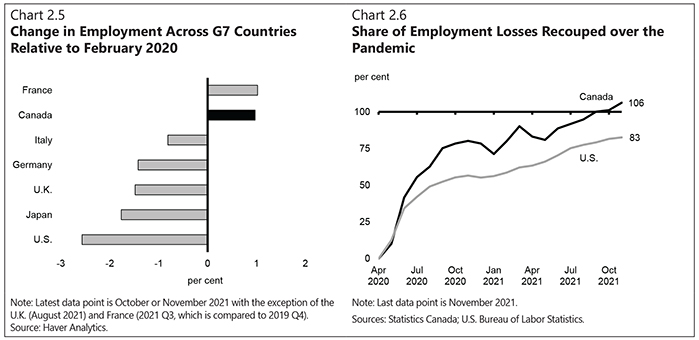

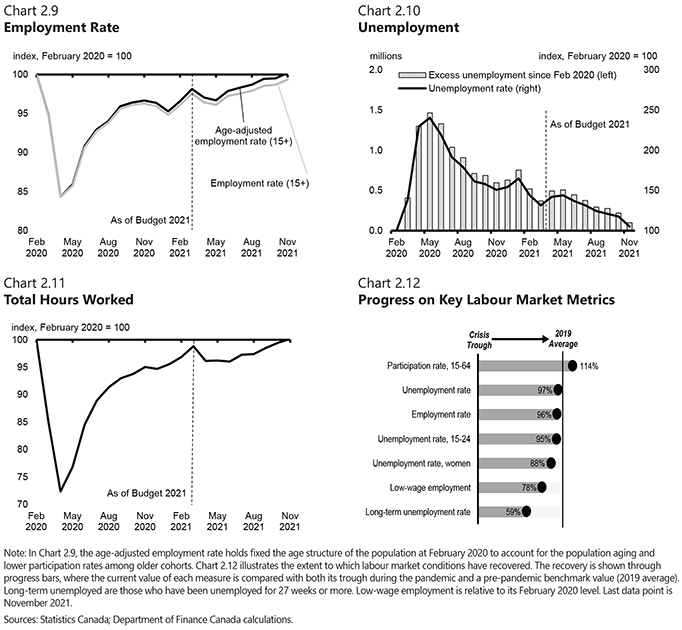

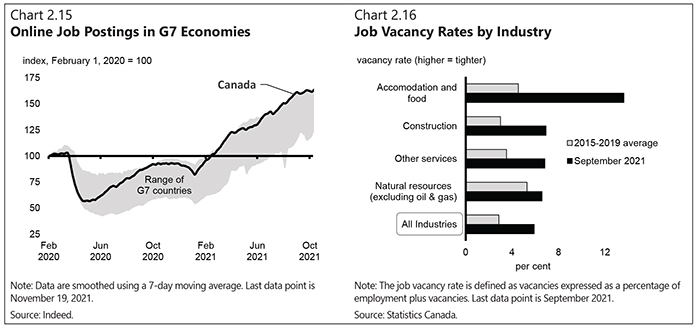

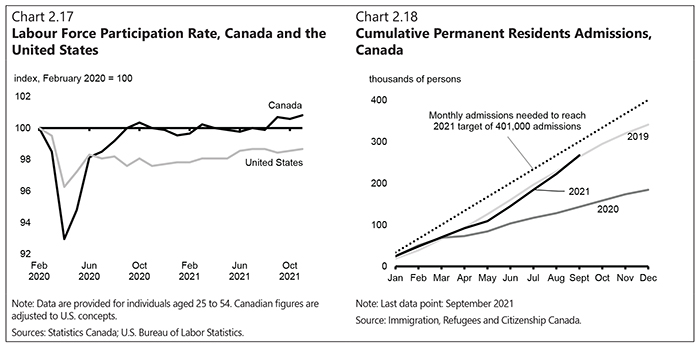

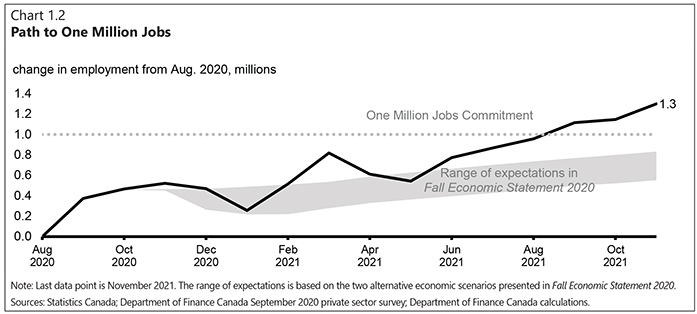

From the start, we understood that having a job is essential to Canadians’ economic wellbeing. That is why our investments have been so singularly focused on employment, and why Canada has experienced the second fastest jobs recovery in the G7.

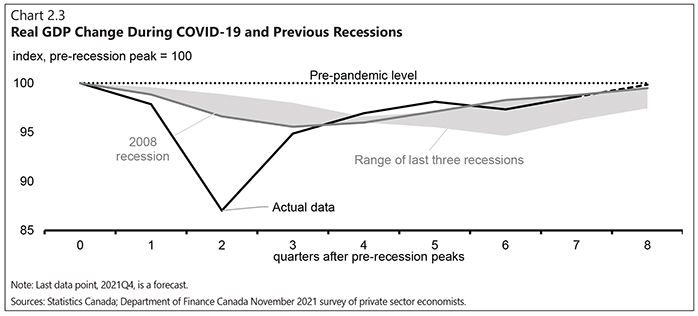

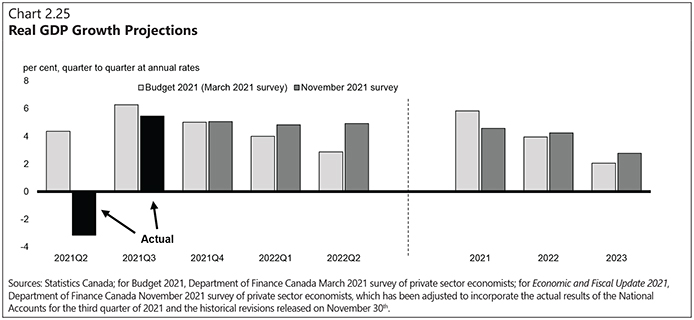

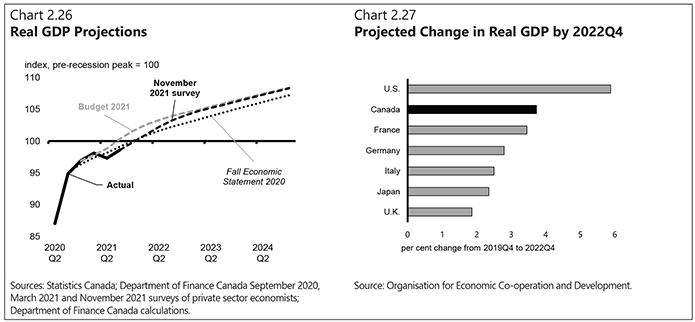

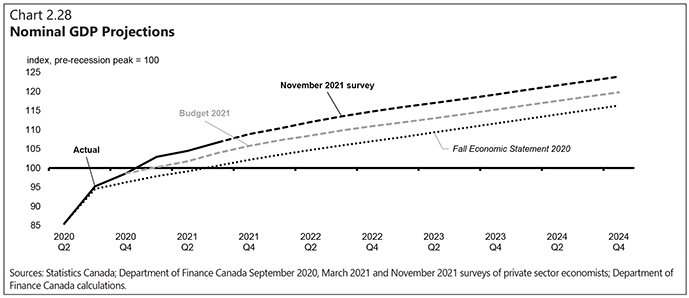

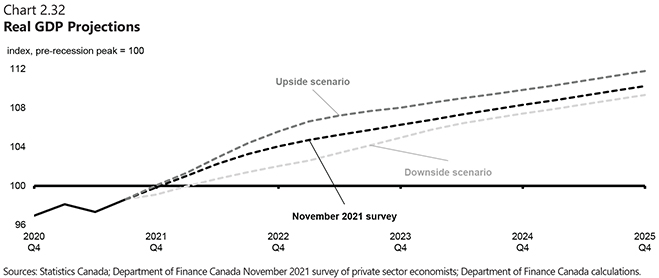

Our GDP returned to near pre-pandemic levels in the third quarter of this year. Our GDP growth of 5.4 per cent, in the third quarter, outpaced the U.S., the U.K., Japan, and Australia. OECD projections suggest that, by 2023, Canada’s recovery will be the second fastest in the G7. This update shows the size of the Canadian economy this year will be $2.48 trillion, almost exactly what we predicted it would be in the 2018 budget when we had no idea we would soon be grappling with a global pandemic.

Canadian exports rose in October and our balance of trade for goods had a surplus of $25.1 billion.

Fewer businesses went bankrupt last year than in 2019, before the pandemic. In fact, there are now an additional 6,000 active businesses in Canada compared to before the pandemic.

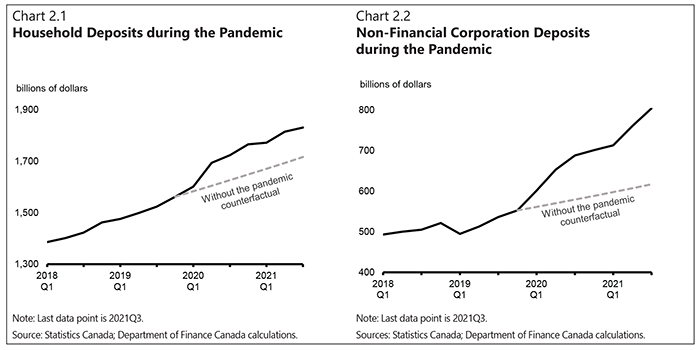

Household employment income is now 7 per cent above its pre-crisis level. And Canadians have used this time when we all hunkered down to pay down their personal debt.

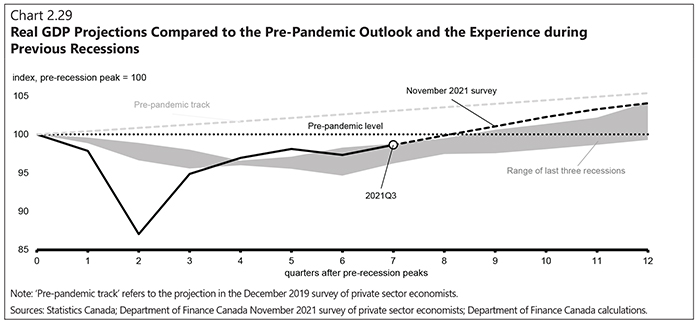

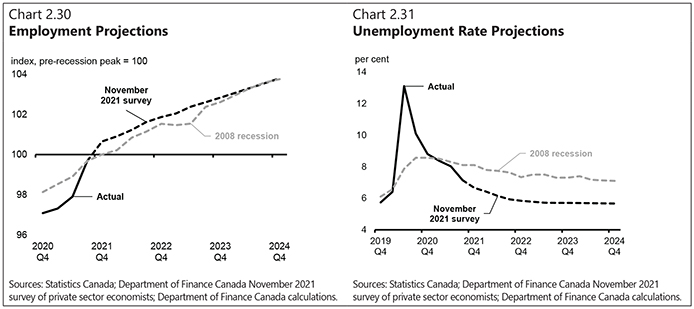

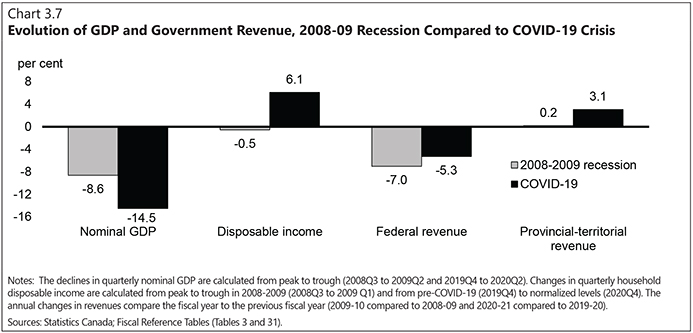

Our recovery from the COVID-19 recession has significantly surpassed Canada’s recovery from the 2008 recession. We have already more than recovered lost jobs, a healing which took eight months longer after the much milder 2008 recession. And we are on track to recover lost GDP five months more quickly than after the 2008 contraction.

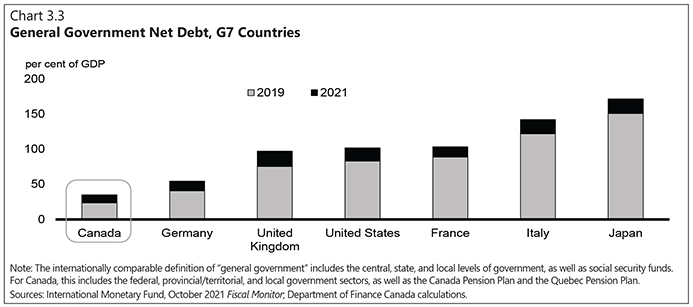

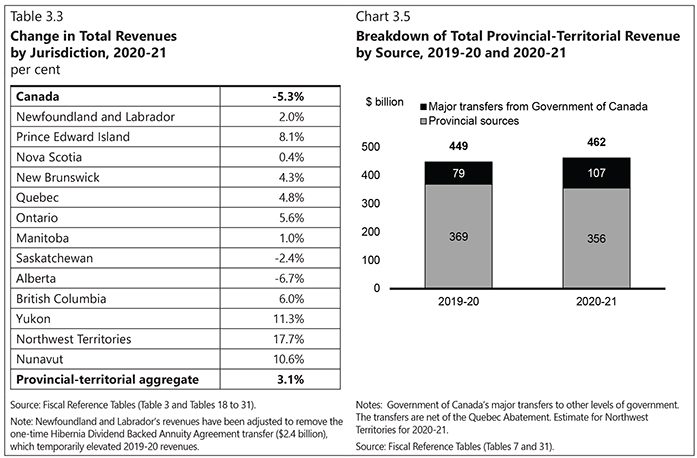

Provincial government balance sheets were sheltered from the pandemic thanks to strong support from the federal government. Provincial and territorial government revenues actually increased in 2020-21. Why? Because of substantial federal support, both through direct transfers and through Canada’s COVID-19 economic response, which helped put a floor under provincial-territorial government revenues thereby limiting their deficits and debt. $8 out of every $10 provided to fight COVID-19 and support Canadians through the pandemic came from the federal government.

By delivering significant fiscal policy support to the economy and avoiding the harmful austerity policies that followed 2008, the government has helped support a rapid and resilient recovery so far. But we know there is more to do, and the future remains uncertain.

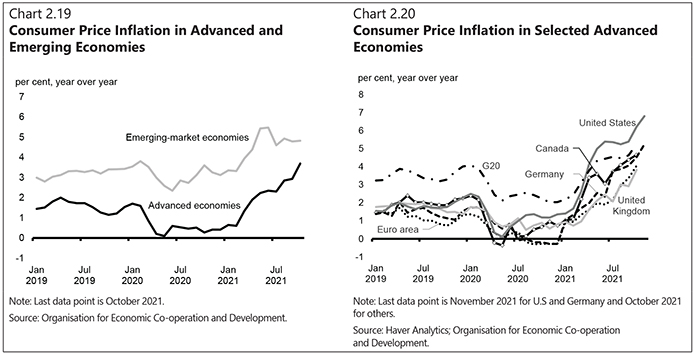

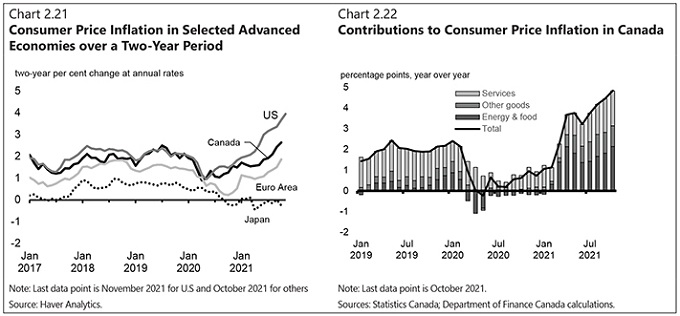

As we look ahead, we are mindful of elevated inflation. We know inflation is a global phenomenon driven by the unprecedented challenge of re-opening the world’s economy.

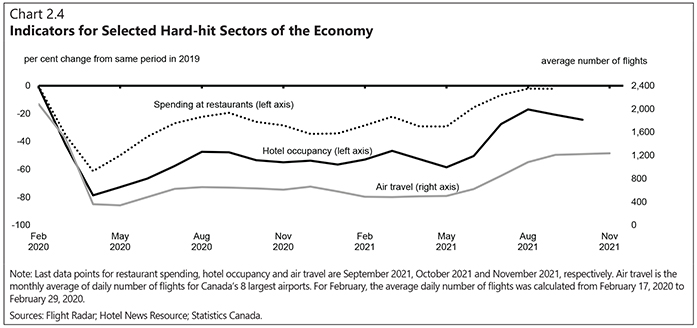

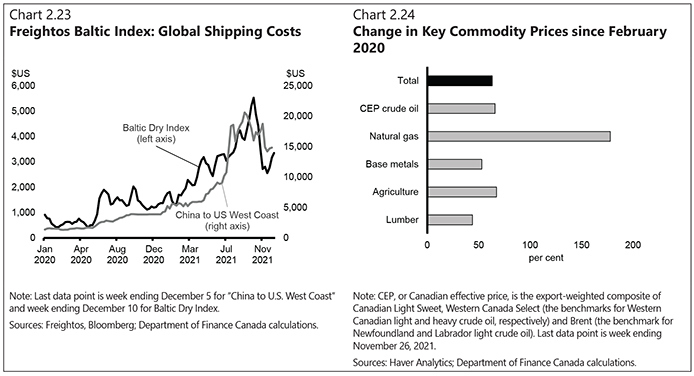

Turning on the global economy is a good deal more complicated than turning it off. We, like other countries, are experiencing the consequences of a time unlike any other. During lockdowns, Canadians’ incomes remained strong, on average, but opportunities to spend on services were severely restricted. The result was that Canadians spent more on durable goods. Without meals in restaurants, personal care, or vacations, Canadians spent their disposable income on renovations, new furniture, appliances, and even cars. It will take some time for supply chains to catch up and for our economy to rebalance itself.

We are very aware of the worries Canadians are having about paying their bills. That is why we made sure to index to inflation the Canada Child Benefit, just as Old Age Security, the Guaranteed Income Supplement, the Goods and Services Tax Credit, and other benefits for the most vulnerable are indexed. We are also delivering thousands of dollars of savings to families with young children as we work to finalize agreements for a Canada-wide early learning and child care system.

To ensure that the current rate of inflation does not become entrenched, we renewed the Bank of Canada’s two-percent inflation target.

We know housing prices are a real concern, especially for those in the middle class looking to buy their first home. Addressing housing affordability remains a priority for our government. Our work is ongoing. We will take further action in the upcoming budget.

Climate change is also causing increased volatility in the economy. Recent and tragic floods in British Columbia devastated homes, farms, and critical infrastructure, and further snarled supply chains. Severe droughts, including across our Prairies, have contributed to increases in food prices.

ii

Denotes measures newly announced in this Economic and Fiscal Update.

Denotes measures newly announced in this Economic and Fiscal Update.