- SUNE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

SUNation Energy (SUNE) DEF 14ADefinitive proxy

Filed: 11 Apr 02, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 | |

COMMUNICATIONS SYSTEMS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

COMMUNICATIONS SYSTEMS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 16, 2002

Notice is hereby given that the Annual Meeting of Shareholders of Communications Systems, Inc. (the "Company") will be held at the Radisson Plaza Hotel, New Sweden Room, 35 South Seventh Street, Minneapolis, Minnesota 55402, on Thursday, May 16, 2002 beginning at 3:00 p.m., Central Daylight Time, for the following purposes:

The Board of Directors has fixed the close of business on March 22, 2002 as the record date for determination of shareholders entitled to notice of and to vote at the meeting.

By Order of the Board of Directors

Richard A. Primuth,

Secretary

Hector, Minnesota

April 10, 2002

TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE SIGN, DATE AND RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE, WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON. SHAREHOLDERS WHO ATTEND THE MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF THEY SO DESIRE.

COMMUNICATIONS SYSTEMS, INC.

213 South Main Street

Hector, Minnesota 55342

(320) 848-6231

This Proxy Statement is furnished to the shareholders of Communications Systems, Inc. ("CSI" or the "Company") in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting of Shareholders to be held at the Radisson Plaza Hotel, New Sweden Room, 35 South Seventh Street, Minneapolis, Minnesota 55402, on Thursday, May 16, 2002, beginning at 3:00 p.m., Central Daylight Time, or at any adjournment or adjournments thereof. The cost of this solicitation will be paid by the Company. In addition to solicitation by mail, officers, directors and employees of the Company may solicit proxies by telephone, telegraph or in person. The Company may also request banks and brokers to solicit their customers who have a beneficial interest in the Company's Common Stock registered in the names of nominees and will reimburse such banks and brokers for their reasonable out-of-pocket expenses.

Any proxy may be revoked at any time before it is voted by receipt of a proxy properly signed and dated subsequent to an earlier proxy, or by revocation of a written proxy by request in person at the Annual Meeting. If not so revoked, the shares represented by such proxy will be voted by the persons designated as proxies in favor of the matters indicated. In the event any other matters which properly come before the meeting require a vote of shareholders, the persons named as proxies will vote in accordance with their judgment on such matters. The Company's corporate offices are located at 213 South Main Street, Hector, Minnesota 55342, and its telephone number is (320) 848-6231. The mailing of this Proxy Statement to shareholders of the Company commenced on or about April 10, 2002.

The total number of shares outstanding and entitled to vote at the meeting on March 22, 2002 was 8,261,493 shares of $.05 par value Common Stock. Only shareholders of record at the close of business on March 22, 2002 will be entitled to vote at the meeting. Each share of Common Stock is entitled to one vote. Cumulative voting in the election of directors is not permitted. The presence in person or by proxy of the holders of a majority of the shares entitled to vote at the Annual Meeting of Shareholders constitutes a quorum for the transaction of business.

Under Minnesota law, each item of business properly presented at a meeting of shareholders generally must be approved by the affirmative vote of the holders of a majority of the voting power of the shares present, in person or by proxy, and entitled to vote on that item of business. However, if the shares present and entitled to vote on any particular item of business would not constitute a quorum for the transaction of business at the meeting, then that item must be approved by holders of a majority of the minimum number of shares that would constitute such a quorum. Votes cast by proxy or in person at the Annual Meeting of Shareholders will be tabulated at the meeting to determine whether or not a quorum is present. Abstentions on a particular item of business will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining approval of the matter. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of the Company's Common Stock owned by each person known by the Company to own of record or beneficially five percent (5%) or more of the Company's Common Stock and all officers and directors of the Company as a group using information available as of March 22, 2002.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||

|---|---|---|---|---|---|

| Curtis A. Sampson 213 South Main Street Hector, MN 55342 | 1,586,495 | (1) | 19.2 | % | |

Putnam Investments, LLC One Post Office Square Boston, MA 02109 | 707,594 | (2) | 8.6 | % | |

Gabelli Asset Management Inc. One Corporate Center Rye, New York 10580-1435 | 649,600 | (3) | 7.9 | % | |

Dimensional Fund Advisors Inc. 1299 Ocean Avenue Santa Monica, CA 90401 | 466,300 | (4) | 5.6 | % | |

Paul N. Hanson 213 South Main Street Hector, MN 55342 | 456,556 | (5) | 5.5 | % | |

John C. Ortman 1506 17th Street Lawrenceville, IL 62439 | 543,350 | 6.6 | % | ||

All directors and executive officers as a group (16 persons) | 2,515,123 | (6) | 30.4 | % |

2

2001: Putnam Investment Management, LLC, The Putnam Advisory Company, LLC and Putnam Investments, LLC.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors is presently comprised of eight director positions, divided into three classes, with each class of directors serving staggered three-year terms. The Board of Directors has nominated and recommends for reelection as directors Edwin C. Freeman, Luella Gross Goldberg and Randall D. Sampson, who currently serve as directors and are each being re-nominated for a three year term expiring in 2005. The Board of Directors believes that each nominee named below will be able to serve, but should a nominee be unable to serve as a director, the persons named in the proxies have advised that they will vote for the election of such substitute nominee as the Board of Directors may propose.

3

Information regarding the nominees and other directors filling unexpired terms is set forth on the following page, including information regarding their principal occupations currently and for the preceding five years. Ownership of Common Stock of the Company is given as of March 22, 2002. To the best of the Company's knowledge, unless otherwise indicated below, the persons indicated possess sole voting and investment power with respect to their stock ownership.

| Name and Age | Principal Occupation and Other Directorships | Director Since | Year Current Term Expires | Amount of Common Stock Ownership | Percent of Outstanding Common Stock | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Election for Terms Expiring in 2005 | |||||||||||

Edwin C. Freeman (46) | Vice President and General Manager, Bro-Tex, Inc. (paper and cloth wiper products, and fiber product recycler) since March 1992. | 1998 | 2002 | 33,738 | (1) | * | |||||

Luella Gross Goldberg (65) | Trustee, University of Minnesota Foundation since 1975; Chair, from 1996 to 1998. Trustee Emerita of Wellesley College since 1996; Trustee, 1978 to 1996. Director, TCF Financial Corporation, NRG Energy, Hormel Foods Corporation and ING Group. | 1997 | 2002 | 17,000 | (2) | * | |||||

Randall D. Sampson (44)† | Chief Executive Officer of Canterbury Park Holding Corporation (thoroughbred race track). | 1999 | 2002 | 67,824 | (3) | * | |||||

Directors Serving Unexpired Terms | |||||||||||

Paul J. Anderson (70) | Private Investor. | 1975 | 2003 | 179,618 | 2.2 | % | |||||

Wayne E. Sampson (72)† | Management consultant; Director of Hector Communications Corporation (independent telephone companies). | 1981 | 2003 | 333,094 | (4) | 4.0 | % | ||||

Frederick M. Green (59) | Chairman of the Board, President and Chief Executive Officer of Ault Incorporated (power conversion products). | 1996 | 2003 | 15,000 | (5) | * | |||||

Curtis A. Sampson (68)† | Chairman of the Board, President and Chief Executive Officer of the Company; Chairman of the Board of Hector Communications Corporation (independent telephone companies); Chairman of the Board of Canterbury Park Holding Corporation (thoroughbred racetrack). | 1969 | 2004 | 1,586,495 | (6) | 19.2 | % | ||||

Gerald D. Pint (66) | Telecommunications Consultant since September 1993. Prior thereto Group Vice President, Telecom Systems Group, 3-M Company, 1989-1993. Director of Norstan, Inc. (telecommunications equipment and service company) and Inventronics Ltd. (telecommunications equipment company). | 1997 | 2004 | 13,000 | (7) | * | |||||

4

Information Regarding Board and Board Committees

The Board of Directors met five times during 2001. Each director nominee and continuing director attended at least seventy-five percent (75%) of the 2001 meetings of the Board and each committee on which such director served.

All directors, other than Curtis A. Sampson, receive a monthly retainer of $750, plus $600 for each Board meeting and $500 for each committee meeting attended. Messrs. Freeman, Wayne E. Sampson and Pint, in consideration for their additional services as members of the Executive Committee, are paid an additional monthly retainer of $250. Mr. Curtis A. Sampson received no additional cash compensation for service on the Board.

Presently, each non-employee member of the Board of Directors receives at the time of the annual meeting of the shareholders an option to purchase 3,000 shares of the Company's Common Stock. Each director's option is granted at a price equal to the fair market value of the Company's Common Stock on the date of grant exercisable over a ten-year period beginning six months after the date the option is granted.

The Company has an Audit Committee, currently consisting of Paul J. Anderson, Edwin C. Freeman and Luella Gross Goldberg, which met once during the last fiscal year. The Audit Committee recommends to the full Board of Directors the selection of independent accountants and reviews the activities and reports of the independent accountants, as well as the internal accounting controls of the Company

The Company has a Compensation Committee currently consisting of Luella Gross Goldberg, Frederick M. Green, Gerald D. Pint and Wayne E. Sampson. The Compensation Committee met once during the last fiscal year.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

The following tables show, for the fiscal years ending December 31, 2001, 2000 and 1999, the cash and other compensation paid to or accrued by the Company for each executive officer whose total cash

5

compensation exceeded $100,000 during fiscal 2001 in all capacities served, as well as information relating to option grants, option exercises and fiscal year end option values applicable to such persons.

| | | | | Long-Term Compensation Awards | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Annual Compensation | | |||||||||||

| Name and Principal Position | Securities Underlying Options(1) | All Other Compensation(2) | |||||||||||

| Year | Salary | Bonus(1) | |||||||||||

| Curtis A. Sampson Chief Executive Officer(3)(4) | 2001 2000 1999 | $ $ $ | 197,077 214,615 202,913 | $ $ $ | -0- - -0- 50,000 | 15,000 21,000 18,000 | $ $ $ | 3,999 - -0- 13,712 | |||||

Jeffrey K. Berg President and Chief Operating Officer(5) | 2001 2000 1999 | $ $ $ | 175,000 147,114 125,867 | $ $ $ | - -0- 55,000 31,250 | 12,000 15,000 15,000 | $ $ $ | 9,249 - -0- 9,957 | |||||

Thomas J. Lapping President and Chief Executive Officer JDL Technologies, Inc. | 2001 2000 1999 | $ $ $ | 119,580 107,788 101,351 | $ $ $ | 10,000 12,359 50,000 | 6,720 9,600 10,005 | $ $ $ | 7,259 - -0- 7,291 | |||||

| Daniel G. Easter, President and Chief Executive Officer Transition Networks, Inc.(6) | 2001 2000 | $ $ | 176,725 177,894 | $ $ | 61,740 55,000 | 12,000 8,400 | $ $ | 8,549 - -0- | |||||

6

to the option exercise. To enable Mr. Berg to exercise an additional stock option, the loan to Mr. Berg was renewed and restated to increase the amount of the loan to $85,000 and to increase the interest rate to 7%. The current loan to Mr. Berg is secured by 12,000 shares of the Company common stock and is payable on demand of the Company. In October 1998 the Company loaned Mr. Berg $190,000 at an adjustable interest rate initially set at 6.5% per annum under a promissory note providing for bi-weekly payments of $600. The current balance of the loan is $178,524. The loan is secured by a mortgage on real estate.

OPTION GRANTS IN 2001

| | Individual Grants | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||

| | Number of Securities Underlying Options Granted | % of Total Options Granted to Employees in 2001 | | | ||||||||

| Name | Exercise Price Per Share | Expiration Date | ||||||||||

| 5% | 10% | |||||||||||

| Curtis A. Sampson | 15,000 | 6.22 | % | 8.80 | 3/5/06 | 36,469 | 80,587 | |||||

| Jeffrey K. Berg | 12,000 | 4.98 | % | 8.00 | 3/5/06 | 26,523 | 58,609 | |||||

| Thomas J. Lapping | 6,720 | 2.79 | % | 8.00 | 3/5/06 | 14,853 | 32,821 | |||||

| Daniel G. Easter | 12,000 | 4.98 | % | 8.00 | 3/5/06 | 26,523 | 58,609 | |||||

AGGREGATED OPTION EXERCISES IN 2001

AND YEAR-END OPTION VALUES

| | | | | | Value of Unexercised In-the-Money Options at FY-End (Based on 12/31/01 Price of $7.54/Share) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | Number of Unexercised Options at 12/31/01 | ||||||||||||

| | | Value Realized (Market Price at exercise less exercise price) | |||||||||||||

| Name | Shares Acquired on Exercise | ||||||||||||||

| Exercisable | Nonexercisable | Exercisable | Nonexercisable | ||||||||||||

| Curtis A. Sampson | -0- | $ | -0- | 80,500 | 17,000 | $ | 606,970 | $ | 128,180 | ||||||

| Jeffrey K. Berg | -0- | $ | -0- | 68,000 | 13,000 | $ | 512,720 | $ | 98,020 | ||||||

| Thomas J. Lapping | -0- | $ | -0- | 18,645 | 7,680 | $ | 140,583 | $ | 57,907 | ||||||

| Daniel G. Easter | -0- | $ | -0- | 35,400 | 34,375 | 266,916 | $ | 259,188 | |||||||

The Compensation Committee appointed by the Company's Board of Directors has primary responsibility in regard to determinations relating to executive compensation and administration of the Company's stock option plans. All decisions by the Compensation Committee pertaining to the compensation of the Company's executive officers are reviewed and approved by the full Board.

Compensation Policies

It is the objective of the Compensation Committee to pay compensation at levels that will attract, retain and motivate executives with superior leadership and management abilities and to structure the

7

forms of compensation paid such that their interests will be closely aligned with achievement of superior financial performance by the Company. With these objectives in mind, the compensation currently paid to the Company's executive officers principally consists of three elements: base salary, bonus and periodic stock option awards.

Compensation Elements

Base salaries of the Company's executive officers are generally established by reference to base salaries paid to executives in similar positions with similar responsibilities based upon publicly available compensation surveys and limited informal surveys by Compensation Committee members. Base salaries are reviewed annually. Adjustments to base salaries are determined by reference to individual and Company performance having in mind both measurable financial factors, as well as subjective judgments by the Compensation Committee in regard to factors such as development and execution of strategic plans, changes in areas of responsibility and the development and management of employees. The Compensation Committee does not, however, assign specific weights to these various quantitative and qualitative factors in reaching its decisions. Following the completion of fiscal 2000, the Committee approved increases in base compensation averaging 2% to the Company's executive officers other than the Company's Chief Executive Officer. By way of comparison, the Company's revenues increased approximately 2% in fiscal 2000 over fiscal 1999, while the Company's net income in fiscal 2000 was $6,672,000 compared to $9,014,000 in fiscal 1999. The Committee regards cash compensation paid to the Company's executive officers as reasonable in relation to published information regarding compensation of executives with similar responsibilities and the Company's financial performance.

Bonuses are intended to provide executives with an opportunity to receive additional cash compensation, but only if they earn it through Company and individual performance. After year-end results are available, the Committee determines each officer's bonus based on the Company's performance, as well as the Compensation Committee's assessment of individual performance in the executive's area of responsibility based on objective and subjective factors. Bonuses paid to the Company's executive officers as a group were $71,740 for fiscal 2001 compare to total bonuses paid for fiscal 2000 of $128,509. Bonuses paid for 2001 primarily reflect achievement by individual officers of specific 2001 financial targets.

Stock options are awarded to the Company's executives under the Company's 1992 Stock Plan. Stock options represent an additional vehicle for aligning management's and stockholders' interests, specifically motivating executives to remain focused on factors that will enhance the market value of the Company's common stock. If there is no price appreciation in the common stock, the option holders receive no benefit from the stock options, because options are granted with an option exercise price at least equal to the fair market value of the common stock on the date of grant. At the beginning of fiscal 2001, the Committee granted stock options to purchase 60,630 shares of common stock to executive officers, which represented approximately 25% of the total options granted to all officers and key employees.

Chief Executive Officer Compensation

Mr. Curtis A. Sampson participates in the same executive compensation plans provided to other senior executives and is evaluated by the same factors applicable to the other executives as described above. Mr. Sampson's total cash compensation with respect to 2001 was $197,077 a decrease of 8% over total cash compensation related to 2000. Mr. Sampson in 2000 and earlier years devoted approximately

8

60% of his working time to the Company and the balance to Hector Communications Corporation, where he also serves as Chief Executive Officer. Effective April 1, 2001 Mr. Sampson adjusted the allocation of his working time to the two companies to 50% each and a significant portion of the decrease in total cash compensation in 2001 reflects the reduction effective April 1, 2001 of Mr. Sampson's annual base compensation from $225,000 to $200,000 to reflect his reduced time commitment to the Company. The decrease in Mr. Sampson's base compensation in 2001 also reflects a further $18,000 (annualized) reduction in base compensation effective July 1, 2001 to offset fees Mr. Sampson receives as a member of the board of a national telecommunications organization. In addition, Mr. Sampson was granted options to purchase 15,000 shares of Company common stock at the beginning of 2001, compared to options covering 21,000 shares granted to Mr. Sampson at the beginning of 2000. Because of his significant holdings of Company common stock, under applicable IRS rules, Mr. Sampson's options are priced at 110% of the market price on the date of grant. The salary and stock option compensation payable to Mr. Sampson for 2001 as compared to 2000 reflects the Committees' evaluation of Mr. Sampson's individual performance and the Company's financial performance. In the 2001 fiscal year the Company posted a 21% decrease in revenues compared to 2000 and experienced an 89% decrease in net income compared to 2000. The Compensation Committee believes, based upon their general knowledge of compensation paid to other chief executives and a review of published regional salary data (but without conducting a formal survey), that Mr. Sampson's total compensation is reasonable in relation to the scope of his responsibilities and financial performance of the Company during the past several years.

Submitted by the Compensation Committee of the Board of Directors

Gerald D. Pint Luella Gross Goldberg Frederick M. Green Wayne E. Sampson

The Audit Committee of the Board of Directors is responsible for providing independent, objective oversight of the Company's financial reporting system by overseeing and monitoring management's and the independent auditors' participation in the financial reporting process. The Audit Committee is comprised of independent directors, and acts under a written charter first adopted and approved by the Board of Directors on May 18, 2000. Each of the members of the current Audit Committee is independent as defined by the NASDAQ listing standards.

The Audit Committee held one meeting during fiscal year 2001. The meeting was designed to facilitate and encourage private communication between the Audit Committee and the Company's independent accountants, Deloitte & Touche.

During the meeting, the Audit Committee reviewed and discussed the audited financial statements with management and Deloitte & Touche. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The discussions with Deloitte & Touche also included the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Deloitte & Touche provided to the Audit Committee the written disclosures and the letter regarding its independence as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). This information was discussed with Deloitte & Touche.

9

The Audit Committee considered whether the provision of information technology services and other non-audit services to the Company by Deloitte & Touche is compatible with maintaining the principal accountant's independence.

Based on the discussions with management and Deloitte & Touche, the Audit Committee's review of the representations of management and the report of Deloitte & Touche, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001, filed with the Securities and Exchange Commission.

Submitted by the Audit Committee of the Company's Board of Directors

Paul J. Anderson Edwin C. Freeman Luella Gross Goldberg

THE PRECEDING REPORT SHALL NOT BE DEEMED INCORPORATED BY REFERENCE BY ANY GENERAL STATEMENT INCORPORATING BY REFERENCE THIS PROXY STATEMENT INTO ANY FILING UNDER THE SECURITIES ACT OF 1933 (THE "1933 ACT") OR THE SECURITIES EXCHANGE ACT OF 1934 (THE "1934 ACT"), EXCEPT TO THE EXTENT THE COMPANY SPECIFICALLY INCORPORATES THIS INFORMATION BY REFERENCE, AND SHALL NOT OTHERWISE BE DEEMED FILED UNDER THE 1933 ACT OR THE 1934 ACT.

10

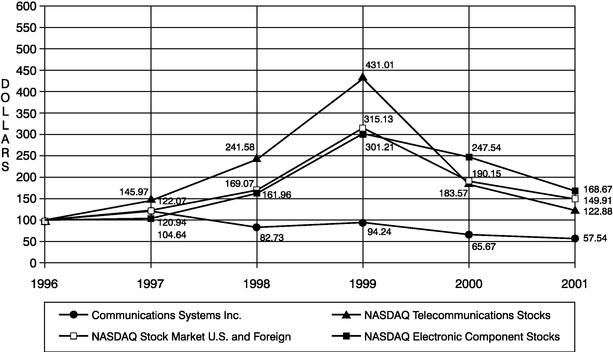

The following graph presents, at the end of each of the Company's last five fiscal years, the cumulative total return on the common stock of the Company as compared to the cumulative total return of the NASDAQ Stock Market Total Return Index (U.S. and foreign companies), NASDAQ Electronic Component Stocks and NASDAQ Telecommunications Stock Total Return Index, assuming, in each case, the investment of $100 on the last business day before January 1, 1997 and the reinvestment of all dividends.

Comparison of Five-Year Cumulative Total Return

| | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| COMMUNICATIONS SYSTEMS, INC. | 100.000 | 120.940 | 82.733 | 94.240 | 65.673 | 57.540 | |||||||

| NASDAQ STOCK MARKET—U.S. and FOREIGN | 100.000 | 122.070 | 169.072 | 315.127 | 190.153 | 149.913 | |||||||

| NASDAQ ELECTRONIC COMPONENT STOCKS | 100.000 | 104.835 | 161.965 | 301.209 | 247.537 | 168.668 | |||||||

| NASDAQ TELECOMMUNICATIONS STOCKS | 100.000 | 145.971 | 241.582 | 431.009 | 183.573 | 122.875 | |||||||

11

PROPOSAL 2

PROPOSAL TO AMEND THE COMPANY'S

1990 EMPLOYEE STOCK PURCHASE PLAN

Introduction

The shareholders of the Company approved the Communications Systems, Inc. 1990 Employee Stock Purchase Plan (the "Purchase Plan") on May 15, 1990 and approved amendments to the Purchase Plan on May 15, 1995 and May 19, 1998. The purpose of the Purchase Plan is to encourage stock ownership by all employees of the Company and to provide incentive to employees to remain in employment, improve operations, increase profits and contribute more significantly to the Company's success.

Amendment to Purchase Plan to Increase Authorized Shares

The Purchase Plan originally authorized the issuance of 100,000 shares of common stock (as adjusted for a subsequent stock split) pursuant to options granted hereunder. At the 1995 Annual Meeting of Shareholders an amendment to increase the number of shares available under the Purchase Plan by 100,000 shares was ratified and approved. The shareholders ratified and approved another amendment to increase the number of shares available under the Purchase Plan by 100,000 at the 1998 Annual Meeting of Shareholders. On April 1, 2002, the Board of Directors voted to amend the Purchase Plan again, subject to the ratification and approval of the Shareholders, to increase the total number of shares available under the Purchase Plan by 100,000 shares to a total of 400,000 shares. As of March 31, 2002, options to purchase 33,600 shares under the Plan were outstanding and an aggregate of 262,346 shares have been purchased through the exercise of options granted under the Plan since its inception.

The Board of Directors believes that the Purchase Plan has provided material benefits to the Company and its employees and has deemed it prudent to increase the shares available for grant under the Purchase Plan by 100,000 shares to enable the continued grant of options and exercise of options pursuant to the terms and conditions of the Plan. The increase would have the effect of increasing the total number of shares available for future issuance under the Purchase Plan to 400,000 shares.

Summary of Terms of Stock Purchase Plan

The Plan is administered by a Committee consisting of not less than three members who are appointed by the Board of Directors. Each member of such Committee must be a director, officer or an employee of the Company.

The Plan commenced on September 1, 1990 and has been carried out in successive phases of one year each with each phase commencing on or about the first day of September in each year as determined by the Committee.

Any employee, including an officer of the Company (other than Curtis Sampson who, as a 5% or more shareholder, is prohibited by law from participating) who as of the first day of the month immediately preceding the Commencement Date of a phase of the Plan, is customarily employed by the Company for more than 15 hours per week, is eligible to participate in the Plan.

Eligible employees elect to participate in the Plan by completing payroll deduction authorization forms prior to the Commencement Date of any phase of the Plan. Payroll deductions are limited to 10% of a Participant's base pay for the term of the phase of the Plan.

12

As of the Commencement Date of any phase of the Plan, an eligible employee who elects to participate in the Plan is granted an option for as many full shares as he or she will be able to purchase pursuant to the payroll deduction procedure. The option price for employees who participate on the Commencement Date of any phase of the Plan is the lower of: (i) 85% of the fair market value of the shares on the Commencement Date of that phase of the Plan, or (ii) 85% of the fair market value of the shares on the Termination Date of that phase of the Plan.

Exercise of the option occurs automatically on the Termination Date of the phase of the Plan, unless a Participant gives written notice prior to such date as to an election not to exercise. A Participant may, at any time during the term of the Plan, give notice that he or she does not wish to continue to participate, and all amounts withheld will be refunded with interest.

The Company believes that the Plan is a "qualified" Plan under Section 423, Internal Revenue Code. Under the Internal Revenue Code, as amended to date, no income will result to a grantee of an option upon the granting or exercise of an option, and no deduction will be allowed to the Company. The gain, if any, resulting from a disposition of the shares received by a Participant, will be reported according to the provisions of Section 423, Internal Revenue Code of 1954, as amended, and will be taxed in part as ordinary income and in part as capital gain.

The Board of Directors may at any time amend the Plan, except that no amendment may make changes in options already granted which would adversely affect the rights of any Participant.

Registration with SEC

The Company intends to file a Registration Statement covering the additional shares authorized for issuance under the Purchase Plan, as amended, with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended.

Vote Required

The affirmative vote of a majority of the outstanding shares of the Company's common stock voting at the meeting in person or by proxy is required for approval of the proposed amendment to the Company's Purchase Plan.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" APPROVAL OF THE AMENDMENT OF THE 1990 EMPLOYEE STOCK PURCHASE PLAN TO INCREASE BY 100,000 SHARES THE NUMBER OF OPTIONS AND WARRANTS WHICH MAY BE GRANTED UNDER THE STOCK PURCHASE PLAN.

Transactions and Shared Management with Hector Communications Corporation

The Company makes available to Hector Communications Corporation ("HCC"), which prior to 1990 was a subsidiary of the Company certain staff services and administrative systems, such as payroll and pension plan administration, with the related costs and expenses being paid by HCC. In 2001 and 2000 HCC paid the Company $286,000 and $314,000, respectively, for such services, amounts which management believes are no less than the cost the Company incurred in connection with providing such services.

13

Historically, two of the Company's executive officers, Curtis A. Sampson and Paul N. Hanson, have each devoted approximately 60% of their working time to the Company. In fiscal 2001, Mr. Sampson devoted approximately 50% of his time to the Company. Messrs. Sampson and Hanson devoted substantially all of the remainder of their working time to HCC, for which Mr. Sampson serves as Chairman and Chief Executive Officer and Mr. Hanson serves as a director and Treasurer. These officers are separately compensated by HCC for their services to HCC.

REPORTS TO THE SECURITIES AND EXCHANGE COMMISSION

The Company's officers, directors and beneficial holders of 10% or more of the Company's securities are required to file reports of their beneficial ownership with the Securities and Exchange Commission on SEC Forms 3, 4 and 5. According to the Company's records, during the period from January 1, 2001 to December 31, 2001, officers, directors and ten percent beneficial holders of the Company filed all reports with the Securities and Exchange Commission required under Section 16(a) related to their beneficial ownership. To the best of the Company's knowledge, all such reports have been filed in a timely manner.

Deloitte & Touche have been the auditors for the Company since 1982 and have been selected by the Board of Directors, upon recommendation of the Audit Committee, to serve as such for the current fiscal year. A representative of Deloitte & Touche is expected to be present at the Annual Meeting of Shareholders and will have an opportunity to make a statement and will be available to respond to appropriate questions.

Audit Fees

The aggregate fees billed to the Company by Deloitte & Touche for professional services rendered for the audit of the Company's consolidated annual financial statements for fiscal year 2001 and the reviews of the financial statements included in the Company's Forms 10-Q for fiscal year 2001 were $114,161.

All Other Fees

Other than those fees listed above, the aggregate fees billed to the Company by Deloitte & Touche for fiscal year 2001, none of which were financial information systems design and implementation fees, were $73,614. This figure includes fees of $10,144 for audit-related services such as pension audits, statutory filings and accounting consultations, and fees of $63,470 for all non-audit services such as tax-related services. The Audit Committee determined that the non-audit services performed by Deloitte & Touche are not incompatible with maintaining Deloitte & Touche's independence with respect to the Company.

14

SHAREHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

The proxy rules of the Securities and Exchange Commission permit shareholders of a company, after timely notice to the Company, to present proposals for shareholder action in the Company's proxy statement where such proposals are consistent with applicable law, pertain to matters appropriate for shareholder action and are not properly omitted by Company action in accordance with the Commission's proxy rules. The next annual meeting of the shareholders of Communications Systems, Inc. is expected to be held on or about May 15, 2003 and proxy materials in connection with that meeting are expected to be mailed on or about April 10, 2003. Shareholder proposals prepared in accordance with the Commission's proxy rules to be included in the Company's Proxy Statement must be received at the Company's corporate office, 213 South Main Street, Hector, Minnesota 55342, Attention: President, by December 31, 2002, in order to be considered for inclusion in the Board of Directors' Proxy Statement and proxy card for the 2003 Annual Meeting of Shareholders. Any such proposals must be in writing and signed by the shareholder.

The Bylaws of the Company establish an advance notice procedure with regard to (i) certain business to be brought before an annual meeting of shareholders of the Company and (ii) the nomination by shareholders of candidates for election as directors.

Properly Brought Business. The Bylaws provide that at the annual meeting only such business may be conducted as is of a nature that is appropriate for consideration at an annual meeting and has been either specified in the notice of the meeting, otherwise properly brought before the meeting by or at the direction of the Board of Directors, or otherwise properly brought before the meeting by a shareholder who has given timely written notice to the Secretary of the Company of such shareholder's intention to bring such business before the meeting. To be timely, the notice must be given by such shareholder to the Secretary of the Company not less than 45 days nor more than 75 days prior to a meeting date corresponding to the previous year's annual meeting. Notice relating to the conduct of such business at an annual meeting must contain certain information as described in Section 2.9 of the Company's Bylaws, which are available for inspection by shareholders at the Company's principal executive offices pursuant to Section 302A.461, subd. 4 of the Minnesota Statutes. Nothing in the Bylaws precludes discussion by any shareholder of any business properly brought before the annual meeting in accordance with the Company's Bylaws.

Shareholder Nominations. The Bylaws provide that a notice of proposed shareholder nominations for the election of directors must be timely given in writing to the Secretary of the Company prior to the meeting at which directors are to be elected. To be timely, the notice must be given by such shareholder to the Secretary of the Company not less than 45 days nor more than 75 days prior to a meeting date corresponding to the previous year's annual meeting. The notice to the Company from a shareholder who intends to nominate a person at the meeting for election as a director must contain certain information as described in Section 3.7 of the Company's Bylaws, which are available for inspection by shareholders as described above. If the presiding officer of a meeting of shareholders determines that a person was not nominated in accordance with the foregoing procedure, such person will not be eligible for election as a director.

15

Management knows of no other matters that will be presented at the meeting. If any other matters arise at the meeting, it is intended that the shares represented by the proxies in the accompanying form will be voted in accordance with the judgment of the persons named in the proxy.

The Company is transmitting with this Proxy Statement its Annual Report for the year ended December 31, 2001.Shareholders may receive, without charge, a copy of the Company's 2001 Form 10-K Report as filed with the Securities and Exchange Commission by writing to Assistant Secretary, Communications Systems, Inc., 213 South Main Street, Hector, Minnesota 55342.

By Order of the Board of Directors,

Richard A. Primuth,

Secretary

16

COMMUNICATIONS SYSTEMS, INC.

ANNUAL MEETING OF SHAREHOLDERS

May 16, 2002

3:00 p.m. Central Daylight Time

Radisson Plaza Hotel

New Sweden Room, 35 South Seventh Street

Minneapolis, Minnesota 55402

| COMMUNICATIONS SYSTEMS, INC. | proxy |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 16, 2002.

The undersigned hereby appoints Paul J. Anderson, Wayne E. Sampson and Frederick M. Green or any of them, as proxies, with full power of substitution to vote all the shares of common stock which the undersigned would be entitled to vote if personally present at the Annual Meeting of Shareholders of Communications Systems, Inc., to be held May 16, 2002, at 3:00 p.m. Central Daylight Time at the Radisson Plaza Hotel, New Sweden Room, 35 South Seventh Street, Minneapolis, Minnesota 55402, or at any adjournment thereof, upon any and all matters which may properly be brought before the meeting or adjournment thereof, hereby revoking all former proxies.

See reverse for voting instructions.

\*/Please detach here \*/

| 1. | ELECTION OF DIRECTORS: | 01 Edwin C. Freeman 02 Luella Gross Goldberg | 03 Randall D. Sampson | o | Vote FOR all nominees (except as marked) | o | Vote WITHHELD from all nominees | |||||

| (Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) | | |||||||||||

2. | PROPOSAL TO APPROVE AN AMENDMENT TO THE COMPANY'S EMPLOYEE STOCK PURCHASE PLAN. | o | FOR | o | AGAINST | o | ABSTAIN | |||||||

3. | THE PROXIES ARE AUTHORIZED TO VOTE IN THEIR DISCRETION UPON ANY OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING. | |||||||||||||

UNLESS OTHERWISE SPECIFIED, THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED "FOR" THE ELECTION OF THE DIRECTORS NAMED ON THE REVERSE SIDE OF THIS CARD.

| Address Change? Mark Box o Indicate Changes Below: | Dated: | | , 2002 | ||||

| Signature(s) in Box Please date and sign exactly as your name(s) appears below indicating, where proper, official position or representative capacity in which you are signing. When signing as executor, administrator, trustee or guardian, give full title as such; when shares have been issued in names of two or more persons, all should sign. | |||||||