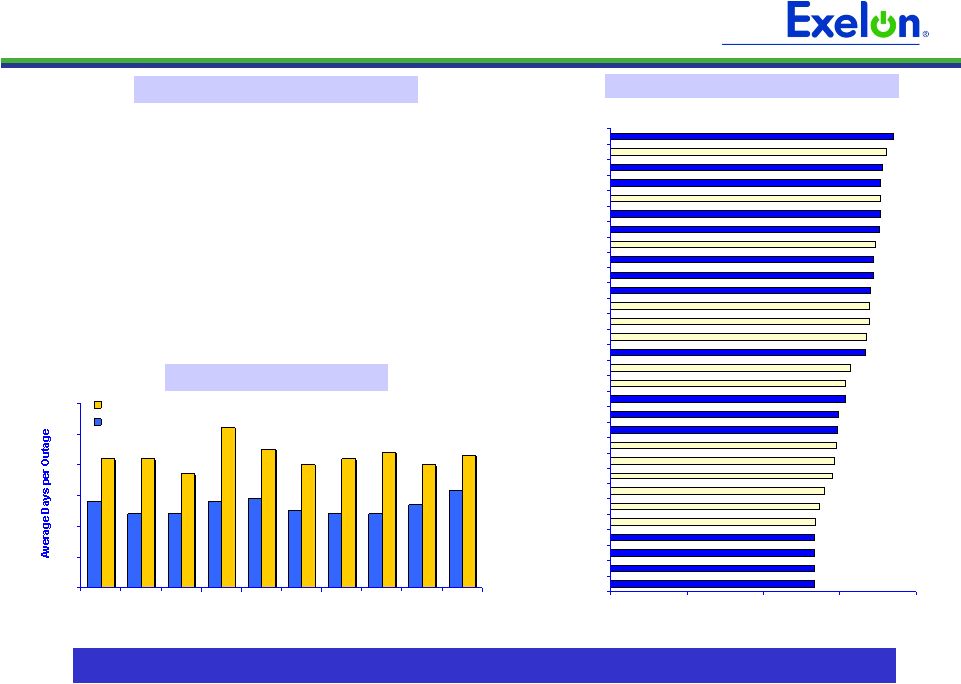

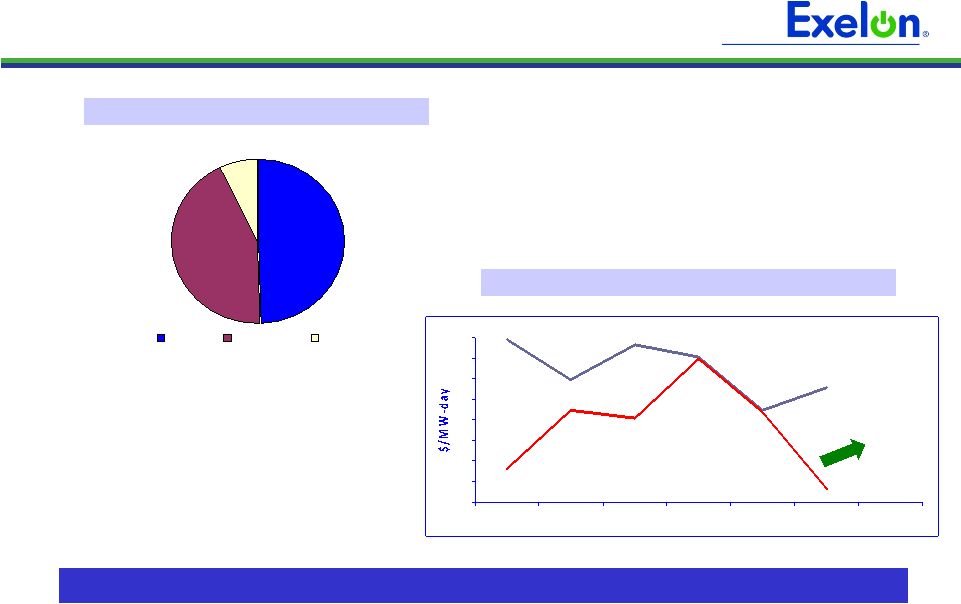

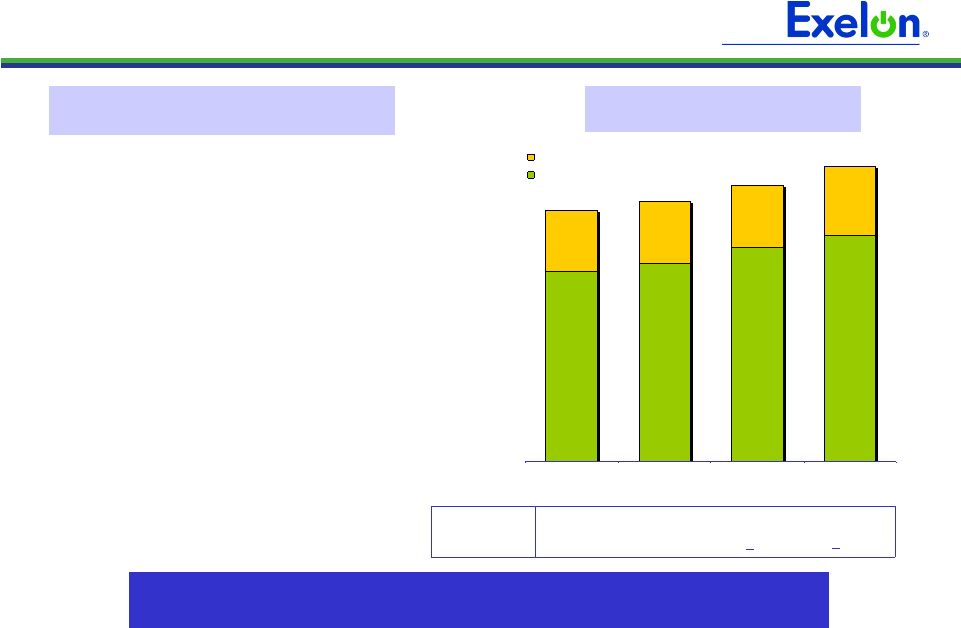

6 6.1 6.9 2.0 2.0 7.3 6.4 2.0 2.2 Transmission Distribution ComEd Building Strength Producing Results with Regulatory Recovery Plan ~46% ~47% 8.5% 46.4% Earned ROE Equity (1) 5.5% 45.4% $8.1 $8.4 $9.4 2008 2009 2011 (Illustrative) (2) Average Annual Rate Base ($ in billions) (1) Equity based on definition provided in most recent Illinois Commerce Commission (ICC) distribution rate case order (book equity less goodwill). (2) Provided solely to illustrate possible future outcomes that are based on a number of different assumptions, including an ROE target, all of which are subject to uncertainties and should not be relied upon as a forecast of future results. Note: Amounts may not add due to rounding. 2010E $8.9 ComEd executing on regulatory recovery plan resulting in healthy increases in earned ROE >10% >10% • Significant improvement in earned ROE, from 5.5% in 2008 to 8.5% in 2009, targeting at least 10% in 2010 • Continued strong operational performance • Anticipate electric distribution rate filing in 2Q 2010 • Benefiting from regular transmission updates through a formula rate plan • Illinois Power Agency’s 2010 procurement plan event scheduled to take place in April-May 2010 • Uncollectibles expense rider tariff approved by ICC in February 2010 • Smart Meter pilot program and rider approved by ICC and underway • Standard & Poor’s raised credit ratings in 3Q09 and Fitch in 1Q10 |