Exhibit C-11

©Her Majesty the Queen in Right of Canada (2017)

All rights reserved

All requests for permission to reproduce this document

or any part thereof shall be addressed to

the Department of Finance Canada.

Cette publication est également disponible en français.

Cat. No.: F1-52E-PDF

TABLE OF CONTENTS

| | | | |

Introduction | | | 1 | |

| |

Chapter 1 – Economic and Fiscal Update | | | 3 | |

| |

Introduction | | | 3 | |

| |

Recent Developments in the Canadian Economy | | | 4 | |

| |

Global Economic Developments and Outlook | | | 13 | |

| |

Private Sector Outlook | | | 19 | |

| |

Risk Assessment | | | 20 | |

| |

Changes to the Fiscal Outlook | | | 21 | |

| |

Impact of Alternative Economic Scenarios | | | 24 | |

| |

Chapter 2 – Results for Middle Class Canadians | | | 25 | |

| |

Introduction | | | 25 | |

| |

Opportunities for the Middle Class | | | 26 | |

| |

An Innovative, Inclusive and Sustainable Economy | | | 33 | |

| |

Chapter 3 – Fairness for the Middle Class and Those Working Hard to Join It | | | 39 | |

| |

Introduction | | | 39 | |

| |

New Measures: Strengthening Support for Canadian Families and Workers | | | 40 | |

| |

A System That Works for the Middle Class | | | 44 | |

| |

Annex 1 – Details of Economic and Fiscal Projections | | | 57 | |

| |

Economic Projections | | | 57 | |

| |

Fiscal Projections | | | 60 | |

FALL ECONOMIC STATEMENT 2017

INTRODUCTION

Since coming into office, the Government has focused on investing in the economy so that it works for the middle class, and those working hard to join it. The investments we’ve made in people, in communities and in the economy have put more money in the pockets of those who need it most, are creating more well-paying jobs and are giving Canadians greater confidence in their future.

Today, Canada is the fastest growing economy in the Group of Seven (G7). The Government’s plan is working.

The new Canada Child Benefit and historic investments in early learning and child care mean a better future for our children, and more money in the pockets of parents who are struggling to make ends meet. They mean families have more money for things like skating lessons, camps or healthier food, and parents have more flexibility when they choose to go back to work after starting or growing their family.

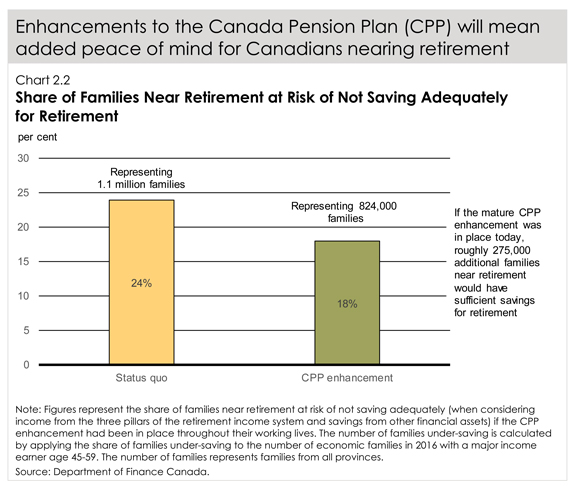

A stronger retirement income system through increases in Old Age Security and the Guaranteed Income Supplement, as well as a strengthened Canada Pension Plan, means more money for seniors now, and will ensure workers today and in the future can look forward to a more secure retirement.

Investments in skills and innovation, a focus on post-secondary education and an immigration system focused on attracting top talent are positioning Canada and Canadians to lead in the rapidly changing global economy. This will create more Canadian jobs, and help students and workers get the tools and knowledge they need to advance throughout their career.

Historic investments in infrastructure projects like light rail transit, roads, bridges and clean water initiatives will help keep our people and our cities moving, support jobs now, and make our communities more efficient in the future.

A strong commitment to a clean growth economy—in partnership with all provinces and territories—means that Canada will continue to do its part to support a more sustainable, low-carbon economy, and provide new jobs and opportunities for Canadians in the process.

A renewed relationship with Indigenous Peoples sets the foundation for greater opportunity, stronger communities with basic necessities such as clean drinking water and more economic success.

The Government’s approach has been to focus on smart, targeted investments designed to create good, well-paying jobs now and to strengthen the economy over the long term, while preserving Canada’s low-debt advantage. Tax cuts for the middle class—including a proposed reduction in the small business tax rate—an historic agreement to strengthen the Canada Pension Plan, and boosts to Old Age Security, the Guaranteed Income Supplement and student grants, combined with transformative investments in infrastructure, have increased consumer confidence and investment. It’s an approach that’s working for the middle class, and those working hard to join it.

| | |

| | | FALL ECONOMIC STATEMENT 2017 1 |

| | |

| | “To support the economy, the government introduced tax cuts for the middle class, expanded family benefits, and raised infrastructure spending… [This agenda] has succeeded in revitalizing the economy after a tough year in 2015.” —International Monetary Fund |

The Government’s plan includes a responsible approach to fiscal management that is appropriate for the current economic cycle and focused on long-term economic growth and fiscal sustainability. This approach has been effective, and the economy is outperforming expectations.

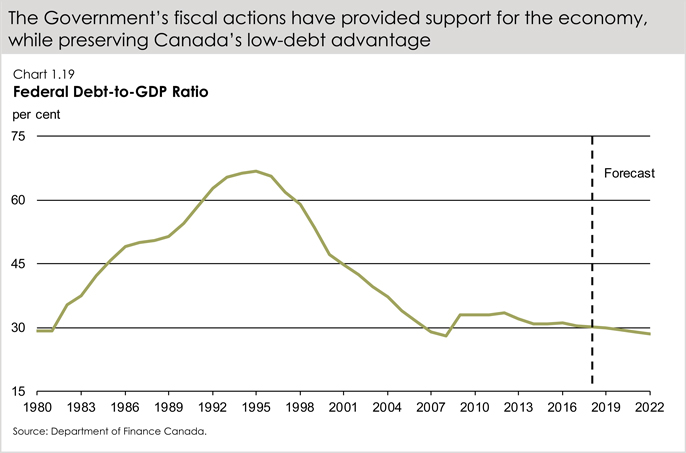

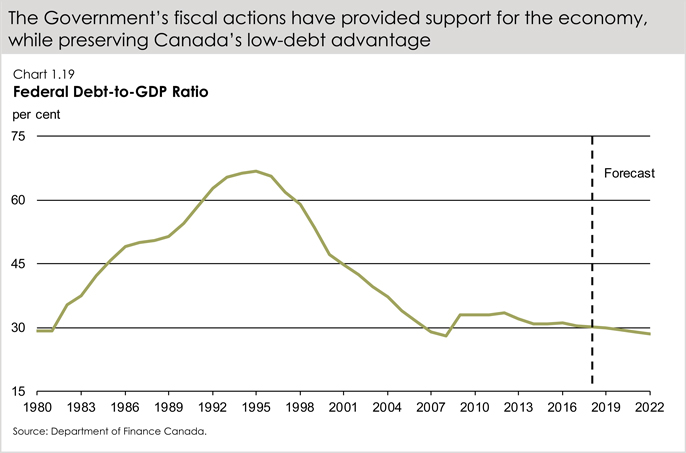

As the economy strengthens, the Government is adjusting its fiscal strategy to adapt to the better-than-expected economic outlook. The current fiscal track shows steady improvements in the Government’s budgetary position along with a decline in the federal debt-to-GDP (gross domestic product) ratio.

The Government will maintain this downward deficit and debt ratio track—preserving Canada’s low-debt advantage for current and future generations.

The Government will continue to make decisions with a clear understanding of their impacts on different groups of women and men, and reduce barriers to individuals’ success. The Budget 2017 Gender Statement was an important step in bringing gender equality to the forefront of budget decision-making, and is contributing to the broader integration of gender and diversity considerations in Government policy-making. The Government will build on this work by ensuring that all future budget decisions are informed by clear and rigorous gender-based analysis, for a budget plan that promotes greater gender equality and inclusiveness.

Chapter 1

ECONOMIC AND FISCAL UPDATE

INTRODUCTION

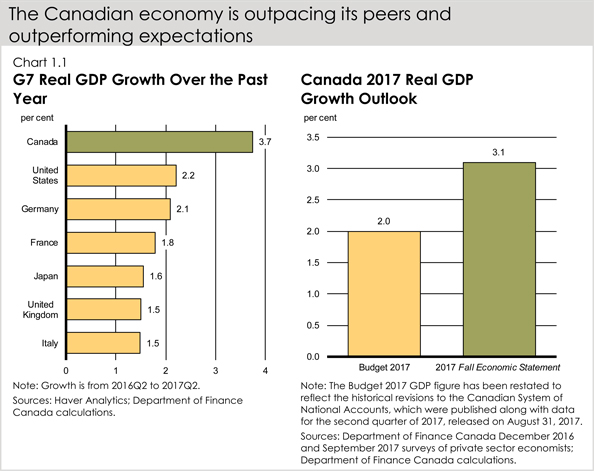

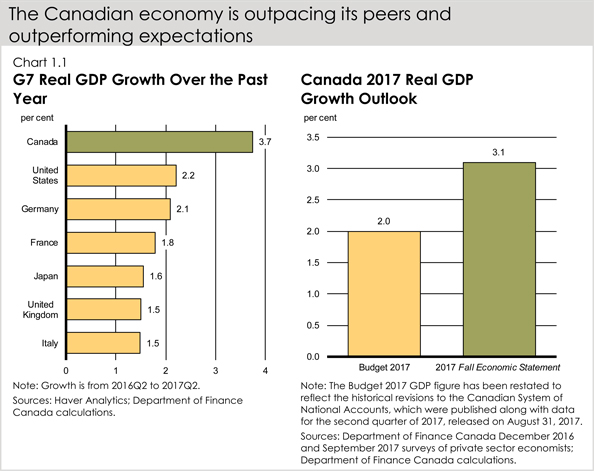

The Government’s plan to invest in the economy and strengthen the middle class is working. The recent resurgence in gross domestic product (GDP) makes Canada the fastest growing economy in the Group of Seven (G7) (Chart 1.1). The economy has created over 450,000 jobs since late 2015, and the unemployment rate has dropped to its lowest level since 2008. Consumer confidence is up, thanks in part to the Canada Child Benefit (CCB), and growth is forecast to be 3.1 per cent in 2017—significantly above expectations at the beginning of the year.

Reflecting this recent economic strength, the fiscal outlook is improving, with projected budgetary balances and debt-to-GDP levels improving across the forecast horizon. The Government remains committed to sound fiscal management—balancing the need to make targeted investments to support economic growth while preserving Canada’s low-debt advantage for current and future generations.

This chapter provides an overview of recent major economic developments and presents the current fiscal situation and outlook.

Notes: This section incorporates data available up to and including October 20, 2017, unless otherwise indicated. All rates are reported at annual rates unless otherwise noted.

| | |

| | | ECONOMIC AND FISCAL UPDATE 3 |

RECENT DEVELOPMENTS IN THE CANADIAN ECONOMY

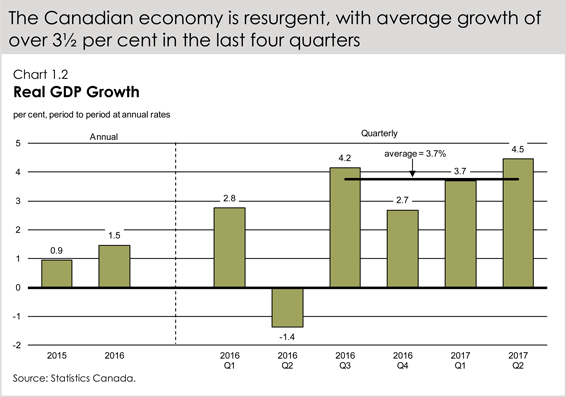

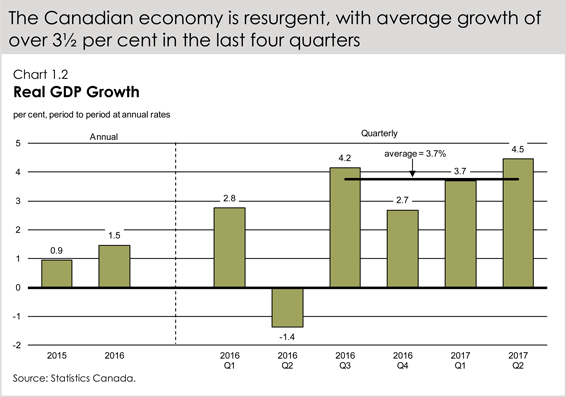

Canadian economic growth has accelerated sharply since the second half of 2016 (Chart 1.2). Over the last four quarters, the Canadian economy has had its fastest rate of growth since the beginning of 2006, and growth is becoming more balanced across sectors and regions.

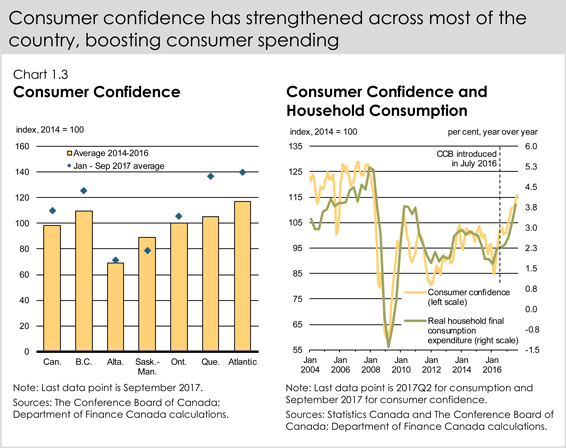

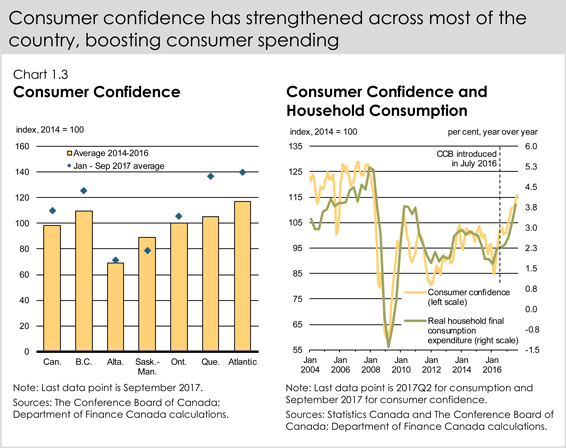

Household consumption has been the main contributor to economic growth over the past year, increasing at or above 3.0 per cent in each quarter since mid-2016, significantly above its post-recession average. Household consumption growth has been fairly broad-based across consumption categories and regions. It has been underpinned by solid employment gains, low interest rates, improving consumer confidence and, since July 2016, by the ongoing support of the CCB to families (Chart 1.3).

Recent strength in economic activity will likely translate into jobs and income gains, which should support continued consumption growth in the near term.

| | |

| | | ECONOMIC AND FISCAL UPDATE 5 |

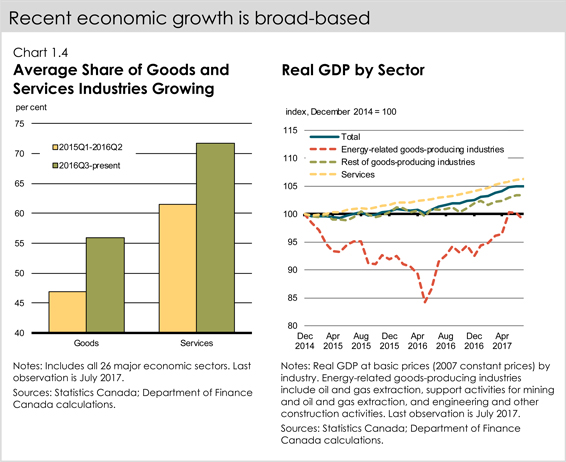

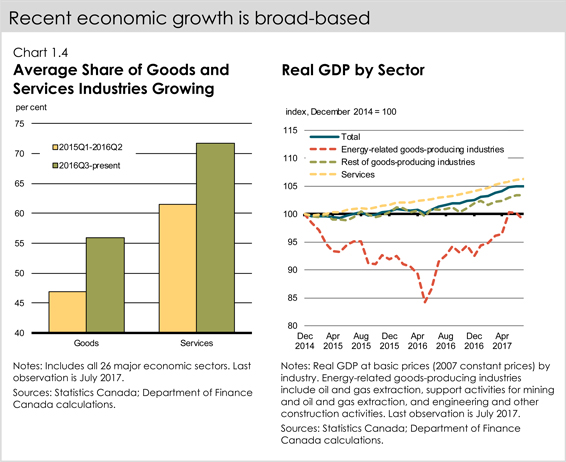

Growth in economic output has been observed across a larger number of both goods and services industries over the past year compared to what was observed in the aftermath of the oil price shock (Chart 1.4).

After being hit by the fall in oil prices, activity in energy-related goods-producing industries stabilized and started to gradually pick up in mid-2016 following the Fort McMurray wildfires in May. Along with this, activity in other related industries (e.g. machinery manufacturing) has also improved, contributing to broader overall growth among goods-producing industries.

Meanwhile, the services sector has continued to grow at a steady pace.

As global crude oil prices have stabilized, so has the economic situation in energy-producing provinces.

Since mid-2016, half of Alberta’s total job losses1 have been recouped, all in full-time positions. However, paid employment2 in the province—which recorded a larger decline as many laid off workers returned to their home province, where they are now accounted for—has recovered less quickly. The rebound in Alberta has boosted national GDP growth directly, as Alberta accounts for about 16 per cent of total Canadian output, and indirectly, as stronger demand from Alberta has boosted growth in other provinces via trade channels.

| 1 | Employment as measured in Statistics Canada’s Labour Force Survey (LFS). |

| 2 | Paid employment (for example, excluding the self-employed) as measured in Statistics Canada’s Survey of Employment, Payroll and Hours (SEPH). |

Similarly, stabilization in energy prices has been reflected in stronger economic activity in

Saskatchewan, with the provincial economy expected to post a strong rebound in real GDP growth in 2017 following two consecutive years of decline.

Growth has also been robust outside of these energy-producing regions, across the country.

For example:

| • | | Growth in the Maritime provinces in 2017 is expected to be at its strongest pace since 2010; |

| • | | The unemployment rate in Quebec is near its lowest level since at least 1976; |

| • | | Ontario has posted its longest back-to-back stretch of real GDP growth of above 2 per cent in over 15 years; and |

| • | | The British Columbia economy has created over 140,000 net new jobs since the beginning of last year—an increase of almost 6 per cent. |

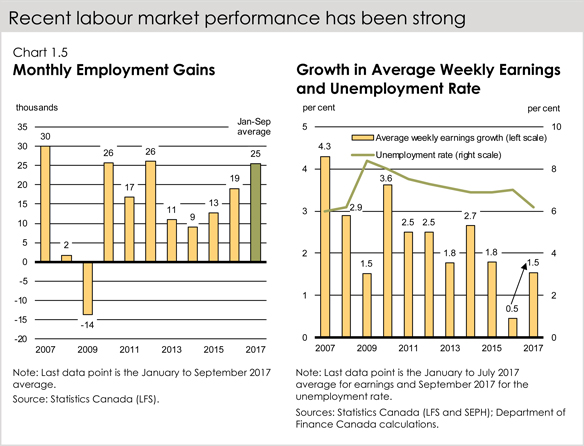

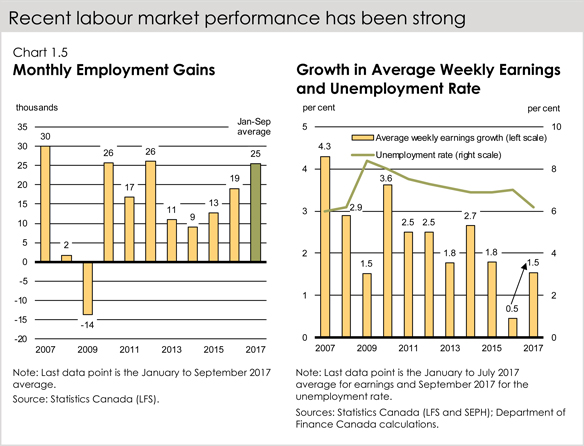

The recent acceleration and broadening of growth has coincided with robust job gains for Canada as a whole, as 472,300 net jobs have been created since November 2015. The pace of job creation so far in 2017—25,000 jobs per month—has been among the fastest in the past decade (Chart 1.5).

These recent gains in the labour market have contributed to lowering the unemployment rate from 7.2 per cent at the beginning of 2016 to 6.2 per cent in September 2017, its lowest level since October 2008. Moreover, according to the Bank of Canada’s Business Outlook Survey, hiring intentions have increased compared to 2015 and mid-2016. The net balance of firms facing greater labour market pressures compared to a year ago—although not yet limiting their ability to meet demand—reached its highest level in over a decade as of the latest survey. Meanwhile, wage growth is picking up, following softness in 2016. Average weekly earnings have increased by $15, or from $954 to $969, in the first seven months of 2017 compared to the same period last year.

| | |

| | | ECONOMIC AND FISCAL UPDATE 7 |

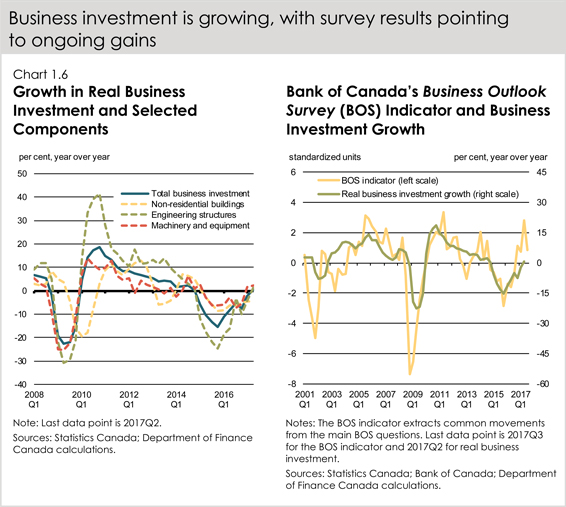

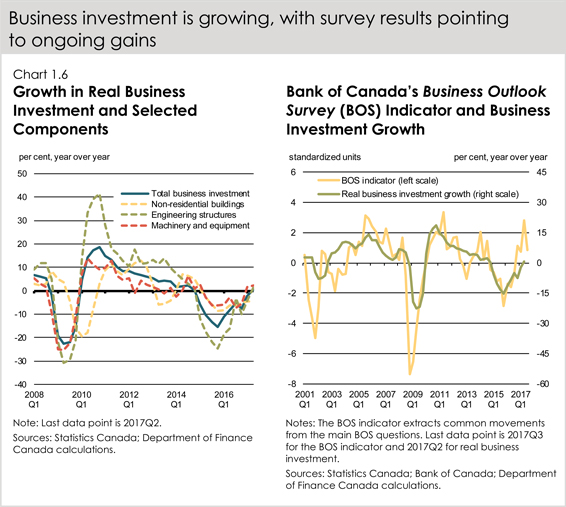

After rebounding rapidly during the recovery from the global recession, real business investment shrank over 2015 and 2016. This fall was driven by dramatic declines in engineering structures in the response to the global oil price shock and resulting pull-back in investment in oil-producing regions (Chart 1.6).

However, business investment is now growing, underpinned by stronger economic activity in both the resource and non-resource sectors and much improved business sentiment. The Bank of Canada’s Business Outlook Survey shows a strong improvement in business investment intentions over the last year. Despite a slight pull-back in the most recent Survey, intentions remain in solid positive territory, pointing to a further recovery in investments going ahead. With capacity utilization rates of several industries currently close to their pre-recession peaks, this suggests that the recent pick-up in business investment may prove to be more enduring.

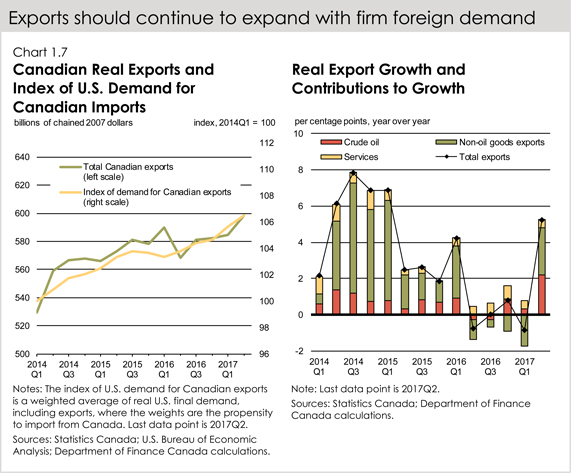

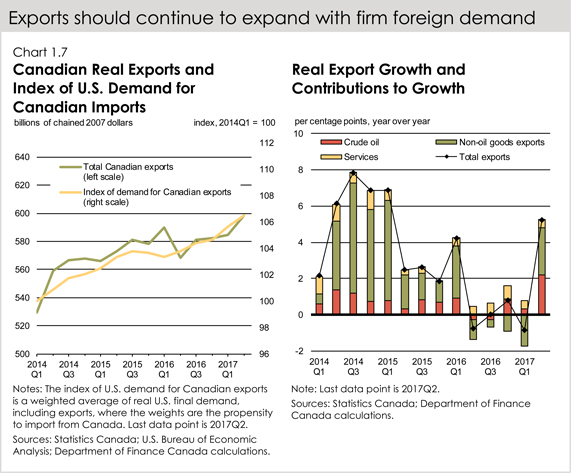

Total Canadian exports have continued to rise in recent years. Growth in non-oil goods exports was the main driver of overall export growth in 2014, largely explained by higher foreign demand (Chart 1.7).

Starting in early 2015, growth in exports of non-oil goods slowed in line with weaker U.S. demand, in spite of the lower Canadian dollar. Looking ahead, non-oil exports should continue to expand in line with a positive U.S. growth outlook.

| | |

| | | ECONOMIC AND FISCAL UPDATE 9 |

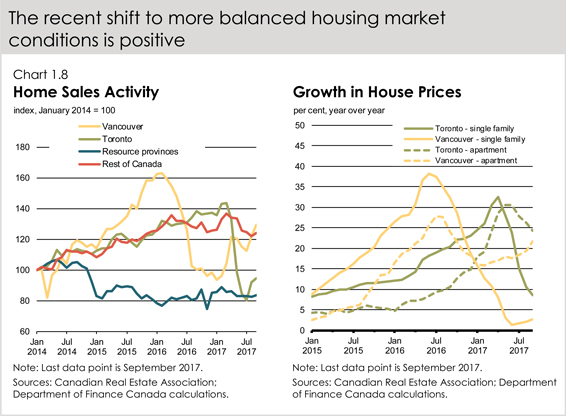

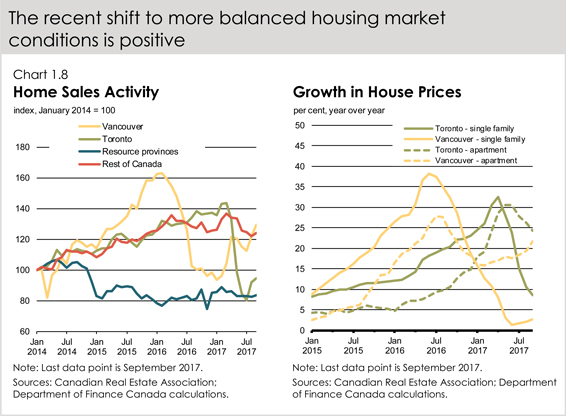

In the Canadian housing market, following rapid price growth in 2016 and early 2017, Toronto and surrounding regions have seen a shift to more balanced market conditions (Chart 1.8). In the Vancouver area, activity has rebounded modestly following a slowdown in the second half of 2016. Nonetheless, affordability remains a pressing concern in these markets, particularly for middle class families and lower-income Canadians. While prices for single-family homes have stagnated or declined, prices for other dwelling types, particularly apartment condominiums, continue to rise. This fall, the Government intends to release details of its National Housing Strategy, first announced in Budget 2017, which is estimated to help up to 500,000 Canadians find a safe and secure place to call home.

Looking ahead, ongoing solid economic conditions will provide support for housing demand across the country. However, rising interest rates, combined with recent federal and provincial housing measures, should temper housing demand going forward.

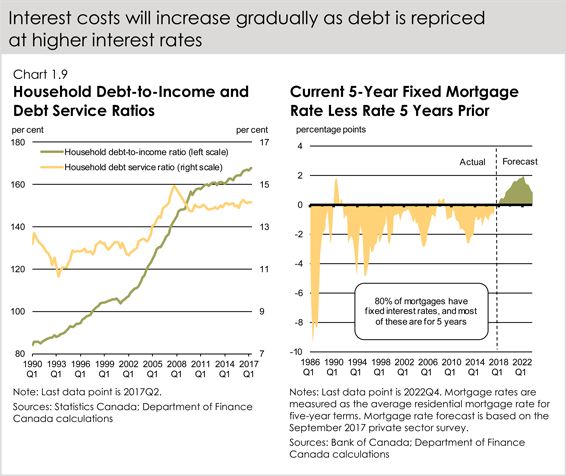

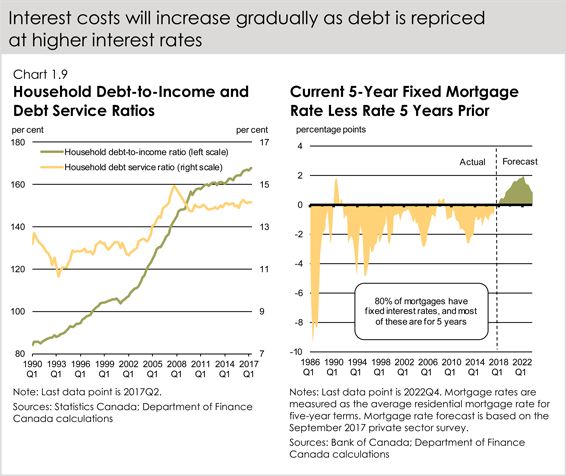

Household debt relative to income is at historic highs and continues to rise gradually, led by growth in mortgage debt (Chart 1.9). However, low interest rates have kept the household debt-service ratio stable, while rising asset values (for both housing and non-housing assets) have kept the debt-to-asset ratio (a measure of household leverage) low.

Rising interest rates are likely to increase debt-service ratios, which will in turn constrain future household spending growth. However, since most borrowers have fixed-rate mortgages that do not need to be renewed over the near term, the economic impacts of higher rates will be felt gradually over time. Nonetheless, households need to be prudent and manage their debt levels in the context of rising interest rates.

The federal government has introduced several measures since 2015 to help ensure the stability of housing and financial markets, protecting what is for many Canadians the most important investment of their lives. These include stricter down payment requirements for higher-priced homes, measures to improve tax fairness by ensuring that the principal residence exemption is available only in appropriate cases, and a mortgage rate stress test for insured mortgages, helping borrowers better afford their mortgages in a rising interest rate environment. The Office of the Superintendent of Financial Institutions also recently announced changes to its mortgage underwriting Guideline B-20 for federally regulated lenders, including a mortgage rate stress test for uninsured mortgages. These new measures will come into effect on January 1, 2018.

The federal government will continue to closely monitor the housing market, working collaboratively with provinces and municipalities.

| | |

| | | ECONOMIC AND FISCAL UPDATE 11 |

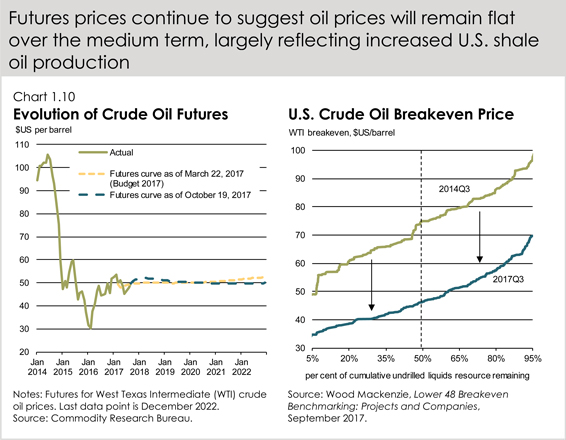

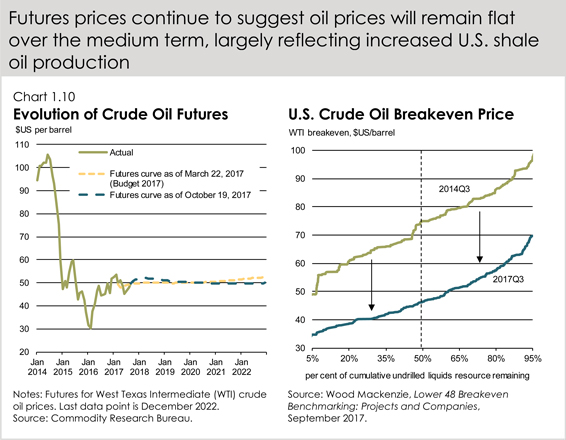

Oil prices have increased modestly from lows reached in early 2016, but are expected to remain largely flat over the medium term (Chart 1.10). This reflects increased output from U.S. shale oil producers, persistently high U.S. crude oil inventories, and concerns over the durability of the Organization of the Petroleum Exporting Countries production cuts.

The U.S. has emerged as the new global swing producer, as productivity enhancements in the industry have lowered costs over the last several years such that over half of undrilled oil reserves in the U.S. are now economical at sub-US$50 market prices.

GLOBAL ECONOMIC DEVELOPMENTS AND OUTLOOK

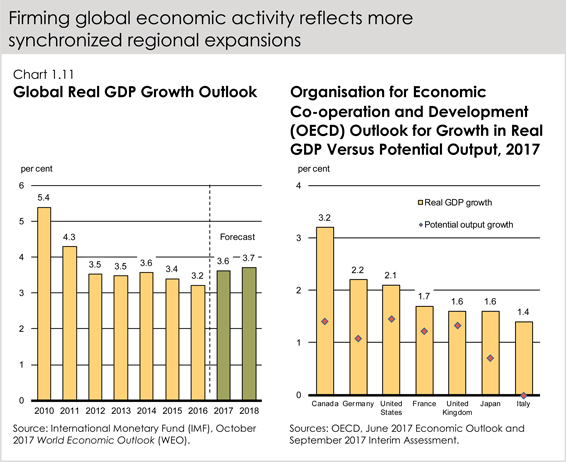

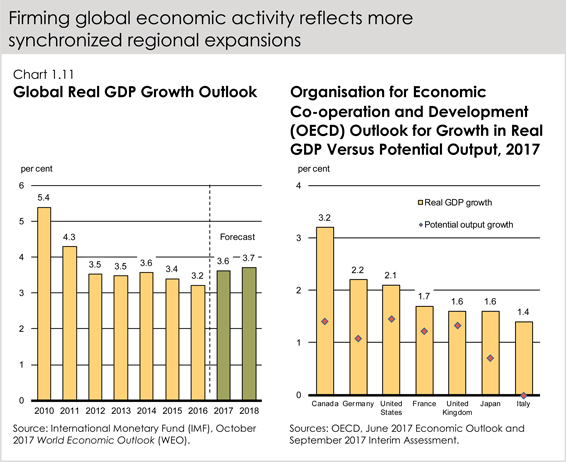

The strong recent economic performance in Canada is taking place in tandem with a firming global economic expansion. Global growth is showing signs of a durable pick-up after two consecutive years of deceleration (Chart 1.11).

All G7 countries are currently expanding faster than their estimated trend growth rates, economic activity in China remains robust, and growth is returning in Russia and Brazil, which faced deep recessions over the last three years.

| | |

| | | ECONOMIC AND FISCAL UPDATE 13 |

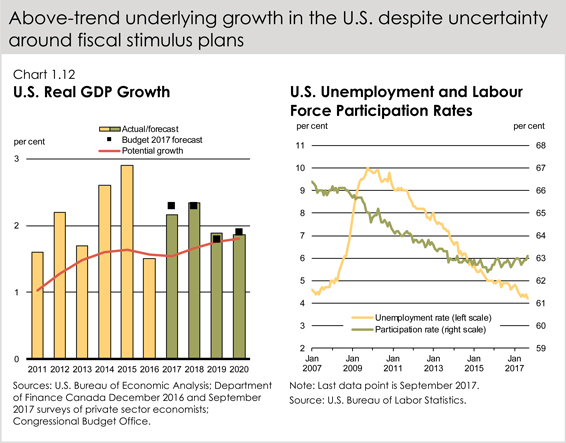

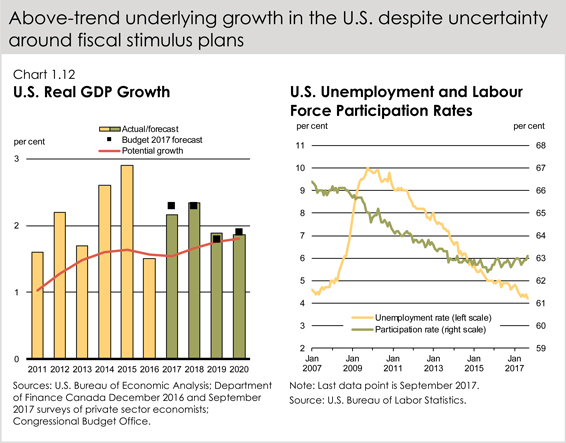

In the United States, the current economic expansion is the third-longest since World War II. Economic activity is growing at a healthy pace of roughly 2 per cent, which is slightly higher than its estimated potential growth rate (Chart 1.12). At the same time, expectations for a policy-driven acceleration in growth this year have been reduced, as prospects for significant fiscal stimulus in 2017 have dimmed. Reflecting this, both the IMF and OECD have unwound a previously assumed near-term boost to growth from their respective U.S. outlooks.

The U.S. labour market has continued to tighten, with the unemployment rate reaching a 16-year low of 4.2 per cent in September 2017. Moreover, the labour force participation rate has been rising modestly in spite of downward pressure from population aging, mainly due to an increase in the participation of women in the workforce. In light of the continued underlying strength of the U.S. economy, the Federal Reserve has increased interest rates twice so far in 2017 and started to very gradually reduce the size of its balance sheet.

The recent natural disasters in Texas and Florida weighed on third-quarter growth as a result of disruptions to economic activity. However, similar to past experience, the macroeconomic impacts are expected to be transitory, as production recovers and reconstruction proceeds.

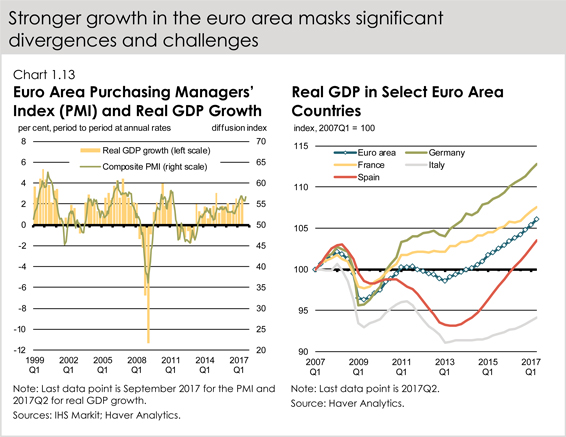

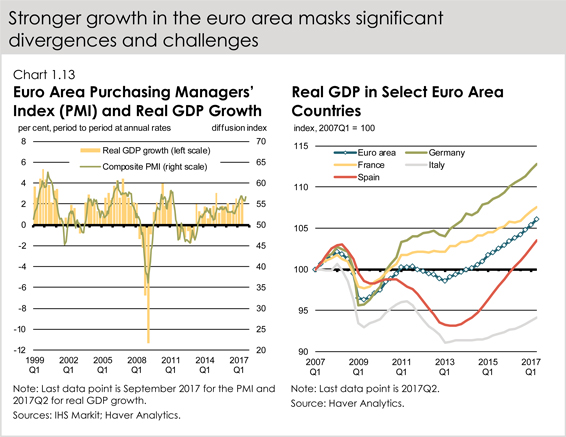

The pace of economic activity has also accelerated this year in Europe, and high-frequency indicators suggest a continuation of above-trend growth into late 2017 (Chart 1.13). With significant excess capacity remaining in many countries, as illustrated by still-elevated unemployment rates and below-target inflation, the European economic recovery has scope to maintain momentum in the coming year. Against this positive backdrop, ongoing vulnerabilities in the banking sector in some countries and uncertainties related to conditions of the United Kingdom’s upcoming exit from the European Union continue to be potential headwinds.

| | |

| | | ECONOMIC AND FISCAL UPDATE 15 |

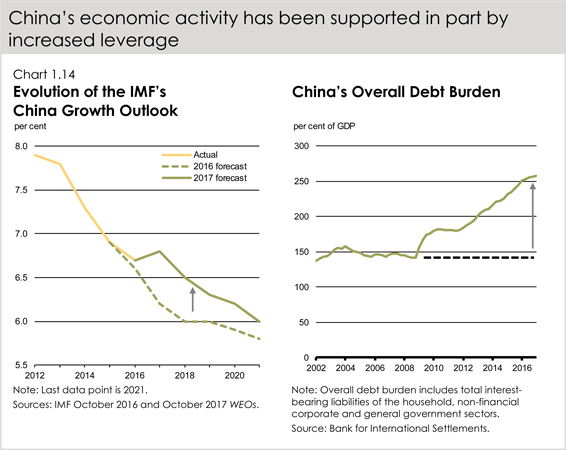

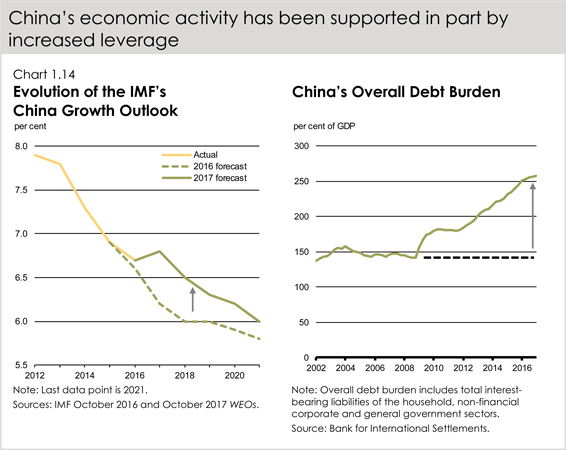

Among emerging economies, forecasts for China’s economy—the single largest contributor to global growth—have been revised up (Chart 1.14). Growth is being significantly aided by stimulative fiscal policy, and increased private and public borrowing. While this approach has supported growth in the short term, medium-term risks, notably related to corporate leverage and a buoyant housing market, remain unaddressed.

Among other large emerging economies, Brazil and Russia have returned to growth following their recent recessions, reflecting a firming in global commodity prices and more favourable financial conditions. In addition, the Indian economy continues to expand at a brisk pace. However, sustained strong growth in emerging economies hinges on domestic economic reforms to foster investment, boost productivity, as well as strengthen fiscal, monetary and exchange rate frameworks.

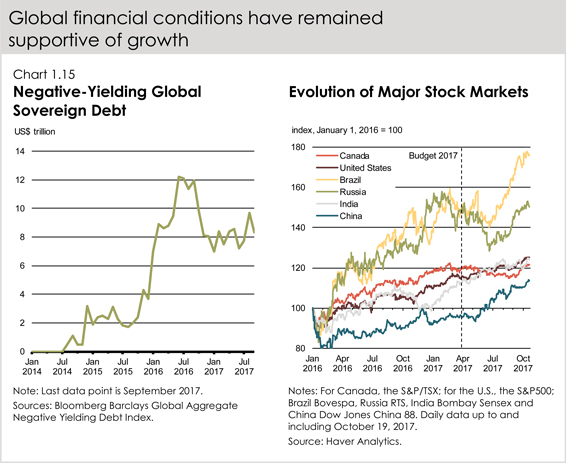

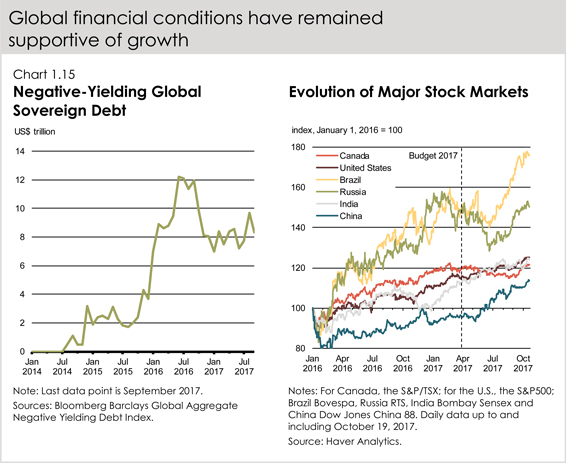

Global financial conditions remain supportive of economic activity (Chart 1.15). Interest rates remain at historically low levels, with short-term interest rates in a number of countries still in negative territory, and some central banks continuing to deploy extraordinary monetary policy measures to close domestic output gaps and stoke inflation. Globally, there remains more than US$8 trillion in negative-yielding sovereign debt, the bulk of which is from Europe and Japan.

In addition, equity markets have continued to rise, supported by the improving global economic backdrop, still highly accommodative monetary policy, increased confidence and investors’ continued search for yield.

Measures of volatility remain muted despite elevated policy, and more recently geopolitical, uncertainty. This situation heightens the risk of complacency among market participants, which could exacerbate any potential financial market turbulence if financial conditions tighten faster than expected as monetary policy normalization proceeds globally. In addition, some emerging economies are more vulnerable to a global repricing of risk, which could trigger sharp movements in capital flows, especially in those countries with large holdings of U.S.-dollar-denominated debt.

| | |

| | | ECONOMIC AND FISCAL UPDATE 17 |

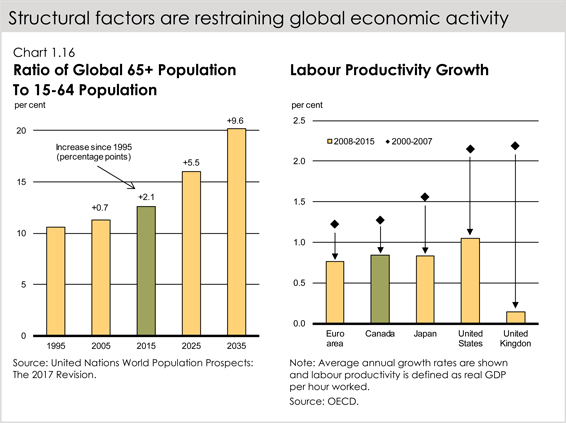

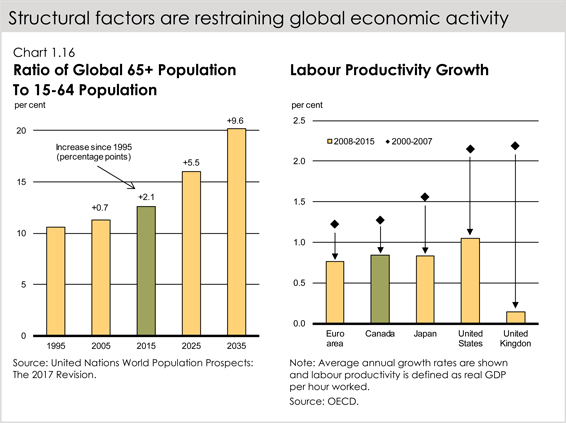

Despite strengthening global economic activity, declining unemployment rates and favourable financial conditions, the global economy continues to face a number of challenges. For example, the current strong economic performance, especially among advanced economies, is likely to moderate as many economies are expected to return to their respective trend growth rates in the short to medium term. In particular, pressures from changing demographics and productivity challenges, as well as risks from rising protectionism, continue to weigh on the outlook (Chart 1.16).

PRIVATE SECTOR OUTLOOK

The fiscal projections contained in this Fall Economic Statement are based on the September 2017 survey of private sector economists. Details of the full private sector economic outlook are presented in Annex 1.

In summary, the economists expect real GDP growth to rise from 1.5 per cent in 2016 to 3.1 per cent in 2017, significantly higher than the 2.0 per cent expected in Budget 2017 and the 2.2 per cent originally projected in Budget 2016. The outlook for real GDP growth is little changed thereafter compared to Budget 2017. Similarly, expectations for growth in nominal GDP—the broadest measure of the tax base—have been revised up for 2017 (from 4.2 per cent to 5.5 per cent), but are largely unchanged thereafter. As a result, the level of nominal GDP over the projection horizon is $30 billion higher per year, on average, than was anticipated in Budget 2017 (Table 1.1).

Table 1.1

Average Private Sector Forecasts

per cent, unless otherwise indicated

| | | | | | | | | | | | | | | | | | |

| | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | | | 2017–

2021 |

Real GDP growth | | | | | | | | | | | | | | | | | | |

Budget 20161 | | 1.4 | | 2.2 | | 2.2 | | 2.0 | | 1.9 | | – | | – | | | | – |

Budget 20171 | | 1.4 | | 2.0 | | 2.0 | | 1.7 | | 1.7 | | 1.8 | | – | | | | 1.8 |

2017 Fall Economic Statement | | 1.5 | | 3.1 | | 2.1 | | 1.6 | | 1.7 | | 1.7 | | 1.8 | | | | 2.0 |

| | | | | | | | | |

GDP inflation | | | | | | | | | | | | | | | | | | |

Budget 20161 | | 0.9 | | 2.4 | | 2.1 | | 2.1 | | 2.1 | | – | | – | | | | – |

Budget 20171 | | 0.5 | | 2.1 | | 2.0 | | 1.8 | | 2.1 | | 2.0 | | – | | | | 2.0 |

2017 Fall Economic Statement | | 0.6 | | 2.4 | | 1.8 | | 1.8 | | 2.0 | | 1.9 | | 1.9 | | | | 2.0 |

| | | | | | | | | |

Nominal GDP growth | | | | | | | | | | | | | | | | | | |

Budget 20161 | | 2.3 | | 4.6 | | 4.3 | | 4.2 | | 4.1 | | – | | – | | | | – |

Budget 20171 | | 1.9 | | 4.2 | | 4.0 | | 3.5 | | 3.8 | | 3.8 | | – | | | | 3.9 |

2017 Fall Economic Statement | | 2.1 | | 5.5 | | 4.0 | | 3.4 | | 3.7 | | 3.6 | | 3.8 | | | | 4.1 |

| | | | | | | | | |

Nominal GDP level ($ billions) | | | | | | | | | | | | | | | | | | |

Budget 20161 | | 2,033 | | 2,126 | | 2,218 | | 2,310 | | 2,404 | | – | | – | | | | |

Budget 20171 | | 2,024 | | 2,109 | | 2,194 | | 2,271 | | 2,357 | | 2,447 | | – | | | | |

2017 Fall Economic Statement | | 2,028 | | 2,140 | | 2,226 | | 2,302 | | 2,388 | | 2,473 | | 2,568 | | | | |

| | | | | | | | | |

Difference between Budget 2016 and

2017 Fall Economic Statement | | -5 | | 13 | | 8 | | -8 | | -16 | | – | | – | | | | – |

Difference between Budget 2017 and

2017 Fall Economic Statement | | 3 | | 30 | | 31 | | 31 | | 31 | | 26 | | – | | | | 30 |

| 1 | GDP figures have been restated to reflect the historical revisions to the Canadian System of National Accounts, which were published along with data for the second quarter of 2017, released on August 31, 2017. |

Sources: For Budget 2016, Department of Finance Canada February 2016 survey of private sector economists; for Budget 2017, Department of Finance Canada December 2016 survey of private sector economists; for the 2017 Fall Economic Statement, Department of Finance Canada September 2017 survey of private sector economists; Statistics Canada.

| | |

| | | ECONOMIC AND FISCAL UPDATE 19 |

RISK ASSESSMENT

Global and Canadian growth have strengthened in recent quarters and upside risks to the outlook are present. Stronger growth in the world economy, particularly in the euro area and more recently in the U.S., could be more durable and self-sustaining than anticipated, which would reinforce Canadian growth. As a result, investment growth could surprise on the upside, boosting Canada’s long-term productive capacity.

There are still downside risks to the outlook. In China, elevated corporate debt levels and the slow pace of economic reforms could lead to a greater-than-expected slowdown in growth. Uncertainty over U.S. economic policies could affect Canadian business confidence. Additionally, global financial markets could experience periods of turbulence as advanced-economy central banks begin or continue the significant task of gradually normalizing monetary policy. This is especially true in the context of muted market volatility and rising market valuations.

On the domestic front, Canada’s household debt-to-income ratio remains elevated historically. This could limit the contribution to growth of both housing and consumer spending in the coming years, particularly in a rising interest rate environment.

Overall, the risks to the September 2017 economic outlook appear broadly balanced. For prudent planning purposes, the adjustment for risk is $1.5 billion in 2017–18 and $3.0 billion in future fiscal years, to account for risks and uncertainty in the economic and fiscal forecast.

CHANGES TO THE FISCAL OUTLOOK

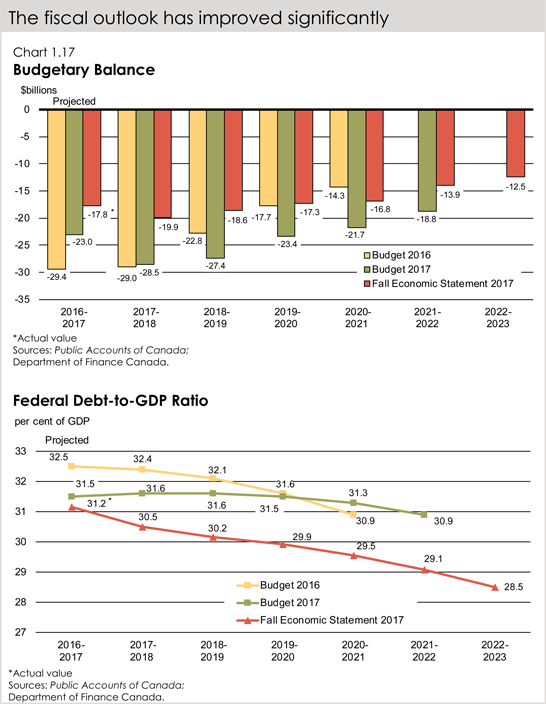

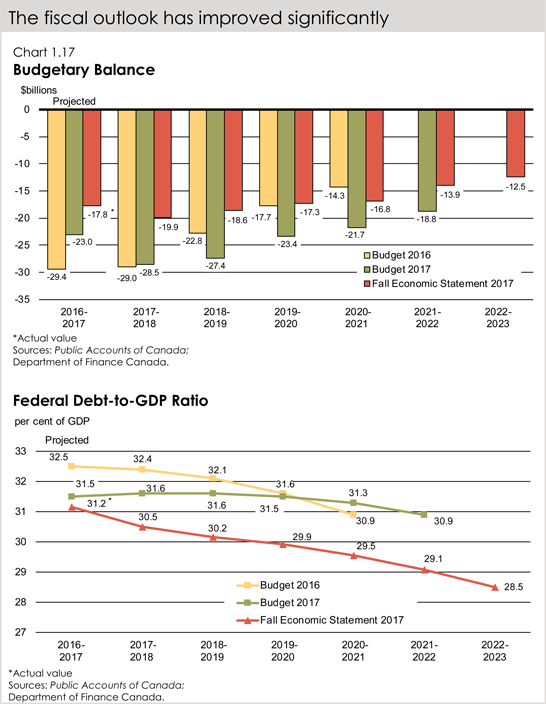

The improvement in the economic outlook of private sector forecasters, combined with the better-than-expected fiscal outcome in 2016–17, has resulted in a significant upward revision to the fiscal outlook (Chart 1.17).

In total, economic and fiscal developments since Budget 2017, including the measures announced in this Fall Economic Statement, have resulted in an improvement in the outlook for the budgetary balance of $8.6 billion in 2017–18, $8.8 billion in 2018–19, $6.1 billion in 2019–20 and $4.9 billion in each of the following two years. Correspondingly, recent strength in the economy and the improved fiscal outlook have reduced the debt-to-GDP ratio throughout the forecast horizon.

| | |

| | | ECONOMIC AND FISCAL UPDATE 21 |

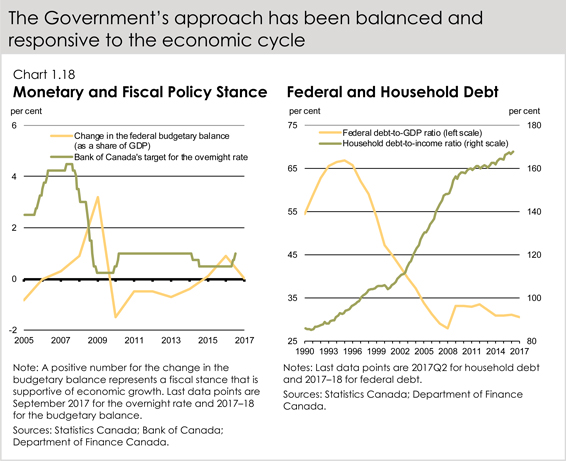

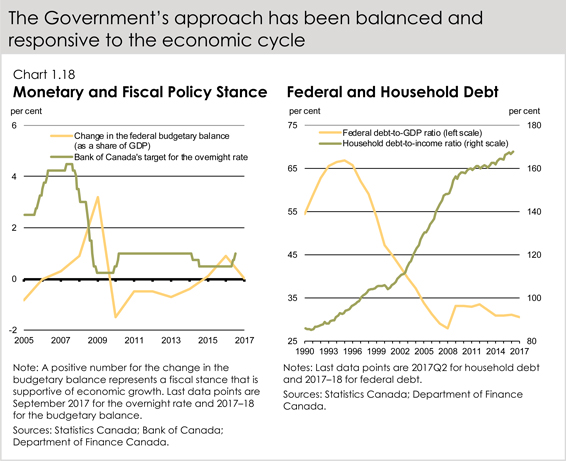

The Government has adopted a responsible approach to fiscal management that is appropriate to the current economic cycle and focused on long-term economic growth and fiscal sustainability.

During the economic weakness of late 2015 and early 2016, the Government made targeted fiscal investments, including tax cuts for the middle class, the Canada Child Benefit and infrastructure investments, that re-established economic momentum in Canada—protecting and creating Canadian jobs and supporting the long-term growth potential of the Canadian economy. These measures put money directly in the pockets of middle class Canadians, empowering them to support local small businesses, pay off their debts and save for the future. In just two years, the Government’s investments have helped to increase consumer confidence and brought hope for the future for millions of Canadian families.

The Government’s fiscal actions provided needed support for the economy—by leveraging the federal balance sheet to support growth at a time when household balance sheets were more leveraged. In this context, monetary and fiscal policies have become more complementary.

This approach has been effective, and the economy is now outperforming expectations. As the economy strengthens, the Government is adjusting its fiscal strategy to adapt to the better-than-expected economic outlook. The current fiscal track shows steady improvements in the Government’s budgetary position along with a commensurate decline in the federal debt-to-GDP ratio.

The Government will maintain this downward deficit and debt ratio track—preserving Canada’s low-debt advantage for current and future generations. Low debt levels support economic growth and intergenerational equity by keeping interest costs low and preserving flexibility to face future economic shocks and challenges.

| | |

| | | ECONOMIC AND FISCAL UPDATE 23 |

IMPACT OF ALTERNATIVE ECONOMIC SCENARIOS

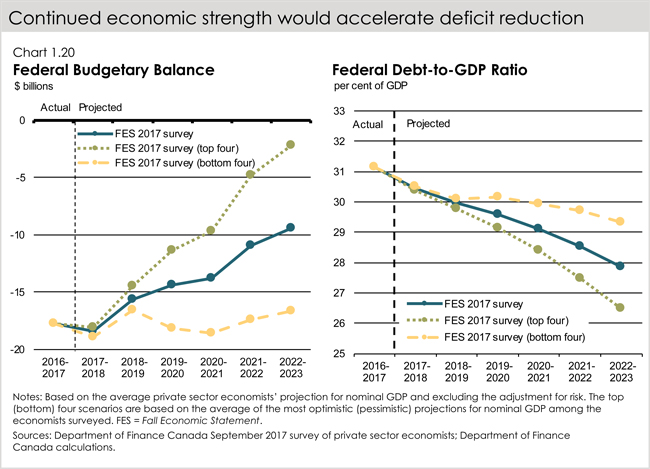

The fiscal projections presented in this Fall Economic Statement are based on an average of the September 2017 private sector economic outlook survey. However, economists surveyed offered a wide range of views regarding future economic growth and, therefore, the path of nominal GDP (the broadest measure of the tax base). Changes in economic growth assumptions can also have large impacts on the budgetary balance and debt-to-GDP profile over an extended projection horizon.

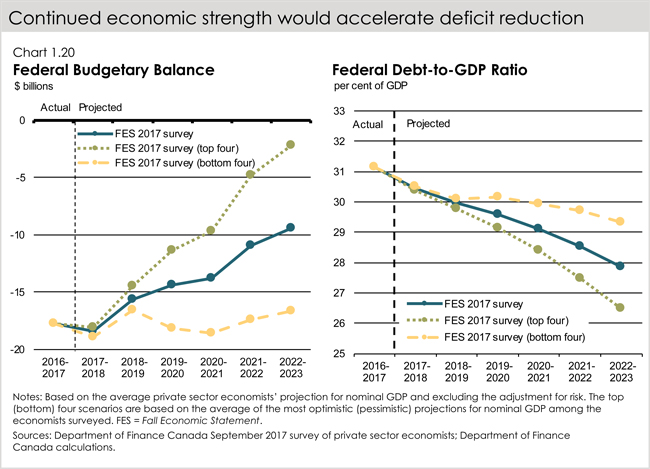

For example, if the Government based current fiscal projections on the average of the top four individual forecasts for nominal GDP growth—which is equivalent to nominal GDP growth being 0.3 percentage points per year higher, on average, than in the full September survey—the budgetary balance would improve by $3.7 billion per year on average (Chart 1.20). Further, this would result in a federal debt-to-GDP ratio of 26.5 per cent, its lowest level since 1977.

Conversely, basing fiscal projections on the average of the bottom four individual forecasts for nominal GDP growth—which is equivalent to nominal GDP growth being 0.3 percentage points per year lower, on average, than in the full September survey—the budgetary balance would worsen by $3.9 billion per year on average, and the federal debt-to-GDP ratio would still decline, but be 1.5 percentage points of GDP higher in 2022–23.

Chapter 2

RESULTS FOR MIDDLE CLASS CANADIANS

INTRODUCTION

Canadians across the country are seeing the results of investments in people and communities in real and tangible ways. From the over 450,000 jobs created since 2015, to a more secure retirement for millions of seniors and workers, to a reduction in the small business tax rate to 9 per cent, to the nine out of 10 families who have more money in their pockets as a result of the Canada Child Benefit, this chapter highlights important accomplishments made over the last two years—and the progress made on an ambitious plan for the middle class and those working hard to join it.

| | | | | | |

What Success Looks Like in 2017: Some Highlights |

| | | |

| | A stronger economy that benefits all Canadians | | ✓ | | Canada now the fastest growing economy in the G7 |

| | | ✓ | | Over 450,000 jobs created since 2015, and unemployment rate at lowest level since 2008 |

| | | ✓ | | Lowest youth unemployment rate on record at 10.3 per cent |

| | | ✓ | | Labour market participation of working-age women at an all-time high |

Opportunities for the Middle Class |

| | | |

| | A better future for children, and more opportunity and security for middle class women and men | | ✓ | | Nine out of 10 Canadian families are receiving more money with the new Canada Child Benefit |

| | | ✓ | | Employment Insurance benefits have improved to support unemployed and underemployed Canadians and families |

| | | ✓ | | Canada Pension Plan maximum retirement benefit will increase by about 50 per cent for workers today and for the next generation |

| | | ✓ | | Restored the eligibility age for Old Age Security and Guaranteed Income Supplement benefits to 65, putting thousands of dollars back in the pockets of Canadians as they become seniors |

| | | |

| | Stronger support for those who need it most | | ✓ | | Increased Guaranteed Income Supplement payments of up to $947 per year are helping nearly 900,000 low-income seniors, of which 70 per cent are women |

| | | ✓ | | Eligible veterans are now receiving 90 per cent of their pre-release salary and will soon qualify for up to $80,000 in financial support to pursue education and training after release |

| | | |

| | A renewed relationship with Indigenous Peoples | | ✓ | | Over $11 billion in new investments, working towards a new fiscal relationship |

| | | ✓ | | Over 50 new Self Determination Tables have been established to date to advance Indigenous rights, needs and interests |

| | | ✓ | | Since November 2015, 26 long-term drinking water advisories have been lifted |

| | | |

| | A fairer tax system for middle class Canadians | | ✓ | | Lower taxes for middle class Canadians and small business |

| | | ✓ | | A tax system better targeted to promote fairness, investment and growth |

| | | ✓ | | Investments in the Canada Revenue Agency to better enforce the rules so that everyone pays their fair share |

| | |

| | | RESULTS FOR MIDDLE CLASS CANADIANS 25 |

| | | | | | |

An Innovative, Inclusive and Sustainable Economy |

| | A Canada with the

skills to thrive in the global economy of tomorrow | | ✓ | | Up to $1,000 more per year for low- and middle-income post-secondary students through Canada Student Grants |

| | | ✓ | | A bold and inclusive Innovation and Skills Plan that builds on Canada’s strengths |

| | | ✓ | | Historically high levels of immigration and a Global Skills Strategy will ensure that Canada attracts top talent and investment from around the world |

| | Communities built for change | | ✓ | | Long-term infrastructure investments will strengthen communities and support sustainable economic growth by helping move goods and people more easily, and by creating jobs for today and tomorrow |

| | | ✓ | | Pan-Canadian Framework on Clean Growth and Climate Change adopted on December 9, 2016 |

OPPORTUNITIES FOR THE MIDDLE CLASS

The Government’s plan for the middle class is creating jobs, improving lives, strengthening communities and growing the economy.

SUPPORTING CHILDREN AND FAMILIES

In the first year of its mandate, the Government acted on two of its cornerstone commitments:

| • | | Middle class tax cut for 9 million Canadians: Single Canadians who benefit are saving an average of $330 each year, and couples who benefit are saving an average of $540 each year. The Government raised taxes on the wealthiest one per cent in order to give the middle class a break. |

| • | | Canada Child Benefit (CCB): Compared to the previous system of child benefits, the CCB is simpler, more generous and better targeted to those who need it most. During the first benefit year, over 3.3 million families received more than $23 billion in CCB payments, and the nine out of 10 families who are better off under the CCB received on average almost $2,300 more in benefits, tax-free. The CCB has helped lift hundreds of thousands of children out of poverty. |

The net result of these two measures has been more money in the pockets of middle class people and their families, contributing significantly to economic growth, creating jobs and bringing renewed confidence for the future for millions of Canadians.

To further help families, in June 2017, federal-provincial-territorial Ministers Responsible for Early Learning and Child Care announced a new agreement on a Multilateral Early Learning and Child Care Framework to make enhancements to provincial and territorial early learning and child care systems. Governments have committed to increase the quality, accessibility, affordability, flexibility and inclusivity in early learning and child care, with consideration for families that need it most. To implement this initiative, the Government of Canada is providing $7.5 billion over 11 years to support and create more high-quality, affordable child care across the country, and is working with provinces and territories to enter into three-year bilateral agreements that will outline their unique early learning and child care needs and the funding allocation for each jurisdiction.

A distinction-based Indigenous Early Learning and Child Care Framework will be developed between partners that will reflect the unique cultural needs of First Nations, Inuit and Métis children across Canada.

A Stronger, More Inclusive Canada

The Government is taking steps to ensure that all Canadians have a real and fair chance at success, and can benefit from a growing economy. This includes making sure all Canadians can look forward to a secure and dignified retirement, fulfilling Canada’s solemn promise to our veterans and ensuring that the most vulnerable in our society have a safe place to call home.

| • | | Seniors are more financially secure today, as a result of increases to the maximum Guaranteed Income Supplement top-up benefit—more than doubling top-up benefits for our most vulnerable single seniors. |

| | |

| | | RESULTS FOR MIDDLE CLASS CANADIANS 27 |

| | |

How Low-Income Single Seniors Benefit | | Lynn is a 74-year-old resident of Montréal, Quebec, who lives alone. With no income apart from Old Age Security and Guaranteed Income Supplement benefits, she struggles to make ends meet. The increase in the Guaranteed Income Supplement top-up benefit for single seniors introduced in Budget 2016 provides Lynn with an additional $947 per year. |

| |

| | Charles is a 68-year-old widower residing in Edmonton, Alberta. Charles receives annual Canada Pension Plan benefits of $5,000 along with Old Age Security and Guaranteed Income Supplement benefits. The increase in the Guaranteed Income Supplement top-up benefit for single seniors introduced in Budget 2016 provides Charles with an additional annual benefit of $848 per year. |

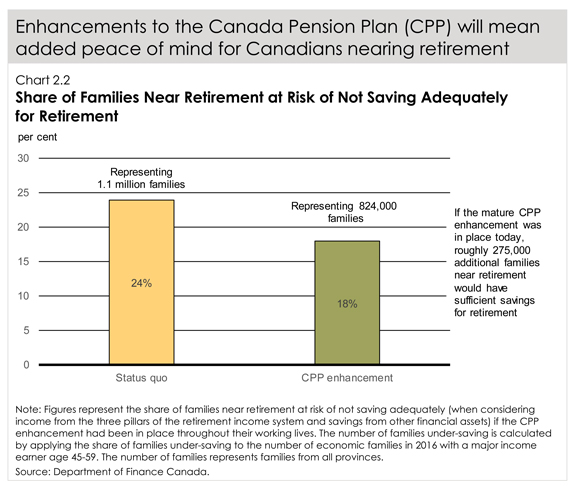

| • | | Future retirees have more peace of mind—as enhancements to the Canada Pension Plan will increase the maximum retirement benefit by about 50 per cent for workers today and for the next generation. |

| • | | Veterans who qualify for disability benefits are now receiving 90 per cent of their pre-release salary as well as more compensation for their pain and suffering. Starting in April 2018, eligible veterans will begin receiving up to $80,000 to go to college, university or a technical school after they complete their service. Further measures will increase financial support for caregivers and expand access to Military Family Resource Centres for the families of veterans living with mental and physical health issues as a result of their service. The total investment in improved veterans’ benefits and services exceeds $6.7 billion over seven years. The Government will continue to work with the veterans’ community to examine the best way to streamline and simplify the system of financial support programs currently offered to veterans. In addition, the Government will be moving forward with its commitment to re-establish lifelong pensions as an option for ill and injured veterans. Details are expected to be announced in advance of Budget 2018. |

|

A New Education Benefit for Veterans |

David is a 32-year-old Canadian Armed Forces member who will be released in the summer of 2018 after 12 years of service in the Regular Force as an ammunition technician. He is planning on going back to school full-time for a three-year college course to become a civil engineering technician. He will receive an education benefit of $20,000 per year for each of those three years. Depending on his family income, David could also be eligible to receive student grants and loans through the Canada Student Loans Program. In addition, David can access employment services such as career counselling and job-search training under the Career Transition Services Program to assist him in re-entering the labour force following the completion of his studies. |

| • | | Low-income Canadians will have improved access to adequate and affordable housing—a cornerstone of sustainable, inclusive communities and a Canadian economy where we can prosper and thrive. The Government is renewing federal leadership in housing with significant new long-term investments. The launch of the National Housing Strategy—a long-term investment of more than $11.2 billion over 11 years—will take place later this fall. One-third of social housing tenants in Canada are seniors. It is expected that the Strategy will have a more pronounced impact on senior women living alone, female-headed lone-parent families, and women with disabilities who currently experience high levels of housing need. |

|

A New Rental Construction Financing Initiative |

In April, the Government announced the launch of the Rental Construction Financing Initiative to help increase the supply of rental housing. Over the next four years, this initiative will offer more than $2.5 billion in low-cost loans to support the construction of new rental housing. These funds will be provided to municipalities, non-profit organizations and housing developers. Low-cost loans will help with the earliest, and most challenging, phases of development, including construction, lease-up and the early stages of property operations. These loans are expected to spur the construction of more than 10,000 new rental housing units across Canada. In exchange for these favourable loans, borrowers will be required to build housing projects that: • are more energy-efficient; • are accessible to Canadians with disabilities; and • have 20 per cent of their units set aside as affordable housing for moderate-income families. |

| | |

| | | RESULTS FOR MIDDLE CLASS CANADIANS 29 |

| • | | Newcomers to Canada will continue to play an important role in supplying Canada’s knowledge economy with innovative, highly skilled and specialized talent, as new permanent and temporary residents are welcomed to Canada to help drive our economic and shared growth. |

|

A Continued Focus on Gender Equality and Inclusiveness |

Since Budget 2017, the Government has continued to pursue policies and investments that support gender equality and inclusiveness. • The new Multilateral Early Learning and Child Care Framework will support access to child care for children of all backgrounds, and allow greater participation in work, education or training, particularly by mothers. • Canada’s new defence policy will promote diversity and inclusion as core institutional values across the Defence team. Gender-based Analysis Plus will be integrated in all Defence activities across the Canadian Armed Forces and the Department of National Defence. A new focus will be placed on recruiting and retaining under-represented populations within the Canadian Armed Forces, including, but not limited to, women, Indigenous Peoples and members of visible minorities, with a target to increase the representation of women to 25 per cent of the overall force. • The new Feminist International Assistance Policy will aim to reduce extreme poverty and build a more peaceful, inclusive and prosperous world—recognizing that promoting gender equality and empowering women and girls is the most effective approach to achieving this goal. • Stronger capacity at Status of Women Canada will support national and international engagement to help advance the Government’s gender equality objectives. The Government continues to work with civil society and international partners to improve how it includes Gender-based Analysis Plus as part of policy development and budget decision-making—and will build on Budget 2017’s Gender Statement to promote greater gender equality and inclusiveness as part of Budget 2018. |

A Renewed Relationship With Indigenous Peoples

The Government is taking concrete steps to achieve reconciliation with First Nations, Inuit and the Métis Nation. To support the renewal of the relationship, the Government announced the creation of two new departments: a Department of Crown-Indigenous Relations and Northern Affairs, and a Department of Indigenous Services. These changes mark an important shift away from historic colonial structures. The Government is also working with First Nations, Inuit and Métis to co-develop policy proposals that respond to their priorities. While significant work remains, progress is being made:

| • | | Budgets 2016 and 2017 invested $11.8 billion to improve quality of life and economic opportunities for Indigenous Peoples. |

| • | | The Canada-Métis Nation Accord was signed by the Prime Minister and the leaders of the Métis Nation. The Accord identifies a wide range of areas for collaboration including education, poverty, housing, health, and fiscal funding mechanisms. |

| • | | The Inuit-Crown Partnership Committee has developed a joint work plan to advance the socio-economic, cultural, and conditions of success for Inuit. |

| • | | The implementation of the United Nations Declaration on the Rights of Indigenous Peoples requires transformative change in the Government’s relationship with Indigenous Peoples. To this end, the Government has released 10 Principles that will guide the renewal of the relationship including through the ongoing work of the Working Group of Ministers on the Review of Laws and Policies Related to Indigenous Peoples. |

| • | | On August 16, 2017, the Government of Canada and 23 Anishinabek Nation First Nations signed an historic self-government agreement on education. Under the agreement, participating First Nations will create the Anishinabek Education System—an education system by Anishinabek First Nations for Anishinabek students. The Manitoba First Nations School System, the result of an Education Governance Agreement between the Government of Canada and the Manitoba First Nations Education Resource Centre, assumed responsibility in July 2017 for administering and managing elementary and secondary education programs and services for 10 participating First Nations. Strong, culturally rooted First Nations-led education will strengthen communities and open opportunities for First Nations students. |

| • | | In August 2017, the Government announced an investment of up to $60.2 million for Wataynikaneyap Power to construct a 117-kilometre power line from Red Lake, Ontario, into the local distribution systems at Pikangikum First Nation. The project will provide clean energy while making an important contribution to the health and safety of community members and boosting the First Nation’s economic development opportunities. |

| • | | Progress continues to be made in addressing long-term drinking water advisories. Since Budget 2016, $733.2 million has been provided to support 348 water and wastewater projects in 275 communities serving approximately 275,000 people. Since November 2015, 26 long-term drinking water advisories have been lifted. |

Combatting International Tax Evasion and Avoidance

To keep taxes low and ensure everyone pays their fair share, the Government of Canada is actively engaged with international partners to ensure that Canada’s tax system is functioning as intended and contributing to the objective of an economy that works for the middle class.

Canada has worked together with the other members of the Group of 20 (G20) and the Organisation for Economic Co-operation and Development (OECD) to develop recommendations that will address base erosion and profit shifting (BEPS). BEPS refers to international tax planning arrangements used by multinational enterprises to unfairly minimize their taxes. For example, some enterprises will shift their taxable profits away from the jurisdiction where the underlying economic activity has taken place in order to avoid paying their fair share.

| | |

| | | RESULTS FOR MIDDLE CLASS CANADIANS 31 |

|

Canada’s Progress—Base Erosion and Profit Shifting

(BEPS) Initiative |

| |

The Government remains firmly committed to protecting Canada’s tax system, and has implemented—or is in the process of implementing—the measures agreed to as minimum standards under the BEPS project: • Legislation was enacted in December 2016 that requires large multinational enterprises to file country-by-country reports. This information will give tax authorities in each country a clearer picture of where the operations of the group in their particular jurisdiction fit into the group’s global operations and assist in high-level risk assessments. • Canada participated in the development of a multilateral instrument to streamline the implementation of tax treaty-related BEPS recommendations. On June 7, 2017, Canada, along with 67 other countries, signed the multilateral instrument. The Government is now undertaking the necessary domestic processes for ratification. • Canada has committed to the effective and timely resolution of tax treaty-related disputes by improving the mutual agreement procedure in Canada’s tax treaties. • The Canada Revenue Agency (CRA) has begun the spontaneous exchange with other tax administrations of tax rulings. With respect to other BEPS recommendations: • Canada has robust “controlled foreign corporation” rules in the form of our foreign accrual property income regime, which helps prevent taxpayers from avoiding Canadian income tax by shifting income into foreign subsidiaries. • Canada has implemented requirements for the disclosure of specified tax avoidance transactions to the CRA. • The CRA is applying revised international guidance on transfer pricing by multinational enterprises. The Government will continue to work with its international partners to ensure a coherent and consistent response to fight tax avoidance through BEPS. The Government is also strengthening its efforts to combat international tax evasion through enhanced sharing of information between tax authorities. The automatic exchange of information with respect to financial accounts held by non-residents—under the framework of the Common Reporting Standard developed by the OECD—is an important tool to promote compliance, combat international tax evasion, and ensure that taxpayers are reporting their income from all sources. To date, more than 100 jurisdictions have committed to implement the new standard. |

Strengthening Corporate and Beneficial Ownership Transparency

The Government of Canada is committed to implementing strong standards for corporate and beneficial ownership transparency that provide safeguards against money laundering, terrorist financing, tax evasion and tax avoidance, while continuing to facilitate the ease of doing business in Canada. Understanding the ownership and control of corporations is vital for good corporate governance and to protect the integrity of the tax and financial systems.

As announced in Budget 2017, the Government is working with the provinces and territories to strengthen the transparency of legal persons and arrangements in order to address blind spots in the availability of beneficial ownership information.

The Government also announced in Budget 2017 that it will examine ways to enhance the tax reporting requirements for trusts in order to improve the collection of beneficial ownership information.

These actions will ensure that law enforcement and other authorities have timely access to the information needed to crack down on money laundering, terrorist financing and tax evasion and to combat aggressive tax avoidance.

AN INNOVATIVE, INCLUSIVE AND SUSTAINABLE ECONOMY

Recognizing the unique opportunities and challenges that a rapidly changing economy presents, the Government took definitive steps to foster innovation, equip Canadians with the skills they need to succeed, and introduce transformational investments in infrastructure.

SKILLS FOR THE NEW ECONOMY

The Government is making targeted investments to expand access to the education, work experiences and employment supports that Canadians need to get high-quality, well-paying jobs. Combining work experience with education ensures that recent graduates have the skills and knowledge employers need. Youth will be better-prepared as they enter the workforce and all workers will have the skills and supports to advance their career throughout their working lives.

Today, these investments are already translating into greater opportunities for students and workers.

Table 2.1

Measurable Impacts to Date

| | |

Post-Secondary Students |

| |

| Expanded student financial assistance for those from low-and middle-income families | | • 347,000 more students from low- and middle-income families and 16,000 more part-time students receive financial assistance each year |

| | • More students will be eligible for grants from expanded income thresholds starting in September 2017 |

| More work-ready students supported through work- integrated learning | | • 10,000 new placements over four years for post-secondary students in business and in science, technology, engineering and mathematics through the Student Work-Integrated Learning Program |

| | • Increasing the annual number of research internships offered by Mitacs from 3,750 to 10,000 over the next five years, providing more job-relevant experiences for students and helping businesses become more innovative |

Youth | | |

| |

| Created more jobs to support youth entering the labour force, through the Youth Employment Strategy | | • 65,800 Canada Summer Jobs, effectively doubling the program in 2016 |

| | • New green jobs are helping young Canadians learn about our natural environment and contribute to economic growth |

| | • Additional heritage sector jobs supported the lead-up to Canada’s 150th anniversary |

| | • Lowest youth unemployment rate on record, at 10.3 per cent |

Unemployed or Underemployed Canadians |

| |

Improved labour market attachment for new entrants and re-entrants to the labour force | | • More than 50,000 additional new entrants and re-entrants now have access to Employment Insurance regular benefits |

| | |

| | | RESULTS FOR MIDDLE CLASS CANADIANS 33 |

In addition, Labour Market Transfer Agreements are being reformed and consolidated in partnership with provincial and territorial governments. Employment and training programs currently supported by nearly $3 billion in annual federal investments will become more flexible, more client-focused and driven by results and innovation.

The Government is also boosting student financial assistance for low- and middle-income adult learners by providing additional funding through Canada Student Grants, and is currently working with provinces and territories to make Canada Students Grants more accessible to adult learners.

Additional investments of $2.7 billion over six years were announced in Budget 2017 and the Employment Insurance Act has been amended to expand eligibility for the Agreements funded through the Employment Insurance program as of April 1, 2018.

Table 2.2

Eligibility for Programs Under Part II of the Employment Insurance Act

| | | | |

| | | Current Labour Market Development

Agreements | | Expanded Labour Market Development

Agreements |

| | |

| Employment benefits (e.g., skills development, wage subsidies) | | Individuals currently receiving or having received Employment Insurance benefits in the past five years | | Expanded to include unemployed individuals who have made minimum Employment Insurance premium contributions above the premium refund threshold (i.e. $2,000) in at least five of the last 10 years |

| | |

| Employment assistance services under support measures (e.g., employment counselling, job search assistance) | | Unemployed Canadians | | Expanded to include employed Canadians |

| | |

| Employer-sponsored training under support measures (Labour Market Partnerships) | | Assistance to employers to support approved training activities for employees facing a loss of employment | | Expanded to include assistance to employers to support approved training activities for employees in order to maintain their employment. This may include employees impacted by technological or structural changes in the economy |

Note: Amendments to the Employment Insurance Act included in Budget Implementation Act, 2017, No. 1.

A More Skilled and Innovative Canada

The Government’s Innovation and Skills Plan is helping Canada realize its potential as a global leader in innovation. Since Budget 2017, the Government has taken steps to advance the Plan’s key measures:

| • | | Innovation Superclusters Initiative: Clusters are dense areas of business activity that bring together a critical mass of large and small companies and post-secondary and other research institutions. Superclusters build on the advantages of clusters, and comparatively these innovation hotbeds have stronger connections, a long-term competitive advantage, global brand recognition, and an outsized positive impact on jobs and growth. Launched in May 2017, this initiative will provide up to $950 million over five years in support of up to five business-led superclusters, on a competitive basis. The Government announced in October 2017 a shortlist of nine applicants invited to submit detailed supercluster proposals by November 24, 2017. These geographically diverse proposals focus on the highly innovative industries identified in Budget 2017, namely advanced manufacturing, agri-food, clean technology, digital technology, health/bio-sciences and clean resources, as well as infrastructure and transportation. It is expected that successful proposals will be announced by early 2018. |

| • | | Strategic Innovation Fund (SIF): Launched in July 2017, this new five-year $1.26 billion fund will attract and support high-quality business investments across all sectors of the economy. SIF projects are currently being assessed with the first announcements to occur imminently. |

| • | | Pan Canadian Artificial Intelligence Strategy: Artificial intelligence (AI) helps create and put to use knowledge that can improve the lives of Canadians through advances such as facilitating medical diagnosis and allowing farmers to maximize crop yields through precision farming. Announced in March 2017, the Government is providing $125 million over five years for an ambitious AI strategy to retain and attract top academic talent and to position Canada as a world-leading destination for companies seeking to invest in AI and innovation. Delivered through the Canadian Institute for Advanced Research (CIFAR), the strategy includes the launch of the Vector Institute, a new independent AI research facility affiliated with the University of Toronto. CIFAR will work with the Vector Institute to support its core activities, including the Canada CIFAR Chairs in AI Science, graduate training, and the participation of the Chairs and trainees in national AI activities. |

Clean Growth and Climate Change

The Pan-Canadian Framework on Clean Growth and Climate Change was adopted by First Ministers on December 9, 2016 to grow Canada’s economy while reducing emissions and building resilience to adapt to a changing climate. The Government has made significant progress in implementing the Framework:

| • | | Clean Technology Financing: The Government is moving ahead to implement the Budget 2017 commitment to make available nearly $1.4 billion in new financing to accelerate the growth of promising clean technology firms, positioning Canada as a leader in the global clean economy. New equity financing, working capital and project financing are being made available through the Business Development Bank of Canada and Export Development Canada, further expanding their business growth and export financing support to Canadian clean technology companies and building on their client-centric collaboration in the sector. Further details will be available later this fall. |

| • | | Oceans Protection Plan: In November 2016, the Government announced $1.5 billion for the Oceans Protection Plan—the most significant investment ever made to protect our oceans and coastlines while growing our economy. Since then, the Government has made progress on a series of measures that will protect the marine environment and coastal communities, such as supporting safer and more efficient Arctic resupply operations, and expanding the Community Participation Funding Program to help Indigenous and local communities take part in improving Canada’s marine transportation system. |

| • | | Low Carbon Economy Fund: In June 2017, the Government announced that this $2 billion fund will be divided into two parts. The Low Carbon Economy Leadership Fund will provide $1.4 billion to provinces and territories that have adopted the Pan-Canadian Framework to help them deliver on their commitments to reduce greenhouse gas emissions, including those that they identified in the Framework. The remainder will be allocated to the Low Carbon Economy Challenge to support projects and to implement the Pan-Canadian Framework. Following the review of proposals by the Government, funding agreements will be finalized and signed with provinces and territories in the coming months. The Low Carbon Economy Challenge is expected to be launched in the coming months to support ambitious projects that can be submitted by all provinces and territories, as well as municipalities, Indigenous governments and organizations, businesses and both not-for-profit and for-profit organizations. |

| • | | Carbon Pricing Backstop: On May 18, 2017, the Government released a technical paper on the proposed federal carbon pricing backstop for comment. The proposed backstop is comprised of a carbon levy on fossil fuels and an output-based pricing system for certain industrial facilities, and will apply in provinces and territories that do not implement their own carbon pricing systems that meet the federal benchmark. The Government is considering comments received as it develops legislation to implement the federal backstop. |

| | |

| | | RESULTS FOR MIDDLE CLASS CANADIANS 35 |

Infrastructure Investments for Communities

Investing in Canada, the Government’s plan to renew Canada’s infrastructure for a generation (over $180 billion over 12 years), has already achieved important results—investing in projects that matter to communities, and that will create jobs and keep Canada’s economy growing now and in the future. The results speak for themselves:

| • | | Ottawa Light Rail Stage 2 Project will become a reality: When construction of this project is completed in 2023, 70 per cent of Ottawa residents will live within five kilometres of light rail transit, helping mom and dad get home faster at the end of a long day. Along with support from the Province of Ontario and the City of Ottawa’s participation in the project, federal investments of $1.09 billion are helping build close to 40 kilometres of track and 23 new transit stations. |

| • | | New and improved YMCA community and recreation centre for Halifax: Serving as both a recreation facility and a community centre, the new building will include an aquatic centre, a gymnasium and indoor track, child care facilities, and a community resource centre for leadership, child and family development. The Government of Canada and the Government of Nova Scotia announced $10 million in joint federal-provincial funding for the construction of this YMCA facility in the Greater Halifax/Dartmouth region. |

| • | | Communities across Nunavut will benefit from faster Internet: Canadians in all 25 Nunavut communities will be able to do business online and participate in distance education because of investments in high-speed Internet. A nearly $50 million federal contribution through the Connect to Innovate program will improve high-speed coverage from Kugluktuk to Pangnirtung in Nunavut. As a result, all Nunavut communities will have access to Internet download speeds of 5 to 15 megabits per second. |

| • | | Brandon Airport Passenger Terminal Redevelopment Project: Thanks to funding from the Government of Canada, the Government of Manitoba and the City of Brandon, the passenger terminal at Brandon Municipal Airport was recently renovated and expanded to three times its former size. This redevelopment project will make travel more comfortable for passengers, allow airport services to be expanded in the future, and provide upgrades to support airport operations, including the installation of a fiber optic cable for fast and reliable broadband connectivity. |

| • | | Support for Montréal’s Réseau électrique métropolitain (REM): Investing in Canada will provide $1.283 billion to support the REM light rail network, subject to necessary due diligence. For the metropolitan area of Montréal, REM will be the largest public transportation project since the completion of the Montréal metro inaugurated in 1966, and one of the most ambitious public transit projects in the nation’s history. |

| • | | Improved service for the Expo, Millennium and Canada Lines: The Government is contributing $149 million through the Public Transit Infrastructure Fund announced in Budget 2016 for the purchase of new SkyTrain vehicles for the Expo, Millennium and Canada Lines. These new vehicles will help reduce wait times and crowding and improve overall customer experience for commuters in the Metro Vancouver area. |

The Government is working with its partners to deploy the initiatives announced in Budget 2017, including the launch of the Canada Infrastructure Bank, the Smart Cities Challenge, and bilateral agreements with provinces and territories. Budget 2017 investments include $25.3 billion for public transit, $21.9 billion for green infrastructure, $21.9 billion for social infrastructure, $10.1 billion for trade and transportation, and $2 billion dedicated to rural and northern communities.

| | | | | | |

| | Launch of the Canada Infrastructure Bank | | |

| | The Government is establishing the Canada Infrastructure Bank (CIB), an arm’s-length organization that will work with provincial, territorial, municipal, Indigenous and private sector investment partners to transform the way infrastructure is planned, funded and delivered in Canada. The CIB will be responsible for investing at least $35 billion in revenue-generating infrastructure projects that are in the public interest, and attracting private sector capital to those projects so that more infrastructure can be built across Canada. | | | | |

| | The implementation of the CIB is advancing on track. The Canada Infrastructure Bank Act is now in place. Earlier this year, the Government announced the appointment of the inaugural Chairperson, Janice Fukakusa, a highly qualified leader with extensive experience in finance and banking. The search process for the CIB’s board directors and its Chief Executive Officer is also well-advanced. The CIB’s headquarters are being established in Toronto, to take advantage of its status as a global financial hub with a vast network and critical mass of financial, legal and construction firms. | | | | |

| | By the end of this year, the CIB will begin work with its partners to bring new investment and transformative new ideas to Canada’s infrastructure landscape. | | | | |

| | |

| | | RESULTS FOR MIDDLE CLASS CANADIANS 37 |

Chapter 3

FAIRNESS FOR THE MIDDLE CLASS AND THOSE WORKING HARD TO JOIN IT

INTRODUCTION

When the economy works for the middle class and those working hard to join it, it works for everyone.

Canadians work hard and should be rewarded for that work with greater opportunities for themselves, and for their families. This sense of optimism is essential to growing our economy. Over the last several decades, however, the benefits of economic growth have not been evenly shared. Over the past 30 years, the median real wage income has barely risen, leaving many Canadians concerned for their future. In contrast, among the wealthiest 0.01 per cent of Canadians, after-tax after-transfer incomes have risen dramatically. Individuals earning more than $1.8 million per year have, on average, seen their incomes rise by nearly 156 per cent in that time (or 3.1 per cent per year on average) after inflation.

The Government of Canada is committed to an economy that works for the middle class. As the economy grows, we will ensure every Canadian pays their fair share, so that the benefits of that growth can be shared by more than just a wealthy few.

In December 2015, the Government raised taxes on the wealthiest one per cent, in order to cut taxes for the middle class, benefitting 9 million Canadians. In its first budget, the Government replaced the previous child benefit system with the Canada Child Benefit, which is simpler, more generous, and better targeted to those who need it most.

The Government also took strong steps to detect, audit and combat tax evasion and aggressive tax avoidance, both at home and around the world, by boosting funding to the Canada Revenue Agency (CRA). These measures are beginning to bear fruit, with the CRA on track to recover over $5 billion in additional federal revenues over six years.

In the Fall Economic Statement, the Government is confirming that it is moving forward on proposals to fix a tax system that encourages the wealthy to incorporate, so they can get a better tax rate.

Fixing unfairness in the tax system not only fulfills our fundamental promise to middle class Canadians, it is at the heart of our plan for long-term, sustainable economic growth. As we continue with this plan, including making smart, necessary investments in our people, our communities and our economy, we will make sure that the success we create together is shared, by reinvesting in Canada’s middle class, in those working hard to join it, and in programs and services that all Canadians benefit from.

| | |

| | | FAIRNESS FOR THE MIDDLE CLASS AND THOSE WORKING HARD TO JOIN IT 39 |

NEW MEASURES: STRENGTHENING SUPPORT FOR

CANADIAN FAMILIES AND WORKERS

In line with its commitment to strengthen the middle class, the Government is announcing measures in this Fall Economic Statement to further support Canadian families and workers. These investments will help to ensure the real value of benefits for families with children is maintained over time, and improve income security and quality of life for low-income working Canadians.

STRENGTHENING THE CANADA CHILD BENEFIT

In Budget 2016, the Government introduced one of the most important and innovative social policy measures in a generation. That budget replaced the previous child benefit system with the new Canada Child Benefit (CCB)—a simpler, more generous, better targeted benefit that is entirely tax-free. During the first benefit year, over 3.3 million families received more than $23 billion in CCB payments, and the nine out of 10 families better off under the CCB received on average almost $2,300 more in benefits, tax-free. The CCB has helped lift about 300,000 children out of poverty and, by the end of this year, child poverty will have been reduced by 40 per cent from what it was in 2013.

The CCB provides greater support to those who need it most: low- and middle-income families. It puts more money in their pockets for soccer cleats, or summer camps, or to put healthy food on the table. The CCB is particularly beneficial for families led by single parents. These families are most often led by single mothers and tend to have lower total incomes, and thus benefit more from a better-targeted CCB. About 65 per cent of families receiving the maximum CCB amounts are single parents, 90 per cent of whom are single mothers.

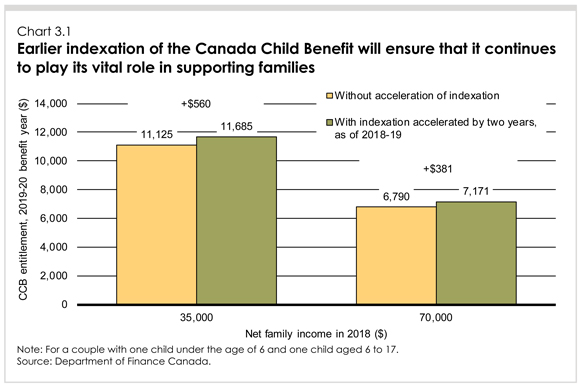

In the fall of 2016, the Government took further action to support Canadian families over the long term by announcing that, as of the 2020–21 benefit year, the CCB would be indexed to ensure it keeps pace with the rising cost of living.

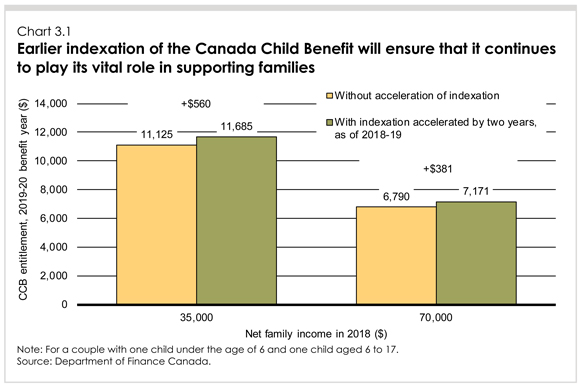

A year later, Canada’s economy is growing faster than expected, thanks in part to the positive effects the CCB has had in improving consumer confidence and consumption. With this increased flexibility, and to ensure benefits of our strong growth are shared with the middle class and those working hard to join it, the Government proposes to accelerate the indexation of the CCB’s benefit amounts and phase-out thresholds by two years to July 2018.

This means better support sooner to ensure that the CCB continues to play a vital role in helping Canadian families and our economy.

Indexing the CCB sooner will provide an additional $5.6 billion in support to Canadian families over the 2018–19 to 2022–23 period.

| | | | | | |

| | Impact of Indexing the Canada Child Benefit Sooner | | |

| | For the 2019–20 benefit year, for a single parent with $35,000 of income and two children (one under the age of 6 and one aged 6 to 17), the accelerated indexation of the CCB will contribute $560 towards the increasing costs of raising their children. | | | | |

INCREASING THE WORKING INCOME TAX BENEFIT FOR THOSE

WORKING TO JOIN THE MIDDLE CLASS

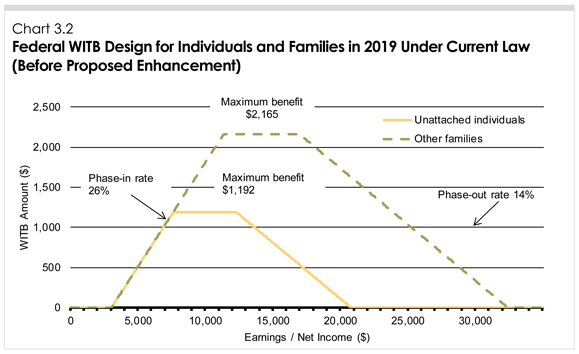

Those working hard to join the middle class, including many low-income working Canadians, face financial barriers to joining or re-joining the workforce, including taxes, expenses, and the loss of supports such as social assistance. First proposed in 2005, the Working Income Tax Benefit (WITB) is a refundable tax credit that provides important income support and helps offset these barriers by supplementing the earnings of low-income workers (by up to $1,043 for single individuals without children and $1,894 for families under the federal design in 2017).

The WITB lets low-income workers keep more of their paycheque, encouraging people into the workforce, which has a long-term impact on income security and quality of life. In 2016, the WITB provided more than $1.1 billion in benefits to over 1.4 million Canadians.

To provide even more support and opportunity for those working to join the middle class, the Government proposes to further enhance the WITB by an additional $500 million annually, starting in 2019. This new enhancement will provide even greater support to current recipients by raising maximum benefit levels and will expand the income range of the WITB so that more workers can qualify.

Together with the increase of about $250 million annually already set to come into effect in 2019 as part of the enhancement of the Canada Pension Plan, these two actions will boost the total amount the Government spends on the WITB by about 65 per cent in 2019.

The Government will provide further details on the design of this new incremental enhancement in Budget 2018.

| | |

| | | FAIRNESS FOR THE MIDDLE CLASS AND THOSE WORKING HARD TO JOIN IT 41 |

In recognition of the important role played by provinces and territories in providing basic income support, the Government of Canada has allowed them to make province-specific changes to the design of the Benefit to better harmonize with their own programs. As such, the Government of Canada will be consulting with provinces and territories before the enhanced WITB takes effect in 2019.

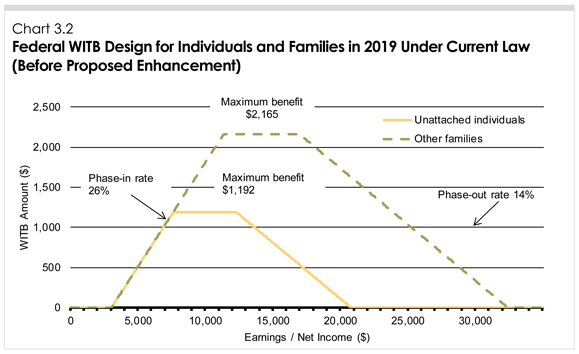

| | | | | | |

| | Increased WITB as Part of the Canada Pension Plan Enhancement | | |

| | As part of the agreement to enhance the Canada Pension Plan, the Government increased benefits under the WITB, beginning in 2019, to roughly offset incremental employee contributions to the Plan. Under that enhancement, as of 2019, the WITB will provide a refundable tax credit of 26 per cent of each dollar of earned income in excess of $3,000, reaching a maximum benefit of $2,165 or $1,192 for families and individuals respectively. The benefit is reduced at a rate of 14 per cent of each additional dollar above the phase-out threshold (projected to be $16,925 and $12,256 for families and individuals respectively in 2019 after indexation with inflation). | | | | |

| | Individuals who are eligible for the Disability Tax Credit may also receive a WITB disability supplement, with a projected value of up to $540 in 2019. | | | | |

| | Chart 3.2 illustrates the maximum benefit, and phase-in and phase-out ranges for the WITB basic benefit for unattached individuals and other families in 2019 taking into account the enhancement associated with the CPP agreement. | | | | |

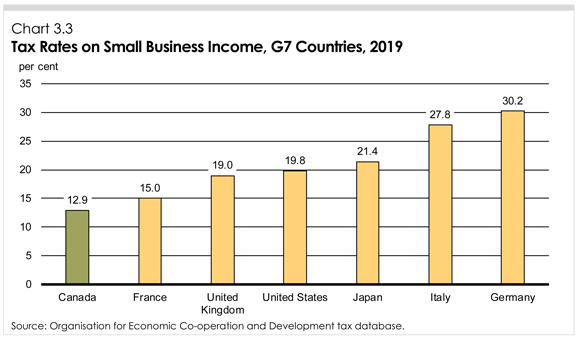

LOWERING TAXES FOR SMALL BUSINESS

Lower tax rates for small businesses allow them to keep more of their hard-earned money so that it can be reinvested to support growth and create jobs.

The Government’s commitment—to both reduce the small business tax rate and address tax planning advantages for high-income earners—is a commitment to invest in our economy while ensuring fairness for all taxpayers.

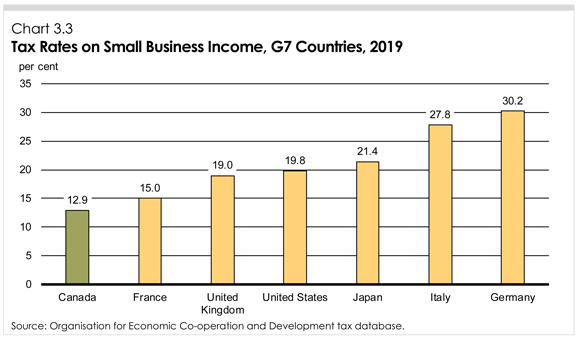

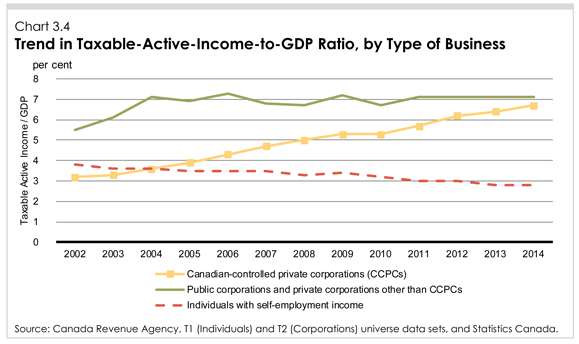

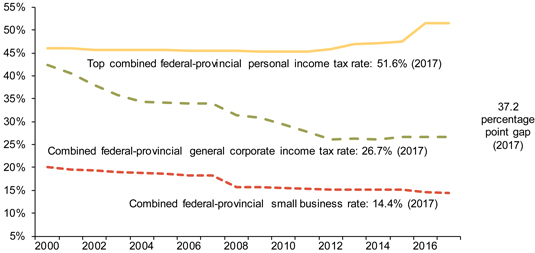

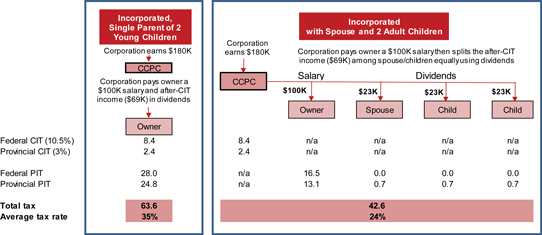

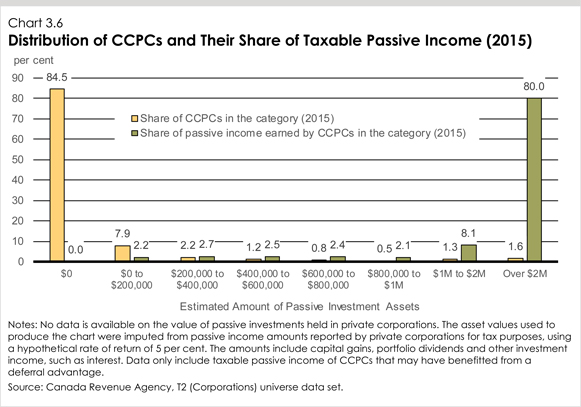

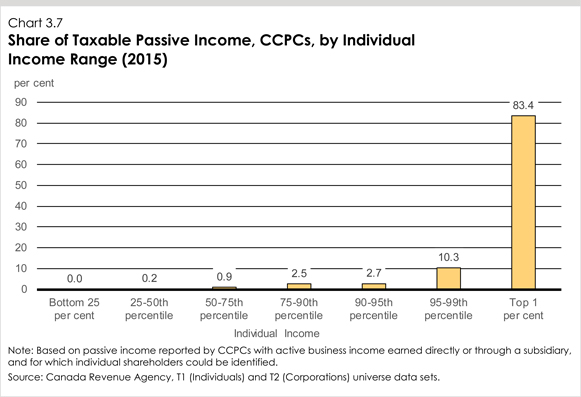

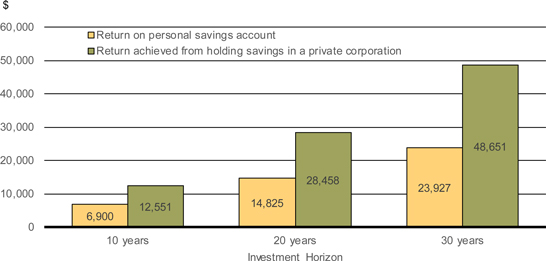

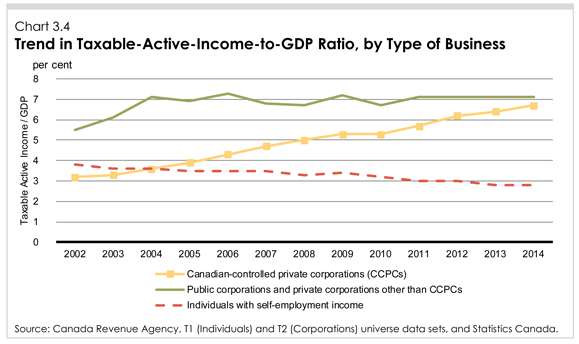

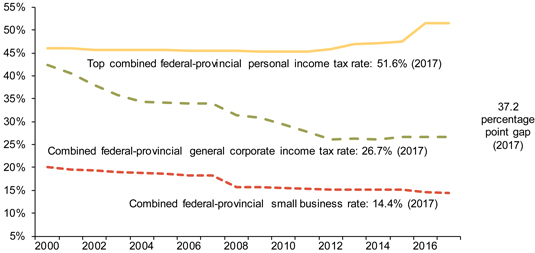

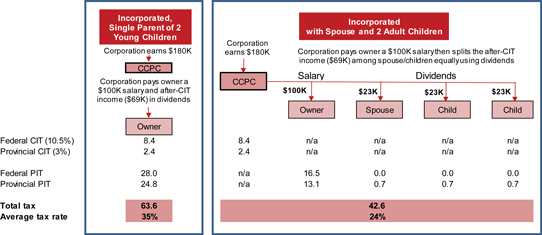

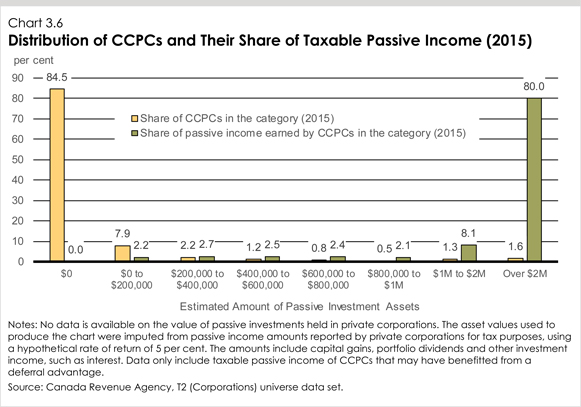

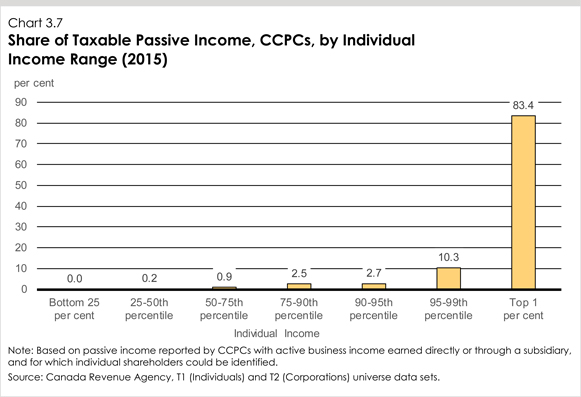

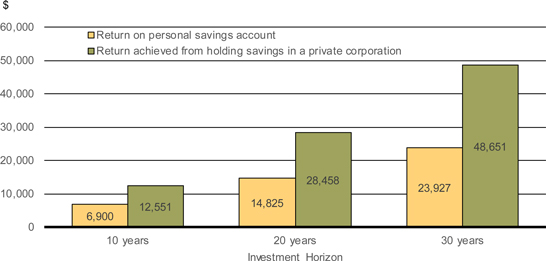

By fixing a system that encourages wealthy individuals to use private corporations as a tool to gain an unfair tax advantage over the middle class, the Government will ensure that Canada’s low corporate tax rates—including the lowest small business tax rate in the G7—are better focused on investments in the businesses themselves, in things like machinery, equipment, and job creation, rather than being used as a means to gain unfair tax advantages.