[LOGO]

Special Meeting of Shareholders October 11th

Purpose of Special Meeting of Shareholders

• Called by dissident shareholder group (representing 10.3% of total shares outstanding) to vote on following proposals:

• Remove all directors (6) serving on the CHC Board, without cause

• Reduce Board to five directors

• Fill vacancies with dissident’s nominated slate of directors

• Meeting to be held on October 11th

• Record date - September 12th

© Computer Horizons Corp. 2005 | | [LOGO] |

1

CHC Board Asks For Your Vote Against Dissident

• Radical proposal to replace an entire Board

• Current Board and Management:

• Authorized hiring of new financial advisor to re-assess ALL strategic alternatives

• Continuing to execute against strategic Three Year Plan

• Proven track record of building value (for example, created and nurtured Chimes)

• Positioned CHC for growth and profitability

• Wealth of experience across all industries

• Re-elected in May 2005 (after proposed merger was announced)

• Dissident group has no articulated plan or vision

2

CHC Will Continue to Execute Existing Three Year Plan (2004-2006)

• Invest in and grow higher-margin solutions business

• Federal government practice (RGII)

• Global delivery model — Nearshore/Offshore

• Invest in and grow Chimes faster than other CHC business units; realize intrinsic value of recurring revenue model

• Restore growth and profitability in commercial business

• Increase consolidated gross and operating margins

• Return ROIC to positive percentage and improve YOY

• Maintain strong balance sheet

• Translate operating performance into increased shareholder value

3

Evaluating All Strategic Alternatives

• Board authorized management to retain new financial advisor to re-assess all strategic alternatives to maximize shareholder value, including:

• the sale of all, or certain parts of the company

• spin-off, or IPO of certain assets

• mergers/acquisitions

• stock repurchase program

• We believe dissident group’s primary objective is to put a “for sale” sign on the company to realize a quick gain

• Current Board and management is better positioned to manage a comprehensive review of all alternatives

• Radical Board change is likely to seriously damage day-to-day business by creating widespread instability and uncertainty among customers and employees

4

CHC’s Board & Management Team: Proven Track Record

• Steered company through global downturn in IT industry (2000-2003)

• CHC experienced YOY consolidated revenue growth (7%) in 2004 for the first time in five years

• EBITDA and gross margins improved, and operating losses were cut in half

• During 1H2005, CHC has returned to both growth and profitability

• Maintained strong balance sheet

• Continued investment in Chimes and made decision to enter Federal Government market through two cash acquisitions (RGII, AIM)

• Built global solutions delivery capability

5

Financial and Operating Performance 2000 – 2004:

Key Perspective

• Over 60% of the $44.7 million operating loss during the 2000-2004 period was related to continued investment in Chimes ($27.3 million)

• Current Board and management believed in Chimes and made conscious decision to continue investing

• All but one of CHC’s peers experienced double digit declines in revenue during 2000-2003 period, the worst historical period for the IT Services industry

• CHC experienced YOY consolidated revenue growth (7%) in 2004 for the first time in five years.

• March 13, 2003 - Change in leadership at Board and CEO level — Stock price $2.84

• Stock price declined 76% during 2000-2004; peer group experienced decline of 64%

6

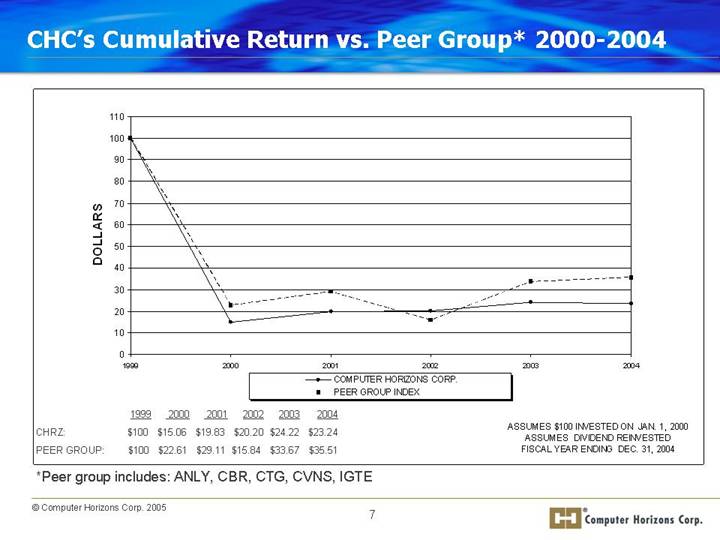

CHC’s Cumulative Return vs. Peer Group* 2000-2004

[CHART]

| | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | |

CHRZ: | | $ | 100 | | $ | 15.06 | | $ | 19.83 | | $ | 20.20 | | $ | 24.22 | | $ | 23.24 | |

PEER GROUP: | | $ | 100 | | $ | 22.61 | | $ | 29.11 | | $ | 15.84 | | $ | 33.67 | | $ | 35.51 | |

ASSUMES $100 INVESTED ON JAN. 1, 2000

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2004

*Peer group includes: ANLY, CBR, CTG, CVNS, IGTE

7

CHC’s Board of Directors: Independent and Experienced

• 5 of 6 directors independent

• Policy initiated in 2003 that all directors own CHC stock

• CHC’s Corporate Governance Quotient (given by ISS) outperforms 96% of the companies in the software & services group and 89% of companies in the Russell 3000 average

• Earl L. Mason (Chairman since 2003; Director since 1999)

• President and Chief Executive Officer of Alliant Exchange Inc. (1999 -2000) .

• Senior Vice President and Chief Financial Officer of Compaq Computer Corp. (1996-1999)

• Currently, Director of EMJ Metals and the Chairman of its Audit Committee and is a Trustee of The Eastern Point Advisors Funds Trust.

• William M. Duncan (Director since 1999)

• Currently, Director of International Studies at Stony Brook University, New York.

• Senior Vice President of JPMorgan Chase Bank (1992–2004)

8

• Eric P. Edelstein (Director since 2003)

• Currently, Executive Vice President and Chief Financial Officer of Griffon Corporation, a leading manufacturer of building products and laminated specialty plastic films used in the healthcare industrial market.

• Managing Partner, Arthur Andersen LLP’s Business Consulting Practice (1972-2002) most recently as Managing Partner of the Business Consulting Practice.

• Currently, Director and a member of the Audit Committee of Valley National Bank.

• William J. Marino (Director since 2002)

• Currently, President and Chief Executive Officer of Horizon Blue Cross Blue Shield of New Jersey (since 1994)

• Director of Sealed Air Corporation and a member of its Compensation Committee.

• William J. Murphy (Director since 1999)

• Currently, President and Chief Executive Officer of CHC (since March 2003)

• Chief Financial Officer of CHC (January 1997 to March 2003)

• Edward J. Obuchowski (Director since 2004)

• Senior Vice President and Chief Information Officer of Alliant Exchange Inc. (1999-2002).

• Vice President Internal Audit of Compaq Computer Corp. (1998-1999)

9

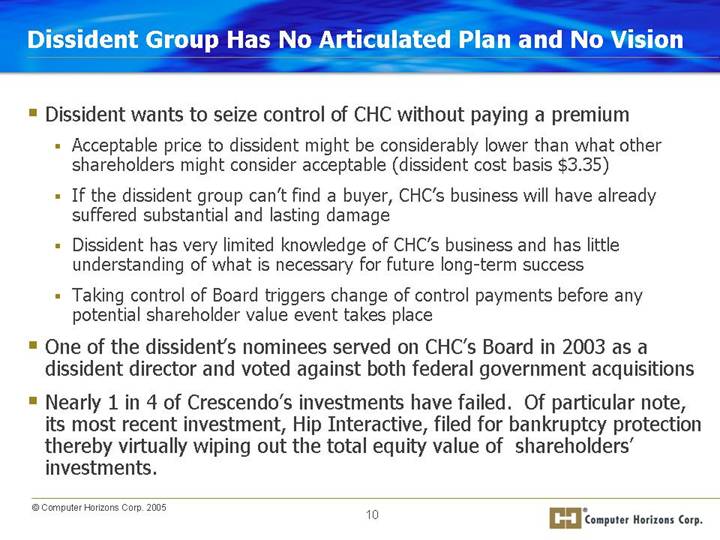

Dissident Group Has No Articulated Plan and No Vision

• Dissident wants to seize control of CHC without paying a premium

• Acceptable price to dissident might be considerably lower than what other shareholders might consider acceptable (dissident cost basis $3.35)

• If the dissident group can’t find a buyer, CHC’s business will have already suffered substantial and lasting damage

• Dissident has very limited knowledge of CHC’s business and has little understanding of what is necessary for future long-term success

• Taking control of Board triggers change of control payments before any potential shareholder value event takes place

• One of the dissident’s nominees served on CHC’s Board in 2003 as a dissident director and voted against both federal government acquisitions

• Nearly 1 in 4 of Crescendo’s investments have failed. Of particular note, its most recent investment, Hip Interactive, filed for bankruptcy protection thereby virtually wiping out the total equity value of shareholders’ investments.

10

Summary

• Radical proposal to replace entire Board without cause

• CHC Board has upheld its fiduciary duty, made sound decisions and is constantly exploring for ways to increase shareholder value

• New financial advisor in process of being retained

• CHC will continue to execute on its strategic Three Year Plan, it’s working

• CHC Board is better qualified to evaluate strategic alternatives

• Financial and operating performance is in line with industry trends, specifically CHC’s peer group, and has significantly improved since March 2003

• Stock price performance in line with industry trends, specifically CHC’s peer group.

• Dissident group has no articulated plan or vision

11

Safe Harbor

• This communication contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,” “plan,” “potential,” “continue” or similar expressions. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. Such forward-looking statements are based upon current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. All forward-looking statements included in this communication are based on information available to Computer Horizons on the date hereof. Computer Horizons undertakes no obligation (and expressly disclaims any such obligation) to update forward-looking statements made in this communication to reflect events or circumstances after the date of this communication or to update reasons why actual results would differ from those anticipated in such forward-looking statements.

12