UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

| | EXCHANGE ACT OF 1934 |

| | For the fiscal year ended March 30, 2007 |

OR |

| r | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

| | EXCHANGE ACT OF 1934 |

| | For the transition period from | to |

Commission File No.: 1-4850 |

COMPUTER SCIENCES CORPORATION

COMPUTER SCIENCES CORPORATION(Exact name of Registrant as specified in its charter)

Nevada | 95-2043126 |

(State of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

2100 East Grand Avenue | |

El Segundo, California | 90245 |

(Address of principal executive offices) | (zip code) |

| | |

Registrant's telephone number, including area code: (310) 615-0311 |

| | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class: | Name of each exchange on which registered |

Common Stock, $1.00 par value per share | New York Stock Exchange |

Preferred Stock Purchase Rights | |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No r

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes r No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No r

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated r Non-accelerated filer r

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes r No x

As of September 29, 2006 the aggregate market value of stock held by non-affiliates of the Registrant was approximately $8,422,000,000.

There were 173,993,039 shares of the Registrant’s common stock outstanding as of May 25, 2007.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement for its 2007 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days after March 30, 2007, are incorporated by reference into Part III hereof.

Explanatory Note

As previously announced and disclosed in a Current Report on Form 8-K dated May 30, 2007, Computer Sciences Corporation (CSC or the Company) has restated its consolidated balance sheet as of March 31, 2006, and the related consolidated statements of income, stockholders’ equity and cash flows for fiscal years ended March 31, 2006 and April 1, 2005 in this Form 10-K as discussed in Note 2, “Restatement of Consolidated Financial Statements” in the Notes to Consolidated Financial Statements. These restatements relate to the 1) completion of the Company’s investigation of its stock option granting practices, 2) the correction of errors relating to the accounting for income taxes, and 3) recognition of revenue for the sale of licenses for a software product. This Form 10-K also reflects the restatement of “Selected Consolidated Financial Data” in Item 6 for the fiscal years ended March 31, 2006, April 1, 2005, April 2, 2004 and March 28, 2003. In addition, the quarterly financial data in Item 8 has been restated.

The Company has not amended and does not plan to amend previously filed Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q for any period affected by this restatement.

Revenue Recognition

The Company determined that it did not correctly apply the provisions of Statement of Position 97-2, “Software Revenue Recognition” with respect to the sale of licenses for a software product. As a result, the Company overstated revenue and unbilled receivables and understated deferred revenue related to this product in fiscal years prior to 2005. In fiscal years 2006 and 2005 this error resulted in an understatement of revenue. The Company has restated revenue for fiscal 2006 and 2005 and as a result revenue increased $23.4 and $21.4 for these years, respectively. The cumulative effect of this error on earnings retained for use in business was a decrease of $51.1 at April 3, 2004.

Income Taxes

The Company identified errors related to income taxes in prior periods. The most significant of these errors related to income tax accounting for amortization of tax bases of assets contributed to a consolidated affiliate. The impact of the correction of this error was an increase in income tax expense of $53.7 and $11.8 for fiscal 2006 and 2005. The cumulative effect of the correction of this error on earnings retained for use in business was a decrease of $91.4 at April 3, 2004.

In addition, the Company identified errors in the accounting for U.S. income tax liabilities related to foreign operations. The impact of the correction of this error was an increase in income tax expense of $6.6 and $5.4 for fiscal 2006 and 2005. The cumulative effect of this error on earnings retained for use in business was a decrease $15.2 at April 3, 2004.

The Company also identified individually immaterial income tax accounting errors that have been corrected. These errors related principally to state income taxes, provision for a gain, the valuation of state net operating losses and deferred tax liabilities related to state taxes. The combined impact of these errors on income tax expense was an increase of $28.4 and $1.4 for fiscal 2006 and 2005 respectively. The cumulative effect of the correction of these errors on earnings retained for use in business was a decrease of $3.6 at April 3, 2004.

Additionally, the Company identified certain errors in the preparation of U.S. federal tax returns. These included an error which understated the deduction of certain general and administrative costs in its U.S. federal income tax returns for fiscal 2002 through fiscal 2005 and resulted in the overstatement of income tax expense by $7.4 for fiscal 2005 and an understatement of income tax expense by $2.1 for fiscal 2006. The cumulative effect of the correction of these errors on earnings retained for use in business was an increase of $17.3 at April 3, 2004.

As a result of the errors noted above the Company incurred interest and penalties. For fiscal 2006 and 2005 the Company has recorded adjustments related to additional interest expense of $16.7 and $2.6, respectively, for the income tax errors. The cumulative effect on earnings retained for use in business was a decrease of $4.8 at April 3, 2004. The Company also recorded penalties related to the income tax errors of $4.0 and $44.3 for fiscal 2006 and 2005, respectively. The cumulative effect of the penalties for periods prior to fiscal 2005 on earnings retained for use in business was a decrease of $7.4 at April 3, 2004.

The total effect of all the income tax adjustments noted above was to increase income tax expense $90.8 ($84.2 net of impact of interest expense) and $11.2 ($10.2 net of the impact of interest expense) for fiscal 2006 and fiscal 2005. The cumulative effect of these errors on earnings retained for use in business was a decrease of $ 105.1 at April 3, 2004.

Stock Options

As announced in a Current Report on Form 8-K filed on February 28, 2007, the Company has completed its internal investigation of its stock option grant practices. As previously announced, in response to investigations of CSC's option grant practices by the Securities and Exchange Commission and the United States Attorney's Office for the Eastern District of New York, the Company's Board of Directors on July 29, 2006, established a special committee, comprised of the two most recently elected independent directors (the Special Committee), to manage and supervise the internal investigation, and to report the results of its investigation to the independent members of the Board of Directors. Upon receipt of the results of the investigation, the independent directors made conclusions required to address the issues raised by the investigation.

Together with its independent counsel and forensic accountants, the Special Committee conducted an extensive review of stock option grants made by the Company between March 1, 1996, and July 31, 2006 (the Relevant Period), which covered 13,564 grants made on 520 dates. The Special Committee cooperated with the SEC and the U.S. Attorney throughout this process.

The Company's independent directors concluded that the evidence obtained by the Special Committee's investigation, as well as by their own interviews of certain current and former employees, did not establish any intentional wrongdoing by current or former employees or directors, and the independent directors continue to have confidence in the integrity of management.

Based on the report of the Special Committee, the independent directors determined that 9,234 stock option grants should be modified, principally due to delays in authorization and approval and the absence of definitive documentation, including:

· | 540 stock option grants made on five dates between May 9, 1996, and June 13, 2002, which should have been accounted for as repricings of prior stock option grants, 527 of which require variable accounting until April 1, 2006, when the Company adopted Statement of Financial Accounting Standards (SFAS) No. 123R, “Share-Based Payment”; |

· | 3,906 other stock option grants made on 108 dates between April 9, 1996, and April 3, 2006, for which the measurement date should be changed to a later date on which the closing stock price was higher, requiring additional compensation expense; and |

· | 4,788 other stock option grants made on 71 dates between April 1, 1996, and July 10, 2006, for which the measurement date should be changed to a later date on which the closing stock price was lower, requiring no additional compensation expense. |

The incremental cumulative non-cash compensation expense, before taxes, from March 1, 1996, through June 30, 2006, related to stock options was approximately $70 million, including approximately $30 million attributable to the repricings requiring variable accounting. This $70 million (approximately $60 million after taxes) has been allocated among the last 11 fiscal years and first three quarters of fiscal 2007 as follows:

| | | Pre-Tax Expense | |

Fiscal Year Ended | | (in millions) | |

| | | | |

| March 29, 1996 | | $ | 0.0 | |

| March 28, 1997 | | $ | 0.4 | |

| April 3, 1998 | | $ | 1.8 | |

| April 2, 1999 | | $ | 3.2 | |

| March 31, 2000 | | $ | 8.7 | |

| March 30, 2001 | | $ | 2.8 | |

| March 29, 2002 | | $ | 16.8 | |

| March 28, 2003 | | $ | (6.5 | ) |

| April 2, 2004 | | $ | 14.1 | |

| April 1, 2005 | | $ | 8.5 | |

| March 31, 2006 | | $ | 20.6 | |

Fiscal Quarter Ended | | | |

| | | | |

| June 30, 2006 | | $ | (0.2 | ) |

The Company also determined that the tax benefits associated with the exercise of certain stock options in foreign jurisdictions had been incorrectly credited against the foreign tax provision, rather than additional paid-in capital. The Company further determined that it had applied the effective rate, rather than the U.S. statutory rate, in recognizing the tax benefits associated with the exercise of stock options in the U.S. Correction of these two tax errors resulted in an incremental cumulative tax provision of approximately $14 million, which is included in the previously stated $60 million incremental cumulative after-tax compensation expense through June 30, 2006.

Unless otherwise indicated, all references hereafter in this explanatory note to years are to calendar years.

Background

During the Relevant Period, CSC granted stock options to two categories of employees:

| · | the Chief Executive Officer, Chief Operating Officer, each of their respective direct reports and each other employee who is an "officer" for purposes of the Securities Exchange Act of 1934 (collectively, Senior Executives); and |

| · | all other employees (collectively, Other Employees). |

Option grants to Senior Executives were approved by the Compensation Committee or the Board of Directors. Approvals for option grants to Other Employees were delegated to the Chief Executive Officer or, after July 1999, in the case of option grants of 5,000 shares or less, to the Corporate Vice President, Human Resources. The Company did not grant stock options to its independent directors.

Option grants during the Relevant Period can be grouped into three general categories:

| · | "Annual Cycle Options," which were granted as part of the annual compensation review process each year; |

| · | "Discounted Options," which, on and prior to May 12, 2004, were granted on the Annual Cycle Option grant date in lieu of a cash bonus, and which typically had an exercise price per share equal to 25% of the closing market price of the Company's common stock on the grant date; and |

| · | "Other Options," which primarily include options granted to new hires (including to employees acquired through acquisitions and outsourcings) and for promotions and special recognition. |

Of the 13,564 option grants made by the Company during the Relevant Period, (i) 9,134 were for Annual Cycle Options, (ii) 262 were for Discounted Options and (iii) 4,168 were for Other Options. The option grants in each category were reviewed to determine the first date upon which the identity of the optionee, the number of shares subject to the option grant and the option exercise price were determined with finality (the measurement date). The following describes the option grants for which the independent directors determined that the measurement date should be a date other than the grant date.

Annual Cycle Options

Annual Cycle Options Granted to Senior Executives.

The independent directors concluded that there was evidence that the Annual Cycle Options granted to Senior Executives in 1996, 1999 and 2002 may each have had two measurement dates: (i) the first occurring on the date of an initial action to select the optionees, the number of option shares and the grant date closing stock price to be used for the exercise price, and (ii) the second occurring on the date of a subsequent action, within 10 days, to select a later grant date closing stock price to be used for the exercise price. Therefore, the Company determined that the aggregate 54 Annual Cycle Option grants to Senior Executives on May 9, 1996, May 10, 1999 and June 13, 2002, should be accounted for as a repricing of options for which a measurement date had previously been established on May 6, 1996, May 3, 1999, and June 3, 2002, respectively. Generally accepted accounting principles in effect at the time require a change from fixed to variable accounting for the 1999 and 2002 repricings, but not for the 1996 repricing. The incremental cumulative non-cash compensation expense before taxes from March 1, 1996, through June 30, 2006, related to accounting for these Annual Cycle Option grants to Senior Executives as repricings was approximately $10 million.

Annual Cycle Options Granted to Other Employees.

In each of the years from 1996 through 2005, there were changes, after the grant date, in the list of Annual Cycle Options to be granted to Other Employees. Therefore, the measurement date for all of the 7,562 Annual Cycle Options (excluding the 260 French grants discussed below) granted to Other Employees in those years was changed to be the first date upon which the list was determined with finality. Of these grants, 3,891 had a lower closing stock price on the new measurement dates than on the related grant dates, which did not result in any additional compensation expense. The remaining 3,671 grants did, however, except as set forth below, result in additional compensation expense amortized over the vesting period.

The new measurement date for the 2001 Annual Cycle Options granted to Other Employees resulted in a repricing requiring variable accounting. On October 29, 2001, the Company commenced an exchange offer (the 2001 Exchange Offer) pursuant to which employees could elect to cancel unexercised options with an exercise price per share of $70 or more in exchange for new options. The 2001 Exchange Offer was specifically designed so that no employee eligible to participate was granted any options during the period beginning six months before the commencement of the 2001 Exchange Offer and ending six months after the option cancellation date. Although the grant date of the Annual Cycle Options granted to Other Employees in 2001 precedes the 2001 Exchange Offer commencement date by more than six months, the new measurement date of these Annual Cycle Options does not. Consequently, certain of these options were treated as a repricing of options held by the same optionee which were cancelled in the 2001 Exchange Offer. The remaining 2001 Annual Cycle Options which were not treated as a repricing also resulted in additional compensation expense, since the new measurement date had a higher closing stock price than the grant date. The incremental cumulative non-cash compensation expense before taxes through June 30, 2006, related to changing the measurement date of the 2001 Annual Cycle Options granted to Other Employees, and accounting for such options as a repricing was approximately $21 million, including approximately $19 million attributable to variable accounting.

By 2006, the Company had revised the annual grant process, and the measurement date of the Annual Cycle Options granted to Other Employees on May 22, 2006, is the same as the grant date.

The foregoing description excludes all Annual Cycle Options granted to Other Employees subject to French taxes (French Options). The Company has a French sub-plan pursuant to which it grants French Options addressing French tax consequences. One of the requirements for these options is that they not be granted during a "closed period," as defined under French tax law. Until recently, the Company understood that the closed period included, among other periods, the 10-trading day period before and after the Company made a material announcement. Since the Company did not determine the grant date of French Options until it had confirmed that no material announcement was made during the following 10 trading days, the measurement date for all of the 260 French Option grants made during the Relevant Period has been changed. The Company currently believes that the closed period does not include the 10-day period after a material announcement (other than an earnings release or the filing of a Form 10-K or Form 10-Q).

The incremental cumulative non-cash compensation expense before taxes from March 1, 1996, through June 30, 2006, related to Annual Cycle Option grants to Other Employees, including the $21 million relating to the 2001 Annual Cycle Options discussed above, constitutes approximately $47 million of the total $70 million incremental cumulative non-cash compensation expense before taxes.

Discounted Options and Restricted Stock

The Company has identified 105 Discounted Options granted on four dates between May 3, 2000, and May 12, 2004, in which the identity of the optionee or the number of shares underlying the option was not determined with finality until after the grant date. The incremental cumulative non-cash compensation expense before taxes from May 3, 2000, through December 29, 2006, related to changing the measurement dates for these Discounted Options grants was approximately $1 million.

In 2005 and 2006, the Company granted restricted stock and restricted stock units, respectively, in lieu of a cash bonus. Sixteen of the restricted stock awards in 2005 were not determined with finality until after the grant date, and the Company recorded an incremental cumulative non-cash compensation expense before taxes from March 1, 1996, through December 29, 2006, related to accounting for the change in the measurement dates for these restricted stock awards of less than $50,000. This amount has been included in the aggregate incremental compensation expense amounts related to stock options.

The Company has also determined it had incorrectly reversed accruals for certain management bonuses which had been exchanged for discounted options and awards. The previously stated allocation of the $68 million incremental cumulative non-cash compensation expense before taxes from March 1, 1996, through December 29, 2006, related to stock options includes the resulting increase or decrease in compensation expense for each period affected. The cumulative impact of the bonus accrual adjustments through June 30, 2006, was approximately $4 million.

By 2006, the Company had revised the process for granting and accounting for equity in lieu of a cash bonus, and the measurement date of the restricted stock units awarded on May 22, 2006, in lieu of a cash bonus is the same as the grant date.

Other Options

During the Relevant Period, the Company issued 4,168 Other Option grants to new hires and for promotions, special recognition and other reasons. Of these, the Company identified 931 which were granted to new hires who joined the Company through an acquisition, or through an outsourcing by their former employer, in which the measurement date should be a date other than the grant date. Although the acquisition or outsourcing agreement generally set forth the aggregate number of option shares to be granted to the new employees, the specific allocation among employees was often not finalized until after the grant date.

The Company has also identified 320 additional Other Option grants in which the measurement date should be a date other than the grant date, and two Other Option grants which should have been accounted for as repricings requiring variable accounting. These Other Option grants were primarily made to new hires or for promotions or special recognition.

By 2006, the Company had revised the processes for granting Other Options, and the measurement date of all Other Options granted after April 3, 2006, other than those granted to French employees, is the same as the grant date. The incremental cumulative non-cash compensation expense before taxes from March 1, 1996, through June 30, 2006, related to Other Option grants was approximately $8 million.

Changes in Option Grant Procedure

Other than options granted to French employees, the Company has not identified any stock option grants made after April 3, 2006, that were accounted for incorrectly. In order to provide greater predictability and transparency in the Company's equity granting process, however, the Board of Directors adopted an Equity Grant Policy on February 23, 2007. The Policy Statement provides that:

· | all terms of each equity grant must be approved on or prior to the grant date; |

· | all stock options must have an exercise price equal to or greater than the closing market price on the grant date; |

· | there will be a fixed, monthly grant date for all equity grants other than those issued to new hires who become CSC employees through a merger, acquisition or outsourcing; |

· | all recipients of equity grants must be notified of such grants as soon as possible after approval, and the Company must use reasonable efforts to notify such recipients on or prior to the grant date; |

· | there is an approval matrix for all equity grants; |

· | the Compensation Committee must approve an annual equity grant budget that cannot be exceeded without its prior approval; and |

· | the Company's management must make a report to the Compensation Committee, within two weeks after the end of each quarter, of all equity grants issued during the quarter. |

The Company has restated previously filed financial statements in this Form 10-K. Adjustments to net income amounted to $15.2 million and $7.3 million, respectively, for the fiscal years ended March 31, 2006 and April 1, 2005.

The incremental impact from recognizing stock-based compensation expense resulting from the investigation of past stock option grants is as follows (dollars in millions):

Fiscal Year | | Pre-Tax Expense | | | After Tax Expense | |

| 1997 | | $ | .4 | | | $ | .3 | |

| 1998 | | | 1.8 | | | | 1.4 | |

| 1999 | | | 3.2 | | | | 1.6 | |

| 2000 | | | 8.7 | | | | 11.6 | |

| 2001 | | | 2.8 | | | | 6.0 | |

| 2002 | | | 16.8 | | | | 11.8 | |

| 2003 | | | (6.5 | ) | | | (4.0 | ) |

| 2004 | | | 14.1 | | | | 8.9 | |

| Total 1997 – 2004 impact | | | 41.3 | | | | 37.6 | |

| 2005 | | | 8.5 | | | | 7.3 | |

| 2006 | | | 20.6 | | | | 15.2 | |

| Total | | $ | 70.4 | | | $ | 60.1 | |

Additionally, the Company has restated the pro forma expense under Statement of Financial Accounting Standards (“SFAS”) No. 123 in Note 1 of the Notes to Consolidated Financial Statements of this Form 10-K to reflect the impact of these adjustments for the years ended March 31, 2006 and April 1, 2005.

TABLE OF CONTENTS

Item | | Page |

| | | |

| | Part I | |

| | | |

| 1. | Business | 1 |

| 1A. | Risk Factors | 5 |

| 1B. | Unresolved Staff Comments | 10 |

| 2. | Properties | 10 |

| 3. | Legal Proceedings | 11 |

| 4. | Submission of Matters to a Vote of Security Holders | 13 |

| | | |

| | Part II | |

| | | |

| 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 14 |

| 6. | Selected Financial Data | 16 |

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 |

| 7A. | Quantitative and Qualitative Disclosures About Market Risk | 47 |

| 8. | Consolidated Financial Statements and Supplementary Data | 48 |

| 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 125 |

| 9A. | Controls and Procedures | 125 |

| 9B. | Other Information | 125 |

| | | |

| | Part III | |

| | | |

| 10. | Directors and Executive Officers of the Registrant | 126 |

| 11. | Executive Compensation | 126 |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 126 |

| 13. | Certain Relationships and Related Transactions | 126 |

| 14. | Principal Accountant Fees and Services | 126 |

| | | |

| | Part IV | |

| | | |

| 15. | Exhibits | 127 |

i

PART I

Item 1. Business

INTRODUCTION AND HISTORY

General

Computer Sciences Corporation (CSC or the Company) is one of the world leaders in the information technology (I/T) and professional services industry. Since it was founded in 1959, the Company has helped clients use I/T more efficiently in order to improve their operations and profitability, achieve business results and focus on core competencies.

CSC offers a broad array of services to clients in the Global Commercial and government markets and specializes in the application of complex I/T to achieve its customers’ strategic objectives. Its service offerings include information technology and business process outsourcing, and I/T and professional services.

Outsourcing involves operating all or a portion of a customer’s technology infrastructure, including systems analysis, applications development, network operations, desktop computing and data center management. CSC also provides business process outsourcing, managing key functions for clients, such as procurement and supply chain, call centers and customer relationship management, credit services, claims processing and logistics.

I/T and professional services include systems integration, consulting and other professional services. Systems integration encompasses designing, developing, implementing and integrating complete information systems. Consulting and professional services includes advising clients on the strategic acquisition and utilization of I/T and on business strategy, security, modeling, simulation, engineering, operations, change management and business process reengineering.

The Company also licenses sophisticated software systems for the financial services markets and provides a broad array of end-to-end e-business solutions that meet the needs of large commercial and government clients. The Company focuses on delivering results by combining business innovation skills with seasoned delivery expertise to provide flexible and scalable solutions. To do so, CSC draws on its vast experience in designing, building and maintaining large, complex, mission-critical systems and applies this knowledge to today’s business challenges.

CSC does not have exclusive agreements with hardware or software providers and believes this vendor neutrality enables it to better identify and manage solutions specifically tailored to each client’s needs.

Major Markets

CSC provides its services to clients in Global Commercial industries and to the U.S. federal and foreign government. Segment and geographic information is included in Note 16 to the notes to consolidated financial statements for the year ended March 30, 2007.

In the Global Commercial market sector, CSC’s service offerings are delivered to clients in a wide array of industries including aerospace/defense, automotive, chemical and resources, consumer goods, financial services, healthcare, manufacturing, retail/distribution, telecommunications, and technology. The Company’s Global Commercial market sector also includes U.S. local and foreign government clients.

The Company has provided I/T services to the U.S. federal government since 1961, is a leading federal contractor and is one of its top I/T service providers. CSC serves a broad federal customer base, including most civil departments and branches of the military, as well as the Department of Homeland Security. The Company provides a broad spectrum of services to the U.S. federal government, ranging from traditional systems integration and outsourcing to complex project management and technical services. Key offerings include enterprise modernization, telecommunications and networking, managed services, base and range operations, and training and simulation.

Geographically, CSC has major operations throughout North America, Europe and the Asia-Pacific region, including India.

During the last three fiscal years, the Company’s revenue mix by major markets was as follows:

| | | 2007 | | | 2006 | | | 2005 | |

| U.S. Commercial | | | 26 | % | | | 28 | % | | | 27 | % |

| Europe | | | 28 | | | | 28 | | | | 31 | |

| Other International | | | 10 | | | | 9 | | | | 9 | |

| Global Commercial | | | 64 | | | | 65 | | | | 67 | |

| U.S. Federal Government | | | 36 | | | | 35 | | | | 33 | |

| Total Revenues | | | 100 | % | | | 100 | % | | | 100 | % |

Fiscal 2007 Overview

During fiscal 2007, CSC announced awards valued at approximately $16.9 billion, including $9.2 billion of Global Commercial awards and $7.7 billion with the U.S. federal government. These multi-year awards represent the estimated value of the Company’s portion at contract signing. They cannot be considered firm orders, however, due to their variable attributes, including demand-driven usage, modifications in scope of work due to changing customer requirements, the annual funding constraints and indefinite delivery/indefinite quantity characteristics of major portions of the Company’s U.S. federal activities.

During April 2006, the Company implemented a restructuring program which is expected to positively impact future cash flow and earnings, enhancing shareholder value. The program is designed to streamline CSC’s global operations and increase the use of lower cost resources, and involves workforce reductions during fiscal 2007 and 2008 to address excess capacity in certain geographies. Restructuring charges consist predominantly of severance and related employee payments resulting from termination. As a result, during fiscal 2007, the company incurred pre-tax restructuring charges of $333.4 million.

During fiscal 2007, the Company completed the acquisition of Datatrac Information Services, Inc., a privately held U.S government services and solutions provider headquartered in Richardson, Texas for an initial purchase price of $123.8 million. The acquisition expands the Company’s I/T Solutions services within the North American Public Sector, and strengthens CSC’s ability to compete for work within the U.S. Department of Homeland Security and other government agencies. For further discussion, please see Note 4 to the notes to consolidated financial statements.

Global Commercial Market Highlights

Within the Global Commercial market, there were several significant awards to CSC during fiscal 2007. Many of the Company’s awards were extensions and/or expansions of existing relationships, a clear indication of customer satisfaction.

CSC’s largest commercial award during fiscal 2007 was the 9 year, $3.7 billion contract with the United Kingdom’s National Health Service. Under this agreement CSC assumes the role of primary contractor from Accenture Ltd. for two additional regions for the implementation of a record keeping system for the National Health Service.

CSC signed a $330 million, 7 year agreement with TDC, the largest telecommunications company in Denmark. Under the seven year contract, CSC will provide the full scope of I/T infrastructure services including desktop, helpdesk, data center and local area networking services.

CSC entered into a $378 million, 8 year agreement with Blue Scope Steel, Ltd, a leading international flat steel solutions company. CSC will be responsible for managing and delivering a diverse set of I/T services ranging from consulting, applications development and support, disaster recovery, systems integration and end-user services on a variety of technology platforms.

CSC signed a $275 million, 7 year contract with UK visas, a joint UK Home Office and Foreign and Commonwealth Office directorate which operates as the overseas arm of the United Kingdom’s integrated border management. CSC will establish Visa Application Centers in three regions covering 15 countries in the Europe, Americas and North African regions.

CSC entered into a $180 million, 7 year I/T services agreement with Newmont Mining Corporation, one of the world’s largest gold mining companies. Under the agreement, CSC will manage operations for all of Newmont’s global shared services operations and regional gold mining facilities, including locations in Denver, Nevada, Ghana, Peru and Australia. CSC will also be responsible for Newmont’s enterprise-wide infrastructure, which includes help desk, desktop, network, and telecommunications, and security services, as well as server support and applications maintenance.

North American Public Sector Highlights

The North American Public Sector (formerly the U.S. Federal Sector) had several significant awards during fiscal 2007 from the U.S. federal government.

The Company’s largest U.S. federal government award during the fiscal year was the $2.0 billion, 3 to 6 year contract with the U.S. Army. The company is one of 11 firms that have been awarded an Information Technology Enterprise Solutions-2 Services contract by the U.S. Army Contracting Agency on behalf of the Army’s Program Executive Office for Enterprise Information Systems. Under the agreement, CSC will provide a comprehensive range of I/T services to support the Army’s enterprise infrastructure worldwide.

CSC signed an $800 million, 4 year contract with the U.S Agency for International Development. CSC is one of 5 firms that have been awarded a Principal Resource for Information Management Enterprise-wide blanket purchase agreement by U.S. Agency for International Development. CSC will provide a comprehensive range of I/T support services in support of USAID’s mission to provide economic development and humanitarian assistance around the world.

CSC entered into a $378 million, 6.5 year agreement with the U.S. Air Force. Under the agreement CSC will provide technical and business transformation services for the U.S. Air Force Expeditionary Combat Support System. The Company will also be the prime systems integrator and provide logistics business process redesign and commercial off-the-shelf enterprise resource planning services.

CSC also signed a $151 million, 5 year contract with the Department of Defense’s Missile Defense Agency. The Company will provide scientific, engineering and technical assistance for the U.S. Ballistic Missile Defense System.

COMPETITION

The I/T and professional services markets in which CSC competes are not dominated by a single company or a small number of companies. A substantial number of companies offer services that overlap and are competitive with those offered by the Company. Some of these are large industrial firms, including computer manufacturers and major aerospace firms that may have greater financial resources than CSC and, in some cases, may have greater capacity to perform services similar to those provided by the Company. The increased importance of offshore labor centers has brought a number of foreign-based firms into competition with CSC.

CSC’s ability to obtain business is dependent upon its ability to offer better strategic concepts and technical solutions, better value, a quicker response, more flexibility or a combination of these factors. In the opinion of the Company’s management, CSC is positioned to compete effectively in the Global Commercial and U.S. federal government markets based on its technology and systems expertise and large project management skills. It is also management’s opinion that CSC’s competitive position is enhanced by the full spectrum of I/T and professional services it provides, from consulting to software and systems design, implementation and integration, to information technology and business process outsourcing to technical services, delivered to a broad commercial and government customer base.

EMPLOYEES

The Company has offices worldwide, and as of March 30, 2007 employed approximately 79,000 persons. The services provided by CSC require proficiency in many fields, such as computer sciences, programming, mathematics, physics, engineering, astronomy, geology, operations, research, economics, statistics and business administration.

U.S. SECURITIES AND EXCHANGE COMMISSION REPORTS

All of the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and all amendments to those reports, filed with or furnished to the U.S. Securities and Exchange Commission (SEC) on or after January 19, 1995 are available free of charge through the Company’s Internet website, www.csc.com, as soon as reasonably practical after the Company has electronically filed such material with, or furnished it to, the SEC.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

All statements and assumptions contained in this Annual Report and in the documents attached or incorporated by reference that do not directly and exclusively relate to historical facts constitute “forward-looking statements” within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements represent current expectations and beliefs of CSC, and no assurance can be given that the results described in such statements will be achieved.

Forward-looking information contained in these statements include, among other things, statements with respect to CSC’s financial condition, results of operations, cash flows, business strategies, operating efficiencies or synergies, competitive positions, growth opportunities, plans and objectives of management, and other matters. Such statements are subject to numerous assumptions, risks, uncertainties and other factors, many of which are outside of CSC’s control, which could cause actual results to differ materially from the results described in such statements. These factors include without limitation those listed below under Item 1A. Risk Factors.

Forward-looking statements in this Annual Report speak only as of the date of this Annual Report, and forward-looking statements in documents attached or incorporated by reference speak only as to the date of those documents. CSC does not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events, except as required by law.

Item 1A. Risk Factors

Past performance may not be a reliable indicator of future financial performance. Future performance and historical trends may be adversely affected by the following factors, as well as other variables, and should not be relied upon to project future period results.

| 1. | Our business may be adversely impacted as a result of changes in demand, both globally and in individual market segments, for information technology outsourcing, business process outsourcing and consulting and systems integration services. |

Economic and political uncertainty adversely impact our customers’ demand for our services. A general economic downturn may adversely impact our customers’ demand for consulting and systems integration services. Our federal government segment generated approximately 36.1% of our revenue for fiscal 2007. While the pipeline for government projects continues to be robust, the budget deficit, the cost of rebuilding infrastructure as a result of natural disasters and the cost of reconstruction in Iraq may reduce the federal government’s demand for information technology projects, adversely impacting our federal government segment and our business.

| 2. | Our ability to continue to develop and expand our service offerings to address emerging business demands and technological trends will impact our future growth. If we are not successful in meeting these business challenges our results of operations and cash flows will be materially and adversely affected. |

Our ability to implement solutions for our customers incorporating new developments and improvements in technology which translate into productivity improvements for our customers and to develop service offerings that meet the current and prospective customers’ needs are critical to our success. The markets we serve are highly competitive. Our competitors may develop solutions or services which make our offerings obsolete. Our ability to develop and implement up to date solutions utilizing new technologies which meet evolving customer needs in consulting and systems integration and technology outsourcing markets will impact our future revenue growth and earnings.

| 3. | Our primary markets, technology outsourcing and consulting and systems integration, are highly competitive markets. If we are unable to compete in these highly competitive markets our results of operations will be materially and adversely affected. |

Our competitors include large, technically competent and well capitalized companies. As a result, the markets which we serve are highly competitive. This competition may place downward pressure on operating margins in our industry, particularly for technology outsourcing contract extensions or renewals. As a result we may not be able to maintain our current operating margins for technology outsourcing contracts, extended or renewed in the future.

Any reductions in margins will require that we effectively manage our cost structure. If we fail to effectively manage our cost structure during periods with declining margins our results of operations will be adversely affected.

| 4. | Our ability to consummate and integrate acquisitions may materially and adversely affect our profitability if we fail to achieve anticipated revenue improvements and cost reductions. |

Our ability to successfully integrate the operations we acquire and leverage these operations to generate revenue and earnings growth will significantly impact future revenue and earnings. Integrating acquired operations is a significant challenge and there is no assurance that the company will be able to manage the integrations successfully. Failure to successfully integrate acquired operations may adversely affect our cost structure thereby reducing our margins and return on investment.

| 5. | Our customers may experience financial difficulties and we may not be able to collect our receivables, materially and adversely affecting our profitability. |

Over the course of a long-term contract our customers’ financial fortunes may change affecting their ability to pay their obligations and our ability to collect our fees for services rendered. Additionally, we may perform work for the federal government, for which we must file requests for equitable adjustment or claims with the proper agency to seek recovery in whole or in part for out-of-scope work directed or caused by the customers in support of their critical missions. While we may resort to other methods to pursue our claims or collect our receivables these methods are expensive and time consuming and success is not guaranteed. Failure to collect our receivables or prevail on our claims would have an adverse affect on our profitability.

| 6. | If we are unable to accurately estimate the cost of services and the timeline for completion of contracts the profitability of our contracts may be materially and adversely affected. |

Our commercial and federal government contracts are typically awarded on a competitive basis. Our bids are based upon, among other items, the cost to provide the services. To generate an acceptable return on our investment in these contracts we must be able to accurately estimate our costs to provide the services required by the contract and to be able to complete the contracts in a timely manner. If we fail to accurately estimate our costs or the time required to complete a contract the profitability of our contracts may be materially and adversely affected.

| 7. | We are defendants in pending litigation which may have a material and adverse impact on our profitability. |

As noted in Item 3, Legal Proceedings, of this Form 10-K we are currently party to a number of disputes which involve or may involve litigation. We are not able to predict the ultimate outcome of these disputes or the actual impact of these matters on our profitability. If we agree to settle these matters or judgments secured against us we will incur charges which may have a material and adverse impact on our liquidity and earnings.

We are engaged in providing services under contracts with the U.S. Government. These contracts are subject to extensive legal and regulatory requirements and, from time to time, agencies of the U.S. Government investigate whether our operations are being conducted in accordance with these requirements. U.S. Government investigations of us, whether related to the Company’s federal government contracts or conducted for other reasons, could result in administrative, civil or criminal liabilities, including repayments, fines or penalties being imposed upon us, or could lead to suspension or debarment from future U.S. Government contracting.

| 8. | Our ability to provide our customers with competitive services is dependent on our ability to attract and retain qualified personnel. |

Our ability to grow and provide our customers with competitive services is partially dependent on our ability to attract and retain highly motivated people with the skills to serve our customers. As we noted above, the markets we serve are highly competitive and competition for skilled employees in the technology outsourcing and consulting and systems integration markets is intense for both on-shore and off-shore locales.

| 9. | Our international operations are exposed to risks, including fluctuations in exchange rates, which may be beyond our control. |

For fiscal 2007 we earned approximately 38% of revenues in currencies other than the U.S. dollar. As a result we are exposed to various risks associated with operating in multiple countries including exposure to fluctuations in currency exchange rates. While this risk is partially mitigated by largely matching costs with revenues in a given currency, our exposure to fluctuations in other currencies against the U.S. dollar increases as revenue in currencies other than the U.S. dollar increase and as more of the services we provide shifted to lower cost regions of the world. We project that the percentage of our revenue denominated in currencies other than the U.S. dollar will continue to represent a significant portion of our revenue. Also, we project that some of our ability to match revenue and expenses in a given currency will decrease as more work is performed at offshore locations.

We operate in 55 countries and our operations in these countries are subject to the local legal and political environments. Our operations are subject to among other things, employment, taxation, statutory reporting, trade restrictions and other regulations. In spite of our best efforts we may not be in compliance with all regulations around the world and may be subject to penalties and or fines as a result. These penalties or fines may materially and adversely impact our profitability.

10. | Our ability to compete in certain markets we serve is dependent on our ability to continue to expand our capacity in certain offshore locations. However, as our presence in these locations increases we are exposed to risks inherent to these locations which may adversely impact our revenue and profitability. |

A significant portion of our application outsourcing and software development activities have been shifted to India and we plan to continue to expand our presence there. As such, we are exposed to the risks inherent to operating in India including 1) a highly competitive labor market for skilled workers which may result in significant increases in labor costs as well as shortages of qualified workers in the future, 2) the tax holiday granted by certain tax jurisdictions in India to the Company, which currently extend through 2010, may not be extended or may be revoked resulting in an increase in income tax expense, 3) the possibility that the U.S. federal government or the European Union may enact legislation which may provide significant disincentives to customers to offshore certain of their operations which would reduce the demand for the services we provide in India and may adversely impact our cost structure and profitability.

11. | In the course of providing services to customers we may inadvertently infringe on the intellectual property rights of others and be exposed to claims for damages. |

The solutions we provide to our customers may inadvertently infringe on the intellectual property rights of third parties resulting in claims for damages against us or our customers. Our contracts generally indemnify our clients from claims for intellectual property infringement for the services and equipment we provide under our contracts. The expense and time of defending against these claims may have a material and adverse impact on our profitability. Additionally, the publicity we may receive as a result of infringing intellectual property rights may damage our reputation and adversely impact our ability to develop new business.

12. | Generally our contracts contain provisions under which a customer may terminate the contract prior to completion. Early contract terminations may materially and adversely affect our revenues and profitability. |

Our contracts contain provisions by which customers may terminate the contract prior to completion of the term of the contract. These contracts generally allow the customer to terminate the contract for convenience upon providing written notice. In these cases we seek, either by defined contract schedules or through negotiations, recovery of our investments in the contracts. There is no assurance we will be able to fully recover our investments.

We may not be able to replace the revenue and earnings from these contracts in the short-term. In the long-term our reputation may be harmed by the publicity generated from contract terminations.

13. | We may be exposed to negative publicity and other potential risks if we are unable to maintain effective internal controls. |

We are required under the Sarbanes-Oxley Act of 2002 to provide a report from management to our shareholders on our internal controls over financial reporting including an assessment of the effectiveness of these controls to provide reasonable assurance a material misstatement did not occur in our financial statements. The failure of our controls to provide reasonable assurance that a material misstatement does not exist or to detect a material misstatement may cause us to be unable to meet our filing requirements and the resulting negative publicity may adversely affect our business, and our stock price may be materially and adversely affected.

14. | We have identified a material weakness related to accounting for income taxes and concluded that our internal control over financial reporting was not effective as of March 30, 2007. Inability to maintain effective internal control over financial reporting could adversely affect our financial results, the market price of our common stock or our operations. |

The Company has identified a material weakness related to accounting for income taxes and, as a result, has concluded that our internal control over financial reporting as of March 30, 2007 was not effective. Remediation of this material weakness may be costly and time consuming. Inability to maintain effective internal control over financial reporting could adversely affect our financial results, the market price of our common stock or our operations.

15. | Our largest customer, the U.S. federal government, accounts for a significant portion of our revenue and earnings. Inherent in the government contracting process are various risks which may materially and adversely affect our business and profitability. |

A significant portion of our revenue, approximately 36.1%, is derived from contracts with the U.S. federal government. As a result our exposure to the risks inherent in the government contracting process is material. These risks include government audits of billable contract costs and reimbursable expenses, project funding and requests for equitable adjustment, compliance with government reporting requirements as well as the consequences if improper or illegal activities are discovered.

If any of these should occur our reputation may be adversely impacted and our relationship with the government agencies we work with damaged resulting in a material and adverse affect on our profitability.

16. | Our ability to raise additional capital for future needs will impact our ability to compete in the markets we serve. |

We may require additional capital to purchase assets, complete strategic acquisitions, repurchase shares on the open market or for general liquidity needs. Declines in our credit rating or limits on our ability to sell additional shares may adversely affect our ability to raise additional capital or materially increase our cost of capital. Our inability to raise additional capital at a reasonable cost may adversely impact our revenue growth and the price of our stock.

17. | As a result of the delayed filing of our Form 10-Q for the quarter ending December 29, 2006, we are currently ineligible to use Form S-3 to register securities with the SEC in capital-raising transactions, which may adversely affect our cost of future capital. |

As a result of the delayed filing of our Form 10-Q for the quarter ended December 29, 2006, we are ineligible to use Form S-3 to register securities for sale by us or for resale by other security holders, in capital raising transactions, until we have timely filed all periodic reports under the Securities Exchange Act of 1934 for at least 12 calendar months following March 5, 2007, the date our Form 10-Q for the quarter ended December 29, 2006 was filed. In the meantime, for capital raising transactions we would need to use Form S-1 to register securities with the SEC, or issue such securities in a private placement, which could increase the costs of raising capital during this period.

18. | Our future profitability may be materially and adversely affected if we fail to execute according to plan the restructuring announced by the Company on April 4, 2006. |

The Company announced a restructuring plan in April 2006, to be carried out during fiscal 2007 and 2008. The restructuring will result in an estimated pre-tax charge of $440 million and have resulted in cost savings of $180 million and an estimated $340 million during fiscal 2007 and 2008, respectively. The majority of the restructuring activities involve employees in central and southern Europe with certain aspects of the restructuring subject to negotiation with employee works councils. Additionally, certain restructured activities will be centralized or transitioned to other locales requiring the transfer of knowledge. If we fail to execute our restructuring plan and achieve the cost savings we have estimated our margins and profitability will be materially and adversely affected.

19. | Our performance on contracts on which we have partnered with third parties may be adversely affected if the third parties fail to deliver on their commitments. |

Our contracts are increasingly complex and require that we partner with parties including software and hardware vendors to provide the complex solutions required by our customers. Our ability to deliver the solution and provide the services required by our customers is dependent on the ability of our partners to meet their delivery schedules. If our partners fail to deliver their services or products on time our ability to complete the contract may be adversely affected which may have a material and adverse impact on our revenue and profitability.

If we are the primary contractor and our partners fail to perform as agreed we may be liable to our customers for penalties or lost profits. These penalties or payments for lost profits may have a material and adverse affect on our profitability.

Item 1B. Unresolved Staff Comments |

| None |

| |

Item 2. Properties

Owned properties as of March 30, 2007 | | Approximate Square Footage | | General Usage |

| Blythewood, South Carolina | | 456,000 | | Computer and General Office |

| Falls Church, Virginia | | 401,000 | | General Office |

| Copenhagen, Denmark | | 368,000 | | Computer and General Office |

| Aldershot, United Kingdom | | 268,000 | | General Office |

| El Segundo, California | | 206,000 | | General Office |

| Austin, Texas | | 203,000 | | General Office |

| Newark, Delaware | | 176,000 | | Computer and General Office |

| Taastrup, Denmark | | 147,000 | | Computer and General Office |

| Norwich, Connecticut | | 144,000 | | Computer and General Office |

| Daleville, Alabama | | 137,000 | | General Office |

| Petaling Jaya, Malaysia | | 136,000 | | Computer and General Office |

| Berkeley Heights, New Jersey | | 119,000 | | Computer and General Office |

| Meriden, Connecticut | | 118,000 | | Computer and General Office |

| Aaurus, Denmark | | 101,000 | | General Office |

| Moorestown, New Jersey | | 99,000 | | General Office |

| Chesterfield, United Kingdom | | 80,000 | | Computer and General Office |

| Maidstone, United Kingdom | | 79,000 | | Computer and General Office |

| Hong Kong, China | | 74,000 | | General Office |

| Jacksonville, Illinois | | 60,000 | | General Office |

| Singapore | | 46,000 | | General Office |

| Turnbridge, United Kingdom | | 43,000 | | General Office |

| Sterling, Virginia | | 41,000 | | General Office |

| Various other U.S. and foreign locations | | 83,000 | | General Office |

| | | | | |

Leased properties as of March 30, 2007 | | | | |

| Washington, D.C. area | | 2,679,000 | | Computer and General Office |

| Texas | | 819,000 | | Computer and General Office |

| India | | 726,000 | | Computer and General Office |

| Australia & other Pacific Rim locations | | 672,000 | | General Office |

| Germany | | 632,000 | | General Office |

| England | | 588,000 | | Computer and General Office |

| Ohio | | 584,000 | | General Office |

| New Jersey | | 401,000 | | General Office |

| Tennessee | | 381,000 | | General Office |

| Denmark | | 374,000 | | General Office |

| California | | 350,000 | | General Office |

| Florida | | 311,000 | | General Office |

| New York | | 295,000 | | General Office |

| Connecticut | | 287,000 | | General Office |

| Georgia | | 285,000 | | General Office |

| Delaware | | 262,000 | | General Office |

| France | | 232,000 | | General Office |

| Illinois | | 226,000 | | General Office |

| Sweden | | 214,000 | | General Office |

| Alabama | | 211,000 | | General Office |

| Massachusetts | | 203,000 | | General Office |

| Various other U.S. and foreign locations | | 2,528,000 | | Computer and General Office |

| | | | | |

Upon expiration of its leases, the Company does not anticipate any difficulty in obtaining renewals or alternative space. Lease expiration dates range from fiscal 2008 through 2018.

Item 3. Legal Proceedings

CSC is engaged in providing services under contracts with the U.S. Government. The contracts are subject to extensive legal and regulatory requirements and, from time to time, agencies of the U.S. Government investigate whether the Company’s operations are being conducted in accordance with these requirements. U.S. Government investigations of the Company, whether related to the Company’s federal government contracts or conducted for other reasons, could result in administrative, civil or criminal liabilities, including repayments, fines or penalties being imposed upon the Company, or could lead to suspension or debarment from future U.S. Government contracting. The Company believes it has adequately reserved for any losses which may be experienced from these investigations.

In the course of business, discrepancies or claims may arise as to the use or reliability of various software products provided by the Company for its customers. During 2005, the Company was named, along with other vendors to the insurance industry and dozens of insurance companies in Hensley, et al. vs. Computer Sciences Corporation, et al., filed as a putative nationwide class action in state court in Miller County, Arkansas shortly before President Bush signed the Class Action Fairness Act into law. The plaintiffs allege the defendants conspired to wrongfully use software products licensed by the Company and the other software vendors to reduce the amount paid to the licensees’ insureds for bodily injury claims. Plaintiffs also allege wrongful concealment of the manner in which these software programs evaluate claims and wrongful concealment of information about alleged inherent errors and flaws in the software. Plaintiffs seek injunctive and monetary relief of less than $75,000 for each class member, as well as attorney’s fees and costs. The Company is vigorously defending itself against the allegations.

Litigation is inherently uncertain and it is not possible to predict the ultimate outcome of the matters discussed above. Considering the early stage of the Hensley case, the complicated issues presented by that matter, and the fact that no class has been certified, it is not possible at this time to make meaningful estimates of the amount or range of loss that could result from this matter. It is possible that the Company’s business, financial condition, results of operations, or cash flows could be affected by the resolution of this matter. Whether any losses, damages or remedies ultimately resulting from this proceeding could reasonably have a material effect on the Company’s business, financial condition, results of operations, or cash flows will depend on a number of variables, including, for example, the timing and amount of such losses or damages, if any, and the structure and type of any such remedies. Depending on the ultimate resolution of these matters, some may be material to the Company's operating results for a particular period if an unfavorable outcome results, although such a material unfavorable result is not presently expected, and all other litigation, in the aggregate, is not expected to result in a material adverse impact to the consolidated financial statements.

As reflected by Form 8-K filings made by Sears Holdings Corporation (SHC) on May 13, 2005 (following merger with K-Mart Holding Corporation), and by the Company on May 16, 2005, SHC's subsidiary, Sears, Roebuck and Co. (Sears), and the Company are in dispute over amounts due and owing and applicable termination fees following Sears' termination of its Master Services Agreement (Agreement) with the Company on May 11, 2005. The dispute which also involves billings for continued services and counterclaim allegations by Sears of contract breaches is expected to be resolved pursuant to negotiations or legal and arbitration proceedings. As of March 30, 2007, the Company’s investment in net assets associated with the Agreement was approximately $80 million. These net assets include accounts receivable, prepaid expenses, outsourcing contract costs, software, and property, plant and equipment. The Company will vigorously pursue recovery for its associated assets and commitments. While the Company expects full recovery of its investments associated with this Agreement, if unsuccessful, the Company may experience a charge, which could be material, associated with the impairment of these assets.

The Company has converted 16 submitted Requests for Equitable Adjustment (REAs) to interest bearing claims under the Contract Disputes Act (CDA) totaling in excess of $1 billion on two U.S. Federal contracts. Included in current assets on the Company’s balance sheet is approximately $820 million of unbilled accounts receivable and deferred costs related to the contracts. CSC has requested payment for certain related out-of-scope work directed or caused by the customers in support of their critical missions. The contractual modification process for scope changes has lagged behind the need for CSC to provide critical on-going operational support. The Company does not record any profit element when it defers costs associated with such REAs/claims. The Company believes it has a legal basis for pursuing recovery of these REAs/claims and that collection is probable with interest on the claims accruing but not being recognized. Settlement of the amounts depends on individual circumstances, negotiations with the parties and prosecution of the claims; we are unable to predict the timing of resolution of these claims.

Several shareholders of the Company have filed purported derivative actions against both the Company, as nominal defendant, as well as certain of CSC's executive officers and directors. These actions generally allege that certain of the individual defendants breached their fiduciary duty to the Company by purportedly “backdating” stock options granted to CSC executives, improperly recording and accounting for allegedly backdated stock options, producing and disseminating disclosures that improperly recorded and accounted for the allegedly backdated options, engaging in acts of corporate waste, and committing violations of insider trading laws. They allege that certain of the defendants were unjustly enriched and seek to require them to disgorge their profits. The Company and certain directors and other individuals have also been sued in a class action proceeding alleging violations of the ERISA statute related to claims of alleged backdating of stock options.

In addition to the matters noted above, the Company is currently party to a number of disputes which involve or may involve litigation. The Company consults with legal counsel on those issues related to litigation and seeks input from other experts and advisors with respect to other matters in the ordinary course of business. Whether any losses, damages or remedies ultimately resulting from such other matters could reasonably have a material effect on the Company's business, financial condition, results of operation, or cash flows will depend on a number of variables, including, for example, the timing and amount of such losses or damages (if any) and the structure and type of any such remedies. For these reasons, it is not possible to make reliable estimates of the amount or range of loss that could result from these other matters at this time. Company management does not, however, presently expect any of such other matters to have a material impact on the consolidated financial statements of the Company.

Item 4. Submission of Matters to a Vote of Security Holders

None.

Executive Officers of the Registrant

Name | Age | | Year First Elected as An Officer | | Term as an Officer | | Position Held With the Registrant | | Family Relationship |

| Michael W. Laphen* | 56 | | 2001 | | Indefinite | | President and Chief Executive Officer | | None |

| Michael E. Keane | 51 | | 2006 | | Indefinite | | Vice President and Chief Financial Officer | | None |

| Hayward D. Fisk | 64 | | 1989 | | Indefinite | | Vice President, General Counsel and Secretary | | None |

| Harvey N. Bernstein | 60 | | 1988 | | Indefinite | | Vice President, Global Legal Compliance & Assistant Secretary | | None |

| Donald G. DeBuck | 49 | | 2001 | | Indefinite | | Vice President and Controller | | None |

| Thomas R. Irvin | 58 | | 2004 | | Indefinite | | Vice President and Treasurer | | None |

| Paul T. Tucker | 59 | | 1997 | | Indefinite | | Vice President, Corporate Development | | None |

* Director of the Company

Business Experience of Officers

Michael W. Laphen joined the Company in 1977 and was elected President and Chief Executive Officer effective May 22, 2007. He was named a director of the Company in February 2007. He previously served as President and Chief Operating Officer. He was Vice President from August 2001 to April 2003. He was President of the European Group from August 2000 to March 2003. Previous positions within the Company include President of the Federal Sector—Civil Group (1998-2000), and President of Systems Group—Integrated Systems Division (1992-1998).

Michael E. Keane joined the Company in 2005 as Vice President—Finance and was elected Vice President and Chief Financial Officer in 2006. Former positions include Senior Vice President and Chief Financial Officer of UNOVA, Inc. (1997-2005), and Senior Vice President and Chief Financial Officer of Western Atlas Inc (1996-1997).

Hayward D. Fisk joined the Company in 1989 as Vice President, General Counsel and Secretary. Prior to joining the Company, he was associated for 21 years with Sprint Corporation (formerly United Telecommunications, Inc.), in various legal and executive officer positions, most recently as Vice President and Associate General Counsel.

Harvey N. Bernstein joined the Company as Assistant General Counsel in 1983. He became Vice President, Global Legal Compliance and Assistant Secretary in 2003 after being elected a Vice President in 1988 and thereafter serving as Deputy General Counsel and Assistant Secretary. Prior to joining the Company, he specialized in government procurement law at the firm of Fried, Frank, Harris, Shriver & Jacobson in Washington, D.C.

Donald G. DeBuck joined the Company in 1979 and was elected Vice President and Controller in August 2001. Previous positions within the Company include Assistant Controller (1998-2001) and Vice President of Finance and Administration, Communications Industry Services (1996-1998).

Thomas R. Irvin joined the Company as Assistant Treasurer in 1987 and was elected Vice President and Treasurer in November 2004. Prior to joining the Company, he held various financial and engineering positions with Ni-Cal Development Corporation, Raytheon and Dravo Corporation.

Paul T. Tucker joined the Company in 1996 as a Corporate Development executive, and in August 1997 was elected Vice President of Corporate Development. From 1990 to 1995 he was President and Chief Executive Officer of Knight-Ridder Financial, an electronic real-time financial market information company. Previously, he founded and served as President and Chief Technologist of HAL Communications Corp., a communications hardware and software company and was an Associate Professor and Senior Research Engineer at the University of Illinois.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

(a) Holders

Common stock of Computer Sciences Corporation is listed and traded on the New York Stock Exchange under the ticker symbol “CSC.”

As of May 25, 2007 the number of registered shareholders of Computer Sciences Corporation’s common stock was 8,441. The table shows the high and low intra-day prices of the Company’s common stock as reported on the composite tape of the New York Stock Exchange for each quarter during the last two calendar years and through May 25, 2007.

| | | 2007 | | | 2006 | | | 2005 | |

Calendar Quarter | | High | | | Low | | | High | | | Low | | | High | | | Low | |

1st | | | 56.25 | | | | 50.38 | | | | 59.09 | | | | 48.01 | | | | 56.51 | | | | 44.03 | |

2nd | | | 59.13 | * | | | 51.55 | * | | | 60.39 | | | | 48.26 | | | | 48.87 | | | | 42.31 | |

3rd | | | | | | | | | | | 53.80 | | | | 46.23 | | | | 47.60 | | | | 43.49 | |

4th | | | | | | | | | | | 54.13 | | | | 47.48 | | | | 59.90 | | | | 44.25 | |

* Through May 25, 2007

It has been the Company’s policy to invest earnings in the growth of the Company rather than distribute earnings as dividends. This policy, under which dividends have not been paid since fiscal 1969, is expected to continue, but is subject to review by the Board of Directors. Under the Company’s most restrictive covenant requirement, $4,250.6 million of retained earnings was available for cash dividends at March 30, 2007.

(b) Purchases of Equity Securities

The following table provides information on a monthly basis for the fourth quarter ended March 30, 2007 with respect to the Company’s purchases of equity securities.

Period | | Total Number of Shares Purchased (1) | | | Average Price Paid Per Share | | Total Number Of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Program | |

| December 29, 2006 to January 26, 2007 | | | | | | | | | | 2,991,766 | |

| January 27, 2007 to February 23, 2007 | | | 170 | | | | 54.69 | | | | | 2,991,766 | |

| February 24, 2007 to March 30, 2007 | | | | | | | | | | | | 2,991,766 | |

| (1) | The Company accepted 170 shares of its common stock in the fourth quarter ended March 30, 2007 from employees in lieu of cash due to the Company in connection with the exercise of stock options. Such shares of common stock are stated at cost and held as treasury shares to be used for general corporate purposes. |

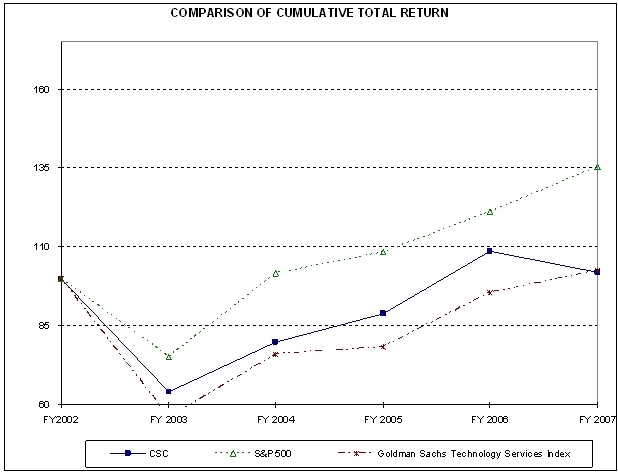

Performance Graph

The following graph compares the cumulative total return on CSC stock during the last five fiscal years with the cumulative total return on the Standard & Poor’s 500 Stock Index and the Goldman Sachs Technology Services Index.

CSC Total Shareholder Return

(Period Ended March 30, 2007)

Indexed Return (2002 = 100) | |

| | | | | | | | | | | | | | | | | | | |

| | | Return 2003 | | | Return 2004 | | | Return 2005 | | | Return 2006 | | | Return 2007 | | | CAGR | |

| CSC Common Stock | | | -35.86 | % | | | 24.44 | % | | | 11.42 | % | | | 22.30 | % | | | -6.16 | % | | | 0.41 | % |

| S&P 500 Index | | | -24.76 | % | | | 35.12 | % | | | 6.69 | % | | | 11.73 | % | | | 11.83 | % | | | 6.27 | % |

| Goldman Sachs Technology Services Index | | | -44.16 | % | | | 36.27 | % | | | 3.06 | % | | | 21.75 | % | | | 7.42 | % | | | 0.51 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Assumes $100 invested on April 1, 2002 in Computer Sciences Corporation Common Stock, the S&P 500 Index, and the Goldman Sachs Technology Services Index. Indexed amounts and return percentages assume a March 31 fiscal year end.

Item 6. Selected Financial Data

COMPUTER SCIENCES CORPORATION

| | | Five Year Review | |

In millions except per-share amounts | | March 30, 2007 | | | March 31, 2006 | | | April 1, 2005 | | | April 2, 2004 | | | March 28, 2003 | |

| | | | | | As Restated (1)(2) | | | As Restated (2) | | | As Restated (2) | | | As Restated (2) | |

| | | | | | | | | | | | | | | | |

| Total Assets | | $ | 13,730.5 | | | $ | 13,021.7 | | | $ | 12,603.2 | | | $ | 11,752.8 | | | $ | 10,356.7 | |

| Debt: | | | | | | | | | | | | | | | | | | | | |

Long-term | | | 1,412.2 | | | | 1,376.8 | | | | 1,303.0 | | | | 2,306.4 | | | | 2,204.7 | |

Short-term | | | 51.9 | | | | 56.6 | | | | 78.4 | | | | 52.9 | | | | 249.9 | |

Current maturities | | | 41.8 | | | | 28.7 | | | | 7.3 | | | | 7.2 | | | | 24.7 | |

Total | | | 1,505.9 | | | | 1,462.1 | | | | 1,388.7 | | | | 2,366.5 | | | | 2,479.3 | |

| Stockholders' equity | | | 5,885.5 | | | | 6,505.4 | | | | 6,314.2 | | | | 5,367.6 | | | | 4,469.7 | |