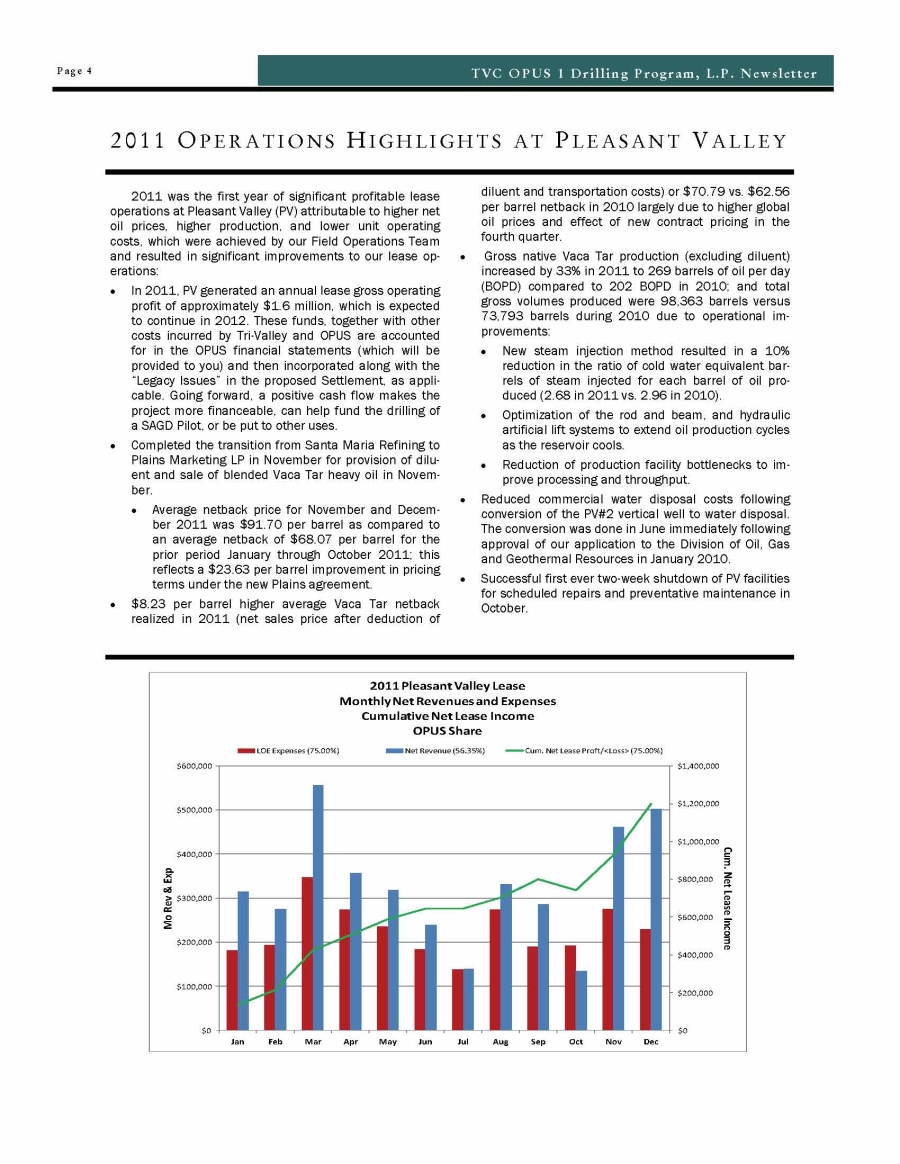

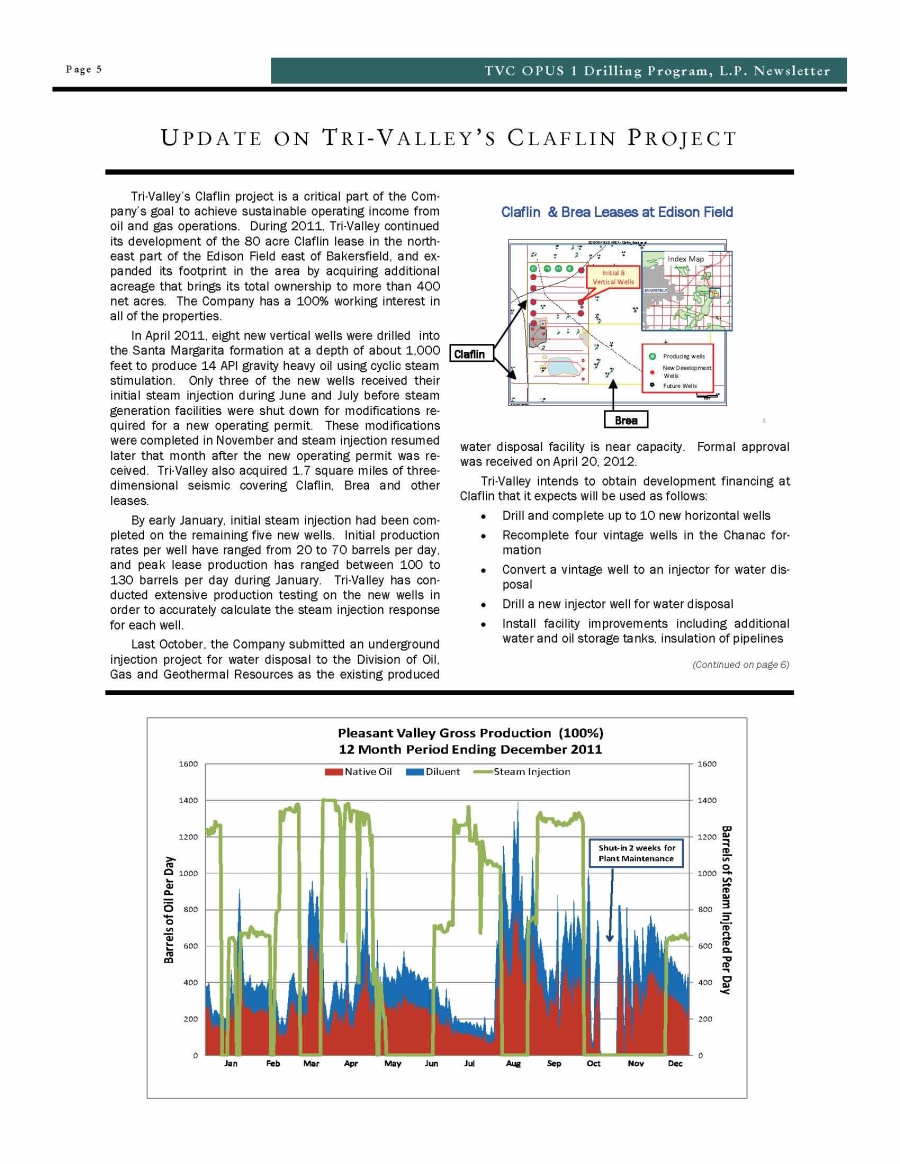

TVC OPUS 1 Drilling Program, L.P. UPDATE ON THE OPUS RESTRUCTURING AND SETTLEMENT May 2012 NEWSLETTER Since December Tri-Valley and the OPUS Special Committee (OSC) have been working on the previously announced OPUS Restructuring and Settlement transaction. The primary purpose of this Newsletter is to give you a summary of the OPUS legacy issues that prompted our call to action. Please see the section of this Newsletter entitled “Important Notices for OPUS Partners” on the last page of this Newsletter for important notices and disclaimers. Tri-Valley has also continued to prepare for a SAGD pilot and development at Pleasant Valley (PV): .. Tri-Valley’s PV Operations Team has continued their work on the Front-end Engineering and Design phase for our SAGD Pilot project and the plans for both the drilling and completion. The production facilities have improved substantially. .. AJM-Deloitte has provided reservoir simulations and evaluations for SAGD, updated reserve reports and provided technical recommendations which have proven valuable in refining our development plan, and has provided a foundation for financing. .. We have recently obtained third party cost estimates for the new wells and facilities for a SAGD Pilot. .. We received a preliminary nonbinding term sheet from a major energy bank to finance the SAGD pilot, and contingent financing for SAGD development at Pleasant Valley, which we are evaluating together along with other alternatives. In August 2011, Tri-Valley and the OPUS Special Committee announced a settlement in concept. To make it a reality has required detailed investigation, analysis and resolution of significant issues. New facts and hurdles required us to re-work the Restructuring and Settlement to arrive at a similar result by different means. But we now believe that we have a workable structure agreed upon in principle that will serve as a guide for completing the definitive agreements. The revised structure includes the formation of a new entity to own and operate the PV properties, with the new entity being jointly owned by Tri-Valley and the OPUS limited partnership. Among other things, the revised framework will utilize a disproportionate sharing of distributable profits over a period of time after SAGD development is completed to compensate OPUS, and allow Tri-Valley to be released from the settled claims at closing. In parallel, Tri-Valley has compiled key information to be included in the detailed disclosures that will be distributed to all OPUS Partners in the Information Statement and Consent Solicitation for your vote on the Restructuring and Settlement: .. We have completed an analysis and reconciliation of approximately $15.0 million in finder’s fees incurred for placement of OPUS units. Of this total, $11.3 million were charged to OPUS and are included in the Settlement. The remaining $3.7 million of finder’s fees were incurred by Tri-Valley. Tri- Valley intends to seek recovery of these commissions from the finders where it is cost-effective to do so. .. We have been required to reconcile the OPUS payable/receivable account with Tri-Valley, including net joint interest billings for lease operations, capital expenditures, administrative costs, and other direct costs charged to OPUS by Tri-Valley, which has uncovered additional errors and improper charges, related both to the “Legacy Issues” and to new issues. .. We have completed an inception through year-end 2011 reconciliation of partnership contributions, revenues, expenditures, and distributions per the financial records to the corresponding tax returns. .. We have completed draft comparative financial statements for OPUS as at December 31, 2011 and 2010, respectively, which will be included in the Information Statement and Consent Solicitation. All of this accounting work was necessary to resolve issues included in the Settlement that cumulatively exceeds $30 million, and these are being disclosed to you in this newsletter with more details to follow in the definitive agreements. Finally, in the title litigation matter affecting the lease on the Hansen property (also referred to as Scholle- Livingston), Tri-Valley was unsuccessful in its defense of lease title in court. As part of the OPUS Settlement, Tri-Valley is responsible for 100% of the legal costs incurred on the title defense on the Hansen property, and the settlement includes a mechanism to deal with loss of the Hansen lease as the settlement allows for Tri-Valley to deal with the loss of the Hansen lease by acquiring, at its sole cost, additional leases for development. A key part of the OPUS settlement and restructuring process has been focused on resolving the “OPUS Legacy Issues” or alleged contract claims which fall into five principal categories: .. Finder’s fees for the private placement of OPUS partnership units to investors, .. Improper repayment of partner contributions, .. Excess costs for turnkey drilling projects, .. Acquisition costs related to oil and gas leases for development projects, and .. Legal costs for defense of title on oil and gas properties. Finder’s Fees: This issue primarily focuses on whether the persons who assisted us with the offer and sale of OPUS partnership interests appropriately acted under the auspices of the broker-dealer registration exemption commonly known as the “finder’s exemption”; or whether, instead, such persons illegally performed actions that are reserved for registered broker-dealers only. A “finder” is generally understood to be a person who simply facilitates introductions of prospective financing sources to the issuer of a security. In general, a “broker-dealer” is defined as a person who engages in the business of effecting transactions in securities for others, as interpreted by the US Securities and Exchange Commission (SEC) and relevant case law. While under certain circumstances a finder can be compensated for making introductions of potential investors to companies seeking capital, as a general rule, the finder’s exemption from broker-dealer registration is narrowly construed. In sum, the existence of one or more of the following factors could negate the finder’s exemption and, accordingly, require broker-dealer registration: (i) active solicitation of investors for a particular investment or securities transaction; (ii) making recommendations about, or marketing the virtue of, the investment or securities transaction; (iii) negotiating, or participating in the negotiation of, the terms of the investment or securities transaction; (iv) receipt of transaction-based compensation (e.g., commissions derived as a percentage of the investment placed by the putative finder); and (v) previous involvement in the sale of securities (as opposed to a one-time, isolated act, for example), or participating in the business of raising funds for profit with some degree of regularity. Under the stewardship of Tri-Valley’s former management team, led by former CEO, F. Lynn Blystone, until his retirement from the Company in March 2010, a total of approximately $97.0 million was raised through the private placement of OPUS partnership units between February 2002 and March 2010. Tri-Valley paid approximately $15.0 million in fees and other costs to 19 finders who assisted in the sale of $94.7 million of these partnership units. The remaining $2.3 million of units were placed directly by Tri-Valley without incurring any finder’s fees. The compensation paid to finders was primarily based on the amount of funds generated from the sales of the partnership units to investors. From the $15.0 million, OPUS was charged $11.3 million for finder’s fees, while Tri-Valley incurred $3.7 million for its own account in additional finder’s fees and other related costs for the placement of OPUS partnership units that could not be charged to OPUS under the partnership agreements. According to the Company’s records, 87.3%, or $13.1 million, of the total $15.0 million in finder’s fees and related costs were paid to Mr. Behrooz Sarafraz. The remaining $1.9 million in fees were paid by Tri-Valley to 18 other finders, sometimes at the request of Mr. Sarafraz, apparently for investor referrals that generated new investments in the partnership. Mr. Sarafraz was Tri-Valley’s principal finder from 1996 until early 2010, and does not appear to have ever been registered as a broker-dealer with the SEC, with the Financial Industry Regulatory Authority (FINRA), or with any other applicable State regulatory authority during that time. Based on Mr. Sarafraz’s role and activities in the private placements of OPUS units, and recently discovered information that Mr. Sarafraz pled guilty in 2000 to a felony for making a false statement to the government in connection with a government investigation into previous sales of securities, Tri-Valley and the OSC have agreed for settlement purposes that such activities exceeded those of a legal finder; and, in all likelihood, required Mr. Sarafraz to be registered as a broker-dealer. Tri-Valley and the OSC discussed this issue and agreed that OPUS will be credited $6.3 million of the $11.3 million finder’s fees in the settlement amount for purposes of determining the disproportionate sharing of revenues generated by the new jointly owned entity. In addition, Tri-Valley has agreed to reimburse OPUS the first $5.0 million it may recover from finders net of legal fees and other costs incurred in the recovery efforts. In this regard, Tri-Valley intends to seek recovery of the finder’s fees from these individuals when circumstances dictate that a recovery effort will be cost-effective. For more information on finders and registration requirements for broker-dealers, please refer to the US Securities and Exchange Commission’s “Guide to Broker-Dealer Registration” which can be accessed on the internet at: http://www.sec.gov/divisions/marketreg/bdguide.htm. Improper Repayment of Partner Contributions : In the fourth quarter of 2008, at a time when Tri-Valley was soliciting other investors for funds, Tri-Valley’s former CEO, Mr. Blystone, allowed the principal finder and OPUS partner, Mr. Sarafraz, to withdraw more than $1.0 million of his OPUS partnership equity, in four transactions, as a loan which was never repaid. Under the OPUS agreements, an OPUS partner does not have the right to be repaid any capital contributions or to withdraw from the partnership except as allowed under the agreements or required by law. Since Tri-Valley was responsible for Mr. Blystone’s having allowed Mr. Sarafraz to be repaid a portion of his OPUS capital contributions, OPUS will be credited in the settle- (Continued on page 3) Page 2 BACKGROUND ON THE OPUS “LEGACY ISSUES” TVC OPUS 1 Drilling Program, L.P. Newsletter ment for the amount of capital repaid to Mr. Sarafraz. Tri- Valley intends to seek recovery of these funds when circumstances dictate that a recovery effort will be costeffective. Excess Costs for Turnkey Drilling: This issue involves the pricing used by Tri-Valley to charge turnkey drilling costs to OPUS for work performed by Tri-Valley’s subsidiary, Tri-Valley Oil and Gas Co. Under the OPUS agreements, Tri-Valley could not charge more than “competitive pricing” for similar services when it provided services to OPUS using its own personnel, equipment, and other resources. Under a turnkey drilling arrangement, the contractor assumes most or all of the financial risk for the project normally assumed by the operator. In return, the contractor is paid a higher fixed lump sum price to compensate for the higher risk being assumed by the contractor versus a day-work or footage based drilling contract. When OPUS was launched in 2002, the offering documents included an exhibit with a list of 26 “turnkey drilling” projects. Between 2002 and 2009, Tri-Valley charged OPUS $24.6 million for turnkey drilling for 3 wells listed on the exhibit and for 10 other wells, including 4 development wells, not included on the exhibit. Tri-Valley’s actual cost for these 13 turnkey wells was $11.4 million, and generated a profit for Tri-Valley of $13.2 million, equal to a 116% markup over actual cost. Tri-Valley was not able to locate any records to substantiate that the turnkey drilling costs charged to OPUS had been based on competitive market rates, nor were former senior officers of Tri-Valley able to provide evidence that these turnkey costs were competitive. Subsequent market research has indicated that a markup of 25%-30% on estimated drilling costs would have been competitive for turnkey drilling projects based on the parameters of the wells that were drilled for OPUS. After a review and discussion of the actual costs and competitive market information, Tri-Valley and the OSC have agreed for settlement purposes that up to a 25% mark-up over the $11.4 million of actual drilling and completion costs was reasonable based on the competitive market data. The excess turnkey drilling costs will be credited to OPUS as part of the settlement for purposes of determining the disproportionate sharing of revenues generated by the new JV entity. Lease Acquisition Costs for Development Properties: This issue involves $7.5 million of costs charged to OPUS following Tri-Valley’s acquisition of certain oil and gas leases in 2005 and 2006. These leases were acquired by Tri-Valley due to a change in strategy to focus future OPUS investments in “exploitation” or development of reserves, rather than in “exploration” projects. These costs were disputed because, under the OPUS partnership agreements, Tri-Valley is obligated to pay 100% of all lease acquisition costs related to the OPUS drilling program. The lease acquisition costs in question were related to the acquisition of Pleasant Valley, Moffat Ranch and Temblor (Belridge and Shields-Arms) properties. These leases were purchased by Tri-Valley at a cost of $6.2 million, which was subsequently “marked up” by $1.3 million and charged to OPUS at a cost of $7.5 million. As a result, Tri- Valley and the OSC have agreed for settlement purposes that OPUS should be credited $7.5 million in the settlement for purposes of determining the disproportionate sharing of revenues generated by the new JV entity. Legal Costs for Defense of Title: This issue deals with the allocation of legal expenses incurred to defend title to oil and gas leases. More specifically the issue centers on the $2.6 million of legal costs incurred by Tri-Valley on a quiet title action filed by Tri- Valley against Hansen et al in May 2009 involving the 1934 Scholle-Livingston oil and gas lease on the Hansen property, and on a second quiet title action filed by Hansen et al against Scholle and Tri-Valley et al in May 2010 involving an oil and gas lease taken by Tri-Valley in 2009 from the Scholle family for 50% interest in the oil and gas minerals on the Hansen property. Since the first day Tri-Valley acquired the Scholle- Livingston lease in May 2005, the lease title was disputed by the Hansen owners as they considered the lease to have terminated due to cessation of production of oil on the property over 10 years prior to Tri-Valley’s purchase. Tri-Valley’s prior management believed that the 1934 lease was still valid and could be held into perpetuity since, according to the lease terms, oil or gas was still “producible” from the property. However, most modern leases require a commercial profit parameter such as production “in paying quantities” to hold a lease beyond the primary term. Tri-Valley made numerous attempts to negotiate with Hansen to amend the terms of the 1934 lease between May 2005 and May 2009, but the parties were never able to reach agreement. In late May 2009, Tri-Valley initiated a quiet title action against Hansen. During the course of preparing the case, it appeared that the Scholle family still owned a 50% reversionary interest in the minerals on Hansen’s property, and Tri-Valley acquired a lease from the Scholle’s in late 2009. As the quiet title action progressed, it appeared that the case hinged on the word “producible” in the 1934 lease, but there was not strong California oil and gas case law to support Tri-Valley’s claim. A loss of the case would also mean loss of the gas pipeline easement that supplies the steam generation for the adjacent Hunsucker lease. During legal discovery in early 2010, it was revealed that Hansen had entered into a new oil and gas lease in September 2009 with another operator, effective from May 1, 2009. Given the legal risk assessment on the quiet title action, including potential loss of the pipeline easement if Tri- (Continued from page 2) (Continued on page 6) Page 3 BACKGROUND ON THE OPUS “LEGACY ISSUES” TVC OPUS 1 Drilling Program, L.P. Newsletter Page 4 2011 OPERATIONS HIGHLIGHTS AT PLEASANT VALLEY TVC OPUS 1 Drilling Program, L.P. Newsletter 2011 was the first year of significant profitable lease operations at Pleasant Valley (PV) attributable to higher net oil prices, higher production, and lower unit operating costs, which were achieved by our Field Operations Team and resulted in significant improvements to our lease operations: .. In 2011, PV generated an annual lease gross operating profit of approximately $1.6 million, which is expected to continue in 2012. These funds, together with other costs incurred by Tri-Valley and OPUS are accounted for in the OPUS financial statements (which will be provided to you) and then incorporated along with the “Legacy Issues” in the proposed Settlement, as applicable. Going forward, a positive cash flow makes the project more financeable, can help fund the drilling of a SAGD Pilot, or be put to other uses. .. Completed the transition from Santa Maria Refining to Plains Marketing LP in November for provision of diluent and sale of blended Vaca Tar heavy oil in November. .. Average netback price for November and December 2011 was $91.70 per barrel as compared to an average netback of $68.07 per barrel for the prior period January through October 2011; this reflects a $23.63 per barrel improvement in pricing terms under the new Plains agreement. .. $8.23 per barrel higher average Vaca Tar netback realized in 2011 (net sales price after deduction of diluent and transportation costs) or $70.79 vs. $62.56 per barrel netback in 2010 largely due to higher global oil prices and effect of new contract pricing in the fourth quarter. .. Gross native Vaca Tar production (excluding diluent) increased by 33% in 2011 to 269 barrels of oil per day (BOPD) compared to 202 BOPD in 2010; and total gross volumes produced were 98,363 barrels versus 73,793 barrels during 2010 due to operational improvements: .. New steam injection method resulted in a 10% reduction in the ratio of cold water equivalent barrels of steam injected for each barrel of oil produced (2.68 in 2011 vs. 2.96 in 2010). .. Optimization of the rod and beam, and hydraulic artificial lift systems to extend oil production cycles as the reservoir cools. .. Reduction of production facility bottlenecks to improve processing and throughput. .. Reduced commercial water disposal costs following conversion of the PV#2 vertical well to water disposal. The conversion was done in June immediately following approval of our application to the Division of Oil, Gas and Geothermal Resources in January 2010. .. Successful first ever two-week shutdown of PV facilities for scheduled repairs and preventative maintenance in October. $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Cum. Net Lease Income Mo Rev & Exp 2011 Pleasant Valley Lease Monthly Net Revenues and Expenses Cumulative Net Lease Income OPUS Share LOE Expenses (75.00%) Net Revenue (56.35%) Cum. Net Lease Proft/<Loss> (75.00%) Page 5 TVC OPUS 1 Drilling Program, L.P. Newsletter UPDATE ON TR I-VALLEY’ S CLAFLIN PROJ ECT Tri-Valley’s Claflin project is a critical part of the Company’s goal to achieve sustainable operating income from oil and gas operations. During 2011, Tri-Valley continued its development of the 80 acre Claflin lease in the northeast part of the Edison Field east of Bakersfield, and expanded its footprint in the area by acquiring additional acreage that brings its total ownership to more than 400 net acres. The Company has a 100% working interest in all of the properties. In April 2011, eight new vertical wells were drilled into the Santa Margarita formation at a depth of about 1,000 feet to produce 14 API gravity heavy oil using cyclic steam stimulation. Only three of the new wells received their initial steam injection during June and July before steam generation facilities were shut down for modifications required for a new operating permit. These modifications were completed in November and steam injection resumed later that month after the new operating permit was received. Tri-Valley also acquired 1.7 square miles of threedimensional seismic covering Claflin, Brea and other leases. By early January, initial steam injection had been completed on the remaining five new wells. Initial production rates per well have ranged from 20 to 70 barrels per day, and peak lease production has ranged between 100 to 130 barrels per day during January. Tri-Valley has conducted extensive production testing on the new wells in order to accurately calculate the steam injection response for each well. Last October, the Company submitted an underground injection project for water disposal to the Division of Oil, Gas and Geothermal Resources as the existing produced water disposal facility is near capacity. Formal approval was received on April 20, 2012. Tri-Valley intends to obtain development financing at Claflin that it expects will be used as follows: .. Drill and complete up to 10 new horizontal wells .. Recomplete four vintage wells in the Chanac formation .. Convert a vintage well to an injector for water disposal .. Drill a new injector well for water disposal .. Install facility improvements including additional water and oil storage tanks, insulation of pipelines (Continued on page 6) 0 200 400 600 800 1000 1200 1400 1600 0 200 400 600 800 1000 1200 1400 1600 Barrels of Steam Injected Per Day Barrels of Oil Per Day Pleasant Valley Gross Production (100%) 12 Month Period Ending December 2011 Native Oil Diluent Steam Injection Shut-in 2 weeks for Plant Maintenance Section 26 T29S R29E 8 3 18-26 10 11 16-26 1 2 4 17A 44A-26 6-27 88-27 11-35 81-34 35-26 46-26 1 1 5 6 1-26 2-26 2-5 2 3 26-2 26-1 26-3 26-4 26-5 26-6 2-6 1-6 3-6 4-6 5-6 1-5B 2-5B 3 4 8 7 6 EDISON FIELD AREA - Claflin_Brea_et al FEET 0 446 PETRA 12/8/2010 3:51:26 PM 1 29S/29E 29S/28E Sec ti on 2 6 Se ctio n 25 Se ctio n 27 Sectio n 35 Se ctio n 36 Sec ti on 2 4 Sectio n 23 Sec ti on 2 2 Sec ti on 3 4 Se ctio n 16 Se cti on 15 Secti on 2 1 Sectio n 17 Sectio n 27 Secti on 2 0 Se ctio n 29 Se ctio n 32 Sectio n 33 T29S R29E Edison Field Ant Hill Field Kern Bluff Field cum 150 mmbo cum 8.5 mmbo Tri -Vall ey Cl afli n leases Hwy 58 Hwy 178 BAKERSFIELD Index Map Producing wells New Development Wells Future Wells Initial 8 Vertical Wells Claflin & Brea Leases at Edison Field Claflin Brea Valley lost the case, a decision was made by the Company to settle the quiet title action with Hansen, which resulted in a quitclaim of the 1934 lease by Tri-Valley to Hansen. The parties agreed that the matter of title validity on the Scholle leases would be the focus of a second quiet title action which was filed by Hansen shortly after the settlement in May 2010 on the 1934 lease. Tri-Valley had relied on the recorded deed for its conclusion that the Scholle’s owned a 50% interest in the minerals when it acquired the leases from the Scholle’s in 2009. In the fall of 2010, Plaintiffs discovered copies of the Scholle family’s 1973 sale purchase agreement which conflicted with the deed, and appeared to indicate that the Scholle’s may have intended to transfer all of their rights and interests in the minerals to the purchaser. The Scholle’s and Tri-Valley believed that the recorded deed would prevail (under the “merger doctrine”) and would prevent copies of the sale agreement (under the “parole evidence rule”) from being considered by the court in its review of the deed. Hansen amended their complaint to a slander of title claim in early 2011 when the Scholle’s and Tri-Valley refused to give up their defense against the quiet title claim after discovery of the copies of the sales purchase documents were discovered. In August 2011, the trial judge decided that the parole evidence rule could be used in this situation since both plaintiffs and defendants argued that the deed was “unambiguous”, yet arrived at opposite conclusions. The effect of his order reformed the deed in a manner that voided the 2009 Scholle leases. The second phase of the trial due to start in the fall of 2011 would deal with the slander of title issue. Potentially this exposed the Scholle’s and Tri-Valley to monetary damages in excess of $4 million, and depending on a jury’s decision, could well have exceeded this amount if punitive damages were applied. Although legal counsel believed there would be reasonable legal arguments for an appeal, the appeal itself would require Scholle’s and Tri-Valley to post a bond for 150% of all damages awarded by a jury. In light of the high financial exposure, Scholle’s and Tri- Valley agreed to join Hansen in a mediation which resulted in a settlement of $1.5 million being paid to the Hansen plaintiffs. The cost of the Hansen settlement and related legal costs will not be charged to OPUS. (OPUS “Legacy Issues” - continued from page 3) Page 6 TVC OPUS 1 Drilling Program, L.P. Newsletter .. Drill a new fresh water well .. Install a natural gas pipeline connection The Company’s ability to continue as a going concern is dependent, in large part, on obtaining working capital and project-level financing as soon as practicable. Please see the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, which was filed with the SEC on April 16, 2012, for important disclosures relating to, among other things, the Company’s liquidity and financial condition outlook for 2012. The SEC maintains a website on the Internet at http://www.sec.gov that contains all of the Company’s filings. These filings may be downloaded free of charge. Such filings may also be obtained on the Company’s website under the “Investors” tab, which may be accessed at http://www.trivalleycorp. com. (Claflin Project - continued from page 5) STATUS OF SEC INQUIRY As Tri-Valley previously reported on February 8, 2012 in an 8K filed with the SEC, the Company and TVC OPUS 1 Drilling Program, L.P. each received a subpoena on February 2, 2012 issued by the staff of the US Securities and Exchange Commission (SEC) that seeks documents and data for the period from January 1, 2002 to the present, relating to their financial condition, results of operations, transactions, activities, business, and offer and sale of securities of the Company and OPUS. The Company is cooperating with the staff's request and is in the process of responding to the subpoena. The SEC inquiry demonstrates the prudence of the Company's decision to address and resolve the substantial legacy issues between the Company and OPUS, and the prudence of establishing the OPUS Special Committee to negotiate a settlement, subject to the approval of the majority of interests in OPUS. Without resolving these major problems, neither Tri-Valley nor OPUS can move forward. Thank you for your patience; we look forward to getting the settlement and disclosure package out to you. Company Contact: Maston Cunningham, CEO Tri-Valley Corp. (661) 864-0500 mcunningham@tri-valleycorp.com Investor Contacts: Doug Sherk/Jenifer Kirtland EVC Group, Inc. (415) 568-9349 dsherk@evcgroup.com jkirtland@evcgroup.com Media Contact: Chris Gale EVC Group, Inc. (646) 201-5431 cgale@evcgroup.com Page 7 TVC OPUS 1 Drilling Program, L.P. Newsletter Special Note Regarding Forward-Looking Statements: All statements contained in this Newsletter that refer to future events or other non-historical matters are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “hope,” “intends,” “may,” “plans,” “potential,” or “predicts,” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions based on Tri-Valley management’s expectations as of the date of this Newsletter, and involve known and unknown risks, uncertainties and other factors, including: Tri-Valley’s and the new JV entity’s ability to obtain additional funding; the outcome of an ongoing investigation of Tri- Valley and OPUS by the staff of the SEC; fluctuations in oil and natural gas prices; imprecise estimates of oil reserves; drilling hazards such as equipment failures, fires, explosions, blow-outs, and pipe failure; shortages or delays in the delivery of drilling rigs and other equipment; problems in delivery to market; adverse weather conditions; compliance with governmental and regulatory requirements; geographical concentration of oil and gas reserves in the State of California; changes in, or inability to enter into or maintain, strategic and joint venture partnerships; pending and threatened lawsuits against us; potential rescission rights stemming from our potential violation of Section 5 of the Securities Act of 1933; our ability to consummate the OPUS restructuring transaction; the continued listing of our common stock on the NYSE Amex; and such other risks and factors that are discussed in our filings with the US Securities and Exchange Commission from time to time, including under “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contained in Tri- Valley’s Annual Report on Form 10-K for the year ended December 31, 2011. Except as required by law, Tri-Valley undertakes no obligation to update or revise publicly any of the forward-looking statements after the date of this Newsletter to conform such statements to actual results or to reflect events or circumstances occurring after the date of this Newsletter. Notice to OPUS Partners and Additional Information about the Restructuring Transaction: No information or disclosures contained in this Newsletter relating to any possible breach or violation of any agreement, law or regulation should be construed as an admission of liability or as an indication that any such breach or violation continues to exist or actually occurred. In connection with the potential restructuring transaction, Tri-Valley Corporation, as the managing partner of OPUS, will prepare and distribute an Information Statement and Consent Solicitation to all OPUS partners. OPUS partners are urged to read carefully the Information Statement and Consent Solicitation, and the other relevant materials, when they become available before making any voting or investment decision with respect to the proposed restructuring transaction, because they will contain important information about the transaction and the parties to the transaction. Tri-Valley Corporation and its respective directors, executive officers, and employees are expected to participate in the solicitation of consents to the proposed restructuring transaction from OPUS partners. OPUS partners may obtain more detailed information regarding the names, affiliations and interests of certain of Tri-Valley’s executive officers, directors and/or other employees in the solicitation by reading the Information Statement and Consent Solicitation, and other relevant materials, when they become available and are distributed to the OPUS partners. When available, Tri-Valley Corporation will distribute the Information Statement and Consent Solicitation, and other relevant materials, to all OPUS partners of record. OPUS partners may obtain free copies of the Information Statement and Consent Solicitation, when available, by contacting Tri-Valley Corporation at 4927 Calloway Drive, Bakersfield, California 93312, or at (661) 864-0500. IMPORTANT NOTICES FOR OPUS PARTNERS