Accounting for Future Possible Developments

Since Budget 2024, the government identified significantly higher contingent liabilities, that is, possible obligations that have been assessed as likely to result in a future payment. While there were no payments associated with these new liabilities in the 2023-24 fiscal year, the federal government is following Canadian public sector accounting standards by transparently accounting for these estimated contingent liabilities in the 2023-24 financial results.

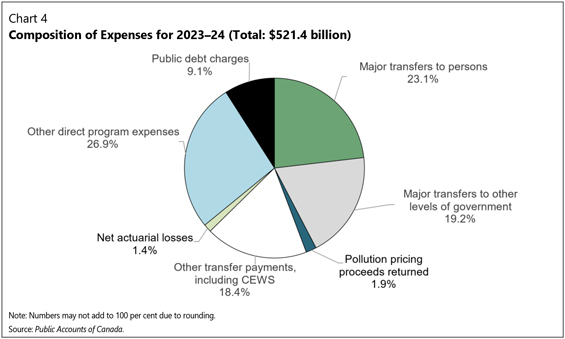

In 2023–24, the government recorded expenses totaling approximately $16.4 billion related to Indigenous contingent liabilities, in advancing its commitment to resolve past injustices and renew its relationship with Indigenous Peoples. In addition, the government recorded expenses totaling $4.7 billion related to COVID-19 pandemic expenses. Absent these expenses, the 2023–24 budgetary deficit would have been roughly $40.8 billion.

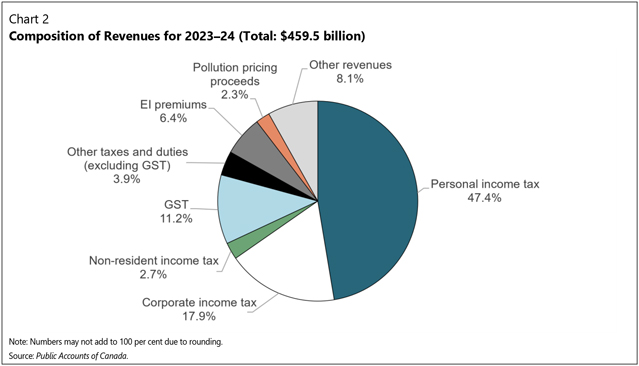

Budget 2024 projected revenues of $465.1 billion for the fiscal year ending March 2024, underpinned by economic data and strong year-to-date revenue results. Revenues for 2023-24 are $5.5 billion lower compared to the projection, due to lower tax revenue, consistent with the softening of the economy from higher interest rates as the Bank of Canada has returned inflation to 2 per cent. This is a variance of 1.2 per cent on total revenue of over $459.5 billion.

Budget 2024 projected total expenses of $505.1 billion for the fiscal year ending March 2024. Actual expenses were $16.3 billion higher than forecast in Budget 2024, due mainly to two factors:

| ● | | higher-than-anticipated provisions for contingent liabilities relating to Indigenous claims; and, |

| ● | | provisions for presently unrecovered loans and benefits from support delivered during the COVID-19 pandemic. |

The expense variance largely reflects the assessment and reassessment by the government of assets and liabilities as required under its accrual accounting framework. That is, these are impacts from past transactions or in anticipation of possible future developments versus new in-year government spending.

Future Potential Payments to Resolve Indigenous Claims

The federal government is advancing reconciliation, supporting Indigenous Peoples’ right to self-determination, and addressing historical wrongs and systemic racism. Since 2016, the government has provided over $60 billion to resolve Indigenous claims. Efforts are ongoing to resolve Indigenous claims, including through the prioritization of negotiations and work to resolve litigation out-of-court. These efforts have contributed to an increase in both the number and value of settlements in recent years.

“Contingent liabilities can be defined as possible obligations that may result in future payments when one or more future events occur or fail to occur. These events may not wholly be within the control of the government but may arise during the normal course of operations.” – Parliamentary Budget Officer (PBO), July 2024

When the probability of a future payment is considered likely, and the amount can be estimated, the government records a provision for the contingent liability. The government cannot estimate with certainty when potential future contingent liabilities would be paid, or if they would be paid at all, as settlements are matters being negotiated with other parties or are before the courts.

“The current stock of the outstanding provision for contingent liabilities, as of March 31, 2023, is $76 billion. This amount has increased significantly in recent years, with an average annual growth of roughly 30 per cent since 2016.” – PBO, July 2024

As part of advancing its commitment to resolve past injustices by accelerating the resolution of Indigenous claims, the government recorded expenses of $17.8 billion in 2023-24, of which $16.4 billion is related to contingent liabilities for Indigenous claims. The remainder represents settlement payments not previously charged to expenses.

4