Report to be made

6 Where a special allowance ceases to be payable in respect of a child for a reason referred to in paragraph 4(4)(a), (b) or (c), the chief executive officer of the department, agency, institution or Indigenous governing body that made the application under paragraph 4(1)(a) in respect of the child shall, as soon as possible after the special allowance ceases to be payable in respect of the child, notify the Minister in the prescribed form and manner.

(2) Subsection (1) is deemed to have come into force on January 1, 2020.

17 (1) Subsections 9(1) and (2) of the English version of the Children’s Special Allowances Act are replaced by the following:

Return of special allowance where recipient not entitled

9 (1) Any person, department, agency, institution or Indigenous governing body that has received or obtained by cheque or otherwise payment of a special allowance under this Act to which the person, department, agency, institution or Indigenous governing body is not entitled, or payment in excess of the amount to which the person, department, agency, institution or Indigenous governing body is entitled, shall, as soon as possible, return the cheque or the amount of the payment, or the excess amount, as the case may be.

Recovery of amount of payment as debt due to Her Majesty

(2) Where a person, department, agency, institution or Indigenous governing body has received or obtained payment of a special allowance under this Act to which the person, department, agency, institution or Indigenous governing body is not entitled, or payment in excess of the amount to which the person, department, agency, institution or Indigenous governing body is entitled, the amount of the special allowance or the amount of the excess, as the case may be, constitutes a debt due to Her Majesty.

(2) Subsection 9(3) of the Children’s Special Allowances Act is replaced by the following:

Deduction from subsequent special allowance

(3) Where any person, department, agency, institution or Indigenous governing body has received or obtained payment of a special allowance under this Act to which the person, department, agency, institution or Indigenous governing body is not entitled, or payment in excess of the amount to which the person, department, agency, institution or Indigenous governing body is entitled, the amount of the special allowance or the amount of the excess, as the case may be, may be deducted and retained in such manner as is prescribed out of any special allowance to which the person, department, agency, institution or Indigenous governing body is or subsequently becomes entitled under this Act.

(3) Subsections (1) and (2) are deemed to have come into force on January 1, 2020.

18 (1) Section 11 of the Children’s Special Allowances Act is replaced by the following:

Agreements for exchange of information

11 The Minister may enter into an agreement with the government of any province, or an Indigenous governing body, for the purpose of obtaining information in connection with the administration or enforcement of this Act or the regulations and of furnishing to that government, or Indigenous governing body, under prescribed conditions, any information obtained by or on behalf of the Minister in the course of the administration or enforcement of this Act or the regulations, if the Minister is satisfied that the information to be furnished to that government, or Indigenous governing body, under the agreement is to be used for the purpose of the administration of a social program, income assistance program or health insurance program in the province or of the Indigenous governing body.

(2) Subsection (1) is deemed to have come into force on January 1, 2020.

19 (1) Paragraph 13(a) of the English version of the Children’s Special Allowances Act is replaced by the following:

Notice of Ways and Means Motion to amend the Income Tax Act and Other Legislation 67

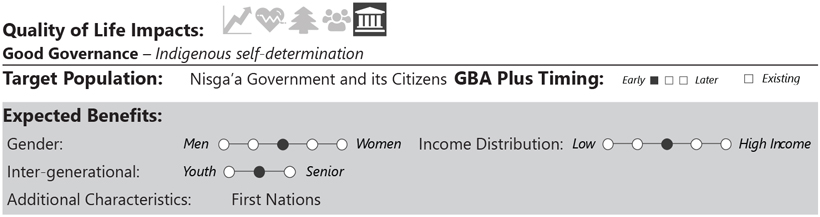

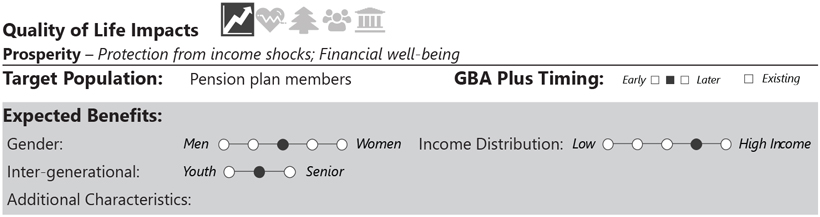

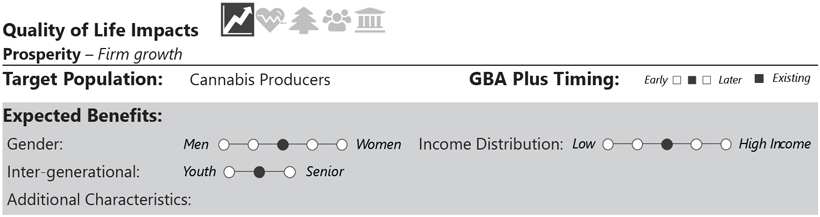

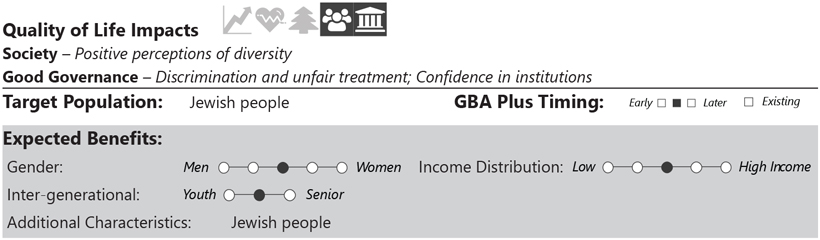

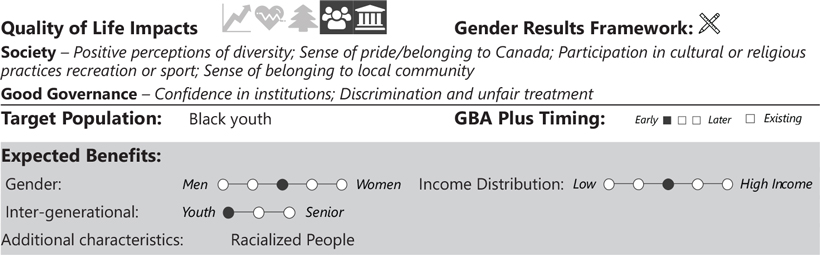

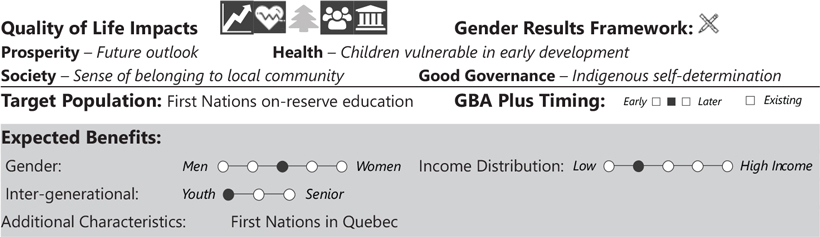

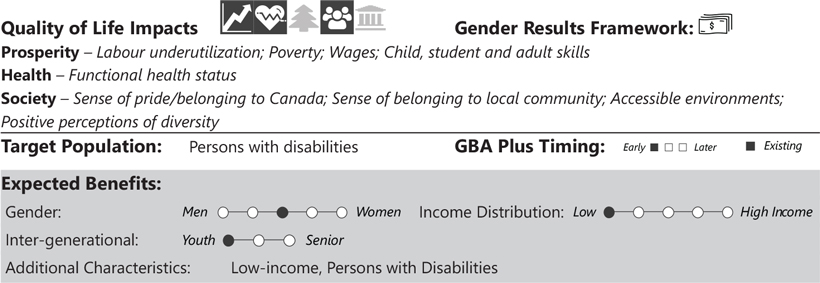

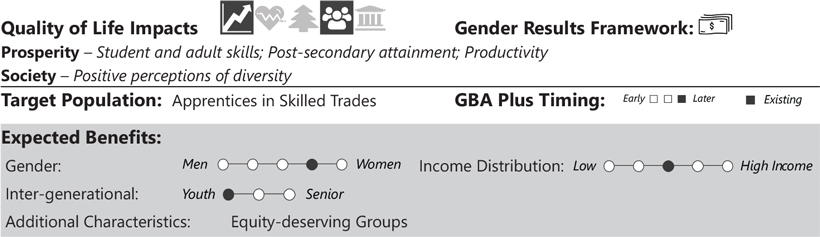

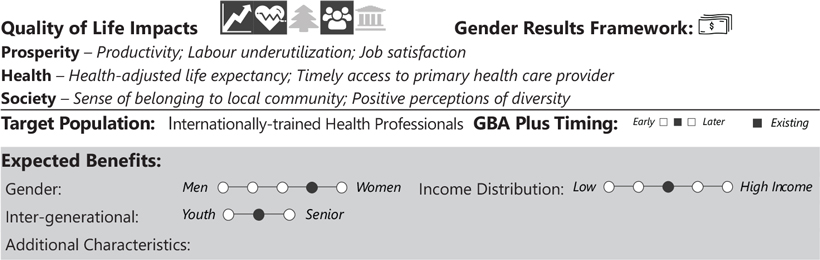

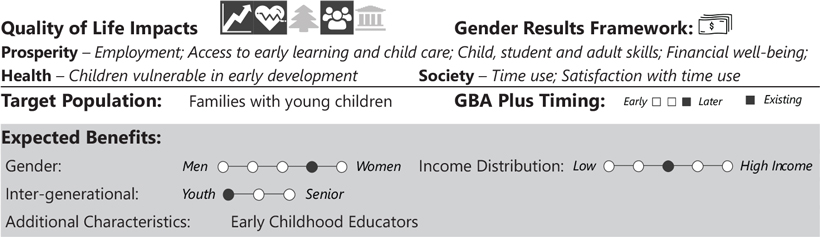

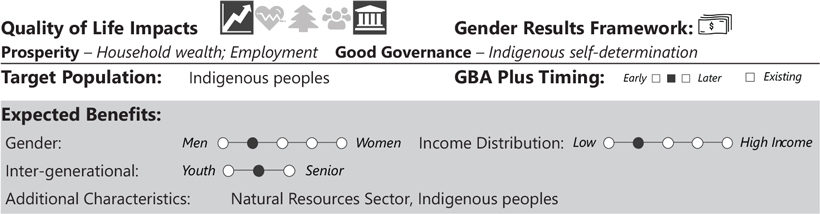

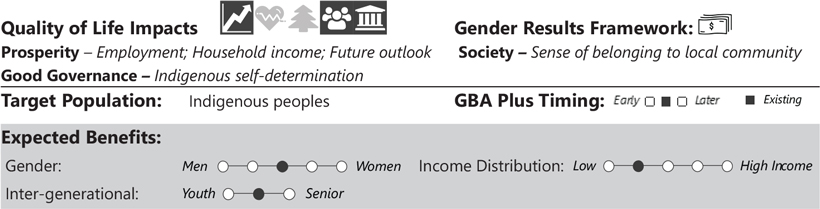

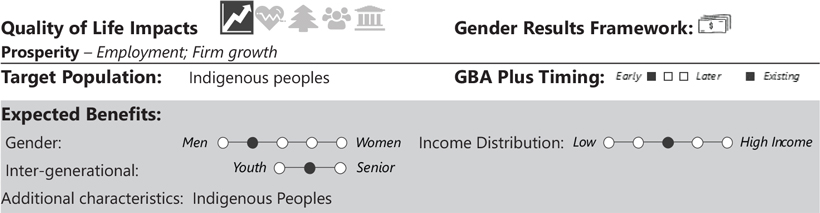

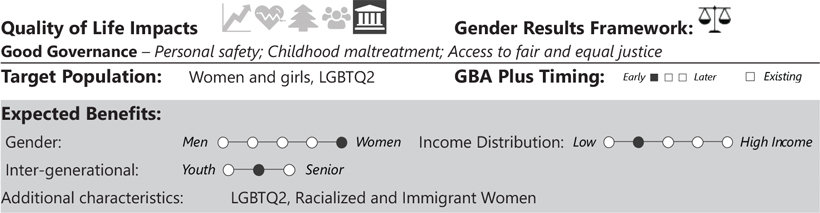

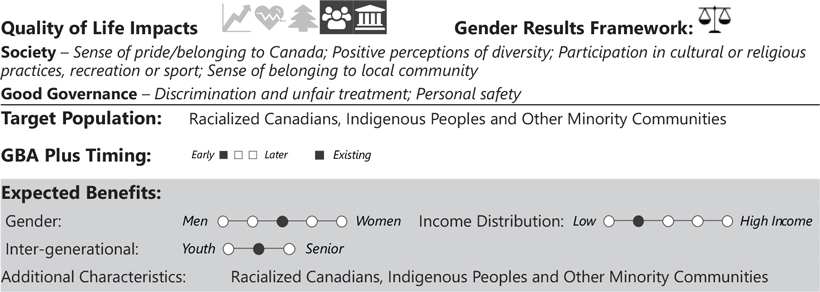

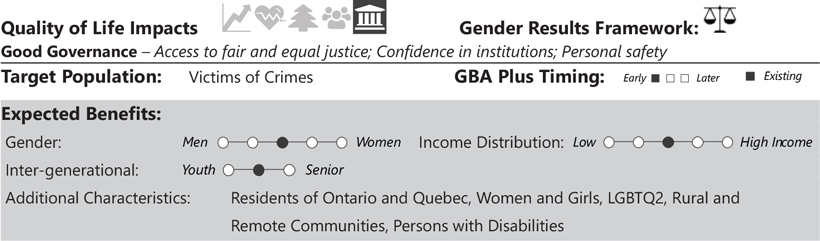

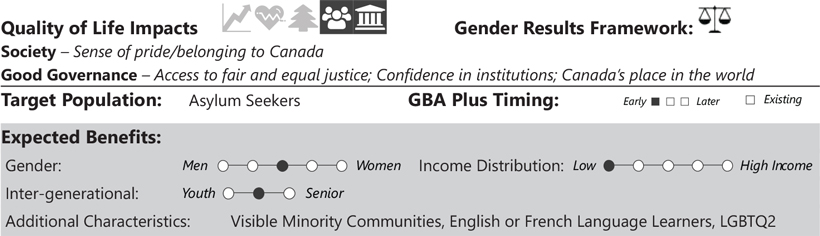

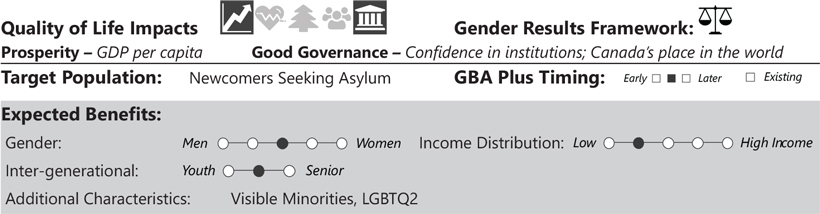

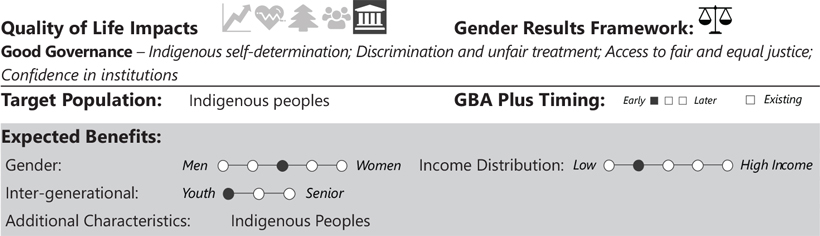

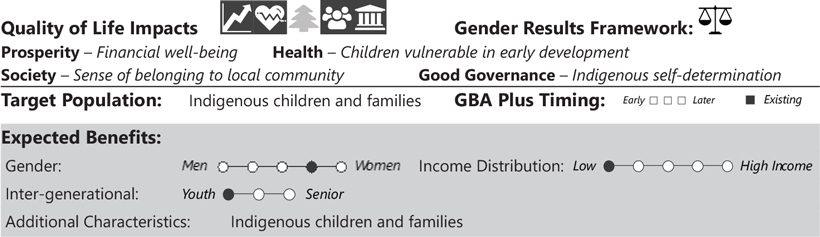

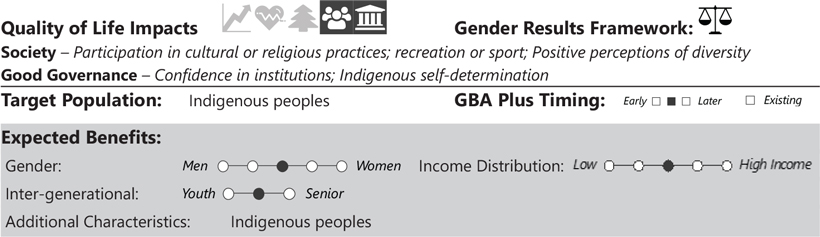

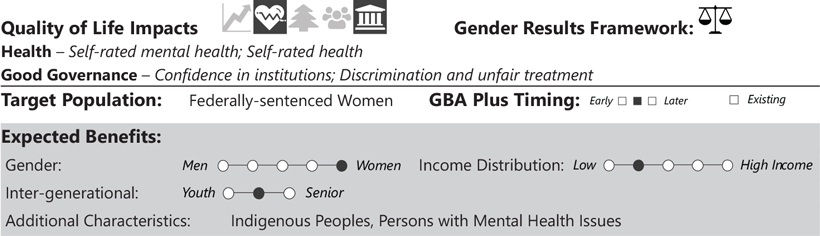

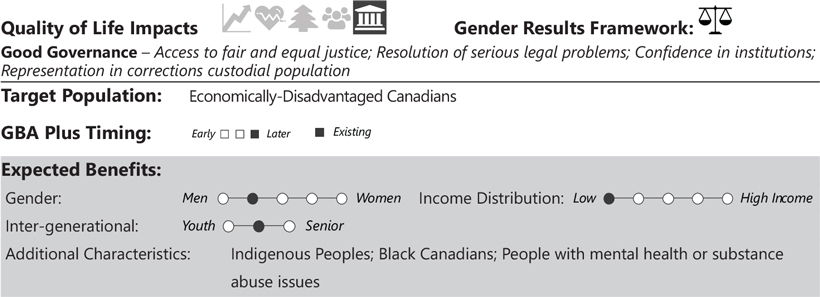

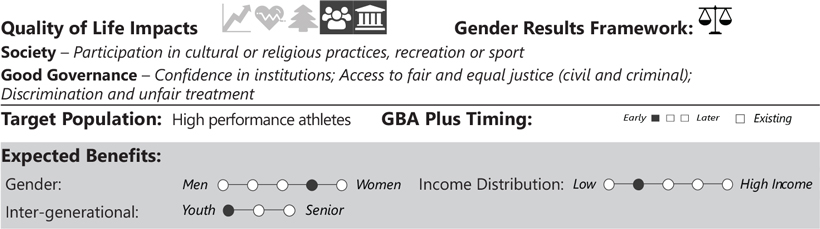

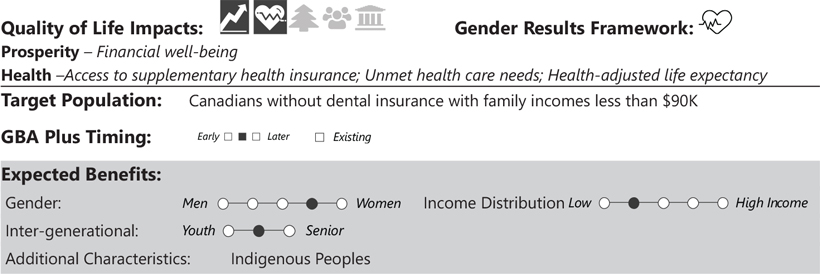

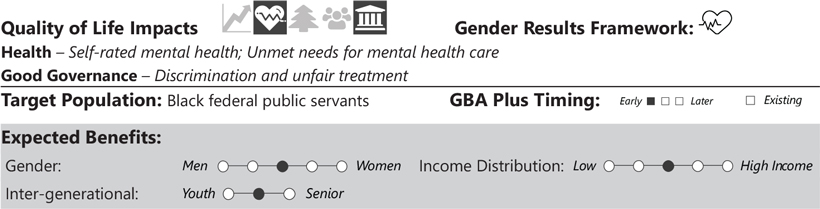

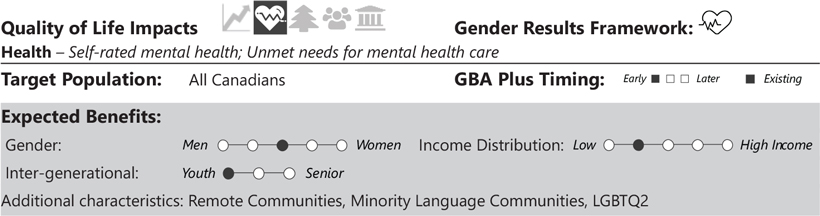

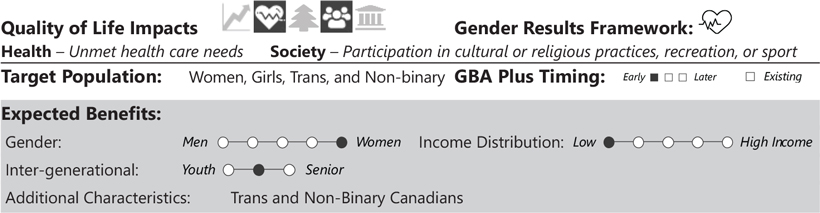

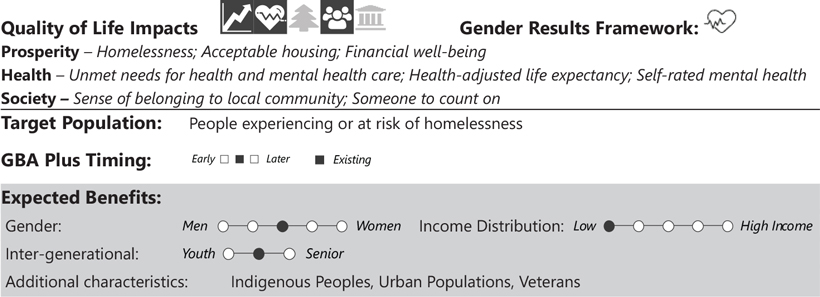

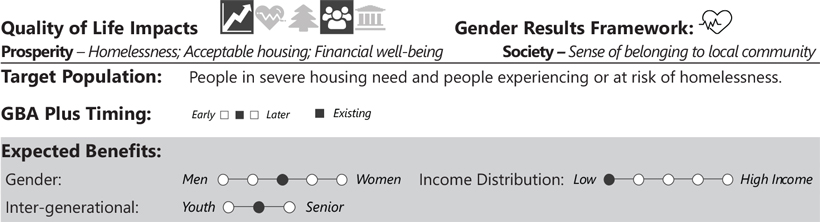

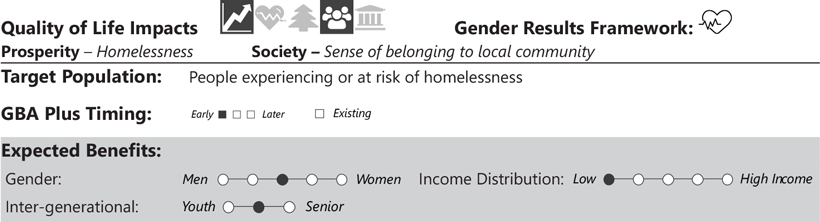

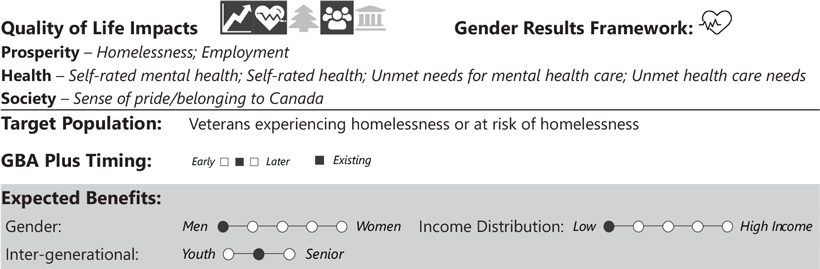

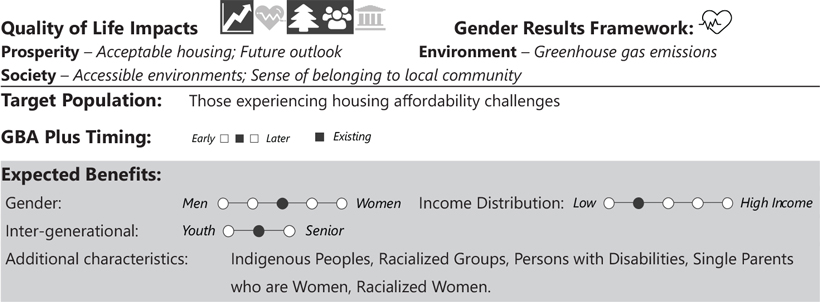

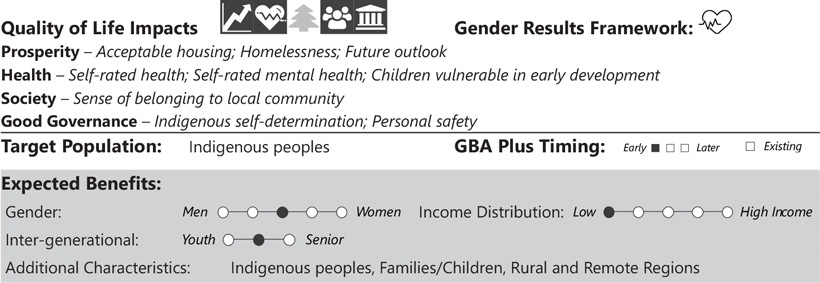

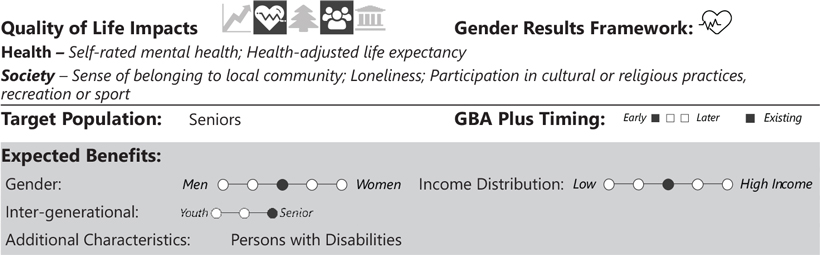

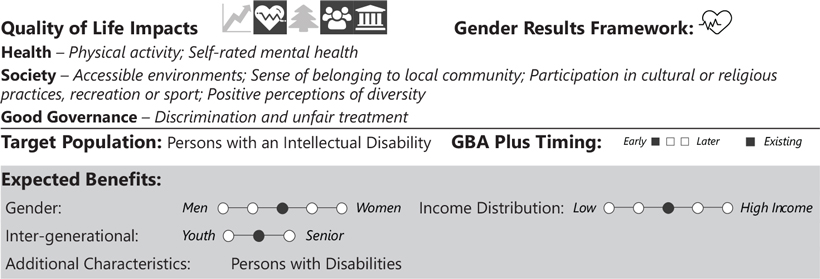

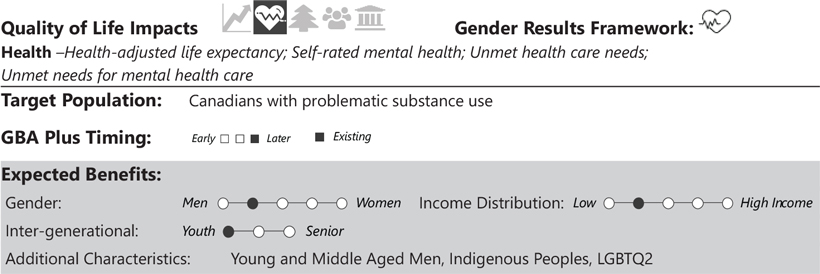

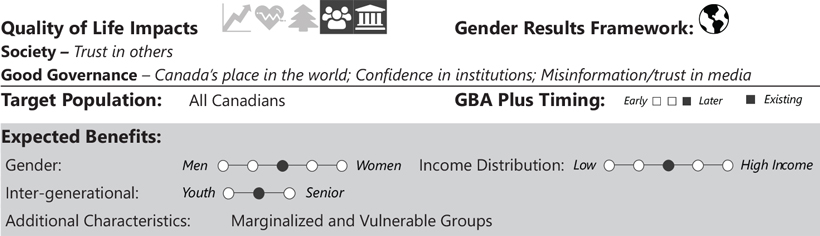

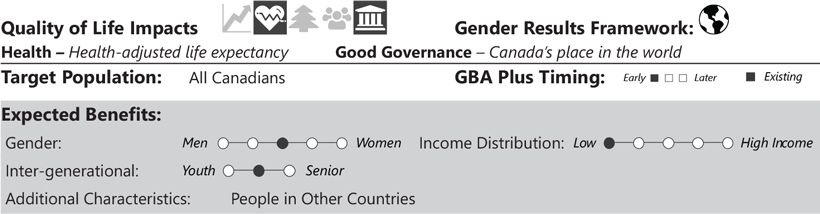

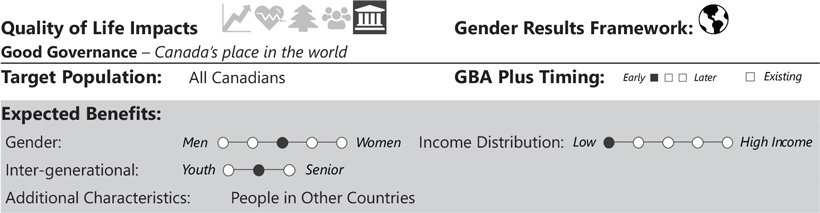

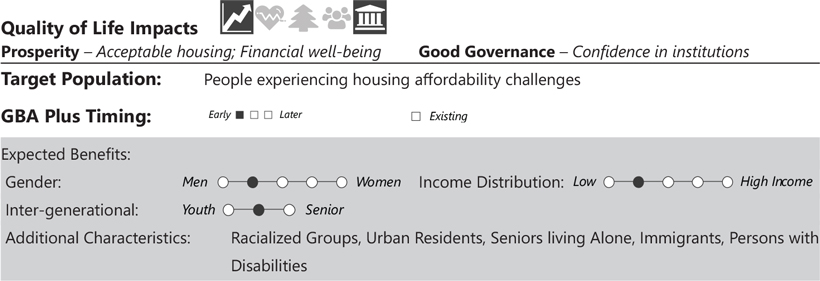

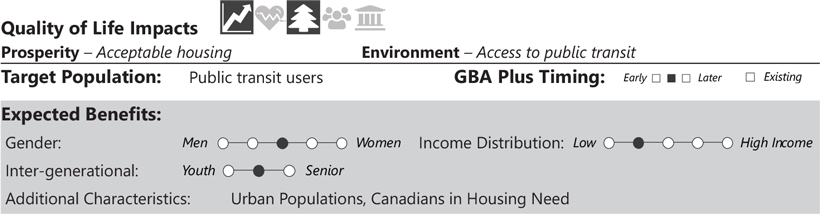

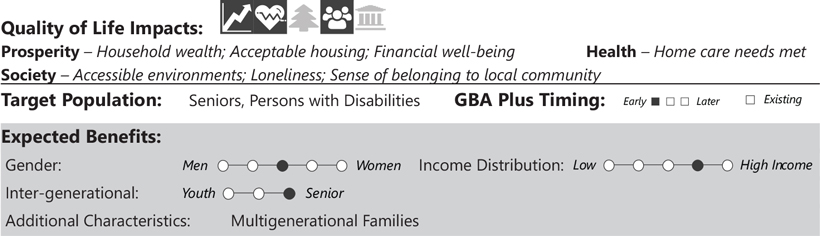

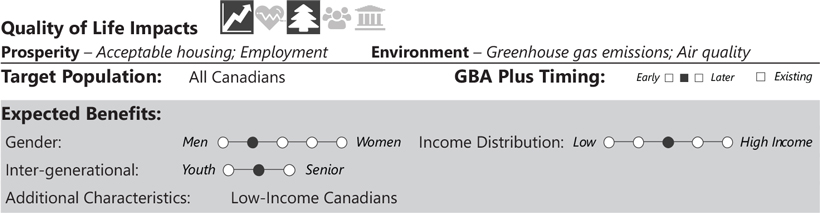

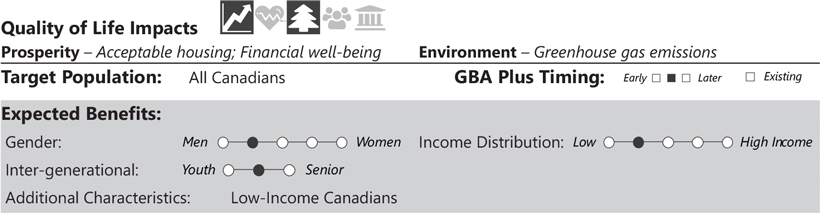

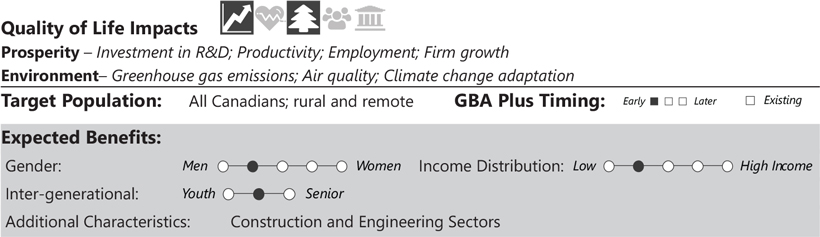

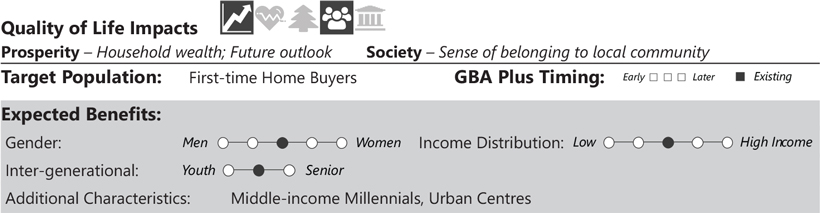

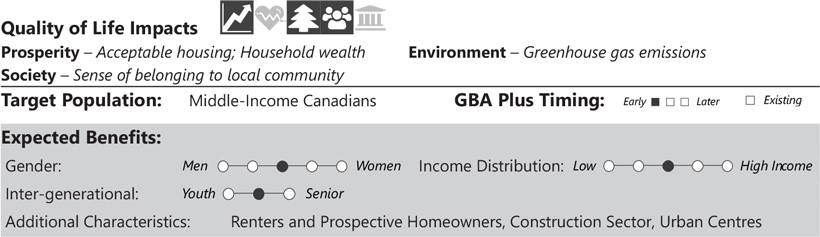

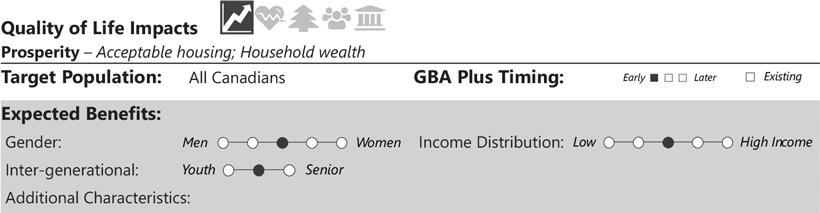

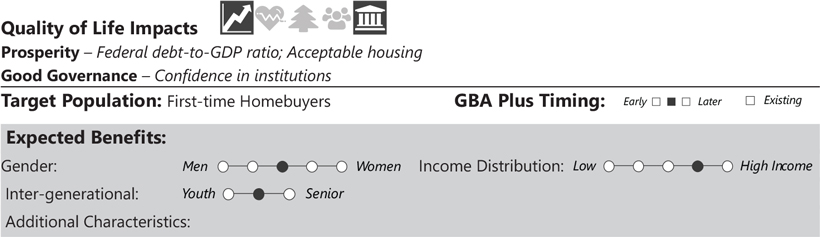

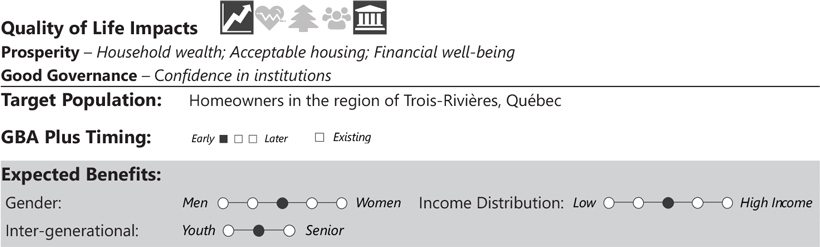

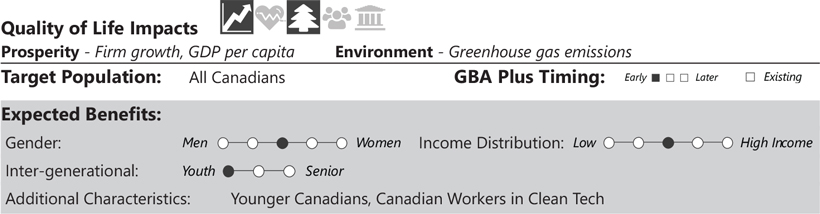

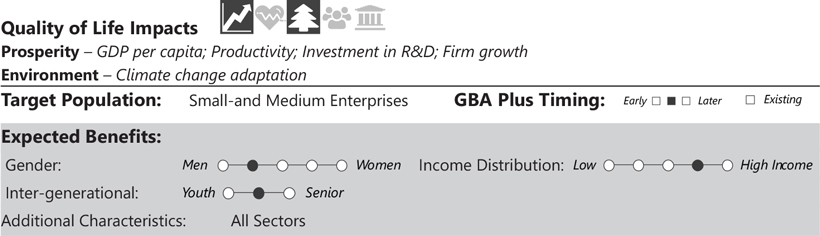

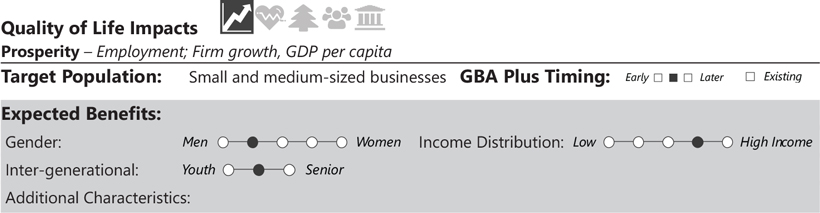

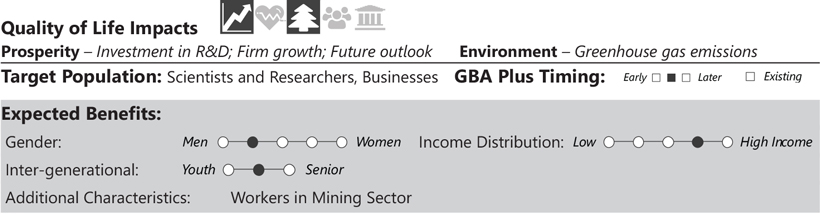

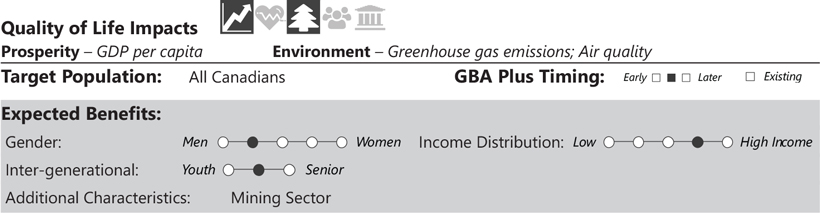

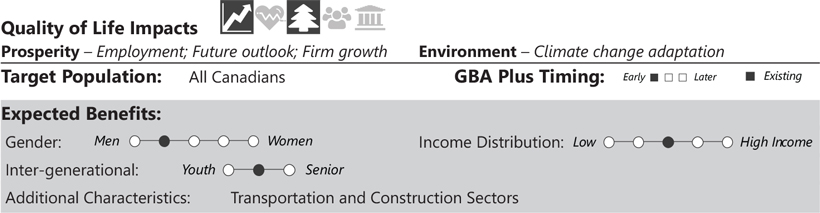

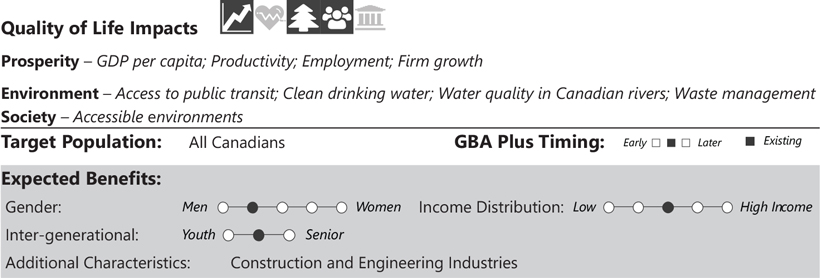

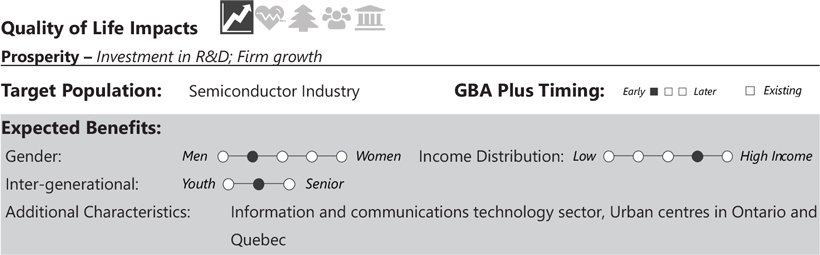

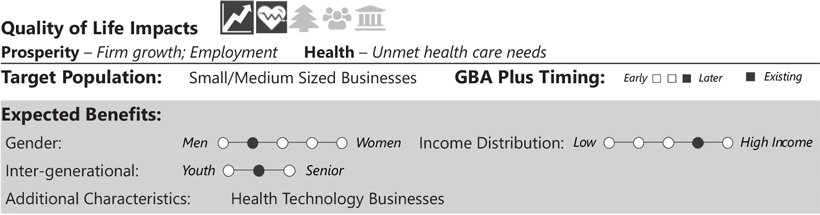

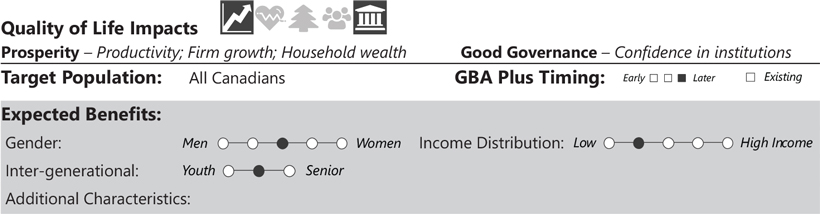

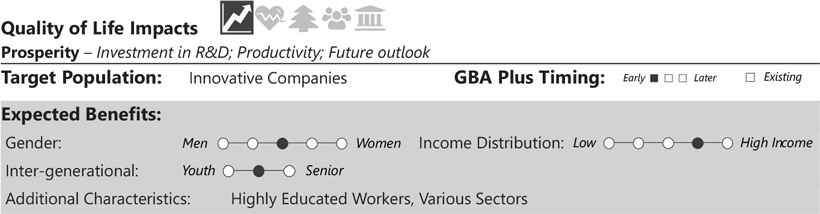

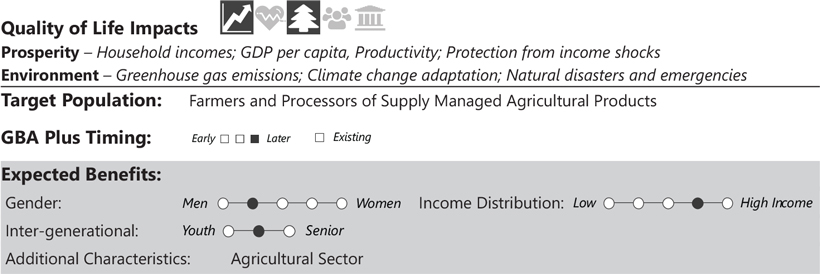

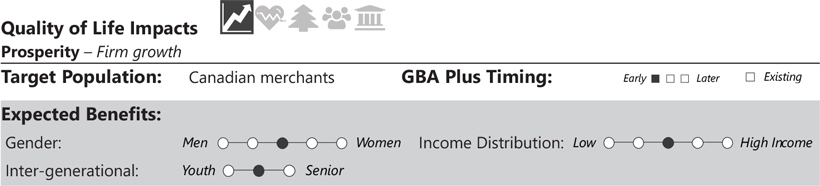

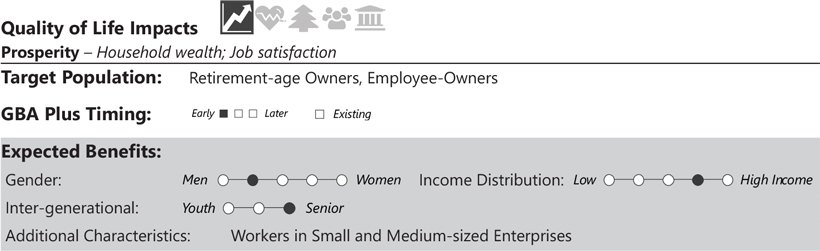

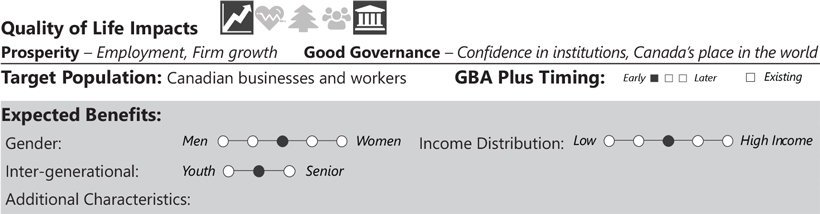

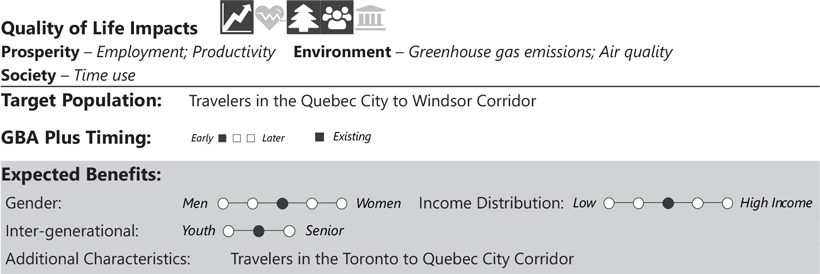

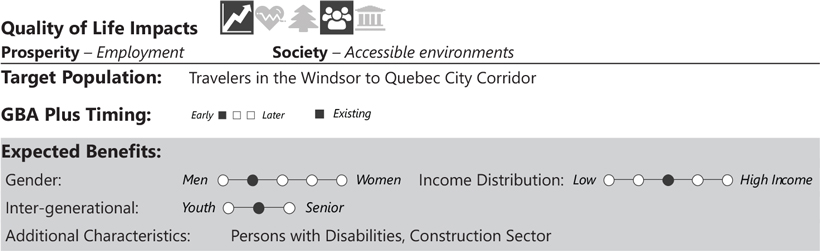

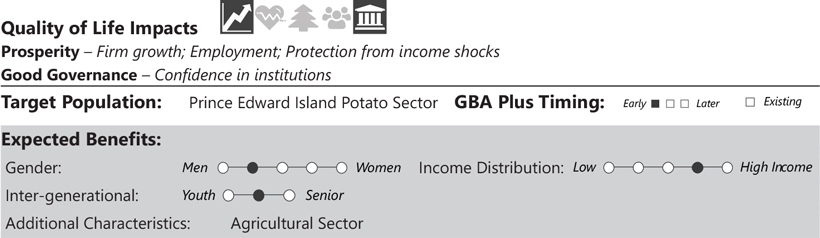

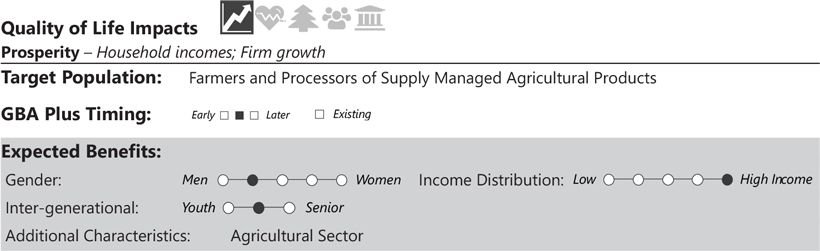

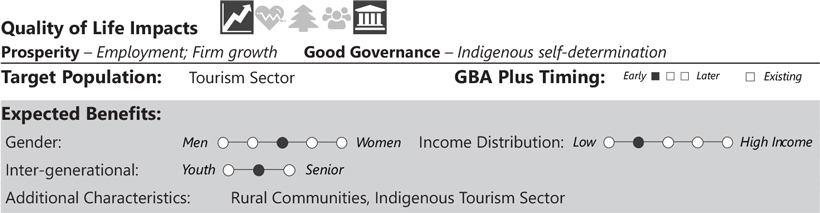

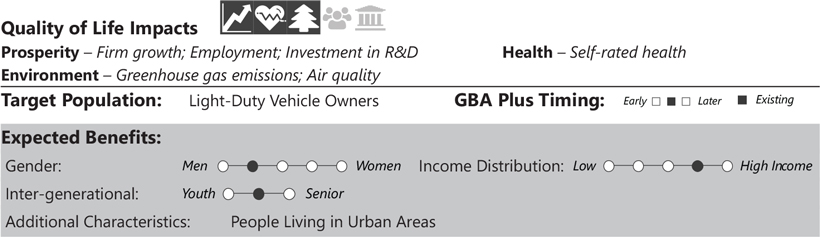

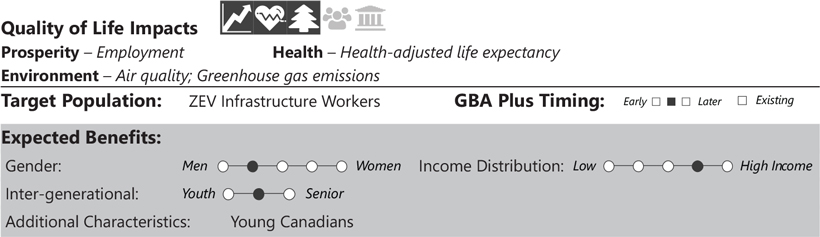

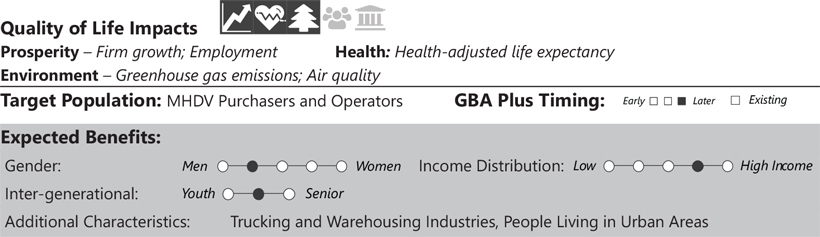

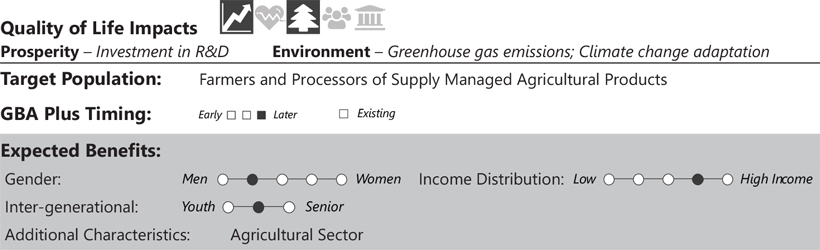

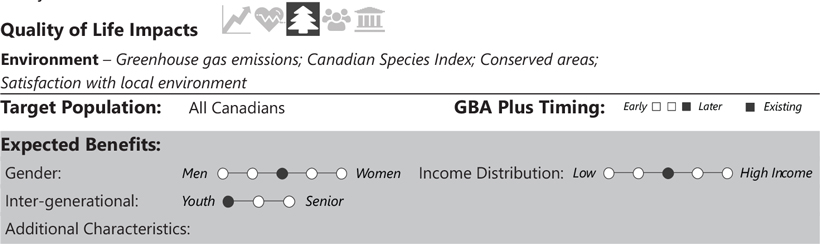

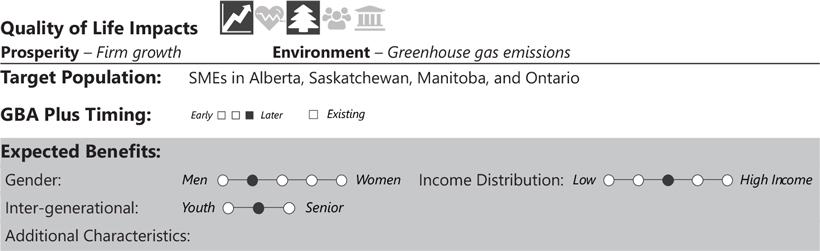

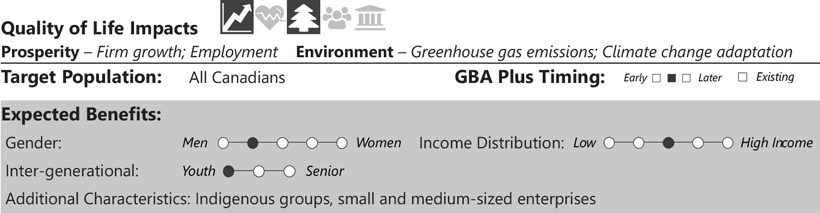

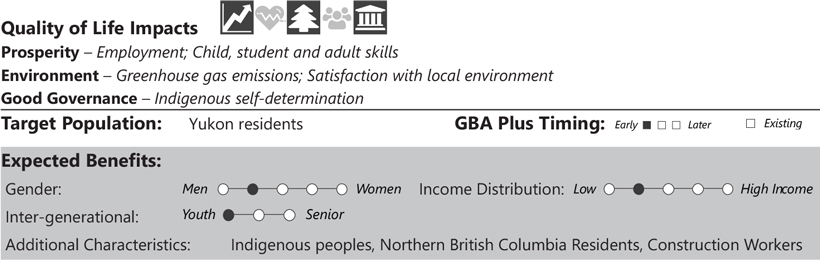

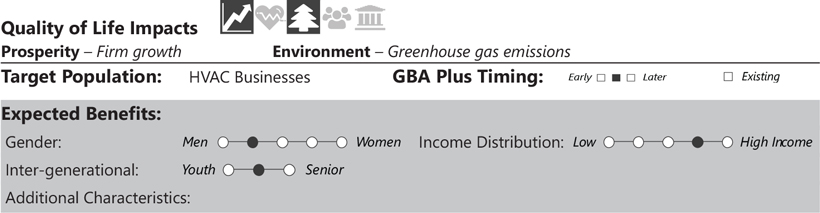

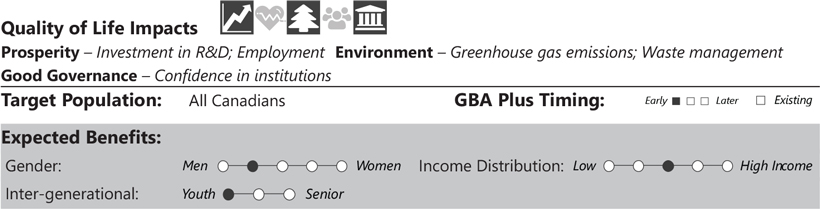

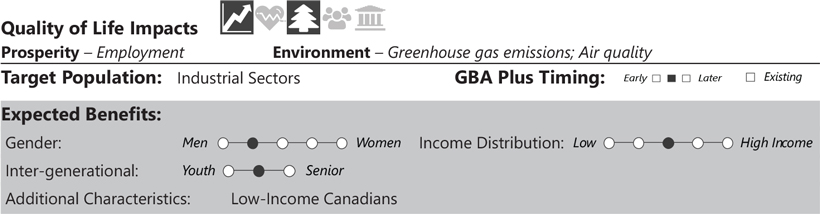

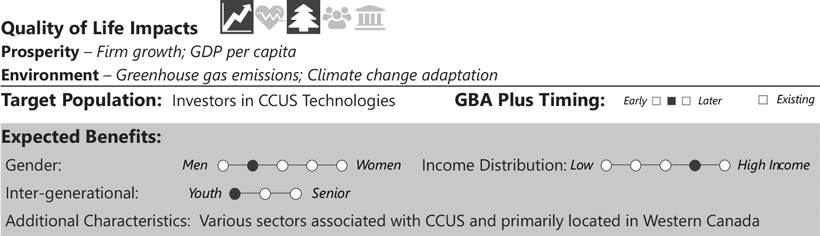

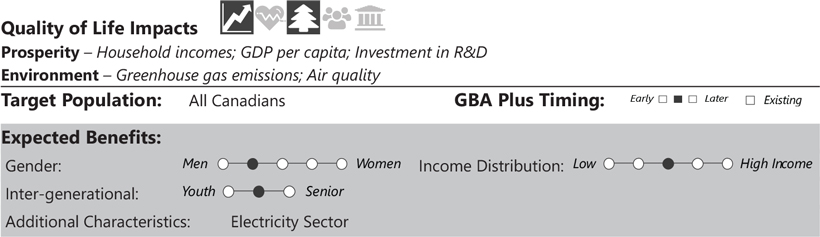

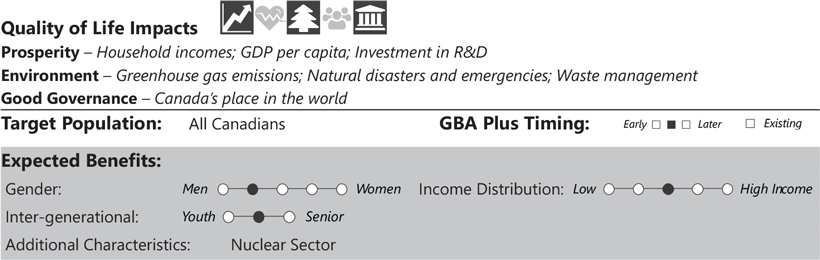

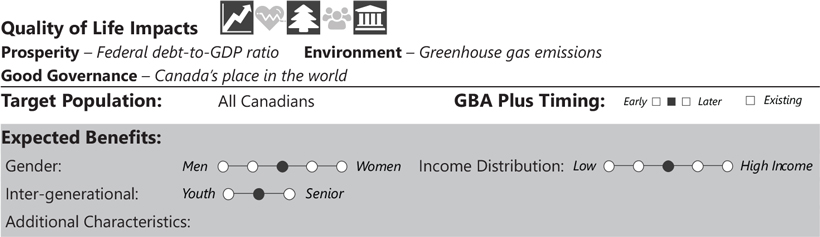

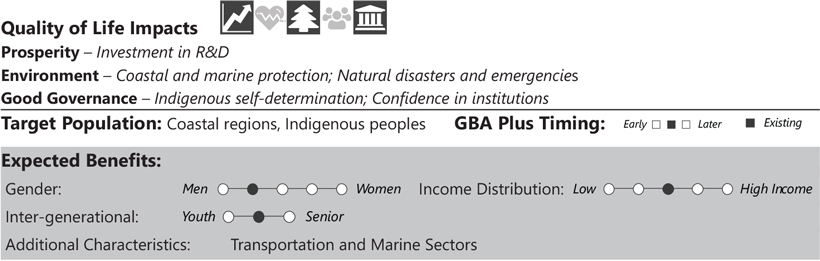

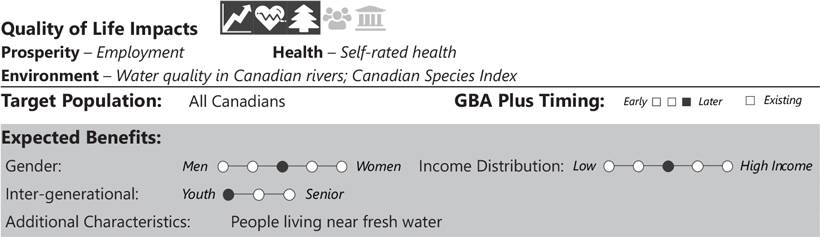

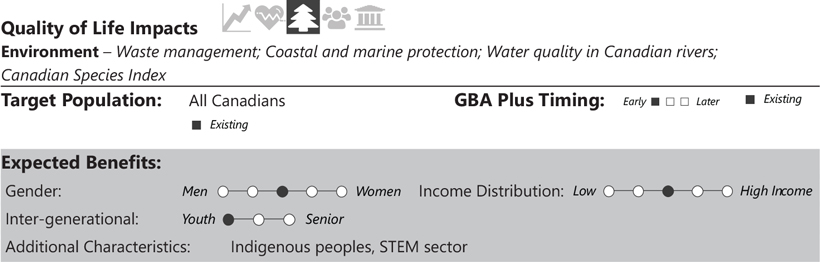

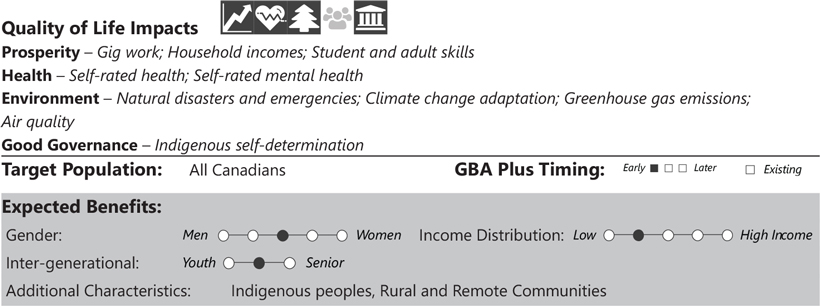

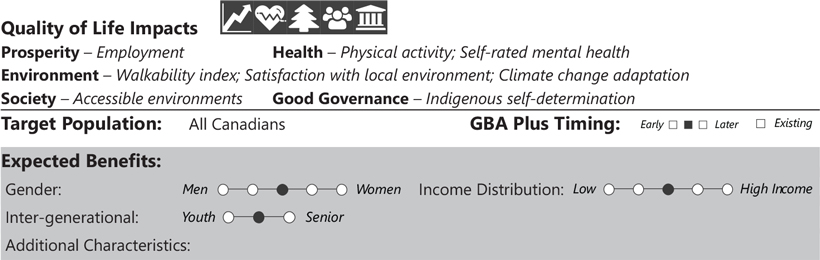

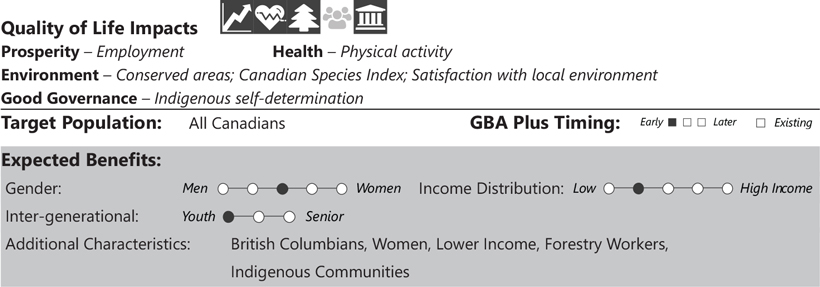

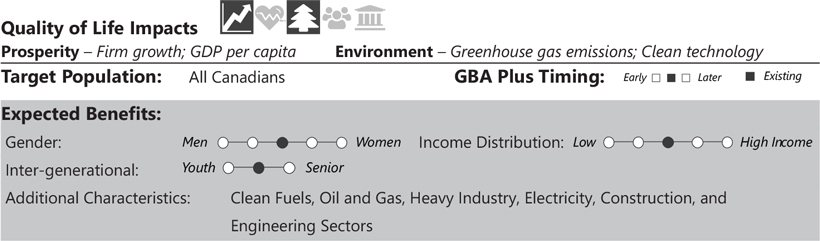

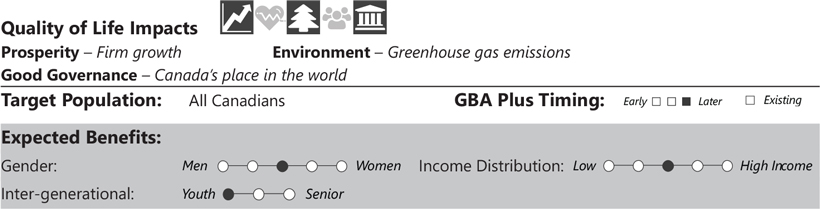

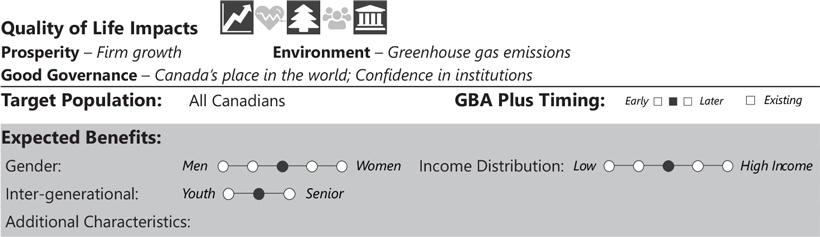

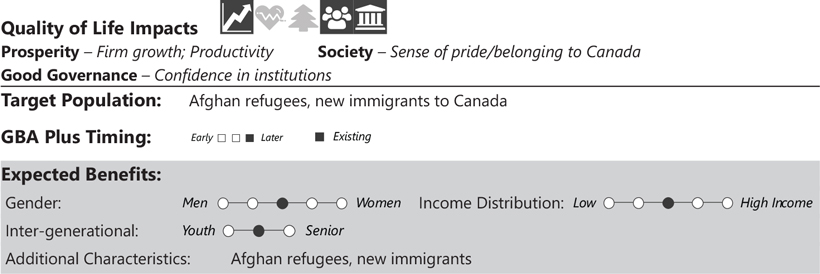

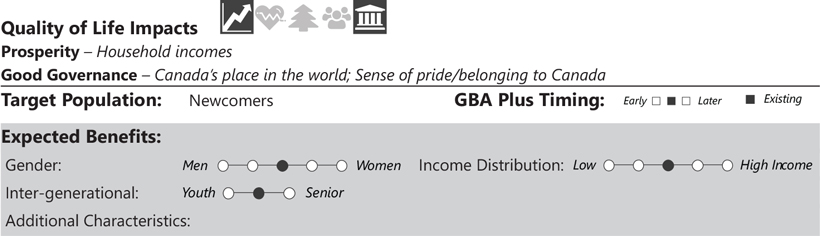

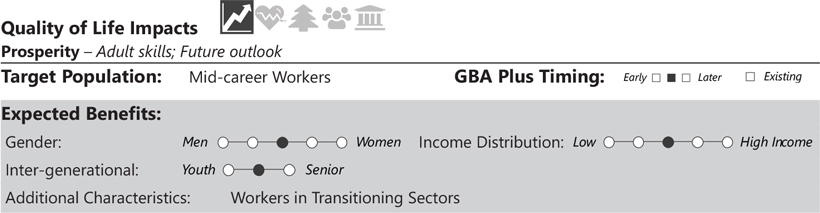

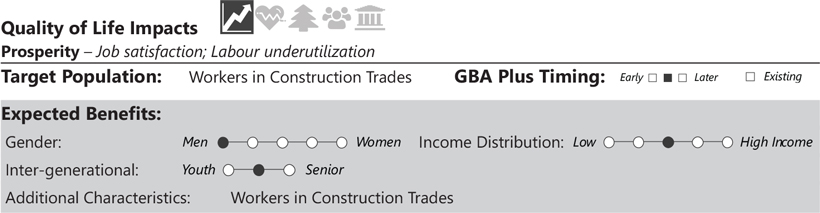

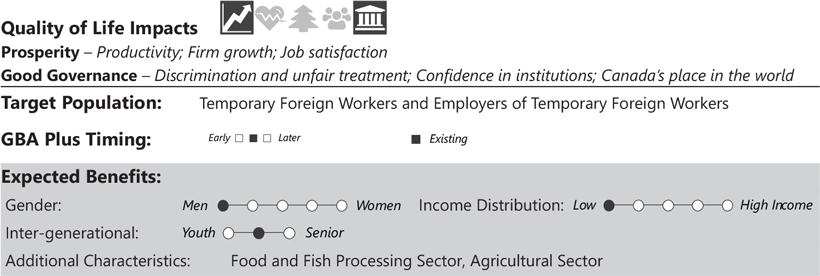

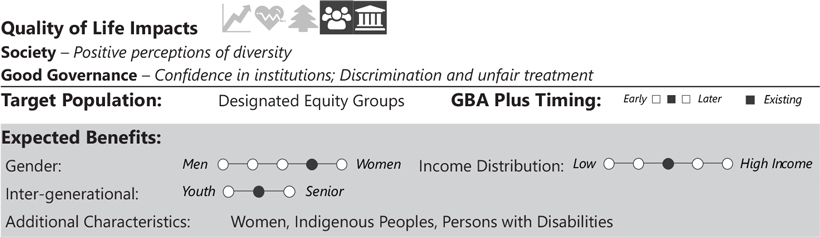

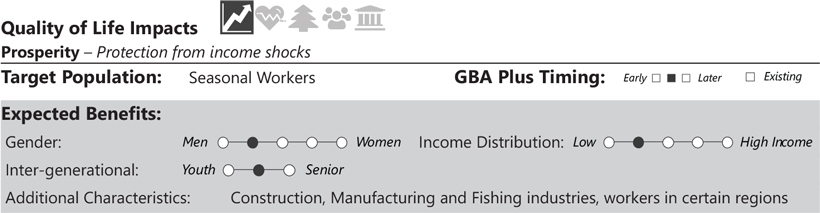

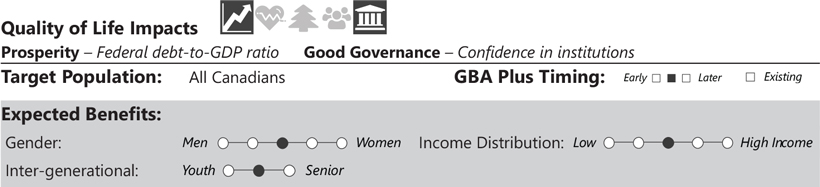

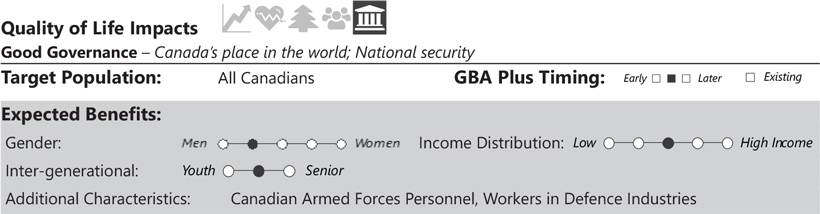

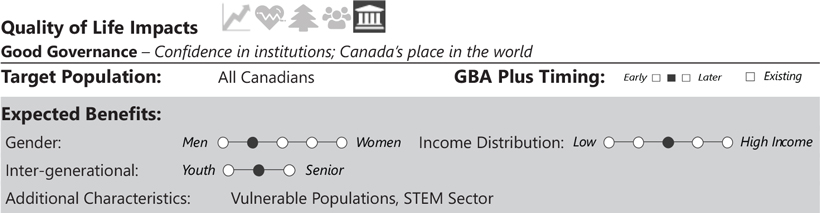

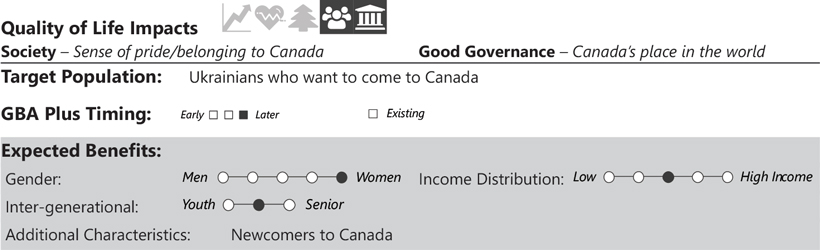

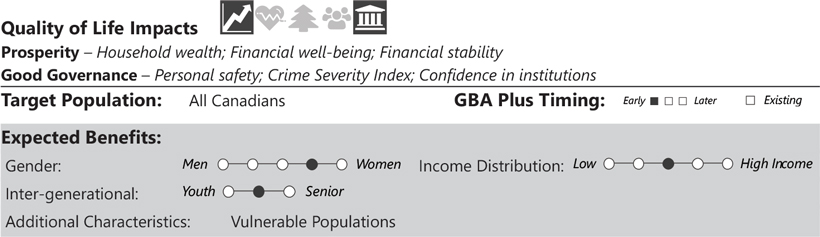

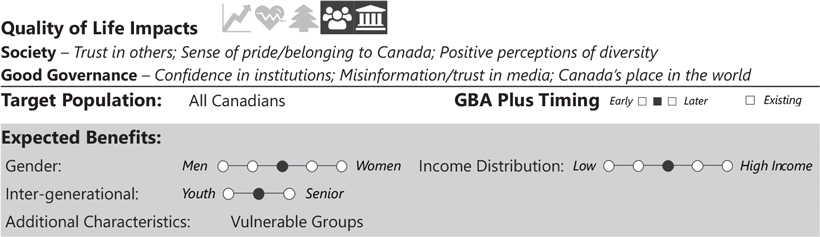

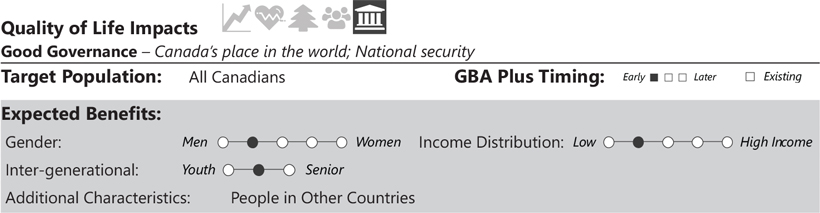

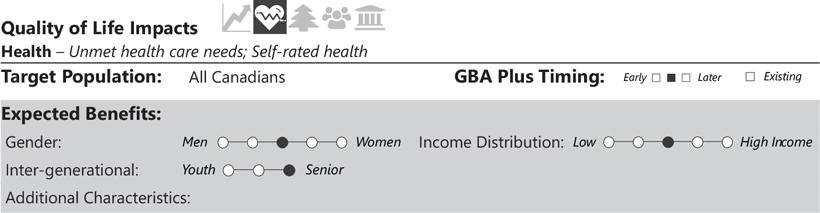

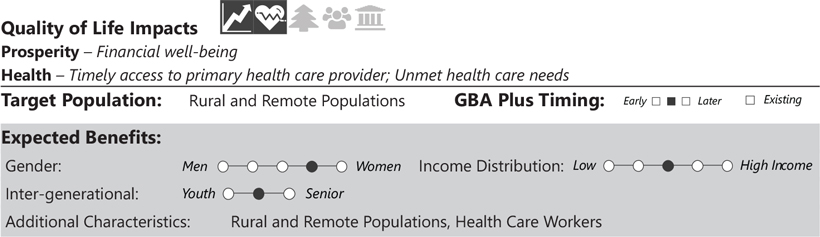

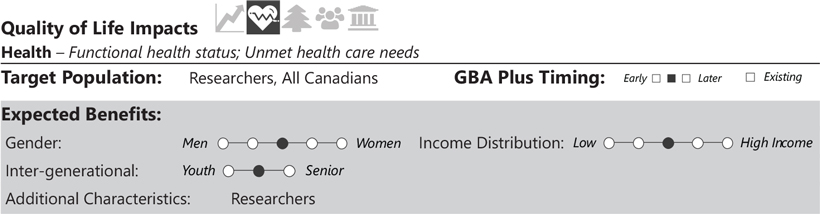

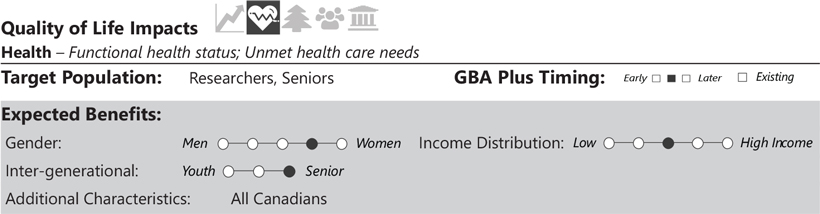

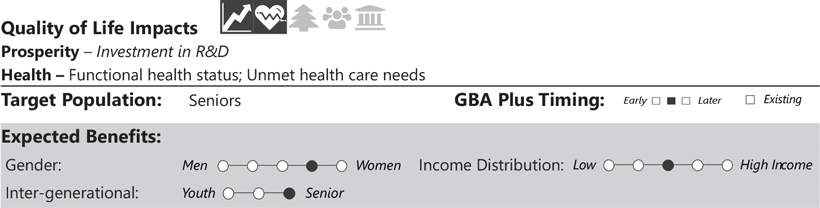

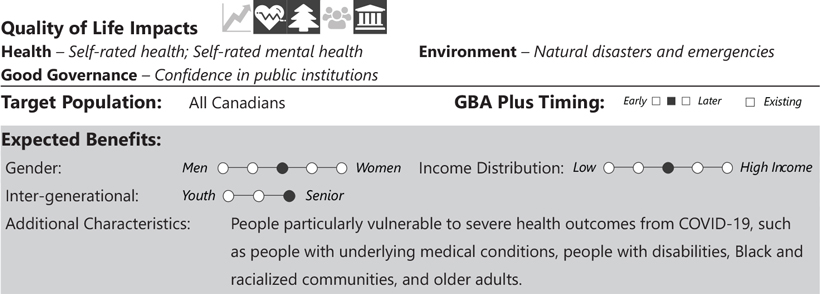

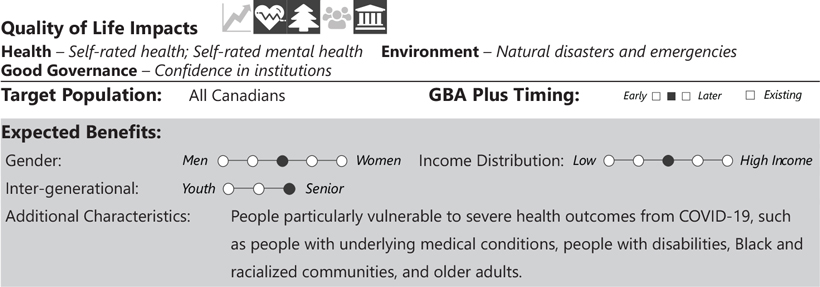

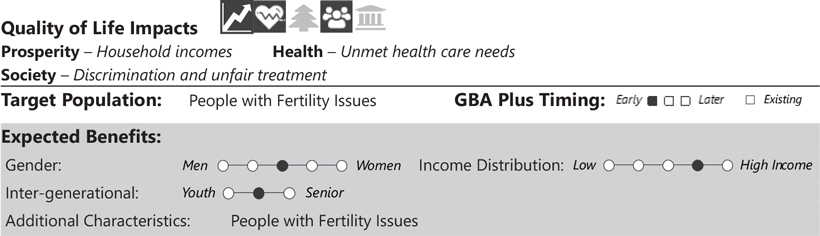

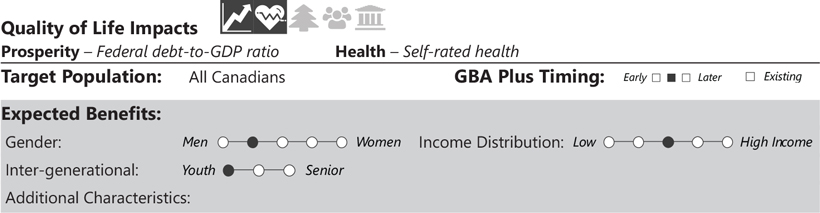

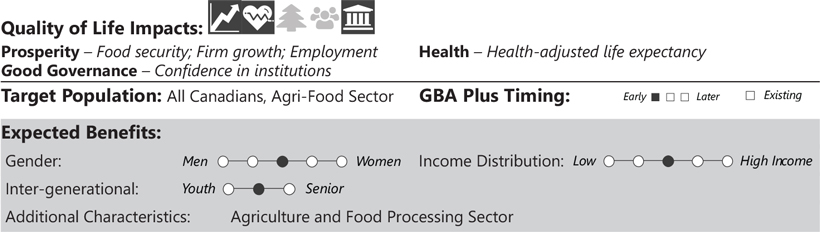

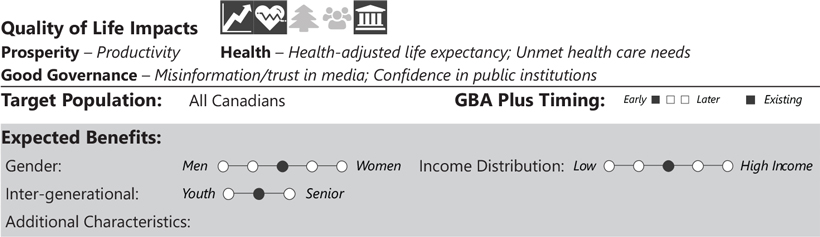

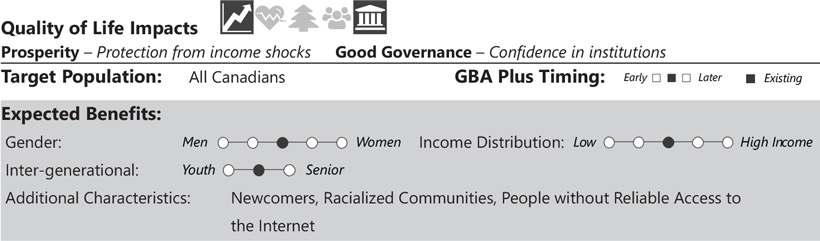

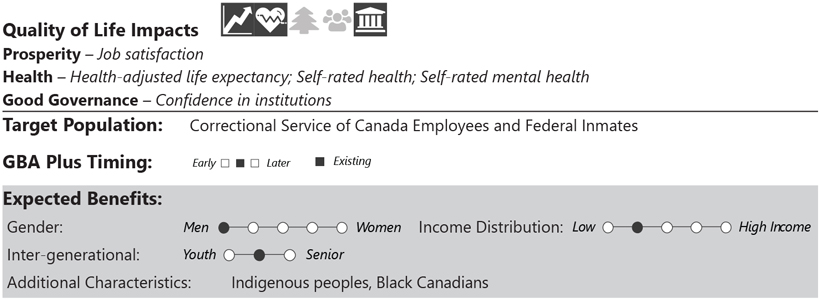

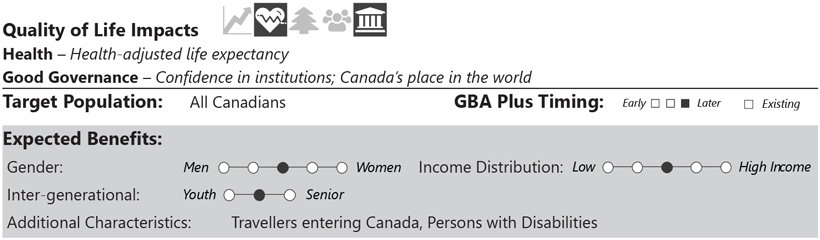

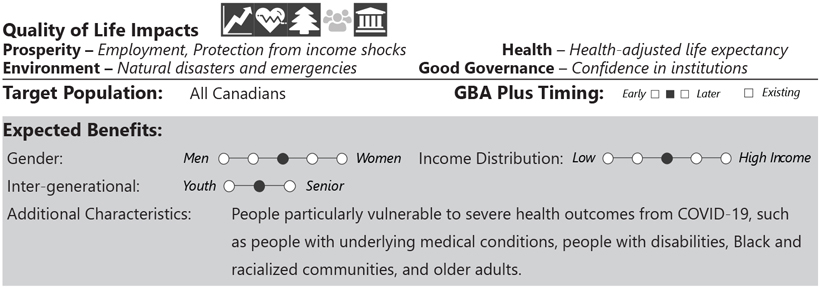

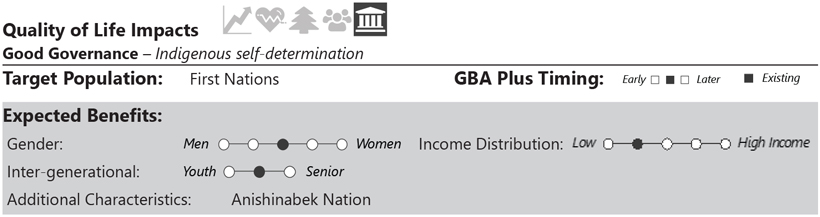

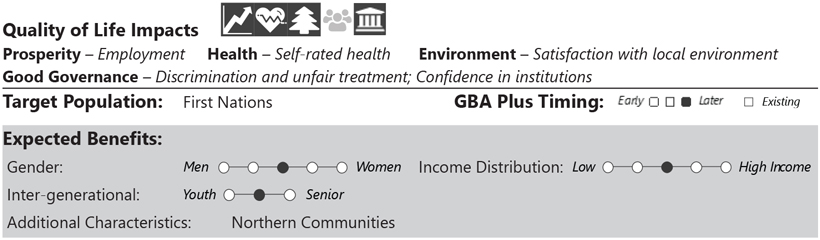

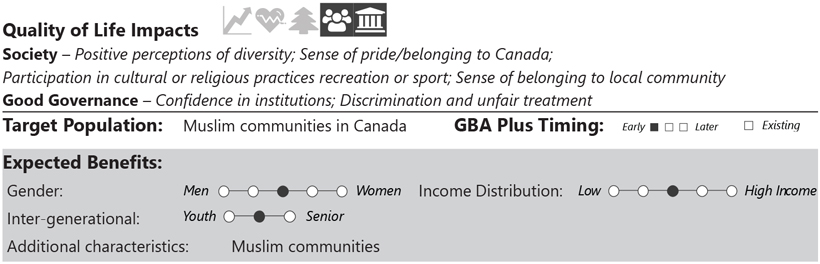

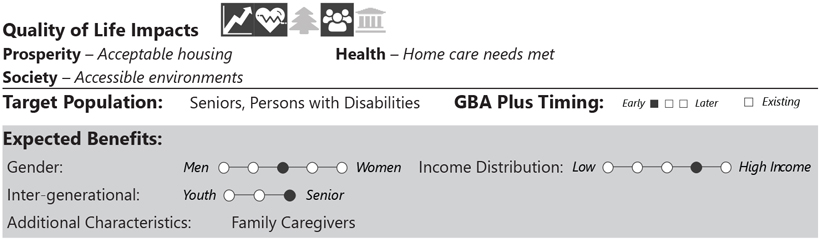

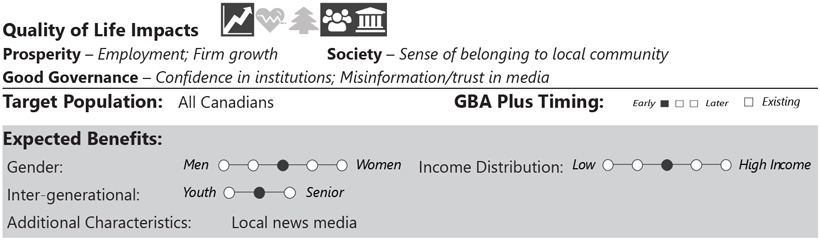

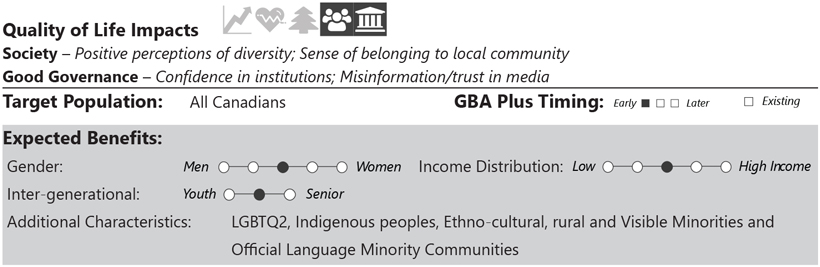

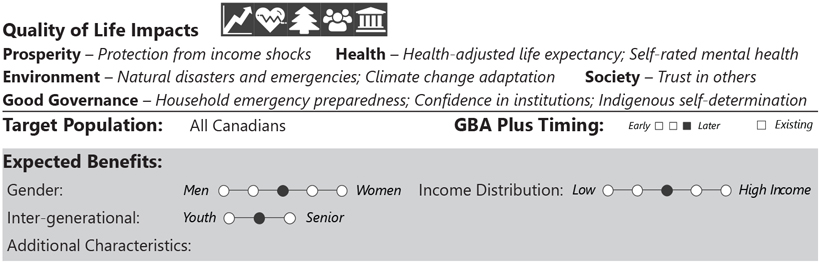

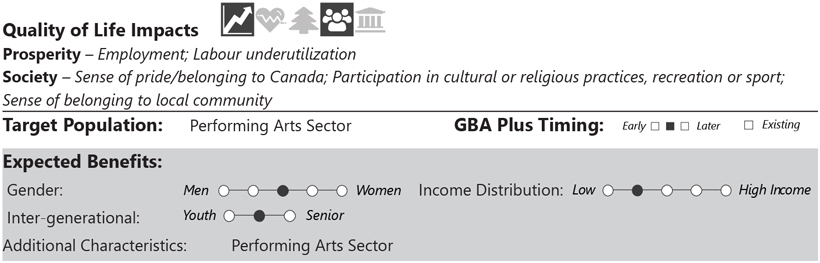

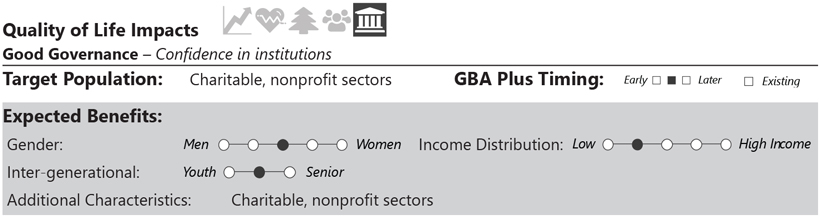

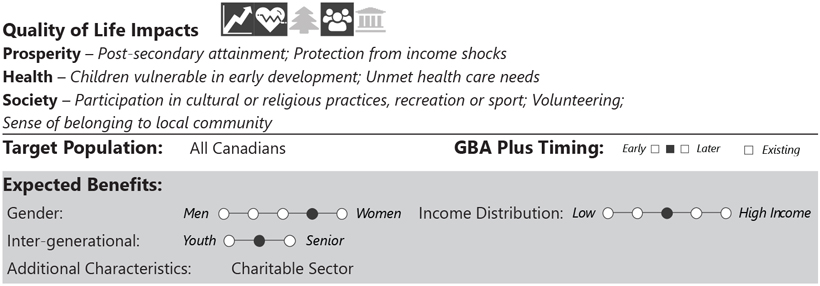

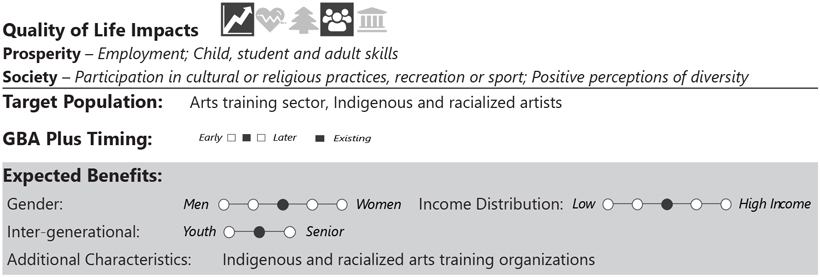

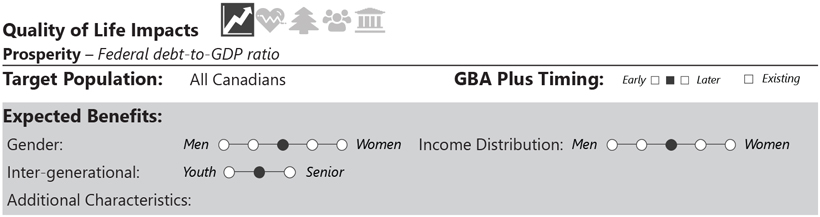

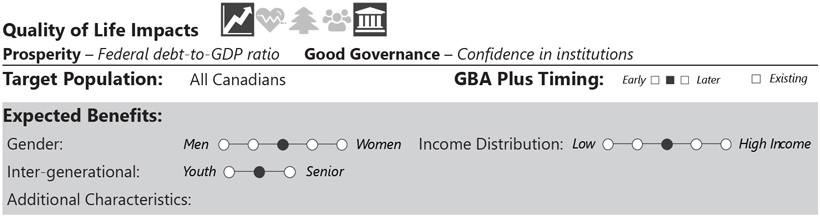

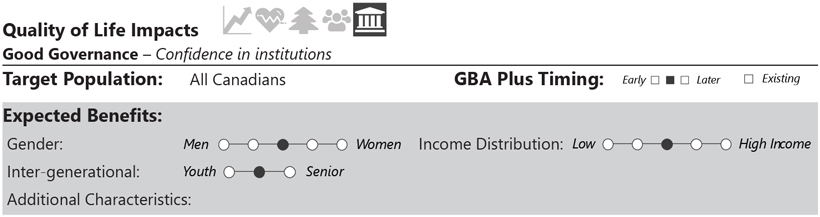

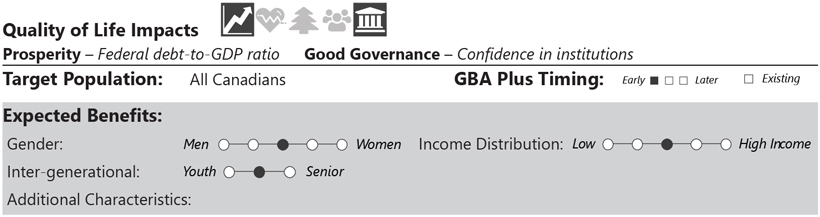

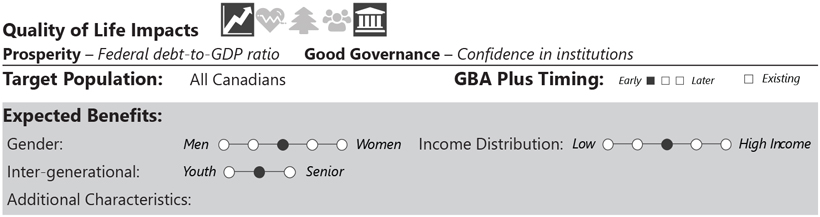

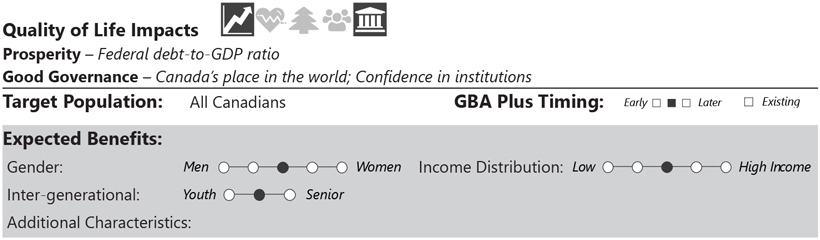

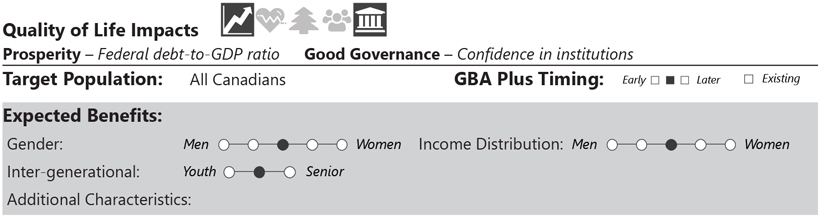

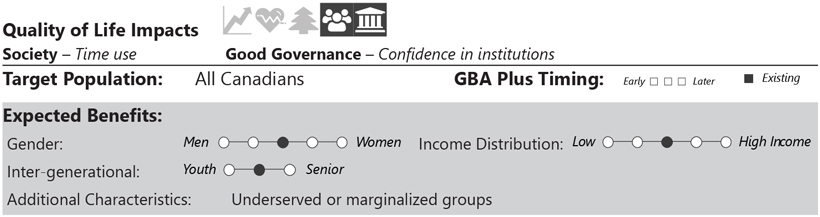

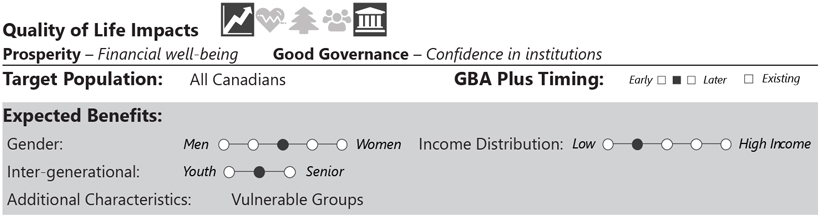

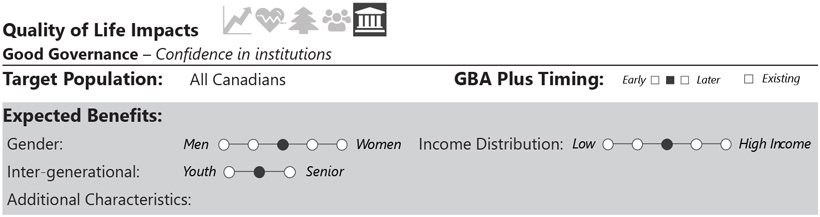

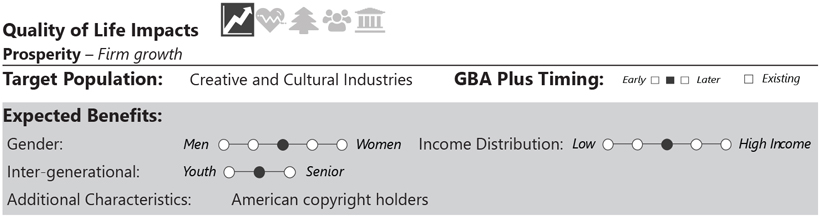

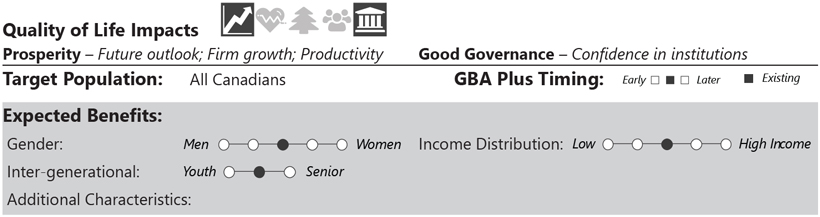

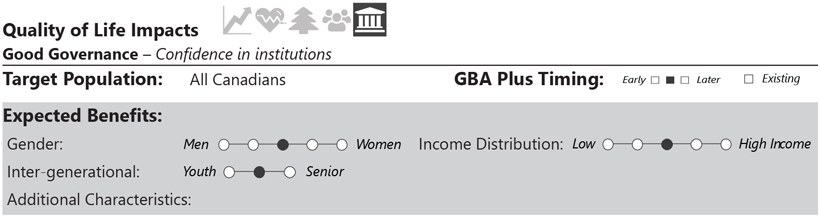

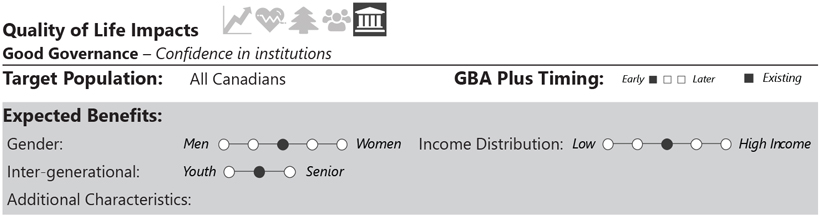

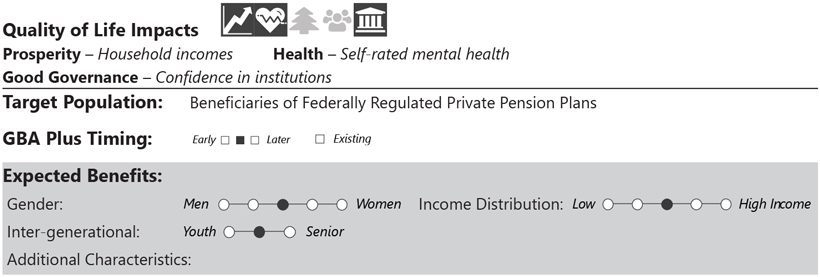

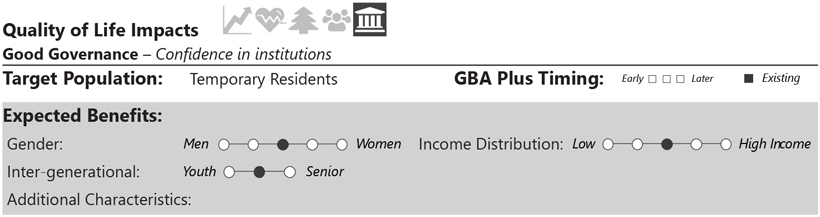

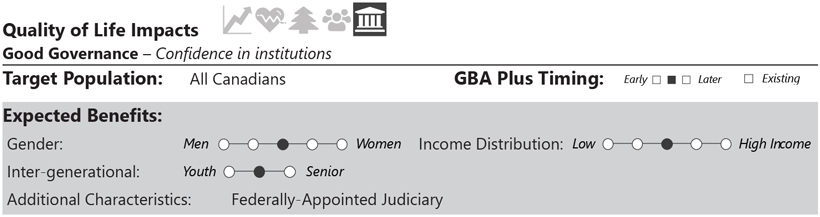

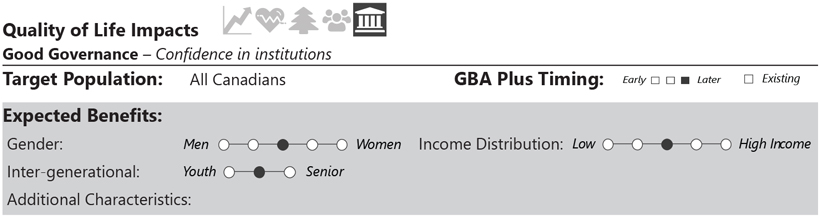

GBA Plus Responsive Approach

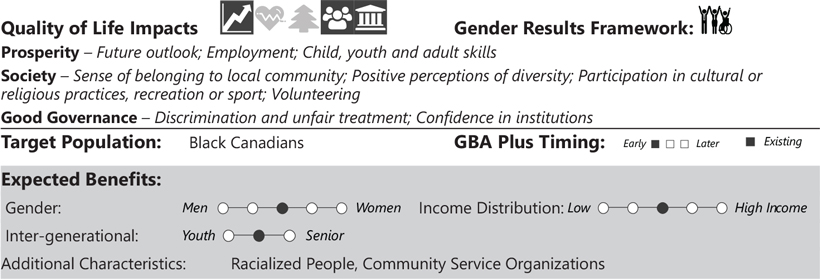

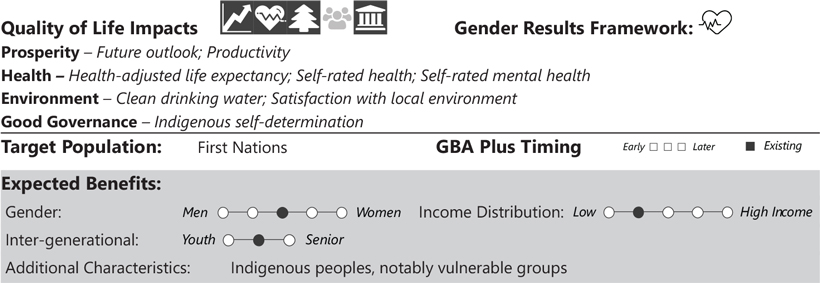

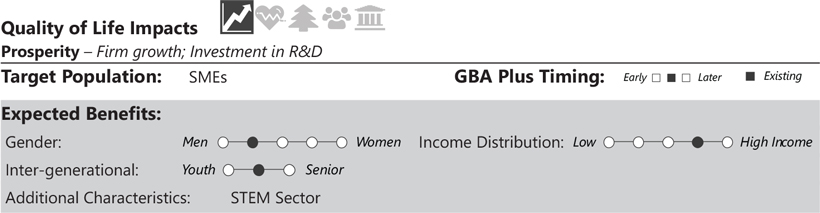

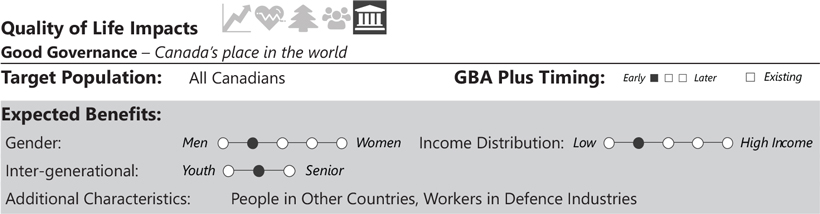

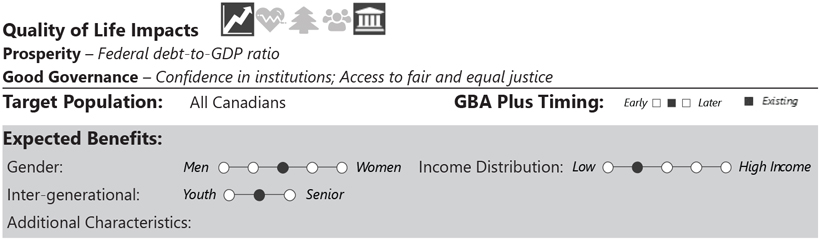

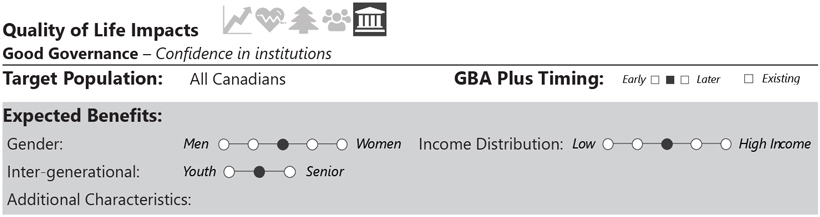

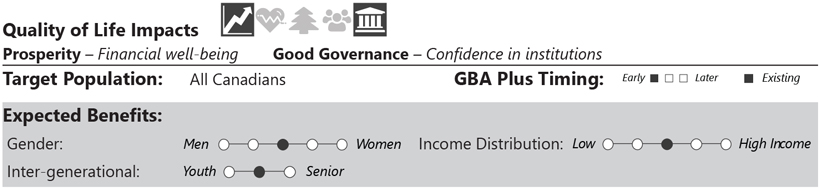

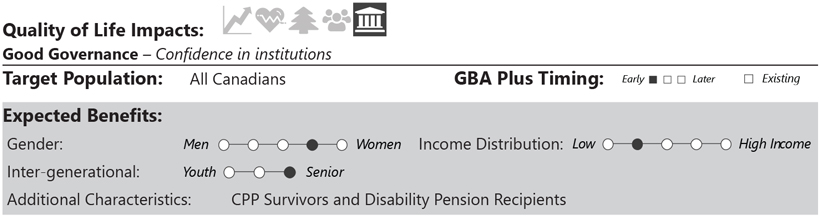

GBA Plus Responsive Approach

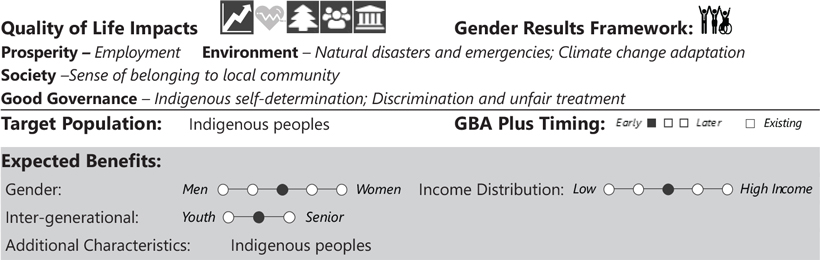

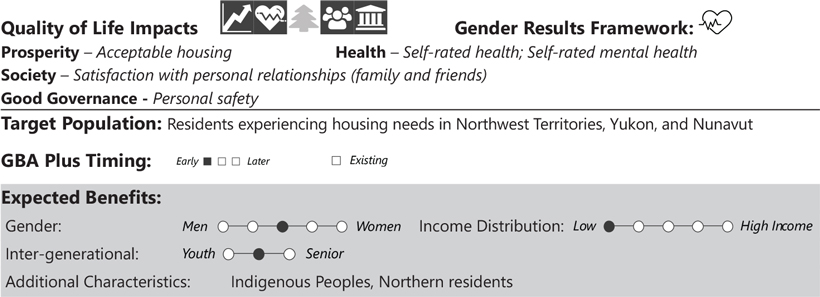

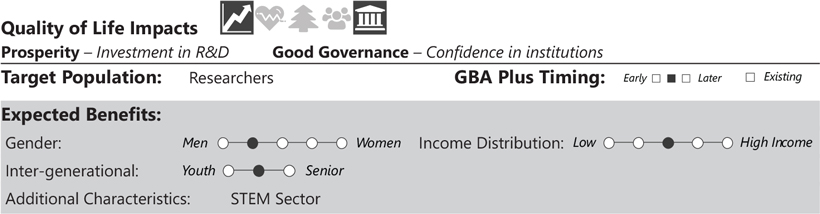

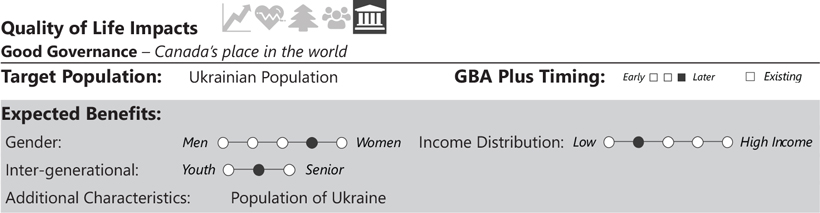

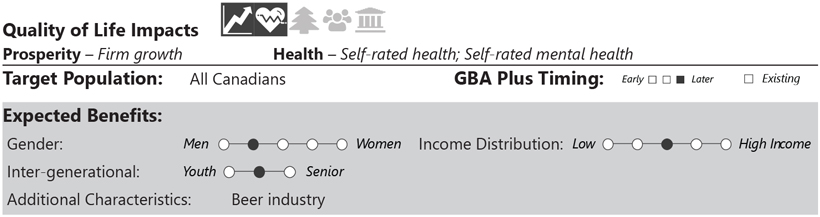

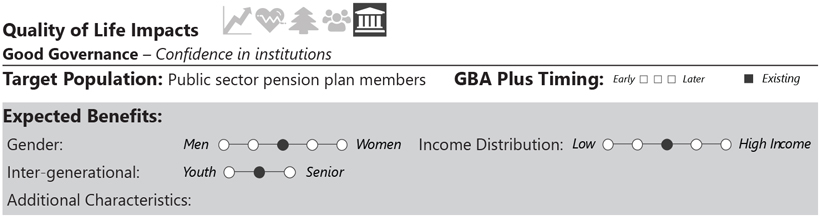

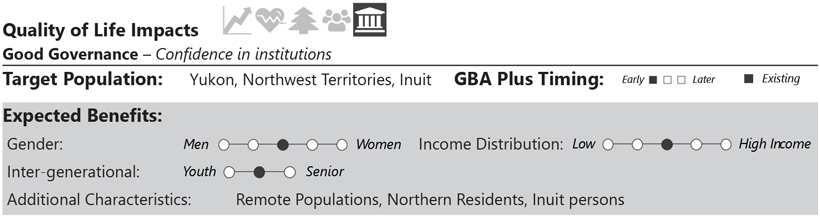

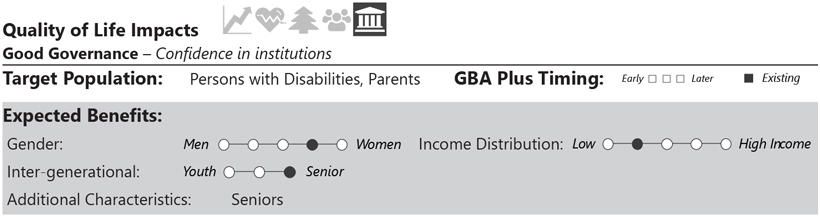

GBA Plus Responsive Approach

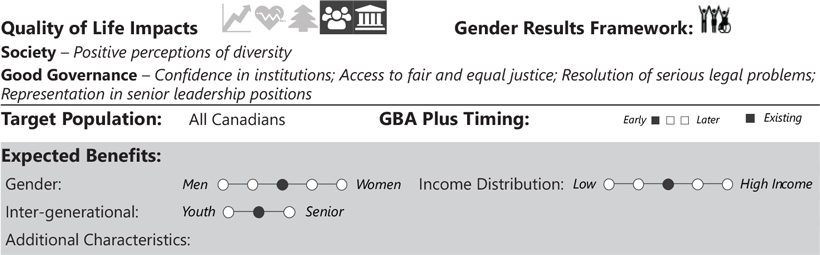

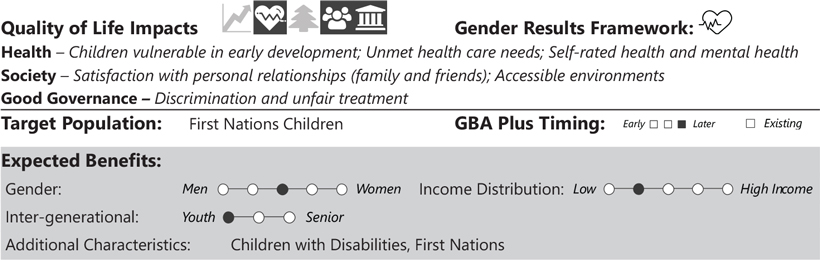

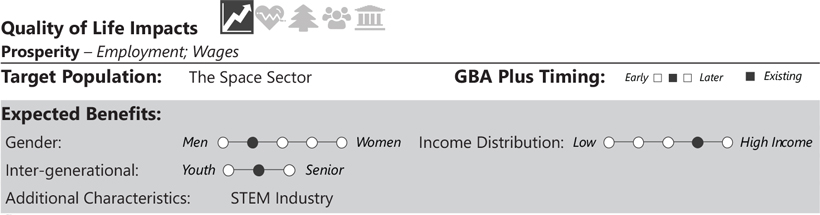

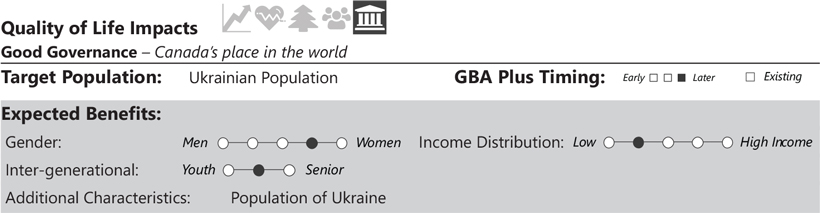

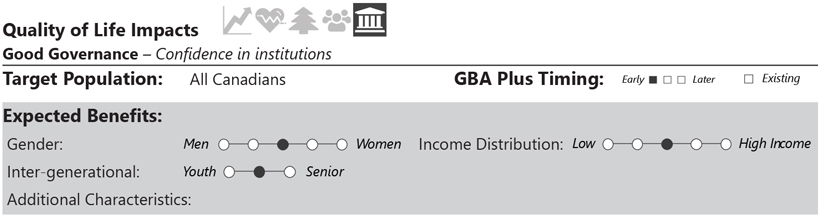

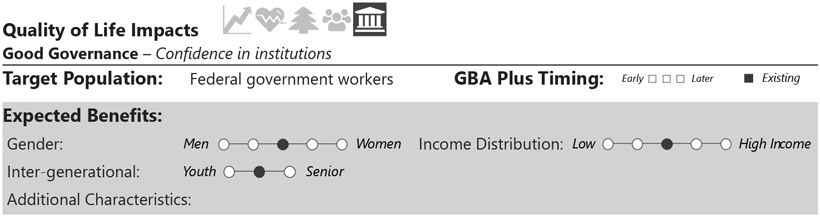

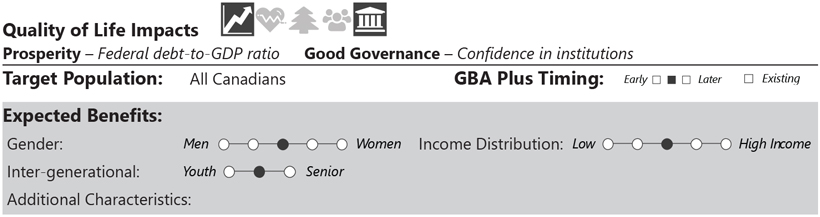

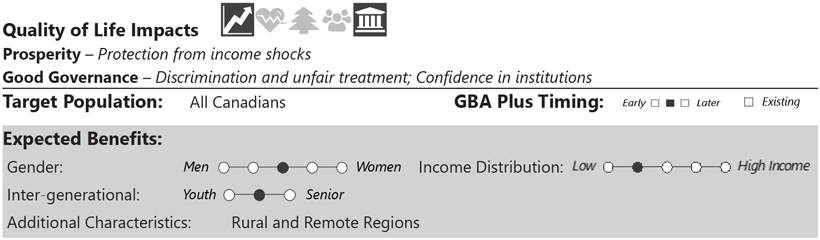

GBA Plus Responsive Approach

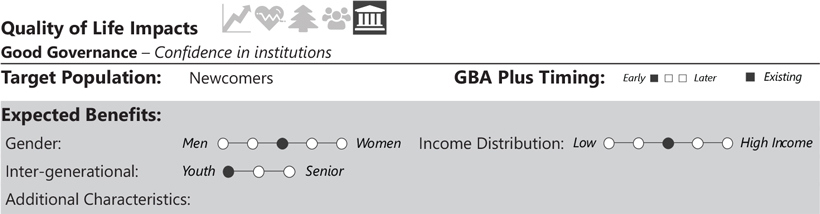

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

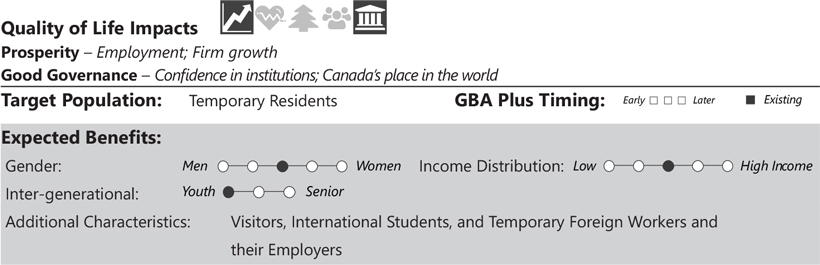

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

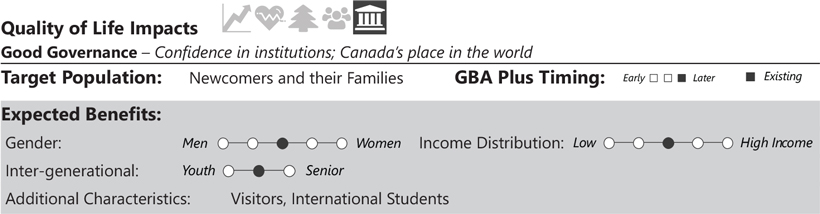

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach

GBA Plus Responsive Approach