UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-2687

Name of Registrant: Vanguard Municipal Bond Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2009 – April 30, 2010

Item 1: Reports to Shareholders

|

| Vanguard Municipal Bond Funds |

| Semiannual Report |

| Vanguard Tax-Exempt Money Market Fund |

| Vanguard Short-Term Tax-Exempt Fund |

| Vanguard Limited-Term Tax-Exempt Fund |

| Vanguard Intermediate-Term Tax-Exempt Fund |

| Vanguard Long-Term Tax-Exempt Fund |

| Vanguard High-Yield Tax-Exempt Fund |

|

> For the six months ended April 30, 2010, the Vanguard Municipal Bond Funds posted returns ranging from just above zero for the Tax-Exempt Money Market Fund to 4.23% for Admiral Shares of the High-Yield Tax-Exempt Fund.

> Investors’ search for higher yields led them to longer-maturity bond funds, while a supply reduction boosted prices for the longest-term bonds.

> The low-quality rally in municipal bonds acted as a headwind to the Vanguard funds, which focus on more highly rated bonds in their respective markets.

| |

| Contents | |

| Your Fund’s Total Returns | 1 |

| Chairman’s Letter | 2 |

| Advisor’s Report | 5 |

| Tax-Exempt Money Market Fund | 7 |

| Short-Term Tax-Exempt Fund | 31 |

| Limited-Term Tax-Exempt Fund | 38 |

| Intermediate-Term Tax-Exempt Fund | 45 |

| Long-Term Tax-Exempt Fund | 52 |

| High-Yield Tax-Exempt Fund | 59 |

| About Your Fund’s Expenses | 66 |

| Trustees Approve Advisory Arrangements | 68 |

| Glossary | 69 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Cover photograph: Veronica Coia.

| | | | | | |

| Your Fund’s Total Returns | | | | |

| |

| |

| |

| |

| Six Months Ended April 30, 2010 | | | | | |

| | | | | | | Taxable- |

| | Ticker | Total | Income | Capital | | Equivalent |

| Vanguard Tax-Exempt Fund | Symbol | Returns | Return | Return | Yield1 | Yield2 |

| Money Market | VMSXX | 0.06% | 0.06% | 0.00% | 0.19% | 0.29% |

| Short-Term | | | | | | |

| Investor Shares | VWSTX | 0.96 | 0.71 | 0.25 | 0.77 | 1.18 |

| Admiral™ Shares3 | VWSUX | 1.00 | 0.75 | 0.25 | 0.85 | 1.31 |

| Limited-Term | | | | | | |

| Investor Shares | VMLTX | 1.92 | 1.19 | 0.73 | 1.43 | 2.20 |

| Admiral Shares3 | VMLUX | 1.96 | 1.23 | 0.73 | 1.51 | 2.32 |

| Intermediate-Term | | | | | | |

| Investor Shares | VWITX | 3.15 | 1.88 | 1.27 | 2.94 | 4.52 |

| Admiral Shares3 | VWIUX | 3.19 | 1.92 | 1.27 | 3.02 | 4.65 |

| Long-Term | | | | | | |

| Investor Shares | VWLTX | 3.50 | 2.22 | 1.28 | 3.60 | 5.54 |

| Admiral Shares3 | VWLUX | 3.54 | 2.26 | 1.28 | 3.68 | 5.66 |

| High-Yield | | | | | | |

| Investor Shares | VWAHX | 4.19 | 2.34 | 1.85 | 3.98 | 6.12 |

| Admiral Shares3 | VWALX | 4.23 | 2.38 | 1.85 | 4.06 | 6.25 |

| |

| |

| Your Fund’s Performance at a Glance | | | | | |

| October 31, 2009–April 30, 2010 | | | | | | |

| | | | | | Distributions Per Share |

| | | Starting | Ending | | Income | Capital |

| Vanguard Tax-Exempt Fund | | Share Price | Share Price | Dividends | Gains |

| Money Market | | $1.00 | $1.00 | | $0.001 | $0.000 |

| Short-Term | | | | | | |

| Investor Shares | | 15.88 | 15.92 | | 0.113 | 0.000 |

| Admiral Shares | | 15.88 | 15.92 | | 0.119 | 0.000 |

| Limited-Term | | | | | | |

| Investor Shares | | 10.97 | 11.05 | | 0.130 | 0.000 |

| Admiral Shares | | 10.97 | 11.05 | | 0.134 | 0.000 |

| Intermediate-Term | | | | | | |

| Investor Shares | | 13.38 | 13.55 | | 0.249 | 0.000 |

| Admiral Shares | | 13.38 | 13.55 | | 0.254 | 0.000 |

| Long-Term | | | | | | |

| Investor Shares | | 10.92 | 11.06 | | 0.239 | 0.000 |

| Admiral Shares | | 10.92 | 11.06 | | 0.243 | 0.000 |

| High-Yield | | | | | | |

| Investor Shares | | 10.26 | 10.45 | | 0.235 | 0.000 |

| Admiral Shares | | 10.26 | 10.45 | | 0.239 | 0.000 |

1 7-day SEC yield for the Tax-Exempt Money Market Fund; 30-day SEC yield for the other funds.

2 This calculation, which assumes a typical itemized tax return, is based on the maximum federal income tax rate of 35%. State and local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

3 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

1

Chairman’s Letter

Dear Shareholder,

The 16-month rally in municipal bonds slowed somewhat during the six months ended April 30, 2010. Investor Shares of the five Vanguard bond funds in this report posted returns ranging from 0.96% for the Short-Term Tax-Exempt Fund to 4.19% for the High-Yield Tax-Exempt Fund. Money market mutual funds (both taxable and tax-exempt) continued to earn near-negligible returns because of Federal Reserve policy, and our Tax-Exempt Money Market Fund was no exception.

The fiscal condition of state and local governments remains a concern, with many still reeling from recession-induced revenue losses. As the broad economy continues to bounce back, the condition of state and municipal finances may improve, but we would expect any improvement to be slow and uneven.

As always, Vanguard’s credit analysts will closely examine all securities considered for our funds and provide independent guidance on their creditworthiness.

Compared with six months ago, when we last reported to you, most of the Vanguard funds’ yields were lower on April 30. As noted above, Fed policy has virtually eliminated yields for money market mutual funds. In the intermediate-term segment of the municipal market, investor demand boosted prices, thereby lowering yields. Much of this increased appetite for intermediate-term munis resulted from a search for higher yields. In the long-term segment, another factor was primarily at work: Investor actions dampened yields because the supply of tax-exempt issues fell as states and municipalities began issuing a new type of bond that is taxable.

Returns of municipals outpaced those of corporate bonds

The broad municipal bond market posted strong results, returning almost 4% for the half-year. By contrast, the broad U.S. taxable bond market, which consists largely of federal government bonds, returned about 3% as investors sought out higher-yielding alternatives. Reflecting reduced demand for federal government bonds, the yields of longer-term Treasury bonds rose during the six months.

The yields of the shortest-term Treasury securities remained around 0%, as the Federal Reserve maintained its tight lid on interest rates. To help stimulate the economy, the central bank has kept its target for short-term interest rates unchanged at 0% to 0.25% since December 2008. The Fed’s April statement noted economic improvements, but said officials still thought that “economic conditions, including low rates of resource

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended April 30, 2010 |

| | Six Months | One Year | Five Years1 |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 2.54% | 8.30% | 5.38% |

| Barclays Capital Municipal Bond Index | | | |

| (Broad tax-exempt market) | 3.68 | 8.85 | 4.51 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.04 | 0.12 | 2.72 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 16.77% | 40.21% | 3.07% |

| Russell 2000 Index (Small-caps) | 28.17 | 48.95 | 5.74 |

| Dow Jones U.S. Total Stock Market Index | 17.91 | 41.12 | 3.73 |

| MSCI All Country World Index ex USA (International) | 5.95 | 40.97 | 6.94 |

| |

| CPI | | | |

| Consumer Price Index | 0.85% | 2.24% | 2.30% |

| 1 Annualized. | | | |

2

utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.” The Fed has, however, begun to wind down credit programs established during the financial crisis.

U.S. stocks extended their post-crisis rally

Despite a few minor setbacks, stocks continued to climb during much of the half-year. The broad U.S. stock market ended the period up about 18%. Since scraping bottom in March 2009, U.S. equities have rebounded dramatically, returning more than 80%.

For the six-month period, stocks of small-capitalization companies significantly outperformed both the broad market and larger-cap issues, returning about 28%. Large-cap stocks returned about 17%, slightly behind the broad market gain. Value stocks generally trumped their growth counterparts for the period, though the differences weren’t all that noteworthy.

International stocks considerably lagged U.S. stocks, but still ended the half-year in positive territory. In Europe, Greece’s financial woes continued to make headlines, precipitating unusual market volatility that continued after the close of the fiscal period. In Asia, the larger developed markets returned about 8%. Most emerging-market stocks, which made a quick and substantial recovery from the global economic slowdown, continued to outperform those in developed markets. China, however, was held back by the prospect of monetary policy tightening.

Muni investors sought higher yields in longer-maturity bonds

Demand for municipal bonds was strong during the six months, which helped to support the returns of the Vanguard Municipal Bond Funds. At the short end of the maturity spectrum, however, investors shied away from the Tax-Exempt Money Market Fund because of its near-zero yield, the source of a half-year return of 0.06%. (The average return of competing money market funds was a flat zero.)

Many tax-exempt investors seeking higher yields turned to funds with relatively longer maturities. At Vanguard, heightened demand from this quarter helped produce Investor Share returns ranging from 0.96% for the Short-Term Tax-Exempt Fund to 3.15% for the Intermediate-Term Tax-Exempt Fund. In between was the Limited-Term Tax-Exempt Fund, which returned 1.92%.

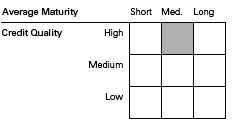

Aided by their lower expense ratios, the Short-Term and Limited-Term Tax-Exempt Funds outpaced the average returns of their peer groups. The Intermediate-Term Tax-Exempt Fund matched its peer-group average: In a period of declining yields, the fund’s shorter duration (a measure of price sensitivity to interest rate changes) restrained its relative return.

The long-term segment of the tax-exempt bond market experienced a supply-demand imbalance because of a new influence in the municipal bond market: the growing issuance of Build America Bonds, which are taxable. These muni securities—which our tax-exempt funds don’t invest in—were created as part of the federal government’s massive stimulus package in early 2009. Because they include subsidies that lower issuers’ financing costs, state and local government issuers have favored the taxable munis over tax-exempts. Continuing demand for traditional long-term muni bonds in the face of lower supply pushed up their prices and lowered yields.

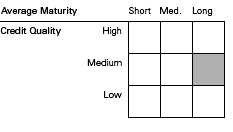

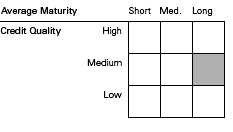

In this environment, the Long-Term Tax-Exempt Fund returned 3.50% for the six months. The fund slightly trailed the average return of its competitors (3.67%), in part because of its relatively shorter duration. Another factor was the fund’s generally higher credit quality compared with peers, because lower-quality issues rebounded the fastest from the market’s late-2008 lows. The credit-quality headwind also affected Vanguard’s other tax-exempt funds.

Vanguard High-Yield Tax-Exempt Fund, which invests more heavily than the other funds in securities rated BBB or below, benefited from the low-quality rally but lagged its peer group notably. The gap resulted from the fund’s bias toward more highly rated issues. The High-Yield Tax-Exempt Fund can invest no more than 20% of assets in below-investment-grade bonds, and it typically allocates much less to them. For the six months, the fund’s 4.19% return trailed the 5.60% average return of competing funds, which generally have far less conservative mandates.

Balance and diversification never go out of season

As the past couple of years have demonstrated, no corner of the financial markets is immune to unsettling, and surprising, change. That is why we believe that an effective investment approach for all market environments is a low-cost portfolio that is balanced among asset classes and diversified within them.

Such a portfolio would include stock, bond, and short-term investments in proportions suited to the investor’s goals, life stage, and risk tolerance. For investors in higher tax brackets, the Vanguard Municipal Bond Funds can be an important element in such a portfolio. The funds are guided by an experienced team of portfolio managers and credit analysts, whose independent conclusions are an invaluable corrective to the sensational headlines and market chatter about the bumpy political process of hammering out budgets.

Indeed, as the headline “noise” volume increases, investors should keep in mind the importance of state and local governments’ taxing power to help meet budget gaps, the municipal bond market’s long history of low default rates compared with corporate bonds, and the Vanguard funds’ focus on high-quality bonds.

3

On another matter, I would like to inform you that on January 1, 2010, we completed a leadership transition that began in March 2008. I succeeded Jack Brennan as chairman of Vanguard and each of the funds. Jack has agreed to serve as chairman emeritus and senior advisor.

Under Jack’s leadership, Vanguard has grown to become a preeminent firm in the mutual fund industry. Jack’s energy, his relentless pursuit of perfection, and his unwavering focus on always doing the right thing for our clients are evident in every facet of Vanguard policy today.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

May 14, 2010

| | |

| Total Returns | | |

| Six Months Ended April 30, 2010 | | |

| |

| | Vanguard | Peer Group |

| Tax-Exempt Fund Investor Shares | Fund | Average1 |

| Money Market | 0.06% | 0.00% |

| Short-Term | 0.96 | 0.66 |

| Limited-Term | 1.92 | 1.52 |

| Intermediate-Term | 3.15 | 3.11 |

| Long-Term | 3.50 | 3.67 |

| High-Yield | 4.19 | 5.60 |

| | | |

| Expense Ratios2 | | | |

| Your Fund Compared With Its Peer Group | | | |

| |

| | Investor | Admiral | Peer Group |

| Tax-Exempt Fund | Shares | Shares | Average1 |

| Money Market | 0.17% | — | 0.65% |

| Short-Term | 0.20 | 0.12% | 0.66 |

| Limited-Term | 0.20 | 0.12 | 0.80 |

| Intermediate-Term | 0.20 | 0.12 | 0.88 |

| Long-Term | 0.20 | 0.12 | 1.04 |

| High-Yield | 0.20 | 0.12 | 1.15 |

1 Peer groups are: for the Tax-Exempt Money Market Fund, Tax-Exempt Money Market Funds; for the Short-Term Tax-Exempt Fund, 1–2 Year Municipal Funds; for the Limited-Term Tax-Exempt Fund, 1–5 Year

Municipal Funds; for the Intermediate-Term Tax-Exempt Fund, Intermediate Municipal Funds; for the Long-Term Tax-Exempt Fund, General Municipal Funds; and for the High-Yield Tax-Exempt Fund, High-Yield

Municipal Funds. Peer-group values are derived from data provided by Lipper Inc. and capture data through year-end 2009.

2 The fund expense ratios shown are from the prospectus dated April 22, 2010, and represent estimated costs for the current fiscal year based on the funds’ net assets as of the prospectus date. For the six months

ended April 30, 2010, expense ratios were: for the Tax-Exempt Money Market Fund, 0.17%; for the Short-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the Limited-Term

Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the Intermediate-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the Long-Term Tax-Exempt

Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the High-Yield Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares.

4

Advisor’s Report

For the six months ended April 30, 2010, the Vanguard Municipal Bond Funds posted returns that ranged from near zero for the Tax-Exempt Money Market Fund to 4.23% for the Admiral Shares of the High-Yield Tax-Exempt Fund. Four of the six funds exceeded the average return of their peers, while the Long-Term and High-Yield Tax-Exempt Funds trailed their peer-group averages.

The investment environment

Since we reported to you on the fiscal year ended October 31, 2009, the municipal bond yield curve—the spectrum of rates from shortest maturity to longest—declined across the board by small amounts. The spread in yields between lowest-risk and higher-risk municipal bonds continued to narrow from the extremely wide spans that characterized the muni bond market during the height of the financial crisis in late 2008 and early 2009.

Pressure on yields at the short end of the spectrum came from the Federal Reserve, which kept its short-term interest rate target between 0% and 0.25%. Unsatisfied with earning virtually nothing on their short-term investments, many investors were willing to move out on the yield curve into municipal bonds and bond funds in the one- to ten-year duration range. At Vanguard, this thirst for yield produced strong cash flows into the Short-Term, Limited-Term, and Intermediate-Term Tax-Exempt Funds, which had average durations of one to six years.

At the longest end of the maturity spectrum, prices rose because of a supply squeeze. This has resulted from the success of taxable Build America Bonds (BABs), which were created in 2009 as part of the federal government’s stimulus package and are accounting for a growing share of the new-issue muni market. For perspective, new issues of municipal bonds have been running at about $400 billion a year. In the 12 months ended April 30, $100 billion worth of new muni bonds were BABs, and estimates for the 2010 calendar year put BAB issuance at $125 billion or more. BABs appeal to state and local governments because the bond issuers receive a federal subsidy, which lowers borrowing costs considerably. Because that benefit is typically greatest for the longest-term bonds (which normally pay the most in interest), the issuance of BABs has been concentrated in this segment.

The end result of these market forces is a yield curve that is anchored at zero at the shortest end, extraordinarily steep in the 1- to 10-year range, and flat at the longest end, where competition for traditional muni bonds has depressed yields. In fact, during the past six months the yields of traditional AAA-rated 30-year munis dipped below 4% for a time, a rare event.

Management of the funds

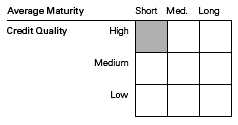

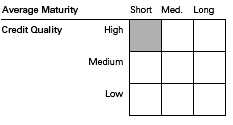

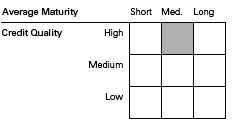

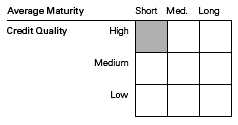

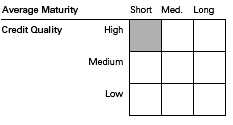

The rally in low-quality fixed income assets that began in January 2009 was a challenge to our funds because of our emphasis on securities with high credit quality. Our three short-term and intermediate-term bond funds nevertheless exceeded the average returns of their peer groups; the long-term and high yield funds did not. Outside the bond arena, our tax-exempt money market fund produced a positive, though negligible, return.

The investment world is now waiting for the Federal Reserve’s next move on interest rates. We believe that the Fed will begin to raise rates when there is consistent month-to-month growth in employment, which is necessary to sustain a recovery from the worst recession since the Great Depression.

| | |

| Yields of Municipal Bonds | | |

| (AAA-Rated General-Obligation Issues) | | |

| | October 31, | April 30, |

| Maturity | 2009 | 2010 |

| 2 years | 0.70% | 0.69% |

| 5 years | 1.85 | 1.72 |

| 10 years | 3.03 | 2.94 |

| 30 years | 4.23 | 4.05 |

Source: Vanguard.

5

Our best estimate suggests that the Fed will begin tightening in 2011. We have set the durations of our funds accordingly. In other words, our funds are positioned for continued economic recovery, and we are poised to react appropriately when the Fed is ready to take its next steps.

At the heart of our funds, of course, is a detailed knowledge of the fiscal conditions of the state and local governments that issue bonds. We expect that most states and municipalities will be able to weather these difficult days—their taxing ability is a powerful tool. We realize that they are having to make many difficult decisions about spending and allocation of resources, and the give and take of the political process can be rough. Moreover, it may be that federal help will diminish as the U.S. government turns to its own critical fiscal challenges.

Our team of credit analysts will be monitoring municipal issuers very closely and, as usual, will be providing views that are independent of those issued by the national credit rating agencies. Our analysts’ independent judgments have become even more valuable because of a change in the rating methodologies employed by some agencies. This change is being termed a “recalibration” of credit ratings.

One consequence of the revised methodology is that many state and local issuers will move up a notch or two in the ratings. Another is that many more issuers will possess similar ratings. This expanding homogeneity puts a premium on the ability to distinguish among equally rated bonds so that we can choose the better investment for our shareholders. We are confident that our analytical insight, our long-term focus, and the portfolios’ low costs will help us deliver competitive returns through both challenging and more normal markets.

Christopher W. Alwine, CFA, Principal, Head of Municipal Bond Group

Marlin G. Brown, Portfolio Manager

Michael G. Kobs, Portfolio Manager

Pamela Wisehaupt Tynan, Principal, Portfolio Manager

Vanguard Fixed Income Group

May 20, 2010

6

Tax-Exempt Money Market Fund

Fund Profile

As of April 30, 2010

| |

| Financial Attributes | |

| Yield1 | 0.19% |

| Average Weighted Maturity | 29 days |

| Average Quality2 | MIG-1 |

| Expense Ratio3 | 0.17% |

| |

| Largest State Concentrations | |

| Texas | 14.1% |

| Illinois | 5.3 |

| Florida | 4.6 |

| North Carolina | 4.6 |

| Tennessee | 4.2 |

| Michigan | 3.9 |

| Wisconsin | 3.8 |

| Colorado | 3.5 |

| Washington | 3.4 |

| Georgia | 3.2 |

| Top Ten | 50.6% |

| |

| Distribution by Credit Quality4 (% of portfolio) |

| MIG-1/SP-1+/F-1+ | 83.7% |

| A-1/P-1 | 16.1 |

| AAA/AA | 0.2 |

1 7-day SEC yield. See the Glossary.

2 Moody’s Investors Service.

3 The expense ratio shown is from the prospectus dated April 22, 2010, and represents estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the six months

ended April 30, 2010, the annualized expense ratio was 0.17%.

4 Ratings: Moody’s Investors Service, Standard & Poor’s, Fitch.

7

Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7 - -day SEC yield reflects its current earnings more closely than do the average annual returns.

| | |

| Fiscal-Year Total Returns (%): October 31, 1999–April 30, 2010 | | |

| |

| | Tax-Exempt | |

| Fiscal | Money Market | Peer Group |

| Year | Fund | Average1 |

| 2000 | 3.9% | 3.4% |

| 2001 | 3.2 | 2.7 |

| 2002 | 1.5 | 0.9 |

| 2003 | 1.0 | 0.5 |

| 2004 | 1.0 | 0.5 |

| 2005 | 2.1 | 1.5 |

| 2006 | 3.3 | 2.6 |

| 2007 | 3.6 | 3.0 |

| 2008 | 2.6 | 2.0 |

| 2009 | 0.6 | 0.3 |

| 20102 | 0.1 | 0.0 |

| 7-day SEC yield (4/30/2010): 0.19% | | |

Average Annual Total Returns: Periods Ended March 31, 2010

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Capital | Income | Total |

| Tax-Exempt Money Market | 6/10/1980 | 0.26% | 2.32% | 0.00% | 2.13% | 2.13% |

1 Average return for Tax-Exempt Money Market Funds is derived from data provided by Lipper Inc.

2 Six months ended April 30, 2010.

Note: See Financial Highlights tables for dividend and capital gains information.

8

Tax-Exempt Money Market Fund

Financial Statements

Statement of Net Assets

As of April 30, 2010

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information). In addition, the fund publishes its holdings on a monthly basis at www.vanguard.com.

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (96.1%) | | | | |

| Alabama (0.4%) | | | | |

| 1 Alabama Housing Finance Agency TOB VRDO | 0.370% | 5/7/10 LOC | 9,425 | 9,425 |

| 1 Alabama Public School & College Auth. TOB VRDO | 0.310% | 5/7/10 | 16,490 | 16,490 |

| 1 Alabama Public School & College Auth. TOB VRDO | 0.330% | 5/7/10 | 9,000 | 9,000 |

| 1 Alabama Special Care Fac. Financing Auth. (Ascension Health) TOB VRDO | 0.300% | 5/7/10 | 6,775 | 6,775 |

| Birmingham AL Public Educ. Building Student Housing Rev. (Univ. Alabama Project) VRDO | 0.300% | 5/7/10 LOC | 4,600 | 4,600 |

| Mobile AL IDR (Kimberly-Clark Tissue Co.) VRDO | 0.340% | 5/7/10 | 33,550 | 33,550 |

| Mobile AL Infirmary Health System Special Care Fac. Financing Auth. Rev. | | | | |

| (Infirmary Health System, Inc.) VRDO | 0.280% | 5/7/10 LOC | 3,000 | 3,000 |

| | | | | 82,840 |

| Alaska (0.2%) | | | | |

| 1 Alaska Housing Finance Corp. TOB VRDO | 0.300% | 5/7/10 LOC | 5,015 | 5,015 |

| Alaska Housing Finance Corp. VRDO | 0.260% | 5/7/10 | 13,500 | 13,500 |

| 1 Alaska State International Airports System Rev. TOB VRDO | 4.300% | 5/7/10 | 11,250 | 11,250 |

| 1 Anchorage AK Water Rev. TOB VRDO | 0.350% | 5/7/10 | 15,315 | 15,315 |

| | | | | 45,080 |

| Arizona (1.7%) | | | | |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.270% | 5/7/10 LOC | 12,300 | 12,300 |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.270% | 5/7/10 LOC | 45,255 | 45,255 |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.290% | 5/7/10 LOC | 16,100 | 16,100 |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.290% | 5/7/10 LOC | 36,900 | 36,900 |

| Arizona Transp. Board Excise Tax Rev. (Maricopa County Regional Area) | 3.000% | 7/1/10 | 6,290 | 6,317 |

| 1 Arizona Transp. Board Highway Rev. TOB VRDO | 0.300% | 5/7/10 | 7,900 | 7,900 |

| 1 Arizona Transp. Board Highway Rev. TOB VRDO | 0.310% | 5/7/10 | 7,860 | 7,860 |

| 1 Gilbert AZ GO TOB VRDO | 0.300% | 5/7/10 | 27,420 | 27,420 |

| 1 Maricopa County AZ Public Finance Corp. Lease Rev. TOB VRDO | 0.310% | 5/7/10 | 8,635 | 8,635 |

| 1 Phoenix AZ Civic Improvement Corp. Transit Rev. TOB VRDO | 0.310% | 5/7/10 (13) | 7,700 | 7,700 |

| 1 Phoenix AZ Civic Improvement Corp. Transit Rev. TOB VRDO | 0.310% | 5/7/10 LOC | 30,840 | 30,840 |

| 1 Phoenix AZ Civic Improvement Corp. Wastewater System Rev. TOB VRDO | 0.310% | 5/7/10 LOC | 19,200 | 19,200 |

| 1 Phoenix AZ Civic Improvement Corp. Water System Rev. TOB VRDO | 0.300% | 5/7/10 | 4,995 | 4,995 |

| 1 Phoenix AZ Civic Improvement Corp. Water System Rev. TOB VRDO | 0.310% | 5/7/10 | 8,240 | 8,240 |

| 1 Phoenix AZ GO TOB VRDO | 0.310% | 5/7/10 | 16,880 | 16,880 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.300% | 5/7/10 | 6,500 | 6,500 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.300% | 5/7/10 | 6,450 | 6,450 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.300% | 5/7/10 | 8,500 | 8,500 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.300% | 5/7/10 | 4,995 | 4,995 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.310% | 5/7/10 | 4,635 | 4,635 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.310% | 5/7/10 | 16,000 | 16,000 |

| Tempe AZ Transit Excise Tax Rev. VRDO | 0.300% | 5/7/10 | 14,355 | 14,355 |

| Yavapai County AZ IDA (Northern Arizona Healthcare) VRDO | 0.330% | 5/7/10 LOC | 3,920 | 3,920 |

| | | | | 321,897 |

| California (2.2%) | | | | |

| California State Econ. Recovery Bonds PUT | 5.000% | 7/1/10 (Prere.) | 62,000 | 62,478 |

| East Bay CA Muni. Util. Dist. Water System Rev. PUT | 0.300% | 12/1/10 | 20,000 | 20,000 |

| 1 Fresno CA Sewer Rev. TOB VRDO | 0.320% | 5/7/10 (12) | 9,000 | 9,000 |

| Kern County CA TRAN | 2.500% | 6/30/10 | 100,000 | 100,295 |

| 1 Los Angeles CA Dept. of Water & Power Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 8,430 | 8,430 |

| Los Angeles CA USD TRAN | 2.000% | 8/12/10 | 100,000 | 100,388 |

| San Bernardino County CA TRAN | 2.000% | 6/30/10 | 20,000 | 20,052 |

| Santa Clara County CA TRAN | 2.000% | 6/30/10 | 25,000 | 25,061 |

| Southern California Public Power Auth. (Linden Windenergy Project) RAN | 2.000% | 10/1/10 | 10,000 | 10,066 |

| Southern California Public Power Auth. Rev. | 2.000% | 8/3/10 | 60,000 | 60,245 |

| | | | | 416,015 |

9

| | | | |

| Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Colorado (3.5%) | | | | |

| 1 Board of Governors of the Colorado State University System Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 21,995 | 21,995 |

| Castle Rock CO COP VRDO | 0.300% | 5/7/10 LOC | 10,800 | 10,800 |

| Colorado Educ. & Cultural Fac. Auth. Nature Conservancy Project VRDO | 0.300% | 5/7/10 | 12,315 | 12,315 |

| Colorado Educ. & Cultural Fac. Auth. Rev. (National Jewish Federation Bond Program) VRDO | 0.270% | 5/3/10 LOC | 15,315 | 15,315 |

| Colorado Educ. & Cultural Fac. Auth. Rev. (National Jewish Federation Bond Program) VRDO | 0.270% | 5/3/10 LOC | 29,780 | 29,780 |

| Colorado Educ. & Cultural Fac. Auth. Rev. (National Jewish Federation Bond Program) VRDO | 0.270% | 5/3/10 LOC | 11,000 | 11,000 |

| Colorado General Fund TRAN | 2.000% | 6/25/10 | 100,000 | 100,233 |

| Colorado Health Fac. Auth. Rev. (Evangelical) VRDO | 0.270% | 5/7/10 LOC | 3,700 | 3,700 |

| Colorado Health Fac. Auth. Rev. (Exempla Inc.) VRDO | 0.310% | 5/7/10 LOC | 6,815 | 6,815 |

| 1 Colorado Housing & Finance Auth. (Single Family Mortgage) TOB VRDO | 0.400% | 5/7/10 (7) | 3,250 | 3,250 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds VRDO | 0.330% | 5/7/10 | 11,800 | 11,800 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds VRDO | 0.350% | 5/7/10 | 19,825 | 19,825 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds VRDO | 0.350% | 5/7/10 | 10,800 | 10,800 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds VRDO | 0.400% | 5/7/10 | 59,510 | 59,510 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.250% | 5/7/10 LOC | 7,930 | 7,930 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.280% | 5/7/10 | 19,900 | 19,900 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.280% | 5/7/10 | 31,000 | 31,000 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.280% | 5/7/10 LOC | 22,730 | 22,730 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.280% | 5/7/10 LOC | 17,690 | 17,690 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.280% | 5/7/10 LOC | 6,500 | 6,500 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.310% | 5/7/10 | 23,000 | 23,000 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.320% | 5/7/10 | 10,425 | 10,425 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.320% | 5/7/10 | 12,500 | 12,500 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.400% | 5/7/10 | 16,230 | 16,230 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.400% | 5/7/10 LOC | 12,000 | 12,000 |

| 1 Colorado Regional Transp. Dist. Sales Tax Rev. TOB VRDO | 0.310% | 5/7/10 | 11,470 | 11,470 |

| Colorado Springs CO Util. System Rev. VRDO | 0.280% | 5/7/10 | 11,000 | 11,000 |

| Colorado State Education Loan Program TRAN | 2.000% | 8/12/10 | 50,000 | 50,203 |

| Denver CO Urban Renewal Auth. Tax Increment Rev. (Stapleton) VRDO | 0.300% | 5/7/10 LOC | 14,735 | 14,735 |

| Moffat County CO PCR (PacifiCorp) VRDO | 0.300% | 5/7/10 LOC | 14,900 | 14,900 |

| Univ. of Colorado Hosp. Auth. Rev. VRDO | 0.300% | 5/7/10 LOC | 17,140 | 17,140 |

| Univ. of Colorado Hosp. Auth. Rev. VRDO | 0.300% | 5/7/10 LOC | 41,500 | 41,500 |

| | | | | 657,991 |

| Connecticut (0.6%) | | | | |

| Connecticut GO BAN | 2.000% | 5/19/11 | 25,000 | 25,405 |

| 1 Connecticut State Health & Educ. (Yale Univ.) TOB VRDO | 0.270% | 5/7/10 | 5,000 | 5,000 |

| Connecticut State Health & Educ. Fac. Auth. (Wesleyan State Univ. System) VRDO | 0.290% | 5/7/10 | 10,725 | 10,725 |

| 1 Connecticut State Health & Educ. Fac. Auth. (Yale Univ.) TOB VRDO | 0.300% | 5/7/10 | 7,300 | 7,300 |

| 1 Connecticut State Health & Educ. TOB VRDO | 0.270% | 5/7/10 | 4,000 | 4,000 |

| Hartford CT Metro. Dist. BAN | 1.500% | 7/15/10 | 60,000 | 60,139 |

| | | | | 112,569 |

| Delaware (0.4%) | | | | |

| Delaware Health Fac. Auth. Rev. (Bay Health Medical) VRDO | 0.280% | 5/7/10 LOC | 5,050 | 5,050 |

| Delaware Health Fac. Auth. Rev. (Nemours Foundation Project) VRDO | 0.320% | 5/7/10 | 11,690 | 11,690 |

| 1 Delaware Housing Auth. Rev. TOB VRDO | 0.370% | 5/7/10 | 7,590 | 7,590 |

| 1 Delaware Housing Auth. Single Family Mortgage Rev. TOB VRDO | 2.300% | 5/7/10 | 5,000 | 5,000 |

| Kent County DE Student Housing Rev. (Deleware State Univ. Student Housing) VRDO | 0.300% | 5/7/10 LOC | 30,615 | 30,615 |

| New Castle County DE Airport Fac. Rev. (FlightSafety) VRDO | 0.370% | 5/7/10 | 24,665 | 24,665 |

| | | | | 84,610 |

| District of Columbia (1.4%) | | | | |

| 1 District of Columbia COP TOB VRDO | 0.300% | 5/7/10 LOC | 17,535 | 17,535 |

| 1 District of Columbia GO TOB VRDO | 0.300% | 5/7/10 LOC | 22,820 | 22,820 |

| District of Columbia GO VRDO | 0.300% | 5/7/10 LOC | 7,700 | 7,700 |

| District of Columbia Rev. (American Univ.) VRDO | 0.330% | 5/7/10 LOC | 7,400 | 7,400 |

| District of Columbia Rev. (Center for Strategic and International Studies, Inc. Issue) VRDO | 0.280% | 5/7/10 LOC | 6,730 | 6,730 |

| District of Columbia Rev. (Council Foreign Relations) VRDO | 0.320% | 5/7/10 LOC | 37,680 | 37,680 |

| District of Columbia Rev. (Family & Child Services) VRDO | 0.330% | 5/7/10 LOC | 6,260 | 6,260 |

| 1 District of Columbia Rev. (Georgetown Univ.) TOB VRDO | 0.310% | 5/7/10 (13) | 20,715 | 20,715 |

| District of Columbia Rev. (Georgetown Univ.) VRDO | 0.260% | 5/7/10 LOC | 2,500 | 2,500 |

| District of Columbia Rev. (Henry J. Kaiser Family Foundation) VRDO | 0.300% | 5/7/10 | 12,000 | 12,000 |

| District of Columbia Rev. (John F. Kennedy Center) VRDO | 0.330% | 5/7/10 LOC | 10,200 | 10,200 |

| District of Columbia Rev. (Society for Neuroscience) VRDO | 0.330% | 5/7/10 LOC | 12,000 | 12,000 |

| District of Columbia Rev. (The Pew Charitable Trust) VRDO | 0.280% | 5/7/10 LOC | 31,000 | 31,000 |

| District of Columbia Rev. (Washington Drama Society) VRDO | 0.300% | 5/7/10 LOC | 13,900 | 13,900 |

| District of Columbia Rev. (Wesley Theological) VRDO | 0.290% | 5/7/10 LOC | 5,000 | 5,000 |

| 1 District of Columbia Water & Sewer Auth. Public Util. Rev. TOB VRDO | 0.300% | 5/7/10 (4) | 8,330 | 8,330 |

| 1 District of Columbia Water & Sewer Auth. Public Util. Rev. TOB VRDO | 0.310% | 5/7/10 LOC | 12,875 | 12,875 |

| 1 District of Columbia Water & Sewer Auth. Public Util. Rev. TOB VRDO | 0.310% | 5/7/10 (4) | 4,000 | 4,000 |

| 1 District of Columbia Water & Sewer Auth. Public Util. Rev. TOB VRDO | 0.350% | 5/7/10 | 11,865 | 11,865 |

| Metro. Washington DC/VA Airports Auth. Airport System Rev. CP | 0.380% | 6/10/10 LOC | 13,500 | 13,500 |

| 1 Metro. Washington DC/VA Airports Auth. Airport System Rev. TOB VRDO | 0.450% | 5/7/10 (4) | 3,495 | 3,495 |

| 1 Washington DC Airport Auth. System TOB VRDO | 0.450% | 5/7/10 | 4,000 | 4,000 |

| | | | | 271,505 |

10

| | | | |

| Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Florida (4.6%) | | | | |

| 1 Brevard County FL School Board COP TOB VRDO | 0.300% | 5/7/10 LOC | 13,890 | 13,890 |

| 1 Broward County FL GO TOB VRDO | 0.310% | 5/7/10 | 7,825 | 7,825 |

| 1 Broward County FL Professional Sports Fac. Tax Rev. TOB VRDO | 0.330% | 5/7/10 (4) | 8,975 | 8,975 |

| 1 Broward County FL School Board COP TOB VRDO | 0.300% | 5/7/10 LOC | 34,675 | 34,675 |

| 1 Broward County FL Water & Sewer Util. Rev. TOB VRDO | 0.300% | 5/7/10 | 5,660 | 5,660 |

| 1 Florida Board of Educ. Public Educ. Capital Outlay TOB VRDO | 0.300% | 5/7/10 | 18,925 | 18,925 |

| 1 Florida Board of Educ. Public Educ. Capital Outlay TOB VRDO | 0.310% | 5/7/10 | 15,000 | 15,000 |

| 1 Florida Board of Educ. Public Educ. TOB VRDO | 0.310% | 5/7/10 | 12,860 | 12,860 |

| 1 Florida Board of Educ. Public Educ. TOB VRDO | 0.310% | 5/7/10 | 9,600 | 9,600 |

| 1 Florida Board of Educ. Public Educ. TOB VRDO | 0.310% | 5/7/10 | 10,335 | 10,335 |

| 1 Florida Board of Educ. TOB VRDO | 0.300% | 5/7/10 | 3,995 | 3,995 |

| Florida Dept. of Environmental Protection & Preservation Rev. VRDO | 0.290% | 5/7/10 (12) | 36,200 | 36,200 |

| Florida Dept. of Environmental Protection & Preservation Rev. VRDO | 0.300% | 5/7/10 (12) | 11,700 | 11,700 |

| 1 Florida Dept. of Management Services COP TOB VRDO | 0.300% | 5/7/10 | 6,955 | 6,955 |

| Florida Dept. of Transp. | 2.000% | 7/1/10 | 2,920 | 2,928 |

| Florida Gulf Coast Univ. Financing Corp. VRDO | 0.360% | 5/7/10 LOC | 4,805 | 4,805 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.370% | 5/7/10 | 11,625 | 11,625 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.370% | 5/7/10 | 8,585 | 8,585 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.370% | 5/7/10 | 4,670 | 4,670 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.370% | 5/7/10 | 10,580 | 10,580 |

| Florida Hurricane Catastrophe Fund Finance Corp. Rev. | 5.000% | 7/1/10 | 7,350 | 7,404 |

| Florida Keys Aqueduct Auth. Rev. VRDO | 0.260% | 5/7/10 LOC | 10,500 | 10,500 |

| 1 Florida State Dept. Transp. Rev. TOB VRDO | 0.300% | 5/7/10 | 8,225 | 8,225 |

| Gainsville FL Util. System Rev. VRDO | 0.270% | 5/7/10 | 7,335 | 7,335 |

| 1 Greater Orlando Aviation Auth. Orlando FL Airport Fac. Rev. TOB VRDO | 0.310% | 5/7/10 | 12,000 | 12,000 |

| 1 Greater Orlando Aviation Auth. Orlando FL Airport Fac. Rev. TOB VRDO | 0.330% | 5/7/10 | 6,665 | 6,665 |

| Highlands County FL Health Fac. Auth. Rev. (Adventist/Sunbelt) VRDO | 0.280% | 5/7/10 LOC | 14,890 | 14,890 |

| Highlands County FL Health Rev. (Adventist Health System) VRDO | 0.300% | 5/7/10 LOC | 5,000 | 5,000 |

| Highlands County FL Health Rev. (Adventist Health System) VRDO | 0.300% | 5/7/10 LOC | 14,300 | 14,300 |

| Jacksonville FL Electric Auth. Electric System Rev. VRDO | 0.300% | 5/7/10 LOC | 11,900 | 11,900 |

| Jacksonville FL Electric Auth. Electric System Rev. VRDO | 0.320% | 5/7/10 | 30,445 | 30,445 |

| Jacksonville FL Electric Auth. Water & Sewer Rev. VRDO | 0.300% | 5/7/10 | 29,500 | 29,500 |

| Jacksonville FL Health Fac. Auth. Hosp. Rev. (Baptist Medical Center) VRDO | 0.290% | 5/7/10 LOC | 5,675 | 5,675 |

| 1 Jacksonville FL Transp. Rev. TOB VRDO | 0.330% | 5/7/10 | 6,330 | 6,330 |

| Jacksonville FL Transp. Rev. VRDO | 0.300% | 5/7/10 LOC | 21,120 | 21,120 |

| 1 Lee Memorial Health System Florida Hosp. Rev. TOB VRDO | 0.310% | 5/7/10 LOC | 14,535 | 14,535 |

| Martin County FL Health Fac. Auth. Hosp. Rev. (Martin Medical Center) VRDO | 0.300% | 5/7/10 LOC | 13,790 | 13,790 |

| Miami FL Health Fac. Auth. (Catholic Health East) VRDO | 0.280% | 5/7/10 LOC | 7,400 | 7,400 |

| 1 Miami-Dade County FL Educ. Fac. Auth. Rev. (Univ. of Miami) TOB VRDO | 0.310% | 5/7/10 (13) | 23,030 | 23,030 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.310% | 5/7/10 (13) | 36,630 | 36,630 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.330% | 5/7/10 (13) | 9,600 | 9,600 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.400% | 5/7/10 (12) | 5,800 | 5,800 |

| Miami-Dade County FL Sports Franchise Fac. Tax Rev. VRDO | 0.300% | 5/7/10 LOC | 30,000 | 30,000 |

| 1 Miami-Dade County FL Water & Sewer Rev. TOB VRDO | 0.400% | 5/7/10 (4) | 3,000 | 3,000 |

| Monroe County FL Airport Rev. (Var-Key West International Airport) VRDO | 0.350% | 5/7/10 LOC | 13,100 | 13,100 |

| Orange County FL Health Fac. Auth. Rev. (Nemours Foundation Project) VRDO | 0.280% | 5/7/10 | 4,250 | 4,250 |

| Orange County FL Health Fac. Auth. Rev. (Nemours Foundation Project) VRDO | 0.280% | 5/7/10 | 4,145 | 4,145 |

| Orange County FL Health Fac. Auth. Rev. (Orlando Regional Healthcare) VRDO | 0.320% | 5/7/10 LOC | 4,630 | 4,630 |

| 1 Orange County FL Health Fac. Auth. TOB VRDO | 0.300% | 5/7/10 | 6,660 | 6,660 |

| 1 Orange County FL Housing Finance Auth. Homeowner Rev. TOB VRDO | 0.370% | 5/7/10 | 3,610 | 3,610 |

| 1 Orange County FL School Board COP TOB VRDO | 0.310% | 5/7/10 LOC | 9,180 | 9,180 |

| Orange County FL School Dist. TAN | 2.000% | 10/1/10 | 80,000 | 80,526 |

| Palm Beach County FL Educ. Fac. Auth. Rev. (Atlantic Univ. Inc.) VRDO | 0.330% | 5/7/10 LOC | 19,675 | 19,675 |

| Palm Beach County FL Rev. (Children’s Home Society Project) VRDO | 0.330% | 5/7/10 LOC | 12,030 | 12,030 |

| Palm Beach County FL Rev. (Community Foundation Palm Beach Project) VRDO | 0.360% | 5/7/10 LOC | 5,700 | 5,700 |

| Palm Beach County FL Rev. (Norton Gallery) VRDO | 0.360% | 5/7/10 LOC | 12,500 | 12,500 |

| 1 Palm Beach County FL TOB VRDO | 0.310% | 5/7/10 | 8,565 | 8,565 |

| 1 Palm Beach County FL Water & Sewer TOB VRDO | 0.300% | 5/7/10 | 5,535 | 5,535 |

| Pembroke Pines FL Charter School Rev. VRDO | 0.310% | 5/7/10 (12) | 29,610 | 29,610 |

| Pembroke Pines FL Charter School Rev. VRDO | 0.310% | 5/7/10 (12) | 11,210 | 11,210 |

| Pinellas County FL Health Fac. Auth. Rev. (Bayfront Hosp.) VRDO | 0.300% | 5/7/10 LOC | 8,875 | 8,875 |

| 1 South Florida Water Management Dist. TOB VRDO | 0.350% | 5/7/10 | 9,800 | 9,800 |

| 1 Tampa Bay FL Water Util. System Rev. TOB VRDO | 0.400% | 5/7/10 | 4,505 | 4,505 |

| 1 Univeristy of North Florida Financing Corp. Capital Improvement Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 5,265 | 5,265 |

| 1 Volusia County FL Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 28,640 | 28,640 |

| West Orange Healthcare Dist. FL Rev. VRDO | 0.300% | 5/7/10 LOC | 13,400 | 13,400 |

| | | | | 876,273 |

| Georgia (3.2%) | | | | |

| 1 Atlanta GA Airport Passenger Charge Rev. TOB VRDO | 0.320% | 5/7/10 (4) | 12,500 | 12,500 |

| Cobb County GA Hosp. Auth. Rev. (Equipment Pool Project) VRDO | 0.300% | 5/7/10 LOC | 25,000 | 25,000 |

| Dalton County GA Dev. Auth. (Hamilton Health Care System) VRDO | 0.330% | 5/7/10 LOC | 16,075 | 16,075 |

| DeKalb County GA Private Hosp. Auth. RAN (Children’s Healthcare) | 3.000% | 11/15/10 | 5,500 | 5,574 |

| 1 DeKalb County GA Water & Sewer Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 16,565 | 16,565 |

| 1 DeKalb County GA Water & Sewer Rev. TOB VRDO | 0.310% | 5/7/10 | 11,990 | 11,990 |

11

| | | | |

| Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Floyd County GA Dev. Auth. Rev. (Berry College) VRDO | 0.300% | 5/7/10 LOC | 33,500 | 33,500 |

| Floyd County GA Dev. Auth. Rev. (Berry College) VRDO | 0.300% | 5/7/10 LOC | 37,705 | 37,705 |

| Fulton County GA Dev. Auth. (Lovett School Project) VRDO | 0.300% | 5/7/10 LOC | 5,000 | 5,000 |

| Fulton County GA Dev. Auth. (Lovett School Project) VRDO | 0.300% | 5/7/10 LOC | 12,000 | 12,000 |

| Fulton County GA Dev. Auth. (Pace Academy Inc. Project) VRDO | 0.330% | 5/7/10 LOC | 4,300 | 4,300 |

| Fulton County GA Dev. Auth. (Piedmont Healthcare Inc. Project) VRDO | 0.300% | 5/7/10 LOC | 70,000 | 70,000 |

| Fulton County GA Dev. Auth. (Robert A. Woodruff Arts Center) VRDO | 0.300% | 5/7/10 LOC | 22,000 | 22,000 |

| Fulton County GA Dev. Auth. (Woodward Academy Project) VRDO | 0.300% | 5/7/10 LOC | 20,595 | 20,595 |

| Fulton County GA Dev. Auth. (Woodward Academy Project) VRDO | 0.300% | 5/7/10 LOC | 32,000 | 32,000 |

| 1 Fulton County GA Dev. Auth. TOB VRDO | 0.300% | 5/7/10 | 11,420 | 11,420 |

| Georgia GO | 5.000% | 5/1/10 | 3,000 | 3,000 |

| Georgia GO | 5.250% | 7/1/10 (Prere.) | 4,000 | 4,033 |

| Georgia GO | 5.500% | 7/1/10 | 4,500 | 4,538 |

| 1 Georgia GO TOB VRDO | 0.320% | 5/7/10 | 9,365 | 9,365 |

| Gwinnett County GA Hosp. Auth. Rev. (Gwinnett Hosp. System Inc.) VRDO | 0.300% | 5/7/10 LOC | 17,100 | 17,100 |

| Gwinnett County GA Hosp. Auth. Rev. (Gwinnett Hosp. System Inc.) VRDO | 0.300% | 5/7/10 LOC | 46,785 | 46,785 |

| 1 Gwinnett County GA Hsg. Auth. (Longwood Visa Apt.) TOB VRDO | 0.370% | 5/7/10 LOC | 8,045 | 8,045 |

| 1 Gwinnett County GA School Dist. GO TOB VRDO | 0.300% | 5/7/10 (Prere.) | 7,045 | 7,045 |

| 1 Gwinnett County GA School Dist. GO TOB VRDO | 0.310% | 5/7/10 | 12,310 | 12,310 |

| 1 Gwinnett County GA School Dist. TOB VRDO | 0.300% | 5/7/10 | 4,500 | 4,500 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.300% | 5/7/10 LOC | 16,475 | 16,475 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.300% | 5/7/10 LOC | 19,390 | 19,390 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.320% | 5/7/10 LOC | 6,000 | 6,000 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.320% | 5/7/10 LOC | 18,800 | 18,800 |

| 1 Macon-Bibb County GA Hosp. Auth. TOB VRDO | 0.300% | 5/7/10 | 4,995 | 4,995 |

| 1 Metro. Atlanta GA Rapid Transp. Auth. Georgia Sales Tax Rev. TOB VRDO | 0.310% | 5/7/10 | 10,435 | 10,435 |

| Muni. Electric Auth. Georgia BAN | 1.250% | 5/7/10 | 23,000 | 23,001 |

| Muni. Electric Auth. Georgia BAN | 1.500% | 5/25/10 | 20,000 | 20,012 |

| 1 Private Colleges & Univ. Auth. of Georgia (Emory Univ.) TOB VRDO | 0.310% | 5/7/10 | 8,820 | 8,820 |

| 1 Private Colleges & Univ. Auth. of Georgia Rev. (Emory Univ.) TOB VRDO | 0.300% | 5/7/10 | 4,440 | 4,440 |

| 1 Private Colleges & Univ. Auth. of Georgia Rev. (Emory Univ.) TOB VRDO | 0.300% | 5/7/10 | 5,630 | 5,630 |

| Savannah GA Econ. Dev. Auth. Rev. (SSU Foundation) VRDO | 0.300% | 5/7/10 LOC | 9,000 | 9,000 |

| Thomasville GA Hosp. Rev. (John D Archbold Memorial Hosp., Inc. Project) VRDO | 0.300% | 5/7/10 LOC | 4,000 | 4,000 |

| Thomasville GA Hosp. Rev. (John D Archbold Memorial Hosp., Inc. Project) VRDO | 0.300% | 5/7/10 LOC | 4,095 | 4,095 |

| Valdosta & Lowndes County GA Hosp. Auth. Rev. (South GA Medical Center Project) VRDO | 0.300% | 5/7/10 LOC | 5,300 | 5,300 |

| | | | | 613,338 |

| Hawaii (0.4%) | | | | |

| 1 Hawaii State GO TOB VRDO | 0.300% | 5/7/10 | 11,245 | 11,245 |

| 1 Honolulu HI City & County Board Water Supply TOB VRDO | 0.300% | 5/7/10 LOC | 7,000 | 7,000 |

| 1 Honolulu HI City & County TOB VRDO | 0.310% | 5/7/10 | 14,995 | 14,995 |

| 1 Honolulu HI City & County TOB VRDO | 0.310% | 5/7/10 | 7,715 | 7,715 |

| 1 Univ. of Hawaii Rev. TOB VRDO | 0.310% | 5/7/10 (13) | 19,800 | 19,800 |

| 1 University of Hawaii Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 12,885 | 12,885 |

| | | | | 73,640 |

| Idaho (2.6%) | | | | |

| Idaho Housing & Finance Assn. (College of Idaho Project) VRDO | 0.290% | 5/7/10 LOC | 6,355 | 6,355 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.350% | 5/7/10 LOC | 12,800 | 12,800 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.350% | 5/7/10 LOC | 7,255 | 7,255 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.350% | 5/7/10 LOC | 13,000 | 13,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 11,185 | 11,185 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 14,110 | 14,110 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 14,615 | 14,615 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 7,630 | 7,630 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 7,090 | 7,090 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 10,485 | 10,485 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 9,740 | 9,740 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 10,115 | 10,115 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 | 8,000 | 8,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 7,000 | 7,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 17,530 | 17,530 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 15,220 | 15,220 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 | 24,000 | 24,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 | 13,335 | 13,335 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 | 14,130 | 14,130 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 15,055 | 15,055 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 14,885 | 14,885 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 6,400 | 6,400 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 | 28,750 | 28,750 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 11,140 | 11,140 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 29,505 | 29,505 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 | 27,000 | 27,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 10,560 | 10,560 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 7,310 | 7,310 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 5,545 | 5,545 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.400% | 5/7/10 LOC | 9,950 | 9,950 |

12

| | | | |

| Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Idaho State Building Auth. Rev. (Prison Fac. Project) VRDO | 0.350% | 5/7/10 | 13,190 | 13,190 |

| Idaho TAN | 2.500% | 6/30/10 | 100,000 | 100,344 |

| | | | | 503,229 |

| Illinois (5.3%) | | | | |

| 1 Aurora IL Single Family Mortage Rev. TOB VRDO | 0.370% | 5/7/10 | 47,795 | 47,795 |

| Bartlett IL Special Services Area (Bluff City LLC) VRDO | 0.360% | 5/7/10 LOC | 12,920 | 12,920 |

| 1 Chicago IL Board of Educ. TOB VRDO | 0.350% | 5/7/10 (4) | 4,995 | 4,995 |

| Chicago IL Board of Educ. VRDO | 0.310% | 5/7/10 LOC | 4,900 | 4,900 |

| Chicago IL Board of Educ. VRDO | 0.310% | 5/7/10 LOC | 5,900 | 5,900 |

| 1 Chicago IL GO TOB VRDO | 0.300% | 5/7/10 | 10,830 | 10,830 |

| 1 Chicago IL GO TOB VRDO | 0.330% | 5/7/10 | 5,500 | 5,500 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.300% | 5/7/10 | 5,005 | 5,005 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.300% | 5/7/10 | 8,710 | 8,710 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.310% | 5/7/10 | 3,655 | 3,655 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.310% | 5/7/10 | 18,925 | 18,925 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.310% | 5/7/10 | 5,000 | 5,000 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 29,765 | 29,765 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 13,690 | 13,690 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.320% | 5/7/10 (4) | 14,645 | 14,645 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.450% | 5/7/10 (4) | 7,495 | 7,495 |

| 1 Chicago IL TOB VRDO | 0.300% | 5/7/10 (12) | 6,600 | 6,600 |

| 1 Chicago IL Wastewater Transmission Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 16,960 | 16,960 |

| Chicago IL Wastewater Transmission Rev. VRDO | 0.250% | 5/3/10 LOC | 7,000 | 7,000 |

| Chicago IL Water Rev. VRDO | 0.290% | 5/7/10 LOC | 19,865 | 19,865 |

| Chicago IL Water Rev. VRDO | 0.290% | 5/7/10 LOC | 5,365 | 5,365 |

| Cook County IL Community Consolidated School Dist. Rev. | 2.000% | 12/1/10 | 8,530 | 8,610 |

| 1 Cook County IL GO TOB VRDO | 0.300% | 5/7/10 LOC | 6,850 | 6,850 |

| 1 Cook County IL GO TOB VRDO | 0.350% | 5/7/10 | 7,460 | 7,460 |

| 1 Hoffman Estates IL TOB VRDO | 0.310% | 5/7/10 | 7,295 | 7,295 |

| Illinois Dev. Finance Auth. Hosp. Rev. (Evanston Northwestern Healthcare Corp.) VRDO | 0.250% | 5/3/10 | 29,660 | 29,660 |

| Illinois Dev. Finance Auth. Rev. (Chicago Horticultural Society) VRDO | 0.360% | 5/7/10 LOC | 20,000 | 20,000 |

| Illinois Dev. Finance Auth. Rev. (Loyola Academy) VRDO | 0.360% | 5/7/10 LOC | 16,245 | 16,245 |

| 1 Illinois Dev. Finance Auth. TOB VRDO | 0.310% | 5/7/10 | 20,500 | 20,500 |

| Illinois Educ. Fac. Auth. Rev. (Columbia College Chicago) VRDO | 0.280% | 5/7/10 LOC | 12,650 | 12,650 |

| 1 Illinois Educ. Fac. Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.300% | 5/7/10 | 9,185 | 9,185 |

| 1 Illinois Educ. Fac. Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.300% | 5/7/10 | 4,165 | 4,165 |

| Illinois Educ. Fac. Auth. Rev. (Univ. of Chicago) VRDO | 0.240% | 5/7/10 | 31,989 | 31,989 |

| Illinois Educ. Fac. Auth. Rev. (Univ. of Chicago) VRDO | 0.240% | 5/7/10 | 39,459 | 39,459 |

| 1 Illinois Finance Auth. (Advocate Health Care) TOB VRDO | 0.300% | 5/7/10 | 14,910 | 14,910 |

| Illinois Finance Auth. IDR (Guesto Packing Company Inc. Project) Rev. VRDO | 0.400% | 5/7/10 LOC | 6,710 | 6,710 |

| Illinois Finance Auth. Rev. (Advocate Health) PUT | 0.350% | 2/1/11 | 25,000 | 25,000 |

| Illinois Finance Auth. Rev. (Advocate Health) VRDO | 0.280% | 5/7/10 | 25,000 | 25,000 |

| Illinois Finance Auth. Rev. (Art Institute of Chicago) VRDO | 0.300% | 5/7/10 LOC | 2,300 | 2,300 |

| 1 Illinois Finance Auth. Rev. (Central DuPage Health) TOB VRDO | 0.300% | 5/7/10 | 8,750 | 8,750 |

| Illinois Finance Auth. Rev. (Chicago Horticulture Project) VRDO | 0.360% | 5/7/10 LOC | 9,000 | 9,000 |

| Illinois Finance Auth. Rev. (Hosp. Sister Services Inc.) CP | 0.270% | 5/25/10 | 30,000 | 30,000 |

| Illinois Finance Auth. Rev. (Hosp. Sister Services Inc.) CP | 0.320% | 7/9/10 | 16,970 | 16,970 |

| Illinois Finance Auth. Rev. (Institute of Chicago) VRDO | 0.270% | 5/7/10 LOC | 2,175 | 2,175 |

| Illinois Finance Auth. Rev. (Northwest Community Hosp.) VRDO | 0.260% | 5/7/10 LOC | 13,330 | 13,330 |

| 1 Illinois Finance Auth. Rev. (Northwestern Memorial Hosp.) TOB VRDO | 0.300% | 5/7/10 | 6,000 | 6,000 |

| 1 Illinois Finance Auth. Rev. (Northwestern Memorial Hosp.) TOB VRDO | 0.300% | 5/7/10 | 11,200 | 11,200 |

| Illinois Finance Auth. Rev. (Northwestern Memorial Hosp.) VRDO | 0.250% | 5/3/10 | 21,285 | 21,285 |

| Illinois Finance Auth. Rev. (Northwestern Memorial Hosp.) VRDO | 0.250% | 5/3/10 | 4,700 | 4,700 |

| Illinois Finance Auth. Rev. (Northwestern Univ.) PUT | 0.400% | 3/1/11 | 20,000 | 20,000 |

| Illinois Finance Auth. Rev. (Northwestern Univ.) PUT | 0.400% | 3/1/11 | 20,000 | 20,000 |

| 1 Illinois Finance Auth. Rev. (Northwestern Univ.) TOB VRDO | 0.300% | 5/7/10 | 8,165 | 8,165 |

| Illinois Finance Auth. Rev. (Rush Univ. Medical Center) VRDO | 0.290% | 5/7/10 LOC | 4,000 | 4,000 |

| Illinois Finance Auth. Rev. (Southern Illinois Healthcare) VRDO | 0.300% | 5/7/10 LOC | 9,525 | 9,525 |

| Illinois Finance Auth. Rev. (Trinity International Univ.) VRDO | 0.300% | 5/7/10 LOC | 12,870 | 12,870 |

| 1 Illinois Finance Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.300% | 5/7/10 | 3,000 | 3,000 |

| 1 Illinois Finance Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.300% | 5/7/10 | 10,265 | 10,265 |

| Illinois Finance Auth. Rev. (Univ. of Chicago) VRDO | 0.240% | 5/7/10 | 30,000 | 30,000 |

| Illinois Finance Auth. Rev. (Wesleyan Univ.) VRDO | 0.300% | 5/7/10 LOC | 5,300 | 5,300 |

| Illinois Finance Auth. Rev. (Xavier Univ.) VRDO | 0.330% | 5/7/10 LOC | 3,900 | 3,900 |

| Illinois Finance Auth. Rev. (YMCA Metro. Chicago Project) VRDO | 0.300% | 5/7/10 LOC | 9,750 | 9,750 |

| 1 Illinois GO TOB VRDO | 0.310% | 5/7/10 LOC | 18,160 | 18,160 |

| 1 Illinois GO TOB VRDO | 0.320% | 5/7/10 (4) | 9,900 | 9,900 |

| Illinois Health Fac. Auth. Rev. (Advocate Health Care Network) PUT | 0.400% | 3/25/11 | 10,000 | 10,000 |

| Illinois Health Fac. Auth. Rev. (Elmhurst Memorial Hosp.) VRDO | 0.280% | 5/7/10 LOC | 8,600 | 8,600 |

| Illinois Health Fac. Auth. Rev. (Northwest Community Hosp.) VRDO | 0.270% | 5/3/10 | 6,500 | 6,500 |

| 1 Illinois Housing Dev. Auth. TOB VRDO | 0.400% | 5/7/10 | 19,500 | 19,500 |

| 1 Illinois Regional Transp. Auth. Rev. TOB VRDO | 0.300% | 5/7/10 | 14,380 | 14,380 |

| 1 Illinois Regional Transp. Auth. Rev. TOB VRDO | 0.300% | 5/7/10 (13) | 11,360 | 11,360 |

| 1 Illinois Regional Transp. Auth. Rev. TOB VRDO | 0.300% | 5/7/10 | 21,325 | 21,325 |

| 1 Illinois State Toll Highway Auth. Toll Highway Rev. TOB VRDO | 0.300% | 5/7/10 | 14,430 | 14,430 |

13

| | | | |

| Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Illinois State Toll Highway Auth. Toll Highway Rev. TOB VRDO | 0.300% | 5/7/10 | 5,330 | 5,330 |

| 1 Lake, Cook, Kane & McHenry Counties IL Community USD TOB VRDO | 0.300% | 5/7/10 (4) | 10,355 | 10,355 |

| 1 Metro. Pier & Exposition Auth. Illinois Dedicated Sales Tax Rev. TOB VRDO | 0.300% | 5/7/10 (4) | 9,275 | 9,275 |

| 1 Schaumburg IL GO TOB VRDO | 0.310% | 5/7/10 (13) | 6,130 | 6,130 |

| Univ. of Illinois Board of Trustees COP VRDO | 0.300% | 5/7/10 | 30,000 | 30,000 |

| 1 Univ. of Illinois Univ. Rev. TOB VRDO | 0.310% | 5/7/10 | 14,660 | 14,660 |

| | | | | 1,013,598 |

| Indiana (2.8%) | | | | |

| Indiana Bond Bank Rev. Advance Funding Program | 2.000% | 1/6/11 LOC | 66,000 | 66,707 |

| Indiana Dev. Finance Auth. Rev. (Children’s Museum) VRDO | 0.300% | 5/7/10 | 29,200 | 29,200 |

| Indiana Dev. Finance Auth. Rev. (Indianapolis Museum of Art) VRDO | 0.300% | 5/7/10 LOC | 18,000 | 18,000 |

| Indiana Educ. Fac. Auth. (Wabash College) VRDO | 0.300% | 5/7/10 LOC | 29,940 | 29,940 |

| Indiana Finance Auth. Health System Rev. (Sisters St. Francis) VRDO | 0.270% | 5/7/10 LOC | 5,000 | 5,000 |

| Indiana Finance Auth. Health System Rev. (Sisters St. Francis) VRDO | 0.270% | 5/7/10 LOC | 5,250 | 5,250 |

| Indiana Finance Auth. Health System Rev. (Sisters St. Francis) VRDO | 0.270% | 5/7/10 LOC | 3,675 | 3,675 |

| Indiana Finance Auth. Hosp. Rev. (Clarian Health Partners, Inc. Obligated Group) VRDO | 0.280% | 5/7/10 LOC | 23,655 | 23,655 |

| Indiana Finance Auth. Hosp. Rev. (Clarian Health Partners, Inc. Obligated Group) VRDO | 0.280% | 5/7/10 LOC | 14,215 | 14,215 |

| Indiana Finance Auth. Rev. (Ascension Health) PUT | 0.390% | 5/17/10 | 8,000 | 8,000 |

| Indiana Finance Auth. Rev. (Ascension Health) PUT | 0.330% | 6/15/10 | 8,090 | 8,090 |

| Indiana Finance Auth. Rev. (Ascension Health) PUT | 0.330% | 6/15/10 | 6,490 | 6,490 |

| Indiana Finance Auth. Rev. (Ascension Health) PUT | 0.330% | 6/15/10 | 6,725 | 6,725 |

| Indiana Finance Auth. Rev. (Columbus Regional Hosp.) VRDO | 0.290% | 5/7/10 LOC | 7,000 | 7,000 |

| Indiana Finance Auth. Rev. (DePauw Univ. Project) VRDO | 0.270% | 5/7/10 LOC | 26,570 | 26,570 |

| Indiana Finance Auth. Rev. (Duke Energy Project) VRDO | 0.340% | 5/7/10 LOC | 6,000 | 6,000 |

| Indiana Finance Auth. Rev. (Lease Appropriation) VRDO | 0.260% | 5/3/10 | 13,900 | 13,900 |

| Indiana Finance Auth. Rev. (Lease Appropriation) VRDO | 0.260% | 5/7/10 | 25,300 | 25,300 |

| Indiana Finance Auth. Rev. (Lease Appropriation) VRDO | 0.290% | 5/7/10 | 20,000 | 20,000 |

| Indiana Finance Auth. Rev. VRDO | 0.280% | 5/7/10 LOC | 18,280 | 18,280 |

| 1 Indiana Health & Educ. Fac. Financing Auth. Health System Rev. | | | | |

| (Sisters of St. Francis Health Services, Inc. Obligated Group) TOB VRDO | 0.350% | 5/7/10 (4) | 3,300 | 3,300 |

| 1 Indiana Health & Educ. Fac. Financing Auth. Rev. (Ascension Health Credit Group) TOB VRDO | 0.300% | 5/7/10 | 19,275 | 19,275 |

| Indiana Health & Educ. Fac. Financing Auth. Rev. (Clarian Health Obligated Group) VRDO | 0.290% | 5/7/10 LOC | 8,875 | 8,875 |

| Indiana Health Fac. Auth. Finance Auth. Rev. (Ascension Health Credit Group) PUT | 5.000% | 11/1/10 | 2,500 | 2,550 |

| 1 Indiana Health Fac. Fin. Auth. Hosp. Rev. (Community Hosp. Project) Rev. TOB VRDO | 0.300% | 5/7/10 LOC | 6,420 | 6,420 |

| 1 Indiana Health Fac. Finance Auth. Rev. (Sisters of St. Francis Health Services, Inc.) TOB VRDO | 0.310% | 5/7/10 (4) | 8,085 | 8,085 |

| 1 Indiana Housing & Community Dev. Auth. Single Family Mortgage Rev. TOB VRDO | 0.370% | 5/7/10 | 2,615 | 2,615 |

| Indiana Housing & Community Dev. Auth. Single Family Mortgage Rev. VRDO | 0.290% | 5/7/10 LOC | 21,135 | 21,135 |

| Indianapolis IN Local Public Improvement Bond Bank Notes | 0.370% | 8/6/10 | 15,000 | 15,000 |

| Indianapolis IN Local Public Improvement Bond Bank Notes | 0.370% | 8/6/10 | 7,500 | 7,500 |

| Lawrenceburg IN Pollution Control Rev. VRDO | 0.290% | 5/7/10 LOC | 13,000 | 13,000 |

| Lawrenceburg IN Pollution Control Rev. VRDO | 0.400% | 5/7/10 LOC | 10,000 | 10,000 |

| 1 New Albany Floyd County IN School Building Corp. TOB VRDO | 0.310% | 5/7/10 (4) | 5,370 | 5,370 |

| Noblesville IN Econ. Dev. Rev. (Greystone Apartments Project) VRDO | 0.350% | 5/7/10 LOC | 10,990 | 10,990 |

| Purdue IN Univ. CP | 0.380% | 6/14/10 | 27,492 | 27,492 |

| Purdue Univ. Indiana Univ. Student Fac. System Rev. VRDO | 0.340% | 5/7/10 | 3,700 | 3,700 |

| 1 Wayne Township IN School Building Corp. Marion County TOB VRDO | 0.300% | 5/7/10 LOC | 25,575 | 25,575 |

| | | | | 532,879 |

| Iowa (0.6%) | | | | |

| 1 Des Moines IA Metro. Wastewater Reclamation Auth. Sewer. Rev. TOB VRDO | 0.310% | 5/7/10 LOC | 12,855 | 12,855 |

| Iowa Finance Auth. (Iowa Schools Cash Anticipation Notes Program) | 2.500% | 6/23/10 | 50,000 | 50,141 |

| Iowa Finance Auth. Rev. (Health Care Fac.) VRDO | 0.300% | 5/7/10 | 5,330 | 5,330 |

| Iowa Finance Auth. Single Family Rev. VRDO | 0.300% | 5/7/10 | 11,500 | 11,500 |

| Iowa Finance Auth. Single Family Rev. VRDO | 0.320% | 5/7/10 | 12,000 | 12,000 |

| 1 Iowa Special Obligation TOB VRDO | 0.310% | 5/7/10 | 11,200 | 11,200 |

| 1 Iowa Special Obligation TOB VRDO | 0.310% | 5/7/10 | 3,800 | 3,800 |

| | | | | 106,826 |

| Kansas (0.6%) | | | | |

| 1 Kansas Dept. of Transp. Highway Rev. TOB VRDO | 0.310% | 5/7/10 | 6,270 | 6,270 |

| Sedgwick County KS Airport Fac. Rev. (FlightSafety) VRDO | 0.370% | 5/7/10 | 34,000 | 34,000 |

| Wichita KS Airport Fac. Rev. VRDO | 0.370% | 5/7/10 | 11,170 | 11,170 |

| Wichita KS Renewal & Improvement Temporary Notes | 0.450% | 3/3/11 | 70,820 | 70,838 |

| | | | | 122,278 |

| Kentucky (1.3%) | | | | |

| Boyle County KY Hosp. Rev. (Ephraim McDowell Health) VRDO | 0.290% | 5/7/10 LOC | 7,560 | 7,560 |

| Christian County KY Association County Leasing Program Rev. VRDO | 0.250% | 5/3/10 LOC | 8,925 | 8,925 |

| Jeffersontown KY Lease Program (Kentucky League of Cities Funding) VRDO | 0.290% | 5/7/10 LOC | 2,700 | 2,700 |

| Kenton County KY Airport Board Special Fac. Rev. (Flightsafety International Inc.) VRDO | 0.370% | 5/7/10 | 4,600 | 4,600 |

| Kenton County KY Airport Board Special Fac. Rev. (Flightsafety International Inc.) VRDO | 0.370% | 5/7/10 (13) | 17,900 | 17,900 |

| Kentucky Econ. Dev. Finance Auth. Hosp. Fac. Rev. (Baptist Healthcare) VRDO | 0.250% | 5/7/10 LOC | 15,980 | 15,980 |

| Kentucky Econ. Dev. Finance Auth. Hosp. Fac. Rev. (Baptist Healthcare) VRDO | 0.290% | 5/7/10 LOC | 12,000 | 12,000 |

| Kentucky Econ. Dev. Finance Auth. Hosp. Fac. Rev. (St. Elizabeth Medical) VRDO | 0.280% | 5/7/10 LOC | 5,500 | 5,500 |

| Kentucky Econ. Dev. Finance Auth. Medical Center Rev. (Ashland Hosp. Corp.) VRDO | 0.300% | 5/7/10 LOC | 35,000 | 35,000 |

| Kentucky Econ. Dev. Finance Auth. Medical Center Rev. (Ashland Hosp. Corp.) VRDO | 0.300% | 5/7/10 LOC | 5,000 | 5,000 |

| Kentucky Higher Educ. Student Loan Corp. Student Loan Rev. VRDO | 0.370% | 5/7/10 LOC | 41,700 | 41,700 |

14

| | | | |

| Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Kentucky Housing Corp. Housing Rev. TOB VRDO | 0.360% | 5/7/10 | 9,635 | 9,635 |

| Kentucky Housing Corp. Single Family Mortgage Rev. VRDO | 0.330% | 5/7/10 | 1,850 | 1,850 |

| 1 Kentucky Infrastructure Auth. Wastewater & Drinking Water Rev. TOB VRDO | 0.300% | 5/7/10 | 6,140 | 6,140 |

| 1 Kentucky Turnpike Auth. Econ. Dev. Road Rev. (Revitalization Project) TOB VRDO | 0.310% | 5/7/10 | 10,435 | 10,435 |

| 1 Louisville & Jefferson County KY Metro. Govt. Parking Rev. TOB VRDO | 0.300% | 5/7/10 | 7,455 | 7,455 |

| Louisville KY Water Works Board Rev. | 5.250% | 11/15/10 (Prere.) | 1,600 | 1,642 |

| Richmond KY League of Cities Funding Lease Program Rev. VRDO | 0.280% | 5/7/10 LOC | 9,000 | 9,000 |

| Warren County KY Rev. (Western Kentucky Univ. Student Life) VRDO | 0.300% | 5/7/10 LOC | 29,350 | 29,350 |

| Williamstown KY League of Cities VRDO | 0.280% | 5/7/10 LOC | 4,850 | 4,850 |

| Williamstown KY League of Cities VRDO | 0.280% | 5/7/10 LOC | 4,800 | 4,800 |

| | | | | 242,022 |

| Louisiana (1.1%) | | | | |

| Ascension Parish LA Ind. Dev. Board Rev. (Geismar Project) VRDO | 0.300% | 5/7/10 LOC | 17,000 | 17,000 |

| Louisiana GO VRDO | 0.280% | 5/7/10 LOC | 23,100 | 23,100 |

| Louisiana Public Fac. Auth. Hosp. Rev. (Franciscan Missionaries) VRDO | 0.310% | 5/7/10 LOC | 13,900 | 13,900 |

| Louisiana Public Fac. Auth. Rev. (Christus Health) VRDO | 0.280% | 5/7/10 LOC | 3,000 | 3,000 |

| Louisiana Public Fac. Auth. Rev. (Tiger Athletic) VRDO | 0.300% | 5/7/10 LOC | 21,285 | 21,285 |

| 1 Louisiana Public Fac. Auth. Rev. TOB VRDO | 0.330% | 5/7/10 LOC | 44,345 | 44,345 |

| 1 Louisiana Public Fac. Auth. Rev. TOB VRDO | 0.330% | 5/7/10 LOC | 42,645 | 42,645 |

| Louisiana Public Fac. Auth. Rev. VRDO | 0.300% | 5/7/10 LOC | 30,000 | 30,000 |

| 1 St. James Parish Louisiana Rev. (Nustar Logistics LP Project) VRDO | 0.300% | 5/7/10 LOC | 10,000 | 10,000 |

| | | | | 205,275 |

| Maine (0.2%) | | | | |

| 1 Maine Housing Auth. Mortgage Rev. TOB VRDO | 0.360% | 5/7/10 | 5,510 | 5,510 |

| 1 Maine Housing Auth. Mortgage Rev. TOB VRDO | 0.370% | 5/7/10 | 3,720 | 3,720 |

| Maine Housing Auth. Mortgage Rev. VRDO | 0.270% | 5/7/10 | 20,000 | 20,000 |

| Maine Housing Auth. Mortgage Rev. VRDO | 0.270% | 5/7/10 | 9,000 | 9,000 |

| | | | | 38,230 |

| Maryland (1.6%) | | | | |

| Baltimore County MD Metro. Dist. CP | 0.270% | 6/8/10 | 23,000 | 23,000 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.360% | 5/7/10 | 7,550 | 7,550 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.370% | 5/7/10 | 5,095 | 5,095 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.400% | 5/7/10 | 4,430 | 4,430 |

| 1 Maryland Dept. of Housing & Community Dev. TOB VRDO | 0.360% | 5/7/10 | 6,325 | 6,325 |

| 1 Maryland Dept. of Housing & Community Dev. TOB VRDO | 0.400% | 5/7/10 | 4,245 | 4,245 |

| Maryland Dept. of Housing & Community Dev. VRDO | 0.310% | 5/7/10 | 7,850 | 7,850 |

| Maryland Dept. of Transp. | 5.000% | 5/1/10 | 16,975 | 16,975 |

| Maryland GO | 5.000% | 8/1/10 | 6,000 | 6,069 |

| Maryland Health & Higher Educ. Fac. Auth. (Johns Hopkins Univ.) CP | 0.240% | 5/25/10 LOC | 21,500 | 21,500 |

| Maryland Health & Higher Educ. Fac. Auth. (Johns Hopkins Univ.) CP | 0.240% | 5/25/10 LOC | 21,500 | 21,500 |

| Maryland Health & Higher Educ. Fac. Auth. (Johns Hopkins Univ.) CP | 0.340% | 6/7/10 LOC | 21,500 | 21,500 |

| Maryland Health & Higher Educ. Fac. Auth. (Johns Hopkins Univ.) CP | 0.320% | 6/10/10 | 15,000 | 15,000 |

| 1 Maryland Health & Higher Educ. Fac. Auth. Rev. (John Hopkins Univ.) TOB VRDO | 0.310% | 5/7/10 | 7,675 | 7,675 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Hosp.) VRDO | 0.280% | 5/7/10 LOC | 8,100 | 8,100 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Univ.) VRDO | 0.280% | 5/7/10 LOC | 4,700 | 4,700 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Univ. of Maryland Medical System) VRDO | 0.280% | 5/7/10 LOC | 5,000 | 5,000 |

| 1 Maryland State Transp. Auth. Rev. TOB VRDO | 0.310% | 5/7/10 (4) | 15,515 | 15,515 |

| Maryland Transp. Auth. Passenger Fac. Charge Rev. VRDO | 0.300% | 5/7/10 LOC | 23,650 | 23,650 |

| 1 Maryland Transp. Auth. Rev. TOB VRDO | 0.300% | 5/7/10 (4) | 29,800 | 29,800 |

| 1 Maryland Transp. Auth. Rev. TOB VRDO | 0.310% | 5/7/10 (4) | 13,860 | 13,860 |

| Montgomery County MD GO | 2.000% | 11/1/10 | 7,800 | 7,865 |

| Montgomery County MD Housing Opportunities Comm. (Multi Family) Rev. VRDO | 0.250% | 5/7/10 LOC | 4,590 | 4,590 |

| Washington Suburban Sanitation Dist. Maryland VRDO | 0.340% | 5/7/10 | 29,000 | 29,000 |

| | | | | 310,794 |

| Massachusetts (2.4%) | | | | |

| Boston MA GO | 2.000% | 4/1/11 | 5,005 | 5,079 |

| Massachusetts Bay Transp. Auth. Rev. CP | 0.250% | 5/4/10 | 9,500 | 9,500 |

| Massachusetts Dept. of Transp. Metro Highway System Rev. VRDO | 0.280% | 5/7/10 | 8,200 | 8,200 |

| Massachusetts Dept. of Transp. Metro Highway System Rev. VRDO | 0.300% | 5/7/10 | 17,000 | 17,000 |

| Massachusetts Dept. of Transp. Metro Highway System Rev. VRDO | 0.310% | 5/7/10 | 33,000 | 33,000 |

| Massachusetts Dept. of Transp. Metro Highway System Rev. VRDO | 0.310% | 5/7/10 | 33,000 | 33,000 |

| Massachusetts Dev. Finance Agency Rev. (Fay School Issue) VRDO | 0.300% | 5/7/10 LOC | 5,400 | 5,400 |

| Massachusetts Dev. Finance Agency Rev. (Shady Hill) VRDO | 0.300% | 5/7/10 LOC | 10,000 | 10,000 |

| Massachusetts Dev. Finance Agency Rev. (Wentworth Institute of Technology) VRDO | 0.300% | 5/7/10 LOC | 17,100 | 17,100 |

| 1 Massachusetts Educ. Finance Auth. Educ. Loan Rev. TOB VRDO | 0.360% | 5/7/10 (12) | 4,390 | 4,390 |

| Massachusetts GO | 5.000% | 1/1/11 (Prere.) | 4,000 | 4,123 |

| Massachusetts GO CP | 0.320% | 5/12/10 | 15,000 | 15,000 |

| Massachusetts GO RAN | 2.500% | 6/24/10 | 40,000 | 40,124 |

| 1 Massachusetts GO TOB VRDO | 0.280% | 5/7/10 LOC | 15,250 | 15,250 |

| 1 Massachusetts GO TOB VRDO | 0.300% | 5/7/10 | 23,935 | 23,935 |

| 1 Massachusetts GO TOB VRDO | 0.300% | 5/7/10 | 36,740 | 36,740 |

| 1 Massachusetts GO TOB VRDO | 0.300% | 5/7/10 | 31,235 | 31,235 |

| 1 Massachusetts GO TOB VRDO | 0.310% | 5/7/10 | 13,545 | 13,545 |

| 1 Massachusetts GO TOB VRDO | 0.350% | 5/7/10 (4) | 1,850 | 1,850 |

15

| | | | |

| Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts GO VRDO | 0.300% | 5/3/10 | 3,700 | 3,700 |

| Massachusetts GO VRDO | 0.310% | 5/7/10 | 10,100 | 10,100 |

| Massachusetts Health & Educ. Fac. Auth. Rev. (Amherst College) PUT | 0.480% | 7/8/10 | 10,725 | 10,725 |

| Massachusetts Health & Educ. Fac. Auth. Rev. (Cil Realty) VRDO | 0.270% | 5/7/10 LOC | 4,000 | 4,000 |

| 1 Massachusetts Health & Educ. Fac. Auth. Rev. (Harvard Univ.) TOB VRDO | 0.300% | 5/7/10 | 7,500 | 7,500 |

| Massachusetts Health & Educ. Fac. Auth. Rev. (Partners Healthcare System Inc.) CP | 0.280% | 6/30/10 | 10,000 | 10,000 |

| Massachusetts Health & Educ. Fac. Auth. Rev. (Partners Healthcare) VRDO | 0.270% | 5/7/10 | 15,000 | 15,000 |

| Massachusetts Health & Educ. Fac. Auth. Rev. VRDO | 0.290% | 5/7/10 LOC | 30,700 | 30,700 |

| 1 Massachusetts Health & Educ. Fac. Auth. TOB VRDO | 0.300% | 5/7/10 | 10,000 | 10,000 |

| 1 Massachusetts Housing Finance Agency Housing Rev. TOB VRDO | 0.360% | 5/7/10 | 5,515 | 5,515 |

| 1 Massachusetts School Building Auth. Dedicated Sales Tax Rev. TOB VRDO | 0.310% | 5/7/10 | 7,550 | 7,550 |

| 1 Massachusetts Water Pollution Abatement Trust TOB VRDO | 0.300% | 5/7/10 | 3,240 | 3,240 |

| 1 Massachusetts Water Resources Auth. Rev. TOB VRDO | 0.310% | 5/7/10 (4) | 7,300 | 7,300 |

| | | | | 449,801 |

| Michigan (3.9%) | | | | |

| Green Lake Township MI Econ. Dev. Corp. Rev. (Interlochen Center Project) VRDO | 0.250% | 5/3/10 LOC | 6,500 | 6,500 |

| Jackson County MI Hosp. Finance Auth. Rev. (W.A. Foote Memorial Hosp.) VRDO | 0.300% | 5/7/10 (12) | 10,000 | 10,000 |

| Kent Hosp. MI Finance Auth. Rev. (Spectrum Health) VRDO | 0.280% | 5/7/10 LOC | 30,000 | 30,000 |

| Michigan Building Auth. CP | 0.350% | 6/24/10 LOC | 17,510 | 17,510 |

| Michigan GO | 2.000% | 9/30/10 | 150,000 | 150,915 |

| 1 Michigan Higher Educ. Student Loan Auth. Rev. TOB VRDO | 0.330% | 5/7/10 LOC | 59,245 | 59,245 |

| 1 Michigan Higher Educ. Student Loan Auth. Rev. TOB VRDO | 0.330% | 5/7/10 LOC | 66,995 | 66,995 |

| 1 Michigan Higher Educ. Student Loan Auth. Rev. TOB VRDO | 0.330% | 5/7/10 LOC | 67,945 | 67,945 |

| 1 Michigan Higher Educ. Student Loan Auth. Rev. TOB VRDO | 0.330% | 5/7/10 LOC | 36,545 | 36,545 |

| Michigan Hosp. Finance Auth. Rev. (Ascension Health) PUT | 0.280% | 5/4/10 | 10,000 | 10,000 |