Covanta Holding Corporation Third Quarter 2012 Earnings Conference Call NYSE: CVA October 18, 2012 1 Exhibit 99.2

All information included in this earnings presentation is based on continuing operations. Forward-Looking Statements Certain statements in this presentation may constitute "forward-looking" statements as defined in Section 27A of the Securities Act of 1933 (the "Securities Act"), Section 21E of the Securities Exchange Act of 1934 (the "Exchange Act"), the Private Securities Litigation Reform Act of 1995 (the "PSLRA") or in releases made by the Securities and Exchange Commission (“SEC”), all as may be amended from time to time. Such forward- looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Covanta and its subsidiaries, or general industry or broader economic performance in global markets in which Covanta operates or competes, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as the words "plan," "believe," "expect," "anticipate," "intend," "estimate," "project," "may," "will," "would," "could," "should," "seeks," or "scheduled to," or other similar words, or the negative of these terms or other variations of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the "safe harbor" provisions of such laws. Covanta cautions investors that any forward-looking statements made by Covanta are not guarantees or indicative of future performance. Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements with respect to Covanta, include, but are not limited to, the risk that Covanta may not successfully grow its business as expected or close its announced or planned acquisitions or projects in development, and those factors, risks and uncertainties that are described in periodic securities filings by Covanta with the SEC. Although Covanta believes that its plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, actual results could differ materially from a projection or assumption in any forward-looking statements. Covanta's future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties. The forward-looking statements contained in this press release are made only as of the date hereof and Covanta does not have or undertake any obligation to update or revise any forward- looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law. Non-GAAP Financial Measures We use a number of different financial measures, both United States generally accepted accounting principles (“GAAP”) and non-GAAP, in assessing the overall performance of our business. The non-GAAP financial measures of Adjusted EBITDA, Free Cash Flow and Adjusted EPS, as described and used in this earnings presentation, are not intended as a substitute or as an alternative to net income, cash flow provided by operating activities or diluted earnings per share as indicators of our performance or liquidity or any other measures of performance or liquidity derived in accordance with GAAP. In addition, our non-GAAP financial measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The presentations of Adjusted EBITDA, Free Cash Flow and Adjusted EPS are intended to enhance the usefulness of our financial information by providing measures which management internally use to assess and evaluate the overall performance of its business and those of possible acquisition candidates, and highlight trends in the overall business. In each case, a reconciliation to the nearest GAAP measure is provided. 2 Cautionary Statements

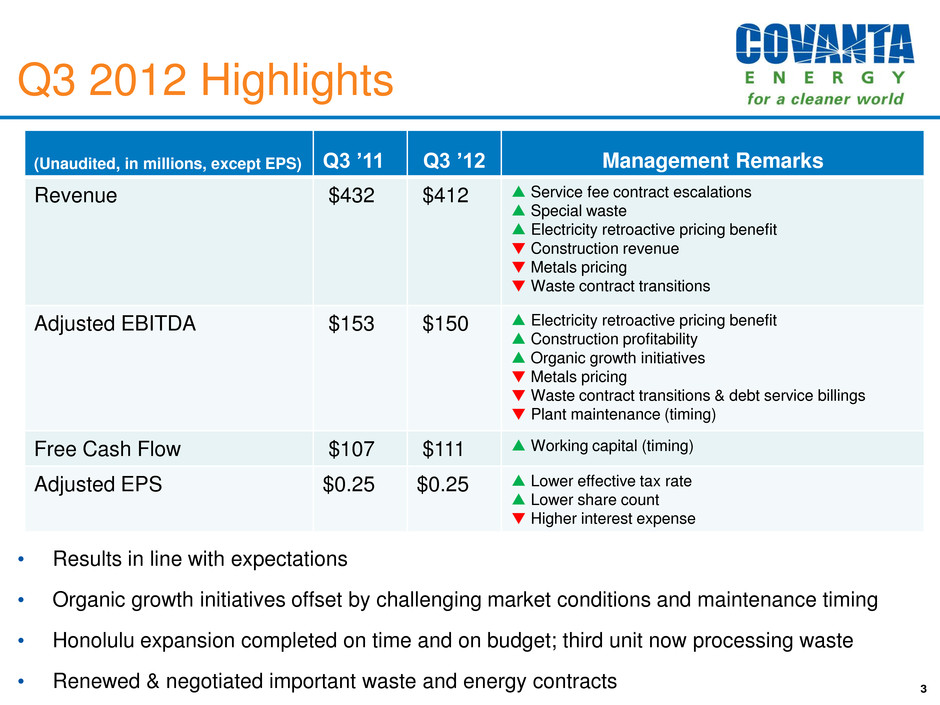

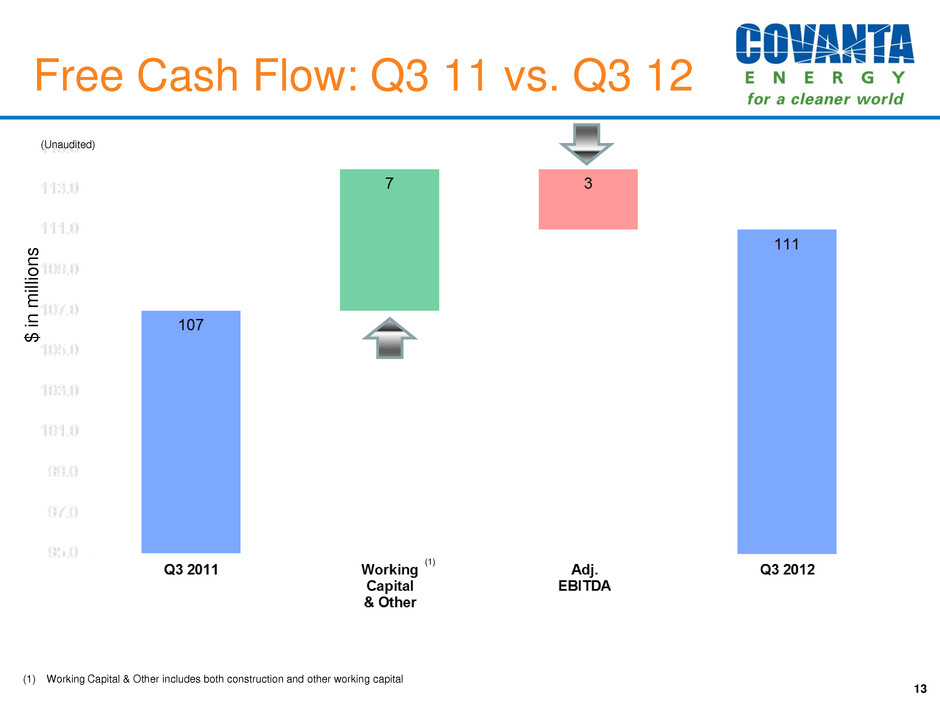

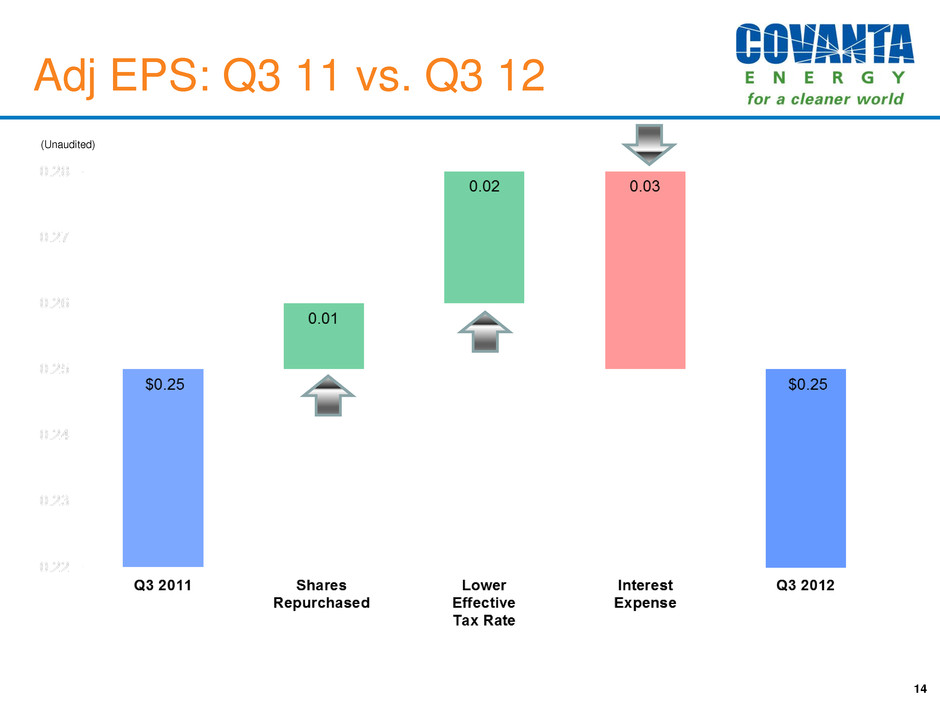

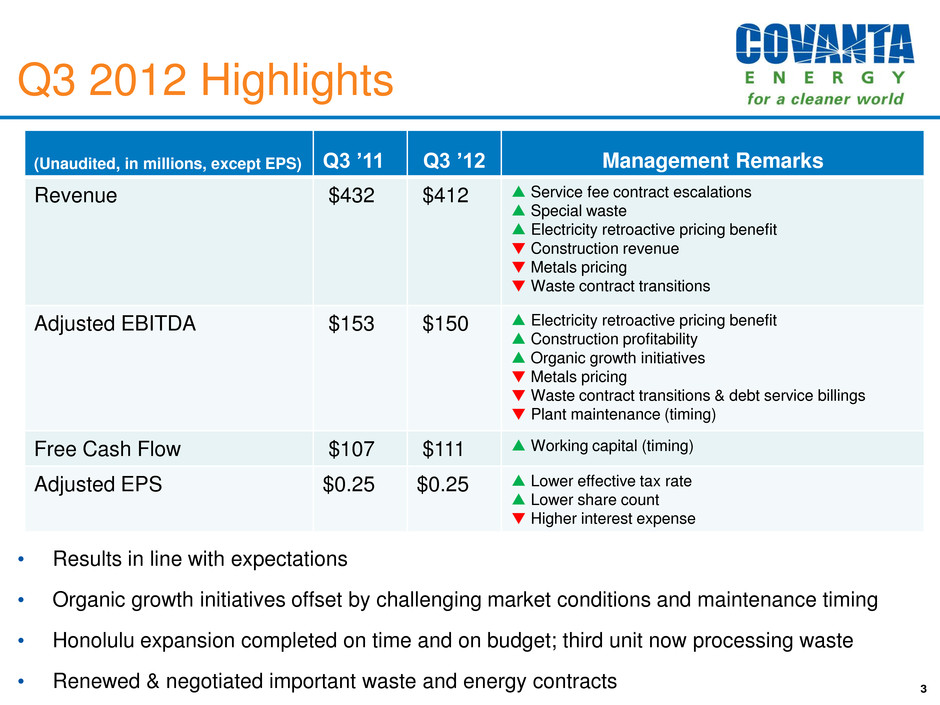

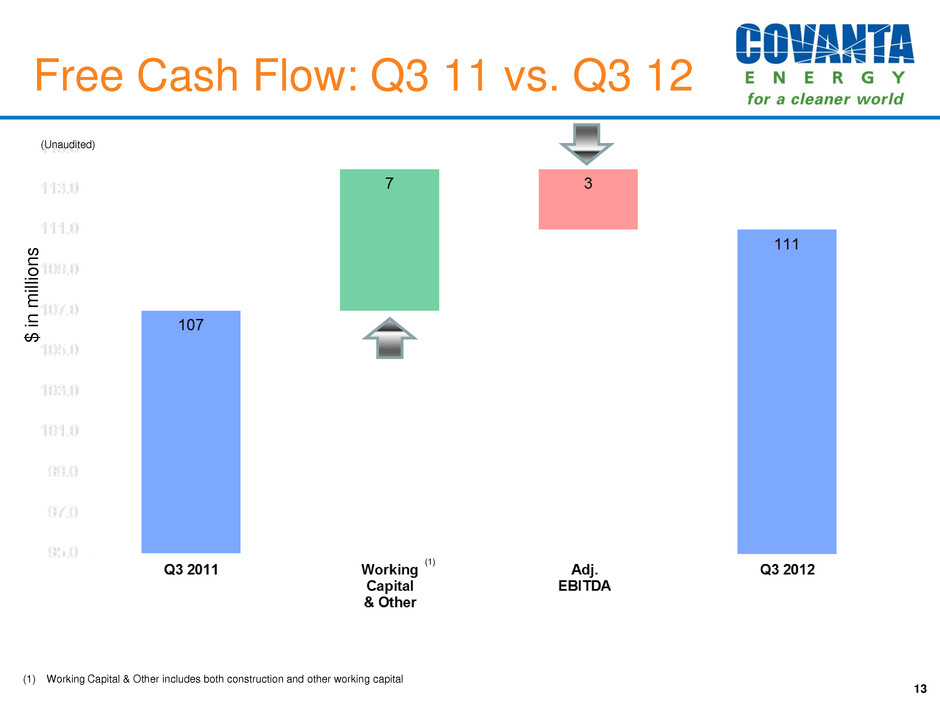

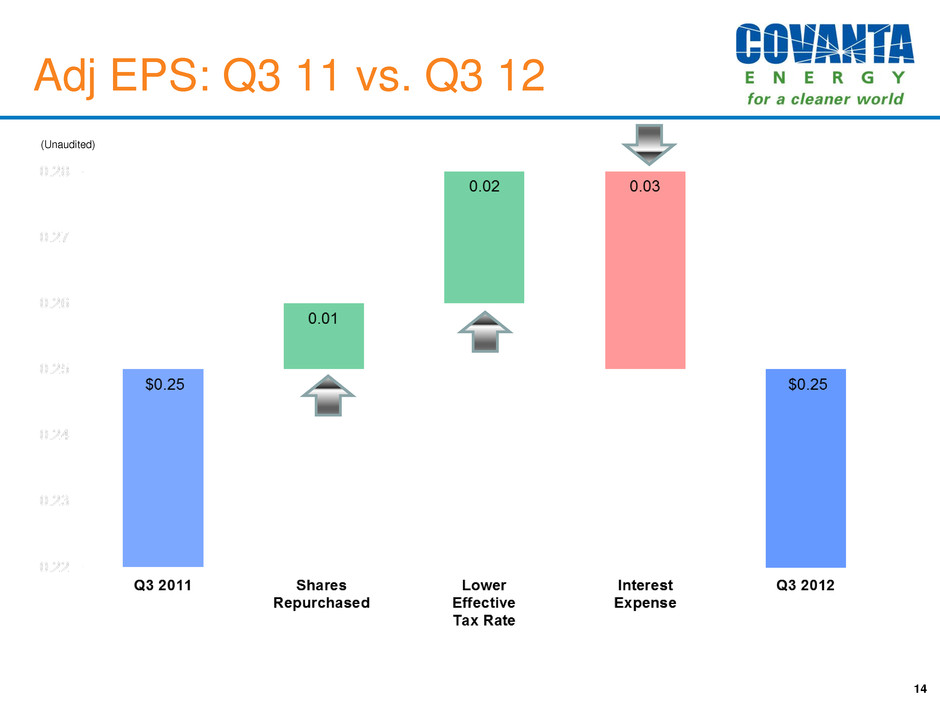

3 • Results in line with expectations • Organic growth initiatives offset by challenging market conditions and maintenance timing • Honolulu expansion completed on time and on budget; third unit now processing waste • Renewed & negotiated important waste and energy contracts Q3 2012 Highlights (Unaudited, in millions, except EPS) Q3 ’11 Q3 ’12 Management Remarks Revenue $432 $412 ▲ Service fee contract escalations ▲ Special waste ▲ Electricity retroactive pricing benefit ▼ Construction revenue ▼ Metals pricing ▼ Waste contract transitions Adjusted EBITDA $153 $150 ▲ Electricity retroactive pricing benefit ▲ Construction profitability ▲ Organic growth initiatives ▼ Metals pricing ▼ Waste contract transitions & debt service billings ▼ Plant maintenance (timing) Free Cash Flow $107 $111 ▲ Working capital (timing) Adjusted EPS $0.25 $0.25 ▲ Lower effective tax rate ▲ Lower share count ▼ Higher interest expense

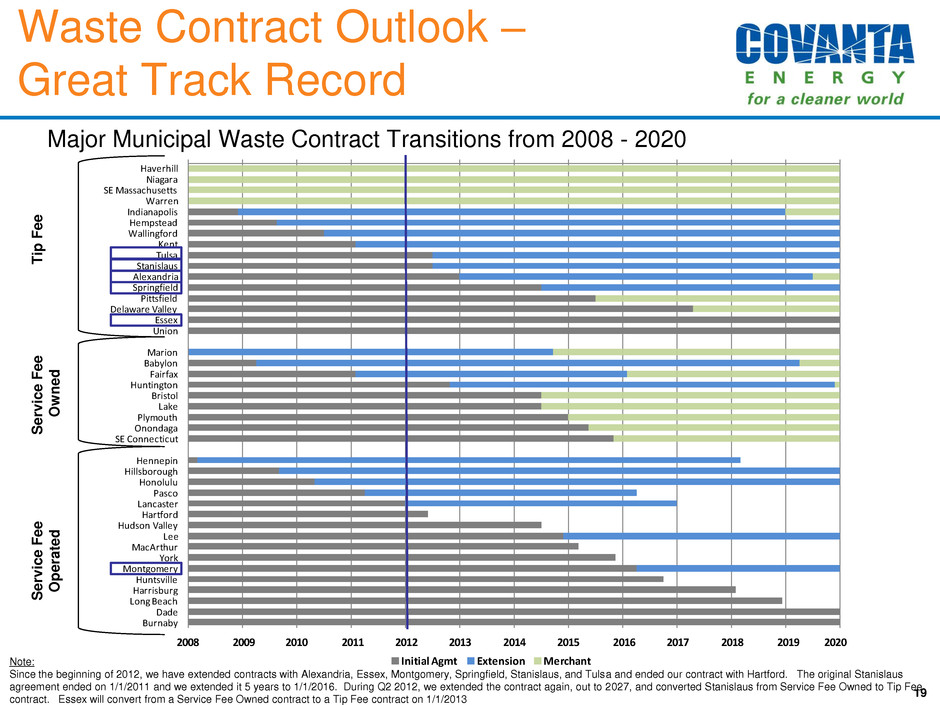

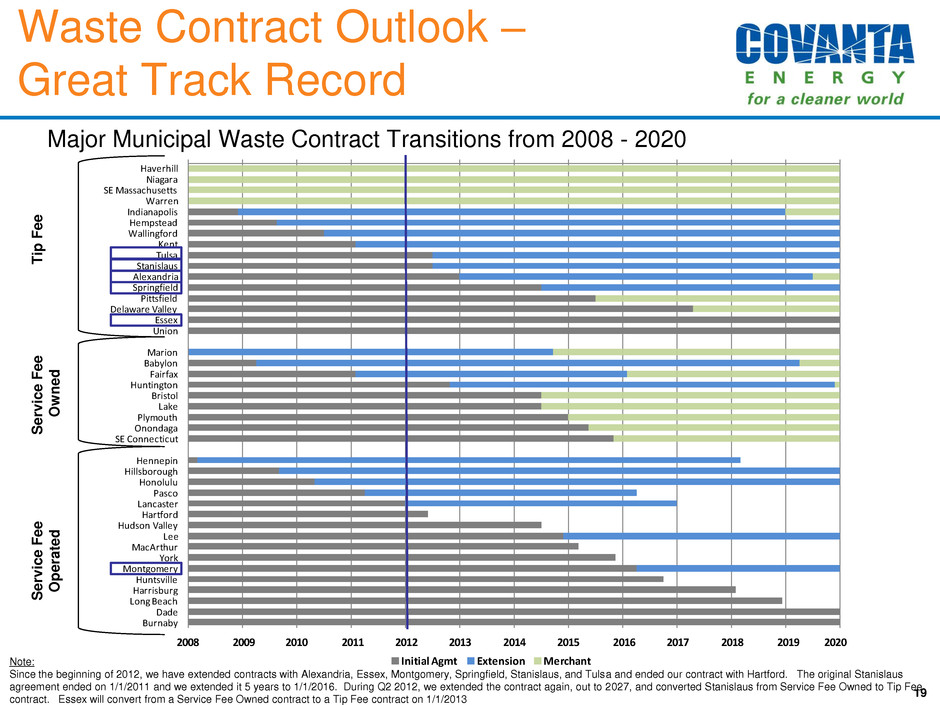

4 • Current Trends – Tip fees up ~2.0% year-over-year in Q3 • Inflation escalators for contracted portion • Special waste displacing lower priced spot waste – Expect tip fee pricing for the full year to be slightly up • Contract Updates – “Bundle of Services” contracts in Connecticut • Signed 7 contracts over the past 10 months; representing ~100,000 tons of waste and 15,000 tons of recyclables • Average contract life of 4 years – Essex contract amendment finalized • Converts from Service Fee to Tip Fee structure (effective January 1, 2013) • Waste contract extended to 2032 for ~500,000 tons/year • Overall contract positive: waste revenue will be lower but will be more than offset by energy pick-up • 2013 Outlook – Anticipate ~75% of waste revenue to be contracted Provides stability – Benefit of special waste and escalations offset by impact of waste contract transitions – Reduction in debt service pass through billings of ~$15 million Waste Update

Energy Update 5 • Current Trends – Unchanged rough rule of thumb: $1/MMBtu natural gas $10-$15 million annualized impact on 2012 Adjusted EBITDA • Original 2012 guidance based on $3/MMBtu FY2012 average price • Current FY2012 estimate ~$2.75/MMBtu $3-4 million reduction from original guidance • Contract Updates – Long Island Power Authority (LIPA) contract finalized for all four facilities on Long Island • Contract benefits municipal clients, LIPA and Covanta • 5 year contract effective April 2012 with options to extend another 10 years • Fixed price contract during first two years, with floor and ceiling price thereafter • ~600,000 MWhs of Covanta’s energy moves from exposed to contracted at prices similar to recent trends – Stanislaus • Entered one year contract at a premium to spot market in recognition of renewable attributes • 2013 Outlook – Total EfW energy share will be 5.5 million MWhs • Increase of ~600,000 MWhs from Essex, Stanislaus, Hawaii and Niagara vs 2012 • Additional MWhs to be offset by lower waste revenues, increased expenses • Expected 1/1/2013 EfW portfolio (in MWhs): Contracted: 3.7 million; Hedged: 0.9 million; Exposed: 0.9 million – 2013 per MWh pricing of total EfW portfolio expected to be about flat with 2012

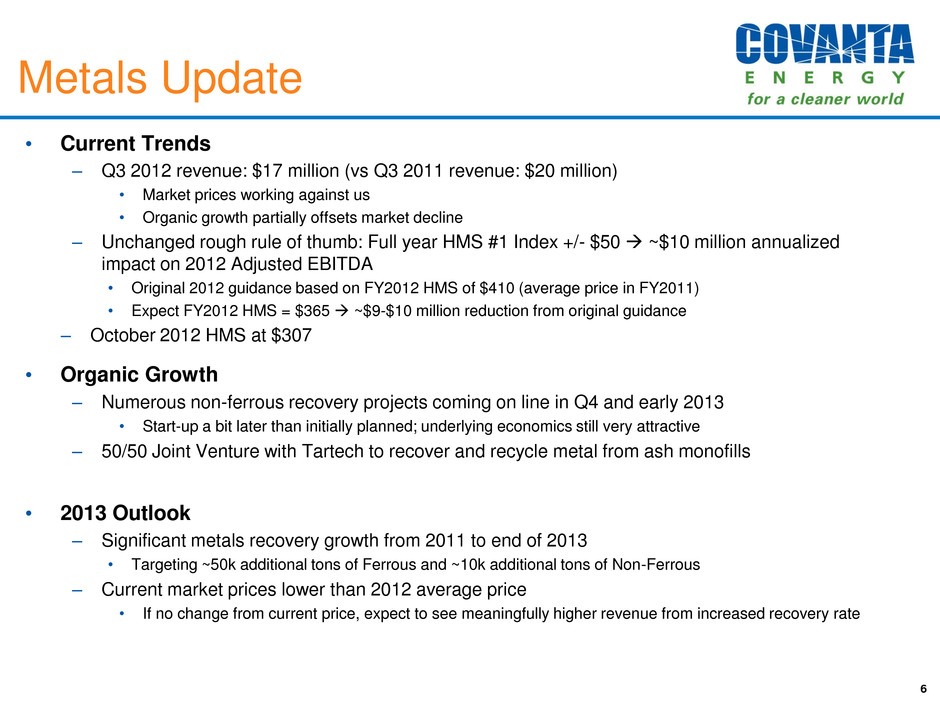

Metals Update 6 • Current Trends – Q3 2012 revenue: $17 million (vs Q3 2011 revenue: $20 million) • Market prices working against us • Organic growth partially offsets market decline – Unchanged rough rule of thumb: Full year HMS #1 Index +/- $50 ~$10 million annualized impact on 2012 Adjusted EBITDA • Original 2012 guidance based on FY2012 HMS of $410 (average price in FY2011) • Expect FY2012 HMS = $365 ~$9-$10 million reduction from original guidance – October 2012 HMS at $307 • Organic Growth – Numerous non-ferrous recovery projects coming on line in Q4 and early 2013 • Start-up a bit later than initially planned; underlying economics still very attractive – 50/50 Joint Venture with Tartech to recover and recycle metal from ash monofills • 2013 Outlook – Significant metals recovery growth from 2011 to end of 2013 • Targeting ~50k additional tons of Ferrous and ~10k additional tons of Non-Ferrous – Current market prices lower than 2012 average price • If no change from current price, expect to see meaningfully higher revenue from increased recovery rate

Organic Growth Update 7 • Special Waste: Remains strong near-term opportunity – >$50 million annual run-rate revenues (by year end 2012) with double digit growth potential – Strong pricing adding value to bottom line • Process Improvements: Continuing to pay off – Technology, work processes and procurement programs • New Units Coming Online: Growing our portfolio – Honolulu: Completed and operational in Q3 2012; 20 year O&M contract started – Durham York: Construction on track; ~25% complete • 2013 Outlook – Continued investment in organic growth initiatives to drive meaningful benefit in 2013 and beyond Durham York Facility Artist Rendering Non-Ferrous Metal Recovery System Honolulu Facility Post Expansion

2012/13 Summary and Outlook • 2012 Outlook – Executing and managing the business well despite macro conditions – Narrowed guidance primarily due to metal and energy pricing • 2013 Outlook – Expect to continue growing the bottom line – Continued organic growth initiatives – Focus remains on free cash flow – Capital allocation and shareholder returns remain a priority 8

Financial Overview 9

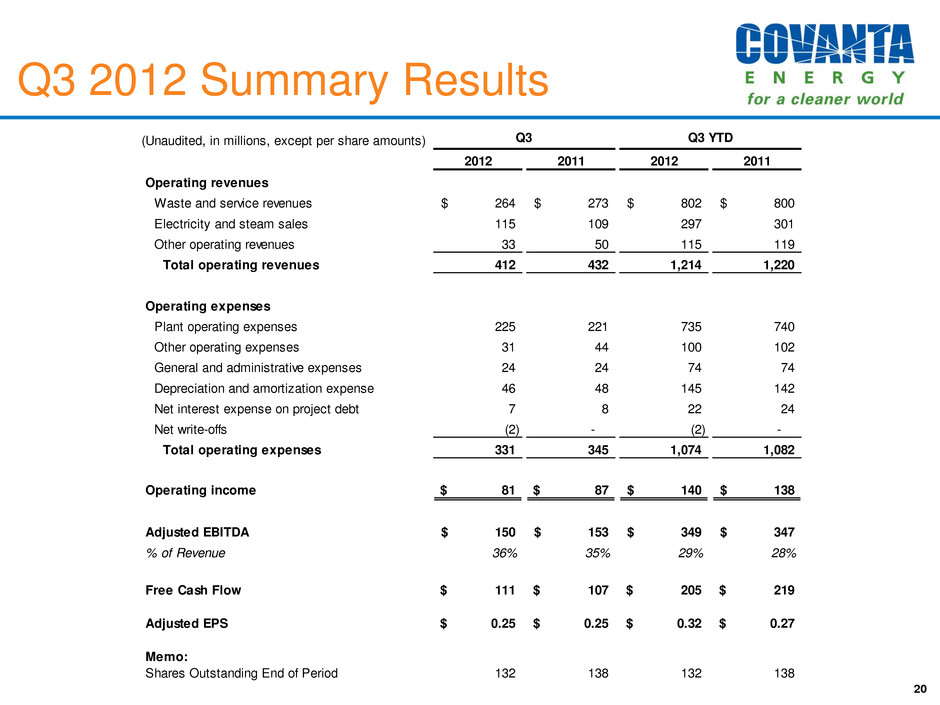

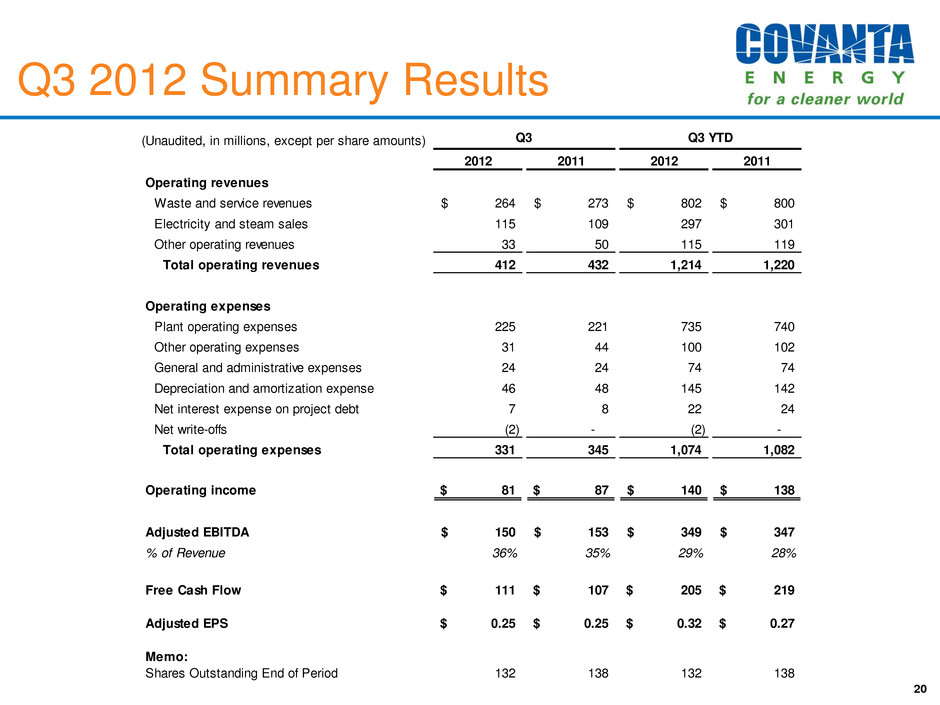

10 Q3 2012 Highlights (Unaudited, in millions, except EPS) Q3 ’11 Q3 ’12 Management Remarks Revenue $432 $412 ▲ Service fee contract escalations ▲ Special waste ▲ Electricity retroactive pricing benefit ▼ Construction revenue ▼ Metals pricing ▼ Waste contract transition Adjusted EBITDA $153 $150 ▲ Electricity retroactive pricing benefit ▲ Construction profitability ▲ Organic growth initiatives ▼ Metals pricing ▼ Waste contract transitions & debt service billings ▼ Plant maintenance (timing) Free Cash Flow $107 $111 ▲ Working capital (timing) Adjusted EPS $0.25 $0.25 ▲ Lower effective tax rate ▲ Lower share count ▼ Higher interest expense

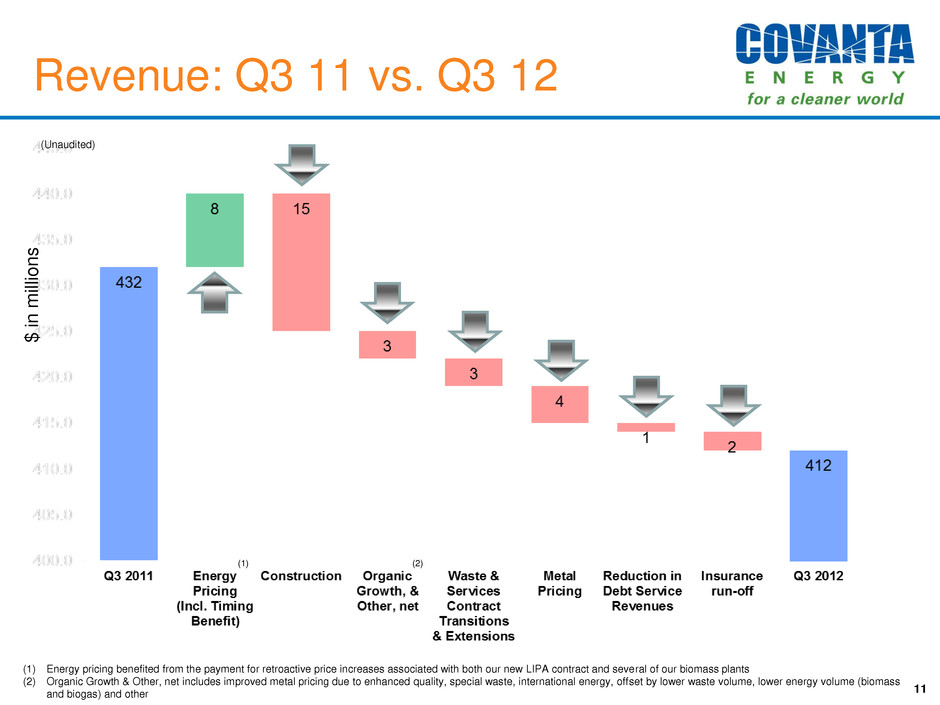

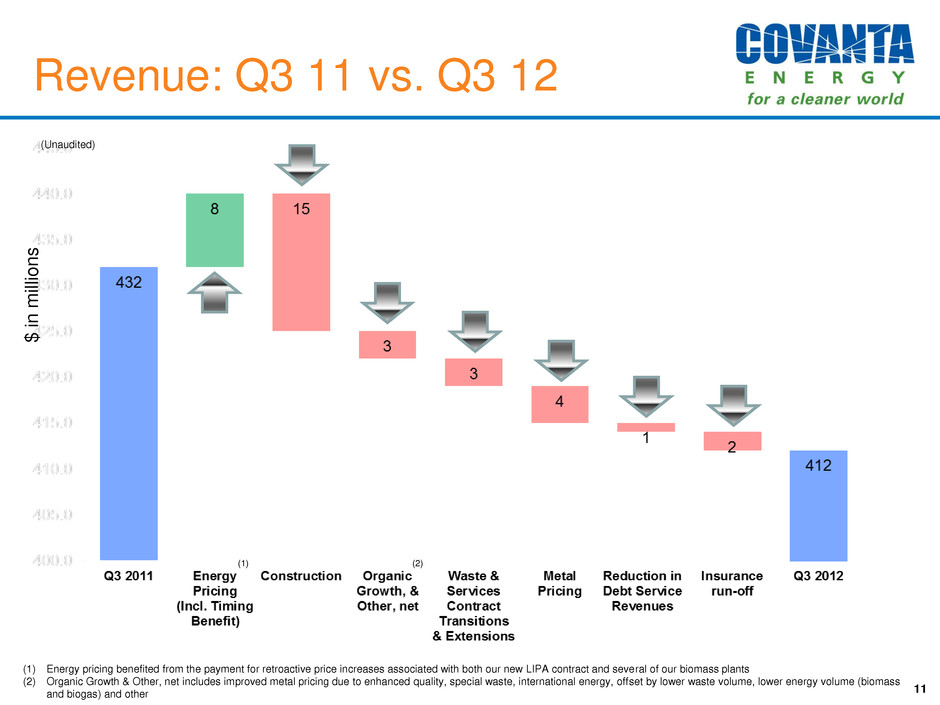

Revenue: Q3 11 vs. Q3 12 $ in m illion s (Unaudited) 11 (1) (2) (1) Energy pricing benefited from the payment for retroactive price increases associated with both our new LIPA contract and several of our biomass plants (2) Organic Growth & Other, net includes improved metal pricing due to enhanced quality, special waste, international energy, offset by lower waste volume, lower energy volume (biomass and biogas) and other

Adj EBITDA: Q3 11 vs. Q3 12 (Unaudited) $ in m illion s 12 (1) (2) (1) Energy pricing benefited from the payment for retroactive price increases associated with our new LIPA contract and several of our biomass plants (2) Organic Growth & Other, net includes improved metal pricing due to enhanced quality, special waste, new units coming online, construction, offset by a reduction in alternative fuel tax credits, lower waste volume, lower energy volume (biomass and biogas), and other

Free Cash Flow: Q3 11 vs. Q3 12 (Unaudited) $ in m illion s 13 (1) (1) Working Capital & Other includes both construction and other working capital

Adj EPS: Q3 11 vs. Q3 12 (Unaudited) 14

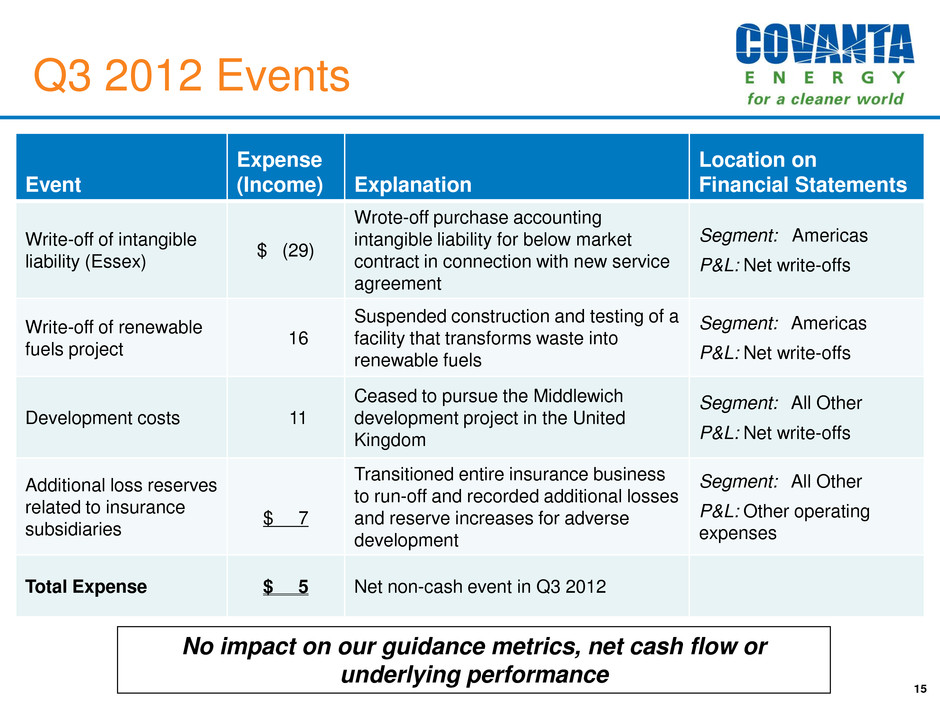

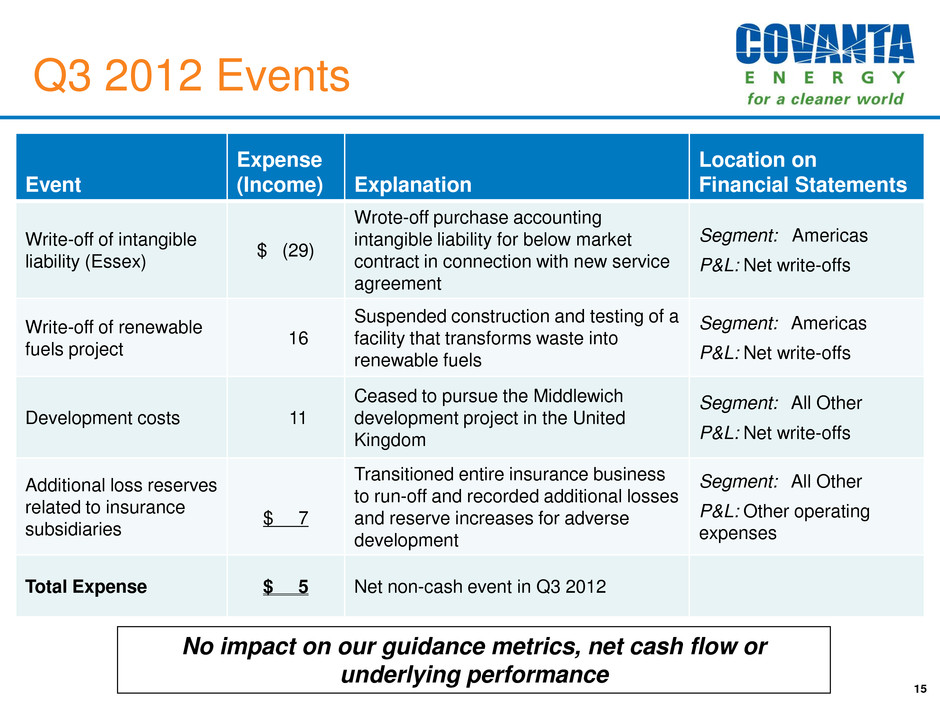

Q3 2012 Events 15 Event Expense (Income) Explanation Location on Financial Statements Write-off of intangible liability (Essex) $ (29) Wrote-off purchase accounting intangible liability for below market contract in connection with new service agreement Segment: Americas P&L: Net write-offs Write-off of renewable fuels project 16 Suspended construction and testing of a facility that transforms waste into renewable fuels Segment: Americas P&L: Net write-offs Development costs 11 Ceased to pursue the Middlewich development project in the United Kingdom Segment: All Other P&L: Net write-offs Additional loss reserves related to insurance subsidiaries $ 7 Transitioned entire insurance business to run-off and recorded additional losses and reserve increases for adverse development Segment: All Other P&L: Other operating expenses Total Expense $ 5 Net non-cash event in Q3 2012 No impact on our guidance metrics, net cash flow or underlying performance

• Dividend – Declared quarterly cash dividend of $0.15 per share during Q3 2012 – Annualized cash dividend is $0.60 per share 3.5% yield1 • Equates to ~30% payout of Free Cash Flow2 • Share repurchases – Repurchased 1.5 million shares during Q3 2012 (~1.1% of shares outstanding) – Repurchased 16.5% of shares outstanding since program inception – As of 9/30/2012, $90 million remaining in share repurchase authorization 16 (Unaudited, in millions) FY 2010 FY 2011 Q1 2012 Q2 2012 Q3 2012 Share Repurchases $95 $230 $30 $30 $25 Dividends Declared $233 $42 $21 $20 $20 Total Returned $328 $272 $51 $50 $45 Shares Outstanding End of Period 150 136 135 133 132 (1) Based on share price of $17.16 as of 9/28/2012 (2) At midpoint of guidance, revised as of 10/17/2012 Actively Returning Capital

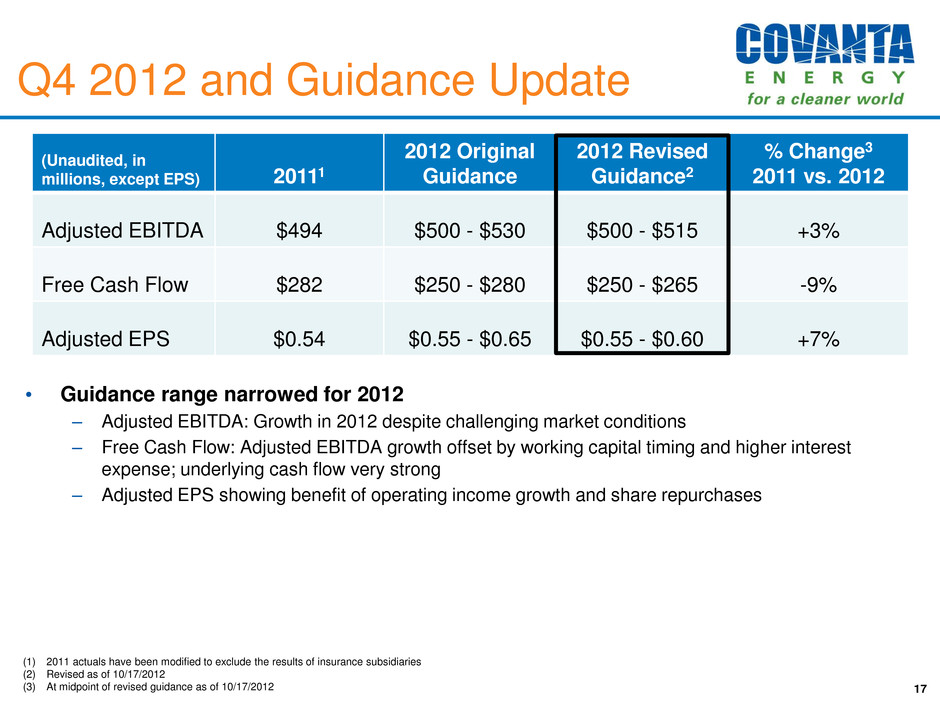

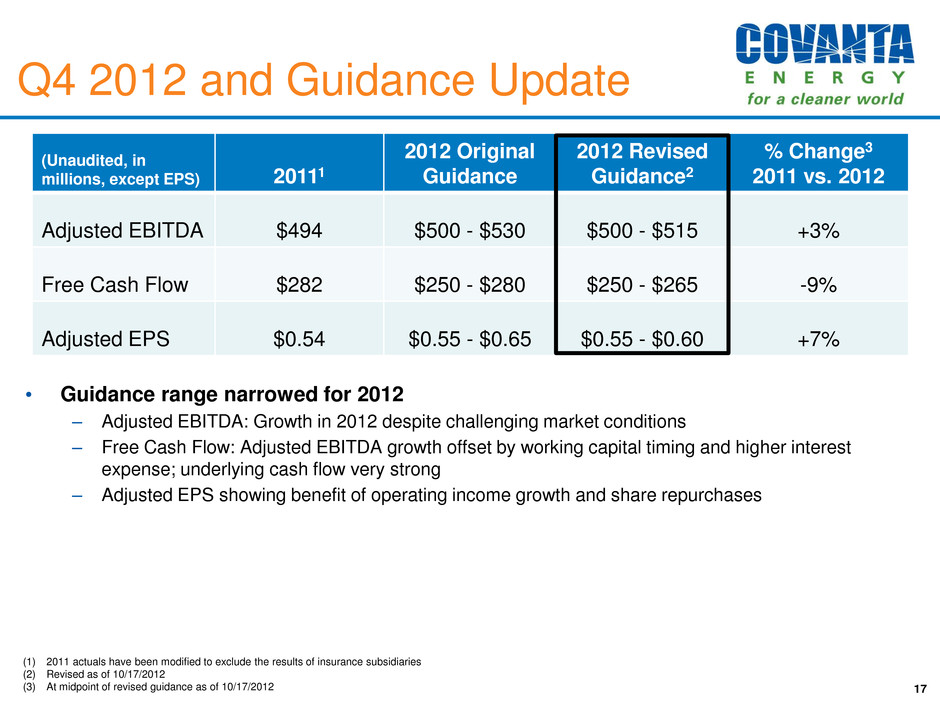

17 (Unaudited, in millions, except EPS) 20111 2012 Original Guidance 2012 Revised Guidance2 % Change3 2011 vs. 2012 Adjusted EBITDA $494 $500 - $530 $500 - $515 +3% Free Cash Flow $282 $250 - $280 $250 - $265 -9% Adjusted EPS $0.54 $0.55 - $0.65 $0.55 - $0.60 +7% (1) 2011 actuals have been modified to exclude the results of insurance subsidiaries (2) Revised as of 10/17/2012 (3) At midpoint of revised guidance as of 10/17/2012 • Guidance range narrowed for 2012 – Adjusted EBITDA: Growth in 2012 despite challenging market conditions – Free Cash Flow: Adjusted EBITDA growth offset by working capital timing and higher interest expense; underlying cash flow very strong – Adjusted EPS showing benefit of operating income growth and share repurchases Q4 2012 and Guidance Update

Covanta Holding Corporation Third Quarter 2012 Earnings Conference Call NYSE: CVA Appendix 18

Haverhill Niagara SE Massachusetts Warren Indianapolis Hempstead Wallingford Kent Tulsa Stanislaus Alexandria Springfield Pittsfield Delaware Valley Essex Union Marion Babylon Fairfax Huntington Bristol Lake Plymouth Onondaga SE Connecticut Hennepin Hillsborough Honolulu Pasco Lancaster Hartford Hudson Valley Lee MacArthur York Montgomery Huntsville Harrisburg Long Beach Dade Burnaby Initial Agmt Extension Merchant 2008 202020192017201620142013201220102009 2011 20182015 Waste Contract Outlook – Great Track Record 19 T ip Fe e S er v ic e F e e O w n e d S er v ic e F e e O p e ra te d Major Municipal Waste Contract Transitions from 2008 - 2020 Note: Since the beginning of 2012, we have extended contracts with Alexandria, Essex, Montgomery, Springfield, Stanislaus, and Tulsa and ended our contract with Hartford. The original Stanislaus agreement ended on 1/1/2011 and we extended it 5 years to 1/1/2016. During Q2 2012, we extended the contract again, out to 2027, and converted Stanislaus from Service Fee Owned to Tip Fee contract. Essex will convert from a Service Fee Owned contract to a Tip Fee contract on 1/1/2013

20 Q3 2012 Summary Results (Unaudited, in millions, except per share amounts) Q3 Q3 YTD 2012 2011 2012 2011 Operating revenues Waste and service revenues 264$ 273$ 802$ 800$ Electricity and steam sales 115 109 297 301 Other operating revenues 33 50 115 119 Total operating revenues 412 432 1,214 1,220 Operating expenses Plant operating expenses 225 221 735 740 Other operating expenses 31 44 100 102 General and administrative expenses 24 24 74 74 Depreciation and amortization expense 46 48 145 142 Net interest expense on project debt 7 8 22 24 Net write-offs (2) - (2) - Total operating expenses 331 345 1,074 1,082 Operating income 81$ 87$ 140$ 138$ Adjusted EBITDA 150$ 153$ 349$ 347$ % of Revenue 36% 35% 29% 28% Free Cash Flow 111$ 107$ 205$ 219$ Adjusted EPS 0.25$ 0.25$ 0.32$ 0.27$ Memo: Shares Outstanding End of Period 132 138 132 138

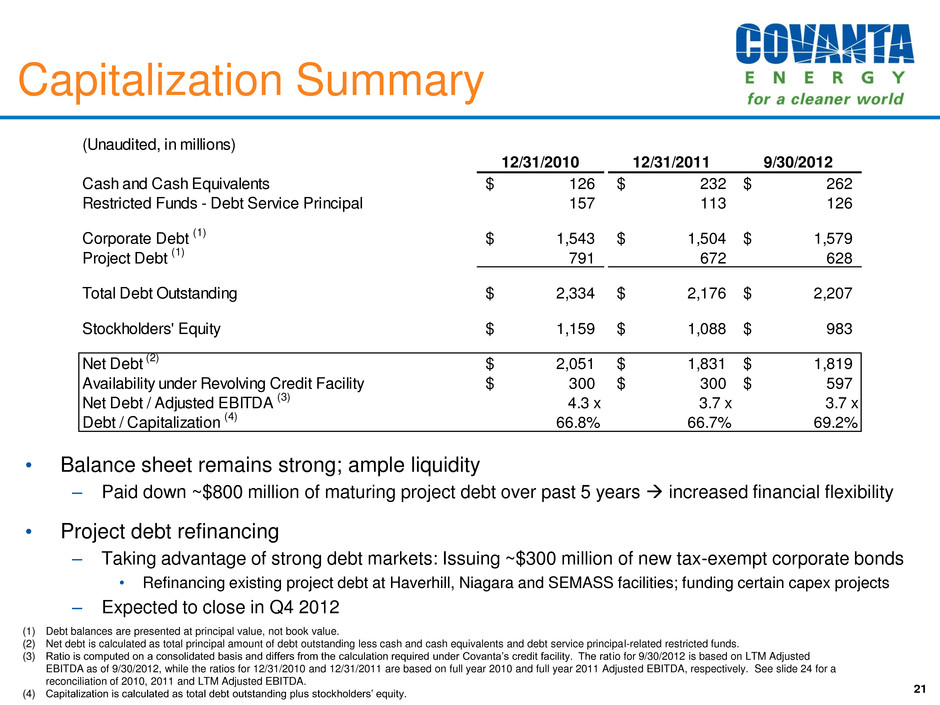

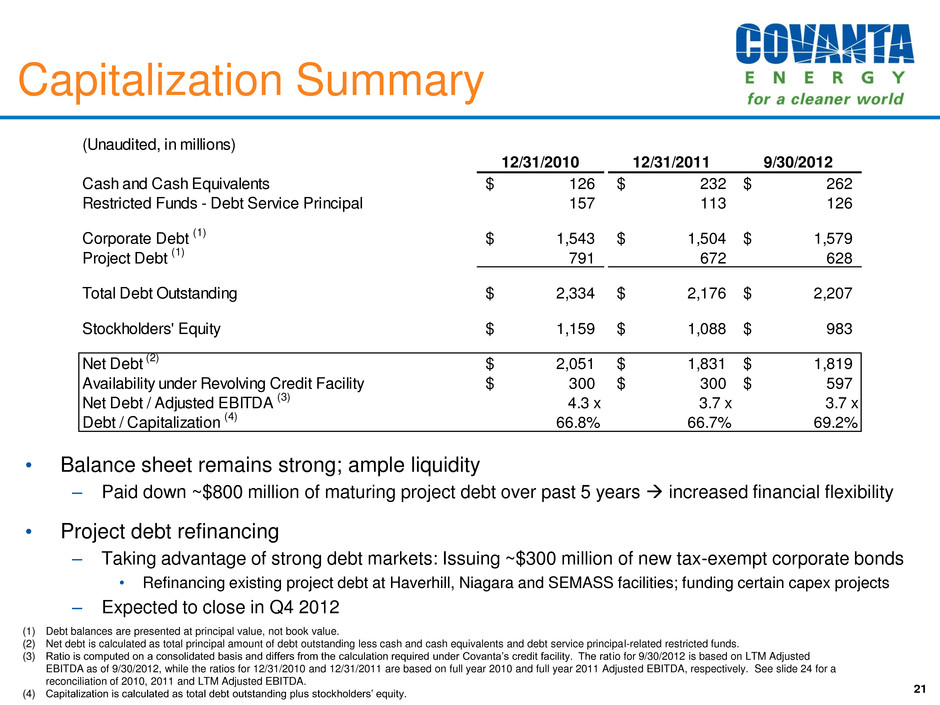

21 (1) Debt balances are presented at principal value, not book value. (2) Net debt is calculated as total principal amount of debt outstanding less cash and cash equivalents and debt service principal-related restricted funds. (3) Ratio is computed on a consolidated basis and differs from the calculation required under Covanta’s credit facility. The ratio for 9/30/2012 is based on LTM Adjusted EBITDA as of 9/30/2012, while the ratios for 12/31/2010 and 12/31/2011 are based on full year 2010 and full year 2011 Adjusted EBITDA, respectively. See slide 24 for a reconciliation of 2010, 2011 and LTM Adjusted EBITDA. (4) Capitalization is calculated as total debt outstanding plus stockholders’ equity. Capitalization Summary • Balance sheet remains strong; ample liquidity – Paid down ~$800 million of maturing project debt over past 5 years increased financial flexibility • Project debt refinancing – Taking advantage of strong debt markets: Issuing ~$300 million of new tax-exempt corporate bonds • Refinancing existing project debt at Haverhill, Niagara and SEMASS facilities; funding certain capex projects – Expected to close in Q4 2012 (Unaudited, in millions) 12/31/2010 12/31/2011 9/30/2012 Cash and Cash Equivalents 126$ 232$ 262$ Restricted Funds - Debt Service Principal 157 113 126 Corporate Debt (1) 1,543$ 1,504$ 1,579$ Project Debt (1) 791 672 628 Total Debt Outstanding 2,334$ 2,176$ 2,207$ Stockholders' Equity 1,159$ 1,088$ 983$ Net Debt (2) 2,051$ 1,831$ 1,819$ Availability under Revolving Credit Facility 300$ 300$ 597$ Net Debt / Adjusted EBITDA (3) 4.3 x 3.7 x 3.7 x Debt / Capitalization (4) 66.8% 66.7% 69.2%

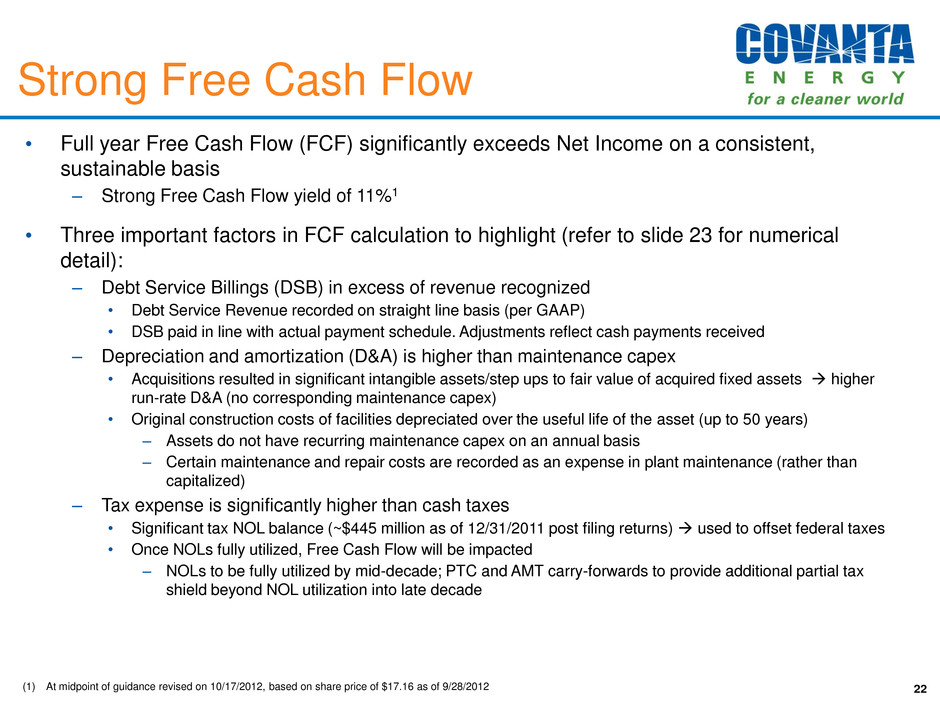

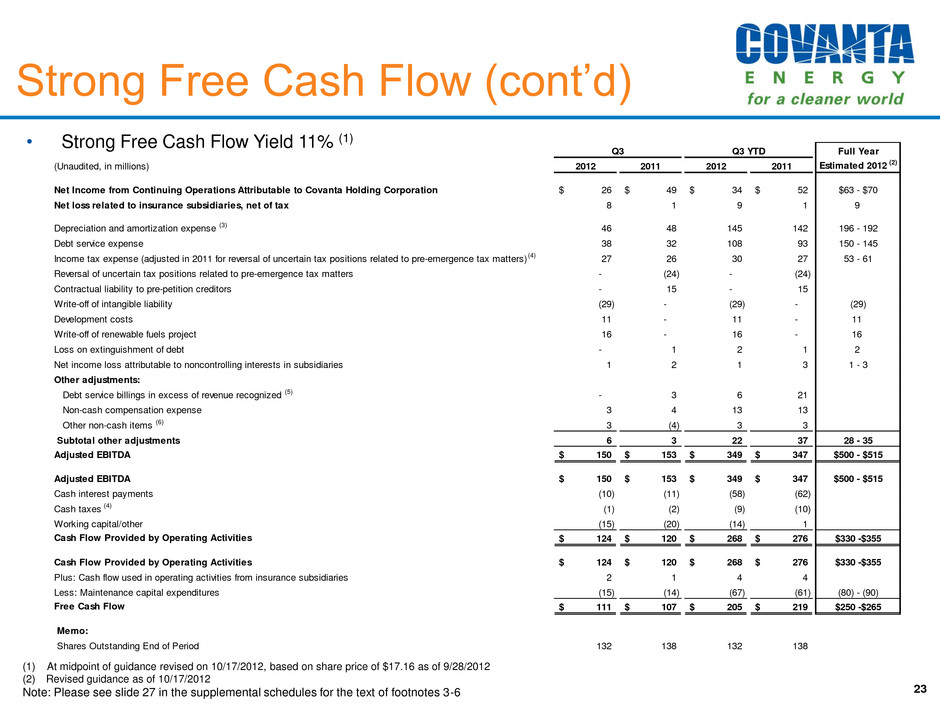

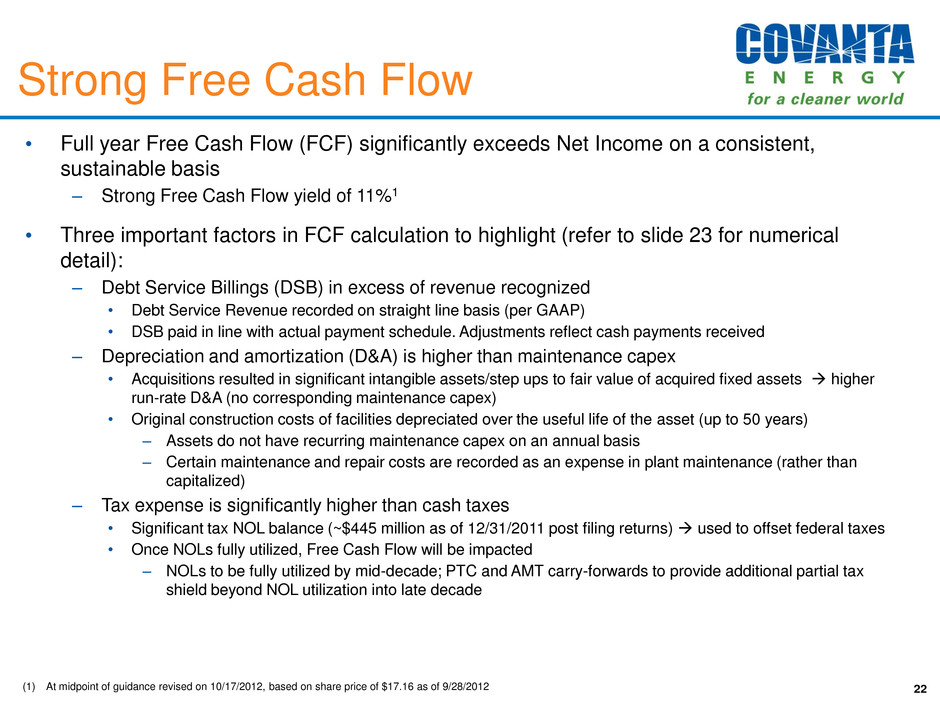

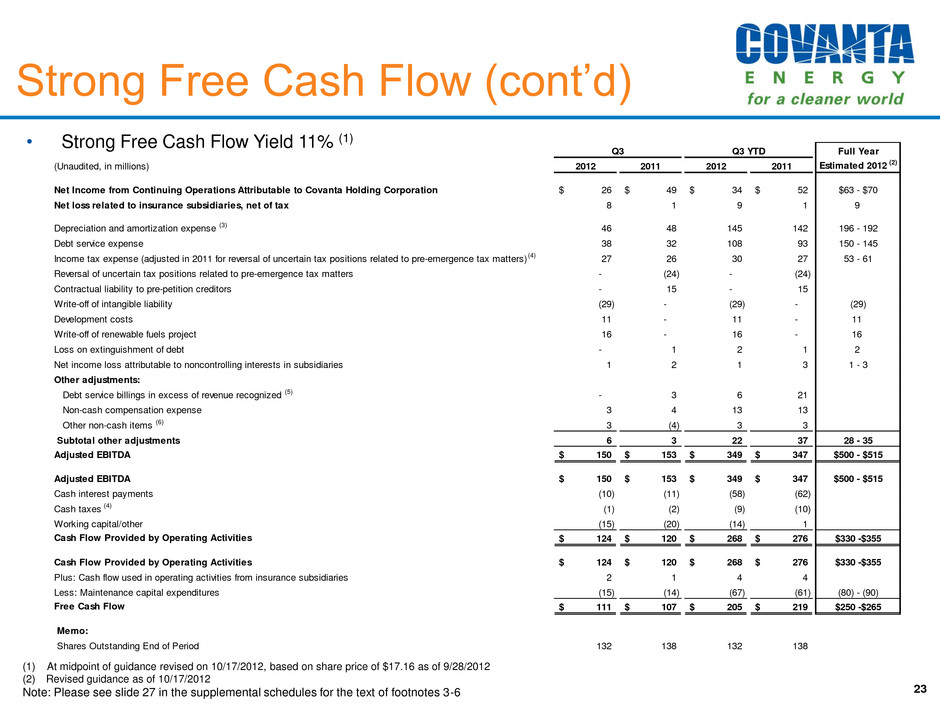

(1) At midpoint of guidance revised on 10/17/2012, based on share price of $17.16 as of 9/28/2012 22 • Full year Free Cash Flow (FCF) significantly exceeds Net Income on a consistent, sustainable basis – Strong Free Cash Flow yield of 11%1 • Three important factors in FCF calculation to highlight (refer to slide 23 for numerical detail): – Debt Service Billings (DSB) in excess of revenue recognized • Debt Service Revenue recorded on straight line basis (per GAAP) • DSB paid in line with actual payment schedule. Adjustments reflect cash payments received – Depreciation and amortization (D&A) is higher than maintenance capex • Acquisitions resulted in significant intangible assets/step ups to fair value of acquired fixed assets higher run-rate D&A (no corresponding maintenance capex) • Original construction costs of facilities depreciated over the useful life of the asset (up to 50 years) – Assets do not have recurring maintenance capex on an annual basis – Certain maintenance and repair costs are recorded as an expense in plant maintenance (rather than capitalized) – Tax expense is significantly higher than cash taxes • Significant tax NOL balance (~$445 million as of 12/31/2011 post filing returns) used to offset federal taxes • Once NOLs fully utilized, Free Cash Flow will be impacted – NOLs to be fully utilized by mid-decade; PTC and AMT carry-forwards to provide additional partial tax shield beyond NOL utilization into late decade Strong Free Cash Flow

Full Year (Unaudited, in millions) 2012 2011 2012 2011 Estimated 2012 (2) Net Income from Continuing Operations Attributable to Covanta Holding Corporation 26$ 49$ 34$ 52$ $63 - $70 Net loss related to insurance subsidiaries, net of tax 8 1 9 1 9 Depreciation and amortization expense (3) 46 48 145 142 196 - 192 Debt service expense 38 32 108 93 150 - 145 Income tax expense (adjusted in 2011 for reversal of uncertain tax positions related to pre-emergence tax matters) (4) 27 26 30 27 53 - 61 Reversal of uncertain tax positions related to pre-emergence tax matters - (24) - (24) Contractual liability to pre-petition creditors - 15 - 15 Write-off of intangible liability (29) - (29) - (29) Development costs 11 - 11 - 11 Write-off of renewable fuels project 16 - 16 - 16 Loss on extinguishment of debt - 1 2 1 2 Net income loss attributable to noncontrolling interests in subsidiaries 1 2 1 3 1 - 3 Other adjustments: Debt service billings in excess of revenue recognized (5) - 3 6 21 Non-cash compensation expense 3 4 13 13 Other non-cash items (6) 3 (4) 3 3 Subtotal other adjustments 6 3 22 37 28 - 35 Adjusted EBITDA 150$ 153$ 349$ 347$ $500 - $515 Adjusted EBITDA 150$ 153$ 349$ 347$ $500 - $515 Cash interest payments (10) (11) (58) (62) Cash taxes (4) (1) (2) (9) (10) Working capital/other (15) (20) (14) 1 Cash Flow Provided by Operating Activities 124$ 120$ 268$ 276$ $330 -$355 Cash Flow Provided by Operating Activities 124$ 120$ 268$ 276$ $330 -$355 Plus: Cash flow used in operating activities from insurance subsidiaries 2 1 4 4 Less: Maintenance capital expenditures (15) (14) (67) (61) (80) - (90) Free Cash Flow 111$ 107$ 205$ 219$ $250 -$265 Memo: Shares Outstanding End of Period 132 138 132 138 Q3 Q3 YTD Strong Free Cash Flow (cont’d) (1) At midpoint of guidance revised on 10/17/2012, based on share price of $17.16 as of 9/28/2012 (2) Revised guidance as of 10/17/2012 Note: Please see slide 27 in the supplemental schedules for the text of footnotes 3-6 23 • Strong Free Cash Flow Yield 11% (1)

Non-GAAP Reconciliation: Adjusted EBITDA 24 Note: Adjusted EBITDA results provided to reconcile the denominator of the Net Debt / Adjusted EBITDA ratios on slide 21 Please see slide 27 for the text of footnotes 3 to 6 Full Year LTM (Unaudited, in millions) 2010 2011 9/30/2012 Net Income from Continuing Operations 30$ 79$ 61$ Net loss related to Insurance subsidiaries 6 2 10 Depreciation and amortization expense (3) 190 193 196 Debt service expense 121 122 137 Income tax expense (adjusted for reversal of uncertain tax positions related to pre-emergence tax matters) (4) 24 52 55 Reversal of uncertain tax positions related to pre-emergence tax matters - (24) - Non-cash liability to pre-petition creditors - 15 - Write-off of intangible liability - - (29) Write-off of renewable fuels project - - 16 Write-down of assets 34 - - Development costs - 5 16 Loss on extinguishment of debt 15 1 2 Gain on sale of business - (9) (8) Net income attributable to noncontrolling interests in subsidiaries 5 5 3 Other adjustments: Debt service billings in excess of revenue recognized (5) 29 22 7 Non-cash compensation expense 17 18 18 Other non-cash items (6) 5 13 12 Subtotal other adjustments 51 53 37 Adjusted EBITDA 476$ 494$ 496$

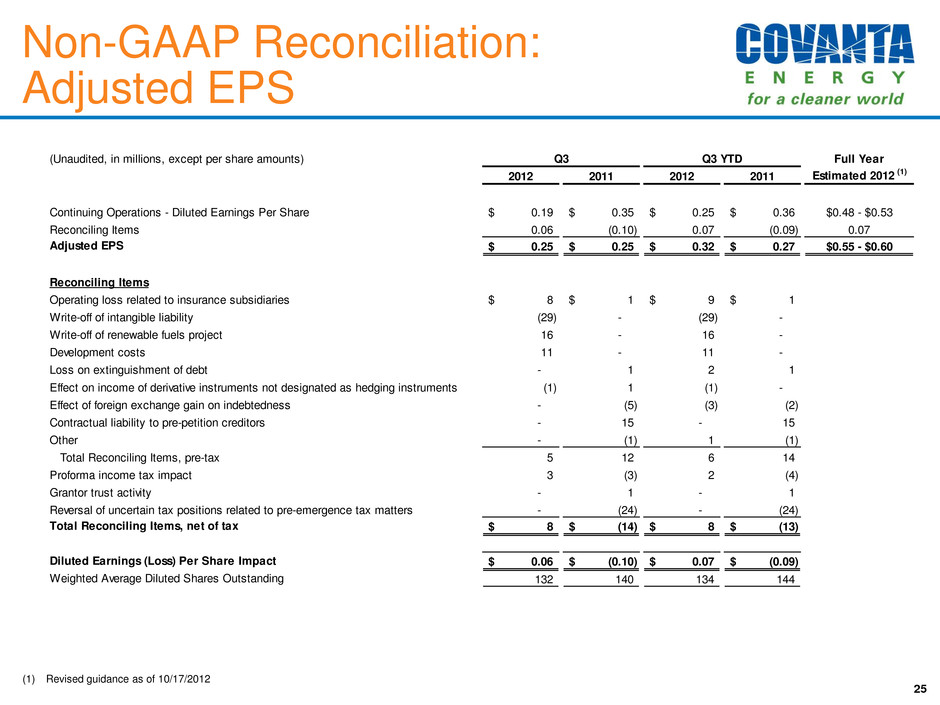

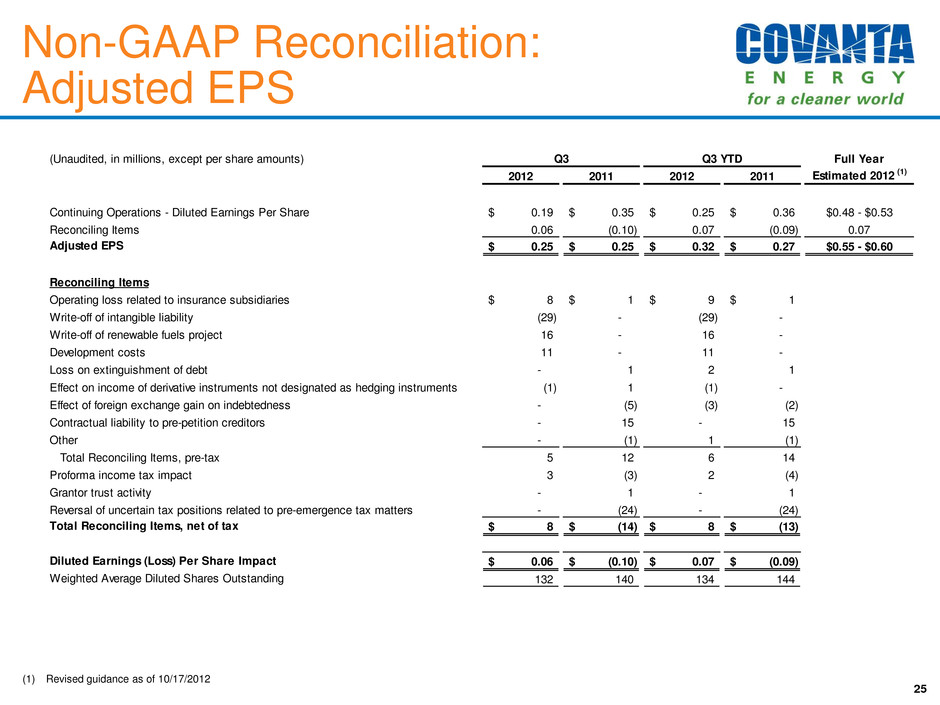

25 (1) Revised guidance as of 10/17/2012 Non-GAAP Reconciliation: Adjusted EPS (Unaudited, in millions, except per share amounts) Full Year 2012 2011 2012 2011 Estimated 2012 (1) Continuing Operations - Diluted Earnings Per Share 0.19$ 0.35$ 0.25$ 0.36$ $0.48 - $0.53 Reconciling Items 0.06 (0.10) 0.07 (0.09) 0.07 Adjusted EPS 0.25$ 0.25$ 0.32$ 0.27$ $0.55 - $0.60 Reconciling Items Operating loss related to insurance subsidiaries 8$ 1$ 9$ 1$ Write-off of intangible liability (29) - (29) - Write-off of renewable fuels project 16 - 16 - Development costs 11 - 11 - Loss on extinguishment of debt - 1 2 1 Effect on income of derivative instruments not designated as hedging instruments (1) 1 (1) - Effect of foreign exchange gain on indebtedness - (5) (3) (2) Contractual liability to pre-petition creditors - 15 - 15 Other - (1) 1 (1) Total Reconciling Items, pre-tax 5 12 6 14 Proforma income tax impact 3 (3) 2 (4) Grantor trust activity - 1 - 1 Reversal of uncertain tax positions related to pre-emergence tax matters - (24) - (24) Total Reconciling Items, net of tax 8$ (14)$ 8$ (13)$ Diluted Earnings (Loss) Per Share Impact 0.06$ (0.10)$ 0.07$ (0.09)$ Weighted Average Diluted Shares Outstanding 132 140 134 144 Q3 Q3 YTD

26 Supporting Reconciliations (Unaudited, in millions) 2012 2011 2012 2011 Purchases of property, plant and equipment: Maintenance capital expenditures (15)$ (14)$ (67)$ (61)$ Capital expenditures associated with construction - (6) - (15) Capital expenditures associated with technology development and organic growth initiatives (7) (1) (18) (6) Capital expenditures - other (6) (2) (9) (9) Total purchases of property, plant and equipment (28)$ (23)$ (94)$ (91)$ 2012 2011 2012 2011 Investments: Non-maintenance capital expenditures (13)$ (9)$ (27)$ (30)$ Acquisition of businesses, net of cash acquired - - - (10) Acquisition of land use rights - - (1) (8) Other investing activities, net (9) (3) (3) (6) Total investments (22) (12) (31) (54) Less: Net proceeds from issuance of project debt - (7) - (15) Investing activities, excluding maintenance capital expenditures (22)$ (19)$ (31)$ (69)$ Q3 Q3 YTD Q3 Q3 YTD

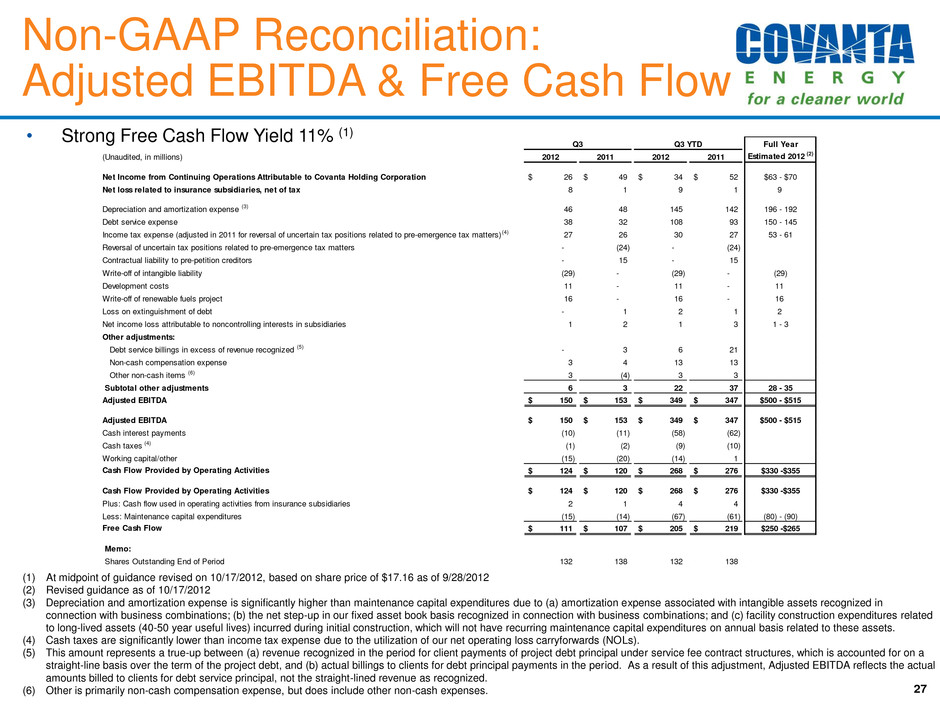

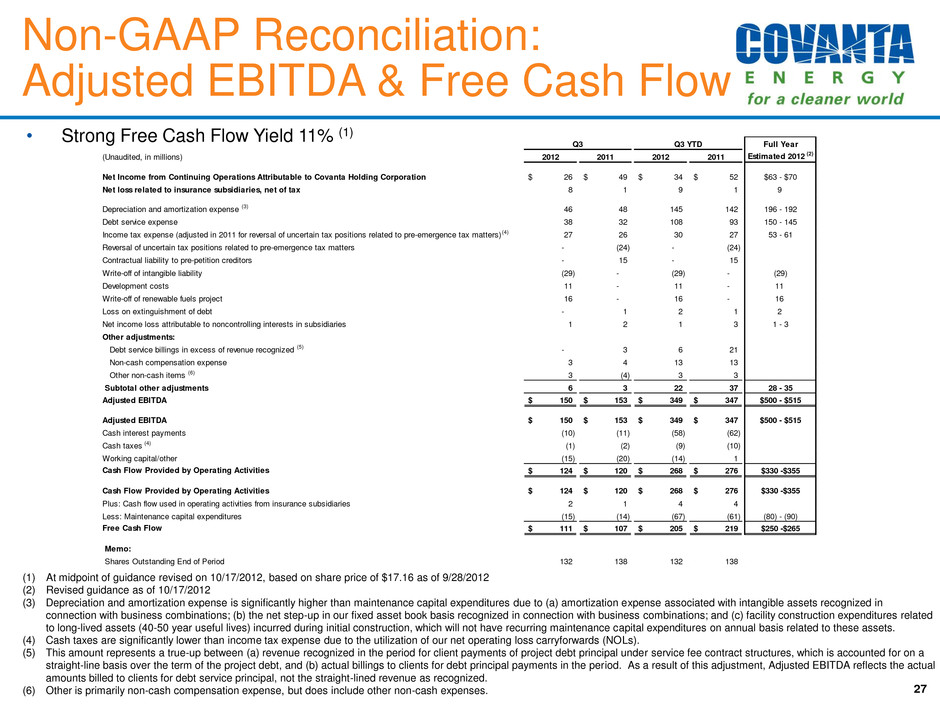

Full Year (Unaudited, in millions) 2012 2011 2012 2011 Estimated 2012 (2) Net Income from Continuing Operations Attributable to Covanta Holding Corporation 26$ 49$ 34$ 52$ $63 - $70 Net loss related to insurance subsidiaries, net of tax 8 1 9 1 9 Depreciation and amortization expense (3) 46 48 145 142 196 - 192 Debt service expense 38 32 108 93 150 - 145 Income tax expense (adjusted in 2011 for reversal of uncertain tax positions related to pre-emergence tax matters) (4) 27 26 30 27 53 - 61 Reversal of uncertain tax positions related to pre-emergence tax matters - (24) - (24) Contractual liability to pre-petition creditors - 15 - 15 Write-off of intangible liability (29) - (29) - (29) Development costs 11 - 11 - 11 Write-off of renewable fuels project 16 - 16 - 16 Loss on extinguishment of debt - 1 2 1 2 Net income loss attributable to noncontrolling interests in subsidiaries 1 2 1 3 1 - 3 Other adjustments: Debt service billings in excess of revenue recognized (5) - 3 6 21 Non-cash compensation expense 3 4 13 13 Other non-cash items (6) 3 (4) 3 3 Subtotal other adjustments 6 3 22 37 28 - 35 Adjusted EBITDA 150$ 153$ 349$ 347$ $500 - $515 Adjusted EBITDA 150$ 153$ 349$ 347$ $500 - $515 Cash interest payments (10) (11) (58) (62) Cash taxes (4) (1) (2) (9) (10) Working capital/other (15) (20) (14) 1 Cash Flow Provided by Operating Activities 124$ 120$ 268$ 276$ $330 -$355 Cash Flow Provided by Operating Activities 124$ 120$ 268$ 276$ $330 -$355 Plus: Cash flow used in operating activities from insurance subsidiaries 2 1 4 4 Less: Maintenance capital expenditures (15) (14) (67) (61) (80) - (90) Free Cash Flow 111$ 107$ 205$ 219$ $250 -$265 Memo: Shares Outstanding End of Period 132 138 132 138 Q3 Q3 YTD Non-GAAP Reconciliation: Adjusted EBITDA & Free Cash Flow (1) At midpoint of guidance revised on 10/17/2012, based on share price of $17.16 as of 9/28/2012 (2) Revised guidance as of 10/17/2012 (3) Depreciation and amortization expense is significantly higher than maintenance capital expenditures due to (a) amortization expense associated with intangible assets recognized in connection with business combinations; (b) the net step-up in our fixed asset book basis recognized in connection with business combinations; and (c) facility construction expenditures related to long-lived assets (40-50 year useful lives) incurred during initial construction, which will not have recurring maintenance capital expenditures on annual basis related to these assets. (4) Cash taxes are significantly lower than income tax expense due to the utilization of our net operating loss carryforwards (NOLs). (5) This amount represents a true-up between (a) revenue recognized in the period for client payments of project debt principal under service fee contract structures, which is accounted for on a straight-line basis over the term of the project debt, and (b) actual billings to clients for debt principal payments in the period. As a result of this adjustment, Adjusted EBITDA reflects the actual amounts billed to clients for debt service principal, not the straight-lined revenue as recognized. (6) Other is primarily non-cash compensation expense, but does include other non-cash expenses. • Strong Free Cash Flow Yield 11% (1) 27

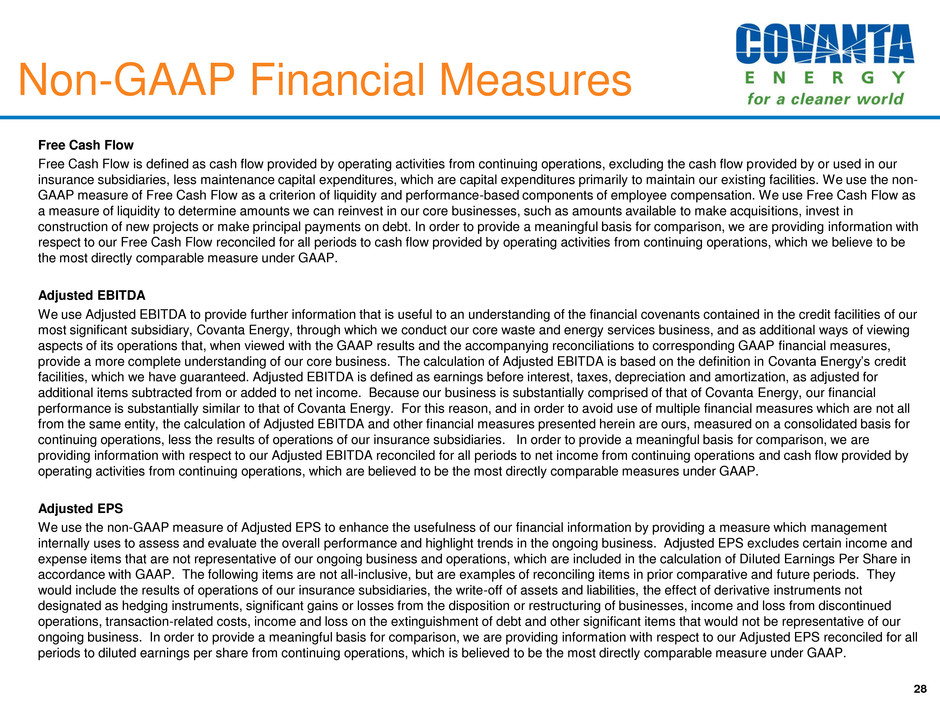

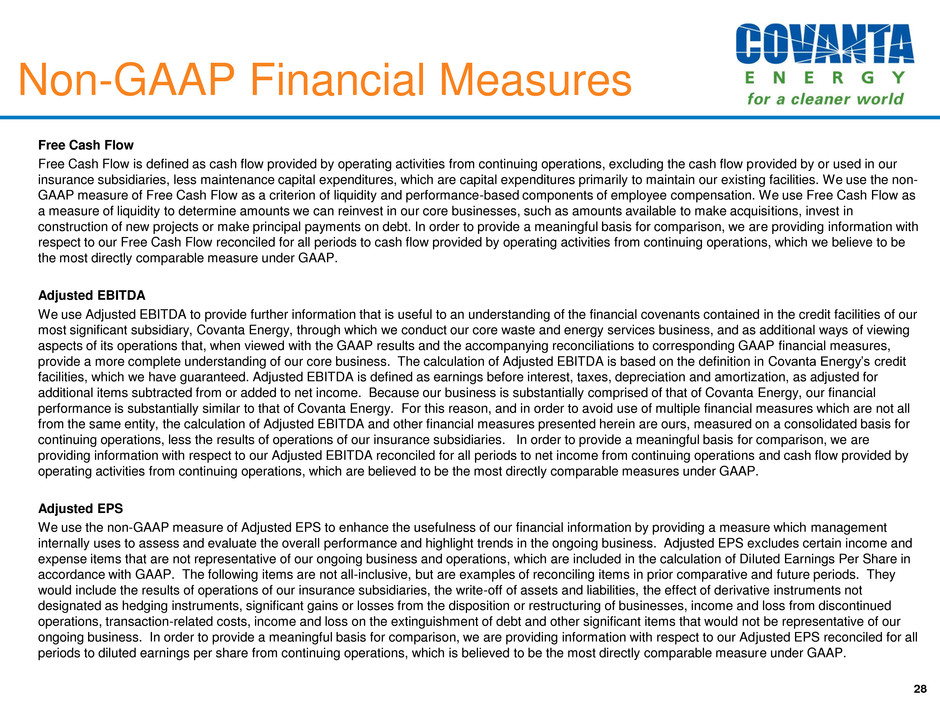

Free Cash Flow Free Cash Flow is defined as cash flow provided by operating activities from continuing operations, excluding the cash flow provided by or used in our insurance subsidiaries, less maintenance capital expenditures, which are capital expenditures primarily to maintain our existing facilities. We use the non- GAAP measure of Free Cash Flow as a criterion of liquidity and performance-based components of employee compensation. We use Free Cash Flow as a measure of liquidity to determine amounts we can reinvest in our core businesses, such as amounts available to make acquisitions, invest in construction of new projects or make principal payments on debt. In order to provide a meaningful basis for comparison, we are providing information with respect to our Free Cash Flow reconciled for all periods to cash flow provided by operating activities from continuing operations, which we believe to be the most directly comparable measure under GAAP. Adjusted EBITDA We use Adjusted EBITDA to provide further information that is useful to an understanding of the financial covenants contained in the credit facilities of our most significant subsidiary, Covanta Energy, through which we conduct our core waste and energy services business, and as additional ways of viewing aspects of its operations that, when viewed with the GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of our core business. The calculation of Adjusted EBITDA is based on the definition in Covanta Energy’s credit facilities, which we have guaranteed. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, as adjusted for additional items subtracted from or added to net income. Because our business is substantially comprised of that of Covanta Energy, our financial performance is substantially similar to that of Covanta Energy. For this reason, and in order to avoid use of multiple financial measures which are not all from the same entity, the calculation of Adjusted EBITDA and other financial measures presented herein are ours, measured on a consolidated basis for continuing operations, less the results of operations of our insurance subsidiaries. In order to provide a meaningful basis for comparison, we are providing information with respect to our Adjusted EBITDA reconciled for all periods to net income from continuing operations and cash flow provided by operating activities from continuing operations, which are believed to be the most directly comparable measures under GAAP. Adjusted EPS We use the non-GAAP measure of Adjusted EPS to enhance the usefulness of our financial information by providing a measure which management internally uses to assess and evaluate the overall performance and highlight trends in the ongoing business. Adjusted EPS excludes certain income and expense items that are not representative of our ongoing business and operations, which are included in the calculation of Diluted Earnings Per Share in accordance with GAAP. The following items are not all-inclusive, but are examples of reconciling items in prior comparative and future periods. They would include the results of operations of our insurance subsidiaries, the write-off of assets and liabilities, the effect of derivative instruments not designated as hedging instruments, significant gains or losses from the disposition or restructuring of businesses, income and loss from discontinued operations, transaction-related costs, income and loss on the extinguishment of debt and other significant items that would not be representative of our ongoing business. In order to provide a meaningful basis for comparison, we are providing information with respect to our Adjusted EPS reconciled for all periods to diluted earnings per share from continuing operations, which is believed to be the most directly comparable measure under GAAP. 28 Non-GAAP Financial Measures