- SIGI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Selective Insurance (SIGI) 8-KRegulation FD Disclosure

Filed: 24 Mar 09, 12:00am

12:30-1:00 p.m. | Registration | |

1:00 p.m. | Welcome | Jennifer DiBerardino, VP Investor Relations |

1:10 p.m. | Strategic Overview | Greg Murphy, Chairman, President and Chief Executive Officer |

1:35 p.m. | Insurance Operations | John Marchioni, Chief U/W & Field Officer |

Business Intelligence | Brenda Hall, SVP Field U/W & Information Strategy | |

Personal Lines | Allen Anderson, SVP Personal Lines | |

2:35 p.m. | Break | |

2:45 p.m. | Agency Panel •HMS Insurance Associates •Eastern Insurance •Berends Hendricks Stuit •BB&T | John Marchioni, moderator Gary Berger Mark Levine Jerry Niewiek David Pruett |

3:45 p.m. | Claims Operations | Mary Porter, Chief Claims Officer |

4:00 p.m. | Enterprise Risk Management and Financial Highlights Investments | Dale Thatcher, Chief Financial Officer Kerry Guthrie, Chief Investment Officer |

4:30 p.m. | Closing and Q&A | Greg Murphy & Management Team |

5:00 p.m. | Reception |

State | Current Share of Wallet | Most Recent Agency Commercial Lines Premium Volume ($M) |

NJ | 13.6% | 2,655 |

MD | 10.0 | 1,174 |

RI | 18.5 | 283 |

PA | 11.4 | 2,215 |

NY | 8.3 | 2,060 |

All other | 5.9 | 10,733 |

Total | 8.3 | 19,120 |

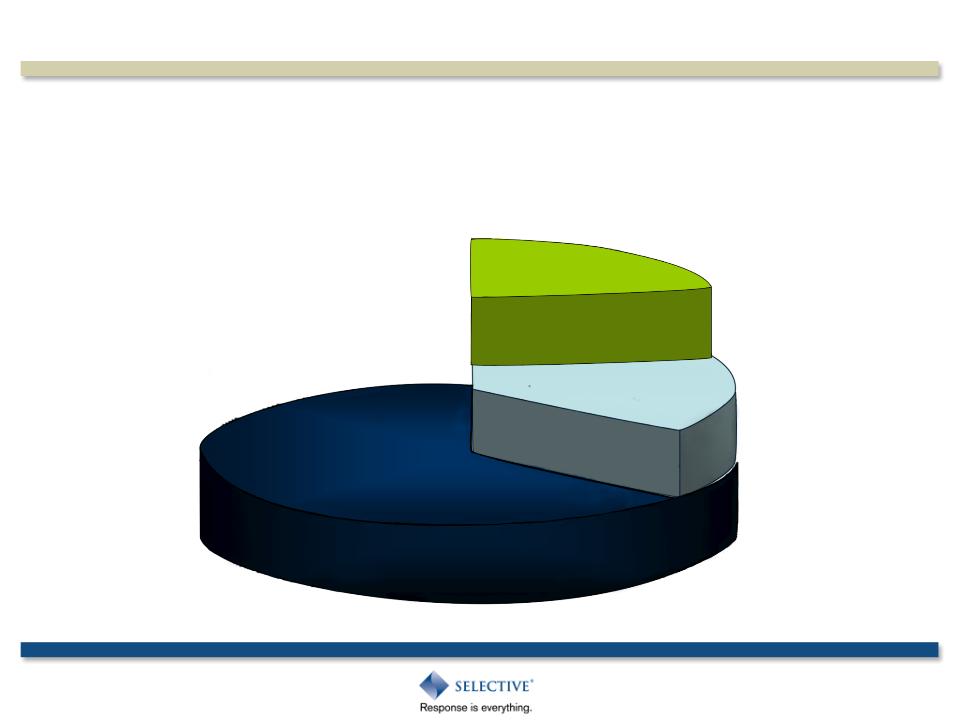

Historical % of Premium | 20% | 30% | 30% | 15% | 5% |

Segment 41 | 95.6% | ||

Segment 60 | 101.0% |

Segment 21 | 86.3% | ||

Segment 40 | 95.3% |

Segment 1 | 68.7% | ||

Segment 20 | 85.8% |

Segment 61 | 101.2% | ||

Segment 80 | 120.2% |

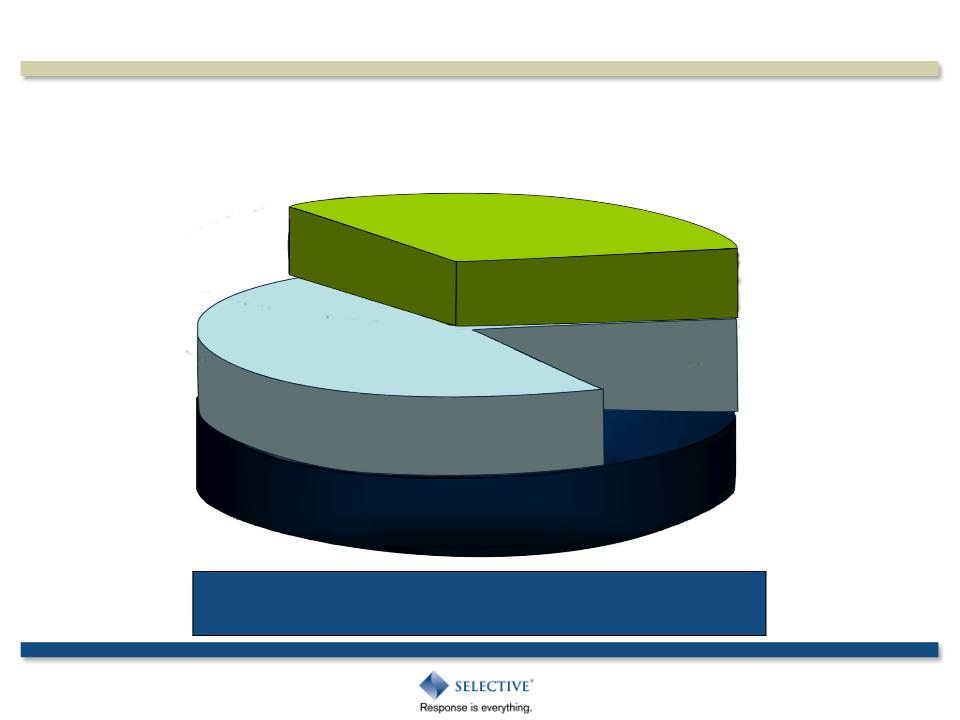

Segment 41 | 95.6% | ||

Segment 60 | 101.0% |

Segment 21 | 86.3% | ||

Segment 40 | 95.3% |

Segment 1 | 68.7% | ||

Segment 20 | 85.8% |

Segment 61 | 101.2% | ||

Segment 80 | 120.2% |

DPW - Total | DPW - NEW | Combined Ratio (%) | |

2002 | $3,985 | $443 | 115.1 |

2003 | $4,561 | $1,701 | 108.1 |

2004 | $6,149 | $1,617 | 79.6 |

2005 | $6,427 | $1,335 | 69.4 |

2006 | $8,610 | $2,825 | 81.2 |

2007 | $10,338 | $3,641 | 93.6 |

2008 | $11,401 | $2,675 | 73.7 |

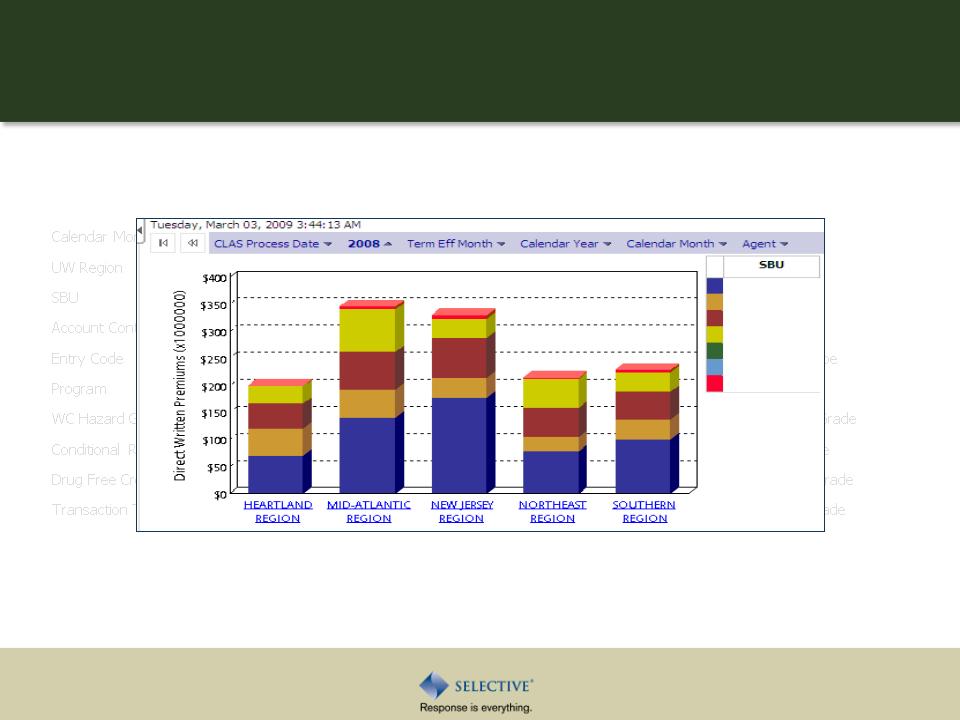

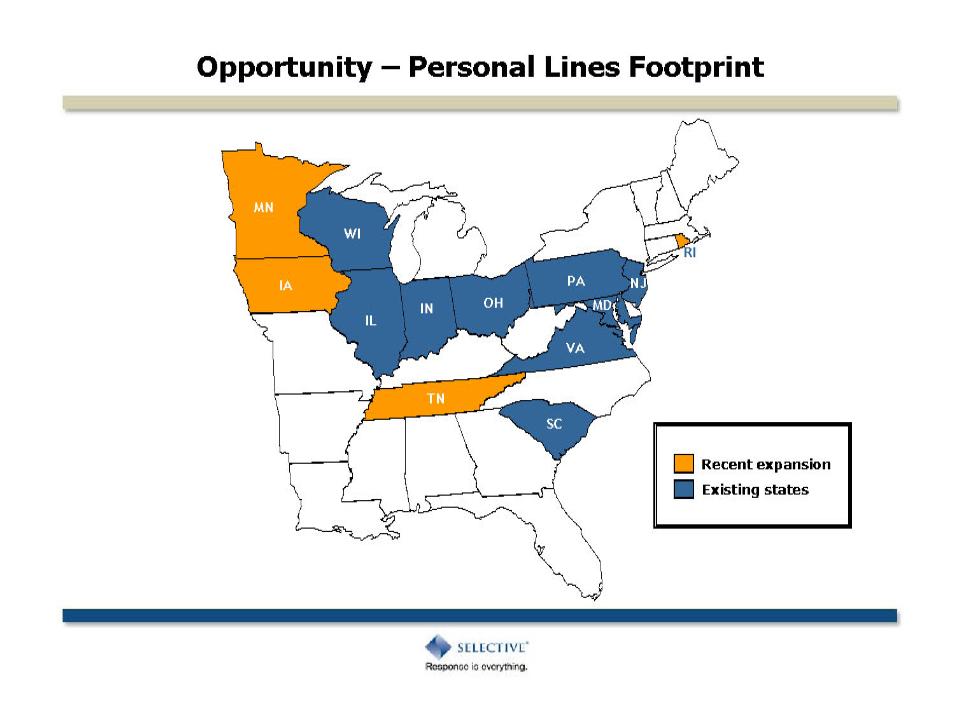

Region | Targeted Market Share ($M) |

Heartland (IL, IN, MN, WI, IA) | 302 |

Mid-Atlantic (PA, MD, OH) | 267 |

New Jersey | 143 |

Northeast (RI) | 13 |

Southern (VA, TN, SC) | 175 |

Total premium at 1.5% market share | $900 |

($ in millions) | Weighted Average Price Change | In-Force Premium Impact |

2008 | 7.4% | $14.9 |

2009 | 4.3% | $ 9.1 |

Non-cash reductions in Book Value per share | |

OTTI | $(0.65) |

Fixed Income | $(1.39) |

Equity | $(1.21) |

Pension charge | $(0.72) |

Total | $(3.97) |