QuickLinks -- Click here to rapidly navigate through this documentBudget Statement and Summary

EXHIBIT 99.C

From the

Swedish Budget Bill

of 2000

1

The revised

Budget Statement

PROP. 1999/2000:1

1 The revised Budget Statement

1.1 The first budget of the twenty-first century

This Budget Bill concludes the twentieth century's economic policy in Sweden. During the past hundred years, our country has developed from a poor agricultural nation into a hi-tech welfare state. In Sweden's twentieth-century history, development and equality have gone hand in hand and each has been a condition for the other.

This bill also marks the end of the economic crisis of the 1990s. Many individuals, households and enterprises have experienced difficulties during the crisis years that we have now left behind us. As a result of a vigorous economic policy for full employment, the Swedish people can for the first time in a decade determine the shape of the future themselves.

Sweden is leaving the nineteenth century in a position of economic strength. We can look forward to the twenty-first century with well-founded expectations and a feeling of growing confidence in the future.

***

Develop the good economy

Sweden's economy is developing well. Employment is rising and unemployment declining. The challenge for economic policy is now to achieve full employment. To do this, the economic upswing must be long-term and sustainable. The key lies in maintaining the good economy and focusing on the potential of the future. Sweden shall cross the threshold to the next century with a policy for development and equality based on the participation of all citizens.

This policy aims at:

- •

- pressing down unemployment and increasing employment. Security for children and the elderly shall be ensured by good quality health care, education and social services. In this way, social welfare can be reinforced and social justice increased in Sweden.

- •

- achieving full employment and increased welfare by sound, sustainable, economic growth. Open unemployment shall be halved to 4 per cent by 2000, and 80 per cent of the population aged between 20 and 64 shall be in regular employment in 2004. These targets are ambitious but possible to achieve.

- •

- to ensure continued sound public finances and stable prices, a prerequisite for high, sustainable growth. Since 1994 therefore, the Government has worked with ambitious budget policy goals. All goals have been surpassed, in most cases by a broad margin. In this way, the basis prerequisites have been created for high, stable growth.

The economic policy strategy of the Government since 1994 has been successful. Public finances have been consolidated. The budget policy goals are being upheld. By keeping control of the development of expenditure, the good economic development can be made sustainable and cutbacks avoided in the next downturn. Strong public finances are a prerequisite for stable social security systems and for all citizens to have a share of the core of welfare—health care, education and social services.

3

After the budget consolidation, policy can now be concentrated on the challenges of the future. The widened gaps must be reduced, the changeover to an ecologically sustainable society accelerated, the supply of labour and educational opportunities increased. Segregation shall be reduced and integration increased in order for everyone's skills to be made use of. At the same time, marginal effects must be reduced for the economy to perform better and competition in the product market must be intensified to press down prices to the benefit of consumers. The conditions for entrepreneurship are to be improved. The whole of Sweden is to be characterised by equality and development. Regional imbalance and segregation are to be counteracted.

To achieve all this, the successes of economic policy must be confirmed and sustained in the coming years. Better conditions shall be created to increase employment to allow everyone to participate in the development of the labour market. The risk that continued high demand will pass over into inflation shall be limited. Measures shall be taken for further improvements in efficiency in product, services, and financial markets as well as on the labour market.

Sweden on the right course

The clear, stringent budget consolidation that has been carried out has lifted Sweden out of the crisis. Sweden and the Swedish economy are developing well.

- •

- Unemployment is falling. Unemployment is estimated to fall to 5.4 per cent this year. The goal of reducing unemployment to 4 per cent in 2000 is within reach.

- •

- Employment is increasing. Compared with last year, 100,000 new jobs have been created. Most of these are in the private sector. The target of 80 per cent employment by 2004 is within reach.

- •

- Growth is good. It is expected to be at least 3 per cent both this year and next year.

- •

- Prices are stable. Inflationary expectations are low. Sweden has one of the lowest rates of inflation in Europe. Real wages are increasing.

- •

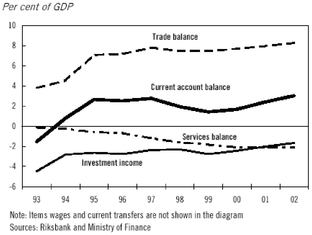

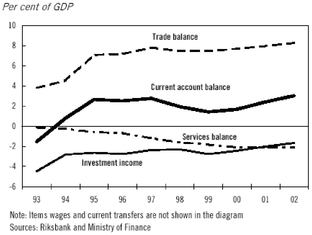

- The balance on current account is positive and increasing. Sweden's large foreign debt is being reduced.

- •

- Public finances have been consolidated. This year the surplus in public finances is expected to be 1.7 per cent of GDP, i.e. the target of 0.5 per cent's surplus in 1999 will be surpassed by a broad margin.

- •

- Public sector debt is being paid off at a fast rate. The net debt will be practically zero by 2002. Already in 2000, general government gross public debt will be less than 60 per cent of GDP.

New initiatives for growth and social justice

The Government is now proposing a number of measures to strengthen growth and social justice. This year's Budget Bill contains a broad, sustainable investment in jobs by at the same time strengthening real purchasing power and the ability of people to live and to earn their livelihood by work and by developing Sweden's good business sector climate. Sweden shall be constructed in an ecologically sustainable way.

- •

- As previously decided, child allowances are to be increased by SEK 100 on 1 January 2000 and 1 January 2001 respectively. There will be a corresponding increase in the supplement for large families.

- •

- Scope has been created for a phased introduction of a universal pre-school and a maximum charge in childcare from 2001.

4

- •

- Development assistance is to be increased. The new national accounts and the good growth entail an increase in both GDP and GNP. The Government now proposes that development assistance be increased by around SEK 1.3 billion in 2000. In this way, the goal of a development assistance frame of 0.72 per cent of GNP will be achieved. Moreover, over SEK 2 billion of saved funds may be used. Altogether, this means a considerable expansion of development assistance by around SEK 3 billion.

- •

- An amount totalling SEK 4 billion will be made available during 2000 and 2001 to those municipalities and county councils that have the greatest economic problems and which are most affected by regional imbalances.

- •

- An additional SEK 1 billion will be made available to health care and social services in 2001.

- •

- The SEK 200 paid in state income tax will be made available to municipalities and county councils in 2001 as well.

- •

- The Government intends later in a special bill to present proposals that entail that persons receiving assistance payments before 65 years of age will continue to receive these payments after attaining the age of 65. The intention is to be able to present the bill in autumn 2000 so that the change in the law can take effect from 1 January 2001. Before a bill can be presented, however, the proposal must be examined by a work group or committee. Negotiations must also take place and an agreement reached with the Swedish Association of Local Authorities. This may affect the time plan.

- •

- There has been a considerable increase in appropriations for land purchase, natural habitat protection, land remediation, and liming, as well as environmental research and environmental monitoring.

The good growth combined with the increased central government grants to municipalities and county councils will mean a strong increase in resources to health care, education and social services. In addition to the increased central government grants, the local government sector's tax revenue will increase by around SEK 25 billion between 1999 and 2000.

The improved prospects for the Swedish economy also make possible tax reductions within the framework of the budget goals which increase growth and strengthen social justice. It is proposed that the tax proposals come into effect on 1 January 2000 and are to be regarded as a first step in a comprehensive tax reform.

- •

- Tax is reduced with a special focus on those with low and medium incomes. Scope has been created from 2001 for a phased introduction of a universal pre-school and a maximum childcare charge. This further reduces the marginal effects. In this way, the supply of labour can increase at the same time as wage earners will be compensated for a quarter of the effects of contributions paid by the individual.

- •

- The threshold for state income tax will be increased so that fewer wage earners will pay state tax. The goal is for the proportion of wage earners who pay state tax to again approach 15 per cent, which was the Riksdag's aim in the 1990-91 tax reform.

- •

- The Government proposes that a further step be taken in a green tax swap by diesel tax, electricity tax and nuclear power tax being increased. The increased tax revenue is to be used for tax reduction in conjunction with individual development of skills in working life and for putting agriculture in the same tax position as industry with regard to energy taxation.

- •

- The opportunities for making allocations are increased inter alia by the period for allocations to accrual funds being increased from five to six years. Coupon tax for dividend on business-related shares to foreign owners is to be abolished from 1 January 2000. It is to be made possible for

5

These measures underline that the Budget Bill is a part of a long-term policy which, at one and the same time, aims at reinforcing justice and growth and contributing to equality, equality of opportunity and development.

Sweden is to be characterised by co-operation

The Government intends during this period of office to try to create the greatest possible support for a policy of full employment. The social partners have an important role in this context.

The Budget Bill is based on an agreement between the Social Democratic government, the Left Party and the Green Party, which support the guidelines for economic policy, budget policy, the expenditure ceiling, the supplementary budget for 1999, the appropriations for 2000 and the tax changes now proposed for 2000.

This co-operation extends to five areas—the economy, employment, social justice, equality of opportunity and the environment—and includes concrete proposals and measures for the future. This co-operation confirms that there is a political majority for an economic policy directed at full employment, a public budget surplus of 2 per cent of GDP on average over the business cycle, and price stability.

The Government strives for a broad basis of support for a future tax reform. All Riksdag parties are taking part in discussions. The main purpose is, on the basis of a just distribution, to create stable rules for growth and employment, an ecologically sound development and to guarantee welfare and its financing.

1.2 Economic development

The international economy is undergoing an upswing. With its economic foundations in order, Sweden can benefit to the full from the upswing. Sweden can thus cross the threshold into the next century with good growth, low inflation, reduced central government debt, increasing employment, falling unemployment, and an offensive environmental policy.

1.2.1 International economic development

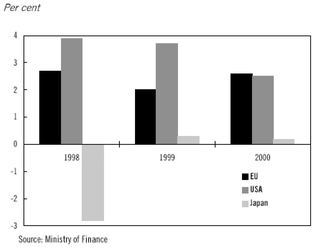

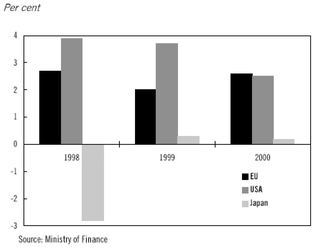

After a period of weak growth, the prospects for a global recovery are favourable. The prospects for Swedish exports have thus improved markedly compared with the beginning of the year.

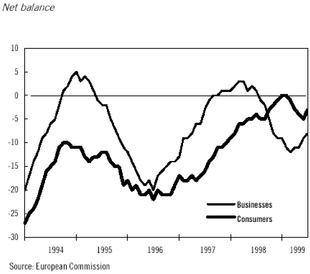

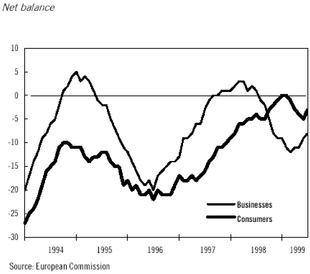

Growth in the EU is expected to increase in the next few years after the slackening off at the end of last year and at the beginning of 1999. Favourable prerequisites in the form of low interest rates and increasing confidence among both companies and households are expected to contribute to increased demand in the EU at the same time as exports increase. Unemployment in the EU is expected to decrease slightly in future. Average unemployment is expected to be 10.1 per cent in 1999.

6

The U.S. economy has continued to develop strongly, at the same time as inflation has been low. The successful monetary policy has played a key role in this favourable development. Due to increasing interest rates and increased savings, among other things, some weakening in activity is expected in future, however. Unemployment in the United States is expected to be 4.3 per cent in 1999.

There has been a slight improvement in the prospects for the Japanese economy recently. No sustainable recovery can yet be discerned, however. It is therefore expected that economic policy will continue to be directed at stimulating the economy. It is very important for the whole region that the reform of the Japanese economy continues. Unemployment in Japan is expected to increase to 4.9 per cent this year.

There are clear signs that a recovery is taking place in the Asian countries previously affected by crisis. After last year's marked reduction in production, positive growth is expected this year for the region as a whole. To ensure a sustainable recovery, it is important, however, that reform work continues even when economic development is favourable. After having increased greatly in 1998, unemployment is expected to fall during the second half of 1999 and 2000 apace with economic activity increasing in the economies previously affected by crisis.

Despite political instability and a slow reform process, some stabilisation has taken place in the Russian economy. To achieve long-term sustainable economic growth, the reform process must continue, however, and measures be taken to deal with the problems in the Russian economy.

1.2.2 Swedish economic development

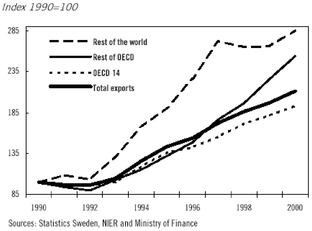

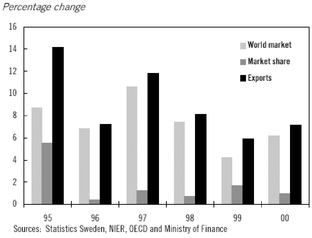

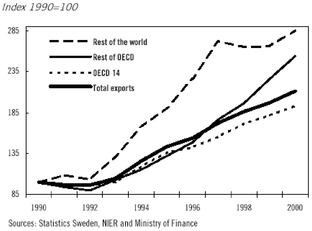

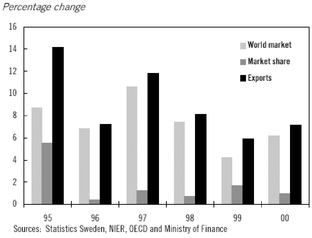

The Swedish economy has developed strongly during the first half of the year. Despite a weak economic activity in Sweden's most important markets, exports have continued to rise at the same time as domestic demand has increased rapidly.

The increase in exports during the first half of the year can primarily be related to continued substantial export successes for telecommunications and pharmaceutical industries while the economic activity in other export industries has been weak. The international recovery that is anticipated during the autumn and next year, will however lead to a broad upswing within the whole export sector.

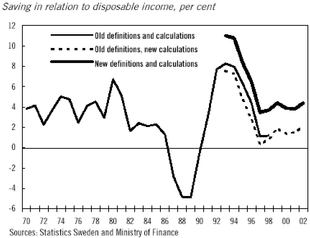

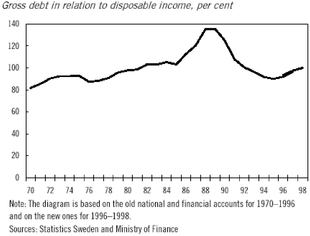

The economic situation of Swedish households has been improved in recent years. The focus of economic policy on consolidating public finances, thus making possible low interest rates and low inflation, has laid the basis for the good development and increased real wages. Rising employment also contributes to a favourable developments in households' real disposable income.

After the low level of purchases of durable consumer goods by households in recent years, there is a great need to replace worn out capital goods. Taken as a whole, these circumstances will contribute to a strong increase in consumption in the next few years.

7

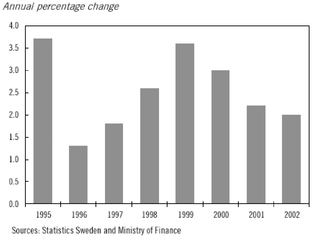

Table 1.1 Demand and output 1999-2000

| | SEK bn

| | Percentage changes, volume

|

|---|

| | 1998

| | 1999

| | 2000

|

|---|

| Household consumption expenditure | | 951 | | 3.1 | | 3.0 |

| General government consumption expenditure | | 499 | | 1.6 | | 1.0 |

| | Central government | | 147 | | 1.5 | | 0.5 |

| | Local government | | 352 | | 1.7 | | 1.3 |

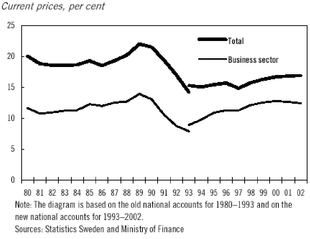

| Gross fixed capital formation | | 296 | | 6.4 | | 5.6 |

| | Business sector, excluding housing | | 227 | | 6.9 | | 5.2 |

| | Housing | | 24 | | 14.8 | | 14.3 |

| | Authorities | | 44 | | -0.8 | | 2.4 |

| Stockbuilding | | 17 | | -0.4 | | 0.1 |

| Exports | | 816 | | 5.0 | | 6.7 |

| Imports | | 705 | | 3.2 | | 7.1 |

| GDP | | 1813 | | 3.6 | | 3.0 |

Sources: Statistics Sweden and Ministry of Finance

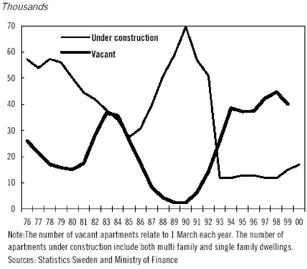

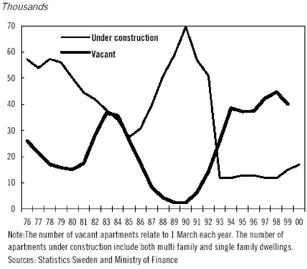

The total investment activity is expected to increase greatly both this year and next year. Housing construction especially is expected to increase sharply in the years ahead. A high resource utilisation in the business sector entails a continued large need to expand capacity. Increases in investments are expected, however, to slacken off somewhat as capacity is increased.

Table 1.2 Selected statistics 1999-2000

Per cent

| | 1900

| | 2000

|

|---|

| CPI, annual average | | 0.3 | | 1.2 |

| Hourly wage costs | | 3.4 | | 3.2 |

| Open unemployment(1) | | 5.4 | | 4.5 |

| Labour market programmes(1) | | 3.3 | | 3.5 |

| Employment | | 2.7 | | 1.6 |

| Real disposable income(2) | | 4.2 | | 2.6 |

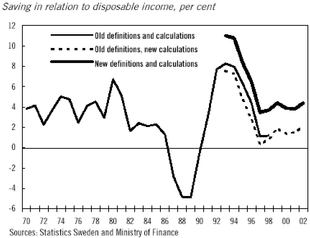

| Household net savings ratio, level(2) | | 4.4 | | 3.9 |

| Current account balance(3) | | 1.4 | | 1.7 |

| German 10-year government bond yield(4) | | 4.4 | | 4.9 |

| Swedish 10-year government bond yield(4) | | 4.9 | | 5.4 |

| TCW-index(4) | | 125 | | 122 |

- (1)

- Per cent of labour force, annual average

- (2)

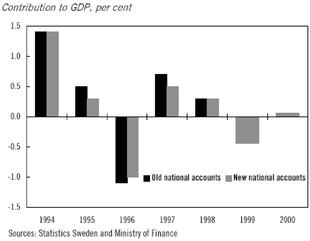

- New definition of saving, new calculations. According to the new national accounts changes in pension funds reserve are now included in the new definition of saving. Hence the level of the net savings ratio has increased by 2.9 percentage points in 1998

- (3)

- Per cent of GDP

- (4)

- Annual average

Sources: Statistics Sweden, the National Labour Market Board, Riksbank and Ministry of Finance.

8

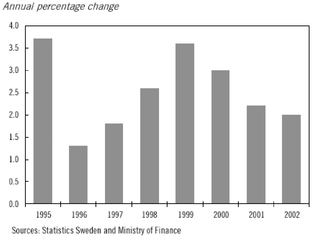

Altogether, GDP is expected to grow by 3.6 per cent this year and by 3 per cent next year. The increase in production this year will be very good especially within the services sector. Next year growth is expected to be export-led to a greater extent as the international business cycle strengthens. It is expected that the construction sector will continue to expand strongly throughout the period, although from a low level. The favourable development in the labour market will lead to a great improvement in the local government sector's finances. Health care, education and social services will be given priority.

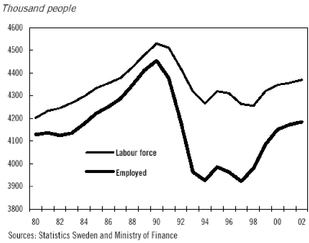

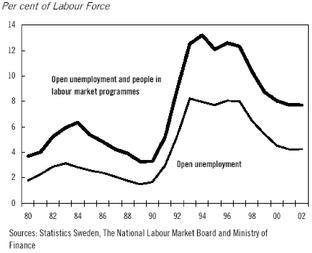

1.2.3 Employment and unemployment

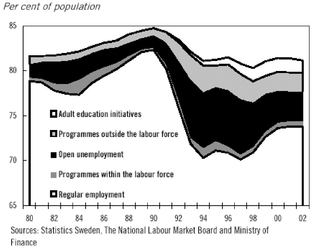

The long-term goal for economic policy is full employment. The Government and the Riksdag have set two goals on the road to full employment.

- •

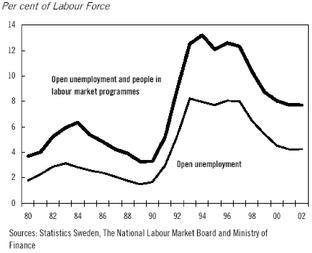

- Open unemployment is to be halved to 4 per cent during 2000.

- •

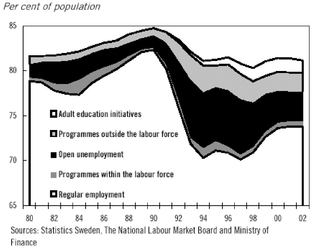

- Regular employment as a proportion of the population aged between 20 and 64 in regular employment shall increase from around 74 per cent in 1997 to 80 per cent in 2004. In this way, the need of social security payments will decrease.

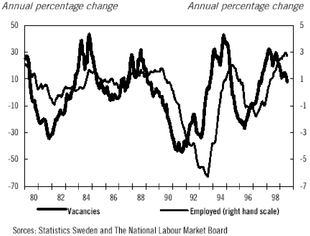

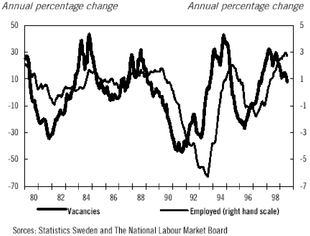

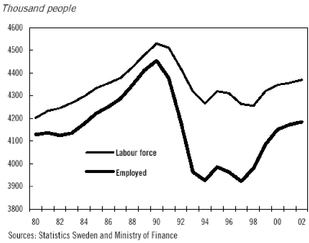

During the past year, employment has increased greatly. During the first half of this year, the number of employed has increased by over 100,000 compared with the corresponding period last year. Since spring 1997, open unemployment has fallen by around 3 percentage points. The greatest increase in employment has taken place in the private services sector but the number of employment opportunities in the local government sector has also increased greatly due to increased resources.

Growth has been employment-intensive during the first six months this year, Viewed in a historical perspective, the growth in productivity for the economy as a whole will thereby be low during 1999. Next year, productivity growth is expected to increase again when industry is responsible for a larger part of the increase in production.

Altogether, it is expected that employment will increase by 4.3 per cent between 1998 and 2000, corresponding to increase by around 170,000 persons. The level of employment will accordingly be considerably higher than the assessment made in the Spring Fiscal Policy Bill. The regular employment ratio for persons aged between 20 and 64 is expected to be around 77 per cent in 2000, compared with 75.6 per cent which was forecast in the Spring Fiscal Policy Bill.

It is expected that the proportion of employed will increase by around 3 percentage points between 1997 and 2000. In order to achieve the employment goal set by the Government, a further increase in the proportion of employed by 3 percentage points is required during the period 2001-2004. For this to be possible, the rate of wage increases must continue to be low at the same time as economic policy must be focused on increasing the supply of labour and strengthening the work and skills principle.

Progress on the labour market becomes even more tangible if it is taken into consideration that more people are actively looking for employment. Thus, the supply of labour has also increased in conjunction with the rise in employment. Altogether, the increase in employment and the supply of labour have led to open unemployment as an annual average falling from 6.5 per cent in 1998 to 4.5 per cent in 2000.

The improved cyclical situation has had positive effects in most parts of Sweden and for most groups in the labour market. Unemployment has fallen throughout the country and the downturn in unemployment has been greatest in Stockholm, Southern Sweden, Western Sweden and Central Norrland. The regional differences in levels of unemployment have persisted and unemployment is highest in Northern Central Sweden and Norrland.

Unemployment has fallen for almost all groups but is still at a high level for persons with a lower level of education. Unemployment for the highly educated has fallen to a relatively low level.

9

The target of 4 per cent's open unemployment will be maintained. According to the present assessment, open unemployment at the end of 2000, will be just over 4 per cent. The goal is within reach.

The Government will monitor development carefully, and, if it proves necessary, will propose further measures in addition to those proposed in this Bill. Unemployment shall be repressed. Sweden shall return to full employment.

1.2.4 Estimates for 2001 and 2002

In addition to the forecast for 1999 and 2000, calculations are presented for the following two years. These calculations are not forecasts. The first and most thorough calculation is based on the Swedish economy developing in accordance with the long-term increase in production after it has recovered from the recession at the beginning of the 1990s.

It is assumed in the first calculation that growth in 2001 and 2002 will approach a normal long-term growth rate of around 2 per cent per year. This means that open unemployment will fall to 4.2 per cent as an annual average in 2001 and remain at the same level in 2002. The regular employment ratio for persons aged between 20 and 64, would be 77.3 per cent given these assumptions.

Table 1.3 Employment, unemployment and wage formation

| | 1993

| | 1994

| | 1995

| | 1996

| | 1997

| | 1998

| | 1999

| | 2000

|

|---|

| Number of employed(1) | | 3.964 | | 3.927 | | 3.986 | | 3.963 | | 3.922 | | 3.979 | | 4.085 | | 4.151 |

| | Private sector(1) | | 2.630 | | 2.633 | | 2.697 | | 2.698 | | 2.695 | | 2.735 | | 2.813 | | 2.864 |

| | Public sector(1) | | 1.328 | | 1.290 | | 1.287 | | 1.263 | | 1.223 | | 1.240 | | 1.268 | | 1.282 |

| Proportion of employed aged between 20 and 64(2) | | 75.9 | | 74.2 | | 74.8 | | 74.6 | | 73.9 | | 74.6 | | 76.2 | | 77.1 |

| Registered unemployment(3) | | 8.2 | | 8.0 | | 7.7 | | 8.1 | | 8.0 | | 6.5 | | 5.4 | | 4.5 |

| Labour market programmes(3) | | 4.3 | | 5.3 | | 4.4 | | 4.5 | | 4.3 | | 3.9 | | 3.3 | | 3.5 |

| Hourly wage cost(4) | | 2.9 | | 2.4 | | 3.3 | | 6.0 | | 4.5 | | 3.8 | | 3.4 | | 3.2 |

| Development of productivity in business section(5) | | | | 3.9 | | 2.6 | | 1.5 | | 2.9 | | 1.0 | | 0.7 | | 1.9 |

- (1)

- Thousands of persons.

- (2)

- Those in regular employment as a percentage of the population aged between 20 and 64

- (3)

- As a percentage of the labour force.

- (4)

- Annual percentage change

- (5)

- Calculated from the expenditure approach.

Sources: Statistics Sweden, National Labour Market Board and Ministry of Finance

During the 1990s the Swedish economy has undergone great changes. There is therefore considerable uncertainty about the extent to which there will be unused resources in the economy after 2000. Two additional alternative calculations are therefore presented where the labour market performs well and where production and employment can grow more quickly at the same time as wages and prices develop in a sustainable way.

10

Table 1.4 Three calculations for GDP in the next few years

| | 1999

| | 2000

| | 2001

| | 2002

|

|---|

| Calculation 1 | | 3.6 | | 3.0 | | 2.2 | | 2.0 |

| Calculation 2 | | 3.6 | | 3.0 | | 2.5 | | 2.5 |

| Calculation 3 | | 3.6 | | 3.0 | | 2.8 | | 2.8 |

Source: Ministry of Finance

In the second calculation, GDP increases by 2.5 per cent per year, which would mean a fall in open unemployment to 3.8 per cent as an annual average in 2002 and a rise in the employment ratio for persons aged between 20 and 64 to 78 per cent.

In the third calculation, GDP increases by 2.8 per cent per year which results in a open unemployment of 3.5 per cent in 2002 and an employment ratio of 78.5 per cent in 2002.

With a long-term policy for growth and social justice focused on an increased supply of labour and a well-functioning wage formation, the two latter forecasts are attainable.

1.3 Economic policy

The fundamental assumption for economic policy is that sound public finances and stable prices are the foundation for a high, sustainable growth and employment. This approach has characterised economic policy since 1994. The result of the policy carried out for both growth and employment has been good.

1.3.1 Sound public finances

With a floating exchange rate and an inflation target, the foremost purpose of fiscal policy is to create good conditions for growth and employment by securing a surplus in public finances on average over the business cycle and keeping expenditure under control. This creates the conditions for low interest rates which in turn leads to high investment, good growth, increased employment and increased opportunities for a good distribution policy.

Since 1994, the Government has controlled fiscal policy with detailed budget policy goals extending over a number of years. Budget policy is governed by two overall goals. Public finance shall show a surplus of an average of 2 per cent of GDP over a business cycle and expenditure shall not exceed the set expenditure ceiling.

On the basis of these overall goals, detailed budget goals extending over a number of years have been established. The result has been good. They have been achieved in every year by a broad margin, This has contributed to keeping down central government debt, interest rates and thus interest expenditure, which in turn has made possible increased resources for priority areas such as health care, education and social services.

Surplus in public finances

The long-term budget goal is a surplus of 2 per cent of GDP over a business cycle. Detailed targets are then set for each year on the basis of this goal.

11

Table 1.5 Public finances

Per cent of GDP

| | 1993

| | 1994

| | 1995

| | 1996

| | 1997

| | 1998

| | 1999

| | 2000

|

|---|

| Expenditure ratio | | 70.1 | | 67.6 | | 64.6 | | 62.7 | | 60.9 | | 58.4 | | 57.5 | | 56.2 |

| Income ratio | | 58.3 | | 56.6 | | 56.7 | | 59.2 | | 59.1 | | 60.7 | | 59.2 | | 58.3 |

| Tax ratio(1) | | 48.5 | | 47.5 | | 48.2 | | 51.1 | | 51.8 | | 53.9 | | 53.0 | | 52.3 |

| Financial balance | | -11.8 | | -11 | | -7.9 | | -3.6 | | -1.8 | | 2.3 | | 1.7 | | 2.1 |

| Surplus target | | | | | | | | | | -3.0 | | 0.0 | | 0.5 | | 2.0 |

| Net debt | | 10.7 | | 21.2 | | 22.8 | | 19.5 | | 18.3 | | 15.4 | | 12.2 | | 5.7 |

| Consolidated gross debt | | 73.7 | | 76.5 | | 75.4 | | 74.4 | | 73.6 | | 71.7 | | 66.1 | | 58.8 |

- (1)

- Including taxes to EU

Sources: Statistics Sweden and Ministry of Finance

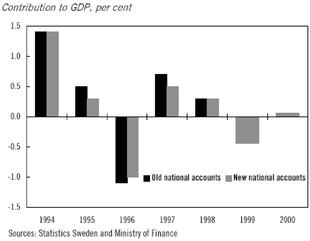

In the 1997 Spring Fiscal Policy Bill, it was established that the goal for 1999 was to be a surplus of 0.5 per cent of GDP, for 2000 1.5 per cent of GDP and for 2001 2 per cent of GDP. The goals apply for the growth estimated in the 1997 Spring Fiscal Policy Bill. If growth deviates considerably from this for cyclical reasons, the equivalent deviation is to be tolerated.

According to present forecasts for 1999 and 2000, it is estimated that the total growth will be slightly higher than forecast in 1997. The Government makes the assessment that this is not a significant deviation. In the 1999 Spring Fiscal Policy Bill, it was estimated that aggregate growth would be slightly lower than forecast in 1997. The Government made the assessment on that occasion as well that this was not an important deviation.

Table 1.6 GDP growth

Per cent

| | 1997

| | 1998

| | 1999

| | 2000

| | Total

|

|---|

| Budget Bill 00 | | 1.8 | | 2.6 | | 3.6 | | 3.0 | | 11.5 |

| Spring Fiscal Policy Bill 97 | | 2.3 | | 2.5 | | 2.8 | | 2.7 | | 10.7 |

| | |

| |

| |

| |

| |

|

| Difference | | -0.5 | | 0.1 | | 0.8 | | 0.3 | | 0.8 |

| | |

| |

| |

| |

| |

|

Sources: Statistics Sweden and Ministry of Finance

Public finances are estimated in 1999 to show a surplus of 1.7 per cent of GDP, i.e. well above the goal of 0.5 per cent. A year ago, the Government proposed that the goal for 2000 should be increased to 2 per cent of GDP, which was later adopted by the Riksdag. This increase in the level of ambition is upheld. As growth is expected to be good both in 1999 and 2000, the Government makes the assessment that this is a well-balanced fiscal policy.

The goal of 2 per cent surplus in 2000 in combination with there being scope for a continued increase in use of resources means that there is scope for reducing taxes with a focus particularly on those on low and medium incomes and on entrepreneurship.

Government debt is falling at a fast rate. The general government gross public debt, i.e. the so-called Maastricht debt will be under 60 per cent of GDP in 2000. Net debt will have been practically removed by 2002.

The surplus targets for 2001 and 2002 are upheld at 2 per cent of GDP. If growth should be considerably stronger or weaker for cyclical reasons, the corresponding deviation should be tolerated.

12

Table 1.7 Expenditure and tax changes now proposed, net

| | 2000

| | 2001

| | 2002

|

|---|

| Expenditure increases | | | | | | |

| Presidency of the EU, etc. | | 190 | | 190 | | 0 |

| Kosovo | | 400 | | | | |

| Assistance payments | | | | 150 | | 200 |

| Big city initiative, education | | 45 | | | | |

| General education | | 10 | | | | |

| Regional policy initiatives | | 306 | | | | |

| Liming, National Chemicals Inspectorate | | 23 | | | | |

| Small-scale electricity production | | 250 | | | | |

| Game damage and key natural habitats | | 27 | | | | |

| Business sector development, Baltic Sea | | -50 | | 50 | | |

| Vehicle tax, local govt comp. | | 100 | | 100 | | 100 |

| Heath care | | | | 1 000 | | |

| Special initiatives, municipalities and county councils | | 0 | | 700 | | |

| Others | | -370 | | -130 | | -130 |

| | |

| |

| |

|

| Total expenditure | | 931 | | 2.060 | | 170 |

| | |

| |

| |

|

Revenue reductions |

|

|

|

|

|

|

| Households | | 12.040 | | 15.800 | | 15.800 |

| Businesses, etc. | | 2.780 | | 4.150 | | 1.800 |

| Energy | | -1.350 | | -1.150 | | -1.150 |

| Skills development | | 1.350 | | 1.150 | | 1.150 |

| SEK 200 to local government | | | | 1.270 | | |

| Pension Agreement | | 650 | | 700 | | 700 |

| Property taxes | | 0 | | 600 | | 600 |

| Reinforced Employment Support | | 90 | | 150 | | 150 |

| Other | | -10 | | -10 | | -20 |

| | |

| |

| |

|

| Total revenue reductions | | 15.550 | | 22.660 | | 19.030 |

| | |

| |

| |

|

| TOTAL | | 16.481 | | 24.720 | | 19.200 |

| | |

| |

| |

|

Source: Ministry of Finance

With good economic growth, it is considered that there is some scope for continued reduction of taxes in coming years, especially for those on low and medium incomes and entrepreneurs. However, this scope is conditional on the social partners taking their responsibility. Wage formation that leads to an increase in inflationary pressure and a fall off in the increase in employment would make continued increases in expenditure and tax reductions impossible. Sweden shall not end up again in a price and wage spiral. The results from the end of the 1980s and the beginning of the 1990s are a deterrent.

The expenditure ceilings

The development with strongly increasing budget deficits at the beginning of the 1990s, was made worse by poor budget discipline. In order not to get into the same situation again, the budget process was reformed in the mid-1990s. By a more stringent budget process, the Government and the Riksdag can now more clearly make political priorities as to how expenditure is to be used.

One of the most important features of the new budget process is that the Government in conjunction with the Spring Fiscal Policy Bill presents proposals for nominal expenditure ceilings for

13

the next three years. Central government expenditure must then be kept under the expenditure ceilings. The expenditure ceiling for 1997 was met by a broad margin. The ceiling for 1998 was also met by a margin.

In the 1999 Spring Fiscal Policy Bill, the Government made the assessment that there was a risk that the expenditure ceiling for 1999 would be exceeded if no measures were taken. The Government therefore proposed certain savings. Moreover, the Government decided on a so-called limit amount for certain appropriations. This means that expenditure may not exceed these amounts. In the assessment of the Government, these measures are sufficient to keep expenditure under the ceiling in 1999. The budgeting margin for 1999 is estimated at around SEK 1 billion.

The situation is also under strain in 2000. The Government is therefore preparing certain measures to restrict expenditure. According to the Government the expenditure ceiling will then be upheld.

After these measures, it is estimated that the budgeting margin for 2000 will amount to around SEK 1.5 billion. The budgeting margin for 2001 is around SEK 3.7 billion. The budgeting margin for 2002 is SEK 22.6 billion. If these margins prove to be insufficient, the Government intends to take further measures. The expenditure ceilings shall be upheld.

A review of the budget process has been initiated in the Riksdag as well as by the Government. The Government's starting point is that its principles on budget discipline and well-ordered public finances shall be maintained. The new budget process has improved the conditions for a responsible economic policy in a decisive way and thus strengthened the prerequisite for Swedish public expenditure being maintained at a reasonable level throughout an entire business cycle.

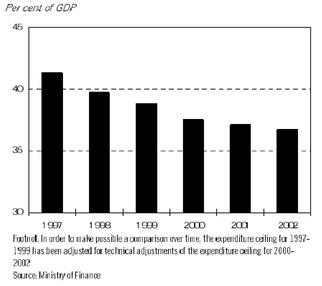

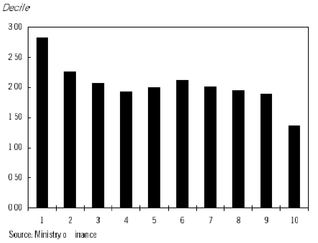

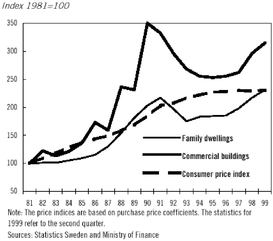

Diagram 1.1 The central government expenditure ceilings

EU budget policy

Budget policy within EU is given continued high priority. A decision was made on a new long-term budget at the extra session of the European Council in Berlin in March 1999. The Government advocated a generally restrictive budget approach, a reduced net Swedish burden, adaptation of the budget to cope with EU enlargement and reform of agricultural policy.

The result was an annual budget frame for 2000-2006 of 92 billion euro on average. This represented a considerable reduction in relation to the Commission's proposal. Financial scope to make possible accession of new members to the Union was created. The reform of agricultural policy was not as radical as Sweden would have liked but nevertheless was a step in the right direction.

14

It is of great importance for the Swedish people's confidence in the EU that the contributions paid to the Union are used in the correct way. Therefore, initiatives are needed to counteract misuse of EU funds. The Fraud Delegation has since 1996 had the commission of co-ordinating the action against fraud, misuse and inefficient handling of EU funds in Sweden. Co-ordination has meant that fraud has been combated more effectively. This activity should be made permanent and transferred to the Economic Crime Bureau.

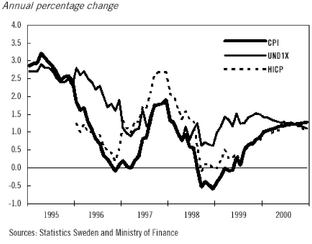

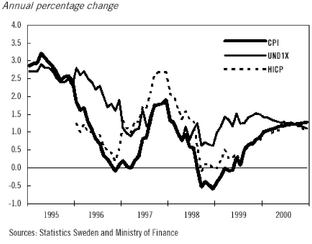

1.3.2 Stable prices

The overall duty for monetary policy is price stability. The Riksbank conducts monetary policy autonomously. The Riksbank has defined price stability so that the increase in the consumer price index shall be limited to 2 per cent with a tolerance of one per cent in each direction. The Government supports the focus of monetary policy and gives its backing to the inflation target.

Stable prices are a basic prerequisite for a successful economic policy. High inflation worsens the conditions for sustainable high growth and thus also for a stable high employment. Moreover, a high and unpredictable inflation rate has negative distribution effects.

During the most recent decades, periods with excessive inflation and increased costs has been followed by downturns in growth and budget deficits, with subsequent cuts in social welfare. This must not happen again.

However, a number of reasons indicate that the risks for a repetition are limited compared with previous decades. A number of structural reforms have been undertaken during the past years to reduce inflationary tendencies in the Swedish economy.

- •

- Public finances have been consolidated. The budget goals and expenditure ceiling contribute to the credibility of economic policy being high.

- •

- The credibility achieved for the price stability policy and the Riksbank's autonomous standing entail continued low inflation expectations.

- •

- Voluntary agreements on parts of the labour market mean improved conditions for continued low pay increases, while employment is increasing. However, there is still a need for further reforms.

- •

- Increased competitive pressure restricts the possibilities for price increases. More stringent competition legislation and deregulation, for instance, of the electricity and telephone markets and in the transport sector have contributed to reducing inflationary tendencies in the economy. Work on improving competition on other markets as well is in process.

- •

- International competition has increased, inter alia by EU membership. Sweden is moreover working actively to remove the remaining obstacles to free mobility in the single market.

- •

- Sweden is in the forefront in Europe with regard to use of Internet, almost every other Swede has access to Internet at home today. Increased electronic trade also restricts the possibilities for price increases on the local markets.

In order to ensure that good growth and high demand can continue for a long time without leading to overheating on the labour market and a subsequent increase in unemployment, further supply side reforms are required in the labour market, however. Among these may be mentioned wage formation, the application of unemployment insurance, and the scope and direction of labour market policy. Competition on the product markets must be further increased.

Inflation is at present exceptionally low. This year, CPI is expected to increase by 0.3 per cent, a fall by a tenth of a percentage point compared with last year. The price increases that can be noted are

15

largely administrative price increases and slightly higher oil prices. Despite good economic growth, no tendency to increased inflationary pressure can be discerned.

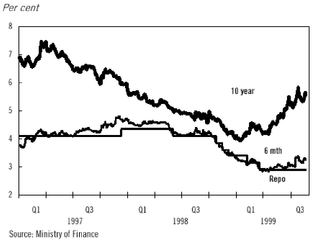

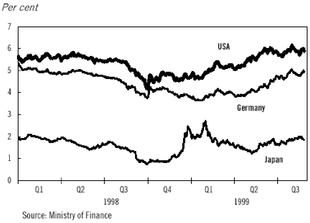

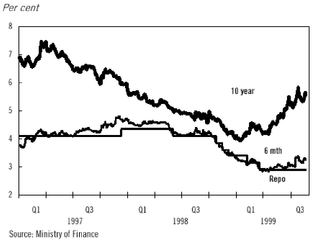

The interest rate

Low inflation and the consolidated public finances have enabled the Riksbank to lower its instrumental rate, the so-called repo rate, to less than 3 per cent. This is the lowest instrumental rate in Sweden since the modern credit market began to take shape during the 1980s.

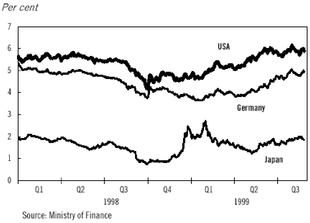

Since the turn of the year, the international interest rate level has risen relatively sharply. The background is, inter alia, continued strong American growth and improved prospects for the European and Asian economies. In the United States, the 10-year bond yield has risen by around 1.3 percentage points.

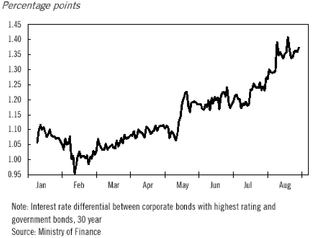

Swedish interest rates are at low levels in a historical perspective despite the international interest rate increase. Sweden has been very greatly affected in earlier periods with international uncertainty and large changes in interest rates. Since the Spring Fiscal Policy Bill, the interest rate difference to Germany has risen by only around a couple of tenths of percentage points despite turbulence on the financial markets. The consolidation of public finances and the focus of monetary policy on price stability are the most important explanations for Sweden having regained stability even in an internationally turbulent environment.

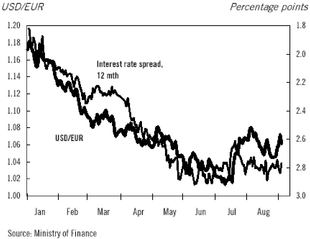

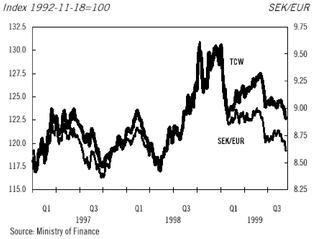

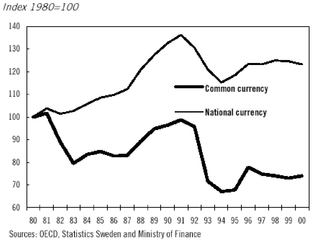

The currency

The krona has strengthened considerably during the year. Compared with a competitively-weighted average of currencies, the krona has appreciated by over five per cent since the turn of the year. This reflects the strength of the Swedish economy but is also a sign of strong confidence in Swedish economic policy.

The stronger Swedish krona reduces an already moderate international inflationary pressure and reduces the risks for overheating within the export industry while import prices are held down.

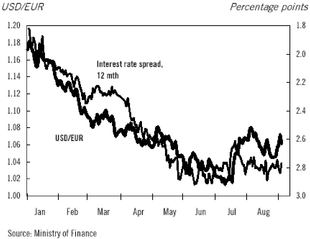

On 1 January, EU's single currency, the euro, was introduced. The introduction of the euro is a historical and important step in European integration. The monetary union affects Sweden economically and politically to a great extent. It is also important for Sweden that the project is a success.

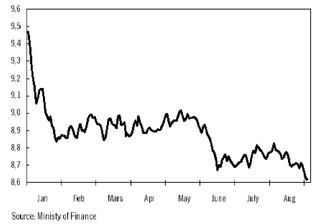

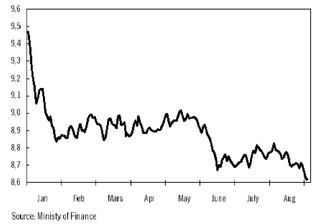

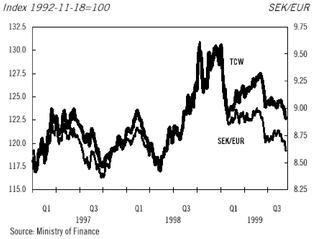

Diagram 1.3 The euro exchange rate 1999

Sweden has decided not to take part in the monetary union from the start. Any decision on participation in the monetary union must have broad popular support. Sweden is holding the door open

16

for later entry into the monetary union. A decision on Swedish participation in the monetary union shall be submitted to the Swedish people for consideration in an election or a referendum. It is important that a future position on participation in the monetary union is preceded by thorough debate and analysis. In order to increase knowledge and stimulate a broad debate on possible Swedish participation, a programme of information and popular education has been initiated.

The Government's view is that it is not at present of immediate interests to take part in the European exchange rate co-operation ERM2. The experiences of the existing policy focused on price stability in combination with a variable exchange rate are good.

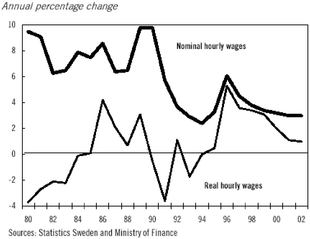

1.3.3 Wage formation

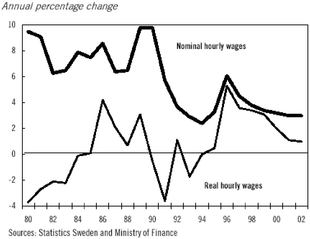

A continued improvement of wage formation is of crucial importance for the good development of employment to be sustained. During recent years, the nominal rate of wage increases has fallen considerably. At the same time, the average wage cost increases are still higher than in our most important competitor countries.

In order to meet the goals for unemployment and employment, a continued high demand for labour must be combined with moderate nominal wage increases. During the autumn, the Government will therefore present a bill with the aim of improving the prospects for wage formation functioning in a way that is compatible with a good increase in employment.

A more efficient labour market is important if the present positive development of the economy is to continue and lead to sustainable higher employment and reduced unemployment. An efficient matching between those looking for employment and vacancies contributes to employment increasing without inflationary bottlenecks arising.

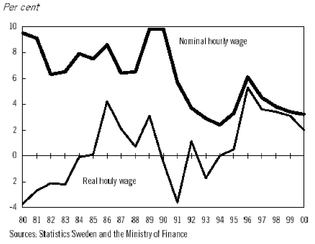

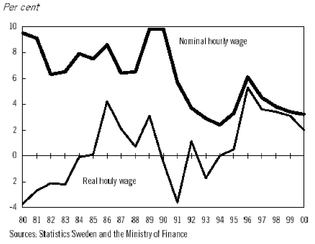

During the 1970s and 1980s, the rate of nominal wage increases was considerably higher than today. However, the low inflation during the 1990s has meant that the increase in real wages during recent years has been considerably higher than during the 1970s and 1980s. Continued moderate wage increases in coming years as well are an important prerequisite for a continued strengthening of wage-earners' purchasing power parallel with increasing employment and falling unemployment.

As the overall goal for economic policy is full employment, continued reductions in tax depend on wage formation functioning well. If wage increases are higher than the Swedish economy can cope with, tax reductions will lead to the economy overheating. This must be avoided.

The main responsibility for wage formation lies with the social partners. Agreements reached will have greater legitimacy if they are negotiated without government intervention. Moreover, the partners themselves are best suited to find efficient solutions to the problems discussed. This also applies to reforming wage formation. However, if the parties are unable to take the necessary responsibility, the final responsibility rests on the Riksdag and the Government.

17

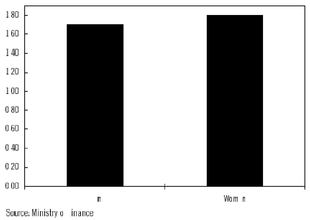

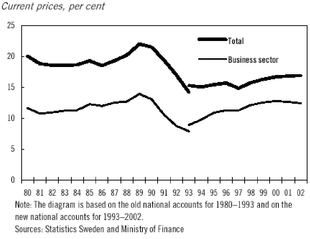

Diagram 1.4 The rate of increase of nominal and real wages 1970-2000

The Riksdag and the Government have overall national responsibility which goes beyond the responsibility for wage formation borne by the social partners. A poorly functioning wage formation undermines welfare for all citizens, even for those whose interests are not primarily represented by the social partners on the labour market. The central government authorities should moreover contribute to creating good prerequisites for an active dialogue between different groups on the labour market with the end of avoiding a situation where a group benefits at the expense of others.

The Riksdag and the Government have moreover a special responsibility for counteracting wage differences due to gender. This is one of the most important issues in the Equal Opportunities Bill. The commissions and measures already decided upon in this field are now to be followed up and analysed by the Government. Moreover, the Government has held discussions during the spring with the social partners on the labour market with a view to accelerating the work carried out by the parties to counteract wage discrimination. The Government intends to take this issue up again during the autumn.

1.4 Growth and social justice

Growth and social justice are not in conflict with one another. On the contrary, growth and social justice go hand in hand. Stable, sustainable growth is based on participation, that all participate to the best of their ability. Social justice is about giving everyone the same opportunity to develop and earn their living and that welfare resources are distributed according to need.

1.4.1 A policy for full employment

The overall goal for economic policy is full employment. In order for this goal to be achieved, the labour market must work well. With public finances in surplus and stable prices, there is now a unique opportunity for sustainably pressing down unemployment to the levels that existed before the crisis of the 1990s. The key is a policy that mobilises Sweden's resources and makes everyone participate in growth.

The good development entails a change in perspective in employment policy. Now it is a matter of giving priority to filling vacancies, training labour to counteract bottlenecks and increase the supply of skilled labour to prevent growth being slowed down due to lack of labour before the goal of full employment has been achieved. Now it is a matter of introducing tax reductions that favour entrepreneurship and thus growth.

18

European co-operation

The struggle against unemployment and for full employment will continue to be an important component of an active Swedish European policy. The political prerequisites for strengthened co-operation are good. The Government intends to strive for the guidelines for employment policy and its monitoring to be given the same importance as the corresponding instruments in the economic field and to make the employment pact agreed upon in Cologne in June a success. Employment policy is a central part of economic policy.

The new section on employment in the EC Treaty has meant that the position of employment has been reinforced in EU co-operation. The general guidelines for economic policy and the common employment guidelines are important instruments for co-ordination of economic policy in the EU. Strong European co-operation creates better prerequisites for concerted action, thereby supporting the national efforts for increased growth and employment.

The general guidelines indicate the importance of the Member States applying a coherent strategy to create good conditions for high growth and employment. This strategy is based on a sound macroeconomic policy, measures to improve the functioning of the labour market and economic reforms intended to increase efficiency in the goods, services and capital markets.

Like last year's guidelines, the employment guidelines for 1999 are broken down in four main areas:

- •

- improving employability

- •

- developing the entrepreneurial spirit

- •

- encouraging the ability to adapt of employees and enterprises, and

- •

- reinforcing equality of opportunity.

Within each area, there are a number of guidelines that specify what Member States should do. In certain cases, there are concrete goals that the countries shall strive to fulfil. The recommendations have been reinforced with regard to the design of tax and benefit systems, access to lifelong learning, measures against discrimination of weak groups, removal of barriers to employment in the services sector, and measures to increase equality of opportunity.

Sweden's employment policy is well in accord with the recommendations of the guidelines. The employability of the labour force must be promoted by active measures, with the emphasis on education and development of skills. Priority shall be given to such measures rather than passive cash support. The tax and benefit system is to be designed in such a way as to make work pay. Equality of opportunity issues are a self-evident part of the work of reform in labour market policy.

In most cases, Sweden complies with the goals and intentions expressed in the guidelines. In a number of cases, the Government's ambition is more far-reaching than the guidelines, for instance with regard to counteracting long-term unemployment among young people.

The work principle

Today, far too many people are excluded from the social community, influence and feeling of being needed that work provides. This means that everyone's experiences and skills are not being made use of.

The most important way to counteract the risk of people being excluded is measures that increase skills and employment. The classical Swedish work principle is thus increasingly becoming a work and skills principle. Everyone must be continually prepared to learn new things and retrain.

19

The proposals announced by the Government in the Spring Fiscal Policy Bill, which are now presented in detail, are aimed to a great extent at the long-term unemployed.

The reorientation of labour market policy to increase quality and reduce the risk for bottlenecks favours growth. The continued comprehensive investments in education and training and a reformed study grant system contributes to reducing social distortion of recruitment. The tax reduction on employment of long-term unemployed persons increases the ability of vulnerable groups to get a foothold in the labour market. In order to increase the proportion covered by this support, the Government now proposes that the support shall extend to all those who have been registered as unemployed or in labour market programme measures for at least two years. This is an expansion of the previous proposal that required at least three years. It is important that the employment offices in future give priority to the long-term unemployed and long-term registered. The labour market situation for immigrants is especially problematic and the employment ratio has fallen markedly since the beginning of the 1990s.

Efficient rehabilitation and intensified co-operation shall enable more of those off work for long periods due to illness to be able to return to work. The right to dormant disability pension shall make it possible for disability pensioners to test their possible work capacity.

The Government is moreover carrying out a long-term work to reduce the marginal effects and remove poverty traps. Work has a value of its own and confers self-esteem. The design of the systems should be improved so that education and work pay better. Compensation for contributions paid by the individual is an important part of this policy. To this end, economic space has been created for introducing a universal pre-school and a maximum pre-school charge in stages starting from 2001. The Government will also carry out a review of economic support to families.

The high marginal effects that exist in the combination of the tax and benefit systems are a great threat to integration and social justice. The marginal effects affect especially vulnerable groups in society. They mean that people cannot appreciably influence their financial situation by working more and increasing their incomes. Taking short-term work, going from unemployment to work, and going up from part-time to full-time sometimes does not pay at all.

The role of unemployment insurance as an adjustment insurance must be safeguarded in order to meet the increased demand for labour. Within the Government Offices, work is in process to clarify the requirements for adjustment at the same time as reinforcing the legal security of the unemployed

These proposals will be circulated for comment after which the Government intends to present proposals to the Riksdag.

The Government takes a serious view of the alarming increase in expenditure in the health insurance scheme, both from a health perspective and from a labour market perspective with respect to access to labour power. If the present trend continues, expenditure on health insurance risks pushing aside other important government initiatives.

The skills principle

Knowledge and education are the key to high employment and growth which does not take place at the cost of increasing injustices and deeper gaps. Therefore continued offensive investments are required in knowledge. Knowledge is a key factor for growth, development and modernisation. Sweden is to be a leading knowledge nation.

The pre-school is the first step in life-long learning. This is one of the reasons why the Government is creating space in the budget for a phased introduction of a universal pre-school and maximum childcare charges from 2001.

20

The compulsory school and upper secondary school shall give all pupils a good basis for lifelong learning. The most important resource for school is well-educated teachers and school leaders, who can lead the pedagogical development. The Government continues to give priority to the work with quality and uniformly high standards in school. Increased resources will be made available to local government in the coming years to strengthen education and increase goal fulfilment. Moreover, good growth will mean local government tax revenue will grow sharply.

The special adult education initiative is now in its third year of operations since starting in autumn 1997. Today, over 200,000 are taking part in adult education at upper secondary school level. During the five-year period up to 2002, the special education initiative will have reached over 800,000 students, of which the majority are women. The Special Adult Education Initiative has given hundreds of thousands of people, mainly previously unemployed, the opportunity to increase their competence and improve their situation in the labour market.

Developments in the labour market and international competition requires that more have higher education. The expansion of higher education is continuing. Study support is being reformed starting in 2001.

The goal for research policy is that Sweden is to be a prominent research nation where research is of high quality and there is scope for both broad and specialised research, The resources for basic research are increased to contribute to the infrastructure of the knowledge-based society. The state guarantees free basic research with a long-term, untied financing.

Sweden also needs more trained researchers to meet the requirements of institutions of higher education and to meet the demand for trained researchers in the business sector and the public sector. A successive investment is therefore taking place in basic research and postgraduate education. The increases in appropriations in 2000 are to be primarily used for developing activity at the new universities.

The Government intends to take further steps in a green tax shift. By increasing diesel, electricity and nuclear power tax, a good environment can be favoured at the same time as funds are made available for the development of skills in working life. The whole of Sweden shall be educated.

Universal welfare for women and men

The goal of the universal welfare policy is social justice and equal conditions of life for women and men. Universal welfare narrows gaps and boundaries between different groups in society and acts as a cohesive force. Child allowance leads to many not being dependent on income-tested grants and thus ending up in a poverty trap. Compulsory insurance based on an income compensation principle guarantees security for the large majority of people.

Social insurance creates driving forces for work since it is employment that provides participation. The Swedish social insurance promotes a high participation in the labour force. Parental insurance has great positive effects for women's ability to enter and remain in the labour market. The new pensions system is another good example of this. Sweden is one of the few countries that has reformed its pension system. The new system is of great importance for confidence in the Swedish economy.

The whole of Sweden is to grow

The high rate of transformation in the business sector and in the labour market makes new demands on policy in a number of areas. In order to be able to handle the consequences of the rapid structural changes in society, policy needs to be more long-term and better at making use of available resources. Policy also needs to be better at adapting to varying regional and social needs. The fall in population in a number of regions in recent years is a serious threat to a balanced regional development and the ability to achieve the regional policy goals. The Government has therefore

21

appointed a parliamentary committee with the task of providing proposals for the future direction and design of future regional policy.

The Riksdag decided on a new regional business sector policy in spring 1998. The goal is to stimulate a sustainable economic growth on the basis of regional conditions which can contribute to more, expanding businesses and thus increase employment for both women and men. Regional growth agreements are the bearing instrument in the new industrial policy. The growth agreements entail a co-ordinated growth and employment policy with considerable regional and local influence. The first agreement period extends from 2000-2002.

All counties have produced draft regional growth agreements. Work on growth agreements has led to broad partnerships being established. There is considerable commitment from the business sector. The measures given priority extend over a large number of areas. Education and training, development of skills, and enterprise promotion dominate. A number of counties have made proposals aiming to improve coordination of initiatives between different areas of policy and to increase the commitment of central government agencies to the process.

The Government is now clarifying the prerequisites for all central government agencies and bodies in preparation for their negotiations with partnerships on implementation and financing of growth agreements. The budget bill includes proposals for labour market policy to be more growth oriented. It furthermore clarifies the link between certain national programmes, e.g. for development within the major city regions and the development of the business sector in the Baltic Sea region with the growth agreements. Regional policy and the new structural fund programmes are to be co-ordinated with the implementation of the growth agreements to produce a greater effect.

Sweden a leading IT nation

Sweden shall reinforce its position as one of the leading IT nations. In the Government's vision of the digital Sweden, the new information technology is used by everyone. No one is excluded, neither the old, the unemployed, the disabled nor others.

Information technology increases people's freedom to choose housing, work and studies. In this way, it counteracts existing regional imbalances. IT makes businesses more efficient and gives the business sector increased international impact. The development of IT also leads to new businesses being created and new employment opportunities being created.

The Government will take a number of measures to reinforce Sweden's position as a world leading IT nation. Three areas are given priority; the regulatory framework, education and the infrastructure.

There must be clear rules of play and high security. Electronic trade shall be stimulated. Rules that prevent the development of a digital society shall be abolished.

In the digital society, knowledge is a strategic resource. Continued investment is therefore being made in education and training and the development of skills. Initiatives shall be taken both on a broad spectrum—e.g. education and businesses—and in leading-edge competence through higher education and research.

Sweden shall benefit from and further develop the successes we now have inter alia through Ericsson, Telia and the new expanding IT companies. The importance of information technology for Sweden's competitiveness is shown among other ways by the great expansion of IT investments by businesses and expansion in the IT sector in the 1990s. It is particularly important for regional growth and the ability of small enterprises to develop and be competitive.

A high technical expansion and international competitiveness is a prerequisite for strong economic growth. A well-developed IT infrastructure is very important for Swedish companies to retain their advanced position both as an IT user and as producers of software, and, for instance,

22

telecommunications products. The IT infrastructure is important for the whole development of the business sector. The Government intends continuously to take the initiative in the area and intends to submit an IT Bill in early 2000.

The Government considers that the state bears a responsibility for ensuring that the IT infrastructure is accessible by making possible investment in open cables, ensuring competition between different operators. This can take the form, for instance, of a national network between all municipalities in the country as a first step towards higher capacity in the network as a whole. This requires new investments in broad band IT infrastructure both under public and private control.

1.4.2 Sustainable growth

The product markets play a key role in a policy for sustainable growth. Well-functioning markets further improve the long-term prospects for growth.

Increased competition leads to rapid increase in productivity, high standard development and an internationally competitive business sector. This promotes high employment. Competition also benefits the consumers in the form of lower prices, better quality and a greater range of goods and services. Improved competition contributes to counteracting the tendencies to increased inflationary pressure that may arise when demand is high in the economy.

A number of structural reforms have been carried out in the 1990s that affect large parts of the Swedish economy:

- •

- Competition legislation has been introduced that contains an explicit prohibition against co-operation between enterprises to restrict competition and abuse of a dominant position.

- •

- An electricity market reform has been carried out. Production and sale of electricity has been transformed into competitive markets.

- •

- Today, Sweden has one of Europe's most deregulated telecommunications markets. The actions of the National Post and Telecom Agency have led to reduced call charges for mobile telephony, which should further improve competition.

- •

- Sweden Post's sole right to the conveyance of mail has been abolished and a number of further reforms have been carried out to increase the accessibility of the postal infrastructure.

- •

- Domestic flights, rail transport and long-distance bus transport have been deregulated.

- •

- A Public Procurement Act has been promulgated.

- •

- The Commission for Competition on Equal Terms for the Private and Public Sector has been set up to improve competition between the private and public sectors.

- •

- Within the EU, Sweden has among the lowest levels of state aid to enterprises.

The Government's work to improve competition and efficiency on the goods, services, and financial markets will continue with undiminished effort.

- •

- A number of industries are at present characterised by lack of competition. The Government has instructed the Competition Authority to survey in detail, analyse and evaluate how competition has been developed on the Swedish market during the 1990s. The Government intends later to present concrete proposals in a special bill on how competition can increase at the same time as the position of the consumer is strengthened.

- •

- The few remaining barriers for competition in the border zone between public and private activities are to be removed. The Agency for Administrative Development has been given the task of reviewing at the earliest opportunity how central government agencies operate in competitive markets.

23

- •

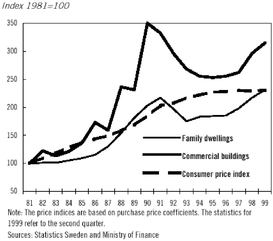

- A well-functioning competition in the construction sector is very important to reduce the risk of increased inflationary pressure. This can moreover lead to a reduction in housing costs in the existing housing stock as well. The continued work of the Building Costs Committee shall be intensified and focused according to the supplementary instructions that the Government submitted to the delegation in May. Building costs shall be reduced and competition on the building and building materials market enhanced.

- •

- Any barriers to a continued swift increase in housing construction in the expansive regions should be removed. On behalf of the Government, the county administrative boards in the growth regions together with the affected municipalities have surveyed and analysed planning and land availability and what can be done to cope with an increased housing construction.

- •

- Sweden's participation in the internal market gives consumers a wider range at lower prices. The Government is working to further strengthen consumer interests in trade policy, among other ways by increased import competition. An example of this is the issue of parallel import expanded.

- •

- The Government has recently instructed Statistics Sweden to investigate the price difference between Swedish and foreign goods. This documentation will be an important basis for further efforts by the Government to reduce the level of prices in Sweden.

A prerequisite for the development of civil society is that the judicial system performs well. The legal system is in the middle of a period of reform work. The Government's ambition is to drive forward the modernisation of the legal system, and introduce changes and efficiency improvements with undiminished vigour. The Government therefore intends in the Spring Fiscal Policy Bill in 2000 to submit proposals to the Riksdag on additional resource increments needed to fulfil the Government's intentions with regard to the development of the judicial system.

The Swedish product markets are strongly dependent on conditions obtaining in the global market. In order to enhance the efficiency of the product and capital markets, increased co-operation must take place with the EU on continued reforms of these markets.

It is important that Europe's customers enjoy the advantages of the single market in a clear way through lower prices, increased choice and better quality of products and services. The Swedish environmental and consumer interests shall be taken into consideration.

Sweden is very positive to EU co-operation on reforms of product and capital markets, the so-called Cardiff process. The aim is to improve the functioning of the single market. The EU Member States shall present annual reports of how more important domestic markets function, which reforms have been carried out, identify remaining deficiencies for efficient competition and finally present the continued reform work.

An important market for Sweden is the Baltic Sea region, which has good prospects to become a dynamic growth region and a market place even in a global perspective. The Öresund region is also part of the region, where the new road and rail link over Öresund, make possible further integration and economic activity over national borders. Due to its location in relation to continental Europe, the growth markets in the East and the rest of the Nordic area, the Öresund region should become very important for the development of the entire Baltic Sea area.

Sustainable Sweden

The Government's overall goal for environmental policy is to be able to hand over to the next generation a society where the major environmental problems in Sweden have been solved. Sweden shall set an example in the transition to sustainable development.

24

The transition to an ecologically sustainable society creates a potential for employment. This must be made use of. Forward-looking requirements to protect nature and people's health and to gradually make the use of resources more efficient creates a pressure for technical development and thus provides opportunities for new entrepreneurship. This contributes to the pressure for change that drives economic development forwards. In this way, additional resources can be made available for sustainable development.

Economic policy must therefore be combined with an efficient environmental policy based on stringent, clear legislation as well as economic means of control and other stimulants. The Government's proposals in the field of taxation for a green tax swap are part of this strategy.

Work on making Sweden an example of ecological sustainability shall continue and be followed up annually by Government communications presented in conjunction with the budget bill. This year's communication will be presented at the beginning of October. It will contain an account of the measures taken and an assessment of the effects they have had for the changeover work. The Government communications will also contain a summary of new measures that follow on from the proposals presented by the Government in bills presented during the year or in conjunction with other decisions.

The appropriations for environmental policy have increased. Local government is involved on a broad front, among other ways by the local investment programmes. The energy agreement means a large investment programme for the changeover of the energy sector. Further measures apply to research, the development of technology, and environmentally-adapted procurement, the promotion of export of Swedish environmental technology, etc. All sectors of society are affected and co-operation with the business sector in these issues must be intensified.

International co-operation within the EU inter alia is of key importance. Work on protecting the environment, stimulating local initiatives and promoting the ecocycle concept is to continue. Measures for ecological sustainability shall stimulate technical development and new entrepreneurship and, accordingly, at the same time strengthen the economy and employment.

Over the past two years, the Government has made major investments in, among other things, nature conservation, environmental monitoring, land remediation and environmental research.

The Government proposes further measures to stimulate the changeover to a Sustainable Sweden:

- •

- An additional SEK 20 million for liming operations.

- •

- An additional SEK 20 million for natural habitat protection to attain a good balance between different state funded measures to preserve biological diversity in the forest.

- •

- A further SEK 3 million for the National Chemicals Inspectorate.

- •

- SEK 500 million for a six-year co-operation with Swedish car manufacturers for research and development of technology for the environmentally-friendly vehicles of the future.

- •

- SEK 5 million for a special initiative to facilitate export of goods and services with a high environmental performance by Swedish businesses.

- •

- A time-limited investment support for thermal solar heat is to be introduced provided that an agreement can be achieved between the state and the solar heating industry. Within the framework of the agreement, principles should be formulated for measures to reduce the costs of the technology.

25

Green key statistics

As one of the first countries in the world, the Government presented green key statistics in the Spring Fiscal Policy Bill. Green key statistics is one of the Government's tools for monitoring the overall goal of environmental policy work of handing over a society to the next generation where the major environmental problems have been solved. The key statistics can be used as guidance for political decisions and as a basis for social debate in the same way as the selected economic statistics.

The development of key statistics is a process where the key statistics must be adapted according to the goals that they are intended to comply with, relevant environmental problems and the overall development of society. The Government will therefore continue work on the further development of the key statistics. The Government is also studying the possibilities for presenting forecasts for certain of the key statistics in future. The Government also intends to present green key statistics to the Riksdag regularly.

Economic development shall be ecologically sustainable. In some cases, there are good opportunities for achieving the environmental quality goals set without substantial costs or sacrifices. In other cases, it is considerably more difficult and involves large costs. The correlation between the environment and growth is not unambiguous. The Government considers it is important to investigate the nature of the relationship and has therefore appointed a special commission to review the relationship between growth and the environment and to investigate the need of measures for a more efficient use of natural resources with the aim of achieving sustainable development.

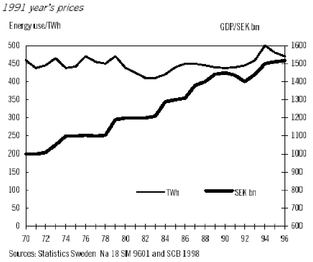

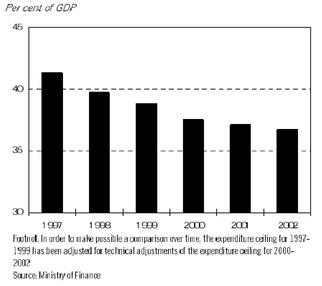

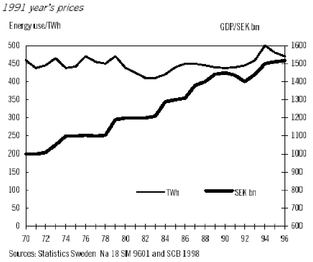

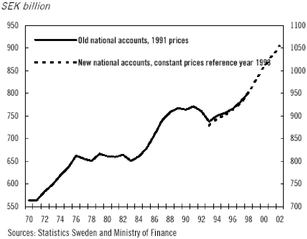

The use of energy in Sweden in the past 30 years shows that technical development makes possible a stable level of energy use at the same time as economic growth has taken place. This is shown in the diagram below.

Diagram 1.5 Total energy use and GDP 1970-1996

The use of energy is strongly related to a number of environmental problems, where the method of producing energy is very important. Continued improvement in the efficiency of use of energy is also necessary to combine positive economic development with reduced environmental problems. Increased use of energy and a changeover to environmentally friendly types of energy can be stimulated in a number of ways, among others by an increased use of economic means of control. The Government's proposals in the Budget Bill on a green tax swap are part of this work.

The use of energy is one of the eleven green key statistics described in expenditure area 20 "General environmental care and conservation", Further green key statistics are presented there that all describe a development in society within areas of great importance for the environment.

26

1.5 Fair taxes for health care, education and social services

The foremost purpose of taxes is to finance welfare, where, the level of tax burden ulitmately determines a country's welfare ambitions. If citizens opt for a welfare society with good health care, education and social services for all, secure insurance against loss of income in the event of illness and unemployment, a good education for all, etc. then the necessary taxes must be collected to finance welfare.

1.5.1 Health care, education and social services