Exhibit C-7

Tax Measures: Supplementary Information Tabled in the House of Commons by the Honourable William Francis Morneau, P.C., M.P. Minister of Finance February 27, 2018

©Her Majesty the Queen in Right of Canada (2018)

All rights reserved

All requests for permission to reproduce this document or any part

thereof shall be addressed to

the Department of Finance Canada.

For more information, please contact Service Canada at

1 800 O-Canada (1-800-622-6232)

TTY: 1-800-926-9105

This document is available on the Internet at www.fin.gc.ca

Cette publication est aussi disponible en français.

Tax Measures: Supplementary Information

Table of Contents

| | | | |

| |

Overview | | | 5 | |

Personal Income Tax Measures | | | 7 | |

Canada Workers Benefit | | | 7 | |

Medical Expense Tax Credit – Eligible Expenditures | | | 10 | |

Registered Disability Savings Plan – Qualifying Plan Holders | | | 10 | |

Deductibility of Employee Contributions to the Enhanced Portion of the Quebec Pension Plan | | | 11 | |

Child Benefits | | | 12 | |

Charities – Miscellaneous Technical Issues | | | 13 | |

Mineral Exploration Tax Credit for Flow-Through Share Investors | | | 14 | |

Reporting Requirements for Trusts | | | 15 | |

Business Income Tax Measures | | | 17 | |

Passive Investment Income | | | 17 | |

Tax Support for Clean Energy | | | 22 | |

Artificial Losses Using Equity-Based Financial Arrangements | | | 23 | |

Stop-Loss Rule on Share Repurchase Transactions | | | 26 | |

At-Risk Rules for Tiered Partnerships | | | 27 | |

Health and Welfare Trusts | | | 28 | |

International Tax Measures | | | 30 | |

Cross-Border Surplus Stripping using Partnerships and Trusts | | | 30 | |

Foreign Affiliates | | | 31 | |

Reassessment Period – Requirements for Information and Compliance Orders | | | 35 | |

Reassessment Period – Non-Resident Non-Arm’s Length Persons | | | 36 | |

Sharing Information for Criminal Matters | | | 37 | |

Sales and Excise Tax Measures | | | 39 | |

GST/HST and Investment Limited Partnerships | | | 39 | |

Tobacco Taxation | | | 39 | |

Cannabis Taxation | | | 40 | |

Proposed Consultations on Tax Measures | | | 44 | |

Consultations on the GST/HST Holding Corporation Rules | | | 44 | |

Previously Announced Measures | | | 45 | |

Notices of Ways and Means Motions | | | 47 | |

Notice of Ways and Means Motion to amend the Income Tax Act and Other Related Legislation | | | 49 | |

Notice of Ways and Means Motion to amend the Excise Tax Act | | | 65 | |

Notice of Ways and Means Motion to amend the Excise Act, 2001 and Other Related Legislation | | | 69 | |

Draft Amendments to Various GST/HST Regulations | | | 73 | |

3

Overview

This annex provides detailed information on each of the tax measures proposed in the Budget.

Table 1 lists these measures and provides estimates of their budgetary impact.

The annex also provides the Notices of Ways and Means Motions to amend the Income Tax Act, the Excise Tax Act, the Excise Act, 2001 and other related legislation and draft amendments to various GST/HST regulations.

In this annex, references to “Budget Day” are to be read as references to the day on which this Budget is presented.

5

Table 1

Cost of Proposed Tax Measures1, 2

Fiscal Costs (millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2017– 2018 | | | 2018– 2019 | | | 2019– 2020 | | | 2020– 2021 | | | 2021– 2022 | | | 2022– 2023 | | | Total | |

Personal Income Tax Measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Canada Workers Benefit – Enhancement | | | - | | | | 125 | | | | 505 | | | | 510 | | | | 515 | | | | 520 | | | | 2 175 | |

Canada Workers Benefit – Improving Access | | | - | | | | 45 | | | | 191 | | | | 195 | | | | 200 | | | | 200 | | | | 830 | |

Medical Expense Tax Credit – Eligible Expenditures | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Registered Disability Savings Plan – Qualifying Plan Holders3 | | | - | | | | 1 | | | | 2 | | | | 2 | | | | 2 | | | | 3 | | | | 10 | |

Deductibility of Employee Contributions to the Enhanced Portion of the Quebec Pension Plan | | | - | | | | 5 | | | | 20 | | | | 35 | | | | 60 | | | | 90 | | | | 210 | |

Child Benefits | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Charities – Miscellaneous Technical Issues | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Mineral Exploration Tax Credit for Flow-Through Share Investors | | | - | | | | 65 | | | | -20 | | | | - | | | | - | | | | - | | | | 45 | |

Reporting Requirements for Trusts | | | - | | | | 12 | | | | 9 | | | | 10 | | | | 14 | | | | 34 | | | | 79 | |

Business Income Tax Measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Passive Investment Income – Business Limit | | | - | | | | 2 | | | | -120 | | | | -430 | | | | -355 | | | | -380 | | | | -1 283 | |

Passive Investment Income – Refundability of Taxes on Investment Income | | | - | | | | -45 | | | | -185 | | | | -220 | | | | -275 | | | | -325 | | | | -1 050 | |

Tax Support for Clean Energy | | | - | | | | - | | | | 3 | | | | 20 | | | | 40 | | | | 60 | | | | 123 | |

Artificial Losses Using Equity-Based Financial Arrangements | | | - | | | | -135 | | | | -245 | | | | -265 | | | | -275 | | | | -295 | | | | -1 215 | |

Stop-Loss Rule on Share Repurchase Transactions | | | - | | | | -230 | | | | -315 | | | | -275 | | | | -265 | | | | -265 | | | | -1 350 | |

At-Risk Rules for Tiered Partnerships | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Health and Welfare Trusts | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

International Tax Measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cross-Border Surplus Stripping using Partnerships and Trusts | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Foreign Affiliates | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Reassessment Period – Requirements for Information and Compliance Orders | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Reassessment Period – Non-Resident Non-Arm’s Length Persons | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Sharing Information for Criminal Matters | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Sales and Excise Tax Measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

GST/HST and Investment Limited Partnerships | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Tobacco Taxation | | | -30 | | | | -375 | | | | -350 | | | | -165 | | | | -240 | | | | -310 | | | | -1 470 | |

Cannabis Taxation | | | - | | | | -35 | | | | -100 | | | | -135 | | | | -200 | | | | -220 | | | | -690 | |

Proposed Consultations on Tax Measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consultations on the GST/HST Holding Corporation Rules | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| 1 | A “–” indicates a nil amount, a small amount (less than $500,000) or an amount that cannot be determined in respect of a measure that is intended to protect the tax base. |

| 2 | Totals may not add due to rounding. |

| 3 | The cost of this measure is attributable to program expenditure. |

6

Personal Income Tax Measures

Canada Workers Benefit

The Working Income Tax Benefit is a refundable tax credit that supplements the earnings of low-income workers and improves work incentives for low-income Canadians.

Enhancement

To provide increased support and further improve work incentives, the 2017 Fall Economic Statement announced the Government’s intention to enhance the benefits provided by the Working Income Tax Benefit by an additional $500 million per year, starting in 2019.

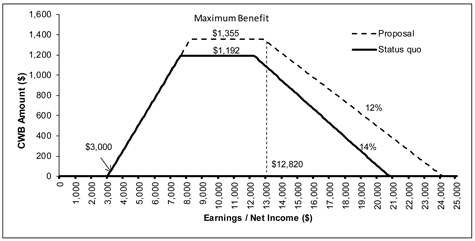

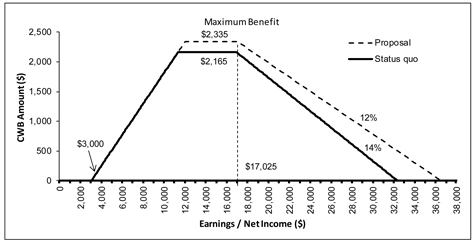

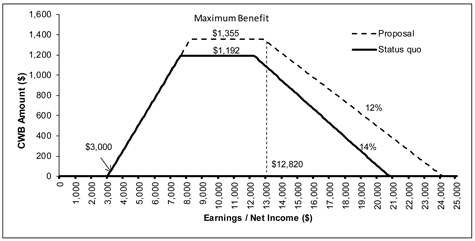

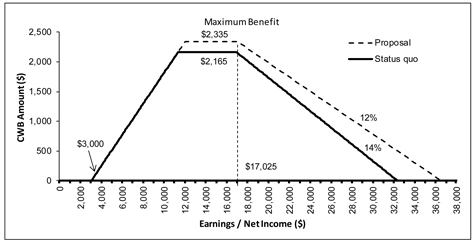

Budget 2018 proposes to rename the program to the Canada Workers Benefit. Using the funding committed in the 2017 Fall Economic Statement, Budget 2018 proposes that, for 2019, the amount of the benefit be equal to 26 per cent of each dollar of earned income in excess of $3,000 to a maximum benefit of $1,355 for single individuals without dependants and $2,335 for families (couples and single parents). The benefit will be reduced by 12 per cent of adjusted net income in excess of $12,820 for single individuals without dependants and $17,025 for families.

Chart 1 shows the proposed enhancement of the Canada Workers Benefit in 2019 for a single individual without dependants and Chart 2 shows the same for families.

Chart 1

Enhanced Canada Workers Benefit — 2019 Taxation Year

(Single Individuals without Dependants)

7

Chart 2

Enhanced Canada Workers Benefit — 2019 Taxation Year

(Single Parents and Couples)

Individuals who are eligible for the Disability Tax Credit may also receive a Canada Workers Benefit disability supplement. Budget 2018 also proposes that the maximum amount of the Canada Workers Benefit disability supplement be increased to $700 in 2019, and the phase-out threshold of the supplement be increased to $24,111 for single individuals without dependants and to $36,483 for families. The reduction rate of the supplement will be decreased to 12 per cent to match the proposed rate for the basic benefit, and to 6 per cent where both partners in a family are eligible for the supplement.

The Government recognizes the efforts that provinces and territories have taken to improve work incentives for low-income individuals and families. To ensure that benefits are harmonized and that the Canada Workers Benefit builds on these efforts, the Government allows for province- or territory-specific changes to the design of the benefit through reconfiguration agreements. These agreements will continue to be guided by the following principles:

| • | | they build on actions taken by the province or territory to improve work incentives for low-income individuals and families; |

| • | | they are cost-neutral to the federal government; |

| • | | they provide for a minimum benefit for all recipients of the benefit; and |

| • | | they preserve harmonization of the benefit with existing federal programs. |

This measure will apply to the 2019 and subsequent taxation years. Indexation of amounts relating to the Canada Workers Benefit will continue to apply after the 2019 taxation year.

8

Improving Access

An individual’s entitlement to the benefit is calculated primarily on the basis of information found on the individual’s annual income tax return. However, in certain cases, additional information is required for this calculation. An individual may claim the benefit by completing Schedule 6, which includes all necessary information to calculate the amount of the benefit, and filing it with their income tax return for the year. If an individual does not claim the benefit, they currently cannot obtain it even if they would otherwise qualify.

Budget 2018 proposes to allow the Canada Revenue Agency (CRA), in circumstances where an individual does not claim the new Canada Workers Benefit, to determine if the individual is eligible to receive the benefit and assess their return as if the benefit had been claimed. Notwithstanding this proposal, it is expected that individuals will continue to complete Schedule 6 in order to properly calculate the amount of tax owing or refundable at the time of filing their returns and in order to avoid any delay where the CRA does not have all necessary information at the time of the initial assessment.

In order to allow the CRA to determine eligibility of an individual who has not completed Schedule 6, the inclusion of certain elements currently required to be included in the calculation of the Canada Workers Benefit will be made optional on the part of the individual. Specifically, an individual will be able to choose whether to include in the calculation of the benefit the tax-exempt part of working income earned on a reserve or an allowance received as an emergency volunteer. An individual who chooses to include any such amount must include all such amounts in both their working income and their adjusted family net income for the purpose of the benefit.

In the case of eligible couples in which neither partner makes a claim, the CRA will designate which spouse or common-law partner receives the benefit.

This measure will apply in respect of income tax returns for 2019 and subsequent taxation years.

To assist in the administration of the Canada Workers Benefit, Budget 2018 also proposes that designated educational institutions in Canada be required to report, to the CRA, prescribed information pertaining to students’ enrolment, effective for months of enrolment after 2018. This reporting will also assist the CRA in the administration of existing measures, such as the Lifelong Learning Plan and the exemption for scholarship, fellowship and bursary income.

9

Medical Expense Tax Credit – Eligible Expenditures

The Medical Expense Tax Credit (METC) is a 15-per-cent non-refundable tax credit that recognizes the effect of above-average medical and disability-related expenses on an individual’s ability to pay tax. For 2018, the METC is available for qualifying medical expenses in excess of the lesser of $2,302 and three per cent of the individual’s net income.

The list of eligible expenses for the METC is regularly reviewed in light of medical or disability-related developments.

The METC currently provides tax relief in respect of certain expenses incurred for an animal specially trained to assist a patient in coping with the following impairments: blindness; profound deafness; severe autism; severe diabetes; severe epilepsy; or a severe and prolonged impairment that markedly restricts the use of the patient’s arms or legs. In order for expenses to qualify for the METC, animals must be provided by a person or organization one of whose main purposes is providing this special training.

Eligible expenses are: the cost of such an animal; costs for its care and maintenance, including food and veterinary care; reasonable travel expenses incurred for a patient to attend a facility that trains patients in the handling of such animals; and reasonable board and lodging expenses for a patient’s full-time attendance at such a facility.

Budget 2018 proposes to expand the METC to recognize such expenses where they are incurred in respect of an animal specially trained to perform tasks for a patient with a severe mental impairment in order to assist them in coping with their impairment (e.g., a psychiatric service dog trained to assist with post- traumatic stress disorder). For example, these tasks may include guiding a disoriented patient, searching the home of a patient with severe anxiety before they enter and applying compression to a patient experiencing night terrors. Expenses will not be eligible if they are in respect of an animal that provides comfort or emotional support but that has not been specially trained to perform tasks as described above.

This measure will apply in respect of eligible expenses incurred after 2017.

Registered Disability Savings Plan – Qualifying Plan Holders

Where the capacity of an adult individual to enter into a contract is in doubt, the Income Tax Act requires that the plan holder of the individual’s Registered Disability Savings Plan (RDSP) be the individual’s legal representative, as recognized under provincial or territorial law.

10

Establishing a legal guardian or other representative can be a lengthy and expensive process that can have significant repercussions for individuals. Some provinces and territories have instituted streamlined processes that allow for the appointment of a trusted person to manage resources on behalf of an adult who lacks contractual capacity, or have indicated that their system already provides sufficient flexibility to address this concern. Others require more time to develop such a process.

Where the adult individual does not have a legal representative in place, a temporary federal measure exists to allow a qualifying family member (i.e., a parent, spouse or common-law partner) to be the plan holder of the individual’s RDSP. This measure is legislated to expire at the end of 2018.

Budget 2018 proposes to extend the temporary measure by five years, to the end of 2023. A qualifying family member who becomes a plan holder before the end of 2023 could remain the plan holder after 2023.

The federal government continues to encourage provinces and territories without streamlined processes in place to examine whether they can accommodate the needs of potential RDSP beneficiaries by developing appropriate, long-term solutions to address RDSP legal representation issues.

Deductibility of Employee Contributions to the Enhanced Portion of the Quebec Pension Plan

On November 2, 2017, the Government of Quebec announced that the Quebec Pension Plan (QPP) would be enhanced in a manner similar to the enhancement of the Canada Pension Plan (CPP) that was announced

in 2016.

As part of the CPP enhancement, the Income Tax Act was amended to provide a tax deduction for employee contributions (as well as the “employee” share of contributions by self-employed persons) to the enhanced portion of the CPP. A tax credit will continue to be provided on employee contributions to the base CPP (i.e., the existing CPP). Contributions to the enhanced portion of the CPP will begin in 2019 and will be fully phased in by 2025.

To provide consistent income tax treatment of CPP and QPP contributions, Budget 2018 proposes to amend the Income Tax Act to provide a deduction for employee contributions (as well as the “employee” share of contributions made by self-employed persons) to the enhanced portion of the QPP. In this regard, the Government of Quebec announced on November 21, 2017 that the enhanced portion of employee CPP and QPP contributions will be deductible for Quebec income tax purposes.

Since contributions to the enhanced portion of the QPP will begin to be phased in starting in 2019, this measure will apply to the 2019 and subsequent taxation years.

11

Child Benefits

Budget 2016 introduced the Canada Child Benefit, replacing the previous child benefit system, which consisted of the Canada Child Tax Benefit, the National Child Benefit supplement and the Universal Child Care Benefit. Payments under the Canada Child Benefit began in July 2016.

Retroactive Eligibility of Foreign-Born Status Indians

Foreign-born status Indians who are neither Canadian citizens nor permanent residents under the Immigration and Refugee Protection Act may legally reside in Canada and be eligible for certain programs and services offered by federal, provincial and territorial governments, such as the Goods and Services Tax/Harmonized Sales Tax credit, the Working Income Tax Benefit, Old Age Security and Employment Insurance.

Under the Canada Child Benefit, as announced in Budget 2016, foreign-born status Indians residing legally in Canada who are neither Canadian citizens nor permanent residents are eligible for the benefit, where all other eligibility requirements are met. However, these individuals were not eligible under the previous system of child benefits.

Budget 2018 proposes that such individuals be made retroactively eligible for the Canada Child Tax Benefit, the National Child Benefit supplement and the Universal Child Care Benefit, where all other eligibility requirements are met.

This amendment applies from the 2005 taxation year to June 30, 2016.

Provincial/Territorial Access to Taxpayer Information

Most provinces and territories have been using taxpayer information related to the National Child Benefit supplement to calculate adjustments to provincial/territorial social assistance payments. Budget 2018 proposes to amend the Income Tax Act to provide legislative authority for the government to share with the provinces and territories taxpayer information related to the Canada Child Benefit, as of July 1, 2018, solely for the purpose of administering their social assistance payment regimes.

Taxpayer information related to the National Child Benefit supplement in respect of prior benefit years will continue to be shared after June 2018. This will ensure that provinces and territories continue to have access to the information required to, for example, calculate adjustments to social assistance payments for prior benefit years.

12

Charities – Miscellaneous Technical Issues

Municipalities as Eligible Donees

The Government of Canada supports registered charities in a number of ways, including through the charitable donation tax credit (for individuals) and deduction (for corporations). As a condition of registration, charities are required to follow certain rules, including that they operate exclusively for charitable purposes, devote all of their resources to charitable activities and file an annual information return six months after their fiscal year-end.

The registration of a charity may be revoked at the request of the charity or because the charity has not complied with its registration requirements. In either case, the Income Tax Act imposes a 100-per-cent revocation tax on the charity based on the total net value of its assets. In order to ensure that a revoked charity’s accumulated property stays within the charitable sector, a charity can reduce the amount of revocation tax by making qualifying expenditures, including gifts to “eligible donees”. Generally speaking, an eligible donee in respect of a particular revoked charity is a registered charity in good standing, the majority of whose directors or trustees deal at arm’s length with the directors or trustees of the revoked charity.

In some circumstances, a charity may not be able to locate an eligible donee that is willing or able to assume ownership of one or more of its assets. For example, a charity may operate in a rural area where there are very few charities or it may own assets that are of importance to the community, such as a fire hall or a cemetery. In such cases, a municipality may be the most appropriate recipient of such property even though it is not a charity.

Budget 2018 proposes to amend the Income Tax Act to allow transfers of property to municipalities to be considered qualifying expenditures for the purposes of the revocation tax, subject to the approval of the Minister of National Revenue on a case- by-case basis. In situations where a suitable recipient cannot be found to keep a property in the charitable sector, this change will allow the property to be transferred to a municipality for the benefit of the community.

This measure will apply to transfers made on or after Budget Day.

Universities Outside Canada

Canadians may claim the charitable donation tax credit or deduction for donations made to registered charities and other “qualified donees”. Since 1966, universities outside Canada have been eligible to be recognized as qualified donees if they demonstrate to the Canada Revenue Agency that, among other things, their student body ordinarily includes students from Canada. Qualifying universities outside Canada are included in Schedule VIII to the Income Tax Regulations.

13

In 2011, the Income Tax Act was amended so that certain categories of qualified donees, including universities outside Canada, are now required to register with the Canada Revenue Agency, and to meet certain receipting and record-keeping conditions. In addition, they may have their registration suspended or revoked for certain non-compliance with the rules. Once these qualified donees are registered, public notification is provided by listing them on the Government of Canada’s website. As a result of these two registration processes, qualifying universities outside of Canada are required to be added to two separate, identical lists.

To simplify the administration of these rules and streamline the registration process for universities outside Canada as qualified donees, Budget 2018 proposes to remove the requirement that universities outside Canada be prescribed in the Income Tax Regulations.

This measure will apply as of Budget Day.

Mineral Exploration Tax Credit for Flow-Through Share Investors

Flow-through shares allow resource companies to renounce or “flow through” tax expenses associated with their Canadian exploration activities to investors, who can deduct the expenses in calculating their own taxable income. The mineral exploration tax credit provides an additional income tax benefit for individuals who invest in mining flow-through shares, which augments the tax benefits associated with the deductions that are flowed through. This credit is equal to 15 per cent of specified mineral exploration expenses incurred in Canada and renounced to flow-through share investors. Like flow-through shares, the credit facilitates the raising of equity to fund exploration by enabling companies to issue shares at a premium.

The Government proposes to extend eligibility for the mineral exploration tax credit for an additional year, to flow-through share agreements entered into on or before March 31, 2019. Under the existing “look-back” rule, funds raised in one calendar year with the benefit of the credit can be spent on eligible exploration up to the end of the following calendar year. Therefore, for example, funds raised with the credit during the first three months of 2019 can support eligible exploration until the end of 2020.

Mineral exploration, as well as new mining and related processing activities that could follow from successful exploration efforts, can be associated with a variety of environmental impacts to soil, water and air and, as a result, could have an impact on the targets and actions in the Federal Sustainable Development Strategy. All such activity, however, is subject to applicable federal and provincial environmental regulations, including project-specific environmental assessments where required.

14

Reporting Requirements for Trusts

Authorities require sufficient information in order to determine taxpayers’ tax liabilities and to effectively counter aggressive tax avoidance as well as tax evasion, money laundering and other criminal activities. Some taxpayers have used trusts in complex arrangements to prevent the appropriate authorities from acquiring this required information.

A trust that does not earn income or make distributions in a year is generally not required to file an annual (T3) return of income. A trust is required to file a T3 return if the trust has tax payable or it distributes all or part of its income or capital to its beneficiaries. Even if a trust is required to file a return of income for a year, there is no requirement for the trust to report the identity of all its beneficiaries. Given the absence of an annual reporting requirement, and the limitations with respect to the information collected when reporting is required, there are significant gaps with respect to the information that is currently collected with respect to trusts.

As a consequence, Budget 2017 announced the Government’s intention to examine ways to enhance the tax reporting requirements for trusts in order to improve the collection of beneficial ownership information.

Reporting Requirements

To improve the collection of beneficial ownership information with respect to trusts, Budget 2018 proposes to require that certain trusts provide additional information on an annual basis. The new reporting requirements will impose an obligation on certain trusts to file a T3 return where one does not currently exist. This information would be used to help the Canada Revenue Agency assess the tax liability for trusts and its beneficiaries.

The new reporting requirements will apply to express trusts that are resident in Canada and to non-resident trusts that are currently required to file a T3 return. An express trust is generally a trust created with the settlor’s express intent, usually made in writing (as opposed to a resulting or constructive trust, or certain trusts deemed to arise under the provisions of a statute). Exceptions to the additional reporting requirements are proposed for the following types of trusts:

| • | | mutual fund trusts, segregated funds and master trusts; |

| • | | trusts governed by registered plans (i.e., deferred profit sharing plans, pooled registered pension plans, registered disability savings plans, registered education savings plans, registered pension plans, registered retirement income funds, registered retirement savings plans, registered supplementary unemployment benefit plans and tax-free savings accounts); |

| • | | lawyers’ general trust accounts; |

| • | | graduated rate estates and qualified disability trusts; |

| • | | trusts that qualify as non-profit organizations or registered charities; and |

| • | | trusts that have been in existence for less than three months or that hold less than $50,000 in assets throughout the taxation year (provided, in the latter case, that their holdings are confined to deposits, government debt obligations and listed securities). |

15

Where the new reporting requirements apply to a trust, the trust will be required to report the identity of all trustees, beneficiaries and settlors of the trust, as well as the identity of each person who has the ability (through the trust terms or a related agreement) to exert control over trustee decisions regarding the appointment of income or capital of the trust (e.g., a protector).

In order to implement the new reporting requirements, and to improve the Canada Revenue Agency’s audit and administration of trusts and trust returns, Budget 2018 proposes to provide funding of $79 million over a five-year period and $15 million on an ongoing basis to the Canada Revenue Agency in order to support the development of an electronic platform for processing T3 returns.

These proposed new reporting requirements will apply to returns required to be filed for the 2021 and subsequent taxation years.

Penalties

To support these new reporting requirements, Budget 2018 proposes to introduce new penalties for a failure to file a T3 return, including a required beneficial ownership schedule, in circumstances where the schedule is required. The penalty will be equal to $25 for each day of delinquency, with a minimum penalty of $100 and a maximum penalty of $2,500. If a failure to file the return was made knowingly, or due to gross negligence, an additional penalty will apply. The additional penalty will be equal to five per cent of the maximum fair market value of property held during the relevant year by the trust, with a minimum penalty of $2,500. As well, existing penalties will continue to apply.

The new penalties will apply in respect of returns required to be filed for the 2021 and subsequent taxation years.

16

Business Income Tax Measures

Passive Investment Income

Active business income earned by private corporations is taxed at corporate income tax rates that are generally lower than personal income tax rates, giving these corporations more money to invest in order to grow their business. In addition, a small Canadian-controlled private corporation (CCPC) can benefit from a corporate income tax rate on qualifying active business income that is lower than the general corporate income tax rate. The intention of the lower small business tax rate is to leave small CCPCs, which may have difficulty accessing capital, with more retained earnings to reinvest in their active businesses.

Business income retained in a corporation, however, can also be used to finance passive investments. The current tax regime relating to passive investment income earned by private corporations has been in place since 1972. In contrast to active business income (which includes investment income that is incidental to an active business), additional taxes apply to passive investment income in the year in which it is earned. These additional taxes are intended to ensure that taxes payable by private corporations on investment income approximate top federal-provincial-territorial personal income tax rates. A portion of the tax on investment income is refundable to a corporation upon the payment of taxable dividends, and the income is then subject to progressive personal income tax rates in the hands of its individual shareholders.

Where funds invested passively within a private corporation have been financed with retained earnings that have been taxed at preferential corporate income tax rates, owners of the corporation can benefit from a tax deferral advantage relative to a situation where the corporation distributes the retained earnings and the owners invest personally in passive investments. This issue was the subject of public consultations that were launched in July 2017.

Budget 2018 proposes two measures, applicable to taxation years that begin after 2018, to limit tax deferral advantages on passive investment income earned inside private corporations. These measures take into account the feedback received from stakeholders in response to the July 2017 consultation.

Business Limit

The Government has proposed to reduce the tax rate for qualifying active business income of small CCPCs from 10.5 per cent to 10 per cent for 2018 and to 9 per cent as of 2019. This lower rate – relative to the 15-per-cent general corporate rate – is intended to increase the after-tax income available for reinvestment in the active business, in recognition that small businesses tend to have more difficulty accessing capital. This rate reduction is provided through the small business deduction.

17

This preferential tax rate applies on up to $500,000 of qualifying active business income of a CCPC (the “business limit”). There is a requirement to allocate the business limit among associated corporations. The business limit is reduced on a straight-line basis for a CCPC and its associated corporations having between $10 million and $15 million of total taxable capital employed in Canada.

When retained earnings taxed at the small business rate are used to invest passively, rather than in the active business, significant tax deferral advantages can be realized relative to an individual investor.

Budget 2018 proposes to reduce the business limit for CCPCs (and their associated corporations) that have significant income from passive investments.

Business Limit – Reduction

Under this measure, the business limit will be reduced on a straight-line basis for CCPCs having between $50,000 and $150,000 in investment income.

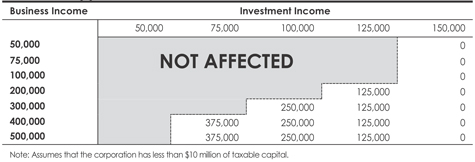

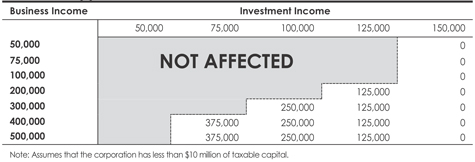

The measure will affect CCPCs only to the extent that their business income exceeds the reduced business limit (Table 2). For example, a CCPC with $100,000 of investment income would have its business limit reduced to $250,000. As long as the reduced business limit remains above the active business income of the CCPC, all of that income would continue to be taxed at the small business tax rate. A CCPC with $75,000 of business income would have to earn more than $135,000 in passive income before its business limit is reduced below its business income. This feature of the proposed rules recognizes that CCPCs with lower amounts of business income generate less retained earnings that can later be used for reinvestment in the business, and may have more difficulty accessing capital. CCPCs with business income above the reduced business limit will be taxed on income above the business limit at the general corporate tax rate.

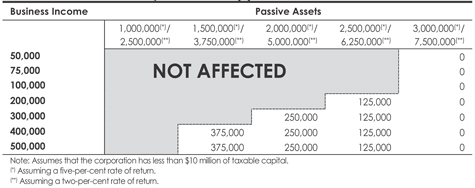

Table 2

Active business income qualifying for the small business tax rate under new business limit ($)

18

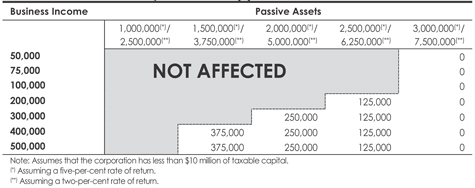

The measure will be implemented based on a CCPC’s investment income, which is earned on the underlying passive investment assets held by the corporation. Assuming a five-per-cent return on such investments, the business limit would effectively be reduced on a straight-line basis for CCPCs having between $1 million and $3 million of passive assets. Assuming a two-per-cent return in low-risk investments, the business limit would be reduced between $2.5 million and $7.5 million of passive assets. For illustrative purposes, Table 3 shows the effect of the measure on qualifying active business income for a given level of passive assets and an assumed rate of return. For instance, a CCPC with $3.75 million in passive assets invested at a two-per-cent rate of return would continue to benefit from the small business tax rate on up to $375,000 of business income.

Table 3

Active business income qualifying for the small business tax rate under new business limit for illustrative passive assets ($)

It is expected that about three per cent of CCPCs claiming the small business deduction will be affected by the measure.

The business limit reduction under this measure will operate alongside the business limit reduction that applies in respect of taxable capital in excess of $10 million. The reduction in a corporation’s business limit will be the greater of the reduction under this measure and the existing reduction based on taxable capital.

The reduction of the business limit for any particular corporation under this measure will be based on the investment income of the corporation and, consistent with the reduction in the business limit based on taxable capital, any other associated corporations with which it is required to share the business limit for a taxation year.

Business Limit – Adjusted Aggregate Investment Income

For the purpose of determining the reduction of the business limit of a CCPC, investment income will be measured by a new concept of “adjusted aggregate investment income” which will be based on “aggregate investment income” (a concept that is currently used in computing the amount of refundable taxes in respect of a CCPC’s investment income) with certain adjustments. The adjustments will include the following:

| • | | taxable capital gains (and losses) will be excluded to the extent they arise from the disposition of |

| | – | | a property that is used principally in an active business carried on primarily in Canada by the CCPC or by a related CCPC; or |

19

| | – | | a share of another CCPC that is connected with the CCPC, where, in general terms, all or substantially all of the fair market value of the assets of the other CCPC is attributable directly or indirectly to assets that are used principally in an active business carried on primarily in Canada, and certain other conditions are met; |

| • | | net capital losses carried over from other taxation years will be excluded; |

| • | | dividends from non-connected corporations will be added; and |

| • | | income from savings in a life insurance policy that is not an exempt policy will be added, to the extent it is not otherwise included in aggregate investment income. |

Consistent with existing rules relating to aggregate investment income, adjusted aggregate investment income will not include income that is incidental to an active business.

Application

This measure will apply to taxation years that begin after 2018.

Rules will apply to prevent transactions designed to avoid the measure, such as the creation of a short taxation year in order to defer its application and the transfer of assets by a corporation to a related corporation that is not associated with it.

Refundability of Taxes on Investment Income

The current tax regime relating to refundable taxes on investment income of private corporations seeks to tax income from passive investments at approximately the top personal income tax rate while that income is retained in the corporation. Some or all of these taxes are added to the corporation’s refundable dividend tax on hand (RDTOH) account and are refundable at a rate of $38.33 for every $100 of taxable dividends paid to shareholders.

For income tax purposes, dividends paid by corporations are either “eligible” or “non-eligible”:

| • | | Non-eligible dividends are presumed to have been paid from a corporation’s active business income that has been subject to the small business tax rate (including non-eligible dividends received by the corporation) or from passive investment income, but excluding the non-taxable portion of capital gains as well as eligible portfolio dividends (i.e., dividends that are paid by non-connected corporations as eligible dividends). An individual who receives non-eligible dividends is entitled to the ordinary dividend tax credit which, at the federal level, the Government has proposed be 10 per cent in 2018, and 9 per cent after 2018. |

20

| • | | Eligible dividends are presumed to have been paid from a corporation’s active business income that has been subject to the general corporate income tax rate (including eligible dividends received by the corporation). An individual who receives eligible dividends is entitled to the enhanced dividend tax credit which, at the federal level, is 15 per cent. |

Generally, investment income earned by private corporations must be paid as non-eligible dividends (exceptions include eligible portfolio dividends, which may be paid as eligible dividends, and the non-taxable portion of capital gains, which may be paid as tax-free capital dividends). A corporation, however, may obtain a refund of taxes paid on investment income, reflected in the corporation’s RDTOH account, regardless of whether the dividends paid are eligible or non-eligible.

As a result, the current system allows a corporation to receive an RDTOH refund upon the payment of an eligible dividend (which entitles an individual receiving the dividend to the enhanced dividend tax credit) in situations where the corporation’s RDTOH was generated from investment income that would need to be paid as a non-eligible dividend. This can provide a tax deferral advantage on passive investment income by allowing private corporations paying eligible dividends sourced from active business income taxed at the general corporate income tax rate to generate a refund of taxes paid on passive income.

To better align the refund of taxes paid on passive income with the payment of dividends sourced from passive income, Budget 2018 proposes that a refund of RDTOH be available only in cases where a private corporation pays non-eligible dividends. An exception will be provided in respect of RDTOH that arises from eligible portfolio dividends received by a corporation, in which case the corporation will still be able to obtain a refund of that RDTOH upon the payment of eligible dividends.

The different treatment proposed regarding the refund of taxes imposed on eligible portfolio dividend income will necessitate the addition of a new RDTOH account.

| • | | This new account (eligible RDTOH) will track refundable taxes paid under Part IV of the Income Tax Act on eligible portfolio dividends. Any taxable dividend (i.e., eligible or non-eligible) will entitle the corporation to a refund from its eligible RDTOH account (subject to the ordering rule described below). |

| • | | The current RDTOH account (which will now be referred to as non-eligible RDTOH) will track refundable taxes paid under Part I of the Income Tax Act on investment income as well as under Part IV on non-eligible portfolio dividends (i.e., dividends that are paid by non-connected corporations as non-eligible dividends). Refunds from this account will be obtained only upon the payment of non-eligible dividends. |

21

RDTOH Recapture – Connected Corporations

Currently, if a corporation obtains a refund of RDTOH upon the payment of a dividend to a connected corporation, the recipient corporation pays refundable tax under Part IV of the Income Tax Act equal to the amount of tax refunded to the payor. This amount is then added to the recipient corporation’s RDTOH account. Under this measure, the corporation receiving such a dividend will continue to pay an amount of Part IV tax equal to the refund obtained by the payor corporation. This amount, however, will be added to the RDTOH account of the recipient corporation that matches the RDTOH account from which the payor corporation obtained its refund.

RDTOH Refunds – Ordering Rule

Upon the payment of a non-eligible dividend, a private corporation will be required to obtain a refund from its non-eligible RDTOH account before it obtains a refund from its eligible RDTOH account.

Application

This measure will apply to taxation years that begin after 2018.

An anti-avoidance rule will apply to prevent the deferral of the application of this measure through the creation of a short taxation year.

A corporation’s existing RDTOH balance will be allocated as follows:

| • | | For a CCPC, the lesser of its existing RDTOH balance and an amount equal to 38 1/3 per cent of the balance of its general rate income pool, if any, will be allocated to its eligible RDTOH account. Any remaining balance will be allocated to its non-eligible RDTOH account. |

| • | | For any other corporation, all of the corporation’s existing RDTOH balance will be allocated to its eligible RDTOH account. |

Tax Support for Clean Energy

Under the capital cost allowance regime, Classes 43.1 and 43.2 of Schedule II to the Income Tax Regulations provide accelerated capital cost allowance rates (30 per cent and 50 per cent, respectively, on a declining- balance basis) for investments in specified clean energy generation and conservation equipment. Both classes include eligible equipment that generates or conserves energy by:

| • | | using a renewable energy source (e.g., wind, solar or small hydro); |

| • | | using a fuel from waste (e.g., landfill gas, wood waste or manure); or |

| • | | making efficient use of fossil fuels (e.g., high efficiency cogeneration systems, which simultaneously produce electricity and useful heat). |

Providing accelerated capital cost allowance is an exception to the general practice of setting capital cost allowance rates based on the useful life of assets. Accelerated capital cost allowance provides a financial benefit by deferring taxation.

22

Class 43.2 was introduced in 2005 and is currently available in respect of property acquired before 2020. It generally includes property that would otherwise be included in Class 43.1, except that in certain cases Class 43.2 imposes stricter eligibility criteria.

Budget 2018 proposes to extend eligibility for Class 43.2 by five years so that it is available in respect of property acquired before 2025.

This measure will continue to encourage investment in technologies that can contribute to a reduction in emissions of greenhouse gases and air pollutants, as well as an increase in the share of Canada’s electricity that is renewable and non-emitting, in support of targets set out in the Federal Sustainable Development Strategy.

Artificial Losses Using Equity-Based Financial Arrangements

The Income Tax Act permits, subject to certain exceptions, a corporation to deduct dividends received on a share of a corporation resident in Canada (a “Canadian share”). The dividend rental arrangement rules provide one such exception by denying the inter-corporate dividend deduction to a taxpayer where the main reason for an arrangement is to enable the taxpayer to receive a dividend on a Canadian share, and the risk of loss or opportunity for gain or profit in respect of the Canadian share accrues to someone else.

In the past, some Canadian financial institutions entered into sophisticated financial arrangements that attempted to circumvent the dividend rental arrangement rules. These arrangements typically involved the use of an equity derivative to transfer all or substantially all of the risk of loss and opportunity for gain or profit in respect of a Canadian share from a taxpayer (the Canadian financial institution), who retained legal ownership of the underlying Canadian share, to an investor seeking economic exposure to the Canadian share (the counterparty under the equity derivative). Under these arrangements, the taxpayer was generally required to transfer the economic benefit of any dividends received through “dividend-equivalent payments” to the investor. On the premise that the dividend rental arrangement rules did not apply, the taxpayer claimed an artificial tax loss on the arrangement by taking advantage of the inter-corporate dividend deduction, resulting in tax-free dividend income, while also deducting the amount of the dividend-equivalent payments made to the investor under the equity derivative.

Budget 2015 introduced amendments to the dividend rental arrangement rules that specifically targeted these arrangements. Subject to certain exceptions (e.g., the “no tax-indifferent investor” exception described below), the Budget 2015 amendments essentially deny the inter-corporate dividend deduction on dividends received by a taxpayer on a Canadian share in respect of which there is a synthetic equity arrangement. In general terms, a synthetic equity arrangement, in respect of a Canadian share owned by a taxpayer, is considered to exist where the taxpayer (or a person that does not deal at arm’s length with the taxpayer) enters into one or more agreements that have the effect of providing to an investor all or substantially all of the risk of loss and opportunity for gain or profit in respect of the Canadian share.

23

The Government is concerned that certain taxpayers are still engaging in abusive arrangements that are intended to circumvent the dividend rental arrangement rules. Although these arrangements can be challenged by the Government based on existing rules in the Income Tax Act, these challenges could be both time- consuming and costly. Accordingly, the Government is introducing specific legislation to clarify certain aspects of the synthetic equity arrangement rules and the securities lending arrangement rules to prevent taxpayers from realizing artificial tax losses through the use of equity-based financial arrangements to circumvent these rules.

Synthetic Equity Arrangements

The no tax-indifferent investor exception is provided where a taxpayer holds a Canadian share and can establish that no tax-indifferent investor has all or substantially all of the risk of loss and opportunity for gain or profit in respect of the share by virtue of

| • | | a synthetic equity arrangement, or |

| • | | another equity derivative that is entered into in connection with the synthetic equity arrangement (referred to as a “specified synthetic equity arrangement”). |

A taxpayer is able to satisfy this exception by obtaining certain specific representations from its counterparty. There is a concern that certain taxpayers take the position that this exception can be met in circumstances where a tax-indifferent investor ultimately obtains all or substantially all of the risk of loss and opportunity for gain or profit of a Canadian share from a counterparty to the taxpayer otherwise than through a synthetic equity arrangement or a specified synthetic equity arrangement.

Budget 2018 proposes an amendment to the no tax-indifferent investor exception to the synthetic equity arrangement rules that will clarify that the exception cannot be met when a tax-indifferent investor obtains all or substantially all of the risk of loss and opportunity for gain or profit in respect of the Canadian share, in any way, including where the tax-indifferent investor has not entered into a synthetic equity arrangement or a specified synthetic equity arrangement in respect of the share.

The proposed amendments will apply to dividends that are paid, or become payable, on or after Budget Day.

Securities Lending Arrangements

The Government has become aware that certain taxpayers may be entering into other types of sophisticated equity-based financial arrangements, such as security lending and repurchase arrangements, in a manner that attempts to achieve the same unintended tax benefit that was targeted by the synthetic equity arrangement rules. In general terms, under these arrangements, a counterparty transfers or lends a Canadian share to a taxpayer, and the taxpayer agrees to transfer or return an identical share to the counterparty in the future. Over the term of the arrangement, the taxpayer is obligated to pay to the counterparty amounts (dividend compensation payments) as compensation for all dividends received on the transferred or lent Canadian share.

24

By acquiring a Canadian share under such an arrangement, a taxpayer could place itself in a similar tax position as if it entered into a synthetic equity arrangement. In particular, the taxpayer could receive dividends on the acquired Canadian share while, at the same time, being obligated to pay dividend compensation payments to the counterparty. To the extent that the taxpayer takes the position that the application of existing income tax rules in its particular circumstances allow it to deduct dividend compensation payments in excess of the amount of dividends received on the Canadian share that is included in its taxable income, it could claim an artificial tax loss on the arrangement.

For example, certain taxpayers may seek a tax benefit by entering into securities lending or repurchase arrangements that are designed to fail the requirements of the “securities lending arrangement” definition in the Income Tax Act. When a securities lending or repurchase arrangement does not meet that definition, dividend compensation payments made by the taxpayer will generally be fully deductible. In these circumstances, these taxpayers take the position that the dividend rental arrangement rules do not apply and claim an inter-corporate dividend deduction on the dividends received on the acquired Canadian share, resulting in tax-free dividend income, while also deducting the amount of the dividend compensation payments.

Budget 2018 proposes an amendment to broaden the “securities lending arrangement” definition in the Income Tax Act to ensure that taxpayers that enter into arrangements that are substantially similar to those that fall within that definition are subject to several provisions normally applicable to “securities lending arrangements”. As a result of this amendment, when a taxpayer receives dividends on a Canadian share acquired under such a substantially similar arrangement, the dividend rental arrangement rules will generally apply. Therefore, the inter-corporate dividend deduction will be denied, resulting in a dividend income inclusion that will appropriately offset the available deduction for the amount of the corresponding dividend compensation payments made to the counterparty under the arrangement.

Budget 2018 also proposes an amendment to clarify the interaction of two rules governing the deductibility of dividend compensation payments made by a taxpayer under a securities lending arrangement. Under the first rule, a taxpayer that is a registered securities dealer is permitted to deduct up to two-thirds of a dividend compensation payment to a counterparty. The second rule applies when a securities lending arrangement is a dividend rental arrangement. In these circumstances, the second rule generally permits the taxpayer, whether or not it is a registered securities dealer, to fully deduct any dividend compensation payment made to the counterparty. The proposed amendment will clarify that this first rule does not apply when the second rule applies.

The proposed amendments to the securities lending arrangement rules will apply to dividend compensation payments that are made on or after Budget Day unless the securities lending or repurchase arrangement was in place before Budget Day, in which case the amendments will apply to dividend compensation payments that are made after September 2018.

25

Stop-Loss Rule on Share Repurchase Transactions

The Income Tax Act generally permits a corporation to deduct dividends received on a share of a corporation resident in Canada in computing its taxable income. This inter-corporate dividend deduction is available for dividends actually received; it is also available for dividends that are deemed to have been received on a share, which can arise on a repurchase of the share. The deduction is intended to limit the imposition of multiple levels of corporate taxation on earnings distributed from one corporation to another.

To prevent abuses of this inter-corporate dividend deduction mechanism, dividend stop-loss rules have been introduced that reduce, in specific cases, the amount of a tax loss otherwise realized by a corporation on a disposition of shares. Such losses are reduced by an amount equal to the tax-free dividends received (or deemed to have been received) on these shares on or before the disposition. However, in certain circumstances, the reduction can be less than the amount of tax-free dividends received.

In the past, some Canadian financial institutions had relied on the exceptions to the dividend stop-loss rule pertaining to shares held as mark-to-market property to realize artificial tax losses on certain share repurchase transactions. In such transactions, a Canadian public corporation seeking to repurchase its shares from the public agreed with a Canadian financial institution that it would repurchase its shares owned by the Canadian financial institution pursuant to a private agreement. Given that the shares were not repurchased in the “open market”, the Canadian financial institution was deemed under normal rules to have received a dividend to the extent that the amount paid to the Canadian financial institution on the repurchase exceeded the paid-up capital of the repurchased shares. The Canadian financial institution then claimed a double deduction on that deemed dividend. First, it claimed an inter-corporate dividend deduction that would offset the deemed dividend. Second, it deducted the amount of the deemed dividend from its proceeds of disposition for the purposes of calculating its profit or loss on the share repurchase.

In these circumstances, the Canadian financial institution sought to realize a tax loss on the share repurchase that exceeded any mark-to-market income that could have been previously realized on the repurchased shares due to their increase in value. This tax benefit would effectively be shared by the Canadian financial institution with the Canadian public corporation by agreeing to a redemption price of the shares below their trading price.

In reaction to these transactions, a measure announced in Budget 2011 makes the dividend stop-loss rule pertaining to shares held as mark-to-market property apply in all cases where the taxpayer is deemed to have received a dividend on a share repurchase. However, the formula under which the allowable loss is calculated was not changed with the result that, even when applicable, the dividend stop-loss rule generally denies only a portion of the tax loss realized on a share repurchase equal to the excess of the original cost of the shares over their paid-up capital. The portion of the tax loss equal to the mark-to-market income previously realized on the shares is allowed on the premise that the Canadian financial institution already paid tax on that income. However, if the

26

repurchased shares were fully hedged, which is typically the case, then this premise does not hold true. In particular, any mark-to-market income realized on the shares due to their increase in value would be fully offset under the hedge. As a result, the Canadian financial institution would realize an artificial tax loss on the share repurchase. Since the 2011 Budget amendment, Canadian financial institutions have continued to enter into these transactions with a view to obtaining these unintended tax benefits.

Although these transactions can be challenged by the Government based on existing rules in the Income Tax Act, these challenges could be both time-consuming and costly.

Budget 2018 proposes to amend the provisions of the Income Tax Act pertaining to shares held as mark-to-market property so that the tax loss otherwise realized on a share repurchase is generally decreased by the dividend deemed to be received on that repurchase when that dividend is eligible for the inter-corporate dividend deduction.

This measure will apply in respect of share repurchases that occur on or after Budget Day.

At-Risk Rules for Tiered Partnerships

The income (or loss) of a partnership for income tax purposes is allocated to its partners, who include (or deduct) the amount in calculating their own income. Limited partners of a partnership may deduct losses of the partnership allocated to them only to the extent of their “at-risk amount” in respect of the partnership. This amount is generally a measure of the limited partner’s invested capital that is at risk in the partnership, and is increased by unpaid income allocated from the partnership. The at-risk rules ensure that a limited partner cannot shelter income from other sources with partnership losses in excess of what they put at risk in the partnership.

Losses of a partnership allocated to a limited partner in excess of their at-risk amount in respect of the partnership are not deductible and become “limited partnership losses”, which are generally eligible for an indefinite carry-forward. If eligible, these losses can be deducted in a future year to the extent that the limited partner’s at-risk amount in the partnership has increased. When a limited partner disposes of a limited partnership interest, any undeducted limited partnership losses of the limited partner are reflected in the adjusted cost base of the partnership interest, which would result in a lower capital gain or higher capital loss on the disposition.

The long-standing understanding of the at-risk rules, on which basis they have been administered since their introduction, has been that their application extends to cases in which the limited partner holding a limited partnership interest is another partnership (a “tiered partnership” structure). In such cases, the limited partnership losses would not be eligible to be carried forward by the partnership holding the limited partnership interest. However, such limited partnership losses would be reflected in the adjusted cost base of the limited partnership interest.

27

A recent Federal Court of Appeal decision has constrained the application of the at-risk rules in the context of tiered partnership structures. The decision is inconsistent with the policy underlying the at-risk rules and could result in limited partnership losses becoming deductible in situations where, under the long-standing understanding of the at-risk rules, they would have been restricted. Given the indefinite carry-forward of limited partnership losses, this poses a significant risk to the tax base.

Budget 2018 proposes to clarify that the at-risk rules apply to a partnership that is itself a limited partner of another partnership. This measure, along with a number of consequential changes, will ensure that the at-risk rules apply appropriately at each level of a tiered partnership structure. In particular, for a partnership that is a limited partner of another partnership, the losses from the other partnership that can be allocated to the partnership’s members will be restricted by that partnership’s at-risk amount in respect of the other partnership.

In addition, consistent with the long-standing understanding of the at- risk rules, limited partnership losses of a limited partner that is itself a partnership will not be eligible for an indefinite carry-forward. Such losses will be reflected in the adjusted cost base of the partnership’s interest in the limited partnership.

This measure will apply in respect of taxation years that end on or after Budget Day, including in respect of losses incurred in taxation years that end prior to Budget Day. In particular, losses from a partnership incurred in a taxation year that ended prior to Budget Day will not be available to be carried forward to a taxation year that ends on or after Budget Day if the losses were allocated – for the year in which the losses were incurred – to a limited partner that is another partnership.

Health and Welfare Trusts

A Health and Welfare Trust is a trust established by an employer for the purpose of providing health and welfare benefits to its employees. The tax treatment of such a trust is not explicitly set out in the Income Tax Act. Since 1966, the Canada Revenue Agency (CRA) has published administrative positions regarding the requirements for qualifying as a Health and Welfare Trust along with rules relating to contributions to, and the computation of taxable income of, such a trust. The tax treatment of health benefits paid to employees is set out in the Income Tax Act.

The Employee Life and Health Trust rules were added to the Income Tax Act in 2010. These trusts also provide health benefits for employees – specifically, group sickness or accident insurance plans, private health services plans and group term life insurance policies. The Employee Life and Health Trust rules in the Income Tax Act are very similar to the CRA’s administrative positions for Health and Welfare Trusts. However, the Employee Life and Health Trust legislation explicitly deals with certain issues (e.g., the treatment of surplus income and pre-funding of benefits) that are not dealt with in the administrative Health and Welfare Trust regime.

28

In order to provide more certainty for taxpayers and greater consistency in the tax treatment of such arrangements, Budget 2018 proposes that only one set of rules apply to these arrangements. As such, the CRA will no longer apply their administrative positions with respect to Health and Welfare Trusts after the end of 2020. To facilitate the conversion of existing Health and Welfare Trusts to Employee Life and Health Trusts, transitional rules will be added to the Income Tax Act. Trusts that do not convert (or wind up) to an Employee Life and Health Trust will be subject to the normal income tax rules for trusts. In addition, the CRA will not apply its administrative positions with respect to Health and Welfare Trusts to trusts established after Budget Day and will announce transitional administrative guidance relating to winding up existing Health and Welfare Trusts.

Stakeholders are invited to submit comments on transitional issues, both administrative and legislative, to facilitate the discontinuation of the Health and Welfare Trust regime. Following the consultation, the Government intends to release draft legislative proposals and transitional administrative guidance. Issues currently under consideration include:

| • | | whether a Health and Welfare Trust can continue as an Employee Life and Health Trust without the creation of a new trust; |

| • | | whether, and under what conditions, a rollover of assets to a new trust will be permitted; and |

| • | | the tax implications for a Health and Welfare Trust that does not satisfy the conditions to become an Employee Life and Health Trust, or where the trustees of a Health and Welfare Trust choose not to convert. |

Please send your comments by June 29, 2018 to HWT-consultation-FSBE@canada.ca.

29

International Tax Measures

Cross-Border Surplus Stripping using Partnerships and Trusts

The paid-up capital (PUC) of the shares of a Canadian corporation generally represents the amount of capital that has been contributed to the corporation by its shareholders. PUC is a valuable tax attribute of a corporation primarily because it can be returned to its shareholders free of tax. It is also included in the determination of a corporation’s equity under the thin capitalization rules, which can increase the amount of its deductible interest expense. Distributions to shareholders that are in excess of PUC are normally treated as taxable dividends and are, for non-resident shareholders, subject to a 25-per-cent withholding tax (which may be reduced under a tax treaty).

The Income Tax Act contains a rule that is intended to prevent a non-resident shareholder from entering into transactions to extract free of tax (or “strip”) a Canadian corporation’s surplus in excess of the PUC of its shares, or to artificially increase the PUC of such shares. When applicable, this rule can result in a deemed dividend to the non- resident or can suppress the PUC that would otherwise have been created as a result of the transactions.

This cross-border anti-surplus-stripping rule seeks to prevent non-residents from achieving these tax benefits through a transfer of the shares of one corporation resident in Canada (the “Canadian subject corporation”), to another such corporation (the “Canadian purchaser corporation”) with which the non-resident does not deal at arm’s length, in exchange for shares of the Canadian purchaser corporation or other forms of consideration.

Although this rule partly addresses the use of a partnership as an intermediary, it does not expressly address situations where a non-resident person disposes of an interest in a partnership that owns shares of a Canadian subject corporation. Some taxpayers have attempted to exploit this aspect of the rule by engaging in internal reorganizations that involve a transfer by a non-resident of shares of a Canadian subject corporation to a partnership in exchange for an interest in the partnership. The partnership interest is then transferred to a Canadian purchaser corporation. The Government also has concerns with variations of this partnership planning, and similar planning involving trusts, both in the context of this rule and a similar rule that applies to corporate immigration.

To ensure that the underlying purposes of the cross-border anti-surplus-stripping rule, and the corresponding corporate immigration rule, cannot be frustrated by transactions involving partnerships or trusts, Budget 2018 proposes to amend these provisions to add comprehensive “look-through” rules for such entities. These rules will allocate the assets, liabilities and transactions of a partnership or trust to its members or beneficiaries, as the case may be, based on the relative fair market value of their interests.

This measure will apply to transactions that occur on or after Budget Day.

30

Transactions that occur before Budget Day may be challenged using the general anti-avoidance rule. Any use of discretionary or similar interests for the purpose of obtaining inappropriate results under the proposed allocation mechanism, or other planning that seeks to achieve indirectly what cannot be done directly under these anti-surplus-stripping rules, would be inconsistent with the policy intent of these rules and would be expected to be challenged using existing rules, including the general anti-avoidance rule.

Foreign Affiliates

The Income Tax Act contains special rules for the taxation of Canadian resident shareholders of foreign affiliates. Budget 2018 proposes modifications to these rules as a result of the Government’s ongoing monitoring of developments in this area.

A foreign affiliate of a taxpayer resident in Canada is a non-resident corporation in which the taxpayer has a significant interest. A controlled foreign affiliate of a taxpayer is generally a foreign affiliate in which the taxpayer has, or participates in, a controlling interest.

The taxpayer’s share of the income of a foreign affiliate from an active business is not taxed until such time as it is paid as a dividend by the affiliate to the taxpayer. This dividend can be received tax-free to the extent that it is paid out of the foreign affiliate’s exempt surplus. A foreign affiliate will have exempt surplus if it has income from an active business carried on by it in a country with which Canada has a tax treaty or a tax information exchange agreement (TIEA) and it is resident in such a country.

Certain income of a controlled foreign affiliate (i.e., income from property, from a business other than active business and from other specified sources) is taxable in the hands of the taxpayer in the year in which it is earned, whether or not it is distributed, with an offsetting deduction for taxes paid by the affiliate. This income is referred to as foreign accrual property income (FAPI).

Investment Businesses

Income from an investment business carried on by a foreign affiliate of a taxpayer is included in the foreign affiliate’s FAPI. An investment business is generally defined as a business the principal purpose of which is to derive income from property. However, an investment business does not include a business carried on by a foreign affiliate if certain conditions are satisfied. One of these conditions, in general terms, is that the affiliate employ more than five full- time employees (or the equivalent) in the active conduct of the business. This condition is sometimes referred to as the “six employees test”. If the affiliate’s investment activities are so significant that they require more than five full-time employees and the other conditions are satisfied, the affiliate’s business is treated as an active business and income from that business is excluded from FAPI.

31

The investment business definition applies on a business-by-business basis. Accordingly, to the extent that a single foreign affiliate carries on multiple businesses, each such business would have to meet the six employees test in order to ensure that it is not an investment business.

Certain taxpayers whose foreign investment activities would not warrant more than five full-time employees have engaged in tax planning with other taxpayers in similar circumstances seeking to meet the six employees test. This planning involves grouping their financial assets together in a common foreign affiliate in order to carry on investment activities outside of Canada through that affiliate. While the taxpayers combine their assets in a common affiliate and take the position that the affiliate is carrying on a single business, their respective returns are determined separately by reference to their contributed assets.

To effect this planning, the share, contractual or other rights under these arrangements typically ensure that each taxpayer retains control over its contributed assets and that any returns from those assets accrue to its benefit. This type of planning is sometimes referred to as a “tracking arrangement”. In such arrangements, the assets contributed by the (often unrelated) Canadian taxpayers are not truly pooled, as the economic outcome for each taxpayer remains unchanged. The affiliate is essentially used as a conduit entity to shift passive investment income offshore and later repatriate that income to Canada tax-free.

It is not intended that taxpayers be permitted to satisfy the six employees test in these circumstances. To ensure the rules operate as intended, Budget 2018 proposes to introduce a rule for the purposes of the investment business definition so that, where income attributable to specific activities carried out by a foreign affiliate accrues to the benefit of a specific taxpayer under a tracking arrangement, those activities carried out to earn such income will be deemed to be a separate business carried on by the affiliate. Each separate business of the affiliate will therefore need to satisfy each relevant condition in the investment business definition, including the six employees test, in order for the affiliate’s income from that business to be excluded from FAPI.

This measure will apply to taxation years of a taxpayer’s foreign affiliate that begin on or after Budget Day.

Whether one or more separate businesses is carried on is a question of fact that must be determined on the basis of all relevant facts and surrounding circumstances. The introduction of this deeming rule for the purposes of the investment business definition ensures that a foreign affiliate will be treated as having separate businesses where a tracking arrangement exists. Some tracking arrangements may give rise to separate businesses irrespective of whether this new rule applies. The Canada Revenue Agency (CRA) may challenge such arrangements (and other planning with similar effect) on this basis and may also seek to apply existing anti-avoidance rules where appropriate.

32

Controlled Foreign Affiliate Status

The FAPI of a foreign affiliate of a taxpayer is included in the taxpayer’s income on an accrual basis only where the affiliate is a controlled foreign affiliate of the taxpayer. To avoid such accrual taxation, certain groups of Canadian taxpayers have used tracking arrangements to avoid controlled foreign affiliate status (i.e., the group of taxpayers is sufficiently large that they take the position that they do not have, and do not participate in, a controlling interest in the affiliate). Under the tracking arrangement, each taxpayer retains control over its contributed assets and any returns from those assets accrue to its benefit. This is sometimes effected through the establishment of separate cells or segregated accounts that track those contributed assets and respective returns. It is not intended that taxpayers avoid controlled foreign affiliate status, and therefore accrual taxation of FAPI, in these circumstances.

To address this concern, Budget 2018 proposes to deem a foreign affiliate of a taxpayer to be a controlled foreign affiliate of the taxpayer if FAPI attributable to activities of the foreign affiliate accrues to the benefit of the taxpayer under a tracking arrangement. This measure is intended to ensure that each taxpayer involved in such a tracking arrangement – no matter how large the group – is subject to accrual taxation in respect of FAPI attributable to that taxpayer.

This measure will apply to taxation years of a taxpayer’s foreign affiliate that begin on or after Budget Day.