As filed with the Securities and Exchange Commission onDecember 8, 2003

Registration No. 333-108522

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3 to

FORM S-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TEXAS-NEW MEXICO POWER COMPANY.

(Exact name of registrant as specified in its charter)

| Texas | | 4911 | | 75-0204070 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

4100 International Plaza

Fort Worth, Texas 76109

(817) 731-0099

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

SCOTT FORBES Senior Vice President and Chief Financial Officer Texas-New Mexico Power Company 4100 International Plaza Fort Worth, Texas 76109 (817) 731-0099 Fax: (817) 737-1333 | | Copy to: PAUL W. TALBOT Senior Counsel & Corporate Secretary Texas-New Mexico Power Company 4100 International Plaza Fort Worth, Texas 76109 (817) 731-0099 |

(Name, address, including zip code, and telephone number, including area code, of agent for service) | | Fax: (817) 737-1333 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

We hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until we shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement becomes effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission relating to these securities is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

SUBJECT TO COMPLETION, DATED DECEMBER 8, 2003

TEXAS-NEW MEXICO POWER COMPANY

Offer to Exchange

Up to $250,000,000 6.125% Senior Notes due 2008

which have been registered under the Securities Act of 1933

for any and all outstanding

6.125% Senior Notes due 2008

Material Terms of the Exchange Offer

| | • | We will issue up to $250,000,000 aggregate principal amount of 6.125% Senior Notes due 2008 (the “exchange notes”) in exchange for all of our outstanding 6.125% Senior Notes due 2008 (the “existing notes”) that are validly tendered and not withdrawn prior to the expiration of the exchange offer. |

| | • | The exchange offer expires at 5:00 p.m., New York City time, on , 2003, unless extended. |

| | • | Tenders of existing notes may be withdrawn at any time prior to the expiration of the exchange offer. |

| | • | The exchange of existing notes for exchange notes will not be a taxable event for U.S. federal income tax purposes for most holders. You should read the section entitled “Certain U.S. Federal Income Tax Considerations” for more information. |

| | • | We do not intend to apply for listing of the exchange notes on any securities exchange or to arrange for the exchange notes to be quoted on any quotation system. There is currently no public market for the exchange notes. |

Material Terms of the Exchange Notes

| | • | Terms: The terms of the exchange notes are substantially identical to the terms of the existing notes, except that exchange notes have been registered under the Securities Act of 1933 and the transfer restrictions and registration rights relating to the existing notes will not apply to the exchange notes. See “The Exchange Offer—Reasons for the Exchange Offer.” |

| | • | Maturity Date: June 1, 2008. |

| | • | Interest Rate: 6.125% per year, payable on May 1 and November 1 of each year, commencing November 1, 2003. |

| | • | Ranking: The exchange notes will be our senior unsecured obligations and will rank equally in right of payment to our existing unsecured indebtedness, consisting of $175 million 6.25% Senior Notes due 2009, and any future senior unsecured indebtedness. The exchange notes will be subordinated to any future indebtedness (including guaranteed obligations) of our subsidiaries. |

| | • | Redemption: We may redeem the exchange notes, in whole or in part, any time prior to May 1, 2005, by paying the redemption price described as the “Make Whole Price” in “Description of Senior Notes – Redemption of the Senior Notes Prior to May 1, 2005.” On or after May 1, 2005, we may redeem the exchange notes, at our option, by paying the redemption price described as the “applicable redemption price” in “Description of the Senior Notes – Redemption of the Senior Notes After May 1, 2005.” In addition, on or after May 1, 2005, we will be required to redeem the exchange notes upon the receipt of proceeds of the stranded cost securitization at the applicable redemption price, as described in “Description of the Senior Notes – Redemption of the Senior Notes After May 1, 2005.” |

Please read “Risk Factors” beginning on page 11 for a discussion of risk factors you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended. A broker-dealer may use this prospectus, as it may be amended or supplemented from time to time, in connection with resales of exchange notes received in exchange for existing notes where the broker-dealer acquired the existing notes as a result of market-making or other trading activities. We have agreed that, for a period of 180 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

The date of this prospectus is , 2003.

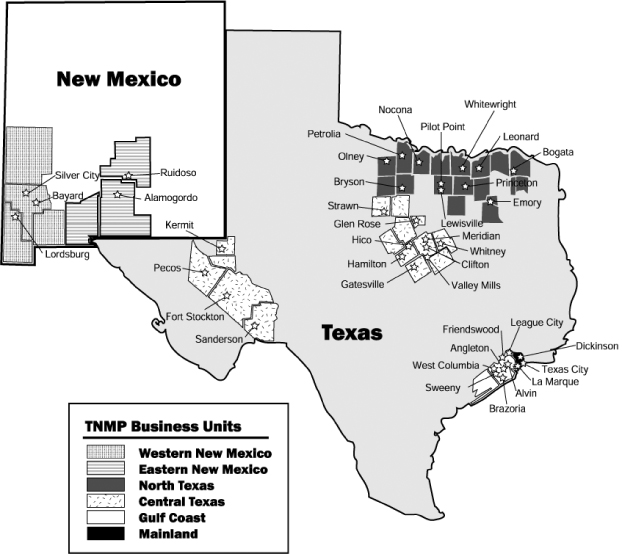

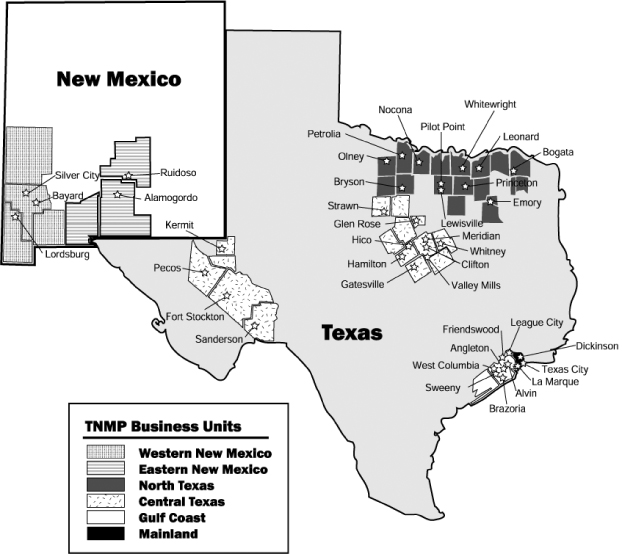

TEXAS-NEW MEXICO POWER COMPANY SERVICE AREAS

TABLE OF CONTENTS

iii

PROSPECTUS SUMMARY

THE COMPANY

We (also referred to as “TNMP” ) are a regulated utility operating in Texas and New Mexico. In Texas, we are a regulated utility engaged solely in the transmission and distribution of electricity. In New Mexico, we provide integrated electricity services under traditional cost of service regulation. Those services include transmitting, distributing, purchasing and selling electricity to our New Mexico customers. Traditional cost-of-service regulation is a method of regulation that sets rates that we can charge to our electricity customers based upon our cost of providing that service. The cost of providing that service includes a return on the capital we have invested and dedicated to providing electric service. See “Business.”

We and First Choice Power, Inc. (“First Choice”) are wholly owned subsidiaries of TNP Enterprises, Inc., a Texas corporation (“TNP Enterprises” or “TNP”) a holding company that transacts business through its subsidiaries. We have two subsidiaries, Texas Generating Company, L.P. (“TGC”), a Texas limited partnership, and Texas Company II, LLC (“TGC II”), a Texas limited liability company). We formed TGC and TGCII to finance construction of TNP One, our sole generation facility. Until May 2001, we owned TNP One together with TGC and TGC II. At that time, we consolidated the ownership of TNP One into TGC to comply with the Texas Electric Choice Act (the “1999 Restructuring Legislation”).

Effective January 1, 2002, the 1999 Restructuring Legislation established retail competition in the Texas electricity market. Prior to January 1, 2002, we operated as an integrated electric utility in Texas, generating, transmitting and distributing electricity to customers in our Texas service territory. As required by the 1999 Restructuring Legislation, and in accordance with a plan approved by the Public Utility Commission of Texas (the “PUCT”), we separated our Texas utility operations into three components:

| | • | | Retail Sales Activities. First Choice assumed the activities related to the sale of electricity to retail customers in Texas, and, on January 1, 2002, our customers automatically became customers of First Choice, unless they chose a different retail electric provider. |

| | • | | Power Transmission and Distribution. We continue to operate our regulated transmission and distribution business in Texas. |

| | • | | Power Generation.TCG became the unregulated entity performing our generation activities in Texas. However, in October 2002, we and TGC sold TNP One to Sempra Energy Resources. As a result of the sale, TGC and TGCII neither own property nor engage in any operating activities and neither we nor any of our affiliates is currently in the power generation business. See “Business – Sale of TNP One.” |

No payments or other consideration were exchanged between us, First Choice or TGC in connection with the separation.

We provide First Choice and TNP Enterprises with corporate support services, including accounting, finance, information services, legal and human resources, under a shared services agreement with First Choice dated March 1, 2001 and a similar agreement with TNP Enterprises dated June 6, 1997. These services are billed at our cost and, in return, TNP Enterprises and First Choice compensate us for the use of the services. These arrangements are discussed in Note 10 to the consolidated financial statements dated December 31, 2002, and Note 6 to the consolidated interim financial statements, both of which are included in this prospectus. You may find more information regarding the separation of our Texas operations due to the beginning of retail competition in the “Business” section and in Note 2 to the consolidated financial statements dated December 31, 2002, both of which are included in this prospectus. ^

In June 2003, we asked the New Mexico Public Regulation Commission (“NMPRC”) for permission to form a new wholly-owned subsidiary in 2003 to acquire and hold our New Mexico properties and to conduct our New Mexico operations, which accounted for approximately 16% of our assets at September 30, 2003, and

1

approximately 18% of our net income for the twelve months ended September 30, 2003. The purpose of the new subsidiary was to disengage our customers in each state from the risks associated with the other, and to provide us with the flexibility to respond to the competitive aspects of the deregulated retail electricity market in Texas while eliminating any unnecessary risks to our New Mexico customers. In October 2003, we withdrew the request in connection with the approval of our request to guarantee certain power supply obligations of First Choice. You may find more information about this request in Note 2 to the consolidated interim financial statements.

TNP Enterprises had consolidated income applicable to common stock of $5.0 million for the quarter ended September 30, 2003, which represents a $13.5 million decrease when compared with income of $18.5 million for the same period in 2002. The decrease was driven by a decrease in First Choice earnings. First Choice had net income of $6.5 million for the quarter ended September 30, 2003, compared with net income of $17.7 million for the corresponding period in 2002. First Choice is our largest customer. You should read the discussion of risks related to the operations of First Choice and other retail electric providers that are our customers that is included in the “Risk Factors” section of this prospectus.

Our executive offices are located at 4100 International Plaza, Fort Worth, Texas 76109, and our telephone number is (817) 731-0099.

2

THE EXCHANGE OFFER

On June 10, 2003, we sold the existing notes in a private offering to Barclays Capital Inc. and CIBC World Markets Corp., collectively referred to as the initial purchasers. As part of the private offering, we entered into a registration rights agreement with the initial purchasers in which we agreed, among other things, to deliver this prospectus to you and to use our reasonable best efforts to complete the exchange offer on or before December 7, 2003. The following is a summary of the material terms of the exchange offer.

Exchange Offer | We are offering to issue up to $250,000,000 aggregate principal amount of registered exchange notes in exchange for the same principal amount of existing notes. We are offering to issue the exchange notes to satisfy our obligations under the registration rights agreement we entered into with the initial purchasers on June 10, 2003. For a description of the procedures for tendering your existing notes, see “The Exchange Offer — Procedures for Tendering.” |

Expiration Date | The exchange offer will expire at 5:00 p.m. New York City time, on , 2003, unless we decide to extend it. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions described under “The Exchange Offer — Conditions to the Exchange Offer,” which we may waive in our sole discretion. We will not be required to accept for exchange, or to issue exchange notes for any existing notes, if: |

| | • | | the exchange offer, or the making of any exchange by a holder of existing notes would violate applicable law or any applicable interpretation of the SEC staff; |

| | • | | an action or proceeding has been instituted or threatened in a court or before a government agency or body with respect to the exchange offer; |

| | • | | a law, statute or regulation that can reasonably be expected to impair our ability to proceed with the exchange offer has been adopted or enacted; |

| | • | | a holder has not made to us the representations described in “The Exchange Offer—Your Representations to Us” and any other representations as may be reasonably necessary under applicable SEC rules, regulations or interpretations to allow us to use an appropriate form to register the exchange notes under the Securities Act; or |

| | • | | a stop order has been threatened or is in effect with respect to the registration statement of which this prospectus is a part or the qualification of the indenture relating to the notes under the Trust Indenture Act of 1939. |

| | The exchange offer is not conditioned upon any minimum principal amount of existing notes being tendered. If any of the conditions to the exchange offer have not been satisfied, we reserve the right, in our sole discretion, to: |

| | • | | delay accepting for exchange, or refuse to accept for exchange, any existing notes, provided that we may not delay acceptance of existing notes tendered for exchange subsequent to the expiration of the |

3

| | exchange offer, other than in anticipation of receiving any necessary government approvals; |

| | • | | extend the exchange offer; |

| | • | | terminate the exchange offer; or |

| | • | | amend the terms of the exchange offer. |

Procedures for Tendering Existing Notes | To participate in the exchange offer, you must follow the automated tender offer program procedures (which we call “ATOP”) established by The Depository Trust Company, referred to as “DTC” in this prospectus, for tendering existing notes held in book-entry form. These procedures require that the exchange agent receive, prior to the expiration date of the exchange offer, a computer generated message known as an “agent’s message” from DTC that states: |

| | • | | DTC has received your instructions to transfer your existing notes; |

| | • | | you agree to be bound by the terms of the letter of transmittal; and |

| | • | | we may enforce such agreement against you. |

| | See “Exchange Offer—Terms of the Exchange Offer” and “— Procedures for Tendering.” |

Guaranteed Delivery Procedures | None |

Issuance of Exchange Notes | We will issue exchange notes that we have accepted for exchange in the exchange offer only after the exchange agent receives, prior to 5:00 p.m., New York City time, on the expiration date: |

| | • | | a book entry confirmation of such existing notes into the exchange agent’s account at DTC; and |

| | • | | a properly transmitted agent’s message. |

Withdrawal of Tenders | You may withdraw your tender of existing notes at any time prior to the expiration date. To withdraw, you must submit a notice of withdrawal to the exchange agent using ATOP procedures before 5:00 p.m. New York City time on the expiration date. See “Exchange Offer — Withdrawal of Tenders.” |

Fees and Expenses | We will bear all expenses related to the exchange offer. See “Exchange Offer — Fees and Expenses.” |

Use of Proceeds | We will not receive any proceeds from the issuance of the exchange notes in the exchange offer. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement. |

Consequences of Failure to Exchange Existing Notes | If you do not exchange your existing notes in this exchange offer, you will no longer be able to require us to register the existing notes under the Securities Act except in the limited circumstances provided under the registration rights |

4

agreement. See “The Exchange Offer—Shelf Registration Statement.” In addition, you will not be able to resell, offer to resell or otherwise transfer the existing notes unless we have registered the existing notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act.

Material Federal Income Tax Considerations | The exchange of exchange notes for existing notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes for most holders. See “Material Federal Income Tax Considerations.” |

Exchange Agent | We have appointed JP Morgan Chase as exchange agent for the exchange offer. Please direct questions and requests for assistance and requests for additional copies of this prospectus (including the letter of transmittal) to the exchange agent addressed as follow: JP Morgan Chase Bank, 2200 Ross Ave., 9th Floor, Dallas, TX 75201, Attention: Registered Bond Processing Department. Eligible institutions may make requests by telephone at 1-800-275-2048 |

Accounting Treatment | We will record the exchange notes in our accounting records at the same carrying value as the existing notes. This carrying value is the aggregate principal amount of the existing notes less any bond discount, as reflected in our accounting records on the date of exchange. Accordingly, we will not recognize any gain or loss for accounting purposes in connection with the exchange offer. |

Ratio of Earnings to Fixed Charges | For the twelve months ended September 30, 2003: 3.1X |

For the years ended December 31,

2002: 3.5X

2001: 3.8X

2000: 2.6X

1999: 2.4X

1998: 1.9X

| | Pro forma for the twelve months ended: |

December 31, 2002: 2.5X

September 30, 2003 2.7X

Resale of Exchange Notes | Based on certain no-action letters issued by the staff of the SEC to third parties in connection with transactions similar to the exchange offer, we believe that you may offer for resale, resell or otherwise transfer any exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act, unless: |

| | • | | you acquire the exchange notes other than in the ordinary course of your business; |

| | • | | you are participating, intend to participate or have an arrangement with any person to participate, in a distribution of the exchange notes; |

| | • | | you are our “affiliate,” as defined in Rule 405 under the Securities Act; or |

5

| | • | | you are a broker-dealer that acquired existing notes directly from us. |

| | In any of the foregoing circumstances: |

| | • | | you will not be able to rely on the interpretations of the staff of the SEC in connection with any offer for resale, resale or other transfer of the exchange notes; and |

| | • | | you must comply with the registration and prospectus delivery requirements of the Securities Act, or have an exemption available, in connection with any offer for resale, resale or other transfer of the exchange notes. |

| | Each broker-dealer that receives exchange notes for its own account in exchange for existing notes, where the existing notes were acquired by that broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

Regulatory Approvals | We have received required approvals of the Federal Energy Regulatory Commission (“FERC”) and the NMPRC to issue new securities in the exchange offer. We are not required to obtain the approval of the PUCT. |

6

Terms of the Exchange Notes

The exchange notes will be identical in all material respects to the existing notes except that the offering of the exchange notes has been registered under the Securities Act and the transfer restrictions and registration rights relating to the existing notes will not apply to the exchange notes. The exchange notes will evidence the same debt as the existing notes, and the same indenture will govern the exchange notes and the existing notes.

The following summary contains basic information about the exchange notes and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the exchange notes, please refer to the section of this prospectus entitled “Description of the Senior Notes.”

Issuer | Texas-New Mexico Power Company |

Securities Offered | $250,000,000 aggregate principal amount of 6.125% Senior Notes due 2008, registered under the Securities Act. |

Maturity Date | June 1, 2008. |

Interest Rate | 6.125% per annum. Interest on the exchange notes will accrue from the date of original issuance of the existing notes or exchange notes, calculated on a basis of a 360-day year consisting of twelve 30-day months. |

Interest Payment Dates | Each May 1 and November 1, commencing on November 1, 2003. |

Ranking | The exchange notes will be our senior unsecured obligations and will rank equally in right of payment to our existing unsecured indebtedness, consisting of $175 million 6.25% Senior Notes due 2009, and any future senior unsecured indebtedness. The exchange notes will be subordinated to any future indebtedness (including guaranteed obligations) of our subsidiaries. We do not currently have outstanding indebtedness that ranks senior to the exchange notes. The terms of a $125 million credit facility between TNP Enterprises, Canadian Imperial bank of Commerce, N.A., as administrative agent, and several lenders, generally limits the ability of us and our Subsidiaries to incur additional indebtedness, other than a limited amount of secured indebtedness, a limited amount of indebtedness to finance working capital needs, refinancing indebtedness, and indebtedness owed to another wholly owned subsidiary of TNP Enterprises. TNP Enterprises’ credit facility expires December 31, 2006. |

Optional Redemption | We may redeem the exchange notes, in whole or in part, any time prior to May 1, 2005, by paying the redemption price described in “Description of Senior Notes – Redemption of the Senior Notes Prior to May 1, 2005.” In addition, on or after May 1, 2005, we may redeem the exchange notes, at our option, by paying the redemption price described in “Description of the Senior Notes – Redemption of the Senior Notes After May 1, 2005.” If less than all of the exchange notes and any remaining existing notes are to be redeemed, such notes will be redeemed on a pro rata basis. |

Mandatory Redemption | On or after May 1, 2005, we will be required to redeem the exchange notes under the circumstances and at the redemption price described in “Description of the Senior Notes – Redemption of the Senior Notes After May 1, 2005.” |

7

Certain Covenants | The terms of the indenture will restrict our ability to, among other things, create liens and engage in sale and lease-back transactions. These restrictions are subject to a number of important qualifications and exceptions, which are described under “Description of the Senior Notes – Restrictions on Liens” and “Description of the Senior Notes – Restrictions on Sale and Lease-Back Transactions.” |

| | The terms of the indenture also require us to: |

| | • | | punctually pay the principal and interest on the exchange notes; |

| | • | | maintain an office or agency in each place where the exchange notes may be presented or surrendered for payment, transfer or exchange; |

| | • | | deposit funds to pay principal and interest for the exchange notes in trust or with a paying agent; |

| | • | | deliver annual reports of our compliance with the indenture to the trustee; |

| | • | | maintain our corporate existence, properties used in the conduct of our business, and insurance; |

| | • | | comply with applicable laws; and |

Events of Default | If an event of default occurs, the principal amount of the exchange notes then outstanding, together with any accrued interest, may be declared immediately due and payable, except that upon the occurrence of certain bankruptcy related events of default described below, such principal and interest will become immediately payable without any such declaration. See “Description of the Senior Notes.” The indenture defines an “Event of Default” as: |

| | (a) | our default in payment of principal (or premium, if any) of any senior debt security of that series when due and payable, at its maturity or otherwise; |

| | (b) | our default in payment of any interest on any senior debt security of that series when due and payable, and continuance of such default for a period of 30 consecutive days; |

| | (c) | our default in the deposit of any sinking fund payment, when and as due by the terms of any senior debt security of that series; |

| | (d) | our default in the performance, or breach, of any of our covenants or warranties in the Indenture (other than certain covenants or warranties) and our continuance of such default or breach for 60 consecutive days after due notice in the performance of any covenants or warranties in the Indenture; |

8

| | (e) | (i) the entry of a decree, order for relief, or order adjudging us bankrupt or insolvent in an applicable federal or state bankruptcy, insolvency, reorganization or similar proceeding; (ii) our commencement of a voluntary case, our consent to the entry of a decree or order for relief in an involuntary case, our filing of a petition, answer or consent seeking reorganization, relief or the appointment of or taking possession by a receiver or similar official, each under applicable federal or state bankruptcy, insolvency, reorganization or other similar law; (iii) our making an assignment for the benefit of creditors; (iv) our written admission of our inability to pay our debts generally as they become due; or (v) our taking corporate action in furtherance of any such action; |

| | (f) | our default or default by any subsidiary under any indebtedness (including a default with respect to senior debt securities of any other series) or under any mortgage, indenture or instrument under which our indebtedness may be evidenced or secured, whether such indebtedness now exists or is hereafter created, in an aggregate principal amount exceeding $10 million, if such default has resulted in such indebtedness becoming or being declared due and payable; and |

| | (g) | any other Event of Default provided with respect to any senior debt securities of that series. |

Exchange Offer;

Registration Rights | In connection with the private offering of the existing notes, on June 10, 2003, we entered into a registration rights agreement with the initial purchasers in which we agreed to file the registration statement of which this prospectus is a part in connection with the exchange offer. We also agreed to file a shelf registration statement to cover resales of the exchange notes if applicable interpretations of the staff of the SEC do not permit us to effect the exchange offer or if for any other reason we do not consummate the exchange offer by January 6, 2004. |

| | Pursuant to the registration rights agreement, you are entitled to receive additional interest on the existing notes or the exchange notes, as the case may be, if: |

| | • | | we fail to file the exchange offer registration statement or any required shelf registration statement within the time period prescribed by the registration rights agreement; |

| | • | | the exchange offer registration statement or any required shelf registration statement that we file is not declared effective within the time period prescribed by the registration rights agreement; or |

| | • | | (i) we do not consummate the exchange offer within the time period prescribed by the registration rights agreement; or (ii) the exchange offer registration |

9

| | statement is declared effective and ceases to be effective prior to the consummation of the exchange offer, or (iii) any required shelf registration statement that we file is declared effective and ceases to be effective at any time prior to June 10, 2005. |

| | Such additional interest would accrue over and above the stated interest rate of 0.25% per annum for the first 90 days following each violation, and an additional 0.25% per annum at the beginning of each subsequent 90-day period. Additional interest may not accrue for more than one violation at any time and will not exceed, in the aggregate, 1.0% over and above the stated interest rate. Once we have cured any defaults under the registration rights agreement, such additional interest will cease to accrue. See “The Exchange Offer—Reasons for the Exchange Offer.” |

Form and Denomination | The exchange notes will be represented by one or more global notes issued in fully registered form that, when issued, will be registered in the name of Cede & Co. as registered owner and nominee of DTC. Purchases of exchange notes or beneficial interests in those notes may be made in denominations of $1,000 or any integral multiples thereof. |

Trustee, Registrar and Paying Agent | JPMorgan Chase Bank |

Risk Factors | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before investing in the exchange notes. |

Governing Law | The exchange notes and documents related to the issuance of the exchange notes will be governed by and construed in accordance with the laws of the State of New York. |

10

RISK FACTORS

You should carefully consider the risks described below as well as other information contained in this prospectus before tendering your existing notes for exchange in the exchange offer. These risks are those currently known to us and unique to our company or industry in Texas that we consider to be material to your decision to tender your existing notes for exchange in the exchange offer. If any of the following risks occur, our business, financial condition or results of operations could be materially harmed which could result in a loss or a decrease in the value of your investment.

Risks Relating to the Company and its Business

Any delay or default in payment from one or more retail electric providers through which we provide transmission and distribution services could adversely affect the timing and receipt of our cash flows, thereby having an adverse effect on our ability to pay our cash obligations when due, including cash payments on the existing notes and the exchange notes.

In Texas we provide transmission and distribution services through various retail electric providers (“REPs”) that, in turn, provide retail electric service within our Texas service area. Currently, we do business with approximately 24 REPs. Our revenues in Texas were approximately $156.1 million for the year ended December 31, 2002 and accounted for approximately 51% of our total revenues. First Choice accounts for approximately 69% of our anticipated 2003 revenues from REPs. Adverse economic conditions (such as high unemployment, a depressed or recessionary economy and high interest rates), structural problems in the newly deregulated Texas electricity market (such as difficulties encountered in the information flow between the various market participants) or financial difficulties of one or more REPs resulting from a distressed or bankruptcy situation could impair the ability of these REPs to pay for our services or could cause them to delay such payments. We depend on these REPs for timely remittance of payments. Any delay or default in payment, particularly by First Choice, could adversely affect the timing and receipt of our cash flows and cash reserves, thereby decreasing our ability to pay our cash obligations when due, including cash payments on the existing notes and the exchange notes.

We have guaranteed First Choice’s performance under a power supply contract. If we are required to perform First Choice’s obligations under the power supply contract in the event of First Choice’s default thereunder, our costs will increase, thereby reducing our ability to pay our cash obligations, including cash payments on the exchange notes.

We have guaranteed First Choice’s performance under a power supply contract with Constellation Power Source, Inc. (“Constellation”) for up to $50 million. Our guarantee requires us to assume the obligations of First Choice in an event of default by First Choice under that agreement. If we are required to perform First Choice’s obligations under the power supply contract pursuant to our guarantee, our costs will increase, thereby reducing our ability to pay our cash obligations, including cash payments on the exchange notes.

Our business is seasonal and extended periods of weather that is cooler than normal will decrease the demand for electricity, thereby diminishing the amount of electricity we distribute on behalf of each REP and the amount of revenues we collect from those REPs.

Our revenue in Texas is derived from rates that we collect from each REP based on the amount of electricity we distribute on behalf of each REP. In New Mexico, our revenue is from integrated electricity services we provide. Our business in Texas and New Mexico is generally seasonal. In both our Texas and New Mexico service areas, demand for power peaks during the hot summer months. We have historically sold less power, and consequently earned less income, when weather conditions are milder. Extended periods of weather that is cooler than normal in the future will decrease the demand for electricity, thereby diminishing the amount of electricity we distribute on behalf of each REP and the amount of revenues we collect from those REPs.

11

Interruptions in service caused by breakdowns of equipment, weather related events, accidents or catastrophic events, or the inability to complete improvements to our transmission and distribution system could adversely affect our revenues and increase our expenses. As we maintain, expand, and upgrade our transmission and delivery systems, circumstances beyond our control could cause maintenance and capital expenditures to increase. These factors could reduce our ability to pay our cash obligations, including cash payments on the exchange notes.

Breakdowns or failures of the equipment or facilities used in our transmission and delivery systems could interrupt energy delivery services and related revenues, and increase repair expenses and capital expenditures. Prolonged or repeated failure of equipment or facilities, whether due to age, accidents, defective equipment, or weather related incidents (such as tornadoes or hurricanes) or accidents could affect customer satisfaction and result in increased regulatory oversight and increased levels of maintenance and capital expenditures. Equipment outages and repair costs due to catastrophic events, such as storms, natural disasters, wars or terrorist acts (to the extent not covered by insurance) would adversely affect our revenues, operating and capital expenses, thereby reducing our ability to pay our cash obligations, including cash payments on the exchange notes.

Our ability to successfully and timely complete capital improvements to existing facilities or other capital projects is contingent upon many variables, including access to adequate funding, weather, availability of replacement equipment and availability of qualified engineering and repair personnel. It is also subject to substantial risks if problems arise with any of these variables. Should any such capital projects be unsuccessful, we could be subject to additional costs and/or the write off of our investment in the project or improvement.

We are subject to merger commitments that may cause costs of operations to increase thereby reducing cash reserves and decreasing our ability to make payments on the exchange notes.

As conditions for approval of the acquisition in April 2000 of our parent, TNP Enterprises, by ST Acquisition Corp. (the “Merger”), TNP Enterprises and we made a number of commitments to both the PUCT and the NMPRC. The commitments cover a wide range of financial, operational, electric reliability, and other standards that we agreed to honor. We made 55 commitments in New Mexico and Texas, of which 47 are currently in effect. These commitments include minimum annual requirements for maintenance and capital expenditures, employee safety and customer service staffing levels, electric reliability standards regarding the duration and frequency of outages, numerous reporting requirements and we must strive to maintain investment grade credit ratings. We monitor compliance on a monthly basis and could be subject to financial penalties for non-compliance with certain commitments. During the years ended December 31, 2002 and 2001, we were not in compliance with one commitment regarding electric reliability standards in Texas, and as a result paid $0.2 million in penalties during the second quarter of 2003. The commitments may affect our operations and further penalties may be incurred in the future. If expenditures required to comply with our merger commitments were to increase substantially, our costs of operations could increase substantially and could impair our ability to make payments on the exchange notes. See the section entitled “Business – Government Regulation; Regulatory Matters—Merger Commitments.”

Increases in our leverage could lower our credit ratings thereby increasing the cost of obtaining financing in the capital markets and increasing our vulnerability to downturns in the economy and industry which reduce our sales, both of which would reduce cash flow from operations and decrease financial institutions’ willingness to provide capital. This reduced cash flow and reduced access to capital markets would result in a reduction in cash available for working capital, capital expenditures and for making payments on the exchange notes and other indebtedness.

Our business is capital intensive. In addition to operating cash flows, we rely on debt financings to fund our business. As of September 30, 2003, our total long term debt outstanding was approximately $424 million. The indenture governing the exchange notes does not prevent us from entering into a variety of acquisition, change of control, refinancing, recapitalization or other highly leveraged transactions. As a result, in the future, we could enter into any such transaction even though such transaction could increase the amount of our outstanding indebtedness. An increase in our leverage could adversely affect us by:

| | • | increasing the cash required for debt service. There may be a shortfall in free cash flow available for such debt service. Increased leverage could also lower our credit ratings thereby increasing |

12

| | the cost of obtaining financing in the capital markets. The impact could be to make it more difficult for us to pay our indebtedness, including the exchange notes and our other indebtedness; |

| | • | increasing our vulnerability to general adverse economic and industry conditions. Such conditions can cause a reduction in sales thereby reducing free cash flow available for debt service. Additionally, such adverse conditions can cause in increase in interest rates and financing costs as well as reducing financial institutions willingness to provide credit and other financing, impacting our ability to make payments on the exchange notes and our other indebtedness; |

| | • | limiting our ability to borrow additional funds or to obtain other financing for working capital, capital expenditures and other general corporate requirements; |

| | • | requiring us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund common dividends, working capital, capital expenditures and other general corporate purposes; |

| | • | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

| | • | requiring us to manage a company subject to financial and other restrictive covenants. Failure to comply with those covenants could result in defaults, which if not cured or waived, could result in an acceleration of our outstanding debt. |

Risks Relating to the Energy Industry

Recent events in the energy markets that are beyond our control have increased the level of public and regulatory scrutiny in our industry and in the capital markets and have resulted in increased regulation and new accounting standards. Increased standards of compliance, monitoring and reporting, modifications in how we operate our business, or required changes in our financial reporting and accounting practices resulting from new accounting standards, laws or regulations could increase our costs and diminish our financial results. These events could reduce cash flow from operations and decrease our ability to make payments on the exchange notes and our access to capital.

As a result of the energy crisis in California during the summer of 2001, the volatility of natural gas prices in North America during the past year, the bankruptcy filing by Enron Corporation and other energy companies, accounting irregularities of public companies, and investigations by governmental authorities into energy trading activities, companies in the regulated and non-regulated utility businesses have been under an increased amount of public and regulatory scrutiny. Accounting irregularities at certain companies in the industry have caused regulators and legislators to review current accounting practices and financial disclosures. The capital markets and ratings agencies also have increased their level of scrutiny. It is difficult or impossible to predict or control what effect these events may have on our business, financial condition or access to the capital markets. Additionally, it is unclear what laws and regulations may develop, and we cannot predict the ultimate impact of any future changes in accounting regulations or practices in general with respect to public companies, the energy industry or its operations specifically. Any such new accounting standards, laws or regulations could increase standards of compliance, monitoring and reporting; require modifications in how we operate our business (such as been done in recent years in the environmental area); or require a change in our financial reporting and accounting practices in order to comply with Generally Accepted Accounting Principles. Such changes could increase our costs and diminish our financial results thereby reducing cash flow from operations and decreasing our ability to make payments on the exchange notes.

13

Risks Relating to a Changing Regulatory Environment

We are subject to substantial governmental regulation. Compliance with regulatory requirements and procurement of necessary approvals, permits and certificates may result in substantial costs to us.

We are subject to substantial regulation from federal, state and local regulatory agencies. We are required to comply with numerous laws and regulations and to obtain permits, approvals and certificates from the governmental agencies that regulate various aspects of our business, including operation and construction of transmission facilities, customer rates, service regulations, retail service territories, sales of securities, asset acquisitions and sales, transactions between us and our affiliates, and accounting policies and practices. Additionally, the PUCT and the NMPRC have broad powers of supervision and regulation over us and the PUCT must approve the rates that we charge to REPs in Texas. We cannot predict the impact on our operating results from future regulatory activities of these agencies.

Given the newness of the competitive electricity market in Texas, existing laws and regulations governing the market structure could be reconsidered, revised or reinterpreted or new laws or regulations could be adopted. Any changes to such laws or regulations that impose new regulatory requirements on us or increase our costs could have a detrimental effect on our business. In recent years there has been significant legislative and regulatory activity throughout the United States, including Texas, to change the nature of regulation of our industry. Further alteration of the regulatory landscape in which we operate will impact the effectiveness of our business plan and may, because of the continued uncertainty, harm our financial condition and results of operations.

We have recorded a significant recoverable stranded cost, but recovery of such stranded cost is subject to review and approval by the PUCT. We may not ultimately recover the full amount of such stranded cost, thereby decreasing our results of operations and cash flows, and reducing the amount of funds available to consummate the mandatory securitization redemption of exchange notes to a level that would prevent the full redemption of outstanding exchange notes.

We are providing transmission and distribution services at regulated rates to customers within our service area. The 1999 Restructuring Legislation provides for recovery of “stranded costs”, the positive excess of the net book value of generation assets over the market value of the assets. Any such stranded costs would be recoverable from our Texas transmission and distribution customers.

We sold TNP One, our sole generation facility and only generation asset, in October 2002. Based on the sale, the fair value of TNP One, less cost to sell, was $117.5 million. The book value of TNP One at December 31, 2001, was approximately $418.5 million. We believe that the difference between the fair value of TNP One, net of selling costs, and its book value at December 31, 2001, is recoverable from our Texas transmission and distribution customers under the provisions of the 1999 Restructuring Legislation. Accordingly, we have recorded a regulatory asset for recoverable stranded cost of approximately $301.0 million.

Under the provisions of the 1999 Restructuring Legislation, the amount and manner of stranded cost recovery is subject to review and approval by the PUCT as part of the stranded cost true-up proceeding that will occur in 2004. Accordingly, action taken by the PUCT in the true-up proceeding could affect the ultimate recovery of the amounts recorded as recoverable stranded costs. Recovery of significantly less than the $301.0 million of estimated stranded costs currently recorded could have a material impact on our financial position and cash flows. Recovery of less than $250.0 million of stranded costs would prevent the full redemption of outstanding exchange notes in the mandatory redemption of such notes with the proceeds of the securitization of stranded costs. (See “Description of the Senior Notes—Redemption of the Senior Notes On or After May 1, 2005”).

There is uncertainty as to our recovery of deferred fuel balances and we may be denied full recovery of these fuel and energy-related purchased power costs, thereby decreasing our results of operations and cash flows.

Prior to the beginning of retail competition in Texas on January 1, 2002, we recovered fuel and the energy-related portion of purchased power costs from our customers in Texas through the fuel adjustment clause authorized by the PUCT. These costs are subject to adjustment or future reconciliation. As of September 30, 2003, we had an over-

14

recovered balance of fuel and energy-related purchased power costs of $24.3 million and currently show that amount as a liability to our customers. On April 1, 2003, we filed an application with the PUCT for the final reconciliation of our fuel and energy-related purchased power costs. This proceeding will reconcile fuel and energy-related purchased power costs incurred between January 1, 2000, and December 31, 2001, in accordance with the provisions of the 1999 Restructuring Legislation. On November 19, 2003, the administrative law judge assigned to this proceeding by the State Office of Administrative Hearings issued a proposed decision that recommends that the PUCT disallow $16.4 million of our fuel and energy-related purchased power costs during this period. The balance of fuel and energy-related purchased power costs ultimately resulting from the final fuel reconciliation will be included in the true-up proceeding for stranded costs that will occur in 2004. Subject to the results of the final fuel reconciliation, any over-recovered balance may reduce the amount of stranded costs we would be entitled to recover from our transmission and distribution customers. If the PUCT upholds the administrative law judge’s proposed decision and denies full recovery of these fuel and energy-related purchased power costs, then the amount shown as a liability to our customers would increase and our results of operations and cash flows would be diminished.

Rate regulation of our business may delay or deny us full recovery of our costs, thereby decreasing our results of operations and cash flows.

Our rates are regulated by the PUCT and the NMPRC through a rate proceeding and based on an analysis of our expenses incurred in a test year. Thus, the rates we are allowed to charge may or may not match our expenses at any given time. The PUCT or the NMPRC might judge some or all of our costs not to have been prudently incurred and therefore disallow full recovery of such costs. If costs were disallowed, it would cause our results of operations and cash flows to be diminished.

We are subject to the risk that our regulators will not permit recovery of material amounts of our purchased power costs or under-collections in New Mexico.

In New Mexico, we recover all purchased power costs through the fuel and purchased power adjustment clause authorized by the NMPRC, which is different than a rate proceeding. The purchased power recovery factor changes monthly to reflect over-collections or under-collections of the respective issues. If under-collections were disallowed, it would cause our results of operations and cash flows to be diminished.

We are subject to extensive environmental regulations that may increase the cost of our transmission and distribution of electricity.

Our business is subject to extensive environmental regulation by federal, state and local authorities. These laws and regulations affect the manner in which we conduct our operations and make capital expenditures. There are capital, operating and other costs associated with compliance with these environmental statutes, rules and regulations, and those costs could increase in the future. Moreover, environmental laws and the relevant standards and interpretations for compliance with such laws are subject to change, which may materially increase our costs of compliance or accelerate the timing of these capital expenditures, and which may not be fully recoverable from our customers.

Risks Related to Market or Economic Volatility

We are subject to risks associated with a changing economic environment, including our ability to obtain insurance, the financial stability of our customers and our ability to raise capital. The presence of such risks could increase our interest costs and results of operations and adversely affect our ability to access the credit and capital markets and impair our results of operations and earnings.

Following the bankruptcy of Enron Corporation, the credit rating agencies initiated a thorough review of the capital structure and earnings power of energy companies, including us. These events could constrain the capital available to our industry and could limit our access to funding for our operations. Our business is capital intensive. If our ability to access capital becomes significantly constrained, our interest costs will likely increase and our financial condition and future results of operations could be significantly impaired.

15

The continuation of the current economic downturn could also constrain the capital available to our industry and could reduce our access to funding for our operations, as well as the financial stability of our customers and counterparties. These factors could adversely affect our future earnings.

In addition, the availability of insurance covering risks that our competitors and we typically insure against has decreased. The insurance we are able to obtain has higher deductibles and higher premiums.

We are subject to insurance-related risks in a changing economic environment. Such risks could result in a reduction in the availability of insurance, a decrease in coverage, an increase in deductibles, an increase in premium expenses, and increased exposure to losses that exceed our insurance coverage or are subject to higher deductibles.

We carry property damage and liability insurance for our properties and operations. As a result of significant changes in the insurance marketplace, due in part to the September 11, 2001 terrorist acts, the availability of insurance covering risks our competitors and we typically insure against has decreased. In addition, the insurance we are able to obtain has higher deductibles and higher premiums. Insurance may not cover any or all of the lost revenues or increased expenses related to an insurance claim, which could erode our financial condition, results of operations, our cash reserves, and our ability to meet our cash obligations, including payments on the exchange notes and could increased exposure to losses that exceed our insurance coverage or are subject to higher deductibles.

Future terrorist attacks or acts of war could adversely affect our results of operations, future growth and ability to raise capital.

Future terrorist attacks or acts of war could affect our operations in unpredictable ways, such as increased security measures. Just the possibility that infrastructure facilities, such as electric transmission and distribution facilities, would be direct targets of, or indirect casualties of, an act of terror or war may affect our operations. War and the possibility of war may have an adverse effect on the economy in general. A lower level of economic activity might result in a decline in energy consumption, which may adversely affect our revenues or restrict our future growth. Instability in the financial markets as a result of war may affect our ability to raise capital.

Our business is dependent on our ability to successfully access capital markets. Our inability to access capital may limit our ability to execute our business plan.

Our business requires considerable capital resources. When necessary, we secure funds from external sources by borrowing from banks and, as required, issuing long-term debt securities. We actively manage our exposure to changes in interest rates through interest-rate swap transactions and our balance of fixed- and floating-rate instruments. We currently anticipate primarily using internally generated cash flows and short-term financing through bank borrowings to fund our operations as well as long-term external financing sources to fund capital requirements as the need arises. The ability to arrange debt financing, to refinance current maturities and early retirements of debt (with respect to which our liquidity needs could exceed our available resources), and the costs of issuing new debt are dependent on:

| | • | credit availability from banks and other financial institutions; |

| | • | maintenance of acceptable credit ratings; |

| | • | investor confidence in us and TNP Enterprises; |

| | • | general economic and capital market conditions; and |

| | • | the overall health of the utility industry. |

If we are unable to secure funds to finance capital expenditures or working capital as needed due to factors such as those mentioned above, we may be unable to undertake maintenance or expansion projects of our energy delivery system, which could adversely affect the reliability of our transmission and distribution system and our ability to serve customers as well as achieve growth objectives; our liquidity and ability to pay operating costs of our

16

business and make payments on the exchange notes may be harmed; and we may be unable to repay or refinance maturing securities.

A downgrade in our credit rating or a downgrade in the credit ratings of TNP Enterprises or First Choice could increase our cost of borrowing, which would diminish our financial results with the resulting decrease in free cash flow reducing our ability to make payments on the exchange notes.

Our credit ratings are affected in part by the credit profile and credit ratings of the consolidated TNP Enterprises. To the extent that the credit ratings of TNP Enterprises or First Choice are downgraded, then our credit ratings could be downgraded.

Moody’s Investors Service (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”), and Fitch Ratings (“Fitch”) rate our senior, unsecured debt at Baa3 (Outlook: Negative), BBB- (CreditWatch-Negative), and BB+ (Outlook: Stable), respectively. If Moody’s, S&P or Fitch were to downgrade our long-term rating, we would likely be required to pay a higher interest rate in future financings, our borrowing costs would increase. Our financial results would be diminished and the resulting decrease in free cash flow would reduce our ability to make payments on the exchange notes. In addition, our potential pool of investors and funding sources could decrease.

Other Risks

We are subject to control by our parent company, TNP Enterprises, which could act in a manner that would benefit TNP Enterprises to the detriment of our creditors, including the holders of the exchange notes.

We are a wholly-owned subsidiary of TNP Enterprises, and, therefore, TNP Enterprises controls decisions regarding our business and has control over our management and affairs. In circumstances involving a conflict of interest between TNP Enterprises, on the one hand, and our creditors, on the other, TNP Enterprises could exercise its power to control us in a manner that would benefit TNP Enterprises to the detriment of our creditors, including the holders of the exchange notes. For example, in the event of the financial distress or bankruptcy of TNP Enterprises, TNP Enterprises could cause us to pay the maximum amount of dividends allowable under regulatory, credit facility and indenture constraints, thereby causing a deficiency in free cash flow, which could adversely affect our ability to make payments on the exchange notes.

TNP Enterprises is not obligated to help maintain our capital or liquidity, which could adversely affect our ability to make payments on the exchange notes, our growth plans, our ability to raise additional debt and the evaluation of our credit by credit rating agencies.

TNP Enterprises is not obligated to provide any loans, further equity contributions or other funding to us or any of our subsidiaries, whether for the purpose of making payments due on the exchange notes, or for other purposes. We must compete with First Choice, the other subsidiary of TNP Enterprises, for capital and other resources. As a member of the TNP Enterprises corporate group, we operate within strategies and policies, including dividend strategies, established by TNP Enterprises that could affect our liquidity by reducing capital and cash reserves. See “Business.” The lack of necessary capital and cash reserves may diminish our ability to make payments on the exchange notes, our growth plans, our ability to raise additional debt and the evaluation of our creditworthiness by rating agencies.

TNP Enterprises and certain of its owners may have interests that conflict with your interests as holders of exchange notes; affiliates of CIBC World Markets Corp., which is an initial purchaser and lender to us, indirectly own interests in TNP Enterprises that may create conflicting interests. These conflicts could cause these persons to act in a manner that is to the detriment of the holders of the exchange notes.

SW Acquisition, L.P. (“SW Acquisition”), a Texas limited partnership, owns 100% of TNP Enterprises’ outstanding common stock. SW Acquisition’s owners include affiliates of CIBC World Markets Corp.(“CIBC World Markets”), which is an initial purchaser of the exchange notes. SW Acquisition controls TNP Enterprises, which in turn controls us. The interests of SW Acquisition and TNP Enterprises could conflict with your interests as a holder of exchange notes. Under certain circumstances, the interests of CIBC World Markets’ affiliates, as holders of limited partnership interests in SW Acquisition, and CIBC World Markets’ affiliate’s interest as a lender under our credit facility, may conflict with CIBC World Markets’ interests as an initial purchaser of the exchange notes. In the event of the financial distress or bankruptcy scenario of TNP Enterprises, SW Acquisition, TNP Enterprises and CIBC World Markets, as our direct and indirect owners, could cause us to pay the maximum amount of dividends allowable under regulatory, credit facility and indenture constraints, thereby causing a deficiency in free cash flow, which could adversely affect our ability to make payments on the exchange notes.

17

Risks Relating to the Exchange Notes

A trading market for the exchange notes may not develop, which could result in a loss or a decrease in the value of your investment or an inability to sell your exchange notes.

The existing notes constituted a new issue of securities with no established trading market. Although we are required under the registration rights agreement to commence an exchange offer to exchange the existing notes for exchange notes, which will be registered securities with substantially the same terms, or to register resales of the exchange notes under the Securities Act, we cannot assure you that such exchange or registration will occur or that an active trading market for the exchange notes or any securities exchanged for the exchange notes will develop. If a large number of holders of existing notes do not tender existing notes or tender existing notes improperly, the limited amount of exchange notes that would be issued and outstanding after we consummate the exchange offer could adversely affect the development of a market for the exchange notes. A small, illiquid trading market for the exchange notes with a limited number of participating investors could result in a loss or a decrease in the value of your investment or an inability to sell your exchange notes.

Existing notes that are not tendered for exchange in the exchange offer, or are not properly tendered for exchange, will continue to be subject to transfer restrictions.

We will only issue exchange notes in exchange for existing notes that you timely and properly tender. Therefore, you should allow sufficient time to ensure timely delivery of the existing notes and carefully follow the instructions on how to tender your existing notes. Neither the exchange agent nor we is required to tell you of any defects or irregularities with respect to your tender of existing notes.

If you do not exchange your existing notes for exchange notes pursuant to the exchange offer, the existing notes you hold will continue to be subject to transfer restrictions. In general, you may not offer or sell the existing notes except under and exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not plan to register existing notes under the Securities Act unless the registration rights agreement with the initial purchasers of the existing notes requires us to do so. Further, if you continue to hold any existing notes after the exchange offer is consummated, you may have trouble selling them because there will be fewer such notes outstanding.

We may have insufficient liquidity or access to capital upon an event of default under the indenture governing the exchange notes preventing us from fulfilling our obligations under the exchange notes.

The indenture governing the exchange notes provides that if certain events of default occur with respect to our outstanding senior debt securities, either the trustee or the holders of not less than 25% in aggregate principal amount of the outstanding senior debt securities may, upon notice as provided in the Indenture, declare the aggregate principal amount of all senior debt securities to be due and payable. The existing notes, exchange notes and the 6.25% Senior Notes due January 2009 currently comprise the senior debt securities with an aggregate principal amount outstanding of $425 million. We have no other debt currently outstanding. If an event of default were to occur, which resulted in acceleration in the repayment of our senior debt, we likely would not have sufficient liquidity or access to capital to repay our outstanding senior debt securities, including those obligations relating to the exchange notes. See the section entitled “Description of the Senior Notes—Events of Default” for more information.

18

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratio of earnings to fixed charges for the periods indicated.

| | | Year Ended December 31,

|

| | | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

Ratio of earnings to fixed charges (1) | | 3.5x | | 3.8x | | 2.6x | | 2.4x | | 1.9x |

Pro Forma Ratio of earnings to fixed charges (2) | | 2.5x | | | | | | | | |

| |

| | | For the Twelve Months Ended September 30, 2003

|

Ratio of earnings to fixed charges (1) | | 3.1x |

Pro Forma Ratio of earnings to fixed charges (2) | | 2.7x |

| (1) | For purposes of computing these ratios, earnings consist of income before cumulative effect of change in accounting plus income taxes and fixed charges. Fixed charges consist of total interest, and amortization of debt discount, premium and expense and the estimated portion of interest implicit in rentals. |

| (2) | Calculated on a pro forma basis to reflect the issuance of the exchange notes with an interest rate of 6.125% and the application of the proceeds from the issuance of the existing notes to pay down borrowings of $207 million under the TNMP/First Choice Credit Facility that were outstanding at the time of the issuance of the existing notes. Our calculation of the pro forma effect for the year ended December 31, 2002 assumed that the exchange notes were issued on January 1, 2002. Our calculation of the pro forma effect for the twelve months ended September 30, 2003 assumed that the exchange notes were issued on October 1, 2002. |

USE OF PROCEEDS

The exchange offer is intended to satisfy our obligations under the registration rights agreement. We will not receive any cash proceeds from the issuance of the exchange notes in the exchange offer.

19

CAPITALIZATION

The following table sets forth the consolidated capitalization of us and our subsidiaries on an actual basis as of September 30, 2003 and as adjusted to give effect to the issuance of the exchange notes and their exchange in the exchange offer for the existing notes, which are substantially identical to the exchange notes.

You should read the information contained in the following table in conjunction with the “Use of Proceeds,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus and our consolidated financial statements and related notes included elsewhere in this prospectus.

| | | As of September 30, 2003

| |

| | | Actual

| | | Adjustments

| | As Adjusted

| |

| | | (In thousands) | |

Cash and cash equivalents | | $ | 65,218 | | | $ | — | | $ | 65,218 | |

| | |

|

|

| |

|

| |

|

|

|

Common shareholder’s equity | | $ | 248,537 | | | | — | | $ | 248,537 | |

| | |

|

|

| |

|

| |

|

|

|

Long-term debt (including current maturities) | | | | | | | | | | | |

6.25% senior notes | | | 175,000 | | | | — | | | 175,000 | |

6.125% senior notes | | | 250,000 | | | | — | | | 250,000 | |

Unamortized discount | | | (1,448 | ) | | | — | | | (1,448 | ) |

| | |

|

|

| |

|

| |

|

|

|

Total debt | | | 423,552 | | | | — | | | 423,552 | |

| | |

|

|

| |

|

| |

|

|

|

Total capitalization | | $ | 672,089 | | | $ | — | | $ | 672,089 | |

| | |

|

|

| |

|

| |

|

|

|

The exchange notes that are the subject of this exchange offer are substantially identical to the existing notes, and will be exchanged for the existing notes upon completion of the exchange offer.

20

SELECTED HISTORICAL FINANCIAL AND OPERATING DATA

The following tables set forth our selected historical financial and operating data for the nine months ended September 30, 2003 and 2002, and for the years ended December 31, 2002, 2001, 2000, 1999 and 1998. Income statement and balance sheet amounts have been derived from our audited financial statements. As the information below is only a summary and does not provide all of the information contained in our financial statements, you should read “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements dated December 31, 2002, consolidated interim financial statements and notes thereto included elsewhere in this prospectus.

We have derived the selected consolidated financial data as of and for the nine months ended September 30, 2002 and September 30, 2003 from our unaudited financial statements, which include all adjustments, consisting only of normal recurring adjustments, that in our opinion are necessary for a fair statement of financial position, results of operations and cash flows as of those dates and for those periods. The results of operations for the interim periods are not necessarily indicative of the results for the full years, due to the seasonality inherent in some of our operations and the possibility of general economic changes.

When retail competition began in Texas on January 1, 2002, we separated our previously integrated Texas utility operations into three components. First Choice assumed the activities related to the sale of electricity to retail customers in Texas and the results of those activities are no longer reflected in our consolidated financial statements. As a result, the amounts shown in our financial statements for 2002 are not comparable to prior years.

The historical information with respect to us as of December 31, 2002 and 2001, and for each of the three years in the period ended December 31, 2002 has been derived from our audited financial statements, which have been audited by Deloitte & Touche LLP, independent auditors. These financial statements appear elsewhere in this prospectus.

21

Texas-New Mexico Power Company and Subsidiaries

Selected Historical Consolidated Financial Data

| | | Nine Months Ended

September 30,

| | | Year Ended December 31,

| |

| | | 2003

| | | 2002

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| | | 1998

| |

| | | (In thousands) | |

Income statement data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating revenues | | $ | 199,079 | | | $ | 240,513 | | | $ | 303,907 | | | $ | 651,532 | | | $ | 644,035 | | | $ | 576,093 | | | $ | 585,892 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Purchased power and fuel | | | 50,843 | | | | 83,093 | | | | 100,679 | | | | 369,857 | | | | 348,461 | | | | 279,587 | | | | 315,949 | |

Other operating and maintenance | | | 47,544 | | | | 57,233 | | | | 75,240 | | | | 98,472 | | | | 97,466 | | | | 99,390 | | | | 91,663 | |

Depreciation of utility plant | | | 21,374 | | | | 20,725 | | | | 27,567 | | | | 42,350 | | | | 41,353 | | | | 39,295 | | | | 38,054 | |

Charge (credit) for recovery of stranded plant | | | — | | | | (733 | ) | | | (733 | ) | | | 1,377 | | | | 18,306 | | | | 23,376 | | | | — | |

Taxes other than income taxes | | | 16,088 | | | | 19,749 | | | | 24,507 | | | | 34,659 | | | | 34,615 | | | | 33,296 | | | | 36,298 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total operating expenses | | | 135,849 | | | | 180,067 | | | | 227,260 | | | | 546,715 | | | | 540,201 | | | | 474,944 | | | | 481,964 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income | | | 63,230 | | | | 60,446 | | | | 76,647 | | | | 104,817 | | | | 103,834 | | | | 101,149 | | | | 103,928 | |

Interest on long-term debt | | | 18,670 | | | | 13,883 | | | | 18,300 | | | | 24,001 | | | | 35,231 | | | | 37,919 | | | | 48,342 | |

Other interest and amortization of debt-related costs | | | 1,977 | | | | 2,686 | | | | 3,514 | | | | 3,172 | | | | 5,291 | | | | 5,205 | | | | 5,385 | |

Other income and deductions, net | | | (1,631 | ) | | | (315 | ) | | | (464 | ) | | | (1,116 | ) | | | (1,626 | ) | | | (1,940 | ) | | | (1,035 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes | | | 44,214 | | | | 44,192 | | | | 55,297 | | | | 78,760 | | | | 64,938 | | | | 59,965 | | | | 51,236 | |

Income taxes | | | 16,031 | | | | 14,930 | | | | 19,166 | | | | 26,626 | | | | 22,981 | | | | 20,522 | | | | 16,915 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before cumulative effect of change in accounting | | | 28,183 | | | | 29,262 | | | | 36,131 | | | | 52,134 | | | | 41,957 | | | | 39,443 | | | | 34,321 | |

Cumulative effect of change in accounting for major maintenance costs, net of taxes (Note 3) | | | — | | | | — | | | | — | | | | (1,170 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income | | | 28,183 | | | | 29,262 | | | | 36,131 | | | | 50,964 | | | | 41,957 | | | | 39,443 | | | | 34,321 | |

Dividends on preferred stock and other | | | — | | | | — | | | | — | | | | — | | | | 38 | | | | (19 | ) | | | 150 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income applicable to common stock | | $ | 28,183 | | | $ | 29,262 | | | $ | 36,131 | | | $ | 50,964 | | | $ | 41,919 | | | $ | 39,462 | | | $ | 34,171 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Balance sheet data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |