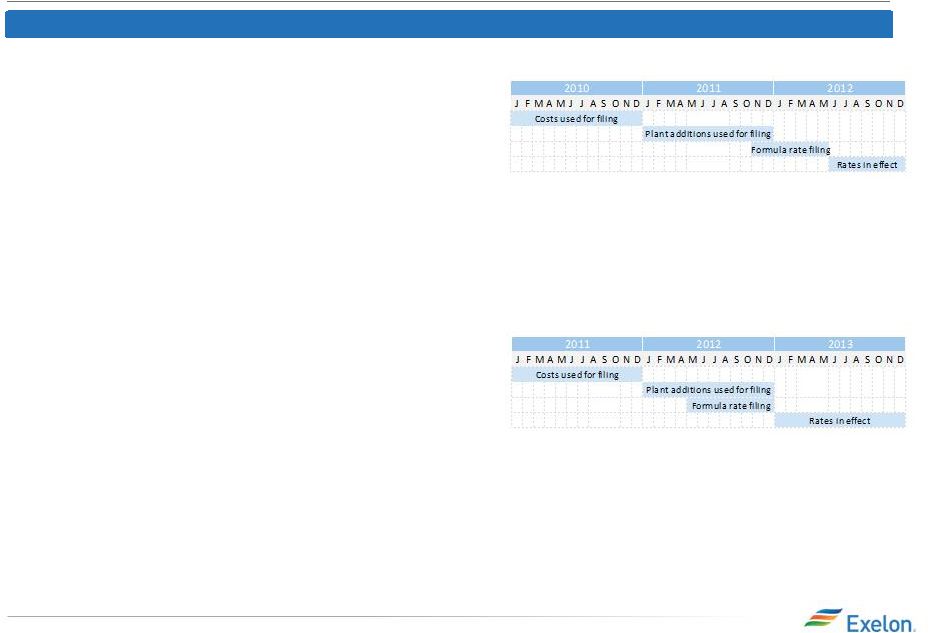

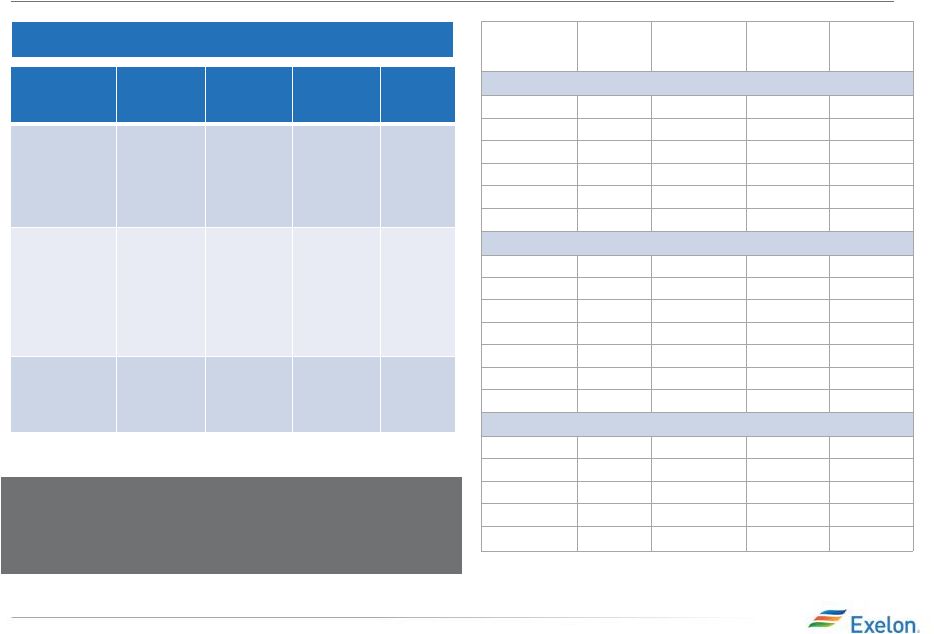

9 ComEd Distribution Rate Case Update 2011 Formula Rate Filing (Docket # 11-0721 filed 11/8/11; rates eff. June 2012) • Based on 2010 calendar year costs and 2011 net plant additions • Supported $59M distribution revenue requirement reduction • 10.05% ROE (2010 Treasury yield of 4.25% + 580 basis point risk premium) ICC Final Order (issued 5/30/12): • $168M revenue requirement reduction; incremental reduction includes: – ~$50M related to costs ICC determined should be recovered through alternative rate recovery tariffs or reflected in reconciliation proceeding; primarily delays timing of cash flows – ~$35M reflects disallowance of return on pension asset – ~$10M reflects incentive compensation related adjustments – ~$15M reflects various adjustments for cash working capital, operating reserves and other technical items • ComEd requested and the ICC granted expedited rehearing on the pension, interest rate and average rate base issues; Commission Final Order expected by Sept. 19 2012 Formula Rate Filing (Docket # 12-0321 filed 4/30/12, rates eff. Jan 2013) • 2012 plan year based on 2011 actual costs and 2012 net plant additions – 9.71% ROE (2011 Treasury yield of 3.91% + 580 basis point risk premium) • Reconciled 2011 revenue requirements in effect to 2011 actual costs incurred – 9.81% ROE (3.91% +590 basis point risk premium) (1) • Initial filing supported $106M distribution revenue requirement increase relative to Dec. 2012 rates as ComEd initially proposed. When factoring in 5/30/12 order for #11-0721, ComEd proposed a $34M reduction • Received staff and intervener testimony on 7/17/12 • ICC order by year end; rates effective January 2013 Summary of Filings (1) 590 basis point premium applies only to 2011 revenue reconciliation. All subsequent revenue reconciliations will assume a 580 basis point premium. Staff proposes an additional $35M reduction beyond ComEd’s filing • |