Issuer Free Writing Prospectus

Filed pursuant to Rule 433(d)

Registration Statement No. 333-178626

February 19, 2014

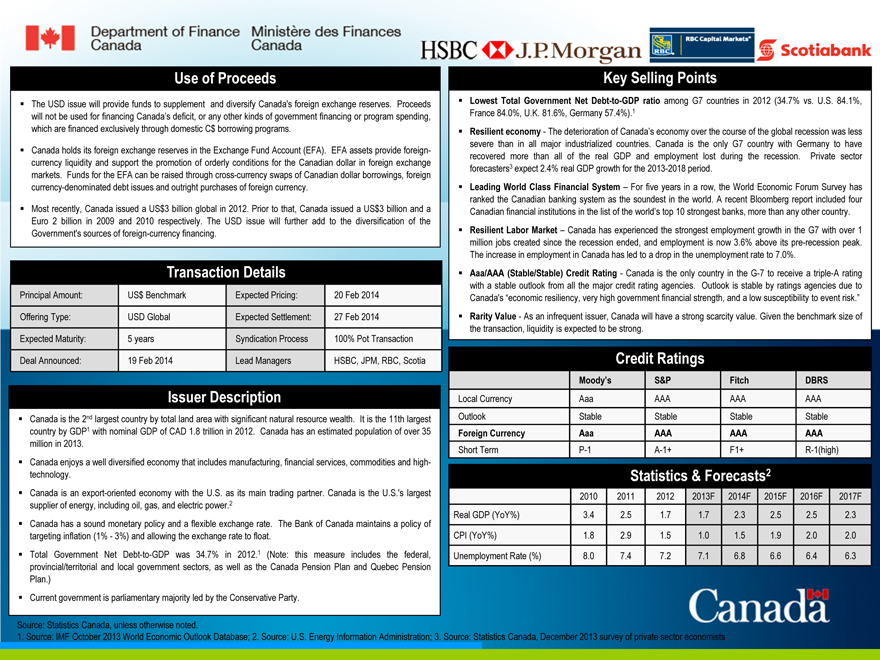

Use of Proceeds

The USD issue will provide funds to supplement and diversify Canada’s foreign exchange reserves. Proceeds

will not be used for financing Canada’s deficit, or any other kinds of government financing or program spending,

which are financed exclusively$ Cthrough domestic borrowing programs.

Canada holds its foreign exchange reserves in the Exchange Fund Account (EFA). EFA assets provide foreign-

currency liquidity and support the promotion of orderly conditions for the Canadian dollar in foreign exchange

markets. Funds for the EFA can be raised through cross-currency swaps of Canadian dollar borrowings, foreign

currency-denominated debt issues and outright purchases of foreign currency.

Most recently, Canada issued a US3 billion global$$USin 2012. Prior to that, Canada issued a 3 billion and a

Euro 2 billion in 2009 and 2010 respectively. The USD issue will further add to the diversification of the

Government’s sources of foreign-currency financing.

Transaction Details

Principal Amount: US$Benchmark Expected Pricing: 20 Feb 2014

Offering Type: USD Global Expected Settlement: 27 Feb 2014

Expected Maturity: 5 years Syndication Process 100% Pot Transaction

Deal Announced: 19 Feb 2014 Lead Managers HSBC, JPM, RBC, Scotia

Issuer Description

Canada is the 2nd largest country by total land area with significant natural resource wealth. It is the 11th largest

country by GDP1 with nominal GDP of CAD 1.8 trillion in 2012. Canada has an estimated population of over 35 million in 2013.

Canada enjoys a well diversified economy that includes manufacturing, financial services, commodities and high-technology.

Canada is an export-oriented economy with the U.S. as its main trading partner. Canada is the U.S.‘s largest

supplier of energy, including oil, gas, and electric power.2

Canada has a sound monetary policy and a flexible exchange rate. The Bank of Canada maintains a policy of

targeting inflation (1%—3%) and allowing the exchange rate to float.

Total Government Net Debt-to-GDP was 34.7% in 2012.1 (Note: this measure includes the federal,

provincial/territorial and local government sectors, as well as the Canada Pension Plan and Quebec Pension

Plan.)

Current government is parliamentary majority led by the Conservative Party.

Key Selling Points

Lowest Total Government Net Debt-to-GDP ratio among G7 countries in 2012 (34.7% vs. U.S. 84.1%,

France 84.0%, U.K. 81.6%, Germany 57.4%).1

Resilient economy—The deterioration of Canada’s economy over the course of the global recession was less

severe than in all major industrialized countries. Canada is the only G7 country with Germany to have

recovered more than all of the real GDP and employment lost during the recession. Private sector

forecasters3 expect 2.4% real GDP growth for the 2013-2018 period.

Leading World Class Financial System – For five years in a row, the World Economic Forum Survey has

ranked the Canadian banking system as the soundest in the world. A recent Bloomberg report included four

Canadian financial institutions in the list of the world’s top 10 strongest banks, more than any other country.

Resilient Labor Market – Canada has experienced the strongest employment growth in the G7 with over 1

million jobs created since the recession ended, and employment is now 3.6% above its pre-recession peak.

The increase in employment in Canada has led to a drop in the unemployment rate to 7.0%.

Aaa/AAA (Stable/Stable) Credit Rating—Canada is the only country in the G-7 to receive a triple-A rating

with a stable outlook from all the major credit rating agencies. Outlook is stable by ratings agencies due to

Canada’s “economic resiliency, very high government financial strength, and a low susceptibility to event risk.”

Rarity Value—As an infrequent issuer, Canada will have a strong scarcity value. Given the benchmark size of

the transaction, liquidity is expected to be strong.

Credit Ratings

Moody’s S&P Fitch DBRS

Local Currency Aaa AAA AAA AAA

Outlook Stable Stable Stable Stable

Foreign Currency Aaa AAA AAA AAA

Short Term P-1 A-1+ F1+ R-1(high)

Statistics & Forecasts2

2010 2011 2012 2013F 2014F 2015F 2016F 2017F

Real GDP (YoY%) 3.4 2.5 1.7 1.7 2.3 2.5 2.5 2.3

CPI (YoY%) 1.8 2.9 1.5 1.0 1.5 1.9 2.0 2.0

Unemployment Rate (%) 8.0 7.4 7.2 7.1 6.8 6.6 6.4 6.3

Source: Statistics Canada, unless otherwise noted.

1. Source: IMF October 2013 World Economic Outlook Database; 2. Source: U.S. Energy Information Administration; 3. Source: Statistics Canada, December 2013 survey of private sector economists.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free at 1-866-811-8049.

You may access the prospectus related to the offering summarized herein on the SEC website at: http://www.sec.gov/Archives/edgar/data/230098/000119312512031295/d291870dsba.htm