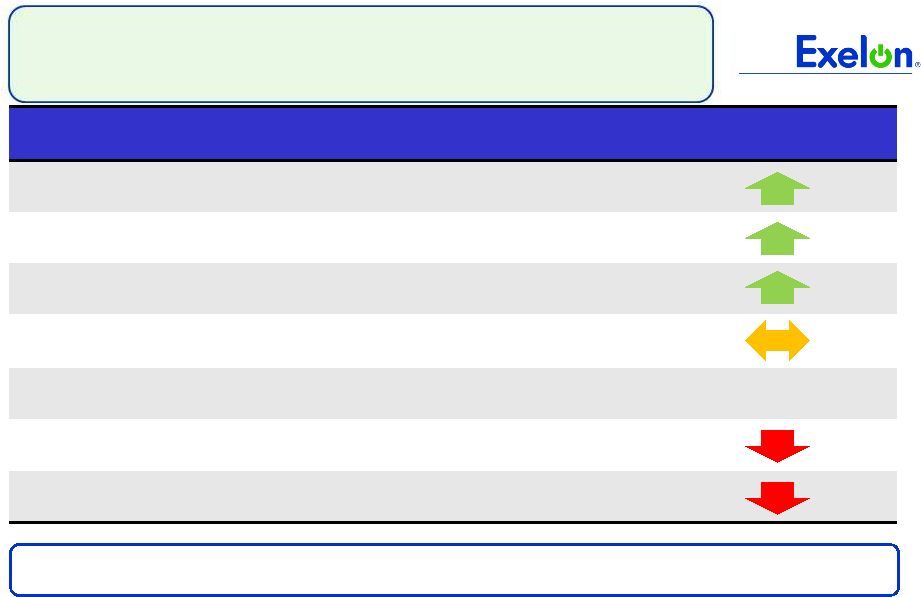

40 Exelon Consolidated Metric Calculations and Ratios Exelon 2010 YE Adjustments FFO Calculation 2010 YE Source - 2010 Form 10-K (.pdf version) Net Cash Flows provided by Operating Activities 5,244 Pg 159 - Stmt. of Cash Flows +/- Change in Working Capital 644 Pg 159 - Stmt. of Cash Flows (1) - PECO Transition Bond Principal Paydown (392) Pg 174 - Stmt. of Cash Flows (2) + PPA Depreciation Adjustment 207 Pg 295 - Commitments and Contingencies (3) +/- Pension/OPEB Contribution Normalization 448 Pg 268-269 - Post-retirement Benefits (4) + Operating Lease Depreciation Adjustment 35 Pg 299 - Commitments and Contingencies (5) +/- Decommissioning activity (143) Pg 159- Stmt. of Cash Flows +/- Other Minor FFO Adjustments (6) (54) = FFO (a) 5,989 Debt Calculation Long-term Debt (incl. Current Maturities and A/R agreement) 12,828 Pg 161 - Balance Sheet Short-term debt (incl. Notes Payable / Commercial Paper) - Pg 161 - Balance Sheet - PECO Transition Bond Principal Paydown - N/A - no debt outstanding at year-end + PPA Imputed Debt 1,680 Pg 295 - Commitments and Contingencies (7) + Pension/OPEB Imputed Debt 3,825 Pg 268 - Post-retirement benefits (8) + Operating Lease Imputed Debt 428 Pg 299 - Commitments and Contingencies (9) + Asset Retirement Obligation - Pg 261-267 - Asset Retirement Obligations (10) +/- Other Minor Debt Equivalents (11) 84 = Adjusted Debt (b) 18,845 Interest Calculation Net Interest Expense 817 Pg 158 - Statement of Operations - PECO Transition Bond Interest Expense (22) Pg 182 - Significant Accounting Policies + Interest on Present Value (PV) of Operating Leases 29 Pg 299 - Commitments and Contingencies (12) + Interest on PV of Purchased Power Agreements (PPAs) 99 Pg 295 - Commitments and Contingencies (13) +/- Other Minor Interest Adjustments (14) 37 = Adjusted Interest (c) 960 Equity Calculation Total Equity 13,563 Pg 161 - Balance Sheet + Preferred Securities of Subsidaries 87 Pg 161 - Balance Sheet +/- Other Minor Equity Equivalents (15) 111 = Adjusted Equity (d) 13,761 (1) Includes changes in A/R, Inventories, A/P and other accrued expenses, option premiums, counterparty collateral and income taxes. Impact to FFO is opposite of impact to cash flow (2) Reflects retirement of variable interest entity + change in restricted cash (3) Reflects net capacity payment – interest on PV of PPAs (using weighted average cost of debt) (4) Reflects employer contributions – (service costs + interest costs + expected return on assets), net of taxes at 35% (5) Reflects operating lease payments – interest on PV of future operating lease payments (using weighted average cost of debt) (6) Includes AFUDC / capitalized interest (7) Reflects PV of net capacity purchases (using weighted average cost of debt) $ in millions (8) Reflects unfunded status, net of taxes at 35% (9) Reflects PV of minimum future operating lease payments (using weighted average cost of debt) (10) Nuclear decommissioning trust fund balance > asset retirement obligation. No debt imputed (11) Includes accrued interest less securities qualifying for hybrid treatment (50% debt / 50% equity) (12) Reflects interest on PV of minimum future operating lease payments (using weighted average cost of debt) (13) Reflects interest on PV of PPAs (using weighted average cost of debt) (14) Includes AFUDC / capitalized interest and interest on securities qualifying for hybrid treatment (50% debt / 50% equity) (15) Includes interest on securities qualifying for hybrid treatment (50% debt / 50% equity) FFO / Debt Coverage = FFO (a) Adjusted Debt (b) FFO Interest Coverage = FFO (a) + Adjusted Interest (c) Adjusted Interest (c) Adjusted Capitalization (e) = Adjusted Debt (b) + Adjusted Equity (d) = 32,606 Rating Agency Debt Ratio = Adjusted Debt (b) Adjusted Capitalization (e) 32% 7.2x 58% = = = 2010A Credit Metrics |