UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

| | Investment Company Act file number 811-02688

Name of Fund: BlackRock Municipal Bond Fund, Inc.

BlackRock High Yield Municipal Fund

BlackRock Municipal Insured Fund

BlackRock National Municipal Fund

BlackRock Short-Term Municipal Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock

Municipal Bond Fund, Inc., 800 Scudders Mill Road, Plainsboro, NJ, 08536. Mailing

address: P.O. Box 9011, Princeton, NJ, 08543-9011

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2008

Date of reporting period: 07/01/2007 – 06/30/2008

Item 1 – Report to Stockholders |

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

BlackRock Municipal Bond

Fund, Inc.

ANNUAL REPORT | JUNE 30, 2008

BlackRock Short-Term Municipal Fund

BlackRock Municipal Insured Fund

BlackRock National Municipal Fund

BlackRock High Yield Municipal Fund |

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE |

| Table of Contents | | |

| |

|

| |

| | | Page |

| |

|

| |

| A Letter to Shareholders | | 3 |

| Annual Report: | | |

| Fund Summaries | | 4 |

| About Fund Performance | | 12 |

| Disclosure of Expenses | | 14 |

| Financial Statements: | | |

| Schedules of Investments | | 18 |

| Statements of Assets and Liabilities | | 39 |

| Statements of Operations | | 41 |

| Statements of Changes in Net Assets | | 42 |

| Financial Highlights | | 46 |

| Notes to Financial Statements | | 60 |

| Report of Independent Registered Public Accounting Firm | | 71 |

| Important Tax Information (Unaudited) | | 71 |

| Disclosure of Investment Advisory Agreement and Subadvisory Agreement | | 72 |

| Officers and Directors | | 76 |

| Additional Information | | 80 |

| Mutual Fund Family | | 82 |

2 BLACKROCK MUNICIPAL BOND FUND, INC.

Dear Shareholder

Throughout the past year, investors were overwhelmed by lingering credit and financial market troubles, surging oil

prices and more recently, renewed inflation concerns. Healthy nonfinancial corporate profits and robust exporting

activity remained among the few bright spots, helping the economy to grow at a modest, but still positive, pace.

The Federal Reserve Board (the “Fed”) has been aggressive in its attempts to stoke economic growth and ease

financial market instability. In addition to slashing the target federal funds rate 325 basis points (3.25%) between

September 2007 and April 2008, the central bank introduced the new Term Securities Lending Facility, granted broker-

dealers access to the discount window and used its own balance sheet to help negotiate the sale of Bear Stearns.

As widely anticipated, the end of the period saw a pause in Fed action, as the central bank held the target rate steady

at 2.0% amid rising inflationary pressures.

As the Fed’s bold response to the financial crisis helped ease credit turmoil and investor anxiety, U.S. equity markets

sank sharply over the last six months, notwithstanding a brief rally in the spring. International markets were not immune

to the tumult, with most regions also registering declines.

Treasury securities also traded in a volatile fashion, but generally rallied (yields fell as prices correspondingly rose), with

investors continuing to seek safety as part of a broader flight to quality. The yield on 10-year Treasury issues, which fell

to 3.34% in March 2008, climbed up to the 4.20% range in mid-June as investors temporarily shifted out of Treasury

issues in favor of riskier assets (such as stocks and other high-quality fixed income sectors), then reversed course and

declined to 3.99% by period-end when credit fears re-emerged.

Tax-exempt issues eked out gains for the reporting period, but underperformed their taxable counterparts, as the group

continued to be pressured by problems among municipal bond insurers and the breakdown in the market for auction

rate securities.

The major benchmark indexes generated results that largely reflected heightened investor risk aversion:

Total Returns as of June 30, 2008 6-month 12-month

| U.S. equities (S&P 500 Index) | | (11.91)% | | (13.12)% |

| |

| |

|

| Small cap U.S. equities (Russell 2000 Index) | | (9.37)% | | (16.19)% |

| |

| |

|

| International equities (MSCI Europe, Australasia, Far East Index) | | (10.96)% | | (10.61)% |

| |

| |

|

| Fixed income (Lehman Brothers U.S. Aggregate Index) | | 1.13% | | 7.12% |

| |

| |

|

| Tax-exempt fixed income (Lehman Brothers Municipal Bond Index) | | 0.02% | | 3.23% |

| |

| |

|

| High yield bonds (Lehman Brothers U.S. Corporate High Yield 2% Issuer Capped Index) | | (1.08)% | | (1.74)% |

| |

| |

|

| | Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly

in an index.

As you navigate today’s volatile markets, we encourage you to review your investment goals with your financial profes-

sional and to make portfolio changes, as needed. For more up-to-date commentary on the economy and financial

markets, we invite you to visit www.blackrock.com/funds. As always, we thank you for entrusting BlackRock with your

investment assets, and we look forward to continuing to serve you in the months and years ahead. |

THIS PAGE NOT PART OF YOUR FUND REPORT

3

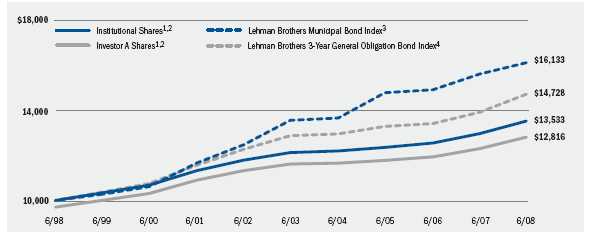

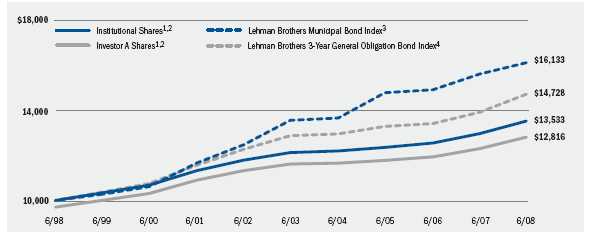

Fund Summary as of June 30, 2008 BlackRock Short-Term Municipal Fund

Portfolio Management Commentary

How did the Fund perform?

•The Fund outperformed both the broad-market Lehman Brothers

Municipal Bond Index and its Lipper Short Municipal Debt Funds cate-

gory average for the 12-month period. Fund returns trailed that of the

Lehman Brothers 3-Year General Obligation Bond Index.

What factors influenced performance?

•U.S.Treasury yields generally declined (while prices correspondingly

rose) during the period in response to weaker U.S. economic growth and

declining equity valuations. The Federal Reserve Board (Fed) cut short-

term interest rates from 5.25% to 2.0% between September 2007 and

April 2008. The municipal market underperformed U.S. Treasury issues,

as credit downgrades of the monoline insurers and the failure of auction

rate securities disrupted normal market function. Liquidity diminished as

broker-dealers reduced activity to protect their fragile balance sheets.

The municipal market experienced its own “flight-to-quality,” with natural

AAA-rated and AA-rated municipal bonds generally performing much

better than lower-rated and insured issues.

•The Fund’s conservative investment strategy and overweight in the front

part of the yield curve were the main factors behind its relative outper-

formance. The Federal Reserve Board’s aggressive easing of monetary

policy in light of the liquidity and credit crisis had the greatest positive

impact on the front end of the yield curve, an area that the Fund was

overweight. The flight to quality that ensued in the fixed income markets

benefited this segment of the curve as well, further enhancing Fund

returns. Also contributing positively was the outperformance of higher-

quality issues versus insured securities and lower-rated spread product.

The Fund’s average credit quality was maintained in the AA category

as purchases were generally focused on prerefunded bonds and high-

quality general obligation bonds, both of which outperformed the

broader market for most of the annual period.

•The unprecedented downgrades of AAA monoline insurance companies

created significant turmoil in lower-rated issues, as well as monoline-

backed securities with lower underlying ratings. Although the Fund has

some exposure to securities backed by monoline insurance, it is minimal

and the underlying issues remain strong. Nevertheless, even a relatively

small allocation in this area modestly detracted from performance

during the year.

Describe recent portfolio activity.

•Cash reserves were drawn down to a minimum in the belief that cash

would underperform issues with a maturity of one to two years during a

period of Fed easing. Additionally, we continued to swap out of insured

bonds and lower-quality issues in favor of prerefunded bonds and

general obligation bonds.

Describe Fund positioning at period-end.

•At period-end, the Fund is positioned for a neutral Fed policy throughout

the remainder of 2008, which should benefit performance as the curve

may continue to steepen due to inflationary concerns. This would nega-

tively impact longer-dated issues, while shorter-term securities should

continue to hold their value. The portfolio’s average credit quality of

AA also bodes well given the continued uncertainty in the economy

and the impact on lower-quality issues.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

| | Fund Profile as of June 30, 2008 |

| | | Percent of |

| | | Long Term |

| | | Investments |

| |

|

| Other Revenue Bonds | | 39% |

| General Obligation & Tax Revenue Bonds | | 33 |

| Prerefunded Bonds | | 28 |

4 BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008

BlackRock Short-Term Municipal Fund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees.

2 The Fund invests primarily in investment grade municipal bonds (bonds rated Baa or better) with a maximum maturity not

to exceed four years or in municipal notes.

3 This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature

within 30 years.

4 This unmanaged Index consists of state and local government obligation bonds that mature in three – four years, rated Baa or better.

Performance Summary for the Year Ended June 30, 2008

| | | | | | | | | | | Average Annual Total Returns1 | | | | |

| | | | | | | 1 Year | | | | 5 Years | | | | 10 Years |

| | | Standardized | | 6-Month | | w/o sales | | w/sales | | w/o sales | | w/sales | | w/o sales | | w/sales |

| | | 30-Day Yields | | Total Returns | | charge | | charge | | charge | | charge | | charge | | charge |

| BlackRock | | 2.42% | | 1.60% | | 4.26% | | — | | 2.22% | | — | | 3.08% | | — |

| Institutional | | 2.41 | | 1.62 | | 4.31 | | — | | 2.21 | | — | | 3.07 | | — |

| Investor A | | 2.09 | | 1.49 | | 4.15 | | 1.03% | | 1.98 | | 1.36% | | 2.82 | | 2.51% |

| Investor A1 | | 2.29 | | 1.57 | | 4.20 | | 3.16 | | 2.11 | | 1.91 | | 2.97 | | 2.87 |

| Investor B | | 2.06 | | 1.44 | | 3.94 | | 2.94 | | 1.85 | | 1.85 | | 2.70 | | 2.70 |

| Investor C | | 1.41 | | 1.11 | | 3.27 | | 2.27 | | 1.20 | | 1.20 | | 2.05 | | 2.05 |

| Lehman Brothers 3-Year | | | | | | | | | | | | | | | | |

| General Obligation | | | | | | | | | | | | | | | | |

| Bond Index | | — | | 1.95 | | 5.75 | | — | | 2.71 | | — | | 3.95 | | — |

| Lehman Brothers Municipal | | | | | | | | | | | | | | | | |

| Bond Index | | — | | 0.02 | | 3.23 | | — | | 3.52 | | — | | 4.90 | | — |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | 1 Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees.

Past performance is not indicative of future results. |

BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008 5

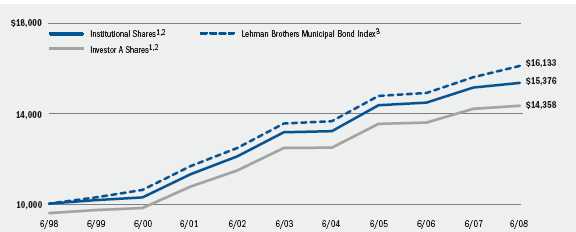

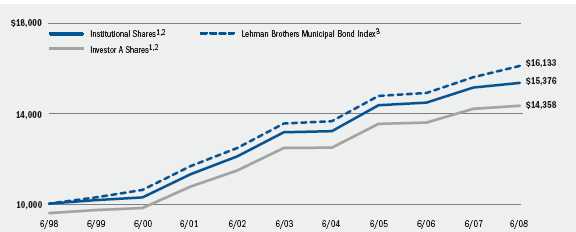

Fund Summary as of June 30, 2008 BlackRock Municipal Insured Fund

Portfolio Management Commentary

How did the Fund perform?

•The Fund underperformed the broad-market Lehman Brothers Municipal

Bond Index for the 12-month period. The Fund’s Institutional shares out-

performed the Lipper Insured Municipal Debt Funds category average,

while Investor A, Investor B, Investor C and Investor C1 shares trailed the

Lipper peers.

What factors influenced performance?

•U.S.Treasury yields generally declined (while prices correspondingly

rose) during the period in response to weaker U.S. economic growth and

declining equity valuations. The Federal Reserve Board cut short-term

interest rates from 5.25% to 2.0% between September 2007 and April

2008. The municipal market underperformed U.S. Treasury issues, as

credit downgrades of the monoline insurers and the failure of auction

rate securities disrupted normal market function. Liquidity diminished as

broker-dealers reduced activity to protect their fragile balance sheets.

The municipal market experienced its own “flight-to-quality,” with natural

AAA-rated and AA-rated municipal bonds generally performing much

better than lower-rated and insured issues.

•Fund performance was negatively impacted by three factors. First, the

Fund was positioned with a more constructive view of the market during

a period in which yields generally rose. The Fund’s overweight in the

longer part of the yield curve further hampered results, as the curve

steepened and short yields declined while long yields rose. Exposure to

insured bonds with weaker underlying ratings, namely those rated A- or

below, also proved detrimental amid the tumult in the municipal market

and among insured bonds, in particular.

•On the positive side, our efforts to upgrade credit quality by purchasing

favored insurers (such as Financial Security Assurance Inc.) aided per-

formance, as the spread between higher- and lower-rated securities

widened. Our efforts to increase coupons and dampen duration exten-

sion also benefited Fund results.

Describe recent portfolio activity.

•The municipal market endured significant stress and volatility throughout

the annual period in light of the transformation in the monoline insur-

ance industry. Three of the four largest bond insurers were downgraded

from AAA status, and have since largely stopped writing new business.

This had far-reaching implications, as insured bonds accounted for

nearly 50% of all municipal issuance as recently as last year. In

response, working with our Municipal Research Group, we combed

through the Fund’s holdings to identify sale candidates based on our

underlying issuer rating and insurer profile. We focused on upgrading

credit quality and increasing overall portfolio liquidity. Additionally, we

worked to increase average coupon and dampen duration extension.

Describe Fund positioning at period-end.

•The Fund was positioned with a modestly constructive view of the

market at period-end, with an overweight to the longer end of the yield

curve. The municipal yield curve steepened significantly over the prior

one-year period and we believe currently offers attractive value. Going

forward, we will look to add premium-coupon bonds from high-quality

insurers and issuers, and will focus primarily on the 25-year area of

the curve.

| | The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Profile as of June 30, 2008

| | | Percent of |

| | | Long Term |

| | | Investments |

| |

|

| Other Revenue Bonds | | 70% |

| General Obligation & Tax Revenue Bonds | | 21 |

| Prerefunded Bonds | | 9 |

6 BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008

BlackRock Municipal Insured Fund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees.

2 The Fund invests primarily in long-term, investment grade municipal bonds (bonds rated Baa or better) covered by portfolio

insurance guaranteeing the timely payment of principal at maturity and interest.

3 This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature

within 30 years.

Performance Summary for the Year Ended June 30, 2008

| | | | | | | | | | | Average Annual Total Returns1 | | | | |

| | | | | | | 1 Year | | | | 5 Years | | | | 10 Years |

| | | Standardized | | 6-Month | | w/o sales | | w/sales | | w/o sales | | w/sales | | w/o sales | | w/sales |

| | | 30-Day Yields | | Total Returns | | charge | | charge | | charge | | charge | | charge | | charge |

| Institutional | | 4.20% | | (0.93)% | | 1.37% | | — | | 3.13% | | — | | 4.40% | | — |

| Investor A | | 3.77 | | (1.19) | | 0.96 | | (3.33)% | | 2.85 | | 1.96% | | 4.13 | | 3.68% |

| Investor B | | 3.45 | | (1.44) | | 0.45 | | (3.41) | | 2.33 | | 1.99 | | 3.61 | | 3.61 |

| Investor C | | 3.19 | | (1.55) | | 0.22 | | (0.74) | | 2.11 | | 2.11 | | 3.36 | | 3.36 |

| Investor C1 | | 3.39 | | (1.46) | | 0.41 | | (0.55) | | 2.28 | | 2.28 | | 3.56 | | 3.56 |

| Lehman Brothers Municipal | | | | | | | | | | | | | | | | |

| Bond Index | | — | | 0.02 | | 3.23 | | — | | 3.52 | | — | | 4.90 | | — |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | 1 Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees.

Past performance is not indicative of future results. |

BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008 7

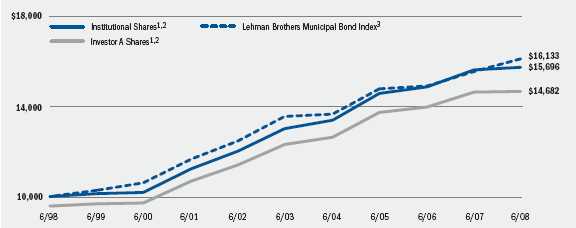

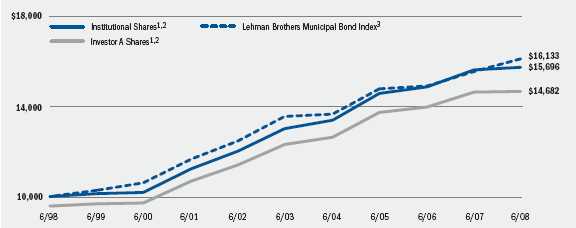

Fund Summary as of June 30, 2008 BlackRock National Municipal Fund

Portfolio Management Commentary

How did the Fund perform?

•The Fund underperformed the broad-market Lehman Brothers Municipal

Bond Index and the Lipper General Municipal Debt Funds category

average for the 12-month period.

What factors influenced performance?

•U.S.Treasury yields generally declined (while prices correspondingly

rose) during the period in response to weaker U.S. economic growth and

declining equity valuations. The Federal Reserve Board cut short-term

interest rates from 5.25% to 2.0% between September 2007 and April

2008. The municipal market underperformed U.S. Treasury issues, as

credit downgrades of the monoline insurers and the failure of auction

rate securities disrupted normal market function. Liquidity diminished

as broker-dealers reduced activity to protect their fragile balance sheets.

The municipal market experienced its own “flight-to-quality,” with natural

AAA-rated and AA-rated municipal bonds generally performing much

better than lower-rated and insured issues.

•In general, any Fund exposure to alternative minimum tax (AMT) bonds,

airline- and tobacco-backed securities and high yield credits detracted

from performance over the one-year period, as these issues suffered

amid substantial credit spread widening. Similarly, any Fund exposure

to insured (monoline-backed) securities proved detrimental, as the entire

sector underperformed following the credit rating downgrades of the

major insurers. In addition, the Fund’s high cash reserve position hin-

dered performance during periods that witnessed improving bond prices,

as it placed us in a less aggressive stance versus other funds in the

Lipper peer group.

•On the positive side, we continued to focus our efforts on delivering a

steady, high level of income for shareholders, within a higher average

credit profile. This was advantageous as it resulted in an above-average

accrual rate and current yield for the Fund. Likewise, the Fund’s credit

quality of AA was additive in a market of declining credit fundamentals

and widening credit spreads. Lastly, the Fund’s high cash reserve posi-

tion was invested in higher-yielding cash equivalents due to dislocation

in the money market fund arena, which also enhanced results.

Describe recent portfolio activity.

•During the annual period, we permitted the Fund’s cash reserves to

accumulate to a historically high percentage as higher-yielding cash

equivalents became available given the abovementioned dislocation

in the money market sector. We also deleveraged some of the Fund’s

inverse floating-rate positions.

Describe Fund positioning at period-end.

•The Fund ended the period with a continued low duration posture

relative to its Lipper peers. The Fund maintains a high current income,

despite its relatively high cash reserve, and a high average credit quality

of AA-. We have ample cash and short-term securities (9% of total

assets) to invest should better yielding securities become available,

either from a growing new-issue calendar or a deteriorating secondary

market. Market illiquidity favors the fund that has cash to spend as

swaps and raising reserves remains difficult in the current environment.

| | The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Profile as of June 30, 2008

| | | Percent of |

| | | Long Term |

| | | Investments |

| |

|

| Other Revenue Bonds | | 72% |

| General Obligation & Tax Revenue Bonds | | 16 |

| Prerefunded Bonds | | 12 |

8 BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008

BlackRock National Municipal Fund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees.

2 The Fund invests primarily in long-term municipal bonds rated in any rating category or unrated.

3 This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature

within 30 years.

Performance Summary for the Year Ended June 30, 2008

| | | | | | | | | | | Average Annual Total Returns1 | | | | |

| | | | | | | 1 Year | | | | 5 Years | | | | 10 Years |

| | | Standardized | | 6-Month | | w/o sales | | w/sales | | w/o sales | | w/sales | | w/o sales | | w/sales |

| | | 30-Day Yields | | Total Returns | | charge | | charge | | charge | | charge | | charge | | charge |

| Institutional | | 4.26% | | (0.62)% | | 0.35% | | — | | 3.80% | | — | | 4.61% | | — |

| Investor A | | 3.86 | | (0.73) | | 0.22 | | (4.04)% | | 3.57 | | 2.68% | | 4.37 | | 3.92% |

| Investor B | | 3.50 | | (0.99) | | (0.30) | | (4.14) | | 3.04 | | 2.71 | | 3.84 | | 3.84 |

| Investor C | | 3.22 | | (1.12) | | (0.57) | | (1.53) | | 2.77 | | 2.77 | | 3.57 | | 3.57 |

| Investor C1 | | 3.46 | | (1.01) | | (0.44) | | (1.39) | | 2.98 | | 2.98 | | 3.78 | | 3.78 |

| Lehman Brothers Municipal | | | | | | | | | | | | | | | | |

| Bond Index | | — | | 0.02 | | 3.23 | | — | | 3.52 | | — | | 4.90 | | — |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | 1 Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees.

Past performance is not indicative of future results. |

BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008 9

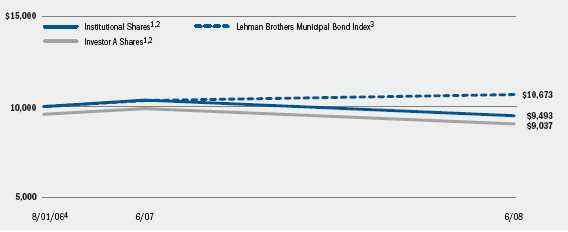

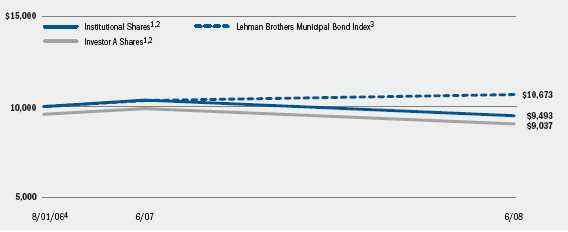

Fund Summary as of June 30, 2008 BlackRock High Yield Municipal Fund

Portfolio Management Commentary

How did the Fund perform?

•The Fund’s total return lagged both the broad-market and performance

benchmarks and its comparable Lipper category average for the 12-

month period.

What factors influenced performance?

•U.S.Treasury yields generally declined (while prices correspondingly

rose) during the period in response to weaker U.S. economic growth and

declining equity valuations. The Federal Reserve Board cut short-term

interest rates from 5.25% to 2.0% between September 2007 and April

2008. The municipal market underperformed U.S. Treasury issues, as

credit downgrades of the monoline insurers and the failure of auction

rate securities disrupted normal market function. Liquidity diminished as

broker-dealers reduced activity to protect their fragile balance sheets.

The municipal market experienced its own “flight-to-quality,” with natural

AAA-rated and AA-rated municipal bonds generally performing much

better than lower-rated and insured issues.

•As stated in our last report to shareholders, the Fund’s exposure at the

lower end of the credit spectrum has suffered disproportionately due to

a prevalence of discounted securities exhibiting relatively high duration

profiles. The Fund’s yield curve exposure also proved detrimental. The

municipal yield curve steepened significantly over the one-year period,

which primarily benefited the short end. In contrast, high yield municipal

issuance is heavily weighted at the long end of the maturity spectrum

and, as a consequence, the Fund’s investments tend to be concentrated

in this segment of the curve.

•On the positive side, performance was aided by an up-in-quality bias

that has been maintained since the Fund’s inception. However, the bene-

ficial impact has been muted somewhat by the extent to which portfolio

investments have been adversely affected by deteriorating credit metrics

within the monoline insurance industry. Some modest additional benefit

can be attributed to an underweight exposure to the airline sector, which

has been subject to particularly acute stress amidst weak economic

growth and rising energy prices.

Describe recent portfolio activity.

•Throughout the year, we continued to pursue opportunities to boost the

Fund’s distribution yield. While some progress was achieved, a dearth of

fairly priced securities in the municipal high yield arena continued to

thwart efforts to reduce cash balances. At times, we sought alternative

methods that included the purchase of higher-yielding short-term vari-

able rate and auction rate instruments, as well as the use of a leveraged

form of income enhancement known as tender option bond trusts. On a

sector basis, recent investments were made in utilities, education and oil

services, while exposures to long-term care and tobacco were either

reduced or eliminated.

Describe Fund positioning at period-end.

•At period-end, the Fund was positioned somewhat lower than bench-

mark duration, largely as a result of a high cash balance. While our pref-

erence is to remain more fully invested, we are satisfied conserving cash

for the investment opportunities that likely lie ahead.

| | The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Profile as of June 30, 2008

| | | Percent of |

| | | Long Term |

| | | Investments |

| |

|

| |

| Other Revenue Bonds | | 91% |

| General Obligation & Tax Revenue Bonds | | 9 |

10 BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008

BlackRock High Yield Municipal Fund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees.

2 The Fund invests primarily in municipal bonds rated in any rating category or in unrated municipal bonds.

3 This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature

within 30 years.

4 Commencement of Operations.

Performance Summary for the Year Ended June 30, 2008

| | | | | | | | | Average Annual Total Returns1 | | |

| | | | | | | 1 Year | | | | Since Inception2 |

| | | Standardized | | 6-Month | | w/o sales | | w/sales | | w/o sales | | w/sales |

| | | 30-Day Yields | | Total Returns | | charge | | charge | | charge | | charge |

| Institutional | | 5.08% | | (2.63)% | | (8.38)% | | — | | (2.68)% | | — |

| Investor A | | 4.64 | | (2.75) | | (8.62) | | (12.51)% | | (2.98) | | (5.16)% |

| Investor C | | 4.05 | | (3.12) | | (9.40) | | (10.27) | | (3.62) | | (3.62) |

| Lehman Brothers Municipal Bond Index | | — | | 0.02 | | 3.23 | | — | | 3.47 | | — |

| |

| |

| |

| |

| |

| |

|

| | 1 Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees.

2 The Portfolio commenced operations on 8/01/06.

Past performance is not indicative of future results. |

BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008 11

About Fund Performance

For BlackRock Short-Term Municipal Fund

•BlackRock Shares are not subject to any sales charge. BlackRock

Shares bear no ongoing distribution or service fees and are available

only to eligible investors. Prior to October 2, 2006, BlackRock Share

performance results are those of the Institutional Shares (which have

no distribution or service fees).

•Institutional Sharesare not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available

only to eligible investors.

•Investor A Sharesincur a maximum initial sales charge (front-end load)

of 3% and a service fee of 0.25% per year (but no distribution fee).

Prior to October 2, 2006, Investor A Share performance results are those

of the Institutional Shares (which have no distribution or service fees)

restated to reflect Investor A Share fees.

•Investor A1 Sharesincur a maximum initial sales charge (front-end load)

of 1% and a service fee of 0.10% per year (but no distribution fee).

•Investor B Sharesare subject to a maximum contingent deferred sales

charge of 1% declining to 0% after three years. In addition, Investor B

Shares are subject to a distribution fee of 0.20% per year and a service

fee of 0.15% per year. These shares automatically convert to Investor A1

Shares after approximately 10 years. (There is no initial sales charge for

automatic share conversions.)

•Investor C Sharesare subject to a distribution fee of 0.75% per year

and a service fee of 0.25% per year. In addition, Investor C shares are

subject to a 1% contingent deferred sales charge if redeemed within one

year of purchase. Prior to October 2, 2006, Investor C Share perform-

ance results are those of the Institutional Shares (which have no distri-

bution or service fees) restated to reflect Investor C Share fees.

For BlackRock Municipal Insured Fund and BlackRock National Municipal Fund

•Institutional Sharesare not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available

only to eligible investors.

•Investor A Sharesincur a maximum initial sales charge (front-end load)

of 4.25% and a service fee of 0.25% per year (but no distribution fee).

•Investor B Sharesare subject to a maximum contingent deferred sales

charge of 4% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.50% per year and a service

fee of 0.25% per year. These shares automatically convert to Investor A

Shares after approximately 10 years. (There is no initial sales charge for

automatic share conversions.).

•Investor C Sharesare subject to a distribution fee of 0.75% per year

and a service fee of 0.25% per year. In addition, Investor C shares are

subject to a 1% contingent deferred sales charge if redeemed within one

year of purchase. Prior to October 2, 2006, Investor C Share performance

results are those of the Institutional Shares (which have no distribution

or service fees) restated to reflect Investor C Share fees.

•Investor C1 Sharesare subject to a distribution fee of 0.55% per year

and a service fee of 0.25% per year. In addition, Investor C1 shares are

subject to a 1% contingent deferred sales charge if redeemed within one

year of purchase.

12 BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008

About Fund Performance (concluded)

For BlackRock High Yield Municipal Fund

•Institutional Sharesare not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available

only to eligible investors.

•Investor A Sharesincur a maximum initial sales charge (front-end load)

of 4.25% and a service fee of 0.25% per year (but no distribution fee).

•Investor C Sharesare subject to a distribution fee of 0.75% per year

and a service fee of 0.25% per year. In addition, Investor C shares are

subject to a 1% contingent deferred sales charge if redeemed within one

year of purchase. |

For All Funds

Performance information reflects past performance and does not guaran-

tee future results. Current performance may be lower or higher than the

performance data quoted. Refer to www.blackrock.com/funds to obtain

performance data current to the most recent month-end. Performance

results do not reflect the deduction of taxes that a shareholder would pay

on fund distributions or the redemption of fund shares. Figures shown

in each of the performance tables on pages 5, 7, 9 and 11 assume

reinvestment of all dividends and capital gain distributions, if any, at net |

asset value on the payable date. The Funds’ investment adviser reim-

bursed a portion of each Fund’s expenses. Without such reimbursement,

a Fund’s performance would have been lower. Investment return and

principal value of shares will fluctuate so that shares, when redeemed,

may be worth more or less than their original cost. Dividends paid to each

class of shares will vary because of the different levels of service, distri-

bution and transfer agency fees applicable to each class, which are

deducted from the income available to be paid to shareholders. |

BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008 13

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a)

expenses related to transactions, including sales charges, redemption

fees and exchange fees; and (b) operating expenses including advisory

fees, distribution fees including 12b-1 fees, and other Fund expenses. The

expense examples on pages 14 – 17 (which are based on a hypothetical

investment of $1,000 invested on January 1, 2008 and held through

June 30, 2008) is intended to assist shareholders both in calculating

expenses based on an investment in a Fund and in comparing

these expenses with similar costs of investing in other mutual funds.

The tables provide information about actual account values and actual

expenses. In order to estimate the expenses a shareholder paid during

the period covered by this report, shareholders can divide their account

value by $1,000 and then multiply the result by the number correspon-

ding to their share class under the heading entitled “Expenses Paid During

the Period.” |

The tables also provide information about hypothetical account values and

hypothetical expenses based on a Fund’s actual expense ratio and an

assumed rate of return of 5% per year before expenses. In order to assist

shareholders in comparing the ongoing expenses of investing in these

Funds and other funds, compare the 5% hypothetical example with the 5%

hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the tables are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such as

sales charges, redemption fees or exchange fees. Therefore, the hypotheti-

cal tables are useful in comparing ongoing expenses only, and will not

help shareholders determine the relative total expenses of owning differ-

ent funds. If these transactional expenses were included, shareholder

expenses would have been higher. |

BlackRock Short-Term Municipal Fund

| | | | | Actual | | | | | | Hypothetical2 | | |

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | January 1, 2008 | | June 30, 2008 | | During the Period1 | | January 1, 2008 | | June 30, 2008 | | During the Period1 |

| BlackRock | | $1,000 | | $1,016.00 | | $1.94 | | $1,000 | | $1,022.80 | | $1.95 |

| Institutional | | $1,000 | | $1,016.20 | | $1.74 | | $1,000 | | $1,023.00 | | $1.75 |

| Investor A | | $1,000 | | $1,014.90 | | $2.99 | | $1,000 | | $1,021.76 | | $3.00 |

| Investor A1 | | $1,000 | | $1,015.70 | | $2.24 | | $1,000 | | $1,022.50 | | $2.25 |

| Investor B | | $1,000 | | $1,014.40 | | $3.49 | | $1,000 | | $1,021.27 | | $3.50 |

| Investor C | | $1,000 | | $1,011.10 | | $6.71 | | $1,000 | | $1,018.05 | | $6.74 |

| |

| |

| |

| |

| |

| |

|

| | 1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.39% for BlackRock, 0.35% for Institutional, 0.60% for Investor A, 0.45% for

Investor A1, 0.70% for Investor B and 1.35% for Investor C), multiplied by the average account value over the period, multiplied by 181/366 to reflect the one-half year

period shown.

2 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

14 BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008

Disclosure of Expenses (continued)

BlackRock Municipal Insured Fund (Including Interest Expense and Fees)

| | | | | Actual | | | | | | Hypothetical2 | | |

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | January 1, 2008 | | June 30, 2008 | | During the Period1 | | January 1, 2008 | | June 30, 2008 | | During the Period1 |

| Institutional | | $1,000 | | $990.70 | | $3.45 | | $1,000 | | $1,021.27 | | $3.50 |

| Investor A | | $1,000 | | $988.10 | | $4.77 | | $1,000 | | $1,019.13 | | $4.84 |

| Investor B | | $1,000 | | $985.60 | | $7.07 | | $1,000 | | $1,017.61 | | $7.18 |

| Investor C | | $1,000 | | $984.50 | | $8.69 | | $1,000 | | $1,015.97 | | $8.82 |

| Investor C1 | | $1,000 | | $985.40 | | $7.36 | | $1,000 | | $1,017.31 | | $7.48 |

| |

| |

| |

| |

| |

| |

|

| | 1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.70% for Institutional, 0.97% for Investor A, 1.44% for Investor B, 1.77% for

Investor C and 1.50% for Investor C1), multiplied by the average account value over the period, multiplied by 181/366 (to reflect the one-half year period shown).

2 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

BlackRock Municipal Insured Fund (Excluding Interest Expense and Fees)

| | | | | Actual | | | | | | Hypothetical2 | | |

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | January 1, 2008 | | June 30, 2008 | | During the Period1 | | January 1, 2008 | | June 30, 2008 | | During the Period1 |

| Institutional | | $1,000 | | $990.70 | | $2.26 | | $1,000 | | $1,022.45 | | $2.30 |

| Investor A | | $1,000 | | $988.10 | | $3.59 | | $1,000 | | $1,021.12 | | $3.65 |

| Investor B | | $1,000 | | $985.60 | | $5.99 | | $1,000 | | $1,018.69 | | $6.09 |

| Investor C | | $1,000 | | $984.50 | | $7.21 | | $1,000 | | $1,017.46 | | $7.33 |

| Investor C1 | | $1,000 | | $985.40 | | $6.23 | | $1,000 | | $1,018.45 | | $6.34 |

| |

| |

| |

| |

| |

| |

|

| | 1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.46% for Institutional, 0.73% for Investor A, 1.22% for Investor B, 1.47% for

Investor C and 1.27% for Investor C1), multiplied by the average account value over the period, multiplied by 181/366 to reflect the one-half year period shown.

2 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008 15

Disclosure of Expenses (continued)

BlackRock National Municipal Fund (Including Interest Expense and Fees)

| | | | | Actual | | | | | | Hypothetical2 | | |

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | January 1, 2008 | | June 30, 2008 | | During the Period1 | | January 1, 2008 | | June 30, 2008 | | During the Period1 |

| Institutional | | $1,000 | | $993.80 | | $3.25 | | $1,000 | | $1,021.46 | | $3.30 |

| Investor A | | $1,000 | | $992.70 | | $4.48 | | $1,000 | | $1,020.23 | | $4.55 |

| Investor B | | $1,000 | | $990.10 | | $6.84 | | $1,000 | | $1,017.85 | | $6.94 |

| Investor C | | $1,000 | | $988.80 | | $8.51 | | $1,000 | | $1,016.17 | | $8.62 |

| Investor C1 | | $1,000 | | $989.90 | | $7.09 | | $1,000 | | $1,017.61 | | $7.18 |

| |

| |

| |

| |

| |

| |

|

| | 1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.66% for Institutional, 0.91% for Investor A, 1.39% for Investor B, 1.73% for

Investor C and 1.44% for Investor C1), multiplied by the average account value over the period, multiplied by 181/366 to reflect the one-half year period shown.

2 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

BlackRock National Municipal Fund (Excluding Interest Expense and Fees)

| | | | | Actual | | | | | | Hypothetical2 | | |

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | January 1, 2008 | | June 30, 2008 | | During the Period1 | | January 1, 2008 | | June 30, 2008 | | During the Period1 |

| Institutional | | $1,000 | | $993.80 | | $2.96 | | $1,000 | | $1,021.76 | | $3.00 |

| Investor A | | $1,000 | | $992.70 | | $4.09 | | $1,000 | | $1,020.62 | | $4.15 |

| Investor B | | $1,000 | | $990.10 | | $6.64 | | $1,000 | | $1,018.05 | | $6.74 |

| Investor C | | $1,000 | | $988.80 | | $7.97 | | $1,000 | | $1,016.72 | | $8.08 |

| Investor C1 | | $1,000 | | $989.90 | | $6.84 | | $1,000 | | $1,017.85 | | $6.94 |

| |

| |

| |

| |

| |

| |

|

| | 1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.60% for Institutional, 0.83% for Investor A, 1.35% for Investor B, 1.62% for

Investor C and 1.39% for Investor C1), multiplied by the average account value over the period, multiplied by 181/366 to reflect the one-half year period shown.

2 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

16 BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008

Disclosure of Expenses (concluded)

BlackRock High Yield Municipal Fund (Including Interest Expense and Fees)

| | | | | Actual | | | | | | Hypothetical2 | | |

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | January 1, 2008 | | June 30, 2008 | | During the Period1 | | January 1, 2008 | | June 30, 2008 | | During the Period1 |

| Institutional | | $1,000 | | $973.70 | | $4.15 | | $1,000 | | $1,020.52 | | $4.25 |

| Investor A | | $1,000 | | $972.50 | | $5.32 | | $1,000 | | $1,019.34 | | $5.44 |

| Investor C | | $1,000 | | $968.80 | | $9.01 | | $1,000 | | $1,015.58 | | $9.22 |

| |

| |

| |

| |

| |

| |

|

| | 1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.85% for Institutional, 1.09% for Investor A and 1.85% for Investor C),

multiplied by the average account value over the period, multiplied by 181/366 to reflect the one-half year period shown.

2 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

BlackRock High Yield Municipal Fund (Excluding Interest Expense and Fees)

| | | | | Actual | | | | | | Hypothetical2 | | |

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | January 1, 2008 | | June 30, 2008 | | During the Period1 | | January 1, 2008 | | June 30, 2008 | | During the Period1 |

| Institutional | | $1,000 | | $973.70 | | $3.90 | | $1,000 | | $1,020.77 | | $4.00 |

| Investor A | | $1,000 | | $972.50 | | $5.07 | | $1,000 | | $1,019.58 | | $5.19 |

| Investor C | | $1,000 | | $968.80 | | $8.81 | | $1,000 | | $1,015.78 | | $9.02 |

| |

| |

| |

| |

| |

| |

|

| | 1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.80% for Institutional, 1.04% for Investor A and 1.81% for Investor C),

multiplied by the average account value over the period, multiplied by 181/366 to reflect the one-half year period shown.

2 Hypothetical 5% annual return before expenses is calculated by pro-rating the actual days in the most recent fiscal half year divided by 366. |

BLACKROCK MUNICIPAL BOND FUND, INC. JUNE 30, 2008 17

Schedule of Investments June 30, 2008

BlackRock Short-Term Municipal Fund (Percentages shown are based on Net Assets)

| | | Par | | |

| Municipal Bonds | | (000) | | Value |

| |

| |

|

| |

| Alabama — 2.6% | | | | |

| Huntsville, Alabama, GO, Refunding, Series A, | | | | |

| 5.25%, 2/01/09 (a) | | $ 8,095 | | $ 8,258,438 |

| |

| |

|

| Arizona — 2.2% | | | | |

| Yavapai County, Arizona, IDA, Solid Waste Disposal | | | | |

| Revenue Bonds (Waste Management Inc. | | | | |

| Project), AMT, 4%, 6/01/27 | | 7,000 | | 6,852,790 |

| |

| |

|

| California — 2.3% | | | | |

| California State, Economic Recovery, GO, Series A, | | | | |

| 5%, 7/01/10 | | 2,000 | | 2,084,320 |

| San Francisco, California, City and County, GO, | | | | |

| Refunding, Series R1, 5%, 6/15/11 | | 5,000 | | 5,275,800 |

| | | | |

|

| | | | | 7,360,120 |

| |

| |

|

| Colorado — 2.3% | | | | |

| Denver, Colorado, City and County Airport, Revenue | | | | |

| Refunding Bonds, AMT, Sub-Series A1, 5%, 11/15/09 | | 7,000 | | 7,110,460 |

| |

| |

|

| Delaware — 3.3% | | | | |

| Delaware State, GO, Refunding, 5%, 3/01/11 | | 10,000 | | 10,516,900 |

| |

| |

|

| District of Columbia — 1.5% | | | | |

| Metropolitan Washington Airports Authority, D.C., Airport | | | | |

| System Revenue Refunding Bonds, AMT, Series A, | | | | |

| 5%, 10/01/10 (c) | | 4,665 | | 4,775,887 |

| |

| |

|

| Florida — 8.6% | | | | |

| Florida Hurricane Catastrophe Fund Financing | | | | |

| Corporation Revenue Bonds, Series A, 5%, 7/01/10 | | 7,000 | | 7,246,680 |

| Florida State Turnpike Authority, Turnpike Revenue | | | | |

| Refunding Bonds, Series A, 5%, 7/01/10 | | 3,000 | | 3,127,080 |

| Miami-Dade County, Florida, Educational Facilities | | | | |

| Authority Revenue Bonds (University of Miami), | | | | |

| Series A, 5.75%, 4/01/10 (c)(d) | | 2,020 | | 2,146,109 |

| Orange County, Florida, Tourist Development, Tax | | | | |

| Revenue Bonds, 5.50%, 10/01/09 (c)(d) | | 14,195 | | 14,768,336 |

| | | | |

|

| | | | | 27,288,205 |

| |

| |

|

| Georgia — 3.1% | | | | |

| Burke County, Georgia, Development Authority, PCR | | | | |

| (Georgia Power Company Vogtle Project), 5th Series, | | | | |

| 4.375%, 10/01/32 (b) | | 4,000 | | 4,037,440 |

| Catoosa County, Georgia, School District, GO, | | | | |

| 4.25%, 8/01/08 (f) | | 5,600 | | 5,611,984 |

| | | | |

|

| | | | | 9,649,424 |

| |

| |

|

| Illinois — 1.7% | | | | |

| Illinois Educational Facilities Authority, Revenue | | | | |

| Refunding Bonds (University of Chicago), | | | | |

| Series A, 5.25%, 7/01/11 (d) | | 5,000 | | 5,362,000 |

| |

| |

|

| | | Par | | |

| Municipal Bonds | | (000) | | Value |

| |

| |

|

| |

| Indiana — 1.9% | | | | |

| Indiana Bond Bank Revenue Bonds (State Revolving | | | | |

| Fund), Series B, 5.30%, 8/01/10 (d) | | $ 4,750 | | $5,043,360 |

| Indiana Health Facilities Financing Authority Revenue | | | | |

| Bonds (Ascension Health Credit Group), Series A3, | | | | |

| 5%, 11/01/27 (b) | | 1,000 | | 1,026,040 |

| | | | |

|

| | | | | 6,069,400 |

| |

| |

|

| Massachusetts — 2.6% | | | | |

| Massachusetts State Health and Educational Facilities | | | | |

| Authority, Revenue Refunding Bonds (Partners | | | | |

| Healthcare System), Series C, 5.75%, 7/01/11 (d) | | 7,600 | | 8,249,344 |

| |

| |

|

| Michigan — 3.1% | | | | |

| Detroit, Michigan, Water Supply System Revenue Bonds, | | | | |

| Second Lien, Series B, 5.50%, 7/01/11 (d)(e) | | 5,000 | | 5,397,600 |

| Michigan State Trunk Line Fund, Revenue Refunding | | | | |

| Bonds, Series B, 5%, 9/01/10 (a) | | 4,120 | | 4,310,756 |

| | | | |

|

| | | | | 9,708,356 |

| |

| |

|

| Minnesota — 2.1% | | | | |

| Minneapolis and Saint Paul, Minnesota, Metropolitan | | | | |

| Airports Commission, Airport Revenue Bonds, AMT, | | | | |

| Series B, 5.50%, 1/01/10 (e) | | 2,620 | | 2,663,335 |

| Minnesota State, GO, 5%, 8/01/11 | | 3,675 | | 3,885,210 |

| | | | |

|

| | | | | 6,548,545 |

| |

| |

|

| Missouri — 1.2% | | | | |

| Missouri State Health and Educational Facilities | | | | |

| Authority, Revenue Refunding Bonds (Ascension | | | | |

| Health), VRDN, Series C-5, 3.50%, 11/15/09 (b) | | 3,780 | | 3,777,694 |

| |

| |

|

| Nebraska — 0.7% | | | | |

| Central Plains Energy Project, Nebraska, Revenue | | | | |

| Bonds (Gas Project Number 1), VRDN, | | | | |

| 2.06%, 12/01/10 (b) | | 2,500 | | 2,356,250 |

| |

| |

|

| Nevada — 4.5% | | | | |

| Clark County, Nevada, Airport System Subordinate Lien | | | | |

| Revenue Bonds, AMT, Series B-1, 5%, 7/01/08 | | 6,500 | | 6,500,455 |

| Clark County, Nevada, EDR (Alexander Dawson School | | | | |

| of Nevada Project), 5.50%, 5/15/09 (d) | | 7,500 | | 7,817,250 |

| | | | |

|

| | | | | 14,317,705 |

| |

| |

|

| New Jersey — 3.2% | | | | |

| New Jersey Building Authority, State Building Revenue | | | | |

| Refunding Bonds, Series B, 5.25%, 12/15/10 (c) | | 4,790 | | 5,022,363 |

| New Jersey State Turnpike Authority, Turnpike Revenue | | | | |

| Refunding Bonds, Series A, 5.75%, 1/01/10 (d)(f) | | 5,000 | | 5,236,700 |

| | | | |

|

| | | | | 10,259,063 |

| |

| |

|

| Portfolio Abbreviations | | | | | | | | |

| |

| |

| |

| |

|

| |

| To simplify the listings of portfolio holdings in the | | DRIVERS | | Derivative Inverse Tax-Exempt Receipts | | M/F | | Multi-Family |

| Schedules of Investments, the names of many of the | | EDA | | Economic Development Authority | | PCR | | Pollution Control Revenue Bonds |

| securities have been abbreviated according to the list | | EDR | | Economic Development Revenue Bonds | | RIB | | Residual Interest Bonds |

| below and on the right. | | GO | | General Obligation Bonds | | SAVRS | | Select Auction Variable Rate Securities |

| | | | | HDA | | Housing Development Agency | | S/F | | Single-Family |

| AMT | | Alternative Minimum Tax (subject to) | | HFA | | Housing Finance Agency | | SIFMA | | Securities Industry and Financial |

| CABS | | Capital Appreciation Bonds | | IDA | | Industrial Development Authority | | | | Markets Association |

| CARS | | Complementary Auction Rate Securities | | IDB | | Industrial Development Board | | TRAN | | Tax Revenue Anticipation Notes |

| COP | | Certificates of Participation | | IDR | | Industrial Development Revenue Bonds | | VRDN | | Variable Rate Demand Notes |

| |

| |

| See Notes to Financial Statements. | | | | | | | | |

| | |

| |

| |

| |

|

18 BLACKROCK MUNICIPAL BOND FUND, INC.

Schedule of Investments (continued)

BlackRock Short-Term Municipal Fund (Percentages shown are based on Net Assets)

| | | | | Par | | |

| Municipal Bonds | | | | (000) | | Value |

| |

| |

| |

|

| |

| New Mexico — 1.8% | | | | | | |

| New Mexico State, Severance Tax Bonds, Series A, | | | | | | |

| 5%, 7/01/08 (f) | | $ 5,685 | | $ 5,685,512 |

| |

| |

|

| New York — 8.1% | | | | | | |

| Metropolitan Transportation Authority, New York, | | | | | | |

| Dedicated Tax Fund Revenue Bonds, Series A, | | | | | | |

| 5.875%, 4/01/10 (d)(e) | | | | 5,000 | | 5,282,100 |

| Metropolitan Transportation Authority, New York, | | | | | | |

| Transportation Revenue Bonds, VRDN, Series B, | | | | | | |

| 5%, 11/15/11 (b) | | | | 4,000 | | 4,163,120 |

| New York City, New York, GO, Refunding, Series B, | | | | | | |

| 5.25%, 8/01/11 | | | | 4,000 | | 4,220,960 |

| New York State Urban Development Corporation, | | | | | | |

| Personal Income Tax Revenue Bonds, Series C, | | | | | | |

| 5%, 3/15/10 | | | | 7,705 | | 8,017,515 |

| Tobacco Settlement Financing Corporation of New York, | | | | |

| Asset-Backed Revenue Refunding Bonds, Series B, | | | | | | |

| 4%, 6/01/09 | | | | 4,000 | | 4,055,600 |

| | | | | | |

|

| | | | | | | 25,739,295 |

| |

| |

| |

|

| North Carolina — 1.4% | | | | | | |

| Mecklenburg County, North Carolina, GO, Series B, | | | | | | |

| 4%, 2/01/10 | | | | 3,000 | | 3,067,110 |

| North Carolina, HFA, M/F Housing Revenue Bonds | | | | | | |

| (Cedar Hills Apartments LLC), VRDN, AMT, | | | | | | |

| 3.70%, 1/01/38 (b) | | | | 1,240 | | 1,238,202 |

| | | | | | |

|

| | | | | | | 4,305,312 |

| |

| |

| |

|

| Ohio — 2.7% | | | | | | |

| Ohio State Building Authority, State Facilities Revenue | | | | |

| Bonds (Administrative Building Fund Projects), | | | | | | |

| Series A, 5.375%, 10/01/08 (d) | | | | 4,400 | | 4,481,840 |

| Ohio State, Common Schools, GO, Series A, | | | | | | |

| 5%, 3/15/11 | | | | 3,875 | | 4,068,169 |

| | | | | | |

|

| | | | | | | 8,550,009 |

| |

| |

| |

|

| Pennsylvania — 5.4% | | | | | | |

| Bethlehem, Pennsylvania, Area School District, GO, | | | | | | |

| Refunding, Series A, 5%, 9/01/10 (f) | | | | 4,000 | | 4,159,560 |

| Buck County, Pennsylvania, IDA, Solid Waste Revenue | | | | | | |

| Bonds (Waste Management, Inc. Project), VRDN, AMT, | | | | |

| 3.90%, 2/01/10 (b) | | | | 2,670 | | 2,636,278 |

| Pennsylvania State, GO, Refunding, Third Series, | | | | | | |

| 5%, 7/01/09 | | | | 5,000 | | 5,160,300 |

| University of Pittsburgh, Pennsylvania, The Commonwealth | | | | |

| System of Higher Education, Revenue Refunding Bonds | | | | |

| (Pittsburgh Asset Notes-Panthers), 5%, 8/01/10 | | | | 5,000 | | 5,233,100 |

| | | | | | |

|

| | | | | | | 17,189,238 |

| |

| |

| |

|

| Rhode Island — 0.3% | | | | | | |

| Rhode Island State and Providence Plantations, GO, | | | | | | |

| Refunding (Consolidated Capital Development Loan), | | | | |

| 5%, 7/15/11 | | | | 1,000 | | 1,053,990 |

| |

| |

| |

|

| | | | | Par | | |

| Municipal Bonds | | | | (000) | | Value |

| |

| |

| |

|

| |

| South Carolina — 2.9% | | | | | | |

| Aiken County, South Carolina, Consolidated School | | | | | | |

| District, GO, Refunding, 5%, 3/01/09 | | $ 4,590 | | $4,689,695 |

| Hilton Head Island, South Carolina, Public Facility | | | | | | |

| Corporation, COP (Beach Preservation Fee Pledge)(f): | | | | |

| 5%, 8/01/08 | | | | 2,160 | | 2,165,810 |

| 5%, 8/01/09 | | | | 2,240 | | 2,311,993 |

| | | | | | |

|

| | | | | | | 9,167,498 |

| |

| |

| |

|

| Tennessee — 1.3% | | | | | | |

| Tennessee Energy Acquisition Corporation, Gas Revenue | | | | |

| Bonds, Series A, 5%, 9/01/09 | | | | 4,000 | | 4,034,360 |

| |

| |

| |

|

| Texas — 16.4% | | | | | | |

| Austin, Texas, Independent School District, GO, | | | | | | |

| Refunding, 5.25%, 8/01/09 | | | | 3,980 | | 4,121,489 |

| Harris County, Texas, Health Facilities Development | | | | | | |

| Corporation, Revenue Refunding Bonds (Saint Luke’s | | | | |

| Episcopal Hospital), Series A, 5.375%, 8/15/11 (d) | | 5,500 | | 5,844,575 |

| Harris County, Texas, Toll Road Revenue Refunding | | | | | | |

| Bonds, Series B-2, 5%, 8/15/21 (b)(e) | | | | 5,000 | | 5,097,550 |

| Matagorda County, Texas, Navigation District Number 1, | | | | |

| PCR, Refunding (AEP Texas Central Company | | | | | | |

| Project), VRDN, 5.125%, 6/01/11 (b) | | | | 5,000 | | 5,014,300 |

| Montgomery County, Texas, Unlimited Tax Adjustable | | | | | | |

| Rate Road, GO, Series B, 5%, 3/01/28 (a)(b) | | | | 2,200 | | 2,210,384 |

| North Texas Tollway Authority, Dallas North Tollway | | | | | | |

| System, Revenue Refunding Bonds, Series B, | | | | | | |

| 5%, 1/01/38 (b)(c) | | | | 2,790 | | 2,789,302 |

| North Texas Tollway Authority, System Revenue | | | | | | |

| Refunding Bonds, First Tier, VRDN, Series E-1, | | | | | | |

| 5%, 1/01/10 (b) | | | | 7,000 | | 7,104,160 |

| San Antonio, Texas, Electric and Gas Revenue Bonds, | | | | | | |

| Junior Lien, VRDN, 3.625%, 12/01/27 (b) | | | | 5,000 | | 5,066,950 |

| Tarrant County, Texas, Cultural Education Facilities | | | | | | |

| Financing Corporation, Revenue Refunding Bonds | | | | | | |

| (Texas Health Resources), Series A, 5%, 2/15/11 | | | | 4,275 | | 4,429,969 |

| Texas State, GO, TRAN, 4.50%, 8/28/08 | | | | 5,000 | | 5,020,750 |

| University of Texas, Financing System Revenue | | | | | | |

| Refunding Bonds, Series B, 5%, 8/15/10 | | | | 5,000 | | 5,228,000 |

| | | | | | |

|

| | | | | | | 51,927,429 |

| |

| |

| |

|

| Virginia — 1.6% | | | | | | |

| Virginia State Public School Authority, School | | | | | | |

| Financing Revenue Bonds, Series B, 5%, 8/01/08 (d) | | 4,885 | | 4,947,381 |

| |

| |

|

| Washington — 4.2% | | | | | | |

| Energy Northwest, Washington, Electric Revenue | | | | | | |

| Refunding Bonds (Columbia Generating Station), | | | | | | |

| Series A, 5.25%, 7/01/09 (c) | | | | 9,940 | | 10,193,768 |

| Tacoma, Washington, Electric System Revenue | | | | | | |

| Refunding Bonds, Series A, 5.625%, 1/01/11 (a)(d) | | 2,900 | | 3,114,252 |

| | | | |

|

| | | | | | | 13,308,020 |

| |

| |

| |

|

| Wisconsin — 2.3% | | | | | | |

| Wisconsin Public Power Inc., Power Supply System, | | | | | | |

| Revenue Refunding Bonds, Series | | | | | | |

| A, 5.25%, 7/01/10 (f) | | | | 7,070 | | 7,365,738 |

| |

| |

| |

|

| Total Municipal Bonds (Cost — $300,084,038) — 95.3% | | | | 301,734,363 |

| |

| |

|

| See Notes to Financial Statements. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

Schedule of Investments (concluded)

BlackRock Short-Term Municipal Fund (Percentages shown are based on Net Assets)

| Short-Term Securities | | Shares | | Value |

| |

| |

|

| Merrill Lynch Institutional Tax-Exempt Fund, | | | | |

| 1.73% (g)(h) | | 9,212,054 | | $ 9,212,054 |

| |

| |

|

| Total Short-Term Securities | | | | |

| (Cost — $9,212,054) — 2.9% | | | | 9,212,054 |

| |

| |

|

| Total Investments (Cost — $309,296,092*) — 98.2% | | | | 310,946,417 |

| Other Assets Less Liabilities — 1.8% | | | | 5,459,169 |

| | | | |

|

| Net Assets — 100.0% | | | | $ 316,405,586 |

| | |

| |

|

* The cost and unrealized appreciation (depreciation) of investments as of June

30, 2008, as computed for federal income tax purposes, were as follows:

| Aggregate cost | | $ 309,296,092 |

| | |

|

| Gross unrealized appreciation | | $ 2,487,125 |

| Gross unrealized depreciation | | (836,800) |

| | |

|

| Net unrealized appreciation | | $ 1,650,325 |

| | |

|

| (a) FSA Insured. | | |

(b) Variable rate security. Rate shown is as of report date. Maturity shown is the final

maturity date.

(c) AMBAC Insured.

(d) U.S. government securities, held in escrow, are used to pay interest on this

security as well as to retire the bond in full at the date indicated, typically at a

premium to par.

(e) FGIC Insured.

(f) MBIA Insured.

(g) Investments in companies considered to be an affiliate of the Fund, for purposes

of Section 2(a)(3) of the Investment Company Act of 1940, were as follows:

| | | Net | | Dividend |

| Affiliate | | Activity | | Income |

| |

| |

|

| Merrill Lynch Institutional Tax-Exempt Fund | | 2,608,852 | | $362,305 |

| |

| |

|

| (h) Represents the current yield as of report date. | | | | |

| | See Notes to Financial Statements. |

20 BLACKROCK MUNICIPAL BOND FUND, INC.

Schedule of Investments June 30, 2008

BlackRock Municipal Insured Fund

(Percentages shown are based on Net Assets)

| | | Par | | |

| Municipal Bonds | | (000) | | Value |

| |

| |

|

| |

| Alabama — 3.2% | | | | |

| Lauderdale County and Florence, Alabama, Health | | | | |

| Care Authority Revenue Refunding Bonds | | | | |

| (Coffee Health Group), Series A, 6%, 7/01/29 (a) | | $10,000 | | $10,548,100 |

| University of Alabama, General Revenue Bonds, | | | | |

| Series A, 5%, 7/01/34 (a) | | 7,840 | | 7,868,224 |

| University of Alabama, University Revenue Bonds | | | | |

| (Birmingham), 6%, 10/01/09 (b)(c) | | 7,000 | | 7,325,710 |

| | | | |

|

| | | | | 25,742,034 |

| |

| |

|

| Arkansas — 0.5% | | | | |

| University of Arkansas, University Revenue Bonds | | | | |

| (Various Facilities-Fayetteville Campus), | | | | |

| 5%, 12/01/27 (c) | | 4,000 | | 4,034,520 |

| |

| |

|

| California — 15.4% | | | | |

| Antelope Valley, California, Community College District, | | | | |

| GO (Election of 2004), Series B, 5.25%, 8/01/39 (a) | | 1,050 | | 1,062,054 |

| Arcadia, California, Unified School District, | | | | |

| GO (Election of 2006), Series A, | | | | |

| 4.96%, 8/01/39 (d)(n) | | 2,800 | | 490,476 |

| Cabrillo, California, Community College District, GO | | | | |

| (Election of 2004), Series B, 5.20%, 8/01/37 (a)(n) | | 4,100 | | 751,120 |

| California State Department of Veteran Affairs, Home | | | | |

| Purchase Revenue Refunding Bonds, Series A, | | | | |

| 5.35%, 12/01/27 (e) | | 2,075 | | 2,108,947 |

| Coast Community College District, California, GO, | | | | |

| Refunding (Election of 2002), Series C (d): | | | | |

| 5.19%, 8/01/13 (p) | | 6,475 | | 4,887,654 |

| 5.392%, 8/01/36 (n) | | 5,800 | | 1,243,056 |

| Corona-Norco, California, Unified School District, GO | | | | |

| (Election of 2006), Series A, 5%, 8/01/31 (d) | | 2,000 | | 2,035,000 |

| Fresno, California, Unified School District, GO | | | | |

| (Election of 2001): | | | | |

| Series D, 5%, 8/01/27 (a) | | 5,170 | | 5,209,654 |

| Series E, 5%, 8/01/30 (d) | | 1,500 | | 1,527,900 |

| Hesperia, California, Public Financing Authority Revenue | | | | |

| Bonds (Redevelopment and Housing Projects), | | | | |

| Series A, 5.50%, 9/01/27 (f) | | 10,000 | | 9,847,900 |

| Los Angeles, California, Municipal Improvement | | | | |

| Corporation, Lease Revenue Bonds, Series B1, | | | | |

| 4.75%, 8/01/37 (c) | | 13,000 | | 12,219,870 |

| Modesto, California, Schools Infrastructure Financing | | | | |

| Agency, Special Tax Bonds, 5.50%, 9/01/36 (e) | | 8,965 | | 8,996,826 |

| Mount Diablo, California, Unified School District, GO | | | | |

| (Election of 2002), 5%, 7/01/27 (c) | | 12,040 | | 11,865,781 |

| Orange County, California, Sanitation District, COP, | | | | |

| Series B, 5%, 2/01/31 (d) | | 1,380 | | 1,387,590 |

| Palm Springs, California, Financing Authority, Lease | | | | |

| Revenue Refunding Bonds (Convention Center Project), | | | | |

| Series A, 5.50%, 11/01/35 (a) | | 6,440 | | 6,603,898 |

| Ramona, California, Unified School District, Convertible | | | | |

| Capital Appreciation Refunding Bonds, COP, | | | | |

| 5.106%, 5/01/32 (c)(p) | | 10,500 | | 8,507,415 |

| Rancho Cucamonga, California, Redevelopment | | | | |

| Agency, Tax Allocation Refunding Bonds (Rancho | | | | |

| Redevelopment Project), Series A, 5%, 9/01/34 (a) | | 675 | | 656,991 |

| Rialto, California, Unified School District, GO, Series A, | | | | |

| 6.24%, 6/01/25 (c)(n) | | 11,685 | | 4,606,461 |

| Roseville, California, Joint Union High School District, | | | | |

| GO (Election of 2004), Series A, 5%, 8/01/29 (c) | | 5,000 | | 5,020,600 |

| | | Par | | |

| Municipal Bonds | | (000) | | Value |

| |

| |

|

| |

| California (concluded) | | | | |

| Sacramento, California, Unified School District, GO | | | | |

| (Election of 1999), Series B, 5%, 7/01/26 (c) | | $ 5,075 | | $5,133,667 |

| San Diego, California, Community College District, | | | | |

| GO (Election of 2002), 5%, 5/01/30 (d) | | 2,685 | | 2,728,309 |

| San Diego County, California, Water Authority, Water | | | | |

| Revenue Refunding Bonds, COP, Series A, | | | | |

| 5%, 5/01/33 (d) | | 4,500 | | 4,559,040 |

| San Jose, California, Airport Revenue Refunding | | | | |

| Bonds, AMT, Series A, 5.50%, 3/01/32 (e) | | 6,600 | | 6,504,960 |

| San Jose, California, GO (Libraries, Parks and Public | | | | |

| Safety Projects), 5%, 9/01/30 (a) | | 3,700 | | 3,729,896 |

| Tahoe Truckee, California, Unified School District, | | | | |

| GO (School Facilities Improvement District | | | | |

| Number 2), Series A, 5.25%, 8/01/29 (a) | | 2,755 | | 2,784,231 |

| Washington, California, Unified School District, | | | | |

| COP (New High School Project), | | | | |

| 5.125%, 8/01/37 (e) | | 10,000 | | 9,734,200 |

| | | | |

|

| | | | | 124,203,496 |

| |

| |

|

| Colorado — 2.6% | | | | |

| Aurora, Colorado, COP, 6%, 12/01/10 (b)(e) | | 19,250 | | 20,666,800 |

| |

| |

|

| Florida — 5.0% | | | | |

| Duval County, Florida, School Board, COP | | | | |

| (Master Lease Program), 5%, 7/01/33 (d) | | 3,800 | | 3,741,366 |

| Hillsborough County, Florida, Aviation Authority Revenue | | | | |

| Bonds, AMT, Series A, 5.375%, 10/01/33 (h) | | 5,000 | | 4,982,450 |

| Miami, Florida, Special Obligation Revenue Bonds | | | | |

| (Street and Sidewalk Improvement Program), | | | | |

| 5%, 1/01/37 (a) | | 1,350 | | 1,286,982 |

| Miami-Dade County, Florida, Aviation Revenue Refunding | | | | |

| Bonds (Miami International Airport), AMT, Series A: | | | | |

| 5.50%, 10/01/26 (h) | | 7,000 | | 7,075,880 |

| 5.50%, 10/01/27 (h) | | 5,495 | | 5,537,312 |

| 5%, 10/01/39 (a) | | 15,000 | | 13,368,900 |

| Miami-Dade County, Florida, School Board, COP, | | | | |

| Refunding, Series B, 5.25%, 5/01/31 (h) | | 2,500 | | 2,522,775 |

| West Coast Regional Water Supply Authority, Florida, | | | | |

| Capital Improvement Revenue Bonds, 10.40%, | | | | |

| 10/01/10 (b)(e) | | 1,260 | | 1,383,946 |

| | | | |

|

| | | | | 39,899,611 |

| |

| |

|

| Georgia — 4.9% | | | | |

| Atlanta, Georgia, Water and Wastewater Revenue | | | | |

| Bonds, 5%, 11/01/34 (d) | | 4,000 | | 4,014,800 |

| Georgia Municipal Electric Authority, Power Revenue | | | | |

| Refunding Bonds (e): | | | | |

| Series EE, 7%, 1/01/25 | | 20,000 | | 25,293,600 |

| Series Y, 6.40%, 1/01/11 (b) | | 90 | | 97,484 |

| Series Y, 6.40%, 1/01/13 | | 8,420 | | 9,200,366 |

| Series Y, 6.40%, 1/01/13 (i) | | 490 | | 537,412 |

| | | | |

|

| | | | | 39,143,662 |

| |

| |

|

| Illinois — 2.3% | | | | |

| Chicago, Illinois, O'Hare International Airport Revenue | | | | |

| Bonds, Third Lien, AMT, Series B-2, 6%, 1/01/27 (a) | | 17,690 | | 18,206,371 |

| |

| |

|

| Kansas — 0.7% | | | | |

| Manhattan, Kansas, Hospital Revenue Bonds | | | | |

| (Mercy Health Center), 5.50%, 8/15/20 (d) | | 5,145 | | 5,386,301 |

| |

| |

|

See Notes to Financial Statements.

| BLACKROCK MUNICIPAL BOND FUND, INC. |

Schedule of Investments (continued)

BlackRock Municipal Insured Fund

(Percentages shown are based on Net Assets)

| | | Par | | |

| Municipal Bonds | | (000) | | Value |

| |

| |

|

| |

| Louisiana — 1.0% | | | | |

| Louisiana State Citizens Property Insurance | | | | |

| Corporation, Assessment Revenue Bonds, | | | | |

| Series B, 5%, 6/01/22 (e) | | $ 2,150 | | $2,082,856 |

| New Orleans, Louisiana, GO (Public Improvements), | | | | |

| 5.25%, 12/01/29 (e) | | 4,000 | | 3,929,160 |

| Rapides Financing Authority, Louisiana, Revenue Bonds | | | | |

| (Cleco Power LLC Project), AMT, 4.70%, 11/01/36 (e) | | 2,800 | | 2,385,544 |

| | | | |

|

| | | | | 8,397,560 |

| |

| |

|

| Maryland — 3.2% | | | | |

| Baltimore, Maryland, Convention Center Hotel Revenue | | | | |

| Bonds, Senior Series A, 5.25%, 9/01/39 (f) | | 20,140 | | 20,526,889 |

| Maryland State Health and Higher Educational Facilities | | | | |

| Authority Revenue Bonds (University of Maryland | | | | |

| Medical System), Series B, 7%, 7/01/22 (c) | | 4,400 | | 5,393,916 |

| | | | |

|

| | | | | 25,920,805 |

| |

| |

|

| Massachusetts — 2.5% | | | | |

| Massachusetts State, HFA, Rental Housing Mortgage | | | | |

| Revenue Bonds, AMT, Series C, 5.60%, 1/01/45 (d) | | 4,000 | | 4,062,920 |

| Massachusetts State, HFA, S/F Housing Revenue | | | | |

| Bonds, AMT, Series 128 (d): | | | | |

| 4.80%, 12/01/27 | | 2,845 | | 2,644,968 |

| 4.875%, 12/01/38 | | 7,000 | | 6,290,480 |

| Massachusetts State School Building Authority, | | | | |

| Dedicated Sales Tax Revenue Bond, Series A, | | | | |

| 5%, 8/15/30 (d) | | 7,000 | | 7,108,570 |

| | | | |

|

| | | | | 20,106,938 |

| |

| |

|

| Michigan — 2.7% | | | | |

| Detroit, Michigan, Sewage Disposal System Second | | | | |

| Lien Revenue Bonds, Series B, 5%, 7/01/36 (c)(a) | | 5,000 | | 4,831,900 |

| Detroit, Michigan, Sewage Disposal System, Second | | | | |

| Lien Revenue Refunding Bonds, Series E, | | | | |

| 5.75%, 7/01/31 (c)(j) | | 4,000 | | 4,338,760 |

| Detroit, Michigan, Water Supply System Revenue Bonds, | | | | |

| Senior Lien, Series A, 5%, 7/01/30 (c) | | 1,500 | | 1,436,310 |

| Michigan State Strategic Fund, Limited Obligation | | | | |

| Revenue Refunding Bonds (Detroit Edison Company | | | | |

| Pollution Control Project), AMT, Series A, | | | | |

| 5.50%, 6/01/30 (f) | | 11,845 | | 11,535,609 |

| | | | |

|

| | | | | 22,142,579 |

| |

| |

|

| Minnesota — 1.9% | | | | |

| Delano, Minnesota, Independent School District | | | | |

| Number 879, GO, Series A, 5.875%, 2/01/25 (d) | | 5,860 | | 6,261,879 |

| Sauk Rapids, Minnesota, Independent School District | | | | |

| Number 047, GO, Series A (a): | | | | |

| 5.65%, 2/01/20 | | 3,735 | | 3,970,417 |

| 5.70%, 2/01/21 | | 4,440 | | 4,725,314 |

| | | | |

|

| | | | | 14,957,610 |

| |

| |

|

| Mississippi — 1.5% | | | | |

| Harrison County, Mississippi, Wastewater Management | | | | |

| District, Revenue Refunding Bonds (Wastewater | | | | |

| Treatment Facilities), Series A, 8.50%, 2/01/13 (c)(i) | | 1,320 | | 1,600,210 |

| Mississippi Hospital Equipment and Facilities Authority | | | | |

| Revenue Bonds (Forrest County General Hospital | | | | |

| Project), 6%, 1/01/11 (b)(d) | | 10,000 | | 10,780,800 |

| | | | |

|

| | | | | 12,381,010 |

| |

| |

|

| | | Par | | |

| Municipal Bonds | | (000) | | Value |

| |

| |

|

| |

| Missouri — 2.8% | | | | |

| Kansas City, Missouri, Airport Revenue Refunding and | | | | |

| Improvement Bonds, Series A (a): | | | | |

| 5.50%, 9/01/13 | | $12,990 | | $ 13,198,879 |

| 5.50%, 9/01/14 | | 9,000 | | 9,143,820 |

| | | | |

|

| | | | | 22,342,699 |

| |

| |

|

| Nebraska — 0.6% | | | | |

| Public Power Generation Agency, Nebraska, Revenue | | | | |

| Bonds (Whelan Energy Center Unit 2), Series A, | | | | |

| 5%, 1/01/25 (e) | | 5,000 | | 5,037,900 |

| |

| |

|

| Nevada — 0.3% | | | | |

| Clark County, Nevada, IDR (Southwest Gas Corp. | | | | |

| Project), AMT (c): | | | | |

| Series A, 4.75%, 9/01/36 | | 1,265 | | 987,244 |

| Series D, 5.25%, 3/01/38 | | 2,200 | | 1,852,730 |

| | | | |

|

| | | | | 2,839,974 |

| |

| |

|

| New Jersey — 8.2% | | | | |

| Cape May County, New Jersey, Industrial Pollution Control | | | | |

| Financing Authority, Revenue Refunding Bonds | | | | |

| (Atlantic City Electric Company Project), Series A, | | | | |

| 6.80%, 3/01/21 (a) | | 6,810 | | 8,028,445 |

| Garden State Preservation Trust of New Jersey, Open Space | | |

| and Farmland Preservation Revenue Bonds, Series A (d): | | |

| 5.80%, 11/01/21 | | 3,125 | | 3,459,250 |

| 5.80%, 11/01/22 | | 8,310 | | 9,163,520 |

| 5.80%, 11/01/23 | | 4,340 | | 4,777,168 |

| New Jersey EDA, Motor Vehicle Surcharge Revenue Bonds, | | |

| Series A (a): | | | | |

| 5%, 7/01/27 | | 5,000 | | 5,010,250 |