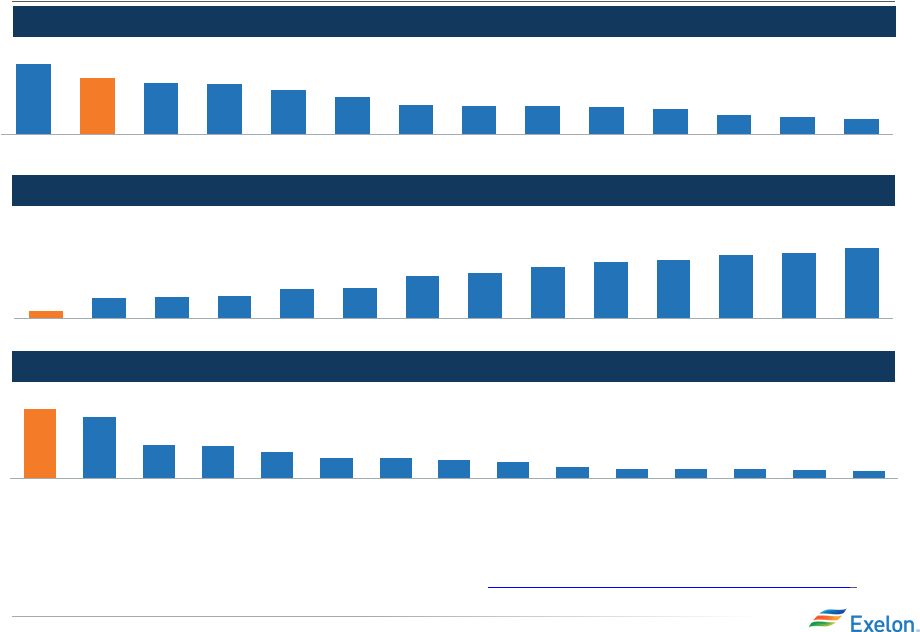

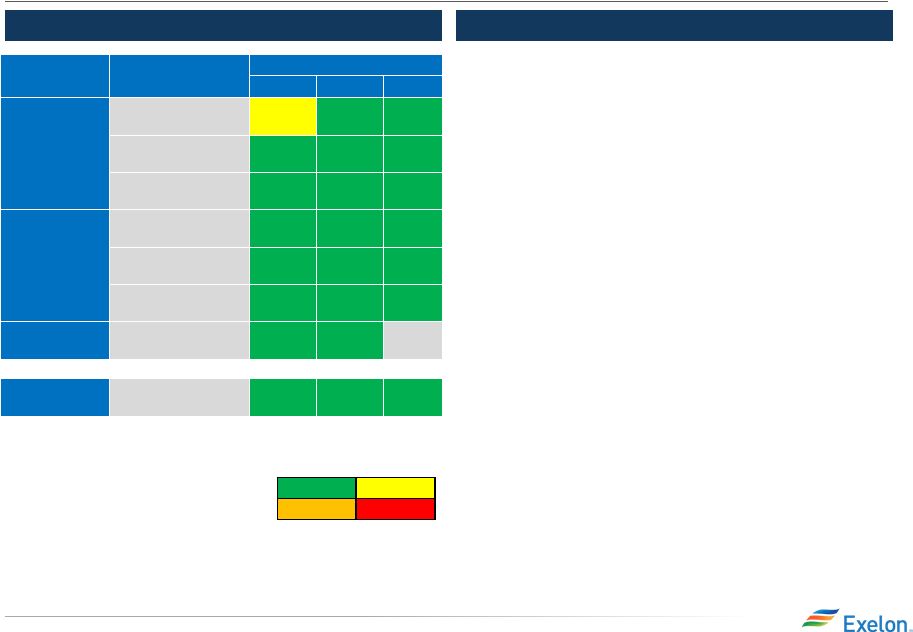

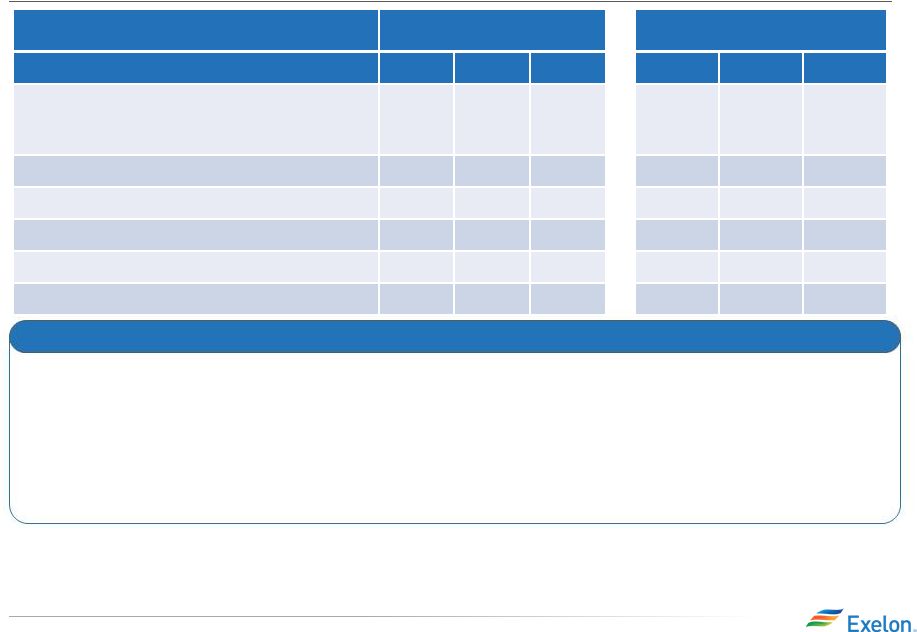

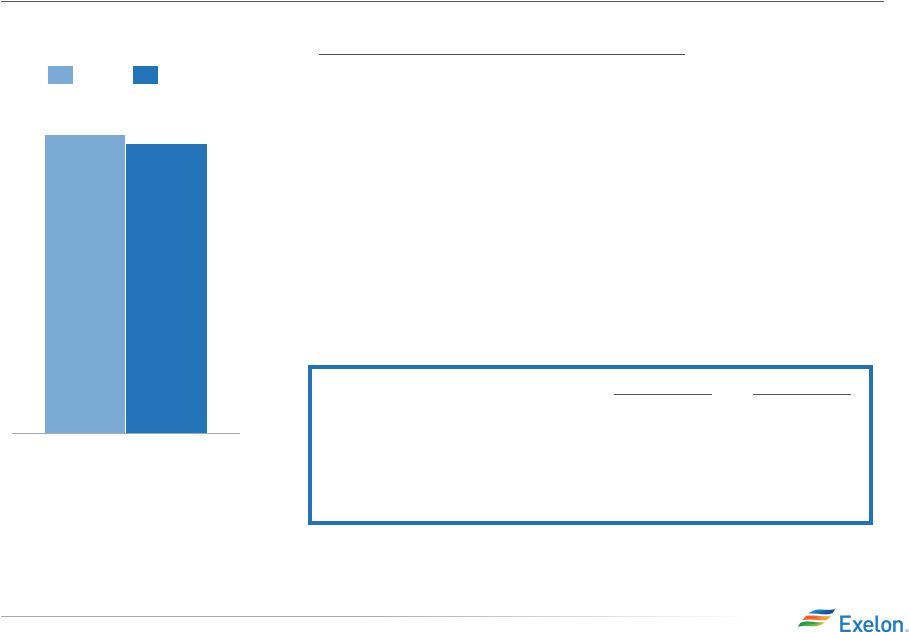

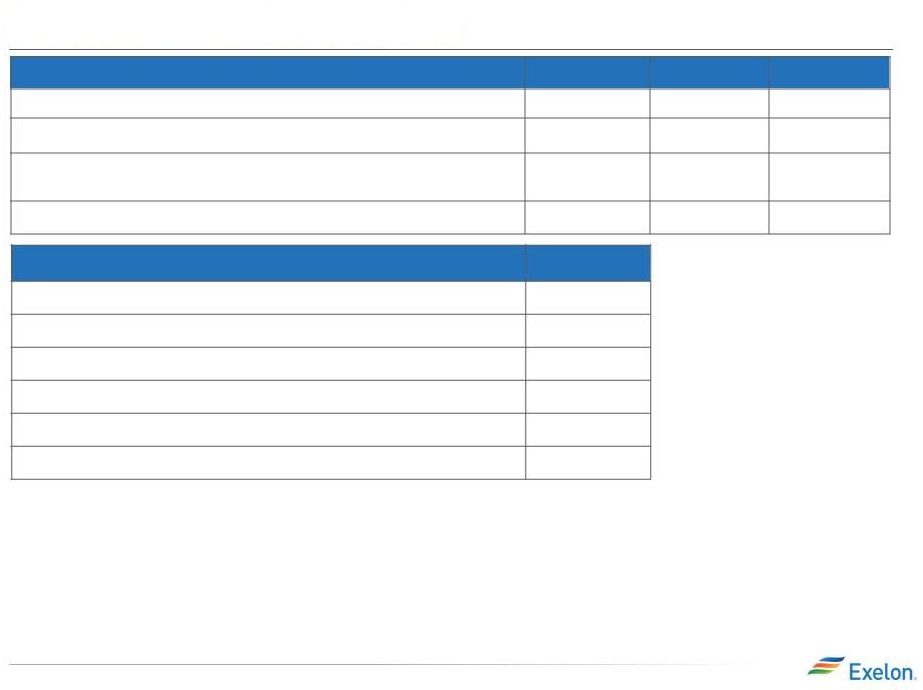

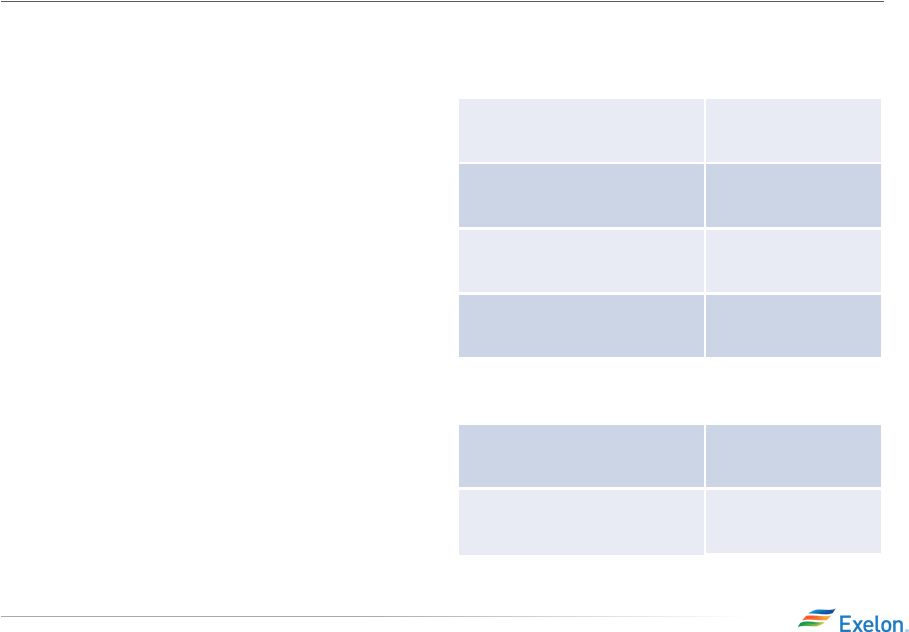

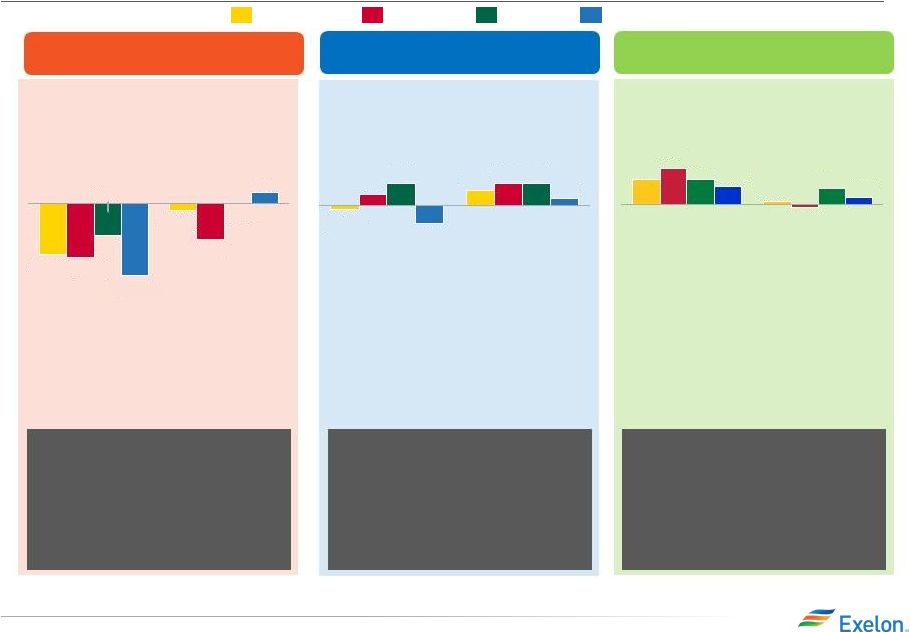

Early Retirement of Clinton and Quad Cities We will shut down Clinton Power Station on June 1, 2017 and Quad Cities Generating Station on June 1, 2018 if Illinois does not pass adequate legislation by May 31, 2016 and if Quad Cities does not clear the 19/20 PJM capacity auction in May Impact on Illinois of Plant Closures (1) • The gross impact of shutting down Clinton and Quad Cities would be: • $1.2 billion annually in lost economic activity in Illinois • 4,200 jobs lost, many of which are highly skilled, good paying jobs • According to independent analyses by PJM and MISO, there would be a significant increase in electricity prices for Illinois residents and businesses • Economic damages associated with an incremental increase in the release of carbon dioxide emissions would cost Illinois consumers nearly $10 billion over 10 years Nuclear Plant Economics Deteriorating • Illinois legislation aimed at leveling the playing field for zero carbon resources has failed to advance in the past two legislative sessions • PJM power prices hit 15 year record low in March • Illinois forward energy prices have declined by roughly 10% in the last year • From 2009 to 2015, Quad Cities and Clinton have sustained more than $800 million in cash flow losses on a pre-tax basis (2) (1) Source: January 5, 2015 Response to the IL General Assembly Concerning House Resolution 1146 prepared by Illinois Commerce Commission, Illinois Power Agency, Illinois Environmental Protection Agency, and Illinois Department of Commerce and Economic Opportunity (2) Revenues include realized energy and capacity revenue excluding any hedges; costs include all site expenses (including taxes other than income taxes), DOE spent fuel fees prior to their suspension in mid-2014, charged and allocated overhead, fuel capex, and non-fuel capex. Losses only reflect the extent to which revenues fell short of cash costs and do not reflect the absence of expected investor return on investment 7 Q1 2016 Earnings Release Slides |