Filed by Computer Horizons Corp. pursuant to Rule 425

under the Securities Act of 1933 and deemed filed pursuant

to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: Computer Horizons Corp.

Commission File No.: 000-07282

The following is a communication being sent to employees of Computer Horizons Corp.

Subject: CHC’s Merger Overview Presentation

To All CHC Managers, Staff and Resources

In our continuing effort to keep everyone informed and current, Bill Murphy and the Executive Management team wanted to share with you the presentation prepared for investors that highlights the important attributes and rationale of our Merger with Analysts. A copy is also posted in the investor section of our web site. If you have any questions or suggestions, please share them with me.

Thank you for your continued support.

For those of you who are shareholders, you should have received a white proxy from the company for all of the shares of CHRZ you own. You should receive a separate proxy from each account where your shares are held. For example, if you participate in the 401K plan, the ESPP and also purchased shares through a broker, you should have received three proxies by now. If you are missing proxies, and you believe they are for shares managed/held by your brokerage firm, call your broker as well. If they are shares held through the 401K or ESPP plan, please let me know immediately and we will help you with the process.

For the reasons in the investor presentation, we encourage you to vote the white proxy and to ignore any green proxy received. Your vote is important regardless of the amount of shares you own. Please vote you shares immediately - - do not wait.

Thanks

David

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Benefits of Proposed Merger |

Computer Horizons Corp (CHRZ) with Analysts International Corporation (ANLY) | [GRAPHIC] |

International Horizons Group, Inc. (IHRZ)

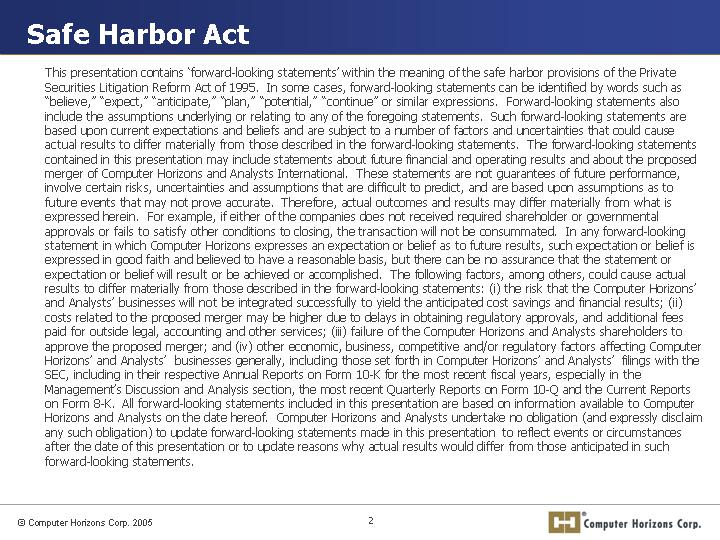

Safe Harbor Act

This presentation contains ‘forward-looking statements’ within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,” “plan,” “potential,” “continue” or similar expressions. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. Such forward-looking statements are based upon current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The forward-looking statements contained in this presentation may include statements about future financial and operating results and about the proposed merger of Computer Horizons and Analysts International. These statements are not guarantees of future performance, involve certain risks, uncertainties and assumptions that are difficult to predict, and are based upon assumptions as to future events that may not prove accurate. Therefore, actual outcomes and results may differ materially from what is expressed herein. For example, if either of the companies does not received required shareholder or governmental approvals or fails to satisfy other conditions to closing, the transaction will not be consummated. In any forward-looking statement in which Computer Horizons expresses an expectation or belief as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement or expectation or belief will result or be achieved or accomplished. The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: (i) the risk that the Computer Horizons’ and Analysts’ businesses will not be integrated successfully to yield the anticipated cost savings and financial results; (ii) costs related to the proposed merger may be higher due to delays in obtaining regulatory approvals, and additional fees paid for outside legal, accounting and other services; (iii) failure of the Computer Horizons and Analysts shareholders to approve the proposed merger; and (iv) other economic, business, competitive and/or regulatory factors affecting Computer Horizons’ and Analysts’ businesses generally, including those set forth in Computer Horizons’ and Analysts’ filings with the SEC, including in their respective Annual Reports on Form 10-K for the most recent fiscal years, especially in the Management’s Discussion and Analysis section, the most recent Quarterly Reports on Form 10-Q and the Current Reports on Form 8-K. All forward-looking statements included in this presentation are based on information available to Computer Horizons and Analysts on the date hereof. Computer Horizons and Analysts undertake no obligation (and expressly disclaim any such obligation) to update forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to update reasons why actual results would differ from those anticipated in such forward-looking statements.

© Computer Horizons Corp. 2005

2

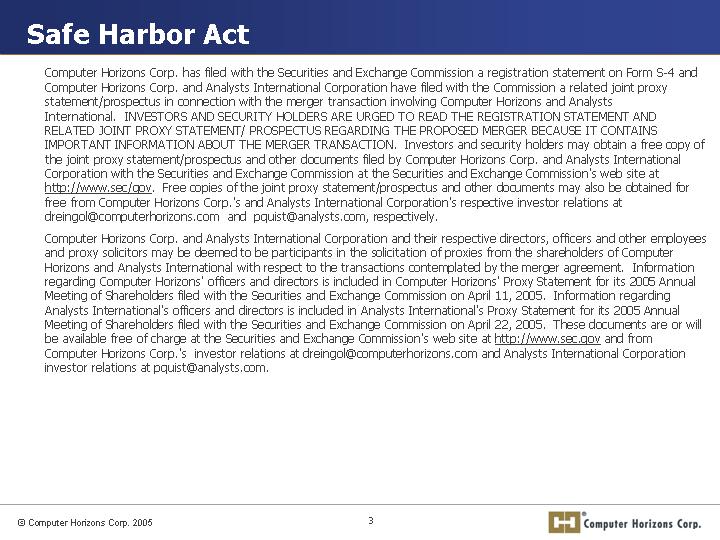

Computer Horizons Corp. has filed with the Securities and Exchange Commission a registration statement on Form S-4 and Computer Horizons Corp. and Analysts International Corporation have filed with the Commission a related joint proxy statement/prospectus in connection with the merger transaction involving Computer Horizons and Analysts International. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND RELATED JOINT PROXY STATEMENT/ PROSPECTUS REGARDING THE PROPOSED MERGER BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT THE MERGER TRANSACTION. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus and other documents filed by Computer Horizons Corp. and Analysts International Corporation with the Securities and Exchange Commission at the Securities and Exchange Commission’s web site at http://www.sec/gov. Free copies of the joint proxy statement/prospectus and other documents may also be obtained for free from Computer Horizons Corp.’s and Analysts International Corporation’s respective investor relations at dreingol@computerhorizons.com and pquist@analysts.com, respectively.

Computer Horizons Corp. and Analysts International Corporation and their respective directors, officers and other employees and proxy solicitors may be deemed to be participants in the solicitation of proxies from the shareholders of Computer Horizons and Analysts International with respect to the transactions contemplated by the merger agreement. Information regarding Computer Horizons’ officers and directors is included in Computer Horizons’ Proxy Statement for its 2005 Annual Meeting of Shareholders filed with the Securities and Exchange Commission on April 11, 2005. Information regarding Analysts International’s officers and directors is included in Analysts International’s Proxy Statement for its 2005 Annual Meeting of Shareholders filed with the Securities and Exchange Commission on April 22, 2005. These documents are or will be available free of charge at the Securities and Exchange Commission’s web site at http://www.sec.gov and from Computer Horizons Corp.’s investor relations at dreingol@computerhorizons.comand Analysts International Corporation investor relations at pquist@analysts.com.

3

Current Company Profiles

Computer Horizons, NOW: | | Analysts International, NOW: |

| | |

• Global provider of IT Services and Solutions | | • Global technology services and solutions company |

| | |

• Founded 1969 | | • Founded 1966 |

| | |

• 2004 revenue of $263 million | | • 2004 revenue of $342 million |

| | |

• 2,500 billable consultants; 31 offices | | • 3,000 billable consultants; 35 offices |

| | |

• Strong East Coast presence with concentrations in financial services and Federal Government verticals | | • Strong Midwest presence with concentrations in services and manufacturing verticals |

| | |

• Business mix: | | • Business mix: |

| | |

• 50% Staffing | | • 72% Staffing |

| | |

• 50% Solutions, including Chimes | | • 28% Solutions |

| | |

• Leadership in VMS marketplace via Chimes; Strong application development/management and network security practice | | • Strong presence in Voice over IP (VoIP), storage and networking infrastructure markets |

| | |

• Offshore/Nearshore solutions centers | | • Strong alliances with technology leaders |

4

Facts on Proposed Merger

• Merger of equals - initially announced April 13, 2005

• Valued at approximately $90 million

• Tax-free stock transaction: 1.15 share of CHC for 1 share of Analysts

• Based on Analysts price one day prior to announcement, 0.3% premium to market

• Post merger ownership: CHC 52%, Analysts 48%

• Form S-4 filed with SEC on May 31st; declared effective on August 4, 2005

• Shareholder approval required for both companies

• Proposed new company name – “International Horizons Group, Inc.”

• Special Shareholders’ meetings scheduled for September 2, 2005

5

Merger Rationale

• Increase shareholder value

• CHC shareholders will have the opportunity to participate in the potential for growth of the combined company after the merger

• Better-serve existing customers with a diverse blend of end-to-end client solutions, while enhancing ability to attract new customers

• Provide greater opportunities for existing employees, while enhancing ability to attract and maintain top talent

• Gain critical mass to leverage existing infrastructure

• Leverage complementary asset base (clients, geographies, industries, services) and enhance CHC’s ability to achieve greater scale and presence in the IT services industry due to little client and geographic overlap

• Better position the combined company to achieve increased growth and profitability

• Attract institutional investor interest and sponsorship

6

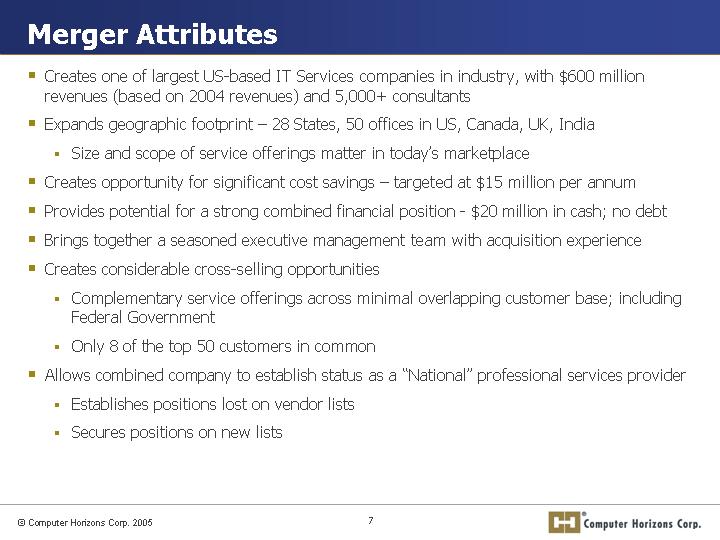

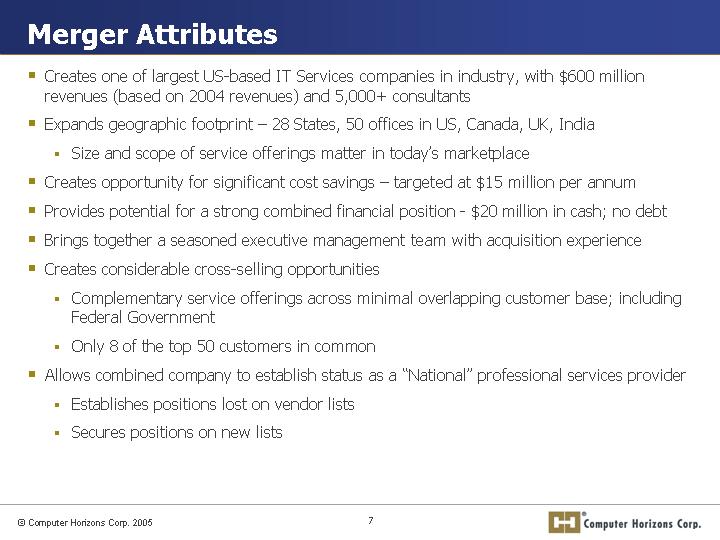

Merger Attributes

• Creates one of largest US-based IT Services companies in industry, with $600 million revenues (based on 2004 revenues) and 5,000+ consultants

• Expands geographic footprint – 28 States, 50 offices in US, Canada, UK, India

• Size and scope of service offerings matter in today’s marketplace

• Creates opportunity for significant cost savings – targeted at $15 million per annum

• Provides potential for a strong combined financial position - $20 million in cash; no debt

• Brings together a seasoned executive management team with acquisition experience

• Creates considerable cross-selling opportunities

• Complementary service offerings across minimal overlapping customer base; including Federal Government

• Only 8 of the top 50 customers in common

• Allows combined company to establish status as a “National” professional services provider

• Establishes positions lost on vendor lists

• Secures positions on new lists

7

Merged Company Profile – International Horizons Group

• International Horizons Group will be one of the largest information technology companies in the U.S. with a successful 40 year track record of innovation and quality service. We will help our customers optimize their investments in IT infrastructure and human capital by innovatively combining people, process and technology with our tested flexible global delivery model.

8

Historical Revenue Mix Comparison – Pro Forma

ANLY 2004 Revenue Breakdown | | Pro Forma Combined 2004 Revenue |

| | |

[CHART] | | [CHART] |

| | |

CHRZ 2004 Revenue Breakdown | | |

| | |

[CHART] | | |

Source: Company filings and CHC and Analysts management estimates.

Note: Federal revenue is solutions based revenue. Analysts subsupplier revenue is incorporated in staffing segment of combined company.

9

Complementary Customers / Limited Overlap

[LOGO] | | Overlap | | [LOGO] |

| | | | |

[LOGO] | | [LOGO] | | [LOGO] |

• 90% of customers are new to both companies.

Only 8 of top 50 overlap

10

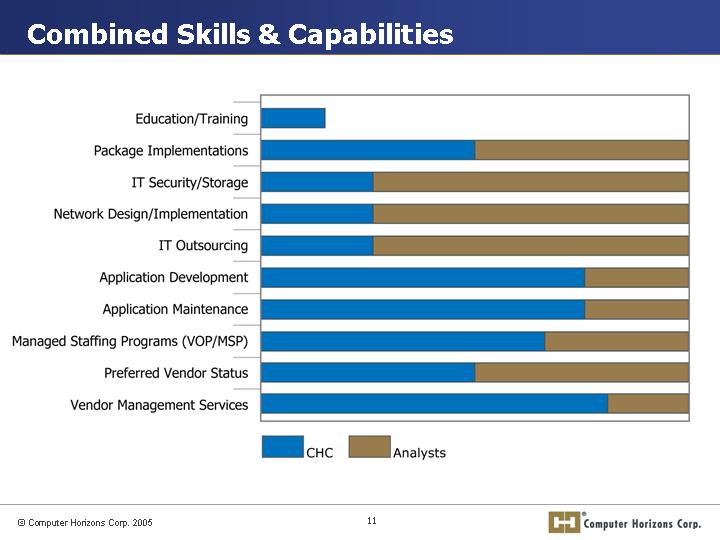

Combined Skills & Capabilities

[CHART]

11

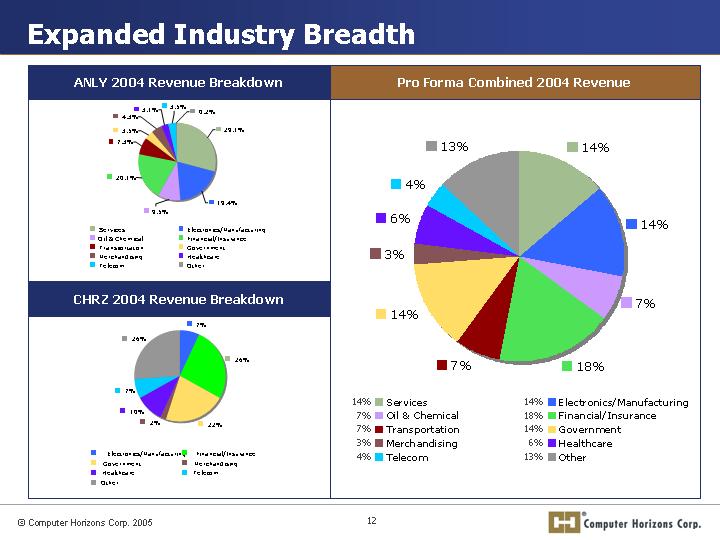

Expanded Industry Breadth

ANLY 2004 Revenue Breakdown | | Pro Forma Combined 2004 Revenue |

| | |

[CHART] | | [CHART] |

| | |

CHRZ 2004 Revenue Breakdown | | |

| | |

[CHART] | | |

12

Combined Geographic Footprint

[GRAPHIC]

• The combined company would have an increased footprint in the U.S., Canada and India

13

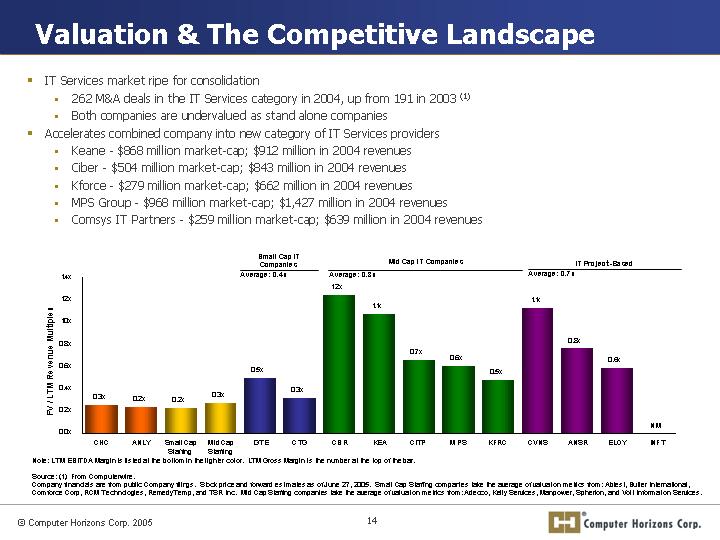

Valuation & The Competitive Landscape

• IT Services market ripe for consolidation

• 262 M&A deals in the IT Services category in 2004, up from 191 in 2003 (1)

• Both companies are undervalued as stand alone companies

• Accelerates combined company into new category of IT Services providers

• Keane - - $868 million market-cap; $912 million in 2004 revenues

• Ciber - - $504 million market-cap; $843 million in 2004 revenues

• Kforce - - $279 million market-cap; $662 million in 2004 revenues

• MPS Group - $968 million market-cap; $1,427 million in 2004 revenues

• Comsys IT Partners - $259 million market-cap; $639 million in 2004 revenues

[CHART]

Note: LTM EBITDA Margin is listed at the bottom in the lighter color. LTM Gross Margin is the number at the top of the bar.

Source: (1) From Computerwire.

Company financials are from public Company filings. Stock price and forward estimates as of June 27, 2005. Small Cap Staffing companies take the average of valuation metrics from: Ablest, Butler International, Comforce Corp, RCM Technologies, RemedyTemp, and TSR Inc. Mid Cap Staffing companies take the average of valuation metrics from: Adecco, Kelly Services, Manpower, Spherion, and Volt Information Services.

14

New Board and Executive Management

• Board of Directors – Ten Directors

• Five Directors from each existing Board

• 8 of 10 Directors are independent

• Co-Chairmen

• Earl Mason (CHC), Michael LaVelle (Analysts)

• William Murphy - CEO

• Jeffrey Baker – President & COO

• David Steichen – CFO

• Michael Shea – Controller

• Michael Caulfield – General Counsel & Secretary

• Extensive experience with successful M&A integration

15

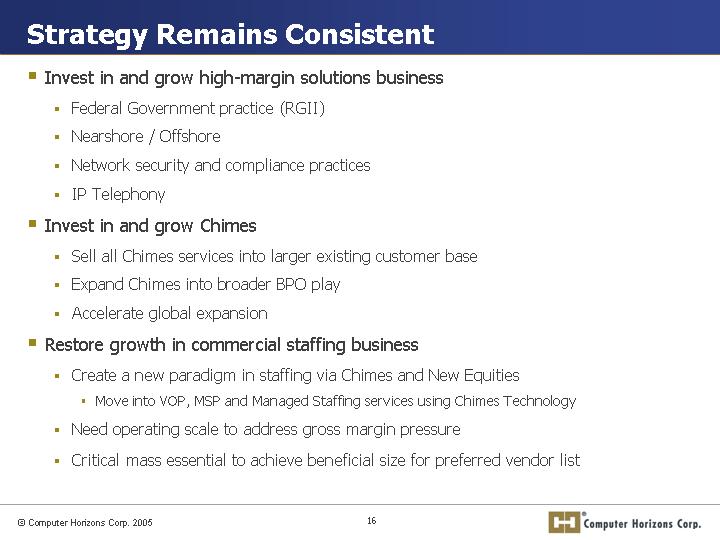

Strategy Remains Consistent

• Invest in and grow high-margin solutions business

• Federal Government practice (RGII)

• Nearshore / Offshore

• Network security and compliance practices

• IP Telephony

• Invest in and grow Chimes

• Sell all Chimes services into larger existing customer base

• Expand Chimes into broader BPO play

• Accelerate global expansion

• Restore growth in commercial staffing business

• Create a new paradigm in staffing via Chimes and New Equities

• Move into VOP, MSP and Managed Staffing services using Chimes Technology

• Need operating scale to address gross margin pressure

• Critical mass essential to achieve beneficial size for preferred vendor list

16

Financial Highlights | | [GRAPHIC] |

August 2005

Potential Cost Savings ($ millions)

Shared Services/Infrastructure Costs | | $ | 7.0 | (1) |

| | | |

Entity-Level Costs | | 5.0 | (2) |

| | | |

Duplicate Facilities Costs | | 3.0 | (3) |

| | | |

Total Potential Savings | | $ | 15.0 | |

(1) | Includes “back-office” personnel (Finance, HR, etc.), several management positions and IT hardware/software costs. |

(2) | “Public Company” costs, including insurance (D&O), outside accounting, legal, Sarbanes-Oxley expenses, directors fees, etc. |

(3) | Duplicate office space (approximately six offices). |

18

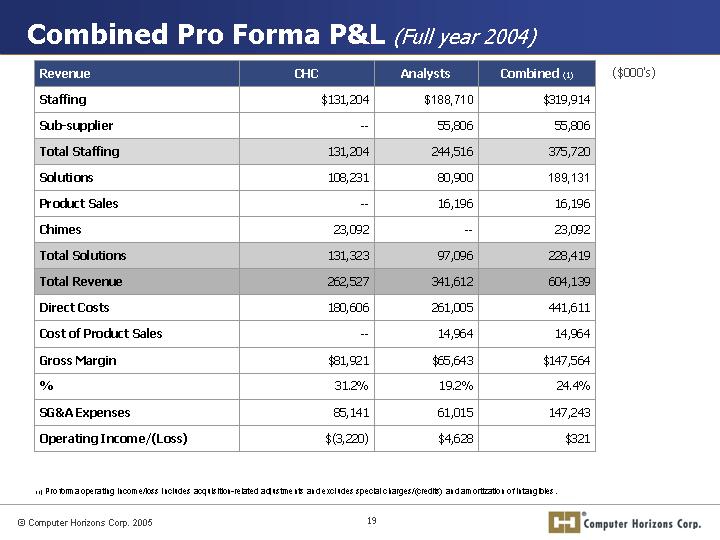

Combined Pro Forma P&L (Full year 2004)

($000’s)

Revenue | | CHC | | Analysts | | Combined (1) | |

Staffing | | $ | 131,204 | | $ | 188,710 | | $ | 319,914 | |

Sub-supplier | | — | | 55,806 | | 55,806 | |

Total Staffing | | 131,204 | | 244,516 | | 375,720 | |

Solutions | | 108,231 | | 80,900 | | 189,131 | |

Product Sales | | — | | 16,196 | | 16,196 | |

Chimes | | 23,092 | | — | | 23,092 | |

Total Solutions | | 131,323 | | 97,096 | | 228,419 | |

Total Revenue | | 262,527 | | 341,612 | | 604,139 | |

Direct Costs | | 180,606 | | 261,005 | | 441,611 | |

Cost of Product Sales | | — | | 14,964 | | 14,964 | |

Gross Margin | | $ | 81,921 | | $ | 65,643 | | $ | 147,564 | |

% | | 31.2 | % | 19.2 | % | 24.4 | % |

SG&A Expenses | | 85,141 | | 61,015 | | 147,243 | |

Operating Income/(Loss) | | $ | (3,220 | ) | $ | 4,628 | | $ | 321 | |

(1) | Pro forma operating income/loss includes acquisition-related adjustments and excludes special charges/(credits) and amortization of intangibles. |

19

Combined Pro Forma P&L (Quarter Ending March 31, 2005)

($000’s)

Revenue | | CHC | | Analysts | | Combined (1) | |

Staffing | | $ | 35,503 | | $ | 46,400 | | $ | 81,903 | |

Sub-supplier | | — | | 7,597 | | 7,597 | |

Total Staffing | | 35,503 | | $ | 53,997 | | $ | 89,500 | |

Solutions | | 24,707 | | $ | 19,650 | | $ | 44,357 | |

Product Sales | | — | | 5,452 | | 5,452 | |

Chimes | | 6,363 | | — | | 6,363 | |

Total Solutions | | 31,070 | | 25,102 | | 56,172 | |

Total Revenue | | 66,573 | | 79,099 | | 145,672 | |

Direct Costs | | 45,588 | | 59,067 | | 104,655 | |

Cost of Product Sales | | — | | 5,107 | | 5,107 | |

Gross Margin | | $ | 20,985 | | $ | 14,925 | | $ | 35,910 | |

% | | 31.5 | % | 18.9 | % | 24.7 | % |

SG&A Expenses | | 20,977 | | 15,454 | | 36,726 | |

Operating Income/(Loss) | | $ | 8 | | $ | (529 | ) | $ | (816 | ) |

(1) | Pro forma operating Income/Loss includes acquisition-related adjustments and excludes special charges/(credits) and amortization of intangibles. |

20

Combined Pro Forma Balance Sheet (as of March 31, 2005)

($ millions)

Cash | | $ | 20 | |

Working capital | | 92 | |

Total assets | | 276 | |

Short-term borrowings | | 0 | |

Long-term debt | | 0 | |

Shareholders’ equity | | 217 | |

Current ratio | | 2.9:1 | |

Book value per share | | $ | 3.65 | |

21

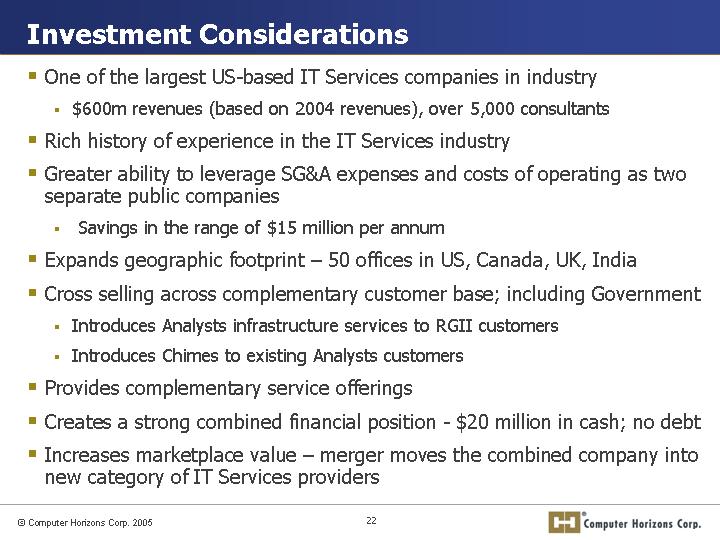

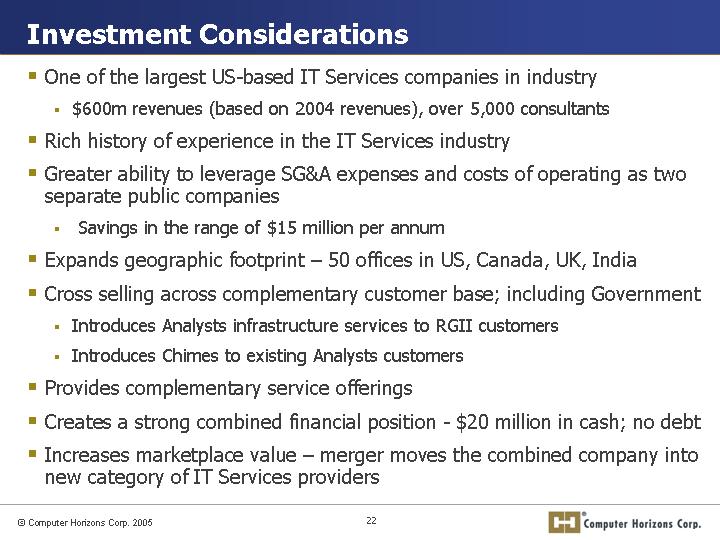

Investment Considerations

• One of the largest US-based IT Services companies in industry

• $600m revenues (based on 2004 revenues), over 5,000 consultants

• Rich history of experience in the IT Services industry

• Greater ability to leverage SG&A expenses and costs of operating as two separate public companies

• Savings in the range of $15 million per annum

• Expands geographic footprint – 50 offices in US, Canada, UK, India

• Cross selling across complementary customer base; including Government

• Introduces Analysts infrastructure services to RGII customers

• Introduces Chimes to existing Analysts customers

• Provides complementary service offerings

• Creates a strong combined financial position - - $20 million in cash; no debt

• Increases marketplace value – merger moves the combined company into new category of IT Services providers

22