Earnings Conference Call • 1 st Quarter 2010 April 23, 2010 Exhibit 99.2 |

2 Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from these forward-looking statements include those discussed herein as well as those discussed in (1) Exelon’s 2009 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2) Exelon’s First Quarter 2010 Quarterly Report on Form 10-Q (to be filed on April 23, 2010) in (a) Part II, Other Information, Item 1A. Risk Factors and (b) Part I, Financial Information, Item 1. Financial Statements: Note 12 and (3) other factors discussed in filings with the Securities and Exchange Commission (SEC) by Exelon Corporation, Commonwealth Edison Company, PECO Energy Company and Exelon Generation Company, LLC (Companies). Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Companies undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. This presentation includes references to adjusted (non-GAAP) operating earnings and non- GAAP cash flows that exclude the impact of certain factors. We believe that these adjusted operating earnings and cash flows are representative of the underlying operational results of the Companies. Please refer to the appendix to this presentation for a reconciliation of adjusted (non-GAAP) operating earnings to GAAP earnings. Please refer to the footnotes of the following slides for a reconciliation non-GAAP cash flows to GAAP cash flows. |

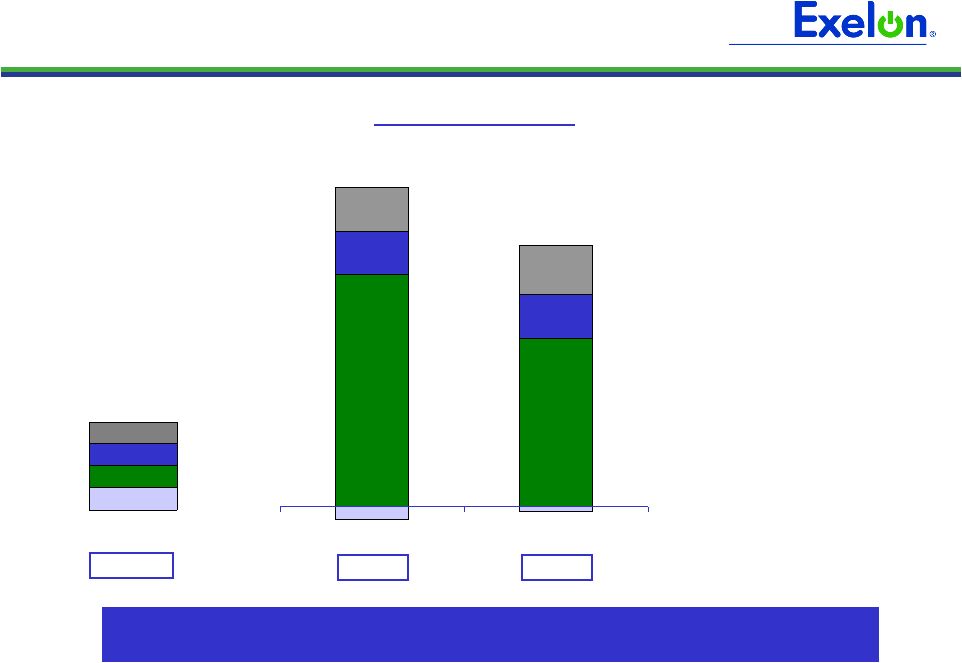

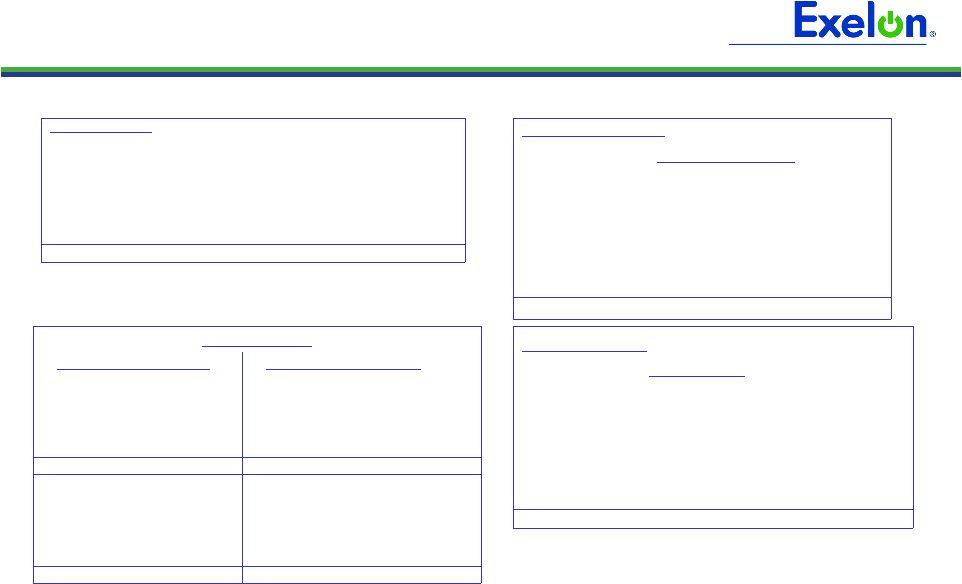

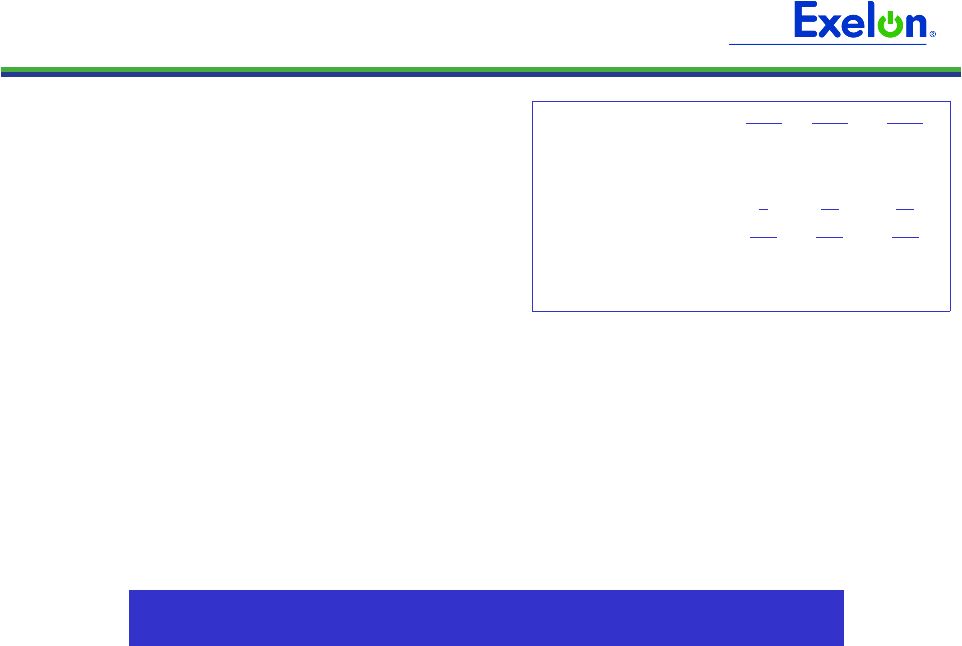

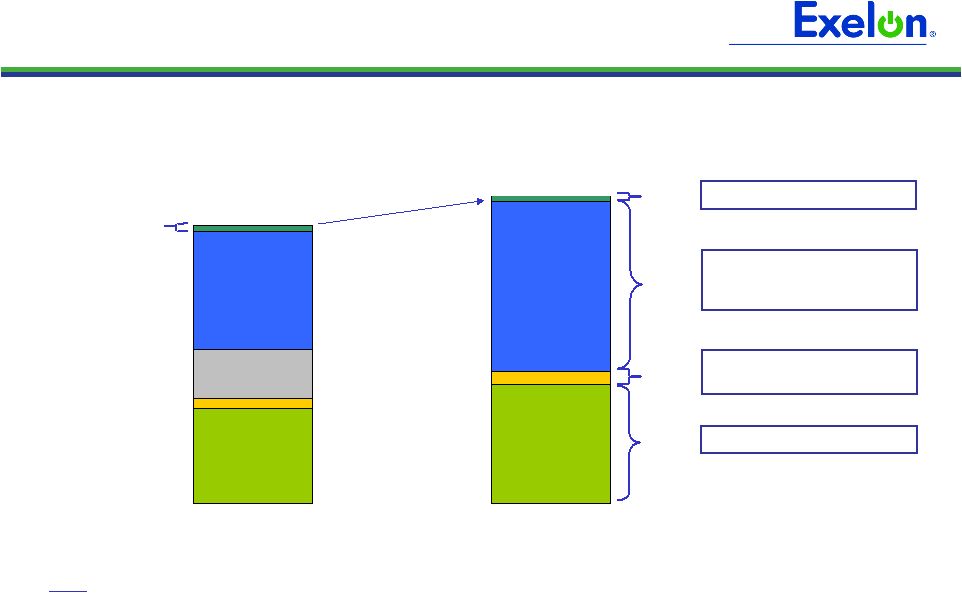

3 2010 Operating Earnings Guidance 2010 Revised 2010 Original $0.40 - $0.50 $2.55 - $2.80 $3.60 - $4.00 (1) ComEd PECO Exelon Generation ComEd PECO Exelon Generation Holdco Holdco Exelon $0.60 - $0.70 Exelon $3.70 - $4.00 (1) $0.60 - $0.70 $0.40 - $0.50 $2.70 - $2.90 Revising 2010 operating earnings guidance to $3.70 – $4.00/share (1) Key Drivers of Guidance Revision + Higher Exelon Generation revenue net fuel + Improved PECO load outlook + Final 2010 pension/OPEB expense lower than anticipated (1) Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. |

4 Key Financial Messages Operating results for 1Q10 • Operating earnings of $1.00/share (1) • 92.3% nuclear capacity factor • Initial signs of economic recovery with improved load outlook in our service areas Revising 2010 operating earnings guidance to $3.70 - $4.00/share (1) • Expect 2Q10 earnings in the range of $0.80 - $0.90/share • On track to meet 2010 O&M targets Improved cash flow from operations for 2010 (2) • Anticipate using cash and debt to make an incremental pension contribution of about $500 million Executing regulatory plan at PECO and ComEd • PECO filed electric and gas distribution rate cases on March 31, 2010 • ComEd is planning to file electric distribution rate case in 2Q10 (1) Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (2) Cash Flow from Operations primarily includes net cash flows provided by operating activities (excluding counterparty collateral activity) and net cash flows used in investing activities other than capital expenditures. Note: Data contained on this slide is rounded. |

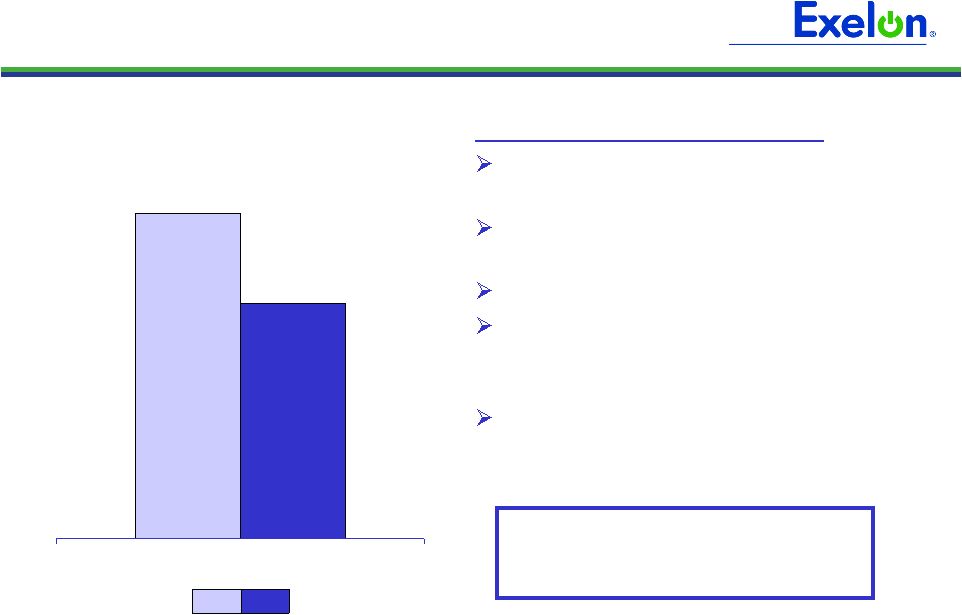

5 $0.91 $0.17 $0.66 $0.17 $0.19 $0.17 2009 2010 Operating EPS HoldCo/Other ExGen PECO ComEd 1st Quarter (1Q) (1) Lower ExGen margins are driving lower quarter over quarter earnings; however, 1Q10 earnings were higher than the guidance of $0.85 - $0.95/share (1) Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. $1.08 $1.13 GAAP EPS $1.00 $1.20 |

6 Exelon Generation Operating EPS Contribution 2010 2009 Key Drivers – 1Q10 vs. 1Q09 (1) Unfavorable market/portfolio conditions: $(0.05) Lower energy prices under the PECO PPA, offset at PECO: $(0.05) Lower nuclear volume: $(0.04) Higher O&M, primarily due to higher nuclear outage days, partially offset by cost management initiatives: $(0.04) Higher nuclear fuel costs: $(0.03) (1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (2) Outage days exclude Salem. 101 34 Refueling 5 13 Non-refueling 1Q10 1Q09 Outage Days (2) 1Q $0.91 $0.66 |

7 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 2007 2008 2009 2010 2011 2012 2013 2014 Actuals PJM Oct '09 FTR Auction 6/30/2009 12/31/2009 3/31/2010 Power Markets Update $32.19 $30.71 $29.73 Ni-Hub ATC ($/MWh) $43.47 $42.04 $39.69 PJM-W ATC ($/MWh) Reference Prices 2010 2011 2012 Percentage of Expected Generation Hedged (1) 95-98% 79-82% 48-51% Midwest 92-95 79-82 52-55 Mid-Atlantic 96-99 81-84 44-47 South 97-100 68-71 41-44 10,300 MW 8,700 MW 1,500 MW RTO EMAAC MAAC Capacity by Region Eligible for 2013/14 RPM Base Residual Auction (2) (1) See footnote 2 on page 34. (2) All generation values are approximate and not inclusive of wholesale transactions. Notes: All capacity values are in installed capacity terms (summer ratings) located in the areas. Reflects the retirements of Eddystone 1 and 2 and Cromby Station. MAAC = Mid-Atlantic Area Council; EMAAC = Eastern MAAC; MAAC area encompasses EMAAC 7% 50% 43% Key drivers expected to impact clearing prices: • Rule change allowing existing demand response resources to bid in above $0 • PJM raised the forecast for demand by 1.7% • First Energy has joined PJM with a net load increase • Delay in Susquehanna-Roseland Transmission line reduces available import capability into EMAAC • Net CONE increasing by 15% and 23% for RTO and EMAAC, respectively AEP-Dayton / NiHub ATC Energy Basis As of March 31, 2010 |

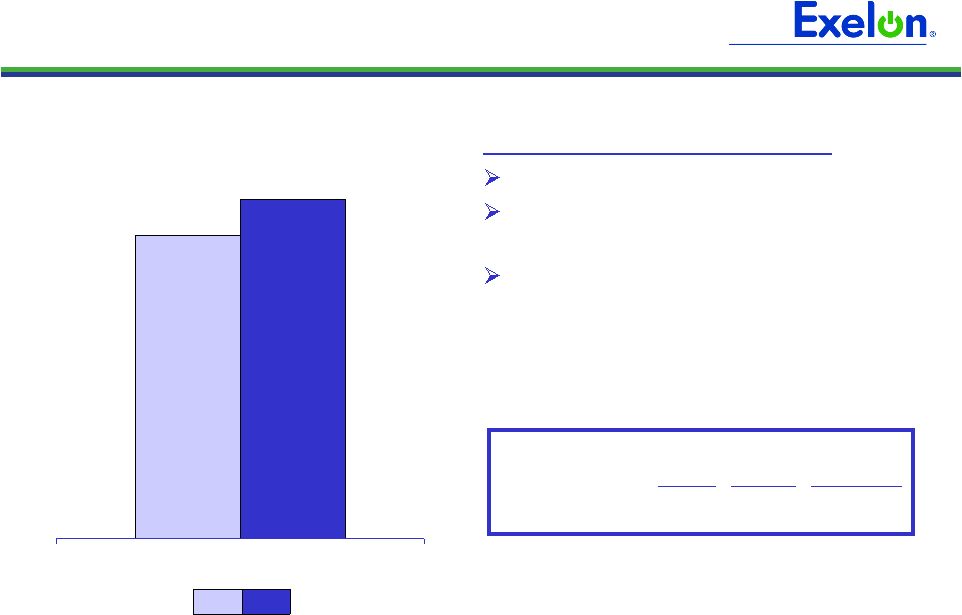

8 Key Drivers – 1Q10 vs. 1Q09 (1) Uncollectible expense rider: $0.06 Lower O&M primarily due to cost management initiatives: $0.03 ‘09 benefit from Illinois tax ruling, which was later reversed in 3Q09: $(0.05) ComEd Operating EPS Contribution (1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. 2010 2009 1Q $0.17 $0.19 1Q10 Actual Normal % Change Heating Degree Days 3,110 3,208 (3.1)% |

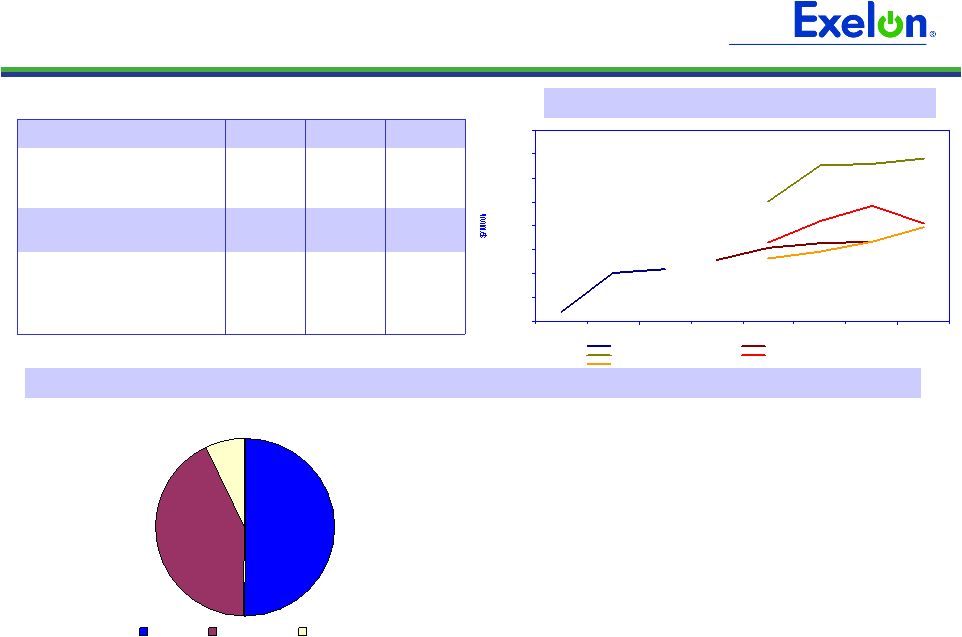

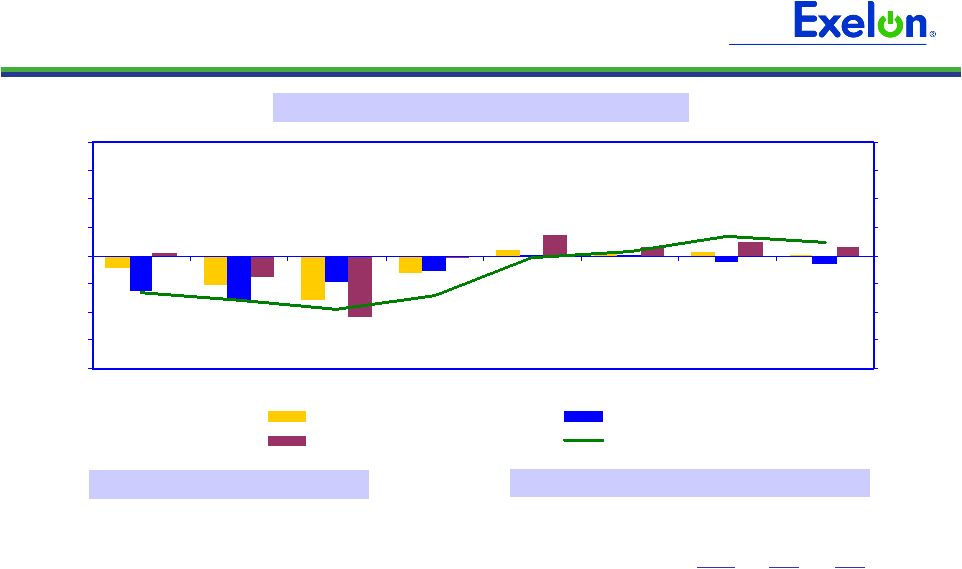

9 -10.0% -7.5% -5.0% -2.5% 0.0% 2.5% 5.0% 7.5% 10.0% 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10E 3Q10E 4Q10E -10.0% -7.5% -5.0% -2.5% 0.0% 2.5% 5.0% 7.5% 10.0% All Customer Classes Large C&I Residential Gross Metro Product ComEd Load Trends Weather-Normalized Load Key Economic Indicators Note: C&I = Commercial & Industrial Weather-Normalized Load Year-over-Year (4) Chicago Unemployment rate (1) 10.9% 2010 annualized growth in gross domestic/metro product (2) 2.9% 1/10 Home price index (3) (4.4)% (1) Source: Illinois Dept. of Employment Security (February 2010) (2) Source: Global Insight (March 2010) (3) Source: S&P Case-Shiller Index (4) Not adjusted for leap year effect 2009 (4) 1Q10 2010E Average Customer Growth (0.4)% (0.1)% 0.1% Average Use-Per-Customer (1.0)% 0.2% 0.1% Total Residential (1.4)% 0.1% 0.2% Small C&I (2.2)% (1.7)% 0.4% Large C&I (6.7)% (1.1)% 1.7% All Customer Classes (3.3)% (0.8)% 0.8% |

10 ComEd Credit Facility One of the largest utility bank refinancings launched to-date in 2010, with strong participation and new benchmark pricing Successfully closed refinancing of $1 billion revolving credit facility on March 25 th • 3-year unsecured facility; initial term to expire 3/25/13 • Use for general corporate purposes and letters of credit • Replaces previous $952 million facility that was due to expire on 2/16/11 Moved the bar on market pricing • Undrawn fee of 0.375%; fully drawn fee of LIBOR + 2.25% • Refinancing deals for similar rated utilities launched late last year priced approximately 0.50-0.75% higher (drawn fee) Reflects strong relationships with large, diverse bank group • 22 banks in facility – none with exposure of more than 6% • Syndication 1.6x oversubscribed |

11 PECO Operating EPS Contribution Key Drivers – 1Q10 vs. 1Q09 (1) Lower energy prices paid to Generation under the PPA, offset at Generation: $0.05 Increased storm costs: $(0.01) CTC amortization: $(0.04) 2010 2009 (1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. 1Q $0.17 $0.17 1Q10 Actual Normal % Change Heating Degree Days 2,411 2,510 (3.9)% |

12 PECO Load Trends Weather-Normalized Electric Load Key Economic Indicators Weather-Normalized Load Year-over-Year (3) Philadelphia Unemployment rate (1) 9.2% 2010 annualized growth in gross domestic/metro product (2) 0.8% (1) Source: U.S Dept. of Labor (PHL - February 2010) (2) Source: Moody’s Economy.com (March 2010) (3) Not adjusted for leap year effect -10.0% -7.5% -5.0% -2.5% 0.0% 2.5% 5.0% 7.5% 10.0% 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10E 3Q10E 4Q10E -10.0% -7.5% -5.0% -2.5% 0.0% 2.5% 5.0% 7.5% 10.0% All Customer Classes Large C&I Residential Gross Metro Product Note: C&I = Commercial & Industrial 2009 (3) 1Q10 2010E Average Customer Growth (0.2)% (0.2)% (0.0)% Average Use-Per-Customer (2.1)% 2.1% 1.2% Total Residential (2.3)% 1.8% 1.1% Small C&I (2.7)% (0.9)% (0.2)% Large C&I (3.0)% 0.1% (0.3)% All Customer Classes (2.6)% 0.5% 0.3% |

13 PECO – Electric & Gas Distribution Rate Case Filings On March 31, PECO filed electric and gas distribution rate cases • First electric distribution rate case since 1989 – Act 129 energy efficiency and smart meter costs recovered separately through rider • Last gas delivery rate case in 2008 53.18% 53.18% Common Equity Ratio R-2010-216-1592 R-2010-216-1575 Docket # 2010 (1) 2010 (1) Test Year ROE: 11.75% ROR: 8.95% ROE: 11.75% ROR: 8.95% Requested Returns $1,100 million $3,236 million Rate Base 6.94% (2) $316 million Electric $44 million Revenue Requirement Increase 5.28% 2011 Proposed Distribution Price Increase as % of Overall Customer Bill Gas Rate Case Request The PAPUC has a nine-month process for litigation of the rate case filings (1) With pro forma adjustments. (2) Excluding Alternative Energy Portfolio Standards and default service surcharge. Note: Electric and gas rate case filings available on PAPUC website or www.peco.com/know. |

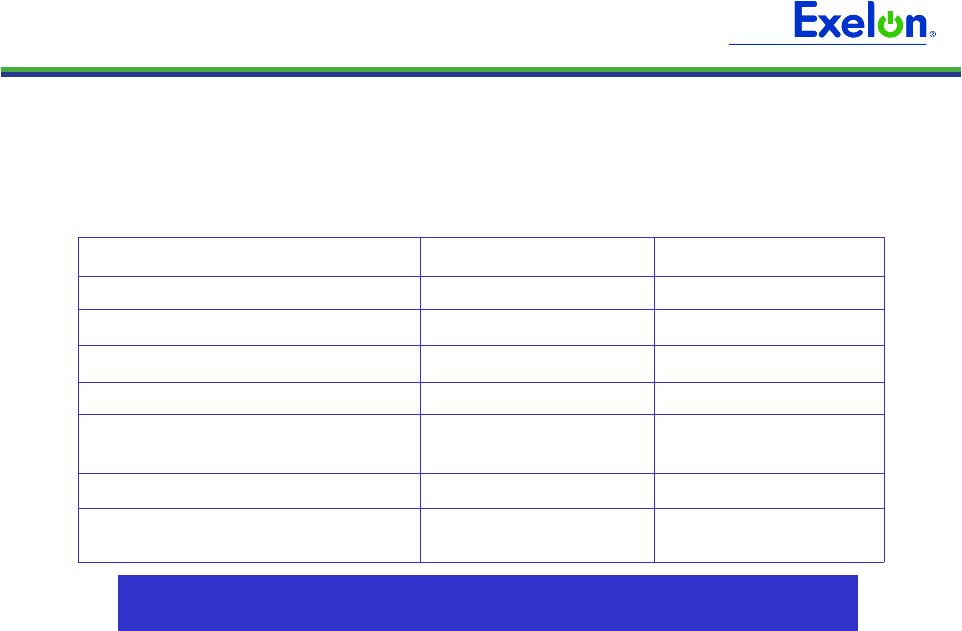

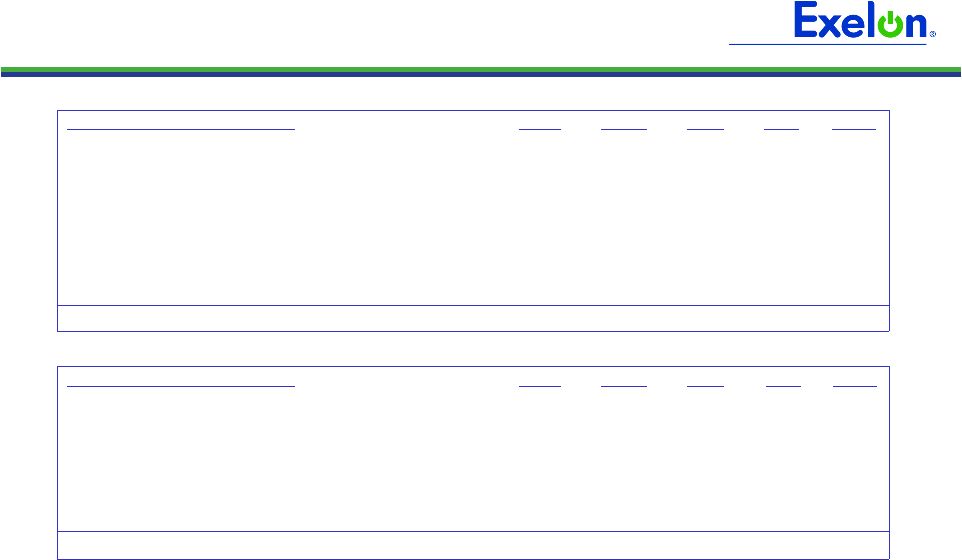

14 2010 Projected Sources and Uses of Cash ($ millions) Exelon (9) Beginning Cash Balance (1) $1,050 Cash Flow from Operations (1)(2) 975 1,050 2,475 4,600 CapEx (excluding Nuclear Fuel, Nuclear Uprates and Solar Project, Utility Growth CapEx) (675) (400) (775) (1,900) Nuclear Fuel n/a n/a (850) (850) Dividend (3) (1,400) Nuclear Uprates and Solar Project n/a n/a (350) (350) Utility Growth CapEx (4) (250) (100) n/a (350) Net Financing (excluding Dividend): Planned Debt Issuances (5)(6) 500 -- 250 750 Planned Debt Retirements (7) (225) (400) -- (1,025) Other (8) (75) 175 -- (25) Ending Cash Balance (1) $500 (1) Excludes counterparty collateral activity. (2) Cash Flow from Operations primarily includes net cash flows provided by operating activities and net cash flows used in investing activities other than capital expenditures. Cash Flow from Operations for PECO and Exelon includes $551 million for competitive transition charges. (3) Assumes 2010 dividend of $2.10/share. Dividends are subject to declaration by the Board of Directors. (4) Represents new business and smart grid/smart meter investment. (5) Excludes Exelon Generation’s $212 million and ComEd’s $191 million of tax-exempt bonds that are backed by letters of credit (LOCs). Excludes PECO’s $225 million Accounts Receivable (A/R) Agreement with Bank of Tokyo. Assumes PECO’s A/R Agreement is extended in accordance with its terms beyond September 16, 2010. (6) Exelon Generation’s financing includes $250 million of debt to refinance a portion of Exelon Corp’s $400 million maturity. (7) Excludes Exelon Generation’s and ComEd’s tax-exempt bonds. PECO’s planned debt retirement of $400 million represents the final retirement of the PECO Energy Transition Trust. (8) “Other” includes PECO Parent Receivable, proceeds from options and expected changes in short-term debt. (9) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. |

15 Appendix |

16 2010 Events of Interest Q1 Q2 Q3 Q4 RPM Base Residual Auction (May) Uncollectibles rider tariff (2/2) Illinois Power Agency supply procurement RFP (4/28, ICC decision to follow) Illinois Primaries (2/2) Pennsylvania Primaries (5/18) Electric and gas distribution rate case filings (3/31) Procurement RFP (May, results in June) Procurement RFP (Sep., results in Oct.) Electric distribution rate case filing (2Q) Illinois Elections (11/2) Pennsylvania Elections (11/2) |

17 Sufficient Liquidity (1) Excludes previous commitment from Lehman Brothers Bank and commitments from Exelon’s Community and Minority Bank Credit Facility. (2) Available Capacity Under Facilities represents the unused bank commitments under the borrower’s credit agreements net of outstanding letters of credit and facility draws. The amount of commercial paper outstanding does not reduce the available capacity under the credit agreements. (3) Includes other corporate entities. -- -- -- -- Outstanding Facility Draws (431) (163) (3) (261) Outstanding Letters of Credit $7,365 $4,834 $574 $1,000 Aggregate Bank Commitments (1) 6,934 4,671 571 739 Available Capacity Under Facilities (2) (164) -- -- (164) Outstanding Commercial Paper $6,770 $4,671 $571 $575 Available Capacity Less Outstanding Commercial Paper Exelon (3) ($ millions) Exelon bank facilities are largely untapped Available Capacity Under Bank Facilities as of April 15, 2010 |

18 Projected 2010 Key Credit Measures 14.3x 9.4x FFO / Interest Generation / Corp: 68% 39% FFO / Debt 54% 68% Rating Agency Debt Ratio BBB A- A- BBB- S&P Credit Ratings (3) BBB+ A BBB+ BBB+ Fitch Credit Ratings (3) A3 A2 Baa1 Baa1 Moody’s Credit Ratings (3) 4.7x 5.2x FFO / Interest ComEd: 23% 21% FFO / Debt 43% 48% Rating Agency Debt Ratio 5.1x 5.0x FFO / Interest PECO: 26% 23% FFO / Debt 45% 49% Rating Agency Debt Ratio 29% 45% Rating Agency Debt Ratio 94% 47% FFO / Debt 20.9x 11.4x FFO / Interest Generation: 47% 41% 8.0x Without PPA & Pension / OPEB (2) 56% Rating Agency Debt Ratio 30% FFO / Debt 7.1x FFO / Interest Exelon Consolidated: With PPA & Pension / OPEB (1) Notes: Exelon and PECO metrics exclude securitization debt. See following slide for FFO (Funds from Operations)/Interest, FFO/Debt and Adjusted Book Debt Ratio reconciliations to GAAP. (1) FFO/Debt metrics include the following standard adjustments: debt equivalents for PV of Operating Leases, PPAs, unfunded Pension and OPEB obligations (after-tax), Capital Adequacy for Energy Trading, and other minor debt equivalents. (2) Excludes items listed in note (1) above. (3) Current senior unsecured ratings for Exelon and Exelon Generation and senior secured ratings for ComEd and PECO as of April 20, 2010. |

19 FFO Calculation and Ratios + Other Non-Cash items (1) - AFUDC/Cap. Interest - Decommissioning activity +/- Change in Working Capital FFO Calculation = FFO - PECO Transition Bond Principal Paydown Net Cash Flows provided by Operating Activities Net Interest Expense Adjusted Interest FFO + Adjusted Interest = Adjusted Interest + 6% interest on Present Value (PV) of Operating Leases + Interest on imputed debt related to PV of Purchased Power Agreements (PPA) + AFUDC & Capitalized interest - PECO Transition Bond Interest Expense FFO Interest Coverage FFO = Adjusted Debt + Off-balance sheet debt equivalents (2) - PECO Transition Bond Principal Balance + STD + LTD Debt: Adjusted Debt (3) FFO Debt Coverage Rating Agency Capitalization Rating Agency Debt Total Adjusted Capitalization Adjusted Book Debt = Total Rating Agency Capitalization + Off-balance sheet debt equivalents (2) Total Adjusted Capitalization = Rating Agency Debt + Off-balance sheet debt equivalents (2) Adjusted Book Debt = Total Adjusted Capitalization + Adjusted Book Debt + Preferred Securities of Subsidiaries + Total Shareholders' Equity Capitalization: = Adjusted Book Debt - Transition Bond Principal Balance + STD + LTD Debt: Debt to Total Cap (1) Reflects depreciation adjustment for PPAs and operating leases. (2) Metrics are calculated in presentation unadjusted and adjusted for debt equivalents for PV of Operating Leases, PPAs, unfunded Pension and OPEB obli gations (after-tax), Capital Adequacy for Energy Trading, and other minor debt equivalents. (3) Uses current year-end adjusted debt balance. |

20 1Q GAAP EPS Reconciliation NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. (0.05) - - - (0.05) Unrealized losses related to nuclear decommissioning trust funds (0.01) (0.01) - - - NRG acquisition costs (0.03) - - - (0.03) 2007 Illinois electric rate settlement 0.17 - - - 0.17 Mark-to-market adjustments from economic hedging activities (0.20) - - - (0.20) Impairment of certain generating assets $1.08 $(0.06) $0.17 $0.17 $0.80 1Q09 GAAP Earnings (Loss) Per Share $1.20 $(0.05) $0.17 $0.17 $0.91 2009 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share Exelon Other PECO ComEd ExGen Three Months Ended March 31, 2009 (0.01) - - - (0.01) Retirement of fossil generating units 0.03 - - - 0.03 Unrealized gains related to nuclear decommissioning trust funds 0.21 - - - 0.21 Mark-to-market adjustments from economic hedging activities (0.10) (0.02) (0.02) (0.02) (0.04) Non-cash charge resulting from healthcare legislation $1.13 $(0.04) $0.15 $0.17 $0.85 1Q10 GAAP Earnings (Loss) Per Share $1.00 $(0.02) $0.17 $0.19 $0.66 2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share Exelon Other PECO ComEd ExGen Three Months Ended March 31, 2010 |

21 Retiring Cromby Station and Eddystone Units 1&2 • Cromby Station – Placed in service in 1954-55 – 144 MW coal and 201 MW oil/gas • Eddystone Station Units 1&2 – Placed in service in 1960 – 588 MW of coal capacity at units 1&2 – Units 3&4 (760 MW oil/gas) and 4 peaking units (60 MW) will continue to operate • Retirements yield ~$165-200 million incremental NPV vs. continuing to operate the units – Avoids ongoing operating and capital costs on aging units – Cromby and Eddystone have not cleared in the past two RPM capacity auctions (2011/12 and 2012/13) – Anticipates more stringent environmental regulations and avoids related capital investment • Agreed to delay deactivation of two units to maintain reliability, provided receipt of required environmental permits and adequate cost-based compensation – Maintaining scheduled retirement date of 5/31/11 for Cromby 1 and Eddystone 1; delaying Cromby 2 to 5/31/12 and Eddystone 2 to 12/31/13 – Pursuing RMR to compensate for cost of maintaining and operating units beyond 5/31/11 $80 $85 $40 Capital Expenditure Reduction $40 $18 $24 Incremental Pre-Tax Operating Income 45 22 0 Depreciation Savings 75 46 24 Operating O&M Savings $(80) $(50) $0 Revenue Net Fuel 2012 2011 2010 ($ in millions) Smaller, less efficient coal plants are challenged by economic and environmental considerations Ongoing Savings Impact Note: RMR = reliability must-run agreement |

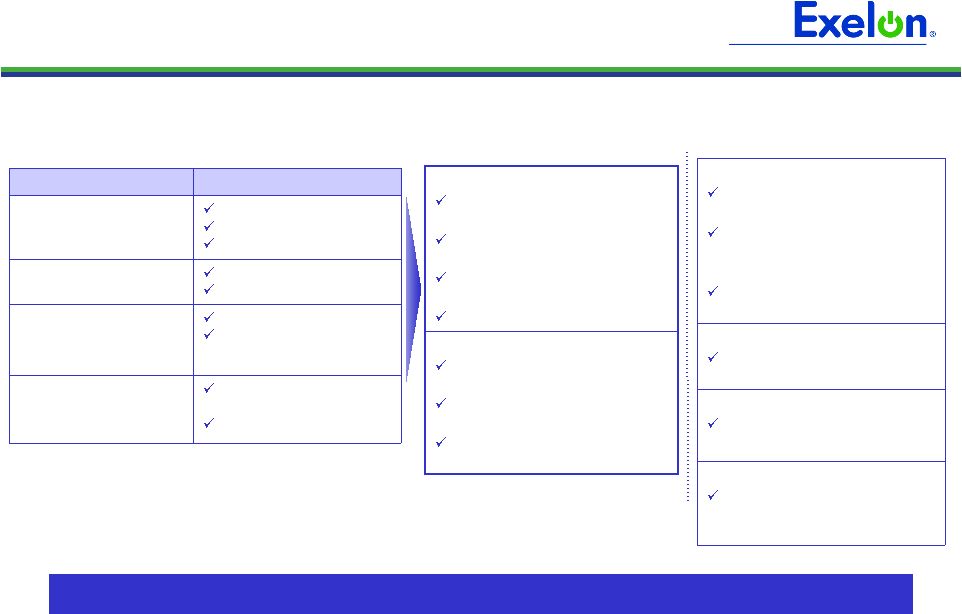

22 Illinois Power Agency (IPA) RFP Procurement • On December 28, 2009, the Illinois Commerce Commission approved the IPA’s Updated Procurement Plan for the 2010/11 planning period, which includes the procurement of: – Monthly peak and off-peak standard wholesale block energy products – 1,887,014 MWh of Renewable Energy Credits (RECs) – 1,400,000 MWh/year of renewable energy and associated RECs through 20-year contracts beginning delivery in June 2012 Delivery Period Peak Off-Peak June 2010 - May 2011 5,528 4,344 June 2011 - May 2012 1,980 549 Volume to be procured in the 2010 IPA Procurement Event (GWh) Note: Chart is for illustrative purposes only. Data on this slide is rounded. 2009 RFP 2009 RFP 2010 RFP 2010 RFP 2011 RFP 2011 RFP 2011 RFP 2012 RFP 2012 RFP 2013 RFP Financial Swap Auction Contract Jun 2009 Jun 2010 Jun 2011 Jun 2012 Jun 2013 Jun 2014 By May 26 By May 5 ComEd files retail generation rates By May 24 By May 3 ICC decision on RFP results and public release of wholesale energy prices By May 19 By April 29 Procurement administrator submits confidential report May 18 April 28 Bids due April 7 – 20 April 7 – 13 Potential bidders submit qualifying proposals RECs (1) Standard Product Event 2010 RFP – Key Dates (1) Timeline and procurement administrator for long-term PPAs has not yet been determined by the IPA. |

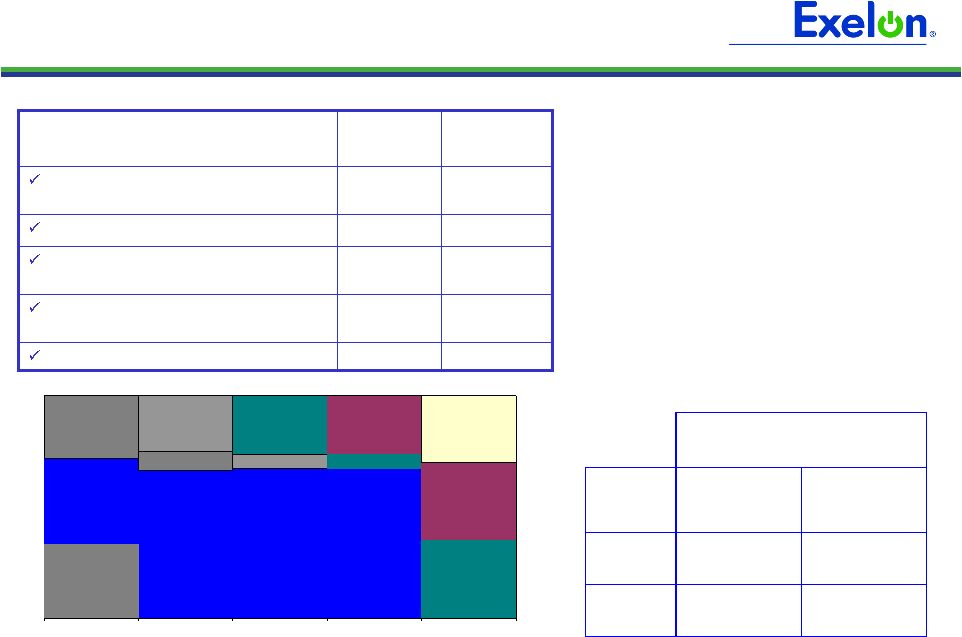

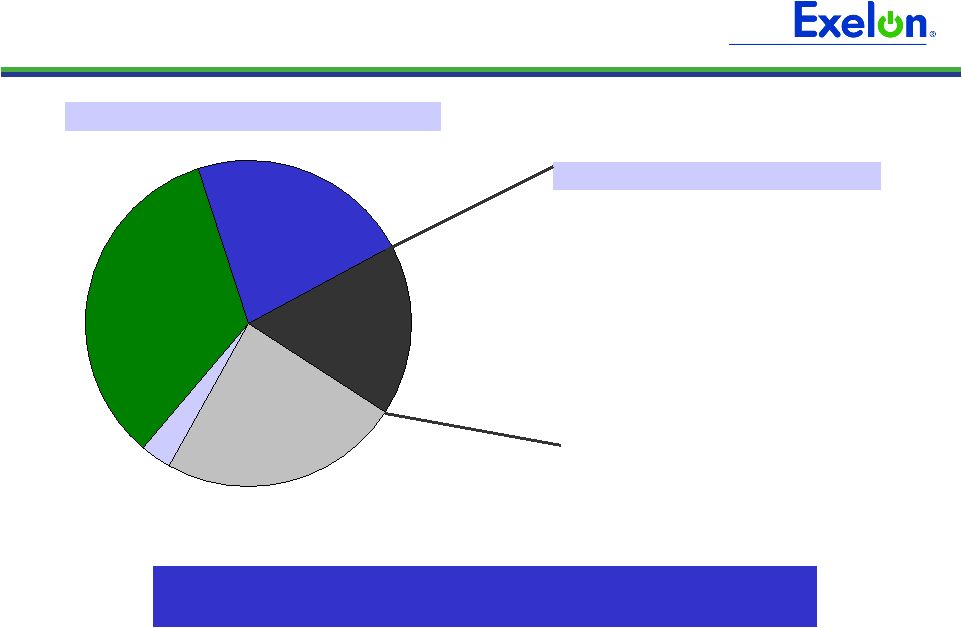

23 ComEd Customer Usage Breakdown Customer Usage by Revenue Class Top 380 Customer Usage by Segment 3% Leisure & Hospitality 9% Trade, Transportation & Utilities 11% Finance, Professional & Business Services 12% Health & Educational Services 13% Government 52% Manufacturing Limited survey of select Large C&I customers has indicated an increase in production via longer production runs and additional shifts due to improved economic conditions for customers in the steel, automotive, and plastic industries Residential 31% Small C&I 36% 380 Large C&I 18% Other Large C&I 13% Other 2% |

24 PECO Procurement Results Next RFP to be held on May 24, 2010, with results public 30 days thereafter Residential Sept ’09 RFP average price of $79.96/MWh (2) June ’09 RFP average price of $88.61/MWh (2) 49% of full requirements product procured 80 MW of block energy procured Small and Medium Commercial Sept ’09 RFP average blended price of $85.85/MWh (2) 24% of Small Commercial full requirements product procured 16% of Medium Commercial full requirements product procured 85% full requirements 15% full requirements spot Medium Commercial (peak demand >100 kW but <= 500 kW) Fixed-Priced Full requirements (3) Hourly Full requirements Large Commercial & Industrial (peak demand >500 kW) 90% full requirements 10% full requirements spot 75% full requirements 20% block energy 5% energy only spot Products Small Commercial (peak demand <100 kW) Residential Customer Class PECO Procurement Plan (1) 2011 Supply procured to date (including June and September 2009 RFPs) Large Commercial and Industrial 100% of planned Fixed - price full requirements contracts (12-mo term) Residential 23% of planned full requirements contracts (17 and 29-mo terms) 140 MW of baseload (24x7) block energy products (12, 24 and 60-mo duration) 40 MW of Jan-Feb 2011 on-peak block energy Small Commercial 36% of planned full requirements contracts (17 and 29-mo term) Medium Commercial 42% of planned full requirements contracts (17-mo term) May 24, 2010 RFP (1) See PECO Procurement website (http://www.pecoprocurement.com) for additional details regarding PECO’s procurement plan and RFP results. (2) Wholesale prices; no Small/Medium Commercial products were procured in the June RFP. (3) For Large C&I customers who have opted to participate in the Fixed-priced Full requirements product. |

25 PECO – Timeline for Rate Cases • Filed: March 31, 2010 • Opposing Parties’ Testimony: June 2010 • Rebuttal Testimony: July 2010 • Hearings: August 2010 • Administrative Law Judge (ALJ) Orders: October 2010 • Final Orders Expected: December 2010 • New Rates Effective: January 1, 2011 Note: Dates are based on typical approach to rate cases but the Pennsylvania Public Utility Commission (PAPUC) will set the actual schedule. Expect schedule to be set at pre-hearing with ALJ around mid-May. |

26 5.03 6.26 6.23 0.51 0.70 2.57 9.01 PECO Electric Residential Rate Increases 2010 to 2011 January 1, 2011 January 1, 2010 Total = 14.7¢ Unit Rates (¢/kWh) Proposed Total Bill Increase ~11 % Total = 16.3¢ AEPS ~0.6% Default Service Surcharge Mechanism based on results of first two procurements ~1.2% Transmission surcharge mechanism ~1.3% Energy / Capacity Competitive Transition Charge Transmission Distribution Distribution rate case ~8.2% 0.38 Energy Efficiency Surcharge Breakdown of 2010 to 2011 ~11% Increase (On Total Bill) Notes: • Rates effective January 1, 2010 include Act 129 Energy Efficiency surcharge of 2%. • Act 129 Smart Meter surcharge will be calculated following approval of PECO’s Smart Meter Plan expected in 2Q10. The Smart Meter surcharge, which will likely be effective 3Q10, is expected to be less than 1% and is not expected to increase until 2Q/3Q of 2011. As a result, the Smart Meter surcharge will have a minimal impact on rate increases effective January 1, 2011. • Low income discounted rates were subsidized in the PPA in 2010 and will be recovered through distribution rates in 2011. 0.29 |

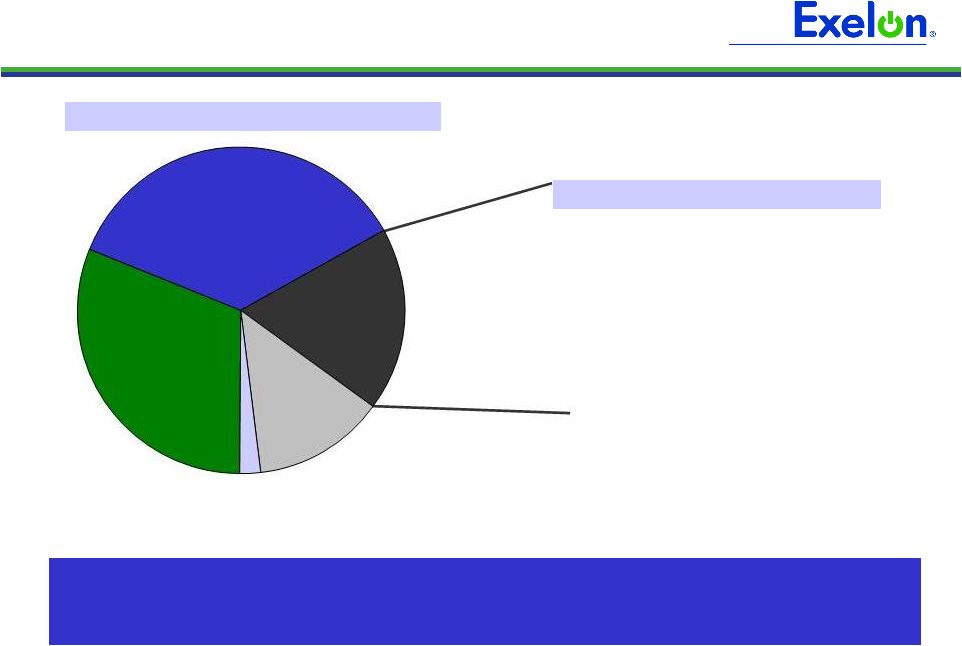

27 PECO Customer Usage Breakdown Other 3% Other Large C&I 24% 150 Large C&I 17% Small C&I 22% Residential 34% Customer Usage by Revenue Class Top 150 Customer Usage by Segment 7% Other 13% Transportation, Communication & Utilities 18% Health & Educational Services 18% Manufacturing 22% Petroleum 2% Retail Trade 9% Finance, Insurance & Real Estate 12% Pharmaceuticals PECO’s load is relatively diversified by customer class and industry; a slow recovery in the second half of 2010 is expected |

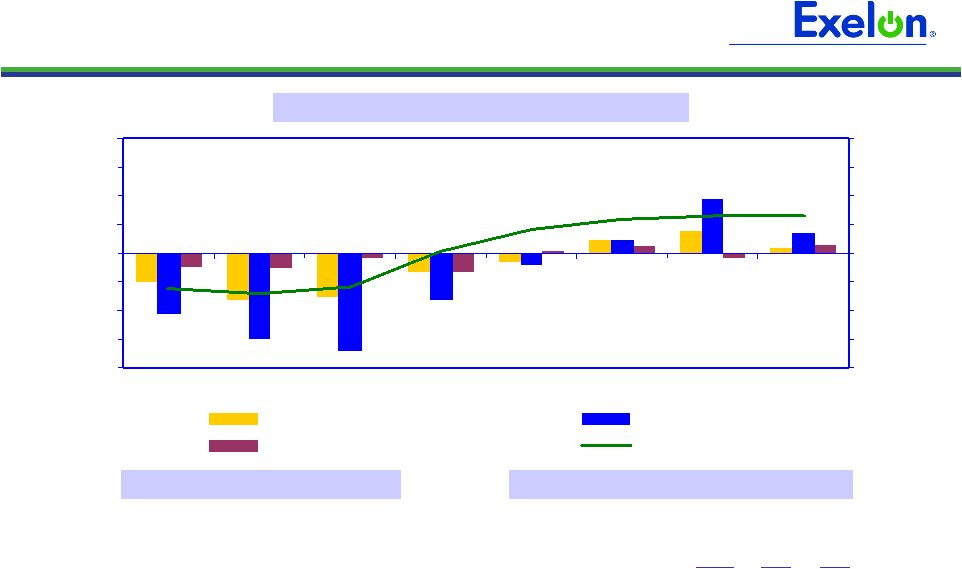

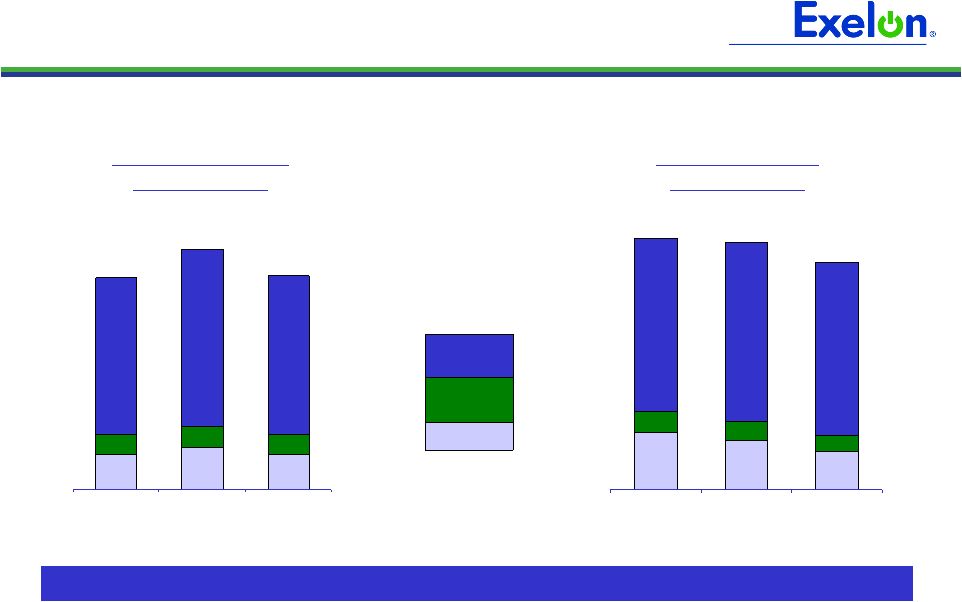

28 ComEd and PECO Accounts Receivable ComEd Accounts Receivable (1) Both ComEd and PECO continue to see an improvement in accounts receivable aging 1Q08 1Q09 1Q10 PECO Accounts Receivable (1) % of AR $846M $831M $764M (1) Accounts receivable amounts include unbilled receivables and are gross of allowance for uncollectible accounts at ComEd and PECO and include, for PECO, pledged and long-term receivables. >60 days 31-60 days 0-30 days Note: Data contained on this slide is rounded. 1Q08 1Q09 1Q10 $723M $730M $821M |

29 2010 Earnings Outlook Exelon’s 2010 adjusted (non-GAAP) operating earnings outlook excludes the earnings effects of the following: • Mark-to-market adjustments from economic hedging activities • Unrealized gains and losses from nuclear decommissioning trust fund investments to the extent not offset by contractual accounting as described in the notes to the consolidated financial statements • Significant impairments of assets, including goodwill • Changes in decommissioning obligation estimates • Costs associated with the 2007 Illinois electric rate settlement agreement • Costs associated with ComEd’s 2007 settlement with the City of Chicago • Costs associated with the retirement of fossil generating units • Non-cash charge resulting from passage of Federal health care legislation • Other unusual items • Significant future changes to GAAP Operating earnings guidance assumes normal weather for remainder of the year Operating O&M target excludes the following items: • Exelon Generation: Decommissioning accretion expense • ComEd: Impact of riders, primarily Rider EDA (Energy Efficiency and Demand Response Adjustment) • PECO: Impact of energy efficiency and smart grid/meter riders |

30 30 30 Important Information The following slides are intended to provide additional information regarding the hedging program at Exelon Generation and to serve as an aid for the purposes of modeling Exelon Generation’s gross margin (operating revenues less purchased power and fuel expense). The information on the following slides is not intended to represent earnings guidance or a forecast of future events. In fact, many of the factors that ultimately will determine Exelon Generation’s actual gross margin are based upon highly variable market factors outside of our control. The information on the following slides is as of March 31, 2010. Going forward, we plan to update the information on a quarterly basis. Certain information on the following slides is based upon an internal simulation model that incorporates assumptions regarding future market conditions, including power and commodity prices, heat rates, and demand conditions, in addition to operating performance and dispatch characteristics of our generating fleet. Our simulation model and the assumptions therein are subject to change. For example, actual market conditions and the dispatch profile of our generation fleet in future periods will likely differ – and may differ significantly – from the assumptions underlying the simulation results included in the slides. In addition, the forward- looking information included in the following slides will likely change over time due to continued refinement of our simulation model and changes in our views on future market conditions. |

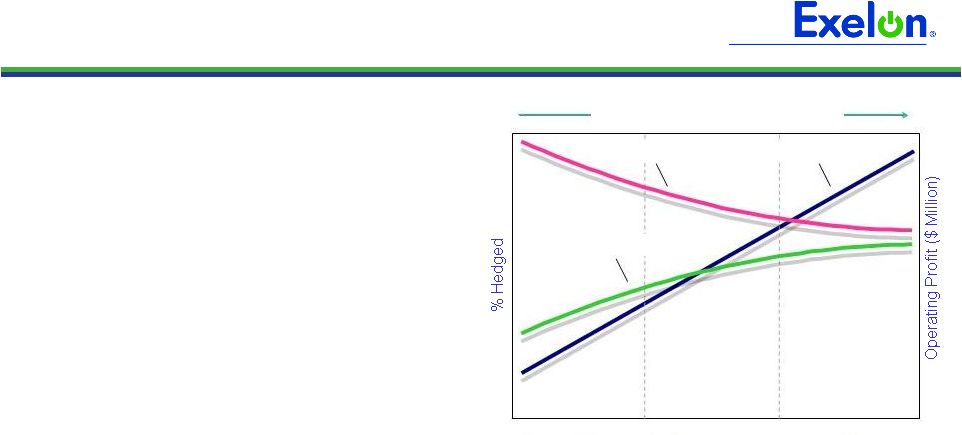

31 31 31 Portfolio Management Objective Align Hedging Activities with Financial Commitments • Power Team utilizes several product types and channels to market • Wholesale and retail sales • Block products • Load-following products and load auctions • Put/call options • Exelon’s hedging program is designed to protect the long-term value of our generating fleet and maintain an investment-grade balance sheet • Hedge enough commodity risk to meet future cash requirements if prices drop • Consider: financing policy (credit rating objectives, capital structure, liquidity); spending (capital and O&M); shareholder value return policy • Consider market, credit, operational risk • Approach to managing volatility • Increase hedging as delivery approaches • Have enough supply to meet peak load • Purchase fossil fuels as power is sold • Choose hedging products based on generation portfolio – sell what we own • Heat rate options • Fuel products • Capacity • Renewable credits % Hedged High End of Profit Low End of Profit Open Generation with LT Contracts Portfolio Optimization Portfolio Management Portfolio Management Over Time |

32 32 32 32 Percentage of Expected Generation Hedged • How many equivalent MW have been hedged at forward market prices; all hedge products used are converted to an equivalent average MW volume • Takes ALL hedges into account whether they are power sales or financial products Equivalent MWs Sold Expected Generation = • Our normal practice is to hedge commodity risk on a ratable basis over the three years leading to the spot market • Carry operational length into spot market to manage forced outage and load-following risks • By using the appropriate product mix, expected generation hedged approaches the mid-90s percentile as the delivery period approaches • Participation in larger procurement events, such as utility auctions, and some flexibility in the timing of hedging may mean the hedge program is not strictly ratable from quarter to quarter Exelon Generation Hedging Program |

33 33 33 33 2010 2011 2012 Estimated Open Gross Margin ($ millions) (1,2) $5,050 $4,900 $4,750 Open gross margin assumes all expected generation is sold at the Reference Prices listed below Reference Prices (1) Henry Hub Natural Gas ($/MMBtu) NI-Hub ATC Energy Price ($/MWh) PJM-W ATC Energy Price ($/MWh) ERCOT North ATC Spark Spread ($/MWh) (3) $4.48 $29.73 $39.69 $0.43 $5.34 $30.71 $42.04 $(0.42) $5.79 $32.19 $43.47 $0.14 Exelon Generation Open Gross Margin and Reference Prices (1) Based on March 31, 2010 market conditions. (2) Gross margin is defined as operating revenues less fuel expense and purchased power expense, excluding the impact of decommissioning and other incidental revenues. Open gross margin is estimated based upon an internal model that is developed by dispatching our expected generation to current market power and fossil fuel prices. Open gross margin assumes there is no hedging in place other than fixed assumptions for capacity cleared in the RPM auctions and uranium costs for nuclear power plants. Open gross margin contains assumptions for other gross margin line items such as various ISO bill and ancillary revenues and costs and PPA capacity revenues and payments. The estimation of open gross margin incorporates management discretion and modeling assumptions that are subject to change. (3) ERCOT North ATC spark spread using Houston Ship Channel Gas, 7,200 heat rate, $2.50 variable O&M. |

34 34 34 34 2010 2011 2012 Expected Generation (GWh) (1) 164,600 161,700 161,200 Midwest 98,600 98,100 97,000 Mid-Atlantic 58,000 56,600 56,600 South 8,000 7,000 7,600 Percentage of Expected Generation Hedged (2) 95-98% 79-82% 48-51% Midwest 92-95 79-82 52-55 Mid-Atlantic 96-99 81-84 44-47 South 97-100 68-71 41-44 Effective Realized Energy Price ($/MWh) (3) Midwest $46.50 $44.50 $44.50 Mid-Atlantic $36.00 $58.00 $51.50 ERCOT North ATC Spark Spread $0.50 $0.50 $(6.50) Generation Profile (1) Expected generation represents the amount of energy estimated to be generated or purchased through owned or contracted for capacity. Expected generation is based upon a simulated dispatch model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products, and options. Expected generation assumes 10 refueling outages in 2010 and 11 refueling outages in 2011 and 2012 at Exelon-operated nuclear plants and Salem. Expected generation assumes capacity factors of 93.5%, 92.8% and 92.8% in 2010, 2011 and 2012 at Exelon-operated nuclear plants. These estimates of expected generation in 2011 and 2012 do not represent guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. (2) Percent of expected generation hedged is the amount of equivalent sales divided by the expected generation. Includes all hedging products, such as wholesale and retail sales of power, options, and swaps. Uses expected value on options. Reflects decision to permanently retire Cromby Station and Eddystone Units 1&2 as of May 31, 2011. (3) Effective realized energy price is representative of an all-in hedged price, on a per MWh basis, at which expected generation has been hedged. It is developed by considering the energy revenues and costs associated with our hedges and by considering the fossil fuel that has been purchased to lock in margin. It excludes uranium costs and RPM capacity revenue, but includes the mark-to-market value of capacity contracted at prices other than RPM clearing prices including our load obligations. It can be compared with the reference prices used to calculate open gross margin in order to determine the mark-to-market value of Exelon Generation's energy hedges. |

35 35 35 35 Gross Margin Sensitivities with Existing Hedges ($ millions) (1) Henry Hub Natural Gas + $1/MMBtu - $1/MMBtu NI-Hub ATC Energy Price +$5/MWH -$5/MWH PJM-W ATC Energy Price +$5/MWH -$5/MWH Nuclear Capacity Factor +1% / -1% 2010 $40 $(20) $20 $(15) $5 $ - +/- $30 2011 $125 $(110) $125 $(115) $75 $(70) +/- $40 2012 $320 $(315) $235 $(225) $175 $(170) +/- $45 Exelon Generation Gross Margin Sensitivities (with Existing Hedges) (1) Based on March 31, 2010 market conditions and hedged position. Gas price sensitivities are based on an assumed gas-power relationship derived from an internal model that is updated periodically. Power prices sensitivities are derived by adjusting the power price assumption while keeping all other prices inputs constant. Due to correlation of the various assumptions, the hedged gross margin impact calculated by aggregating individual sensitivities may not be equal to the hedged gross margin impact calculated when correlations between the various assumptions are also considered. |

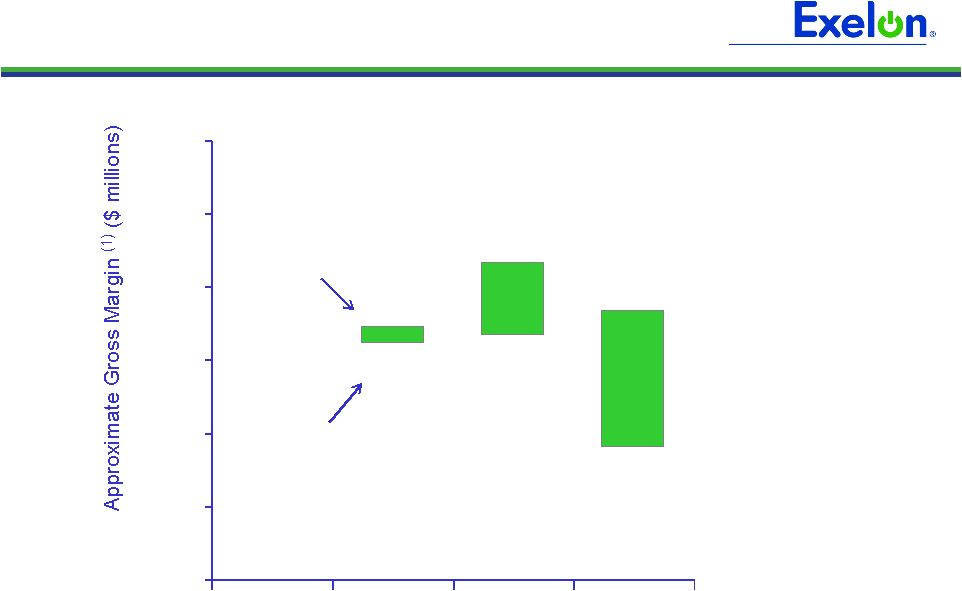

36 36 36 36 95% case 5% case $6,500 $6,200 $4,800 $7,200 $6,300 $6,600 Exelon Generation Gross Margin Upside / Risk (with Existing Hedges) $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 2010 2011 2012 (1) Represents an approximate range of expected gross margin, taking into account hedges in place, between the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot market. Approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market inputs, future transactions and potential modeling changes. These ranges of approximate gross margin in 2011 and 2012 do not represent earnings guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. The price distributions that generate this range are calibrated to market quotes for power, fuel, load following products, and options as of March 31, 2010. |

37 37 37 37 Midwest Mid-Atlantic ERCOT Step 1 Start with fleetwide open gross margin $5.05 billion Step 2 Determine the mark-to-market value of energy hedges 98,600GWh * 93% * ($46.50/MWh-$29.73/MWh) = $1.54 billion 58,000GWh * 97% * ($36.00/MWh-$39.69/MWh) = $(0.21 billion) 8,000GWh * 98% * ($0.50/MWh-$0.43/MWh) = $0.00 billion Step 3 Estimate hedged gross margin by adding open gross margin to mark-to- market value of energy hedges Open gross margin: $5.05 billion MTM value of energy hedges: $1.54 billion + $(0.21 billion) + $0.00 billion Estimated hedged gross margin: $6.38 billion Illustrative Example of Modeling Exelon Generation 2010 Gross Margin (with Existing Hedges) |

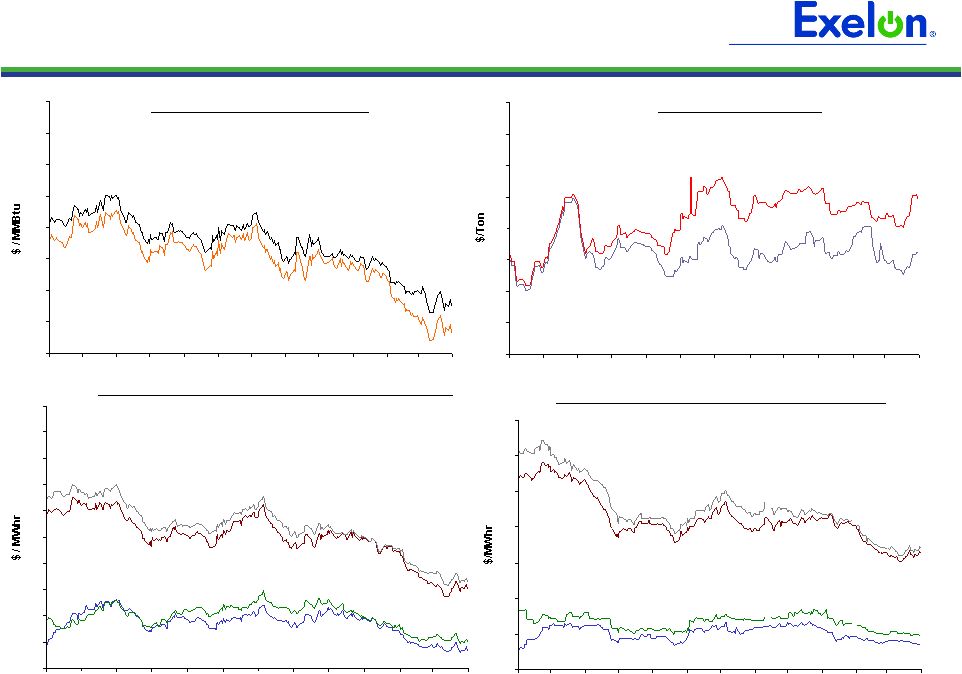

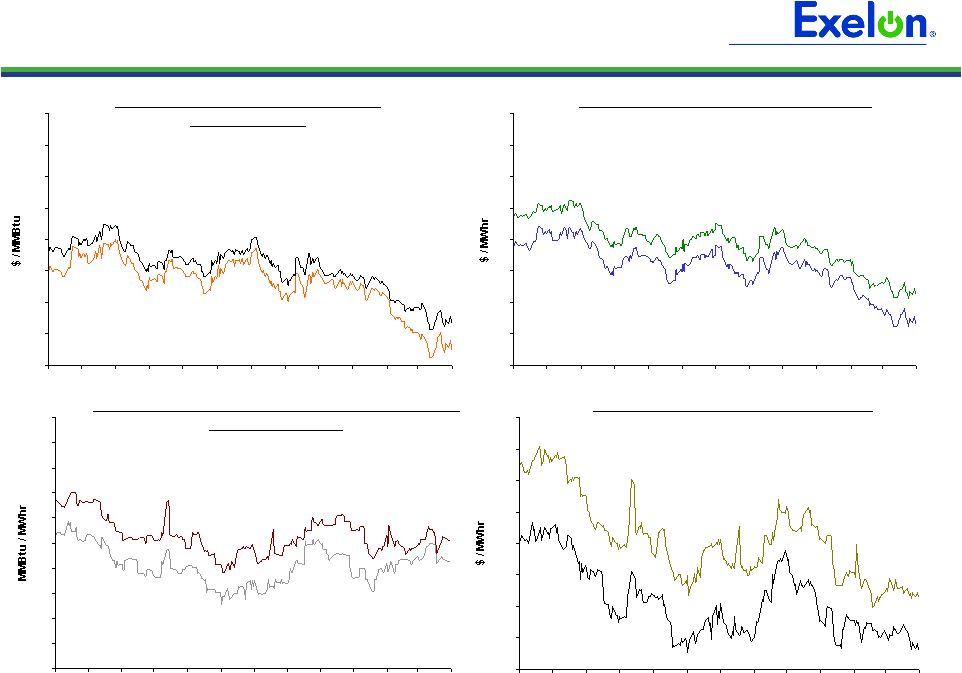

38 38 38 38 38 38 50 55 60 65 70 75 80 85 90 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 20 25 30 35 40 45 50 55 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 35 40 45 50 55 60 65 70 75 80 85 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 5 5.5 6 6.5 7 7.5 8 8.5 9 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 38 Market Price Snapshot Forward NYMEX Natural Gas PJM-West and Ni-Hub On-Peak Forward Prices PJM-West and Ni-Hub Wrap Forward Prices 2011 $5.31 2012 $5.75 Rolling 12 months, as of April 15, 2010. Source: OTC quotes and electronic trading system. Quotes are daily. Forward NYMEX Coal 2011 $66.00 2012 $75.15 2011 Ni-Hub $38.34 2012 Ni-Hub $40.07 2012 PJM-West $51.68 2011 PJM-West $50.21 2011 Ni-Hub $23.49 2012 Ni-Hub $24.74 2012 PJM-West $36.97 2011 PJM-West $36.26 |

39 39 39 39 39 39 5.5 6.5 7.5 8.5 9.5 10.5 11.5 12.5 13.5 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 8 8.2 8.4 8.6 8.8 9 9.2 9.4 9.6 9.8 10 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 40 45 50 55 60 65 70 75 80 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 5 5.5 6 6.5 7 7.5 8 8.5 9 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 39 Market Price Snapshot 2012 $9.03 2011 $8.86 2011 $46.41 2012 $51.22 2011 $5.24 2012 $5.67 Houston Ship Channel Natural Gas Forward Prices ERCOT North On-Peak Forward Prices ERCOT North On-Peak v. Houston Ship Channel Implied Heat Rate 2011 $6.09 2012 $7.79 ERCOT North On Peak Spark Spread Assumes a 7.2 Heat Rate, $1.50 O&M, and $.15 adder Rolling 12 months, as of April 15, 2010. Source: OTC quotes and electronic trading system. Quotes are daily. |