Economic Developments1

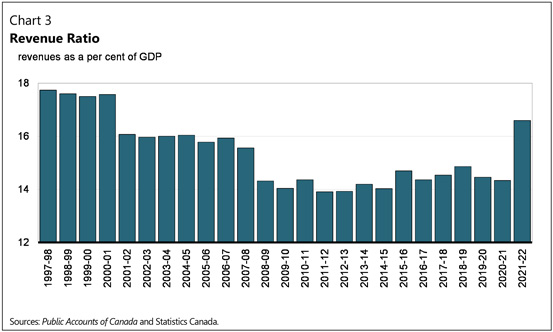

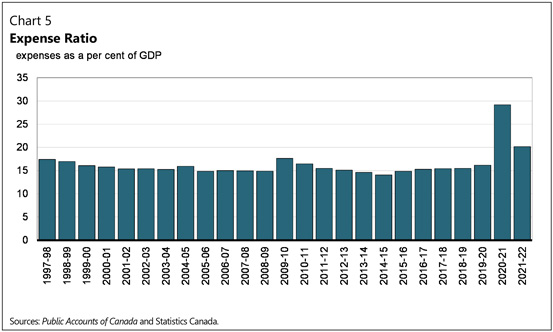

The Canadian economy staged a strong recovery in 2021 after contracting by 17 per cent and shedding 3 million jobs during the depths of the COVID-19 pandemic in 2020. Workers and businesses have displayed remarkable resilience as the world endured multiple waves of COVID-19. Real GDP returned to pre-pandemic levels earlier than expected, while Canada’s jobs recovery has meanwhile outperformed most of its G7 peers and surpassed expectations.

For 2021 as a whole, real GDP expanded 4.5 per cent, returning to its pre-pandemic level in the fourth quarter of 2021. The economy maintained a healthy momentum heading into 2022, leaving real GDP close to 1 per cent above its pre-pandemic level by the first

quarter—the second fastest recovery among G7 peers behind only the United States. The solid economic conditions also helped bring close to 870,000 additional Canadians in employment relative to 2020, contributing to a notable decline in the unemployment rate. Elevated demand, particularly for goods, paired with supply chain bottlenecks, meanwhile drove an increase in consumer prices of 3.4 per cent. This, along with the strength in commodity prices, contributed to the solid rise in Canada’s nominal GDP, the broadest measure of the tax base, which grew 13 per cent in 2021 after contracting by 4.5 per cent in 2020.

Canada entered the 2021–22 fiscal year just as the impacts of the subsequent pandemic waves of fall 2020 and winter 2021 were beginning to subside, providing strong footing to the economy heading into the spring of 2021. Provincial re-openings and the loosening of related public health measures supported a solid rebound in employment, with the economy adding more than 700,000 jobs between June and November 2021, bringing employment back to its pre-pandemic level. Overall, Canada experienced one of the fastest job recoveries among G7 economies.

As the Canadian economy was recovering, the Omicron variant of COVID-19 emerged in late fall, triggering household cautiousness and the reintroduction of targeted restrictions. Public health measures and widespread worker absences related to the Omicron variant slowed economic activity at the beginning of the first quarter of 2022 and led to a loss of 200,000 jobs in January 2022. However, the overall economic impacts were milder and shorter-lived than previous waves, with real GDP and employment rebounding to pre-Omicron levels by February 2022.

By that point, there was growing optimism that, with the worst of the pandemic behind us and higher vaccination rates, economies would return to normal, allowing consumer demand to rebalance away from traded goods, which would support the easing of supply chain bottlenecks globally. The end of February 2022 was however marked by one of the most significant geopolitical developments of the last decades with the invasion of Ukraine by Russia. The war had far-reaching economic impacts, weighing on global activity and resulting in greater volatility in financial markets. Russia and Ukraine are both critical suppliers of many commodities, including energy and food, and with the war disrupting global transportation and imports of these products, this led to sudden increases in the prices of those commodities. These price pressures were rapidly felt by consumers globally. By the end of March 2022, Canadian consumers were paying roughly 25 per cent more for gasoline than they were just three months prior.

It is also against the stronger economic backdrop of spring 2021 that inflation began to accelerate, surpassing the Bank of Canada’s target’s upper bound of 3 per cent for the first time since 2011. The inflation rate progressively increased and reached 6.7 per cent year-over-year by the end of 2021–22. The war-induced rise in commodity prices paired with rebounding demand and acute supply chain stress pushed inflation to rates not seen since the early 1990s. The Bank of Canada started to tighten monetary policy with a 25 basis points hike in its policy rate to 0.5 per cent in early March 2022. The increase was the first time the Bank has tightened monetary policy since 2018. Since then, the Bank of Canada has raised its policy rate three more times by a combined 200 basis points to 2.5 per cent, while inflation reached 8.1 per cent in June, before decelerating slightly in July.

| 1 | This section incorporates data available up to and including August 16, 2022. The annual results are on a calendar year basis. |

8