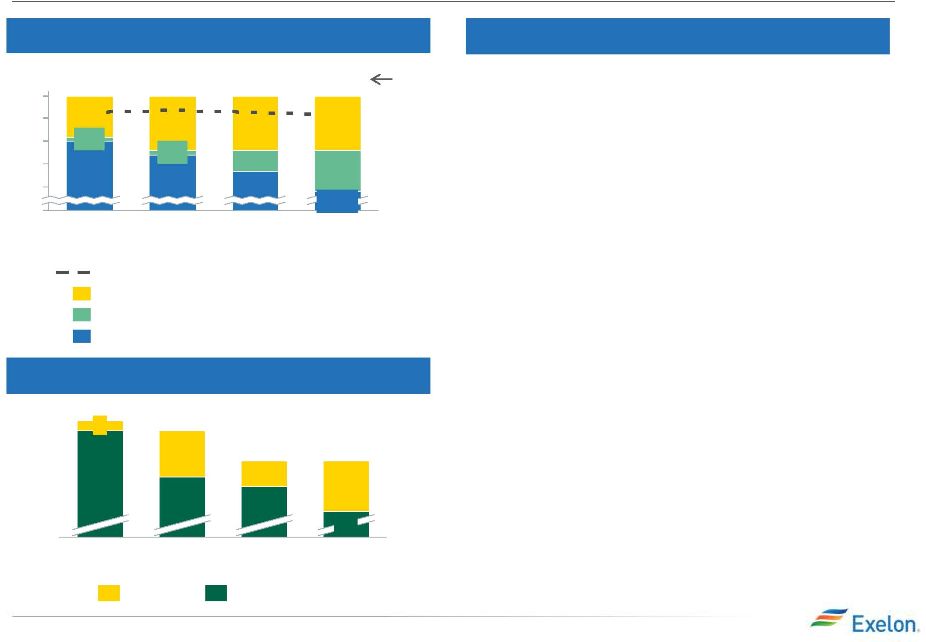

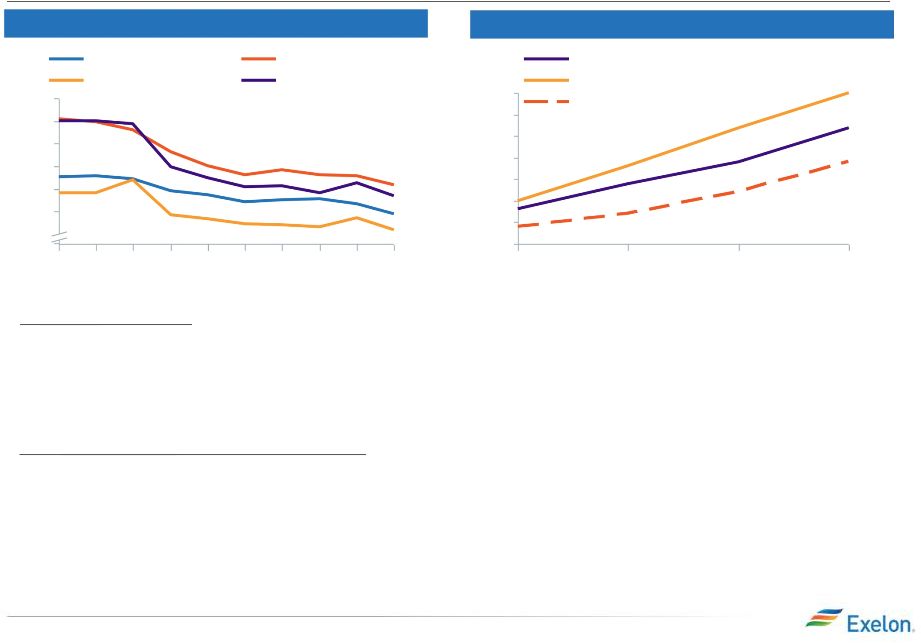

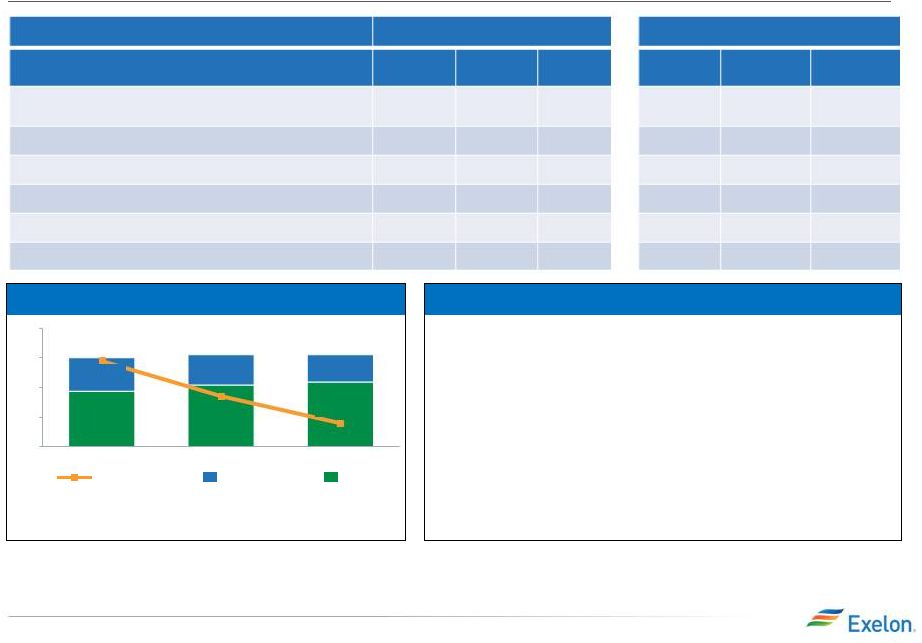

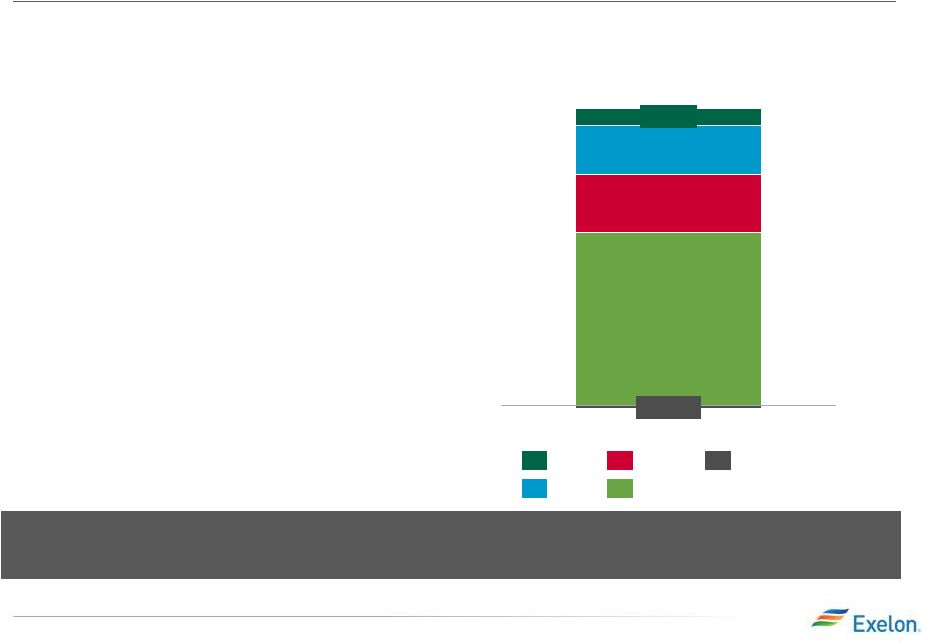

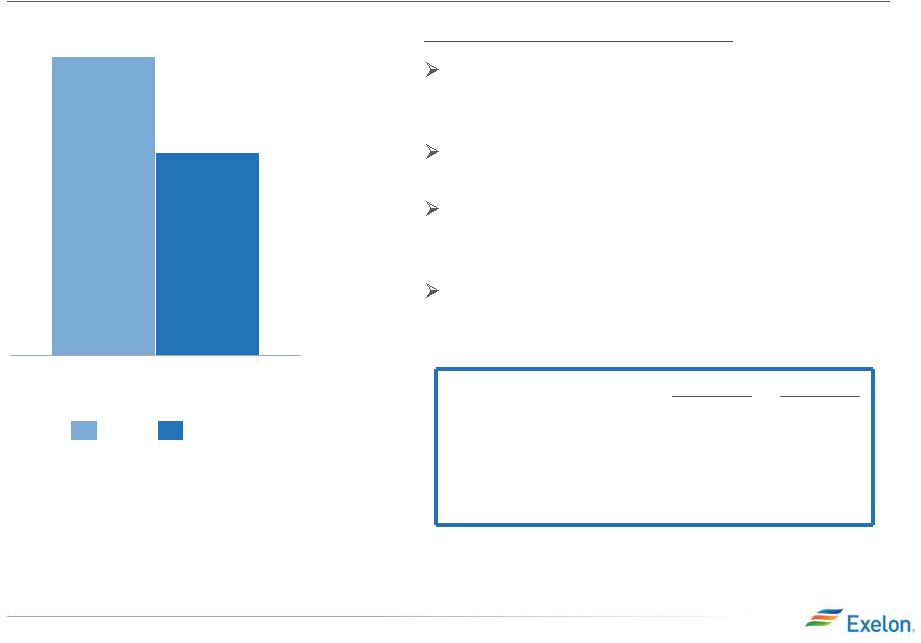

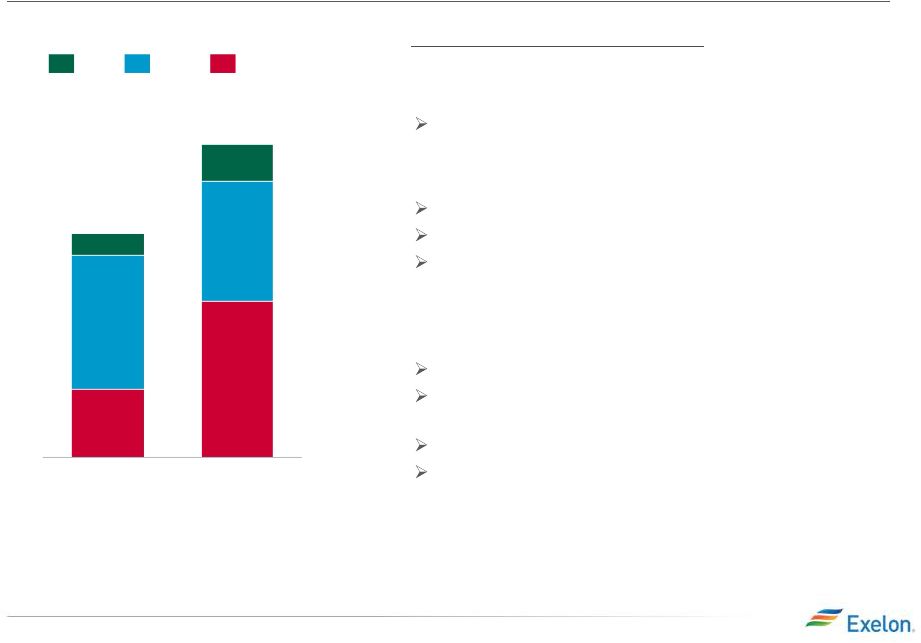

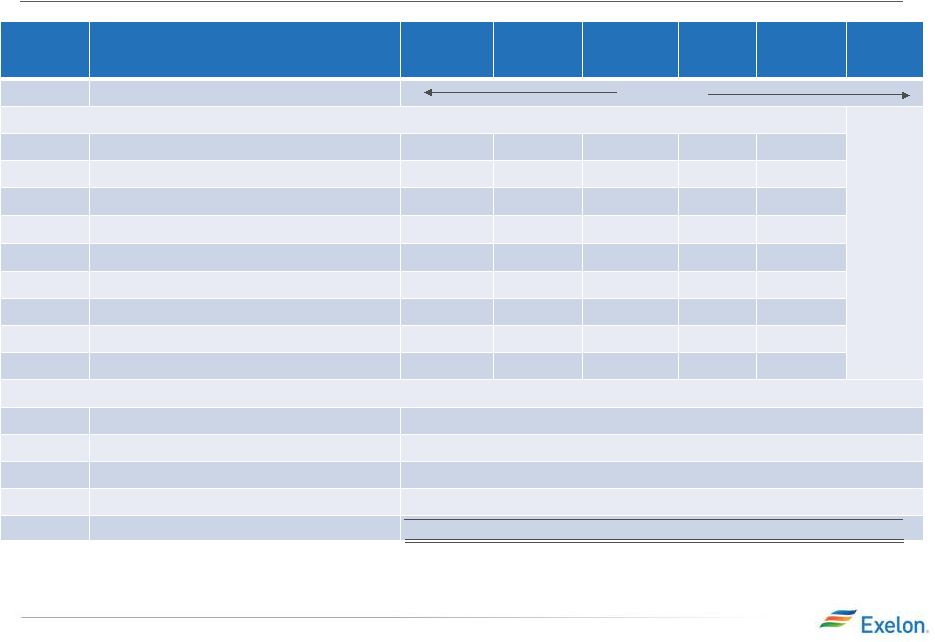

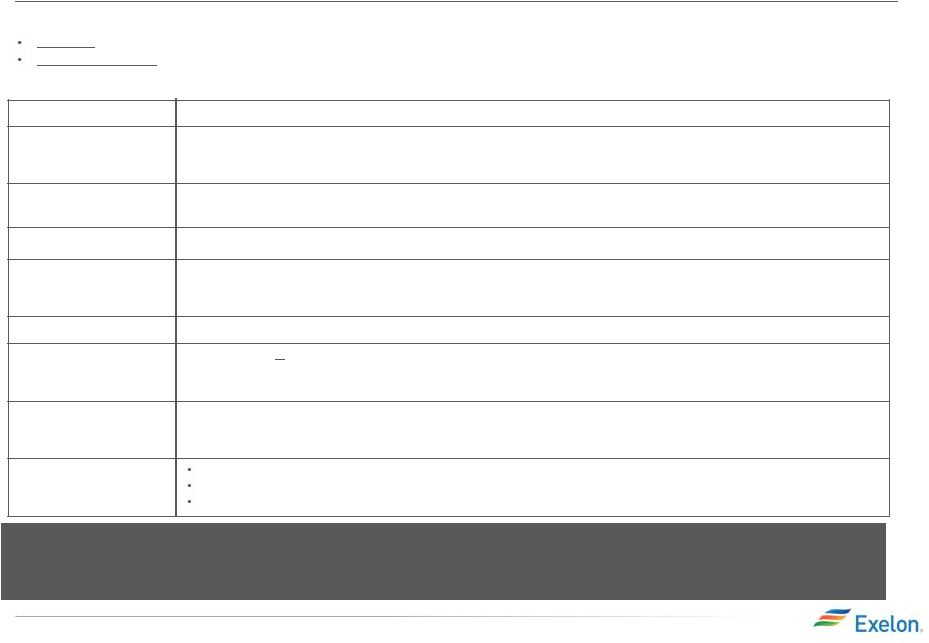

2013 2Q Earnings Release Slides 21 ComEd May 2013 Distribution Formula Rate Updated Filing Note: Disallowance of any items in the 2013 distribution formula rate filing could impact 2013 earnings in the form of a regulatory asset adjustment. Docket # 13-0318 Filing Year Reconciliation Year Common Equity Ratio ROE Rate Base Revenue Requirement Increase Timeline The 2013 distribution formula rate filing establishes the net revenue requirement used to set the rates that will take effect in January 2014 after the ICC’s review. The filing was updated to reflect the impact of Senate Bill 9. There are two components to the annual distribution formula rate filing: Filing Year: Based on prior year costs (2012) and current year (2013) projected plant additions. Annual Reconciliation: For the prior calendar year (2012), this amount reconciles the revenue requirement reflected in rates during the prior year (2012) in effect to the actual costs for that year. The annual reconciliation impacts cash flow in the following year (2014) but the earnings impact has been recorded in the prior year (2012) as a regulatory asset. 04/29/13 Filing Date 240 Day Proceeding ICC order by year end; rates effective January 2014 2012 Calendar Year Actual Costs and 2013 Projected Net Plant Additions are used to set the rates for calendar year 2014. Rates currently in effect (docket 12-0321) for calendar year 2013 were based on 2011 actual costs and 2012 projected net plant additions. Reconciles Revenue Requirement reflected in rates during 2012 to 2012 Actual Costs Incurred. Revenue Requirement for 2012 is based on dockets 10-0467, 11-0721 May Order and 11-0721 October Re-hearing Order. ~ 45% for both the filing and reconciliation year 8.27% for both the filing and reconciliation year (2012 30-yr Treasury Yield of 2.92% + 580 basis point risk premium). For 2013 and 2014, the actual allowed ROE reflected in net income will ultimately be based on the average of the 30-year Treasury Yield during the respective years plus 580 basis point spread. ~7% For the both the filing and reconciliation Year $6,717 million $359M capital additions). 2013 and 2014 earnings will reflect 2013 and 2014 year-end rate base respectively. - Reconciliation year (represents year-end ate base for 2012) $6,390 million ($165M is due to the 2012 reconciliation, $194M relates to the filing year). The 2012 reconciliation impact on net income was recorded in 2012 as a regulatory asset. This increase also reflects the decrease in 2013 rates as a result of Senate Bill 9. Filing year (represents projected year-end rate base using 2012 actual plus 2013 projected Requested Rate of Return Given the retroactive ratemaking provision in the EIMA legislation, ComEd net income during the year will be based on actual costs with a regulatory asset/liability recorded to reflect any under/over recovery reflected in rates. Revenue Requirement in rate filings impacts cash flow. |