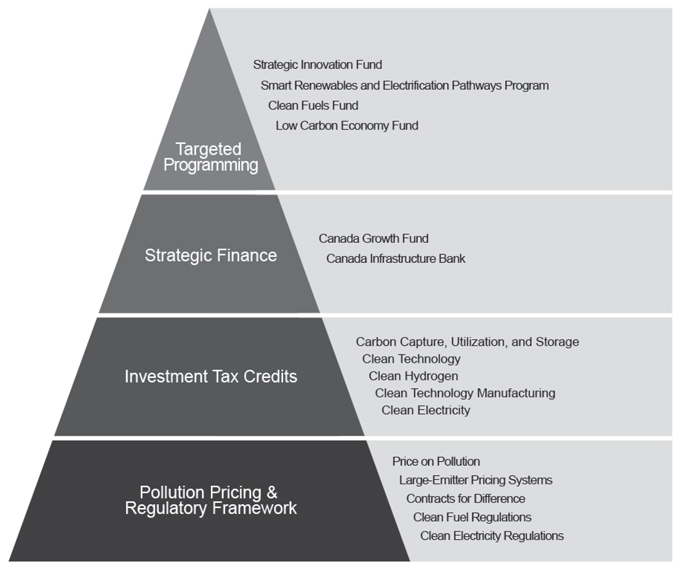

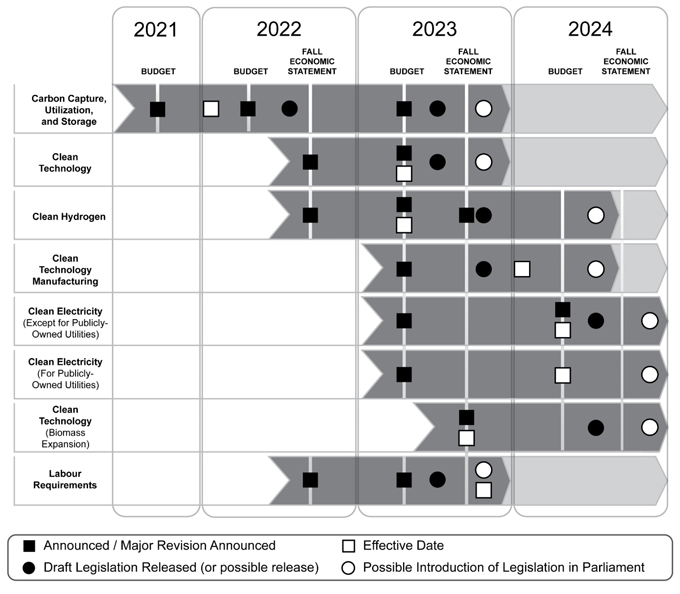

As an important pillar of Canada’s clean economy jobs plan, the government is focused on implementing, on a priority basis, the new clean economy investment tax credits for carbon capture, utilization, and storage; clean technology adoption; clean hydrogen; clean technology manufacturing; and clean electricity. The following timelines outline the federal government’s path towards delivering all investment tax credits in 2024. The clean economy investment tax credits will be implemented as follows, subject to the results of consultations: Carbon Capture, Utilization, and Storage (CCUS): - Legislation will be introduced in Parliament this fall. - Consultations on draft legislation were held from August 4, 2023, to September 8, 2023. - The tax credit would be available from January 1, 2022. Clean Technology: - Legislation will be introduced in Parliament this fall. - Consultations on draft legislation were held from August 4, 2023, to September 8, 2023. - The tax credit would be available from March 28, 2023. Clean Hydrogen: - Consultations on draft legislation will launch this fall. - The government is targeting to introduce legislation in Parliament in early 2024. - The tax credit would be available from March 28, 2023. Clean Technology Manufacturing: - Consultations on draft legislation will launch this fall. - The government is targeting to introduce legislation in Parliament in early 2024. - The tax credit would be available from January 1, 2024. Clean Electricity (Except for Publicly-Owned Utilities): - Design and implementation details will be published in early 2024. - Consultations on draft legislation will launch in summer 2024. - The government is targeting to introduce legislation in Parliament in fall 2024. - The tax credit would be available from the day of Budget 2024 for projects that did not begin construction before March 28, 2023. Clean Electricity (For Publicly-Owned Utilities): - Consultations with provinces and territories will take place in 2024. - The government is targeting to introduce legislation in Parliament in fall 2024. - The tax credit would be available from the day of Budget 2024 for projects that did not begin construction before March 28, 2023. Expanding Eligibility for the Clean Technology and Clean Electricity Investment Tax Credits to Support Using Waste Biomass to Generate Heat and Electricity: - Consultations on draft legislation will launch in summer 2024. - The government is targeting to introduce legislation in Parliament in fall 2024. - The expansion of the Clean Technology investment tax credit would be available from the day of the 2023 Fall Economic Statement. - The expansion of the Clean Electricity investment tax credit would be available from the day of Budget 2024 for projects that did not begin construction before March 28, 2023. |