Selective Insurance Group, Inc.

Keefe, Bruyette & Woods

Insurance Conference

September 10, 2009

Financial Strength

Dale Thatcher

Executive Vice President

Chief Financial Officer & Treasurer

Forward Looking Statement

Certain statements in this report, including information incorporated by reference, are “forward-looking statements” as that term is

defined in the Private Securities Litigation Reform Act of 1995 (“PSLRA”). The PSLRA provides a safe harbor under the Securities Act of

1933 and the Securities Exchange Act of 1934 for forward-looking statements. These statements relate to our intentions, beliefs,

projections, estimations or forecasts of future events or our future financial performance and involve known and unknown risks,

uncertainties and other factors that may cause our or our industry's actual results, levels of activity, or performance to be materially

different from those expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements

by use of words such as "may," "will," "could," "would," "should," "expect," "plan," "anticipate," "target," "project," "intend," "believe,"

"estimate," "predict," "potential," "pro forma," "seek," "likely" or "continue" or other comparable terminology. These statements are only

predictions, and we can give no assurance that such expectations will prove to be correct. We undertake no obligation, other than as

may be required under the federal securities laws, to publicly update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Factors, that could cause our actual results to differ materially from those projected, forecasted or estimated by us in forward-looking

statements are discussed in further detail in Selective’s public filings with the United States Securities and Exchange Commission. These

risk factors may not be exhaustive. We operate in a continually changing business environment, and new risk factors emerge from time-

to-time. We can neither predict such new risk factors nor can we assess the impact, if any, of such new risk factors on our businesses or

the extent to which any factor or combination of factors may cause actual results to differ materially from those expressed or implied in

any forward-looking statements in this report. In light of these risks, uncertainties and assumptions, the forward-looking events discussed

in this report might not occur.

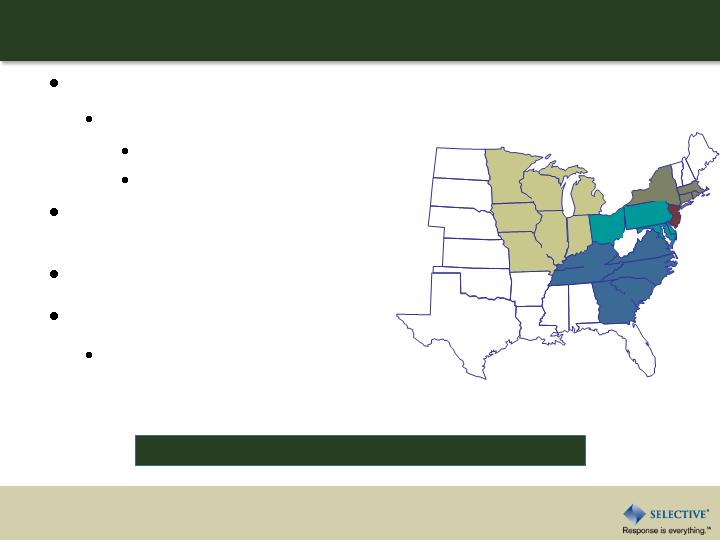

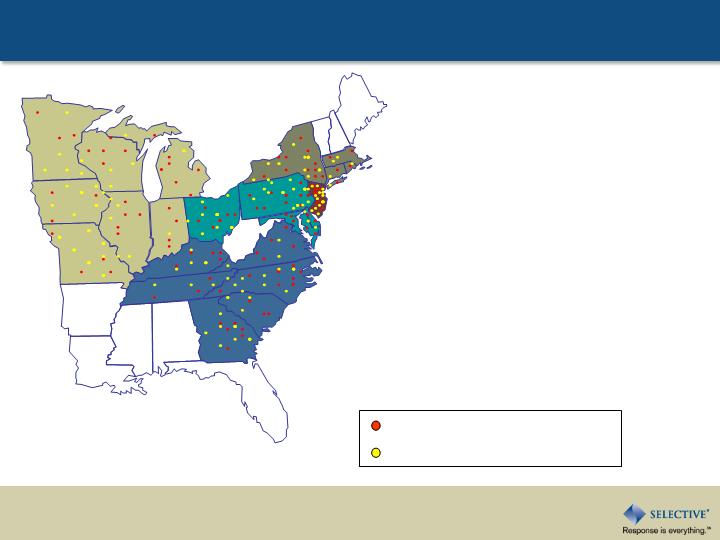

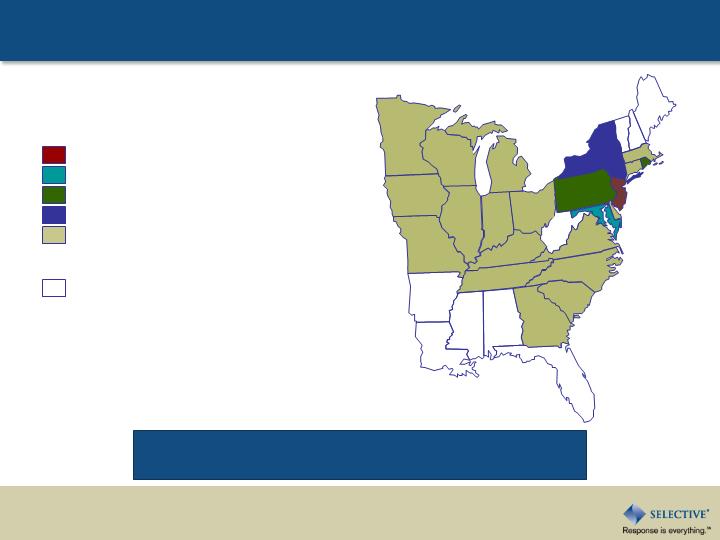

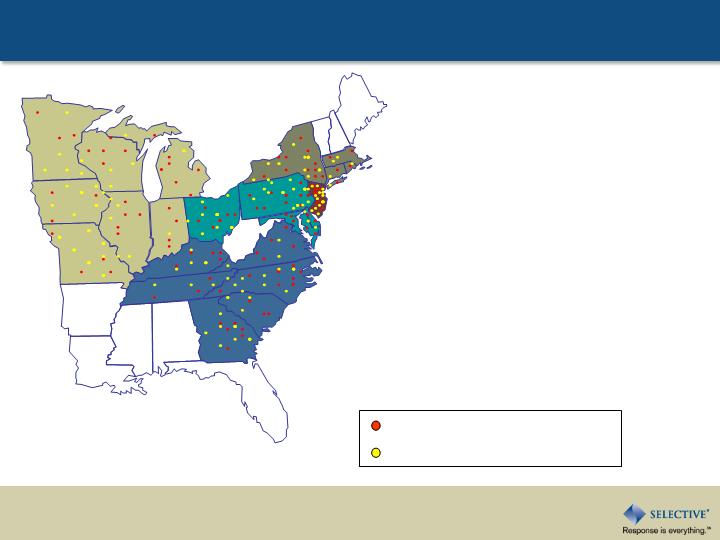

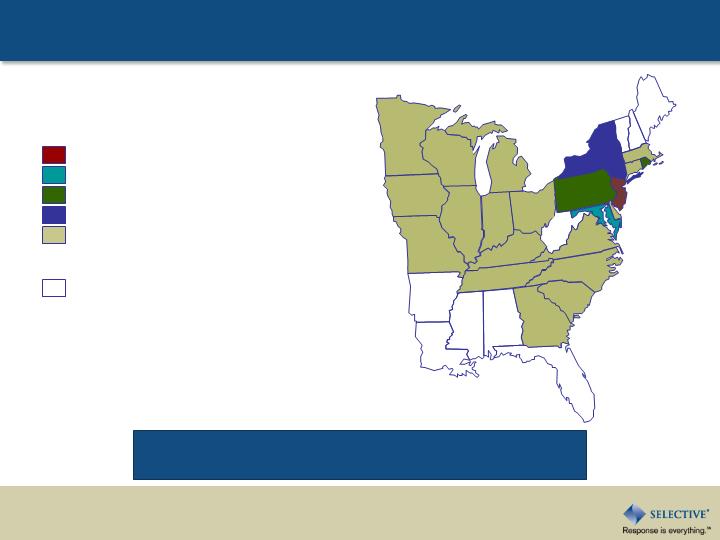

22-state super-regional

$1.5B NPW

86% commercial lines

14% personal lines

Distribution partner with 960

independent agents

Best in class field model

History of financial strength

A.M. Best rated “A” or better for 78

years, and “A+” for past 48 years

Selective Profile

Only 9% of P&C carriers rated A+ or better

CT

MN

IA

MO

WI

I

L

I

N

KY

OH

MI

MI

GA

SC

NC

VA

PA

NY

MD

NJ

RI

DE

CT

MA

TN

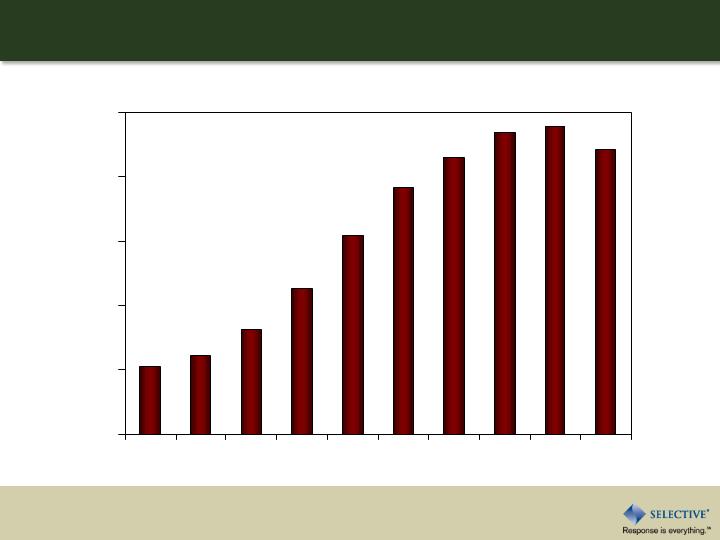

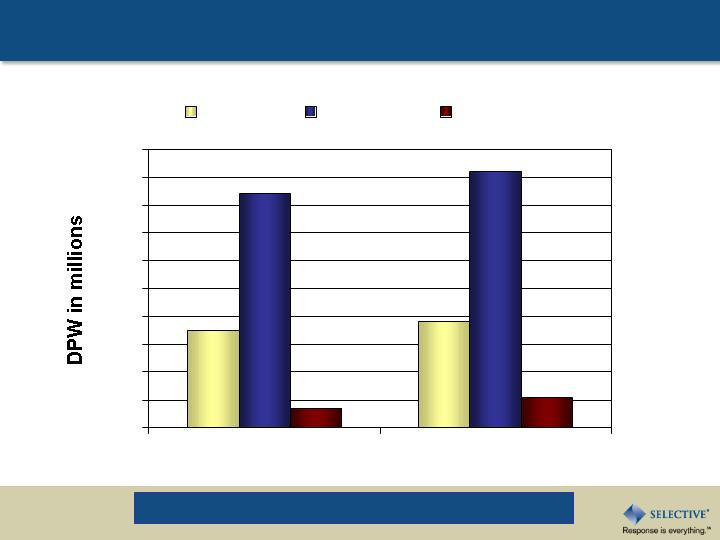

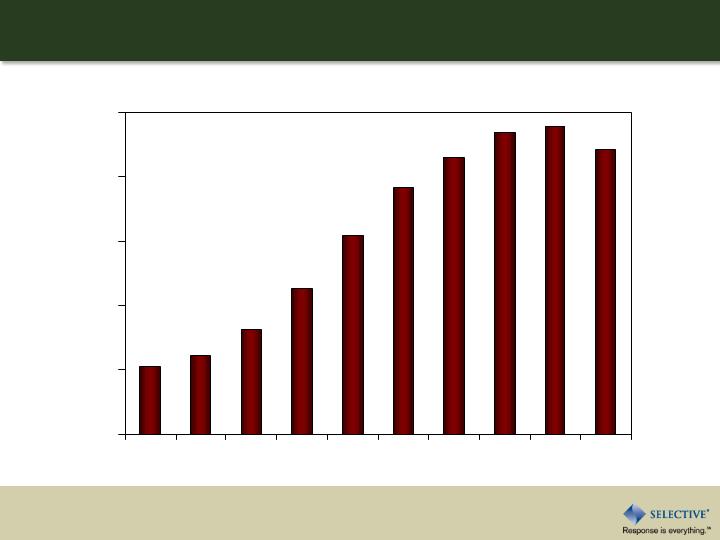

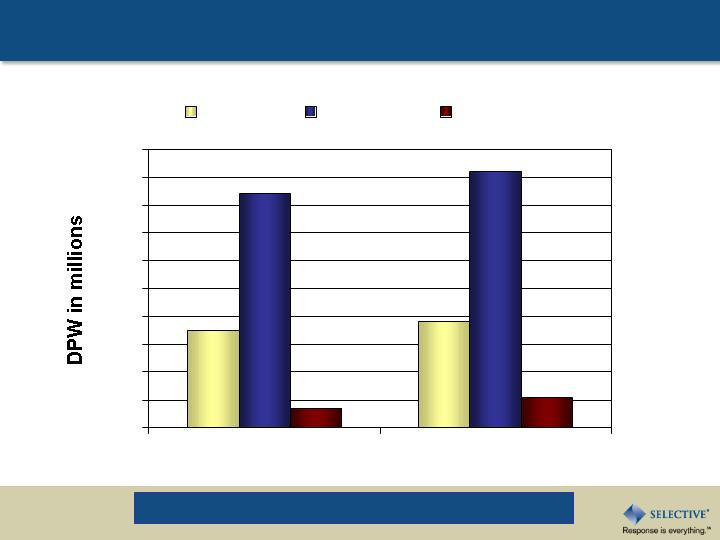

Net Premium Written

$ in millions

600

800

1,000

1,200

1,400

1,600

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

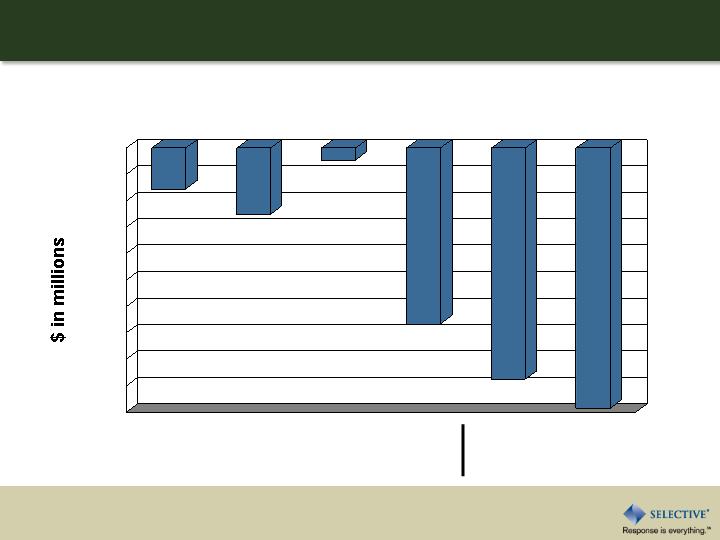

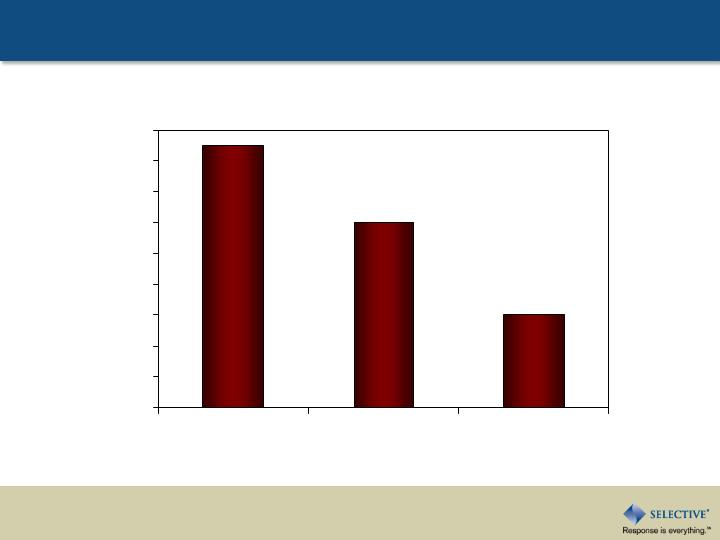

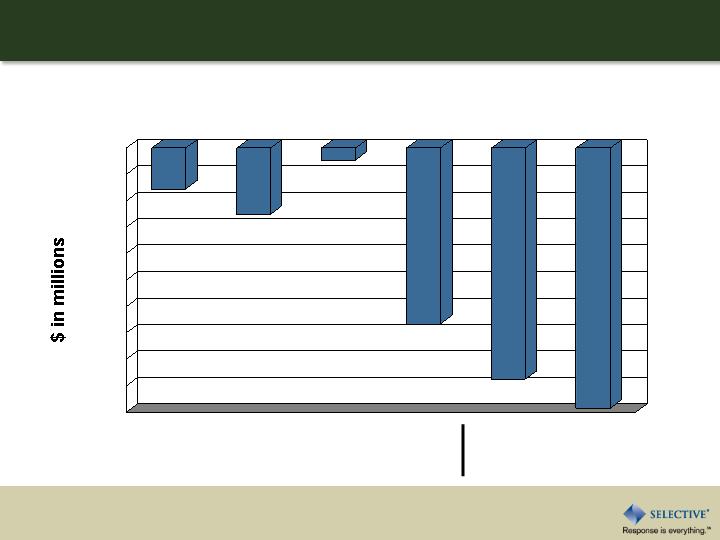

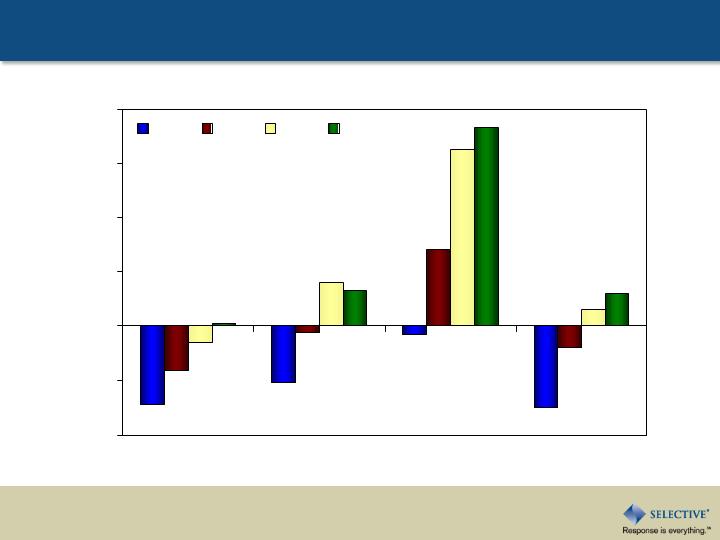

Current Economic Impact on

Premium Growth

2009

2008

-20

-18

-16

-14

-12

-10

-8

-6

-4

-2

0

1Q

2Q

3Q

4Q

1Q

2Q

Audit and Endorsement Returned Premium

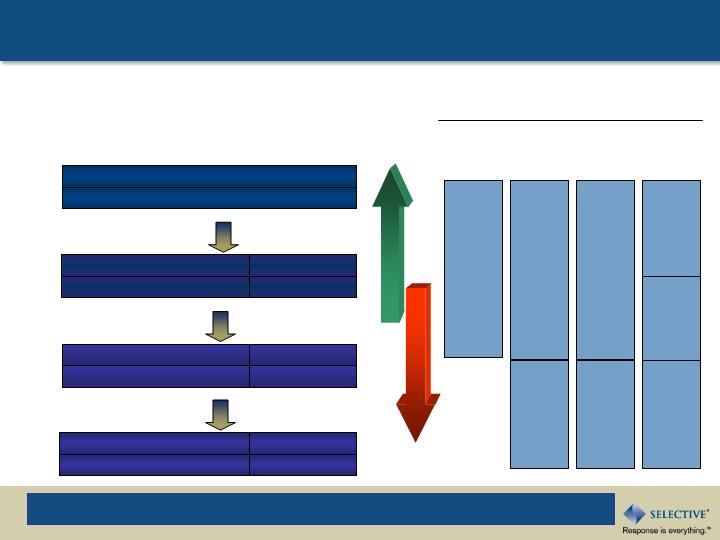

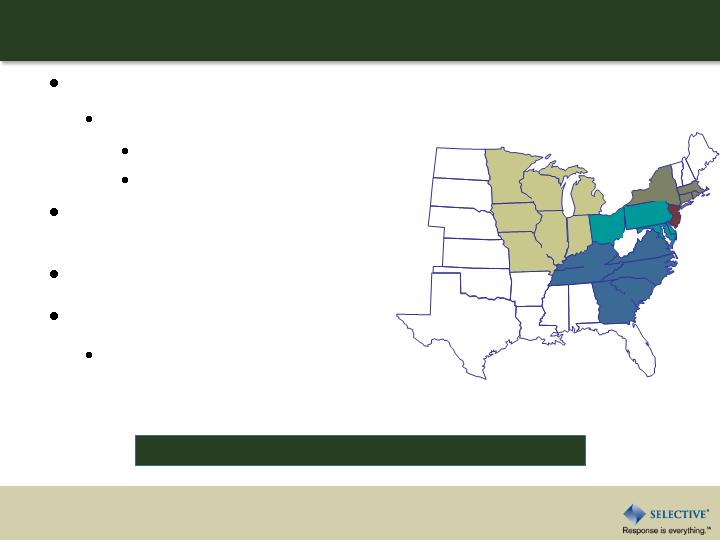

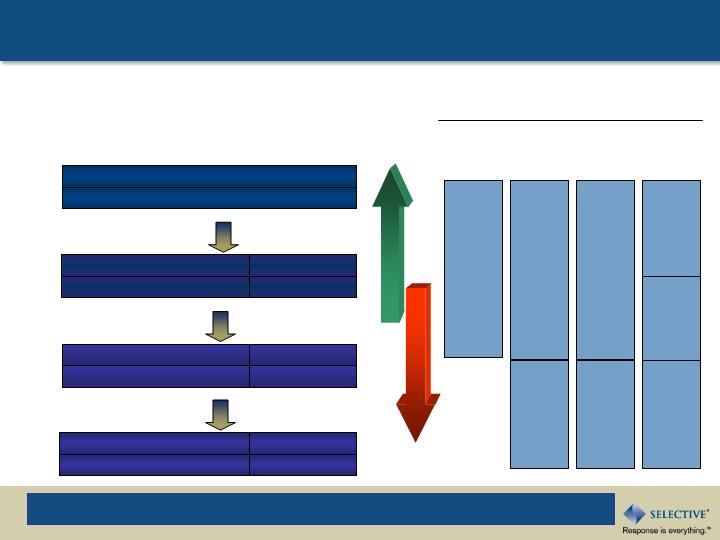

A Foundation of Financial Strength

Focused expense management

Conservative investment portfolio

Disciplined reserving practices

Strong reinsurance program

Proactively managed capital

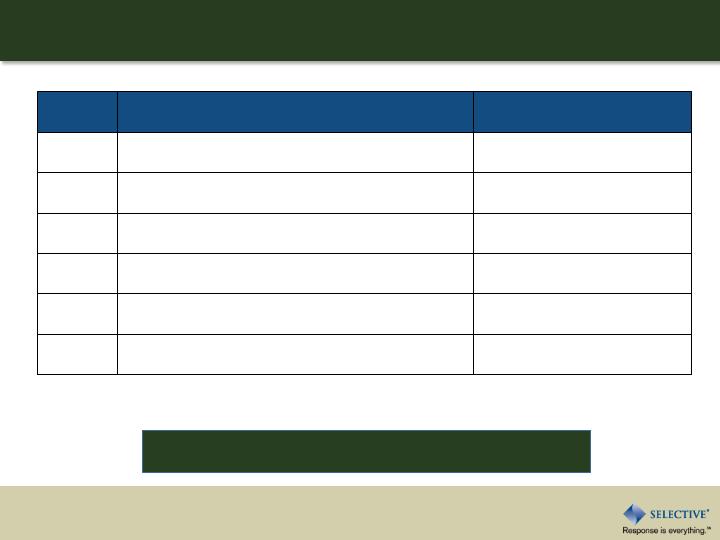

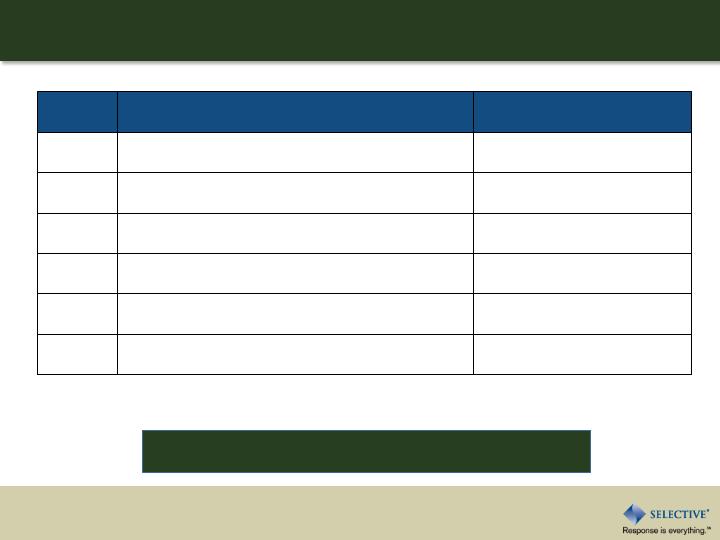

Focused Expense Management

$1 million

Vendor consolidation project

$1 million

Tax credits and incentives

$4 million, one time

Benefits changes

2009

$2 million

Indiana re-domestication

$7 million

Restructuring

$7 million

Targeted commission reductions

2008

Savings

Initiative

Next expense focus area is claims

Average “AA+” bond quality

Approximately 3.5 year average

duration, including short-term &

cash

Equities outperformed S&P 500 for

nine consecutive years

Alternative investments have

outperformed S&P 500 since 1997

Conservative Investment Portfolio

$3.6B Invested Assets

as of June 30, 2009

Equities

2%

Bonds

89%

Short-Term

5%

Alternative

Investments

4%

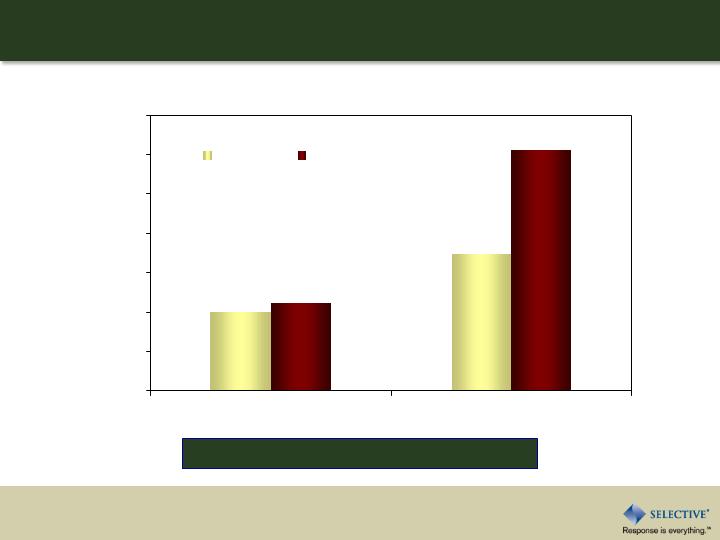

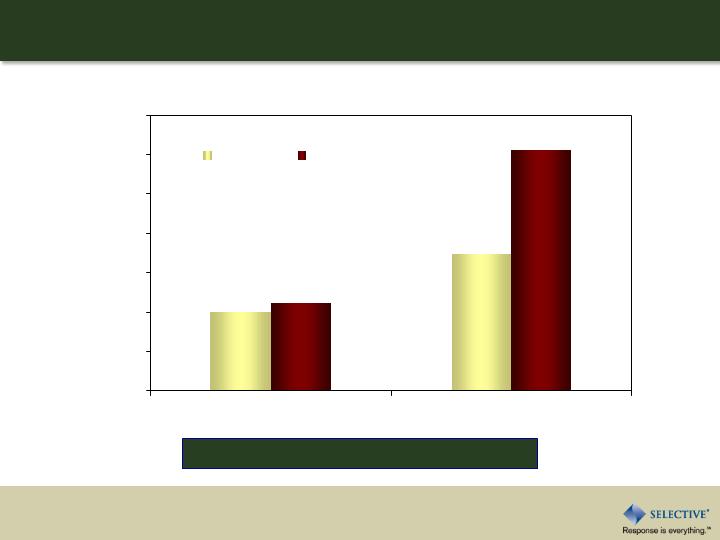

Alternative Investment Strategies

($ in millions)

Alternative strategies generated $7 million in additional equity over S&P 500 since 1997

Market Values of $143M at June 30, 2009

0

5

10

15

20

25

30

35

Venture Capital

Mezzanine Financing

Real Estate

Private Equity

Secondary Private Equity

Distressed Debt

Energy/Power Generation

Carried

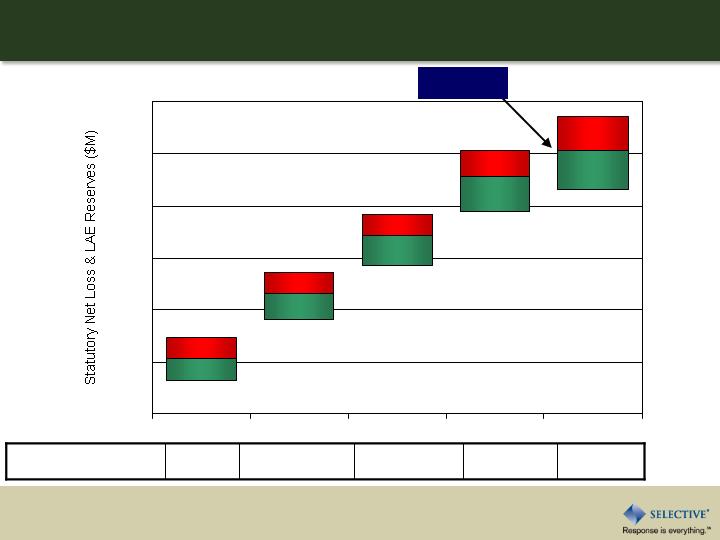

$2,415M

53.9%

57.5%

56.9%

54.8%

52.6%

($10M)

$18M

$16M

$7M

($5M)

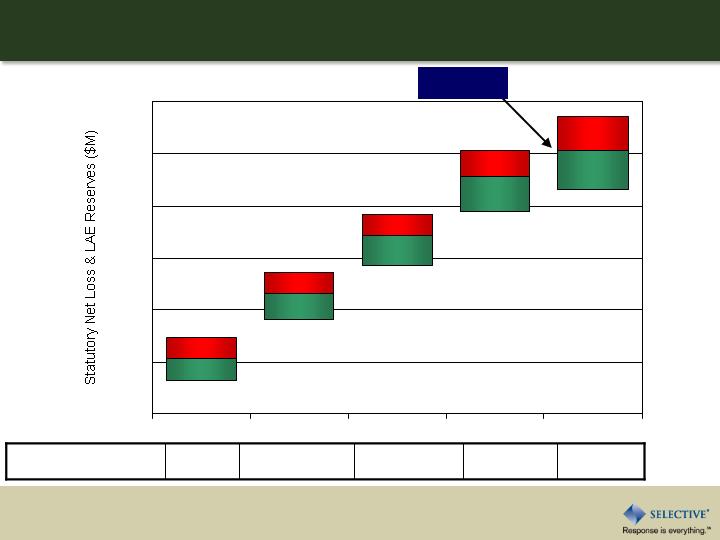

Calendar Year Reserve

Development (p/t)

Disciplined Reserving Practices

Actuarial Reserve Ranges

$102

$112

$135

$150

$84

$85

$99

$128

$87

$79

1,400

1,600

1,800

2,000

2,200

2,400

2,600

2004

2005

2006

2007

2008

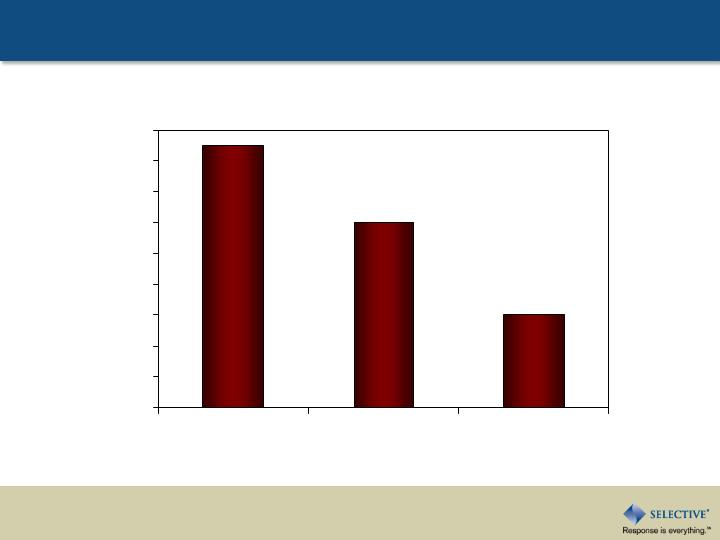

Strong Natural Catastrophe Program

RMS Model

CAT cover: $310M in excess of $40M

% of Equity at Risk

Percentages are net of tax, reinsurance and reinstatement premium.

RMS data as of 7/1/07; Equity data as of 6/30/09.

4%

7%

4%

12%

0%

2%

4%

6%

8%

10%

12%

14%

1% Probability

0.4% Probability

8.0 Historic

8.0 Stochastic

Capital Position

Premium to surplus: 1.7x

Debt to total capitalization:

Total: 21.7%

Adjusted: 15.4%

Weighted average life of debt: 35 years

Book value per share $17.85

As of June 30, 2009

Profitability Improvement

Greg Murphy

Chairman, President & CEO

Strategies for Long-Term Profitable Growth

Best in class agency relationships and field model

Commercial lines pricing power

Quality of new business through predictive modeling

Diversification of commercial lines book

Personal lines improvement plan

Best in class claims practices

Best in Class Field Model

CT

MN

IA

MO

WI

IL

IN

KY

OH

MI

MI

GA

SC

NC

VA

PA

NY

MD

NJ

RI

DE

CT

MA

TN

100 Agency Management Specialists

140 Claims Management Specialists

…one of the great things with the AMS field model is

the fact that our AMS is out visiting with us every

other week…looking at new opportunities…

Mark Levine of Eastern Insurance

Commercial Lines New Business

Commercial lines new business up 12% YTD

0

10

20

30

40

50

60

70

80

90

100

6 mos 2008

6 mos 2009

One & Done

Middle Market

Large Account

99.1%

Segment 60

94.6%

Segment 41

94.0%

Segment 40

87.2%

Segment 21

87.2%

Segment 20

65.4%

Segment 1

117.7%

Segment 80

99.3%

Segment 61

Profitability Monitoring

Operational Areas

Marketing

Safety

Management

Training

Pricing

Average

Lower

Than

Average

Higher

Than

Average

Growth

Profitability

Improvement

Marketing

Materials

Stewardship

Service

Retention

Sales

Training

Boundary

Control

Corrective

Action

Business Segment

4-Year AY

Combined

Ratio (2008)

Predictive modeling improves performance on an account basis

Percent of Total New Premium Diamond Distribution

WC, BOP, CPP, CA

For lines < $50,000

Commercial Lines Quality Improvement

53%

59%

29%

12%

25%

9%

17%

30%

66%

0%

10%

20%

30%

40%

50%

60%

70%

5 & 4 Diamond

3 Diamond

2 & 1 Diamond

Pre-Modeling

2008

2009 YTD June

Retaining our Best Commercial Business

Retention at point of renewal as of June 30, 2009

5 & 4 Diamond

3 Diamond

2 & 1 Diamond

86%

80%

91%

74%

76%

78%

80%

82%

84%

86%

88%

90%

92%

Commercial Lines Diversification

99.4%

93.2%

91.7%

94.4%

60

100 %

90

80

70

Further diversification results in lower combined ratio

10

15

20

25

30

35

40

45

50

Contractors

Merc/Serv

Manufacturing

Specialty

2008

YTD 2009 June

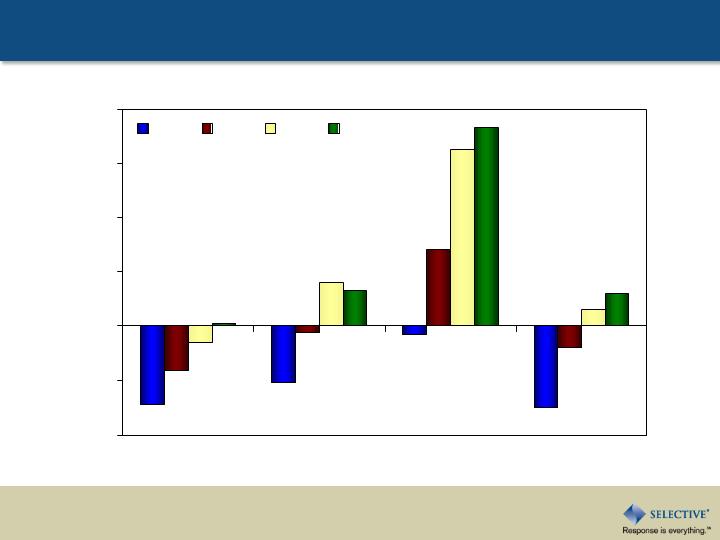

Selective Total Pricing

Commercial Lines Pricing Power

Jul/Aug:09

2Q:09

1Q:09

4Q08

-3.0%

-0.8%

0.6%

1.2%

-4.0%

-2.0%

0.0%

2.0%

Selective Pricing by Diamond

Commercial Lines Pricing Power

Total

2&1

Diamond

3

Diamond

5&4

Diamond

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

4Q:08

1Q:09

2Q:09

Jul/Aug:09

Selective Pricing vs. Industry Indices

Commercial Lines Pricing Power

2Q:09

1Q:09

4Q:08

-3.0%

-0.8%

0.6%

-2.8%

-0.6%

0.5%

-3.1%

-0.5%

-1.1%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

Selective

CLIPS

Advisen ADVx

Personal Lines

$24M in-force price change on $213M book

Underwriting and automation improvements – reduced

operating costs and increased data quality

13-state footprint opportunity – $900 million

Key Claims Strategies

Litigation management

Vendor management

Integrated outcomes

Workers compensation

Other casualty lines

Heightened fraud monitoring

MA

MN

IA

MO

WI

IL

IN

KY

OH

MI

MI

GA

SC

NC

VA

PA

NY

MD

NJ

RI

DE

CT

TN

Commercial Lines

State Market Opportunity

>4% (NJ)

3% to <4% (MD)

2% to <3% (RI & PA)

1% to <2% (NY)

0% to <1% (GA, KY, NC, SC, TN,

VA, IA, IL, IN, MI, MN, MO, WI, OH,

MA, CT, DE)

Not currently in footprint

SIGI’s current average market share = 1.1%.

At 4% market share, premiums would be > $5B

Selective’s Current Market Share

Commercial Lines

Agency Market Opportunity

19,120

10,733

2,060

2,215

283

1,174

2,655

Most Recent

Agency

Commercial

Lines Premium

Volume ($M)

8.3

Total

5.9

8.3

11.4

18.5

10.0

13.6%

Current

Share of

Wallet

NY

All

other

PA

RI

MD

NJ

State

*Includes agents appointed prior to 2006 only

Source: Highline Data

18% Share of

Wallet Results in

$3.4 Billion DPW

Long-Term Shareholder Value Creation

*Fiscal-year dividend

*

Selective Insurance Group, Inc.

Keefe, Bruyette & Woods

Insurance Conference

September 10, 2009