AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON April 9 2013

FILE NO. _______

SECURITIES AND EXCHANGE COMMISSION

|

| WASHINGTON, D.C. 20549 |

| FORM N-14 |

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| |

| o | Pre-Effective Amendment No. |

| o | Post-Effective Amendment No. |

|

| VANGUARD MUNICIPAL BOND FUNDS |

| (Exact Name of Registrant as Specified in Declaration of Trust) |

|

| 100 VANGUARD BLVD., MALVERN, PA 19355 |

| (Address of Principal Executive Office) |

|

| Registrant’s Telephone Number (610) 669-1000 |

|

| 100 VANGUARD BLVD., MALVERN, PA 19355 |

| (Name and Address of Agent for Service) |

|

| Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement becomes |

| effective. |

| |

| It is proposed that this filing will become effective on May 9, 2013, pursuant to Rule 488 under the Securities Act of |

| 1933. |

| |

| The title of securities being registered are Vanguard Long-Term Tax-Exempt Fund Investor Shares and Admiral |

| Shares. |

| |

| No filing fee is due in reliance on Section 24(f) under the Investment Company Act of 1940. |

IMPORTANT PROXY NEWS FOR SHAREHOLDERS Vanguard Florida Focused Long-Term Tax-Exempt Fund Proxy Information

Vanguard Florida Focused Long-Term Tax-Exempt Fund (the “Florida Fund”) will host a Special Meeting of Shareholders on Monday, July 22, 2013, at 4:00 p.m., Eastern Time, at Vanguard’s headquarters in Malvern, Pennsylvania. The purpose is for shareholders to vote on a proposal to reorganize the Florida Fund on a tax-free basis into the Vanguard Long-Term Tax-Exempt Fund.

The first few pages of this booklet highlight key points about the proposed reorganization and explain the proxy process--including how to cast your votes. Before you vote, please read the full text of the combined proxy statement/prospectus for a complete understanding of the proposal.

Please Vote Immediately!

You can vote by mail or telephone, through the Internet, or in person; details can be found on the enclosed proxy insert.

KEY POINTS ABOUT THE PROPOSED REORGANIZATION

Purpose of the Reorganization

The purpose of the proposed reorganization is to combine the Vanguard Florida Focused Long-Term Tax-Exempt Fund (the “Florida Fund”) with the Vanguard Long-Term Tax-Exempt Fund (the “National Fund”) (each, a “Fund” and collectively, the “Funds”). The reorganization has been proposed in response to changes in Florida’s tax laws and to allow Florida Fund shareholders to invest in a more broadly diversified fund. Prior to January 1, 2007, Florida residents were subject to the Florida Intangible Personal Property Tax, which taxed certain assets, such as investments in mutual funds. Florida residents holding mutual funds that invested predominantly in bonds issued by Florida, its municipalities, and agencies (“Florida issuers”) were not subject to this tax. On January 1, 2007, the Florida Intangible Personal Property Tax was repealed. The repeal of this tax has decreased the economic benefit derived from investing in a municipal bond fund that holds a considerable amount of its assets in bonds issued by Florida issuers. The proposed reorganization offers Florida Fund shareholders an opportunity to merge into a larger, more diversified fund that also seeks to provide current income exempt from federal income taxes, with expense ratios identical to and performance comparable with the Florida Fund.

The Florida Fund was introduced in 1992. This Fund seeks to provide current income that is exempt from federal income taxes, with the expectation that the Fund’s shares will be exempt from Florida state taxes, if any. The Florida Fund is intended for Florida residents only. The Fund’s primary investment strategy is to invest primarily in high-quality municipal bonds issued by state and local governments and regional governmental authorities. Under normal circumstances, at least 80% of the Florida Fund’s assets will be invested in securities whose income is exempt from federal income taxes and Florida state taxes, if any. The Fund invests at least 50% of its assets in municipal bonds of Florida issuers.

The National Fund, which has a significantly larger asset base than the Florida Fund, was introduced in 1977. The Fund seeks to provide a high and sustainable level of current income that is exempt from federal income taxes. Under normal market conditions, the National Fund invests at least 80% of its assets in tax-exempt securities.

Florida Fund shareholders would benefit from becoming shareholders of the National Fund, which is a larger, more broadly diversified fund. The Florida Fund is classified as nondiversified and may invest a greater percentage of its assets in the securities of a few issuers, while the National Fund is diversified and invests in a broader range of issuers. Both Funds have identical expense ratios, comparable performance and common strategies and risks. Since the change to Florida’s tax laws, Florida Fund shareholders receive no additional tax benefits from investing in the Fund as compared to the National Fund. Investors in the Florida Fund would be able to receive the same tax treatment from owning a long-term tax-exempt mutual fund that seeks to provide current income exempt from federal income taxes, like the National Fund. Finally, combining the Funds would benefit both sets of shareholders by allowing fixed costs to be spread over a larger asset base, which could lead to lower expenses for the combined fund over time.

Identical Low Costs for Shareholders

The Funds have identical expense ratios: each Fund’s Investor Shares and Admiral Shares have expense ratios of 0.20% and 0.12%, respectively, which translates into an annual cost to shareholders of $20 and $12, respectively, for each $10,000 invested.

Common Investment Objectives, Investment Strategies, Risks and Investment Advisory Arrangements

Both Funds have an investment objective of seeking current income exempt from federal income taxes; however, there is an expectation that the Florida Fund’s shares will be exempt from Florida state taxes, if any. The Florida Fund is classified as nondiversified and it invests at least 50% of its assets in municipal bonds issued by Florida issuers. The Fund may also invest up to 50% of its assets in non-Florida municipal bonds. The National Fund is a diversified fund, and invests 80% of its assets in tax-exempt securities that are issued by state and local municipalities. The Funds have identical portfolio maturity policies. Both Funds invest at least 75% of their assets

in municipal securities within the top three credit-rating categories as determined by a nationally recognized statistical rating organization (e.g., Aaa, Aa, and A by Moody’s Investors Service, Inc.), with each Fund being able to invest up to 20% of its assets in securities that are subject to the alternative minimum tax. Finally, both Funds benchmark their returns to the same index, the Barclays Municipal Bond Index, which includes most investment-grade tax-exempt bonds that are issued by state and local governments.

The Funds have almost the identical set of primary risks. Since the Florida Fund is classified as nondiversified and invests at least 50% of its assets in the municipal bonds of Florida issuers, the Fund has two additional primary risks: nondiversification risk and state-specific risk. The Florida Fund is more vulnerable to unfavorable developments in Florida than are funds that do not focus their investments in that state. The Florida Fund may invest a greater percentage of its assets in particular issuers compared to other mutual funds, which subjects the Fund to the risk that its performance may be hurt disproportionately by the poor performance of relatively few securities. All of the other risks for both Funds are identical.

The Vanguard Group, Inc. (“Vanguard”) serves as investment advisor to both Funds through its Fixed Income Group. However, the Funds have different portfolio managers that are primarily responsible for each Fund’s day-today management.

Comparable Investment Performance

As shown in the following table, the average annual total returns of the Investor and Admiral Shares of the National Fund have been comparable to those of the Florida Fund. Also shown are the returns of the Funds’ benchmark, the Barclays Municipal Bond Index, which is an index that includes most investment-grade tax-exempt bonds that are issued by state and local governments.

| | | |

| Average Annual Total Returns1 for Year Ended Decem ber 31, 20122 | | |

| |

| | 1 Year | 5 Years | 10 Years |

| Vanguard Florida-Focused Long-Term Tax-Exempt Fund | | | |

| Investor Shares | 7.61% | 5.69% | 4.86% |

| Vanguard Florida-Focused Long-Term Tax-Exempt Fund | | | |

| Admiral Shares | 7.70% | 5.77% | 4.94% |

| Vanguard Long-Term Tax-Exempt Fund | | | |

| Investor Shares | 8.08% | 5.67% | 4.84% |

| Vanguard Long-Term Tax-Exempt Fund | | | |

| Admiral Shares | 8.16% | 5.76% | 4.92% |

| Barclays Municipal Bond Index | 6.78% | 5.91% | 5.10% |

| 1 | Returns shown are before taxes and net of fees. |

| 2 | Keep in mind that the Funds’ past performance does not indicate how they will perform in the future. Actual future performance may be higher or lower than the performance shown. |

Service Arrangements

Each Fund is part of the Vanguard group of investment companies, which consists of more than 180 funds. Through their jointly owned subsidiary, Vanguard, the Funds obtain at cost virtually all of their corporate management, administrative, and distribution services. Vanguard also provides investment advisory services on an at-cost basis to the Funds. Vanguard employs a supporting staff of management and administrative personnel needed to provide the requisite services to the Funds and also furnishes the Funds with necessary office space, furnishings, and equipment.

Each Fund pays its share of Vanguard’s operating expenses, which are allocated among the Funds under methods approved by the board of trustees of each Fund. In addition, each Fund bears its own direct expenses, such as legal, auditing, and custodial fees.

How the Reorganization Will Affect Your Account

If Florida Fund shareholders approve the proposed reorganization, then your Florida Fund shares will be exchanged, on a tax-free basis, for an equivalent dollar amount of shares in the National Fund. Your shares will be of the same class, Investor or Admiral. Your account registration and account options will be the same, unless you alter them. In addition, your aggregate tax basis in your shares will remain the same.

The Florida Fund is closed to new accounts, and it will stop accepting purchase requests from existing accounts shortly before the reorganization is scheduled to occur.

Tax-Free Nature of the Reorganization

The proposed exchange of shares is expected to be accomplished on a tax-free basis. Accordingly, we anticipate that Florida Fund shareholders will not realize any capital gains or losses from the reorganization. However, you should pay close attention to these points:

- Florida Fund’s final distribution. Prior to the reorganization, the Florida Fund will distribute its realized capital gains, if any.

- Payments of distributions. Following the reorganization, National Fund shareholders (including former shareholders of the Florida Fund) will participate fully in the daily income distributions and annual capital gain distributions, if any, made for the Investor or Admiral Shares, as appropriate, of the National Fund.

- Cost basis. Following the reorganization, your aggregate cost basis and your holding period in your shares will remain the same. However, your nominal per-share cost basis will change as a result of differences in the share prices of the Florida Fund and the National Fund. Vanguard will provide to you certain cost basis information in connection with the reorganization on its Report of Organizational Actions Affecting Basis of Securities, which will be available on www.vanguard.com shortly after the Reorganization.

Questions & Answers

| Q. | Who gets to vote? |

| A. | Any person who owned shares of the Florida Fund on, May 1, 2013, the “record date,” gets to vote – even if |

| | the | investor later sold the shares. |

| Q. | How can I vote? |

| A. | You can vote in any one of four ways: |

| | 1. | Through the Internet at the website listed on the enclosed proxy card or voting instruction card. |

| | 2. | By telephone, with a toll-free call to the number listed on the enclosed proxy card or voting instruction card. |

| | 3. | By mail, with the enclosed proxy card or voting instruction card. |

| | 4. | In person at the shareholder meeting in Malvern, Pennsylvania, on July 22, 2013. |

| | | Vote through the internet |

| | | Log on to the website listed on the enclosed proxy card or voting instruction card. Follow the on-screen instructions. |

| | | Vote by phone |

| | | Call the phone number indicated on your proxy card or voting instruction card. Follow the recorded instructions available 24 hours per day. |

| | | Vote by mail |

| | | Vote, sign, and date the proxy card and return in the postage-paid envelope. |

| | | Vote in person |

| | | Attend the Shareholder Meeting on July 22, 2013, at Vanguard’s Malvern, Pennsylvania headquarters at 100 Vanguard Boulevard, Malvern, PA 19355. |

| | | We encourage you to vote through the Internet or by telephone, using the voting control number that appears on your proxy card or voting instruction card. These voting methods will save your fund money (because they require no return postage). Whichever method you choose, please take the time to read the full text of our proxy statement/prospectus before you vote. If you would like to change your previous vote, you may do so using any of the methods described above. |

| Q. | I PLAN TO VOTE BY MAIL. HOW SHOULD I SIGN MY PROXY CARD? |

| A. | You should sign your name exactly as it appears on the enclosed proxy card or voting instruction card. |

Unless you have instructed us otherwise, either owner of a joint account may sign the card, but again, the owner must sign the name exactly as it appears on the card. The proxy card or voting instruction card for other types of accounts should be signed in a way that indicates the signer’s authority—for example “John Brown, Custodian.”

| Q. | WHOM SHOULD I CALL WITH QUESTIONS? |

| A. | Please call Vanguard at 800-662-7447 with any additional questions about the proposed reorganization or the upcoming shareholder meeting. |

VANGUARD FLORIDA FOCUSED LONG-TERM TAX-EXEMPT FUND, A SERIES OF VANGUARD FLORIDA TAX-FREE FUNDS

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Vanguard Florida Focused Long-Term Tax-Exempt Fund (the “Florida Fund”) will host a Special Meeting of Shareholders on July 22, 2013, at 4:00 p.m., Eastern Time. At the meeting, we will ask shareholders of the Florida Fund to vote:

| 1. | To approve or disapprove the Agreement and Plan of Reorganization, providing for (i) the transfer of substantially all of the assets of the Florida Fund to the Vanguard Long-Term Tax-Exempt Fund (the “National Fund”), a series of Vanguard Municipal Bond Funds, in exchange for shares of beneficial interest of the National Fund; (ii) the assumption by the National Fund of the liabilities of the Florida Fund; and (iii) the distribution of National Fund shares to the shareholders of the Florida Fund in complete liquidation of the Florida Fund. |

| 2. | To transact such other business as may properly come before the Special Meeting. |

The Special Meeting will be held at Vanguard’s Malvern, Pennsylvania headquarters at 100 Vanguard Boulevard, Malvern, PA 19355. The board of trustees for the Florida Fund has fixed the close of business on May 1, 2013, as the record date for the determination of those shareholders entitled to receive notice of, and to vote at, the Special Meeting.

By Order of the Board of Trustees

Heidi Stam, Secretary

[__________], 2013

YOUR VOTE IS IMPORTANT

YOU CAN VOTE EASILY AND QUICKLY THROUGH THE INTERNET, BY TOLL-FREE TELEPHONE CALL, OR BY MAIL. JUST FOLLOW THE SIMPLE

INSTRUCTIONS THAT APPEAR ON YOUR PROXY CARD OR VOTING

INSTRUCTION CARD. YOU MAY ALSO VOTE IN PERSON AT THE MEETING ON JULY 22, 2013. PLEASE HELP YOUR FUND AVOID THE EXPENSE OF A FOLLOW-UP MAILING BY VOTING TODAY.

COMBINED PROXY STATEMENT/PROSPECTUS

VANGUARD FLORIDA FOCUSED LONG-TERM TAX-EXEMPT FUND

A SERIES OF VANGUARD FLORIDA TAX-FREE FUNDS

VANGUARD LONG-TERM TAX-EXEMPT FUND

A SERIES OF VANGUARD MUNICIPAL BOND FUNDS

INTRODUCTION

Proposal Summary. This combined proxy statement/prospectus describes a reorganization proposal to combine the Vanguard Florida Focused Long-Term Tax-Exempt Fund (the “Florida Fund”) with and into the Vanguard Long-Term Tax-Exempt Fund (the “National Fund”) (each, a “Fund” and collectively, the “Funds”). The Florida Fund’s investment objective is to provide current income that is exempt from federal income taxes; with the expectation that the Fund’s shares will be exempt from Florida state taxes, if any. The National Fund’s objective is to provide a high and sustainable level of current income that is exempt from federal personal income taxes. The reorganization has been proposed in response to changes in Florida’s tax laws that eliminate the tax benefit previously realizable through ownership of a Florida-specific municipal bond fund.

The reorganization involves a few basic steps. The Florida Fund will transfer substantially all of its assets and liabilities to the National Fund. Simultaneously, the National Fund will open an account for each shareholder of the Florida Fund, crediting it with an amount of the National Fund’s Investor or Admiral Shares, as appropriate, equal in value to the shares of the Florida Fund owned by each shareholder at the time of the reorganization. Thereafter, the Florida Fund will be liquidated and dissolved. These steps together are referred to in this proxy statement/prospectus as the “Reorganization.”

The address for the Florida Fund and the National Fund is P.O. Box 2600, Valley Forge, PA 19482 and the telephone number is 610-669-1000 or 800-662-7447. The Florida Fund is a series of Vanguard Florida Tax-Free Funds, and the National Fund is a series of Vanguard Municipal Bond Funds. Both Funds are series of Delaware statutory trusts.

Read and Keep These Documents. Please read this entire proxy statement/prospectus along with the enclosed National Fund prospectus, dated February 27, 2013, before casting your vote. The prospectus sets forth concisely the information about the National Fund that a prospective investor ought to know before investing. These documents contain information that is important to your proxy vote decision, and you should keep them for future reference.

Additional Information Is Available. The National Fund’s statement of additional information (dated February 27, 2013) contains important information about the National Fund. It has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated into this proxy statement/prospectus by reference. In addition, the Florida Fund’s prospectus and statement of additional information, each dated March 28, 2013, as supplemented, are incorporated by reference into and are considered part of this proxy statement/prospectus. The statement of additional information relating to the Reorganization dated [___________], 2013 also is incorporated by reference into this proxy statement/prospectus. The audited financial statements and related independent registered public accounting firm’s report for the Florida Fund are contained in the annual report for the year ended November 30, 2012 and in the National Fund annual report for the year ended October 31, 2012. You can obtain copies of these documents without charge, by calling Vanguard at 1-800-662-7447, by writing to us at P.O. Box 2600, Valley Forge, PA 19482-2600, or by visiting the SEC’s website (www.sec.gov).

The board of trustees for the Florida Fund has fixed the close of business on May 1, 2013, as the record date for the determination of those shareholders entitled to receive notice of, and to vote at, the Special Meeting. The number of

i

Florida Fund shares outstanding on May 1, 2013, was [______________]. This proxy statement/prospectus is expected to be first sent to shareholders on or about May [_], 2013.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

ii

OVERVIEW

This section summarizes key information concerning the proposed Reorganization. Keep in mind that more detailed information appears throughout the proxy statement/prospectus. Please be sure to read everything.

The Proposed Reorganization. At a meeting on March 21, 2013, the board of trustees for the Florida Fund approved a plan to combine the Florida Fund with the National Fund. The plan calls for the Florida Fund to transfer substantially all of its assets and liabilities to the National Fund in exchange for Investor or Admiral Shares, as appropriate, of the National Fund. Shareholders of the Florida Fund would receive shares of the corresponding class of the National Fund equivalent in value to their investments in the Florida Fund at the time of the Reorganization. The closing of the Reorganization is currently expected to occur on or about July 26, 2013. The Florida Fund then would be liquidated and dissolved. The Reorganization will result in an exchange of your shares in the Florida Fund for new Investor Shares or Admiral Shares, as appropriate, of the National Fund, and it is expected to occur on a tax-free basis. The board of trustees of the Florida Fund has concluded that the participation by the Florida Fund in the proposed Reorganization is in the best interests of the Florida Fund and will not dilute the interests of Florida Fund shareholders.

Accordingly, the board of trustees of the Florida Fund is submitting the Reorganization to the shareholders of the Florida Fund and recommending that shareholders of the Florida Fund vote “FOR” the Reorganization.

Investment Objectives, Strategies, and Risks of Each Fund. The investment objectives, primary investment strategies, and primary risks of the Florida Fund are similar to the National Fund.

Both Funds seek current income that is exempt from federal income taxes. However, there is an expectation that the Florida Fund’s shares will be exempt from Florida state taxes, if any. The Florida Fund is intended for Florida residents only. The National Fund’s investment objective is to provide a high and sustainable level of current income that is exempt from federal personal income taxes only, without a state-specific mandate.

The Funds have similar investment strategies, with the exception that the Florida Fund has a greater exposure to bonds issued by Florida issuers. The Florida Fund invests at least 80% of its assets in securities whose income is exempt from federal income and Florida state taxes, with at least 50% of its assets in municipal bonds of Florida issuers. However, the Florida Fund may invest up to 50% in non-Florida municipal bonds. The National Fund invests at least 80% of its assets in tax-exempt securities, which are state and local municipal securities that provide income that is exempt from federal income taxes. The Funds have the same portfolio maturity policies and credit quality criteria.

The Funds have identical primary risks, except that the Florida Fund has two additional primary risks: state-specific risk and nondiversification risk. State-specific risk relates to the chance that developments in Florida will adversely affect the securities held by the Fund and that the Fund is more vulnerable to unfavorable developments in Florida than other funds not focusing on a particular state. Nondiversification risk relates to the chance that the Fund’s performance may be hurt disproportionately by the performance of relatively few securities since it may invest a greater percentage of its assets in the securities of particular issuers. The Florida Fund has these risks because the Fund is required to invest at least 50% of its assets in municipal bonds of Florida issuers.

These investment objectives, strategies, and risks are discussed in detail below under “Investment Practices and Risk Considerations.” Complete descriptions of the investment objectives, policies, strategies, and risks of the Florida Fund and the National Fund are contained in each Fund’s prospectus, along with any accompanying prospectus supplements, and statement of additional information.

If Florida Fund shareholders do not approve the Reorganization, then its board of trustees will consider other alternatives, including but not limited to liquidation of the Florida Fund.

1

Investment Advisor. The Vanguard Group, Inc. (“Vanguard”) serves as investment advisor to both Funds. Vanguard manages the investment and reinvestment of the Funds’ respective assets and continuously reviews, supervises, and directs the Funds’ investment programs. Further details about the advisory arrangements for the Florida Fund and National Fund are provided in this Overview and under the section entitled “Additional Information About the Funds.”

Service Arrangements. Each Fund is part of the Vanguard group of investment companies, which consists of more than 180 funds. Through their jointly owned subsidiary, Vanguard, the Funds obtain at cost virtually all of their corporate management, administrative, and distribution services. Vanguard also provides investment advisory services on an at-cost basis to the Funds. Vanguard employs a supporting staff of management and administrative personnel needed to provide the requisite services to the Funds and also furnishes the Funds with necessary office space, furnishings, and equipment. Each Fund pays its share of Vanguard’s operating expenses, which are allocated among the Funds under methods approved by the board of trustees of each Fund. In addition, each Fund bears its own direct expenses, such as legal, auditing, and custodial fees.

Vanguard was established and operates under an Amended and Restated Funds’ Service Agreement (“Funds’ Service Agreement”). The Funds’ Service Agreement provides that each Fund may be called upon to invest up to 0.40% of its current net assets in Vanguard. The amounts that each Fund has invested are adjusted from time to time in order to maintain the proportionate relationship between each Fund’s relative net assets and its contribution to Vanguard’s capital. As of October 31, 2012, the National Fund had contributed $1,131,000 in capital to Vanguard, representing 0.01% of the Fund’s average net assets and 0.45% of Vanguard’s capitalization. As of November 30, 2012, the Florida Fund had contributed $134,000 in capital to Vanguard, representing 0.01% of the Fund’s average net assets and 0.05% of Vanguard’s capitalization.

Additional information about the service agreements for each Fund appears under “Additional Information About the Funds.”

Purchase, Redemption, Exchange, and Conversion Information. The purchase, redemption, exchange, and conversion features of the National Fund and the Florida Fund are identical.

Distribution Schedules. The Funds have identical distribution schedules. Each Fund’s income dividends are declared daily and distributed monthly; capital gains distributions, if any, generally occur annually in December.

Tax-Free Reorganization. It is expected that the proposed Reorganization will constitute a tax-free reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (or the “Code”). As a condition to closing the Reorganization, the Funds will receive a favorable opinion from legal counsel as to the foregoing income tax consequences of the Reorganization. Please see “Investment Practices and Risk Considerations: Information About the Reorganization: Tax-Free Reorganization” for additional information.

Fees and Expenses

The tables below compare the fees and annualized expenses of Investor Shares and Admiral Shares of the Florida Fund as of November 30, 2012, and the fees and annualized expenses of Investor Shares and Admiral Shares of the National Fund as of October 31, 2012. The tables also show the estimated fees and expenses of Investor Shares and Admiral Shares of the combined Fund, on a pro forma basis, as of October 31, 2012, and do not include the estimated costs of the Reorganization (for information about the costs of the Reorganization please see Expenses of the Reorganization). The actual fees and expenses of the Funds and the combined Fund as of the closing date may differ from those reflected in the table below.

2

| | | |

| Investor Shares | | | |

| |

| Shareholder Fees (fees paid directly from your investment) | |

| |

| | Florida Fund | National Fund | National Fund |

| | Investor Shares | Investor Shares | Pro Forma |

| | | | Combined Fund |

| | | | Investor Shares |

| Sales Charge (Load) | None | None | None |

| Imposed on | | | |

| Purchases | | | |

| |

| Transaction Fee on | None | None | None |

| Purchases | | | |

| |

| Sales Charge (Load) | None | None | None |

| Imposed on | | | |

| Reinvested | | | |

| Dividends | | | |

| |

| Redemption Fee | None | None | None |

| |

| Account Service Fee | $20/year | $20/year | $20/year |

| (for fund account | | | |

| balances below | | | |

| $10,000) | | | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | | |

| | Florida Fund | National Fund | National Fund |

| | Investor Shares | Investor Shares | Pro Forma |

| | | | Combined Fund |

| | | | Investor Shares |

| Management Expenses | 0.17% | 0.16% | 0.16% |

| |

| 12b-1 Distribution Fee | None | None | None |

| |

| Other Expenses | 0.03% | 0.04% | 0.04% |

| |

| Total Annual Fund | 0.20% | 0.20% | 0.20% |

| Operating Expenses | | | |

Example

The following examples are intended to help you compare the cost of investing in Investor Shares of the Florida Fund, the National Fund and the combined Fund with the cost of investing in other mutual funds. The examples assume that you invest $10,000 for the time periods indicated; the results apply whether or not you redeem your shares at the end of each period. These examples also assume that each year your investment has a 5% return and that each Fund’s operating expenses remain the same. Although your actual costs and returns might be different based on these assumptions, your costs would be:

3

| | | | |

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Florida Fund | $20 | $64 | $113 | $255 |

| Investor Shares | | | | |

| |

| National Fund | $20 | $64 | $113 | $255 |

| Investor Shares | | | | |

| |

| National Fund | $20 | $64 | $113 | $255 |

| Pro Forma | | | | |

| Combined Fund | | | | |

| Investor Shares | | | | |

These examples should not be considered to represent actual expenses or performance from the past or for the future. Actual future expenses may be higher or lower than those shown.

Admiral Shares

Shareholder Fees (fees paid directly from your investment)

| | | |

| | Florida Fund | National Fund | National Fund |

| | Admiral Shares | Admiral Shares | Pro Forma |

| | | | Combined Fund |

| | | | Admiral Shares |

| Sales Charge (Load) | None | None | None |

| Imposed on | | | |

| Purchases | | | |

| |

| Transaction Fee on | None | None | None |

| Purchases | | | |

| |

| Sales Charge (Load) | None | None | None |

| Imposed on | | | |

| Reinvested | | | |

| Dividends | | | |

| |

| Redemption Fee | None | None | None |

| |

| Account Service Fee | $20/year | $20/year | $20/year |

| (for fund account | | | |

| balances below | | | |

| $10,000) | | | |

4

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | | |

| | Florida Fund | National Fund | National Fund |

| | Admiral Shares | Admiral Shares | Pro Forma |

| | | | Combined Fund |

| | | | Admiral Shares |

| Management Expenses | 0.10% | 0.09% | 0.09% |

| |

| 12b-1 Distribution Fee | None | None | None |

| |

| Other Expenses | 0.02% | 0.03% | 0.03% |

| |

| Total Annual Fund | 0.12% | 0.12% | 0.12% |

| Operating Expenses | | | |

Example

The following examples are intended to help you compare the cost of investing in Admiral Shares of the Florida Fund, the National Fund and the combined Fund with the cost of investing in other mutual funds. The examples assume that you invest $10,000 for the time periods indicated; the results apply whether or not you redeem your shares at the end of each period. These examples also assume that each year your investment has a 5% return and that each Fund’s operating expenses remain the same. Although your actual costs and returns might be different based on these assumptions, your costs would be:

| | | | |

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Florida Fund | $12 | $39 | $68 | $154 |

| Admiral Shares | | | | |

| |

| National Fund | $12 | $39 | $68 | $154 |

| Admiral Shares | | | | |

| |

| National Fund | $12 | $39 | $68 | $154 |

| Pro Forma | | | | |

| Combined Fund | | | | |

| Admiral Shares | | | | |

These examples should not be considered to represent actual expenses or performance from the past or for the future. Actual future expenses may be higher or lower than those shown.

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the examples, affect each Fund’s performance. During the most recent fiscal year, the Florida Fund’s portfolio turnover rate was 16%. During the most recent fiscal year, the National Fund’s portfolio turnover rate was 15%.

5

INVESTMENT PRACTICES AND RISK CONSIDERATIONS

Following is a brief discussion of the investment objectives, strategies, and risks of the Funds. More detailed information is available in each Fund’s prospectus and any accompanying prospectus supplements, and statement of additional information.

Investment Objective

The investment objective of the Florida Fund is to seek to provide current income that is exempt from federal income taxes, with the expectation that the Fund’s shares will be exempt from Florida state taxes, if any. The Florida Fund is intended for Florida residents only. The National Fund seeks to provide a high and sustainable level of current income that is exempt from federal personal income taxes.

The investment objectives of both Funds are fundamental and any change thereto would require shareholder approval of a majority of a Fund’s shares, meaning the lesser of (1) shares representing 67% or more of a Fund’s net assets voted, so long as shares representing more than 50% of a Fund’s net assets are present or represented by proxy, or (2) shares representing more than 50% of a Fund’s net assets.

Primary Investment Strategies

The Florida Fund invests primarily in high-quality municipal bonds issued by state and local governments and regional governmental authorities. Under normal circumstances, at least 80% of the Fund’s assets will be invested in securities whose income is exempt from federal income and Florida state taxes, if any. The Florida Fund invests at least 50% of its assets in municipal bonds of Florida issuers and is classified as nondiversified. The Fund may, however, invest up to 50% in non-Florida municipal bonds.

The National Fund invests mainly in state and local municipal securities that provide tax-exempt income. The Fund is required to invest 80% of its assets in tax-exempt securities under normal market conditions. The National Fund is classified as diversified and may not be able to invest more than 5% of its assets in a single issuer.

Vanguard, the advisor for both Funds, uses a “top down” investment management approach. The advisor sets, and periodically adjusts, a duration target for each Fund based upon expectations about the direction of interest rates and other economic factors. The advisor then buys and sells securities to achieve the greatest relative value within a Fund’s target duration.

Neither Fund has a limitation on the maturity of individual securities, but each Fund is expected to maintain a dollar-weighted average maturity of 10 to 25 years. At least 75% of the securities held by each Fund are municipal bonds in the top three credit-rating categories as determined by a nationally recognized statistical rating organization (“NRSRO”) (e.g., Aaa, Aa, and A by Moody‘s Investors Service, Inc.). No more than 20% of a Fund’s assets may be invested in bonds in a medium-grade category as determined by an NRSRO (e.g., Baa by Moody‘s). The remaining 5% may be invested in securities with lower credit ratings or in securities that are unrated. Each Fund may invest up to 20% of its assets in securities that are subject to the alternative minimum tax.

Primary Risks

Each Fund is subject to the risks associated with the bond markets, which could cause an investor to lose money. Any investment in a Fund could lose money over short or even long periods. Investors should expect each Fund’s share price and total return to fluctuate within a wide range, like the fluctuations of the overall bond market.

6

Both Funds have the following primary risks:

- Income risk, which is the chance that a Fund’s income will decline because of falling interest rates. Income risk is generally low for long-term bond funds.

- Interest rate risk, which is the chance that bond prices overall will decline because of rising interest rates. Interest rate risk should be high for a Fund because it invests primarily in long-term bonds, whose prices are much more sensitive to interest rate changes than are the prices of short-term bonds.

- Call risk, which is the chance that during periods of falling interest rates, issuers of callable bonds may call (redeem) securities with higher coupons or interest rates before their maturity dates. A Fund would then lose any price appreciation above the bond’s call price and would be forced to reinvest the unanticipated proceeds at lower interest rates, resulting in a decline in the Fund’s income. Call risk is generally high for long-term bond funds.

- Liquidity risk, which is the chance that a Fund may not be able to sell a security in a timely manner at a desired price. Liquidity risk is generally high for long-term bond funds.

- Manager risk, which is the chance that poor security selection will cause a Fund to underperform relevant benchmarks or other funds with a similar investment objective.

- Credit risk, which is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. In general, credit risk should be low for each Fund because it invests primarily in bonds that are considered to be of high quality.

Since the Florida Fund is nondiversified and invests at least 50% of its assets in Florida issuers, the Fund has two additional primary risks:

- State-specific risk, which is the chance that developments in Florida will adversely affect the securities held by the Florida Fund. Because the Fund invests at least 50% of its assets in securities issued by Florida and its municipalities, it is more vulnerable to unfavorable developments in Florida than are funds that do not focus their investments in a particular state. Unfavorable developments in any economic sector may have far-reaching ramifications on the overall Florida municipal market.

- Nondiversification risk, which is the chance that the Florida Fund’s performance may be hurt disproportionately by the poor performance of relatively few securities. The Fund is considered nondiversified, which means that it may invest a greater percentage of its assets in the securities of particular issuers as compared with other mutual funds.

As with an investment in the Florida Fund, an investment in the National Fund could lose money over short or even long periods, and you should expect the National Fund’s share price and total return to fluctuate within a wide range, like the fluctuations of the overall bond market. There can be no assurance that the investment objective or strategies of either Fund will be achieved.

Other Investment Policies and Risks

In addition to investing in municipal securities, each Fund may make other kinds of investments to achieve its objective.

When-Issued Securities. Each Fund may purchase tax-exempt securities on a “when-issued” basis. When investing in “when-issued” securities, a Fund agrees to buy the securities at a certain price on a certain date, even if the market price of the securities at the time of delivery is higher or lower than the agreed-upon purchase price.

7

Derivatives. Each Fund may invest in derivatives only if the expected risks and rewards of the derivatives are consistent with the investment objective, policies, strategies, and risks of the Fund. In particular, derivatives will be used only when they may help the advisor:

- Invest in eligible asset classes with greater efficiency and lower cost than is possible through direct investment;

- Add value when these instruments are attractively priced; or

- Adjust sensitivity to changes in interest rates.

The Funds’ derivative investments may include fixed income futures contracts, fixed income options, interest rate swaps, total return swaps, credit default swaps, or other derivatives. Losses (or gains) involving futures contracts can sometimes be substantial—in part because a relatively small price movement in a futures contract may result in an immediate and substantial loss (or gain) for a Fund. Similar risks exist for other types of derivatives.

Each Fund may invest in tender option bond programs, a type of municipal bond derivative that allows the purchaser to receive a variable rate of tax-exempt income from a trust entity that holds long-term municipal bonds. A Fund may invest in these derivatives if, in the advisor’s opinion, they are consistent with the Fund’s objective of producing current tax-exempt income. Derivative securities are subject to certain structural risks that, in very rare circumstances, could cause the Fund’s shareholders to lose money or receive taxable income.

Derivatives can take many forms. Some forms of derivatives, such as exchange-traded futures and options on securities, commodities, or indexes, have been trading on regulated exchanges for decades. These types of derivatives are standardized contracts that can easily be bought and sold, and whose market values are determined and published daily. Nonstandardized derivatives (such as swap agreements), on the other hand, tend to be more specialized or complex, and may be harder to value.

In general, derivatives may involve risks different from, and possibly greater than, those of the underlying securities, assets, or market indexes.

Cash Management. Each Fund’s daily cash balance may be invested in one or more Vanguard CMT Funds, which are very low-cost money market funds. When investing in a Vanguard CMT Fund, each Fund bears its proportionate share of the at-cost expenses of the CMT Fund in which it invests.

Temporary Investment Measures. Each Fund may temporarily depart from its normal investment policies and strategies—for instance, by allocating substantial assets to cash investments, U.S. Treasury securities, or other investment companies (including exchange-traded funds)—in response to adverse or unusual market, economic, political, or other conditions. Such conditions could include a temporary decline in the availability of municipal obligations. By temporarily departing from its normal investment policies, a Fund may distribute income subject to federal personal income tax, and may otherwise fail to achieve its investment objective.

Comparison of Investment Objectives, Investment Strategies and Risks

The Florida Fund and the National Fund have similar investment objectives. Both Funds seek to provide current income that is exempt from federal income taxes. The National Fund also seeks to provide a high and sustainable level of current income while the shares of the Florida Fund have an expectation that its shares will be exempt from Florida taxes, if any. The combined fund will have the investment objective of the National Fund. There is no guarantee that each Fund will achieve its stated objective.

The Funds have similar primary investment strategies. The Funds both invest in municipal bonds issued by state and local governments; however, the Florida Fund is required to invest at least 50% of its assets in municipal bonds of Florida issuers. Both Funds have identical portfolio maturity policies, as well as credit quality criteria. The combined fund will utilize the investment strategies of the National Fund.

8

Both Funds have identical primary risks, with the exception of the Florida Fund having two additional primary risks due to its classification as a nondiversified fund and requirement to invest at least 50% of its assets in Florida issuers. These primary risks are nondiversification risk and state-specific risk. The combined fund will have the risks of the National Fund.

Investment Advisor and Portfolio Managers

The Funds have the same investment advisor, Vanguard, and are overseen by the same group within Vanguard, the Vanguard Fixed Income Group.

Mortimer J. Buckley, Chief Investment Officer and Managing Director of Vanguard. As Chief Investment Officer, he is responsible for the oversight of Vanguard’s Equity Investment and Fixed Income Groups. The investments managed by these two groups include active quantitative equity funds, equity index funds, active bond funds, index bond funds, stable value portfolios, and money market funds. Mr. Buckley joined Vanguard in 1991 and has held various senior leadership positions with Vanguard. He received his A.B. in Economics from Harvard and an M.B.A. from Harvard Business School.

Robert F. Auwaerter, Principal of Vanguard and head of Vanguard’s Fixed Income Group. He has direct oversight responsibility for all money market funds, bond funds, and stable value portfolios managed by the Fixed Income Group. He has managed investment portfolios since 1978 and has been with Vanguard since 1981. He received his B.S. in Finance from The Wharton School of the University of Pennsylvania and an M.B.A. from Northwestern University.

Christopher W. Alwine, CFA, Principal of Vanguard and head of Vanguard’s Municipal Bond Funds. He has direct oversight responsibility for all tax-exempt bond funds managed by the Fixed Income Group. He has been with Vanguard since 1990, has worked in investment management since 1991, and has managed investment portfolios since 1996. He received his B.B.A. from Temple University and an M.S. from Drexel University.

Pamela Wisehaupt Tynan, Principal of Vanguard and head of Vanguard’s Municipal Money Market Funds. She has direct oversight responsibility for all tax-exempt money market funds managed by the Fixed Income Group. She has been with Vanguard since 1982 and has managed investment portfolios since 1988. She received her B.S. from Temple University and an M.B.A. from St. Joseph’s University.

The managers primarily responsible for the day-to-day management of the Funds are different.

The Florida Fund is overseen by:

Marlin G. Brown, Portfolio Manager. He has worked in investment management for Vanguard since 1996; has managed investment portfolios since 2007; and has managed the Florida Fund since 2011. He received his B.S. from University of Virginia.

The National Fund is overseen by:

Mathew M. Kiselak, Principal of Vanguard. He has worked in investment management since 1987; has managed investment portfolios since 1990; and has managed the National Fund since joining Vanguard in 2010. He received his B.S. from Pace University.

9

Comparison of Fundamental Investment Restrictions

The Florida Fund and National Fund have the following identical fundamental investment restrictions:

Borrowing –Each Fund may borrow money only as permitted by the Investment Company Act of 1940 (“1940 Act”) or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over a Fund.

Commodities – Each Fund may invest in commodities only as permitted by the 1940 Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over a Fund.

Industry Concentration – Each Fund will not concentrate its investments in the securities of issuers whose principal business activities are in the same industry.

Investment Objective – The investment objective of each Fund may not be materially changed without a shareholder vote.

Loans – Each Fund may make loans to another person only as permitted by the 1940 Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over the Fund.

Real Estate – Each Fund may not invest directly in real estate unless it is acquired as a result of ownership of securities or other instruments. This restriction shall not prevent a Fund from investing in securities or other instruments (1) issued by companies that invest, deal, or otherwise engage in transactions in real estate, or (2) backed or secured by real estate or interests in real estate.

Senior Securities - Each Fund may not issue senior securities except as permitted by the 1940 Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over a Fund.

Underwriting – Each Fund may not act as an underwriter or another issuer’s securities, except to the extent that the Fund may be deemed to be an underwriter within the meaning of the Securities Act of 1933 (the “1933” Act), in connection with the purchase and sale of portfolio securities.

The Funds have different fundamental investment policies relating to the 80% Policy and Diversification.

The Florida Fund has the following fundamental investment policies:

80% Policy – The Florida Fund will invest at least 80% of its assets in securities exempt from federal taxes and the taxes of the state indicated by the Fund’s name, under normal market conditions. In applying this 80% policy, assets include net assets and borrowings for investment purposes.

Diversification – The Florida Fund will limit the value of all holdings (other than U.S. government securities, cash, and cash items as defined under subchapter M of the Internal Revenue Code), each of which exceeds 5% of the Fund’s total assets or 10% of the issuer’s outstanding voting securities, to an aggregate of 50% of the Fund’s total assets as of the end of each quarter of the taxable year. Additionally, the Florida Fund will limit the aggregate value of holdings of a single issuer (other than U.S. government securities, as defined in the Code) to a maximum of 25% of the Fund’s total assets as of the end of each quarter of the taxable year.

The National Fund has the following fundamental investment policies:

80% Policy – The National Fund will invest at least 80% of its assets in tax-exempt securities under normal market conditions. For purposes of the 80% policies, assets include net assets and borrowings for investment purposes.

10

Diversification – The National Fund may not purchase securities of any issuer if, as a result, more than 5% of the Fund’s total assets would be invested in that issuer’s securities. This limitation does not apply to obligations of the U.S. government or its agencies or instrumentalities, or any municipal bond guaranteed by the U.S. government.

In addition, the Florida Fund has listed an additional fundamental investment policy that relates to its 80% policy mentioned above.

Tax-Exempt Investments – For a description of the Florida Fund’s fundamental policy on tax-exempt investments see “Fundamental Policies — 80% Policy.”

The Florida Fund has a fundamental policy to invest its assets in the state of Florida and is classified as nondiversified. The National Fund invests at least 80% of its assets in any type of tax-exempt security and is not limited to a state. The National Fund is diversified and cannot hold more than 5% of its assets in a single issuer. As a result of the reorganization, the combined fund will retain the fundamental investment policies of the National Fund.

INVESTMENT PERFORMANCE OF THE FUNDS

Investment Performance of Florida Fund

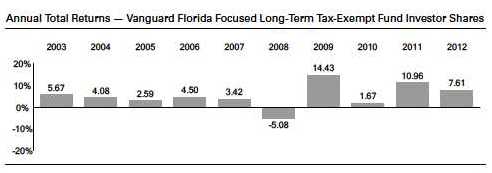

Annual Total Returns

The following bar chart and table are intended to help you understand the risks of investing in the Florida Fund. The bar chart shows how the performance of the Florida Fund‘s Investor Shares has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns of the share classes presented compare with those of a relevant market index, which have investment characteristics similar to those of the Florida Fund. Keep in mind that the Florida Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

During the periods shown in the bar chart, the highest return for a calendar quarter was 7.25% (quarter ended September 30, 2009), and the lowest return for a quarter was -4.55% (quarter ended December 31, 2010).

Performance through the most recent calendar quarter ended March 31 was 0.32%.

11

| | | |

| Average Annual Total Returns for Periods Ended December 31, 2012 | | |

| | 1 Year | 5 Years | 10 Years |

| Vanguard Florida Focused Long-Term Tax-Exempt Fund | | | |

| Investor Shares | | | |

| Return Before Taxes | 7.61 % | 5.69 % | 4.86 % |

| Return After Taxes on Distributions | 7.58 | 5.68 | 4.81 |

| Return After Taxes on Distributions and Sale of Fund Shares | 6.33 | 5.48 | 4.76 |

| Vanguard Florida Focused Long-Term Tax-Exempt Fund | | | |

| Admiral Shares | | | |

| Return Before Taxes | 7.70 % | 5.77 % | 4.94 % |

| Barclays Municipal Bond Index | | | |

| (reflects no deduction for fees, expenses, or taxes) | 6.78 % | 5.91 % | 5.10 % |

Investment Performance of National Fund

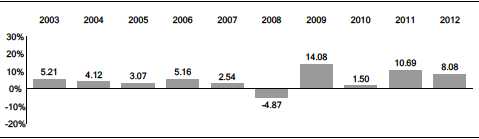

Annual Total Returns

The following bar chart and table are intended to help you understand the risks of investing in the National Fund. The bar chart shows how the performance of the National Fund‘s Investor Shares has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns of the share classes presented compare with those of a relevant market index, which has investment characteristics similar to those of the National Fund. Keep in mind that the National Fund’s past performance (before and after taxes) does not indicate how the National Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

Annual Total Returns —National Fund Investor Shares

During the periods shown in the bar chart, the highest return for a calendar quarter was 7.95% (quarter ended September 30, 2009), and the lowest return for a quarter was -4.64% (quarter ended December 31, 2012).

Performance through the most recent calendar quarter ended March 31 was 0.40%.

12

| | | |

| Average Annual Total Returns for Periods Ended Decem ber 31, 2012 | | |

| | 1 Year | 5 Years | 10 Years |

| Vanguard Long-Term Tax-Exem pt Fund Investor Shares | | | |

| Return Before Taxes | 8.08% | 5.67% | 4.84% |

| Return After Taxes on Distributions | 8.08% | 5.67% | 4.84% |

| Return After Taxes on Distributions and Sale of Fund Shares | 6.61 | 5.48 | 4.78 |

| Vanguard Long-Term Tax-Exem pt Fund Adm iral Shares | | | |

| Return Before Taxes | 8.16% | 5.76% | 4.92% |

| Barclays Municipal Bond Index | | | |

| (reflects no deduction for fees, expenses, or taxes) | 6.78% | 5.91% | 5.10% |

Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capital gains or upon redemption. State and local income taxes are not reflected in the calculations. Please note that after-tax returns are shown only for the Investor Shares and may differ for each share class. After-tax returns are not relevant for a shareholder who holds fund shares in a tax-deferred account, such as an individual retirement account or a 401(k) plan. Also, figures captioned Return After Taxes on Distributions and Sale of Fund Shares will be higher than other figures for the same period if a capital loss occurs upon redemption and results in an assumed tax deduction for the shareholder.

Share Price

Each of the Funds’ share price, also known as net asset value (“NAV”), is calculated each business day as of the close of regular trading on the New York Stock Exchange (or “Exchange”), generally 4 p.m., Eastern time. Each share class has its own NAV, which is computed by dividing the total assets, minus liabilities, allocated to each share class by the number of Fund shares outstanding for that share class. On holidays or other days when the Exchange is closed, the NAV is not calculated, and the Funds do not transact purchase or redemption requests.

Debt securities held by a Vanguard fund are valued based on information furnished by an independent pricing service or market quotations. Certain short-term debt instruments used to manage a fund’s cash and the instruments held by a money market fund are valued on the basis of amortized cost. The values of any mutual fund shares held by a fund are based on the NAVs of the shares. The values of any exchange-trade fund or closed-end fund shares held by a fund are based on the market value of the shares.

When a Fund determines that pricing-service information or market quotations either are not readily available or do not accurately reflect the value of a security, the security is priced at its fair value (the amount that the owner might reasonably expect to receive upon the current sale of the security). A Fund also may use fair-value pricing on bond market holidays when the fund is open for business (such as Columbus Day and Veterans Day).

Fair-value prices are determined by Vanguard according to procedures adopted by the board of trustees. When fair-value pricing is employed, the prices of securities used by a Fund to calculate the NAV may differ from quoted or published prices for the same securities.

Vanguard fund share prices are published daily; share prices are available on our website at vanguard.com/prices.

Purchases, Redemptions and Exchanges of Fund Shares; Other Shareholder Information

Purchase, Redemption, and Exchange Information. The following chart highlights the purchase, redemption, and exchange features of the Florida Fund as compared to such features of the National Fund.

13

| | |

| Purchase, Redemption and | Florida Fund | National Fund |

| Exchange Features | Investor Shares | Investor Shares |

| |

| Minimum initial purchase | $3,000 | $3,000 |

| amount | | |

| |

| Additional investment | | |

| purchase amount | $100 | $100 |

| | (other than by Automatic | (other than by Automatic |

| | Investment Plan, which has | Investment Plan, which has |

| | no established minimum) | no established minimum) |

| |

| Purchases | Through Vanguard’s | Through Vanguard’s |

| | website, mobile application, | website, mobile application, |

| | by telephone, or by mail | by telephone, or by mail |

| |

| Redemptions | Through Vanguard’s | Through Vanguard’s |

| | website, mobile application, by website, mobile application, |

| | telephone, or by mail | by telephone, or by mail |

| |

| Free Exchange Privileges | Yes, through Vanguard’s | Yes, through Vanguard’s |

| | website, mobile application, by website, mobile application, |

| | telephone, or by mail | by telephone, or by mail |

| |

| |

| |

| Purchase, Redemption and | Florida Fund | National Fund |

| Exchange Features | Admiral Shares | Admiral Shares |

| |

| Minimum initial purchase | $50,000 | $50,000 |

| amount | | |

| |

| Additional investment | | |

| purchase amount | $100 | $100 |

| | (other than by Automatic | (other than by Automatic |

| | Investment Plan, which has | Investment Plan, which has |

| | no established minimum) | no established minimum) |

| |

| Purchases | Through Vanguard’s | Through Vanguard’s |

| | website, mobile application, | website, mobile application, |

| | by telephone, or by mail | by telephone, or by mail |

| |

| Redemptions | Through Vanguard’s | Through Vanguard’s |

| | website, mobile application, by website, mobile application, |

| | telephone, or by mail | by telephone, or by mail |

14

| | |

| Free Exchange Privileges | Yes, through Vanguard’s | Yes, through Vanguard’s |

| | website, mobile application, by website, mobile application, |

| | telephone, or by mail | by telephone, or by mail |

Purchases

Trade Date

The trade date for any purchase request received in good order will depend on the day and time Vanguard receives your request, the manner in which you are paying, and the type of fund you are purchasing. Your purchase will be executed using the net asset value (NAV) as calculated on the trade date. NAVs are calculated only on days that the New York Stock Exchange (NYSE) is open for trading (a business day).

If your purchase request is not accurate and complete, it may be rejected.

You generally begin earning dividends on the business day following your trade date.

Other Purchase Rules You Should Know

Please note that Admiral Shares generally are not available for:

- SIMPLE IRAs and Individual 403(b)(7) Custodial Accounts or

- Certain retirement plan accounts receiving special administrative services from Vanguard, including Vanguard Individual 401(k) Plans.

Converting Shares

When a conversion occurs, you receive shares of one class in place of shares of another class of the same Fund. At the time of conversion, the dollar value of the “new” shares you receive equals the dollar value of the “old” shares that were converted. In other words, the conversion has no effect on the value of your investment in a Fund at the time of the conversion. However, the number of shares you own after the conversion may be greater than or less than the number of shares you owned before the conversion, depending on the net asset values of the two share classes.

A conversion between share classes of the same Fund is a nontaxable event.

Trade Date

The trade date for any conversion request received in good order will depend on the day and time Vanguard receives your request. Your conversion will be executed using the NAVs of the different share classes on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day). For a conversion request received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date will be the same day. For a conversion request received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date will be the next business day.

Conversions From Investor Shares to Admiral Shares

15

Self-directed conversions. If your account balance in a Fund is at least $50,000, you may ask Vanguard to convert your Investor Shares to Admiral Shares. You may request a conversion through our website (if you are registered for online access), by telephone, or by mail. Institutional clients should contact Vanguard for more information on special eligibility rules that may apply to them.

Automatic conversions. Vanguard conducts periodic reviews of account balances and may, if your account balance in a Fund exceeds $50,000, automatically convert your Investor Shares to Admiral Shares. You will be notified before an automatic conversion occurs and will have an opportunity to instruct Vanguard not to effect the conversion. Institutional clients should contact Vanguard for more information on special eligibility rules that may apply to them.

Mandatory Conversions to Investor Shares

If an account no longer meets the balance requirements for Admiral Shares, Vanguard may automatically convert the shares in the account to Investor Shares. A decline in the account balance because of market movement may result in such a conversion. Vanguard will notify the investor in writing before any mandatory conversion occurs.

Redeeming Shares

Trade Date

The trade date for any redemption request received in good order will depend on the day and time Vanguard receives your request and the manner in which you are redeeming. Your redemption will be executed using the NAV as calculated on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day).

You generally will continue earning dividends until the first business day following your trade date. Generally, the exception to this rule is if you redeem shares by writing a check against your account, the shares will stop earning dividends on the day that your check posts to your account.

Other Redemption Rules You Should Know

Documentation for certain accounts. Special documentation may be required to redeem from certain types of accounts, such as trust, corporate, nonprofit, or retirement accounts. Please call us before attempting to redeem from these types of accounts.

Potentially disruptive redemptions. Vanguard reserves the right to pay all or part of a redemption in kind—that is, in the form of securities—if it reasonably believes that a cash redemption would negatively affect a Fund’s operation or performance or that the shareholder may be engaged in market-timing or frequent trading. Under these circumstances, Vanguard also reserves the right to delay payment of the redemption proceeds for up to seven calendar days. By calling Vanguard before attempting to redeem a large dollar amount, the investor may avoid in-kind or delayed payment of your redemption.

Recently purchased shares. Although you can redeem shares at any time, proceeds may not be made available to you until the fund collects payment for your purchase. This may take up to seven calendar days for shares purchased by check or by electronic bank transfer. If you have written a check on a fund with checkwriting privileges, that check may be rejected if your fund account does not have a sufficient available balance.

Share certificates. Share certificates are no longer issued for Vanguard funds. Shares currently held in certificates cannot be redeemed, exchanged, converted, or transferred (reregistered) until you return the certificates (unsigned) to Vanguard by registered mail.

Address change. If you change your address online or by telephone, there may be up to a 14-day restriction on your ability to request check redemptions online and by telephone. You can request a redemption in writing at any time. Confirmations of address changes are sent to both the old and new addresses.

16

Payment to a different person or address. At your request, we can make your redemption check payable, or wire your redemption proceeds, to a different person or send it to a different address. However, this generally requires the written consent of all registered account owners and may require a signature guarantee or a notarized signature. You may obtain a signature guarantee from some commercial or savings banks, credit unions, trust companies, or member firms of a U.S. stock exchange.

No cancellations. Vanguard will not accept your request to cancel any redemption request once processing has begun. Please be careful when placing a redemption request.

Emergency circumstances. Vanguard funds can postpone payment of redemption proceeds for up to seven calendar days. In addition, Vanguard funds can suspend redemptions and/or postpone payments of redemption proceeds beyond seven calendar days at times when the NYSE is closed or during emergency circumstances, as determined by the SEC.

Exchanging Shares

An exchange occurs when you use the proceeds from the redemption of shares of one Vanguard fund to simultaneously purchase shares of a different Vanguard fund. You can make exchange requests online (if you are registered for online access), by telephone, or by written request.

If the NYSE is open for regular trading (generally until 4 p.m., Eastern Time, on a business day) at the time an exchange request is received in good order, the trade date generally will be the same day.

Vanguard will not accept your request to cancel any exchange request once processing has begun. Please be careful when placing an exchange request.

Please note that Vanguard reserves the right, without notice, to revise or terminate the exchange privilege, limit the amount of any exchange, or reject an exchange, at any time, for any reason. See Frequent-Trading Limitations for additional restrictions on exchanges.

Payments to Financial Intermediaries

The National Fund and its investment advisor, Vanguard, do not pay financial intermediaries for sales of its shares.

Advisory Arrangements

The Vanguard Group, Inc. (Vanguard), P.O. Box 2600, Valley Forge, PA 19482, which began operations in 1975, serves as advisor to both Funds through its Fixed Income Group. As of December 31, 2012, Vanguard served as advisor for approximately $2 trillion in assets under management. Vanguard provides investment advisory services to the Funds at an at-cost basis, subject to the supervision and oversight of the trustees and officers of each Fund.

For the most recent fiscal year ended for both Funds, the advisory expenses represented an effective annual rate of 0.01% of each Fund’s average net assets.

For a discussion of why the board of trustees approved the National Fund’s investment advisory arrangement, see the most recent semiannual report to shareholders covering the fiscal period ended April 30, and the most recent semiannual report to shareholders covering the fiscal period ended May 31 for the Florida Fund.

17

Dividends, Capital Gains, and Taxes

Fund Distributions

Each Fund distributes to shareholders virtually all of its net income (interest less expenses) as well as any net capital gains realized from the sale of its holdings. The Fund’s income dividends are declared daily and distributed monthly; capital gains distributions, if any, generally occur annually in December. You can receive distributions of income or capital gains in cash, or you can have them automatically reinvested in more shares of the National Fund.

Basic Tax Points

Vanguard will send you a statement each year showing the tax status of all your distributions. A majority of the income dividends you receive from the Fund are expected to be exempt from federal income taxes. In addition, you should be aware of the following basic federal income tax points about tax-exempt mutual funds:

• Distributions of capital gains are taxable to you whether or not you reinvest these amounts in additional Fund shares.

• Capital gains distributions declared in December—if paid to you by the end of January—are taxable as if received in December.

• Any short-term capital gains distributions that you receive are taxable to you as ordinary income.

• Any distributions of net long-term capital gains are taxable to you as long-term capital gains, no matter how long you’ve owned shares in a Fund.

• Capital gains distributions may vary considerably from year to year as a result of the Fund’s normal investment activities and cash flows.

• Exempt-interest dividends from a tax-exempt fund are taken into account in determining the taxable portion of any Social Security or railroad retirement benefits that you receive.

• Income paid from tax-exempt bonds whose proceeds are used to fund private, for-profit organizations may be subject to the federal alternative minimum tax.

• A sale or exchange of Fund shares is a taxable event. This means that you may have a capital gain to report as income, or a capital loss to report as a deduction, when you complete your tax return.

• Any conversion between classes of shares of the same fund is a nontaxable event. By contrast, an exchange between classes of shares of different funds is a taxable event.

Individuals, trusts, and estates whose income exceeds certain threshold amounts will be subject to a 3.8% Medicare contribution tax in tax years beginning on or after January 1, 2013, on “net investment income.” Net investment income includes dividends paid by the Fund and capital gains from any sale or exchange of Fund shares.

Dividend and capital gains distributions that you receive, as well as your gains or losses from any sale or exchange of Fund shares, may be subject to state and local income taxes. Income dividends from interest earned on municipal securities of a state or its political subdivisions are generally exempt from that state’s income taxes. Almost all states, however, tax interest earned on municipal securities of other states.

This proxy statement provides general tax information only. Please consult your tax advisor for detailed information about any tax consequences for you.

General Information

18

Backup withholding. By law, Vanguard must withhold 28% of any taxable distributions or redemptions from your account if you do not:

- Provide us with your correct taxpayer identification number;

- Certify that the taxpayer identification number is correct; and

- Confirm that you are not subject to backup withholding.

Similarly, Vanguard must withhold taxes from your account if the IRS instructs us to do so.

Foreign investors. Vanguard funds offered for sale in the United States (Vanguard U.S. funds), including the Funds offered in this prospectus, generally are not sold outside the United States, except to certain qualified investors. Non-U.S. investors should be aware that U.S. withholding and estate taxes and certain U.S. tax reporting requirements may apply to any investments in Vanguard U.S. funds.

Invalid addresses. If a dividend or capital gains distribution check mailed to your address of record is returned as undeliverable, Vanguard will automatically reinvest the distribution and all future distributions until you provide us with a valid mailing address. Reinvestments will receive the net asset value calculated on the date of the reinvestment.

Frequent-Trading Policy

Because excessive transactions can disrupt management of a Fund and increase the Fund’s costs for all shareholders, the board of trustees of each Vanguard fund places certain limits on frequent trading in the funds. Each Vanguard fund (other than money market funds and short-term bond funds) limits an investor’s purchases or exchanges into a fund account for 60 calendar days after the investor has redeemed or exchanged out of that fund account. ETF Shares are not subject to these frequent-trading limits.

For Vanguard Retirement Investment Program pooled plans, the limitations apply to exchanges made online or by phone.

These frequent-trading limitations do not apply to the following:

• Purchases of shares with reinvested dividend or capital gains distributions.

• Transactions through Vanguard’s Automatic Investment Plan, Automatic Exchange Service, Direct Deposit Service, Automatic Withdrawal Plan, Required Minimum Distribution Service, and Vanguard Small Business Online®.

• Redemptions of shares to pay fund or account fees.

• Transaction requests submitted by mail to Vanguard from shareholders who hold their accounts directly with Vanguard or through a Vanguard brokerage account. (Transaction requests submitted by fax, if otherwise permitted, are subject to the limitations.) • Transfers and reregistrations of shares within the same fund.

• Purchases of shares by asset transfer or direct rollover.

• Conversions of shares from one share class to another in the same fund. • Checkwriting redemptions.

• Section 529 college savings plans.

19

• Certain approved institutional portfolios and asset allocation programs, as well as trades made by Vanguard funds that invest in other Vanguard funds. (Please note that shareholders of Vanguard’s funds of funds are subject to the limitations.)

For participants in employer-sponsored defined contribution plans,* the frequent-trading limitations do not apply to: • Purchases of shares with participant payroll or employer contributions or loan repayments.