Exhibit D

DESCRIPTION OF CANADA

TABLE OF CONTENTS

| | | | | |

| | Page |

| General Information | | | 3 | |

| The Canadian Economy | | | 6 | |

| External Trade | | | 12 | |

| Balance of Payments | | | 14 | |

| Foreign Exchange and International Reserves | | | 16 | |

| Government Finances | | | 17 | |

| Debt Record | | | 30 | |

| Monetary and Banking System | | | 31 | |

| Tables and Supplementary Information | | | 36 | |

Unless otherwise indicated, dollar amounts hereafter in this document are expressed in Canadian dollars. On December 16, 2004 the noon buying rate in New York City payable in Canadian dollars (“$”), as reported by the Federal Reserve Bank of New York, was $1.00 = $0.8089 United States dollars (“U.S.$”). See “Foreign Exchange and International Reserves”.

2

Certain information contained in the Exhibit has been extracted or compiled from public official documents of Canada, which include statistical data subject to revision. Canada is sometimes referred to as the “Government of Canada” or the “Government” in this Exhibit.

CANADA

GENERAL INFORMATION

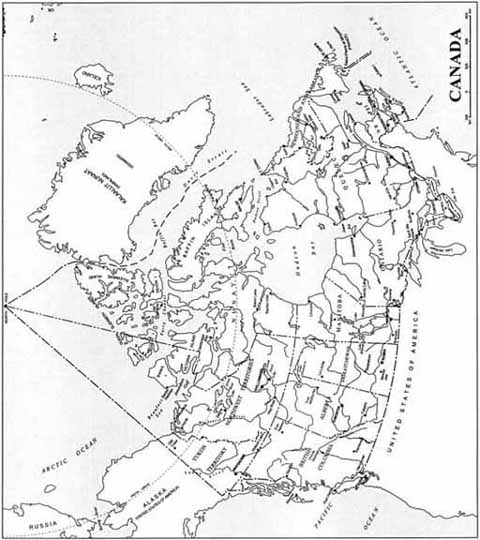

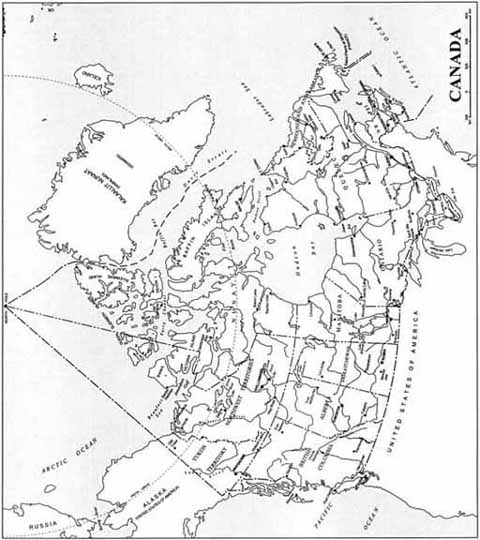

Area and Population

Canada is the second largest country in the world, with an area of 9,984,670 square kilometers of which about 891,163 square kilometers are covered by fresh water. The occupied farm land is about 7% and the productive forest land is about 25% of the total area. The population on July 1, 2004 was estimated to be 32 million. Approximately 64% of Canada’s population lives in metropolitan areas of which Toronto, Montreal and Vancouver are the largest. Most of Canada’s population lives within 325 kilometers of the United States border.

Form of Government

Canada is a federal state composed of ten provinces and three territories. In 1867, the United Kingdom Parliament adopted the British North America Act, which established the Canadian federation comprised of, at that time, the Provinces of Ontario, Québec, Nova Scotia and New Brunswick. Since then, six additional provinces (Manitoba, British Columbia, Prince Edward Island, Saskatchewan, Alberta and Newfoundland and Labrador), along with the Yukon Territory, the Northwest Territories and the new territory of Nunavut (which was carved out of the Northwest Territories on April 1, 1999), have become parts of Canada.

The British North America Act (which has been renamed the Constitution Act, 1867) gave the Parliament of Canada legislative power in relation to a number of matters including all matters not assigned exclusively to the legislatures of the provinces. These powers now include matters such as defense, the raising of money by any mode or system of taxation, the regulation of trade and commerce, the public debt, money and banking, interest, bills of exchange and promissory notes, navigation and shipping, extra-provincial transportation, aerial navigation and, with some exceptions, telecommunications. The provincial legislatures have exclusive jurisdiction in such areas as education, municipal institutions, property and civil rights, administration of justice, direct taxation for provincial purposes and other matters of purely provincial or local concern.

The executive power of the federal Government is vested in the Queen, represented by the Governor General, whose powers are exercised on the advice of the federal Cabinet, which is responsible to the House of Commons. The legislative branch at the federal level, Parliament, consists of the Crown, the Senate and the House of Commons. The Senate has 105 seats. There are 24 seats each for the Maritime Provinces, Québec, Ontario and Western Canada, 6 for Newfoundland and 1 each for the three territories. Senators are appointed by the Governor General on the advice of the federal Cabinet and hold office until age 75. The House of Commons has 308 members, elected by voters in single-member constituencies. The leader of the political party that gains the most seats in each general election is usually invited by the Governor General to be Prime Minister and to form the Government. The Prime Minister selects the members of the federal Cabinet from among the members of the House of Commons and the Senate (in practice almost entirely from the former). The House of Commons is elected for a period of five years, subject to earlier dissolution upon the recommendation of the Prime Minister or because of the Government’s defeat in the House of Commons on a vote of no confidence.

The most recent general election was held on June 28, 2004. As a result of that election the Liberal Party forms the Government. The distribution of seats in the House of Commons is as follows: the Liberal Party has 133 seats, the Conservative Party has 99 seats, the Bloc Québécois has 54 seats, and the New Democratic Party has 19 seats. There are 2 independent members and 1 vacant seat.

The executive power in each province is vested in the Lieutenant Governor, appointed by the Governor General on the advice of the federal Cabinet. The Lieutenant Governor’s powers are exercised on the advice of the provincial cabinet, which is responsible to the legislative assembly. Each provincial legislature is composed of a Lieutenant Governor and a legislative assembly made up of members elected for a period of five years. The practice of selecting the provincial premier and the provincial cabinet in each province follows that described for the federal level, as does dissolution of a legislature.

3

The judicial branch of government in Canada is composed of an integrated set of courts created by federal and provincial law. At the federal level there are two principal courts, the Supreme Court of Canada which is the highest appeal court in Canada and the Federal Court of Canada which, among other things, deals with federal revenue laws and claims involving the Government. Judges of the two federally constituted courts and those of the provincial superior and county courts are appointed by the Governor General on the advice of the federal Cabinet and hold office during good behavior until age 70 or 75. Judges of the magistrates courts (commonly now known as provincial courts) are appointed by the provincial government and usually hold office until age 65 or 70.

Constitutional Reform

In April 1982, Her Majesty the Queen proclaimed the Constitution Act, 1982, terminating British legislative jurisdiction over Canada’s Constitution. The Constitution Act, 1982 provides that Canada’s Constitution may be amended pursuant to an amending formula contained therein and contains the Canadian Charter of Rights and Freedoms, including the linguistic rights of Canada’s two major language groups.

The government of Québec did not sign the constitutional agreement which led to the repatriation of the Canadian Constitution and the proclamation of the Constitution Act, 1982. Although Québec is legally bound by the Constitution Act, 1982, the government of Québec set out five conditions for accepting the legal legitimacy of the Act. Discussions on those principles led on April 30, 1987 at Meech Lake to a unanimous agreement by First Ministers on principles respecting each of Québec’s conditions.

A constitutional resolution to give effect to the Meech Lake Accord was adopted by Parliament and eight provinces before the deadline for ratification on June 23, 1990. In the absence of ratification by Newfoundland and Manitoba, the amendment was not adopted. In the wake of this event, the most extensive series of public consultations on constitutional matters ever to occur in Canada began through the work of both provincial and federal commissions and committees, among other things. Recommendations produced by this process were then assessed by a series of multilateral negotiations involving the federal, provincial and territorial governments and four national Aboriginal organizations, held from April to July 1992. Agreement was reached on a wide range of constitutional issues through the multilateral process which led to a First Ministers’ Conference held in Charlottetown in August 1992.

The Charlottetown Accord was an extensive package of reforms agreed upon by the federal, provincial and territorial governments and the four Aboriginal organizations. On October 26, 1992 Canadians were asked in a referendum if they agreed that the Constitution of Canada should be renewed on the basis of the Charlottetown agreement. A majority of Canadians in a majority of the provinces, including a majority in Québec and a majority of Status Indians living on reserves, declined to provide such a mandate. Consequently, governments set aside the constitutional issue and announced their intention to concentrate on social and economic initiatives that do not require constitutional change.

Québec

In September 1994, the Parti Québécois was elected, and its platform called for Québec’s accession to independence. On October 30, 1995, the government of Québec held a consultative referendum under provincial law, seeking a mandate to secede from Canada and proclaim Québec’s independence, after having made a formal offer of a new economic and political partnership between Québec and the rest of Canada. The government’s proposal was rejected by a vote of 50.6% against and 49.4% in favour, with a participation rate of 93%. While all sides accepted the 1995 referendum results, the Parti Québécois has not abandoned the goal of achieving independence for Québec.

In September 1996, the Government of Canada referred a series of legal questions to the Supreme Court of Canada with a view to clarifying, at both domestic and international law, whether the government of Québec has the right to secede from Canada unilaterally. On August 20, 1998, the Supreme Court rendered judgment, ruling that the government of Québec cannot, under either the Constitution of Canada or international law, legally effect the unilateral secession of Québec from Canada. The Supreme Court also stated that, if a clear majority of Québecers were to clearly and unambiguously express their will to secede, the federal and provincial governments in Canada would then have a constitutional obligation to

4

enter into negotiations to address the potential act of secession as well as its possible terms should, in fact, secession proceed.

On June 29, 2000, the Government of Canada enacted a law to give effect to the requirement for clarity set out in the opinion of the Supreme Court. That law requires the House of Commons to assess, prior to any future referendum on the secession of a province, whether the referendum question made clear that the province would cease to be part of Canada and become an independent country. The law further requires that, after the vote itself, the House of Commons also assess whether there appeared to be a clear majority in support of the question. Only if both these conditions were met would the Government of Canada be authorized to enter into negotiations which might lead to the constitutional amendments required to effect secession.

In the provincial election of April 14, 2003, the federalist Québec Liberal Party was elected with a majority of 76 out of 125 seats in Québec’s National Assembly, as compared to 45 for the main opposition Parti Québécois, and 4 for the Action Démocratique du Québec party. The Québec Liberal Party obtained 45.9% of the votes cast, the Parti Québécois, 33.2% and the Action Démocratique du Québec, 18.2%.

5

THE CANADIAN ECONOMY*

General

The following chart shows the distribution of real gross domestic product (“GDP”) at basic prices (1997 constant dollars) in 2003, which is indicative of the structure of the economy.

DISTRIBUTION OF REAL GROSS DOMESTIC PRODUCT AT BASIC PRICES(1)

Percentage Distribution in 2003(2)

Source: Statistics Canada, Gross Domestic Product by Industry.

(1) GDP is a measure of production originating within the geographic boundaries of Canada, regardless of whether factors of production are Canadian or non-resident owned, whereas gross national product (“GNP”) measures the value of Canada’s total production of goods and services — that is, the earnings of all Canadian owned factors of production. Quantitatively, GDP is obtained from GNP by adding investment income paid to non-residents and deducting investment income received from non-residents. GDP at basic prices represents the value added by each of the factors of production and is equivalent to GDP at market prices less net taxes on products. These differences can cause discrepancies in levels and growth rates of GDP at basic prices on pages 6 and 7 at GDP market prices on pages 8 and 9.

(2) May not add to 100.0% due to rounding.

(3) The agriculture, forestry, fishing, hunting, mining and oil and gas extraction sectors include a service component.

The volume of industry and sector output in the following discussion provides “constant dollar” measures of the contribution of each industry to GDP at basic prices. The share of service-producing industries in real GDP was 68.9% in 2003 while the remaining 31.1% was attributed to goods-producing industries.

| |

| * | Quarterly and semi-annual figures or changes are based upon seasonally adjusted data, except where otherwise indicated. All percentage changes are compounded at annual rates. For percentage changes over more than one year the method of computation includes growth over the entire period indicated. For percentage changes over less than one year the method of calculation utilizes observations for the period stated and the previous period of the same length. Unless otherwise specified, all growth rates on page 7 are calculated using real GDP at basic prices, 1997 chained dollars. |

6

The following table shows the composition of Canada’s real GDP at basic prices (1997 constant dollars) by sector in 1989 and over the 1999-2003 period.

REAL GROSS DOMESTIC PRODUCT AT BASIC PRICES BY INDUSTRY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | For the years ended December 31, |

| |

|

| | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1989(2) | | 2003 | | 1999 | | 1989(2) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | | | |

| | (millions of 1997 dollars) | | (percentage distribution) |

| Agriculture | | $ | 14,643 | | | $ | 12,928 | | | $ | 13,702 | | | $ | 15,876 | | | $ | 16,667 | | | $ | 11,510 | | | | 1.4 | % | | | 1.9 | % | | | 1.6 | % |

| Forestry, fishing and hunting | | | 7,345 | | | | 7,241 | | | | 7,144 | | | | 7,028 | | | | 6,655 | | | | 8,150 | | | | 0.7 | | | | 0.7 | | | | 1.2 | |

| Mining and oil and gas extraction | | | 37,493 | | | | 35,204 | | | | 35,650 | | | | 35,459 | | | | 34,399 | | | | 26,944 | | | | 3.7 | | | | 3.8 | | | | 3.8 | |

| Manufacturing | | | 174,208 | | | | 174,049 | | | | 170,729 | | | | 179,564 | | | | 161,526 | | | | 122,046 | | | | 17.1 | | | | 18.0 | | | | 17.3 | |

| Construction | | | 56,193 | | | | 53,797 | | | | 52,182 | | | | 48,833 | | | | 46,415 | | | | 47,930 | | | | 5.5 | | | | 5.2 | | | | 6.8 | |

| Utilities | | | 25,780 | | | | 26,338 | | | | 25,678 | | | | 26,502 | | | | 26,409 | | | | 22,815 | | | | 2.5 | | | | 2.9 | | | | 3.2 | |

| Transportation and warehousing | | | 47,694 | | | | 47,503 | | | | 46,803 | | | | 45,765 | | | | 43,604 | | | | 33,011 | | | | 4.7 | | | | 4.9 | | | | 4.7 | |

| Wholesale and retail trade | | | 119,879 | | | | 114,845 | | | | 108,129 | | | | 103,987 | | | | 97,964 | | | | 75,397 | | | | 11.8 | | | | 10.9 | | | | 10.7 | |

| Finance, insurance, real estate and leasing | | | 203,152 | | | | 198,827 | | | | 190,055 | | | | 181,064 | | | | 174,007 | | | | 122,047 | | | | 20.0 | | | | 19.4 | | | | 17.3 | |

| Public administration and defence | | | 56,547 | | | | 54,895 | | | | 53,575 | | | | 53,208 | | | | 51,828 | | | | 46,494 | | | | 5.6 | | | | 5.8 | | | | 6.6 | |

| Community, business and personal services | | | 273,035 | | | | 267,097 | | | | 257,835 | | | | 248,740 | | | | 237,103 | | | | 186,547 | | | | 26.9 | | | | 26.4 | | | | 26.5 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | TOTAL (1) | | $ | 1,015,969 | | | $ | 992,724 | | | $ | 961,482 | | | $ | 946,026 | | | $ | 896,577 | | | $ | 703,946 | | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Source: Statistics Canada, Input Output Division.

(1) May not add to total due to rounding.

(2) Data does not add to total due to rebasing.

The share of service-producing industries in real GDP at basic prices increased from 65.8% in 1989 to 68.9% in 2003. The fastest growing groups in this sector have been wholesale and retail trade and finance, insurance, real estate and leasing which grew at average compounded annual rates of 3.4% and 3.7% respectively, between 1989 and 2003, compared to an average annual growth rate of 2.6% for total real GDP (1997 constant dollars). The goods-producing sector constituted 31.1% of real GDP at basic prices in 2003, down from 34.0% in 1989. The decline was most evident in construction with its share declining from 6.8% in 1989 to 5.5% in 2003, and in utilities, where the share fell from 3.2% to 2.5%.

Real GDP growth was 5.6% in 1999 and 5.3% in 2000. Manufacturing output growth exceeded total output growth over this period, increasing by 8.3% in 1999 and by 9.9% in 2000. Total year-over-year GDP growth slowed in 2001 to 1.7%, rebounded in 2002 to 3.4%, and eased in 2003 to 2.2%, before advancing over 2004 to 2.3%, 3.2% and 3.7% in the first, second and third quarters respectively. After contracting by 4.0% in 2001, manufacturing output rebounded to grow at 2.4% in 2002, followed by a retreat to 0.1% growth in 2003. On a year-over-year basis, manufacturing output growth has since recovered in 2004 to 0.6%, 4.1%, and 6.6% in the first, second, and third quarters respectively.

The construction sector was the second largest goods-producing sector in Canada in 2003. Construction activity rose by 4.5% in 1999, 5.5% in 2000 and 6.9% in 2001, followed by a slowing in 2002 to 2.9%. Year-over-year output growth in this industry has since strengthened in 2003 to 4.4% and in the first quarter of 2004 to 4.8%, before moderating to 4.0% and 3.1% in the second and third quarters of 2004.

Output from mining and oil and gas extractions saw no growth in 1999, rose by 3.0% in 2000 and fell by 0.9% in 2001. Recovering to 0.6% in 2002 and 3.9% in 2003, output growth continued to strengthen on a year-over-year basis into the first and second quarters of 2004 to 4.6% and 5.5% respectively, before slowing to 0.8% in the third quarter.

Although the share of agricultural output in total real GDP in 2003 was 1.4%, agriculture is an important part of Canada’s economy and a significant contributor to foreign exchange earnings. Wheat is Canada’s principal agricultural crop and one of its largest export products by value. The wheat crop was 27.0 million tonnes in the 1999-2000 crop year and 26.5 million tonnes in the 2000-2001 crop year. Total wheat production fell to 20.6 million tonnes and 16.2 million tonnes in the 2001-2002 and 2002-2003 crop years respectively, followed by a rebound to 23.5 million tonnes in the 2003-2004 year. For the 2004-2005 year, Statistics Canada estimates wheat production to be 25.9 million tonnes.

7

Gross Domestic Income and Expenditure*

Nominal GDP at market prices was about $1.2 trillion in 2003. Nominal GDP grew at 7.4% in 1999 and 9.6% in 2000, with growth tapering off to 2.9% in 2001 before regaining strength to 4.5% in 2002 and 5.3% in 2003. In 2004, nominal GDP growth was 3.4%, 6.5% and 7.3% in the first, second and third quarters respectively (year-over-year basis).

GROSS DOMESTIC INCOME AND EXPENDITURE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | First 3 quarters (10) | | For the years ending December 31, |

| |

| |

|

| | 2004 | | 2003 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (in millions of dollars) |

| INCOME | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Labor income (1) | | $ | 635,359 | | | $ | 611,344 | | | $ | 613,718 | | | $ | 592,692 | | | $ | 570,008 | | | $ | 545,204 | | | $ | 502,726 | |

| | Corporate profits (2) | | | 175,271 | | | | 150,259 | | | | 151,210 | | | | 137,480 | | | | 126,620 | | | | 135,978 | | | | 110,769 | |

| | Non-farm unincorporated business income | | | 80,660 | | | | 76,932 | | | | 77,382 | | | | 73,841 | | | | 68,364 | | | | 64,944 | | | | 61,466 | |

| | Farm income | | | 805 | | | | 759 | | | | 694 | | | | 889 | | | | 1,633 | | | | 1,243 | | | | 1,819 | |

| | Other net domestic income (3) | | | 124,641 | | | | 124,067 | | | | 123,492 | | | | 110,428 | | | | 116,247 | | | | 115,885 | | | | 104,006 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | Net domestic income | | | 1,016,736 | | | | 963,360 | | | | 966,496 | | | | 915,330 | | | | 882,872 | | | | 863,254 | | | | 780,786 | |

| | Indirect taxes, capital consumption | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | allowances and residual error | | | 266,488 | | | | 250,428 | | | | 252,276 | | | | 242,638 | | | | 225,328 | | | | 213,323 | | | | 201,655 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| GROSS DOMESTIC INCOME | | $ | 1,283,224 | | | $ | 1,213,788 | | | $ | 1,218,772 | | | $ | 1,157,968 | | | $ | 1,108,200 | | | $ | 1,076,577 | | | $ | 982,441 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| EXPENDITURE | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consumer expenditure | | $ | 718,152 | | | $ | 686,501 | | | $ | 688,707 | | | $ | 657,302 | | | $ | 622,903 | | | $ | 596,009 | | | $ | 560,884 | |

| | Government expenditure | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (goods & services): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Federal (4) | | | 50,472 | | | | 48,059 | | | | 48,422 | | | | 44,795 | | | | 42,500 | | | | 41,412 | | | | 37,641 | |

| | Provincial-municipal (5) | | | 230,840 | | | | 219,233 | | | | 220,805 | | | | 208,454 | | | | 195,621 | | | | 183,220 | | | | 171,449 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total government (6) | | | 281,312 | | | | 267,292 | | | | 269,227 | | | | 253,249 | | | | 238,121 | | | | 224,632 | | | | 209,090 | |

| | | | | of which current | | | 248,577 | | | | 235,895 | | | | 237,711 | | | | 223,677 | | | | 211,115 | | | | 200,084 | | | | 186,054 | |

| | | | | of which capital (7) | | | 32,735 | | | | 31,397 | | | | 31,516 | | | | 29,572 | | | | 27,006 | | | | 24,548 | | | | 23,036 | |

| | Residential construction | | | 83,128 | | | | 72,272 | | | | 73,757 | | | | 65,829 | | | | 55,140 | | | | 48,572 | | | | 45,100 | |

| | Business fixed investment: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Non-residential construction | | | 53,476 | | | | 50,789 | | | | 51,155 | | | | 49,686 | | | | 52,927 | | | | 49,826 | | | | 47,229 | |

| | | Machinery and equipment | | | 84,272 | | | | 81,092 | | | | 80,963 | | | | 82,313 | | | | 82,558 | | | | 83,350 | | | | 79,102 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total | | | 137,748 | | | | 131,881 | | | | 132,118 | | | | 131,999 | | | | 135,485 | | | | 133,176 | | | | 126,331 | |

| | Inventory accumulation: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Business non-farm | | | 2,467 | | | | 6,513 | | | | 6,119 | | | | 1,094 | | | | -5,251 | | | | 11,355 | | | | 4,951 | |

| | | Farm | | | 853 | | | | 1,336 | | | | 1,543 | | | | -1,662 | | | | -1,019 | | | | 150 | | | | 39 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total | | | 3,320 | | | | 7,849 | | | | 7,662 | | | | -568 | | | | -6,270 | | | | 11,505 | | | | 4,990 | |

| | Exports (goods & services) (8) | | | 493,688 | | | | 464,732 | | | | 461,596 | | | | 479,358 | | | | 483,053 | | | | 490,688 | | | | 424,258 | |

| | Imports (goods & services) (9) | | | -434,004 | | | | -415,840 | | | | -413,611 | | | | -428,248 | | | | -419,508 | | | | -428,754 | | | | -388,303 | |

| | Residual error of estimate | | | -120 | | | | -900 | | | | -684 | | | | -953 | | | | -724 | | | | 749 | | | | 91 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| GROSS DOMESTIC EXPENDITURE | | $ | 1,283,224 | | | $ | 1,213,788 | | | $ | 1,218,772 | | | $ | 1,157,968 | | | $ | 1,108,200 | | | $ | 1,076,577 | | | $ | 982,441 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| GROSS DOMESTIC EXPENDITURE IN 1997 CHAIN-FISHER DOLLARS | | $ | 1,121,797 | | | $ | 1,093,681 | | | $ | 1,096,359 | | | $ | 1,074,621 | | | $ | 1,038,845 | | | $ | 1,020,488 | | | $ | 969,750 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Source: Statistics Canada, National Income and Expenditure Accounts.

(1) Includes military pay and allowances.

(2) Includes net interest and dividends paid to non-residents.

(3) Includes interest, miscellaneous investment income and government business enterprise profits before taxes, taxes less subsidies on factors of production and inventory valuation adjustment.

(4) Net spending (outlays minus sales) including gross capital formation and Canada Pension Plan.

(5) Net spending (outlays minus sales) including gross capital formation and Québec Pension Plan.

(6) Includes government inventories.

(7) Includes inventory accumulations at all levels of government.

(8) Excludes investment income received from non-residents.

(9) Excludes investment income paid to non-residents.

(10) Seasonally adjusted, annual rates.

*Year-over-year growth rates for nominal GDP at market prices are based on not seasonally adjusted data.

8

Economic Developments*

Real output growth experienced gains of 5.5% in 1999 and 5.2% in 2000, before slowing to 1.8% in 2001, and rebounding to 3.4% in 2002. In 2003 real GDP growth eased to 2.0%, continued to slow to 1.6% in the first quarter of 2004, before regaining strength on a year-over-year basis to 2.8% and 3.3% in the second and third quarters respectively.

Real consumer spending rose by 3.8% in 1999, 4.0% in 2000, 2.7% in 2001, 3.4% in 2002 and 3.1% in 2003. Year-over-year growth in consumer spending remained robust at 3.5% in the first quarter, 3.2% in the second quarter and 2.9% in the third quarter of 2004. The personal savings rate was 3.2% in 2002 and 1.4% in 2003, falling to 0.6% in the first quarter of 2004, 0.5% in the second quarter and 0.0% in the third quarter of 2004.

Year-over-year growth in non-residential business fixed investment was 7.2% in 1999, 4.7% in 2000 and 0.7% in 2001. The strength in non-residential business investment in 1999 and 2000 was largely due to strong increases in machinery and equipment investment. Non-residential business fixed investment fell 4.0% in 2002, but rebounded with growth of 3.2% in 2003 and year-over-year growth of 5.5%, 5.6% and 3.9% in the first three quarters of 2004, respectively.

Housing starts have increased in recent years. Following a level of 150 thousand units in 1999, housing starts continued to rise to 152 thousand units, 163 thousand units, 205 thousand units and 218 thousand units in 2000, 2001, 2002, and 2003 respectively. In the first three quarters of 2004, the level of housing starts increased further to 226 thousand, 233 thousand and 238 thousand units respectively (at annual rates).

Government spending on current goods and services grew by 2.1% in 1999, 3.1% in 2000, 3.7% in 2001, 2.8% in 2002, and 3.8% in 2003. Year-over-year growth in government spending on goods and services for 2004 was 3.2% in the first quarter, 2.1% in the second quarter and 3.0% in the third quarter.

In current dollar terms, the trade balance on a balance of payments basis was $35.4 billion in 1999, $61.3 billion in 2000 and $62.8 billion in 2001. The surplus on the foreign trade balance slid to $50.3 billion and $47.3 billion in 2002 and 2003 respectively, and has since increased in 2004 to $52.4 billion, $64.9 billion and $58.9 billion (at annual rates) in the first, second and third quarters respectively. (See also “Balance of Payments”.)

| |

| * | In this section all figures are reported in real terms and growth rates are calculated from chained 1997 dollars, seasonally adjusted at annual rates unless otherwise noted. |

9

Prices and Costs

The year-over-year increase in the GDP implicit price deflator was 1.7% in 1999, 4.2% in 2000, and 1.1%, 1.0% and 3.2% in 2001, 2002 and 2003 respectively. Year-over-year growth in the implicit price deflator was 1.7% for the first quarter of 2004, 3.6% in the second quarter and 3.9% in the third quarter.

The year-over-year increase in the consumer price index (“CPI”) has been moderate. It registered increases of 1.7% in 1999, 2.7% in 2000 and 2.6% in 2001. The increase in 2000 is largely attributable to a surge in energy prices, while the increase observed in 2001 was more broadly-based. CPI inflation dipped slightly to 2.2% in 2002 before rising again to 2.8% in 2003, and sliding to 0.9% in the first quarter of 2004 before rebounding to 2.2% and 2.0% in the second and third quarters respectively.*

PRICE DEVELOPMENTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | G.D.P. | | Consumer Price Index | | |

| | Implicit | |

| | Industrial |

| | Chain | | | | Total | | | | Total Excluding | | | | Product |

| For the years | | Price Index | | | | Excluding | | | | Food & | | Shelter | | Price |

| ended December 31, | | (1) | | Total | | Food | | Food | | Energy | | Energy | | Services | | Index |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (annual percentage changes) |

| 1999 | | | 1.7 | | | | 1.7 | | | | 1.3 | | | | 1.7 | | | | 5.7 | | | | 1.5 | | | | 1.1 | | | | 1.8 | |

| 2000 | | | 4.2 | | | | 2.7 | | | | 1.4 | | | | 3.1 | | | | 16.2 | | | | 1.5 | | | | 2.1 | | | | 4.3 | |

| 2001 | | | 1.1 | | | | 2.6 | | | | 4.5 | | | | 2.1 | | | | 3.3 | | | | 2.0 | | | | 2.5 | | | | 1.0 | |

| 2002 | | | 1.0 | | | | 2.2 | | | | 2.6 | | | | 2.1 | | | | –2.0 | | | | 2.7 | | | | 1.9 | | | | 0.1 | |

| 2003 | | | 3.2 | | | | 2.8 | | | | 1.7 | | | | 3.0 | | | | 7.9 | | | | 2.6 | | | | 2.7 | | | | –1.4 | |

| 2003 Q4 | | | 2.2 | | | | 1.7 | | | | 1.9 | | | | 1.7 | | | | 1.6 | | | | 1.8 | | | | 2.7 | | | | –3.9 | |

| 2004 Q1 | | | 1.7 | | | | 0.9 | | | | 1.1 | | | | 0.8 | | | | –2.8 | | | | 1.3 | | | | 2.3 | | | | –2.0 | |

| 2004 Q2 | | | 3.6 | | | | 2.2 | | | | 1.4 | | | | 2.3 | | | | 11.8 | | | | 1.4 | | | | 2.2 | | | | 5.2 | |

| 2004 Q3 | | | 3.9 | | | | 2.0 | | | | 2.5 | | | | 1.8 | | | | 7.5 | | | | 1.3 | | | | 2.5 | | | | 5.2 | |

Source: Statistics Canada, National Income and Expenditure Accounts; Consumer Prices and Price Indexes; Industry Price Indexes.

(1) This implicit price index is based on seasonally adjusted data.

The average annual increase in new collective agreements (without cost of living clauses) involving 500 or more employees for all industries was 2.5% in 2003. Average wage gains (over the life of the contract) increased steadily between 1999 and 2001, before dipping in 2002. The average settlement was 2.2% in 1999, 2.5% in 2000, 3.2% in 2001, 2.8% in 2002 and 2.5% in 2003. Year-over-year, wage gains were 2.8% in the first quarter of 2004, 1.3% in the second quarter and 1.3% in the third quarter.

| |

| * | Year-over-year growth rates for CPI are based on not seasonally adjusted data. |

10

Labor Market*

The following table shows labor market characteristics for the periods indicated.

LABOR MARKET CHARACTERISTICS(1)

(thousands of persons)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Canada | | Atlantic Provinces | | Québec |

| |

| |

| |

|

| For the years | | Labor | | Employ- | | Unemploy- | | Labor | | Employ- | | Unemploy- | | Labor | | Employ- | | Unemploy- |

| ended December 31, | | Force | | ment | | ment Rate | | Force | | ment | | ment Rate | | Force | | ment | | ment Rate |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| 1999 | | | 15,721 | | | | 14,531 | | | | 7.6 | | | | 1,136 | | | | 1,003 | | | | 11.7 | | | | 3,702 | | | | 3,357 | | | | 9.3 | |

| 2000 | | | 15,999 | | | | 14,910 | | | | 6.8 | | | | 1,152 | | | | 1,023 | | | | 11.2 | | | | 3,753 | | | | 3,438 | | | | 8.4 | |

| 2001 | | | 16,246 | | | | 15,077 | | | | 7.2 | | | | 1,172 | | | | 1,035 | | | | 11.7 | | | | 3,807 | | | | 3,475 | | | | 8.7 | |

| 2002 | | | 16,689 | | | | 15,412 | | | | 7.7 | | | | 1,194 | | | | 1,055 | | | | 11.6 | | | | 3,930 | | | | 3,593 | | | | 8.6 | |

| 2003 | | | 17,047 | | | | 15,746 | | | | 7.6 | | | | 1,205 | | | | 1,067 | | | | 11.4 | | | | 4,017 | | | | 3,650 | | | | 9.1 | |

| 2003 Q4 | | | 17,160 | | | | 15,875 | | | | 7.5 | | | | 1,206 | | | | 1,067 | | | | 11.5 | | | | 4,058 | | | | 3,683 | | | | 9.2 | |

| 2004 Q1 | | | 17,190 | | | | 15,917 | | | | 7.4 | | | | 1,217 | | | | 1,081 | | | | 11.2 | | | | 4,039 | | | | 3,683 | | | | 8.8 | |

| 2004 Q2 | | | 17,246 | | | | 15,996 | | | | 7.2 | | | | 1,224 | | | | 1,088 | | | | 11.1 | | | | 4,035 | | | | 3,705 | | | | 8.2 | |

| 2004 Q3 | | | 17,284 | | | | 16,050 | | | | 7.1 | | | | 1,227 | | | | 1,095 | | | | 10.8 | | | | 4,049 | | | | 3,717 | | | | 8.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Ontario | | Prairie Provinces | | British Columbia |

| |

| |

| |

|

| For the years | | Labor | | Employ- | | Unemploy- | | Labor | | Employ- | | Unemploy- | | Labor | | Employ- | | Unemploy- |

| ended December 31, | | Force | | ment | | ment Rate | | Force | | ment | | ment Rate | | Force | | ment | | ment Rate |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| 1999 | | | 6,071 | | | | 5,688 | | | | 6.3 | | | | 2,734 | | | | 2,576 | | | | 5.8 | | | | 2,079 | | | | 1,906 | | | | 8.3 | |

| 2000 | | | 6,228 | | | | 5,872 | | | | 5.7 | | | | 2,766 | | | | 2,628 | | | | 5.0 | | | | 2,100 | | | | 1,949 | | | | 7.2 | |

| 2001 | | | 6,364 | | | | 5,963 | | | | 6.3 | | | | 2,799 | | | | 2,662 | | | | 4.9 | | | | 2,104 | | | | 1,942 | | | | 7.7 | |

| 2002 | | | 6,532 | | | | 6,068 | | | | 7.1 | | | | 2,877 | | | | 2,723 | | | | 5.4 | | | | 2,158 | | | | 1,973 | | | | 8.5 | |

| 2003 | | | 6,694 | | | | 6,229 | | | | 7.0 | | | | 2,929 | | | | 2,777 | | | | 5.2 | | | | 2,202 | | | | 2,023 | | | | 8.1 | |

| 2003 Q4 | | | 6,723 | | | | 6,267 | | | | 6.8 | | | | 2,951 | | | | 2,800 | | | | 5.1 | | | | 2,221 | | | | 2,058 | | | | 7.4 | |

| 2004 Q1 | | | 6,756 | | | | 6,299 | | | | 6.8 | | | | 2,958 | | | | 2,805 | | | | 5.2 | | | | 2,220 | | | | 2,050 | | | | 7.7 | |

| 2004 Q2 | | | 6,794 | | | | 6,325 | | | | 6.9 | | | | 2,964 | | | | 2,822 | | | | 4.8 | | | | 2,228 | | | | 2,057 | | | | 7.7 | |

| 2004 Q3 | | | 6,801 | | | | 6,344 | | | | 6.7 | | | | 2,967 | | | | 2,817 | | | | 5.0 | | | | 2,241 | | | | 2,076 | | | | 7.3 | |

Source: Statistics Canada, The Labour Force.

(1) Unemployment levels are calculated using the difference between Labor Force and Employment for the quarters.

On a year-over-year basis, employment in recent years has averaged more than two percent growth, increasing by 2.8% and 2.6% respectively in 1999 and 2000, before slowing to 1.1% in 2001 and returning to 2.2% in 2002 and 2.2% in 2003. Growth in the labor force was not as strong, registering growth of 2.0%, 1.8% and 1.5% in 1999 through 2001 respectively with a rise to 2.7% in 2002 before moderating to 2.1% in 2003. Year-over-year employment growth in 2004 was 1.6% in the first quarter, 1.9% in the second quarter and 1.9% in the third quarter. Growth in the labor force was 1.5%, 1.3% and 1.1% respectively over the same period.

The unemployment rate fell from 7.6% in 1999 to 6.8% in 2000, followed by a rise back to 7.2% in 2001, 7.7% in 2002 and 7.6% in 2003. So far in 2004, the unemployment rate has declined from 7.4% in the first quarter to 7.2% and 7.1% in the second and third quarters respectively.

* Year-over-year growth rates for employment are based on not seasonally adjusted data.

11

EXTERNAL TRADE

Canada has continued to work towards implementing its trade goals of freer and more open markets based on internationally agreed rules and practices at multilateral, regional and bilateral levels.

At the multilateral level, Canada continues to be an active member of the World Trade Organization (“WTO”) and continues to fully participate in multilateral trade negotiations launched in Doha, Qatar in November 2001.

At the regional level, Canada is a member of the North American Free Trade Agreement (“NAFTA”) with both the United States and Mexico. Under NAFTA, as of January 1, 2003, virtually all tariffs for goods originating in Canada, the United States, and Mexico have been eliminated.

Canada currently has bilateral free trade agreements in place with the following countries: Chile, Costa Rica, and Israel.

Merchandise Trade

The following table sets forth the composition of Canadian trade for the periods indicated.

THE COMPOSITION OF CANADIAN MERCHANDISE TRADE

(Balance of Payments Basis)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | First 3 quarters (2) | | For the years ended December 31, |

| |

| |

|

| | 2004 | | 2003 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (in millions) |

| Value of Exports | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wheat | | $ | 2,863 | | | $ | 1,948 | | | $ | 2,809 | | | $ | 3,071 | | | $ | 3,807 | | | $ | 3,609 | | | $ | 3,356 | |

| | Other agricultural products | | | 18,413 | | | | 17,795 | | | | 23,576 | | | | 25,292 | | | | 24,499 | | | | 21,403 | | | | 19,524 | |

| | Crude petroleum | | | 18,728 | | | | 15,481 | | | | 20,644 | | | | 18,551 | | | | 15,370 | | | | 19,166 | | | | 11,017 | |

| | Natural gas | | | 20,231 | | | | 20,796 | | | | 26,083 | | | | 18,372 | | | | 25,595 | | | | 20,537 | | | | 10,951 | |

| | Ores and metals | | | 24,142 | | | | 19,099 | | | | 26,029 | | | | 28,079 | | | | 26,008 | | | | 26,618 | | | | 23,555 | |

| | Lumber | | | 8,710 | | | | 6,621 | | | | 8,941 | | | | 10,852 | | | | 11,571 | | | | 12,217 | | | | 13,225 | |

| | Pulp and paper | | | 9,859 | | | | 9,529 | | | | 12,529 | | | | 13,262 | | | | 15,300 | | | | 16,860 | | | | 13,668 | |

| | Other materials | | | 58,599 | | | | 52,561 | | | | 70,133 | | | | 70,126 | | | | 72,764 | | | | 71,102 | | | | 60,124 | |

| | Motor vehicles | | | 47,030 | | | | 44,826 | | | | 59,488 | | | | 67,672 | | | | 65,872 | | | | 69,676 | | | | 70,459 | |

| | Motor vehicle parts | | | 20,916 | | | | 20,905 | | | | 27,886 | | | | 29,004 | | | | 26,655 | | | | 28,210 | | | | 26,833 | |

| | Machinery | | | 14,445 | | | | 14,426 | | | | 18,909 | | | | 20,300 | | | | 19,995 | | | | 19,571 | | | | 17,179 | |

| | Other end products | | | 68,085 | | | | 66,185 | | | | 86,880 | | | | 94,470 | | | | 98,865 | | | | 105,678 | | | | 85,483 | |

| | Special transactions | | | 9,961 | | | | 12,294 | | | | 16,103 | | | | 14,745 | | | | 14,356 | | | | 14,726 | | | | 13,662 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | TOTAL EXPORTS (1) | | $ | 321,981 | | | $ | 302,465 | | | $ | 400,010 | | | $ | 413,796 | | | $ | 420,657 | | | $ | 429,372 | | | $ | 369,035 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Value of Imports | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Edible products | | $ | 14,873 | | | $ | 15,243 | | | $ | 20,129 | | | $ | 20,432 | | | $ | 19,086 | | | $ | 17,389 | | | $ | 16,552 | |

| | Crude petroleum | | | 11,510 | | | | 9,981 | | | | 13,301 | | | | 11,723 | | | | 12,814 | | | | 13,437 | | | | 7,160 | |

| | Other crude materials | | | 8,689 | | | | 6,945 | | | | 9,332 | | | | 8,568 | | | | 8,119 | | | | 8,026 | | | | 7,156 | |

| | Fabricated materials | | | 54,895 | | | | 50,389 | | | | 66,586 | | | | 69,547 | | | | 69,420 | | | | 69,871 | | | | 62,412 | |

| | Motor vehicles | | | 27,599 | | | | 28,242 | | | | 37,547 | | | | 38,003 | | | | 31,825 | | | | 32,479 | | | | 30,242 | |

| | Motor vehicle parts | | | 30,477 | | | | 29,565 | | | | 38,813 | | | | 43,463 | | | | 40,753 | | | | 44,954 | | | | 45,692 | |

| | Machinery and equipment | | | 77,983 | | | | 74,395 | | | | 98,237 | | | | 105,848 | | | | 112,525 | | | | 122,913 | | | | 108,247 | |

| | Other end products | | | 35,353 | | | | 34,814 | | | | 46,259 | | | | 46,444 | | | | 42,923 | | | | 40,115 | | | | 37,000 | |

| | Special transactions | | | 8,675 | | | | 8,790 | | | | 11,629 | | | | 12,552 | | | | 13,218 | | | | 13,153 | | | | 12,566 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | TOTAL IMPORTS (1) | | $ | 270,053 | | | $ | 258,363 | | | $ | 341,833 | | | $ | 356,581 | | | $ | 350,683 | | | $ | 362,337 | | | $ | 327,026 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Source: Statistics Canada, Canadian International Merchandise Trade.

(1) May not add to total due to rounding.

(2) Seasonally adjusted.

12

Canada is one of the leading trading nations of the world. Canada’s exports have always reflected the country’s high endowment in natural resources. However, Canada has been diversifying its exports over time, relying less on commodities and more on finished goods. The value of commodity exports as a share of merchandise exports dropped from 69% in 1980 to 50.2% in the first three quarters of 2004. Over this period the increase in exports of finished goods was led by automotive and miscellaneous end products. Canada’s imports consist mostly of manufactured goods; the two main components are machinery and equipment and automotive products.

Canada and the United States are each other’s largest trading partners, reflecting the physical proximity of the two countries and their close economic and financial relationship. In 2003, trade with the United States accounted for 82.6% of the value of Canada’s merchandise exports and 70.2% of the value of Canada’s merchandise imports. According to the United States Department of Commerce, trade with Canada accounted for 23.8% of the United States’ exports and 17.6% of its imports in 2003.

GEOGRAPHICAL DISTRIBUTION OF CANADIAN MERCHANDISE TRADE

(Balance of Payments Basis)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | First 3 quarters | | For the years ended December 31, |

| |

| |

|

| | 2004 | | 2003 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

| |

| |

| |

| |

| |

| |

| |

|

| Exports (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | United States | | | 81.6 | % | | | 82.9 | % | | | 82.6 | % | | | 83.9 | % | | | 83.7 | % | | | 83.6 | % | | | 83.8 | % |

| | Japan | | | 2.4 | | | | 2.5 | | | | 2.4 | | | | 2.5 | | | | 2.4 | | | | 2.6 | | | | 2.7 | |

| | United Kingdom | | | 2.2 | | | | 1.8 | | | | 1.9 | | | | 1.5 | | | | 1.6 | | | | 1.7 | | | | 1.6 | |

| | European Union (2) | | | 4.2 | | | | 4.1 | | | | 4.1 | | | | 4.0 | | | | 4.0 | | | | 3.9 | | | | 3.9 | |

| | Other | | | 9.7 | | | | 8.8 | | | | 8.9 | | | | 8.2 | | | | 8.3 | | | | 8.1 | | | | 8.0 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Imports (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | United States | | | 69.2 | % | | | 70.2 | % | | | 70.2 | % | | | 71.5 | % | | | 72.7 | % | | | 73.6 | % | | | 76.3 | % |

| | Japan | | | 2.8 | | | | 3.2 | | | | 3.1 | | | | 3.3 | | | | 3.0 | | | | 3.2 | | | | 3.2 | |

| | United Kingdom | | | 2.6 | | | | 2.6 | | | | 2.6 | | | | 2.9 | | | | 3.4 | | | | 3.4 | | | | 2.4 | |

| | European Union (2) | | | 7.4 | | | | 7.7 | | | | 7.6 | | | | 7.3 | | | | 6.6 | | | | 5.8 | | | | 6.3 | |

| | Other | | | 18.0 | | | | 16.4 | | | | 16.5 | | | | 15.1 | | | | 14.3 | | | | 14.0 | | | | 11.8 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Source: Statistics Canada, Canadian International Merchandise Trade.

| |

| (1) | May not add to total due to rounding. |

| (2) | Excludes the United Kingdom. Includes Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, and Sweden. |

The following table presents volume and price indices of Canada’s merchandise trade for the periods indicated.

MERCHANDISE TRADE INDICES

(Balance of Payments Basis)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | First 3 quarters | | For the years ended December 31, |

| |

| |

|

| | 2004 | | 2003 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

| |

| |

| |

| |

| |

| |

| |

|

| | | | |

| | (1997 = 100) | | |

| Indices of physical volume | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Exports | | | 132.5 | | | | 125.4 | | | | 125.9 | | | | 128.6 | | | | 127.7 | | | | 132.3 | | | | 121.2 | |

| | Imports | | | 132.7 | | | | 122.8 | | | | 123.8 | | | | 119.7 | | | | 118.0 | | | | 125.0 | | | | 115.1 | |

| Indices of prices | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Exports | | | 106.9 | | | | 106.0 | | | | 104.8 | | | | 106.0 | | | | 108.5 | | | | 107.0 | | | | 100.3 | |

| | Imports | | | 97.6 | | | | 101.0 | | | | 99.4 | | | | 107.2 | | | | 107.0 | | | | 104.4 | | | | 102.3 | |

| | Terms of trade (1) | | | 109.5 | | | | 105.0 | | | | 105.4 | | | | 98.9 | | | | 101.4 | | | | 102.4 | | | | 98.1 | |

Source: Statistics Canada, National Income and Expenditure Accounts.

(1) Index of price of exports divided by index of price of imports multiplied by 100.

13

BALANCE OF PAYMENTS

The following table presents the balance of international payments for the periods indicated.

CANADIAN BALANCE OF INTERNATIONAL PAYMENTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | First 3 quarters(1) | | For the years ended December 31, |

| |

| |

|

| | 2004 | | 2003 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (in millions of dollars) |

| CURRENT ACCOUNT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | RECEIPTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Goods and services | | $ | 368,853 | | | $ | 347,339 | | | $ | 459,974 | | | $ | 477,694 | | | $ | 481,383 | | | $ | 489,090 | | | $ | 422,670 | |

| | | | Goods | | | 322,486 | | | | 302,465 | | | | 400,010 | | | | 413,795 | | | | 420,657 | | | | 429,372 | | | | 369,035 | |

| | | | Services | | | 46,367 | | | | 44,874 | | | | 59,964 | | | | 63,899 | | | | 60,725 | | | | 59,718 | | | | 53,636 | |

| | | Investment Income | | | 29,592 | | | | 23,631 | | | | 32,700 | | | | 31,185 | | | | 25,866 | | | | 36,755 | | | | 32,905 | |

| | | Current transfers | | | 5,373 | | | | 5,008 | | | | 6,714 | | | | 6,957 | | | | 6,970 | | | | 6,116 | | | | 5,644 | |

| | | | Current account receipts | | | 403,817 | | | | 375,980 | | | | 499,388 | | | | 515,836 | | | | 514,219 | | | | 531,961 | | | | 461,219 | |

| | PAYMENTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Goods and services | | | 324,808 | | | | 311,184 | | | | 412,688 | | | | 427,382 | | | | 418,612 | | | | 427,836 | | | | 387,298 | |

| | | | Goods | | | 269,934 | | | | 258,363 | | | | 341,833 | | | | 356,581 | | | | 350,682 | | | | 362,337 | | | | 327,026 | |

| | | | Services | | | 54,875 | | | | 52,819 | | | | 70,855 | | | | 70,801 | | | | 67,930 | | | | 65,500 | | | | 60,272 | |

| | | Investment Income | | | 45,266 | | | | 42,801 | | | | 56,443 | | | | 59,839 | | | | 65,231 | | | | 69,863 | | | | 66,518 | |

| | | Current transfers | | | 5,016 | | | | 4,839 | | | | 6,440 | | | | 5,951 | | | | 5,373 | | | | 4,992 | | | | 4,834 | |

| | | | Current account payments | | | 375,089 | | | | 358,824 | | | | 475,570 | | | | 493,171 | | | | 489,216 | | | | 502,692 | | | | 458,649 | |

| | BALANCES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Goods and services | | | 44,046 | | | | 36,156 | | | | 47,287 | | | | 50,312 | | | | 62,770 | | | | 61,254 | | | | 35,373 | |

| | | | Goods | | | 52,553 | | | | 44,102 | | | | 58,177 | | | | 57,214 | | | | 69,975 | | | | 67,036 | | | | 42,009 | |

| | | | Services | | | -8,507 | | | | -7,945 | | | | -10,891 | | | | -6,903 | | | | -7,204 | | | | -5,782 | | | | -6,636 | |

| | | Investment Income | | | -15,675 | | | | -19,170 | | | | -23,743 | | | | -28,653 | | | | -39,365 | | | | -33,109 | | | | -33,613 | |

| | | Current transfers | | | 357 | | | | 170 | | | | 274 | | | | 1,006 | | | | 1,598 | | | | 1,124 | | | | 810 | |

| | | | Current account balance | | | 28,728 | | | | 17,156 | | | | 23,818 | | | | 22,664 | | | | 25,003 | | | | 29,269 | | | | 2,570 | |

| CAPITAL AND FINANCIAL ACCOUNT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | CAPITAL ACCOUNT | | | 3,224 | | | | 3,052 | | | | 3,968 | | | | 4,988 | | | | 5,784 | | | | 5,314 | | | | 5,049 | |

| | FINANCIAL ACCOUNT | | | -20,994 | | | | -15,918 | | | | -24,694 | | | | -17,837 | | | | -21,163 | | | | -27,070 | | | | -17,531 | |

| | CANADIAN ASSETS, NET FLOWS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Canadian direct investment abroad | | | -48,365 | | | | -10,932 | | | | -30,191 | | | | -41,472 | | | | -55,918 | | | | -66,352 | | | | -25,625 | |

| | | Portfolio investment | | | -9,988 | | | | -7,365 | | | | -12,519 | | | | -25,087 | | | | -37,573 | | | | -63,927 | | | | -23,101 | |

| | | | Foreign bonds | | | -8,699 | | | | -6,170 | | | | -8,071 | | | | -6,229 | | | | -1,920 | | | | -3,963 | | | | -2,477 | |

| | | | Foreign stocks | | | -1,288 | | | | -1,196 | | | | -4,449 | | | | -18,858 | | | | -35,653 | | | | -59,965 | | | | -20,623 | |

| | | Other investment | | | -11,230 | | | | -17,355 | | | | -25,401 | | | | -13,206 | | | | -20,251 | | | | -11,759 | | | | 6,780 | |

| | | | Loans | | | -1,956 | | | | 3,544 | | | | 6,171 | | | | -8,182 | | | | -8,219 | | | | -5,126 | | | | 2,680 | |

| | | | Deposits | | | -2,931 | | | | -14,029 | | | | -23,234 | | | | 5,731 | | | | -2,172 | | | | 3,973 | | | | 10,592 | |

| | | | Official international reserves | | | -510 | | | | 2,944 | | | | 4,693 | | | | 298 | | | | -3,353 | | | | -5,480 | | | | -8,818 | |

| | | | Other assets | | | -5,832 | | | | -9,814 | | | | -13,030 | | | | -11,053 | | | | -6,507 | | | | -5,125 | | | | 2,326 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total Canadian assets, net flows | | | -69,582 | | | | -35,652 | | | | -68,111 | | | | -79,765 | | | | -113,743 | | | | -142,039 | | | | -41,946 | |

| | CANADIAN LIABILITIES, NET FLOWS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Foreign direct investment in Canada | | | 11,265 | | | | 10,049 | | | | 9,222 | | | | 33,026 | | | | 42,561 | | | | 99,198 | | | | 36,762 | |

| | | Portfolio investment | | | 39,595 | | | | 8,340 | | | | 18,469 | | | | 20,935 | | | | 38,509 | | | | 14,598 | | | | 3,738 | |

| | | | Canadian bonds | | | 13,074 | | | | 3,052 | | | | 7,000 | | | | 18,684 | | | | 41,733 | | | | -21,458 | | | | 2,602 | |

| | | | Canadian stocks | | | 29,589 | | | | 7,704 | | | | 12,931 | | | | -1,531 | | | | 4,125 | | | | 35,232 | | | | 14,346 | |

| | | | Canadian money market | | | -3,067 | | | | -2,418 | | | | -1,461 | | | | 3,782 | | | | -7,349 | | | | 824 | | | | -13,209 | |

| | | Other investment | | | -2,271 | | | | 1,346 | | | | 15,726 | | | | 7,967 | | | | 11,510 | | | | 1,173 | | | | -16,086 | |

| | | | Loans | | | -2,112 | | | | -2,731 | | | | 1,741 | | | | 1,400 | | | | -6,493 | | | | 3,396 | | | | 6,641 | |

| | | | Deposits | | | 2,290 | | | | 8,133 | | | | 18,265 | | | | 13,568 | | | | 23,716 | | | | -962 | | | | -24,103 | |

| | | | Other liabilities | | | -2,450 | | | | -4,058 | | | | -4,280 | | | | -7,001 | | | | -5,713 | | | | -1,261 | | | | 1,377 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total Canadian liabilities, net flows | | | 48,588 | | | | 19,734 | | | | 43,417 | | | | 61,928 | | | | 92,580 | | | | 114,969 | | | | 24,415 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | | Total capital and financial account, net flows | | | -17,770 | | | | -12,866 | | | | -20,725 | | | | -12,850 | | | | -15,379 | | | | -21,756 | | | | -12,481 | |

| | Statistical discrepancy | | | -10,655 | | | | -3,526 | | | | -3,092 | | | | -9,815 | | | | -9,624 | | | | -7,514 | | | | 9,912 | |

Source: Statistics Canada, Canada’s Balance of International Payments

(1) Year-to-date (not annualized). Current account data are seasonally adjusted. Capital account data are not seasonally adjusted.

14

Canada’s current account balance improved from a surplus of $2.6 billion in 1999 to a surplus of $23.8 billion in 2003. The current account maintained an average surplus of $38.3 billion (seasonally adjusted, annualized level) in the first three quarters of 2004. Over the period since 1999, the three main components of the current account have evolved as follows:

| |

| | (1) The merchandise trade surplus increased from $42.0 billion in 1999 to $58.2 billion in 2003. In the first three quarters of 2004, the merchandise trade surplus averaged $70.1 billion (annualized level). |

| | (2) The service account deficit worsened from $6.6 billion in 1999 to $10.9 billion in 2003. The services deficit averaged $11.3 billion (annualized level) in the first three quarters of 2004. |

| | (3) The deficit on net investment income payments narrowed from $33.6 billion in 1999 to $23.7 billion in 2003. The investment income deficit averaged $20.9 billion in the first three quarters of 2004 (annualized level). |

Low inflation and a depreciation of the Canadian dollar helped support the merchandise trade surplus in 2001. An uneven recovery in the United States provided limited stimulus to exports in 2002 and an appreciation of the Canadian dollar restrained gains in the surplus when growth in the United States shifted to a higher pace in 2003 and the first three quarters of 2004.

In 1999, the net outflow in the capital and financial account stood at $12.5 billion. Following that, Canada registered net outflows of $21.8 billion, $15.4 billion, $12.9 billion and $20.7 billion in 2000, 2001, 2002 and 2003 respectively. The net outflow in the first three quarters of 2004 averaged $23.7 billion (annualized level).

Various Canadian financial instruments were acquired by non-residents during the 1990s and early 2000s. Non-resident net purchases of Canadian bonds, stocks and money market instruments amounted to $3.7 billion in 1999. After rising to $38.5 billion in 2001, purchases of Canadian financial instruments decreased again to $20.9 billion in 2002 and $18.5 billion in 2003. The first three quarters of 2004 saw net purchases of Canadian bonds, stocks and money market instruments average $52.8 billion (annualized level).

Foreign direct investment in Canada rose from $36.8 billion in 1999 to $99.2 billion in 2000 before sliding to $42.6 billion in 2001, $33.0 billion in 2002 and $9.2 billion in 2003. Foreign direct investment in the first three quarters of 2004 averaged $15.0 billion (annualized level).

15

FOREIGN EXCHANGE AND INTERNATIONAL RESERVES

Since May 31, 1970 the Canadian dollar has been allowed to float so that the rate of exchange is determined by conditions of supply and demand in the market. During this period, the Canadian dollar has floated between a high of 104.43 U.S. cents that occurred in April 1974 and a low of 61.79 U.S. cents in January 2002. The dollar closed 2003 at 77.13 U.S. cents. In 2004 through November 30, trading has been in a range of 71.41 to 85.14 U.S. cents; the dollar closed at 84.32 U.S. cents on November 30, 2004.

EXCHANGE RATE FOR THE CANADIAN DOLLAR

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | For the years ended December 31, |

| | 2004 through | |

|

| | November 30 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | | 1995 | | 1994 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (in U.S. cents) |

| High | | | 85.14 | | | 77.89 | | 66.54 | | 67.11 | | 69.84 | | 69.35 | | 71.23 | | 74.93 | | 75.26 | | 75.33 | | 76.42 |

| Low | | | 71.41 | | | 63.38 | | 61.79 | | 62.30 | | 63.97 | | 64.62 | | 63.11 | | 69.45 | | 72.12 | | 70.09 | | 70.97 |

Source: Bank of Canada.

Canada does not have foreign exchange controls. Foreign exchange operations conducted by the Bank of Canada on behalf of the Minister of Finance are directed toward the maintenance of orderly conditions in the foreign exchange market in Canada through the purchase or sale of United States dollars for Canadian dollars. The following table shows Canada’s official international reserves on the dates indicated.

CANADA’S OFFICIAL INTERNATIONAL RESERVES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | At December 31, |

| | At November 30, | |

|

| | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | | 1995 | | 1994 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (in millions of U.S. dollars) |

| Total | | | 34,066 | | | | 36,268 | | | | 37,169 | | | | 34,248 | | | | 32,424 | | | | 28,646 | | | | 23,427 | | | | 17,969 | | | | 20,578 | | | | 15,227 | | | | 12,475 | |

Source: Department of Finance.

Canada’s official reserves at November 30, 2004 consisted of United States dollars in the amount of U.S.$14,108 million, U.S.$49 million in gold (valued at U.S.$453.40 per fine ounce), U.S.$3,334 million in the form of the reserve position in the International Monetary Fund (“IMF”), U.S.$912 million in Special Drawing Rights (“SDRs”) and U.S.$15,663 million in other convertible currencies.

Beginning in 1978 transactions relating to foreign currency debt undertaken for reserve management purposes have had an important effect on the level of official reserves. The Government maintains a U.S.$6,000 million standby credit facility with a group of foreign banks. Since August 31, 1986 no drawings have been outstanding on the standby credit facility. The “Canada Bills” program was launched in October 1986. Under this program U.S. dollar-denominated short-term notes are issued in the United States money market. There were U.S.$1,682 million of Canada Bills outstanding on September 30, 2004. The “Canada Notes” program was launched in March 1996. Canada Notes are interest-bearing marketable notes that mature not less than nine months from their date of issue. As of September 30, 2004, there was a total of U.S.$909 million equivalent of Canada Notes outstanding. A Euro Medium Term Note program was launched in March 1997. As of September 30, 2004, there was a total of U.S.$2,413 million equivalent of Euro Medium Term Notes outstanding. As of September 30, 2004, there was a total of U.S.$10,098 million equivalent of other marketable bonds, comprised of 6 global bond issues and 4 Petro Canada bond issues assumed by the Government of Canada on February 5, 2001, on the dissolution of Petro Canada Limited.

16

GOVERNMENT FINANCES

Introduction

The financial structure of the Government of Canada rests on a constitutional and statutory framework dating back to the British North America Act, 1867. That Act, which has been renamed the Constitution Act, 1867, gave constitutional foundation to the principles of financing that are basic to responsible government, while other necessary financial administrative machinery and procedures were established by subsequent legislation, most notably the Financial Administration Act. The proclamation in 1982 of the Constitution Act, 1982 terminated British legislative jurisdiction over Canada’s Constitution in accordance with an amending formula that permits amendment of the Constitution without resorting to the Parliament of the United Kingdom.

Within the confines of the Constitution, the authority of Parliament is supreme. Ultimate control of the public purse and the financial structure of the Government rests with Parliament. This is reflected in the fundamental principles that no tax shall be imposed and no money shall be spent without the authority of Parliament, and that expenditures shall be made only for the purposes authorized by Parliament.

Public money received by the Government is deposited in the Consolidated Revenue Fund of Canada. Withdrawals of public money out of the Consolidated Revenue Fund may not be made without the authority of Parliament.

The Government has two major sources of money: budgetary revenues and borrowing. The main sources of revenue are personal and corporate income taxes, employment insurance premiums, and excise taxes and duties. These revenues are authorized by specific acts passed by Parliament. The Government’s revenues also include net gains/losses from Crown corporations, such as the Bank of Canada and Canada Mortgage and Housing Corporation; foreign exchange revenues; and other revenues (primarily revenues from the sales of goods and services). The other major source of money to finance Government operations is borrowing. Borrowing limits are established by acts of Parliament. The main sources of borrowing are marketable bonds, treasury bills and Retail Debt.

Parliament authorizes the disbursement of moneys out of the Consolidated Revenue Fund by means of Appropriation Acts passed on an annual basis by Parliament and based on the Main Estimates submitted by the various departments. In addition to the Appropriation Acts, authority for payments may also be found in certain statutes which authorize certain payments out of the Consolidated Revenue Fund. Expenditures for public debt charges, social security payments and transfers to other levels of government are authorized in this way. Appropriations may also be made by the Governor in Council for urgent payments. Such appropriations may be made only when Parliament is not in session, and must be laid before Parliament during the subsequent session.

Information on the Government’s planned revenues and expenditures is presented to Parliament primarily in two documents: the Budget and the Main Estimates, which are both presented in the House of Commons. The Budget, which may be delivered at any time during the fiscal year, provides the occasion on which the Minister of Finance generally brings under review the whole financial position of the Government, present and prospective, and announces the Government’s plans and proposals. The Main Estimates are tabled (i.e., introduced) once each year and outline the Parliamentary authority, either existing or required, for disbursements. Supplementary Estimates may also be tabled during the year to provide authority for spending as the need arises.

The considerations for overall resource availability and demands for new policies and programs are reconciled through the establishment of a two year Fiscal Plan reflecting Government priorities. This Fiscal Plan, which is presented with the Budget, establishes an expenditure framework, in which the Cabinet establishes priorities. This ensures that expenditure decisions are made within the context of Government priorities and do not exceed the provision for such expenditures set out in the expenditure framework. The Government also releases an Economic and Fiscal Update in the fall for pre-budget consultation purposes.

17

The reporting entity of the Government of Canada includes all departments, agencies, corporations and funds which are owned or controlled by the Government and which are accountable to Parliament. The financial activities of all departments, agencies, corporations and funds are consolidated in the Government’s financial statements, except for enterprise Crown corporations and other government business enterprises which are not dependent on the Government for financing their activities. For these corporations, the Government reports in its financial statements only the cost of its investment and an allowance for valuation which includes their annual net profits and losses. In addition, any amounts receivable from or payable to these corporations are reported.

The primary source of information on all actual financial transactions of the Government is the Public Accounts of Canada, which are required by the Financial Administration Act to be tabled in Parliament each year. The other chief accountability reports are the statements of budgetary and non-budgetary financial transactions and of the Government’s cash and debt position published monthly in The Fiscal Monitor and in the Annual Financial Report.

For the first time, the financial statements for fiscal 2002-03 were presented on the full accrual basis of accounting, replacing the modified accrual standard that had been used since the mid 1980s. The Government’s fiscal anchor remains the budgetary balance, which will now provide a more comprehensive and up-to-date picture of the financial situation. Prior to the shift to accrual accounting, there was no distinction between net debt and the accumulated deficit, or federal debt, so these terms were used interchangeably. Under full accrual accounting, this is no longer the case. Net debt is the Government’s net liabilities excluding the value of its non-financial assets. The federal debt takes into account the value of non-financial assets. The two indicators now represent different measures of the Government’s financial position. The Federal debt will now represent the accumulation of surpluses and deficits in the past and is the key measure of debt. Data from fiscal 1983-84 are not directly comparable with earlier years due to a break in the series following the introduction of full accrual accounting.

Fiscal Policy

The era of chronic deficits and rising debt began in the early 1970s when productivity and economic growth declined from the buoyant trend of prior decades. One effect of this fundamental shift that had taken place in the economy was to reduce the underlying rate of growth of tax revenues, while expenditure growth remained strong. Consequently, the divergence between expenditure and revenue trends produced an uninterrupted string of deficits until fiscal 1997-98.

The severity of the 1982 recession resulted in a sharp increase in the deficit in fiscal 1982-83, eventually peaking at $37.2 billion or 8.3% of GDP in fiscal 1984-85. During the middle to late 1980s, the Government instituted a number of measures to increase revenues and constrain the growth in expenditures. These measures, in conjunction with the sustained recovery from the 1982 recession, helped to lower the deficit by about half relative to GDP by fiscal 1989-90. Further progress was arrested by the onset of the recession in 1990, which proved to be much longer and more severe than expected. While the measures to control spending succeeded in preventing government expenditures from increasing substantially in response to the recession, the sluggish recovery and the lagged impact of the recession resulted in substantial declines in budgetary revenues. This caused the deficit to increase to $39.0 billion, or 5.6% of GDP, in fiscal 1992-93.

Since 1993, the Government’s fiscal objective has been to balance the budget. Implicit in this objective was the need to halt the rise in the debt-to-GDP ratio and to put it on a permanent downward track. On a full accrual basis of accounting, the budgetary balance went from a deficit of $38.5 billion, or 5.3% of GDP in fiscal 1993-94 to seven consecutive surpluses over the fiscal 1997-98 to fiscal 2003-04 period. The fiscal 2003-04 surplus was $9.1 billion, or 0.7% of GDP. As a percentage of GDP, program expenses declined from 15.7% in fiscal 1993-94 to 11.6% in fiscal 2003-04, and public debt charges fell from 5.5% in fiscal 1993-94 to 2.9% in fiscal 2003-04. Coupled with economic growth, the fiscal turnaround has also led to a fall in federal debt as a share of GDP of over 27 percentage points to 41.1% in fiscal 2003-04, from the peak of 68.4% in fiscal 1995-96. This is the eighth consecutive year in which the debt-to-GDP ratio has declined.

18

This turnaround in federal finances underlined the soundness of the Government’s Debt Repayment Plan — basing budget plans on two-year rolling fiscal targets, economic planning projections based on the average of the private sector economic forecasts backed by fiscal prudence and fiscal forecasts backed by a Contingency Reserve and adopting policies which have engendered economic growth and job creation. Prudence is of two types — the Contingency Reserve and economic prudence. Prudence in budget planning has meant that budgetary balance targets have been consistently bettered in each and every year. The Contingency Reserve of $3.0 billion per year provides an extra measure of back-up against adverse errors in the economic forecast. Under the Debt Repayment Plan, the Contingency Reserve, if not needed, will be used to pay down the public debt. It is not a source of funds for new policy initiatives. Economic prudence provides an extra measure of back-up to ensure that the fiscal target is met. The economic prudence grows over time.

The budgetary deficit/surplus — the budgetary balance — is the most comprehensive measure of the Government’s fiscal results. It is presented on a full accrual basis of accounting, recording government assets and liabilities when they are earned or incurred, regardless of when the cash is received or paid. In addition, the budgetary balance includes only those activities over which the Government has legislative control. However, it is only one measure of the Government’s financial position.

Another important measure is financial source/requirement. Financial source/requirement measures the difference between cash coming in to the Government and cash going out. It differs from the budgetary balance in that it includes transactions in loans, investments and advances, federal employees’ pension accounts, other specified purpose accounts, foreign exchange activities, changes in other financial assets, liabilities and non-financial assets. These activities are included as part of non-budgetary transactions. The conversion from full accrual to cash accounting is also reflected in non-budgetary transactions. In contrast to the large financial requirements observed from the mid 1970s through the mid 1990s, financial surpluses have now been recorded in six of the past seven years. As a result, the Government has retired $38.6 billion of market debt since fiscal 1996-97. Market debt as a percentage of GDP has declined to 36.1% from the peak of 58.2% in fiscal 1995-96.

BUDGETARY BALANCE, FINANCIAL SOURCE/REQUIREMENT AND NET FINANCING ACTIVITIES

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | For the years ended March 31, |

| |

|

| | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| | |

| | (in millions) |

| BUDGETARY TRANSACTIONS | | | | | | | | | | | | | | | | | | | | |

| | Revenues | | $ | 198,547 | | | $ | 190,232 | | | $ | 183,676 | | | $ | 194,120 | | | $ | 176,067 | |

| | Program expenses | | | -153,695 | | | | -145,993 | | | | -137,006 | | | | -130,066 | | | | -119,538 | |

| | | Operating surplus or deficit ( - ) | | | 44,852 | | | | 44,239 | | | | 46,670 | | | | 64,054 | | | | 56,529 | |

| | Public debt charges | | | -35,769 | | | | -37,270 | | | | -39,651 | | | | -43,892 | | | | -43,384 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | Budgetary surplus or deficit ( - ) | | | 9,083 | | | | 6,969 | | | | 7,019 | | | | 20,162 | | | | 13,145 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| NON-BUDGETARY TRANSACTIONS | | | | | | | | | | | | | | | | | | | | |

| | Loans, investments and advances | | | -5,800 | | | | -2,192 | | | | 16 | | | | -3,212 | | | | -587 | |

| | Pensions and other liabilities | | | 2,611 | | | | 346 | | | | -1,031 | | | | 3,222 | | | | 7,560 | |

| | Non-financial assets | | | -578 | | | | -878 | | | | -1,621 | | | | -1,512 | | | | -1,507 | |

| | Other transactions | | | -3,708 | | | | 260 | | | | -2,944 | | | | 1,419 | | | | -3,933 | |

| | Foreign exchange transactions | | | 4,637 | | | | 3,096 | | | | -1,776 | | | | -8,776 | | | | -6,826 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | Total non-budgetary transactions | | | -2,838 | | | | 632 | | | | -7,356 | | | | -8,859 | | | | -5,293 | |

| FINANCIAL SOURCE/REQUIREMENT | | | 6,245 | | | | 7,601 | | | | -337 | | | | 11,303 | | | | 7,852 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| UNMATURED DEBT TRANSACTIONS | | | -2,185 | | | | -2,475 | | | | -4,104 | | | | -10,013 | | | | -4,034 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| CHANGE IN CASH BALANCES | | | 4,060 | | | | 5,126 | | | | -4,441 | | | | 1,290 | | | | 3,818 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| CASH AT END OF YEAR | | $ | 20,546 | | | $ | 16,486 | | | $ | 11,360 | | | $ | 15,801 | | | $ | 14,511 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Source: Public Accounts of Canada, 2004.

19

Budgetary Revenue

The Government reports revenue on an accrual basis in the period in which the event that gave rise to the revenue took place. Income tax revenue is recognized when the taxpayer has earned the income subject to tax. Personal income taxes accounted for about 47% and corporate income taxes accounted for about 14% of Government revenue in fiscal 2003-04.

Since 2001, the Canadian income tax system has comprised four tax brackets, 16%, 22%, 26% and 29%. For 2004, the tax thresholds, accounting for inflation indexing, are 16% for income up to $35,000, 22% for income between $35,001 and $70,000, 26% for income between $70,001 and $113,804 and 29% for income $113,805 and higher.

The 2004 Budget proposed to extend eligibility for the education tax credit, increase the Canada Education Savings Grant contribution limit, introduce a Canada Learning Bond for certain children born after 2003, improve the tax recognition of medical and disability related costs incurred by caregivers, introduce a disability supports deduction to assist persons with disabilities with employment and education related expenses and make employment income earned by military and police personnel serving in high-risk missions outside Canada tax free to prescribed limits.

The general federal corporate income tax rate in Canada in 2004 is 21%. The federal corporate tax rate is 12% for the first $250,000 of active business income earned by a Canadian controlled private corporation. Most corporations are also subject to a federal surtax equal to 4% of their federal income tax liability (computed without reference to the small business deduction and most tax credits). The large corporations tax is 0.2% of taxable capital employed in Canada in excess of $50 million. The 4% surtax may be credited against the large corporations tax liability. An additional capital tax (effectively a minimum tax since it is creditable against basic income tax) is levied on large financial institutions.