© CSC 2012 CSC INVESTOR DAY 2012 September 10, 2012

© CSC 2012 2 September 10, 2012 Forward-Looking Statements All written or oral statements made by CSC at this meeting or in these presentation materials that do not directly and exclusively relate to historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements represent CSC’s expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved. These statements are subject to risks, uncertainties, and other factors, many outside of CSC’s control, that could cause actual results to differ materially from the results described in such statements. For a description of these factors, please see CSC’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

© CSC 2012 3 September 10, 2012 Non-GAAP Reconciliations This presentation includes certain non-GAAP financial measures, such as operating income, operating margin, Earnings Before Interest and Taxes (EBIT), free cash flow, capital expenditures and capital intensity. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for results prepared in accordance with accounting principles generally accepted in the United States (GAAP). A reconciliation of non-GAAP financial measures included in this presentation to the most directly comparable financial measure calculated and presented in accordance with GAAP accompanies this presentation and is on our website at www.csc.com. CSC management believes that these non-GAAP financial measures provide useful information to investors regarding the Company’s financial condition and results of operations as they provide another measure of the Company’s profitability and ability to service its debt, and are considered important measures by financial analysts covering CSC and its peers.

© CSC 2012 4 September 10, 2012 12:30 – 1:10 Mike Lawrie, President and CEO 1:10 – 1:30 Paul Saleh, CFO 1:30 – 2:00 Q&A Agenda SC 2012

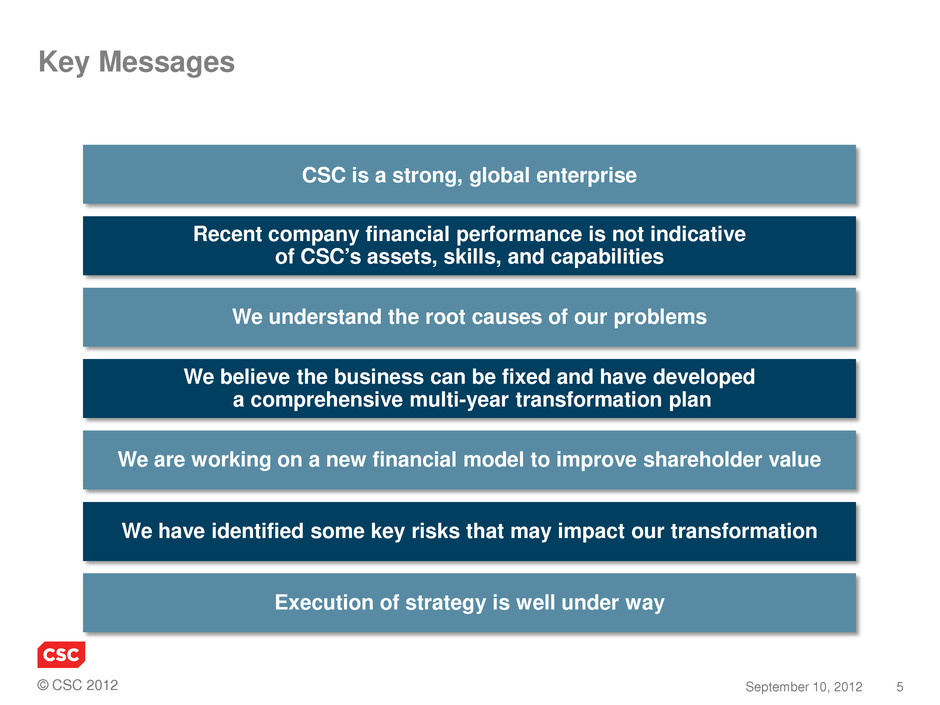

© CSC 2012 5 September 10, 2012 Key Messages CSC is a strong, global enterprise Recent company financial performance is not indicative of CSC’s assets, skills, and capabilities We understand the root causes of our problems We believe the business can be fixed and have developed a comprehensive multi-year transformation plan We are working on a new financial model to improve shareholder value We have identified some key risks that may impact our transformation Execution of strategy is well under way

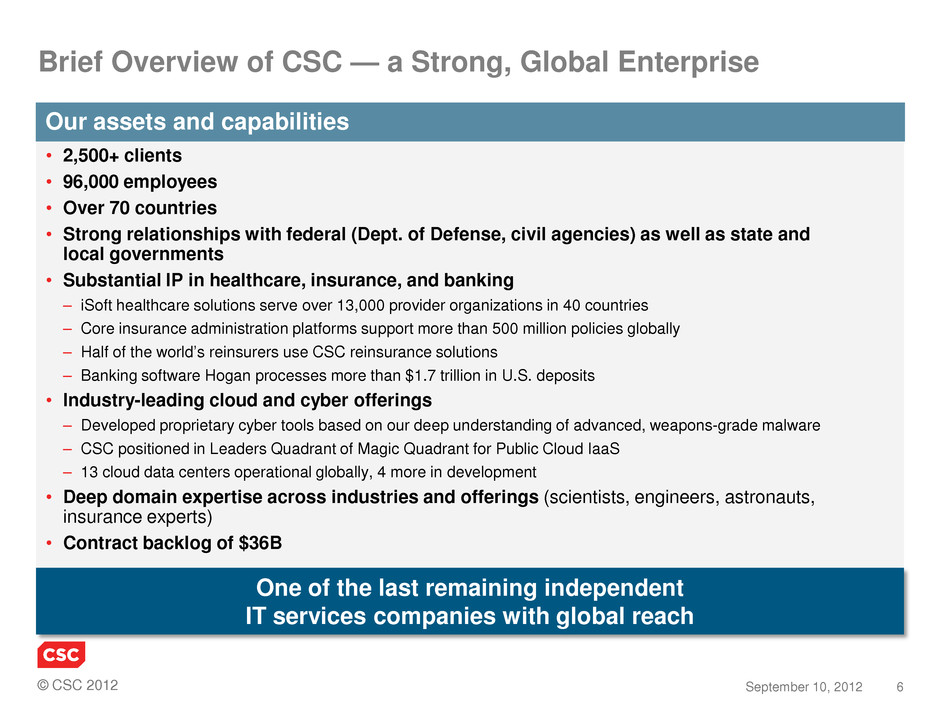

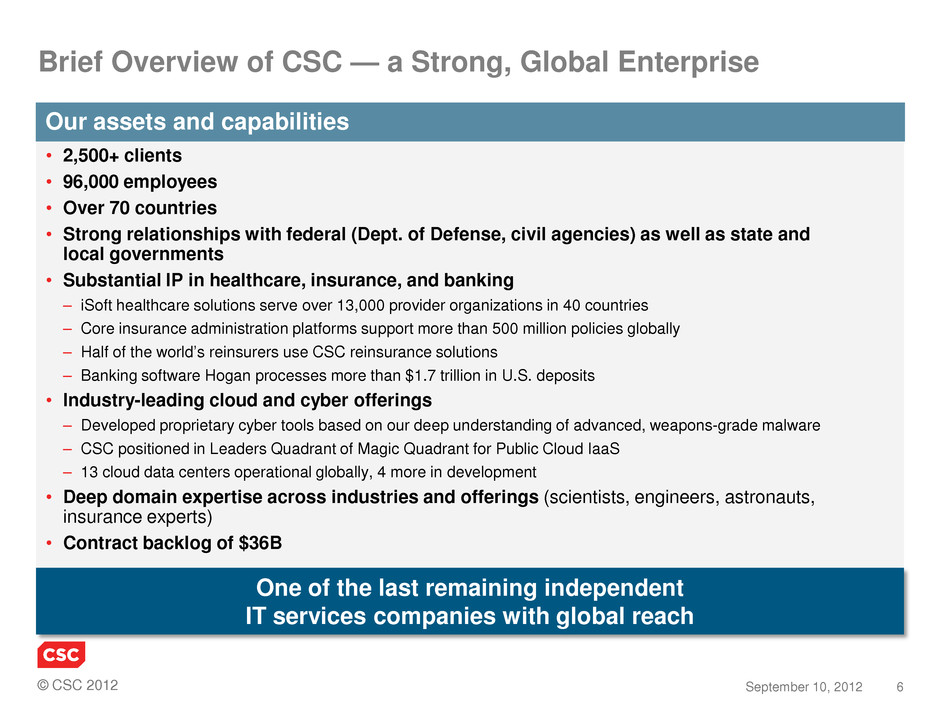

© CSC 2012 6 September 10, 2012 Brief Overview of CSC — a Strong, Global Enterprise • 2,500+ clients • 96,000 employees • Over 70 countries • Strong relationships with federal (Dept. of Defense, civil agencies) as well as state and local governments • Substantial IP in healthcare, insurance, and banking – iSoft healthcare solutions serve over 13,000 provider organizations in 40 countries – Core insurance administration platforms support more than 500 million policies globally – Half of the world’s reinsurers use CSC reinsurance solutions – Banking software Hogan processes more than $1.7 trillion in U.S. deposits • Industry-leading cloud and cyber offerings – Developed proprietary cyber tools based on our deep understanding of advanced, weapons-grade malware – CSC positioned in Leaders Quadrant of Magic Quadrant for Public Cloud IaaS – 13 cloud data centers operational globally, 4 more in development • Deep domain expertise across industries and offerings (scientists, engineers, astronauts, insurance experts) • Contract backlog of $36B One of the last remaining independent IT services companies with global reach Our assets and capabilities

© CSC 2012 7 September 10, 2012 Financial Services Healthcare Manufacturing Diversified Public Sector Diverse and Global Client Base Ministry of Health, Malaysia Sirirai Hospital, Thailand

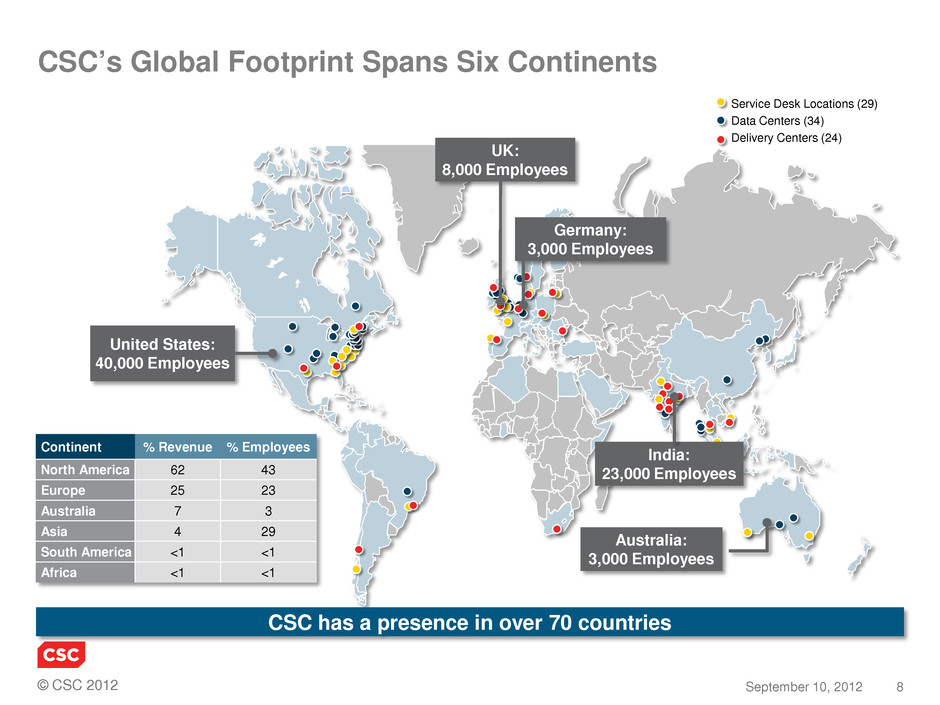

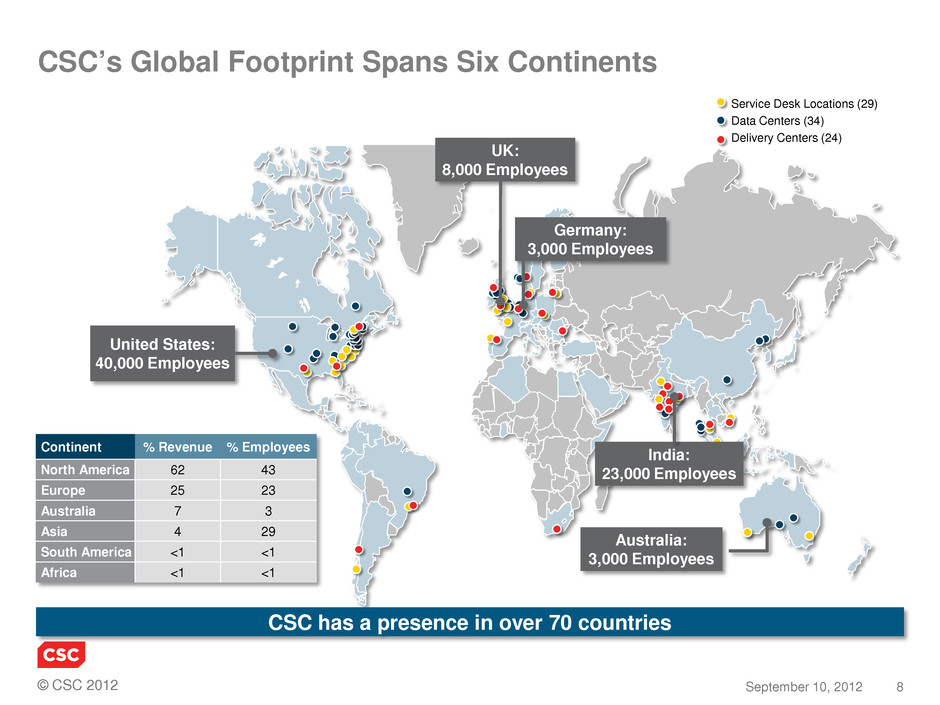

© CSC 2012 8 September 10, 2012 CSC’s Global Footprint Spans Six Continents Service Desk Locations (29) Data Centers (34) Delivery Centers (24) United States: 40,000 Employees UK: 8,000 Employees Germany: 3,000 Employees India: 23,000 Employees Australia: 3,000 Employees Continent % Revenue % Employees North America 62 43 Europe 25 23 Australia 7 3 Asia 4 29 South America <1 <1 Africa <1 <1 CSC has a presence in over 70 countries

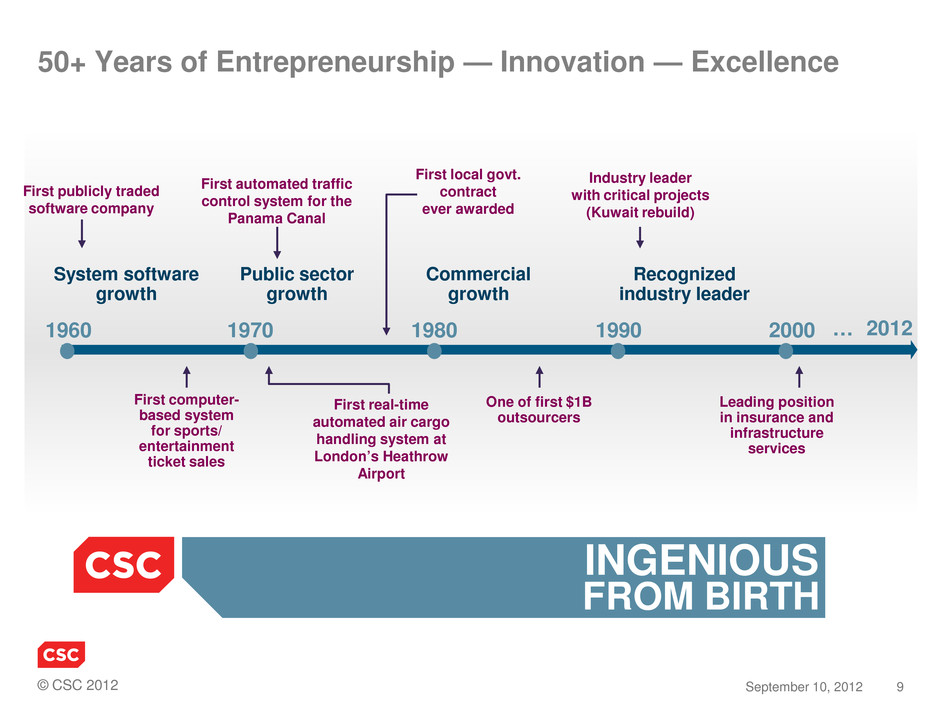

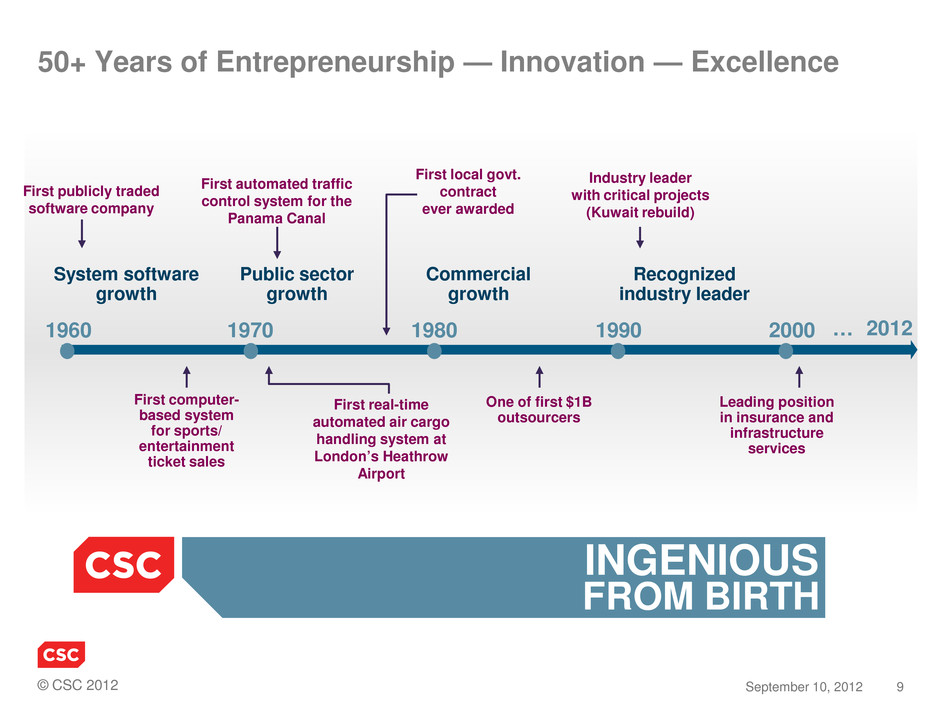

© CSC 2012 9 September 10, 2012 Public sector growth Recognized industry leader System software growth Commercial growth 1960 1970 1980 2000 1990 First publicly traded software company First computer- based system for sports/ entertainment ticket sales First automated traffic control system for the Panama Canal First local govt. contract ever awarded First real-time automated air cargo handling system at London’s Heathrow Airport One of first $1B outsourcers Industry leader with critical projects (Kuwait rebuild) Leading position in insurance and infrastructure services INGENIOUS FROM BIRTH 50+ Years of Entrepreneurship — Innovation — Excellence 2012 …

© CSC 2012 10 September 10, 2012 CSC Has Underperformed in the Last Few Years Root causes of our underperformance ... … impacted our portfolio in many ways … … which reflected in our financial performance … … and reached a tipping point in FY 2011/2012 In the process, CSC lost its identity and its value proposition • Over-indexed toward rapidly commoditizing traditional infrastructure • Business became too capital intensive • Large number of high-risk infrastructure and application projects • Proliferation of customized, non-standard offerings, which added cost, complexity, and sluggishness to our business • $1.5B NHS contract charge and $2.7B in goodwill impairment • SEC investigation in FY 2011 • 40 major contracts underperformed • Lost more than 50% of our market cap from May 2011 to December 2011 • Strategy didn’t recognize shift in industry trends (e.g., fewer outsourcing mega-deals) and led to misalignment of resources • Incentives were misaligned (e.g., revenue focus) • Weak discipline around contract and delivery management • Company fragmented into several units — “the whole was less than the sum of its parts” — leading to fragile financial controls and systems • This led to an unaffordable cost structure -1 1 0 0 400 800 1200 OI FY08 – FY12 FCF FY08 – FY12 Revenue FY08 – FY12 0 10 15 $ Billion $ Billion $ Million 5

© CSC 2012 11 September 10, 2012 CSC’s Unique Value Proposition One of the last remaining independent IT services companies with global reach Substantial IP and industry-focused solutions • Leader in European life insurance policy administration • Process ~11 million contracts, policies, and loans worth $7.6B in premiums • iSoft touches 13,000+ healthcare providers and 70 million patients in 40 countries • Designed and implemented super-precise dispatching system for Swiss Federal Railway Extraordinary skills and domain knowledge • Team of PhDs working to develop and lead emerging “Climate and Energy” market • Working with industry experts through CSC Leading Edge Forum to address global technology challenges • More than half of CSC’s Homeland Security and Law Enforcement Division leaders formerly U.S. DHS and DOJ officials Leading next-generation infrastructure offerings • Introduced first hybrid cloud — BizCloud • Standard architecture across public and private clouds • Part of Defense Industrial Base program to protect U.S. DoD from network attacks • Building our own global threat intelligence capability, and global cybersecurity information architecture Deep experience in federal government, defense, intelligence, and civil agencies • Conducting naval aviation simulator training programs for U.S. Navy • Developing courses for Defense Cyber Investigations Training Academy (DCITA) • Supporting CDC on World Trade Center program for treatment of workers affected by 9/11 • Processed more than 40 million visas in 20+ languages and 100 countries

© CSC 2012 12 September 10, 2012 CSC Vision, Mission, and Strategy Vision To be the world’s leading next-generation technology solutions and services provider. Our clients achieve superior returns on their technology investments through our best-in-class industry solutions, passion, and domain expertise of our people, and our global scale To create superior value for our customers, shareholders, and employees by being the industry leader in next-generation technology services and industry-specific solutions through leveraging the world’s best talent and global scale Mission and Purpose Fix the foundation Expand market coverage and drive demand Move up the value chain Scale next- gen infra- structure offerings Rationalize and standardize offerings Disciplined, transparent, account- ability- oriented manage- ment system 1 2 3 4 5 6 Strategy

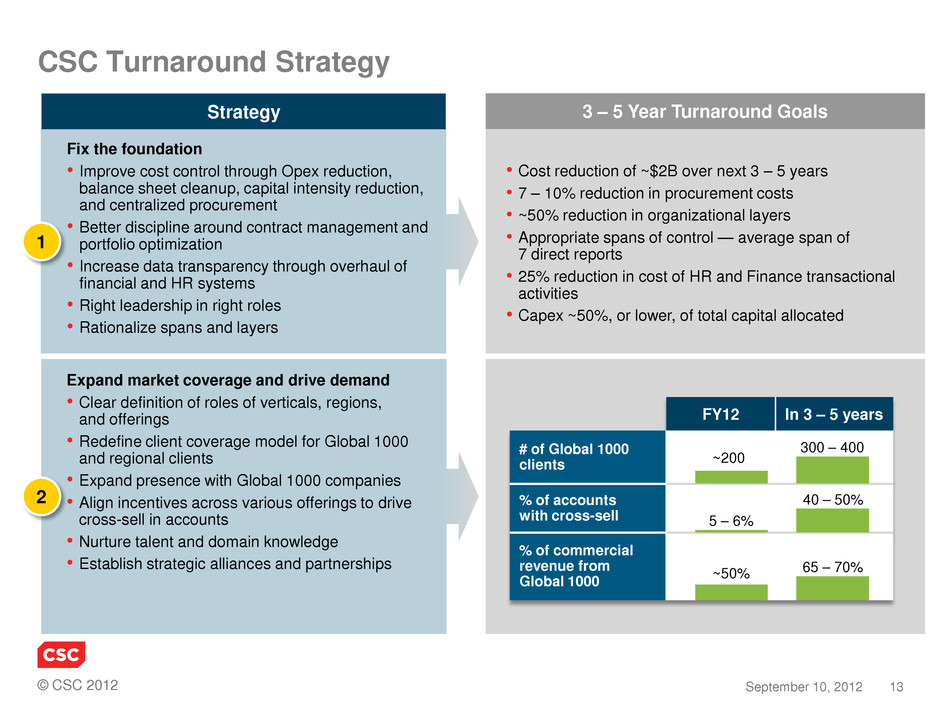

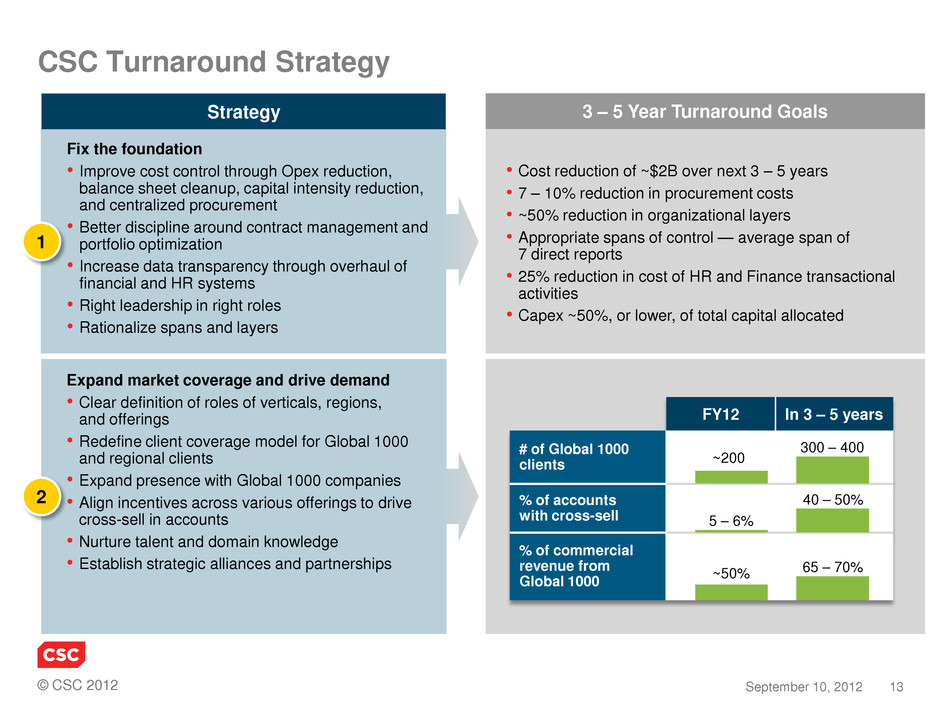

© CSC 2012 13 September 10, 2012 CSC Turnaround Strategy Expand market coverage and drive demand • Clear definition of roles of verticals, regions, and offerings • Redefine client coverage model for Global 1000 and regional clients • Expand presence with Global 1000 companies • Align incentives across various offerings to drive cross-sell in accounts • Nurture talent and domain knowledge • Establish strategic alliances and partnerships 2 Fix the foundation • Improve cost control through Opex reduction, balance sheet cleanup, capital intensity reduction, and centralized procurement • Better discipline around contract management and portfolio optimization • Increase data transparency through overhaul of financial and HR systems • Right leadership in right roles • Rationalize spans and layers 1 Strategy • Cost reduction of ~$2B over next 3 – 5 years • 7 – 10% reduction in procurement costs • ~50% reduction in organizational layers • Appropriate spans of control — average span of 7 direct reports • 25% reduction in cost of HR and Finance transactional activities • Capex ~50%, or lower, of total capital allocated 3 – 5 Year Turnaround Goals FY12 In 3 – 5 years # of Global 1000 clients % of accounts with cross-sell % of commercial revenue from Global 1000 ~200 300 – 400 5 – 6% 40 – 50% ~50% 65 – 70%

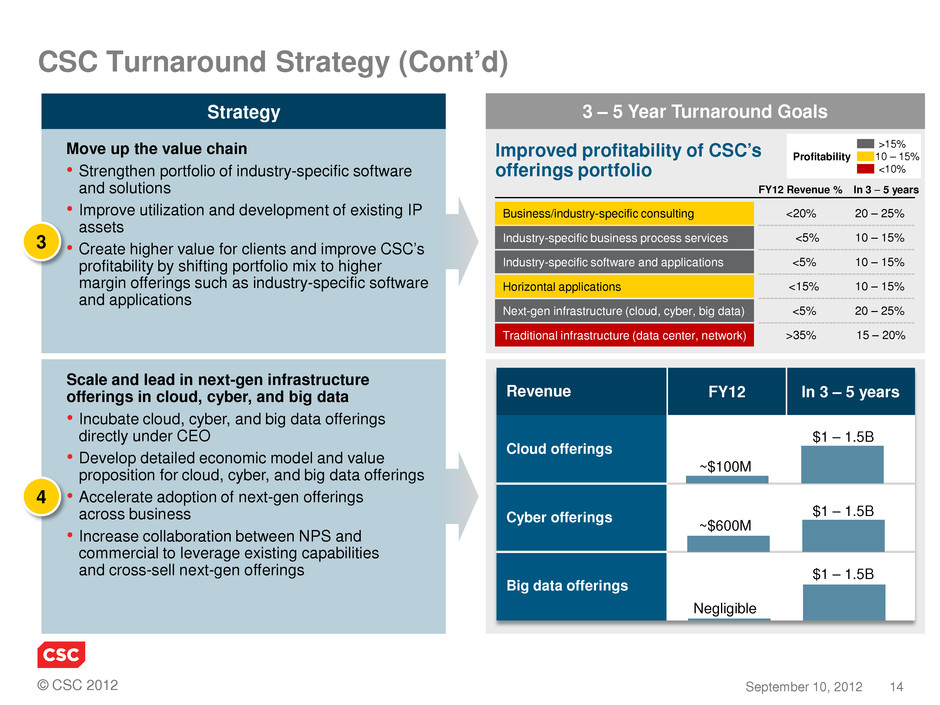

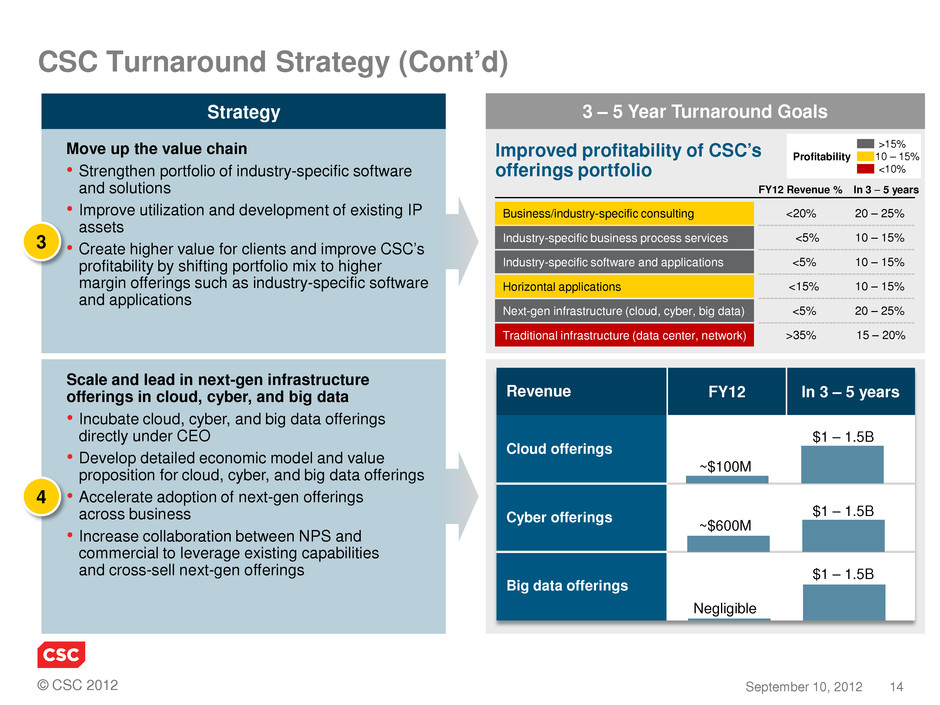

© CSC 2012 14 September 10, 2012 CSC Turnaround Strategy (Cont’d) Strategy 3 Move up the value chain • Strengthen portfolio of industry-specific software and solutions • Improve utilization and development of existing IP assets • Create higher value for clients and improve CSC’s profitability by shifting portfolio mix to higher margin offerings such as industry-specific software and applications 4 Scale and lead in next-gen infrastructure offerings in cloud, cyber, and big data • Incubate cloud, cyber, and big data offerings directly under CEO • Develop detailed economic model and value proposition for cloud, cyber, and big data offerings • Accelerate adoption of next-gen offerings across business • Increase collaboration between NPS and commercial to leverage existing capabilities and cross-sell next-gen offerings 3 – 5 Year Turnaround Goals Improved profitability of CSC’s offerings portfolio Business/industry-specific consulting Horizontal applications Next-gen infrastructure (cloud, cyber, big data) Industry-specific software and applications Industry-specific business process services Traditional infrastructure (data center, network) FY12 Revenue % In 3 – 5 years <20% <5% <5% <15% <5% >35% 20 – 25% 10 – 15% 10 – 15% 10 – 15% 20 – 25% 15 – 20% >15% 10 – 15% <10% Profitability Revenue FY12 In 3 – 5 years Cloud offerings Cyber offerings Big data offerings ~$100M $1 – 1.5B ~$600M $1 – 1.5B Negligible $1 – 1.5B

© CSC 2012 15 September 10, 2012 Strategy 5 Rationalize and standardize offerings • Focus on differentiated, less capital-intensive offerings • Standardize, consolidate, and streamline service delivery through global delivery networks • Exit non-strategic low-margin offerings • Adopt standardized offering life-cycle management (OLM) processes • Drive meaningful innovation throughout the organization 6 Disciplined, transparent, accountability-oriented management system • Laser focus on operational metrics, with clear accountability • Disciplined approach to drive value to customer and CSC • Invest in world-class talent and retention • Drive and support innovation • Forward-looking strategy relative to market trends and opportunity CSC Turnaround Strategy (Cont’d) 3 – 5 Year Turnaround Goals

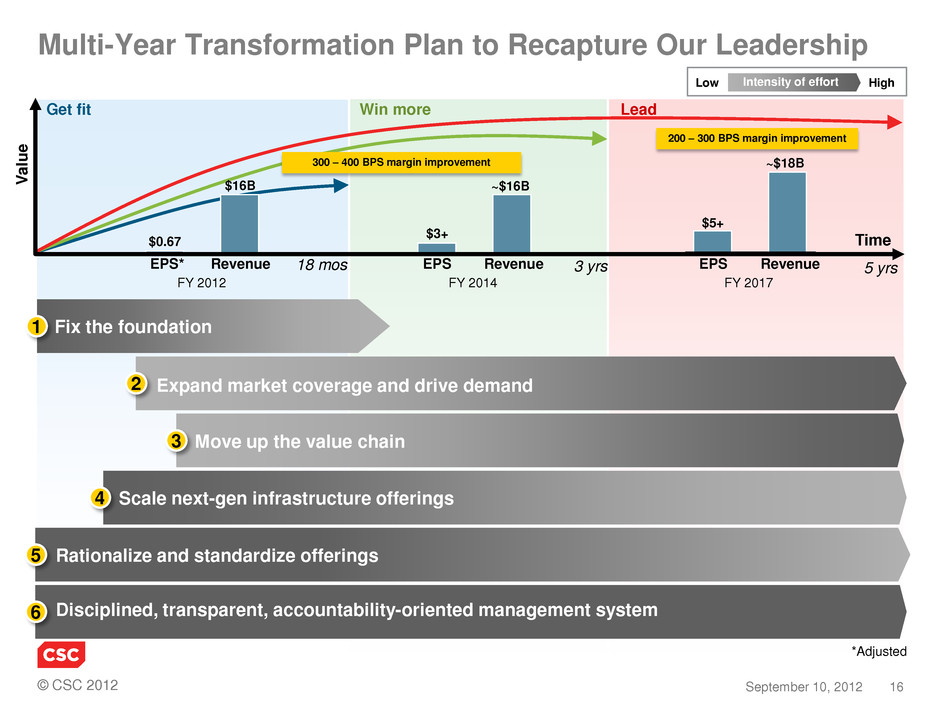

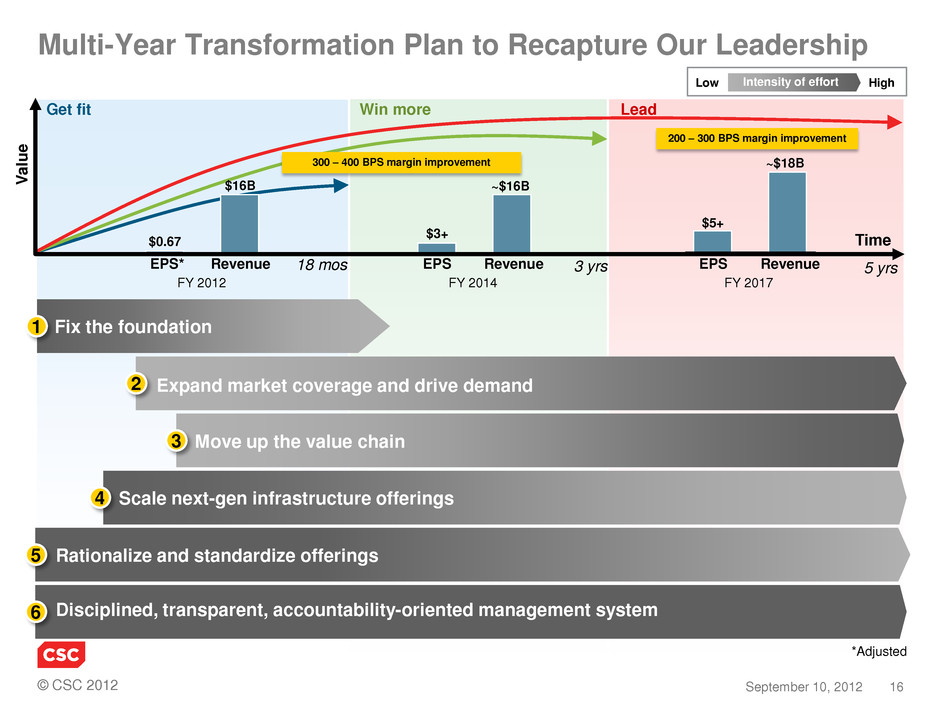

© CSC 2012 16 September 10, 2012 Multi-Year Transformation Plan to Recapture Our Leadership Get fit V al ue Time Low High Intensity of effort Fix the foundation 1 Expand market coverage and drive demand 2 Move up the value chain 3 Scale next-gen infrastructure offerings 4 Rationalize and standardize offerings 5 Disciplined, transparent, accountability-oriented management system 6 ~$18B $5+ Revenue EPS ~$16B $3+ Revenue EPS Revenue EPS* $16B $0.67 FY 2017 FY 2014 FY 2012 Win more Lead 18 mos 3 yrs 5 yrs 300 – 400 BPS margin improvement 200 – 300 BPS margin improvement *Adjusted

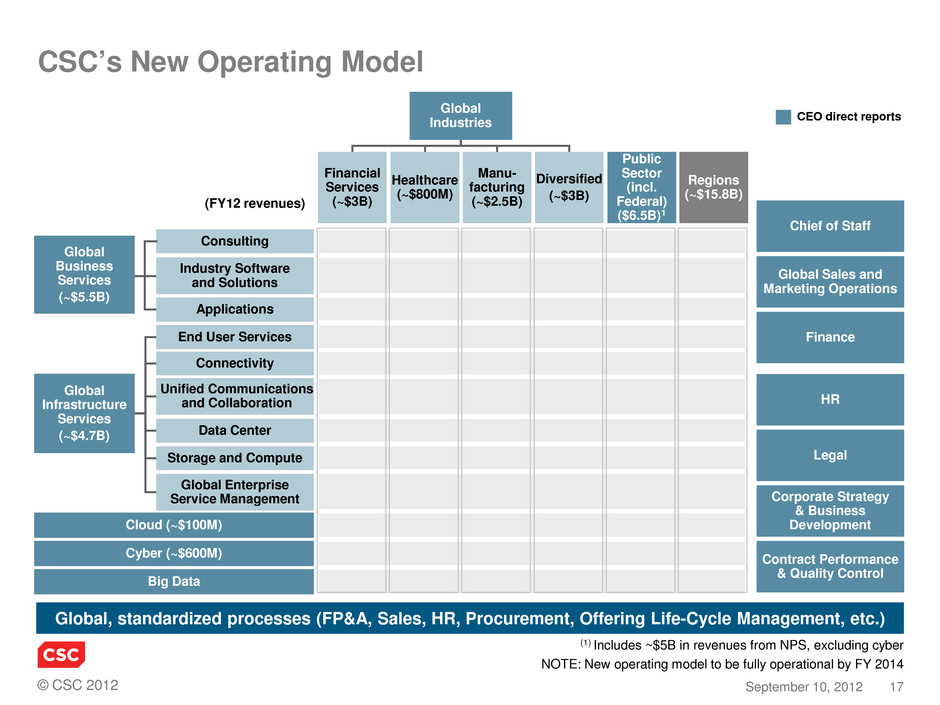

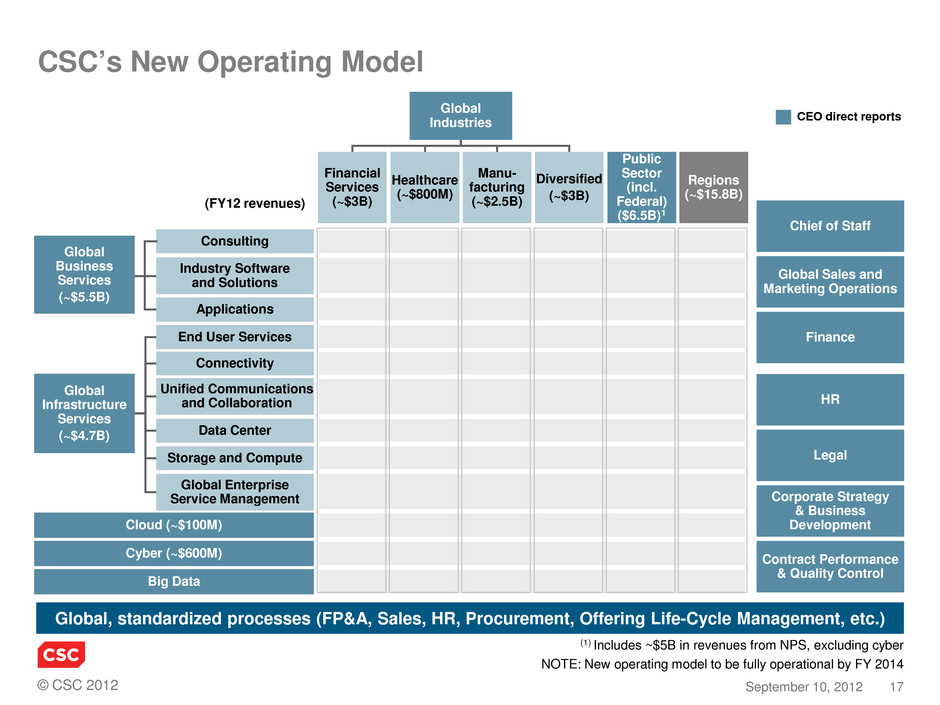

© CSC 2012 17 September 10, 2012 CSC’s New Operating Model Global, standardized processes (FP&A, Sales, HR, Procurement, Offering Life-Cycle Management, etc.) Financial Services (~$3B) Healthcare (~$800M) Manu- facturing (~$2.5B) Diversified (~$3B) Public Sector (incl. Federal) ($6.5B)1 Regions (~$15.8B) Global Industries End User Services Cloud (~$100M) Cyber (~$600M) Big Data Connectivity Storage and Compute Data Center Global Enterprise Service Management Global Infrastructure Services (~$4.7B) Global Business Services (~$5.5B) Industry Software and Solutions Global Sales and Marketing Operations Finance HR Legal Corporate Strategy & Business Development Contract Performance & Quality Control Applications Consulting CEO direct reports Chief of Staff (1) Includes ~$5B in revenues from NPS, excluding cyber (FY12 revenues) NOTE: New operating model to be fully operational by FY 2014 Unified Communications and Collaboration

© CSC 2012 18 September 10, 2012 Key Markers of Success Revenue Mix (%) 20 7 11 4 37 20 Industry software and solutions Applications Consulting Other Traditional infrastructure Next-gen infrastructure Consulting Traditional infrastructure Next-gen infrastructure Industry software and solutions Applications (20% – 25%) (20% – 25%) (15% – 17%) (20% – 25%) (15% – 20%) Revenue ($B) ~$16B ~$18B YoY Revenue Growth (%) ~0% 3% – 5% EPS ($) $0.67* $5+ EBIT (%) 2%* 7% – 9% FCF (% of Net Income) NMF ** >100% Capital Intensity (%) 70% ~50% or less FY 2012 **NMF = No Meaningful Figure *Adjusted In 5 Years

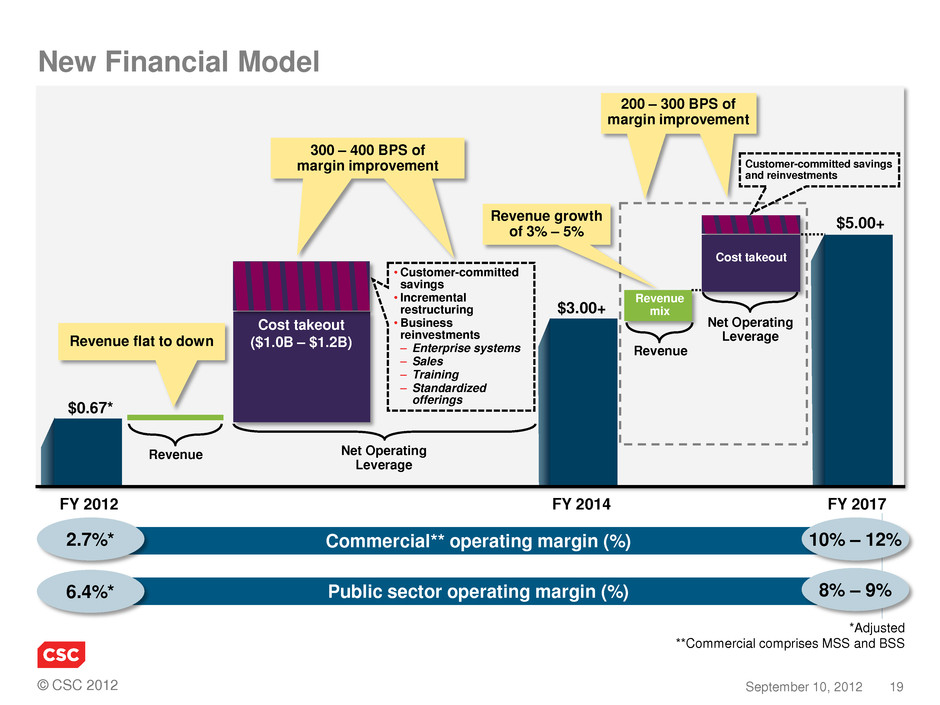

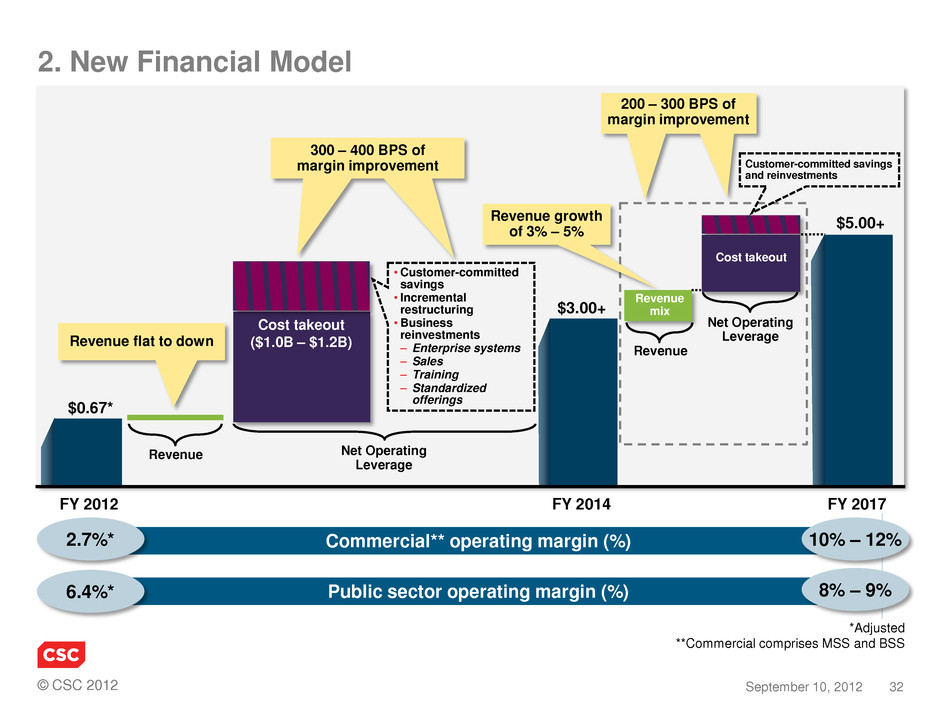

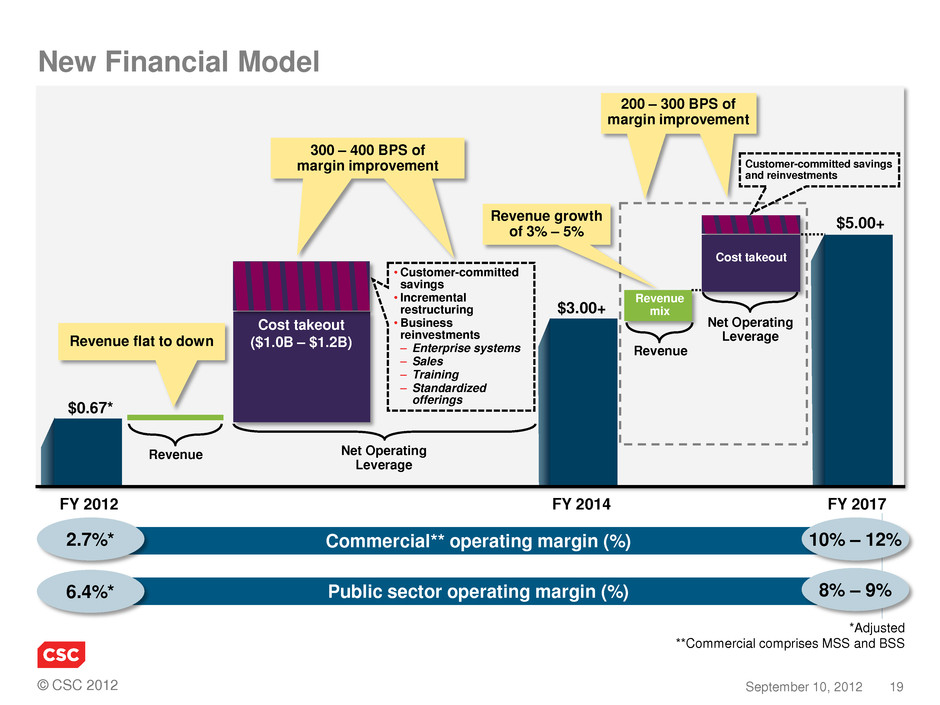

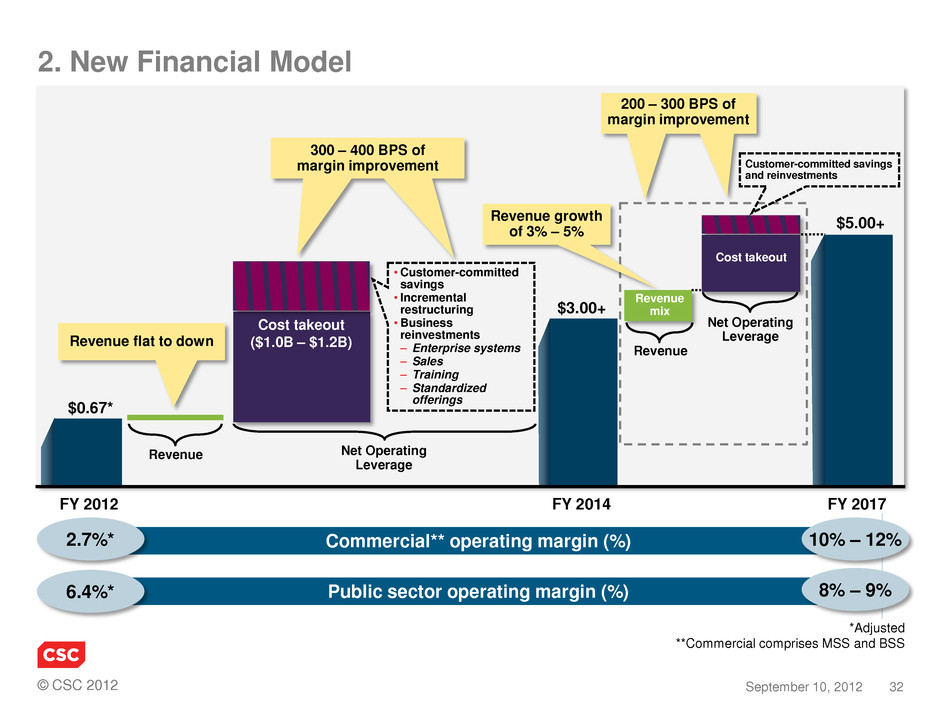

© CSC 2012 19 September 10, 2012 FY 2017 FY 2014 Net Operating Leverage Revenue $0.67* FY 2012 Net Operating Leverage Revenue Cost takeout ($1.0B – $1.2B) $5.00+ $3.00+ 300 – 400 BPS of margin improvement Revenue flat to down Revenue growth of 3% – 5% New Financial Model 10% – 12% Commercial** operating margin (%) 2.7%* 8% – 9% Public sector operating margin (%) 6.4%* Revenue mix Cost takeout Customer-committed savings and reinvestments • Customer-committed savings • Incremental restructuring • Business reinvestments – Enterprise systems – Sales – Training – Standardized offerings 200 – 300 BPS of margin improvement *Adjusted **Commercial comprises MSS and BSS

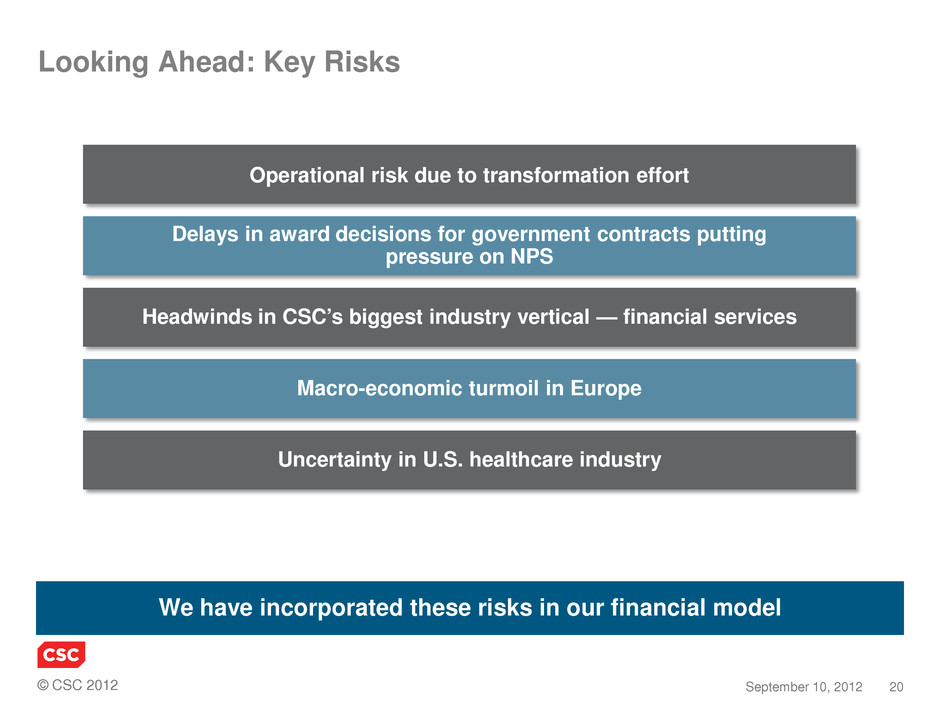

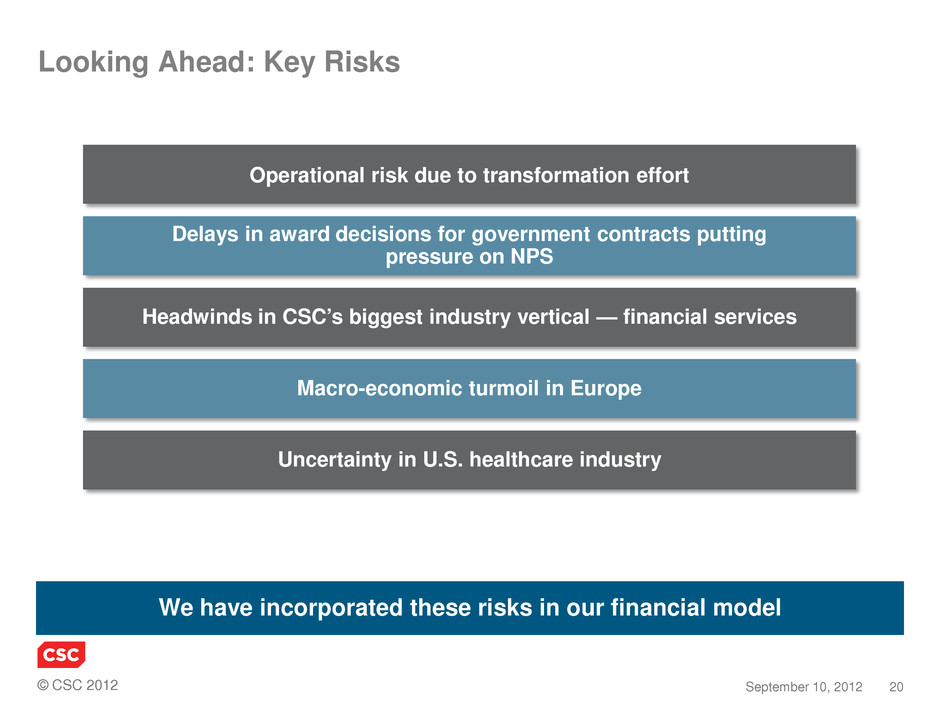

© CSC 2012 20 September 10, 2012 Looking Ahead: Key Risks Operational risk due to transformation effort Delays in award decisions for government contracts putting pressure on NPS Headwinds in CSC’s biggest industry vertical — financial services Macro-economic turmoil in Europe Uncertainty in U.S. healthcare industry We have incorporated these risks in our financial model

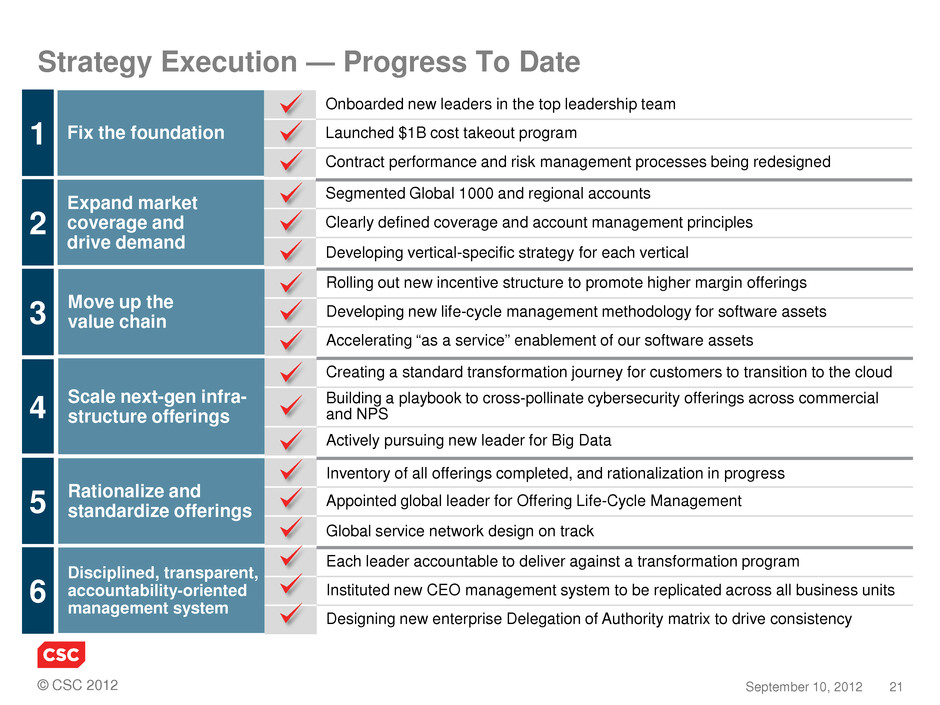

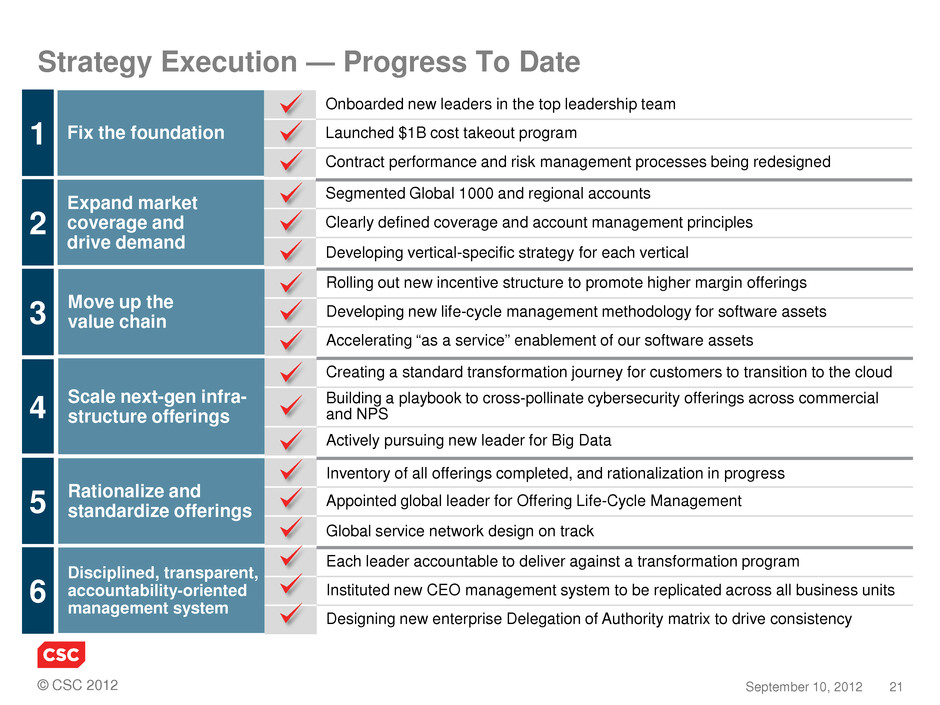

© CSC 2012 21 September 10, 2012 Rationalize and standardize offerings Inventory of all offerings completed, and rationalization in progress Appointed global leader for Offering Life-Cycle Management Global service network design on track Strategy Execution — Progress To Date Disciplined, transparent, accountability-oriented management system Each leader accountable to deliver against a transformation program Instituted new CEO management system to be replicated across all business units Designing new enterprise Delegation of Authority matrix to drive consistency Scale next-gen infra- structure offerings Creating a standard transformation journey for customers to transition to the cloud Building a playbook to cross-pollinate cybersecurity offerings across commercial and NPS Actively pursuing new leader for Big Data Move up the value chain Rolling out new incentive structure to promote higher margin offerings Developing new life-cycle management methodology for software assets Accelerating “as a service” enablement of our software assets Expand market coverage and drive demand Segmented Global 1000 and regional accounts Clearly defined coverage and account management principles Developing vertical-specific strategy for each vertical Fix the foundation Onboarded new leaders in the top leadership team Launched $1B cost takeout program Contract performance and risk management processes being redesigned 1 2 3 4 5 6

© CSC 2012 22 September 10, 2012 12:30 – 1:10 Mike Lawrie, President and CEO 1:10 – 1:30 Paul Saleh, CFO 1:30 – 2:00 Q&A Agenda SC 2012

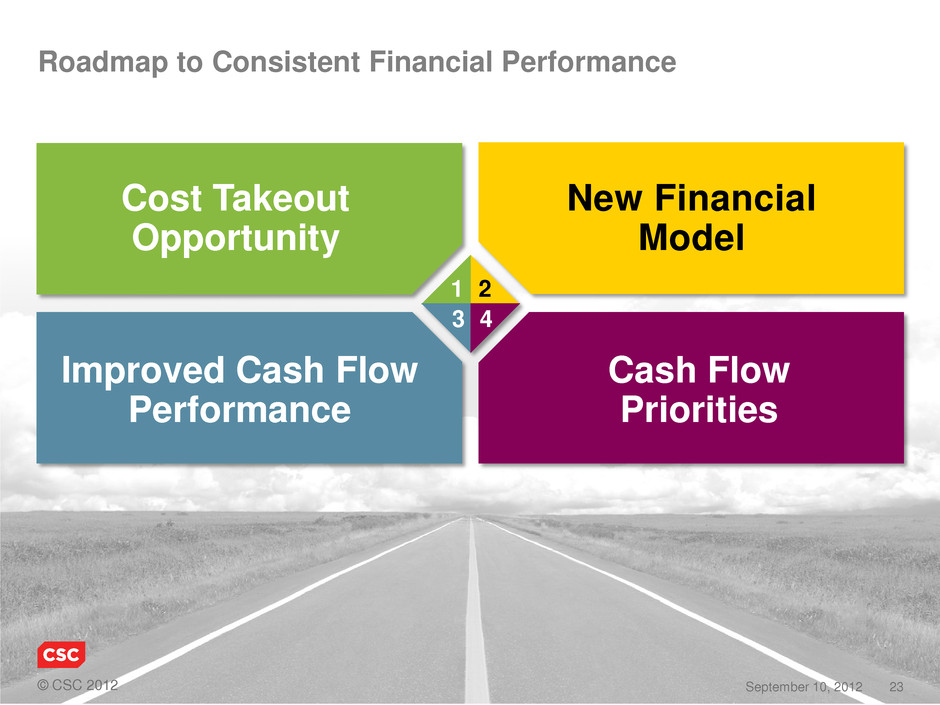

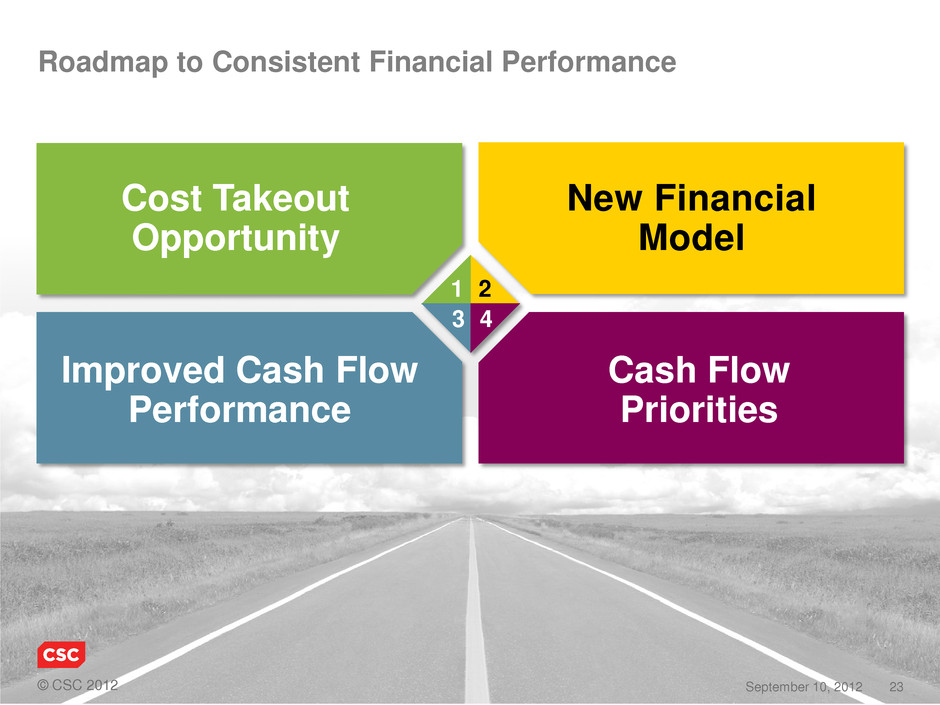

© CSC 2012 23 September 10, 2012 Cost Takeout Opportunity New Financial Model Improved Cash Flow Performance Cash Flow Priorities Roadmap to Consistent Financial Performance 1 2 3 4

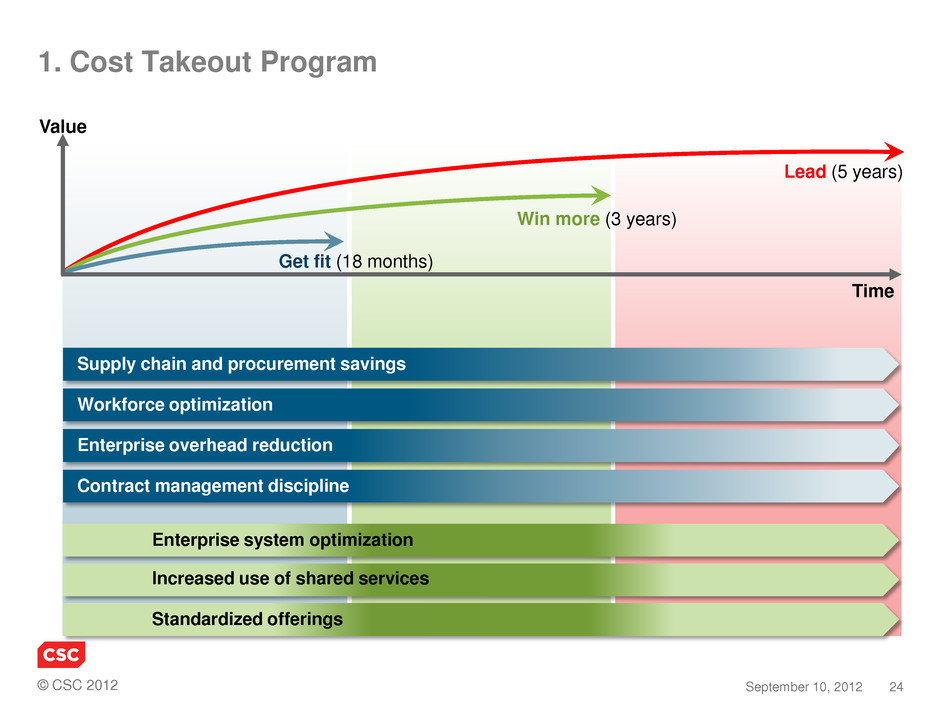

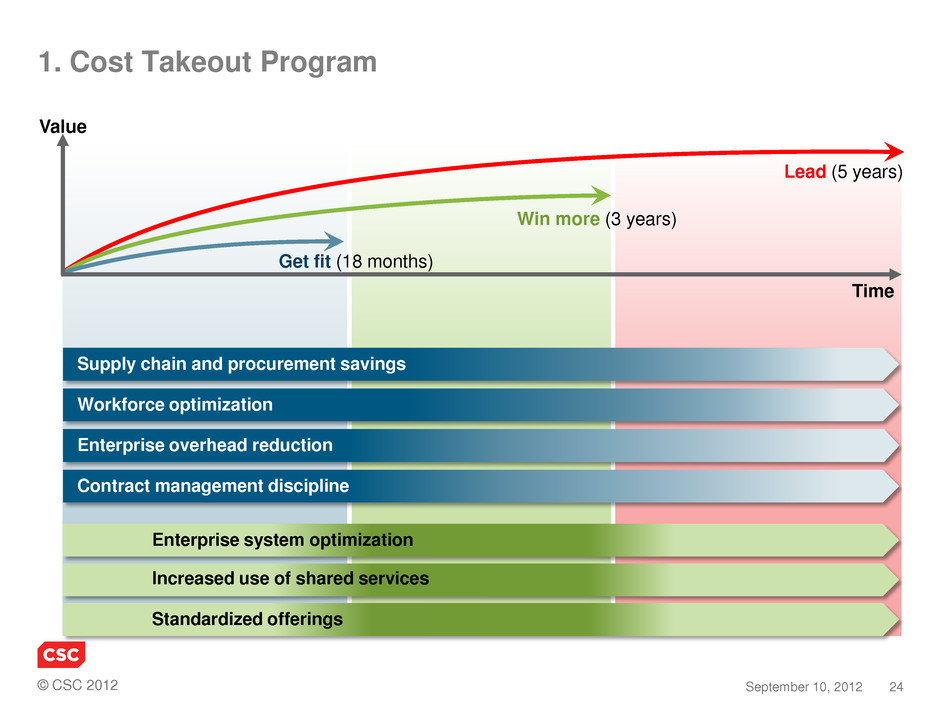

© CSC 2012 24 September 10, 2012 1. Cost Takeout Program Lead (5 years) Value Time Win more (3 years) Get fit (18 months) Enterprise overhead reduction Workforce optimization Supply chain and procurement savings Contract management discipline Enterprise system optimization Increased use of shared services Standardized offerings

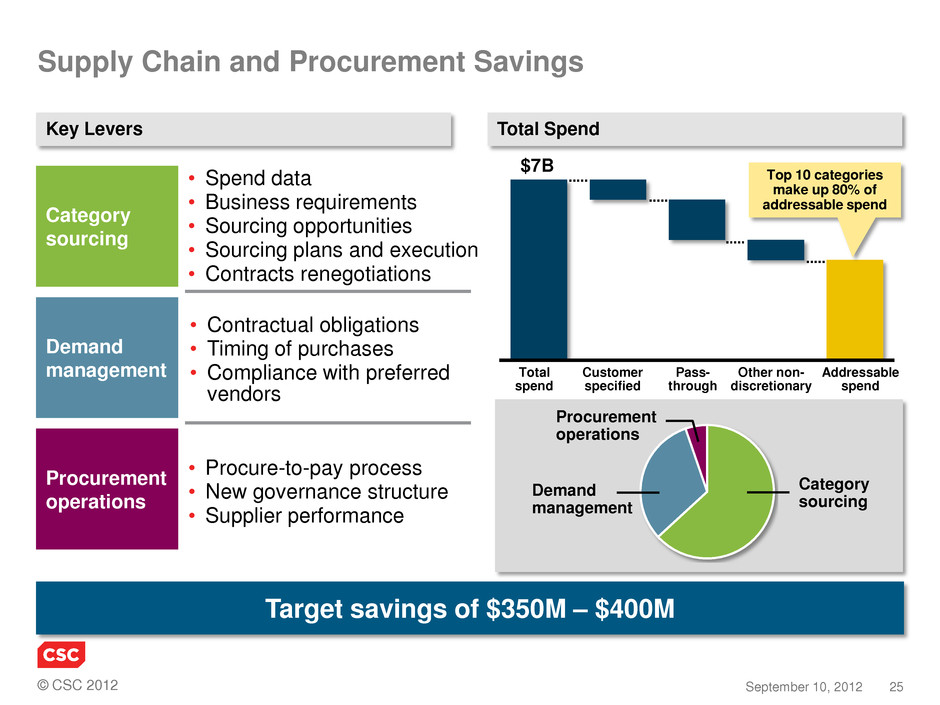

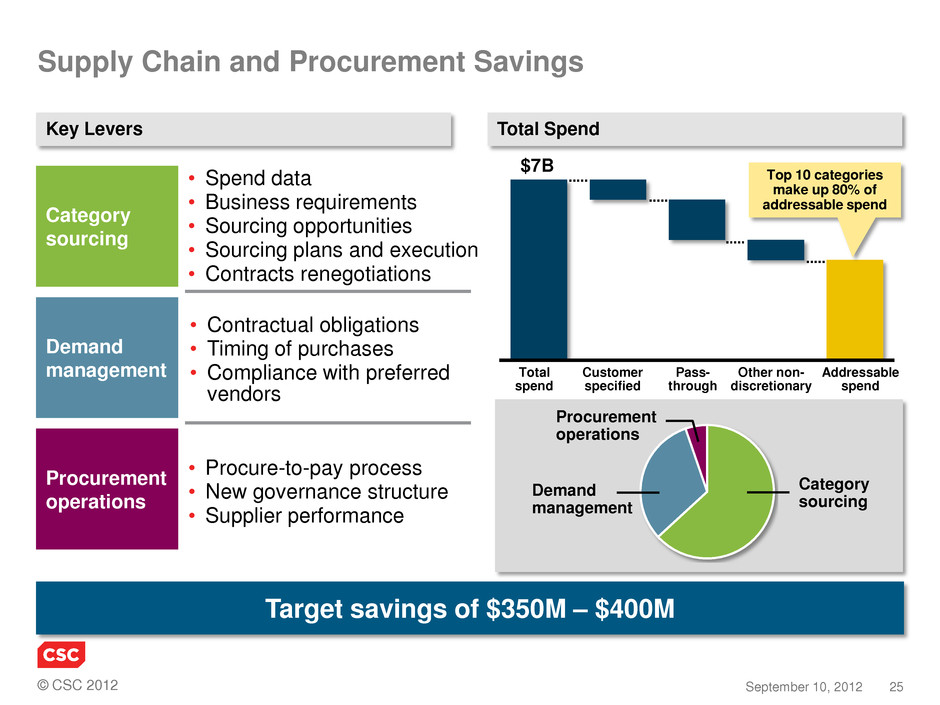

© CSC 2012 25 September 10, 2012 Supply Chain and Procurement Savings Key Levers Total Spend Category sourcing Demand management Procurement operations $7B Procurement operations Demand management Category sourcing Pass- through Other non- discretionary Total spend Addressable spend Customer specified Top 10 categories make up 80% of addressable spend • Spend data • Business requirements • Sourcing opportunities • Sourcing plans and execution • Contracts renegotiations • Contractual obligations • Timing of purchases • Compliance with preferred vendors • Procure-to-pay process • New governance structure • Supplier performance Target savings of $350M – $400M

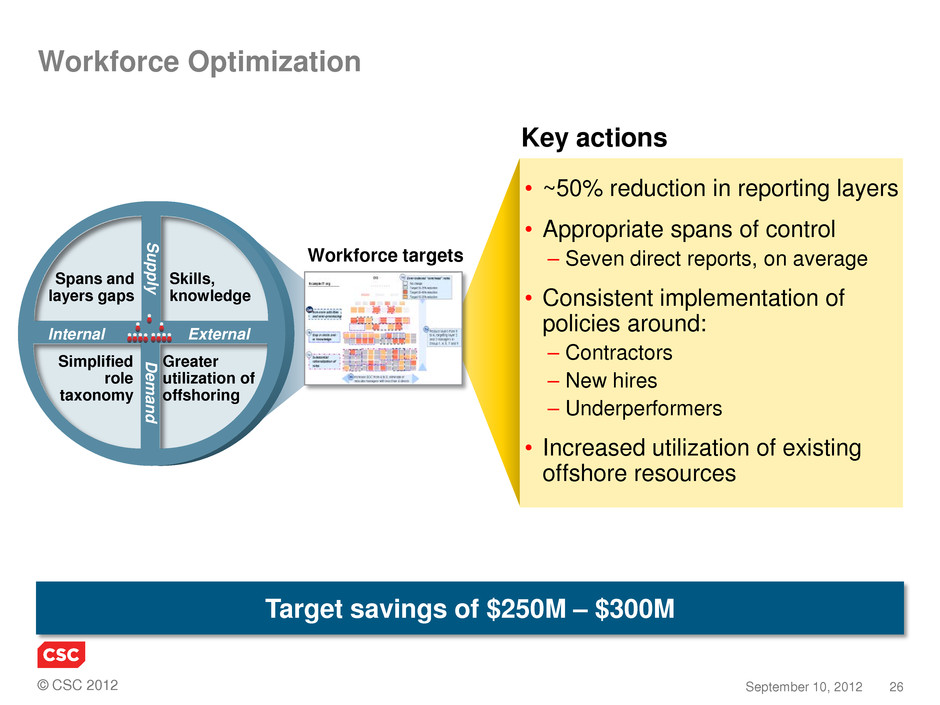

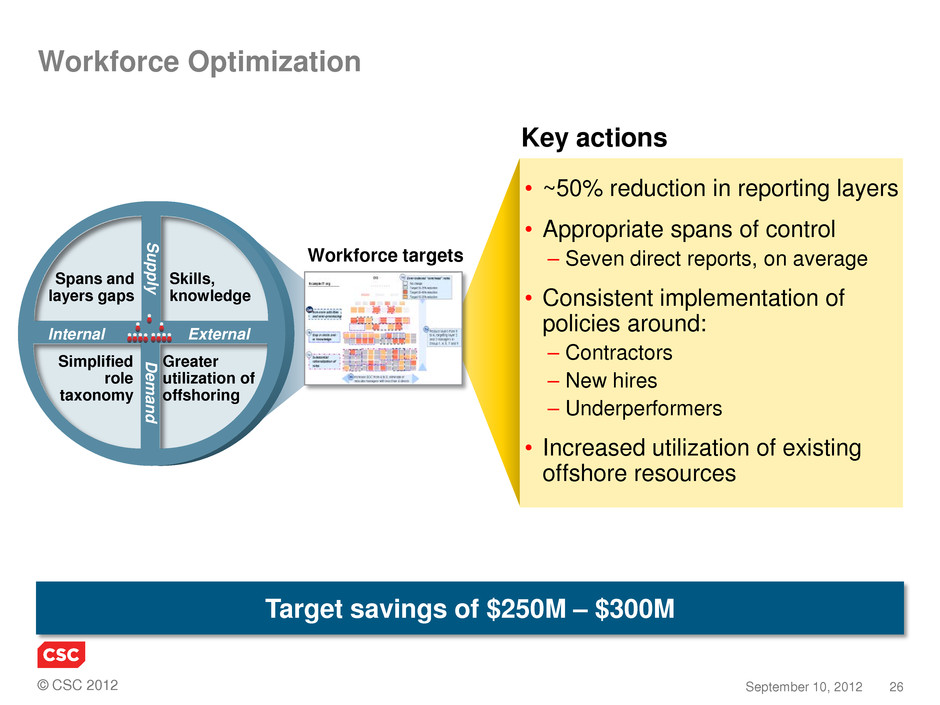

© CSC 2012 26 September 10, 2012 • ~50% reduction in reporting layers • Appropriate spans of control – Seven direct reports, on average • Consistent implementation of policies around: – Contractors – New hires – Underperformers • Increased utilization of existing offshore resources Workforce Optimization Greater utilization of offshoring Spans and layers gaps Simplified role taxonomy Skills, knowledge External S upply D em and Internal Workforce targets Key actions Target savings of $250M – $300M

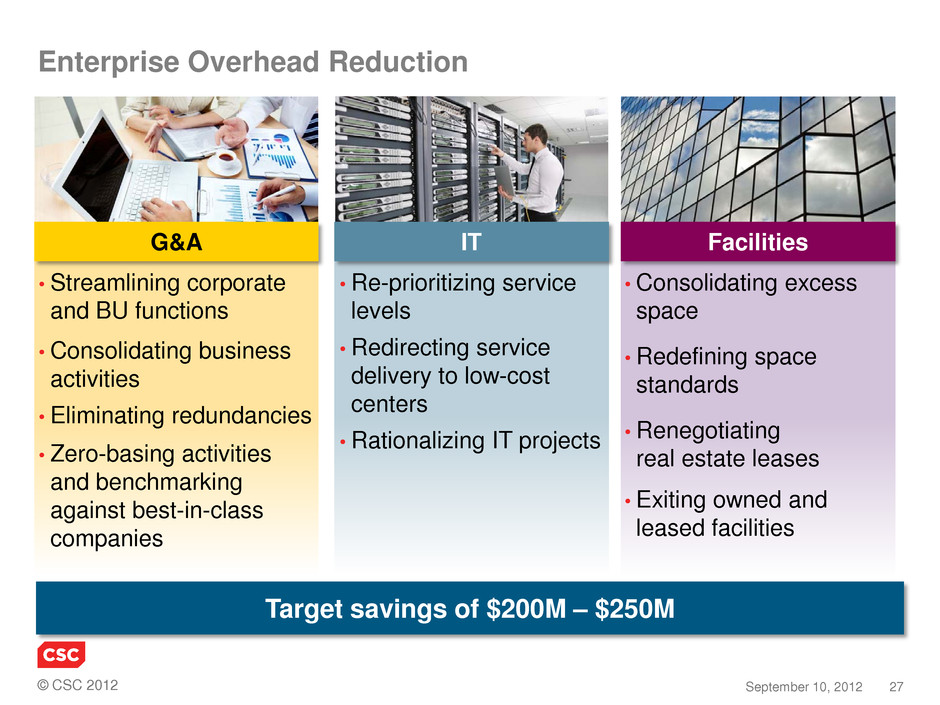

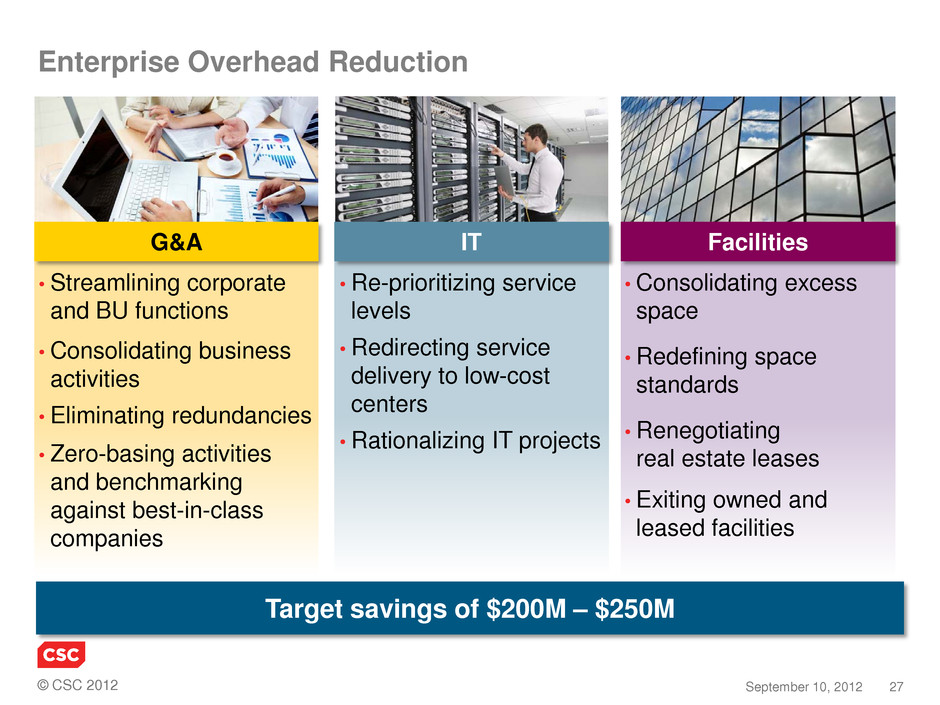

© CSC 2012 27 September 10, 2012 • Consolidating excess space • Redefining space standards • Renegotiating real estate leases • Exiting owned and leased facilities • Re-prioritizing service levels • Redirecting service delivery to low-cost centers • Rationalizing IT projects • Streamlining corporate and BU functions • Consolidating business activities • Eliminating redundancies • Zero-basing activities and benchmarking against best-in-class companies Enterprise Overhead Reduction G&A IT Facilities Target savings of $200M – $250M

© CSC 2012 28 September 10, 2012 • Detailed review of account performance • Action plans to close gap to bid model • Tighter focus on contractual commitments • Change control discipline • Contract renegotiation • Acceleration of offshoring activities • Consistent contract process • Tighter bid review and approval • Economic game plans • Risk identification and mitigation – Team composition – Scope definition – Governance – Continuity of coverage – Transition plans • Performance tracking against bid model and timelines Capture Contracting Delivery Renewal Contract Management Discipline Strengthening contract management process Balancing portfolio of risks and returns Improving performance of focus accounts Target savings of $200M – $250M

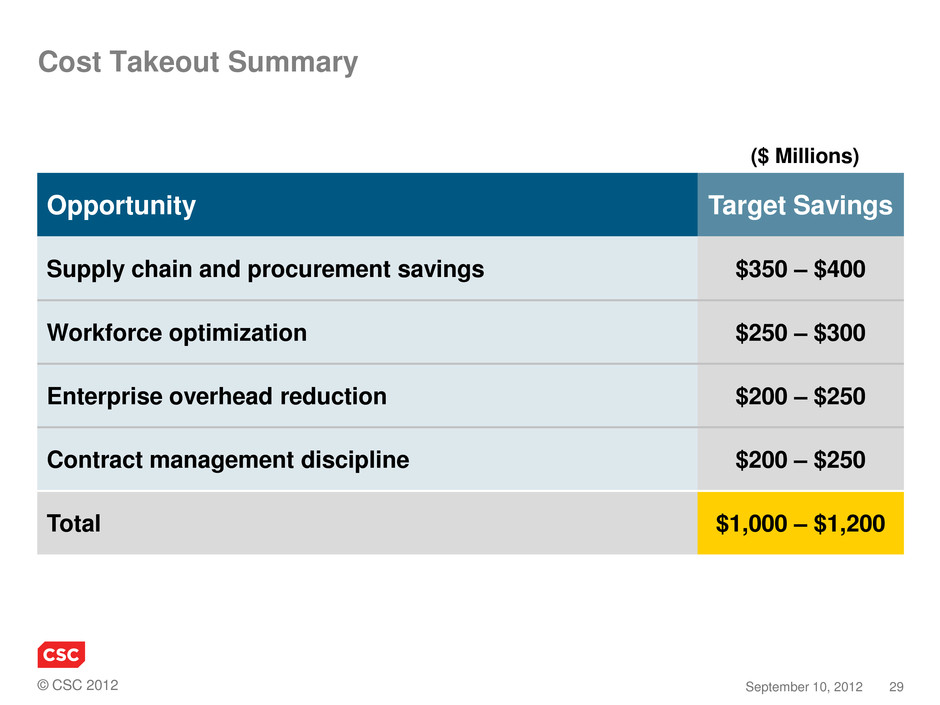

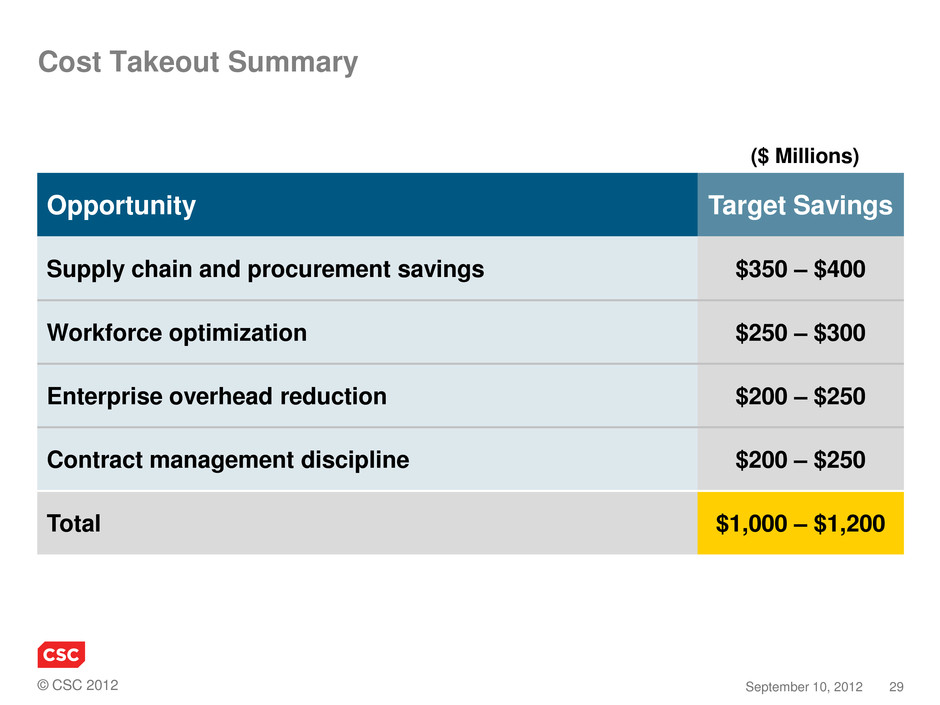

© CSC 2012 29 September 10, 2012 Cost Takeout Summary Opportunity Supply chain and procurement savings Workforce optimization Enterprise overhead reduction Contract management discipline Total ($ Millions) Target Savings $350 – $400 $250 – $300 $200 – $250 $200 – $250 $1,000 – $1,200

© CSC 2012 30 September 10, 2012 Additional Cost Takeout Opportunities Automated controls Common tools and systems Standardized processes Data consistency and transparency Enterprise systems optimization Increased Use of Shared Services Business Units 25% Cost Reduction Transaction Activities Current State Procurement Accts. payable Payroll Benefits administration Travel & expense Additional Activities HR recruiting Tax Labor sourcing Inter-company transactions Contract compliance General accounting Treasury operations Fixed assets Billing Master data maintenance Analytics Sales support Sterling Prague Chennai Shared Services

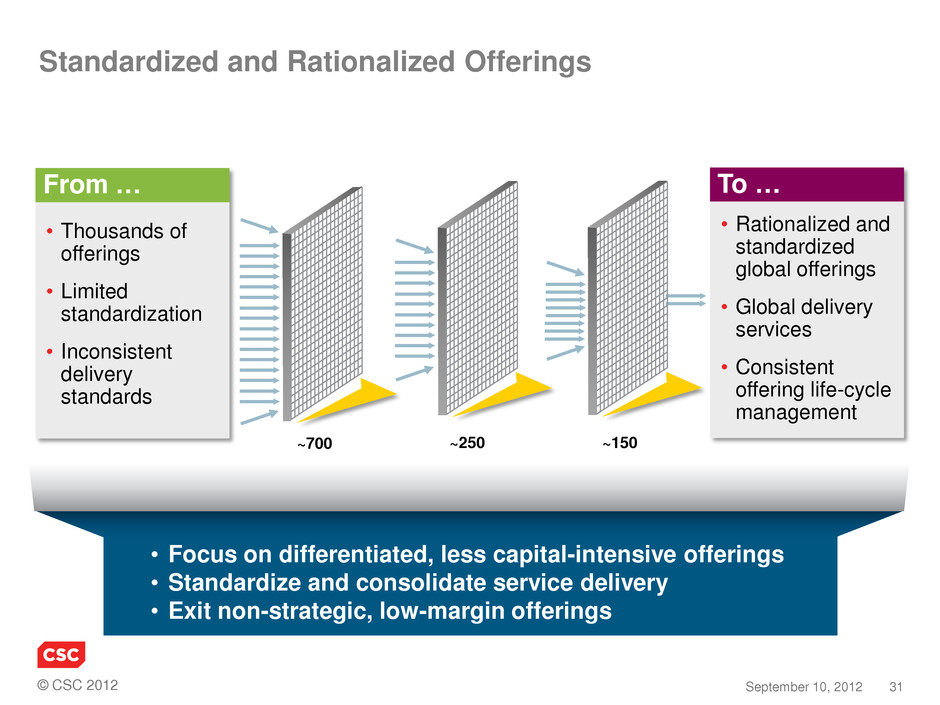

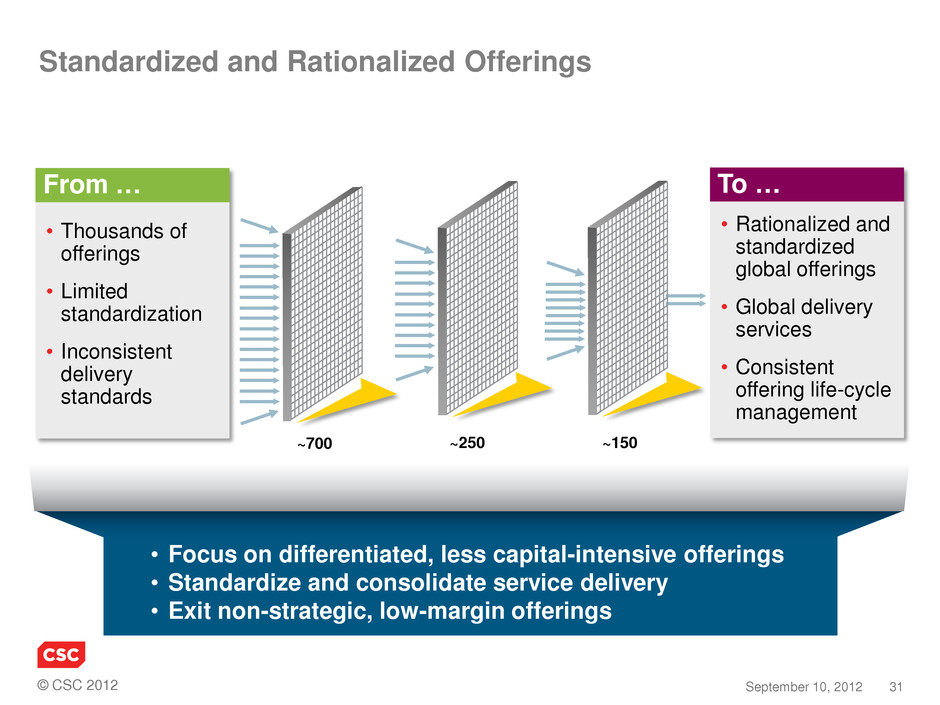

© CSC 2012 31 September 10, 2012 Standardized and Rationalized Offerings From … • Thousands of offerings • Limited standardization • Inconsistent delivery standards To … • Rationalized and standardized global offerings • Global delivery services • Consistent offering life-cycle management ~700 ~250 ~150 • Focus on differentiated, less capital-intensive offerings • Standardize and consolidate service delivery • Exit non-strategic, low-margin offerings

© CSC 2012 32 September 10, 2012 FY 2017 FY 2014 Net Operating Leverage Revenue $0.67* FY 2012 Net Operating Leverage Revenue Cost takeout ($1.0B – $1.2B) $5.00+ $3.00+ 300 – 400 BPS of margin improvement Revenue flat to down Revenue growth of 3% – 5% 2. New Financial Model 10% – 12% Commercial** operating margin (%) 2.7%* 8% – 9% Public sector operating margin (%) 6.4%* Revenue mix Cost takeout Customer-committed savings and reinvestments • Customer-committed savings • Incremental restructuring • Business reinvestments – Enterprise systems – Sales – Training – Standardized offerings 200 – 300 BPS of margin improvement *Adjusted **Commercial comprises MSS and BSS

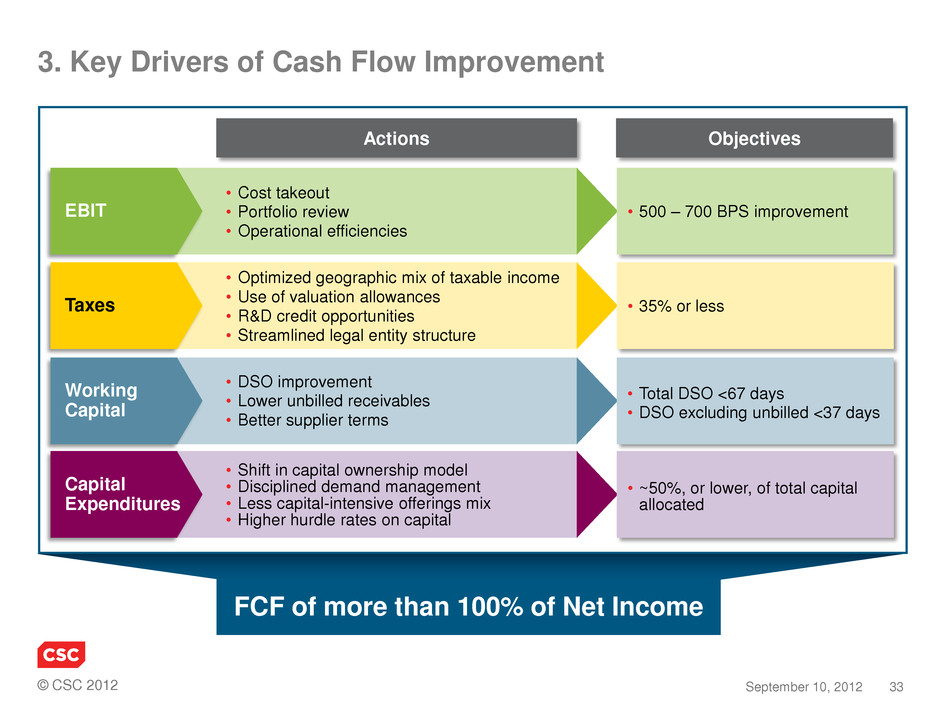

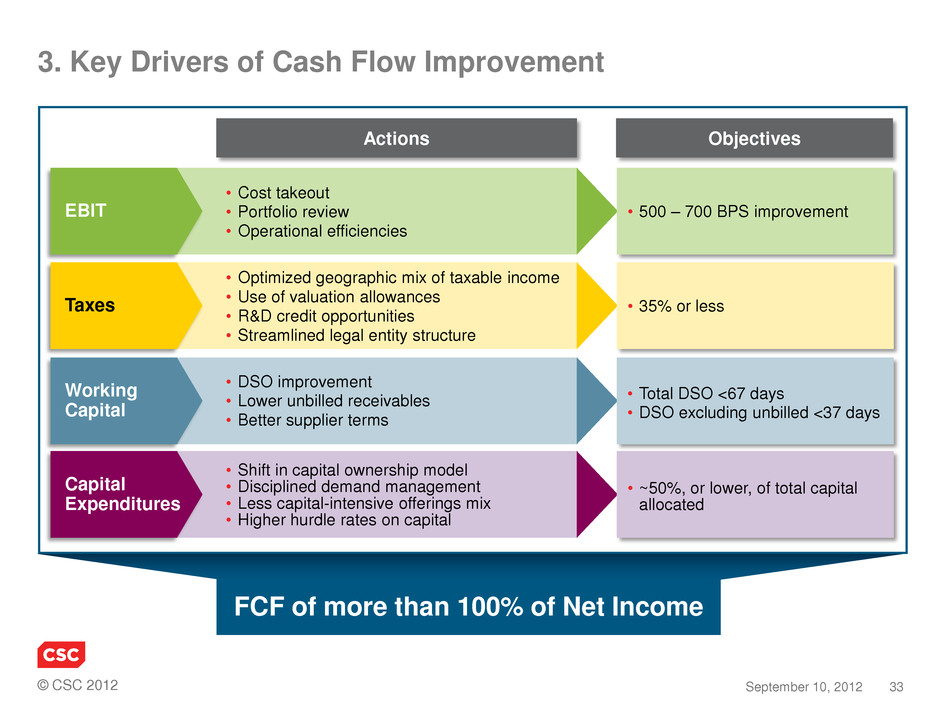

© CSC 2012 33 September 10, 2012 • Shift in capital ownership model • Disciplined demand management • Less capital-intensive offerings mix • Higher hurdle rates on capital • Cost takeout • Portfolio review • Operational efficiencies • Optimized geographic mix of taxable income • Use of valuation allowances • R&D credit opportunities • Streamlined legal entity structure • DSO improvement • Lower unbilled receivables • Better supplier terms 3. Key Drivers of Cash Flow Improvement • 500 – 700 BPS improvement • 35% or less EBIT Taxes Working Capital Capital Expenditures • ~50%, or lower, of total capital allocated • Total DSO <67 days • DSO excluding unbilled <37 days Actions Objectives FCF of more than 100% of Net Income

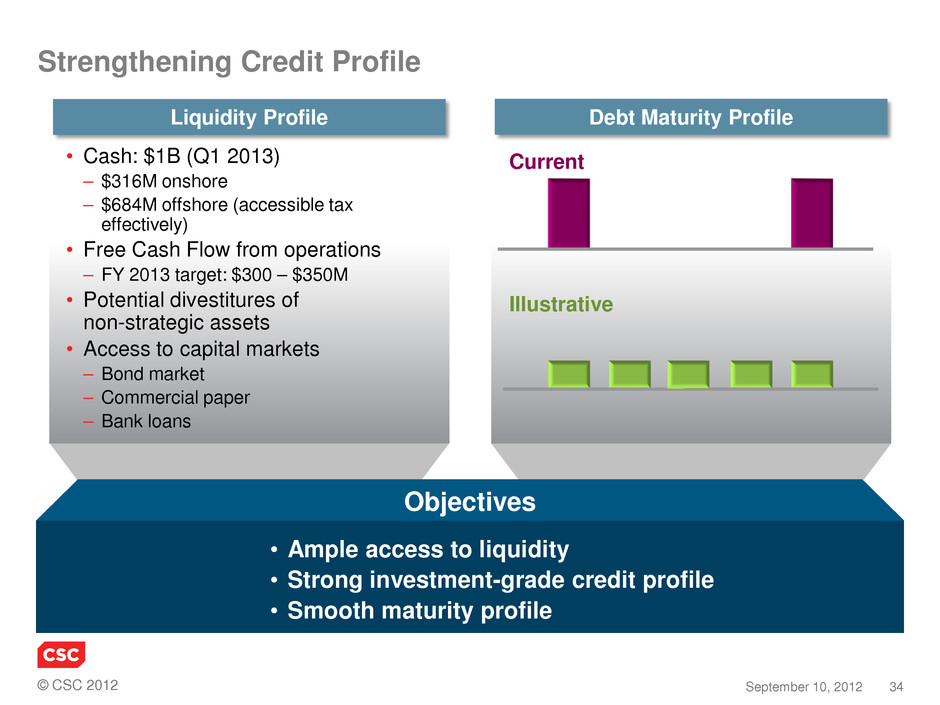

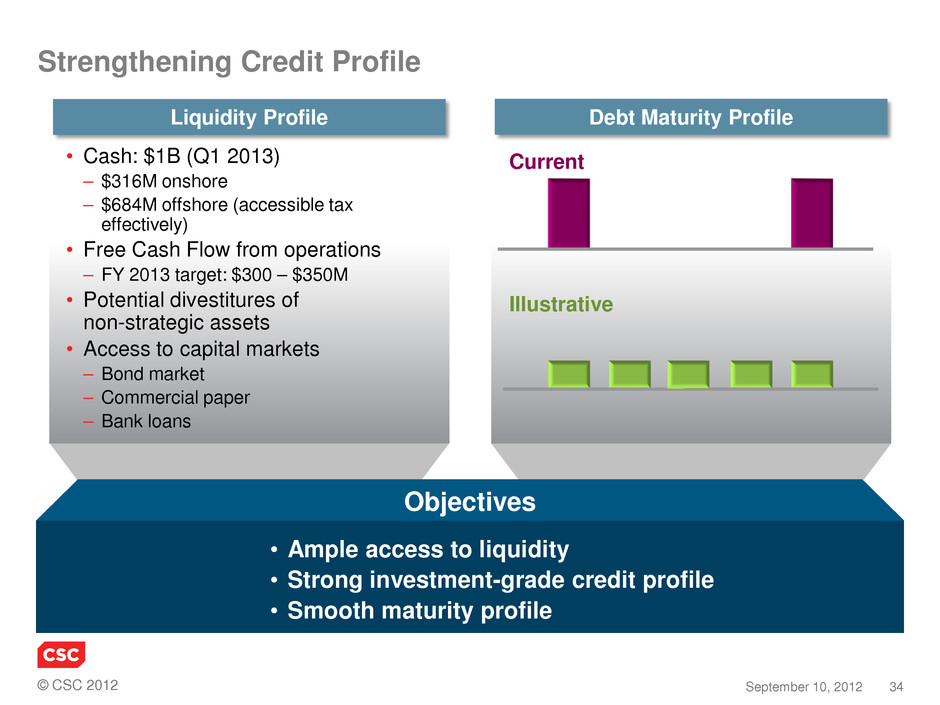

© CSC 2012 34 September 10, 2012 Strengthening Credit Profile Liquidity Profile Debt Maturity Profile Current Illustrative • Ample access to liquidity • Strong investment-grade credit profile • Smooth maturity profile Objectives • Cash: $1B (Q1 2013) – $316M onshore – $684M offshore (accessible tax effectively) • Free Cash Flow from operations – FY 2013 target: $300 – $350M • Potential divestitures of non-strategic assets • Access to capital markets – Bond market – Commercial paper – Bank loans

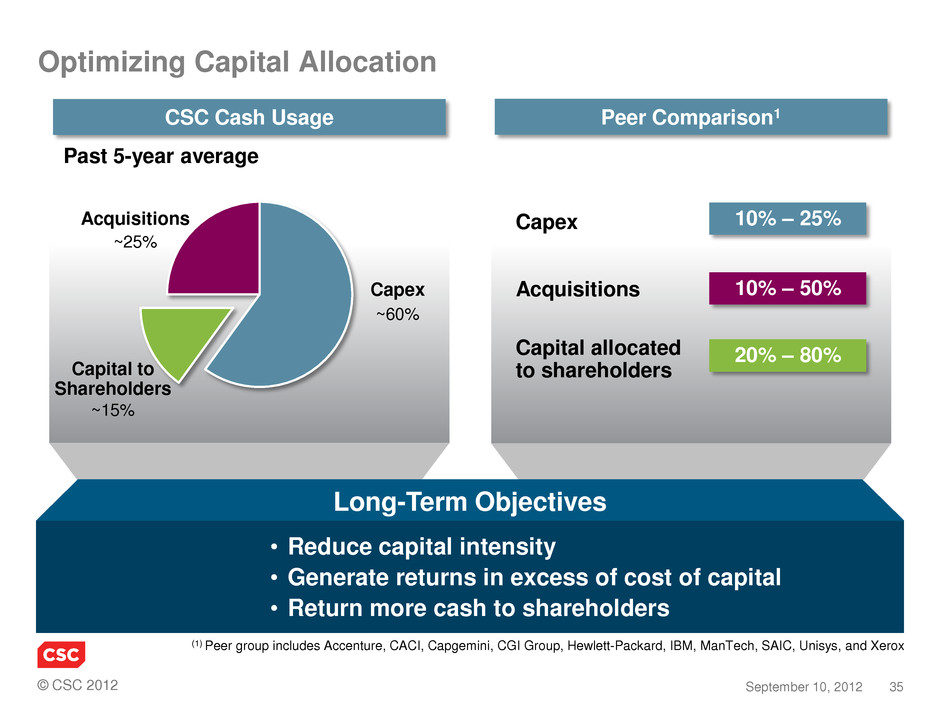

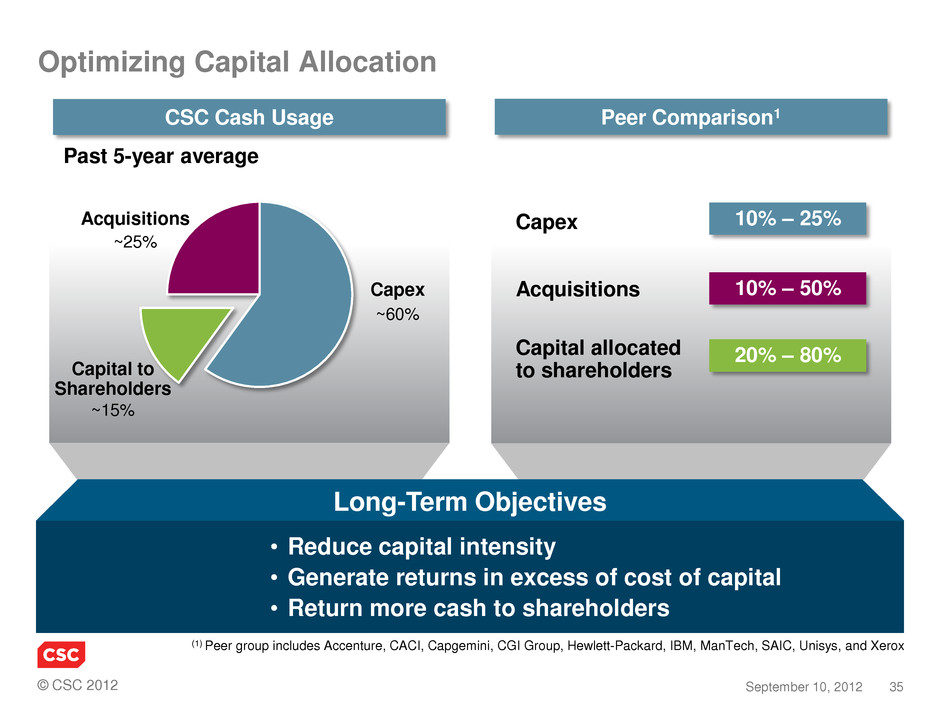

© CSC 2012 35 September 10, 2012 CSC Cash Usage Capex Acquisitions Capital to Shareholders Optimizing Capital Allocation Past 5-year average ~25% ~15% ~60% Peer Comparison1 Capex Acquisitions Capital allocated to shareholders 10% – 25% 10% – 50% 20% – 80% (1) Peer group includes Accenture, CACI, Capgemini, CGI Group, Hewlett-Packard, IBM, ManTech, SAIC, Unisys, and Xerox • Reduce capital intensity • Generate returns in excess of cost of capital • Return more cash to shareholders Long-Term Objectives

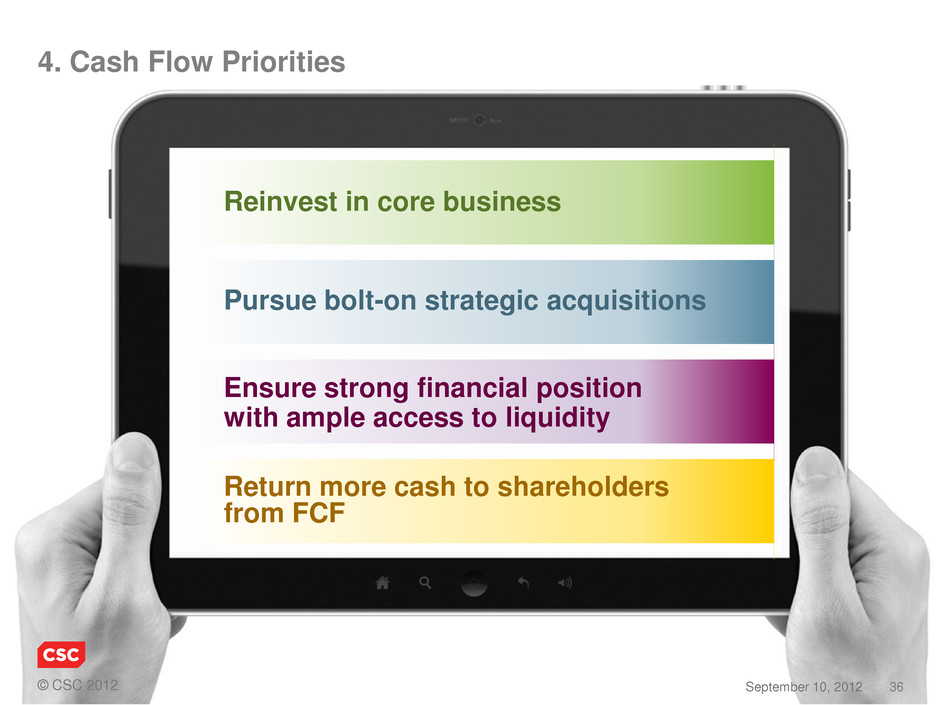

© CSC 2012 36 September 10, 2012 4. Cash Flow Priorities Reinvest in core business Pursue bolt-on strategic acquisitions Return more cash to shareholders from FCF Ensure strong financial position with ample access to liquidity

© CSC 2012 37 September 10, 2012 12:30 – 1:10 Mike Lawrie, President and CEO 1:10 – 1:30 Paul Saleh, CFO 1:30 – 2:00 Q&A Agenda SC 2012

© CSC 2012 38 September 10, 2012 Thank You

© CSC 2012 CSC INVESTOR DAY 2012 SUPPLEMENTAL INFORMATION September 10, 2012

© CSC 2012 40 September 10, 2012 Non-GAAP Reconciliations This presentation includes certain non-GAAP financial measures, such as operating income, operating margin, Earnings Before Interest and Taxes (EBIT), free cash flow, capital expenditures and capital intensity. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for results prepared in accordance with accounting principles generally accepted in the United States (GAAP). A reconciliation of non-GAAP financial measures included in this presentation to the most directly comparable financial measure calculated and presented in accordance with GAAP accompanies this presentation and is on our website at www.csc.com. CSC management believes that these non-GAAP financial measures provide useful information to investors regarding the Company’s financial condition and results of operations as they provide another measure of the Company’s profitability and ability to service its debt, and are considered important measures by financial analysts covering CSC and its peers.

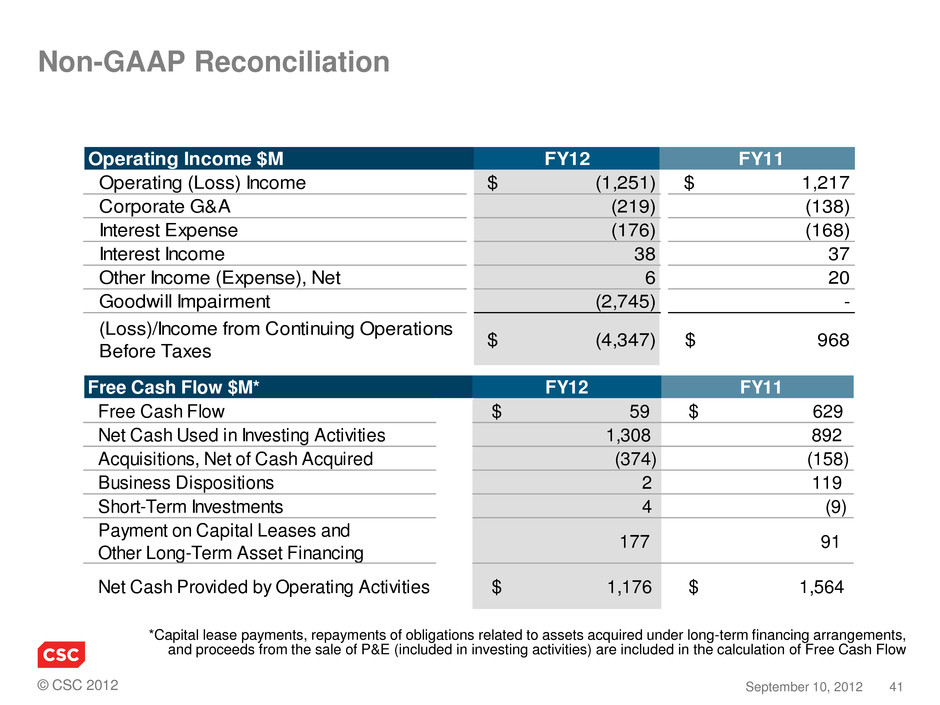

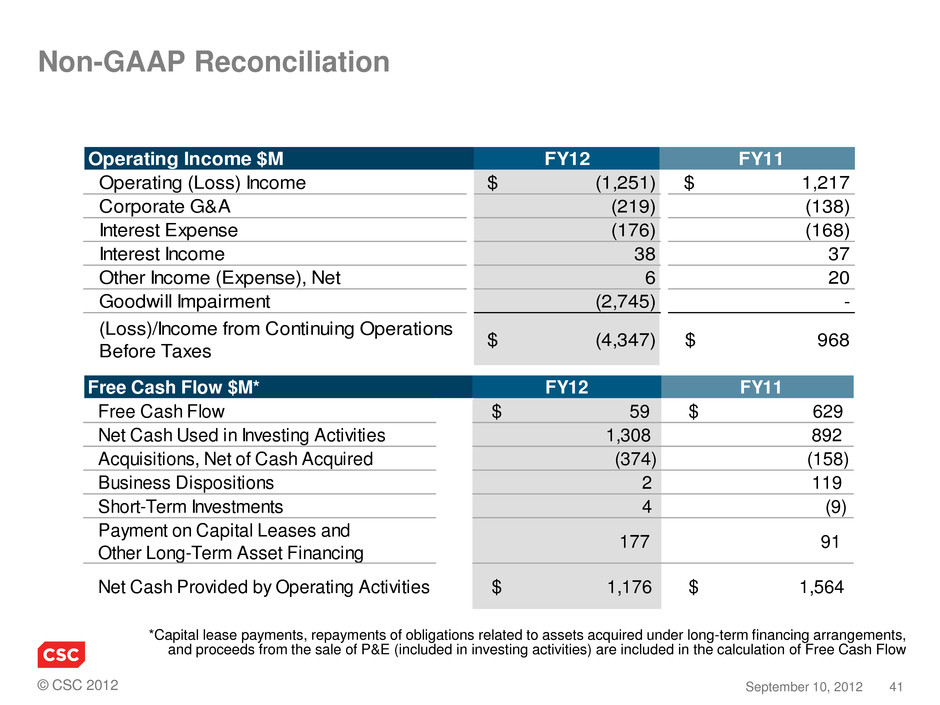

© CSC 2012 41 September 10, 2012 Non-GAAP Reconciliation *Capital lease payments, repayments of obligations related to assets acquired under long-term financing arrangements, and proceeds from the sale of P&E (included in investing activities) are included in the calculation of Free Cash Flow Free Cash Flow $M* FY12 FY11 Free Cash Flow $ 59 $ 629 Net Cash Used in Investing Activities 1,308 892 Acquisitions, Net of Cash Acquired (374) (158) Business Dispositions 2 119 Short-Term Investments 4 (9) Payment on Capital Leases and Other Long-Term Asset Financing 177 91 Net Cash Provided by Operating Activities $ 1,176 $ 1,564 Operating Income $M FY12 FY11 Operating (Loss) Income $ (1,251) $ 1,217 Corporate G&A (219) (138) Interest Expense (176) (168) Interest Income 38 37 Other Income (Expense), Net 6 20 Goodwill Impairment (2,745) - (Loss)/Income from Continuing Operations Before Taxes $ (4,347) $ 968

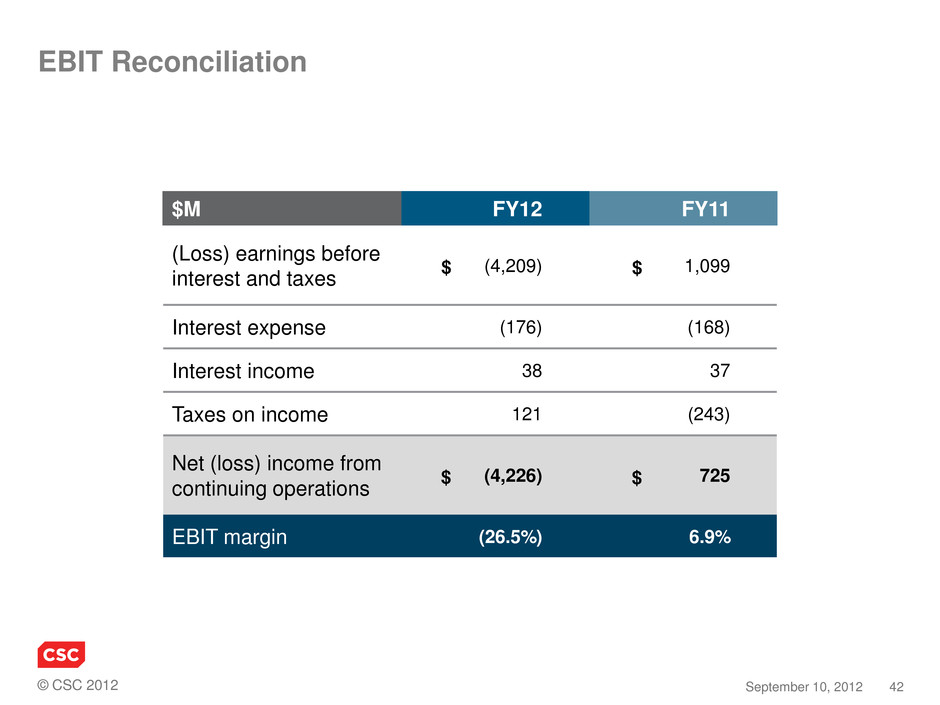

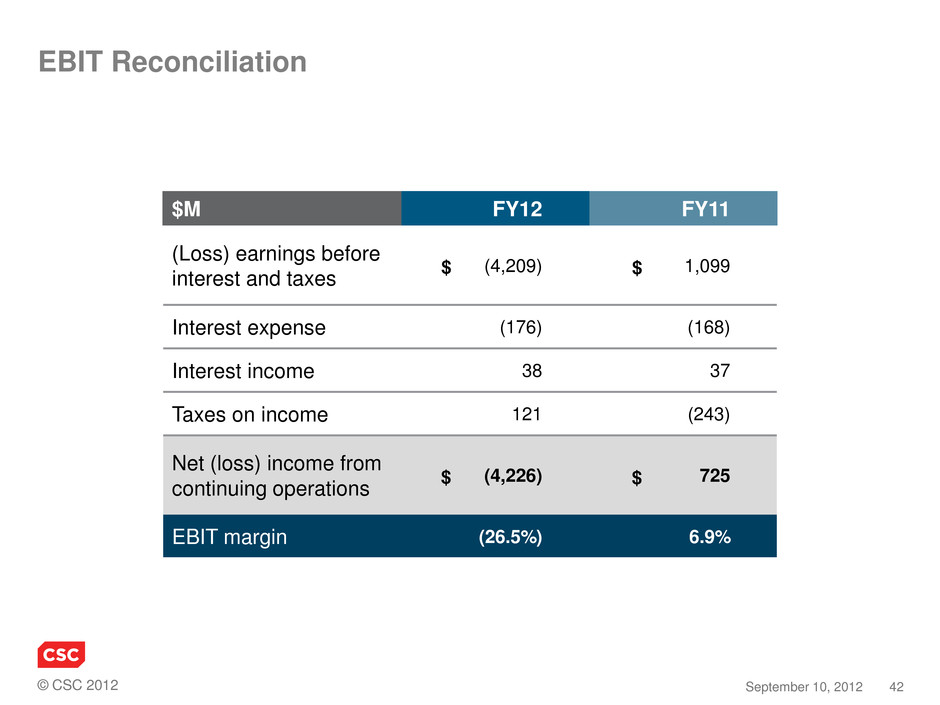

© CSC 2012 42 September 10, 2012 EBIT Reconciliation $M FY12 FY11 (Loss) earnings before interest and taxes (4,209) 1,099 Interest expense (176) (168) Interest income 38 37 Taxes on income 121 (243) Net (loss) income from continuing operations (4,226) 725 EBIT margin (26.5%) 6.9% $ $ $ $

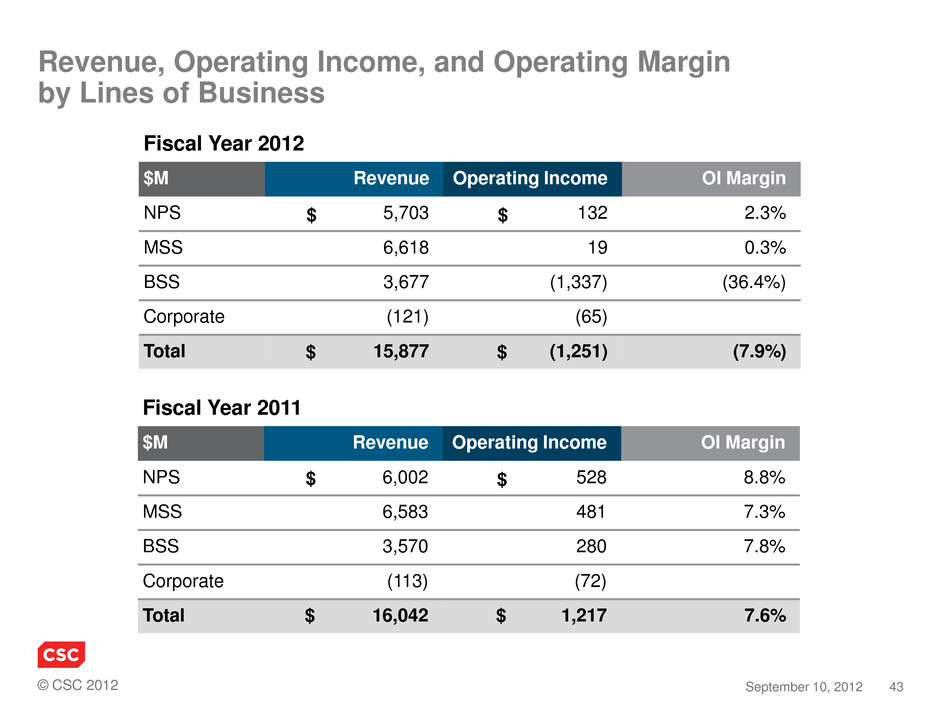

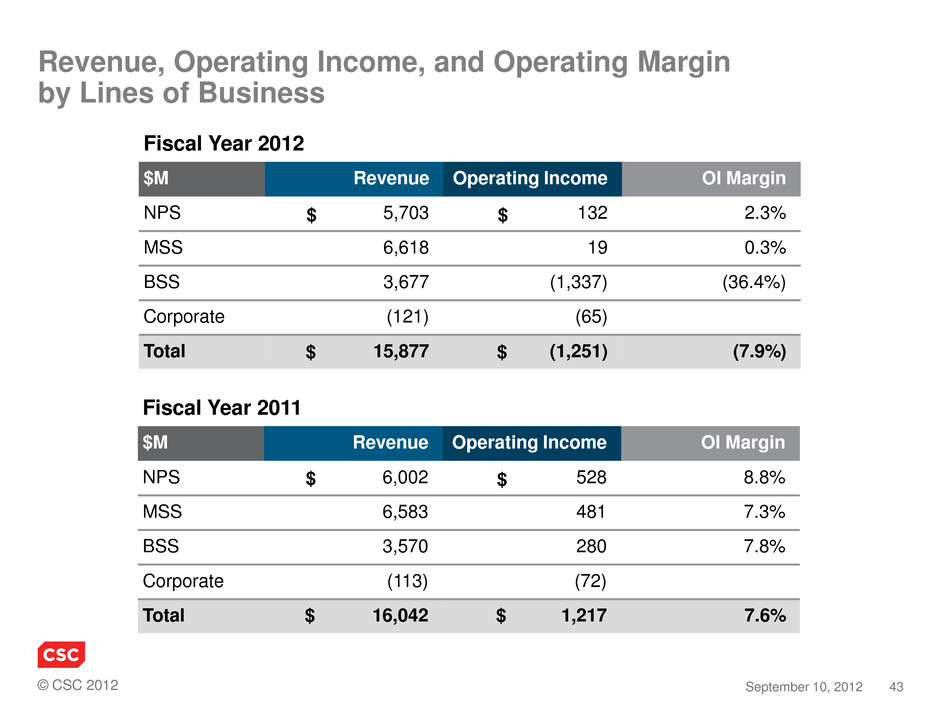

© CSC 2012 43 September 10, 2012 Fiscal Year 2012 $M Revenue Operating Income OI Margin NPS 5,703 132 2.3% MSS 6,618 19 0.3% BSS 3,677 (1,337) (36.4%) Corporate (121) (65) Total 15,877 (1,251) (7.9%) $ Revenue, Operating Income, and Operating Margin by Lines of Business $ $ $ Fiscal Year 2011 $M Revenue Operating Income OI Margin NPS 6,002 528 8.8% MSS 6,583 481 7.3% BSS 3,570 280 7.8% Corporate (113) (72) Total 16,042 1,217 7.6% $ $ $ $

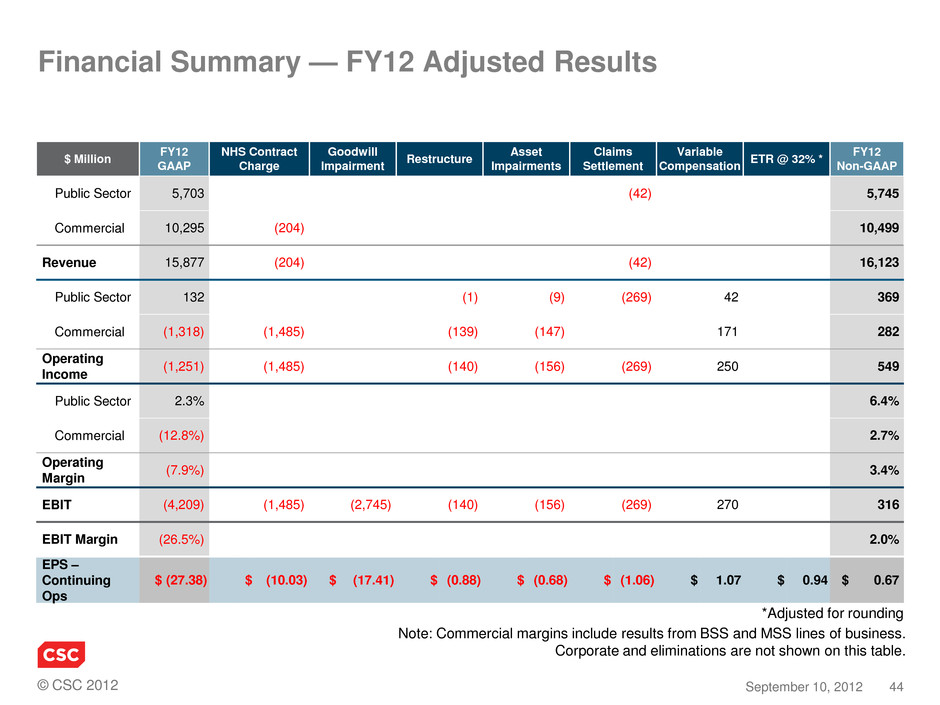

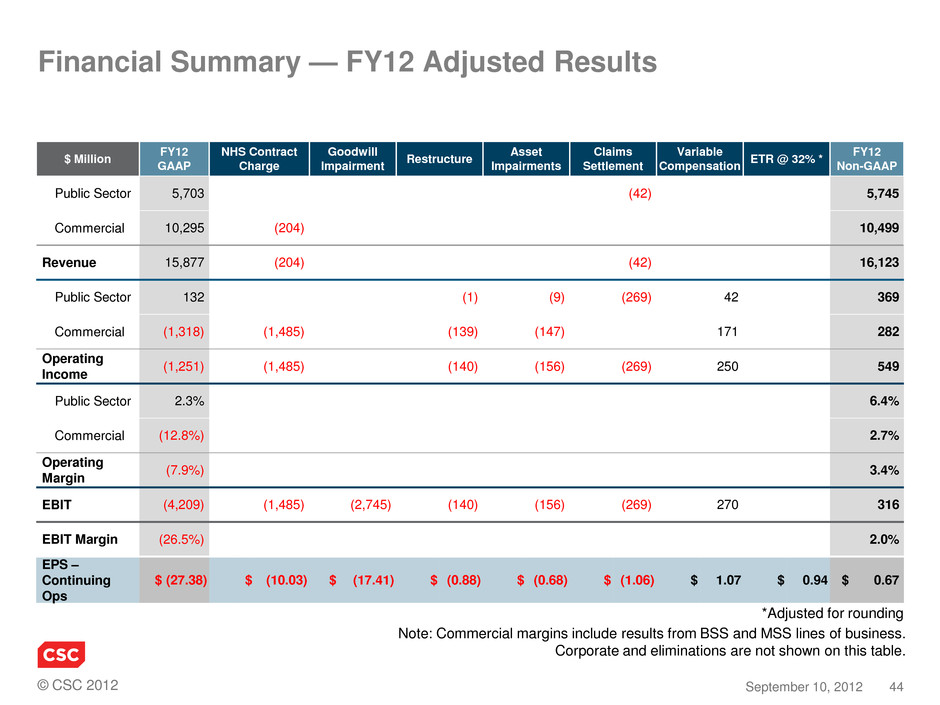

© CSC 2012 44 September 10, 2012 *Adjusted for rounding Financial Summary — FY12 Adjusted Results $ Million FY12 GAAP NHS Contract Charge Goodwill Impairment Restructure Asset Impairments Claims Settlement Variable Compensation ETR @ 32% * FY12 Non-GAAP Public Sector 5,703 (42) 5,745 Commercial 10,295 (204) 10,499 Revenue 15,877 (204) (42) 16,123 Public Sector 132 (1) (9) (269) 42 369 Commercial (1,318) (1,485) (139) (147) 171 282 Operating Income (1,251) (1,485) (140) (156) (269) 250 549 Public Sector 2.3% 6.4% Commercial (12.8%) 2.7% Operating Margin (7.9%) 3.4% EBIT (4,209) (1,485) (2,745) (140) (156) (269) 270 316 EBIT Margin (26.5%) 2.0% EPS – Continuing Ops $ (27.38) $ (10.03) $ (17.41) $ (0.88) $ (0.68) $ (1.06) $ 1.07 $ 0.94 $ 0.67 Note: Commercial margins include results from BSS and MSS lines of business. Corporate and eliminations are not shown on this table.

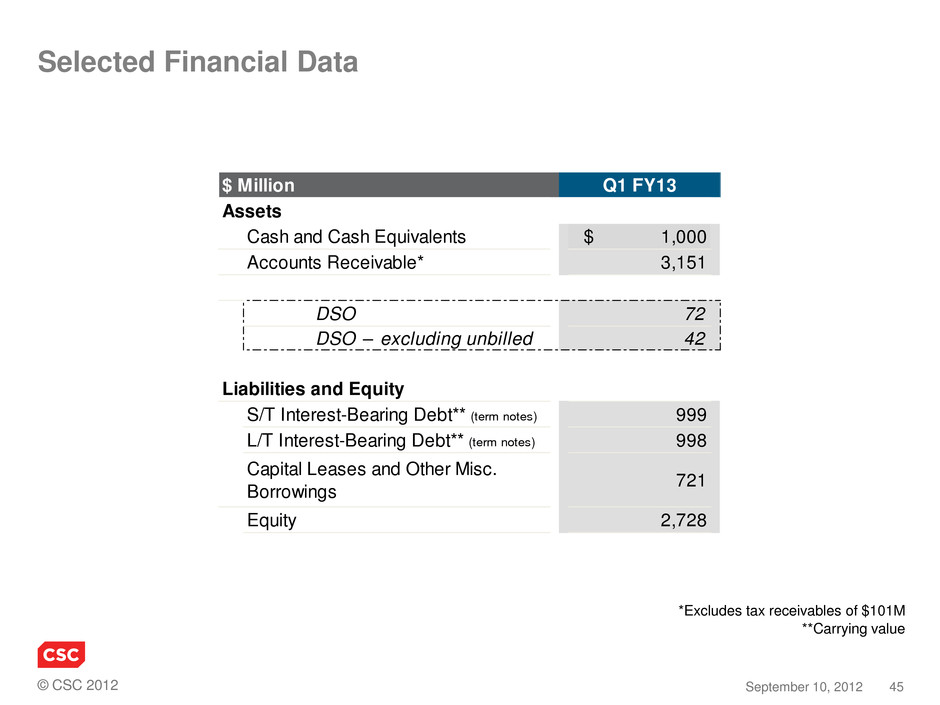

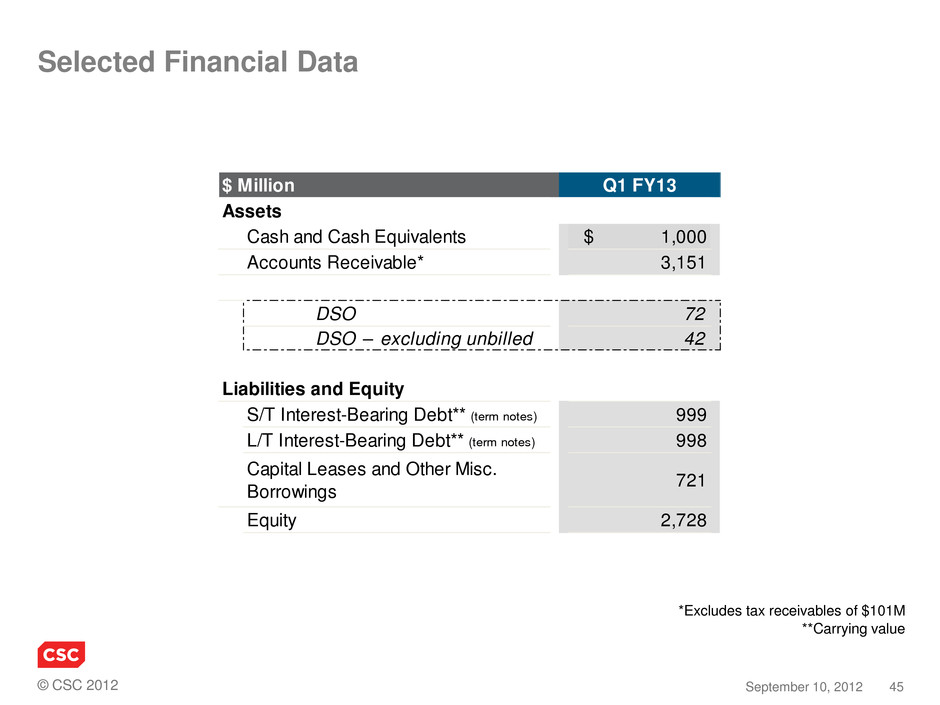

© CSC 2012 45 September 10, 2012 Assets Cash and Cash Equivalents $ 1,000 Accounts Receivable* 3,151 DSO 72 DSO – excluding unbilled 42 Liabilities and Equity S/T Interest-Bearing Debt** (term notes) 999 L/T Interest-Bearing Debt** (term notes) 998 Capital Leases and Other Misc. Borrowings 721 Equity 2,728 $ Million Q1 FY13 *Excludes tax receivables of $101M **Carrying value Selected Financial Data

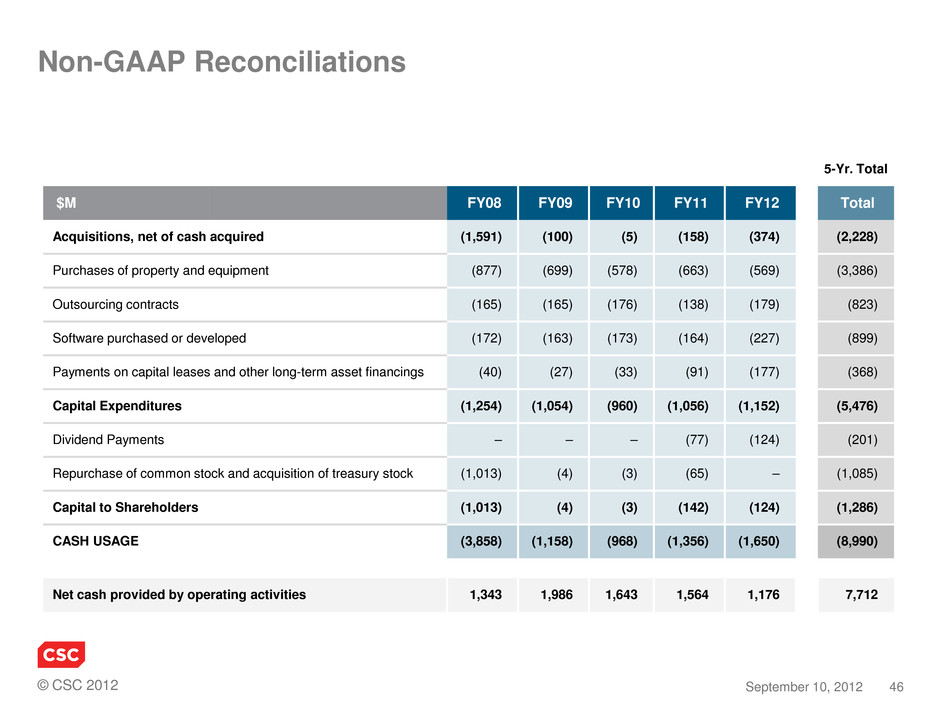

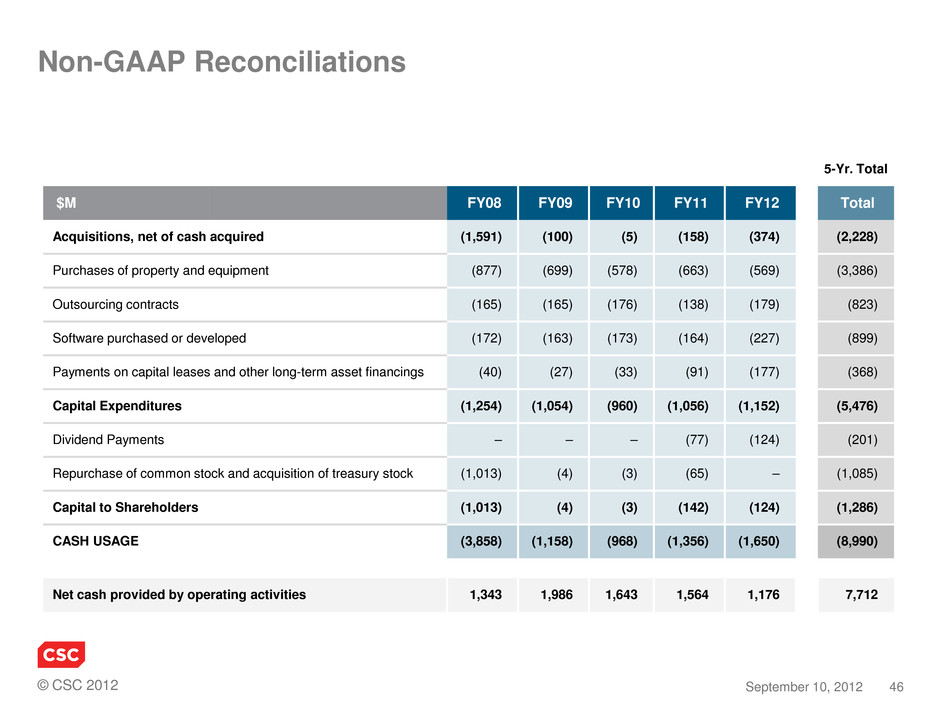

© CSC 2012 46 September 10, 2012 Non-GAAP Reconciliations 5-Yr. Total $M FY08 FY09 FY10 FY11 FY12 Total Acquisitions, net of cash acquired (1,591) (100) (5) (158) (374) (2,228) Purchases of property and equipment (877) (699) (578) (663) (569) (3,386) Outsourcing contracts (165) (165) (176) (138) (179) (823) Software purchased or developed (172) (163) (173) (164) (227) (899) Payments on capital leases and other long-term asset financings (40) (27) (33) (91) (177) (368) Capital Expenditures (1,254) (1,054) (960) (1,056) (1,152) (5,476) Dividend Payments – – – (77) (124) (201) Repurchase of common stock and acquisition of treasury stock (1,013) (4) (3) (65) – (1,085) Capital to Shareholders (1,013) (4) (3) (142) (124) (1,286) CASH USAGE (3,858) (1,158) (968) (1,356) (1,650) (8,990) Net cash provided by operating activities 1,343 1,986 1,643 1,564 1,176 7,712

© CSC 2012 47 September 10, 2012 Non-GAAP and Other Definitions • Operating Cost: Equal to the sum of (1) cost of services, (2) business unit SG&A, (3) depreciation and amortization, (4) restructuring costs • Operating Income: Revenue minus operating cost before Corporate G&A expenses • Operating Income Margin: Operating Income as a percentage of Revenue • DSO: Total receivables at quarter end divided by revenue per day. Revenue per day equals total revenues for the last quarter divided by the number of days in the fiscal quarter. Total receivables includes unbilled receivables but excludes income tax receivables • DSO Excluding Unbilled Receivables: Total receivables excluding income tax receivables less unbilled receivables at quarter end divided by revenue per day. Revenue per day equals total revenues for the last quarter divided by the number of days in the fiscal quarter • Free Cash Flow: Equal to the sum of (1) operating cash flows, (2) investing cash flows, excluding business acquisitions and dispositions, and investments (including short-term investments and purchase or sale of available-for-sale securities), and (3) payments on capital leases and other long-term asset financings • Earnings Before Interest and Taxes: Revenue minus cost of services, selling general and administrative expenses, depreciation and amortization, goodwill impairment, restructuring costs and other income (expense) • Earnings Before Interest and Taxes Margin: Earnings Before Interest and Taxes as a percentage of Revenue • Capital Expenditures: Equal to the sum of cash flow from (1) purchases of property and equipment, (2) outsourcing contracts, (3) software purchased or developed, and (4) payments on capital leases and other long- term asset financings • Capital to Shareholders: Equal to the sum of (1) dividend payments and (2) repurchase of common stock and acquisition of treasury stock • Cash Usage: Equal to the sum of (1) acquisitions, net of cash acquired, (2) capital expenditures, and (3) capital to shareholders • Capital Intensity: Capital expenditures divided by cash usage

© CSC 2012 48 September 10, 2012 Thank You