Exhibit 99.2

| | | |

| | | |

| | | |

| | | |

| | | |

| | | ® |

| | | |

| | | |

| | | |

| | | |

| Supplemental Investor Package |

| ________________________________ |

| | | |

| | | |

Fourth Quarter and Full Year 2008 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Investor Contact: |

| | | Jennifer DiBerardino |

| | | Vice President, Investor Relations |

| | | Tel: 973-948-1364 |

| | | Jennifer.diberardino@selective.com |

| | | |

| | | |

SELECTIVE INSURANCE GROUP, INC.

INVESTOR PACKET

TABLE OF CONTENTS

| Earnings Press Release | 1 |

| Selected Balance Sheet Data | 8 |

| Selected Income Statement Data | 9 |

| Quarterly Investment Income | 10 |

| Investment Yield and Tax Rate Portfolio Breakdown | 11 |

| Statutory Combined Ratio Summary by LOB Quarter | 12 |

| Statutory Combined Ratio Summary by LOB YTD | 13 |

| DIS Results and PEO Statistics | 14 |

| Consolidated Balance Sheet | 15 |

| Consolidated Statement of Income | 16 |

| Consolidated Statement of Stockholder’s Equity | 17 |

| Consolidated Statement of Cash Flows | 18 |

| Statutory Balance Sheet | 19 |

| Statutory Statement of Combined Income | 20 |

| Investment Portfolio – Appendix | |

| | Municipal Fixed Income Portfolio Exhibit | 21 |

| | Ratings on Municipal Fixed Income Portfolio Exhibit | 22 |

| | Muni Bonds with Credit Enhancement Exhibit | 23 |

| | Structured Securities Chart | 24 |

| | RMBS & RABS Chart | 25 |

| | RMBS & RABS by Vintage Year Exhibit | 26 |

| | RMBS and RABS by Type Exhibit | 27 |

| | RMBS & RABS Ratings Migrations | 28 |

| | CMBS Chart | 29 |

| | CMBS by Vintage Year Exhibit | 30 |

| | CMBS by Type Exhibit | 31 |

| | CMBS Ratings Migration | 32 |

| | 2007 Vintage CMBS Chart | 33 |

| | 2007 Vintage CMBS Exhibit | 34 |

| | Alt-A RMBS Chart | 35 |

| | Alt-A by Vintage Year Exhibit | 36 |

| | Asset Backed Securities with Insurance Exhibit | 37 |

| | Fixed Income Government & Agency Exposure Exhibit | 38 |

| | AFS Fixed Maturities Severity & Duration of Unrealized Losses Exhibit | 39 |

| | Credit Quality of AFS Securities Exhibit | 40 |

Selective Insurance Group, Inc.

Selected Balance Sheet Data (unaudited)

($ in thousands, except per share amounts)

| | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| | | Balance | | | Market | | | Unrealized | | | Balance | | | Market | | | Unrealized | |

| | | Sheet | | | Value | | | Gain/(Loss) | | | Sheet | | | Value | | | Gain/(Loss) | |

| Invested Assets: | | | | | | | | | | | | | | | | | | |

Corporate bonds1,2 | | $ | 1,024,179 | | | | 1,024,181 | | | | (124,294 | ) | | $ | 1,299,055 | | | | 1,299,057 | | | | (688 | ) |

Gov't\ Municipal bonds2 | | | 2,011,262 | | | | 2,011,275 | | | | 35,240 | | | | 1,780,275 | | | | 1,780,417 | | | | 24,466 | |

| Total bonds | | | 3,035,441 | | | | 3,035,456 | | | | (89,054 | ) | | | 3,079,330 | | | | 3,079,474 | | | | 23,778 | |

| Equities | | | 132,131 | | | | 132,131 | | | | 6,184 | | | | 274,705 | | | | 274,705 | | | | 114,315 | |

| Short-term investments | | | 198,111 | | | | 198,111 | | | | - | | | | 190,167 | | | | 190,167 | | | | - | |

| Trading securities | | | 2,569 | | | | 2,569 | | | | (1,216 | ) | | | - | | | | - | | | | - | |

| Other investments | | | 172,057 | | | | 172,057 | | | | (5,585 | ) | | | 188,827 | | | | 188,827 | | | | 30,647 | |

| Total invested assets | | | 3,540,309 | | | | 3,540,324 | | | | (89,671 | ) | | | 3,733,029 | | | | 3,733,173 | | | | 168,740 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | 4,941,332 | | | | | | | | | | | | 5,001,992 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Reserve for losses | | | 2,256,329 | | | | | | | | | | | | 2,182,572 | | | | | | | | | |

| Reserve for loss expenses | | | 384,644 | | | | | | | | | | | | 359,975 | | | | | | | | | |

| Unearned premium reserve | | | 844,334 | | | | | | | | | | | | 841,348 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liabilities | | | 4,050,839 | | | | | | | | | | | | 3,925,949 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Stockholders' equity | | | 890,493 | | | | | | | | | | | | 1,076,043 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total debt to capitalization ratio | | | 23.5 | % | | | | | | | | | | | 21.5 | % | | | | | | | | |

Adjusted total debt to capitalization ratio 3 | | | 17.0 | % | | | | | | | | | | | 15.2 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Book value per share | | | 16.84 | | | | | | | | | | | | 19.81 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Book value per share excluding | | | | | | | | | | | | | | | | | | | | | | | | |

| FAS 115 unrealized gain or loss on bond portfolio | | | 17.94 | | | | | | | | | | | | 19.53 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| NPW per insurance segment employee | | | 797 | | | | | | | | | | | | 797 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Statutory premiums to surplus ratio | | | 1.7 | x | | | | | | | | | | | 1.5 | x | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Statutory surplus | | | 866,035 | | | | | | | | | | | | 1,034,294 | | | | | | | | | |

| 1 | Includes mortgage-backed and asset backed securities. |

| 2 | Certain prior year amounts were reclassified to confrom with currrent year presentation. |

| 3 | The adjusted debt to capitalization ratio reflects a reduction in debt for amounts held in an irrevocable trust for the benefit of senior note holders as well as the median rating agency equity treatment of 75% applied to our $100 million Junior Subordinated Notes issued September 25, 2006. |

| Selective Insurance Group, Inc. | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Income Statement Data (unaudited) | | | | | | | | | | | | | | | | | | | | | | | | |

| December 2008 | | THREE MONTHS ENDED DECEMBER 31, | | | TWELVE MONTHS ENDED DECEMBER 31, | |

| ($ in thousands, except per share amounts) | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| | | | | | Per diluted share | | | | | | Per diluted share | | | | | | Per diluted share | | | | | | Per diluted share | |

| Consolidated | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | $ | 380,398 | | | | | | $ | 466,611 | | | | | | $ | 1,695,979 | | | | | | $ | 1,846,228 | | | | |

| Operating income | | | 5,315 | | | | 0.10 | | | | 32,243 | | | | 0.60 | | | | 75,902 | | | | 1.42 | | | | 124,818 | | | | 2.21 | |

| Net realized (losses) gains, after tax | | | (19,703 | ) | | | (0.38 | ) | | | 3,997 | | | | 0.07 | | | | (32,144 | ) | | | (0.60 | ) | | | 21,680 | | | | 0.38 | |

| Net (Loss) income | | | (14,388 | ) | | | (0.28 | ) | | | 36,240 | | | | 0.67 | | | | 43,758 | | | | 0.82 | | | | 146,498 | | | | 2.59 | |

| Operating return on equity | | | 2.3 | % | | | | | | | 12.2 | % | | | | | | | 7.7 | % | | | | | | | 11.6 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Insurance Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | | | 358,381 | | | | | | | | 369,702 | | | | | | | | 1,708,793 | | | | | | | | 1,752,248 | | | | | |

| Net premiums written | | | 306,431 | | | | | | | | 323,236 | | | | | | | | 1,484,041 | | | | | | | | 1,554,867 | | | | | |

| Net premiums earned | | | 366,618 | | | | | | | | 382,682 | | | | | | | | 1,495,490 | | | | | | | | 1,517,306 | | | | | |

| Underwriting (loss) profit - before tax | | | (4,785 | ) | | | | | | | 1,264 | | | | | | | | (15,226 | ) | | | | | | | 15,957 | | | | | |

| - after tax | | | (3,110 | ) | | | (0.06 | ) | | | 822 | | | | 0.02 | | | | (9,897 | ) | | | (0.19 | ) | | | 10,372 | | | | 0.18 | |

| GAAP combined ratio | | | 101.3 | % | | | | | | | 99.7 | % | | | | | | | 101.0 | % | | | | | | | 98.9 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial lines | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net premiums earned | | | 312,887 | | | | | | | | 331,044 | | | | | | | | 1,285,547 | | | | | | | | 1,314,002 | | | | | |

| GAAP combined ratio | | | 99.6 | % | | | | | | | 95.9 | % | | | | | | | 99.5 | % | | | | | | | 96.8 | % | | | | |

| Personal lines | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net premiums earned | | | 53,731 | | | | | | | | 51,638 | | | | | | | | 209,943 | | | | | | | | 203,304 | | | | | |

| GAAP combined ratio | | | 111.2 | % | | | | | | | 123.8 | % | | | | | | | 110.2 | % | | | | | | | 112.9 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diversified Insurance Services | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | | 26,002 | | | | | | | | 26,380 | | | | | | | | 116,346 | | | | | | | | 115,566 | | | | | |

| (Loss) income - after tax | | | (217 | ) | | | (0.00 | ) | | | 2,358 | | | | 0.04 | | | | 9,606 | | | | 0.18 | | | | 12,355 | | | | 0.22 | |

| Return on revenue | | | (0.8 | )% | | | | | | | 8.9 | % | | | | | | | 8.3 | % | | | | | | | 10.7 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income - before tax | | | 18,517 | | | | | | | | 49,965 | | | | | | | | 131,032 | | | | | | | | 174,144 | | | | | |

| - after tax | | | 17,043 | | | | 0.33 | | | | 37,315 | | | | 0.68 | | | | 105,039 | | | | 1.97 | | | | 133,669 | | | | 2.34 | |

| Effective tax rate | | | 8.0 | % | | | | | | | 25.3 | % | | | | | | | 19.8 | % | | | | | | | 23.2 | % | | | | |

| Annual after-tax yield on | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment portfolio | | | | | | | | | | | | | | | | | | | 2.9 | % | | | | | | | 3.6 | % | | | | |

| Annual after-tax, after-interest | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| expense yield | | | | | | | | | | | | | | | | | | | 2.5 | % | | | | | | | 3.2 | % | | | | |

| Invested assets per $ of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| stockholders' equity | | | | | | | | | | | | | | | | | | | 3.98 | | | | | | | | 3.47 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other expenses (net of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| other income) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense - before tax | | | (5,036 | ) | | | | | | | (5,640 | ) | | | | | | | (20,508 | ) | | | | | | | (23,795 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual interest expense - after tax | | | (3,273 | ) | | | | | | | (3,666 | ) | | | | | | | (13,330 | ) | | | | | | | (15,467 | ) | | | | |

| Interest expense addback for dilution | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| - after tax | | | - | | | | | | | | 208 | | | | | | | | - | | | | | | | | 1,293 | | | | | |

| Adjusted interest expense - after tax | | | (3,273 | ) | | | (0.06 | ) | | | (3,458 | ) | | | (0.06 | ) | | | (13,330 | ) | | | (0.25 | ) | | | (14,174 | ) | | | (0.25 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other - after tax | | $ | (5,128 | ) | | | (0.11 | ) | | $ | (4,586 | ) | | | (0.08 | ) | | | (15,516 | ) | | | (0.29 | ) | | $ | (16,111 | ) | | | (0.28 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted weighted avg shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| outstanding | | | 51,948 | | | | | | | | 54,746 | | | | | | | | 53,319 | | | | | | | | 57,165 | | | | | |

Selective Insurance Group, Inc. and Consolidated Subsidiaries

Quarterly

GAAP Investment Income

($ in thousands)

(Unaudited)

| | | For the three months ended | | | % | | | Year to Date | | | % | |

| | | December | | | December | | | Increase | | | December | | | December | | | Increase | |

| | | 2008 | | | 2007 | | | (Decrease) | | | 2008 | | | 2007 | | | (Decrease) | |

Investment Income: | | | | | | | | | | | | | | | | | | |

Interest: | | | | | | | | | | | | | | | | | | |

Fixed Maturity Securities | | $ | 36,874 | | | | 36,665 | | | | 0.6 | | | $ | 146,555 | | | | 140,383 | | | | 4.4 | |

Short-term | | | 549 | | | | 2,369 | | | | (76.8 | ) | | | 4,252 | | | | 8,563 | | | | (50.3 | ) |

Other Investments: | | | | | | | | | | | | | | | | | | | | | | | | |

Alternative Investments | | | (18,036 | ) | | | 6,361 | | | | (383.5 | ) | | | (12,676 | ) | | | 19,201 | | | | (166.0 | ) |

Other | | | - | | | | 2,391 | | | | (100.0 | ) | | | - | | | | 2,391 | | | | (100.0 | ) |

Dividends | | | 1,920 | | | | 3,619 | | | | (46.9 | ) | | | 5,603 | | | | 8,626 | | | | (35.0 | ) |

Change in Fair Value (1) | | | (1,681 | ) | | | - | | | | N/M | | | | (8,129 | ) | | | - | | | | N/M | |

Miscellaneous | | | 105 | | | | 77 | | | | 36.4 | | | | 340 | | | | 236 | | | | 44.1 | |

| | | | 19,731 | | | | 51,482 | | | | (61.7 | ) | | | 135,945 | | | | 179,400 | | | | (24.2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Expense | | | 1,214 | | | | 1,517 | | | | (20.0 | ) | | | 4,913 | | | | 5,256 | | | | (6.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income Before Tax | | | 18,517 | | | | 49,965 | | | | (62.9 | ) | | | 131,032 | | | | 174,144 | | | | (24.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Tax | | | 1,474 | | | | 12,650 | | | | (88.3 | ) | | | 25,993 | | | | 40,475 | | | | (35.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | |

After Tax | | $ | 17,043 | | | | 37,315 | | | | (54.3 | ) | | $ | 105,039 | | | | 133,669 | | | | (21.4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | |

per Share | | | 0.33 | | | | 0.68 | | | | (51.5 | ) | | | 1.97 | | | | 2.34 | | | | (15.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Effective Tax Rate | | | 8.0 | % | | | 25.3 | % | | | | | | | 19.8 | % | | | 23.2 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Average Yields: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed Maturity Securities | | | | | | | | | | | | | | | | | | | | | | | | |

Pre Tax | | | | | | | | | | | | | | | 4.6 | % | | | 4.5 | % | | | | |

After Tax | | | | | | | | | | | | | | | 3.6 | % | | | 3.6 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio | | | | | | | | | | | | | | | | | | | | | | | | |

Pre Tax | | | | | | | | | | | | | | | 3.6 | % | | | 4.8 | % | | | | |

After Tax | | | | | | | | | | | | | | | 2.9 | % | | | 3.6 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the three months ended | | | | | | | Year to Date | | | | | |

| | | December | | | December | | | | | | | December | | | December | | | | | |

Net Realized Gains (Losses) | | 2008 | | | 2007 | | | | | | | 2008 | | | 2007 | | | | | |

Fixed Maturities | | | (13,388 | ) | | | (5,063 | ) | | | | | | | (54,159 | ) | | | (6,705 | ) | | | | |

Equity Securities | | | (11,769 | ) | | | 11,212 | | | | | | | | 13,292 | | | | 40,895 | | | | | |

Other | | | (5,156 | ) | | | - | | | | | | | | (8,585 | ) | | | (836 | ) | | | | |

Total | | | (30,313 | ) | | | 6,149 | | | | | | | | (49,452 | ) | | | 33,354 | | | | | |

Net of Tax | | | (19,703 | ) | | | 3,997 | | | | | | | | (32,144 | ) | | | 21,680 | | | | | |

| | (1 ) | Selective adopted Fas 159, the Fair Value Option for Financial Assets and Financial Liablilities - Including an amendment |

| | | of FASB Statement No. 115, on January 1, 2008 and elected to apply the fair value option to certain securities that were |

| | | being managed by an outside manager at the time of adoption. |

Selective Insurance Group, Inc. and Consolidated Subsidiaries

Investment Yield and Effective Tax Rate Portfolio Breakdown

December 31, 2008

($ in thousands)

(Unaudited)

| | | | | | Q4 2008 | | | FY 2008 | |

| | | Market Value | | | Yield | | | Effective Tax Rate | | | Yield | | | Effective Tax Rate | |

| | | ($) | | | (%) | | | (%) | | | (%) | | | (%) | |

| | | | | | | | | | | | | | | | | |

Fixed Maturities Securities: | | | | | | | | | | | | | | | | |

State & Municipal T/E | | | 1,686,822 | | | | 0.9 | | | | 3.3 | | | | 3.8 | | | | 4.1 | |

State & Municipal Tax | | | 72,302 | | | | 1.3 | | | | 35.0 | | | | 5.4 | | | | 35.0 | |

State & Municipal | | | 1,759,124 | | | | 0.9 | | | | 5.2 | | | | 3.9 | | | | 6.1 | |

U.S. Gov't (1) (2) | | | 252,151 | | | | 1.0 | | | | 35.0 | | | | 3.5 | | | | 35.0 | |

Corporate | | | 366,535 | | | | 1.4 | | | | 35.0 | | | | 5.8 | | | | 35.0 | |

ABS's (1) | | | 61,418 | | | | 2.3 | | | | 35.0 | | | | 6.8 | | | | 35.0 | |

MBS's (1) | | | 596,228 | | | | 1.5 | | | | 35.0 | | | | 5.9 | | | | 35.0 | |

Total Debt Securities | | | 3,035,456 | | | | 1.1 | | | | 20.8 | | | | 3.0 | | | | 21.6 | |

Equity Securities | | | 132,131 | | | | 1.1 | | | | 29.2 | | | | 2.8 | | | | 20.4 | |

Trading Securities (3) | | | 2,569 | | | | (30.8 | ) | | | 35.0 | | | | (56.6 | ) | | | 35.0 | |

Short-term Investments | | | 198,111 | | | | 0.3 | | | | 35.0 | | | | 2.1 | | | | 29.8 | |

Other Investments | | | | | | | | | | | | | | | | | | | | |

Alternative Investments | | | 165,017 | | | | (9.5 | ) | | | 35.0 | | | | (7.6 | ) | | | 35.0 | |

Other | | | 7,040 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

| | | | 3,540,324 | | | | 0.5 | | | | 8.0 | | | | 3.6 | | | | 19.8 | |

| (1) | Certain prior year amounts were reclassified to conform with current year presentation. |

| (2) | U.S. Government includes corporate securities fully guaranteed by the Federal Deposit Insurance Corporation (FDIC). |

| (3) | Selective adopted Fas 159, the Fair Value Option for Financial Assets and Financial Liabilities - Including an amendment |

| | of FASB Statement No. 115, on January 1, 2008 and elected to apply the fair value option to certain securities that were |

| | being managed by an outside manager at the time of adoption. |

Selective Insurance Group, Inc.

2008 Statutory Results by Line of Business

4th Qtr 2008 (unaudited)

($ in thousands)

| | | Net | | | | | | Net | | | | | | | | | | | | Underwriting | | | Dividends to | | | Combined | | | Combined | | | | |

| | | Premiums | | | Percent | | | Premiums | | | Percent | | | Loss | | | LAE | | | Expense | | | Policyholders | | | Ratio | | | Ratio | | | Underwriting | |

| | | Written | | | Change | | | Earned | | | Change | | | Ratio | | | Ratio | | | Ratio | | | Ratio | | | 2008 | | | 2007 | | | Gain/(Loss) | |

Personal Lines: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Homeowners | | $ | 16,867 | | | | 3.0 | % | | $ | 17,311 | | | | 7.2 | % | | | 47.2 | % | | | 7.6 | % | | | 34.4 | % | | | 0.0 | % | | | 89.2 | % | | | 126.5 | % | | $ | 2,026 | |

Auto | | | 31,653 | | | | 1.6 | % | | | 34,018 | | | | 2.1 | % | | | 77.8 | % | | | 10.8 | % | | | 30.1 | % | | | 0.0 | % | | | 118.7 | % | | | 116.8 | % | | | (5,658 | ) |

| Other (including | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

flood) | | | 2,488 | | | | 8.6 | % | | | 2,401 | | | | 10.2 | % | | | 89.7 | % | | | (7.7 | )% | | | (37.7 | )% | | | 0.0 | % | | | 44.3 | % | | | 97.8 | % | | | 1,369 | |

Total | | $ | 51,009 | | | | 2.4 | % | | $ | 53,731 | | | | 4.1 | % | | | 68.5 | % | | | 9.0 | % | | | 28.1 | % | | | 0.0 | % | | | 105.6 | % | | | 118.8 | % | | $ | (2,263 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial Lines: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fire/IM | | $ | 42,168 | | | | (0.9 | )% | | $ | 48,936 | | | | (0.2 | )% | | | 38.5 | % | | | 4.8 | % | | | 39.1 | % | | | 0.1 | % | | | 82.5 | % | | | 94.6 | % | | $ | 11,210 | |

| Workers | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

compensation | | | 58,077 | | | | (8.3 | )% | | | 74,267 | | | | (9.7 | )% | | | 56.4 | % | | | 13.0 | % | | | 30.3 | % | | | 2.4 | % | | | 102.1 | % | | | 108.2 | % | | | 3,348 | |

General liability | | | 74,766 | | | | (12.5 | )% | | | 95,004 | | | | (7.9 | )% | | | 54.7 | % | | | 18.3 | % | | | 37.2 | % | | | 0.1 | % | | | 110.3 | % | | | 100.0 | % | | | (2,268 | ) |

Auto | | | 61,114 | | | | (3.7 | )% | | | 74,995 | | | | (3.8 | )% | | | 66.9 | % | | | 5.6 | % | | | 32.3 | % | | | 0.0 | % | | | 104.8 | % | | | 94.5 | % | | | 859 | |

BOP | | | 15,708 | | | | 9.9 | % | | | 14,944 | | | | 9.1 | % | | | 69.3 | % | | | 12.8 | % | | | 34.7 | % | | | 0.0 | % | | | 116.8 | % | | | 90.3 | % | | | (2,780 | ) |

Bonds | | | 3,754 | | | | (13.7 | )% | | | 4,606 | | | | (4.2 | )% | | | 18.1 | % | | | 4.8 | % | | | 67.0 | % | | | 0.0 | % | | | 89.9 | % | | | 96.7 | % | | | 1,034 | |

Other | | | 2,055 | | | | 0.8 | % | | | 2,356 | | | | 5.1 | % | | | (4.7 | )% | | | 0.2 | % | | | 57.0 | % | | | 0.0 | % | | | 52.5 | % | | | 46.8 | % | | | 1,291 | |

Total | | $ | 257,643 | | | | (6.5 | )% | | $ | 315,108 | | | | (5.4 | )% | | | 55.2 | % | | | 11.4 | % | | | 35.2 | % | | | 0.6 | % | | | 102.4 | % | | | 99.4 | % | | $ | 12,694 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Grand Total | | $ | 308,651 | | | | (5.1 | )% | | $ | 368,839 | | | | (4.1 | )% | | | 57.2 | % | | | 11.0 | % | | | 34.0 | % | | | 0.5 | % | | | 102.7 | % | | | 101.9 | % | | $ | 10,431 | |

Note: Some amounts may not foot due to rounding.

| | | 2008 | | | 2007 | | | | | | | | | | | | | | | | | | | | |

| | Losses Paid | | $ | 199,130 | | | $ | 151,857 | | | | | | | | | | | | | | | | | | | | |

| | LAE Paid | | | 36,095 | | | | 36,233 | | | | | | | | | | | | | | | | | | | | |

| | Total Paid | | $ | 235,225 | | | $ | 188,090 | | | | | | | | | | | | | | | | | | | | |

Selective Insurance Group, Inc.

2008 Statutory Results by Line of Business

December 2008 YTD (unaudited)

($ in thousands)

| | | Net | | | | | | Net | | | | | | | | | | | | Underwriting | | | Dividends to | | | Combined | | | Combined | | | | |

| | | Premiums | | | Percent | | | Premiums | | | Percent | | | Loss | | | LAE | | | Expense | | | Policyholders | | | Ratio | | | Ratio | | | Underwriting | |

| | | Written | | | Change | | | Earned | | | Change | | | Ratio | | | Ratio | | | Ratio | | | Ratio | | | 2008 | | | 2007 | | | Gain/(Loss) | |

Personal Lines: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Homeowners | | $ | 69,087 | | | | 5.6 | % | | $ | 68,088 | | | | 9.3 | % | | | 56.0 | % | | | 7.8 | % | | | 35.1 | % | | | 0.0 | % | | | 98.9 | % | | | 114.7 | % | | $ | 410 | |

Auto | | | 134,535 | | | | 3.4 | % | | | 132,845 | | | | (0.1 | )% | | | 71.0 | % | | | 12.8 | % | | | 30.0 | % | | | 0.0 | % | | | 113.8 | % | | | 109.6 | % | | | (18,893 | ) |

| Other (including | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

flood) | | | 9,564 | | | | 12.4 | % | | | 9,010 | | | | 11.5 | % | | | 60.8 | % | | | (15.7 | )% | | | (51.1 | )% | | | 0.0 | % | | | (6.0 | )% | | | 29.8 | % | | | 9,837 | |

Total | | $ | 213,185 | | | | 4.5 | % | | $ | 209,943 | | | | 3.3 | % | | | 65.7 | % | | | 10.0 | % | | | 28.0 | % | | | 0.0 | % | | | 103.7 | % | | | 107.9 | % | | $ | (8,646 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial Lines: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fire/IM | | $ | 194,550 | | | | (2.2 | )% | | $ | 196,189 | | | | 2.9 | % | | | 50.3 | % | | | 4.6 | % | | | 37.8 | % | | | 0.2 | % | | | 92.9 | % | | | 92.7 | % | | $ | 14,465 | |

| Workers | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

compensation | | | 303,783 | | | | (9.6 | )% | | | 308,618 | | | | (5.2 | )% | | | 57.4 | % | | | 11.6 | % | | | 25.6 | % | | | 1.5 | % | | | 96.1 | % | | | 101.6 | % | | | 13,180 | |

General liability | | | 393,012 | | | | (6.5 | )% | | | 396,066 | | | | (3.4 | )% | | | 51.1 | % | | | 17.4 | % | | | 33.5 | % | | | 0.0 | % | | | 102.0 | % | | | 98.8 | % | | | (6,715 | ) |

Auto | | | 300,391 | | | | (5.9 | )% | | | 307,388 | | | | (2.5 | )% | | | 61.8 | % | | | 7.4 | % | | | 30.5 | % | | | 0.0 | % | | | 99.7 | % | | | 88.1 | % | | | 3,099 | |

BOP | | | 60,428 | | | | 8.6 | % | | | 58,058 | | | | 9.8 | % | | | 64.0 | % | | | 12.6 | % | | | 36.5 | % | | | 0.0 | % | | | 113.1 | % | | | 109.7 | % | | | (8,444 | ) |

Bonds | | | 18,239 | | | | (5.2 | )% | | | 18,831 | | | | (1.3 | )% | | | 14.1 | % | | | 4.1 | % | | | 62.3 | % | | | 0.0 | % | | | 80.5 | % | | | 84.4 | % | | | 4,038 | |

Other | | | 9,350 | | | | 2.6 | % | | | 9,295 | | | | 12.4 | % | | | (0.2 | )% | | | 0.3 | % | | | 47.2 | % | | | 0.0 | % | | | 47.3 | % | | | 41.3 | % | | | 4,870 | |

Total | | $ | 1,279,753 | | | | (5.8 | )% | | $ | 1,294,444 | | | | (2.1 | )% | | | 54.7 | % | | | 11.2 | % | | | 32.2 | % | | | 0.4 | % | | | 98.5 | % | | | 95.9 | % | | $ | 24,493 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Grand Total | | $ | 1,492,938 | | | | (4.5 | )% | | $ | 1,504,387 | | | | (1.4 | )% | | | 56.2 | % | | | 11.0 | % | | | 31.7 | % | | | 0.3 | % | | | 99.2 | % | | | 97.5 | % | | $ | 15,847 | |

Note: Some amounts may not foot due to rounding.

| | | 2008 | | | 2007 | | | | | | | | | | | | | | | | | | | | |

| | Losses Paid | | $ | 768,165 | | | $ | 635,173 | | | | | | | | | | | | | | | | | | | | |

| | LAE Paid | | | 140,877 | | | | 133,983 | | | | | | | | | | | | | | | | | | | | |

| | Total Paid | | $ | 909,042 | | | $ | 769,156 | | | | | | | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. |

Diversified Insurance Services |

( $ in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended December 31, 2008 (unaudited) |

| | | Revenue | | Net Income (Loss) | | Return on Revenue |

| | | 2008 | | 2007 | | % Change | | 2008 | | 2007 | | % Change | | 2008 | | 2007 | | Pt Change |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Flood | | | 11,620 | | | | 10,754 | | | | 8 | % | | | 1,442 | | | | 1,220 | | | | 18 | % | | | 12.4 | % | | | 11.3 | % | | | 1.1 | |

Human Resource Administration Outsourcing | | | 11,836 | | | | 13,339 | | | | (11 | )% | | | (2,208 | ) | | | 442 | | | | (600 | )% | | | (18.7 | )% | | | 3.3 | % | | | (22.0 | ) |

Other | | | 2,546 | | | | 2,287 | | | | 11 | % | | | 549 | | | | 696 | | | | (21 | )% | | | 21.6 | % | | | 30.4 | % | | | (8.8 | ) |

Total | | | 26,002 | | | | 26,380 | | | | (1 | )% | | | (217 | ) | | | 2,358 | | | | (109 | )% | | | (0.8 | )% | | | 8.9 | % | | | (9.7 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Twelve Months Ended December 31, 2008 (unaudited) |

| | | Revenue | | Net Income | | Return on Revenue |

| | | 2008 | | 2007 | | % Change | | 2008 | | 2007 | | % Change | | 2008 | | 2007 | | Pt Change |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Flood | | | 52,943 | | | | 47,842 | | | | 11 | % | | | 6,920 | | | | 6,734 | | | | 3 | % | | | 13.1 | % | | | 14.1 | % | | | (1.0 | ) |

Human Resource Administration Outsourcing | | | 53,147 | | | | 59,109 | | | | (10 | )% | | | (343 | ) | | | 2,862 | | | | (112 | )% | | | (0.6 | )% | | | 4.8 | % | | | (5.4 | ) |

Other | | | 10,256 | | | | 8,615 | | | | 19 | % | | | 3,029 | | | | 2,759 | | | | 10 | % | | | 29.5 | % | | | 32.0 | % | | | (2.5 | ) |

Total | | | 116,346 | | | | 115,566 | | | | 1 | % | | | 9,606 | | | | 12,355 | | | | (22 | )% | | | 8.3 | % | | | 10.7 | % | | | (2.4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Human Resource Administration Outsourcing Statistics (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | 2007 | | % Change | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Worksite EE - (Selective Agents Production) | | | 1,491 | | | | 2,025 | | | | (26 | )% | | | | | | | | | | | | | | | | | | | | | | | | |

Total New Worksite EE - All Agents (Production) | | | 1,789 | | | | 2,740 | | | | (35 | )% | | | | | | | | | | | | | | | | | | | | | | | | |

Total Worksite EE | | | 22,520 | | | | 25,111 | | | | (10 | )% | | | | | | | | | | | | | | | | | | | | | | | | |

Annual Gross Billings (000's) | | $ | 948,263 | | | | 1,000,126 | | | | (5 | )% | | | | | | | | | | | | | | | | | | | | | | | | |

Annual Gross Billings / Avg Worksite EE | | $ | 39,476 | | | | 37,980 | | | | 4 | % | | | | | | | | | | | | | | | | | | | | | | | | |

| SELECTIVE INSURANCE GROUP, INC. | | Unaudited | | | | |

| CONSOLIDATED BALANCE SHEETS | | December 31, | | | December 31, | |

| ( in thousands, except share amounts) | | 2008 | | | 2007 | |

| ASSETS | | | | | | |

| Investments: | | | | | | |

| Fixed maturity securities, held-to-maturity - at amortized cost | | | | | | |

(fair value: $1,178 – 2008; $5,927 – 2007) | | $ | 1,163 | | | | 5,783 | |

| Fixed maturity securities, available-for-sale - at fair value | | | | | | | | |

(amortized cost: $3,123,346 – 2008; $3,049,913 – 2007) | | | 3,034,278 | | | | 3,073,547 | |

| Equity securities, available-for-sale - at fair value | | | | | | | | |

(cost of: $125,947 – 2008; $160,390 – 2007) | | | 132,131 | | | | 274,705 | |

| Short-term investments (at cost which approximates fair value) | | | 198,111 | | | | 190,167 | |

| Equity securities, trading – at fair value | | | 2,569 | | | | - | |

| Other investments | | | 172,057 | | | | 188,827 | |

| Total investments | | | 3,540,309 | | | | 3,733,029 | |

| Cash and cash equivalents | | | 18,643 | | | | 8,383 | |

| Interest and dividends due or accrued | | | 36,538 | | | | 36,141 | |

| Premiums receivable, net of allowance for uncollectible | | | | | | | | |

accounts of: $4,237 – 2008; $3,905 – 2007 | | | 480,894 | | | | 496,363 | |

| Other trade receivables, net of allowance for uncollectible | | | | | | | | |

accounts of: $299 – 2008; $244 – 2007 | | | 19,461 | | | | 21,875 | |

| Reinsurance recoverable on paid losses and loss expenses | | | 6,513 | | | | 7,429 | |

| Reinsurance recoverable on unpaid losses and loss expenses | | | 224,192 | | | | 227,801 | |

| Prepaid reinsurance premiums | | | 96,617 | | | | 82,182 | |

| Current federal income tax | | | 26,327 | | | | 4,235 | |

| Deferred federal income tax | | | 146,801 | | | | 22,375 | |

| Property and Equipment – at cost, net of accumulated | | | | | | | | |

depreciation and amortization of: $132,609 – 2008; $117,832 – 2007 | | | 51,697 | | | | 58,561 | |

| Deferred policy acquisition costs | | | 212,319 | | | | 226,434 | |

| Goodwill | | | 29,637 | | | | 33,637 | |

| Other assets | | | 51,384 | | | | 43,547 | |

Total assets | | $ | 4,941,332 | | | | 5,001,992 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Liabilities: | | | | | | | | |

| Reserve for losses | | $ | 2,256,329 | | | | 2,182,572 | |

| Reserve for loss expenses | | | 384,644 | | | | 359,975 | |

| Unearned premiums | | | 844,334 | | | | 841,348 | |

| Senior convertible notes | | | - | | | | 8,740 | |

| Notes payable | | | 273,878 | | | | 286,151 | |

| Commissions payable | | | 48,560 | | | | 60,178 | |

| Accrued salaries and benefits | | | 147,050 | | | | 88,079 | |

| Other liabilities | | | 96,044 | | | | 98,906 | |

Total liabilities | | | 4,050,839 | | | | 3,925,949 | |

| | | | | | | | | |

| Stockholders' Equity: | | | | | | | | |

Preferred stock of $0 par value per share: Authorized shares: 5,000,000; no shares issued or outstanding | | | | | | | | |

| Common stock of $2 par value per share: | | | | | | | | |

| Authorized shares: 360,000,000 | | | | | | | | |

Issued: 95,263,508 – 2008; 94,652,930 – 2007 | | | 190,527 | | | | 189,306 | |

| Additional paid-in capital | | | 217,195 | | | | 192,627 | |

| Retained earnings | | | 1,128,149 | | | | 1,105,946 | |

| Accumulated other comprehensive (loss) income | | | (100,666 | ) | | | 86,043 | |

| Treasury stock – at cost (shares: 42,386,921 – 2008; 40,347,894 – 2007) | | | (544,712 | ) | | | (497,879 | ) |

Total stockholders' equity | | | 890,493 | | | | 1,076,043 | |

Commitments and contingencies | | | | | | | | |

Total liabilities and stockholders' equity | | $ | 4,941,332 | | | | 5,001,992 | |

| Consolidated Statements of Income | | | | | | | | | |

| Years Ended December 31, | | | | | | | | | |

| (in thousands, except per share amounts) | | 2008 | | | 2007 | | | 2006 | |

| Revenues: | | | | | | | | | |

| Net premiums written | | $ | 1,484,041 | | | | 1,554,867 | | | | 1,535,961 | |

| Net decrease (increase) in unearned premiums and prepaid reinsurance | | | | | | | | | | | | |

| premiums | | | 11,449 | | | | (37,561 | ) | | | (36,297 | ) |

| Net premiums earned | | | 1,495,490 | | | | 1,517,306 | | | | 1,499,664 | |

| Net investment income earned | | | 131,032 | | | | 174,144 | | | | 156,802 | |

| Net realized (losses) gains | | | (49,452 | ) | | | 33,354 | | | | 35,479 | |

| Diversified Insurance Services revenue | | | 116,346 | | | | 115,566 | | | | 110,526 | |

| Other income | | | 2,563 | | | | 5,858 | | | | 5,396 | |

Total revenues | | | 1,695,979 | | | | 1,846,228 | | | | 1,807,867 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Losses incurred | | | 845,656 | | | | 829,524 | | | | 791,955 | |

| Loss expenses incurred | | | 168,160 | | | | 169,682 | | | | 168,028 | |

| Policy acquisition costs | | | 490,040 | | | | 497,229 | | | | 478,339 | |

| Dividends to policyholders | | | 5,211 | | | | 7,202 | | | | 5,927 | |

| Interest expense | | | 20,508 | | | | 23,795 | | | | 21,411 | |

| Diversified Insurance Services expenses | | | 97,819 | | | | 96,943 | | | | 92,718 | |

| Goodwill impairment | | | 4,000 | | | | - | | | | - | |

| Other expenses | | | 25,199 | | | | 29,095 | | | | 28,979 | |

Total expenses | | | 1,656,593 | | | | 1,653,470 | | | | 1,587,357 | |

| | | | | | | | | | | | | |

| Income before federal income tax | | | 39,386 | | | | 192,758 | | | | 220,510 | |

| | | | | | | | | | | | | |

| Federal income tax expense (benefit): | | | | | | | | | | | | |

| Current | | | 22,293 | | | | 43,046 | | | | 66,717 | |

| Deferred | | | (26,665 | ) | | | 3,214 | | | | (9,781 | ) |

Total federal income tax (benefit) expense | | | (4,372 | ) | | | 46,260 | | | | 56,936 | |

| | | | | | | | | | | | | |

| Net Income | | | 43,758 | | | | 146,498 | | | | 163,574 | |

| | | | | | | | | | | | | |

| Earnings per share: | | | | | | | | | | | | |

| Basic net income | | $ | 0.84 | | | | 2.80 | | | | 2.98 | |

| | | | | | | | | | | | | |

| Diluted net income | | $ | 0.82 | | | | 2.59 | | | | 2.65 | |

| | | | | | | | | | | | | |

| Dividends to stockholders | | $ | 0.52 | | | | 0.49 | | | | 0.44 | |

| Consolidated Statements of Stockholders' Equity | | | | | | | | | | | | | |

| Years Ended December 31, | | | | | | | | | | | | | |

| (in thousands, except per share amounts) | | 2008 | | 2007 | | 2006 | |

| | | | | | | | | | | | | | |

| Common stock: | | | | | | | | | | | | | |

| Beginning of year | $ | 189,306 | | | | 183,124 | | | | 173,085 | | | |

| Dividend reinvestment plan | | | | | | | | | | | | | |

(shares: 81,200 – 2008; 78,762 – 2007; | | | | | | | | | | | | | |

64,072 – 2006) | | 162 | | | | 158 | | | | 128 | | | |

| Convertible debentures | | | | | | | | | | | | | |

(shares: 45,759 – 2008; 2,074,067 – 2007; | | | | | | | | | | | | | |

3,999,128 – 2006) | | 92 | | | | 4,148 | | | | 7,998 | | | |

| Stock purchase and compensation plans | | | | | | | | | | | | | |

(shares: 483,619 – 2008; 937,835 – 2007; | | | | | | | | | | | | | |

956,520 – 2006) | | 967 | | | | 1,876 | | | | 1,913 | | | |

| End of year | | 190,527 | | | | 189,306 | | | | 183,124 | | | |

| | | | | | | | | | | | | | |

| Additional paid-in capital: | | | | | | | | | | | | | |

| Beginning of year | | 192,627 | | | | 153,246 | | | | 71,638 | | | |

| Dividend reinvestment plan | | 1,677 | | | | 1,708 | | | | 1,604 | | | |

| Convertible debentures | | 645 | | | | 9,806 | | | | 51,249 | | | |

| Stock purchase and compensation plans | | 22,246 | | | | 27,867 | | | | 28,755 | | | |

| End of year | | 217,195 | | | | 192,627 | | | | 153,246 | | | |

| | | | | | | | | | | | | | |

| Retained earnings: | | | | | | | | | | | | | |

| Beginning of year | | 1,105,946 | | | | 986,017 | | | | 847,687 | | | |

| Cumulative-effect adjustment due to adoption of FAS | | | | | | | | | | | | | |

| 159, net of deferred income tax effect of $3,344 | | 6,210 | | | | | | | | | | | |

| Net income | | 43,758 | | 43,758 | | 146,498 | | 146,498 | | 163,574 | | 163,574 | |

| Dividends to stockholders | | | | | | | | | | | | | |

($0.52 per share –2008; $0.49 per share – 2007; | | | | | | | | | | | | | |

$0.44 per share – 2006) | | (27,765 | ) | | | (26,569 | ) | | | (25,244 | ) | | |

| End of year | | 1,128,149 | | | | 1,105,946 | | | | 986,017 | | | |

| | | | | | | | | | | | | | |

| Accumulated other comprehensive (loss) income: | | | | | | | | | | | | | |

| Beginning of year | | 86,043 | | | | 100,601 | | | | 118,121 | | | |

| Cumulative-effect adjustment due to adoption of FAS | | | | | | | | | | | | | |

| 159, net of deferred income tax effect of $(3,344) | | (6,210 | ) | | | | | | | | | | |

| Other comprehensive (loss) income, (increase) decrease in: | | | | | | | | | | | | | |

| Net unrealized gains on investment securities, | | | | | | | | | | | | | |

| Net of deferred income tax effect of | | | | | | | | | | | | | |

| $(76,831) – 2008; $(10,925) – 2007; | | | | | | | | | | | | | |

| $(2,031) – 2006 | | (142,685 | ) | (142,685 | ) | (20,289 | ) | (20,289 | ) | (3,772 | ) | (3,772 | ) |

| Defined benefit pension plans, net of deferred | | | | | | | | | | | | | |

| income tax effect of $(20,362) – 2008; | | | | | | | | | | | | | |

| $3,086 – 2007; $(7,403) – 2006 | | (37,814 | ) | (37,814 | ) | 5,731 | | 5,731 | | (13,748 | ) | - | |

| End of year | | (100,666 | ) | | | 86,043 | | | | 100,601 | | | |

| Comprehensive (loss) income | | | | (136,741 | ) | | | 131,940 | | | | 159,802 | |

| | | | | | | | | | | | | | |

| Treasury stock: | | | | | | | | | | | | | |

| Beginning of year | | (497,879 | ) | | | (345,761 | ) | | | (229,407 | ) | | |

| Acquisition of treasury stock | | | | | | | | | | | | | |

(shares: 2,039,027 – 2008; 6,057,920 – 2007; | | | | | | | | | | | | | |

4,335,622 – 2006) | | (46,833 | ) | | | (152,118 | ) | | | (116,354 | ) | | |

| End of year | | (544,712 | ) | | | (497,879 | ) | | | (345,761 | ) | | |

| | | | | | | | | | | | | | |

| Total stockholders' equity | $ | 890,493 | | | | 1,076,043 | | | | 1,077,227 | | | |

| Consolidated Statements of Cash Flows | | | | | | | | | |

| Years Ended December 31, | | | | | | | | | |

| (in thousands) | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | |

| Operating Activities | | | | | | | | | |

| Net income | | $ | 43,758 | | | | 146,498 | | | | 163,574 | |

| | | | | | | | | | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | |

| Depreciation and amortization | | | 28,552 | | | | 29,139 | | | | 25,684 | |

| Stock-based compensation expense | | | 17,215 | | | | 20,992 | | | | 14,524 | |

| Undistributed losses (income) of equity method investments | | | 13,753 | | | | (4,281 | ) | | | (3,511 | ) |

| Net realized losses (gains) | | | 49,452 | | | | (33,354 | ) | | | (35,479 | ) |

| Deferred tax (benefit) expense | | | (26,665 | ) | | | 3,214 | | | | (9,781 | ) |

| Unrealized loss on trading securities | | | 8,129 | | | | - | | | | - | |

| Debt conversion inducement | | | - | | | | - | | | | 2,117 | |

| Impairment of goodwill | | | 4,000 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Changes in assets and liabilities: | | | | | | | | | | | | |

| Increase in reserves for losses and loss expenses, net of reinsurance recoverable | | | | | | | | | | | | |

on unpaid losses and loss expenses | | | 102,100 | | | | 227,749 | | | | 223,231 | |

| Increase (decrease) in unearned premiums, net of prepaid reinsurance and advance | | | | | | | | | | | | |

| premium | | | (10,766 | ) | | | 38,346 | | | | 35,708 | |

| Increase in net federal income tax recoverable | | | (22,092 | ) | | | (3,767 | ) | | | (2,761 | ) |

| Decrease (increase) in premiums receivable | | | 15,469 | | | | (37,911 | ) | | | (11,232 | ) |

| Decrease (increase) in other trade receivables | | | 2,414 | | | | (487 | ) | | | (4,835 | ) |

| Decrease (increase) in deferred policy acquisition costs | | | 14,115 | | | | (8,331 | ) | | | (13,271 | ) |

| Increase in interest and dividends due or accrued | | | (431 | ) | | | (1,331 | ) | | | (2,280 | ) |

| Decrease (increase) in reinsurance recoverable on paid losses and loss expenses | | | 916 | | | | (2,736 | ) | | | (144 | ) |

| Increase (decrease) in accrued salaries and benefits | | | (3,100 | ) | | | (3,266 | ) | | | 5,385 | |

| (Decrease) increase in accrued insurance expenses | | | (15,880 | ) | | | 6,370 | | | | (1,566 | ) |

| Purchase of trading securities | | | (6,587 | ) | | | - | | | | - | |

| Sale of trading securities | | | 21,002 | | | | - | | | | - | |

| Other, net | | | 5,819 | | | | 9,444 | | | | 7,692 | |

| Net adjustments | | | 197,415 | | | | 239,790 | | | | 229,481 | |

| Net cash provided by operating activities | | | 241,173 | | | | 386,288 | | | | 393,055 | |

| | | | | | | | | | | | | |

| Investing Activities | | | | | | | | | | | | |

| Purchase of fixed maturity securities, available-for-sale | | | (587,430 | ) | | | (580,864 | ) | | | (801,647 | ) |

| Purchase of equity securities, available-for-sale | | | (70,651 | ) | | | (148,569 | ) | | | (52,429 | ) |

| Purchase of other investments | | | (53,089 | ) | | | (80,147 | ) | | | (71,486 | ) |

| Purchase of short-term investments | | | (2,204,107 | ) | | | (2,198,362 | ) | | | (2,290,937 | ) |

| Net proceeds from sale of subsidiary | | | - | | | | - | | | | 376 | |

| Sale of fixed maturity securities, available-for-sale | | | 152,655 | | | | 102,613 | | | | 306,044 | |

| Sale of short-term investments | | | 2,196,162 | | | | 2,205,194 | | | | 2,279,055 | |

| Redemption and maturities of fixed maturity securities, held-to-maturity | | | 4,652 | | | | 4,051 | | | | 3,635 | |

| Redemption and maturities of fixed maturity securities, available-for-sale | | | 294,342 | | | | 319,118 | | | | 187,608 | |

| Sale of equity securities, available-for-sale | | | 102,313 | | | | 187,259 | | | | 108,382 | |

| Proceeds from other investments | | | 26,164 | | | | 40,115 | | | | 8,350 | |

| Purchase of property and equipment | | | (8,083 | ) | | | (14,511 | ) | | | (18,670 | ) |

| Net cash used in investing activities | | | (147,072 | ) | | | (164,103 | ) | | | (341,719 | ) |

| | | | | | | | | | | | | |

| Financing Activities | | | | | | | | | | | | |

| Dividends to stockholders | | | (25,804 | ) | | | (24,464 | ) | | | (22,831 | ) |

| Acquisition of treasury stock | | | (46,833 | ) | | | (152,118 | ) | | | (116,354 | ) |

| Proceeds from issuance of notes payable, net of issuance costs | | | - | | | | - | | | | 96,263 | |

| Principal payments of notes payable | | | (12,300 | ) | | | (18,300 | ) | | | (18,300 | ) |

| Net proceeds from stock purchase and compensation plans | | | 8,222 | | | | 8,609 | | | | 11,560 | |

| Excess tax benefits from share-based payment arrangements | | | 1,628 | | | | 3,484 | | | | 3,903 | |

| Borrowings under line of credit agreement | | | - | | | | 6,000 | | | | - | |

| Repayment of borrowings under line of credit agreement | | | - | | | | (6,000 | ) | | | - | |

| Principal payments of convertible bonds | | | (8,754 | ) | | | - | | | | (2,117 | ) |

| Principal payments of senior convertible notes | | | - | | | | (37,456 | ) | | | - | |

| Net cash used in financing activities | | | (83,841 | ) | | | (220,245 | ) | | | (47,876 | ) |

| Net increase in cash and cash equivalents | | | 10,260 | | | | 1,940 | | | | 3,460 | |

| Cash and cash equivalents, beginning of year | | | 8,383 | | | | 6,443 | | | | 2,983 | |

| Cash and cash equivalents, end of year | | $ | 18,643 | | | | 8,383 | | | | 6,443 | |

| | | | | | | | | | | | | |

| Supplemental Disclosures of Cash Flows Information | | | | | | | | | | | | |

| Cash paid during the year for: | | | | | | | | | | | | |

| Interest | | $ | 20,647 | | | | 25,311 | | | | 21,391 | |

| Federal income tax | | | 42,750 | | | | 43,809 | | | | 65,575 | |

| Supplemental schedule of non-cash financing activity: | | | | | | | | | | | | |

| Conversion of convertible debentures | | | 169 | | | | 12,066 | | | | 58,534 | |

| Selective Insurance Group, Inc. |

| Combined Insurance Company Subsidiaries |

| Unaudited Statutory Balance Sheets |

| ($ in thousands) |

| | | | | | | |

| | | | | | | |

| | | December 31 | | | December 31 | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| ASSETS | | | | | | |

| Bonds | | $ | 3,104,395 | | | | 3,041,373 | |

| Common stocks | | | 156,304 | | | | 297,102 | |

| Other investments | | | 172,346 | | | | 188,827 | |

| Short-term investments | | | 137,878 | | | | 125,650 | |

| Total investments | | | 3,570,923 | | | | 3,652,952 | |

| | | | | | | | | |

| Cash on hand and in banks | | | (36,472 | ) | | | (33,209 | ) |

| Interest and dividends due and accrued | | | 36,523 | | | | 36,057 | |

| Premiums receivable | | | 476,768 | | | | 491,308 | |

| Reinsurance recoverable on paid losses and expenses | | | 6,513 | | | | 7,429 | |

| Federal income tax recoverable | | | 12,069 | | | | - | |

| Deferred tax recoverable | | | 86,208 | | | | 87,951 | |

| EDP equipment | | | 3,815 | | | | 4,691 | |

| Equities and deposits in pools and associations | | | 8,517 | | | | 10,411 | |

| Receivable for sold securities | | | 13,278 | | | | 167 | |

| Other assets | | | 28,720 | | | | 32,105 | |

| Total assets | | $ | 4,206,862 | | | | 4,289,862 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Reserve for losses | | $ | 2,031,947 | | | | 1,953,960 | |

| Reinsurance payable on paid loss and loss expense | | | 716 | | | | 1,310 | |

| Reserve for loss expenses | | | 382,796 | | | | 358,126 | |

| Unearned premiums | | | 747,717 | | | | 759,166 | |

| Reserve for commissions payable | | | 48,560 | | | | 60,178 | |

| Ceded balances payable | | | 8,421 | | | | 8,192 | |

| Federal income tax payable | | | - | | | | 14,084 | |

| Premium and other taxes payable | | | 20,721 | | | | 24,982 | |

| Reserve for dividends to policyholders | | | 5,023 | | | | 5,651 | |

| Reserves for unauthorized/overdue reinsurance | | | 1,416 | | | | 1,258 | |

| Funds withheld on account of others | | | 4,977 | | | | 5,070 | |

| Accrued salaries and benefits | | | 74,287 | | | | 48,582 | |

| Other liabilities | | | 14,246 | | | | 15,009 | |

| Total liabilities | | | 3,340,827 | | | | 3,255,568 | |

| | | | | | | | | |

| | | | | | | | | |

| POLICYHOLDERS' SURPLUS | | | | | | | | |

| Capital | | | 28,325 | | | | 28,325 | |

| Paid in surplus | | | 235,792 | | | | 235,792 | |

| Unassigned surplus | | | 601,918 | | | | 770,177 | |

| Total policyholders' surplus | | | 866,035 | | | | 1,034,294 | |

| Total liabilities and policyholders' surplus | | $ | 4,206,862 | | | | 4,289,862 | |

| Selective Insurance Group, Inc. |

| Combined Insurance Company Subsidiaries |

| Unaudited Statutory Statements Of Income |

| ($ in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | | | Twelve Months Ended | | | | |

| | | December | | | | | | December | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

UNDERWRITING | | 2008 | | | | | | 2007 | | | | | | 2008 | | | | | | 2007 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net premiums written | | $ | 308,651 | | | | | | | 325,309 | | | | | | | 1,492,938 | | | | | | | 1,562,728 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net premiums earned | | | 368,839 | | | | | | | 384,772 | | | | | | | 1,504,386 | | | | | | | 1,525,163 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net losses paid | | | 199,130 | | | | | | | 151,857 | | | | | | | 768,165 | | | | | | | 635,173 | | | | |

| Change in reserve for losses | | | 11,670 | | | | | | | 61,553 | | | | | | | 77,988 | | | | | | | 194,809 | | | | |

| Net losses incurred | | | 210,800 | | | | 57.2% | | | | 213,410 | | | | 55.5% | | | | 846,153 | | | | 56.2% | | | | 829,982 | | | | 54.4% | |

| Net loss expenses paid | | | 36,095 | | | | | | | | 36,233 | | | | | | | | 140,877 | | | | | | | | 133,983 | | | | | |

| Change in reserve for loss expenses | | | 4,512 | | | | | | | | 5,085 | | | | | | | | 24,670 | | | | | | | | 33,265 | | | | | |

| Net loss expenses incurred | | | 40,607 | | | | 11.0% | | | | 41,318 | | | | 10.7% | | | | 165,547 | | | | 11.0% | | | | 167,248 | | | | 11.0% | |

| Net underwriting expenses incurred | | | 103,189 | | | | 33.4% | | | | 113,795 | | | | 35.1% | | | | 470,362 | | | | 31.6% | | | | 497,946 | | | | 31.8% | |

| Total deductions | | | 354,596 | | | | | | | | 368,523 | | | | | | | | 1,482,062 | | | | | | | | 1,495,176 | | | | | |

| Statutory gain | | | 14,243 | | | | | | | | 16,249 | | | | | | | | 22,324 | | | | | | | | 29,987 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss from premium balances | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| charged off | | | (1,440 | ) | | | | | | | (880 | ) | | | | | | | (3,876 | ) | | | | | | | (2,831 | ) | | | | |

| Finance charges and other income | | | (426 | ) | | | | | | | 1,437 | | | | | | | | 2,610 | | | | | | | | 5,833 | | | | | |

| Total other income | | | (1,866 | ) | | | 0.6% | | | | 557 | | | | -0.2% | | | | (1,266 | ) | | | 0.1% | | | | 3,002 | | | | -0.2% | |

| Policyholders' dividends incurred | | | (1,946 | ) | | | 0.5% | | | | (3,253 | ) | | | 0.8% | | | | (5,211 | ) | | | 0.3% | | | | (7,202 | ) | | | 0.5% | |

| Total underwriting gain | | | 10,431 | | | | 102.7% | | | | 13,553 | | | | 101.9% | | | | 15,847 | | | | 99.2% | | | | 25,787 | | | | 97.5% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

INVESTMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income earned | | | 32,886 | | | | | | | | 48,237 | | | | | | | | 156,336 | | | | | | | | 166,327 | | | | | |

| Net realized (loss) gain | | | (23,392 | ) | | | | | | | 6,148 | | | | | | | | (37,352 | ) | | | | | | | 33,359 | | | | | |

| Total income before income tax | | | 19,925 | | | | | | | | 67,938 | | | | | | | | 134,831 | | | | | | | | 225,473 | | | | | |

| Federal income tax (benefit) expense | | | (9,996 | ) | | | | | | | 18,022 | | | | | | | | 34,898 | | | | | | | | 57,851 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 29,921 | | | | | | | | 49,916 | | | | | | | | 99,933 | | | | | | | | 167,622 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Policyholders' Surplus | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Surplus, beginning of period | | $ | 932,846 | | | | | | | | 1,071,166 | | | | | | | | 1,034,294 | | | | | | | | 1,030,078 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | 29,921 | | | | | | | | 49,916 | | | | | | | | 99,933 | | | | | | | | 167,622 | | | | | |

| Change in deferred tax | | | (4,682 | ) | | | | | | | (1,669 | ) | | | | | | | 14,677 | | | | | | | | 1,047 | | | | | |

| Change in unrealized losses | | | (44,624 | ) | | | | | | | (13,433 | ) | | | | | | | (107,020 | ) | | | | | | | (20,288 | ) | | | | |

| Dividends to stockholders | | | - | | | | | | | | (63,637 | ) | | | | | | | (77,045 | ) | | | | | | | (139,649 | ) | | | | |

| Change in reserve for unauthorized | | | (159 | ) | | | | | | | 312 | | | | | | | | (159 | ) | | | | | | | 312 | | | | | |

| Change in non-admitted assets | | | (19,068 | ) | | | | | | | (8,190 | ) | | | | | | | (70,169 | ) | | | | | | | (11,542 | ) | | | | |

| Change in minimum pension liability | | | (28,748 | ) | | | | | | | - | | | | | | | | (28,748 | ) | | | | | | | - | | | | | |

| Surplus adjustments | | | 549 | | | | | | | | (171 | ) | | | | | | | 272 | | | | | | | | 6,714 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net change in surplus for period | | | (66,811 | ) | | | | | | | (36,872 | ) | | | | | | | (168,259 | ) | | | | | | | 4,216 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Surplus, end of period | | $ | 866,035 | | | | | | | | 1,034,294 | | | | | | | | 866,035 | | | | | | | | 1,034,294 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Statutory underwriting gain: | | $ | 10,431 | | | | | | | | 13,553 | | | | | | | | 15,847 | | | | | | | | 25,787 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjustments under GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deferred policy acquisition costs | | | (11,785 | ) | | | | | | | (8,725 | ) | | | | | | | (14,116 | ) | | | | | | | 8,331 | | | | | |

| Flood income reclassification | | | (2,225 | ) | | | | | | | (1,884 | ) | | | | | | | (10,672 | ) | | | | | | | (10,386 | ) | | | | |

| Other, net | | | (1,206 | ) | | | | | | | (1,680 | ) | | | | | | | (6,285 | ) | | | | | | | (7,775 | ) | | | | |

| GAAP underwriting (loss) gain | | $ | (4,785 | ) | | | | | | | 1,264 | | | | | | | | (15,226 | ) | | | | | | | 15,957 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Note: Some amounts or ratios may not foot due to rounding. |

| Certain amounts have been reclassified to conform to the current year's presentation. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. and Consolidated Subsidiaries

Municipal Fixed Income Portfolio as of December 31, 2008

($ in millions)

(unaudited)

| | Average | | Market | | | % of Total | | | Unrealized | | |

| | Credit Rating | | Value | | | Muni Portfolio | | | Gain/(Loss) | | |

| | | | | | | | | | | | |

| Uninsured Securities | AA+ | | | 932 | | | | 53 | % | | | 7 | | |

| | | | | | | | | | | | | | | |

Securities with Insurance Enhanced1 | AA+ | | | 827 | | | | 47 | % | | | 12 | | |

| Without Insurance Enhancement | AA- | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total | | | $ | 1,758 | | | | 100 | % | | $ | 19 | | |

1 Includes $13.3 million of unrated municipal fixed income securities which we consider to be investment grade.

A "BBB-" rating has been applied to these municipal fixed income securities in the interest of conservatism.

Note: Some amounts may not foot due to rounding.

Selective Insurance Group, Inc. and Consolidated Subsidiaries

Ratings on Municipal Fixed Income Portfolio

December 31, 2008

($ in millions)

(unaudited)

| | | Uninsured Securities | | | Insurance Enhanced Securities1 | | | Underlying Rating of Insurance Enhanced Securities1 | | | Total Municipal Fixed Income Portfolio (with Insurance Enhancement) | | | Total Municipal Fixed Income Portfolio (without Insurance Enhancement) | |

| | | (1) | | | (2) | | | (3) | | | (1) + (2) | | | (1) + (3) | |

| S&P or equivalent ratings | | Market Value | | | % of Total | | | Market Value | | | % of Total | | | Market Value | | | % of Total | | | Market Value | | | % of Total | | | Market Value | | | % of Total | |

| AAA | | $ | 486 | | | | 52 | % | | $ | 238 | | | | 29 | % | | $ | 61 | | | | 7 | % | | $ | 724 | | | | 41 | % | | $ | 548 | | | | 31 | % |

| AA+ | | | 148 | | | | 16 | % | | | 70 | | | | 8 | % | | | 107 | | | | 13 | % | | | 218 | | | | 12 | % | | | 254 | | | | 14 | % |

| AA | | | 194 | | | | 21 | % | | | 357 | | | | 43 | % | | | 158 | | | | 19 | % | | | 551 | | | | 31 | % | | | 352 | | | | 20 | % |

| AA- | | | 56 | | | | 6 | % | | | 90 | | | | 11 | % | | | 249 | | | | 30 | % | | | 146 | | | | 8 | % | | | 304 | | | | 17 | % |

| A+ | | | 20 | | | | 2 | % | | | 12 | | | | 1 | % | | | 88 | | | | 11 | % | | | 32 | | | | 2 | % | | | 108 | | | | 6 | % |

| A | | | 3 | | | | 0 | % | | | 52 | | | | 6 | % | | | 86 | | | | 10 | % | | | 54 | | | | 3 | % | | | 89 | | | | 5 | % |

| A- | | | 18 | | | | 2 | % | | | 5 | | | | 1 | % | | | 52 | | | | 6 | % | | | 23 | | | | 1 | % | | | 70 | | | | 4 | % |

| BBB+ | | | 1 | | | | 0 | % | | | 3 | | | | 0 | % | | | 7 | | | | 1 | % | | | 4 | | | | 0 | % | | | 8 | | | | 0 | % |

| BBB | | | 6 | | | | 1 | % | | | - | | | | 0 | % | | | - | | | | 0 | % | | | 6 | | | | 0 | % | | | 6 | | | | 0 | % |

| BBB- | | | - | | | | 0 | % | | | - | | | | 0 | % | | | 18 | | | | 2 | % | | | - | | | | 0 | % | | | 18 | | | | 1 | % |

| BB+ | | | 1 | | | | 0 | % | | | - | | | | 0 | % | | | - | | | | 0 | % | | | 1 | | | | 0 | % | | | 1 | | | | 0 | % |

| Total | | $ | 932 | | | | 100 | % | | $ | 827 | | | | 100 | % | | $ | 827 | | | | 100 | % | | $ | 1,758 | | | | 100 | % | | $ | 1,758 | | | | 100 | % |

| Average Rating: | | | | | | AA+ | | | | | | | AA+ | | | | | | | AA- | | | | | | | AA+ | | | | | | | AA | |

| Unrealized Gain/(Loss): | | | 7 | | | | | | | | 12 | | | | | | | | | | | | | | | | 19 | | | | | | | | | | | | | |

1 Includes $13.3 million of unrated municipal fixed income securities which we consider to be investment grade.

A "BBB-" rating has been applied to these municipal fixed income securities in the interest of conservatism.

Note: Some amounts may not foot due to rounding.

Selective Insurance Group, Inc. and Consolidated Subsidiaries

Muni Bonds with Credit Enhancement

December 31, 2008

($ in thousands)

(unaudited)

Credit Enhancement | Underlying Composite Rating | | Market Value | | | Book Value | | | Unrealized | |

| AMBAC | AAA | | | 17,161 | | | | 16,643 | | | | 519 | |

| (Ratings: | AA+ | | | 19,006 | | | | 18,651 | | | | 355 | |

| Moody's = Baa1 | AA | | | 21,965 | | | | 21,728 | | | | 236 | |

| S&P = A | AA- | | | 14,378 | | | | 14,077 | | | | 300 | |

| Fitch = WD) | A+ | | | 6,116 | | | | 6,067 | | | | 49 | |

| | A | | | 28,301 | | | | 29,055 | | | | (754 | ) |

| | A- | | | 9,027 | | | | 9,097 | | | | (70 | ) |

| | BBB+ | | | 2,954 | | | | 3,257 | | | | (302 | ) |

| | N/R | | | 5,682 | | | | 5,720 | | | | (38 | ) |

| AMBAC Total | | | $ | 124,590 | | | $ | 124,296 | | | $ | 295 | |

BHAC (Ratings: Moody's = Aaa S&P = AAA Fitch = NR) | A | | | 4,265 | | | | 4,161 | | | | 104 | |

| BHAC Total | | | $ | 4,265 | | | $ | 4,161 | | | $ | 104 | |

| FGIC | AAA | | | 12,508 | | | | 11,914 | | | | 595 | |

| (Ratings: | AA+ | | | 17,704 | | | | 17,186 | | | | 518 | |

| Moody's = Caa1 | AA | | | 23,510 | | | | 22,855 | | | | 656 | |

| S&P = CCC | AA- | | | 59,491 | | | | 59,364 | | | | 127 | |

| Fitch = WD) | A+ | | | 24,974 | | | | 25,672 | | | | (698 | ) |

| | A | | | 8,814 | | | | 8,746 | | | | 68 | |

| | A- | | | 8,749 | | | | 8,713 | | | | 36 | |

| | BBB- | | | 2,782 | | | | 2,873 | | | | (91 | ) |

| | N/R | | | 513 | | | | 514 | | | | (2 | ) |

| FGIC Total | | | $ | 159,045 | | | $ | 157,837 | | | $ | 1,208 | |

| FSA | AAA | | | 25,406 | | | | 25,140 | | | | 266 | |

| (Ratings: | AA+ | | | 53,033 | | | | 52,002 | | | | 1,031 | |

| Moody's =Aa3 | AA | | | 42,587 | | | | 41,799 | | | | 789 | |

| S&P = AAA | AA- | | | 72,737 | | | | 70,337 | | | | 2,400 | |

| Fitch = AAA) | A+ | | | 18,889 | | | | 18,654 | | | | 236 | |

| | A | | | 22,610 | | | | 22,305 | | | | 304 | |

| | A- | | | 9,106 | | | | 8,935 | | | | 172 | |

| FSA Total | | | $ | 244,369 | | | $ | 239,172 | | | $ | 5,197 | |

| MBIA | AAA | | | 6,107 | | | | 5,691 | | | | 416 | |

| (Ratings: | AA+ | | | 17,172 | | | | 16,938 | | | | 234 | |

| Moody's = Baa1 | AA | | | 70,288 | | | | 68,249 | | | | 2,040 | |

| S&P = AA | AA- | | | 101,985 | | | | 98,847 | | | | 3,138 | |

| Fitch = WD) | A+ | | | 34,988 | | | | 34,673 | | | | 315 | |

| | A | | | 22,199 | | | | 22,468 | | | | (269 | ) |

| | A- | | | 25,469 | | | | 25,862 | | | | (393 | ) |

| | BBB- | | | 1,800 | | | | 2,127 | | | | (327 | ) |

| | BBB+ | | | 4,159 | | | | 4,060 | | | | 99 | |

| | N/R | | | 7,070 | | | | 7,182 | | | | (112 | ) |

| MBIA Total | | | $ | 291,236 | | | $ | 286,095 | | | $ | 5,142 | |

XLCA (now Syncora) (Ratings: Moody's = Caa1 S&P = B Fitch = WD) | A+ | | | 3,346 | | | | 3,874 | | | | (528 | ) |

| XLCA Total | | | $ | 3,346 | | | $ | 3,874 | | | $ | (528 | ) |

| Grand Total | | | $ | 826,852 | | | $ | 815,435 | | | $ | 11,418 | |

| Muni's with Insurance as a % of total Munis | 47% | | |

| Note: Some amounts may not foot due to rounding. | |

Selective Insurance Group, Inc. and Consolidated Subsidiaries

Structured Securities

December 31, 2008

($ in thousands)

(unaudited)

| | •Market Value = $657,645 ; Unrealized Gain/(Loss) = ($101,444) |

| | •Structured Security Portfolio S&P Average Rating = AA+ |

| | •Structured Securities = 18.6% of the Total Portfolio |

Selective Insurance Group, Inc. and Consolidated Subsidiaries

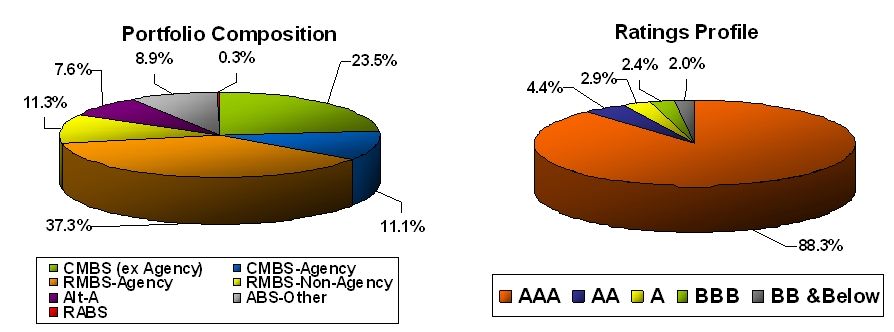

Residential Mortgage Backed (RMBS) and Residential Asset Backed (RABS) Securities

December 31, 2008

($ in thousands)

(unaudited)

| | •Market Value = $372,215; Unrealized Gain/(Loss) = ($54,323) |

| | •RMBS & RABS Portfolio S&P Average Rating = AA+ |

| | •RMBS & RABS Securities = 10.5% of the Total Portfolio |

Selective Insurance Group Inc. and Consolidated Subsidiaries

Residential Mortgage Backed Securities (RMBS) and Residential Asset Backed (RABS)- by Vintage Year

December 31, 2008

($ in thousands)

(unaudited)

Market Value

| Vintage Yr | AAA | AA | A | BBB | BB | B | Total | % of Total RMBS & RABS | % of Total Fixed Income Portfolio | % of Total GAAP Equity |

| 1983 | $ 19 | $ - | $ - | $ - | $ - | $ - | $ 19 | 0% | 0% | 0% |

| 2002 | 66,512 | - | 2,227 | - | - | - | 68,739 | 18% | 2% | 8% |

| 2003 | 61,812 | - | 1,628 | - | - | - | 63,441 | 17% | 2% | 7% |

| 2004 | 34,531 | 1,296 | - | - | - | - | 35,827 | 10% | 1% | 4% |

| 2005 | 53,839 | - | - | - | - | - | 53,839 | 14% | 2% | 6% |

| 2006 | 79,335 | 4,221 | - | 11,920 | 7,364 | 2,096 | 104,936 | 28% | 3% | 12% |

| 2007 | 11,000 | 1,759 | 2,579 | 435 | - | - | 15,773 | 4% | 1% | 2% |

| 2008 | 29,641 | - | - | - | - | - | 29,641 | 8% | 1% | 3% |

| Total RMBS & RABS-Market Value | $ 336,689 | $ 7,276 | $ 6,435 | $ 12,355 | $ 7,364 | $ 2,096 | $ 372,215 | 100% | 12% | 42% |

| % of Total RMBS & RABS | 90% | 2% | 2% | 3% | 2% | 1% | 100% | | | |

| % of Total Fixed Income Portfolio | 11% | 0% | 0% | 1% | 0% | 0% | 12% | | | |

| % of Total GAAP Equity | 38% | 1% | 1% | 1% | 1% | 0% | 42% | | | |

| Weighted Average Market Price | 92.7 | 67.4 | 40.6 | 65.6 | 49.1 | 68.7 | 87.3 | | | |

| |

| Unrealized Gain/(Loss) |

| |

| Vintage Yr | AAA | AA | A | BBB | BB | B | Total | | | |

| 1983 | $ 1 | $ - | $ - | $ - | $ - | $ - | $ 1 | | | |

| 2002 | 1,653 | - | (247) | - | - | - | 1,405 | | | |

| 2003 | (527) | - | (784) | - | - | - | (1,311) | | | |

| 2004 | (2,692) | (534) | - | - | - | - | (3,226) | | | |

| 2005 | (12,329) | - | - | - | - | - | (12,329) | | | |

| 2006 | (12,845) | (2,028) | - | (6,197) | (7,630) | (956) | (29,657) | | | |

| 2007 | 150 | (956) | (8,372) | (290) | - | - | (9,468) | | | |

| 2008 | 261 | - | - | - | - | - | 261 | | | |

| Total RMBS & RABS - Unrealized | $ (26,329) | $ (3,518) | $ (9,403) | $ (6,487) | $ (7,630) | $ (956) | $ (54,323) | | | |

| % of Total RMBS & RABS | 48% | 7% | 17% | 12% | 14% | 2% | 100% | | | |

| | | | | | | | | | | |

| Note: Some amounts may not foot due to rounding. |

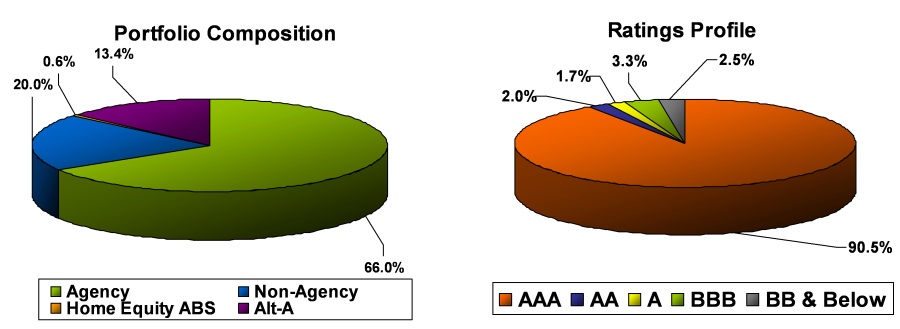

Selective Insurance Group Inc. and Consolidated Subsidiaries

Residential Mortgage Backed Securities (RMBS) and Residential Asset Backed (RABS)- by Type

December 31, 2008

($ in thousands)

(unaudited)

Market Value

| RMBS Type | AAA | AA | A | BBB | BB | B | Total | % of Total RMBS & RABS | % of Total Fixed Income Portfolio | % of Total GAAP Equity |

| Agency | $ 233,700 | $ - | $ - | $ - | $ - | $ - | $ 233,700 | 63% | 8% | 26% |

| FHA/VA | 11,825 | - | - | - | - | - | 11,825 | 3% | 0% | 1% |

| Total Agency | 245,525 | - | - | - | - | - | 245,525 | 66% | 8% | 28% |

| Alt-A | 39,162 | 1,296 | - | 3,516 | 4,122 | 1,182 | 49,278 | 13% | 2% | 6% |

| Alt-A CDO | - | - | - | - | - | 913 | 913 | 0% | 0% | 0% |

| Home Equity ABS | - | - | 2,227 | - | - | - | 2,227 | 1% | 0% | 0% |

| Non-Agency & Other Prime | 52,002 | 5,980 | 4,208 | 8,839 | 3,242 | - | 74,271 | 20% | 2% | 8% |

| Total RMBS & RABS-Market Value | $ 336,689 | $ 7,276 | $ 6,435 | $ 12,355 | $ 7,364 | $ 2,096 | $ 372,215 | 100% | 12% | 42% |

| % of Total RMBS & RABS | 90% | 2% | 2% | 3% | 2% | 1% | 100% | | | |

| % of Total Fixed Income Portfolio | 11% | 0% | 0% | 1% | 0% | 0% | 12% | | | |

| % of Total GAAP Equity | 38% | 1% | 1% | 1% | 1% | 0% | 42% | | | |

| Weighted Average Market Price | 92.7 | 67.4 | 40.6 | 65.6 | 49.1 | 68.7 | 87.3 | | | |

| |

| Unrealized Gain/(Loss) |

| |

| RMBS Type | AAA | AA | A | BBB | BB | B | Total | | | |

| Agency | $ 5,233 | $ - | $ - | $ - | $ - | $ - | $ 5,233 | | | |

| FHA/VA | (978) | - | - | - | - | - | (978) | | | |

| Total Agency | 4,255 | - | - | - | - | - | 4,255 | | | |

| Alt-A | (16,411) | (534) | - | (6,141) | (5,874) | (956) | (29,916) | | | |

| Alt-A CDO | - | - | - | - | - | - | - | | | |

| Home Equity ABS | - | - | (247) | - | - | - | (247) | | | |

| Non-Agency & Other Prime | (14,173) | (2,984) | (9,156) | (346) | (1,756) | - | (28,415) | | | |

| Total RMBS & RABS - Unrealized | $ (26,329) | $ (3,518) | $ (9,403) | $ (6,487) | $ (7,630) | $ (956) | $ (54,323) | | | |

| % of Total RMBS & RABS | 48% | 7% | 17% | 12% | 14% | 2% | 100% | | | |

| | | | | | | | | | | |

| Note: Some amounts may not foot due to rounding. |

Selective Insurance Group Inc. and Consolidated Subsidiaries

Residential Mortgage Backed (RMBS) and Residential Asset Backed (RABS) Securities

Ratings Migration (1)

December 31, 2008

($ thousands)

(unaudited)

Original Rating | Current Rating |

Rating | Amount | AAA | AA | A | BBB | BB | B |

AAA | 364,690 | 336,479 | 5,517 | 2,227 | 11,920 | 7,364 | 1,183 |

AA | 4,978 | 210 | 1,759 | 2,096 | - | - | 913 |

A | 2,112 | - | - | 2,112 | - | - | - |

BBB | 435 | - | - | - | 435 | - | - |

BB | - | - | - | - | - | - | - |

Total Market Value | 372,215 | 336,689 | 7,276 | 6,435 | 12,355 | 7,364 | 2,096 |

| |

Note (1): Migration period is from the purchase date of each security to December 31, 2008 |

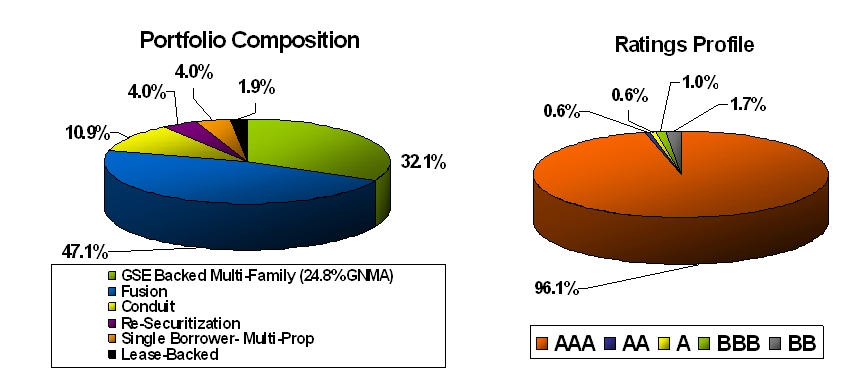

Selective Insurance Group, Inc. and Consolidated Subsidiaries

Commercial Mortgage Backed (CMBS) Securities

December 31, 2008

($ in thousands)

(unaudited)

| | •Market Value = $227,152; Unrealized Gain/(Loss) = ($32,028) |

| | •CMBS Portfolio S&P Average Rating = AAA |

| | •CMBS Securities = 6.4% of the Total Portfolio |

Selective Insurance Group Inc. and Consolidated Subsidiaries

Commercial Mortgage Backed Securities (CMBS)- by Vintage Year

December 31, 2008

($ in thousands)

(unaudited)

Market Value

| Vintage Yr | AAA | AA | A | BBB | BB | Total | % of Total CMBS | % of Total Fixed Income Portfolio | % of Total GAAP Equity | |

| 1996 | $ 4,981 | $ - | $ - | $ - | $ - | $ 4,981 | 2% | 0% | 1% | |

| 1999 | 26,945 | - | - | - | - | 26,945 | 12% | 1% | 3% | |

| 2000 | 33,119 | - | - | - | - | 33,119 | 15% | 1% | 4% | |

| 2001 | 47,429 | - | - | - | - | 47,429 | 21% | 2% | 5% | |

| 2002 | 44,277 | - | - | - | - | 44,277 | 19% | 1% | 5% | |

| 2003 | 1,819 | - | - | - | - | 1,819 | 1% | 0% | 0% | |

| 2004 | 8,586 | - | - | - | - | 8,586 | 4% | 0% | 1% | |

| 2005 | 1,628 | - | 1,361 | 894 | 423 | 4,306 | 2% | 0% | 0% | |

| 2006 | 14,327 | 568 | - | - | - | 14,895 | 7% | 1% | 2% | |

| 2007 | 35,139 | 800 | - | 1,421 | 3,435 | 40,795 | 18% | 1% | 5% | |

| Total CMBS-Market Value | $ 218,250 | $ 1,368 | $ 1,361 | $ 2,315 | $ 3,858 | $ 227,152 | 100% | 7% | 26% | |

| % of Total CMBS | 96% | 1% | 1% | 1% | 2% | 100% | | | | |

| % of Total Fixed Income Portfolio | 7% | 0% | 0% | 0% | 0% | 7% | | | | |

| % of Total GAAP Equity | 25% | 0% | 0% | 0% | 1% | 26% | | | | |

| Weighted Average Market Price | 93.3 | 32.5 | 30.0 | 28.4 | 46.7 | 87.6 | | | | |

| | |

| Unrealized Gain/(Loss) | |

| | |

| Vintage Yr | AAA | AA | A | BBB | BB | Total | | | | |

| 1996 | $ (275) | $ - | $ - | $ - | $ - | $ (275) | | | | |

| 1999 | (61) | - | - | - | - | (61) | | | | |

| 2000 | (380) | - | - | - | - | (380) | | | | |

| 2001 | 420 | - | - | - | - | 420 | | | | |

| 2002 | (1,555) | - | - | - | - | (1,555) | | | | |

| 2003 | (186) | - | - | - | - | (186) | | | | |

| 2004 | (914) | - | - | - | - | (914) | | | | |

| 2005 | (407) | - | (3,175) | (3,906) | (2,399) | (9,887) | | | | |

| 2006 | (9,175) | - | - | - | - | (9,175) | | | | |

| 2007 | (3,247) | (2,836) | - | (1,932) | (2,000) | (10,015) | | | | |

| Total CMBS-Unrealized | $ (15,780) | $ (2,836) | $ (3,175) | $ (5,837) | $ (4,399) | $ (32,028) | | | | |

| % of Total CMBS | 49% | 9% | 10% | 18% | 14% | 100% | | | | |

| | |

| Note: Some amounts may not foot due to rounding. | |

Selective Insurance Group Inc. and Consolidated Subsidiaries

Commercial Mortgage Backed Securities (CMBS)- by Type

December 31, 2008

($ thousands)

(unaudited)

Market Value

| CMBS Type | AAA | AA | A | BBB | BB | Total | % of Total CMBS | % of Total Fixed Income Portfolio | % of Total GAAP Equity | |

| Agency MultiFamily | $ 72,887 | $ - | $ - | $ - | $ - | $ 72,887 | 32% | 2% | 8% | |

| Conduit | 24,706 | - | - | - | - | 24,706 | 11% | 1% | 3% | |

Fusion (1) | 104,599 | 800 | - | 1,114 | 435 | 106,947 | 47% | 4% | 12% | |

| Lease-Backed | 4,264 | - | - | - | - | 4,264 | 2% | 0% | 0% | |

| Re-Securitization | 6,844 | 568 | 1,361 | - | 423 | 9,197 | 4% | 0% | 1% | |

| Single Borrower - Multiple Properties | 4,949 | - | - | 1,201 | 3,000 | 9,150 | 4% | 0% | 1% | |

| Total CMBS-Market Value | $ 218,250 | $ 1,368 | $ 1,361 | $ 2,315 | $ 3,858 | $ 227,152 | 100% | 7% | 26% | |

| % of Total CMBS | 96% | 1% | 1% | 1% | 2% | 100% | | | | |

| % of Total Fixed Income Portfolio | 7% | 0% | 0% | 0% | 0% | 7% | | | | |

| % of Total GAAP Equity | 25% | 0% | 0% | 0% | 1% | 26% | | | | |

| Weighted Average Market Price | 93.3 | 32.5 | 30.0 | 28.4 | 46.7 | 87.6 | | | | |

| | |

| Unrealized Gain/(Loss) | |

| | | | | | | | | | | |

| CMBS Type | AAA | AA | A | BBB | BB | Total | | | | |

| Agency MultiFamily | $ 2,800 | $ - | $ - | $ - | $ - | $ 2,800 | | | | |

| Conduit | (1,075) | - | - | - | - | (1,075) | | | | |

Fusion (1) | (8,622) | (2,836) | - | (5,039) | - | (16,496) | | | | |

| Lease-Backed | (95) | - | - | - | - | (95) | | | | |

| Re-Securitization | (8,693) | - | (3,175) | - | (2,399) | (14,268) | | | | |

| Single Borrower - Multiple Properties | (95) | - | - | (799) | (2,000) | (2,894) | | | | |

| Total CMBS-Unrealized | $ (15,780) | $ (2,836) | $ (3,175) | $ (5,837) | $ (4,399) | $ (32,028) | | | | |

| % of Total CMBS | 49% | 9% | 10% | 18% | 14% | 100% | | | | |

| | |

| | |

(1) Fusion means a CMBS composed of large and small loans. | |

| Note: Some amounts may not foot due to rounding. | |

Selective Insurance Group Inc. and Consolidated Subsidiaries

Commercial Mortgage Backed Securities (CMBS)

Ratings Migration (1)

December 31, 2008

($ thousands)

(unaudited)

Original Rating | Current Rating |

Rating | Amount | AAA | AA | A | BBB | BB |

AAA | 208,800 | 206,448 | 568 | 1,361 | - | 423 |

AA | 12,602 | 11,802 | 800 | - | - | - |

A | - | - | - | - | - | - |

BBB | 2,750 | - | - | - | 2,315 | 435 |

BB | 3,000 | - | - | - | - | 3,000 |

Total Market Value | 227,152 | 218,250 | 1,368 | 1,361 | 2,315 | 3,858 |

Note (1): Migration period is from the purchase date of each security to December 31, 2008

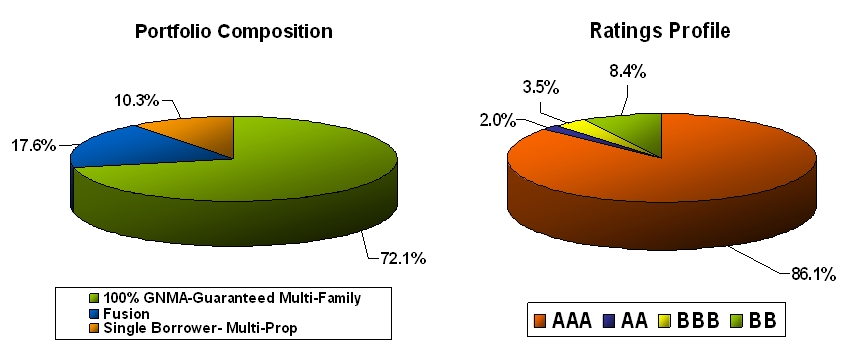

Selective Insurance Group, Inc. and Consolidated Subsidiaries

2007 Vintage Commercial Mortgage Backed (CMBS) Securities

December 31, 2008

($ in thousands)

(unaudited)

| | •Market Value = $40,795; Unrealized Gain/(Loss) = ($10,015) |

| | •2007 Vintage CMBS Portfolio S&P Average Rating = AA+ |

| | •2007 Vintage CMBS Securities = 1.2% of the Total Portfolio |

Selective Insurance Group Inc. and Consolidated Subsidiaries

2007 Vintage Commercial Mortgage Backed Securities (CMBS)

December 31, 2008

($ in thousands)

(unaudited)

Market Value