| FILING PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933, AS AMENDED |

| |

| FILER: COMPUTER SCIENCES CORPORATION |

| |

| SUBJECT COMPANY: DYNCORP (001-03879) |

Computer Sciences Corporation will file a proxy statement/prospectus and other relevant documents concerning the proposed merger with DynCorp with the Securities and Exchange Commission. The directors, certain executive officers and other employees and representatives of CSC may be deemed to be participants in the solicitation of proxies for the meeting of the shareholders of DynCorp relating to the proposed merger. YOU ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND THE OTHER RELEVANT DOCUMENTS FILED WITH THE COMMISSION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ON SUCH POTENTIAL CSC PARTICIPANTS AND THE PROPOSED BUSINESS COMBINATION. You will be able to obtain the proxy statement/prospectus (when it becomes available) and the other documents filed with the SEC free of charge at the Commission's website, www.sec.gov. In addition, you may obtain the proxy statement/prospectus (when it becomes available) and the other documents filed by CSC with the Commi ssion by requesting them in writing from Computer Sciences Corporation, 2100 East Grand Avenue, El Segundo, California 90245, Attention: Investor Relations, telephone: (310) 615-0311; e-mail: investorrelations@csc.com.

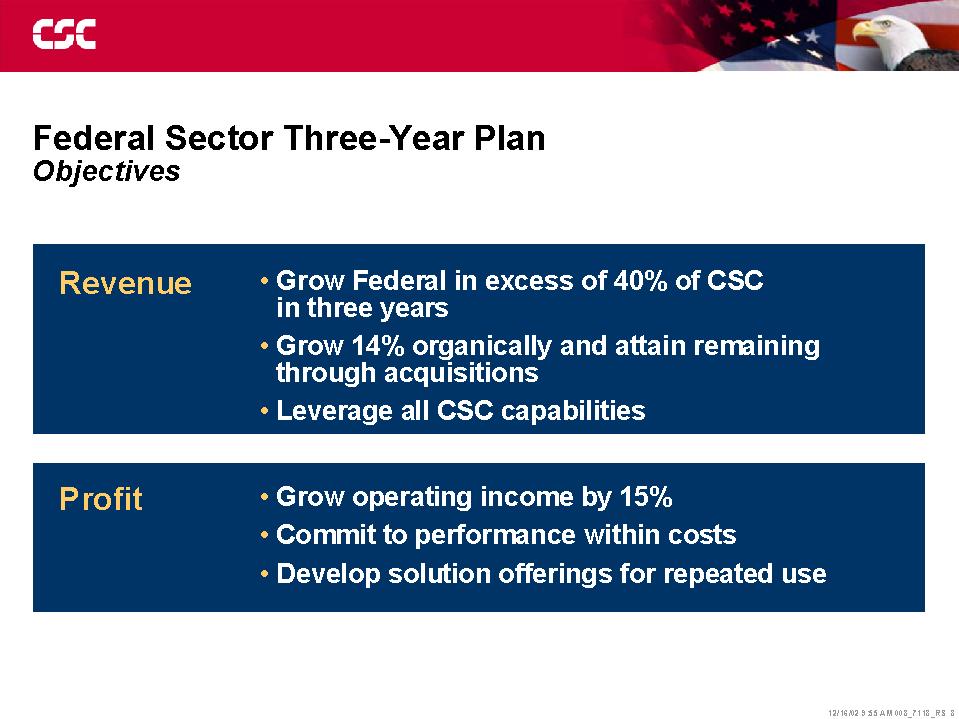

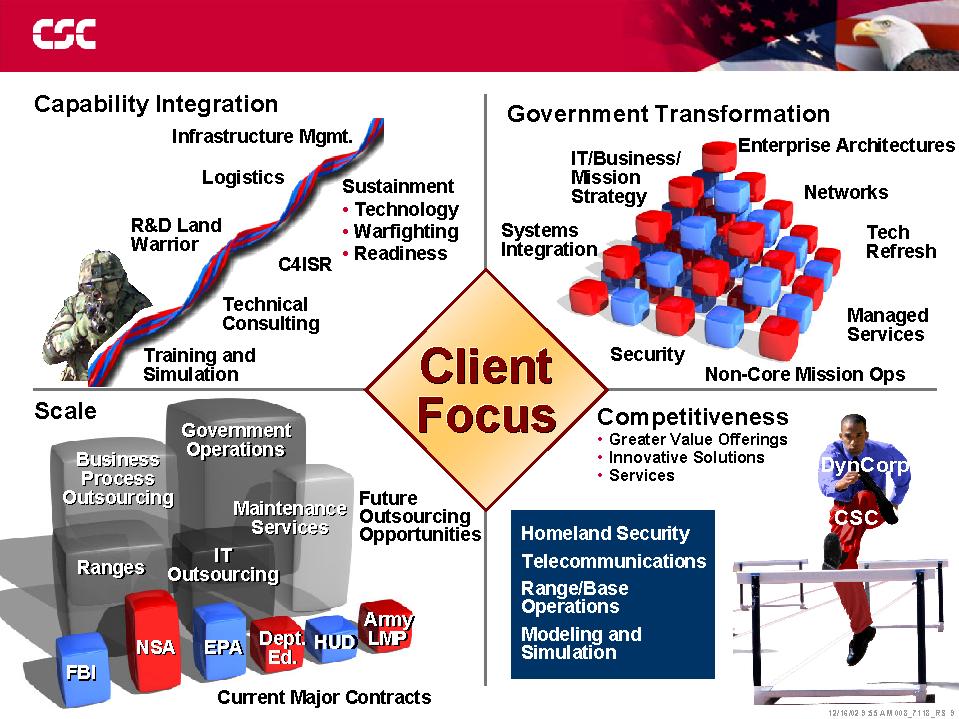

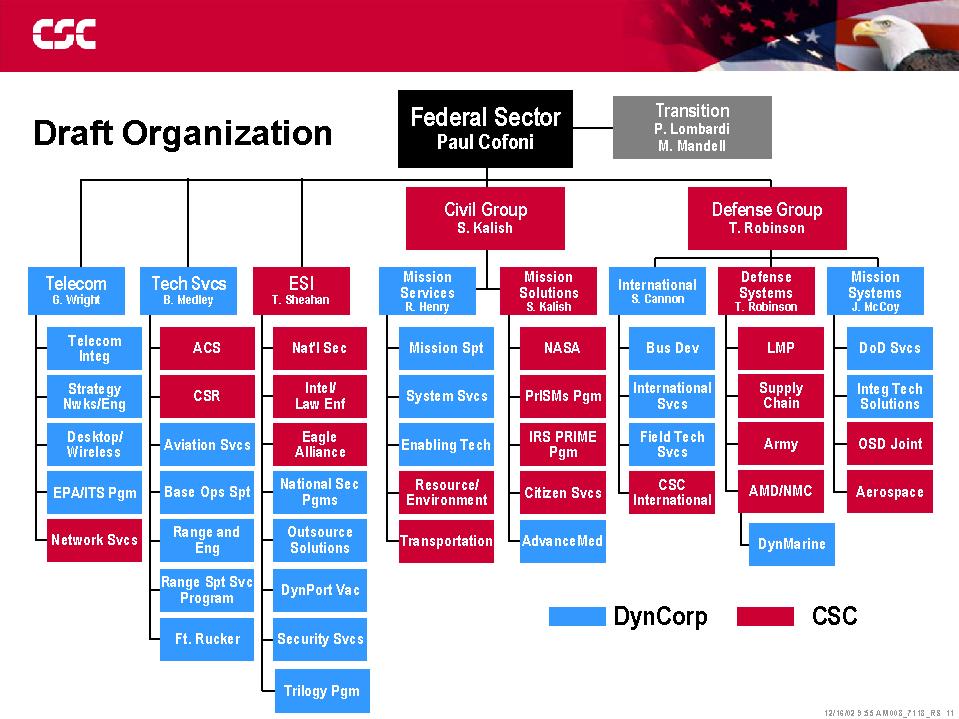

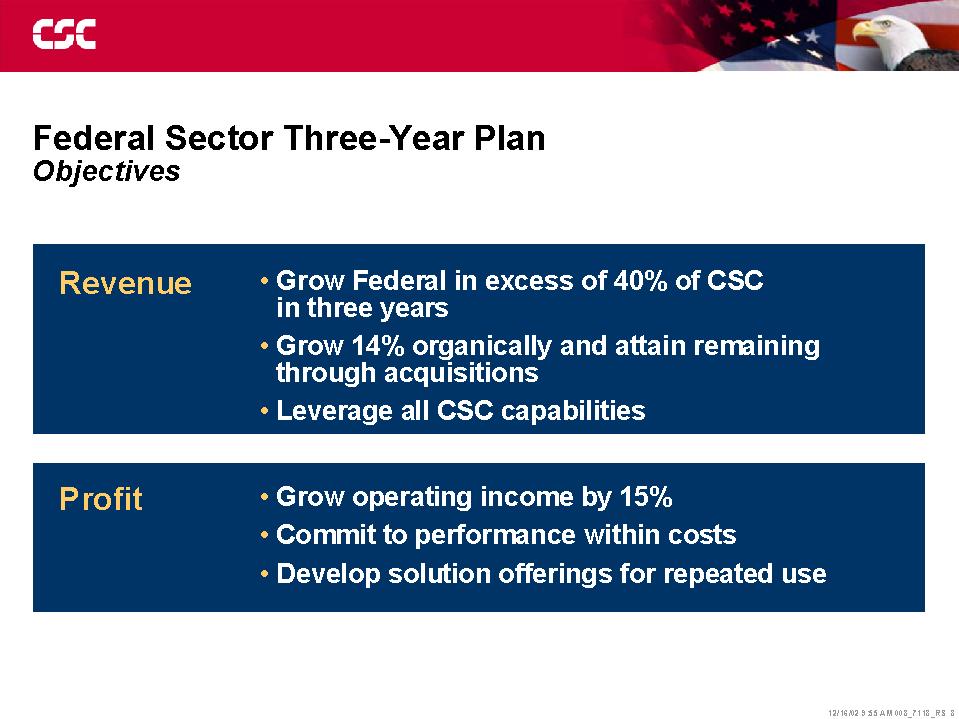

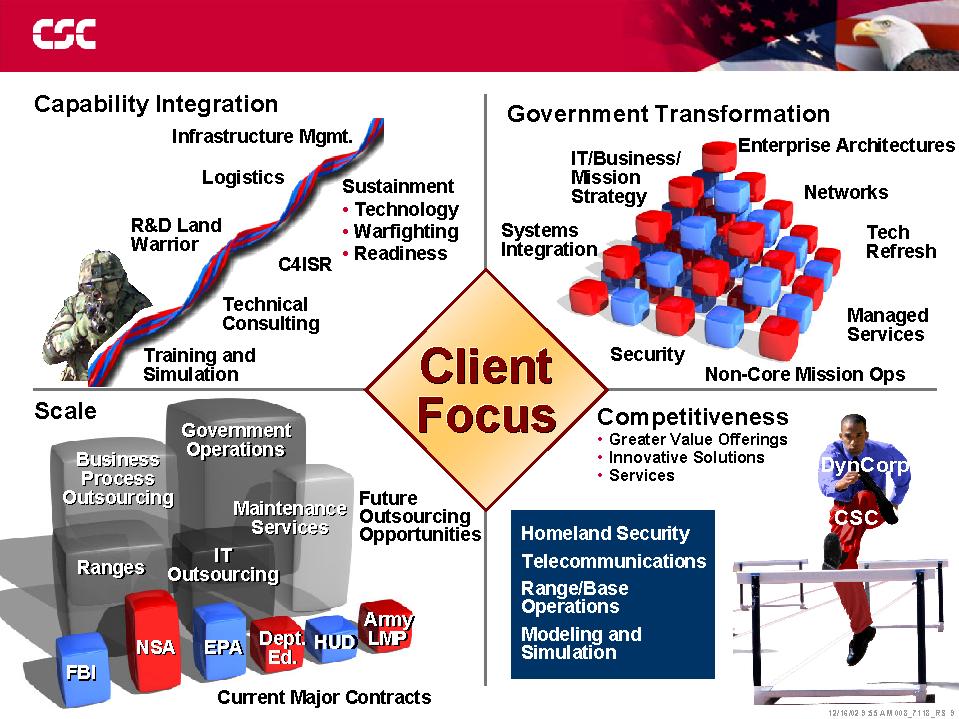

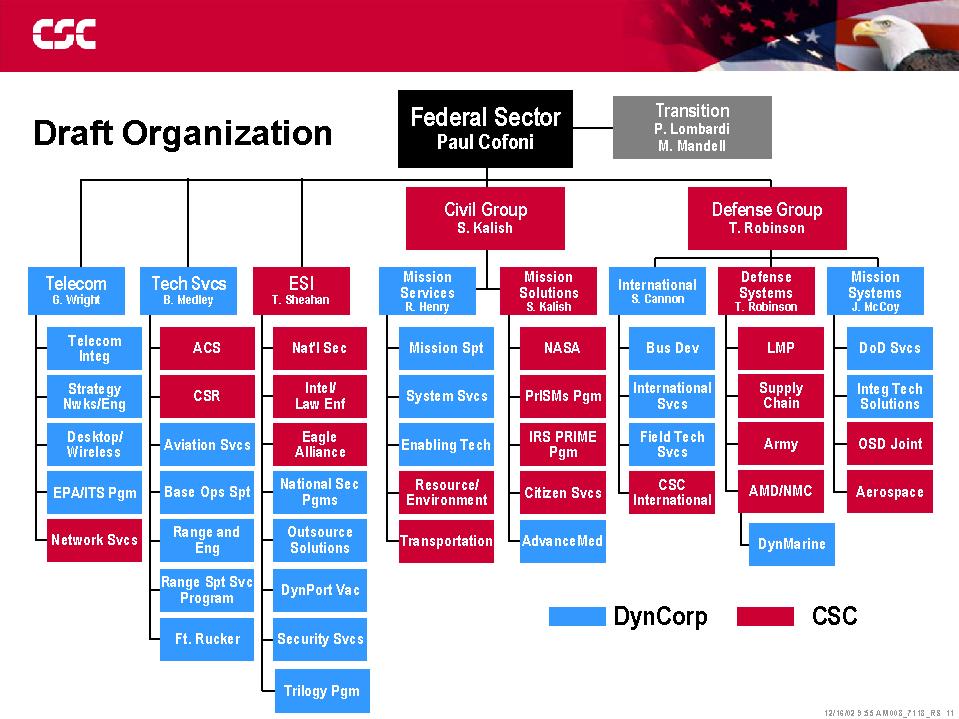

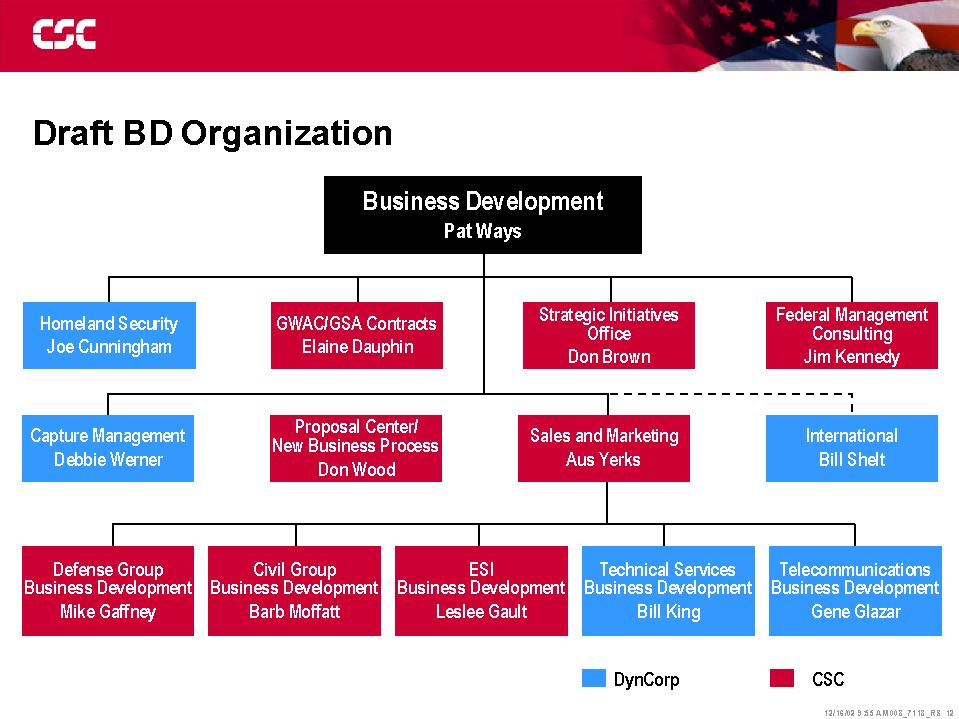

The following slides will be used in meetings with DynCorp employees commencing December 16, 2002.

All statements in the preceding communication that do not directly and exclusively relate to historical facts constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements represent the current expectations and beliefs of Computer Sciences Corporation and no assurance can be given that the results described in such statements will be achieved.

These statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results described in such statements, including the following factors relating specifically to the merger: (i) the inability to obtain or meet conditions imposed for, or governmental approvals required for, the merger; (ii) the failure of the DynCorp stockholders to approve the merger; (iii) the risk that the CSC and DynCorp businesses will not be integrated successfully; (iv) the risk that the expected benefits of the merger may not be realized; (v) the risk that resales of CSC stock following the merger may cause the market price to fall; and (vi) CSC's increased indebtedness after the merger.

For a description of non merger-related factors, see the section titled "Management's Discussion and Analysis of Financial Conditions and Results of Operations; Forward-Looking Statements" in CSC's Quarterly Report on Form 10-Q for the fiscal quarter ended September 27, 2002.