Economic Developments1

The global economic expansion moderated in 2018 after two years of strong growth, which was broad-based across most regions of the world. Towards the end of the year increased trade tensions, notably between the U.S. and China, and lower expectations for growth translated into increased financial market volatility, lower commodity prices, and a decline in government bond yields.

Against the backdrop of easing global growth, the Canadian economy moderated to a more sustainable pace in line with underlying fundamentals. Real GDP grew 1.9 per cent in 2018 after the strong growth of 2017 (3.0 per cent). Throughout the year, the labour market continued to be strong. Since the fall of 2015, the economy has generated close to 1 million jobs with the unemployment rate reaching its lowest level in more than 40 years.

Supported by accommodative monetary and fiscal policy, consumer spending and business investment led Canadian economic growth in 2018, while lower global oil prices over the second half of the year and slower housing market activity weighed on the economy.

There was continued volatility in commodity markets over the year with the price of West Texas Intermediate crude oil increasing to nearly US$70 per barrel in October, its highest level since before the oil shock, before retreating again to below US$50 per barrel toward the end of 2018.

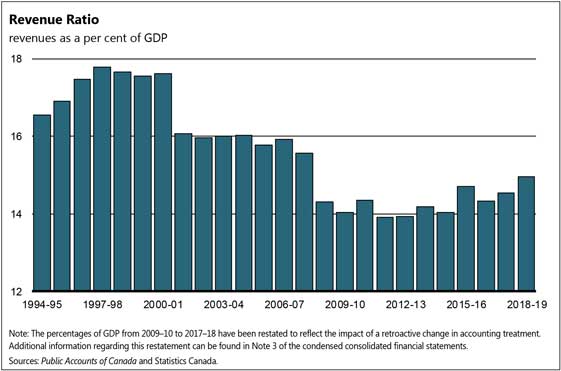

Canada’s nominal GDP, the broadest measure of the tax base, grew 3.6 per cent in 2018, down from 5.6 per cent in 2017. Lower nominal growth was due to more moderate real GDP growth as well as lower GDP inflation, the latter reflecting a decrease in global and Canadian oil prices at the end of the year. Both real and nominal GDP growth in 2018 were in line with the Budget 2019 forecast.

Both short- and long-term interest rates in Canada continued to increase over most of 2018 as a result of increases in the Bank of Canada’s policy target rate. However, interest rates across the yield curve remained historically low in 2018, and long-term interest rates began to subside towards the end of the year in response to expectations for easing monetary policy in the U.S., and overall economic uncertainty.

Going forward, there remain important uncertainties and risks in the global and domestic economies. The Government regularly surveys private sector economists on their views on the economy to assess and manage risk. The survey of private sector economists has been used as the basis for economic and fiscal planning since 1994 and introduces an element of independence into the Government’s forecasts. This practice has been supported by international organizations, such as the International Monetary Fund (IMF).

| 1 | This section incorporates data available up to and including August 10, 2019. The annual results are on calendar year basis. |