total annual operating expenses are 1.77% and 1.76% for Class C of Fidelity High Income Fund and Fidelity High Income Fund Pro forma combined, respectively. |

Class I

Shareholder Fees (paid directly from your investment)

| | | | | | |

| | | Fidelity Global High Income Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Maximum sales charge (load) on purchases (as a % of offering price) | | None | | None | | None |

Maximum contingent deferred sales charge (as a % of the lesser of original purchase price or redemption proceeds) | | None | | None | | None |

Annual Class Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | |

| | | Fidelity Global High Income Fund | | Fidelity High Income Fund | | Fidelity High Income Fund Pro forma Combined |

| | | |

Management fee | | 0.84%A, B | | 0.72%A, B | | 0.72%A, B |

| Distribution and/or Service (12b-1) fees | | None | | None | | None |

| Other expenses | | 0.26%B | | 0.03%B | | 0.03%B |

| Acquired Fund Fees and Expenses | | 0.00% | | 0.15%D | | 0.14%D |

| | | | | | |

| Total annual operating expenses | | 1.10% | | 0.90% | | 0.89% |

| Fee waiver and/or expense reimbursement | | 0.30%B, C | | 0.00% | | 0.00% |

| | |

| Total annual operating expenses after fee waiver and/or expense reimbursement | | 0.80% | | 0.90%D | | 0.89%D |

| A | The management fee covers administrative services previously provided under separate services agreements with the fund, for which 0.23% for Fidelity Global High Income Fund and 0.23% for Fidelity High Income Fund was previously charged under the services agreements. |

| B | Adjusted to reflect current fees. |

| C | FMR has contractually agreed to reimburse the class of shares of the fund to the extent that total operating expenses (excluding interest, certain taxes, fees and expenses of the Independent Trustees, proxy and shareholder meeting expenses, extraordinary expenses, and acquired fund fees and expenses (including fees and expenses associated with a wholly owned subsidiary), if any, as well as non-operating expenses such as brokerage commissions and fees and expenses |

13

| | associated with the fund’s securities lending program, if applicable), as a percentage of its average net assets, exceed 0.80% (the Expense Cap). If at any time during the current fiscal year expenses for the class of shares of the fund fall below the Expense Cap, FMR reserves the right to recoup through the end of the fiscal year any expenses that were reimbursed during the current fiscal year up to, but not in excess of, the Expense Cap. This arrangement will remain in effect through August 31, 2024. FMR may not terminate this arrangement before the expiration date without the approval of the Board of Trustees and may extend it in its discretion after that date. |

| D | Includes interest expense of certain underlying Fidelity funds. Excluding interest expense of the applicable underlying Fidelity funds, Total annual operating expenses are 0.77% and 0.76% for Class I of Fidelity High Income Fund and Fidelity High Income Fund Pro forma combined, respectively. |

Examples of Effect of Fund Expenses

The following tables illustrate the expenses on a hypothetical $10,000 investment in each fund under the current and pro forma (combined fund) expenses calculated at the rates stated above, assuming a 5% annual return after giving effect to the Reorganization. The tables illustrate how much a shareholder would pay in total expenses if the shareholder sells all of his or her shares at the end of each time period indicated and if the shareholder holds all of his or her shares, as applicable.

Retail Class

| | | | | | | | | | | | |

| | | Fidelity Global High Income Fund | | | Fidelity High Income Fund | | | Fidelity High Income Fund Pro forma Combined | |

| | | |

1 year | | | $86 | | | | $87 | | | | $86 | |

3 years | | | $318 | | | | $271 | | | | $268 | |

5 years | | | $568 | | | | $471 | | | | $466 | |

10 years | | | $1,285 | | | | $1,049 | | | | $1,037 | |

Class A

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fidelity Global High Income Fund | | | Fidelity High Income Fund | | | Fidelity High Income Fund Pro forma Combined | |

| | | | | | |

| | | Sell All | | | Hold All | | | Sell All | | | Hold All | | | Sell All | | | Hold All | |

1 year | | | $508 | | | | $508 | | | | $512 | | | | $512 | | | | $511 | | | | $511 | |

3 years | | | $787 | | | | $787 | | | | $748 | | | | $748 | | | | $745 | | | | $745 | |

5 years | | | $1,087 | | | | $1,087 | | | | $1,003 | | | | $1,003 | | | | $997 | | | | $997 | |

10 years | | | $1,938 | | | | $1,938 | | | | $1,731 | | | | $1,731 | | | | $1,720 | | | | $1,720 | |

Class M

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fidelity Global High Income Fund | | | Fidelity High Income Fund | | | Fidelity High Income Fund Pro forma Combined | |

| | | | | | |

| | | Sell All | | | Hold All | | | Sell All | | | Hold All | | | Sell All | | | Hold All | |

1 year | | | $508 | | | | $508 | | | | $513 | | | | $513 | | | | $512 | | | | $512 | |

3 years | | | $787 | | | | $787 | | | | $751 | | | | $751 | | | | $748 | | | | $748 | |

5 years | | | $1,087 | | | | $1,087 | | | | $1,008 | | | | $1,008 | | | | $1,003 | | | | $1,003 | |

10 years | | | $1,938 | | | | $1,938 | | | | $1,742 | | | | $1,742 | | | | $1,731 | | | | $1,731 | |

14

Class C

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fidelity Global High Income Fund | | | Fidelity High Income Fund | | | Fidelity High Income Fund Pro forma Combined | |

| | | | | | |

| | | Sell All | | | Hold All | | | Sell All | | | Hold All | | | Sell All | | | Hold All | |

1 year | | | $288 | | | | $188 | | | | $293 | | | | $193 | | | | $292 | | | | $192 | |

3 years | | | $634 | | | | $634 | | | | $597 | | | | $597 | | | | $594 | | | | $594 | |

5 years | | | $1,106 | | | | $1,106 | | | | $1,026 | | | | $1,026 | | | | $1,021 | | | | $1,021 | |

10 years | | | $2,411 | | | | $2,411 | | | | $2,222 | | | | $2,222 | | | | $2,212 | | | | $2,212 | |

Class I

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fidelity Global High Income Fund | | | Fidelity High Income Fund | | | Fidelity High Income Fund Pro forma Combined | |

| | | | | | |

| | | Sell All | | | Hold All | | | Sell All | | | Hold All | | | Sell All | | | Hold All | |

1 year | | | $87 | | | | $87 | | | | $92 | | | | $92 | | | | $91 | | | | $91 | |

3 years | | | $325 | | | | $325 | | | | $287 | | | | $287 | | | | $284 | | | | $284 | |

5 years | | | $582 | | | | $582 | | | | $498 | | | | $498 | | | | $493 | | | | $493 | |

10 years | | | $1,318 | | | | $1,318 | | | | $1,108 | | | | $1,108 | | | | $1,096 | | | | $1,096 | |

These examples assume that all dividends and other distributions are reinvested and that the percentage amounts listed under Annual Operating Expenses remain the same in the years shown. These examples illustrate the effect of expenses, but are not meant to suggest actual or expected expenses, which may vary. The assumed return of 5% is not a prediction of, and does not represent, actual or expected performance of any fund.

Do the procedures for purchasing and redeeming shares of the funds differ?

Except as discussed below, the procedures for purchasing shares of the funds are the same.

Effective the close of business on March 22, 2024, new positions in Fidelity Global High Income Fund may no longer be opened pending the Reorganization. Shareholders of the fund on that date may continue to add to their fund positions existing on that date. Effective May 20, 2024, shareholders of Fidelity Global High Income Fund may no longer purchase shares of the fund. Shareholders of Fidelity Global High Income Fund may redeem shares of the fund through the Closing Date of the fund’s Reorganization.

Aside from the closing of Fidelity Global High Income Fund, the procedures for purchasing and redeeming shares of the funds are the same. The procedures for purchasing and redeeming shares of the combined fund will remain unchanged.

For more information about the procedures for purchasing and redeeming the funds’ shares, including a description of the policies and procedures designed to discourage excessive or short-term trading of fund shares, please refer to the “Additional Information about the Purchase and Sale of Shares” section of the funds’ Prospectuses, and to the “Buying, Selling, and Exchanging Information” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Do the funds’ exchange privileges differ?

No. The exchange privileges currently offered by the funds are the same. The exchange privileges offered by the combined fund will remain unchanged.

For more information about the funds’ exchange privileges, please refer to the “Exchanging Shares” section of the funds’ Prospectuses, and to the “Buying, Selling, and Exchanging Information” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Do the funds’ dividend and distribution policies differ?

The funds’ dividend and distribution policies are the same. Each fund normally declares dividends daily and pays dividends monthly. Each fund normally pays capital gain distributions in June and December. The dividend and distribution policies of the combined fund will be the same as the current dividend and distribution policies of Fidelity High Income Fund.

On or before the Closing Date, Fidelity Global High Income Fund may declare additional dividends or other distributions in order to distribute substantially all of its investment company taxable income and net realized capital gain (if any).

15

For more information about the funds’ dividend and distribution policies, please refer to the “Dividends and Capital Gain Distributions” section of the funds’ Prospectuses, and to the “Distributions and Taxes” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Who bears the expenses associated with the Reorganization?

FMR will bear a portion of the one-time administrative costs associated with the Reorganization. Any transaction costs associated with portfolio adjustments to Fidelity Global High Income Fund and Fidelity High Income Fund due to the Reorganization that occur prior to the Closing Date will be borne by Fidelity Global High Income Fund and Fidelity High Income Fund, respectively, notwithstanding the contractual expense caps in place with respect to each class of Fidelity Global High Income Fund. Any transaction costs associated with portfolio adjustments to Fidelity Global High Income Fund and Fidelity High Income Fund due to the Reorganization that occur after the Closing Date and any additional merger-related costs attributable to Fidelity High Income Fund that occur after the Closing Date will be borne by Fidelity High Income Fund.

For more information, please refer to the section entitled “Additional Information about the Funds – Expenses.”

COMPARISON OF PRINCIPAL RISK FACTORS

Many factors affect each fund’s performance. Developments that disrupt global economies and financial markets, such as pandemics and epidemics, may magnify factors that affect a fund’s performance. A fund’s share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. A fund’s reaction to these developments will be affected by the types of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund’s level of investment in the securities of that issuer. When you sell your shares they may be worth more or less than what you paid for them, which means that you could lose money by investing in a fund.

The following is a summary of the principal risks associated with an investment in the funds. Because the funds have identical investment objectives and somewhat similar strategies as described above, the funds are subject to substantially similar investment risks. Because the funds have some different principal investment strategies as described above, the funds are also subject to some different investment risks, of which you should be aware.

What risks are associated with an investment in both of the funds?

Each fund is subject to the following principal risks:

| | • | | Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments. |

| | • | | Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease. |

| | • | | Foreign Exposure. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market. |

| | • | | Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. |

Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer.

What additional risks are associated with an investment in Fidelity Global High Income Fund?

Fidelity Global High Income Fund is subject to the following additional Foreign Exposure risk in light of its principal investment strategy related to investments in emerging markets, which is not part of the Foreign Exposure risk generally associated with an investment in Fidelity High Income Fund:

The extent of economic development; political stability; market depth, infrastructure, and capitalization; and regulatory oversight can be less than in more developed markets. Emerging markets typically have less established legal, accounting and financial reporting systems than those in more developed markets, which may reduce the scope or quality of financial information available to investors.

Emerging markets can be subject to greater social, economic, regulatory, and political uncertainties and can be extremely volatile.

Foreign exchange rates also can be extremely volatile.

For more information about the principal risks associated with an investment in the funds, please refer to the “Investment Details” section of the funds’ Prospectuses, and to the “Investment Policies and Limitations” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

16

How do the funds compare in terms of their performance?

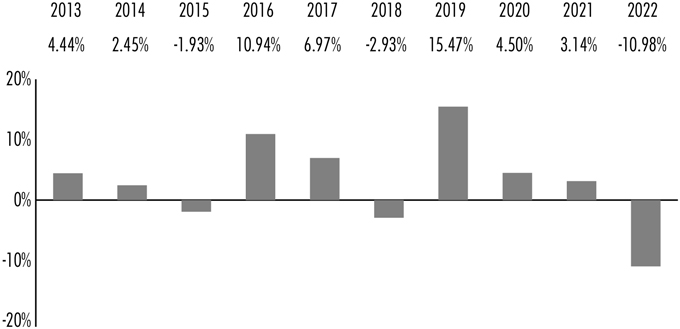

The following information is intended to help you understand the risks of investing in the funds. The information illustrates the changes in the performance of each fund’s shares from year to year and compares the performance of each fund’s shares to the performance of a securities market index and, for Fidelity Global High Income, a hypothetical composite of market indexes over various periods of time. The index descriptions appear in the “Additional Index Information” section of the funds’ Prospectuses. Past performance (before and after taxes, if applicable) is not an indication of future performance.

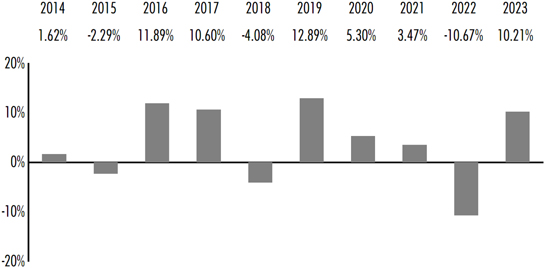

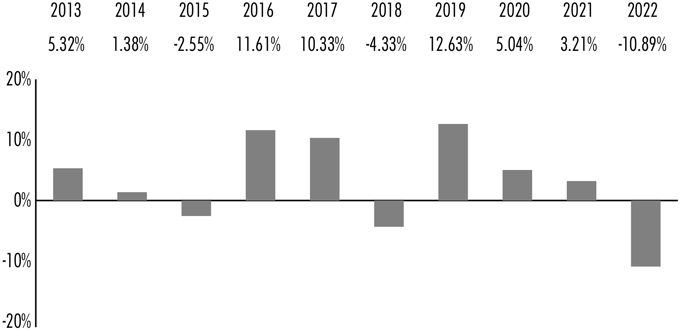

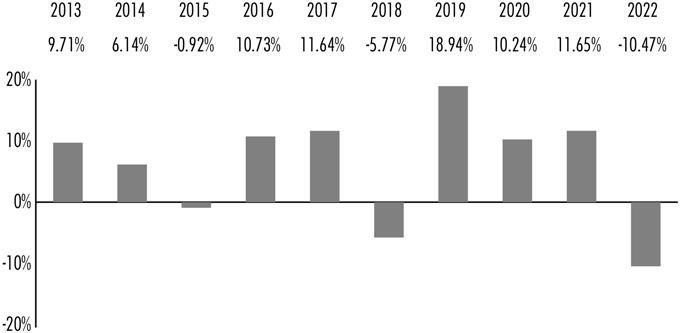

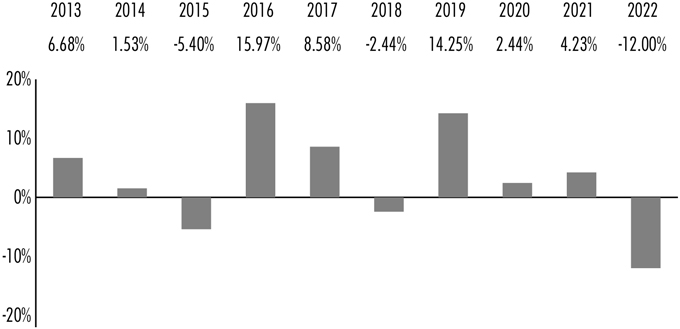

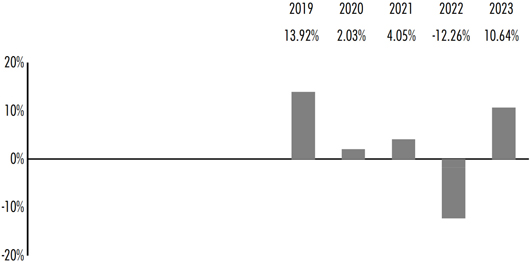

Year-by-Year Returns

Fidelity Global High Income Fund – Retail Class

| | | | |

During the periods shown in the chart: | | Returns | | Quarter ended |

| | |

Highest Quarter Return | | 12.74% | | June 30, 2020 |

Lowest Quarter Return | | -15.69% | | March 31, 2020 |

Year-to-Date Return | | 2.13% | | March 31, 2024 |

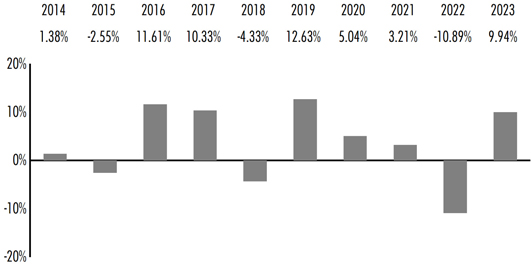

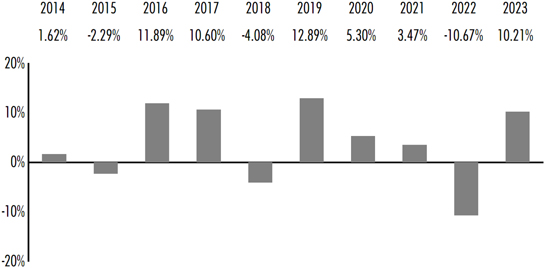

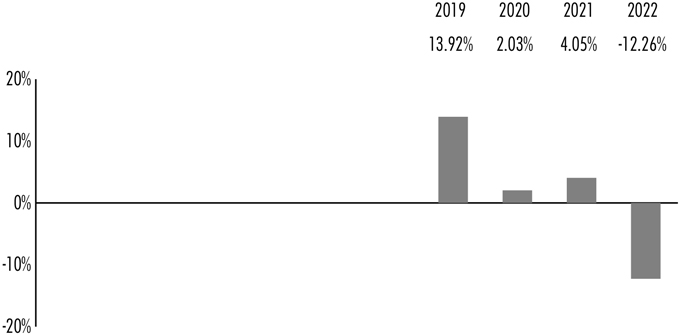

Fidelity Global High Income Fund – Class A

| | | | |

During the periods shown in the chart for Class A: | | Returns | | Quarter ended |

| | |

Highest Quarter Return | | 12.56% | | June 30, 2020 |

| | |

Lowest Quarter Return | | -15.75% | | March 31, 2020 |

| | |

Year-to-Date Return | | 2.06% | | March 31, 2024 |

17

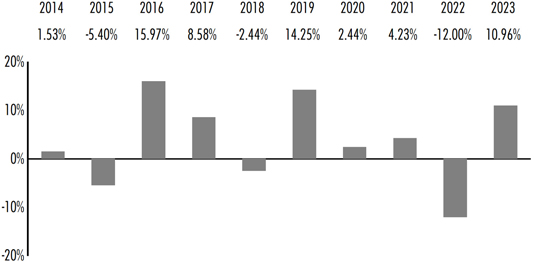

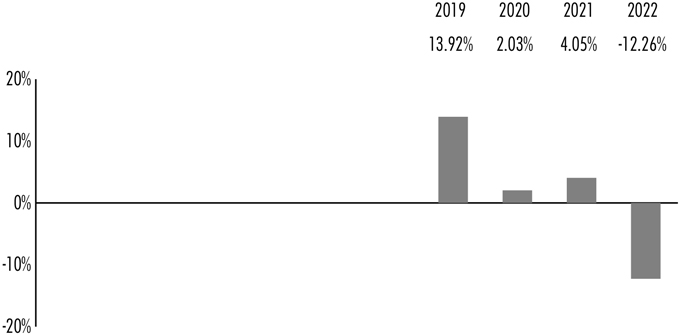

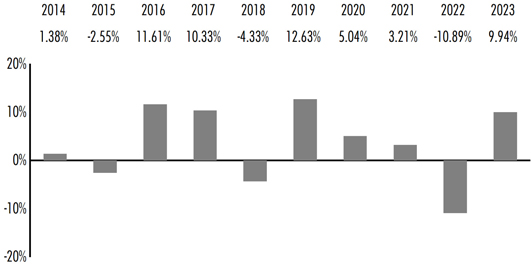

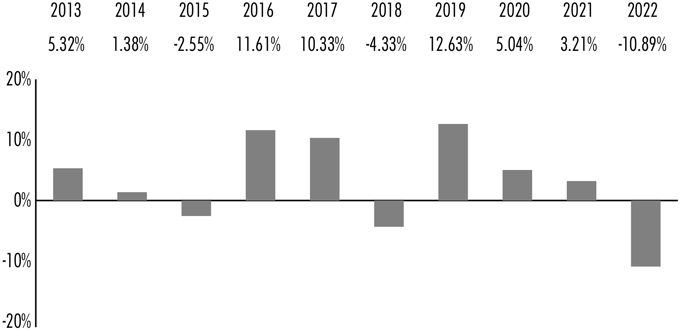

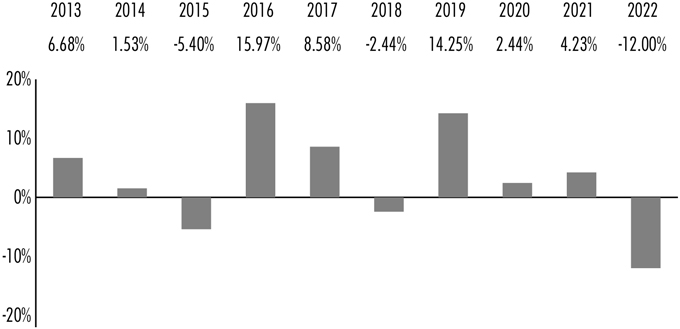

Fidelity High Income Fund – Retail Class

| | | | |

During the periods shown in the chart: | | Returns | | Quarter ended |

| | |

Highest Quarter Return | | 8.25% | | June 30, 2020 |

| | |

Lowest Quarter Return | | -13.34% | | March 31, 2020 |

| | |

Year-to-Date Return | | 2.33% | | March 31, 2024 |

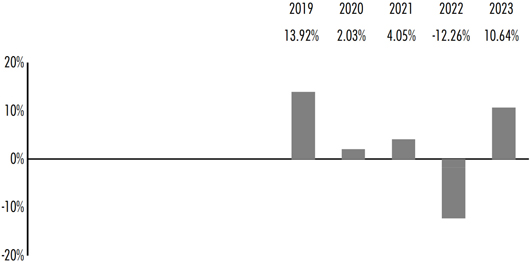

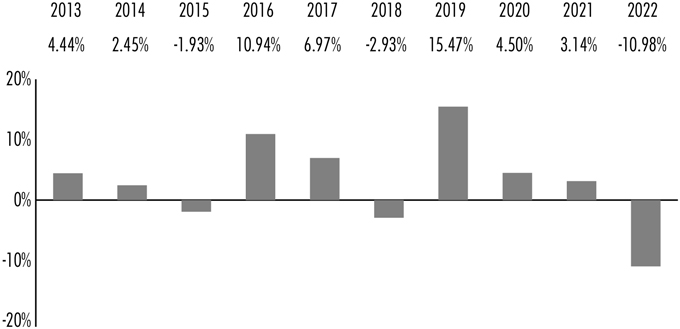

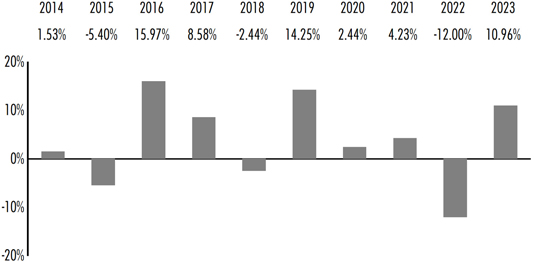

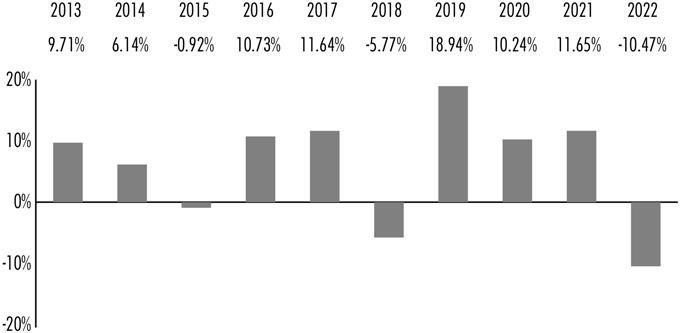

Fidelity High Income Fund – Class A

| | | | |

During the periods shown in the chart for Class A: | | Returns | | Quarter ended |

| | |

Highest Quarter Return | | 8. 17% | | June 30, 2020 |

| | |

Lowest Quarter Return | | -13.40% | | March 31, 2020 |

| | |

Year-to-Date Return | | 2.26% | | March 31, 2024 |

Average Annual Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement, such as an employee benefit plan (profit sharing, 401(k), or 403(b) plan). Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

18

Fidelity® Global High Income Fund

| | | | | | | | | | | | |

For the periods ended December 31, 2023 | | Past 1 year | | | Past 5 years | | | Past 10 years | |

| | | |

Fidelity Global High Income Fund - Retail Class | | | | | | | | | | | | |

Return Before Taxes | | | 10.21 | % | | | 3.90 | % | | | 3.62 | % |

Return After Taxes on Distributions | | | 8.36 | % | | | 2.03 | % | | | 1.51 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 5.99 | % | | | 2.19 | % | | | 1.84 | % |

Fidelity Advisor Global High Income Fund - Class A | | | 5.54 | % | | | 2.81 | % | | | 2.94 | % |

Fidelity Advisor Global High Income Fund - Class M | | | 5.54 | % | | | 2.81 | % | | | 2.94 | % |

Fidelity Advisor Global High Income Fund - Class C | | | 8.12 | % | | | 2.88 | % | | | 2.75 | % |

Fidelity Advisor Global High Income Fund - Class I | | | 10.21 | % | | | 3.91 | % | | | 3.62 | % |

ICE BofA Global High Yield & Emerging Markets Plus Index

(reflects no deduction for fees, expenses, or taxes) | | | 13.01 | % | | | 2.92 | % | | | 2.89 | % |

Fidelity Global High Income Composite Index | | | 12.25 | % | | | 4.02 | % | | | 3.72 | % |

Fidelity® High Income Fund

| | | | | | | | | | | | |

For the periods ended December 31, 2023 | | Past 1 year | | | Past 5 years | | | Past 10 years/ Life of Class | |

| | | |

Fidelity High Income Fund - Retail Class | | | | | | | | | | | | |

Return Before Taxes | | | 10.96 | % | | | 3.56 | % | | | 3.46 | % |

Return After Taxes on Distributions | | | 8.47 | % | | | 1.45 | % | | | 1.15 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 6.41 | % | | | 1.83 | % | | | 1.61 | % |

Fidelity Advisor High Income Fund - Class A | | | 6.22 | % | | | 2.42 | % | | | 1.83 | %A |

Fidelity Advisor High Income Fund - Class M | | | 6.21 | % | | | 2.41 | % | | | 1.82 | %A |

Fidelity Advisor High Income Fund - Class C | | | 8.93 | % | | | 2.49 | % | | | 1.89 | %A |

Fidelity Advisor High Income Fund - Class I | | | 10.99 | % | | | 3.55 | % | | | 2.93 | %A |

Fidelity Advisor High Income Fund - Class Z | | | 11.03 | % | | | 3.63 | % | | | 3.01 | %A |

ICE BofA US High Yield Constrained Index

(reflects no deduction for fees, expenses, or taxes) | | | 13.47 | % | | | 5.19 | % | | | 4.51 | % |

| A | Commenced operations December 4, 2018. |

THE TRANSACTION

AGREEMENT AND PLAN OF REORGANIZATION BETWEEN FIDELITY GLOBAL HIGH INCOME FUND AND FIDELITY HIGH INCOME FUND.

Agreement and Plan of Reorganization

The terms and conditions under which the transaction may be consummated are set forth in the Agreement. Significant provisions of the Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Agreement, a copy of which is attached as Exhibit 1 to this Information Statement.

The Agreement contemplates (a) Fidelity High Income Fund acquiring as of the Closing Date all of the assets of Fidelity Global High Income Fund in exchange solely for shares of Fidelity High Income Fund and the assumption by Fidelity High Income Fund of Fidelity Global High Income Fund’s liabilities; and (b) the distribution of shares of Fidelity High Income Fund to the shareholders of Fidelity Global High Income Fund as provided for in the Agreement.

The value of Fidelity Global High Income Fund’s assets to be acquired by Fidelity High Income Fund and the amount of its liabilities to be assumed by Fidelity High Income Fund will be determined as of the close of business of the NYSE on the Closing Date, using the valuation procedures set forth in Fidelity High Income Fund’s then-current Prospectuses and Statements of Additional Information. The net asset value of a share of Fidelity High Income Fund will be determined as of the same time using the valuation procedures set forth in its then-current Prospectuses and Statements of Additional Information.

As of the Closing Date, Fidelity High Income Fund will deliver to Fidelity Global High Income Fund, and Fidelity Global High Income Fund will distribute to its shareholders of record, shares of Fidelity High Income Fund so that each Fidelity Global High Income Fund shareholder will receive the number of full and fractional shares of Fidelity High Income Fund equal in value to the aggregate net asset value of shares of Fidelity Global High Income Fund held by such shareholder on the Closing Date; Fidelity Global High Income Fund will be liquidated as soon as practicable thereafter. Each Fidelity Global High Income Fund shareholder’s account shall be credited with the respective pro rata number of full and fractional shares of Fidelity High Income Fund due that shareholder. The net asset value per share of Fidelity High Income Fund will be unchanged by the transaction. Thus, the Reorganization will not result in a dilution of any shareholder’s interest.

19

Any transfer taxes payable upon issuance of shares of Fidelity High Income Fund in a name other than that of the registered holder of the shares on the books of Fidelity Global High Income Fund as of that time shall be paid by the person to whom such shares are to be issued as a condition of such transfer. Any reporting responsibility of Fidelity Global High Income Fund is and will continue to be its responsibility up to and including the Closing Date and such later date on which Fidelity Global High Income Fund is liquidated.

FMR will bear a portion of the one-time administrative costs associated with the Reorganization, including professional fees, expenses associated with the filing of registration statements, which will consist principally of printing and mailing Prospectuses and the Information Statement.

In connection with the Reorganization, FMR will sell a portion of the securities held by Fidelity Global High Income Fund and purchase other securities. Any transaction costs associated with portfolio adjustments to Fidelity Global High Income Fund and Fidelity High Income Fund due to the Reorganization that occur prior to the Closing Date will be borne by Fidelity Global High Income Fund and Fidelity High Income Fund, respectively, notwithstanding the contractual expense caps in place with respect to each class of Fidelity Global High Income Fund. Any transaction costs associated with portfolio adjustments to Fidelity Global High Income Fund and Fidelity High Income Fund due to the Reorganization that occur after the Closing Date and any additional merger-related costs attributable to Fidelity High Income Fund that occur after the Closing Date will be borne by Fidelity High Income Fund. The funds may recognize a taxable gain or loss on the disposition of securities pursuant to these portfolio adjustments.

The consummation of the Reorganization is subject to a number of conditions set forth in the Agreement, some of which may be waived by a fund. In addition, the Agreement may be amended in any mutually agreeable manner.

Reasons for the Reorganization

In determining whether to approve the Reorganization, the Board of Trustees (the Board) considered a number of factors, including the following:

| | (1) | the compatibility of the investment objectives, strategies, and policies of the funds; |

| | (2) | the historical performance of the funds; |

| | (3) | the fees and expenses and the relative expense ratios of the funds; |

| | (4) | the potential benefit of the Reorganization to shareholders of the funds; |

| | (5) | the costs to be incurred by each fund as a result of the Reorganization; |

| | (6) | the tax consequences of the Reorganization; |

| | (7) | the relative size of the funds; and |

| | (8) | the potential benefit of the Reorganization to FMR and its affiliates. |